Gold World News Flash |

- OCC Derivatives Report Suggests U.S. Government Has Seized All Commodity Markets

- Silver About to Turn More Volatile

- Coming To America: The Hoarding Begins: Greeks Rush To Grocery Stores, Gas Stations and ATMs In Anticipation of Collapse

- Goldman Just Crushed The "Strong Fundamentals" Lie; Cuts EPS, GDP, Revenue And Profit Forecasts

- Gold Price Today Lost $7.00 Closing at $1,171.50

- The Care And Feeding Of A Financial Black Hole

- Chinese QE Calls Officially Begin: Bond Swap "Sucks Liquidity", "Contributes To Stock Slump", Broker Claims

- How do you change a currency fast?

- ECB poised to raise heat on Greece's beleaguered banks

- No End In Sight For Higher-Education Malinvestment

- For Greeks The Nightmare Is Just Beginning: Here Come The Depositor Haircuts

- How China Lost an Entire Spain in 17 Days

- Gold Daily and Silver Weekly Charts - End of Quarter, Hearts of Darkness, Web of Lies

- June 26 Silver Flash Crash: A Forensic Analysis

- The Solvency of the ECB is at Stake

- When Gold is Declared Illegal

- Jeb Handwerger: “Picking the top 2 Stocks on OTCQX® in 2014 is a Great Blessing”

- Bron Suchecki: OCC's gold derivatives chart is wrong, and derivatives went down

- Gold Bullion Stored In Singapore Is Safest

- Bet On The House — Go Long With Copper

- U.S. Dollar Final Rally

- Greece likely to Default on its IMF Loans

- What The ECB Will Do

- Greece: The Global Template for Collapse

- Puerto Rico is a Bigger Risk Than Greece

- Stocks Plunge on Greece Euro-Zone Financial Armageddon Blackmail

- Greece Crisis Shows Importance of Gold as Europeans Buy Coins and Bars

- Gold GDXJ : Impulse Move Pending

- Crude Oil Weakness is Not Gold Friendly

- Fed Interest Rate Increase Could Be Best Thing to Happen to Gold

- Current Oil Price Slump Far From Over

| OCC Derivatives Report Suggests U.S. Government Has Seized All Commodity Markets Posted: 01 Jul 2015 12:00 AM PDT by Chris Powell, GATA:

Citing the latest quarterly report of the U.S. Office of the Comptroller of the Currency, Zero Hedge concludes tonight that JPMorganChase has “cornered the commodity derivative market,” the notional value of the investment bank’s commodity derivative position having just exploded from around $200 billion to nearly $4 trillion. The OCC report, Zero Hedge adds, has ceased distinguishing gold derivatives from foreign exchange derivatives, but the combined total of gold and FX derivatives held by investment banks is shown to have exploded as well. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver About to Turn More Volatile Posted: 30 Jun 2015 11:00 PM PDT by Gary Christenson, Deviant Investor:

Silver has moved sideways for about nine months, after it moved sideways from a slightly higher level for about 14 months. Boring! The big events in the past 5 years have been:

Very little has happened in the silver market, other than a developing bottom in prices, since the High Frequency Traders and Wall Street | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Jun 2015 10:00 PM PDT by Mac Slavo, SHTFPlan:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldman Just Crushed The "Strong Fundamentals" Lie; Cuts EPS, GDP, Revenue And Profit Forecasts Posted: 30 Jun 2015 07:15 PM PDT In the past week, the one recurring theme among the permabullish parade on financial propaganda TV has been to ignore the closed stock market and banks in suddenly imploding Greece, the situation in Puerto Rico, the recent plunge in US stocks which are now unchanged for the year, and what may be the beginning of the end of the Chinese bubble and instead focus on the "strong" US fundamentals, especially among tech stocks - the only shiny spot an an otherwise dreary landscape (and definitely ignore the energy companies; nobody wants to talk about those). So we decided to take a look at just what this "strength" looks like. Well, we already saw the collapse in hedge fund hotel Micron Technology, which plunged 30% after it slashed its guidance last week. Alas that may be just the beginning. Here are the year-over-year revenue "growth" estimates for some of the biggest tech companies in Q2:

And that is the best sector among the "strong fundamentals" story. In fact, the only bright light in the entire tech space may well be AAPL whose sales are expected to grow 29%. We wish Tim Cook lot of strength if the recent Chinese market crash has dampened discretionary spending and demand for AAPL gizmoes in China. He will need it. But what's worse is that while reality will clearly be a disaster, there is always hype and always hope that the great rebound is just around the corner, if not in Q2 then Q3, or Q4, etc. This time even the hype is be over because none other than the most influential bank on Wall Street, the one all other sellside "strategists" religiously imitate, Goldman Sachs, just slashed its EPS and S&P500 year end price forecast for both 2015 and 2016. Here is Goldman with its explanation why it is lowering S&P 500 EPS:

However...

So earnings are bad and getting worse, but for Goldman that is not a reason to cut its S&P forecast simply because the economy is weaker than expected and also getting worse which means the rate hike originally forecast to take place in June is now set to take place in December, and thus boost P/E multiples (it won't of course but that will be Greece's fault).

So... the combination of deteriorating earnings and an even bigger slowdown in the economy ends up being a wash and keeping the S&P year end price target at 2100. Ah, the magic of financial Goldman's financial gibberish. So aside from Goldman's 21x forward multiple (because 114 non-GAAP is about 100 GAAP which means Goldman is expecting a 21 Price to GAAP Earnings multiple) simply due to the Fed's hike delay from June to December, is there any good news? No. In fact, this is what Goldman's David Kostin has to say: "Macro headwinds diminish 2015 earnings growth prospects. S&P 500 sales will fall by 2% in 2015, the first annual decline in five years. Margins will slip to 8.9%. Energy is a drag on both sales and margins." Let's just focus on the "near-term" slip before we worry about the "long-term rebound." And before the intrepid questions of "this is only due to energy" arise, here is Goldman explaining that the weakness was broad, and impacted every single sector.

But wait, there's more: because in addition to its EPS forecast, Goldman also slashed its GDP and the 10Y yield forecast as well.

So ok, Goldman had a 25% error in its forecast in just under 9 months. Does that mean that the vampire squid is even remotely remorseful or concerned about the credibility of its 2017 and 2018 (yes, 2018) forecasts? Not at all: those are expected to remain completely unchanged on the back of some of the highest EPS gains in recent history. In fact, putting in context, Goldman now expects just 1% EPS growth in 2015 which will then magically soar to 11% in 2016 before "stabilizing" to a "modest" 7% annual EPS growth rate.

With just a little hyperbole, we can say that the only way S&P EPS will grow at that pace is if the S&P ends up buying back half its float. But while one can double seasonally adjust non-GAAP BS until a massive loss becomes a huge profit, one item can not be fabricated: sales. It is here that Goldman has far less to say for obvious reasons.

Yes you read that right "sales per share", because if buybacks can boost Non-GAAP earnings, why not revenues too. If there is a silver lining on the horizon it is one: "We forecast Health Care will grow sales faster than consensus expects." The corporations thank you Obamacare. * * * So to summarize: the first revenue drop for the S&P in 5 years, a major downward revision in EPS now expecting just 1% increase in 2015 EPS, a 25% cut to GDP forecasts, a machete taken to corporate profits and 10 Yields, and not to mention double digit sales declines for some of the most prominent tech companies in the world. And that, in a nutshell, is the "strong fundamentals" that everyone's been talking about. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Today Lost $7.00 Closing at $1,171.50 Posted: 30 Jun 2015 06:22 PM PDT

First, the GOLD/SILVER RATIO. It closed yesterday at 75.236, today at 75.333, a new high for the move. Good (don't drop yore teeth, Granma!), I say. Ratio needs to top before silver and GOLD PRICES will turn. Remember that I expect the window for the seasonal silver and gold low will shut by 10 July or sooner. Don't overlook that footnote. Since Sunday the price of gold has been steadily backing up, and was pressured again all day today. About 12:15 Eastern time it hit a low at $1,165.40, shot up to $1,180, but was forced back again. Lay aside for a moment all my comments about the Nice Government Men and just look at the chart. The gold price keeps on holding up around that $1,168 mark. WHY? Only one reason a market stops dropping: people start buying. I don't know about the rest of the world, but we have been HOPPING. Customers I haven't seen in years are coming back for another round with silver and gold, and new customers, too. Serious ones. Looking at support areas, there are previous lows at $1,162 and $1,141 and $1,130. Maybe on the announcement of whatever rat -- whoa, sorry, make that "rabbit" -- the Euros will pull out of their hat, gold spikes down. If so, I am guessing not further than $1,140, although it's looking less and less like that will happen. Things don't look much different for silver. This $15.50 area has been what I expect to hold, but it could spike to $15.00 or even $14.50. Probably tomorrow will tell the tale. Any good news for Greece and Europe will be bad news for safe haven gold and silver, so the maximum damage will come with that first blow. Watch closely. Without judging the justification or lack thereof for their suspicions, several people a day call me saying something like, "I just don't trust the dollar, the market, the financial system." Whatever the central banks have sown, distrust and fear are coming up. I bought some gold and silver today. If it drops tomorrow, I will buy more. We are right now watching the last lows for the year. But don't take my word for it! I ain't no mor'n a nat'ral born durned fool from Tennessee! But I know this: if the whole doldurned fynanshul system and almighty US dollar to boot go belly up, I can buy me a tin bill and peck in the dirt with the chickens and still make a livin'. Some other folks may go hungry, Lord have mercy on 'em. Please forgive me for missing a commentary yesterday. My out of town guests arrived before I could write it. Here's one for y'all to write down in your books, a headline from Marketwatch.com yesterday: "Why Greek financial crisis won't hurt US economy." Y'all write that down right next to Irwin Fisher's famous statement right before the 1929 crash, "Stocks have reached a permanently high plateau." Let's catch up first. The Greek government shut down the banks, declaring a six day bank holiday, as well as capital controls. Greeks can withdraw in cash from ATMs only 60 euros a day, with a max of 1600 euros a month. Greeks may not send money out of the country without going through an official board (fat chance). Just to heap up the plate of Debt Gone Rancid, Puerto Rico announced yesterday it can't pay its $72 billion debt and is days away from collapse. But markets didn't do what you'd expect, not exactly. Try to put yourself in the Nice Government Men's place. What would YOU do, faced with their needs? European and US NGM have known for months and months Greece might default, and we know all central banks manipulate exchange rates, so you know they've put their heads together to work out their emergency response. Basic parameters are: 1. No stampede out of the euro 2. No stampede into the dollar 3. No stampede into gold 4. No really nasty stampede out of stocks, but some trampling okay. Once you understand which stampedes you must stop, you know the manipulations you must make. With that in mind, let us ponder yesterday and today -- philosophically, to keep down the tics and retching and fury. Against all odds the US dollar index, which overnight had shot up to 96.69, punching into overhead resistance, dropped 70 basis points (0.73%) to close at 94.95, well below its 20 DMA. Right. Sure. Of COURSE the US dollar index, safely-haven of scrofulous fiat currencies, would DROP on the day the euro threatens to come unglued. Sure, yeah, natural as a jet engine. Or it could have been a short squeeze in the euro. On the same day the Euro, flying apart like a Yugo at high speeds, still manages to rise 0.7% to $1.1246. Call me loony, I don't believe it. And the price of gold, which had jumped up to $1,187 over the weekend, added only $5.60 to $1,178.50. Silver fell 7.1 cents to $15.664. Oh, yeah. Stocks were allowed some trampling. The Dow Industrials crashed through their 200 DMA (17,681) scraping off 350.33 (1.95%!) to 17,596.35. Whoops! That's about 200 points lower than the Dow closed 2014. Yea, behold a low lower than any since April, below existing support, below water and taking on more at every seam. S&P lost more, 2.09%, to 2,057.64, but floated bare points above its 200 DMA (2,053.90). Y'all stop and chew on this a moment. The Greek crisis is only a CATALYST, not a cause for this plunge. Did no weakness beforehand exist, no market would plunge. Regardless how Greece is papered over, cascades, Niagaras, Iguaçus are coming in stocks, and soon. Today stocks traded in a tight range (138 points) and the Dow (or the NGM) managed to add 23.16 (0.13%) to 16,619.51, STILL below the 200 DMA. S&P500 added 5.47 (0.27%) to 2,063.11. Say, did I mention to y'all that the Shanghai Stock Exchange fell 3.3% yesterday? Or that it as of yesterday's close it had fallen 21.5% since 12 June? I am so forgetful. Never mind European stock markets.

Dow in Silver didn't quite hit its upper Gator Jaw, but has now broken its uptrend. Closed today up 0.71% at S$1,454.25 silver dollars (1,124.77 troy ounces). Chart's on the left: Dow in Silver didn't quite hit its upper Gator Jaw, but has now broken its uptrend. Closed today up 0.71% at S$1,454.25 silver dollars (1,124.77 troy ounces). Chart's on the left:Both indicators are blowing the klaxon: ABANDON STOCKS!

Today the US dollar index rose 71 basis points (0.75%) to 95.66, safely tamed from yesterday's impulse to escape, and above both short term moving averages. If y'all want to see the Invisible Hand at work, chart on right. Euro lost 0.9% today to $1,1138. Ready to fall off the face of the earth. Yen jumped up today, gapped up yesterday, and has a little rally up out of that pit whereinto it had fallen. Closed up 0.07% at 81.65. US treasury yields remain high. 10 year treasury note fell below its 20 DMA yesterday, but made up much of that loss today. 30 year bond punched into its uptrend line yesterday, but came back a little today. Overall bonds have been falling and yields rising since 1 February. I hope Janet Yellen has stocked in a good supply of industrial strength anti-perspirant. Dad blast it, I disremembered something else! Anent Puerto Rico, do y'all think that's the only governmental entity in the US with debt problems? Jefferson County Alabama (Birmingham) sank in the largest municipal bankruptcy in history, Detroit is in bankruptcy, Chicago is teetering, California (I will bet small money without looking) ain't in great shape, and how many others are hiding in the woodwork? Don't it just make you tingle with joy to know you are surrounded by such magnificent examples of financial management? Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Care And Feeding Of A Financial Black Hole Posted: 30 Jun 2015 06:15 PM PDT Submitted by Dmitry Orlov via Club Orlov blog, A while ago I had the pleasure of hearing Sergey Glazyev—economist, politician, member of the Academy of Sciences, adviser to Pres. Putin—say something that very much confirmed my own thinking. He said that anyone who knows mathematics can see that the United States is on the verge of collapse because its debt has gone exponential. These aren't words that an American or a European politician can utter in public, and perhaps not even whisper to their significant other while lying in bed, because the American eavesdroppers might overhear them, and then the politician in question would get the Dominique Strauss-Kahn treatment (whose illustrious career ended when on a visit to the US he was falsely accused of rape and arrested). And so no European (never mind American) politician can state the obvious, no matter how obvious it is. The Russians have that pretty well figured out by now. Yes, maintaining a dialogue and cordial directions with the Europeans is important. But it is well understood that the Europeans are just a bunch of American puppets with no will or decision-making authority of their own, so why not talk to the Americans directly? Alas, the Americans too are puppets. The American officials and politicians are definitely puppets, controlled by corporate lobbyists and shady oligarchs. But here's a shocker: these are also puppets—controlled by the simple imperatives of profitability and wealth preservation, respectively. In fact, it's puppets all the way down. And what's at the bottom is a giant, ever-expanding, financial black hole. Do you like your black hole? If you aren't sure you like it, then let me ask you some other questions: Do you like the fact that your credit cards still work, or that you can still keep money in the bank and even get cash out of an ATM machine, or that you are either receiving or hope to eventually receive a pension? Do you like the fact that you can get useful things—food, gas, airline tickets—for mere pieces of paper with pictures of dead white men on them? Do you like the fact that you have internet access, that the lights are on, and that there is water on tap? Well, if you like these things, then you must also like the financial black hole, because that's what's making all of these things possible in spite of your country being bankrupt. Perhaps it's a love-hate relationship: you love being able to pretend that everything is still OK even though you know it isn't, and you wish to enjoy a bit more of the business-as-usual before it all goes to hell, be it for a few more days or another year or two; but you hate the fact that eventually the black hole will suck you in, after which point things will definitely... suck. In the United States, so far the black hole has been sucking in individual families (although it does sometimes suck in entire cities, like Detroit, Michigan, or Bakersfield, California, or Camden, New Jersey). With the help of the fraudulent mortgage racket, it sucks in houses, and spits them out again encumbered with bad debt. With the help of the medical industry, it sucks in sick people and spits them out again, bankrupt. With the help of the higher education racket, it sucks in hopeful young people, and spits them out as graduates, with worthless degrees and saddled with mountainous student debt. With the help of the military-industrial complex, it sucks in just about anything and spits out corpses, invalids, environmental damage, terrorists and global instability. And so on. But the black hole can also suck in entire countries. Right now it's busy trying to suck in Greece, but it's having a hard time with it, because Greece is, of all things, a democracy. This has the black hole's puppets in quite a state at the moment, and starting to clamor for “regime change” in Greece, so that Greece can be made to capitulate before the black hole gets hungry. The way the black hole sucks in entire countries is as follows. If the black hole doesn't have enough to suck in for a period of time, it gets hungry and makes the financial markets go into free-fall. The financial instruments of countries that happen to be farther away from the black hole—out on the periphery—fall faster. In search of a “safe haven,” money floods out of these countries and into the “core” countries that are clustered tightly around the black hole—the US, Germany, Japan and a few others. The black hole gobbles up this money, but is then hungry for more. But since the periphery countries are now financially too weak to resist, they can easily be turned into black hole fodder. This is done by saddling the country with a foreign debt it can never repay, then forcing it to keep making payments against this debt by making it a condition for maintaining a financial lifeline—keeping the banks open, the ATMs stocked, the lights on and so on. To be able to make the payments, the country is forced to dismantle its society and economy through the imposition of austerity, to privatize everything in sight turning it into collateral for more loans, and to surrender its sovereignty to some transnational organizations, such as the IMF and the ECB, which are directly involved in the care and feeding of the black hole. Who is in charge of all this? you might ask. If all there is is the black hole, the puppets charged with its care and feeding, and its hapless victims, then who is making the decisions? Well, it turns out that the black hole is sentient. But it is also very, very stupid. And the way is enforces its will is by destroying the minds of its puppets—by making them unable to understand certain things. However, stupidity is a double-edged sword, and in enforcing its will in this manner the black hole also thwarts its own purpose.

Back to the real world: the poor puppets are unable to understand that there is no military option when it comes to Russia: it's a nuclear power with an excellent strategic deterrent, a well-defended territory, and no aggressive intentions against anyone. But the puppets, with their warped minds, cannot see that, and so they pile various kinds of obsolete military junk along Russia's borders, and are even threatening to bring into Europe the entirely obsolete Pershing medium-range nuclear missiles. They are obsolete because the Russians now have the S-300 system with which to shoot them all down. The military option just isn't going to work, but don't tell that to the puppets—they cannot absorb such information without sustaining further neurological damage. Back to Greece: tiny Greece certainly isn't mighty Russia, but it nevertheless refused to capitulate to the demands of the black hole. It was asked to completely wreck its society and its economy as a condition for maintaining its financial lifelines from the IMF and the ECB. Most inconveniently for the black hole and its puppets, Greece is not some obscure “third world” country peopled by dark-skinned people you wouldn't want your daughter to marry, but a European nation that is the cradle of European civilization and democracy. Greece managed to elect a government that tried to negotiate in good faith, but the puppets don't negotiate—they demand, threaten and cause damage until they get their way—or until their heads explode. This one will be interesting to watch. If the black hole does succeed in sucking in Greece, then which country is next? Will it be Italy, Spain or Portugal? And, as that process continues, at what point will enough people say that enough is enough? Because when they do, the black hole will shrivel up. It's not a real black hole that's made up of incredibly dense matter—so dense that its gravitational field traps even light. It's a fake black hole, made up of everyone's combined greed. It has greed at its core, and fear all around it, and it sustains itself by feeding on fear. If it can continue sucking in people, families and entire countries, it can keep the greed at its core alive, but if it can't, then the greed will also turn to fear, and it will shrivel up and die. And I hope that when it dies all of its brain-damaged puppets will snap out of it, realize how deluded they have been, and go find something useful to do—farm sheep, grow vegetables, dig for clams... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Jun 2015 05:40 PM PDT On Monday, we highlighted what we called an "insane" debt chart and explained what it means for the PBoC. Here's a recap:

As a reminder, we've long said China's LGB refi initiative would eventually form the backbone of Chinese QE. Here is what we said in March when the program was in its infancy: "It seems as though one way to address the local government debt problem would be for the PBoC to simply purchase a portion of the local debt pile and we wonder if indeed this will ultimately be the form that QE will take in China." Similarly, UBS has suggested that when all is said and done, the PBoC will end up buying the new munis outright. From a March client note:

And so, here we are barely a month into the new LGB debt swap initiative (which, you're reminded, has already morphed into a Chinese LTRO program after the PBoC, recognizing that banks would be generally unwilling to take a 300bps hit in the swap, promised to allow participating banks to pledge the new munis for cash loans which can then be re-lent in the real economy at 6-7%) and the calls have begun for outright QE. Here's Bloomberg:

Note that this rather hyperbolic appeal for implementing full-on QE in China checks all the boxes: there's a reference to bond market illiquidy, an assertion about constraints on bank balance sheets (which, with credit creation stalling in China, is a big deal), and most importantly, a contention that somehow, the LGB debt swap program is contributing to the implosion of China's all-important equity bubble. A few more 'independent' assessments like these is likely all the PBoC will need to justify joining the global QE parade. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How do you change a currency fast? Posted: 30 Jun 2015 05:33 PM PDT By Isabelle Fraser The drachma was the world's oldest existing currency before it was replaced by the euro on January 1, 2001. And it may be about to make a comeback. This Sunday's referendum is described by European leaders as a vote for or against the euro. If Greece votes "oxi," the country may soon be looking for a new currency. Haris Theoharis, a politician in the centrist party To Potami, said: "There's already a team within the prime minister's office, with staff from the general accounting office, right now working on the drachma." But how? Has anything like this ever been done before? Not really. The last time a currency union broke up was the Austro-Hungarian empire in 1918. ... ... For the remainder of the report: http://www.telegraph.co.uk/finance/economics/11708576/How-do-you-change-... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECB poised to raise heat on Greece's beleaguered banks Posted: 30 Jun 2015 05:21 PM PDT Claire Jones and Alex Barker When the eurozone's central bankers meet in Frankfurt on Wednesday, they could make a decision that some officials fear could push one or more of Greece's largest banks over the edge. The European Central Bank's governing council is poised to impose tougher haircuts on the collateral Greek lenders place in exchange for the emergency loans. If the haircuts are tough enough, they could leave banks struggling to access vital funding. The ECB on Sunday imposed an E89 billion ceiling for so-called emergency liquidity assistance, effectively putting the Greek banking system into hibernation. If, to reflect the increased risk of default, the ECB now applied bigger discounts to the Greek government bonds and government-backed assets that lenders use as collateral, that could leave banks struggling to roll over those emergency overnight loans. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/2d09e45a-1f43-11e5-ab0f-6bb9974f25d0.html ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No End In Sight For Higher-Education Malinvestment Posted: 30 Jun 2015 05:05 PM PDT Submitted by Doug French via The Mises Institute, Those of us leaning in the Austrian direction see bubbles and malinvestments around every corner and assume, wrongly as it turns out, the market will right these wrongs lickety-split. But, for the moment a rational market is no match for cheap money. “Any college that is thinking about capital expansion, now is a very good time,” Robert Murray, an economist at Dodge Data told the Wall Street Journal. “Several years down the road, the climate might not be as good.” Now being a good time because stock market gains have pumped up endowments, “and low interest rates have created a favorable environment for colleges to build,” writes Constance Mitchell Ford. The campus building boom marches on. In 2014 colleges and universities commenced construction on $11.4 billion worth of projects, a 13 percent increase from the previous year. It’s the largest dollar value of construction starts since the heady days of 2008. Ms. Ford’s piece highlights a $2 billion project at Cornell and sixteen new buildings at Columbia worth $6 billion. But here in Auburn, Alabama the campus has been a construction zone since 2008 when I arrived. Multiple new dorms, a basketball arena, a fancy student center, and various new classroom buildings have been constructed at a time when funding from the state has been cut back. What’s now underway is the largest scoreboard in college football, with a plan to expand the stadium next. Back in the 1985–86 school year, full time tuition at Auburn for a non-resident was $2,585. Thirty years later it is now $28,040. That’s a compounded annual growth rate of 8.27 percent. According to Bloomberg, college tuition and fees have increased 1,120 percent since records began in 1978, and the rate of increase in college costs has been “four times faster than the increase in the consumer price index.” Tuiton at state schools is rising even faster says Peter Cappelli, professor of management at the Wharton School of the University of Pennsylvania. He told Becky Quick on CNBC’s “Squawk Box” the cost of an education has risen 50 percent faster at state schools versus private in roughly the last decade. Cappelli said a critical question is whether students will graduate in the first place, noting that only 40 percent of full-time students earn a degree within four years, and 30 million — and perhaps as many as 35 million — young adults do not finish their studies. Unfinished college is as useful as an unfinished building. College degrees are similar to what Austrians call higher-order goods. It’s believed a student will gain knowledge and seasoning in college, making him or her more productive and a candidate for a high-paying career. The investment of time and money in knowledge are undertaken for the payoff of higher productivity and a high future income. Higher education is the higher-order means to a successful career. The assumption is those high-pay jobs, (A) will require a college degree, and (B) they will be plentiful when the student graduates. Borrowing $100,000 to earn a law degree is a malinvestment if the student ends up writing briefs for $15 per hour. A recent graduate of the Charleston School of Law put fliers on cars announcing that he or she had borrowed $200,000 to attend school and is now working at Walmart for $35,000 a year. A post on the “Above The Law” blog revealed, “As of the 2013–2014 academic year, the total cost of a three-year J.D. degree from Charlotte Law was $123,792.00, while the median loan debt per graduate was $159,208.00. Just 34 percent of the class of 2014 was employed in full-time, long-term jobs where bar passage was required. ...” “More college graduates are working in second jobs that don’t require college degrees,” writes Hannah Seligson in the New York Times, “part of a phenomenon called ‘mal-employment.’ In short, many baby-sitters, sales clerks, telemarketers and bartenders are overqualified for their jobs.” Ludwig von Mises wrote in Human Action,

As it is now, parents and students still have the belief that college is the way to, if not riches, at least a well-paying career. In a 2011 piece for mises.org with what turned out to be the hasty title of “The Higher-Education Bubble Has Popped” I quoted PayPal founder and early Facebook investor Peter Thiel, who questioned the value of higher education. He told TechCrunch,

Like most bubbles this one is being fueled by debt. USA Today reports, 40 million borrowers owe $29,000 each, totaling $1.2 trillion outstanding. Student loan debt is easy to get, but hard to get rid of. It’s hard to pay back without a high salary, nor can it be bankrupted away. “Government either guarantees or owns most of the student loans and has the power to sue and to garnish wages, tax refunds, and federal benefits like Social Security when borrowers default,” Kelley Holland writes. Defaults are plentiful. In the third quarter of last year, the three-year default rate was roughly 13.7 percent, with the average amount in default per borrower just over $14,000. These debtors “are postponing marriage, childbearing and home purchases, and ... pretty evidently limiting the percentage of young people who start a business or try to do something entrepreneurial,” says Mitch Daniels, president of Purdue University I administer funds for a small scholarship for graduating high school seniors in my old home town. This year, for the first time, an applicant wrote that he needed financial help for college because his father, a veterinarian, can’t help his children because he’s struggling to make payments on his own student debt. The college boom is not just on campus. Student housing developers have been riding the college boom as well. Two years ago in a piece for The Freeman, I wrote about developers cashing in building dorms. These developers have even found Auburn, with its population of only 50,000. A project called 160 Ross has long-time residents in an uproar with its high density. But as much as locals don’t like it, students have snapped up units at $599 a bed. That rack rate has large student housing developers coming to town and CV Ventures is ready to break ground for a six-story mixed-used project on just one acre featuring 456 beds, stumbling distance from the college bars, with a Waffle House across the street. Meanwhile, everyday we hear about how online courses being the death knell for brick-and-mortar institutions. For the moment traditional colleges seem safe. “Because traditional campuses offer peer and teacher interaction,” writes Ron Kennedy, “as well as a plethora of other important benefits often sought by traditional, college-aged students, there will remain a need for traditional education.” More importantly, Kennedy continues, “Research has shown that students who interact face-to-face with their instructors and other students tend to be more academically balanced than their online counterparts. This is one reason why most employers still prefer students who have attended traditional campuses.” Trees don’t grow to the sky and neither will tuition. However, it’s doubtful young people will suddenly stay home with their parents and work toward degrees taking online classes. Parents who can afford it want to relive their college days vicariously through their kids. The higher education bubble continues to inflate.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

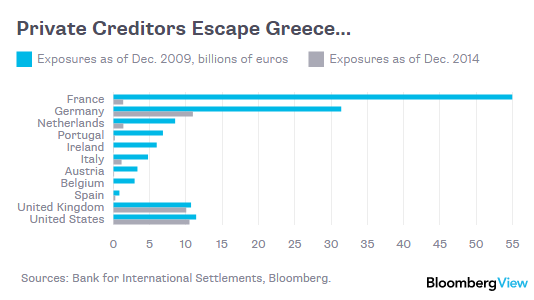

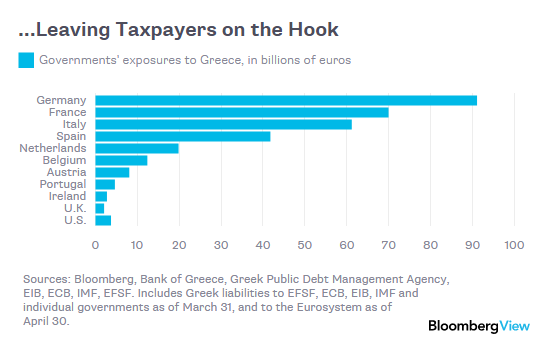

| For Greeks The Nightmare Is Just Beginning: Here Come The Depositor Haircuts Posted: 30 Jun 2015 04:30 PM PDT With capital controls already imposed on Greece, some have wondered if this is as bad as it gets. Unfortunately, as the Cyprus "template" has already shown us, for Greece the nightmare on Eurozone street is just beginning. As a reminder, over the past few months there have been recurring rumors that as part of its strong-arming tactics the ECB may eventually move to raise the haircuts the Bank of Greece is required to apply to assets pledged by Greek banks as collateral for ELA. The idea is to ensure the haircuts are representative of both the deteriorating condition of Greece's banking sector and the decreased likelihood that Athens will reach a deal with its creditors. Flashback to April when, on the heels of a decree by the Greek government that mandated the sweep of "excess" cash balances from local governments to the Bank of Greece's coffers, Bloomberg reported that the ECB was considering three options for haircuts on ELA collateral posted by Greek banks. "Haircuts could be returned to the level of late last year, before the ECB eased its Greek collateral requirements; set at 75 percent; or set at 90 percent," Bloomberg wrote, adding that "the latter two options could be applied if Greece is in an 'orderly default' under a formal ECB program or a 'disorderly default.'" While it's too early to say just how "orderly" Greece's default will ultimately be, default they just did if only to the IMF (for now), in the process ending their eligibility under the bailout program and ending any obligation by the European Central Bank to maintain its ELA or its current haircut on Greek collateral, meaning the ECB will once again reconsider their treatment of assets pledged for ELA and as FT reported earlier today, Mario Draghi may look to tighten the screws as early as tomorrow:

Recall that in mid-June, Greek banks were said to have had as much as €32 billion in ELA eligible collateral that served as a buffer going forward. Since then, the ELA cap has been lifted by around €5 billion, meaning that a generous estimate (and we say "generous" because according to JPM, Greek banks ran out of ELA collateral weeks ago) puts the buffer at a little more than €25 billion. As the haircut rises, that buffer disappears and once the discount applied to the collateral reaches a certain level, an implied depositor haircut materializes. Why? Because by simple balance sheet rules, assets must match liabilities (leaving a token €0.01 for shareholder equity) and once the haircuts eat through the collateral buffer, the implied value of Greece's pledged assets (currently at around €125 billion) will quickly fall below the value of Greek banks' unsecured liabilities which sit at around (but really under) €120 billion as of the date capital controls were imposed in Greece over the weekend. These liabilities are better known as "deposits." At that point, a depositor haircut is required. Although the collateral haircuts aren't public, the face value of pledged collateral is (it can be found on the BoG's balance sheet) as is the ELA cap, meaning it's possible to estimate the current haircut and, starting with the assumption that a generous €25 billion buffer remained as of the ECB's Sunday freeze of the ELA ceiling at €89 billion, project the implied depositor bail-in for different collateral haircut assumptions. Here is the summary sensitivity analysis indicating what a specific ELA haircut translates to in terms of deposit haircut.

Another way of showing this dynamic is presenting the ELA haircut on the X-axis and the corresponding deposit haircut on the Y-axis once the critical "haircut" threshold of 60% in ELA haircuts is crossed. As can be seen raising the haircut to 75% implies a €33 billion (or 37%) depositor bail-in or "haircut", while raising the haircut to 90% implies a €67 billion (or 55%) hit. Note that the latter scenario looks quite familiar to what happened in Cyprus, and indeed that's not at all surprising because if, as Dijsselbloem himself said, Cyrpus is a "template", then the next step after capital controls is a depositor bail-in. And while we wish we could have some good news for the Greek population, this outcome may have been preordained by none other than Goldman whose Hugh Pill, who on June 28 suggested the following:

And as Goldman's former employee and current head of the ECB is about to have his way, the pensioners and public employees will be the first to suffer - first with capital controls and then with ever increasing haircuts on their deposits. In other words, in order for the Troika to finally achieve its goal of either forcing Tsipras to relent or inflicting enough pain on Syriza's "core constituency of pensioners and public sector employees" to compel them to drive the PM from office, after capital controls come the depositor haircuts, first small, then ever greater until Greece collectively Cries Uncle and begs Europe to take it back while presenting Merkel with Tsipras and Varoufakis' heads on a proverbial (and metaphorical, we hope) silver platter. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How China Lost an Entire Spain in 17 Days Posted: 30 Jun 2015 03:58 PM PDT By EconMatters

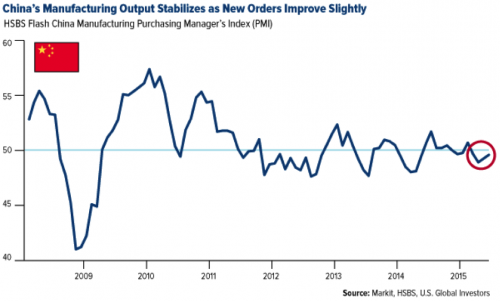

Concerned about a tumbling equity market, PBOC moved to cut both interest rates and the reserve requirement ratio for banks over the weekend. However, increasingly wary of a market bubble in China, investors still sent Shanghai Composite spiraling down another 3.3% on Monday after the dramatic 7.4% plunge last Friday despite the support from the central bank.

Investors are also unnerve by the latest development of Greece just days before a total default and Grexit out of EU, and the news that Puerto Rico could become another Greece of the U.S. facing a financial crisis and cannot pay back its $70 billion in municipal debt.

Read: China's $370 Billion Margin Call

VIX Spike

MarketWatch reported that VIX spiked 33% to above 18, the highest since February, implying that investors are very nervous about the chaos going around.

Beijing Targets Soft Landing?

If you think U.S. stocks are lofty trading at an average of 16 times last year's earnings, the average Chinese stock is now trading at 30 times earnings.

Analysts at HSBC think the China's central bank was trying to engineer a "soft landing" for stocks. But this could be a difficult balancing act trying to shore up investors' confidence while keeping a lid on the speculative fever among Chinese retailer investors (Remember those Chinese housewives who bought up 300 tons of gold and made Goldman Sachs swallow their gold selling recommendation?)

Read: Is China Under The Skyscraper Curse?

$1.3 trillion, an Entire Spain, in 17 Days

Size Does Matter

Only time will tell if Beijing's able to turn the situation (i.e. slowing economy with a bubbling equity market) around. But if the world's biggest trading nation suddenly has a crisis of some sort, it would be a catastrophe of a different scale. Size does matter when it comes to financial collapse, and China could do far worse damage than any Grexit or PIIGS debt default.

Chart Source: Quartz

© EconMatters All Rights Reserved | Facebook | Twitter | Free Email | Kindle | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - End of Quarter, Hearts of Darkness, Web of Lies Posted: 30 Jun 2015 01:19 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 26 Silver Flash Crash: A Forensic Analysis Posted: 30 Jun 2015 12:57 PM PDT Monetary Metals | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Solvency of the ECB is at Stake Posted: 30 Jun 2015 12:04 PM PDT This post The Solvency of the ECB is at Stake appeared first on Daily Reckoning. Make no mistake; the Greek crisis is a euro crisis that threatens the solvency of the European Central Bank (ECB) itself, and therefore confidence in the currency. Before going into why, a few comments on Greece will set the scene… Last weekend it became clear that Greece is heading for both a default on its government debt and also a failure of its banking system. With the benefit of hindsight it appears that the Greek government was unwilling to pretend that it was solvent and extend its financial support as if it was. The other Eurozone finance ministers and the troika were not prepared to accept this reality. There is no immediate benefit from debating why. What matters now are the economic and financial consequences, which are basically two: the Eurozone's banking system is very fragile and cannot absorb any sovereign default shocks easily, and the ECB itself now needs refinancing. Let's concentrate on the ECB first. The losses the ECB face from Greece alone are about twice its equity capital and reserves. The emergency liquidity assistance (ELA) owed by Greece to the ECB totals some €89 billion, and the TARGET2 balance owed by the Bank of Greece to the other Eurozone central banks is a further €100 billion, which at the end of the day is the ECB's liability. The total from these two liabilities on their own is roughly twice the ECB's equity and reserves, which total only €98 billion. Given the likely collapse of the Greek banking system and the government's default on its debt, we can assume any collateral held against these loans, as well as any Greek bonds held by the ECB outright are more or less worthless. The ECB has two courses of action: either it continues to support Greece to avoid crystallizing its own losses or it recapitalizes itself with a call upon its shareholders. The former appears to have been ruled out by last weekend's events. For the latter a rights issue looks challenging to say the least, because not all the EU national central banks are in a position to contribute. Instead it is likely that some sort of qualifying perpetual bond will be issued for which there should be ready subscribers. How this is handled is crucial, because there is considerable danger to the ECB from the instability of the whole Eurozone banking system, which is highly geared and extremely vulnerable to any reassessment of sovereign credit risk. If you believe that the Greek crisis has no implications for Italy, Spain, Portugal and even France, you will rest easy. This surely is how the ECB would like to represent the situation. If on the other hand you suspect that the collapse of the Greek banking system, plus their sovereign default, together with a knock-on effect in derivative markets, have important implications for euro-denominated bond markets, you will probably run for the hills. The latter being the case, highly geared Eurozone banks are likely to face difficulties, and they will affect the ECB's own holdings of all bonds, both owned outright and held as collateral against loans to rickety banks. In short, the ECB's balance sheet, which is heavily dependent on Eurozone bond prices not collapsing, is itself extremely vulnerable to the knock-on effects from Greece. As the situation at the ECB becomes clear to financial markets, the euro's legitimacy as a currency may be questioned, given it is no more than an artificial construct in circulation for only thirteen years. In conclusion, the upsetting of the Greek applecart risks destabilizing the euro itself, and a sub-par rate to the US dollar beckons. This week should see the dollar strong against the euro and the euro price of gold can be expected to rise. The extent to which these happen may depend on whether or not central banks intervene. For what it's worth last time this happened (over Cyprus February 2013) Europeans were reported to be requesting physical delivery against their unallocated gold accounts. The following April a co-ordinated bear raid of unprecedented size pushed the gold price down from $1,580 to a low of $1,183. The purpose of the raid was to disabuse investors of the safe-haven trade, in which it succeeded. There is little such appetite for gold bullion today so a similar move is probably viewed by central banks as unnecessary; but if the gold price was to move significantly higher attempts to defuse the rise are less likely to succeed because there are very few sellers in western markets and the short positions on Comex in the Managed Money category start at record levels. Regards, Alasdair MacLeod P.S. I originally posted this article, right here, at GoldMoney.com Editor’s Note: Nothing lasts forever. And that's especially true for paper currencies. When the dollar finally goes the way of the dodo, will you be prepared? Sign up for the FREE Daily Reckoning to receive expert advice on how to secure your finances no matter what happens to the "almighty dollar." The post The Solvency of the ECB is at Stake appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Jun 2015 11:50 AM PDT This post When Gold is Declared Illegal appeared first on Daily Reckoning. Over the weekend, the lines in Greece stretched along the street. Around the corner. Down the block. Lines to get cash. Lines to buy gas. Lines of people eager to get their hands on something of value. Food. Fuel. Cash. Pity the poor guy who was last in line… …the poor taxi driver, for example, standing behind 300 other people, trying to get 200 lousy euros out of an ATM. Like a tragic nightclub customer… among the last to smell the smoke. By the time he headed for the exit, it was clogged with desperate people, all struggling to get through the same narrow door at the same time. Remember: When a bear attacks in the woods, you don't have to be faster than the bear. You just have to be faster than at least one other hiker… Likewise, you don't have to be the first one to get your money out of an ATM. You just want to be sure you get your money before the machine runs out of cash. And when a bear attacks Wall Street, you don't have to be the first to sell. But you definitely don't want to be the last. The Dow lost 350 points yesterday – its biggest point drop in two years. Today, Greece is expected to default on a $1.7-billion payment to the International Monetary Fund (IMF). And on the other side of the planet, analysts are looking at "the beginning of the end for Chinese stocks." We doubt it is the beginning of the end. More likely, it is just the end of the beginning. On Friday, the People's Bank of China cut rates to a record low, after stocks in Shanghai slipped 7% in a single day (the equivalent of about 1,300 points on the Dow). Analysts expected a big rally in response to the rate cut. Instead, the Shanghai Index plunged again on Monday, dropping 3%. Greece… China… said one commentator interviewed by Bloomberg: "You have a potentially very ugly situation this week." Our guess: Stocks in the U.S. and China have topped out. Old-timer Richard Russell, who has been studying markets since 1958, agrees: I believe the top has appeared, like the proverbial thief in the night. The Dow has fallen below the 18,000-point level, and is now negative for the year. The Transports, which have led the way recently, are down triple digits for today and are only 89 points above the critical level of 8,000. The Nasdaq has closed under 5,000. At the market's close, gold was up 5.3 at 1,179. But wait… What about silver and gold? As regular readers know, we recommend having some cash on hand in case of a monetary emergency. But a reader asks: What good is gold when gold is declared illegal? First, precious metals aren't illegal, so far. Second, making something illegal doesn't necessarily make it unpopular. President Roosevelt banned gold in 1933. The feds wanted complete control of money. The dollar was backed by gold. So getting control of the dollar meant getting control of gold. Once the feds had the gold, they could devalue the dollar by resetting the dollar-gold price from $20 to $35. In an instant, people lost more than 40% of their wealth (as measured by gold). That ban lasted for 42 years. It ended in 1975, largely because of our old friend Jim Blanchard. Jim set up the National Committee to Legalize Gold and worked hard to get the ban lifted. Today, the feds don't need to outlaw gold. It is regarded as "just another asset," like Van Gogh paintings or '66 Corvettes. Few people own it. Few people care – not even the feds. They are unlikely to pay much attention to it – at least, for now. That could change when the lines begin to grow longer. Smart people will turn to gold… not just in time, but just in case. It is a form of cash – traditionally, the best form. You can control it. And with it, you can trade for fuel, food, and other forms of wealth. Lots of things can go wrong in a crisis. Cash helps you get through it. Generally, the price of gold rises with uncertainty and desperation. Gold is useful. Like Bitcoin and dollars in hand (as opposed to dollars the bank owes you), gold is not under the thumb of the government… or the banks. You don't have to stand in line to get it. Or to spend it. Yes, as more and more people turn to gold as a way to avoid standing in lines, the feds could ban it again. But when we close our eyes and try to peer into a world where gold is illegal, what we see is a world where we want it more than ever. Regards, Bill Bonner P.S. I originally posted this essay, right here, at the Diary of a Rogue Economist. The post When Gold is Declared Illegal appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

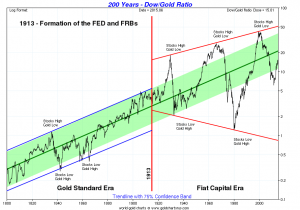

| Jeb Handwerger: “Picking the top 2 Stocks on OTCQX® in 2014 is a Great Blessing” Posted: 30 Jun 2015 11:42 AM PDT Jeb Handwerger: Fed Interest Rate Increase Could Be Best Thing to Happen to GoldSource: JT Long of The Gold Report June 30, 2015 A true contrarian knows that when everyone says an interest rate hike by the Federal Reserve would kill stocks, that is the best time to double down on junior mining names. In this interview with The Gold Report, Gold Stock Trades author Jeb Handwerger shares the names of the companies he thinks could do well through the drill bit or by acquisition regardless of when the inevitable turnaround comes. The Gold Report: Common wisdom says that when the U.S. Federal Reserve raises interest rates later this year, it will prove negative for gold. Do you agree? Jeb Handwerger: I think it’ll be the opposite. Money printing and easy credit has fueled the stock market rally and beaten down commodities. Investors flocked to dividend-paying stocks, and became speculative in tech, which has led to huge overvaluations similar to the late 1990s dot-com debacle. We’ve had a four-year parabolic rise in the Dow without a meaningful correction. Most investors who have been in this business for a while know that every four years you get a bear market with about a 30-50% correction. Rising interest rates may be the catalyst that causes investors to flee the general stock market, which has proven attractive in a low rate environment. Higher interest rates concurrent with a pickup in inflation could result in a rush to a safe haven in commodities and wealth from the earth–natural resources and precious metals, which is historically a hedge against a pickup in inflation. The Dow-gold ratio is a critical tool to see the inverse relationship between stocks and gold. When stocks move higher investors abandon gold and vice versa. Notice the pattern since 1913 when the Federal Reserve was created. The stock booms and busts are much more dramatic. In the 20th century we saw the Dow-gold ratio move close to parity during the Great Depression and in 1980 when interest rates soared to record territory. Notice in the 1970s there was a much more severe decline than in the 1930s as money printing and debt soared after gold was completely abandoned during the Nixon Administration. Eventually this will revert back to 1:1 or possibly lower sometime in the next 10-20 years. Investors must be prepared for such a scenario as the supply of global fiat money is much higher than in the past. It may not occur as fast as people expect it to, but over the next four to five years, we could eventually see the Dow-gold ratio correct. Notice the recent uptick in favor of the Dow. It looks quite similar to what happened in the 1970s when investors were suckered back into stocks only to witness a major parabolic move in gold from the sidelines. This move higher in the Dow could be a suckers’ rally and that is what we’re preparing for. The balancing will probably come from a combination of a real spike in gold prices after underinvesting in resource exploration constricts gold supplies and the popping of our current stock market bubble, 2000 dot-com style. It has to happen eventually. The broad overvaluation in banking and technology is not supported by fundamentals. Mobile app companies are getting billion-dollar valuations with no revenues; that’s a sign that we’re near a market top. Quantitative easing and negative interest rates are some of the causes of the inflated market prices. Once rates start moving back up again, that’s when we’ll see precious metals start moving again as in the 1970s. Gold will top again as it did in the 1980s with record high interest rates, not negative interest rates. Rising rates might be the catalyst for investors to rotate into the commodities, particularly into precious metals. TGR: We are also in the middle of an annual summer seasonal low. How are you positioning yourself to take advantage of the opportunities you’re seeing right now? JH: There are two periods where you get bargains in the junior mining sector: December tax-loss selling and the summer doldrums, characterized by a lack of market activity due to investors being on summer vacation. But summer is actually one of the best times to buy because that’s when explorers and developers, especially the ones in the snowy north with a limited work year, have the most news flow. Investors who buy now and then wait until September or October can see huge upside. This is bargain time for the junior mining sector. If you’re a contrarian investor, this is a great opportunity to take at least some of your profits from the overblown markets and wade into the beaten down junior mining sector where the best opportunities live. TGR: Despite these overall trends, some companies did well last year. What were the traits these winners shared? JH: In 2014, something very interesting happened. Despite the bear market in the junior sector, two mining companies, which I’m a shareholder of and which I spoke about numerous times in 2014, led the entire OTCQX. No. 1 was Western Lithium USA Corp. (WLC:TSX; WLCDF:OTCQX). No. 2 was NioCorp Developments Ltd. (NB:TSX). Western Lithium had a 2,566% increase in daily trading volume in 2014. NioCorp gained 394% in market cap. They were the top two of the best 50 OTCQX® companies. See the full list here. TGR: Both of those companies have moved down from their highs at the beginning of this year. Was there a common event that pushed them up and then down again? JH: Sometimes things overshoot to the upside, and they come back to the mean. That’s what happened with NioCorp. When things are going parabolic, that is not the time to buy but the time to be careful and possibly take partial profits especially after making a double, triple or grand slam tenbagger. Stocks go through periods of undervaluation and overvaluation. We have to be careful about being on margin or in debt in this rising rate environment. Right now, the overvaluation is in the general equity markets, which are definitely in need of a significant correction after going straight up for four years artificially from an extremely accommodating Fed. TGR: What are some companies in the junior resource sector going against the trend this year? JH: One of our best performing gold equities has been Integra Gold Corp. (ICG:TSX.V; ICGQF:OTCQX). It has outperformed the junior mining index by a significant margin, and it may be just beginning to break out into new highs. The company recently announced results from the compilation of 75 years of historical mine data, and it identified a major exploration target. Integra is in the center of Val-d’Or, Quebec, which is one of the best mining jurisdictions in the world. It has infrastructure, a permitted mill on site, and development potential. It is a world-class asset with a lot of working capital. Company management has done an excellent job of building new shareholders. Integra is probably one of the most aggressive explorers and developers in the entire junior mining industry. This is a story that has performed very well for me in a challenging bear market in junior gold miners. TGR: In a recent report, the company identified 8-20 million tons grading 5.5-6.5 grams per ton (5.5-6.5 g/t) at the Sigma-Lamaque project. Was that enough to get investors excited about it? JH: I think that’s why the market is reacting so positively, and that’s why it’s going to new highs. Everyone knew that this project was high grade. Everyone knew this was economic. What they wanted to see was the size. Now, Integra is beginning to show the market that there’s size, there’s growth and there’s even more potential here. The company recently released its 75-year proprietary data on the mine to the public and offered a $1 million ($1M) prize to the best prospector who identifies the next big target. This is similar to what Goldcorp Inc. (G:TSX; GG:NYSE) did when Rob McEwen was running it and it turned out to be a great success. Integra is outperforming the Market Vectors Junior Gold Miners ETF and hitting new highs, when many of these junior gold miners are hitting new lows. Integra is continuing to drill test, and there should be continuing news. There is going to be an aggressive summer and fall for this company. TGR: What is another company that has been creating excitement with the drill bit? JH: Another one that has done well for us in 2015 is NuLegacy Gold Corporation (NUG:TSX.V; NULGF:OTCPK). It has been drilling in Nevada’s Cortez Trend next to Barrick Gold Corp.’s (ABX:TSX; ABX:NYSE) Goldrush discovery and made some impressive results. The company has an experienced technical management team led by Dr. Roger Steininger, who discovered the Pipeline deposit for Royal Gold Inc. (RGL:TSX; RGLD:NASDAQ) in 1989, which eventually came into production through Barrick. Needless to say, he has a great relationship with Barrick. He’s very well respected. In late May, NuLegacy drillers intersected two gold-bearing zones with extremely high assay results of around 25 g/t over 4 meters (4m) within over 40m of 4 g/t material. One of NuLegacy’s directors, Alex Davidson, the former Barrick executive vice president of acquisitions, said that this result might indicate that the Iceberg gold deposit, which NuLegacy owns, is a very robust Carlin-type gold system and significantly expands its exploration potential. TGR: Does NuLegacy have enough funds to realize its earn-in with Barrick? JH: The company just raised over $2M, so it has enough funds to make it to the end of 2015 when it will earn in and Barrick will have to make a decision about spending $15M and bringing the project to feasibility with NuLegacy as a 30% carried interest. Recent drill results make us think there is a very good chance that that happens. Nevada is where Barrick’s lowest cost, most economic and most profitable mines are located. The major has had to write down a bunch of assets in risky jurisdictions and will need to find the next source for low-cost resource growth in a stable jurisdiction. Barrick may just say it wants 100% and buy NuLegacy outright. TGR: What is another one that has been doing well? JH: Another gold company that I think should be on the radar of junior mining investors is Pershing Gold Corp. (PGLCD:OTCBB). The company just announced a share consolidation and introduced two new board members. This is setting it up for a better listing. Pershing has some of the strongest shareholders in the U.S.–Dr. Phillip Frost and Barry Honig. It’s run by transaction attorney CEO Stephen Alfers, who has been around the gold mining sector for years, most notably with Franco-Nevada Corp. (FNV:TSX; FNV:NYSE). Pershing could get into near-term production at Relief Canyon, which has shown some incredibly high grades and has a permitted mill. Plus, it could make more accretive acquisitions. Pershing might be a vehicle for some of these top shareholders to pick up high-quality assets at bargain basement prices. TGR: Are you looking at that as a mergers and acquisitions (M&A) play? JH: Yes, but the uplisting from the OTC is key to raising capital from institutions. That would make it an exciting story in H2/15. Canada has had a lot of M&A activity because of the relative value of the Canadian dollar. The Alamos Gold Inc. (AGI:TSX; AGI:NYSE)- AuRico Gold Inc. (AUQ:TSX; AUQ:NYSE) deal was partly the result of Alamos looking to expand into Canada. AuRico has great Canadian prospects, particularly with Carlisle Goldfields Ltd. (CGJ:TSX; CGJCF:OTCQX), which is developing the Lynn Lake gold project in Manitoba where AuRico is a partner. Manitoba is quite exciting now that Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) has acquired Mega Precious Metals Inc. (MGP:TSX.V). That takeover could make Carlisle the next takeout target because low power costs make the province one of the lowest operating expenditure cost regions in the world TGR: What are some other junior names that could be buyout prospects this year? JH: Red Eagle Mining Corp. (RD:TSX.V), which is coming close to production in Colombia with an incredibly high economic project, could be a target. It is fully permitted and fully in construction of a very high-grade gold mine. It is also in acquisition mode. Next week, CB Gold Inc. (CBJ:TSX.V) shareholders will vote on an all-share offer Red Eagle made to merge those two companies. Corvus Gold Inc. (KOR:TSX) just announced an extremely economic preliminary economic assessment and a new resource from the high-grade YellowJacket discovery in Nevada. This could be the start of a new district in Nevada and could make Corvus a target for one of the majors. One that really has tenbagger potential if there is a black swan that takes gold back above $1,500 per ounce is International Tower Hill Mines Ltd. (ITH:TSX; THM:NYSE.MKT), which is owned by AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE), Tocqueville Asset Management L.P. and Paulson & Company Inc. This company has a huge amount of leverage in case gold jumps. It’s trading at pennies on the dollar. It has 20 million ounces of gold, but it needs a much higher gold price. That’s my short list of companies that I’m betting are going to see some sort of transaction. There are more I discuss in my newsletter. TGR: Please debunk one myth in the gold space that could hold resource investors back. JH: One of the myths that you always hear is that gold is going to be sold off if interest rates rise. If interest rates rise, that means the powers that be are worried about inflation. Why do we invest in gold? To hedge against inflation. The real myth, especially in the U.S., is that hyperinflation can never come to America. It can happen in Argentina. It can happen in Greece. It can happen in Europe. It can happen in Japan. But it will never happen in the U.S. because the dollar is king. That myth could cost people their fortunes. We have had cheap prices since the 1970s. The greatest misconception is that it will stay like that. But trends change direction. It’s wrong to think that just because we’ve seen a trend in lower interest rates and low inflation that there can’t be higher interest rates and higher inflation down the road. That is what we’re prepared for at Gold Stock Trades, and that is why subscribers continue to read and stick with junior mining investments. Those might not be their whole portfolios, but they maintain a percentage of their wealth in gold because they’re concerned that hyperinflation could happen anywhere. The greatest concern I have right now for U.S. investors is that they’ve become complacent. They think that everything is hunky dory. Unemployment is going down. There’s no inflation. But there really are issues. We’re seeing riots, drought, increased conflict in Syria and Iraq. The euro is collapsing. What happens if interest rates rise while oil companies are sitting on huge amounts of debt in the U.S.? The greatest danger, I think, is complacency. TGR: Thank you for sharing. Jeb Handwerger is an author, speaker and founder of Gold Stock Trades. He studied engineering and mathematics at University of Buffalo and earned a master’s degree at Nova Southeastern University. After teaching technical analysis to professionals in South Florida for over seven years, Handwerger began a daily newsletter, which grew to include thousands of readers from over 40 nations. Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Interviews page. DISCLOSURE: 1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None. Streetwise – The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part. Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported. Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bron Suchecki: OCC's gold derivatives chart is wrong, and derivatives went down Posted: 30 Jun 2015 10:07 AM PDT 1p ET Tuesday, June 30, 2015 Dear Friend of GATA and Gold: Perth Mint market researcher Bron Suchecki writes today that Zero Hedge was wrong in asserting last night that the new quarterly report from the U.S. Office of the Comptroller of the Currency shows a huge increase in issuance of gold derivatives, because, Suchecki maintains, a chart in the OCC report is erroneous. Suchecki does not challenge Zero Hedge's larger assertion, that the report shows a fantastic increase in investment bank JPMorganChase's commodity market derivatives. Suchecki's analysis is headlined "Precious Metal Derivatives Decline 29%" and it's posted at the Perth Mint's Internet site here: http://research.perthmint.com.au/2015/06/30/precious-metal-derivatives-d... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bullion Stored In Singapore Is Safest Posted: 30 Jun 2015 09:41 AM PDT This post Gold Bullion Stored In Singapore Is Safest appeared first on Daily Reckoning. I spoke with Dr. Marc Faber about his strategies for protecting and growing wealth in 2014 and beyond (this video is part two of a series — if you missed part one, watch it here). In the webinar, some of the topics covered with Dr Faber included:

The interview was as informative as ever and Dr. Faber took the time to answer some questions from participants. Click on the video above to watch. Regards, Mark O'Byrne P.S. This article was originally posted on GoldCore's blog, right here. Editor's Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Gold Bullion Stored In Singapore Is Safest appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

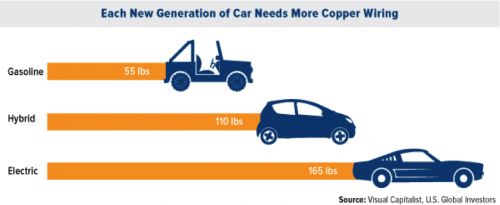

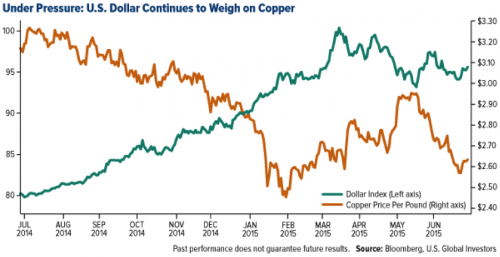

| Bet On The House — Go Long With Copper Posted: 30 Jun 2015 09:27 AM PDT This post Bet On The House — Go Long With Copper appeared first on Daily Reckoning. Here’s a bit of energizing news: In 2014, for the first time in four decades, the global economy grew along with energy demand without an increase in global carbon emissions. That’s according to energy policy group REN21’s just-released Renewables 2015 Global Status Report, which attributes this stabilization to “increased penetration of renewable energy and to improvements in energy efficiency.” What this means is that as the world’s population continues to grow, and as more people in developing and emerging countries gain access to electricity, the role alternative energy sources such as wind, solar and geothermal play should skyrocket. Between now and 2040, a massive $8 trillion will be spent globally on renewables, about two thirds of all energy spending, according to Bloomberg New Energy Finance. Solar power alone is expected to draw $3.7 trillion.