Gold World News Flash |

- Gold Up & S&P Down?

- Gold Daily and Silver Weekly Charts – No Soup For You

- GUEST POST: Piece by Piece… or All At Once?

- First Warning Signs of a 2008-Like SILVER SHORTAGE – U.S. Mint Just Suspended U.S. Silver Eagle Sales, Due to MASSIVE DEMAND

- Price of Gold Plunged $20.50 or 1.7 Percent to Close Comex at $1,152.40

- 'Owners Per Ounce' of Gold at the Comex

- Bron Suchecki: Conspiracy, complacency, and the death spiral phase

- China Crashes Most Since 2007 Amid "Panic Sentiment"; Over Half Stocks Suspended, PBOC Promises "Liquidity Support"

- U.S. Mint sold out of silver coins due to strong demand

- China Now Risks "Financial Crisis"; Loses Could Be "In The Trillions" BofA Says

- Greek Meltdown Spells Trouble For U.S. Markets

- Merkel Mocks Greece And The Referendum: There Is Money, But The Deal Is Much Harsher Now (And No Debt Haircut)

- Cronyism Pays: Eric Holder Triumphantly Returns To Law Firm That Lobbies For Banks

- GERALD CELENTE - The Collapse Has Already Begun. Watch Out For China!

- Americans wary of Financial Collapse -- The Alex Jones Show July 7 2015

- Gold Daily and Silver Weekly Charts - No Soup For You

- Cosmic Consciousness - Dr. Bill Deagle

- My Conversation With Ben Bernanke

- Aspartame Is Killing You! Stop Now! -- Betty Martini

- USAGold: U.S. Mint suspends sale of silver eagle coins

- Can You Imagine The Fed Raising Rates In This World?

- Understanding China, Gold, & Seasonality

- TF Metals Report: Commodity collapse

- Greece Debt Crisis to Trigger Euro-zone Credit Freeze, Expiry of Greek Euro Bank Notes

- Don't keep monetary metals in bank safe-deposit boxes, Turk warns

- Dave Kranzler: Gold and silver are paper-slammed -- Is the system collapsing?

- Chinese trading suspensions freeze $1.4 trillion of shares amid rout

- Rick Rule: Some of the Best Oil Plays Are in “Midstream” Stocks

- Greece is Just the First of MANY Countries That Will Be Going Belly-Up

- One Last Ditch Effort To Agree

- Koos Jansen: China rapidly changing international gold market

- Major Market Events Take Shape

- New Zealand Dollar Could Rally Double Digits in the Coming Months

| Posted: 07 Jul 2015 11:30 PM PDT by Gary Christenson, Deviant Investor:

This begs the question, is the S&P high, gold low, or both? Consider this log-scale chart of the S&P and the 65 week moving average. The S&P 500 Index is about 100 points (June 26, 2015) above its 65 week moving average, as shown by the blue moving average line on the graph. The Disparity Index (deviation from the 65 week moving average) shows that the S&P has been strong since 2012. The upward trend line will be broken with a decisive fall below about 2,080, which seems likely to occur soon. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts – No Soup For You Posted: 07 Jul 2015 09:40 PM PDT from Jesse's Café Américain:

Stocks were rallied hard off the bottom, as some fearless buyer stepped in and sparked a short covering rally. Gold languished, but silver managed to take back the 15 handle at least. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| GUEST POST: Piece by Piece… or All At Once? Posted: 07 Jul 2015 08:25 PM PDT by Bill Holter, SGT Report:

Now what? Greece basically can go down three very different roads. They can use their “new freedom” to either negotiate new aid and restructuring, they can stay in the Eurozone while not paying on their debt and using a new drachma or, …they can go full Iceland! Please understand this, no matter what they choose, their banking system is inedible toast and they cannot pay their debt service let alone the principal. The bottom line is “someone” will have to eat the losses. Whether it be the ECB itself, European banks or whomever, the debt will not be paid and someone, somewhere will have to “lose”. Keep in mind this is happening while liquidity is already quite tight.

It is possible we could see some sort of deal where “the world is saved” and a violent short covering rally in everything ensues. Should this occur, do not be fooled because nothing can nor will be fixed. Can they buy a month or three months time with Greece? Probably but as liquidity is drying up, accidents are more likely to happen. Countering this thought process, Greece does also have an “out” should they decide to turn toward any help offered by Russia and China. If this is the choice, I believe it’s a very good bet that rioting and even a coup may be “helped” from the shadows. I won’t elaborate on this but should it appear Greece is moving away from the West, unrest of all sorts will surely be “stirred” up! Of their options available, I personally believe they should go “whole hog Iceland”. What is best for Greece for the future would be to put a moratorium on payments and outright default. They would then be forced to issue a new drachma to conduct commerce with. I also believe they should leave the Eurozone and focus trade toward the East where their new drachma would be more likely to be accepted. Greece would be forced to “start over” from ground zero, not a happy prospect but one where at least a foundation exists. The “old” world order will not stand in the long run, it may fall apart piece by piece or all at once. The piece by piece scenario would include Portugal, then Spain, and then Italy (with France mixed in there) wanting to go down the same Greek road. We very well may see national referendums becoming the new fad. All of these countries will want some sort of relief from their debt as the numbers are clearly unsustainable. Talk of the situation being contained is laughable. So laughable, the whole system could go from “normal” to “over” in 48 hours in my opinion. Look around the world, China is now down 25+% in just over three weeks. Europe, it’s currency and even the Union itself is in question …and the Federal Reserve needs to do something in the credibility department. What I am saying is this, can the Fed really tighten ANYTHING in the current environment? As I mentioned previously, liquidity is rapidly going away …in an over indebted system this is the most potent of poison! As I see it, a massive dose of new QE will have to be administered just to keep the doors open. Watch for this! Meanwhile, “we” look like idiots to those we have tried to help. While the credit market is on the cusp of breakdown and full seizure, gold and silver prices got smashed again today. Funny thing though, even though there has been so much “selling”, the U.S. Mint has apparently suspended sales of Silver Eagles! I will ask the question again as I have before, if there is so much “selling” of silver, why can’t the Mint source it to sell? It is their mandate! It is the law (which matters not anymore)! Are we moving into a zone where COMEX prices will get hit further …while the mint sells nothing until August (if we even make it to August) …and then we see some sort of credit/financial/international event where force majeure is declared? For whatever reason the Mint can conjure …can’t source metal …can’t keep up with demand …or whatever, a suspension of sales does not jibe with massive panic selling of “metal”. Unless of course they say “we are suspending sales because there is no demand”. I am sure a statement like this could be spun as Gospel truth! Folks, we stand on the verge of the global credit markets coming to a grinding halt. In our current world, NOTHING that we consider “normal” will transact or transpire without credit. Our lives will change literally overnight without credit. We are about to live through a massive wildfire of credit values burning to the ground, gold and silver will still be standing when the smoke clears. It is completely laughable to see gold and silver forced down when the fear of credit collapse is rising. Mother Nature doesn’t work this way, central banks wish she did! I hope you have the will to “see through it”, the coordinated efforts to support paper markets and suppress gold and silver have been truly impressive. The currency of the biggest, most indebted and “brokest” issuer in the world is attracting safe haven bids. I assure you, once control is lost and we go into all out panic, even those pulling the levers will be moving against their own central banks! Bill Holter photo: Wikipedia | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jul 2015 08:00 PM PDT by Andrew Hoffman, Miles Franklin:

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Price of Gold Plunged $20.50 or 1.7 Percent to Close Comex at $1,152.40 Posted: 07 Jul 2015 07:42 PM PDT

Let's get one thing straight: my interpretation presupposes that we are witnessing seasonal lows for silver and GOLD PRICES that will follow the usual seasonal pattern and pull up the rest of the year. If I am wrong about that, then silver and gold prices could plunge as bad as some analysts have been calling for. Until I see that confirmed, I will stick with my seasonal low interpretation. The gold price made its low for the post-2011 correction last November at $1,130.40. Draw a line from there through the March low and it will form the bottom boundary of an even-sided triangle that gold broke up out of in May, only to collapse. Extend that boundary and you catch today's gold low. Also, gold is right on that downtrend from October 2012. Gainsayers: RSI is not oversold as it was in November and May, nor are other indicators at the same extremes. That makes me gulp, but I'm sticking to my seasonal pattern story all the same. The SILVER PRICE pierced $15.50 support stretching back to last November. Remember that freaky one day silver plunge on 1 December 2015, when it went down to $14.165 instantaneously and just as instantaneously recovered on huge volume? Well, that's the next support, if today doesn't belong to a one or two day wonder spike low. As with the gold price, RSI and other indicators aren't particularly encouraging, but that's the way it always is at bottoms. Confirmation comes later.

I'll be switched! I have one other little thing to think about: Bollinger Bands. Gold price today touched its THREE standard deviation lower BB. Silver cut clean through its 3-sigma BB and then some, just like 1 Dec 2014. That would indicate a turnaround lies not far in the future. I'm not minimizing the risk that silver and gold will fall further here, but I am also looking at a world economy trying to shake apart like an old Yugo, with the only rotten, scrofulous fiat currency standing the US dollar, and it's leprous. Whatever respectability the dollar had left has been all squandered since 2008 by the Fed. In a panic that dollar might shoot up, but when the dust begins settling, silver and gold will surge -- and last. I know y'all are all worked up about today's markets and the metals' plunge, but I'm gonna circle around it first.

Sprinkle in liberally a little history: the development of every undeveloped economy always ends in overdevelopment and crash. Then there is the myth peddled everywhere and believed by everyone that a nation run by socialists at the top -- notwithstanding their ingrained Marxism --can become the world's economic Wunderkind. I reckon all those believers thought corruption was going to save Chinese capitalism from communism. Since about 16 June the Shanghai Index has plummeted 28% at today's low. Last week the Chinese government pulled out all stops to check the panic, even buying stock futures just like the Nice Government men here, servants of our socialist masters. Over the weekend government out did the capitalists: offered a stock stabilization fund, moratorium on IPOs, liquidity pledge from the People's Bank of China, and guaranteed liquidity to the state-backed margin lender. Shanghai rose 8% Monday, and then fell again today 1.29% to a new intraday low for the move. This much of the China myth is true: they've been buying lots of commodities for years. That's what routed commodity markets today, most likely, the prospect of the Chinese ceasing to buy and stockpile huge amounts of commodities. That probably helped rout silver and gold, too, as perhaps Chinese seeking to meet margin calls sold gold. Sad lesson coming for the Chinese about the difference between stocks and gold. Finally, China has 1.357 billion people and an $18.9 trillion GDP while Greece has 0.0108 billion people and a $0.294 trillion economy. Even a no-nothing hick like me can see there ain't no comparison for trouble-causing potential. While Europe (not zackly in prime economic shape itself) keeps diddling with Greece and bailing out its banks, now China is threatening to blow apart. It's enough to send our Masters of the Universe running for the Excedrin -- or reaching for a waste basket to puke in. We've closed the circle now and come round to today's markets. The Nice Government Men for the Socialist States of America managed to jack the Dow from a 17,466 low, down 218 points, to ending up 93.33 (0.53%) at 17,776.91. Call me a conspiracy theorist, see if I care. They've got a Plunge Protection Team and they use it. Besides go search the Wall St. Journal archives for that November or December 1987 post mortem series on the 1987 stock market crash. It's all in there -- from Greenspan to the lower apparatchiki, they all braggd how they bought the S&P500 futures and smashed gold by trashing platinum futures, arm-twisted CEOs to buy their own stocks, etc. So don't turn your New York nose up at me as a "conspiracy theorist." Everybody knows the Wall Street Journal wouldn't print no lie. Whooo. Got worked up there. Sorry. S&P500 rose 12.58 (0.61%) to 2,081.34, respectable enough, and like the Dow, to bring it back from beneath the 200 DMA AND a new intraday low for the move. Y'all think I'm jes' a barfut nat'ral born durned fool from Tennessee, but if y'all stick with them stocks, y'all are gonna take a Chinese lickin'. But the Dow in Gold and Dow in silver both took lickin's today, too. As you'd expect because of silver's greater volatility, it took a bigger hit. Dow in silver closed up 5.25% at S$1,531.27 silver dollars (1,184.34 ounces), a new high for the move and 2.7% above the last high. Dow in Gold hit only G$318.55 gold dollars (15.41 troy ounces). That matched the high close of 23 June, but not the G$322.07 (15.58 oz) high in March, the highest level since the gator jaws began forming. (Significance of that 2.7% DiS number is the 3% rule, markets need to exceed old highs by 3% to break out.) Am I digging around in my drawer for a box cutter to open a vein because they punched into the top gator jaw? Don't hold yer breath. Punching into that overhead jaw is consistent with seasonal lows in silver and gold prices. And on plunges silver always plays the weak sister.

Euro is the mirror image of the dollar index, so it dropped 0.49% today to $1.1004, targeting $1.0350 or oblivion, take your pick. Yen is even trying to rally, but the Japanese NGM are keeping it tame. Up 0.03% today to 81.61, but intraday tried to punch through its 50 DMA. As you'd expect with the dollar index rising and somebody fixing to panic, yields on US Treasuries gapped down again today (Treasury prices gapped up), for the second day. Clearly, some of the guests are paying big money to check out of the Hotel California. Today I was slated to take six of my grandchildren, my son's mother-in-law, and her visiting mother to Shiloh battlefield. I stopped by the office to pick something up and the first thing that struck my eyes was silver at 1483c. I had to go anyway. Today was also the day the socialist US Mint announced it is suspending silver (not gold) American Eagle deliveries for an unspecified time. Any private business would ramp up production to meet demand, but not no gummit agincy, no sirree! Silver Eagles' already overblown premium will rise . I don't recommend them now, as I didn't recommend them yesterday or for the whole course of their existence, because they are too blasted expensive and OVER TIME PREMIUM ALWAYS DISAPPEARS. On 7 July 1863 the US (north) began its first military draft. You could buy an exemption for $100 or 4.8375 gold ounces, today about $5,565. So many northerners opted out that the yankee government started running out of soldiers and stooped to kidnapping Irishmen off the boats and importing Germans who couldn't read US newspapers. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 'Owners Per Ounce' of Gold at the Comex Posted: 07 Jul 2015 07:42 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Bron Suchecki: Conspiracy, complacency, and the death spiral phase Posted: 07 Jul 2015 07:10 PM PDT 10:14p ET Tuesday, July 7, 2015 Dear Friend of GATA and Gold: Central banks aren't the only ones with potentially a lot of money to deploy trading gold, Perth Mint analyst Bron Suchecki writes tonight, adding that some major investment houses lately have expressed negative sentiment about the monetary metal. While Suchecki acknowledges that some central banks are active in the gold market, his suggestion that investment houses might influence the market to an equal extent seems improbable. After all, central banks, unlike investment houses, are authorized to create not a few billion or even tens of billions but actually infinite money and to apply it in secret, even through some of the investment houses Suchecki cites. And while investment houses, if they are truly acting on their own, ordinarily care only about making money regardless of a market's direction, central banks have a longstanding policy interest, overwhelmingly documented -- http://www.gata.org/node/14839 -- of wanting to hold the gold price down to protect their own currencies, bonds, and interest rates. Further, of course, the financial market maxim is not "Don't fight Bessemer Trust" but rather "Don't fight the Fed," though lately it might be amended as "Don't fight JPMorganChase when it is trading for the Fed." But Suchecki finds it "interesting" that Bloomberg View columnist Barry Ritholtz, disparaging gold as an investment last week and inviting critics to e-mail him, did not respond to the specific questions GATA put to him about surreptitious central bank intervention in the gold market, and "interesting" may be close enough to "telling." Suchecki's commentary is headlined "Conspiracy, Complacency, and the Death Spiral Phase" and it's posted at the Perth Mint's research page here: http://research.perthmint.com.au/2015/07/07/conspiracy-complacency-and-t... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jul 2015 06:19 PM PDT Some context...

For a record 12th day in a row, Chinese margin debt balances have dropped with today's 8.5% collapse the largest in history. As of last night, there were around 570/1694 Shenzhen stocks halted/suspended and hundreds more on the Shanghai bourse leaving more than 54% of all Chinese stocks frozen ($2.6 trillion or 40% of value). China continues to try to manage leverage down (raising margin requirements on stock futures) while encouraging speculation (easing rules for insurers to buy blue chips and financing the purchase of smaller company shares directly) and CYNK'ing the entire market - if it's not open, you can't sell it and the price cannot fall! It's not working as CSI-300 futures are now down 7.9% in the preopen.

China appears to be trying to manage leverage...

While encouraging speculation...

China news is domninated by dozens of pages of this...

With what we estimate is around 850-900 Shenzhen Composite stocks suspended (over half of the 1694 stocks in the index) and almost 25% of Shanghai Composite stocks, it appears China has resorted to the endgame in managing a collapse...

In other words - the whole Chinese market just got CYNK'd * * * It's not working...

It looks like today could see China go red for the year... * * * China weakness and European rhetoric wearing S&P futures lower (down 11 points from cash close)... * * * Another day another attemnpt to stabilize...

Just add this to the list of interventions... Perhaps if you just stare at it long enough, it will rise...

Just remember this crash is telling us somethinmg about China...

As NYU Professors Jennfier Carpenter and Robert Whitelaw told CNBC in January...

Shut Up!!! Exhibit 1 - Based on 'fundamentals', The Shanghai Composite has a long way to go...

Exhibit 2 - If Dr. Copper is right about the state of the world, The Shanghai Composite won't find support until it has fallen another 60%...

Exhibit 3 - Judging by historical analogs, The Shanghai Composite will need to destroy all gains in the last 2 years before 'value' is once again seen...

Chinese investor psychology has shifted. Period. The more the government intervenes to lift stock prices explicitly, the more local and professsional leveraged investors will use any strength to unwind their positions (profitably or unprofitably). | ||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Mint sold out of silver coins due to strong demand Posted: 07 Jul 2015 06:07 PM PDT From Reuters The U.S. Mint said on Tuesday it temporarily sold out of its popular 2015 American Eagle silver bullion coins due to a "significant" increase in demand, the latest sign that plunging prices have spurred a resurgence of retail buying. In a statement sent to its biggest U.S. wholesalers, the Mint said its facility in West Point, New York, continues to produce coins and expects to resume sales in about two weeks. This is the second time the mint has sold out of silver coins in the past nine months. It ran out of 2014-dated American Eagles in November last year. In 2013 the historic drop in precious metals prices unleashed a surge in global demand for coins, forcing the mint to ration silver coin sales for 18 months. ... ... For the remainder of the report: http://www.reuters.com/article/2015/07/07/usmint-coins-sales-idUSL1N0ZN1... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| China Now Risks "Financial Crisis"; Loses Could Be "In The Trillions" BofA Says Posted: 07 Jul 2015 06:00 PM PDT

That's BofAML's take on why Beijing is now throwing the kitchen sink at a Chinese equity market that's sold off to the tune of 30% in the space of just three weeks, vaporizing $3 trillion in market value in the process. Zero Hedge readers are by now well versed in the relatively brief history of unofficial, backdoor Chinese margin lending. This shadowy world, which includes umbrella trusts, structured funds, and P2P lending, has served to funnel somewhere in the neighborhood of CNY1 trillion into Chinese equities. Apparently, the powers that be in China — who are quite adept at monitoring "threats" to the Party line and are quick to remove all traces of "objectionable" material from the internet — completely missed the giant margin bubble that was allowed to inflate outside of brokers' books. A far more realistic explanation of course is that Beijing was well aware of what was going on but let it continue due to the fact that China's world-beating equity rally was the only thing distracting the country from flatlining economic growth and a bursting real estate bubble. Whatever the case may be, the margin mania unwind is upon us and as noted earlier today, nothing seems to be able to stop it. Not suspending compulsory liquidation for unmet margin calls, not billions in committed market support from brokerages, not a PBoC backstop for the CFSC, and not even a ban on selling by the Social Security Council (we'll see when the SHCOMP opens on Wednesday morning if banning bearish language has any effect). As Chinese stocks climbed ever higher earlier this year, some commentators began to ask if a stock market collapse would have implications for the broader Chinese economy. In short, just about the last thing the country needs amid slumping global (not to mention domestic) demand is for a crisis of confidence in local equity markets to spill over into the real economy and derail consumer spending just as Beijing attempts to transition the country away from a smokestack model and towards an economic future characterized by services and consumption. Generally speaking, the consensus was that any fallout from the bursting of the equity bubble would largely be confined to the financial markets. Now, analysts are very quietly starting to suggest that if the sell-off doesn't end soon, it could metastasize and spread "far beyond the stock market." * * * From BofAML: The A-share correction: The damage could spread far beyond the stock market A dent to market's faith in government role We believe that the biggest damage caused by the A-share market's roller-coaster ride since the middle of last year has been to investors' faith in the government's ability to manage asset prices (stock, RMB, debt and even property) reasonably smoothly. The difficulty the government has faced to stabilize the stock market has demonstrated the downside of that faith. As a result, we expect many of these assets to be re-priced lower going forward. Also,the ripple effect from the market correction has yet to show up – we expect slower growth, poorer corporate earnings, and a higher risk of a financial crisis. Many assets in China may get re-priced lower We question the implementation of government policy in urging people to buy stocks. Regarding the deleveraging process in the market, in our view the government started too late & without adequate preparation for the potential downside (we suspect because it didn't know the true extent of shadow margin financing activities) and it resorted to administrative control when the market turned down. So far, government measures have appeared to us to be behind the curve. As a result, we expect investors to assign less value to various perceived government "puts" going forward. The fall in the stock market could also make the government even more cautious towards QE and potentially using the property market or debt market to hold up growth, in our view – a burst of any of these bubbles, if fully developed, will be far more difficult to deal with than what's happening in the stock market. Real economy & corporate earnings will suffer The net result of this volatile market is a transfer of wealth from the people on the street to the wealthy, including many major shareholders, who cashed out. We expect this will likely hurt consumption down the road. More critical is a potential distortion to credit flows due to the impairment to financial institutions' balance sheets – as experience with Japanese banks shows, even if they don't have to mark to market and book losses, their lending attitude may turn more cautious. Of course, the impact of a full-blown financial crisis in China, if it materializes, on the economy would likely be severe. On corporate earnings, other than the drag from slower growth, many companies may have to book stock-market related losses over the next few quarters by our assessment. A possible trigger for a financial crisis in China If the market continues to fall sharply, stock lending related losses could run into Rmb trillions, of which, banks and brokers may have to bear a meaningful share. These potential losses can be especially dangerous to brokers whose capital base is less than Rmb1tr. Even more important, the opaqueness of China's financial system and the lack of clear definition of risk responsibility mean that contagion risk is high, similar to the subprime crisis. We had always considered the risk of a financial crisis in China as high. What has happened in the stock market has likely increased the risks considerably and also brought forward the timeline by our assessment – the leverage is much higher now and economic growth rate, potentially lower. * * * We'll leave you with following chart from Morgan Stanley which should be enough to dispel the notion that the deleveraging in China might have run its course:

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Greek Meltdown Spells Trouble For U.S. Markets Posted: 07 Jul 2015 05:56 PM PDT Greek banks are preparing contingency plans for a possible "bail-in" of depositors amid fears the country is heading for financial collapse. Experts have repeatedly warned that a global financial collapse is imminent. Will the U.S. be prepared for so-called banking holidays in a cashless... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Jul 2015 05:52 PM PDT Another day came and went with no breakthrough in negotiations between Athens and Brussels as new Greek FinMin Euclid Tsakalotos reportedly showed up to Tuesday's Eurogroup with nothing to discuss. With the ECB tightening the screws on Greek banks and the German finance ministry as well as German lawmakers tightening the screws on Angela Merkel, the Chancellor is drawing a hard line toward the Greeks in the face of calls for debt writedowns from the IMF, Greek PM Alexis Tsipras and the Greek people.

More from Reuters:

In other words, Merkel just told the Greeks yes, there is some money, but forget debt haircut, and the new deal is far harsher than what was on the table because the Greek economy is now imploding. Also, the deal will be 2-3 years at least to start, so even more austerity is on the table. So to all those who voted "Oxi", if you want your deposits unlocked well... tough. The headlines keep coming hot and heavy, in which we find that Europe now thinks it is Greece's god:

As Bloomberg reports, "Sunday now looms as the climax of a five-year battle to contain Greece's debts, potentially splintering a currency that was meant to be irreversible and throwing more than a half-century of economic and political integration into reverse. "We have a Grexit scenario prepared in detail," European Commission President Jean-Claude Juncker said, using the shorthand for expulsion from the now 19-nation currency area. And just so it is clear who is calling the shots, here is Juncker explaining:

What happens then? "Our inability to find agreement may lead to the bankruptcy of Greece and the insolvency of its banking system," European Union President Donald Tusk said. "If someone has any illusions that it will not be so, they are naive." And just in case Greece decides to disobey, Europe is ready to treat Greece as an African nation:

The only good news for Greece, which was just clearly reduced to a vassal nation state of Europe, is that Merkel did not demand Tsipras' head on a silver platter. Then again, if he does indeed fold, it may be the Greek people themselves who ask for it instead... | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Cronyism Pays: Eric Holder Triumphantly Returns To Law Firm That Lobbies For Banks Posted: 07 Jul 2015 05:35 PM PDT Submitted by Mike Krieger via Liberty Blitzkrieg blog, Trying to determine Barack Obama’s most corrupt, crony appointee presents a virtually impossible task. Every single person he’s appointed to a position of power over the course of his unfathomably shady, violent and unconstitutional presidency, has been little more than a gatekeeper for powerful vested interests. Obama’s job was to talk like a marxist, but act like a robber baron. In this regard, his reign has been an unprecedented success. All that said, if anyone is a top contender for the worst of the worst of the Obama Administration, it’s Eric Holder. As head of the Department of Justice, he was the one man who could’ve played an enormously positive role in American society, by punishing those responsible for creating the financial crisis that destroyed tens of millions of lives globally. Instead, he chose to actively protect the financial oligarchs and ushered in a tragic new era for these United States. One in which the world suddenly realized that the U.S. is little more than a glorified oligarchy. Essentially an aggressive Banana Republic armed with nuclear weapons and the swagger of a third world dictator. Holder’s list of failures and evidence shameless cronyism are virtually endless. I’ve covered many of them on this site. Here are just a few: The U.S. Department of Justice Handles Banker Criminals Like Juvenile Offenders…Literally Eric Holder Announces Task Force to Focus on “Domestic Terrorists” Eric Holder and the DOJ Have Spent Millions of Taxpayer Dollars on Unreported Personal Travel Elizabeth Warren Confronts Eric Holder, Ben Bernanke and Mary Jo White on Bankster Immunity Even Washington D.C. Insiders Admit Eric Holder is a Bankster Puppet Eric Holder Claims Emails Using Words ‘Fast and Furious’ Don’t Refer to Operation Fast and Furious For all his hard work protecting and coddling criminal financial oligarchs, Eric Holder was always going to be paid handsomely once he left office. That time has come. From the Intercept:

For all intents and purposes, he never really left Covington. He just took a sabbatical to protect the banksters for a few years.

Of course, Mr. Holder is not the only shameless crony to join Covington. It seems the firm almost makes a point to hire the most compromised, Washington D.C. parasites they can find. As the New York Times noted:

History shows that Breuer wouldn’t challenge bankers if they threw his own mother out on the street. Meanwhile, Chertoff is famous for trying to make a fortune by scaremongering the American taxpayer into buying his worthless Rapiscan naked body scanners. Moving along, let’s try to look on the bright side. With Holder gone, his replacement couldn’t possibly be worse, right? Wrong. Recall: Meet Loretta Lynch – Obama’s Attorney General Nominee Who Might be Even Worse than Eric Holder Now I’d like to say farewell to Eric Holder the only way I know how… | ||||||||||||||||||||||||||||||||||||||||||||||||||

| GERALD CELENTE - The Collapse Has Already Begun. Watch Out For China! Posted: 07 Jul 2015 03:24 PM PDT Despite constant reassurances from federal overseers, Americans are becoming increasingly aware of the economy's frail nature.While media pundits and analysts desperately push the failure of central planning and Keynesian economics, these five experts continue to be proven right on the dangers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Americans wary of Financial Collapse -- The Alex Jones Show July 7 2015 Posted: 07 Jul 2015 01:16 PM PDT The Alex Jones Show (VIDEO Commercial Free) Tuesday July 7 2015: News Date: 07/07/2015 -- -Today - On this Tuesday, July 7 edition of the Alex Jones Show, we cover the latest as the financial overlords prepare to make Greece suffer for its resistance to the tyranny of the banks. A report by... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - No Soup For You Posted: 07 Jul 2015 01:16 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Cosmic Consciousness - Dr. Bill Deagle Posted: 07 Jul 2015 12:35 PM PDT Jeff Rense & Dr. Bill Deagle - Cosmic Consciousness Clip from June 25, 2015 - guest Dr. Bill Deagle on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||

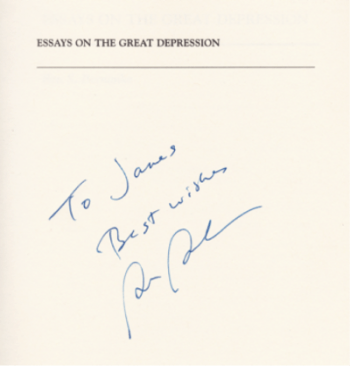

| My Conversation With Ben Bernanke Posted: 07 Jul 2015 12:31 PM PDT This post My Conversation With Ben Bernanke appeared first on Daily Reckoning. Editor's Note: Jim Rickards has published a third book entitled "The Big Drop: How to Grow Your Wealth During the Coming Collapse." It's available exclusively for readers of his monthly investment letter called Strategic Intelligence. Before you read today's essay, please click here to see why it's the resource every investor should have if they're concerned about the future of the dollar.] On May 27, I had the privilege of spending time with Ben Bernanke, former chairman of the Federal Reserve System, in Seoul, South Korea. We were both there as keynote speakers at an international financial forum sponsored by the leading business publication in Korea. The theme of the conference was currency wars and their impact on Korea. Our audience was interested in how monetary policy and exchange rate fluctuations affected Korea versus its trading partners and competitors, especially China, Japan and Taiwan. Above all, the audience wanted to learn how Fed policy on interest rates would affect the dollar, and what impact policy would have on developed economies and emerging markets. In addition to the formal presentations, our event sponsors organized a small VIP reception that included Bernanke and me along with the CEOs of the Korea stock exchange, the Korea Banking Institute, the Korea Federation of Banks and the Korea Financial Investment Association. There were about 10 of us in all representing the financial elites of Korea and some distinguished scholars and economists from Japan; Bernanke and I were the only Americans. The setting was private and allowed us ample time for one-on-one discussions before the main conference commenced. My conversation with Bernanke began casually enough. In the early 2000s, I had helped to establish the Center for Financial Economics at Johns Hopkins University. The center had selected its director from among the senior monetary economists at the Federal Reserve. Not long after bringing our director on board, Bernanke tapped him to return to the Fed to serve as special adviser for communications, the person responsible for crafting announcements of Federal Open Market Committee actions that Wall Street economists slavishly dissect after each FOMC meeting for clues about interest rate policy changes. I chided Bernanke for "picking off" our director. He laughed and said, "We didn't pick you off, we just borrowed him; we gave him back," which was true enough. Our director had just returned to the center after two years at the Fed. That was a good icebreaker to turn the conversation to more serious matters. I had a copy of Bernanke's book, Essays on the Great Depression (2000), which contains much of the research on which he built his academic reputation. Bernanke had shown that gold was not a constraint on money supply creation during the Great Depression, contrary to what many economists and analysts take for granted. From 1929-1933, money supply was capped at 250% of the market value of gold held by the U.S. government. The actual money supply never exceeded 100% of the value of the gold. This meant that the Fed could have more than doubled the money supply without violating the gold constraint. The implication is that policy failure during the Great Depression was caused by the Fed's discretionary monetary policy, and not gold. I told Bernanke that I had used his research in my own work on gold in my book, Currency Wars (2011). When I offered my interpretation of his work, he replied, "That's right." This confirmation was ironic because the Fed is facing the same challenges today in increasing bank lending and money velocity as it did in the Great Depression. Gold is not even part of the system today. Bernanke may have identified the money velocity problem in his book, but as chairman, he had no greater success in solving it than his predecessors.

Former Fed Chairman Ben Bernanke warmly inscribed my copy of his book Essays on the Great Depression (2000). It includes research that shows gold did not constrain money supply growth during the Great Depression, contrary to what many analysts assert. Following this introduction, Bernanke then made a set of remarks that I found both surprising in their candor and refreshing in the extent to which he was willing to take issue with some of what his successor, Janet Yellen, has said recently on the subject of Fed interest rate hikes. Yellen gave a speech just prior to my meeting with Bernanke in which she said, "I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate." In contrast, Bernanke told me, "The interest rate increase, when it comes, is good news, because it means the U.S. economy is growing strongly enough to bear the costs of higher rates without slowing growth." Unlike Yellen, Bernanke did not tie himself to a particular month or year. He explicitly said the rate hike would come in an environment of strong growth. Today the U.S. economy is close to negative growth and is nowhere near the kind of robust growth that Bernanke associated with a rate increase. The clear implication is that the Fed will be in no position to raise rates anytime soon. Bernanke also warned that the rate increase had to be clearly communicated and anticipated by the markets. He said, "Markets are not as deep and liquid as they were before the crisis." The suggestion was that market expectations and Fed actions need to be aligned in order to raise rates without a market crash. He expressed the hope that "The rate increase may be an anticlimax because the markets anticipate it." That makes sense. The problem is that right now markets anticipate the first fed funds rate increase in early 2016, not in 2015. Bernanke's warning about illiquidity and hope for an anticlimactic market reaction are further evidence that he does not see a rate hike coming before 2016, at the earliest. Turning to the international monetary system, Bernanke was also candid and said, "The international monetary system is not coherent." He explained that the current combination of floating exchange rates, fixed exchange rates and moving pegs means that trading partners have no confidence in their relative terms of trade and this acts as a drag on trade, foreign direct investment and capital expenditures. He said, "Over time, it would be important for the countries of the world to talk more about how to avoid the mixture of fixed and floating exchange rates. We need new 'rules of the game.'" Of course, international monetary experts know that the phrase "rules of the game" is code for a reformation of the international monetary system, or what some call a global reset. Bernanke was explicit that this reset is needed to end the dysfunction of the current system. Some aspects of a global reset have already been put in place. For the past several years, the IMF has been attempting to change its quota system to give China more votes at the IMF, more in line with China's 10% share of global GDP. Right now China has less than 5% of the votes, which is low compared with some much smaller economies in Europe. The U.S. Congress has refused to approve legislation needed to implement the changes at the IMF. Referring to the closed-door negotiations among the U.S., IMF and China that led to the proposed reset in the quotas, Bernanke said, "I participated in this." This was surprising to me because traditionally matters involving the IMF are handled by the Treasury Department rather than the Federal Reserve. Bernanke's confirmation of his participation made it clear that the Fed, Treasury, IMF and China are working hand in glove on the early stages of the reset. China has grown increasingly frustrated at the delays from Washington in changing the IMF quotas to give China a larger vote. The Chinese have begun building their own version of the IMF in the form of the Asian Infrastructure Investment Bank (AIIB) and other institutions through the BRICS and the Shanghai Cooperation Organization. Bernanke was dismissive of the AIIB and said, "I don't think it's going to be very important. It's going to be a footnote." I took this to mean that Bernanke expects the IMF voting reforms to move forward, in which case, China will be happy to play by the rules of the existing Bretton Woods institutions rather than try to start its own club independent of the IMF. This interpretation is consistent with China's large gold acquisitions in recent years. The U.S. has about 8,000 tons of gold, the eurozone has about 10,000 tons, and the IMF has about 3,000 tons. China would need at least 4,000 tons, probably more, to be a credible member of this elite group. The AIIB is best seen as a kind of head fake, and Bernanke implicitly confirmed this. China's real goal is to acquire gold, have the yuan included in the IMF's special drawing rights basket and have its IMF votes increased. All of these resets are now well underway. Bernanke next discussed whether the stock market was in a bubble. In typical Fed style, he said, "It's very difficult to know." He also seemed relaxed about a sudden market correction. He said, "What if the stock market dropped 10% or 15%? What difference does it make? Is there anything that looks like a systemic risk? I don't see that right now, I don't see anything that looks like a threat." In other words, the Fed's job is to protect the system as a whole, not to protect investors from sudden drops in stock values. Bernanke could be wrong about a bubble. He certainly missed the mortgage market bubble in 2007 and the systemic risk that emerged in 2008. Whether he's right or wrong about bubbles, he clearly said he's not concerned about a 3,000-point drop in the Dow Jones index. Investors are on their own when it comes to that. Finally, in discussing his legacy as Fed chair, Bernanke turned back to his research on the Great Depression, where our conversation began. He said the three lessons of the Great Depression were that the Federal Reserve needed to perform as a lender of last resort, increase the money supply when needed and be willing to "experiment" in the style of FDR. Bernanke defined "experiment" as being willing to do "whatever it takes" to head off deflation and depression. In summing up his own performance, he said, "We tried to do whatever it took. We don't know yet what the long-term implications are." His forecast was that "the Fed will be more proactive in the future." My impression was that Bernanke knows the jury is still out on his tenure as Fed chairman. There is no doubt that his actions in 2008 and 2009 prevented a worse result at the time. But they may have produced a more dangerous condition today. There was good justification for QE1 in 2008 and 2009 as an emergency liquidity response to a global financial panic. This is consistent with the Fed's role as lender of last resort, as Bernanke said. But QE2 and QE3 were not in response to any liquidity crisis. They were in the category of "experiments," as Bernanke defined them. Experiments are fine in the laboratory but much riskier in the real world. Experiments are a good way to advance science, but every scientist knows that most experiments fail to produce expected results. Ben Bernanke was generous with his time and candid in his remarks. Still, I was left with an unsettling feeling that he knew that QE2 and QE3 were failed experiments, despite his public defense of them. Growth in the U.S. has been anemic for six years, and there is good evidence that we are sliding into a new recession. The Fed can't cut rates now, because they failed to raise them when they had the chance in 2010 and 2011. Markets are probably in bubble territory, which means they could easily fall 30-50%. The Fed will not act during the first 15% of a market crash, because they will see it as a normal correction, not a bursting bubble. By the time the Fed is ready to act, it will be too late, just as it was in 2008. The collapse momentum will feed on itself in ways the Fed cannot control. Bernanke may have learned some lessons from the Great Depression, but it seems he has not learned the lessons of the Panic of 2008. Regards, Jim Rickards Photo credit: Medill DC, Flickr P.S. If you haven't heard, I've just released a new book called The Big Drop. It wasn't a book I was intending to write. But it warns of a few critical dangers that every American should begin preparing for right now. Here's the catch — this book is not available for sale. Not anywhere in the world. Not online through Amazon. And not in any brick-and-mortar bookstore. Instead, I'm on a nationwide campaign to spread the book far and wide… for FREE. Because every American deserves to know the truth about the imminent dangers facing their wealth. That's why I've gone ahead and reserved a free copy of my new book in your name. It's on hold, waiting for your response. I just need your permission (and a valid U.S. postal address) to drop it in the mail. Click here to fill out your address and contact info. If you accept the terms, the book will arrive at your doorstep in the next few weeks. The post My Conversation With Ben Bernanke appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Aspartame Is Killing You! Stop Now! -- Betty Martini Posted: 07 Jul 2015 12:28 PM PDT Betty Martini: "If You Are Taking Aspartame, It Is Killing You! Stop Now!" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||

| USAGold: U.S. Mint suspends sale of silver eagle coins Posted: 07 Jul 2015 11:33 AM PDT 2:32p ET Tuesday, July 7, 2015 Dear Friend of GATA and Gold: USAGold in Denver reports today that the U.S. Mint has suspended sale of U.S. silver eagle coins: http://www.usagold.com/cpmforum/2015/07/07/mint-suspends-american-silver... This is another of the counterintuitive things that happen when central banks try to smash down the price of monetary metals. If, as the silver futures market is proclaiming today, silver is so darned plentiful and cheap, why are the silver coins disappearing from the mint? Why aren't they turning up as the prize in Crack Jack boxes? One thing is certain: None of this will spark any curiosity among mainstream financial journalists. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Can You Imagine The Fed Raising Rates In This World? Posted: 07 Jul 2015 11:31 AM PDT $1.4 trillion of Chinese stocks have stopped trading. Greece is finally imploding. The US trade deficit is widening on falling exports.Copper just fell back to 2009 levels. And safe-haven capital flows are revving up again, with Swiss 10-year bonds once again trading with negative yields. Yet somehow a majority of economists and money managers continue to believe that not only will the fed hike rates at its next meeting, but that it should do so. The IMF isn’t normally the voice of reason on major financial issues, but in this case — perhaps because it has its hands full with Europe — its caution seems appropriate:

“Weaker global growth” indeed. The next two charts show GDP growth for Japan and Germany. Note that they’re both positive (barely) but are also lower than the previous year. So momentum was already slowing before Greece blew up and China’s stock bubble burst. For the world’s biggest economy to respond to the above with steps to slow down its growth would be at best ill-mannered and at worst the kind of slap in the face that sets off global contagions. So yeah, it’s kind of hard to imagine. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Understanding China, Gold, & Seasonality Posted: 07 Jul 2015 11:11 AM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Commodity collapse Posted: 07 Jul 2015 10:15 AM PDT 1:14p ET Tuesday, July 7, 2015 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson today attempts some technical analysis of the crash in commodity prices but qualifies it this way: "We keep repeating the mantra 'there are no markets, just interventions,' and, if that's the case, maybe all my old tried-and-true methods are now obsolete." Ferguson adds: "In the end, if you still believe that the entire global market structure is a fraud with limited lifespan, then the ability to convert fiat and stack physical metal at these depressed paper prices is a gift, not a disaster." Of course it would be a much more valuable gift for people in their 20s and 30s than for people in their 60s and 70s. Indeed, for the latter group it could look more like another ripoff. Ferguson's commentary is headlined "Commodity Collapse" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/6974/commodity-collapse CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Greece Debt Crisis to Trigger Euro-zone Credit Freeze, Expiry of Greek Euro Bank Notes Posted: 07 Jul 2015 09:32 AM PDT According to to Syriza politicians, Tsipras and Varoufakis a NO vote would have delivered the Greek people victory in its negotiation with the Troika with promises of an agreement already on the table and of course the banks would reopen Tuesday. Which just like a string of promises made for the whole of 2015 have proved totally worthless propaganda aimed at convincing a delusional Greek electorate that a paradise of sorts was awaiting them if only they voted NO / committed mass suicide, the reality of which is only slowly starting to dawn on an increasingly panicky Greek people who are experiencing economic collapse accelerate on a daily basis. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Don't keep monetary metals in bank safe-deposit boxes, Turk warns Posted: 07 Jul 2015 09:21 AM PDT 12:20p ET Tuesday, July 7, 2015 Dear Friend of GATA and Gold: Government intervention in markets always makes things worse, GoldMoney founder and GATA consultant James Turk tells King World News today, adding that as the world financial system teeters, gold and silver owners better not be keeping their metal in bank safe-deposit boxes. An excerpt from Turk's interview is posted at the KWN blog here: http://kingworldnews.com/another-terrifying-global-collapse-is-imminent/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Dave Kranzler: Gold and silver are paper-slammed -- Is the system collapsing? Posted: 07 Jul 2015 09:05 AM PDT 12:04p ET Tuesday, July 7, 2015 Dear Friend of GATA and Gold: Dave Kranzler of Investment Research Dynamics today notes the latest "paper slam" of monetary metals prices and wonders if the world financial system is collapsing. Kranzler writes: "How is it that day after day gold and silver get smashed when the New York Comex floor trading opens? Does it seem odd that all of a sudden, nearly every day for the last four-plus years at 8:20 a.m. ET all the world decides to unload paper gold and silver positions? "How is it at all possible that the prices of gold and silver are collapsing like this when China has imported a record amount of gold in the first half of 2015? China and India combined are importing more gold than is being produced on a daily basis. India is importing by far a record amount of physical silver. These countries require the physical delivery of the metal they buy. It's not good enough for the bullion banks to offer free vault storage in London or New York. The misrepresentation of the true, intrinsic price of gold and silver by the New York and London paper markets is perhaps the greatest fraud in history. "The criminality operating in the U.S. financial markets has become pervasive. The markets just ooze with unfettered theft and wealth confiscation. The government doesn't just 'look the other way.' The government is the criminal cartel. ..." Kranzler's commentary is headlined "Gold and Silver Are Paper-Slammed -- Is the System Collapsing?" and it's posted at the Investment Research Dynamics Internet site here: http://investmentresearchdynamics.com/gold-and-silver-are-paper-slammed-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese trading suspensions freeze $1.4 trillion of shares amid rout Posted: 07 Jul 2015 08:35 AM PDT By Fox Hu Chinese companies have found a guaranteed way to prevent investors from selling their shares: suspend trading. Almost 200 stocks halted trading after the close on Monday, bringing the total number of suspensions to 745, or 26 percent of listed firms on mainland exchanges, according to data compiled by Bloomberg. Most of the halts are by companies listed in Shenzhen, which is dominated by smaller businesses. The suspensions have locked up $1.4 trillion of shares, or 21 percent of China's market capitalization, and are becoming increasingly popular as equity prices tumble. If not for the halts, a 28 percent plunge in the Shanghai Composite Index from its June 12 peak would probably be even deeper. "Their main objective is to prevent share prices from slumping further amid a selling stampede," said Chen Jiahe, a strategist at Cinda Securities Co. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2015-07-07/chinese-trading-halts-... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Rick Rule: Some of the Best Oil Plays Are in “Midstream” Stocks Posted: 07 Jul 2015 08:00 AM PDT This post Rick Rule: Some of the Best Oil Plays Are in "Midstream" Stocks appeared first on Daily Reckoning. Dear Resource Hunter, "Midstream" oil stocks are this attractive about once every decade, says Rick Rule, Chairman of Sprott U.S. Holdings. In a recent round-table with Byron King (Agora Financial) and Matt Badiali (Stansberry & Associates), Rick explained why he's looking at one segment of the oil sector. You can listen to his full comments here (registration required):

Midstream companies are involved in processing and transportation of oil and gas. These companies have been popular with investors because they may be less risky and volatile than exploration and production companies. They tend to make money through long-term transportation contracts that are "insulated" from oil price swings. In particular, Master Limited Partnerships (MLPs) own transportation infrastructure such as pipelines and charge oil companies to move oil and gas to market. These companies pass on their revenues to shareholders, which can lead to large dividends with moderate exposure to oil and gas prices. The last major opportunity for MLPs was in March 2009, after the financial crisis cut down energy prices and stocks. The Alerian MLP index, which tracks 50 prominent companies in the sector, rose 356% from then through September 2014.1 MLPs are not completely independent of oil prices. Since September, the Alerian MLP Index is down around 25%. Last year, Boardwalk Pipeline Partners cut its payout to investors by 80% after it failed to renew its existing contracts with oil producers.2 Rick sees this as a good chance to start buying MLPs as they're still generating attractive yields. The Alerian MLP Index pays a 6.29% yield as of June 29, versus 2.04% for the broad stock market (as represented by the S&P 500). "We are seeing returns of 6% cash already, and MLPs will be able to grow their topline free cash flows," says Rick. He believes that some MLPs will be able to pay out even more thanks to today's ultra-low interest rates. MLPs can borrow cheaply to acquire new assets from distressed sellers – groups that are "monetizing" their processing and transportation assets to pay salaries. MLPs can increase their payouts from here if they act aggressively and use low interest rates to fund acquisitions, says Rick. Rick also believes there is an opportunity to fund exploration and production in oil and gas, by lending money or acquiring stakes in projects. Bankers are less willing to lend money for oil production now. As Rick explained, during the last few years where oil prices were high, individual bankers often booked big bonuses for making loans to oil and gas firms. Their bonuses didn't depend on how well those loans performed over the long haul, so this led to lower standards and excessive credit being extended for oil and gas. Now that returns are being affected by low oil prices, banks will probably revise their incentive structures, so that individual bankers will not pour as much money into oil and gas. At the same time, financial regulations known as "Basel III" discourage the largest banks from lending to private companies – like those in the oil and gas sector. Rick explained how this works: "Banks have different reserve requirements for different classifications of loans. "If Deutsche Bank, which is one of the major capital banks, makes a loan to Shell or Exxon, they have to make a provision for that loan on their balance sheets. They have to set aside 7% or 8% of the value of that loan (in case it goes bad). "By contrast, if they were lending money to a sovereign entity – even Greece, Ireland, or Portugal – the bank doesn't need to have any provision for that loan so long as they purport to hold that loan to maturity, irrespective of its market valuation in the future. "So a bank can borrow cash from depositors at 1% and lend it out to a sovereign borrower at, say, 3.5%, picking up 2.5% without having to reserve any space on its balance sheet. "So the incentives are increasing for big banks to make sovereign loans as opposed to loans to private companies (where they would have to make higher loss provisions)." Now that banks are less interested in making loans to oil and gas companies, this can be a good opportunity to step in as a lender, says Rick. You see, some oil and gas companies stand to lose their drilling rights on a property if they do not go through with drilling. In some cases, they may have spent $1 million or more preparing a property for a drill program. That money has gone into administration, exploration, 3D seismic, or geophysical surveys. That investment will go to waste if the company loses its drilling rights, so investors can obtain favorable terms if they choose to participate, says Rick. "The industry has 'down' cycles. Being aggressive during those down cycles and then profiting during the last three upcycles is what made me rich," Rick comments. Want to know more about how to play upcycles and down cycles? Meet us in Vancouver this summer, at the Sprott-Stansberry Vancouver Natural Resource Symposium. Rick will be hosting the event and speaking with investors at length. Henry Bonner P.S. Ever wonder how you can make a lot of money from oil without owning a well? Or whether or not you should buy gold and silver? Or is fracking just a flash in the pan? Get insight, insider scoops and actionable investment tips twice a week with Daily Resource Hunter? Just click here for a FREE subscription! The post Rick Rule: Some of the Best Oil Plays Are in "Midstream" Stocks appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Greece is Just the First of MANY Countries That Will Be Going Belly-Up Posted: 07 Jul 2015 07:59 AM PDT ALL of the so called, “economic recovery” that began in 2009 has been based on the Central Banks’ abilities to rein in the collapse. The first round of interventions (2007-early 2009) was performed in the name of saving the system. The second round (2010-2012) was done because it was generally believed that the first round hadn’t completed the task of getting the world back to recovery. | ||||||||||||||||||||||||||||||||||||||||||||||||||