Gold World News Flash |

- Gold, Inflation Expectations and Economic Confidence

- Large Comex Gold Withdrawal As Paper Price Manipulated Lower

- They’re Burning The Furniture Now

- Gold, Yen, Central Banks and the Endgame

- On Collapse, Justice & Why Drug Dealers Love the War on Drugs — Marc Victor and Doug Casey

- The LAST Move Before Checkmate…

- We Have Just Witnessed The Last Gasp Of The Global Economy

- A Signal of Coming Collapse

- Seth Lipsky: Republicans should start by fixing the Fed

- The Revenge Of A Government On Its People

- Why Are Countries Training Armies To Control Mass Riots?

- Gold, Bonds, & "Maybe History Has Stopped"

- Silver and Gold Prices Free Fell Today with the Gold Price Losing $22.00 Closing at $1,145.40

- Lassonde reconsiders, admits BIS may be manipulating gold market

- Dallas Fed president warns Republicans against making central bank account for itself

- Demand For Coins And Bars Exploding While Gold And Silver Prices Pushed Down

- The Tragedy of Common Politics

- Silver and Powerful Forces

- Get Your Gas Money Back In One Easy Step

- Gold, silver in backwardation as a result of BIS paper dumping, Kaye tells KWN

- Koos Jansen: The mainstream media vs. gold

- Pierre Lassonde’s Shocking Comments On Gold & Silver Plunge

- Gold Daily and Silver Weekly Chart - Send In the Clowns

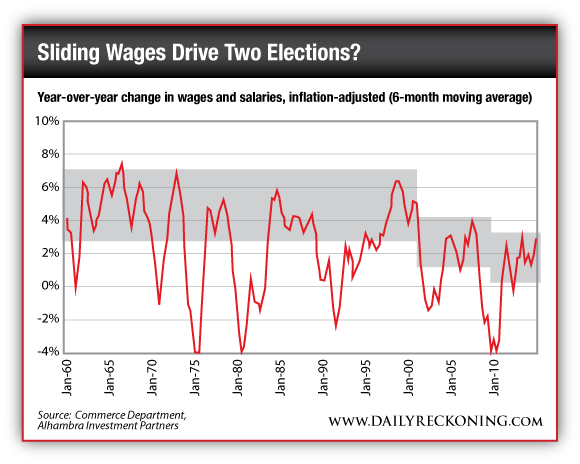

- Eerie Similarities Between the 2006 and 2014 Mid-Terms – and What They Mean for the Future

- Where Are Gold Prices Headed and How to Profit

- U.S. Mint temporarily sold out of silver eagles amid huge demand

- Ron Paul Says: Watch the Petrodollar

- The Big Mining Macro Picture

- Unwanted Competition: The Real Reason Youth Unemployment is So High

- Global Scramble For Silver - Coins “Hard To Get,†“Premiums Likely To Jumpâ€

- Guest Post: Why is gold mining such a crappy business?

- 4 Important Lessons Politicians Can Learn from the US Energy Miracle

- In The News Today

- Jim’s Mailbox

- Shocking Facts About Today’s Smash In Gold & Silver

- A Republican Senate Could Mean Huge Gains for Coal. Here’s Why.

- Price tumble prompts scramble for silver coins and bars

- World Gold Council has nothing to say about Swiss gold referendum

- Plunging gold price has mining companies selling at a loss

- Gold funds down by 80pc: should you invest?

- Tech Stocks That Will Profit Thanks to U.S. Election

- Gold, Economic Theory and Reality: A Conversation with Alan Greenspan

- A Sneak Peek at The Colder War

| Gold, Inflation Expectations and Economic Confidence Posted: 05 Nov 2014 11:00 PM PST Speculative Investor | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

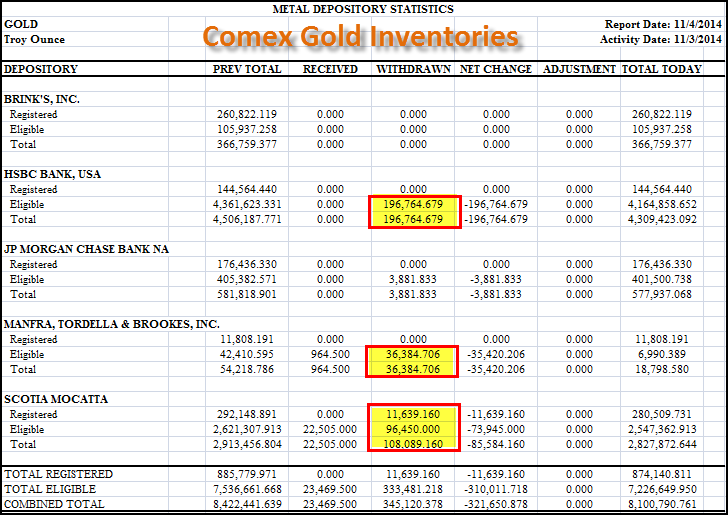

| Large Comex Gold Withdrawal As Paper Price Manipulated Lower Posted: 05 Nov 2014 09:45 PM PST from SRS Rocco:

In just one day, 321,650 ounces of gold were removed from the Comex: As we can see from table, 196,764 oz of gold were removed from the HSBC's vault and a total of 85,584 oz were taken off Scotia Mocatta. The total 321,650 oz removed represents 36% of the total gold in the Registered Category. The Registered category is gold that is available for delivery into the market.

Furthermore, JP Morgan only has 577,937 oz of gold remaining in its vaults. A few weeks ago, JP Morgan experienced a ONE DAY removal of 321,500 oz from its warehouse stocks. This is not a trend JP Morgan can afford to continue. Furthermore, total Comex gold inventories fell nearly 2 million oz since its high of 10 million ounces at the end of August. This is a 20% decline of total gold warehouse stocks in just three months. Gold Paper Price Smash During the Swiss Gold-Backed Franc Referendum Right now the Swiss are voting on whether to back their Swiss Franc with gold. The voting takes place throughout the month and will be tallied on November 30th. It's no coincidence that the paper price of gold is being smashed during this important Swiss vote, that if passed, could be a huge LOSS for the BANKING CARTEL. Of course, there are no REAL MARKETS anymore as every thing is being rigged by the Fed and Central Banks. Before the Fed took control of the markets in 2008, the Stock markets and the precious metals all declined in the same fashion. However, today we see a totally disconnect. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| They’re Burning The Furniture Now Posted: 05 Nov 2014 09:41 PM PST by Dave Kranzler, Investment Research Dynamics:

Last night around 12:30 a.m. EST, $1.5 billion of paper gold was dumped into the Comex Globex computer trading system during one of the least liquid periods of trading in any 24 hour period. It was done when there was almost no resistance from the physical market. The two largest physical buying markets in the world were dormant when this hit occurred: India was closed for holiday observance and Shanghai was on its mid-day trading hiatus.

Dumping this enormous load of paper gold onto the market like this can only be done by an entity that has an agenda other than profit motive. Even if a big player wanted to establish or add to a short position to express a bearish view on gold, a position of this size would be carefully set up in order to maximize the price level received for selling-short the gold futures. Instead, a powerful entity who can easily absorb the likely losses dumped this paper gold on the market with the goal of manipulating the price lower. To be sure, hoards of "little guys" in the U.S. seem to understand the real truth. The record buying of U.S. minted silver eagles – aka "poor man's gold – during September and October bears witness to this assertion. As the western Governments force the price lower with phony paper gold and continue to loot all visible sources of physical gold in order to meet delivery requirements, it seems that the "hoi polloi" is fighting back by buying even more physical metal. It's not just in the U.S. The Royal Canadian Mint reports its silver maple leaf sales on a lagged basis but unofficial reports suggest that buyers there have been wiping clean the cupboard. And a report surfaced out of Germany about a run on silver coins there by the public (LINK). One can only wonder what the ultimate end-game agenda is here, because if these prices stick for awhile the majority of gold/silver mines globally will be forced to shut down. Many people believe this move in the metals is directed at the Swiss Gold Initiative vote at the end November. But I believe it's fait accompli predetermined to fail. I think what's happening now is a desperate attempt to defer much bigger problems. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Yen, Central Banks and the Endgame Posted: 05 Nov 2014 09:41 PM PST Japan is frantically trying to stop its deflationary trap and its immense debt burden. The population is aging and prospects look dire. On Halloween (great timing) the Bank of Japan threw the kitchen sink at the problem by announcing that they would increase their QE from ¥60-70 trillion, to ¥80 trillion ($700 B) and would increase its purchases of ETF and REIT's. In addition, Japan's $US1.2 trillion Government Pension Investment Fund will dramatically rebalance its portfolio away from bonds and into stocks. These actions have depreciated the Yen versus the dollar by about 5% since the announcement and have created about an 8% jump in the Nikkei. If you extend the time period to the summer, the Yen is down about 13% while the Nikkei is up about 10%. If you are a Japanese citizen, you have lost a significant amount of purchasing power unless you own a bunch of stocks (which they don't). Going back to 2012, the purchasing power loss is over 30%: Let us be clear about Central Bank objectives:

Number 4 is the item that we will focus on. Japan's debt to GDP is well over 200% (¥1 quadrillion!) and rising quickly. They have had a hard time getting their inflation to move upward and they have also added some taxes to try to bring their deficit down which has probably counteracted their inflation and growth targets. Inflation is the only plausible solution and depreciation of the Yen is key to Japan's predicament. The recent aggressiveness of the Bank of Japan smells more of desperation than solution. The one thing that I can cite as factual is that the Bank of Japan often purchases equities and other assets (not just government bonds) and is not bashful about it. My summary of their actions is that anything is game. Since the Bank of Japan is purchasing all of their own debt and a good chunk of Japanese debt in existance are owned by Japanese families or Japanese entities, they have not seen the bond vigilantes who usually make governments become honest about their problems. Without rising interest rates, Japan just needs to keep investors psychologically calm so that there is not a hyper-inflationary or crashing currency situation. One of the ways to keep investors calm is to stop gold and silver from skyrocketing in price due to a lack of faith in the currency (government) and a scramble to preserve wealth through hard assets. It just so happens that the ex-Assistant Treasurer to the Reagan administration and co-drafter of the Economic Recovery Tax Act of 1981, Paul Craig Roberts hit the idea of central banks' interaction with the gold market right on the head: As we have demonstrated in previous articles, the bullion banks (primarily JP Morgan, HSBC, ScotiaMocatta, Barclays, UBS, and Deutsche Bank), most likely acting as agents for the Federal Reserve, have been systematically forcing down the price of gold since September 2011. Suppression of the gold price protects the US dollar against the extraordinary explosion in the growth of dollars and dollar-denominated debt. It is possible to suppress the price of gold despite rising demand, because the price is not determined in the physical market in which gold is actually purchased and carried away. Instead, the price of gold is determined in a speculative futures market in which bets are placed on the direction of the gold price. Practically all of the bets made in the futures market are settled in cash, not in gold. Cash settlement of the contracts serves to remove price determination from the physical market. Cash settlement makes it possible for enormous amounts of uncovered or "naked" futures contracts — paper gold — to be printed and dumped all at once for sale in the futures market at times when trading is thin. By increasing the supply of paper gold, the enormous sales drive down the futures price, and it is the futures price that determines the price at which physical quantities of bullion can be purchased. You can read the full article here. What I liked even more was the fact that over the last five years, when Asian physical delivery markets are open the returns are positive whereas they are negative when the London/US markets are open: Lastly - Japan was successful in depreciating its currency starting in 2012. At the start of that slaughtering, Gold started to rally in Yen rather dramatically. By early 2013 that trend started to reverse and since mid 2013, Gold in Yen has been relatively flat even though the Yen has been continuously crucified. Is it possible that the Bank of Japan wants to keep Gold unexciting as a preservation of wealth and wants to move their citizens into stocks and "more productive" assets such as stocks? Most interesting question is: How can record demand for physical silver occur at the same time that the price is falling like a rock? - U.S. Mint temporarily sold out of Silver Eagles amid huge demand | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| On Collapse, Justice & Why Drug Dealers Love the War on Drugs — Marc Victor and Doug Casey Posted: 05 Nov 2014 09:40 PM PST from Casey Research: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The LAST Move Before Checkmate… Posted: 05 Nov 2014 09:05 PM PST from Silver Doctors:

Without the Shanghai physical drain on silver supplying the mints, the COMEX and LBMA would have defaulted by now. This is no accident. China created the loophole like a Trojan horse targeting the Achilles' heel of the financial system. Silver is the sacrificial pawn. Wall Street took the arbitraged silver bait and it's almost time to back up the truck and go ALL-IN! Gold and silver are about to slingshot out of the station! The game ends when Shanghai runs out of real silver!

With prices now scraping the upper $15′s and expected to keep falling till December due to huge short positions, the cartel is forced to push the paper price even lower in preparation for the inevitable COMEX default and paper settle. Wall Street took the arbitraged silver bait and it's almost time to back up the truck and go ALL-IN! Gold and silver are about to slingshots out of the station! The game ends when Shanghai runs out of real silver! The checkmate is now in full view! The numbers are in. A record 5.79 million silver Eagles were sold in October! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| We Have Just Witnessed The Last Gasp Of The Global Economy Posted: 05 Nov 2014 07:25 PM PST Submitted by Brandon Smith via Alt-Market blog,

It is difficult to find the motivation to write about the state of the global economy these days, if only because there is not much left to say. I feel like I am composing multiple obituaries for the same long dead corpse. Most of the Liberty Movement and I suspect a small portion of the mainstream market understand that there is no tangible or legitimate recovery, let alone a stable fiscal ladder to rest our feet upon. There is literally nothing left to the financial system but rigged statistics, false promises, and ever expanding debt. In fact, the concept of debt creation is the only thing holding our facade of an economy together. You and I probably find this rather strange. We come from a long forgotten school of economics, in which demand, supply, and savings actually mean something in terms of our fiscal health. I have come across many mainstream economic acolytes and cultists in recent months who disregard ALL logic and reason, forsaking the realities of demand based trade and immersing themselves in a grand delusion in which central bank generated debt and inflation are the real source of “prosperity”. I feel sorry for them in a way, because the truth is right in front of their faces, and yet, they will never see it, not until they are buried alive in it. Nothing makes this problem more apparent than the behavior of equities in the past month. Stocks are, of course, a sham of the highest magnitude, but they do still say something about the greater truth behind our financial condition. The fact that many market traders clearly KNOW that it's all a farce, and are actually banking and betting on the scam, tells me exactly how close we are to the end of the line. The recent near 10% drop in the Dow at the beginning of Fall must have certainly been a shock for the day trading community as well as mainstream pundits. The assumption for the past few years has been that central bank stimulus guarantees a constantly growing bull market, and to experience a considerable decline in equities even while QE was still in action was at least a noticeable wake up call. I suspect that this decline in markets was not necessarily planned by the central banks, and was a stumble in their scheme to keep stocks elevated until after the QE taper had settled. It was also a stumble I expected a little earlier, around the end of Summer to be exact. Since the drop, central banks and the mainstream media have reacted forcefully to manipulate public perception as well as investor optimism, but this cannot go on for much longer. In almost every instance of market decline, financial news group Reuters has injected false rumors of more stimulus from the European Central Bank. This was also the case in October as markets began to crash. These rumors were later dashed by the Financial Times, but not before the mere mention of more fiat stimulus from any central bank sent stocks soaring yet again. This also occurred when middle management Federal Reserve member John Williams hinted in interviews of the possibility of “QE4” if the economy began to show signs of regression. Williams, of course, has no say in the decision to reintroduce QE, but this did not matter to investors, who immediately latched onto the meaningless news like anxious children, and threw their money back into stocks again. And, most recently, Japan's central bank announced a sudden and surprising re-ignition of stimulus measures to the tune of 80 Trillion Yen a year. This announcement, once again, sent global stocks skyrocketing, even though it was a stark admission by Japan's financial elite that all their inflationary printing efforts for the past several years have failed miserably. As I have warned in the past, when bad news becomes good news because bad news promises more central bank intervention, the economy is truly on the verge of a reckoning. Hopefully, we can all see the trend taking place here. With the end of the Federal Reserve taper now complete, and questions circling as to when interest rates will be raised, a market volatility not seen since 2008-2009 is returning. The ONLY measure that has slowed the crash is the use of false news stories hinting at further stimulus, as well as futile efforts by other central banks to pick up where the Federal Reserve left off. This shows that the investment world is so thoroughly addicted to QE that even the mere hint of another small fix of their favorite drug is enough to get them out of bed and excited. They know that the entire system is rigged by central banks, and they don't care. In fact, they revel in it. The only goal of your average day trader now is to profit on the scam for as long as humanly possible, even though the ultimate conclusion of the scam will mean the utter destruction of their profits and the end of their way of life. I hate to use a cinema analogy for a very real threat, but investors today remind me of Joe Pantoliano's character in 'The Matrix'; the guy who is fully aware that the Matrix is an illusion, but wants to experience the pleasure of the illusion all the same. So much so that he doesn't mind being exploited like a slave by the system, and is willing to sacrifice all measure of truth and even the future just to get a taste of the fantasy again. But what is the reality that the central banks are trying to hide, and why? This I have written about in detail on literally hundreds of occasions, so I will only cover the very latest news briefly here, and why I think the overall dynamic is about to change for the worse.

But this is all rudimentary. Most analysts in the Liberty Movement agree that our fiscal structure is on the edge of collapse; what they tend to bicker about is HOW and WHEN the structure will collapse. Guessing market declines has been extremely difficult in the midst of a fiat soaked fiscal environment. Nothing is ever quite what it seems. My predictions of a 10% drop by the end of Summer were off by three weeks. Because of the nature of QE stimulus manipulation of the Dow, our only real guide has been the timeline of the Fed taper, and the fact that major banks have been relying on fed fiat to continually cycle capital into equities through the use of low interest loans to corporations and the stock buyback scam. Company buybacks have given steady boosts to the markets at least since 2008, and many corporations are using up to 50% of their “profits” just to continue buying their own stocks. This strategy, however, is reaching a point of diminishing returns as many companies are issuing too much debt in the process. IBM is a perfect example of a company that has hit the ceiling on stock buybacks. This odd coordinated attempt by corporations and central banks to keep markets propped up even as companies sacrifice whatever debt stability they had left indicates a state of collusion between such institutions that goes far beyond the mere idea of "mutually assured greed". Since at least 2008, there has indeed been a "conspiracy" amongst banks and international companies to generate a massive stock bubble designed to keep the masses calm and placated. However, these groups understand, better than many give them credit for, that such measures will have to end, or be revealed. With the taper finished and QE money drying up, it is important to ask a few questions. For example, how are companies going to continue to accumulate capital to dump into their own stocks if fed money is becoming scarce and consumer spending is in decline? And, if they can't continue stock buybacks because of a lack of funds or an overburden of debt, how are equities markets going to stay afloat? And what about government debt? As it stands now, foreign interest in U.S. treasury bonds is waning. The vast majority of new bonds sold are short term. Until now, the Fed has been the primary buyer of long term debt, snapping up 10 year bonds from the market while other investors lose confidence in America's ability to pay off liabilities in the future. Now that QE is over, who is going to buy the ever expanding U.S. government debt? I aimed this question recently at a Fed cultist and his response was “Well...obviously somebody will buy it...”, though he couldn't specify. The spike in short term debt purchases after the end of QE3 was also predictable, but it can only be sustained IF stocks begin to fall considerably yet again. Think about it; interest in U.S. debt has been on the decline for years, not just because foreign banks are shifting away from the dollar, but also because stocks have been a much more attractive investment with greater returns guaranteed by Fed QE. The taper announces a violent change in circumstances. The only way for interest in U.S. debt to be energized, even for a short time, is for stocks to crash, leaving bonds as the only safe haven left. I discussed this development in detail in my article 'The Final Swindle Of Private American Wealth Has Begun' at the beginning of this year. All other investment avenues seem to be in decline, from foreign markets and forex, to commodities like oil. Even gold and silver have taken a hit. For the average investor, if a route in stocks occurs, they will immediately jump into bonds. This plays into my theory on the coming financial end game, which I will be discussing in my next article. Investor's are counting on an eventual QE4, but I think this might also be wishful thinking. At the end of 2013, I predicted the Fed would indeed follow through with the taper of QE3, and that they would drastically reduce stimulus measures. I believe this is in preparation for a major implosion of U.S. markets in particular. The whole point of the taper is to support the illusion that the U.S. economy has recovered, and that the Fed has “accomplished its mission”. When a crash does take place, I think it will be ALLOWED to move freely and that new QE intervention will not be taken. I have no doubt this crash will be blamed on an outside force or act of fate (the ebola outbreak, which is doubling in cases every three weeks, is a perfect possible catalyst), and that banks will be absolved of all blame in the mainstream. A coming crash is not only my personal view. It is important to note that behind the background noise of the recovery party, international bankers are sending a very different message about economic health. On the same day as the Federal Reserve announced the end of QE3, former chairman Alan Greenspan gave a speech to the Council On Foreign Relations in which he lamented that the QE unwind would be painful, that stimulus measures had not achieved their goals in the past, and that gold might be a good investment today. The International Monetary Fund and the ECB also released statements warning that “accommodative stimulus policies” could contribute to economic volatility. That is to say, stimulus might be setting the stage for fiscal instability. The IMF claims that “bold action” is required to “reset” the global system. And, the ever present overlords at the Bank Of International Settlements have posted a stark warning about our financial future, predicting a “violent reversal” in markets. The last time the BIS made such a prediction was in the summer of 2007, just before the derivatives crash. But this is the M.O. of the central banks, to warn of coming calamity just before the event, but not long enough before the event to make any difference. They present themselves as prognosticators of economic future, but in reality, they are the instigators of every disaster they predict. I do not know how the markets will react to the likely landslide "victory" by Republicans in mid-term elections (can one ever be "victorious" in a rigged contest?), but what I do know is that a Republican majority offers an even greater opportunity for further collapse. Negative movements in markets that have been obstructed through manipulation can now be unleashed and then blamed on "government gridlock", or the inability of conservatives to "compromise" fiscally. A Republican shift in government only offers more cover for a collapse that is slated to occur regardless. I believe that the admissions of financial danger by internationalists, the sharp drop in stocks at the beginning of fall, the reversal of the political theater, and the fact that mainstream investors now recognize the illegitimacy of the markets yet continue with the scam anyway, signals the last gasp of the global economy. I expect increasing market instability from this point on, as well as numerous geopolitical distractions which will be blamed for the fiscal chaos. I have left out my explanation of the final end game so that I can cover it more fully in my next article. Needless to say, the coming storm is a deliberately engineered one, meant to achieve very specific goals, including a fearful and panicked populace, easy to manipulate as the system goes off the rails for the last time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 Nov 2014 07:25 PM PST by Keith Weiner

I proposed seven drivers of financial implosion in my dissertation. My recent writing has focused on two of them. One is the falling rate of interest on the 10-year government bond. As interest falls, the burden of debt rises. Since the falling rate incentivized more and more people to borrow, the number of indebted people, businesses, corporations, and of course governments is large. When the rate gets to zero, the burden of debt becomes theoretically infinite. In the US, the downward trend is still in a deceptively mild phase (though there was a vicious spike down on Oct 15 to 1.87%). The rate on the 10-year Treasury is 2.3% today. In Germany, it is down to 0.82% and in Japan the metastatic cancer is much closer to causing multiple organ failures, with a yield of just 0.46%. Two is gold backwardation, which has also been quiescent of late. Although it is worth noting that with these lower gold prices, temporary backwardation has returned. The December gold cobasis is over +0.2%). I haven't written much about a third indicator yet. What proportion of government bond issuance does the central bank have to buy? I theorized that when the central bank is buying all of the bonds issued by the government, that this is another sign of imminent collapse. I phrased it, as with the other indicators, as a value that is falling. Collapse happens when it hits zero, if not earlier. Here is what I wrote:

Bloomberg recently published an article about the Bank of Japan's announcement of a new bond-buying program. Bloomberg presents two facts. One, the Bank plans to buy ¥8 to ¥12 trillion per month. Two, the government is selling ¥10 trillion per month in new bonds. This is an astonishing development. The Bank of Japan will buy 100 percent of the new government bond issuance. Popular theory holds that a currency's value falls as the quantity issued rises. In this view, the yen falls as the yen supply increases. While admittedly not scientific, here are graphs of the Japanese yen supply and the price of the yen in dollars from 1970 through present.

The yen has been falling since 2012, but not because of its quantity. It has been falling because the market is questioning its quality. One way to do this is to borrow yen, trade the yen for another currency, and buy an asset in that currency. This carry trade is equivalent to shorting the yen. So long as the yen is falling, and the interest rate on the bond in the other currency is higher than the interest rate paid to borrow the yen, this is a good trade. What happens as the yen falls faster? Contrary to populist economics, it's not good for Japanese businesses. However, it is a free transfer of wealth to those engaged in the carry trade. They can repay the borrowed yen at a cheaper and cheaper cost. When the yen goes to zero (which may take a while to play out), their debt is wiped out. That's what a currency collapse is. It's a total wipeout of debt denominated in that currency. Since the currency itself is just a slice of debt, the currency itself loses all value. While on the surface it may seem good for debtors, it's a horrific catastrophe. No one who understands the human toll, the cost in terms of the lives wrecked (and lost) would look forward to this with anything but dread. The objective of my writing is to try to prevent it from happening. We need a graceful transition to gold, not an abrupt collapse like 476AD. It may be too late for the hapless Japanese. I hope it's not too late for the rest of the civilized world. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seth Lipsky: Republicans should start by fixing the Fed Posted: 05 Nov 2014 06:15 PM PST By Seth Lipsky The Republican sweep offers the new Congress a chance to do a lot of good things, but none is more timely or strategic than monetary reform. Of all the things the Democratic Senate was getting in the way of, it's the most important. I'd start with "Audit the Fed." As recently as September, this passed by an overwhelming bipartisan margin in the House, 333 to 92. The idea is not simply to look at the Federal Reserve's books. (They're audited every year.) It's to find out what the Fed is doing at home and abroad and how it makes its decisions. ... ... For the complete commentary: http://nypost.com/2014/11/05/gop-should-start-fixing-the-fed/ ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Revenge Of A Government On Its People Posted: 05 Nov 2014 05:43 PM PST Submitted by Raul Ilargi Meijer via The Automatic Earth blog,  Arnold Genthe 17th century Iglesia el Carmen, Antigua, Guatemala 1915 I know I’ve written a lot about Japan lately, and that for some it’s been enough for a while, but still, what happens today under the no longer rising sun is going to have such repercussions worldwide that it would be foolish not to pay attention. Moreover, there’s something about what Bank of Japan Governor Haruhiko Kuroda said this morning that both perfectly and painfully illustrates to what depths, economically as well as morally, the country has sunk. BOJ’s Kuroda Vows To Hit Price Goal, Stands Ready To Do More

You would expect falling oil prices to provide the Japanese, like Americans, with some very welcome, even necessary, financial breathing room. But PM Abe and BoJ’s Kuroda will have none of it. And no matter how you look at it, there’s something at best curious about a central bank that decides to throw ‘free money’ at an economy BECAUSE it sees falling resource prices, which would supposedly make money available already. What Kuroda in effect says is that he won’t allow the Japanese to profit from, or even feel the relief of, lower oil prices, because they can’t be trusted to spend it. The Japanese government and central bank have no confidence at all – anymore? – that people will spend the money which they save on gas, on something else. They expect for people to, exclusively, sit on those savings. And they’re probably right, which says plenty about how the Japanese people feel about their economy: there is no confidence left whatsoever, not in Abe, not in Kuroda. Moreover, of course, many, the poorest, the indebted, simply won’t have any extra spending cash even if they do save a few yen on gas. For them, Kuroda’s policies are very damaging. Which further undermines their confidence, and makes more people sit on more money. This goes way beyond a central bank pushing on a string. This is the picture of the trust between a government and its people having been irrevocably broken. And Abenomics doesn’t repair that trust, it only damages it further. The people don’t trust the government, and the government doesn’t trust the people. Neither thinks the other will deliver what it desires. And since it’s ultimately the government which hold the reins of power, it’s using those reins to throw the people under the bus. Abe and Kuroda’s ‘logic’ is ‘if the people don’t do what I want them to do, why should I take them into account, or care about them’? The line of thinking is borderline psychopath. Adding insult to injury, a beggar thy neighbor fall in the yen is supposed to be good for exports, even though that hardly pans out at all so far. It also, and more importantly, makes imported goods more expensive. In Abe and Kuroda’s twisted logic that should drive up prices, but in reality it means people buy even less than before, which accentuates deflation instead of ‘solving’ it. Who do you think Abe blames for this? And the psychopaths are not done with their people. They not only control the monetary base through what is by now QE9 (not of which, just like in the US, reaches main street), they have also seized control of Japan’s pensions. The rationale is: we’re going to take their pensions and spend them in the casino disguised as the global stock markets, because that MIGHT give a better return that sovereign bonds, especially Japanese ones. If there’s one thing that’s kept Japan more or less standing upright over the past 25 years, it’s that the vast majority of its wealth was invested domestically. No more. And you might argue this is Japan exporting its deflation across the globe, but at the very least that’s not what pension beneficiaries will experience. They will simply, when markets tumble, see their pensions vanish into thin air. US Will Benefit Most From Japan’s Pension Fund Reform

So tell me, what do you think, is this still an attempt to fight – domestic – deflation, or has it become a revenge on the Japanese people for not doing what Abe ‘ordered’ them to do? Note that early this year, he said Abenomics would work if only the people believed it would. In his view, they let him down. In their view, he’s an abject failure. He is. Unless the Japanese people get rid of Abe and Kuroda real fast, they’re going to cause a lot more destruction. We need to see this in the context of a society in which obedience is considered much more important than in the west. In Abe and Kuroda’s eyes, the people fail, because they fail to obey their edict of increased spending. The people, too, have a hard time not obeying, but after 20 years of deflation, they find it too risky to go out and spend. That’s not just a deflationary ‘mindset’, as the powers that be would have you believe, it’s something much more real than that. If the global markets start leaning on Japan, something that may happen any moment now because of its behemoth debt levels, the entire country could start going up in smoke. Abe has given signs of seeking to take the blame for his failures out on China, and the nationalist streak in the population may follow him to an extent, but it doesn’t look like there’s enough trust left. In that regard, it’s undoubtedly for the better (though we don’t know who will succeed Abe). But it’s still a highly volatile situation that Japan finds itself in, with huge potential downside effects for the whole world because it’s such a large economy that’s failing here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Are Countries Training Armies To Control Mass Riots? Posted: 05 Nov 2014 05:08 PM PST Euro zone retail sales plunge. ADP reports private employment is up but corporations are laying off people. Mortgage apps fall again.US mint sold out of silver eagle coins. Europe and Canada want the youth to work for free. Australia might need stimulus as the economy starts to falter. Russia... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Bonds, & "Maybe History Has Stopped" Posted: 05 Nov 2014 05:03 PM PST Via Paul Singer's letter to investors, THE TREND IS YOUR FRIEND... MAYBE When markets are trending, they can appear unstoppable. Every sale in a rising market feels like a bad one, and every purchase in a rapidly falling market is punished by losses within minutes or hours. It is so much less painful to go along with the trend than to buck the trend – at least in the short or possibly medium term. Furthermore, in the modern world of super-leverage and group-think, valuations can go far beyond the estimates of every expert and practitioner. That is, of course, until they stop. One of the main challenges of a long career in money management is that the distance (in terms of time and cost) between an intelligent conclusion that prices are massively wrong in either direction, and the actual reversal of valuations toward the range of "reasonableness," can sometimes be too long to bear. One could have easily become stridently bearish on stocks in 1995 (as we did), when in America equity prices passed all-time highs by nearly every measure, selling at 22 times earnings, a level that was previously reached in only September 1929 and March 1972 (both serious peaks). But they did not top out until early 2000 at 40 times earnings. And, in October 2008, those who thought that markets had fallen as far as they possibly could, and backed that belief with massive buying, found themselves weeks or months away from what was an extraordinarily painful and confusing bottom, with horrifying losses mounting by the day. Today, one could be bullish on the long-term value of gold and be not only sitting on losses but also experiencing incoming ridicule and schadenfreude. In the same vein, based on the extraordinary monetary policy being practiced by the world's central bankers, one could be completely convinced that medium- and long-term bonds are staggeringly overpriced, with nowhere to go but down in price (up in yield). But watching bonds persist in their long-term uptrend regardless of money printing, and watching gold prices languish with no understanding by investors that throughout history gold has always been considered the only real money in a world of monetary fakery, is concerning to say the least. Maybe history has stopped. We do not have a solution to the problem of assessing the outer boundaries of the price ranges of a host of financial assets, nor do we have a key to refining the timing of turning points in trends. The only appropriate answers are: "Who knows?" and, "Whenever they feel like turning." But we do have thoughts about survival as money managers, based on our own experience as well as observation and data. Every money manager with aspirations of a long career must govern his or her purchases to take into account the uncertainties we have described above. There must be a "Plan B" when purchasing or selling assets, so that capital is kept intact even if trends or turning points do not follow expectations. Being "wrong" may (or may not) be a temporary thing, but money managers who want to stick with long or short positions must determine how they are going to trade, hedge, or increase or decrease their positions if the prices continue to go against them. It is surprising how few money managers ask themselves: "What if I am wrong, or early? What do I do then?" These are particularly important issues at present, with bonds across the globe still absurdly treated as "safe havens." They are not safe havens with the 30-year euro swap rate trading at 1.85%, or the Japanese 20-year swap rate at 1.35%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Free Fell Today with the Gold Price Losing $22.00 Closing at $1,145.40 Posted: 05 Nov 2014 04:36 PM PST

Merciful heavens! I'm reading people crowing about gold going to $700 and I guess if it does they'll be charging you to haul away silver by the truckload. I just can't get it into my head that the Fed is that good, but maybe they're not. Maybe the whole world is just that unhinged and fluid. Anyway silver and GOLD PRICES just free-fell today, and nothing is turning up. When gigantic amounts of paper silver can be sold versus the available physical supply, and when leveraged players all hop on a market, y'all can throw statistics out the window. It's gonna fall till it stops. The gold price needs to close above $1,170 even to hint of a reversal. The SILVER PRICE needs $16.25. They were simply slammed with selling that began about midnight Eastern time. Too much weight on the selling side. I reckon y'all who believe the Republicans are going to save the country are preening your feathers today. Personally I couldn't slip a cigarette paper into a slot the size of the difference between Democrats and Republicans, but I wish y'all well. The US Mint is temporarily sold out of silver American Eagles following "tremendous" demand in the past several weeks. The mint will continue striking 2014 dated coins. This announcement indicates strong physical demand. However, silver American Eagles are the WORST buy in silver with the highest cost per ounce of all bullion products. Worse yet, premium always disappears over time, so you won't recapture that premium when you sell. Speaking of silver, today I did one of the best gold to silver swaps I've every done. Person had bought gold one day off the silver top in April 2011 when the ratio was 31.082. He swapped it today for silver at 71.51:1 and took out 130% more silver than if he had bought silver in the first place. More than that, when silver and gold eventually begin rising again, he will have 2.3 times the silver ounces to enjoy that ride. Apparently stock buyers and dollar investors are Republicans, or just any news will stimulate their buying gland. Either way, both the dollar and stocks rose. Dow rose 100.69 (0.58% to a new all time high at 17,484.53. And the S&P500 was running right along its side, up 11.47 (0.57%) to 2,023.57, also a new high. And if you live in Oregon, Alaska, or DC voters approved a new high for you last night, legalizing small amounts of dope. I hate to bust up the party, but it's a plain fact that both major stock indices are nearing the upper boundary of trading the last year. Now maybe they can punch through that and run higher, but it ain't likely. That line stands about 17,500 for the Dow and 2040 for the S&P500. Listen, durn it! I ain't nothin' but a nat'ral born durned fool from Tennessee, but if I know anything, I know can't nobody PRINT their way into prosperity. Dumb as I look, I have read the history of every inflation on the face of the globe, and hadn't a one of 'em succeeded. Oh, yeah, for a while everybody was wearing silver slippers and clicking their heels, until the balloon burst. Now on every side the poor public-miseducated folk think the Wise Central Bankers can print up some prosperity for us. I jes' have a single question: If printing money makes everybody rich, why don't we jes' print up a bunch of it and see? Fact is, that's what they're doing now, and the end will be weeping and wailing and gnashing of teeth, and maybe even decorating lampposts with central bankers. Hack, hack, that bone's out of my throat, so on to the US dollar Index. It rose 38 basis points today (0.43%) to 87.54 and a new high for the move. Lo, it's true I am sour, but there's an old technical rule called the 3% rule, namely, that a market has to rise at least 3% to PROVE a breakout. Breakout for the Dollar index was about 85.5, so it really needs to reach 88.07 to achieve escape velocity. Maybe it can, I don't know. Don't nothin' make sense to me no more. Yen is seeking the bottom of the scabrous, scurvy fiat currency heap. Fell another 0.97% 5today to 87.23 cents/Y100. No hope of a turnaround when the Bank of Japan has already poisoned the well. Euro doesn't look much better. It dropped 0.48% today to $1.2486, bumping along where the previous bottom was $1.2501. Nothing hopeful appears in the chart. Remember, Remember, the fifth of November/Gunpowder, treason and plot! On 5 November 1605 the Gunpowder Plot was discovered. Guy Fawkes and other conspirators tried to blow up King James I while he opened Parliament, but the large stash of gunpowder was discovered. Fawkes was caught and tortured in Guantanamo, and he and seven others were later executed. Since then the English have celebrated Guy Fawkes Day by bonfires onto which they throw stuffed manikins called "guys." Oh, yes, some of them drink beer, too, and some drink whiskey. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lassonde reconsiders, admits BIS may be manipulating gold market Posted: 05 Nov 2014 03:56 PM PST 7p ET Wednesday, November 5, 2014 Dear Friend of GATA and Gold: Mining entrepreneur and former World Gold Council Chairman Pierre Lassonde, who lately has been saying that central banks don't even think about gold -- http://www.gata.org/node/13683 http://www.gata.org/node/13105 http://www.kitco.com/news/video/show/GSA-Investor-Day-2014/558/2014-02-2... -- today applied for a tin-foil hat. Pressed by Eric King of King World News, Lassonde acknowledged that, as Hong Kong fund manager William Kaye had told KWN a little earlier, the Bank for International Settlements very well might be pushing the gold market around. "It would not be the first time that we've seen this and it won't be the last time either." Lassonde told KWN. "There is obviously an entity or trading house who must have a short position and they are using the paper gold market to move the price." Things must have gotten beyond obvious. What's next? Anarchist Doug Casey retracting his claim that central banks are irrelevant? Commodity leter writer Dennis Gartman's deciding to care about market manipulation, or about anything? Lassonde's interview is excerpted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/5_Pi... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dallas Fed president warns Republicans against making central bank account for itself Posted: 05 Nov 2014 02:50 PM PST Fed's Fisher Tells Congress: Don't Mess with Central Bank By Matthew Boesler and Michael McKee NEW YORK -- Senate Republicans should resist the temptation to erode Federal Reserve independence after victory in mid-term elections, Dallas Fed President Richard Fisher said. "Think about this: Here's a Congress that can't even get its own budget together. Do you want them running the central bank?" Fisher, a former deputy U.S. trade representative under President Bill Clinton, said today in an interview on Bloomberg Television. Republicans who already run the House won command of the Senate yesterday and will take charge of the Senate Banking Committee, which oversees the U.S. central bank, when the next Congress convenes in January. Lawmakers have sponsored several bills that propose changes in the way the Fed conducts monetary policy and would subject the institution to greater congressional scrutiny. ... ... For the remainder of the report: http://www.bloomberg.com/news/2014-11-05/fed-s-fisher-tells-congress-don... ADVERTISEMENT Sinclair's Next Market Seminar Is Nov. 15 in San Francisco Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar from 10 a.m. to 3 p.m. on Saturday, November 15, at the Holiday Inn at San Francisco International Airport in South San Francisco, California. Admission will be $100. For more information and to register, please visit: http://www.jsmineset.com/2014/10/10/san-francisco-qa-session-announced/ Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demand For Coins And Bars Exploding While Gold And Silver Prices Pushed Down Posted: 05 Nov 2014 02:47 PM PST While the price of silver and gold have been breaking down, the demand for coins and bars is exploding, as evidenced by the following facts: Bloomberg reports on October 31st “U.S. Mint Silver-Coin Sales Jump to 21-Month High“:

Reuters reports today, November 5th “Silver lining in precious metals’ rout catches out coin mints“:

Reuters reports today, November 5th “U.S. Mint temporarily sold out of Silver Eagles amid huge demand“:

In Germany, precious metal dealers have literally been run down in the last week, as evidenced by GoldReporter:

Resource Investor reports on November 4th “Indian gold bullion imports hit 17-month high“:

Bullionstar on November 2nd: “Insatiable Chinese Gold Demand Continues Unabated.” Based on these data, except for the Perth Mint in Australia, all other sources are reporting a huge increase in demand for coins and bars across the globe. Retail investors primarily are looking taking advantage of these bargain prices. The price setting in the COMEX futures market has its effect on real world demand. The question is, when will wholesale demand start piling up on precious metals to trigger a supply shortage? That would be fun to observe … but we are unfortunately not there yet … prices should go even lower to trigger such a situation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Tragedy of Common Politics Posted: 05 Nov 2014 02:47 PM PST This post The Tragedy of Common Politics appeared first on Daily Reckoning. "Don't let anybody tell you," Hillary Clinton recently told a crowd in Boston, "it's corporations and businesses that create jobs. You know, that old theory 'trickle-down economics.' That has been tried. That has failed. It has failed rather spectacularly." I just received my issue of the Laissez Faire Letter by email this morning. My favorite section is one called "They Said What?!" Hillary Clinton's quote, while undoubtedly taken out of some wildly rhetorical context, stands out. How can you read it… and not read it again… just for the pleasure of the deep belly laugh it will give you? Go ahead… read it again. I dare you. Even if you vote, you have to admit the theatrics are amazing. This morning, we were parsing the election results with friends and colleagues. Yeah, yeah… we don't vote, so why bother, right? It's still great entertainment. Even if you vote, you have to admit the theatrics are amazing. If you weren't paying attention, let me give you a quick election breakdown: The Senate majority is now Republican. The GOP picked up seven seats — in Iowa, North Carolina, Montana, Colorado, Arkansas, South Dakota and West Virginia. The dastardly, old-fart Republicans increased their hold on the House, too. Somehow they managed to get out of their rockers and wrestle away 11 seats from the people-and-peace-loving Democrats. The cranky old elephants can now move those rockers onto the hallowed porches of governor's mansions in red states like Illinois, Massachusetts and Maryland, too. From the bands playing and the "free" booze flowing here in Baltimore City, you would have thought the Republicans even knew how to throw a party. As we were discussing the results, we turned to Dave Gonigam, elusive editor of The 5 Min. Forecast. Daily Reckoning: Maybe we'll finally get a Senate vote on "Audit the Fed," eh? Dave replied: Something watered down, perhaps, for show. Me: Good point. Dave: I suspect the pressure will become very intense on Rand Paul to "tone down the foreign policy stuff," lest he "tear the party apart" at a moment of opportunity and hand 2016 to Hillary. My biggest nightmare is that he somehow pulls it off in 2016, and then the big crisis comes and "libertarianism" is discredited for decades… I said: You're probably right. That was the downfall of capitalism after Reagan. He said: Ever read Rothbard's "Ronald Reagan: An Autopsy"? Me: I haven't… Dave: He said Reagan was the worst thing that ever happened. The '70s were the zenith of mistrust of government… Vietnam, Watergate, you actually had CIA dirt uncovered by the Church Committee… then Reagan comes along and restores people's trust that government can still work. I thought: Hmmn… good point. Dave: "So there will be no misunderstanding," Ronald Reagan said in 1981, in his first inaugural address, "it is not my intention to do away with government. It is rather to make it work — work with us, not over us; to stand by our side, not ride on our back. Government can and must provide opportunity, not smother it; foster productivity, not stifle it." "Ronald Reagan called himself a conservative," Bill Bonner commented in the book we co-authored, Empire of Debt. "This part of his inaugural address made us think he really was one. But people come to believe what they must believe in order to play their roles — even conservatives. Reagan's real revolution lay in redefining conservatism as an activist, imperial creed. First, the neocons took over foreign policy. "Soon, Americans were stirring up trouble everywhere, from Latin America to Afghanistan. Then, they took over domestic policy. In a few cases, the ghastly remnants of previous improvers — such as 70% top marginal rates — were knocked over. In more cases, new edifices were built up. But the major failure was that the sharp tax cuts of 1981 were not followed by sharp spending cuts. Instead, spending went up. And not just on defense. Reagan had pledged to abolish the Department of Education. "Instead, he increased its budget by 50%." The Reagan revolution transformed the Republican Party. Rather than continuing to fight a rearguard action against leftist activists, Republicans were emboldened to take the lead, becoming activists themselves. This they did by relying on a monumental fraud. "It's amazing that Democrats, in particular," our friend Steve Forbes wrote back in July, alluding to the same fraud, "throw rose petals at Bernanke's feet for practicing what liberals always — and falsely — accuse Republicans of: trickle-down economics. "Bernanke wants high stock and bond prices to create a 'wealth effect' that will trigger investment, which will, in turn, trickle down to the masses via greater economic growth." For fun, let's recap the way this essay began: "Don't let anybody tell you," Hillary Clinton recently told a crowd in Boston, "it's corporations and businesses that create jobs. You know, that old theory 'trickle-down economics.' That has been tried. That has failed. It has failed rather spectacularly." What's fun about politics is how spectacular the politicians are at confounding, conflating, confusing and abusing the "issues" to their own ends. Let's break down Hillary's statement: "Don't let anybody tell you it's corporations and businesses that create jobs." Well, one might be tempted to ask, if not whipped up into a crowd frenzy, who does create jobs? "You know, that old theory 'trickle-down economics.'" Otherwise, known as the political straw dog of the Clintons since ol' Bill ran for president in 1992. Even though the record most likely shows he was the most laissez faire president in the last 53 years… "That has been tried. That has failed. It has failed rather spectacularly." It hasn't actually been tried. But why would we want to? Hillary is only arguing out of both sides of her tuchis. Her implication that government — not business — creates jobs and "trickle-down economics" requires you to first believe that all good things come from government. Far be it from us… a group of ne'er-do-wells with keyboards and frequent-flier status (still, believe it or not)… to disagree. "Here at home," our essayist from yesterday, the former congressional stalwart Ron Paul, said on RT, "we don't have true democracy. We have a monopoly of ideas that are controlled by leaders of two parties. And they call it two parties, but it's really one philosophy… I think the status quo is pretty strong right now, and I imagine the status quo is going to win the election tonight." "Addison," we quote a reader from Texas who corresponds frequently, "you, like Mencken, are quick to belittle American ideals and offerings, but, I might add, also as quick to plop your ass down, bitch and do little to try to improve our situation. "Admittedly, the American system has been going to hell, basically from the get-go, but to my knowledge, there has been nothing better offered in the ENTIRE world in my lifetime. Remember that there are millions who fight for the right to vote in the rest of the world. And for that matter, there are thousands who die basically every day trying to get here to share that which you and yours simply bitch about. Nor do you mention that billions of people overseas vote 85-97% in every election. And true, it usually doesn't improve their lot, but by God, they tried to do something. "Unlike you, who sit around griping about that which you gleefully partake of, but which you have not improved in any way." Allow me to respond with an anecdote. (Brace yourself if you don't have a little extra time right now.) In 2006, I had the good fortune to be sitting at dinner, at a beachside cafe in Cannes, with the good doctor Richebacher. If you're a longtime Daily Reckoning sufferer, as our friend Bill would say, you know Dr. Richebacher by name. And you probably also know… he was kind of a crank. He was a special kind of crank, though. Kurt wrote a newsletter for more than 40 years. Not by accident. After World War II, Kurt had made a name for himself as the best known financial journalist in Germany — a razor-sharp critic of what he saw as the stupid economic and fiscal policies of the postwar German government. By 1957, he'd become one of the top commentators in London on British economic policy. But it all really began for Kurt Richebacher in 1964. That's when he took over the post of chief economist and managing director of the massive and world-famous Dresdner Bank. Kurt advised billion-dollar banking clients what to watch for in the unfolding world economy. Kurt didn't avoid controversy. He just told it like it was, giving the bank's uber-rich clients every possible insight they needed to protect and grow their money. The clients couldn't get enough of it. But German Chancellor Helmut Schmidt wanted it to stop. So much that he personally begged Jurgen Ponto, then the chairman of the Dresdner Bank, to put Richebacher on a leash. But Ponto knew what Richebacher had to say was too important. So Ponto defied the chancellor and protected Richebacher's right to publish his scathing observations. However, on July 30, 1977, Jurgen Ponto was murdered. This tragic turn of events — a kidnapping gone wrong – forced the creation of one of the most respected financial advisory letters ever produced, The Richebacher Letter. Without Ponto, Dr. Richebacher made a clean break from the bank and published his viewpoints entirely on his own. At his Dresdner farewell party, former Federal Reserve Chairman Paul Volcker was one of the guests. Another was famous Wall Street economist Henry Kaufman. When I was having dinner with him overlooking the Mediterranean, we had spent several weeks trying to assemble what would then have been the first critique of the Bernanke Fed, even before Bernanke had officially taken his seat behind the googly-eyed Greenspan. We never finished his manuscript. Within a few months, the octogenarian Richebacher grew ill and passed away. When he died, he willed his library to us. It's an adjunct to my office in 808 St. Paul Street, here in Baltimore:

In addition to his books, which still contain margin notes written in German, he left me with a lifelong motivating insight. At dinner that evening on the beach in Cannes, I had a burning question for Dr. Richebacher. "After 40 years," I genuinely wanted to know, "why do you continue to criticize bankers, politicians… corporate leaders? After a while, doesn't it just get old? Aren't you successful enough that you don't have to do it anymore? I mean… look at this place." "Addison," he said in his thick German accent, marveling at our waitress walking by, "what good would it do for me to write about all the things that are going right with the world? We should simply enjoy those things." As, we suggest, should you. Cheers, Addison Wiggin P.S. If you haven't signed up to receive our Daily Reckonings by email, click here. We do our best to make each one the most informative and entertaining 15 minute read of your day. The post The Tragedy of Common Politics appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 Nov 2014 02:15 PM PST Example 1: When a golfer hits a shot to the green he often yells "sit" as he orders the ball to slow or stop near the flag. Even professionals indulge in this bit of satisfying self-delusion. However, the ball responds to powerful forces, such as wind, the undulations of the green, its own momentum, and gravity. Example 2: A mother demands that her teenage son clean his room. Instead he responds to powerful forces, such as testosterone surges, cute girls, and teenage rebellion. Example 3: Silver prices surged higher in early 2011 and have collapsed since then in spite of increasing investment demand. The silver market was responding to powerful forces. What forces?

What seems strange Demand for silver is strong and apparently increasing but the COMEX driven price for silver has been weak; it just hit a four plus year low. The "all-in" cost of silver production has been widely quoted at or considerably ABOVE current prices. But how long can this continue? Consider this chart of the S&P 500 Index and the Fed balance sheet. It appears that the $ Trillions created by the Fed dramatically assisted the S&P in its upward journey. But what happens when the newly created dollars, euros, and yen are used to buy silver and gold instead of bonds or stocks? Consider this graph of silver investment demand, which has increased substantially. (2014 demand has been even stronger.) Consider these graphs that show (estimates for) Chinese and Russian demand for gold. From which vaults do you think all that gold was removed?

Powerful forces can impact markets for considerable time. Gold has broken its triple bottom at about $1,180. Silver has made a new four year low near $15 – about a 70% loss from its 2011 high. What happens next? My guess is that the High-Frequency-Traders will attempt to squash all rallies until The-Powers-That-Be are properly positioned to make a fortune on the inevitable rally.

The longer a market is repressed or levitated, the more violent the correction. I suspect we will see violent corrections in the next six months in the silver, gold and stock markets. For several years it seems that powerful forces have been aligned against gold and silver. What will happen to prices when some or all of those powerful forces reverse and align in favor of precious metals, for their own protection and profit? They Are Burning The Furniture Now

Gary Christenson | The Deviant Investor | GEChristenson.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

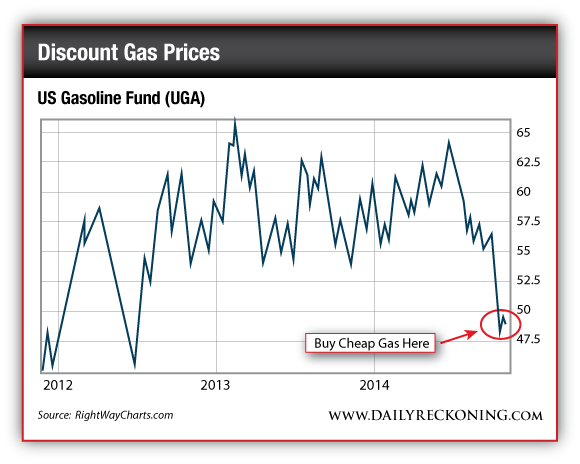

| Get Your Gas Money Back In One Easy Step Posted: 05 Nov 2014 01:50 PM PST This post Get Your Gas Money Back In One Easy Step appeared first on Daily Reckoning. [Ed. Note: As gas prices continue falling across the U.S., it appears the "oil boom" we've been following these past few years has finally hit home for consumers across America. But even though gas prices are low right now, the slightest change in the market could easily push them back up again. Below Matt Insley explains how you can effectively "lock in" today's low gas prices for months or even years to come. Read on...] I don't know about you, but 2008's oil spike made me angry. Back then oil was sitting around $140 a barrel and gas was $4.50 a gallon. It took me about $50 to fill up the 'lil 12-gallon tank — which really got my blood boiling. Another reason I remain bitter stems from the fact that I don't even know who was getting my money. Some of it went to the Middle East, some of it ended up with big international oil companies (IOCs), and a portion of it went to our government through taxes — those are three charities I normally wouldn't hand a donation to. So here we are six years since oil's all-time high. Today oil is sitting around $80 a barrel — not bad, eh? Gasoline is also "cheap." Most of the local stations in my area are flashing prices below $3 a gallon — a far cry from those 2008 prices! So here's a question for you… If you're like me and believe that sub-$3 gasoline is cheap… and that prices are only likely to rise from here on out (think: spring 2015 driving season)… Wouldn't you like to "lock in" today's cheap gas price for months, or even years to come? Indeed, even with booming U.S. production, all it takes to goose the price of oil back up is a supply disruption in the Middle East. Or, if the Asian tiger economies ramp up, added demand could nudge prices higher. Add it all up and it wouldn't take much to push the price back up to triple digits again. You can bet your bottom dollar that gasoline prices will follow, too. Well, today I want to share a way that you can virtually "lock in" today's cheap price for gasoline. It's fast. It's easy. Best of all you don't need to own your own gas station to make it happen! "Hedging" has been around for centuries, but interestingly enough, not many consumers use it — a true shame in my mind. This according to Investopedia: Hedging is nothing more than a simple tool to offset risk. The classic example of hedging is when a farmer wants to make sure he gets a good price for his crop. You see, a farmer has a lot at stake. They till, buy equipment, fertilize, water, and harvest their crop all without really knowing what price they'll get for it. That's a huge risk to take. By hedging, a farmer is able to lock in a set price ahead of the harvest. This can come in the form of a forward contract or by using the futures market. Another example is when airlines hedge the price of crude oil or jet fuel. Much like a farmer, airlines have a lot of risk — prices for jet fuel can swing wildly and have a drastic effect on an airline's profitability. That's why most major airlines use future contracts to control the prices they expect to pay for their fuel. (Or if you're Delta, you just buy your own refinery!) Either way, it's just smart business. But you don't have to be a large-scale farm or airline company to get involved. Hedging is simple, and as long as you have risk — which you do if you intend on driving over the next five-10 years — you can easily protect yourself against the rising price of gasoline. So what can we do to "lock in" today's low gas prices? In lieu of owning your own gas station, buying your own oil well and controlling your own prices, here's what you can do: buy into the United States Gasoline Fund (NYSE:UGA). The fund offers a relatively pure way to hedge the price you pay at the pump. In short, the fund buys futures contracts for reformulated gasoline. Here's what the prospectus has to say:

That's it. There are no CEOs or earnings announcements. The fund just follows the price of gasoline with the use of futures contracts. So it's safe to assume that if gas goes higher, this fund will follow. Each share you buy could act as your personal hedge and gives you a way to ride the rising cost of gas. As the price of gasoline goes up, this fund will also rise — it's an effective way to offset the price you pay at the pump. Indeed, had you bought this fund back in 2009 when gas prices were insanely low (sub-$2), you'd be sitting on a 118% gain. That's plenty of profit to offset higher gas prices. Right now the fund is cheap. Like the price of gas, UGA is trading at a steep discount to recent prices. Take a look… As you can see at your local station, gas prices have taken a beating over the past few months — hooray! Likewise the share price of UGA has also pulled back. But I don't expect prices to stay low — and neither should you. Especially not over the next five or 10 years. That's why now may be the perfect time to hedge your gasoline usage and pick up some shares of UGA (currently trading around $50 a share). As the price of gasoline rises, so will the price of your shares. You'll benefit in every move gas makes on the upside, so in five years, if the price of gas triples, you'll have three times your investment. That's profit that you can use to offset (hedge) the price you'll be paying at the pump! Under-$3 gas for the next five years sounds OK to me. Keep your boots muddy, Matt Insley Ed. Note: Where gas prices are headed in the immediate future is anyone guess. But over the long run, you can bet they’ll probably trend upward. And this is just one actionable piece of advice Matt has in store. Sign up for his Daily Resource Hunter e-letter to get an even more detailed look at the resource and energy markets… and you’ll also discover profit opportunities you won’t find anywhere. Best of all, signing up is completely FREE and there’s no obligation once you sign up. So what are you waiting for? Click here now to sign up for FREE, before you do anything else today. The post Get Your Gas Money Back In One Easy Step appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, silver in backwardation as a result of BIS paper dumping, Kaye tells KWN Posted: 05 Nov 2014 01:38 PM PST 4:35p ET Wednesday, November 5, 2014 Dear Friend of GATA and Gold: Gold and silver are in backwardation, Hong Kong fund manager William Kaye today tells King World News, which is "typical of what you see when there is overt manipulation." Kaye attributes the situation to "an awful lot of paper gold intentionally dumped in a programmed algorithm ... most likely by the Bank for International Settlements." An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/5_Sh... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||