Gold World News Flash |

- COMEX Silver 'Owners Per Ounce' and the Great JPM Silver Hoard

- Somebody Big’s Sitting on the Gold Price

- Preparedness Critics Are History's Cannon Fodder

- The "Historic NYSE Halt" Post-Mortem: The Shock And Awe When It All Went Down

- Conspiracy, Complacency and the Death Spiral Phase

- Greece Enters Its Crack-Up Boom

- The Media, Gold & One World Dictatorship Are You Ready?

- What To Do Before CYBER Collapse

- BRICS Bank Officially Launches As Sun Sets On US Hegemony

- Gold Price Regained $9.10 or 1.14 Percent Closing at $1,163.30

- Caught On Tape: The Other Crisis Happening In Greece

- Cyber False Flag -- Do You Really Believe A Glitch Closed The Stock Market

- Why Silver Wheaton Corp. Dropped 11% on Tuesday

- CRITICAL: Major Global Deleveraging Occurring NOW! NYSE Trading HALTED. By Gregory Mannarino

- Gold Daily and Silver Weekly Charts - Fearful Odds

- Jade Helm toys for kinder and friendlier Martial Law

- Brush Fires Everywhere

- The Mother of All Hacks

- A bullion banker sings in Berkeley Square

- U.S. Mint Suspends Silver Sales

- Gold and Silver Spot Prices Increasingly Detached from Reality

- ALERT! U.S. Mint Suspends American Silver Eagle Sales

- Understanding China, Gold, & Seasonality

| COMEX Silver 'Owners Per Ounce' and the Great JPM Silver Hoard Posted: 08 Jul 2015 10:12 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Somebody Big’s Sitting on the Gold Price Posted: 08 Jul 2015 09:40 PM PDT by Peter Cooper, Arabian Money:

Safe haven 'Either 5,000 years of safe haven buying has just become bunk, or there is a desire to portray what it is evidently a financial and economic crisis as nothing to be concerned about.' However, things look very different to eurozone gold holders whose currency has depreciated around 15 per cent against the US dollar. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preparedness Critics Are History's Cannon Fodder Posted: 08 Jul 2015 08:00 PM PDT Submitted by Brandon Smith via Alt-Market.com,

The world is entering a kind of no man’s land, in between the realms of insane denial and utterly obvious crisis. Europe is now destabilizing amid the Greek soap opera (an event that I predicted in January would occur in 2015); China’s stock market bubble is bursting; and the U.S. dollar’s world reserve status is about to be decimated by the global shift toward the International Monetary Fund’s basket currency reserve system. I’m afraid I’m going to have to say this because I don’t know if anyone else will admit it: Alternative economic analysts were right, and the mainstream choir was either terribly wrong or disgustingly dishonest. However, as most of us in the liberty movement are well aware, being right is not necessarily a solution to disaster. At the forefront of alternative economics and constitutional vigilance are the people doing the real work in the movement: the preppers. These are the activists taking concrete action in the tangible world (as opposed to the ethereal laziness of the intellectual world) first to make themselves as independent as possible from the mainstream grid, thereby removing themselves as a potential refugee or looter in the event of national crisis. Second, they are the people mastering valuable and necessary skills that will allow them to rebuild any collapsed social and financial system. Third, they are the people most capable of defending our inherent freedoms and the principles of our founding culture, and they are the only people organizing locally for mutual aid and security. The fact of the matter is preppers are free, and almost everyone else is a slave — a slave to dependency, a slave to doubt, a slave to ignorance, a slave to fear and, thus, a slave to petty establishment authority. During the Great Depression, the vast majority of American citizens were rural, farm-oriented people with survival skills far beyond the modern American. “Prepping” in those days was ingrained in our society, rather than marginalized and labeled “fringe.” Today, the numbers are reversed, with a dwindling number of farm-experienced Americans and a vast wasteland of urban and suburban citizens — many with few, if any, legitimate skill sets. During the Great Depression, millions of people died of starvation and general poverty, despite the incredible number of people with rural survival knowledge. What do you think would happen to our effeminate; metrosexual; iPhone-addicted; lisping; limp-wristed; self-obsessed; Twitter-, texting-, video game-addled; La-Z-Boy-riding; overgrown-child culture in the event that another economic crisis even remotely similar were to occur? Yes, most of them would die, probably in a horrible fashion. Think about it for a moment. An incredible subsection of Americans do not know how to feed themselves; they do not know how to hunt; they do not know how to grow crops; they do not know how to repair any necessary items used for subsistence; they do not know how to build anything useful; they do not know how to shoot; they do not know how to defend themselves; they don’t even know how to cook a pot of rice properly. Their only skills involve parroting snarky remarks from their favorite lowest-common-denominator television and Web shows, building ample karma points on Reddit, and avoiding any stance contrary to what they perceive to be the majority opinion (which they also derive from mainstream media and websites). It is decidedly ironic given the uselessness of such people that it is often the worst subsections of the blind, deaf and dumb that choose to “critique” the prepper lifestyle as “disturbed” or “dangerous.” In my view, they are absolutely damned pathetic and should be looked down upon with utter contempt as the most concentrated example of slithering human misery ever to smear across the pages of history. But, hey, that doesn’t mean I wish them harm. People who are unaware and unprepared are not necessarily our enemies. At one time or another, we all were unaware of the underlying truths to our system and our future, until we woke up one day. On the other hand, there are some people who have truly evolved from the sickly and bitter bile scraped from the lower intestine of the grotesquely ignorant. These people are the anti-preppers. Anti-preppers are well aware of the philosophies and fact-based arguments of prepper activism; but rather than ignoring or dismissing us outright and moving on with their vapid lives, they instead seek to destroy preppers and the prepping ideal. Why? To understand that, you have to understand the nature of statists and collectivists because that it where these people root themselves and their twisted worldview. I recently read an article by Joshua Krause over at The Daily Sheeple in which he countered a mainstream hit piece article against preppers titled “Be prepared For preppers.” The article is itself an immensely disturbed display, first using typical and unimaginative ad hominem arguments to marginalize preppers, then mutating into a treatise on why preppers should all be exterminated. Krause did a fine job of dismantling the substandard and journalistically challenged propaganda essay, but I would like to go beyond the typical arguments of anti-preppers and into the mindset that drives them. I recommend you read “Be prepared for preppers” for good measure, being that it is a perfect example of the psychopathic nature of the common statist. Then, I would like to perform a little brain surgery here and peel away some layers of psyche so that you can understand why these people hate us so much. The Prepper Stereotype The sad reality is most anti-preppers I’ve dealt with in person have never even talked to a prepper face to face until they had met me. They tend to enter into an immediate debate posture with multiple assumptions in terms of what a prepper believes and how a prepper lives. This posture begins with an incredulous and sarcastic demeanor. And as they begin to realize that the prepper they are dealing with is smarter than they are, their attitude devolves into conditioned talking points and generally indignant frothing. Anti-preppers do not know or associate with real preppers. Rather, they derive their opinions of us from popular media, which is in most cases openly biased; episodes of “Doomsday Preppers” and other shows designed to make us look ridiculous; and Southern Poverty Law Center-influenced news articles loaded with carefully crafted slander. They rarely, if ever, confront a prepper or preppers on neutral ground and address facts or figures honestly. The bulk of what makes up the prepper stereotype is utter nonsense. But it reinforces the anti-prepper’s hateful inclinations, so they eat it up without question. They Hate Us Because Of Our Freedom Are anti-preppers “terrorists?” Yes, they are. It might sound harsh, but consider the attitude of the anti-prepper for a moment. He hates you because you have chosen a lifestyle that is independent from the system and ideology of which he chooses to remain a part. He hates you because you have a measure of freedom he does not have, but could have if only he had the guts to do something about it. He hates you because you do not want to participate in the meaningless game of collectivism he has spent his whole life attempting to master. He hates you because you are walking away from his system and doing your own thing. How dare you do your own thing! Many of us who appreciate libertarian-oriented ideals are proponents of the “non-aggression principle,” which, to summarize, states that respect for individual freedom is the paramount value of any society that seeks to sustain itself peacefully and indefinitely. Human society is not a nexus; it is not a hive. Society, if it is anything at all, is a collection of individual minds and souls acting voluntarily for the advancement the community, but never at the cost of personal liberty. Contrary to popular mainstream belief, the individual does NOT owe society a thing. Non-aggression requires that society will not violate personal liberty for arbitrary collective gain and that individuals will not use violence or coercion to forcefully mandate the participation of others. That is to say, you leave me to my dream and I leave you to yours. But if you try to deliberately trample my dream in order to enrich your own, I am then within my rights to bring a mighty friggin' hammer down on your skull until you leave me alone. Anti-preppers have no capacity to grasp this concept. To them, each human being is property of the larger group and defiance of the state is blasphemy. Such collectivists are also predictably devout followers of the religion of resource management, and often argue that preppers are in fact "horders" of resources. Under this ideology, resources do not belong to the people who actually worked to earn them. Rather, resources somehow belong to EVERYONE no matter how lazy they are, and must be constantly redistributed so that all people (common people, not elites) have the same exact amount. They can never seem to define what exactly a "fair share" actually is, and I believe this is because as long as a "fair share" remains ambiguously up to them, they retain the ultimate power to take what they want whenever they want always under the rationale that yesterday you and I had enough, but today we again have too much. The anti-prepper argument that "hording" is harmful to the collective and that all resources, even your food storage, should be managed by the group (the state), is THE propaganda model of the future. Do not forget this because you will be seeing this propaganda take center stage very soon. Anti-preppers are often the kinds of social justice circus clowns that preach unerring tolerance and claim disdain for any form of discrimination, yet they are at the same time violently discriminatory against anyone who will not preach their particular collectivist gospel. The social collectivist model is by every definition a form of cultism, and in most cases the god of this cult is the state. It treats the state as an infallible omnipotent presence: mother and father, caretaker and disciplinarian. To refuse participation is to deny the collectivist god, and the kinds of horrors we read about of the religious zealotry of medieval Christian inquisitions pale in comparison to the death and destruction dealt by modern collectivists. Their worship of the state is energized by their love of its collective power - the state is the ultimate weapon to those who think they can successfully wield it. The state has the ability to "legally" imprison and/or kill, and it has the ability to threaten such consequences against anyone who refuses to conform to the ideological whims of the people who exploit it. Unless, that is, the victims of the state become revolutionaries. This is the great fear of collectivists in terms of the prepper movement; they see us as potential revolutionaries that could conceivably extinguish their mechanism of control, and they don't like that one bit. The Psychotic Zealotry Of Anti-Preppers Many anti-preppers are not content only to attack the character of the prepper movement — at least, not anymore. You see, despite the rabid attempts to undermine the validity of prepping and dissuade the growth of the movement, preppers are now legion, with millions of active participants and effective alternative media experts who are dominating Web traffic and crushing traditional media into archaic bone meal. We have made the mainstream media a mainstream joke, and this does not sit well in the minds of statist adherents who once had the power to bottleneck all discussion. If we are so desperately fringe, there would be no need to write unprovoked hit pieces against us to begin with. Who are they trying to convince? Since they now know they cannot win the war of information, they increasingly foster fantasies of genocide. This quote (in reference to methods for solving the “prepper problem”) from the article linked above truly says it all: "Furthermore, consumed with the heady lust of their own unexpected survival (see any episode of The Walking Dead), and with only expired condoms at their disposal (not even Doom and Bloom stocks birth-control pills) these mouth-breathers will doubtless multiply rapidly, and, ergo, must be stopped before such an advent. That can mean only one thing: key preparation in any disaster for the rest of us (other than a map to all of Wal-Mart’s distribution warehouses) is this: be prepared to neuter preppers by any means available. … Not only will such noblesse oblige ensure a stronger gene pool going forward, but hey — those bastards have all the gear and food and fish antibiotics you’ll ever need." And there you have it: the comic book delusion of the anti-prepper, so desperate to stop us from stockpiling food and essentials, so disturbed by our local organization and ability to defend ourselves, that they would prefer to see us all “neutered,” i.e., killed. Note also the obsession with the sterilization of the gene pool as socialists in their psychotic fury often harken back to their fascist and communist forefathers. It is perhaps not coincidental that the people most in love with the state are often the first ones to be annihilated by it. Avid lower echelon and middlemen agents of tyranny are in many cases exterminated by the very system they helped to dominance. If they do not meet their demise at the hands of the establishment, then they invariably meet their demise at the hands of those fighting against the establishment. The problem for anti-preppers is that most of them are weaklings and cowards who are incapable of carrying out their vision of a final program. They have always needed a warrior class mandated by the state to implement the killing they desire. Hilariously, this particular anti-prepper spends 80% of his article shoveling poorly written character assassinations like so much manure as if our concerns of crisis are inconsequential, then goes on to describe his idea of wiping out all preppers and stealing our supplies in the event that the system does collapse. If we are all such “kooks” and paranoid hillbillies, then why even entertain the notion of having us snuffed out so that our stores can be redistributed? Surely, such a collapse will never occur in the midst of our invincible American economy; and, thus, preppers are nothing more than harmless eccentrics wasting our money on boxes of food we won’t touch for another 20 years. Right? History does not support the assumptions of anti-preppers. And throughout history, anti-preparedness people tend to be the first to meet an early demise in the wake of fiscal and social collapse because they have no utility and because, frankly, no one really likes them. They also aren’t the brightest bulbs around (the guy actually thinks he’s going to find food at a Wal-Mart distribution center after a breakdown in civil order). Anti-preppers today are promoting violent action against preparedness culture because in the far reaches of their sickly subconscious, they know we are right and that we will not be controlled when the system breaks. These people accuse us of lusting after collapse, when it is in fact they who salivate over mass die-off scenarios in which they fantasize that they will somehow be the survivors despite the fact that they are born victims. They imagine a time when, after the “gene pool has been cleansed,” they will rebuild society as a perfect socialist utopia in which every ideology contrary to their own has been erased from all memory, leaving their ultimate prize: a blank slate world to do with as they wish. The goal behind the prepper movement is simple, not sinister; we seek to defuse crisis before it occurs by providing our own necessities without the need for a mainstream grid that could easily malfunction and a government that is corrupt beyond repair. If your neighbor is a prepper, be thankful, for you have one less person on your street to worry about as a potential looter during an emergency. If your neighbor is an anti-prepper, beware, for this person sees you as a potential source of supply and thinks you owe him merely because you have something he does not. The bottom line is if the world were full of preppers, there would be no such thing as crisis because there would be no lack of necessity or individual ingenuity. In the land of preppers, disaster vanishes. When was the last time an anti-prepper did anything to improve anything for anyone other than himself? Ask yourself which you would rather be in the end: ready for anything or ready for nothing? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The "Historic NYSE Halt" Post-Mortem: The Shock And Awe When It All Went Down Posted: 08 Jul 2015 07:59 PM PDT What began as a glitch in pre-market trading turned into the NYSE's longest trading halt since Hurrican Sandy battered the East Coast. The ever-increasing complexity of US equity markets combined with an ever-decreasing pool of greater fools leaves windows open on down days (for it appears these 'glitches' only ever occur on down days) for markets to break. While NYSE traders defended the very market structure they have abhorred in the past as evidence that today was "not a failure," we can't help but find CNBC's Scott Wapner's amusing remark that "if retail investors want low cost liquid trading they are going to have learn to live with it" the perfect post-mortem for a rigged system brimming with confident insiders ever excited to take mom-and-pop's money. As Bloomberg reported, "What began Wednesday morning with a seemingly workaday software glitch soon escalated into one of the most startling computer outages in Wall Street history -- and, for the Big Board, a race against the clock."

NYSE BREAK #1 Occurred shortly before the market open as the SNB-driven rebound from overnight weakness was beginning to fade...

Stocks rallied into the open while the NYSE was broken. The issues were resolved shortly after the market opened... and stocks then plunged:

The tumbling stock market meant there was only one option: NYSE BREAK #2 Occurred shortly before the European close...

And once again... stocks ripped higher and the world rejoiced that Greece and China didn't matter after all.

But then, once that problem was resolved, stocks plunged again, which left only one option for the PPT which learned its lesson from China where if there is selling, just halt the stocks being sold. NYSE BREAK #3 - The Big One started shortly after the European close with stocks near the lows of the day... CNBC went into full "turmoil" mode:

And this happened:

The NYSE CEO told CNBC that he "didn't know" if the early halts and glitches were related to the catastrophe that halted the entire exchange for almost 4 hours. Well as a help for him, here is a simple chart from Nanex that shows the last group of trades before the NYSE Blackout were in the same stocks they reported an issue with earlier in the day...

Simply put - they were related. Why does the market break? Here's why: an ever increasing level of complexity in the market structure (as machines game each other to death)...

... Meets an ever-decreasing pool of greater fools: But why 4 hours?

So, to summarize, the NYSE has a disaster recovery center which... they choose not to use because it is an inconvenience to clients who would rather be unable to trade! Maybe there was a different angle altogether: with China crashing and halting 70% of the market, the US had just one response:

Here is the "official" reason according to the NYSE CEO:

Of course it's not the first time NYSE has been halted (as MotherJones reports)

And won't be the last: as we wrote last year, the entire market is now like the infamous "social-network" stock CYNK that never existed: it too was pumped up to ridiculous valuations on no volume, not to mention no revenues, no profit and no employees ... and then when the selling began it was quietly halted. Permanently. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conspiracy, Complacency and the Death Spiral Phase Posted: 08 Jul 2015 07:40 PM PDT from Perth Mint:

While Bullion Vault saw "internet traffic from Greece rise 50% during the first half of this year from the Jan-June period of 2014″ they reported no new accounts from Greece, noting that "the preferred choice for Greeks buying gold has remained bullion coin. Specifically gold Sovereigns" which can only be bought from their central bank, the Bank of Greece – the volume of which had doubled according to the Royal Mint. Predictably, goldbugs jumped to their favourite "disconnect" and "conspiracy" narratives, noting the failure of gold to go up in the face of this strong demand as proof of central bank market manipulation/rigging. Now don't get me wrong, I certainly don't deny central bank activity in the gold market (BTW, interesting that Barry didn't respond to GATA's questions). I mean, central bankers don't pay $4,500 for the World Gold Council's Executive Program in Gold Reserves Management to learn how to store, stocktake and shine up their stash. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greece Enters Its Crack-Up Boom Posted: 08 Jul 2015 07:22 PM PDT The Austrian School of economics has a concept called a “crack-up boom” in which a critical mass of people conclude that their government is actively trying to devalue its currency. Consumers respond by front-running the government, spending their paychecks immediately in order to convert their soon-to-be-less-valuable money into real things. Merchants, not happy about the sudden influx of suspect currency (and sensing the panic of their customers) hold out for ever-higher prices, causing inflation to spike. But it’s a special kind of inflation, driven not by a sudden increase in the money supply but by collapsing confidence among holders of the currency. In a very short time, so goes the theory, the supply of stuff available for purchase dries up, prices hyperinflate, and the economy collapses. Welcome, in other words, to Greece:

When Greeks start clamoring to pre-pay their taxes, you know the end is near. But viewed through a Keynesian rather than Austrian lens, this process actually looks kind of positive, like really effective stimulus. The Greeks appear to have discovered the secret to convincing an over-indebted people to keep borrowing and spending: Just telegraph the destruction of their savings and watch the little folks consume. In an era when new and wild economic theories are being tested on a weekly basis, Greece is perhaps the most interesting laboratory of all. If this sudden burst of consumption and tax compliance results in “growth” and “a balanced budget” then don’t be surprised if the people running the eurozone, Japan and maybe the US come to the comical but from their point of view logical conclusion that far from screwing up, Germany actually did something right in Greece. And that maybe the rest of the world should pre-announce capital controls and bank bail-ins to get their citizens off their butts and into the mall. Which, when you think about it, might be exactly what the war on cash is setting up. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Media, Gold & One World Dictatorship Are You Ready? Posted: 08 Jul 2015 07:20 PM PDT from JayTaylorMedia: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What To Do Before CYBER Collapse Posted: 08 Jul 2015 06:00 PM PDT The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BRICS Bank Officially Launches As Sun Sets On US Hegemony Posted: 08 Jul 2015 06:00 PM PDT Before the Asian Infrastructure Investment Bank and, to a lesser extent, the Silk Road Fund became international symbols for the end of Western economic hegemony, there was the BRICS Bank. Or at least there was the idea of the BRICS bank. The supranational lender imagined by Russia, China, Brazil, India, and South Africa is, like the AIIB, largely a response to the failure of US-dominated multilateral institutions to meet the needs of modernity and offer representation that's commensurate with the economic clout of their members. As Bloomberg points out, the countries' combined economic output is now roughly equal to that of the US. "Back in 2007, the U.S. economy was double the BRICS," Bloomberg notes. As a refresher, here's how the Washington Post described the bank's structure and purpose on the heels of last summer's BRICS summit in Fortaleza:

On Tuesday, ahead of this year's summit in Ulfa, the BRICS countries officially launched the new bank along with the reserve currency pool. Here's WSJ:

The BRICS nations will also look to begin settling more trade in national currencies, a shift we highlighted recently in "The PetroYuan Is Born: Gazprom Now Settling All Crude Sales To China In Renminbi", "PetroYuan Proliferation: Russia, China To Settle "Holy Grail" Pipeline Sales In Renminbi," and "De-Dollarization Du Jour: Russia Backs BRICS Alternative To SWIFT." This comes at a convenient time for Russia, which is attempting to diversify away from the dollar amid Western economic sanctions (recently extended into next year) imposed on Moscow in retaliation for the Kremlin's perceived involvement in Ukraine. RT has more:

And of course no story about the BRICS bank (or the AIIB for that matter) would be complete these days without some mention of Greece and the possibility that Athens may be forced to look elsewhere for help in the event it's driven out of the euro and Jean Claude-Juncker's "humanitarian" plan B proves inadequate to keep the country out of the Third World after Berlin digitally bombs its citizens back to barter status. For today's Russian/Chinese pivot allusion, we go to IBTimes:

Yes, the bank must "carve out a niche", and preferably one which takes every opportunity to undercut the influence of the US-dominated multilateral institutions that have defined the post-war world and served to underwrite six decades of dollar dominance. So we suppose it's not all bad news for China these days. Beijing may have a decelerating economy and a stock market collapse on its hands, but at the end of the day, the country now controls not one (AIIB), not two (Silk Road Fund), but three (BRICS bank) development banks, which gives Xi Jinping quite a few options when it comes to embedding the yuan in global investment and trade which, in the long-run, is far more important than where the SHCOMP closes on Thursday.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Regained $9.10 or 1.14 Percent Closing at $1,163.30 Posted: 08 Jul 2015 05:24 PM PDT

Bounce in silver and GOLD PRICES today tells us nothing, really. Day after a huge drop a bounce often happens. Dead cats bounce when you drop 'em off a 40 story building, but that's not a sign of life. I need proof. The gold price is certainly at a place where it might have stopped falling, given the summer seasonal pattern. But it could just as well fall further. Silver's low yesterday was $14.62, not far from that $14.16 December 2015 low. Still, we need to see some technical sign it has turned. Certainly, hitting the 3-sigma Bollinger Bands yesterday points to a reversal, but now price action has to confirm. That means a two-day key reversal or a sudden climb above $1,170 and $15.50. Since the US Mint suspended (not often I get to use that word twice in one commentary) deliveries of silver American Eagles, premium at wholesale has risen from $2.30 to $2.75. Interesting that the better alternative, US 90% silver coin, has been gaining premium and now is at $2.60 an ounce over spot at wholesale sell. That rising 90% premium also promises good days for silver. Y'all remember those old cartoons from the 1930s and 1940s when some character would hit a clock with a hammer and springs and clock parts would fly out of the clock? Imagine somebody like that hitting the world's stock markets and economy with a hammer. It gets worse. Shanghai composite lost another 5.9% today and from the 11 June high has now fallen 32%. Like King Canute trying to command the sea, today the Chinese suspended trading in at least a third of the companies listed on the major exchanges. And Brokerage houses have been ordered to pump billions back into the market. The fun part is that most of the investors are retail investors, small time folk investing their life savings in the market for the first time. That promises a deep well of social unrest and further economic troubles. It gets worse still. From about 11:30 today for 4 hours the New York Stock Exchange halted trading due to a "computer glitch". Exchange officials were quick to deny it was a cyber attack, which forces me to recall the French proverb, "Nothing is confirmed until officially denied." Truth is, business and government officials in the US have told so many lies for so long that you never know what to believe: is it real, or Memorex? Oddly enough, the Wall Street Journal experienced computer troubles, too, and United Airlines was forced to ground all US flights because of, you guessed it, computer issues. If you were going to wage war, what a efficient way to wage it, crippling your enemy's economy without his ever knowing where the attack comes from, leaving him absolutely defenseless. Enough of this fun, let me share something with y'all. Day before yesterday an overseas friend sent me a summary of gold's summer seasonal rallies from 2001 through 2014. Now y'all listen, this is important: from the summer low in June, July, or August to the next peak, gold has rallied every single year an average of 14.9%. Yes, that does include the last 4 bear years. I couldn't resist doing the same for silver. Every single year 2001 - 2014 silver rallied off summer lows (one on 30 May, rest June, July) substantially -- an average 26.9%. No exceptions. I checked year-end prices, too. On average from the summer silver low to year-end silver gained 15.6%. In only 5 years was the year-end price not higher than the summer low: 2008 (financial crisis), 2011, 2013, and 2014, those last bear market years. I'm counting that as supporting my presupposition we are seeing summer lows, or at least decreasing the riskiness of it. The halt on the NYSE did not mean stocks could not be traded on other exchanges, so investors took advantage of that flexibility to SELL elsewhere. Dow waterfalled 261.49 (-1.47%) to 17,515.42 -- the lowest close since 3 February. S&P500 cascaded 34.66 (-1.53%) to 2,046.68. You are seeing gator jaws within gator jaws within gator jaws snapping shut. Dow is now firmly below its 200 DMA. So, too, is the S&P500, at its lowest since March. Ditto for the Dow Jones Composite, Dow Transports, and Dow Utilities. It's a breakdown whichever way you look.

US dollar index - Thanks to the Nice Government Men?? -- fell back today below 96.50 to 96.47, losing a large 60 basis points (0.62%). Odd, but it doesn't invalidate the uptrend, or even the breakout. It fell barely back into the even-sided triangle, and should continue rising. Raising more suspicions, the euro, which has all the same charms going for it as the anthrax bacillus, rose 0.66% today to $1.1076. In currency markets, when things don't trade as expected, there's a reason, and usually it's political. Treasury yields fell slightly today (bond prices rose slightly), with no sign of reversing. Uptrend has been broken in the yield. On 8 July 1889 the Wall Street Journal began publishing. On 8 July 1896 presidential candidate William Jennings Bryan gave his famous cross of gold speech at the Democratic Convention in Chicago. Arguing for a return to gold/silver bi-metallism and away from the gold standard that had been imposed on the US, Bryan concluded his speech, "You shall not press down upon the brow of labor this crown of thorns; you shall not crucify mankind upon a cross of gold." Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Caught On Tape: The Other Crisis Happening In Greece Posted: 08 Jul 2015 05:00 PM PDT With all eyes firmly focused on pensioners at the gate and ATM lines, there is another - just as cruel and unusual - crisis occurring in Greece. Europe's immigration 'problem' is front-and-center on the island of Lesvos, as KeepTalkingGreece reports, unbelievable scenes as refugees try to raid a food truck. No, this is not Somalia...

The incident took place when nearly 2,500 migrants hosted in the camp of Lesvos (Mytilene) municipality in Kara Tepe saw the catering truck approaching. They started to run for a plate with food. Reason fro the panic to be left hungry without food was a rumor claiming that catering service for refugees had stopped on the island of Samos due to debts. With hundreds of refugees and undocumented migrants arrive daily to Greece from Turkey, the situation has gone out of control.

On Tuesday, another boat carrying people to Greece sank, more than 10 people went missing. Next to the Greek humanitarian and economic crisis and the country on the brink of collapse, there is also the Refugees Crisis. Europe is keeping eyes and ears closed, while Eurocrats like European Commission President Jean-Claude Juncker are making ‘nice promises’ for aid and relocation to other EU countries. On the islands in Eastern Greece where the refugees arrive per boat and in other cities, many citizens have been set volunteers’ initiatives to help refugees. The initiatives are been supported by local business that do whatever they can amid the worst financial crisis since 2010.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cyber False Flag -- Do You Really Believe A Glitch Closed The Stock Market Posted: 08 Jul 2015 03:12 PM PDT Alex Jones breaks down how you are being distracted by nonsense while the globalists destroy the world. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Silver Wheaton Corp. Dropped 11% on Tuesday Posted: 08 Jul 2015 02:45 PM PDT On Tuesday Silver Wheaton Corp. (TSX:SLW)(NYSE:SLW) dropped from the previous day’s close of $22 to $19.70, a whopping 11%. What caused the drop? The Canadian Revenue Agency (CRA) is proposing to reassess Silver Wheaton relating to income earned by the company’s foreign subsidiaries outside of Canada. The CRA thinks the tax should be increased for the 2005-10 taxation years. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRITICAL: Major Global Deleveraging Occurring NOW! NYSE Trading HALTED. By Gregory Mannarino Posted: 08 Jul 2015 02:00 PM PDT The dollar is dying as can be seen by the price action of gold. In 2008 an ounce of gold was $800 an ounce, today it is $1,150. Simply put, it now takes more weaker dollars to buy one ounce of gold. 2. It is NO SECRET that world central banks ARE buying gold. 3. In my opinion silver is the most... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Fearful Odds Posted: 08 Jul 2015 01:38 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jade Helm toys for kinder and friendlier Martial Law Posted: 08 Jul 2015 01:09 PM PDT Step right up folks and get your full color brochure on the new transhuman virtual human soldier that improve lethality with offense cyber operations. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Jul 2015 01:00 PM PDT This post Brush Fires Everywhere appeared first on Daily Reckoning. "Beijing is throwing everything and the deep-fry wok at the markets to try and stabilize them," writes Greg Guenthner of our trading desk. "The big joke now is that they’ll just give up and make it illegal to sell shares." Some joke. Moments after Greg's Rude Awakening hit subscriber inboxes this morning, Bloomberg posted this story: "China's securities regulator banned major shareholders, corporate executives and directors from selling stakes in listed companies for six months, the latest effort to stop a $3.5 trillion rout in the nation's equity market." About half of China's listed companies have suspended trading anyway — up from about a third yesterday. Still, the Shanghai Composite Index slid another 6% today. That's a 32% drop from the peak on June 12. On the other hand, it's still up 72% from this time a year ago. "I have mentioned before that a 40% correction in Chinese stocks should be expected?" writes the estimable Marc Faber in his latest Gloom, Boom & Doom Report. "This would likely lead to weakness in other Asian stock markets as well. Should Asian stock markets decline more meaningfully (by 20% or more), it is likely that there would be a spillover effect, which would spread to Europe and the U.S. as well." Tumultuous, for sure, but not the end of the world. "China may have a multibillion-dollar meltdown," our own Jim Rickards explained in Monday's Daily Reckoning, "but it has a multitrillion-dollar fire hose in the form of its official reserves." For what it's worth, Chinese state media are taking the longer view. The business programming on English-language CCTV News acknowledges the market turmoil, but it's not the big story… Ufa, Russia, is the scene of two summits this week. First come the BRICS nations — Brazil, Russia, India, China, South Africa. At the top of the agenda is the launch of something called the New Development Bank — a competitor to the World Bank and International Monetary Fund. Then comes the Shanghai Cooperation Organization — comprising China, Russia and four of the central Asian "-stan" countries. India and Pakistan are likely to join this week. Both groupings amount to what Jim Rickards labels an anti-dollar alliance. "All of these countries," he said here in The 5 last December, "are clear about their desire to break free of U.S. dollar dominance." Regards, Dave Gonigam P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Brush Fires Everywhere appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

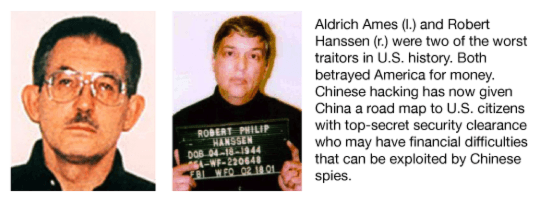

| Posted: 08 Jul 2015 12:54 PM PDT This post The Mother of All Hacks appeared first on Daily Reckoning. Editor's Note: Jim Rickards has published a third book entitled "The Big Drop: How to Grow Your Wealth During the Coming Collapse." It's available exclusively for readers of his monthly investment letter called Strategic Intelligence. Before you read today's essay, please click here to see why it's the resource every investor should have if they're concerned about the future of the dollar.] Computer hacking is commonplace. Barely a day goes by without some company or government agency announcing that one of its systems has been compromised or attacked. These attacks can take many forms. The most common is a distributed denial of service, or DDOS. In this type of attack, a system is overwhelmed with malicious message traffic so that legitimate users of a website cannot gain access. A DDOS attack does not actually penetrate the system or steal information. It simply obstructs normal access so that the target site is effectively shut down. Attacks that penetrate firewalls and get inside a system are more serious. These are often conducted by criminal cybergangs who steal credit card and password information that can then be used to conduct unauthorized purchases of goods and services. This is a more serious kind of breach, but the damage is usually limited by cancelling compromised credit cards or accounts and issuing new ones to affected customers. This can be annoying, time-consuming and somewhat costly, but not life-threatening to the parties involved. In addition to financial losses, such attacks can cause enormous reputational damage to the entity whose systems were breached. The 2013 hack of Target Corp. (NYSE: TGT) was executed just ahead of the Thanksgiving-to-Christmas shopping season and involved the theft of 40 million credit card numbers and 70 million pieces of personal information, such as customer addresses and phone numbers. Target's stock crashed, and the company was subject to over 90 lawsuits alleging negligence. Target spent over $60 million in damage control immediately following the attack, but final damages will total in the billions. Many customers closed their Target accounts and refuse to make further purchases there. The reputational damage to the Target brand continues to this day. Similar attacks have been launched against JPMorgan Chase, Home Depot and Anthem Health Insurance. Many more have happened, and many more are yet to come. The most damaging attacks are not those launched by criminal gangs seeking financial gain. The most dangerous are those launched by the military and intelligence agencies of Iran, China, Russia and other rivals of the United States aimed at damaging national security and critical infrastructure. These attacks may involve the theft of secret military, intelligence and diplomatic files. Some attacks seek to gain control of critical infrastructure and involve the use of sleeper viruses that can be switched on to disrupt a system at a particularly opportune time for an enemy. For example, a virus implanted in the control system of a hydroelectric dam could open floodgates to inundate downstream targets, killing thousands by drowning and destroying bridges, roads and agriculture. Other viruses could shut down major stock and commodity exchanges. In 2010, the FBI and Department of Homeland Security discovered an attack virus in the computer systems of the Nasdaq stock market. That virus was disabled, but others may remain. On Aug. 22, 2013, the Nasdaq was mysteriously shut down for over three hours, disrupting trading in Apple, Google, Facebook and other investor favorites. No detailed explanation for the outage has ever been offered except for vague comments about "connectivity." A malicious attack by Russia has not been ruled out. Military planners make use of a fighting doctrine called the "force multiplier." The idea is that any given weapon can be used with greater-than-normal effect when combined with some other state or condition that gives the weapon greater impact. For example, if Russia wanted to disrupt a U.S. stock exchange, they might wait until the market is down over 3%, say, 500 points on the Dow Jones index, for reasons unrelated to the cyberattack. Launching the attack on a day when the market is already nervous would "multiply" the impact of the attack and possibly result in a drop of 4,000 Dow points or more, comparable in percentage terms to the one-day drop on Oct. 19, 1987. All of these scenarios are worrying enough, but the U.S. government has just suffered a cyberattack even worse than shutting a stock exchange or opening the floodgates on a dam. Last month, it was revealed that Chinese hackers had gained access to the files of the U.S. Office of Personnel Management (OPM). The exact number of files stolen is not clear, but estimates of individuals affected range from 4 million up to 32 million. The Chinese hackers actually obtained credentials to gain access to the system, and once inside systematically downloaded the database. If the stolen information were limited to names, addresses, Social Security numbers and the like, the damage would be immense and the affected individuals would be at constant risk of harassment and identity theft. But the damage was far worse. Many of the files consisted of responses to a questionnaire called Standard Form 86, or SF-86. This is the form used to apply for security clearances up to and including the top-secret level. The form itself is 127 pages long, which is daunting enough. But the attachments and documentation required to support the information on the form, including tax returns, personal net worth statements, explanations of answers to certain questions, etc., can run to hundreds of pages more. The government requests this information in order to evaluate the fitness and loyalty of those applying for security clearances. A typical question is: "Have you EVER been a member of an organization dedicated to the use of violence or force to overthrow the United States government, and which engaged in activities to that end with an awareness of the organization's dedication to that end or with the specific intent to further such activities?" The U.S. government also requests extensive personal financial information. The reason is that someone with a security clearance who is in personal financial distress can be compromised by a foreign intelligence agency that offers that individual cash to betray his country. Treason for money was the motivating factor in the notorious cases of Aldrich Ames at the CIA and Robert Hanssen at the FBI.

Since the U.S. uses SF-86 to identify vulnerabilities in our intelligence agents, the Chinese can do the same. By gaining access to the SF-86 files in the OPM computers, the Chinese have a virtual playbook on how to identify and compromise those entrusted with America's most sensitive top-secret information. Many observers believe that such cyberwarfare and criminal cyberhacking is inevitable and there is not much that computer systems operators can do to fight it. This is not true. In fact, there are effective firewall, encryption, compartmentalization, verification and other cybersecurity techniques that companies and governments can use to safeguard their information. The problem is that such solutions are expensive, and so far, companies and government agencies have been unwilling or simply slow to take the needed measures to protect critical data. This mindset is changing. The costs of data breaches, both financially and in terms of national security, are simply too high. Suddenly solutions that used to seem expensive now seem cost-effective compared with the damage caused by systems compromises. A massive multibillion-dollar tidal wave of spending on software and systems security is about to be unleashed. A relatively small number of firms stand to benefit the most because of their talent, track records and trustworthiness. The time to look at this space is now. Regards, Jim Rickards P.S. If you haven't heard, I've just released a new book called The Big Drop. It wasn't a book I was intending to write. But it warns of a few critical dangers that every American should begin preparing for right now. Here's the catch — this book is not available for sale. Not anywhere in the world. Not online through Amazon. And not in any brick-and-mortar bookstore. Instead, I'm on a nationwide campaign to spread the book far and wide… for FREE. Because every American deserves to know the truth about the imminent dangers facing their wealth. That's why I've gone ahead and reserved a free copy of my new book in your name. It's on hold, waiting for your response. I just need your permission (and a valid U.S. postal address) to drop it in the mail. Click here to fill out your address and contact info. If you accept the terms, the book will arrive at your doorstep in the next few weeks. The post The Mother of All Hacks appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A bullion banker sings in Berkeley Square Posted: 08 Jul 2015 08:49 AM PDT 12:05p ET Wednesday, July 8, 2015 Dear Friend of GATA and Gold: In an interview posted today at Arabian Money, the CEO of London bullion dealer Sharps Pixley, Ross Norman, makes comments that Arabian Money construes to mean: "Somebody big is sitting on the gold price": http://www.arabianmoney.net/gold-silver/2015/07/08/somebody-big-is-sitti... That's not a direct quote from Norman's interview. It's Arabian Money's characterization of his remarks, placed in the interview's headline, and seems to be drawn from this quotation: "'Gold is looking like the dog that just did not bark -- but not uniquely so. Most safe-haven assets are looking distinctly lackluster, including the VIX index. Either 5,000 years of safe-haven buying has just become bunk, or there is a desire to portray what is evidently a financial and economic crisis as nothing to be concerned about." ... Dispatch continues below ... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: But Norman can't be displeased with Arabian Money's characterization, since at this hour Sharps Pixley is leading its own Internet site with the same headline and a link to the interview: Since Sharps Pixley and Norman are -- or at least long have been -- prominent and fully respectable members of the London bullion banking establishment, with offices at Berkeley Square in exclusive Mayfair, Norman's remarks are stunning, even if many dreary years of anomalous behavior in the gold market have been required to provoke them. So is it possible that obliviousness or disingenuousness are no longer prerequisites for membership in that establishment? Might, a few centuries from now, even the supposed representative of the gold mining industry and gold investors, the World Gold Council, also notice and acknowledge what Norman has just noticed and acknowledged, thereby ending the council's daily re-enactment of the "nothing to see here" scene from "The Naked Gun"?: https://www.youtube.com/watch?v=rSjK2Oqrgic Just imagine what might come of broader acknowledgment that "somebody big is sitting on the gold price." Eventually others in the gold business might wonder: Exactly who is big enough to sit on the gold price so successfully? Who has done it before and would have such enormous resources and such compelling interest to do so again? Might central banks have anything to do with it? Should someone ask them? (Documentation relevant to such suspicions can be found at GATA's Internet site here: http://www.gata.org/node/14839.) After all, there's a central bank -- the Bank of England -- only 3 miles east of Berkeley Square and less than a mile east of the World Gold Council's luxurious offices at Old Bailey. Someone could always knock on the door. Maybe the major news organizations headquartered in London could be induced to ask as well, on the possibility that the gold market might have implications for other financial markets -- implications even for the distribution of power throughout the world. In that case Norman's interview could turn out to be the most momentous event in Berkeley Square since the nightingale chirped at the songwriter and his lady friend: https://www.youtube.com/watch?v=xTeiYN_Vq6E CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Mint Suspends Silver Sales Posted: 08 Jul 2015 07:34 AM PDT This post U.S. Mint Suspends Silver Sales appeared first on Daily Reckoning. Today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! Well, here we are on a Wonderful Wednesday, and the currencies are attempting to fight back this morning, but the results are mixed at this point. Greece made their journey to Brussels yesterday, and requested a loan from the ESM (Emergency Stability Mechanism). Greece has basically been told to come back by the end ofThursday with their plan to reform their economy, so that paying back the loan is workable. Sunday apparently is the “drop dead” date after that, Greece is in uncharted waters of gloom, despair and agony on them. Spending cuts, higher taxes, and reforms to pension programs that pay out more than they take in. Does that sound like too harsh of austerity measures to obtain a loan that would keep your country from falling into an abyss? Say with me again, spending cuts, higher taxes and pension reforms. Spending cuts, higher taxes, and pension reforms. Sort of like Dorothy, the scarecrow, the Tin Man, and of course Toto, saying, “lions and tigers and bears, oh my, Lions and tigers and bears, oh my.” And the thing that scares the bejeebers out of them is the Cowardly Lion. Which seems so apropos given this situation in Greece. The euro is one of the currencies with gains vs. the dollar this morning. I guess there’s a new attitude toward coming together and forming an agreement among the members. Donald Tusk, who chairs meetings of European leaders, is hoping that the negotiators can “do better,” for if they don’t, “everyone will lose.” And that’s basically where this all is as we head to the end of the work week. We’ll know for sure at the end of this week (Sunday) if there is a deal to kick the can down the road, or prepare for an exit. There are so many economists, analysts, pundits saying that an exit is the only answer for Greece, but remain steadfast in my thought that an exit won’t happen. I saw a comment online last night that would be funny if it weren’t true. That China has lost many multiples of Greece in market cap in the last three weeks. Kind of puts the Greek thing in perspective, doesn’t it? Alrighty then… let’s talk about something else besides Greece and the eurozone! The price of oil keeps dropping, along with the yield of the 10-year treasury. So, what is it that the bond guys are telling us right now? Just a couple of weeks ago, the 10-year yield was heading toward 2.40%, and today it’s 2.21%… Sure safe haven buying is pushing yields down further, but it can’t be all that, can it? Is this also an indication that the bond guys don’t think interest rates are going higher this year? Probably some of both. Speaking of whether there’s a rate hike this year or not… It’s not often that I get to mention the IMF without a sneer on my face, or having a snarky remark in my back pocket to pull out and use when appropriate, but not today. So, without further ado… I see where the IMF is telling our Fed Reserve (Fed) that the IMF doesn’t see inflation as measured by the Fed’s favorite measure — remember I told you it was the PCE? — hitting 2% through 2017. The IMF is fearful of a Fed rate hike, folks. They are fearful, because the world’s economy is on tenterhooks, and a tightening of money in the economy that’s tied for first place in size with China would negatively affect the rest of the world’s economies. Earlier this year, the IMF requested that the Fed wait on hiking rates. I’m not sure how well that played over at the Fed’s offices. Was it on the Hit Parade with a bullet to the top? Or was it deep sixed in the nearest trash can? I don’t like it, you can’t dance to it, and I don’t understand the words! HA! You see, I don’t think the Janet Yellen-led Fed, appreciates one iota being told or even hinting at what they should do by the IMF, or anyone as far as that’s concerned. But, the IMF is correct when they say, “We feel there is space for them to wait,” said Nigel Chalk, the IMF’s U.S. mission chief, noting that inflation is far from the Fed’s 2% annual rate target. As measured by the personal consumption expenditure price index, the annual growth in inflation was just 0.2% in May.” I, myself, have pointed this out to you previously, so maybe the folks at the IMF are Pfennig Readers! I also pointed out the NAIRU, remember? The “non-accelerating interest rate of unemployment,” and we’re still a few percentage points away from that, when you use the BLS’s figures. I’m sure the Fed’s economists are smarter than the average bear, and aren’t confused by the BLS figures. Well, I’m hoping they don’t! A couple of months ago, I told you about the Rocktober time table that a few writers are writing about as the time when the financial system comes under tremendous pressure, and collapses. I had several dear readers send me notes asking me what I thought about this. And I told them that I understand the basis from which these analysts/writers are coming from with this call, but I hesitate to put down a date by which something will happen. Remember Iben Browning? He was the scientist that said that the New Madrid Fault, of which we live nearby, would cause a major earthquake in early December 1990. I’ll always remember this, for I was on the “earthquake preparedness team” at Mark Twain Bank. We had to do Disaster Planning and the whole 9 yards to prepare for the devastating earthquake that never came. Two things to think about folks; when you put a data on something, it can come back to haunt you, and was all the planning for a disaster a waste of time? Hardly. The Bank experienced things it should have been aware of or thinking of and at least doing something about. And in the end was it bad thing that they were prepared for the worst, and it didn’t come? No. And that’s how I tie this all to owning gold. You’ll have to put two and two together here, because to go any further would put me in line to get my wrists slapped. But I’m sure you won’t have any problems seeing where I would be going with that… I can’t get my arms completely around the financial system collapse, but I have to say that I’ve read all the reports and they make sense. I just never really thought that what we have now would collapse, and there would be a “reset”, especially with China around. But now China is having problems of their own it makes a little more sense. But I worry about this Rocktober date, and cringe. And whenever someone mentions a data that the markets, economies will react to something, I think of Iben Browning. Speaking of China… it appears that even with the announcement of Sunday of an injection of liquidity into the stock market, that the selling is going to continue, and that has me worried about how China will react to this. I sure hope they don’t go the Japanese route, when their stock market began to crumble in 1990… for that sure didn’t work. Budget stimulus, Quantitative Easing, (it wasn’t called that then) and ZIRP (zero interest rate policy). Memo to China: I know you have a treasure chest of reserves, but don’t blow them all on attempting to save your stock market from a nasty sell off. It’s far better to just allow the excesses to clean themselves out, and start again from a new base. In other words, just allow the markets to be markets. Remember when the rumors of LIBOR (London Inter-Bank Offering Rate) price manipulation were considered to be conspiracy, and something that “couldn’t happen”? Well, conspiracy has become fact in this case, and to show you just how brazen these guys were doing the manipulation, a traders at UBS Group AG was on the witness stand in court yesterday and the prosecution presented an email that he sent 9 years ago that asked him if the LIBOR fixings were manipulated, and he responded, “Yes, of course they are, just give the cash desk a Mars bar and they’ll do whatever you want.” I would say that this guy’s claim that he’s not guilty of conspiracy to manipulate LIBOR, is not on terra firma after this email, eh? I tell you this to point out that the conspiracy things I used to talk about aren’t always a bunch of baloney! And this seems to be about as good a place to talk about gold as any, eh? Yesterday, on the website www. How is it that day after day gold and silver get smashed when the New York Comex floor trading opens? Does it seem odd that all of a sudden, nearly every day for the last four-plus years at 8:20 a.m. ET all the world decides to unload paper gold and silver positions? How is it at all possible that the prices of gold and silver are collapsing like this when China has imported a record amount of gold in the first half of 2015? China and India combined are importing more gold than is being produced on a daily basis. India is importing by far a record amount of physical silver. These countries require the physical delivery of the metal they buy. It’s not good enough for the bullion banks to offer free vault storage in London or New York. The misrepresentation of the true, intrinsic price of gold and silver by the New York and London paper markets is perhaps the greatest fraud in history. Well, gold got whacked again yesterday, and the only thing I can say about it all is to think of all this whacking as an opportunity to buy at cheaper levels, for I don’t believe this to be something that’s going to last forever, the cheaper prices that is. Yesterday, Gold Researcher, Koos Jansen wrote a very interesting piece for the website: www.bullionstar.com, titled “China Rapidly Changing International Gold Market,” and in the piece, he shows readers the steps China has made, and is proceeding toward making, to changing the international gold market, as part of a detailed plan to move the pricing of gold from West to East. I strongly suggest you go there and read that. you can find it by clicking here. And get this… the U.S. Mint suspended sales of American Eagle coins due to strong demand outpacing supply. The Mint said they would resume sales in two weeks. So, on a day when the U.S. Mint suspends silver sales, how can the price of silver lose nearly 1 full cent? Lucy. You’ve got some explainin’ to do! There was some good news someplace in the world overnight. Down under in New Zealand, they printed a better than expected Treasury surplus of NZ$ 1.18 billion vs. a forecast of NZ$ 193 million. So, it blew the forecast out of the water! But even with this news, the N.Z. Budget is still expected to be a deficit this year of NZ$ 684 million. Wouldn’t that be great to have a budget deficit here in the U.S. of $684 million? We spend, as a nation, more than that daily as a part of deficit spending… Oh! Sorry to go off on that tangent! Kiwi is stronger by ½ cent this morning on this news, but hasn’t been able to drag the Aussie dollar (A$) along for the ride today. Tonight, Australia will print their latest labor numbers, and any upside surprise would help the A$ to recover some lost ground, in my opinion, which could be wrong! The U.S. data cupboard has May consumer credit, which given the retail sales in May which weren’t that great, we could actually see consumer credit (read debt), drop a bit from the April figure of $20.5 billion. But the Big Kahuna as far as the markets are concerned in an attempt to get Greece off their minds, will be the printing of FOMC’s latest meeting minutes from June. You know the one where the Janet Yellen had to inform the markets that there would be no rate hike? Yes, that one. Yesterday’s data cupboard saw the trade deficit widen, but that was expected, so we move along for these aren’t the droids we’re looking for. Last week I told you about the problems with Puerto Rico’s debt and their inability to repay it, and how the muni-bond insurers like AIG, and others, would be on the hook for this inability to repay $72 billion of debt. Well, yesterday, Puerto Rico’s request to have their debt treated like bankruptcy was turned down, and that brings them back to square one and their inability to repay the debt. You see, Puerto Rico is a territory not a state, and therefore it can’t file bankruptcy like a state or city like Detroit can. And they can’t restructure their debt either. Uh-Oh! I found this on the Bloomberg this morning folks. And unlike most things I find on the Bloomberg, this one can be found on the internet by clicking here. Of course I have a couple of snippets for you here: Greece’s debt turmoil has found a favorite conduit for spreading contagion: the $5.3 trillion-a-day foreign-exchange market. From Sweden to Switzerland, central banks are battling to contain an appreciation of their currencies versus the euro. Greek risks are also infiltrating markets in Eastern Europe after Greece’s decisive vote against austerity this week. Even the Bank of England, whose economy is showing signs of a gradual recovery, may find itself compelled to delay tightening monetary policy, while Japan has signaled it may boost stimulus if the yen strengthens. “The likes of the Swedish krona and Swiss franc should be worried about a cheaper euro,” said Stuart Bennett, London-based head of Group-of-10 currency strategy at Banco Santander SA, Spain’s biggest bank. “If that happens, it hampers their fight against their low inflation. The BOE might not like the idea that sterling gains as a safe haven. It’s a European issue, but a global foreign-exchange risk.” The concern for the Swiss National Bank and Sweden’s Riksbank is that the Greek crisis will weaken the euro. Both are struggling to stoke inflationary pressures, and strengthening currencies make that harder. The BOE, which saw the pound reach a seven-year high against the euro last week, has also expressed concern that the exchange rate with the euro may slow U.K. economic growth. Chuck again. Yes, they had better be prepared to fight off euro weakness from here, because it will make their lives very difficult. And you know who else will suffer from euro weakness? The U.S., because imports from the eurozone will be so much cheaper, and imports could outweigh exports, as the dollar strength puts the kybosh on exports. That’s it for today. I hope you have a wonderful Wednesday! Regards, Chuck Butler P.S. The Daily Pfennig is first published everyday, right here. Editor's Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post U.S. Mint Suspends Silver Sales appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Spot Prices Increasingly Detached from Reality Posted: 08 Jul 2015 05:46 AM PDT Clint Siegner writes: An insolvent Greece has defaulted. On June 30th, officials missed repayment of billions in lMF loans and declared a banking holiday. Predictably, many Greek citizens responded to the crisis and bought gold coins. So did a lot of people here in the U.S. and around the world. You just wouldn’t know it by looking at spot prices. The regular disconnect between the futures markets, where spot prices are set, and the physical markets reveals a growing problem. The link between the spot price and physical demand is thin at best. That is why the base price for gold coins in an Athens coin shop can get cheaper, but the all-in cost of buying the coins goes up as the line of buyers grows. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ALERT! U.S. Mint Suspends American Silver Eagle Sales Posted: 08 Jul 2015 02:29 AM PDT ALERT! We have received word through an industry source that the U.S. Mint temporarily suspended sales of American Silver Eagles due to strong investor demand. It intends to resume sales in two weeks. The Mint sent out an announcement to this effect earlier today. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Understanding China, Gold, & Seasonality Posted: 07 Jul 2015 11:11 AM PDT Graceland Update |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Somebody big is sitting on the gold price and a relief rally when the Fed raises interest rates is 'a distinct possibility', Ross Norman, CEO of Sharps Pixley and London Bullion Market Association's top forecaster of the past 15 years, told ArabianMoney today. 'Gold is looking like the dog that just did not bark – but not uniquely so,' he commented. 'Most safe haven assets are looking distinctly lacklustre, including the VIX index.

Somebody big is sitting on the gold price and a relief rally when the Fed raises interest rates is 'a distinct possibility', Ross Norman, CEO of Sharps Pixley and London Bullion Market Association's top forecaster of the past 15 years, told ArabianMoney today. 'Gold is looking like the dog that just did not bark – but not uniquely so,' he commented. 'Most safe haven assets are looking distinctly lacklustre, including the VIX index.

The failure of gold to respond to Greece has attracted a lot of mainstream and goldbug comment. Goldbugs have focused on increases in demand as reported by coin dealers in articles such as

The failure of gold to respond to Greece has attracted a lot of mainstream and goldbug comment. Goldbugs have focused on increases in demand as reported by coin dealers in articles such as

No comments:

Post a Comment