saveyourassetsfirst3 |

- Wall Street Officially Becomes a Parody of Itself

- The Federal Reserve is intentionally attacking savers. Here’s proof…

- 113 Federal Reserve Staff Members Make $250,000 Annually

- 2:00PM Water Cooler 10/23/14

- Controversial post: A long-term U.S. dollar bull market could be starting now

- SILVER SQUELCHERS PART 4: And Their Interesting Associates

- Gold 1217 and 1207 are Possible Support Levels

- If you expect the Fed to raise interest rates soon, you need to see this

- Upside Down and Backwards: Here We Go Again

- Brighter euro zone PMI surveys help euro recover from lows

- The China Gold Association Confirms Koos' Numbers

- Current Financial World: A House Of Cards Built On Sand

- The U.S. and Russia are now “joining forces”… But you might not believe why

- Gold retreats as dollar index rises

- Metals market update for October 23

- African Barrick sees potential for big gold deal in 2015

- Harvey Organ: LBMA to Stop Publishing GOFO Rates!

- Mel Watt, Federal Housing Finance Agency Head, is Pushing Banks to Make Extremely Risky Home Loans

- SNB could be forced to buy $60bn of gold

- Silver stays strong

- Pakistani investigation agency probes gold export scam

- The gold price looks vulnerable - Phillips

- Prepare for Global Gold Confiscation and Orwells 1984, Warns Rickards

- If you don’t own these world-class shale companies, you could soon have an incredible chance to buy

- Prepare for Global Gold Confiscation and Orwell’s 1984, Warns Rickards

- Harmony Gold net loss confirmed

- Yes vote in an early lead in the Swiss referendum to boost gold to 20% of total currency reserves

- It’s Official—China’s Gold Demand in 2013 Was 2,199 Tonnes

- Ukraine's multi-billion dollar gas debt: Who pays?

- Good fundamentals make ruble ‘stable’ currency - Russian Central Bank

- Nelson Bunker Hunt, 88, Oil Tycoon With a Texas-Size Presence, Dies

- Gold Is Undervalued – Ned Goodman

- Keith Barron, PhD: "I believe we’ve seen Peak Gold*"

- Gold miners' outstanding forward sales jump 61 percent in Q2/14 - report

- Goldcorp chief says Asian buying will support price of gold

- Koos Jansen: It's official -- China's gold demand in 2013 was 2,199 tonnes

- This Dhanteras, gold coins are in, jewellery is out

- Kolkata’s gold panners reap rewards at India festival time

- Huge, honkin’ gold nugget hits the market in San Fransisco

- Nelson Hunt the man who took silver to $50 an ounce in 1980 dies aged 88

- Gold and Silver Demand is Spiking Higher

- What Happens When Cash Is No Longer Trash?

- HUI to Gold Ratio Collapsing

- Golden Secrets (IV) The Chinese Imperial Gold

- Low Inflation? The Price Of Ground Beef Has Risen 17 Percent Over The Past Year

- Gold Mining Stocks Continue to Sink

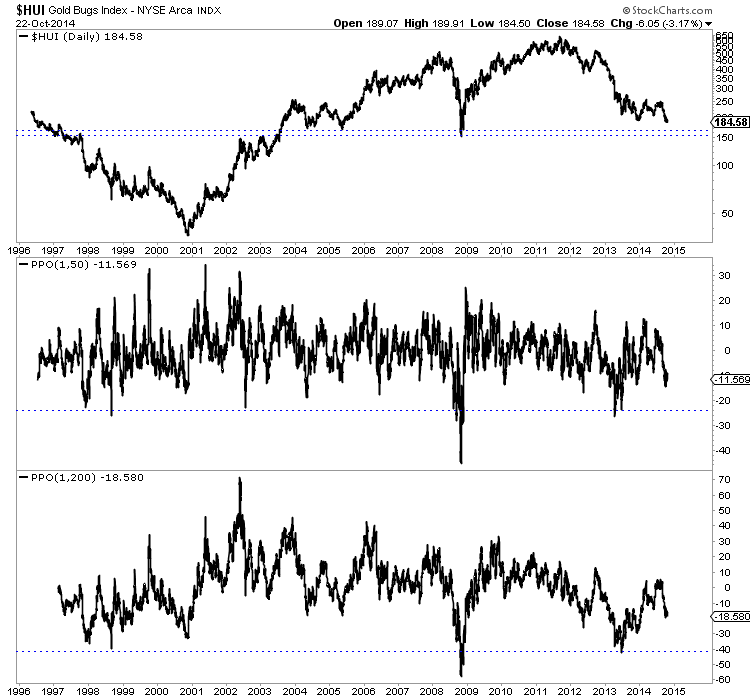

- HUI Gold Bugs Index Distance from 50-Day & 200-Day MA

- Silver Investment Demand To Increase By One Billion Ounces Over Next Decade

- Cerulean Dollars – Go Deep or Go Home

- Is A Demand Shock In The Gold Market Coming?

| Wall Street Officially Becomes a Parody of Itself Posted: 23 Oct 2014 01:00 PM PDT Yes it's official, Wall Street has become a literal parody of itself. Submitted by Michael Krieger, Liberty Blitzkrieg: Longtime readers will know that I think the greatest parody of Wall Street ever created is courtesy of SNL about a made-up firm called Global Century Investments. Before I provide a link to the video, I want […] The post Wall Street Officially Becomes a Parody of Itself appeared first on Silver Doctors. | ||||||||||||||||||||||||

| The Federal Reserve is intentionally attacking savers. Here’s proof… Posted: 23 Oct 2014 11:33 AM PDT From Chris Martenson at Peak Prosperity: There’s something we ‘regular’ citizens wrestle with that the elites never seem to: a sense of moral duty. For example, following the collapse of the housing bubble, many people struggled with mortgages they could no longer afford to pay, fearing the shame of default. Many believed defaulting was wrong somehow; that it was their moral obligation to pay their mortgages, no matter how dire their personal situation. And of course, the mortgages lenders did their utmost to reinforce this perception. In a perfect world, we would honor our debts and obligations, every one of us. But the world is an imperfect place, and moral obligation is something that almost never enters into the decision matrix of our society’s richest. Or the banking industry. For them, the number one (and two, and three…) rule is that whatever is expedient and makes the most money is the right thing to do. For the bottom 99%, it's like playing with a stricter set of rules than your opponent: you're not allowed to hit below the belt, and they've brought a baseball bat into the ring. Note how this guy had to fight through his middle class conditioning before coming to a sense of peace over his decision to enter into a short sale on his house:

This poor guy has a very bad case of 'middle class morality'. It’s a very real phenomenon. All our lives, we are all taught (programmed?) to stay within the true and narrow groove of middle class life, pay our bills, and be on the hook should things go awry. Not everybody holds that view, however. As he continues in the piece, the author discovers something important along the way:

Rich people have terrible credit. They know that there's a system and it has rules. And, for them, these rules can (and should) be optimized for their own benefit. So they do anything and everything that works to their advantage. There's a reason and a logic to that which I can appreciate, but it makes me wonder where the rest of us obtained our deep-seeded beliefs about duty and responsibility towards debts. Similar to rich people, banks do not have any entangling moral restrictions on their behaviors. That absence allows them to get away with extraordinary misdeeds, none more obvious and damaging than those that the Federal Reserve has perpetrated on the nation, specifically, and the world, more broadly. To understand why, we first have to discuss something called Financial Repression. Financial Repression In my recent interview with Daniel Amerman, to whom I will credit much of the concise thinking and for unearthing the sources that I will weave throughout the remainder of this piece (please read his excellent article on Financial Repression here), the truly immoral intent of the Fed’s policies really sank in. In response to the Fuzzy Numbers chapter (18) of the Crash Course, reader JBarney pondered the following:

The answer is that while inflation always steals from savers, it really does its dirty work when the central bank and government conspire to create a condition of pervasive and unavoidable negative real interest rates. This is the heart of Financial Repression: an environment in which you literally cannot save money without paying a penalty. The main takeaway of Chapter 18 on Fuzzy Numbers is not that the government fibs a little now and then (okay, all the time) merely because that’s politically expedient, but it does so in service to a larger and more pernicious aim: forcing people to accept an inflation rate that is higher than either their income growth and/or the market’s safe rate of return. As soon as you are locked into a negative interest rate regime, your capital is losing purchasing power. But simple accounting rules dictate that loss of wealth had to go somewhere. So where did it go? To somebody else. Negative real interest rates transfer money from every saver to every over-extended borrower. This is especially true with the government (largely because of its special revolving door relationship with the Fed, which both issues the money out of thin air and then buys government debt forcing rates into negative territory). It’s really that simple. The Fed has openly and actively suppressed rates — not to help the credit markets, as they claim, but to engineer a condition of Financial Repression. Because that’s what the government needs to stealthily take your wealth to pay down the prior debts it accumulated. Thus ‘negative real rates’ are the essential component of transferring wealth from the many to the few, with the ‘few’ being defined as the government, Wall Street, and others who exploit leverage and liabilities at sufficient scale to be on the right side of that wealth transfer. This well-known phenomenon is a thoroughly accepted and well-described practice of governments and central banks everywhere. One of the better descriptions of it comes to us courtesy of the BIS in this working paper published in 2011. From the abstract:

Let me decode that.

And this is exactly what has happened. All of the talk about the Fed focusing on unemployment or inflation or whatever are red herrings. What the Fed is really trying to do is to create a set of macro conditions that will allow the federal government to slowly crawl out from under a pile of debt and entitlement obligations that it literally cannot pay by honest, above board means. I guess if we were to imagine a “Step 4″ in the above process, it would be to wait for the head of the central bank to come out and deliver a speech in which she expresses a grandmotherly concern for the wealth gap that naturally results from all this, but to deflect attention away from this being a direct and understood consequence of the Fed’s intentional goal of financial repression… and towards some failure on the part of those who have been targeted to donate to the cause of bailing out the profligate and rewarding the borrowers. Oh, wait. That did just happen. Here it is, Step 4, courtesy of Janet Yellen last week:

At this point, based on Yellen’s testimony, I think it’s time to say what everybody is already thinking: the Fed Chairwoman is literally displaying psychopathic tendencies by blaming her victims. I’m serious: if the Fed were an individual, we'd have no problem identifying its behaviors in psychologically pathological terms. I understand that some, or perhaps many, will excuse this last point by saying that the Fed cannot possibly state the truth because doing so would create loss of confidence or public anger. But I submit that the so-called “white lie” defense is utter nonsense. A greater harm is done by lying than by telling the truth. You can get away with small lies for a while, but they never actually go away, they just sit there corrosively undermining the very foundation of trust upon which civilized society rests. Large lies just do more damage over a shorter period of time, and that's exactly where we are today. This explains much in terms of people's general sense of unease despite an apparently reasonable economy and awesome living standards (by any historical measure). Here’s what truth would sound like if I were to re-write Yellen’s speech:

| ||||||||||||||||||||||||

| 113 Federal Reserve Staff Members Make $250,000 Annually Posted: 23 Oct 2014 11:30 AM PDT Just in case you need another reason to dislike the thieving Federal Reserve… Submitted by Michael Krieger, Liberty Blitzkrieg: From Reuters: (Reuters) – The top 113 earners among staff at the Federal Reserve's Washington headquarters make an average of $246,506 per year, excluding bonuses and other benefits – more than Fed Chair Janet Yellen and nearly double the normal […] The post 113 Federal Reserve Staff Members Make $250,000 Annually appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Posted: 23 Oct 2014 10:58 AM PDT | ||||||||||||||||||||||||

| Controversial post: A long-term U.S. dollar bull market could be starting now Posted: 23 Oct 2014 10:16 AM PDT From InvesTRAC: Make a note of the following: The reversal of a thirty-year bear trend… plus an eleven-year base… equals a major new bull market in progress. What market is this you ask? Well, it’s the much-maligned U.S. dollar… Take a look at the monthly chart below of InvesTRAC’s U.S. Dollar index, which dates back to 1983. You can see for yourself the major, thirty-year-long downtrend has been reversed. Then look at the base pattern that has been building since 2003. Recent strength has pushed the index into a short-term overbought situation just shy of the resistance line (which can be seen as the lid on the base). There is likely to be some (downside) prior to the violation of this resistance, but once it gives way there should be an almost 30% rise to the previous top… On the technical evidence, it could make sense to buy the dollar on short-term weakness and hold for the long haul.

| ||||||||||||||||||||||||

| SILVER SQUELCHERS PART 4: And Their Interesting Associates Posted: 23 Oct 2014 10:15 AM PDT "GOLD HAS NO USEFUL PURPOSE TO SERVE IN THE POCKETS OF THE PEOPLE"—Pilgrims Society member Alan Sproul, president of Federal Reserve Bank of New York, addressing the anti-precious metals American Bankers association meeting in San Francisco. By Charles Savoie, SRSRocco Report: "LONDON, May 16— The Pilgrims Society, which was quietly organized here less than a […] The post SILVER SQUELCHERS PART 4: And Their Interesting Associates appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Gold 1217 and 1207 are Possible Support Levels Posted: 23 Oct 2014 09:57 AM PDT | ||||||||||||||||||||||||

| If you expect the Fed to raise interest rates soon, you need to see this Posted: 23 Oct 2014 09:14 AM PDT From Dr. David Eifrig, MD, MBA, editor, Income Intelligence: Should you sell everything and go to cash? It’s the biggest question I’ve received recently in my e-mail inbox… After all, stocks aren’t cheap today. The S&P 500 is now valued at around 17 times earnings and yields less than 2%. It has pulled back from its September all-time highs, and could certainly correct further. As for bonds, both high-yield (or “junk”) bonds and U.S. Treasury securities are yielding much lower than their historical averages. And if you suspect the Federal Reserve will raise long-term interest rates, then the value of fixed-income investments, like bonds, will fall further. Bond prices, of course, move in a teeter-totter relationship with interest rates. But we haven’t seen a collapse in bonds. That’s because investors haven’t run fully to cash… They’ve reallocated a bit and maybe taken some stock profits. But the majority of their money is still sitting in stocks and in bonds. It’s earning interest in certificates of deposit (CDs) or money-market accounts (which means it’s really in short-term debt). After all, people need to earn something on their money… This is why we don’t expect rates will rise any time soon… We’ll have at least until next spring. Let me explain… After the financial crisis, the U.S. Federal Reserve cut short-term interest rates and started buying up bonds in an effort to keep interest rates low. Low interest rates are meant to encourage people to spend and they make it cheaper to borrow to expand businesses. The goal was to stimulate the economy. This drove interest rates to historically low levels. For example, the 10-year U.S. Treasury has delivered an average yield of 6.5% over the past 50 years. Today, it yields just 2.3%.

Many expected that the Fed’s so-called “money printing” would lead to price inflation. It hasn’t. And since the Fed doesn’t want inflation, many expected that when inflation showed up, the Fed would raise short-term interest rates and all rates would rise. That hasn’t happened either. Even if the Fed did raise short-term interest rates – the only interest rates that it directly controls – it’s unlikely that long-term rates like the 10-year or 30-year Treasury would rise in tandem. The Fed is “powerless,” and it’s all because you – along with billions of other savers – still have your money in the markets. The Fed can’t push up interest rates because interest is the “price” of borrowing money. Prices, of course, are determined by supply and demand. It’s basic economics. Despite the Fed’s posturing, interest rates on everything but overnight loans between banks reflect the supply of bonds outstanding and the demand, as determined by the amount of dollars ready to buy up bonds. You can’t short circuit the supply-and-demand equation. There’s no such thing as “artificially” low interest rates, like some Fed skeptics argue. Bonds will rise and fall based on changing investor perceptions leading to higher or lower demand… not because of a decision from a central bank. But we think there’s an even bigger trend holding interest rates down. And it’s not going away any time soon… Rising Capital Means Falling Interest Rates The world has seen an amazing build-up of capital, especially over the last two decades. This capital wants a place to go and that demand is bidding up financial assets like bonds and notes and thus keeping interest rates down. According to the financial-services giant Credit Suisse’s Global Wealth Databook, total global wealth has risen to $240 trillion in 2013. That’s more than double the $113 trillion in 2000 (and up 31% since the $183 trillion total after the 2008 financial crisis). Where’s the wealth coming from? Exponential growth accounts for some of this wealth. Prior to the industrial revolution, there was a minimal amount of accumulated capital. Since then, wealth keeps growing… often at rates exceeding global gross domestic product (GDP)… and even a small annual return above the global GDP means that the amount of capital in the world will grow faster than it can be put to use. The wealth also comes from the growth of emerging-market economies. These countries often have higher savings rates than the U.S. In less stable economies, earners are more likely to save for a rainy day. After the 1997 Asian currency crisis, those countries started building up massive reserves as protection against another meltdown. According to the International Monetary Fund, China holds $4 trillion in currency reserves. This is 43% of its GDP. Japan has $1.2 trillion (24%). Taiwan has $428 billion (82%), and two autonomous cities, Hong Kong and Singapore, combine for another $600 billion (120% and 90%, respectively). Other countries with a lot of natural resources have built up reserves as well. Saudi Arabia has $745 billion and Russia has $454 billion. Corporations have loads of cash, too. Right now, non-financial companies have amassed more than $1 trillion that they aren’t using. And while we use the term “cash,” we really mean that this money is sitting in Treasury securities. The developed world is also undergoing a demographic shift toward much older populations. In the U.S., the median age has climbed from 29.5 years old in 1960 to 37.2 in 2010. In Europe, the median age has grown to 41.9 years old. These older populations have more savings built up for retirement living. This means retirement accounts, pension funds, and government programs have all built up cash. All that savings needs to be invested. That leads to extreme examples like One57, a 90-story glass-and-steel tower on the northern border of New York’s Central Park. It’s the tallest residential structure in the city and cost $2 billion to build. Many of the multimillion-dollar condominiums went to wealthy Russian, European, and Asian buyers. They’ll sit empty most of the year. It’s just a safe place to park cash outside of their unstable home countries. Ultimately, the owners of much of the world’s capital want to be invested in things that are as risk-free as U.S. Treasury securities are perceived to be. That has been difficult lately… While many worry about our national debt, our spending gap has been significantly downsized over the past seven years. The deficit has dropped from $1.4 trillion to about $700 billion – from 10% to 4% as a percentage of GDP.

In turn, this means the government is borrowing less money and issuing fewer Treasury securities. So this massive pile of savings and wealth (the “global savings glut”) is chasing a smaller pile of available assets. As a result, the market is faced with higher demand and lower supply. That keeps interest rates on Treasury securities down. The demand for financial investments spills out into other assets, like junk bonds, stocks, and New York luxury condos. Compared with this real demand, the Fed setting rates – and its relatively small bond-buying programs, known as quantitative easing – has little effect on where rates will be in the near future. Crux note: Doc Eifrig says interest rates won’t rise any time soon, but that doesn’t mean income investors have to settle for tiny yields. In fact, Doc recently released a report detailing a series of little-known income opportunities that could help you collect an extra $24,000 every single year, for the rest of your life. Click here for the details. | ||||||||||||||||||||||||

| Upside Down and Backwards: Here We Go Again Posted: 23 Oct 2014 09:00 AM PDT The Fed will continue to be the buyer of last resort until the population and culture wake up to “bank holidays, runs and/or “bail ins”. Grandma Yellen won’t let you starve. It seems the next downturn in equities, housing, and bonds is meant to bring the masses under the big circus tent of control once […] The post Upside Down and Backwards: Here We Go Again appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Brighter euro zone PMI surveys help euro recover from lows Posted: 23 Oct 2014 08:30 AM PDT The euro recovered from a two-week low against the dollar on Thursday after data showing an unexpected pick-up in euro zone business growth, though gains could be fleeting amid continued expectations of more monetary easing... Read | ||||||||||||||||||||||||

| The China Gold Association Confirms Koos' Numbers Posted: 23 Oct 2014 08:00 AM PDT Now even the China Gold Association is openly admitting that total Chinese wholesale demand was 2,200 metric tonnes in 2013. Of course, the only "analysis" that seems to matter creeps from the bowels of The World Gold Council, which continues to understate Chines demand fully by half. Why does the WGC persist with their imaginary numbers? Could an agenda be involved? | ||||||||||||||||||||||||

| Current Financial World: A House Of Cards Built On Sand Posted: 23 Oct 2014 08:00 AM PDT History shows that all fiat paper currency systems fail. Will this time around be any different? Submitted by ETP: Take heart PM community, your turn is coming. What is happening in the stock market is a harbinger of what is sure to come for gold and silver, at some point in the future. When? Ah, that elusive […] The post Current Financial World: A House Of Cards Built On Sand appeared first on Silver Doctors. | ||||||||||||||||||||||||

| The U.S. and Russia are now “joining forces”… But you might not believe why Posted: 23 Oct 2014 07:51 AM PDT From Bloomberg: The U.S. and Russia are joining forces to block a European plan to raise the protection of nuclear reactors against natural disasters after the meltdowns at Japan’s Fukushima Dai-Ichi power plant, diplomats say. Envoys from both countries are trying to derail a Swiss-led initiative that would force nuclear operators to invest more on safety, undermining attempts to harmonize global safety regulation, according to eight European and U.S. diplomats who attended meetings in Vienna last week. All asked not to be named in line with rules kept by the Convention on Nuclear Safety, the legal body overseeing the talks. Even as relations between Russia and the U.S. have sunk to a post-Cold War low over the crisis in Ukraine, the two powers have come together to press their shared interest in resisting more stringent safety guidelines, said the diplomats. The U.S. is the world’s biggest nuclear-power generator, while Russia exports more reactors than anyone else. “Switzerland, as the initiator of the proposal, will continue to collaborate with all delegations and do everything to find a solution that is acceptable to all of us,” Georg Schwarz, deputy director general of the Swiss nuclear-safety regulator, ENSI, said in an e-mailed reply to questions. Nuclear Secrecy The U.S.-Russia collaboration reflects a nuclear-safety convention whose secrecy is laid bare in documents obtained by Bloomberg News under a Freedom of Information Act request. It also underscores the high stakes for an industry trying to bounce back after the Fukushima accident. European attempts to impose higher safety standards would make nuclear power more costly just as plant operators come under price pressure from cheaper natural gas. Prompted by the March 2011 Fukushima incident, European regulators are seeking to rewrite international standards to ensure nuclear operators not only prevent accidents but mitigate consequences if they occur, by installing costly new structures built to survive natural disasters. The meltdown caused by a tsunami forced 160,000 people to flee radioactive contamination and led to the shutdown of all of Japan’s nuclear plants. The European attempt became public in April during the previous Convention on Nuclear Safety meeting in Vienna. Switzerland consulted with engineers, regulators and diplomats from more than 50 countries before proposing the new rules. The stricter requirements were in line with a European Union directive issued three months later that required nuclear operators to bolster infrastructure at existing plants. Less Stringent U.S. regulators aren’t requiring the same stringent modifications, according to Edwin Lyman of the Cambridge, Massachusetts-based Union of Concerned Scientists, an advocacy group. European utilities pay as much as five times more to fit out plants to withstand earthquakes and floods as a result, he said. Electricite de France SA is spending about 10 billion euros ($13 billion) on additional safety features for its 59 reactors, according to its regulator, the Autorite de Surete Nucleaire. U.S. utilities will spend about $3 billion on portable generators and cooling reserves for about 100 reactors, FirstEnergy Corp. (FE) President Pete Sena said in July 31 testimony to the Nuclear Regulatory Commission. ‘Hardened Core’ French costs are higher because operators have to build a “hardened core” around their reactors that will be able to contain fallout if an accident occurs, its regulatory chief, Jean-Christophe Niel, said in July testimony to the NRC in Rockville, Maryland. Engineers are designing reinforced bunkers for back-up power and installing emergency cooling systems to contain a meltdown. The country is also reinforcing the concrete bases of its oldest reactors and creating elite teams of emergency responders. At last week’s meeting, convened at the International Atomic Energy Agency’s headquarters, Russian envoy Oleg Postnikov offered praise for his American counterpart, Eliot Kang, after the U.S. argued against the European initiative, people who attended the meeting said. U.S. officials confirmed that their delegation fell into an uneasy alliance with Russia. The U.S. State Department declined to comment on the record. Russian diplomats accredited to the IAEA didn’t respond to written requests and phone calls seeking comment. ‘Shocking’ Secrecy Created in response to the 1986 Chernobyl nuclear reactor meltdown in Ukraine, the convention has struggled to broaden safety standards. The group’s own secrecy has often undermined its intents. One former French envoy, Jean-Pierre Clausner, said that the opacity of the organization was “shocking,” according to the documents obtained under the Freedom of Information request. “The whole process needs to be reviewed and significant changes should be introduced if the contracting parties are willing to maintain the usefulness of the convention,” Clausner wrote in 2005, the first year that the body allowed notes taken from its meeting to be preserved. While nuclear meltdowns are considered cross-border incidents because of the radioactive fallout that can result, no international authority exists to compel countries to adopt safety standards. Instead, regulators from around the world routinely review each other’s practices to figure out which works best. Laggards face peer criticism that can make them look bad in forums like the convention. Falsified Data At the convention’s 2008 meeting — the last before Fukushima — Japan was criticized by peers for being slow to overhaul a reporting system that had been caught using “falsified inspection data,” the documents show. Participants also urged Japan, then the world’s third-largest nuclear-power generator, to review how safe its reactors were against earthquakes. Countries like China and India, where companies are building new reactors to cover growing electricity demand, have given some support to the European initiative, according to the diplomats. The safety-upgrade costs to new reactors aren’t as burdensome as retrofitting existing infrastructure, they said. The U.S. said that the Europeans bushwhacked their delegation earlier this year by calling a vote to consider the safety amendment. The country’s nuclear industry would suffer if the European measure were to be adopted because it would create an international perception that the U.S. took safety less seriously. “The nuclear industry in the U.S. is under great pressure from lower natural gas prices,” said Lyman from Vienna, where he is attending an IAEA meeting. “At the same time, the potential for capital upgrades to deal with post-Fukushima requirements was a worry that it could push them over the edge.” Argentina’s IAEA envoy, Rafael Mariano Grossi, will convene the next safety meeting Feb. 9 to 13, when countries will decide on the Swiss measure. The biggest challenge for the U.S. and Russia may not be convincing enough countries to vote against the measure, according to an official who organized last week’s talks. Their real test, he said, will be to come up with something better. | ||||||||||||||||||||||||

| Gold retreats as dollar index rises Posted: 23 Oct 2014 07:29 AM PDT Gold prices gave back some ground today as stocks fell and the dollar index rose. | ||||||||||||||||||||||||

| Metals market update for October 23 Posted: 23 Oct 2014 07:10 AM PDT Gold fell $6.80 or 0.54% to $1,241.50 per ounce and silver slid $0.36 or 2.06% to $17.15 per ounce yesterday. | ||||||||||||||||||||||||

| African Barrick sees potential for big gold deal in 2015 Posted: 23 Oct 2014 07:07 AM PDT "Next year we will start to look around," CEO Brad Gordon said in an interview. | ||||||||||||||||||||||||

| Harvey Organ: LBMA to Stop Publishing GOFO Rates! Posted: 23 Oct 2014 07:05 AM PDT Today, we had a huge withdrawal in inventory at the GLD. of 2.1 tonnes. On the 22nd the LBMA stated that they will no longer publish GOFO rates. It looks to me like these rates are now fully manipulated. Submitted by Harvey Organ: Gold: 1244.80 down $6.20 Silver: 17.18 down 18 cents In the […] The post Harvey Organ: LBMA to Stop Publishing GOFO Rates! appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Mel Watt, Federal Housing Finance Agency Head, is Pushing Banks to Make Extremely Risky Home Loans Posted: 23 Oct 2014 07:00 AM PDT Rule Number 1 of Oligarch Club: Always make sure you sell to the muppets before the music stops. Here we go again. Submitted by Michael Krieger, Liberty Blitzkrieg: Mel Watt is one of the most dangerous financial oligarch puppets operating in America today. The first time he came across my radar screen was back in 2009, when […] The post Mel Watt, Federal Housing Finance Agency Head, is Pushing Banks to Make Extremely Risky Home Loans appeared first on Silver Doctors. | ||||||||||||||||||||||||

| SNB could be forced to buy $60bn of gold Posted: 23 Oct 2014 06:53 AM PDT After the first poll on the impending Swiss referendum shows a 'Yes' vote could be on the cards. | ||||||||||||||||||||||||

| Posted: 23 Oct 2014 06:46 AM PDT The latest research report released by CPM Group states that investment demand for silver is likely to remain robust in the upcoming years. | ||||||||||||||||||||||||

| Pakistani investigation agency probes gold export scam Posted: 23 Oct 2014 06:36 AM PDT The Federal Investigation Agency has intensified its probe into the multi-billion dollar fraud involving illegal gold exports by Pakistani jewelers to the United Arab Emirates. | ||||||||||||||||||||||||

| The gold price looks vulnerable - Phillips Posted: 23 Oct 2014 05:38 AM PDT The gold price closed at $1,241.50 down $6.80 on Wednesday. London took it down to $1,243. | ||||||||||||||||||||||||

| Prepare for Global Gold Confiscation and Orwells 1984, Warns Rickards Posted: 23 Oct 2014 05:03 AM PDT gold.ie | ||||||||||||||||||||||||

| If you don’t own these world-class shale companies, you could soon have an incredible chance to buy Posted: 23 Oct 2014 05:00 AM PDT From Matt Badiali, editor, S&A Resource Report: If you’re worried about U.S. oil stocks, today’s essay is for you… Over the past few months, the price of oil has crashed. Meanwhile, many oil stocks are down double digits. That’s a big loss. But the downturn is creating a great opportunity for investors… As regular Growth Stock Wire readers know, new drilling techniques have allowed the U.S. to tap into vast oil and gas reserves locked away in shale. As a result, U.S. oil production has increased 63% from the low in 2008 to today. That’s a massive increase in a short period of time. And as we’ve shown in these pages before, these technologies will help U.S. oil production keep soaring. But rising supply of oil and a strong U.S. dollar have caused the oil price to fall recently. West Texas Intermediate (WTI) crude oil has fallen from around $106 per barrel in June to about $83 per barrel today. This has caused investors to flee oil stocks. The SPDR Energy Select Fund (XLE) – which holds big oil producers like ExxonMobil and Chevron – closed down 18% on Monday from its June high. What investors are forgetting is that oil is tremendously cyclical. That means its price moves in waves. It goes through cycles of boom and bust. And the best time to buy oil stocks is when everyone hates the oil sector. You can see this in the below chart of the price of WTI crude and XLE… In the past five years, the price of oil was in “bust” mode five times (the red arrows) due to temporary fears of oversupply. But after each time, the world realized there was still more demand for oil than supply. Oil prices went on to boom an average of 39% (the green arrows show the peaks). Oil stocks followed the oil price and soared an average of 37%.

At today’s $83-per-barrel price, oil is at its historical average. Over the past five years, oil prices fell as much as 29% before recovering… while oil producers have fallen as much as 26% before recovering. So the price of oil and oil stocks could fall a little further from here. But they will recover, as they did previously. As we’ve shown you before, while U.S. oil supply might be increasing, world oil demand will continue to outpace world oil supply. According to the Energy Information Administration, the world will need 94.1 million barrels of oil per day in 2015. But the world will only produce 92.9 million barrels of oil next year. That number includes America’s production. More demand than supply should push global oil prices higher in the months ahead. And as my colleague Jeff Clark showed you last week, with the U.S. dollar breaking down, the next oil rally could be just around the corner. You see, assets like oil often trade opposite of the U.S. dollar. So oil falls when the dollar rallies… And oil rallies when the dollar falls. With the dollar falling, oil should soar as it becomes more expensive relative to the U.S. dollar. In short, history shows the next “boom” in oil could be worth 37% gains in oil stocks through XLE. But the gains could be even bigger in shale producers. You see, while XLE is down around 18% since June, 10 of the best shale oil and gas producers in the world are down more than that. Take a look:

These are the best shale companies in the world. They are the companies responsible for the surge in U.S. oil and gas production. If you don’t already own some of these names, I recommend looking into a few today. When oil enters its next “boom” phase, the share prices of these companies will soar. Crux note: Like it or not, the U.S. government will play a major role in harnessing the full potential of U.S. shale energy. That’s why Matt believes the 2016 presidential election will be one of the most important in recent history. In fact, he just spent the last three months writing a special report on this issue… and how you can put yourself in the best possible position to profit from it. Matt says it’s some of the most important wealth-generating information he’s ever published. Click here for the details. | ||||||||||||||||||||||||

| Prepare for Global Gold Confiscation and Orwell’s 1984, Warns Rickards Posted: 23 Oct 2014 04:59 AM PDT Prepare for Global Gold Confiscation and Orwell’s 1984, Warns Rickards We do not believe Rickard’s prognostications for a “New World Order” will come to pass. “How would that happen? The G-20 meetings struggle to agree on a final communique. How could they agree something like that?” asks Arabian Money in their review of Rickards’ article. We do see potential for a major crisis in the financial and monetary system along the lines that Rickards describes. And with this in mind we emphasise once again the prudence of storing gold and silver in fully segregated and fully allocated accounts in ultra-secure vaults in the safest jurisdictions in the world.

Prepare for Global Gold Confiscation and Orwell’s 1984, Warns Rickards Microchips embedded in the arms of citizens to track their activities, the total destruction of the middle classes and a cashless economy where an authoritarian state can freeze the accounts of dissenting citizens excluding them from all economic activity….. These are all part of the cheery scenario painted by the highly respected author and IMF-insider with connections to the Pentagon, Jim Rickards in his most recent article for Agora Financial. “In the year 2024″ as the article is called, capitalism and markets will have been abolished in favour of a marxist dystopia managed by the “New World Order.” The savings and assets of the middle classes will have been annihilated. This unfolds through a series of panics and shocks to the markets and hyper-inflation. As the hyperinflation takes hold there is a mass exodus out of paper currency and into gold. The G-20 arrange for the mass confiscation of gold, to be stored in an enormous vault in the Swiss Alps, in order to force the public back onto newly created digital currency. To ensure that the public cannot protect themselves from the profligacy of governments gold is taken out of circulation forever. He references Naomi Klein’s Shock Doctrine: The Rise of Disaster Capitalism when explaining “how power elites such as central bankers, finance ministers and the ultra-rich work behind the scenes” to achieve this Orwellian vision. “Shock doctrine is simple. Political leaders use crises to ramrod policies into place no one would accept in normal times.” Using this model the elites simply wait for the next crisis to unfold and then use the fear and confusion (“people begin to value order over liberty”) as cover for implementing anti-democratic agendas. Rickards cites the USA Patriot Act which was passed by congress following the 9-11 attacks. In that highly charged atmosphere, reams of legislation – which had obviously been drafted before the attacks just waiting for the appropriate crisis – were rushed through congress. Privacy in the face of the state is now a thing of the past in the U.S. The private communication of all citizens are collected and stored on a database to be monitored at will by intelligence agencies who are not accountable to the public in any real way. While we have more faith in humanity than Mr. Rickards, it is clear that the scenario he describes is not beyond possibility. The U.S. enjoyed the status of sole superpower for more than fifteen years after the fall of the Soviet Union. Naturally, it has attracted that element of humanity who crave power and control above all else. The Germans – arguably among the most sophisticated people in the world at the dawn of the twentieth century – still succumbed, following a series of crises, to a devious, vindictive, militaristic dictatorship by the 1930′s. On the flip side of that coin, average people have never had such ease of access to the information they want. So now, more than ever before in history, we can make informed choices. So the political outcome of the monetary crisis facing the world today is far from certain. We find Rickards’ description of how the current crisis facing the Central Banking establishment (damned if they do, damned if they don’t) will unfold is more plausible. He takes the line that QE will be pursued until the system crashes, referencing QE-7 in 2018. When the public finally lose faith in paper money it will cause savers to gush out of paper currencies and into gold, silver, agricultural land and fine art. However, he warns that – before inflation takes hold on the wider economy – these safe havens will already have been bid up to extraordinarily high prices and will therefore be unattainable to those people wishing to protect their wealth from hyperinflation. We do not believe Rickard’s prognostications for a “New World Order” will come to pass. “How would that happen? The G-20 meetings struggle to agree on a final communique. How could they agree something like that?” asks Arabian Money in their review of Rickards’ article. We do see potential for a major crisis in the financial and monetary system along the lines that Rickards describes. And with this in mind we emphasise once again the prudence of storing gold and silver in fully segregated and fully allocated accounts in ultra-secure vaults in the safest jurisdictions in the world. Get Breaking News and Updates on the Gold Market Here GOLDCORE MARKET UPDATE Gold fell $6.80 or 0.54% to $1,241.50 per ounce and silver slid $0.36 or 2.06% to $17.15 per ounce yesterday. Gold in Swiss storage or for immediate delivery climbed 2.9% this month on the heels of equities losses, after the U.S. Fed said slowing foreign economies were a risk to U.S. growth and the International Monetary Fund cut its growth outlook. In London, the yellow metal pulled back as a positive surprise in eurozone business activity data lifted stock markets from early lows, while the dollar index remained near its highest in a week. Spot gold was down 0.1% at $1,239.50 an ounce at 0936 GMT, while U.S. gold futures for December delivery were off $5.60 an ounce at $1,239.90. Gold increased after its biggest loss in over two weeks as the festival and wedding season in India saw purchases of gold coins, bars and especially jewellery. Silver and platinum gained. See Essential Guide to Storing Gold In Switzerlandhere | ||||||||||||||||||||||||

| Harmony Gold net loss confirmed Posted: 23 Oct 2014 02:28 AM PDT The net loss was mainly due to the R1.38bn impairment of the company's Phakisa mine. | ||||||||||||||||||||||||

| Yes vote in an early lead in the Swiss referendum to boost gold to 20% of total currency reserves Posted: 23 Oct 2014 01:07 AM PDT The Swiss financial establishment must be in a state of shock after an early poll put 45 per cent in favor of raising gold to 20 per cent of national currency reserves and just 39 per cent against. After ArabianMoney broke this story we had several posts suggesting that it was most unlikely to be passed (click here). Switzerland has run its gold reserves down since 2000 and presently holds a little over 1,000 tonnes of gold. To raise gold from the current 7.7 per cent of total currency reserves to 20 per cent would mean buying some 1,700 tonnes. Gold price hike Even if phased over several years this volume of official gold buying would send prices to the moon. It would also set a precedent for other central banks to follow. Switzerland would then have the third highest gold holdings in the world, and all that for a relatively small country. The referendum also demands repatriation of foreign held Swiss gold and a moratorium on selling future gold holdings. It was initiated by the Swiss People's Party MP Luzi Stamm and two other MPs who obtained the necessary 100,000 signatures to hold the referendum. This is the largest party in the Federal Assembly, with 54 members of the National Council and five of the Council of States. Of course the campaigning has yet to really start and the ‘no’ camp will no doubt be all the more vociferous after this early polling setback. However, it suggests the public mode is far more pro-gold than anticipated by observers. Oh no! Switzerland has always been a conservative country with a strong currency and low inflation. But in recent years it has been forced to track the weakening euro or risk making its industrial base hopelessly uncompetitive in Europe. Voters are savers who have seen the value of their money falling and low interest rates, and this could be the beginning of a rebellion, albeit a conservative one. Could this be the chance to strike back against the money printers for the Swiss general public? It would not be the first time that a referendum did not go as expected. Are you getting ready for the next gold price hike? Readers of our monthly private-circulation newsletter are already learning what to do (click here). | ||||||||||||||||||||||||

| It’s Official—China’s Gold Demand in 2013 Was 2,199 Tonnes Posted: 22 Oct 2014 11:26 PM PDT "Mining executives don't care what happens to their public stockholders" ¤ Yesterday In Gold & SilverThe gold price didn't do much of anything in Far East or early London trading on their Wednesday---and the smallish rally that developed once the noon London silver 'fix' was in, got in the neck at precisely 8:30 a.m. EDT---ten minutes after the Comex open. From there it chopped sideways until the 1:30 p.m. Comex close. Then further selling pressure entered the market---and gold got closed almost on its low tick. The high and low were recorded by the CME Group as $1,250.20 and $1,240.70 in the December contract. Gold finished the trading day in New York yesterday at $1,241.00 spot, down $8.40 from Tuesday's close. Net volume was 103,000 contracts. As usual, silver got hit the moment that trading began in New York on Tuesday evening---and never recovered. The tiny rally that developed right at the Comex open ran into 'da boyz' and their algorithms---and silver, like gold, was closed almost on its low tick. The high and low were recorded as $17.535 and $17.115 in the December contract, which was an intraday move of more than 2 percent. Silver closed in New York yesterday at $17.17 spot, down 34.5 cents. Net volume was pretty decent at 36,000 contracts. Platinum hit its high at 9 a.m. Tokyo time---and then got sold down to unchanged. The real selling pressure began the moment that Zurich opened---and platinum was closed on its absolute low of the day, down twenty bucks from Tuesday. Palladium did very little on Wednesday, at least up until its brief spike shortly after 11:30 a.m. in New York yesterday morning. From that spike high it got sold down with a vengeance as the powers-that-be closed it down an even 10 bucks from Tuesday's close. The dollar index closed late on Tuesday afternoon in New York at 85.40---and after a brief dip to its 85.24 low around 2:10 p.m. Hong Kong time on their Thursday afternoon, it chopped higher until around 2:40 p.m. EDT---and from there it traded pretty flat into the close. The index finished the Wednesday session at 85.75---up another 35 basis points. Here's the 6-month U.S. dollar index so you can see what's happened since its low in early May. The gold stocks gapped down at the open---and the rally that developed shortly after the London p.m. fix didn't last. It was down hill all the way from there, as the HUI closed on its absolute low tick, down 3.17%. [NOTE: My new HUI chart is courtesy of Nick Laird, for which I thank him] The performance of the golds stocks looked terrific compared to the silver equities, as they got crushed to the tune of 6.37%. Once again the sell-off in the precious metal shares was out of all proportion to the loses in the underlying metal. The CME Daily Delivery Report showed that 1 gold and 10 silver contracts were posted for delivery within the Comex-approved depositories on Friday. The link to yesterday's Issuers and Stoppers Report is here. The CME Preliminary Report for the Wednesday trading session showed that gold open interest in October dropped to 235 contracts---and October o.i. in silver was cut from 102 contracts down to 14 contracts, from which must be subtracted the deliveries posted in the previous paragraph. The October delivery month, which concludes one week from today, will go off the board without incident. There was anther withdrawal from GLD yesterday. This time an authorized participant took out 67,293 troy ounces. And as of 9:27 p.m. EDT yesterday evening, there were no reported changes in SLV. There was no sales report from the U.S. Mint. There were no in/out movements in gold at the Comex-approved depositories on Tuesday but, as usual, it was a totally different story in silver, as 585,333 troy ounces were received---and 446,684 troy ounces were shipped out. Almost all the action was at Brink's, Inc. and the CNT Depository. The link to that action is here. I don't have all that many stories today, so I hope you have the time to read the ones you like. ¤ Critical ReadsKyle Bass warns Q.E. end will shake up marketsCentral banks meeting next week will expose a huge divergence in monetary policy between several major economies, putting the macro environment in focus and weighing on foreign exchange, hedge fund manager Kyle Bass said Wednesday. The founder of the $1.7 billion hedge fund Hayman Capital thinks the Fed likely will taper its bond-buying stimulus to zero next week. The Bank of Japan, however, likely will announce it will do whatever it takes to prevent the world's third-largest economy from heading into a major crisis. "They still run 10 percent fiscal deficits. We think they're going to run a current account deficit of 2 to 4 percent next year and Japan is going to have to buy more bonds and the U.S. is going to buy no more," Bass said on "Squawk on the Street." "And so when the training wheels come off the market in central bank land, macro becomes functionally much more relevant." There are three CNBC video clip with Kyle that run concurrently. In total, all three run for 7 minutes. They showed up on their website around 9 a.m. EDT on Wednesday morning. They're worth watching. I thank reader David Ball for today's first story. McDonald's Franchisees Say the Company is Bankrupting ThemMcDonald's franchisees are furious that the company's aggressive promotions and costly restaurant upgrades are squeezing their profits, according to a new survey. "Growth for McDonald's is over," one franchisee wrote in response to the survey by the financial services firm Janney Capital Markets. "I am just hoping to be flat," another franchisee said. "[The] customer has lost faith in the brand." "We are leaderless," said a third. A fourth franchisee complained, "They are being successful in bankrupting us." This very interesting news item appeared on the businessinsider.com Internet site at 4:48 p.m EDT on Monday---and it's courtesy of reader Brad Robertson. Manufacturing moving from China to U.S. - surveyLarge manufacturers are increasingly moving production back to the United States from China, according to a new report by The Boston Consulting Group released Thursday. In the third annual survey of US-based senior executives at manufacturing companies with annual sales of at least $1 billion, the number of respondents who said their companies were currently reshoring to the U.S. from China increased 20 percent from a year ago. Given the fact that China's wage costs are expected to grow, do you expect your company will move manufacturing to the United States?" the August survey asked executives at an unspecified number of companies that currently manufacture in China. The executives who said "Yes, we are already actively doing this" rose to roughly 16 percent in the "Made in America, Again" survey in August from 13 percent a year earlier and seven percent in the first survey in the series, in February 2012. This AFP news item appeared on the france24.com Internet site at 9:05 a.m. Europe time this morning---and I thank South African reader B.V. for sliding it into my in-box shortly before I filed today's column. Fed spotted JPMorgan 'Whale' risks years before scandal: inspectorThe Federal Reserve's New York branch knew about risks JPMorgan Chase & Co was taking with its massive "London Whale" derivatives bets four years before they imploded, but it failed to act properly to head them off, the U.S. central bank's inspector general said. The Fed's Office of Inspector General said on Tuesday one of the key flaws it uncovered in its probe of the 2008 transaction at the Wall Street bank was the New York Fed's over-reliance on certain personnel who left the supervisory team in 2011. That created a "significant loss of institutional knowledge" within the team assigned to inspect JPMorgan, the report said. In what amounts to another recent black eye for the New York Fed's bank supervision unit, the report also noted that competing supervisory priorities and limited resources contributed to a failure to conduct key follow-up examinations. This Reuters article, co-filed from New York and Washington, put in an appearance on their Internet site at 1:59 p.m. EDT on Tuesday afternoon---and it's a story I found in yesterday's edition of the King Report. All the Markets Need is $200 Billion a Quarter From the Central BankersThe central-bank put lives on. Policy makers deny its existence, yet investors still reckon that whenever stocks and other risk assets take a tumble, the authorities will be there with calming words or economic stimulus to ensure the losses are limited. A put option gives investors the right to sell their asset at a set price so the theory goes that central banks will ultimately provide a floor for falling asset markets to ensure they don’t take economies down with them. Last week as markets swooned again, it was St. Louis Federal Reserve President James Bullard and Bank of England Chief Economist Andrew Haldane who did the trick. Bullard said the Fed should consider delaying the end of its bond-purchase program to halt a decline in inflation expectations, while Haldane said he’s less likely to vote for a U.K. rate increase than three months ago. Just a softer way of saying the President's Working Group on Financial Markets, now shortened to the Plunge Protection Team. This Bloomberg offering, filed from London, showed up on their Internet site at 5:18 a.m. Mountain Daylight Time on Tuesday morning---and it's the second item in a row that I plucked from yesterday's edition of the King Report. Currency wars are back: 'Export your deflation to someone else'Brazil Finance Minister Guido Mantega popularized the term “currency war” in 2010 to describe policies employed at the time by major central banks to boost the competitiveness of their economies through weaker currencies. Now, many see lower exchange rates as a way to avoid crippling deflation. Weak price growth is stifling economies from the euro region to Israel and Japan. Eight of the 10 currencies with the biggest forecasted declines through 2015 are from nations that are either in deflation or pursuing policies that weaken their exchange rates, data compiled by Bloomberg show. “This beggar-thy-neighbor policy is not about rebalancing, not about growth,” David Bloom, the global head of currency strategy at London-based HSBC Holdings Plc, which does business in 74 countries and territories, said in an Oct. 17 interview. “This is about deflation, exporting your deflationary problems to someone else.” This Bloomberg news item, filed from London, appeared on their Internet site at 8:24 a.m. Denver time yesterday morning. It---and the headline---were something I found at the gata.org Internet site. Why it's now too late for Germany to rescue the eurozone aloneThe eurozone is yet again in a nasty state. As it suffers from low growth and low inflation, the two combine to make a nasty cocktail. Without much of either, unemployment remains stuck at an eye-watering high 11.5pc, and government debt burdens are likely to feel increasingly heavy. The European Central Bank (ECB) has announced a variety of acronyms - CBPP3, TLTROs, and an ABS purchase scheme - all stimulus measures designed to combat the euro area’s low inflation crisis. Yet so far, they’ve been insufficient to raise expectations of future inflation, implying that the firepower just isn’t strong enough. Economists are hoping that the ECB will deploy outright quantitative easing, and start buying up the sovereign bonds of eurozone governments. This article appeared on the telegraph.co.uk Internet site at 2:14 p.m. BST on their Wednesday afternoon---and it's courtesy of South African reader B.V. France moves to make presidents impeachableThe French parliament voted Tuesday in favour of a draft law that could, for the first time, make it possible to remove the country’s president from office through a US-style impeachment. The bill, already passed by France’s lower house, was approved by the Senate by 324 votes to 18. It will now go to France’s Constitutional Council, which must decide if the bill complies with the French constitution, before becoming law. If approved, the law would represent a radical change to the legal status of the French head of state – who has so far enjoyed greater legal protection than almost any other Western leader. This news item was posted on the france24.com Internet site yesterday---and it's the second offering in a row from reader B.V. Christophe de Margerie: Total's mustachioed maverickAsked in 2010 if oil companies were right to make deals with the world’s despots and dictators, Christophe de Margerie, the boss of Total who died in a plane crash in Russia Monday night, gave a typically unequivocal answer: “bloody right.” It was a reply that summed up a man unapologetic about doing whatever was necessary to keep the oil and profits flowing, no matter the opinion of the public, politicians or regulators. De Margerie’s bushy, walrus-like facial hair earned him the nickname “Big Moustache”, but in his younger years he went by a different sobriquet – “Mr Middle East” – heading Total’s operations in that area from 1995. It was a job that saw him scour for oil in some of the world’s most politically volatile places and made him a natural choice to head the French oil giant’s exploration and production department when the role became vacant in 2002. This very interesting but longish commentary/obituary appeared on the france24.com Internet site on Tuesday Europe time---and it's the fourth article of the day from reader B.V. Ukraine's multi-billion dollar gas debt: Who pays?Ukraine plans to buy $770 million worth of gas (2 billion cubic meters) from Russia this winter to keep the heat on. The question is: who is going to pay the bill? All three parties, Russia, the E.U., and Ukraine met in Brussels on Tuesday and confirmed Kiev will pay $385 per 1,000 cubic meters of Russian supplied gas through the end of March. Before Ukraine can start purchasing gas, they need to pay off $1.45 billion in debt. “There’s one obstacle: Ukraine failed to pay for Russian-supplied gas for seven months,” Oettinger said Tuesday. It will be difficult for Ukraine to find a benefactor, since, as Oettinger pointed out, its credit history is less than stellar. The economy is in ruin and may already need extra IMF money to stay afloat. This Russia Today article showed up on their website at 2:53 p.m. Moscow time on their Internet site yesterday---and I thank Roy Stephens for sending it our way. Reader Jim Skinner sent a story from the fortune.com Internet site on this issue. It's headlined "Russia calls Europe's bluff on Ukraine gas deal." Russia says Ukraine should find money to pay for gas within a weekUkraine should be able to find ways of paying for Russian gas supplies within a week, Russian Energy Minister Alexander Novak said on Wednesday, suggesting a standoff would end once Moscow received financial guarantees from Kiev. The latest round of gas talks between Moscow and Kiev ended late on Tuesday in Brussels with no agreement in a dispute that prompted Russia to cut off gas supplies to its neighbor in mid-June, potentially hurting flows west to the European Union. But while Novak said he was optimistic for new talks on Oct. 29, Ukrainian Prime Minister Arseny Yatseniuk said he was skeptical about building ties with Russia, underlining how efforts to reach a deal are hampered by a wider political conflict between the two countries. Another conflicting story on Ukraine's gas issue. This Reuters article, filed from Moscow, was posted on the their website at 7:14 a.m. EDT on Wednesday---and it's the second offering of the day from reader Jim Skinner. Ukraine's multi-billion dollar gas debt: Who pays? Posted: 22 Oct 2014 11:26 PM PDT Ukraine plans to buy $770 million worth of gas (2 billion cubic meters) from Russia this winter to keep the heat on. The question is: who is going to pay the bill? All three parties, Russia, the E.U., and Ukraine met in Brussels on Tuesday and confirmed Kiev will pay $385 per 1,000 cubic meters of Russian supplied gas through the end of March. Before Ukraine can start purchasing gas, they need to pay off $1.45 billion in debt. “There’s one obstacle: Ukraine failed to pay for Russian-supplied gas for seven months,” Oettinger said Tuesday. It will be difficult for Ukraine to find a benefactor, since, as Oettinger pointed out, its credit history is less than stellar. The economy is in ruin and may already need extra IMF money to stay afloat. This Russia Today article showed up on their website at 2:53 p.m. Moscow time on their Internet site yesterday---and I thank Roy Stephens for sending it our way. Reader Jim Skinner sent a story from the fortune.com Internet site on this issue. It's headlined "Russia calls Europe's bluff on Ukraine gas deal." | ||||||||||||||||||||||||

| Good fundamentals make ruble ‘stable’ currency - Russian Central Bank Posted: 22 Oct 2014 11:26 PM PDT Russia’s currency has taken a significant 20 percent plunge this year against the dollar and euro, but analysts are confident that Russia’s sturdy stash of foreign reserves and miniscule external debt make the ruble one of the ‘most stable’ currencies. Russia’s vast gold and foreign currency reserves will help weather the ruble’s rough patch. At more than $450 billion, they are the third largest reserves in the world. "We believe that the fundamental factors that determine the value of our currency were unchanged. Fundamentally the balance of our budget, the absence of significant external debt of our state. Precisely because of this ruble is one of the most stable currencies," Deputy Chairman of the Bank of Russia, Mikhail Sukhov, told TASS Wednesday. The Central Bank has already spent more than $10 billion in October to stymie the ruble’s fall, and $50 billion since the beginning of the year. However, the bank has signaled it won’t continue to prop up the ruble with billions more. This must read article appeared on the Russia Today website at 4:16 p.m. Moscow time on their Tuesday afternoon---and it's the final offering of the day from Roy Stephens. | ||||||||||||||||||||||||

| Nelson Bunker Hunt, 88, Oil Tycoon With a Texas-Size Presence, Dies Posted: 22 Oct 2014 11:26 PM PDT Nelson Bunker Hunt, the down-home Texas oil tycoon who owned a thousand race horses, drove an old Cadillac and once tried to corner the world’s silver market only to lose most of his fortune when the price collapsed, died on Tuesday in Dallas. He was 88. His death, at an assisted living center, followed a long period of treatment for cancer and dementia, The Dallas Morning News reported. “A billion dollars ain’t what it used to be,” he said in 1980 after silver stakes he had amassed with two brothers, Herbert and Lamar, fell to $10.80 from $50.35 an ounce. In barely two months, their holdings and contracts for purchases — corralling a third to half the world’s deliverable silver — had plunged from a $7 billion value in January to a $1.7 billion loss in March. With the Hunts unable to cover enormous margin calls, the debacle endangered financial markets and brokerage houses, forcing federal regulators and the nation’s banks to step in with a $1 billion line of credit, a bailout that saved the system from a stampede and the Hunts from a meltdown. This very interesting fairy tale, at least considering what's mentioned in the above four paragraphs, showed up on The New York Times website yesterday---and I thank Casey Research's BIG GOLD editor, Jeff Clark, for bringing it to my attention---and now to yours. It's worth reading---but I hope its written with less bias than their reporting on the Ukraine/Russia situation. For that reason you should read it with your b.s. meter on its most sensitive setting. | ||||||||||||||||||||||||

| Gold Is Undervalued – Ned Goodman Posted: 22 Oct 2014 11:26 PM PDT Ned Goodman, president and chief executive officer of Dundee Corp., believes gold is undervalued while equities are poised for a crash. Speaking at a keynote luncheon at the Quebec Mining Exploration Xplor 2014 Convention in Montreal, Quebec, Goodman was blunt regarding gold prices and where they’re heading. “We think gold is very undervalued at current gold prices,” Goodman said. “I think gold will hit $1,200, and when it does, be a buyer because I think that will be a good place to be.” Touching on stock markets, Goodman didn’t pull any punches, calling it a Botox market where all deficiencies are simply covered and propped up to look healthy. This story appeared on the kitco.com Internet site yesterday at 2:38 p.m. EDT yesterday---and it's the second contribution in a row from BIG GOLD editor Jeff Clark. | ||||||||||||||||||||||||

| Keith Barron, PhD: "I believe we’ve seen Peak Gold*" Posted: 22 Oct 2014 11:26 PM PDT On behalf of Matterhorn Asset Management, financial journalist Lars Schall talked with exploration geologist and mining entrepreneur Dr. Keith Barron. Keith is a scientist and he explains in no uncertain terms what is going on in the mining industry, the false accounting relative to the cost of exploration, what happened when gold went up to 1,900, why gold versus USD simply must go to at least 5,000, why ‘gold above ground’, if anything, is overstated and why the Swiss Gold Initiative is indeed very important and not just for the Swiss People, as well as Keith Barron’s view on Silver. Barron is a day late and a dollar short on this topic, as several other gold commentators/mining executives have already been down this road already this year. This 47:17 minute interview was posted on the goldswitzerland.com Internet site yesterday---and I found it in a GATA release. | ||||||||||||||||||||||||

| Gold miners' outstanding forward sales jump 61 percent in Q2/14 - report Posted: 22 Oct 2014 11:26 PM PDT The volume of gold sold forward by mining companies jumped 61 percent in the second quarter after Russia's Polyus Gold added a major new hedge position, an industry report showed on Wednesday. In their quarterly Global Hedge Book Analysis, released on Wednesday, Societe Generale and GFMS analysts at Thomson Reuters said they are predicting net hedging for the year of 40 tonnes, the most since 1999. They forecast in July that gold producers would return to net hedging this year for the first time since 2011. Volumes of hedging predicted for this year are still well below the levels seen in the late 1990s. Net producer hedging in 1999 reached 506 tonnes, according to GFMS data. I'm sure you've heard the expression "much ado about nothing." Well, despite the headline, that's what this Reuters story is. However, it's worth your while as a trip down memory lane---and I thank Manitoba reader U.M. for sending it. | ||||||||||||||||||||||||

| Goldcorp chief says Asian buying will support price of gold Posted: 22 Oct 2014 11:26 PM PDT Demand from China and other parts of Asia will support the price of gold, the chief executive of one of its largest miners said, as the precious metal traded near its strongest level in six weeks. Chuck Jeannes of Goldcorp said he saw "as much clarity in the market as there has ever been," with a "floor" created by strong demand whenever gold reached or fell below about $1,200 per ounce. "The anecdotal evidence is that gold goes down and physical demand goes up," Mr. Jeannes said in an interview with the Financial Times. "A huge number of physical buyers in the world see gold as a bargain below $1,200." You wonder how people such as him make it to positions of responsibility when they don't know anything about how their product is priced in the market---and run screaming when you attempt to explain it. The above three paragraphs from a Financial Times article from yesterday, is all that's posted in the clear in this GATA release. The rest is subscriber protected. | ||||||||||||||||||||||||

| Koos Jansen: It's official -- China's gold demand in 2013 was 2,199 tonnes Posted: 22 Oct 2014 11:26 PM PDT The China Gold Association has confirmed that China's gold off-take in 2013 reached 2,200, Bullion Star market analyst and GATA consultant Koos Jansen reported yesterday. That would constitute most of world gold mine production and the figure apparently does not include purchases by the People's Bank of China, which remain the most sensitive state secret. "Why the Western media don't report on these numbers is a mystery," Jansen writes. "This data is not a secret. Yet the Chinese have been trying to hide it as much as possible---and it looks like either they're being helped by Western institutions, or these institutions are ignorant." Of course there is still another explanation: that Western financial news organizations and the World Gold Council very much intend not to deal with this issue honestly, since doing so would impugn the whole Western financial system, built as it is on currency and commodity market rigging. This must read commentary was posted on the Singapore website bullionstar.com on Tuesday---and this is another gold-related news item I found posted on the gata.org Internet site. | ||||||||||||||||||||||||

| This Dhanteras, gold coins are in, jewellery is out Posted: 22 Oct 2014 11:26 PM PDT Instead of the usual rush for jewellery, this Dhanteras sees a reversal of buyer's preferences, with more people opting for the traditional gold coin. We talk to some shopkeepers and buyers to understand this shift in choices For many families in the city, a visit to their family jeweller today is as important as lighting lamps on Diwali. Jewellers too look forward to the festival of Dhanteras all year long, in the hope of making up for slow sales and the lean months. Unlike last year, this Dhanteras, the gold rate is lower compared to the last few months, which has given many store owners hope for a busy shopping day today. But in an interesting twist, the low gold rate hasn't motivated people to increase their Dhanteras budget and buy jewellery instead of the traditional gold coins. Shoppers told DT why they would prefer to wait for the remaining festive days to pass before making any major ornamental purchases and why they will stick to the traditional coin purchases instead. Crowded shops, busy salespeople and `formality shoppers' make Dhanteras a bad day for investing in jewellery because like they say, buying an ornament is an experience that can be done once the hustle and bustle of Diwali is over. This article showed up on the Times of India website at 11:41 a.m. IST on Tuesday---and I thank reader U.M. for finding it for us. | ||||||||||||||||||||||||

| Kolkata’s gold panners reap rewards at India festival time Posted: 22 Oct 2014 11:26 PM PDT As 40-year-old Mohammed Iqbal sifts through sludge in the back alleys of Kolkata’s jewellery market for gold dust, his weathered face brightens slightly at the recent uptick in work. For generations, the city’s group of “newaras” — gold dust scavengers — have been scratching a living by panning for fine particles swept from the 2,000-odd jewellery workshops operating in the alleys. Iqbal estimates he normally earns just 150 to 200 rupees ($2.40 to $3.20) a day from selling flecks of the precious metal that he painstakingly finds on the ground and in the drains of the grimy alleys. But the onset of India’s raucous festival season, especially the biggest Hindu celebration of Diwali on Thursday, brings a relative bonanza for Iqbal, with his income more than doubling. This extremely interesting AFP story appeared on the aquila-style.com Internet site early yesterday morning EDT---and I thank reader U.M. for sliding it into my in-box late yesterday evening MDT. It's also her final contribution to today's column. | ||||||||||||||||||||||||

| Huge, honkin’ gold nugget hits the market in San Fransisco Posted: 22 Oct 2014 11:26 PM PDT Here we go again — what is believed to be the biggest gold nugget found in modern times in California’s historic Gold Country is going on sale Thursday in San Francisco. This 6.07-pound whopper is being sold by Tiburon coin dealer Don Kagin, the same dealer who is selling the $10 million worth of gold coins that made such a stir this year after they were found in a couple’s backyard in the Sierra. The “Butte Nugget,” so named because it was found by a gold hunter in the Butte County mountains, will be unveiled at the prestigious San Francisco Fall Antiques Show. The show opens Thursday at Fort Mason. This very interesting news item put in an appearance on the sfgate.com Internet site at 10:33 a.m. Pacific Daylight Time yesterday---and my thanks go out to reader Carl Lindfors for digging it up for us. And if you don't want to read the article, you should at least look at the picture. | ||||||||||||||||||||||||

| Nelson Hunt the man who took silver to $50 an ounce in 1980 dies aged 88 Posted: 22 Oct 2014 09:57 PM PDT Nelson Bunker Hunt, the Texan oil billionaire whose cornering of the silver market in the late 70s took the silver price to what is still its all-time high of $50 an ounce has died at the age of 88 in a care home. In the oil boom of the 1980s Mr. Hunt was reckonned to be the world’s richest man, a title held by Bill Gates founder of Microsoft today. Apart from his huge oil investments Mr. Hunt diversified into cattle, race horses, land and other real estate, sugar, banks, art, a pizza chain as well as most famously silver. Inflation hedge In 1973 Bunker and his brother Herbert embarked on an audacious attempt to corner the world's silver market as a hedge against inflation and to diversify the family's interests away from oil. Together with two Saudi princes, they set up a trading vehicle, and by 1979 had amassed about half the world's deliverable supply. By January 1980 the value of his holdings topped $4.5 billion but he lost more than a billion in the silver price collapse that year. Subsequent litigation followed him for many years resulting in further losses and far exceeded a $10 million fine from the Commodity Futures Trading Commission for alleged price manipulation, although ironically it was an unexpected change to, or official manipulation of the futures market that brought Mr. Hunt down. The price of other commodities also tumbled in the eighties with disastrous consequences for the Hunt brothers. Mr. Hunt filed for bankruptcy in 1988 and much of his remaining fortune was liquidated to pay creditors and the US taxman. In many ways he was born with a silver spoon in his mouth as one of seven children belonging to the ‘first family’ of legendary H.L. Hunt, a Texan oil pioneer who made a huge fortune from Placid Oil then one of the largest of the independent oil companies. Nelson Hunt went on to bigger and bigger things until the shiniest of precious metals caught his eye. All-time high It is a remarkable testament to his powers of manipulation that the silver price has never recovered to the price he forced it to in 1980, admittedly at a moment in history that was also a high for gold with inflation raging in the West, the Iranian hostage crisis and the Soviet Union’s invasion of Afghanistan. Today silver sits at $17 an ounce and at a historic low in relation to gold. It’s a no-brainer as a shield against future inflation but where is that at the moment? Eventually all the money printed by the global central banks will most likely result in inflation of consumer prices like the 1970s, and it will be silver’s day again. History does tend to repeat itself. But the greatest silver speculator of all time has not lived to see it. Here’s a video tribute: | ||||||||||||||||||||||||

| Gold and Silver Demand is Spiking Higher Posted: 22 Oct 2014 09:22 PM PDT Russia has added another 1,200,000 ounces of physical gold to their reserves during September, the largest month-on-month increase EVER. Gold imports into India in September were worth $3.8 billion. This figure is almost double the $2 billion spent by Indians in August! To put this figure in context it is worth noting that in August 2013 […] | ||||||||||||||||||||||||

| What Happens When Cash Is No Longer Trash? Posted: 22 Oct 2014 07:52 PM PDT Those who actually create value as opposed to chasing yield with nearly-free money will actually have some traction once the swamp of excess liquidity drains. When those closest to the money spigots of the Federal Reserve can borrow billions for next to nothing, cash–laboriously saved from years of paychecks–is reduced to trash. What chance does a saver have in a bidding war for a house or other asset against a financier who can borrow essentially unlimited cash? Answer: none.