saveyourassetsfirst3 |

- Gold Rebounds but Gold Miners Struggle

- Gold/Silver Ratio – the Big Debate

- This could be the best news for gold investors in over 15 years

- Stronger mining CSR means more benefits for host nations - WGC

- Must-read: The simple, easy way to protect yourself against the next financial disaster

- BOOM: First Majestic Silver CEO Calls on Fellow Miners to Form OPEC-Like Cartel & HALT PHYSICAL SILVER SALES to End the Paper Manipulation

- Cash-rich African Barrick Gold seeks 3rd 'transformational asset'

- Swiss gold campaigns compete in Bern

- Customs officials nab record number of gold smugglers

- Metals market update for October 24

- Indian gold demand remains robust for 2014

- GLD Drained Again Yesterday – 33% of JPM’s Comex Gold Is Drained

- A Key Moment Awaits

- Steve Sjuggerud: Why I'm making a big change with my investments

- India Gold prices 7% lower this Diwali season

- Swiss ‘Yes’ and ‘No’ Gold Initiative Campaigns Compete at Launches in Bern

- Swiss ‘Yes’ and ‘No’ Gold Initiative Campaigns Compete at Launches in Bern

- Platinum and palladium price Fixing settled - now for gold

- Junior gold plays - New Orleans Investment Conference

- Scientists Discover Gold Grows On Trees

- Massive gold nugget goes on sale for $400,000

- First Majestic Silver CEO Wants Silver Miners to Form Counter-Cartel Against Futures Shorters

- Foreign central banks cut U.S. bond stakes to lowest since May

- Bank of England targets end of bank bail-out era

- Market Update: #HeartofGold & Gold Symposium Update

- First Majestic CEO wants silver miners to form counter-cartel against futures shorters

- Chris Powell: The crucial questions financial journalism won't ask and central banks won't answer

- JP MORGAN GOLD INVENTORIES: Fall A Stunning 33% In One Day

- Jim Willie: Shanghai Shock to Shatter the Gold Market!

- Must Watch Video

- Protected: A Look at Gold & Gold Miners

- Harvey Organ’s Update: Gold & Silver Whacked!

- What Is The Link Between Gold And QE?

- Precious Metals vs The Formidable Loss Of Purchasing Power Of The Dollar

- Jim Willie: Shanghai Shock to Shatter the Gold Market!

| Gold Rebounds but Gold Miners Struggle Posted: 24 Oct 2014 12:31 PM PDT Several weeks ago the entire precious metals space was extremely oversold and due for at the least, a reflex rally. Gold was down in nine of twelve weeks with Silver down in eleven of those twelve weeks. The miners experienced a nasty September and were down five consecutive weeks. With Gold rallying from $1185 to $1255, we would expect Silver and the mining stocks to rebound strongly in percentage terms. However, those markets have lagged Gold badly. The mining stocks are essentially back to their lows and Silver hasn't fared much better. The recent stark underperformance of Silver and the mining stocks especially is a warning sign of further downside. The weekly candle chart below plots Gold and Silver. We can see how Gold has rallied for a few weeks following its weekly close below $1200. Yet over the past two weeks Gold has tested $1250 and failed to close above it. This week Gold will close near the low of the week and below its 50-day or 10-week moving average. Gold is sitting less than 3% above important weekly support and remains below key short-term moving averages. Meanwhile, Silver has not touched $18 yet, let alone rallied back to previous support.

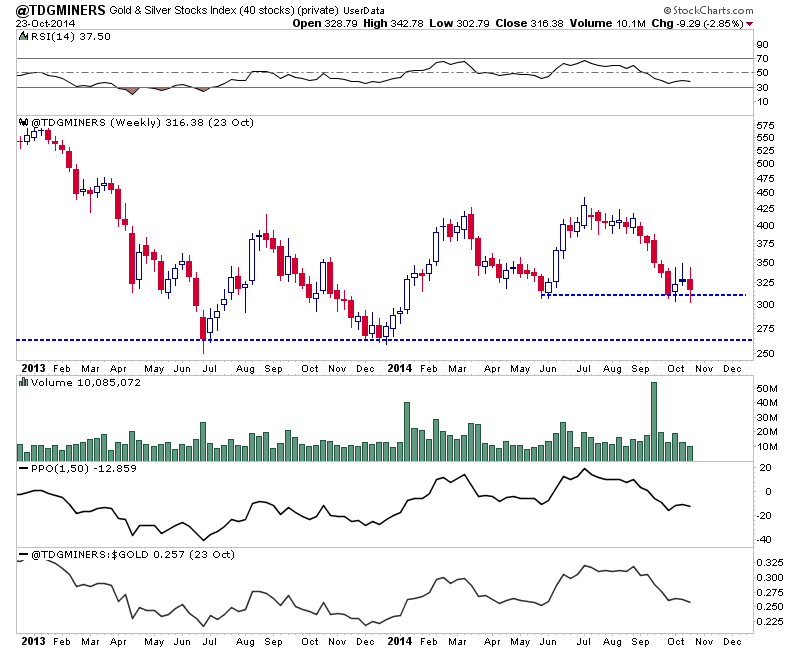

While Gold gained as much as $70/oz, the miners couldn't sustain any gains. The weekly candle chart below is our top 40 index. It contains various gold and silver stocks and the median capitalization is $520 Million. The index has consistently outperformed GDXJ over the past two years. At present the index is barely holding onto important support. It rebounded for two weeks but closed nowhere near the highs of the week. It reached as high 343 this week but was sitting at 316 heading into Friday. If Gold breaks then this index is headed for a test of the 2013 lows. It's a strong bearish warning when the higher quality companies are this weak.

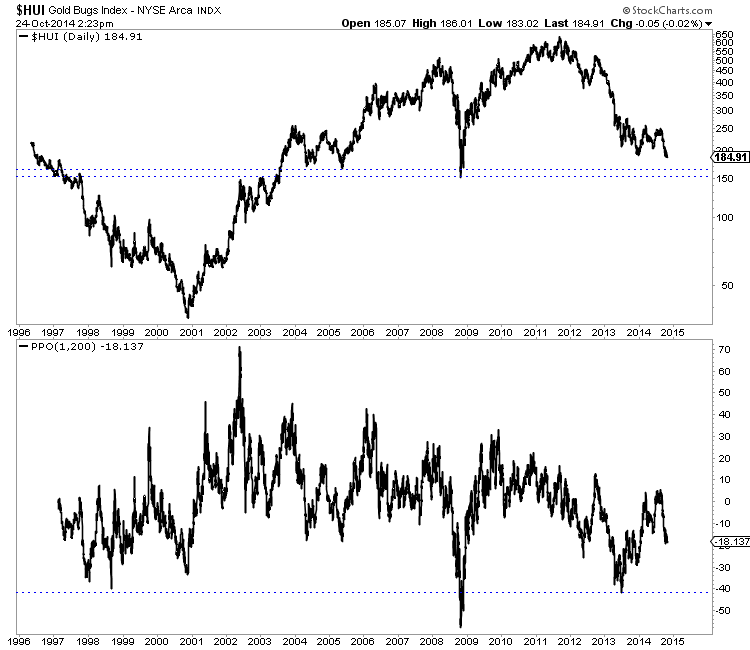

Meanwhile, the HUI Gold Bugs index has already broken to new lows. It has declined eight straight weeks and could close at a new low today. In the chart we plot the HUI's distance from its 200-day exponential moving average. The current reading is 18%. Major oversold readings can surpass 30%. The HUI can become much more oversold before it puts in a final bottom. Its trading at 185 and there isn't strong support until the 155 to 168 range.

Gold has rallied as much as $70 but the action in Silver and the miners, the speculative components of the sector is very worrisome. It is reminiscent of the autumn of 2008 but to a smaller degree. The mining stocks lead the metal at key turning points and their recent performance continues to warn that the worst may not be over. The sector remains oversold but very vulnerable. The reprieve we wrote about two weeks ago could continue for a few more weeks or it could be ending now. In any event, please protect yourself. While we are at the tail end of a bear market, the miners could decline another 20% before the final low. If the sector declines 20% then certain stocks could decline more. Please stand aside for the time being. I see a potential lifetime buying opportunity emerging in the months ahead. Consider learning more about our premium service including a report on our top 5 stocks to buy at the coming bottom.

Good Luck! Jordan Roy-Byrne, CMT The post Gold Rebounds but Gold Miners Struggle appeared first on The Daily Gold. |

| Gold/Silver Ratio – the Big Debate Posted: 24 Oct 2014 10:30 AM PDT Not everybody is aware that there is a big debate among precious metal investors regarding the importance of silver to protect from the dollar's demise. We have a similar debate that is better known when it comes to precious metals versus Bitcoin and other virtual currencies. Many precious metal investors disregard Bitcoin as a proper […] The post Gold/Silver Ratio – the Big Debate appeared first on Silver Doctors. |

| This could be the best news for gold investors in over 15 years Posted: 24 Oct 2014 10:20 AM PDT From Dave Forest at Pierce Points: Things have changed a lot in the gold market − in a very short period of time. And news this week suggests that further structural changes are coming to the market. The kind we haven’t seen in over 15 years. Specifically when it comes to gold hedging, the practice of forward-selling bullion in order to lock in a fixed price. With gold rising over a good part of the last decade, investors wanted as much exposure as possible to prices. With buyers betting that prices would continue to rise − generating increasing profits for companies that produce bullion. That led to a decrease in hedging − with gold producers sometimes paying billions of dollars to “unwind” their hedges. And regain complete exposure to market prices. But a survey released on Wednesday suggests that gold companies are now going the exact opposite direction. Increasing their hedges − by a significant amount. The study’s authors − gold market experts GFMS along with Societe Generale − said they expect total hedging in the gold industry to rise to 40 tonnes of metal in 2014. A mark that would be the highest yearly figure since 1999. There’s reason to believe the prediction. In the second quarter alone, total hedging across the gold industry jumped 61% as compared to the year-ago period. Suggesting that producers are indeed returning to hedges in a big way. The strategy makes sense in light of recent market activity. With gold prices having once again dipped below $1,200 per ounce over the last several weeks, producers are anxious about further declines. And therefore want to lock in prices in order to protect against further falls. The 40 tonnes of total hedging predicted by GFMS this year is of course not huge in a historical perspective. Given that the previous high in 1999 was over 500 tonnes. But it’s interesting to note that the 1999 high in hedging activity coincided exactly with a multi-year low point for the gold price − when bullion dropped to $250 per ounce. After which the market rose steadily and significantly for several years. |

| Stronger mining CSR means more benefits for host nations - WGC Posted: 24 Oct 2014 09:59 AM PDT A new World Gold Council report seeks to address concerns of a 'trust and data deficit'. |

| Must-read: The simple, easy way to protect yourself against the next financial disaster Posted: 24 Oct 2014 09:54 AM PDT From Brian Hunt in The S&A Digest: You wake up in the morning, turn on the news, and get a sick feeling in your stomach. The stock market is crashing again. Another big Wall Street bank has failed. Your 401(k) has lost another 25%. It’s bleeding value every week. Your dream of early retirement is history. You’ve lost so much money in stocks that even a “regular” retirement is in jeopardy. If you live a long life, there’s no way you’ll have enough money. This is the financial disaster scenario that terrifies a lot of investors. It’s what kept people up at night during the 2008 credit crisis. Could it happen again? Could another crisis cause the value of the U.S. dollar to collapse? Could the stock market suffer another epic decline? Many people say the answer to these questions is “yes.” Fortunately, I don’t need to know the answer to these questions… and neither do you. The good news is that it’s very easy to buy insurance against financial disasters like these. I personally own this insurance. Many of the smartest, wealthiest people I know own it, too. It could mean the difference between a comfortable, early retirement… or just barely getting by. First, it’s important to agree on what “insurance” is. In my book, buying insurance comes down to spending a little bit of money to hedge yourself against a disaster. Throughout our lives, we spend a little bit of money on insurance and hope we never have to use it. For example, home insurance costs a small fraction of your home’s value. Buy it and hope you never have to use it. Same goes for car insurance. It costs a fraction of your car’s value, so you buy it and hope you never have to use it. It’s the same with investment insurance. You can buy “investment insurance” and hope to never have to use it. There are hundreds of wealth and investment insurance policies out there. They involve intricate details, lots of forms to sign, and payment of big fees to advisors and salesmen (which are often the same thing). I’d rather keep things simple and keep money in my pocket instead of a salesman’s pocket. Here’s how you can do it… Put a small portion of your wealth in gold bullion. That’s it. That’s all it takes to insure yourself against a financial disaster. No complicated insurance products. No big fees to pay. Just pay a small commission to a gold seller, store the gold in a safe place, and you’re done. Here’s why this “insurance” is important… Some popular market gurus are predicting a global depression, a collapse in the dollar, and a huge increase in the price of gold. The chances of them being right are relatively slim. People have been predicting the “next depression” for 30 years. The world just has a way of not ending. However, the “doom and gloom” gurus bring up some good points. They aren’t crazy. There are some big risks to our financial system. The U.S. government is spending way too much money on wars, Obamacare, welfare, and other programs. Europe and China’s economies could decline and trigger a global recession. These are all real risks to your retirement account. I’m no doom and gloomer. I think the economy will deal with these risks and keep growing. Again, the world just has a way of not ending like so many people believe it will. That’s why I want to own stocks, bonds, and real estate. These assets will do well if the crap doesn’t hit the fan. However, I also want insurance in case I’m wrong and the potential disaster that some are predicting takes place. People would likely flock to gold in a global financial disaster… and cause its price to soar. That’s why it makes sense to buy gold as a form of insurance. The good news is that you don’t have to buy a huge amount of gold to have a good insurance policy. You can place just 5% of your portfolio into gold. Let’s say you have a $100,000 portfolio with 95% of it blue-chip stocks and income-paying bonds. You place the remaining 5% of your portfolio into gold. This gives you $95,000 in stocks and bonds and $5,000 in gold. If the predicted financial disaster doesn’t strike, your stocks and bonds will increase in value. Your gold will probably hold steady in price or decline a little. Since the bulk of your portfolio is in stocks and bonds, you’ll do just fine. But what if the financial disaster strikes? I’ve heard some top financial analysts say gold could climb to $7,000 an ounce in the financial-disaster scenario. Let’s say a financial disaster sends the value of your stocks and bonds down 50%. That would be a massive decline. Throughout history, only the worst, most severe bear markets sent stocks down this much. This epic financial disaster would cut your $95,000 stock and bond position by 50%, leaving you with $47,500. But let’s say this disaster also causes gold to rise to $7,000 an ounce. Right now, gold is $1,230 per ounce. A rise to $7,000 would produce a more-than-fivefold increase in the value of your gold. It would cause the value of your $5,000 gold stake to rise to about $28,455. Post-financial disaster, you’re left with $75,955 ($47,500 from stocks and bonds + $28,455 from gold). The disaster still hits you, but not nearly as hard. Your insurance played a big role in limiting the damage. But what if you think the chances of financial disaster are higher than “unlikely”? What if you’re more worried than the average Joe? If you are, simply increase the “insurance” portion of your portfolio. Instead of a 5% position in gold, you could increase it to 20%. If the previously mentioned financial disaster were to strike your $100,000 portfolio weighted 80% in stocks/bonds and 20% in gold, the math works out like this: The 50% decline in your $80,000 stocks/bond position leaves you with $40,000. Gold’s increase to $7,000 an ounce makes your $20,000 gold position increase to $113,821. Your large gold insurance position actually produces a net gain in this scenario. You’re left with $153,821… an increase of more than 50%. As you can see, the larger your gold-insurance policy, the better you do in the financial-disaster scenario. But if the financial disaster doesn’t strike, you won’t benefit as much because you hold less money in stocks and bonds, which do well if the economy carries on. And keep in mind… it would take a serious financial disaster to send stocks down by 50% and gold to $7,000. Depending on what you think the chances of financial disaster are, you can adjust your gold-insurance policy. It all depends on your goals and beliefs. Think the chances of disaster are slim? Consider a gold-insurance policy equivalent to 1%-5% of your portfolio. Think the chances of disaster are high? Consider a gold-insurance policy equivalent to 20% of your portfolio. Are the “gloom and doom” gurus right? Is the financial disaster around the corner? I don’t know the answer. Nobody does. But if you buy some “investment insurance” in the form of gold, you don’t need to know the answer. It’s simple. It’s easy. It’s low cost. You buy gold and hope to never have to use it. You’ll do fine if things carry on. You’ll do fine if the crap hits the fan. And the peace of mind you get from owning gold “insurance” is worth even more than the money it could save you. At Stansberry Research, we’ve found many Americans are woefully underprepared for financial and personal disasters. Most people don’t realize that they are taking extraordinary risks with their finances, health, and homes. What if there’s another large-scale terrorism attack on U.S. soil… or a major flu pandemic… or an economic crisis that disrupts the entire fabric of our society? Who do you think your family is counting on in the event of a crisis? Whether you know it or not… whether they’ve told you this or not… your family is counting on you. Do you have a plan in case the power goes out for a week or more… or if you don’t have access to running water for two weeks? Do you know what to do if the banks close for an extended period of time… or if it’s not safe to go outside because of some type of health epidemic? If you don’t have a good plan for these scenarios, I have something special for you to pay attention to today. You see, our own Dr. David “Doc” Eifrig has put together a fascinating presentation on something he calls the “Doctor’s Protocol.” It’s a simple four-step plan that will ensure you are ready for just about any type of crisis. I strongly, strongly encourage you to take a look at Doc’s work. It’s a real eye-opener. It will help you look at the world in a different way. It will give you more confidence on a day-to-day basis and will help you sleep better at night. It will make you a much more valuable member of your community… and it could literally save your life. You can access Doc’s informative presentation, free of charge, right here. |

| Posted: 24 Oct 2014 08:00 AM PDT In the MUST LISTEN interview with Future Money Trends below, First Majestic Silver CEO Keith Neumeyer issues a call to fellow silver mining companies to HALT physical silver sales, and band together to form an OPEC-like cartel to combat the criminal banking cabal manipulating the precious metals markets! "We all know the paper market has […] The post BOOM: First Majestic Silver CEO Calls on Fellow Miners to Form OPEC-Like Cartel & HALT PHYSICAL SILVER SALES to End the Paper Manipulation appeared first on Silver Doctors. |

| Cash-rich African Barrick Gold seeks 3rd 'transformational asset' Posted: 24 Oct 2014 07:56 AM PDT ABG has reiterated 2014 full production guidance upwards of 700,000 gold ounces. |

| Swiss gold campaigns compete in Bern Posted: 24 Oct 2014 07:46 AM PDT Switzerland's potentially historic gold initiative referendum takes place on Sunday, Nov. 30. |

| Customs officials nab record number of gold smugglers Posted: 24 Oct 2014 07:31 AM PDT The customs officials at the Mumbai International Airport in India are all set to create new record in gold seizures this year. |

| Metals market update for October 24 Posted: 24 Oct 2014 07:28 AM PDT Gold fell $8.60 or 0.69% to $1,232.90 per ounce and silver climbed $0.07 or 0.41% to $17.22 per ounce yesterday. |

| Indian gold demand remains robust for 2014 Posted: 24 Oct 2014 07:17 AM PDT The trade statistics released by the All India Gems and Jewellery Trade Federation indicates 20% jump in gold sales during Diwali this year. |

| GLD Drained Again Yesterday – 33% of JPM’s Comex Gold Is Drained Posted: 24 Oct 2014 07:00 AM PDT Another 2 tonnes of gold was removed from the GLD trust yesterday. The last time the reported amount of gold in GLD was this low was November 18, 2008. The price of gold was $738. Despite the fact that the price of gold is up about 2% YTD, 6% of GLD's reported amount of gold has […] The post GLD Drained Again Yesterday – 33% of JPM's Comex Gold Is Drained appeared first on Silver Doctors. |

| Posted: 24 Oct 2014 06:57 AM PDT Both gold and silver are progressing toward defining moments. How the charts get resolved will go a long way toward determining which direction the metals trade in 2015. |

| Steve Sjuggerud: Why I'm making a big change with my investments Posted: 24 Oct 2014 06:46 AM PDT From Steve Sjuggerud, editor, True Wealth: My friend, the time has FINALLY come… It is time to buy commodities. For years, I’ve urged you to invest in the stock market and the housing market. (I hope you took my advice… Stocks and housing have soared!) But one asset class has been completely left out of the fun… commodities. In the summer of 2008, big investors loved commodities… The Dow Jones-AIG Commodity Index peaked at a value around 240. And Harvard University, a big investor, allocated 8% of its endowment to “public commodities.” Now commodities are hated by big investors… Earlier this year, the Dow Jones-AIG Commodity Index hit 122 – down nearly 50% from its 2008 highs. And big investors have bailed completely. Harvard announced it will be allocating 0% to “public commodities” in 2015. The story gets even crazier… You see, the Dow Jones-AIG Commodity Index was at 128 in 1997. That means commodities in general are now trading at prices last seen 17 years ago. And going back 80 years, you can see that commodity prices are trading near all-time lows:

As the chart shows, over the long run, the trend in commodity prices is down. However, there are moments – like in the 1970s and 2000s – where commodity prices can have extended bull markets. So what’s going on? Why are commodities crashing right now? To answer that, let’s look at what causes commodity prices to go up… Commodity prices soar when three things are happening: 1. Commodities rise when there are concerns about a shortage (like a bad year of crops). 2. They rise when the world economy is booming (for instance, when China’s demand for industrial metals exceeds the supply). 3. They rise when the dollar is falling (because it would take more dollars to buy the same amount of gold, for example). Importantly, NONE of these things are in place right now. Grains (wheat and corn) for example, are having a bumper-crop year. So instead of a shortage, there’s way too much wheat and corn. The world economy is not booming, either… In Europe, the talk is about slipping back into a recession. So there’s not a strong demand for commodities at the moment. And the dollar has been soaring, not falling. The fear of deflation is now more prevalent than the fear of inflation. This is why commodity prices have crashed – nothing that causes commodity prices to go up is in place right now. The picture for commodities, at the moment, appears terrible. But moments like this are where the greatest opportunities are born… One of the greatest investing lessons I’ve ever learned is: The biggest gains come when things go from “bad” to “less bad.” You’ve heard me talk about this idea before. I call it “The Secret to 1,000% Returns.” I don’t mean that this idea always generates 1,000% returns… What I mean is, if you want the opportunity for huge, triple-digit-plus returns, you have to be willing to buy just before the dawn. Right now, we are in the darkness… but we are starting to see light on the horizon. All the big investors have finally thrown in the towel. And several uptrends are now in place in commodities. Is it possible that I’m seeing things that aren’t there yet? Yes. The uptrends today are very young and not well defined. But I think they’re there. In short, we may be at a historic extreme in commodities right now. Commodities are cheap. They’re hated. And we are just now seeing a glimmer of an uptrend. We have everything we look for in an investment… It’s finally time to buy commodities. Do it with a tight stop-loss… But do it. P.S. Inside the latest issue of my True Wealth newsletter, I share my two favorite ways to take advantage of the next major shift in the commodities markets… including a new way to buy gold with 100%-plus upside and single-digit downside. To access this research and more, click here. |

| India Gold prices 7% lower this Diwali season Posted: 24 Oct 2014 05:43 AM PDT Rajesh Exports Ltd. anticipated jewelry sales rising between 30% and 40% during Dhanteras, and, as noted by several news reports, gold purchases were running 15% to 20% higher on average for Dhanteras |

| Swiss ‘Yes’ and ‘No’ Gold Initiative Campaigns Compete at Launches in Bern Posted: 24 Oct 2014 05:01 AM PDT gold.ie |

| Swiss ‘Yes’ and ‘No’ Gold Initiative Campaigns Compete at Launches in Bern Posted: 24 Oct 2014 04:35 AM PDT Swiss 'Yes' and 'No' Gold Initiative Campaigns Compete at Launches in Bern

Swiss Flag in the Swiss Alps [1] https://www.news.admin.ch/dienstleistungen/00009/index.html?lang=fr&even… 'Yes' Campaign Launch Ulrich Schlüer, a former SVP National Councillor, disputed the recent claim by Swiss Finance Minister Eveline Widmer-Schlumpf that since the gold initiative calls for 20% of the reserves of the Swiss National Bank (SNB) to be kept in gold, that this would mean that the SNB would need to buy SwF 60 billion worth of gold to raise the percentage of gold on the SNB's balance sheet to 20%. Schlüer said that this was not true, and that one alternative would be for the SNB to reduce the size of its balance sheet, bringing down the absolute level of foreign exchange reserves, thereby meeting the 20% target this way. Schlüer argued that given that the SNB would have five years in which to meet this 20% floor level, this would not necessarily impact the SwF / Euro target band, and furthermore, it was also the responsibility of the European Central Bank to manage the Euro's value, not just the SNB. SVP National Councillor Lukas Reimann (SG) highlighted that the gold initiative's stipulation of gold holdings as a minimum target of 20% of the SNB's balance sheet is still a lot lower than other countries, for example, Germany. The Swiss Federal Council and the SNB have frequently used the comparative statistic of gold reserves per head of population to justify their argument that Swiss gold holdings are the highest in the world (per capita), but in a world of absolute central bank gold rankings, this argument is immaterial. Paper Decays, Gold holds its Value Lukas Reimann said that while gold is money and it defies crises, paper money can be reproduced at will and is easily manipulated. SVP National Councillor Luzi Stamm (AG) said that “paper decays, money holds its value." According to Stamm, the SNB's talk of “excess gold reserves” in the 1990s was very misleading. [1] http://www.nzz.ch/schweiz/papier-zerfaellt-gold-haelt-1.18410163 Luzi Stamm lamented that the Swiss gold sales of 2000-2008, when the SNB sold 1,550 tonnes of Switzerland's gold, were 'a big mistake' and that retrospectively, the sales had been conducted "at incredibly low prices” or “cut-price” levels due to Switzerland having "bowed to foreign pressure." On the question of why the Gold Initiative Committee wants all Swiss gold to be stored in Switzerland, Luzi Stamm asked “who seriously believes that we could bring back the gold in the event of a serious crisis in Switzerland”. He added that there was absolutely “no compelling reason” to keep Swiss gold abroad.

On the specific issue of the referendum vote on the 30th November, Lukas Reimann said that he had never experienced such a large discrepancy between the disinterest which is being displayed by the Swiss media on the gold initiative referendum, and the active interest that is being displayed by the Swiss population to the referendum. Reimann pointed out that the only Swiss political party that has officially backed a 'Yes' vote for the gold initiative is the small EDU party (Federal Democratic Union of Switzerland). Even his own party, the SVP, is showing limited support, and when the gold initiative petition came through the Swiss parliament earlier this year, not even half the SVP grouping voted for it. 'No' Campaign Launch – Alphabet Soup Opposition to the Gold Initiative in Swiss politics is widespread and has evolved into a very well structured alliance of political parties from right across the Swiss political spectrum, even to the extent of a well-funded and well-organised cross-party committee actively campaigning to defeat the initiative. This cross-party committee consists of an alphabet soup of seven political parties and various other economic groups and unions. The party names can be confusing since they mostly have multiple names and abbreviations depending on whether the French, German or Italian name is being used. The seven political parties are (in French terms): the PDC, the PEV, the PDB, the PLR, the PS, Les Verts (The Greens), and the Vert’Libéraux[1]. There are also SVP politicians aligned to this committee. Notably, there are a top-heavy eight co-presidents on the 'No' Gold-Initiative Committee (Gold-Initiative Nein) from all the main political parties, and over 123 politicians listed as committee members on the campaign's web site. The head of the 'No' campaign is Matthias Leitner, from the FDP, Liberals' party (PLR in French). The eight co-presidents of the committee are Karin Keller-Sutter, advisor PLR States, Alex Kuprecht, advisor UDC (SVP) States, National Councillor Dominique de Buman for the PDC, National Councillor Urs Gasche for the PBD, National Councillor Philipp Hadorn for the PSS, State Councillor Konrad Graber for the CVP, National Councillor Kathrin Bertschy for the GLP, and Ursula Gut, State Councillor Zurich PLR. Six of these politicians spoke at the launch of the 'Gold-Initiative Nein' campaign in Bern, as well as another politician, Beat Flach of the small GLP party. [1] https://s.bsd.net/economie/main/page/file/e166d3e9070191a779_rom6btyxf.pdf Unsaleable Gold Like an Unusable Fire Extinguisher? At their press conference yesterday (23 October), National Councillor Karin Keller-Sutter of the FDP said that the initiative was a fire hazard, and that 'unsaleable gold' destroys jobs and undermines federal and cantonal budgets[1]. One of the two Swiss National Bank headquarters, on the Bundesplatz in Bern. The majority of the Swiss gold reserves are said to be stored in gold vaults under the Bank and the Bundesplatz National Councillor Urs Gasche of the PBD claimed that a strong Swiss Franc would negatively impact on exports and tourism, and that the SNB had saved jobs and rescued the Swiss economy through its use of the SwF/Euro peg. Alex Kuprecht, actually representing the SVP, said that the gold initiative would put the SNB in chains and that “the SNB must always be able to use the full width of monetary opportunities and act accordingly in crises". Dominique de Buman of the PDC said that gold would be useless if it could not be sold, like a fire extinguisher, which you could not use in the event of a fire. Philipp Hadorn was concerned that if, in the long term, the SNB balance sheet shrank, then gold could end representing a majority of that balance sheet in terms of assets. Financial Director of Zurich Canton, Ursula Gut, invoked the gold price fluctuation argument, drawing the conclusion that if the gold price fell, it could mean that the SNB would not distribute profits into the federal and cantonal budgets, thereby leaving the federal state and the cantons to have to increase taxes and borrowing, while degrading the service performance of the federal and cantonal governments. Another speaker, Beat Flach, a representative of the smaller GLP party, said that foreign gold storage is wise for crisis preparedness, and that gold stored in the 'Swiss gold trading centre' would not work in times of crisis. This is notwithstanding the fact that Switzerland is the largest physical gold trading centre in the world. Furthermore, if the Swiss politicians and the Swiss National Bank are so concerned with maintaining feign storage locations for Swiss gold, then why, when the Swiss National Bank sold 1,550 tonnes of sold between 2000 and 2008, did the vast majority of these gold sales emanate from SNB gold holdings at the Federal Reserve Bank in New York which ultimately settled at the Bank of England in London? Swiss Electorate 5.2 million Double Majority including Cantons What this means is as follows. There are 20 full cantons and 6 half-cantons i.e. the equivalent of 23 full cantons. If the majority of voters in a full canton vote for a referendum proposal, this creates one canton vote in favour. If the majority of voters in a half-canton vote in favour, this creates one half of a canton vote in favour. The double majority is explained in Article 142 of the Constitution: 2 Proposals that are submitted to the vote of the People and Cantons are accepted if a majority of those who vote and a majority of the Cantons approve them. 3 The result of a popular vote in a Canton determines the vote of the Canton. 4 The Cantons of Obwalden, Nidwalden, Basel-Stadt, Basel-Landschaft, Appenzell Ausserrhoden and Appenzell Innerrhoden each have half a cantonal vote. For there to be a majority of the cantons, at least the equivalent of 12 full cantons (out of the equivalent of 23 full cantons) must have voted for the referendum proposal. Otherwise it will not pass, despite the fact that overall a majority of Swiss citizens voted for the proposal. This is another peculiarity of the Swiss federal referendum system which makes estimation of the referendum outcome harder to predict. The half cantons are Obwalden and Nidwalden, Basel-Stadt and Basel-Landschaft, and Appenzell Ausserrhoden and Appenzell Inner Rhoden. Whereas two of the half-canton 'pairs' do have very small populations (and therefore very small electorates), namely, Appenzell Inner Rhoden. Rh 11,473, Appenzell Ausser Rhoden 38,330, Obwalden 25,905, Nidwalden 30,635. The other half-canton 'pair' representing Basel have relatively large populations, Basel-Stadt 114,051 and Basel-Landschaft 187,247. However, some full cantons also have very small electorates, such as Glarus 26,153 and Uri 26,278. by the Dozen For the upcoming referenda on 30th November, there are actually two other popular initiative referenda taking place alongside the "”Save our Swiss Gold initiative" referendum, namely “Stop the tax breaks for millionaires (abolition of lump-sum taxation)” and “Stop Overpopulation – to secure the natural foundations of life.” There has been speculation in the media as to how, if at all, the scheduling together of these three referenda might affect the outcome of the gold initiative, due to the possibility that more people who might be in favour of the gold initiative might also be in favour of saying 'Yes' to the other two referenda. Since there are so many variables involved in this speculation, its difficult to draw any conclusions at this stage. Sometimes There Are Shock Results The voter statistics for the immigration vote last February were "Total eligible voters: 5,211,426", "Of which abroad: 137,480", with "Total votes 2,948,156" and "Turnout 56.57%". In Switzerland, a few months after referendums take place, the Federal Administration provides very in-depth data on the voting results, giving details on voting patterns across the German, French and Italian speaking areas and also voting patterns between cities, smaller towns and rural communities. The overall result in the 'limiting mass immigration' referendum which produced the 50.3% 'Yes' vote hid a lot of interesting variations between urban and rural centres and also between German Switzerland, French Switzerland and Italian Switzerland. Whereas urban centres only voted 41.5% for the motion, rural communities voted 57.6% in favour, highlighting a more conservative stance in rural areas, as would be expected. More interestingly, Italian Switzerland voted 68% 'Yes' against 52% 'Yes' from German Switzerland, and 41.5% 'Yes' from French Switzerland. This just shows the variability across the urban-rural divide and across the country. Its also important to note that most federal popular initiatives get rejected by the electorate. Of 118 federal popular initiatives voted on between 1981 and September 2014, only 15 were adopted (12.7%) and 103 were discarded. Other referendums types, namely, mandatory and optional referenda, had a far higher adoption rate over the same period, with 61 of 79 mandatory referendums passing (81%), and 59 of 85 optional referendums passing (69%). However, in the February 2014 'limiting mass immigration' referendum (referendum #580), the only main party to call for a 'yes' vote was the SVP (People's Party), and the referendum still passed, despite the fact that all other main parties had called for a 'no' vote. Therefore, with both the 'Yes' and 'No' gold initiative campaigns only now officially beginning, the field is wide open, and the success of each side's campaigning over the next five weeks will be crucial. With the only opinion poll so far, earlier this week, showing the Swiss electorate swaying towards a 'Yes' vote, Luzi Stamm's Gold Action Committee appears to have gained the strongest initial momentum. by Ronan Manly, GoldCore Consultant GOLDCORE MARKET UPDATE Spot gold in Singapore eased 0.1% to $1,230.48 an ounce by 0020 GMT, after slipping over 1% in the prior two sessions. The yellow metal is headed for a weekly loss of 0.6%, its first decline in three weeks, while the U.S. dollar gained after two weekly declines in a row. Palladium raked in the best performance among precious metals with over a 4% jump set for its biggest gain since March. In London, gold in Swiss storage traded near its lowest price in a week as investors weighed economic data pointing to signs that the U.S. economy is recovering. Silver for immediate delivery added 0.4% to $17.2702 an ounce in London. Platinum was nearly unchanged at $1,256.63 an ounce. Gold bullion bounced back from lows made on October 6 after the U.S. Fed said slowing overseas economies were a risk to U.S. expansion. Traders have pushed back estimates for when policy makers will raise U.S. interest rates. G Platinum and palladium price Fixing settled - now for gold Posted: 24 Oct 2014 03:06 AM PDT |

| Junior gold plays - New Orleans Investment Conference Posted: 24 Oct 2014 01:26 AM PDT Taking a closer look at high-risk junior gold stock at Brien Lundin's New Orleans Investment Conference. |

| Scientists Discover Gold Grows On Trees Posted: 24 Oct 2014 01:00 AM PDT Perth Mint Blog. |

| Massive gold nugget goes on sale for $400,000 Posted: 24 Oct 2014 12:52 AM PDT The 5-pound gold nugget was dug up in Northern California this past summer. |

| First Majestic Silver CEO Wants Silver Miners to Form Counter-Cartel Against Futures Shorters Posted: 23 Oct 2014 11:12 PM PDT "An engineered rally 'failure' at the 50-day moving average would be the perfect way to pull it off" ¤ Yesterday In Gold & SilverThe gold price traded pretty flat for most of the early going in the Far East trading session on their Thursday. The tiny rally that developed at noon Hong Kong time, ran into a willing seller around 2:30 p.m.---and the price chopped lower until the Comex open. It traded sideways from there into the London p.m. gold fix---and once that was out of the way, 'da boyz' and their algorithms showed up---and the low tick was printed at the 4 p.m. BST London close, which was 11 a.m. EDT in New York. The gold price traded quietly higher from there before running into a determined seller short after 3 p.m. in electronic trading---and it traded sideways into the 5:15 p.m. close. The high and low ticks were reported by the CME Group as $1,244.90 and $1,226.30 in the December contract. Gold finished the Thursday session at $1,31.90 spot, down $9.10 from Wednesday's close. Net volume was 128,000 contracts. After opening lower, as per usual, the silver price chopped sideways, hitting its high tick at the same time as gold, just before 2:30 p.m. Hong Kong time---and about forty minutes before the London open. The low of the day was printed around 12:40 p.m. in London---and the subsequent rally [such as it was] got capped shortly before the equity markets opened in New York. From there the silver price chopped sideways in ten cent price range for the remainder of the day. The high and low in silver were recorded as $17.25 and $17.035 in the December contract. Silver closed in New York yesterday at $17.195 spot, up 2.5 cents from Wednesday's close. Net volume was 28,000 contracts. Platinum rallied six or seven bucks at the open in New York on Wednesday evening and, like gold and silver, hit its high shortly before 2:30 p.m. Hong Kong time on their Thursday afternoon. Except for a tiny rally at the Comex open, the platinum price also got sold down, with its low tick coming at 11 a.m. EDT in New York. Platinum rallied back ten bucks from there---and closed down only 2 bucks. Palladium also rallied at the open in New York open on Wednesday evening. But the attempted sell-off in palladium at 2:20 p.m. Hong Kong time met with little success---as the rally that began after the spike down at 11 a.m. EDT took the metal to its $778 the ounce high just before 12:30 p.m. in New York. The rally got cut off at the knees at that point---and the metal didn't do much after that. Palladium closed up 14 dollars. The dollar index closed late on Wednesday afternoon in New York at 85.75---and then it did nothing of significance during the entire Thursday session, closing at 85.83---up 8 basis points. The gold stocks gapped down at the open, but rallied back to unchanged shortly after 10 a.m. EDT, before getting sold down again. Then they traded sideways before developing a positive bias at the 1:30 p.m. EDT close of Comex trading. The gold shares really took off to the upside a few minutes before 3 p.m., but once they were in the green to the tune of 1 percent or so, there was a willing seller there to drop them back to unchanged. However, they did manage to close slightly in the black, as the HUI finished the Thursday session up 0.21%---which is quite amazing when you consider that gold was closed down nine bucks on the day. Some traders appeared to be bottom fishing. The silver equities followed a very similar pattern at the beginning, but their low tick came shortly before 11:30 a.m. in New York---and they rallied steadily from there, culminating in an identical spike to gold's that also began shortly before 3 p.m.---and it met the same fate. Nick Laird's Intraday Silver Sentiment Index closed up 0.63%. The CME Daily Delivery Report showed that zero gold and 8 silver contracts were posted for delivery within the Comex-approved depositories on Monday. Nothing to see here. The CME Preliminary Report for the Thursday trading session showed that there are still 233 gold contracts open in October, down 2 contracts from yesterday's report. Silver's open interest in October is now down to 10 contracts---minus the 8 from the previous paragraph, so the silver is just about done for the month---unless a surprise buyer demanding physical delivery shows up between now and next Thursday. There were no reported changes in GLD yesterday---and as of 9:40 p.m. EDT yesterday evening, there were no reported changes in SLV, either. Since yesterday was Thursday, the folks over at the iShares.com Internet site updated the in/out activities of SLV as of the close of trading on Wednesday. Joshua Gibbons, the "Guru of the SLV Bar List" reported on that--and here's what he had to say: "Analysis of the 22 October 2014 bar list, and comparison to the previous week's list -- 1,150,689.2 troy ounces were removed (all from Brinks London). No bars were added or had a serial number change." "The bars removed were from: Russian State Refineries (0.4M oz), Uralelectromed (0.2M oz), Almalyk (0.2M oz), and 11 others." "As of the time that the bar list was produced, it was overallocated 60.7 oz. All daily changes are reflected on the bar list. All of the bars removed are ones that had been in there for many years." The link to Joshua's website is here. For the second day in a row, there was no sales report from the U.S. Mint. The was a big shipment in gold out of the Comex-approved depositories on Wednesday, as 321,500.000 troy ounces were shipped out JPMorgan's vault---and that works out to precisely 10,000 kilobars of the stuff---and probably China bound. The link to that activity is here. For a change, there wasn't much in/out activity in silver. Nothing was reported received---and only 66,519 troy ounces were shipped out. The link to that 'action' is here. It was a very slow news day yesterday---and the pickings were slim. ¤ Critical ReadsWarren Buffett loses $2.5 billion in three days on Coca-Cola and IBMIt's not been a good week for billionaire investor Warren Buffett, as his bet on Coca-Cola and American tech giant IBM have cost him more than $2 billion in just three days. On Monday, Buffett lost nearly $1 billion after shares in IBM plummeted to a three-year low after it badly missed third-quarter earnings estimates and announced it would pay $1.5 billion to ditch its loss-making chip division. That’s bad news for Buffett considering his investment firm, Berkshire Hathaway, is the largest investor in IBM. Yesterday, Buffett's week of hell continued after Coca-Cola shares plummeted six per cent in New York trading after it reported flat sales and lowered its guidance for the year. The set of disappointing results from both companies come after Buffett admitted he made a "huge mistake" investing in Tesco, which has seen its share price more than halve in the past 12 months following a series of profit warnings. This article appeared on the independent.co.uk Internet site on Wednesday BST sometime---and today's first story is courtesy of reader 'h c'. Shrinking is the New Growth: CAT Did it Through Buybacks, Not SalesThose who have been following Caterpillar actual top-line performance know that things for the industrial bellwether have been going from bad to worse, with not only retail sales declining across the globe, as documented here previously, but with the current stretch of declining global retail sales now longer than during what was seen during the Great Recession. And yet, moments ago, CAT, which is a major DJIA component, just reported blow-away EPS of $1.72, far above the $1.35 expected. How did it achieve this stunning number which has pushed DJIA futures higher by almost half a percent? Simple: first there was the usual exclusions, with “restructuring costs” adding back some $0.09 to the bottom line number. But the punchline was this: “In addition to the profit improvement, we have a strong balance sheet and through the first nine months of the year, we’ve had good cash flow. So far this year, we’ve returned value to our stockholders by repurchasing $4.2 billion of Caterpillar stock and raising our quarterly dividend by 17 percent,” Oberhelman said.” This Zero Hedge piece showed up on David Stockman's website yesterday sometime---and it's the first offering of the day from Roy Stephens. It's worth your time. Foreign central banks cut U.S. bond stakes to lowest since MayForeign central banks slashed their holdings of U.S. Treasuries at the Federal Reserve to their lowest level since May, Fed data released on Thursday showed. Analysts said the decline in U.S. government bond holdings likely stemmed from a combination of factors including booking profits on the recent rally in Treasuries, and the dollar which hit a four-plus year peak earlier this month. "Some central banks might be selling dollars to arrest its rise against their currencies. While export-oriented countries typically like a stronger dollar, they don't want it go up too fast because they could make some imports very expensive," said Christopher Low, chief economist at FTN Financial. This Reuters article appeared on their Internet site at 6:08 p.m EDT yesterday evening---and I found it in a GATA release that Chris Powell sent out just after midnight. Interest rates could stay low permanently, says Bank of England deputy governorInterest rates could now be permanently lower, a prominent member of the Bank of England’s committee of interest rate setters has warned. Ben Broadbent, deputy governor for monetary policy at the Bank of England, said on Thursday that the low level of interest rates has “recently fuelled talk of a “secular stagnation””. He said that “rates are likely to stay low for some time yet”, while whether the downward path of interest is a “secular” phenomenon remains “anyone’s guess”. The Bank of England’s Monetary Policy Committee (MPC) voted to maintain Bank rate at its historic low of 0.5pc this October, as policymakers voted 7-2 to keep rates on hold. As Jim Rickards said some time ago---no interest increases ever again. But Broadbent won't admit that its the interference of the central banks in the free market that caused this problem in the first place. This article appeared on the telegraph.co.uk Internet site at 9:29 a.m. BST on their Thursday morning. This is the second offering of the day from reader 'h c'. Bank of England targets end of bank bail-out eraThe Bank of England could fire bank bosses on the spot and replace them with outside executives should the bank collapse under new rules designed to prevent taxpayers bailing out banks. The Bank would step in and take control of a failing bank over a 48-hour period, usually a weekend, and decide how to deal with it in order to protect customers. Instead of the Government stepping in, long-term bondholders would exchange debt for equity in the bank under a so-called “bail-in” method should it collapse. If these methods, which were detailed by the bank on Thursday, had been in place when RBS went under in 2008, not a single penny of taxpayer funds would have been used to rescue the bank. Ah, yes---preparing for the next collapse of the banking system in England---and soon to show up in your country as well. This article appeared on The Telegraph's website at 4:14 p.m. BST yesterday---and I thank U.K. reader Tariq Khan for sharing it with us. E.U. Banking Stress Tests: 'Far-Reaching Reforms Are Needed'On Sunday, Europe will release the results of its banking stress tests. In an interview, former PIMCO head Mohamed El-Erian speaks with SPIEGEL about what to expect and how Europe's core countries are failing to adequately confront a flagging economy. SPIEGEL: Mr. El-Erian, the results of the stress test on European banks will be published on Sunday. If you had a billion dollars to bet for or against European banks, what would you do? El-Erian: Stock markets are altogether overvalued; people took risks in financial markets that were too high. Banking stocks often exaggerate the development: If stock markets rise, bank shares rise higher. If stock markets fall, they fall deeper. Therefore, I would buy neither stocks nor bank bonds prior to a correction. I would focus on highly secured banking bonds. SPIEGEL: How poorly are Europe's banks doing? El-Erian: Soon, banks will no longer be the biggest risk to the financial system and the economy. And five years from now, many credit institutions will be smaller than they are today, having discontinued some types of business, and will better support the real economy. This short interview was posted on the German website spiegel.de at 4:48 p.m. Europe time on their Thursday afternoon---and it's worth reading. It's the second contribution of the day from Roy Stephens. Could France sell the Mona Lisa to pay off its debts?France is in debt to the tune of 2,000 billion euros. Could selling off the country’s art make a dent in that figure? Leonardo da Vinci’s Mona Lisa is probably the best known work of art in the world. Her enigmatic smile beams down on hundreds of thousands of tourists a year at the Louvre Museum in Paris. She could also bring a smile to France’s cash-strapped government if a sale could ease the national debt. Heavily-indebted Portugal is doing something similar, putting its state-owned collection of Miro paintings up for sale. This very interesting article showed up on the france24.com Internet site way back on September 2---and I thank reader M.A. for digging it up for us. Barroso clashes with Italy over published budget warningEuropean Commission president Jose Manuel Barroso has hit out at Italy for publishing a letter the commission sent asking Rome to justify its budget for 2015. "It was a unilateral decision by the Italian government to publish the letter on the finance ministry's website. The commission was not in favour of that letter being made public," Barroso said on Thursday (23 October). The letter, sent Tuesday, says Italy's draft budget, submitted last week along with other national budgets for review in Brussels, "plans to breach" the debt and deficit rules underpinning the euro. "According to our preliminary analysis Italy plans a significant deviation from the required adjustment path towards its medium-term budgetary objective," says the letter. This news item, filed from Brussels, appeared on the euobserver.com Internet site at 3:32 p.m. Europe time yesterday afternoon---and I thank Roy Stephens for sending it. Blackwater contractors convictedA federal jury here on Wednesday convicted one former Blackwater contractor of murder and three of his colleagues of voluntary manslaughter in the deadly shootings of 14 unarmed civilians killed in Baghdad's Nisour Square seven years ago. The judge in the case ordered the men detained pending sentencing. The massacre, which resulted in a wave of popular anger in Iraq against the United States, and especially the army of private security contractors which it employed there, contributed heavily to the Iraqi government's later refusal to sign an agreement with Washington to extend the US military presence there. It also sealed the reputation of Blackwater, a "private military" firm headed by Erik Prince, a right-wing former Navy Seal, as a trigger-happy mercenary outfit whose recklessness and insensitivity to local populations jeopardized Washington's interests in conflict situations. Seven years is better than never, I suppose. This Asia Times article appeared on their website yesterday sometime---and I thank reader M.A. for sliding it into my in-box very late last night MDT. China Cuts Saudi Oil Imports Amid Colombia Shipment BoostChina reduced oil imports from Saudi Arabia even as the world’s largest crude exporter cuts prices to lure Asian customers amid intensifying competition from Colombia to Oman. Oil deliveries from Saudi Arabia fell 2.7 percent to 4.74 million metric tons last month from a year earlier, according to data released today by the General Administration of Customs in Beijing. Shipments from Colombia surged 389.6 percent, while Russian deliveries increased by 56.8 percent. Asian consumers are benefiting from a wider choice |

| Foreign central banks cut U.S. bond stakes to lowest since May Posted: 23 Oct 2014 11:12 PM PDT Foreign central banks slashed their holdings of U.S. Treasuries at the Federal Reserve to their lowest level since May, Fed data released on Thursday showed. Analysts said the decline in U.S. government bond holdings likely stemmed from a combination of factors including booking profits on the recent rally in Treasuries, and the dollar which hit a four-plus year peak earlier this month. "Some central banks might be selling dollars to arrest its rise against their currencies. While export-oriented countries typically like a stronger dollar, they don't want it go up too fast because they could make some imports very expensive," said Christopher Low, chief economist at FTN Financial. This Reuters article appeared on their Internet site at 6:08 p.m EDT yesterday evening---and I found it in a GATA release that Chris Powell sent out just after midnight. |

| Bank of England targets end of bank bail-out era Posted: 23 Oct 2014 11:12 PM PDT The Bank of England could fire bank bosses on the spot and replace them with outside executives should the bank collapse under new rules designed to prevent taxpayers bailing out banks. The Bank would step in and take control of a failing bank over a 48-hour period, usually a weekend, and decide how to deal with it in order to protect customers. Instead of the Government stepping in, long-term bondholders would exchange debt for equity in the bank under a so-called “bail-in” method should it collapse. If these methods, which were detailed by the bank on Thursday, had been in place when RBS went under in 2008, not a single penny of taxpayer funds would have been used to rescue the bank. Ah, yes---preparing for the next collapse of the banking system in England---and soon to show up in your country as well. This article appeared on The Telegraph's website at 4:14 p.m. BST yesterday---and I thank U.K. reader Tariq Khan for sharing it with us. |

| Market Update: #HeartofGold & Gold Symposium Update Posted: 23 Oct 2014 11:12 PM PDT Last week, ABC Bullion was delighted to attend the 7th annual Gold Investment Symposium, which was held at the Sofitel Sydney Wentworth Hotel. As we have for the past few years now, we were proud to sponsor the event alongside our sister company Custodian Vaults, and were delighted to catch up with not only a number of key industry contacts, but also to talk to many of the attendees, including a large number who are clients of ABC Bullion. Considering the general pessimism and apathy regarding gold as an investment right now, attendance was not as high as it was back in 2011 when gold was threatening to push through the USD $2000oz mark. From a contrarian perspective, this is of course encouraging news, and whilst no one was denying or attempting to gloss over the pain that the last three years has brought, their was a general perception that maybe, just maybe, the precious metal community has weathered the worst of this corrective storm, and there will be more profitable times ahead. Some news from "the land down under"---as we don't hear much from them. It was posted on the abcbullion.com.au Internet site eight days ago---and my thanks go out to Wesley Legrand for sharing it with us. |

| First Majestic CEO wants silver miners to form counter-cartel against futures shorters Posted: 23 Oct 2014 11:12 PM PDT First Majestic Silver CEO Keith Neumeyer, interviewed by Future Money Trends, argues that silver miners should form a counter-cartel to combat the investment houses selling silver short on futures markets. My congratulations to Keith Neumeyer and Co. for stepping up to the plate on this issue. I certainly hope that silver producers both big and small will rally around the flag that First Majestic has planted in the ground here, especially the producers based out of Vancouver. This call to arms is not without dangers though, as Vancouver-based producers such as Pan American Silver and Silver Standard Resources will certainly not support such an initiative, as their masters at The Silver Institute wouldn't allow it. Let's see what happens---but for moment I thing we should all be grateful to Keith, along with the entire organization, for having the gonads to do what was necessary. And if you want to help out here, you should contact the I.R. departments of any silver companies that you own shares in. A few keystrokes into your computer's search engine will bring up the required 1-800 number or e-mail address---and be polite, but forceful---and don't procrastinate, do it NOW! The interview runs for 15:41 minutes---and can be heard at their website linked here. I found this in a GATA release posted on their Internet site very late last night. |

| Chris Powell: The crucial questions financial journalism won't ask and central banks won't answer Posted: 23 Oct 2014 11:12 PM PDT Remarks by Chris Powell, Secretary/Treasurer, Gold Anti-Trust Action Committee Inc...New Orleans Investment Conference...Thursday, October 23, 2014 For many years this conference has bravely invited GATA Chairman Bill Murphy and me to speak here about the evidence of manipulation of the gold market, particularly manipulation undertaken directly or indirectly by central banks, and every year there has been new documentation to report. This documentation has been compiled at GATA's Internet site, GATA.org. The last two months have brought confirmation that, as we long have suspected, GATA has outlined only a small part of the surreptitious market manipulation being undertaken by central banks -- that this manipulation is actually comprehensive, that it covers nearly every major market in the world. This confirmation is largely the work of Eric Scott Hunsader, founder of the market data and research company Nanex in Winnetka, Illinois, who publicized, through the Zero Hedge Internet site, documents recently filed with the U.S. government, two of them with the Commodity Futures Trading Commission and one with the Securities and Exchange Commission. The first document is a letter to the CFTC, dated January 29 this year, from CME Group, the operator of the major futures exchanges in the United States, and signed by CME Group's managing director and chief regulatory counsel, Christopher Bowen: The letter notifies the CFTC of changes to CME Group's discount trading program for central banks. That is, the letter reveals that central banks are getting discounts for trading all futures on CME Group's exchanges, including the New York Commodity Exchange, the major mechanism for "price discovery" in the monetary metals. This speech that Chris gave yesterday in New Orleans falls into the absolute must read category, so top up your coffee and have at it. It was posted on the gata.org Internet site late last night. |

| JP MORGAN GOLD INVENTORIES: Fall A Stunning 33% In One Day Posted: 23 Oct 2014 09:00 PM PDT As the increasingly volatile stock markets bounced back higher today, JP Morgan experienced one of the largest withdrawals of gold from its inventories this year. In just one day, a stunning 321,500 oz of gold (10 metric tons) were removed from JP Morgan's Eligible inventories: Silver Shield Documents the “7 Sins of Obama” in this […] The post JP MORGAN GOLD INVENTORIES: Fall A Stunning 33% In One Day appeared first on Silver Doctors. |

| Jim Willie: Shanghai Shock to Shatter the Gold Market! Posted: 23 Oct 2014 07:06 PM PDT The pattern of central bank covering the debt is clear. The lesson is that central banks can apply paper patches to the failed banks, and buy more time, then repeat the process on the next failed bank event. No limit to their bank patches seems to be in force. The banker cabal can continue […] The post Jim Willie: Shanghai Shock to Shatter the Gold Market! appeared first on Silver Doctors. |

| Posted: 23 Oct 2014 06:01 PM PDT By now, most have seen last week's announcement from First Majestic Silver regarding their decision to withhold some silver from the market at these price levels. In this remarkably candid interview, the CEO of First Majestic proposes a new "Silver Producer Cartel" to counter the price manipulations so prevalent in today's paper markets. |

| Protected: A Look at Gold & Gold Miners Posted: 23 Oct 2014 04:41 PM PDT The post Protected: A Look at Gold & Gold Miners appeared first on The Daily Gold. |

| Harvey Organ’s Update: Gold & Silver Whacked! Posted: 23 Oct 2014 04:00 PM PDT Gold & silver were whacked again today, while JPMorgan saw a MASSIVE decline in gold inventory. Let’s head immediately to see the major data points for today: Submitted by Harvey Organ: Gold: $1228.50 down $16.30 Silver: $17.11 down 7 cents In the access market 5:15 pm: Gold $1233.00 silver $17.21 […] The post Harvey Organ’s Update: Gold & Silver Whacked! appeared first on Silver Doctors. |

| What Is The Link Between Gold And QE? Posted: 23 Oct 2014 02:58 PM PDT The intuitive response on the question what the link is between gold and QE is that QE (or “money printing”) is devaluing money and, consequently, appreciating the value of gold. That correlation became clear during the first two rounds of QE when the gold price more than doubled in dollar and euro terms in some 3 years and silver went three times higher. However, QE3 resulted in the opposite effect. The chart shows how prices of key assets (stocks, bonds, commodities, gold) evolved between the start of QE3 and the start of tapering. Logically, the end of QE3 should be impacting gold in a positive way. The tapering of QE3 is a long process, which, so far, has resulted in a decrease of the bond and mortgage backed securities supply by the US Fed from 85 billion US dollar per month to 25 billion.

The next chart clearly shows how stocks have been suffering as the taper process progessed, while gold has been stable since the start of tapering.

What to make out of this? It is clear that "money printing" as such does not correlate in a one-to-one way with precious metals, although it is, so far, higly correlating with stocks. During all the QE phases, stocks have been performing well, while gold has only benefited from QE1 and QE2 as those periods where associated by the market with inflation. On the other hand, QE3 provided THE ultimate "risk on" trade; because the invisible hand of the almighty central bank was there stimulate endless risk. That is when gold was literally ababonded, at least among Western investors. The interesting part is that gold is today behaving as a "risk off" trade, sort of a "safe haven" trade. What does this mean going forward? That’s hard to say, but the more likely answer is that the "safe haven" trade should continue. With multiple bubbles, including the ones in geopolitical tensions, ebola and currency wars, it is fair to expect a continuing safe haven bid. That would imply that gold investors would be relatively better off compared to silver investors, until inflation expectations return (e.g. because of monetary policy). The next round of QE, whenever it would be announced, should be analyzed closely on the “set of circumstances” of that moment, as well as the resulting effect on market sentiment. |

| Precious Metals vs The Formidable Loss Of Purchasing Power Of The Dollar Posted: 23 Oct 2014 02:40 PM PDT If you had purchased $100 in gold in 1971, it would be worth over $3,040 in today's dollars. But if you had left your $100 in cash, you would still have only $100 in cash, which today only retains about 17% of its former value. Similar to gold, if you had purchased $100 in silver back in 1971, it would be worth over $1,200 in today's dollars. Because the Federal Reserve continues to print money out of thin air, or inject new dollars into the financial system with mere keystrokes, real gold and silver will continue to rise in nominal dollar price. As the purchasing power of the U.S. Dollar decreases by the year, investors are turning to precious metals. The public has not yet figured out that the dollar’s devaluation is ongoing and that holding physical precious metals rather than cash is an effective way of protecting their purchasing power over time. Grasping the concept of dollar devaluation is difficult for many. One of the most effective methods used to illuminate this concept is through illustrations. Money Metals Exchange, a gold and silver bullion provider, has created a very interesting infographic which summarizes and illustrates all this.

|

| Jim Willie: Shanghai Shock to Shatter the Gold Market! Posted: 23 Oct 2014 01:08 PM PDT

Click here for the latest Hat Trick Letter on the coming Shanghai Shock to the Gold Market: |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment