saveyourassetsfirst3 |

- What Happens With The Gold Price If Deflation Wins?

- The Development and Opening of China’s Gold Market

- Mining veteran: This is the 1990′s all over again in the gold market

- Leading Indicators for Gold’s Turnaround

- Silver Prices Are Ready to Rally!

- Welcome to Arcadia – The California Suburb Where Wealthy Chinese Criminals are Building Mansions to Stash Cash

- China gold output growth to slow in coming years - BMI

- Porter Stansberry: This is the “drawbridge” that’s destroying America’s middle class

- 5 Bills in the Land of the Free that are straight out of Atlas Shrugged

- End of the Empire

- SD’s AGXIIK Ready For Ebola (Or Thanksgiving Turkey)

- Steve Sjuggerud: It’s official… The U.S. dollar has topped

- San Francisco Pension Fund Asks Hedge Fund Manager Whether it Should Invest in Hedge Funds

- Ebola delaying Liberia’s first modern gold mine

- “Save Our Swiss Gold ” - Game Changer For Gold?

- “Save Our Swiss Gold ” – Game Changer For Gold?

- Gold making cat-like moves, is it about to pounce?

- Gold rebound thwarted by positive US data, equity gains

- Gold price upside limited in 2015 - Scotiabank

- LBMA names Morgan Stanley as gold/silver market maker

- Anglo Asian set for 29% annual increase in Azerbaijan

- With Seizures Up, Indian Gold Smuggling Loses Its Shine

- Thomas L. Friedman: a Pump War?

- Dana Allen: How the Soviet Empire’s Fall was Engineered

- LME to take over London platinum, palladium fixes

- Is Gold as Dead as This Year's Hurricane Season?

- Jewellery sales double on the occasion of Gurupushya Nakshatra

- Singapore Exchange meets demand for physical gold

- With seizures up, Indian gold smuggling loses its shine

- Is there a lifeline available for the eurozone this time around?

- Harvey Organ’s Gold & Silver Update: Something Has Got to Give!

- The Height of Idiocy: US Government Hijacks the Whole Swiss Banking System

- Silver Myths Smashed, Pt. 3: The Silliest Question You Could Possibly Ask about Silver

| What Happens With The Gold Price If Deflation Wins? Posted: 17 Oct 2014 01:05 PM PDT Since writing last month that inflation was on the rise, things have taken an abrupt turn. Look at the deflationary actions that have recently taken place:

Further, just last week the International Monetary Fund cut its global economic growth forecast for the third time this year. Why? It doubts how quickly "rich countries will be able to pull free from high debt and unemployment in the wake of the 2007-2009 global financial crisis." It's hard to argue that high debt levels are deflationary. And with the current expansion based largely on debt, we can't expect sustainably higher economic activity to be generated. So what happens if deflation wins? Even if we eventually get inflation, what happens to our gold investments if we first go through a deflationary bust? There aren't a lot of modern-day examples of deflation. The Consumer Price Index (CPI), as faulty as it may be, has registered only three declines since 2000, and all were short-lived. The CPI fell:

That's it. You can find other fleeting periods further back, but nothing long enough to draw any strong conclusions. The only example we have of true deflation is the Great Depression. The Great Depression SpeaksYou'll recall that the United States was on a gold standard at the time. But there's still a lesson to be learned about gold and deflation… On April 5, 1933, President Roosevelt issued an executive order forcing delivery (confiscation) of gold owned by private citizens to the government in exchange for compensation at the fixed price of $20.67/oz. Less than nine months later, he raised the gold price to $35, effectively diluting the dollar in every wallet 41% overnight and swindling everyone who had turned in gold. So even in the midst of one of the biggest deflations the world has ever seen, the government raised the gold price. We don't know exactly what an untethered gold price would have done during the Depression, but given its distinction in history as a store of value, it's likely to retain its purchasing power in a deflationary setting regardless of its nominal price. In other words, while the price of gold might not rise or could even fall, it would still provide monetary protection against an unstable economic environment, especially when you consider that most other assets would be in decline. The Gold Rush of the Great DepressionPerhaps a more direct example is the miners. It was the only way citizens could effectively own gold after Roosevelt's confiscation. The comparability isn't perfect, but again, there's something to learn. When the stock market crashed in 1929, gold stocks were part of the general wreckage. The market then rallied and recovered almost 50% of its losses by April 1930, with gold shares again tagging along. It's what happened next that gives us another clue about gold and deflation… When the bear market resumed in the summer of 1930, all securities sold off again—except gold stocks. Gold shares stayed basically flat until early 1931, when their appeal to the masses kicked into high gear. Look at how shares of Homestake Mining, the largest gold miner in the US at the time, and Dome Mines, Canada's senior producer, performed during the Great Depression.

During a period of soup lines, crashing stock markets, and falling standards of living, investors fled to the only gold they could own at the time. Yes, volatility was high throughout the Depression, with occasional wild price swings, but after the 1929 crash most of the volatility was to the upside. From Homestake's chart, you get a clear picture of the rush to own gold compared to the market as a whole:

Notice the large spike down in both Homestake and the Dow during the 1929 crash—but then look at Homestake's recovery immediately afterward, returning close to its old high. You'll then notice the stock took almost two years to exceed its old high, but once it broke out, it was off to the races. The stock doubled four times in five years during a seven-year run to its peak after the '29 crash. The conclusion? If history is any guide, gold can hold its own against deflation. Its status as a safe-haven asset during one of the greatest times of economic distress was demonstrated clearly by investors buying the stocks. All this said, the overriding concern is that in a fiat system, any deflation will be met with an inflationary overreaction. And the worse the deflation, the more extreme the overreaction will be. QE5, anyone? There's turmoil ahead, and almost certainly another crisis. The recent decline in the gold price has only served to make our insurance cheaper. Accumulating physical bullion will offset whatever form that crisis may take. The Hard Assets Alliance can help, learn how. This article was published in the October issue of the SmartMetals Investor—a free, monthly newsletter from the Hard Assets Alliance featuring the precious metals news and commentary investors need today. The full issue—including the real reason to own precious metals, why the strong dollar will pass, and what that means for gold, and a silver lining for silver—is available now with free sign up to the SmartMetals Investor. | ||||||||||||

| The Development and Opening of China’s Gold Market Posted: 17 Oct 2014 12:27 PM PDT This is a translation of a speech delivered by Xu Luode, Chairman of the Shanghai Gold Exchange, at the LBMA Bullion Market Forum in Singapore on 25 June, 2014. Thank you for inviting me to attend the LBMA Singapore Forum. It's my great pleasure to be here. So now let me give you a brief introduction on our country's gold market. First of all, let us all have a look at China's current gold production. For seven consecutive years, gold production in China has been the largest in the world, with nearly 430 tonnes produced last year. China has the second- largest gold reserves in the world. This is the latest figure. Before that, China had been ranked third.

Next is our consumption of gold. According to the statistics compiled by Mr Zhang Bingnan, gold consumption reached 1,174 tonnes last year, and that is also the largest in the world. I slightly disagree with Mr Zhang, as I think we might have consumed even more than that. I think that it is always a good thing to have a higher figure, rather than a lower one. There are two factors supporting consumption in China's gold market. One of them is jewellery. China has an extremely high level of jewellery consumption. Such growth in jewellery consumption shows that China's level of consumption, as in gold consumption, is in a very healthy state. The other one would be gold bullion, as residents are now allocating gold to their asset allocation, and this volume is currently also high. Next is imports. Data on China's gold imports has not previously been made available to the public. However, gold has historically been imported through Hong Kong, and Hong Kong is highly transparent, disclosing details such as the number of tonnes of gold imported on a monthly basis. Last year, China imported 1,540 tonnes of gold. Such imports, together with the 430 tonnes of gold we produced ourselves, means that we have, in effect, supplied approximately 2,000 tonnes of gold last year. The 2,000 tonnes of gold were consumed by consumers in China. Of course, we all know that the Chinese 'dama' [middle-aged women] accounts for a significant proportion in purchasing gold. So last year, our gold exchange's inventory reduced by nearly 2,200 tonnes, of which 200 tonnes was recycled gold. Seeing such a tremendous market in China last year, many of you are very concerned about what will happen not only this year but also in the future. In my opinion, there will certainly be some differences this year compared to last year. One factor is that the growth rate is slowing down. In the first quarter of this year, gold consumption was still increasing and the import volume remained steady. In terms of the general trend, Mr Albert Cheng from the World Gold Council has estimated that the per capita gold consumption is only 4.5 grams in China whereas it is as high as 24 grams worldwide. The difference of nearly 20 grams represents the potential growth of the physical gold market in China. So I think that China still has a significant growth potential. Many of you are very concerned about the structure of the gold market in China at the moment. China is a country that is undergoing a significant degree of market transformation. China's gold market has only undergone 10 to 12 years of development, but has its own distinctive features. There are differences when compared with the gold markets of some of the developed countries and even with Singapore's gold market. So I call it 'One Body with Two Wings', where 'One Body' refers to our Shanghai Gold Exchange, and 'Two Wings' refers to the sub-market of our commercial banks, as well as the sub-market of our futures exchange. Many of you asked if I have seen ourselves as being too important. Why are we One Body, while others are Two Wings? It is not that I have seen ourselves as too important. I have always held the opinion that any market must have physical commodities as the basis. Be it bulk commodities or other trading markets, transactions are based on physical commodities, and our gold exchange is one based on physical commodities. An exchange with no physical commodities as the basis may grow to a gigantic scale, but there will still be some restrictions when it comes to supporting the physical economy or wielding influence on other aspects of the market. Therefore, I think that as a market trading mainly physical commodities while also trading derivatives, our gold exchange should indeed be playing the role of a central hub in China's gold market. As for the current gold market of our commercial banks, Mr Zhou Ming will be providing an explanation later in his presentation. Our futures exchange is not represented here today, but I can tell all of you that China's futures exchange has also been doing very well in many aspects. Many of you here today are their members. At the SGE, trading of physical commodities accounts for 35% of total transactions, and investment trading, or rather, derivatives trading accounts for 65% of the total transactions. I believe there will still be changes to this ratio in the future, as in the percentage of transactions accounted for by derivatives may increase further. In my opinion, the desired ratio should be something like 20%/80% or 10%/90%. As for our exchange, let me give a brief introduction to all of you as some of you are familiar while others are unfamiliar with it. The SGE was established in 2001 and officially commenced operations in 2002. Chart 2 shows the transaction volumes of the SGE's products since 2009. As at the end of last year, we have traded more than 11,000 tonnes of gold and 430,000 tonnes of silver. Despite relatively large fluctuations in gold prices this year, we have still managed to maintain a 17% growth in our gold trading volume compared to the corresponding period last year. So the momentum is still healthy. Besides, we have established a system for logistics, delivery and distribution, as well as a funds clearing system. It should indeed be said that the development outlook is still promising. In terms of development opportunities for the entire gold market in China, I have mentioned earlier that there is a tremendous potential for our physical gold market. However, we think that our market as a whole is facing three critical opportunities. The first one is a critical period of strategic opportunities. The keynote speaker, Jeremy East, from Standard Charted, explained this point very well earlier today (Jeremy's speech is reproduced on page 10). He talked about the impact of China on the world economy, the global impact of RMB internationalisation and the global impact of China's gold market. China's economy is developing at a medium to high speed, with an annual growth rate of 7.5%. I think this level of growth is sustainable for many years to come. Therefore, such a rate is a significant factor supporting the development of China's gold market, as well as a fundamental factor supporting the flow of gold from West to East. So in this regard, China's gold market is currently still in a period of strategic development. The second one is a period of accelerated development. With China's investors becoming increasingly mature, participants in China steadily increasing in number and our products getting richer day by day, especially our continually enhanced innovation capabilities, our market is experiencing a period of accelerated comprehensive development. The third is an increasing international presence. Until recently, China's gold market was a closed market. Other than imports, China's gold is invested in by domestic investors and onshore funds. We think that China's gold market has reached a new phase of opening up. It is because the extent of China's economic openness is getting increasingly larger, and our RMB internationalisation is accelerating, especially when we have set up a free trade zone in Shanghai in which free conversion of RMB is possible. Another reason is that China's gold market has now developed to a reasonable size. That is why we think that the time has come for China to open up its gold market to the world. As well, we should have an overall goal for the opening up of China's gold market. Just as Singapore's Minister for Trade and Industry told us today that Singapore has an overall goal and overall plan for its gold market, China also has an overall goal for the opening up of our gold market to the world. First of all, we should leverage the opportunities presented by RMB internationalisation to open up China's gold market gradually to the world. Secondly, we have technically implemented such opening up through the establishment of our Shanghai Gold Exchange International Board. So how do we open up to the world? The international board will help to open the door and invite everyone into China's gold market. Thirdly, we find that we should have a target of serving global investors to create an influential international gold market in China. In other words, China should still have the opportunity to become a prominent gold market, and Shanghai should become a global centre for gold trading. I think we are rather confident about this. This is our goal. So has such a goal obtained the support of the Chinese government, or rather, the support of our regulatory authorities? I am very pleased to say that this is indeed the case. The international board has obtained approval from our central bank, the PBOC, and received support and made the relevant institutional arrangements. Many of you were very concerned about whether you can trade with US dollars or offshore RMB, and how to participate in trading. Let me tell you, we have now completed the design such that you can trade on the international gold board with your offshore RMB and offshore foreign currency through a free-trade account in the free trade zone. One week before I came here, we signed an agreement with the regulatory authorities for the use of free-trade accounts. So what are the specific details of the design of our international gold board? I have thought for a long time about how best to explain this clearly to all of you. It is, in fact, very simple. First of all, who are the participants, as in the ones who can participate in trading on our international board? Well, any foreign legal entity or any legal entity that will be established in the Shanghai Free Trade Zone is eligible to apply to become a member of our gold exchange. Of course, there will be many applications, and there will also be some criteria and qualifications for the admission of members. Similarly, there are strict requirements for those wanting to become members of the LBMA. There would still be some requirements in order to participate. We welcome anyone meeting these requirements to join us. Those who cannot meet our requirements can still participate in trading through any of our future international members who can act as brokers. Secondly, the transactions on our exchange are priced in RMB. I believe that such a design will enrich the international gold market and make it more credible. We have US dollar pricing. We have London gold pricing. And we can also have RMB pricing. Earlier, I have reported on the data that physical gold consumption in China's gold market has, in effect, reached more than 2,000 tonnes last year. All of you here are experts in this industry and are very clear about the percentage accounted for by these 2,000 tonnes of physical gold in the global market. So I think that RMB pricing should enhance the entire price mechanism. After fixing the price in RMB, you can participate in transactions on our international board with your offshore RMB or even offshore foreign currencies. These days, I often have friends asking me whether we have two boards, one called the international board, and the other called the domestic board. We have, in effect, only one board where domestic and foreign investors trade together with onshore and offshore funds based on a single price. So they are, in fact, together, not separate. If that is the case, what is the purpose of setting up the SGEI? It has three main responsibilities. The first one is to serve as an IT system interface enabling international members to trade on our main board. The second role is to implement the clearing of funds. I mentioned earlier that trading would be done through an FT account. Incoming offshore funds should still be subject to regulation, meaning that incoming funds can only be used to invest in the trading of products on our gold exchange. You cannot use these funds to do any other thing, such as to buy properties or stocks in China. So the account is needed for you to place your money in it. This account will be opened in the name of our SGEI. Therefore, it serves the role of the clearing and management of funds. And what is the third role? We have created the role of transhipment trade. Many international gold experts have mentioned that Shanghai could serve as a centre for the transhipment of gold. In other words, countries in Southeast Asia or certain parts of East Asia could import gold through Shanghai. So we have, in fact, adopted this suggestion. As such, we designed an important function on our international board for it to be equipped with the ability to conduct transhipment trade. This is an institutional arrangement. For the purpose of such an arrangement, we have set up a 1,500-tonne gold vault in the Shanghai Free Trade Zone. This can serve as a delivery store for both gold imported into China and transhipped to other destinations. So what is the current status of preparations for the international board? As our market is now transforming from an entirely domestic market to an international market, some of our rules have been adapted. We are also soliciting opinions on this matter from some of our participants, and this is more or less completed. Secondly, the IT system has been built and is now technically online, with the capability to conduct transactions. What we are doing right now is to invite international members to become members of our exchange. Many of the banks, corporations and investment companies or funds that are present here today have established very good relations with us. I might also have sent our invitation to many of you. At this stage, we are only engaging in discussions. We would like to see all of them become members of our exchange, and their responses have been encouraging. They said that they would be very willing to participate in China's market and become a member of our exchange. We expect to launch this international board officially before the end of 2014. Another thing I would like to elaborate on is that, as our international board is priced in RMB, there are many other opportunities involved. As we all know, there is a difference in interest rates between onshore and offshore RMB funds, or between onshore RMB funds and foreign-currencies. Furthermore, as transactions are quoted in RMB, you are, in effect, using RMB during settlement. So there is an exchange rate difference involved here. We all know that China's exchange rate has appreciated continually over the past few years. However, the RMB exchange rate is now fluctuating more flexibly in both directions, sometimes appreciating and sometimes depreciating. The degree of daily exchange rate fluctuations in China was 1%, but it has now relaxed to 2%. If the exchange rate fluctuates by 2% daily, I suppose this is not a small amount. In other words, investing in such a product from our gold exchange would involve gold price fluctuations, as well as interest rate and exchange rate fluctuations. Therefore, it is, in effect, a three- in-one product that provides investors with the potential for profit. I think China's gold market is developing very well. So I am very confident about the launch of our international board. I am also very optimistic about the development of our gold market as a whole. So I would like to take this opportunity to thank all of you for your support and welcome your participation in our market. Together with all of you, we will take our global gold market to greater heights! Thank you for listening. Chairman of the SGE Mr Xu Luode, Bachelor of Economics and senior accountant, is the Chairman of Shanghai Gold Exchange. He is also the Vice Chairman of China Gold Association, the Vice Chairman of China Payment and Settlement Association, the Executive Member of China Society for Finance & Banking and the Executive Member of China Numismatic Society. Before taking the current position, Mr Xu Luode served successively as the Deputy General Director of the General Office in People's Bank of China, the Director General of Payment and Settlement Department in People's Bank of China, and the President of China UnionPay. | ||||||||||||

| Mining veteran: This is the 1990′s all over again in the gold market Posted: 17 Oct 2014 11:47 AM PDT From Henry Bonner in Sprott’s Thoughts: It looks like the late 90′s are back in vogue in the mining industry. Steve Todoruk, a mining veteran who joined Rick Rule in 2003 at Sprott Global Resource Investments Ltd. says he’s seeing some key similarities between today and the last big bear market for resource stocks, which lasted from around 1998 to 2001. Many of today’s mining legends made their reputation and their fortune during that time. See Steve’s latest note below: The last time we saw this happen was in the late 1990′s. Gold was around $300 per ounce; silver was near $6; and copper was $0.60 a pound. Commodity prices had fallen so much that big miners were producing near or below the sale price of their product. In some cases, the more they produced the more money they lost. Many mines had been shut down or were in the process of closing due to their inability to produce a profit. Copper miners needed around $1.10 per pound to make a decent profit. At $0.60 these companies were losing their shirts. In the gold space, Goldcorp was one of the very few miners to eke out a small profit because they had only one mine, which happened to be one of the richest high-grade gold mines in the world. Today, most industry experts believe that the ‘all-in sustaining cost’ to produce one ounce of gold is somewhere between $1,000 and $1,300. The all-in sustaining costs include all the costs of running current mining operations plus cash spent finding new ounces to replace mined reserves. Gold is trading around $1,200 right now, which means that most companies are probably losing money or breaking even. Few are making any kind of a profit. An important difference between the late 90′s and today is the amount of hedging. In the 90′s, companies often sold their gold forward (hedged), so when gold prices fell to $300, they had pre-sold a lot of their production at over $400 per ounce − enough to keep many mines open that would have almost definitely been shut down otherwise. Over the last decade, investors demanded full exposure to a rising gold price as the reason to buy shares in producing miners. Companies listened and almost all eventually got rid of their hedging agreements. Few or none of the big producers hedge any gold to speak of. As a result, gold miners today don’t have the benefit of having hedged some of their gold production at higher prices. They have to sell their production at the current market. One temporary measure they can use is to mine only the high-grade areas of their deposit, but that game cannot last long and can greatly reduce the long-term production potential of a mine. Throughout my life, I’ve been through 5 cycles in commodity prices, which correlate to bear markets and bull markets in mining stocks. Some cycles are more dramatic than others, but they all pretty well play out in the same way. You see a decline in the prices of the commodities and the share prices of the producers, followed by a rise in commodity prices and rising share prices. In the late 1990s, the miners needed to start making money if the world economies wanted to continue having a supply of metals. This would also make money available for exploration of new deposits of gold, silver, copper, uranium, or other metals. Smart investors bought shares in some of the miners since they stood to make money if commodity prices went up. They also bought up exploration companies with deposits that would increase substantially in value if metals prices rose. One of these companies was Bob Quartermain’s Silver Standard Resources (SSRI). Ross Beaty of Pan American Silver (PAAS) was one of the ‘smart investors’ in the space. He went out and acquired a number of copper deposits that he believed were cheaply priced, and he was well-rewarded. My boss Rick Rule started his first two Limited Partnerships in 1998 and 2000, buying shares in companies like Silver Standard and Pan American Silver, to the delight of his investors when commodity prices started to rise in the early 2000s. Today may offer a similar opportunity for investors. The miners are hurting. Mines may soon start shutting down, and that pain is also killing junior mining stocks. There always will be a mining industry. The world needs the metals. The world also needs the junior miners since they make most of the discoveries which the majors end up turning into mines. Some companies will therefore survive – but probably not all. One indication that a company may be viable is its ability to continue to raise funds in a bear market. On the other hand, the companies that cannot raise money tend to go quiet. They slow down or become inactive. Some merge with other companies or get bought out, and some simply close up shop. It’s time to respond like we’re right back in the 90′s. Just like the ‘smart investors’ of that period, we want to choose the survivors that could become much more valuable if metals prices rise. Steve recently commented that some stocks are staying well above their former lows, and that recent deals raise the specter of more mergers and acquisitions coming. These are encouraging signs, even if things could get worse before they get better. Read more here. | ||||||||||||

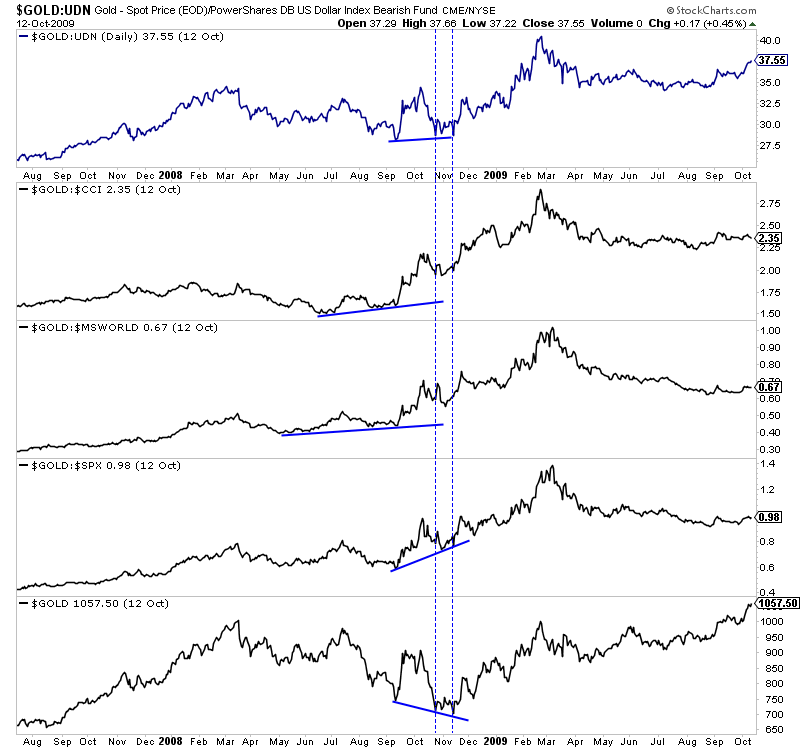

| Leading Indicators for Gold’s Turnaround Posted: 17 Oct 2014 11:39 AM PDT Gold is currently getting a reprieve as it trades close to $1240 which is above important weekly support at $1200. It's safe for the time being but we believe that Gold will ultimately break back below $1200 and below $1100 before the end of the already long in the tooth bear market. Because Gold is somewhat of an anti-asset, it's important to chart its course against other asset classes. Gold performs best when its strong against all other classes. Moreover, prior to recent important bottoms Gold bottomed first against other classes before bottoming in nominal terms. It appears that could happen again. The first chart looks back at the 2008 bottom. We plot Gold against foreign currencies, commodities, global equities and the S&P 500. Gold's lowest tick was late October 2008 while its daily low was in November 2008. Against other asset classes, Gold bottomed before then. Gold bottomed against foreign currencies and the S&P 500 in September while bottoming against global equities in May and commodities in June.

We should also note that while Gold bottomed in April 2001, it bottomed in real terms (against foreign currencies, equities and commodities) months before then. Let's look at the same charts today. While Gold has only recently emerged from a weak triple bottom, it is showing more strength against the other asset classes. Against foreign currencies Gold is nearly 10% above the December 2013 low. Gold is very close to an 11-month high against commodities and is trading at a 7-month high against global equities. Gold remains weak against the S&P 500.

Going forward there are a few things we will be watching. Assuming Gold breaks back below $1200 and eventually below $1100, will it be able to hold these recent lows against the other asset classes? If yes then that will show that though Gold is declining it is maintaining the kind of relative strength that was in place at previous major bottoms. Secondly, the Gold vs. S&P 500 ratio is very important. US equities and precious metals have been on a divergent course since the summer of 2011. If we get a weekly close in the ratio above 0.75 then it would signal a major turning point in favor of Gold. In the meantime we would advise continued caution. Gold and Silver have bounced but only from an extreme oversold condition. Though Gold has rallied $50/oz the miners have done nothing. The large caps (GDX, HUI) are trading dangerously close to recent lows while the juniors (GDXJ) have tread water at best. They are hinting that this rally won't last. Please stand aside for the time being. I see a potential lifetime buying opportunity emerging in the months ahead. Consider learning more about our premium service including a report on our top 5 stocks to buy at the coming bottom. Good Luck!

Jordan Roy-Byrne, CMT

The post Leading Indicators for Gold's Turnaround appeared first on The Daily Gold. | ||||||||||||

| Silver Prices Are Ready to Rally! Posted: 17 Oct 2014 11:30 AM PDT Silver is currently inexpensive compared to the S&P 500 Index, crude oil, the size and rate of increase of the national debt, and especially the future price for silver after markets have reset, paper assets have devalued, and hard assets have jumped much higher in price. Examine the following graph of weekly silver prices since […] The post Silver Prices Are Ready to Rally! appeared first on Silver Doctors. | ||||||||||||

| Posted: 17 Oct 2014 10:52 AM PDT

Well it appears that one of those communities is the 57,000 person Los Angeles suburb known as Arcadia. The suburb had a relatively insignificant Asian population of 4% in 1980, but it is now 59%. Of course, I could care less what the ethnic mix of any particular suburb is, but what does concern me is that a lot of the recent money coming in seems to be from questionable characters. The buyers are getting access to U.S. real estate via the EB-5 visa program, and of the 10,000 of these given away this year, 85% went to the Chinese. Oh, and it's estimated some 20% of these home sit vacant. A great use of resources… Read the rest here. | ||||||||||||

| China gold output growth to slow in coming years - BMI Posted: 17 Oct 2014 10:51 AM PDT BMI analysts say growth will slow significantly in coming years in the face of declining ore grades and waning profitability. | ||||||||||||

| Porter Stansberry: This is the “drawbridge” that’s destroying America’s middle class Posted: 17 Oct 2014 10:00 AM PDT From Porter Stansberry in The S&A Digest: In today’s Friday Digest, I want to talk about the drawbridge that’s destroying America. Yes, that’s right. The drawbridge. Just give me a minute to show you what I’m talking about… First, a few facts. The real (adjusted for inflation) median household income in the U.S. has declined over the last decade or so, from $57,000 to just under $52,000. That represents about a 9% decline in the standard of living for the average American household. Nearly the entire decline in real incomes has occurred since 2008, which returns the average American household back to its standard of living in the mid-1990s – before the entire Internet revolution. For most people in America, income is in a serious decline. That has never happened before over a decade-long period in the United States. What’s worse is that prior to this decline, real incomes had been stagnant for a long time. Median household income hasn’t materially increased since 1973, when real average household income was $48,557. And even this is misleading… In the early 1970s, there weren’t as many families with two wage-earners as there are now. For the last 40 years or so, families have made up for America’s stagnant standard of living by sending the wife to work outside the home and then, later, by running up huge debts and speculating in real estate. These aren’t solutions to the problem. And now, the problem is getting much, much worse. The underlying economic cause of this problem is easy to see and easy to understand. Wages are no longer connected to gains in productivity. As you can see from the following chart, since 1948, productivity has grown 254%, but hourly wages have only grown 113%. The disconnect begins in 1971… the same year President Nixon untethered the U.S. dollar from gold.

Lest you think this economic history is in some way unduly influenced by my libertarian political orientation, this chart appeared in Paul Krugman’s New York Times column on July 18, 2012. Krugman, as you may know, is among the most liberal economists published anywhere in the world today. Now… about that drawbridge. The chart above – which shows the sudden and lasting disconnect between increases to productivity and wages – is the explanation for Americans’ stagnant incomes over the last 40 years. Something has substantially changed in the way our economy works. Working harder or – working smarter – isn’t benefiting employees anymore. And now, these stagnant incomes have begun to decline significantly. On the other hand, Americans who own assets and businesses – whether they’re small entrepreneurs like landlords, technology titans who created Internet businesses, or private-equity investors (like Warren Buffett) – have seen their wealth soar over the last 40 years. This is the drawbridge I’m talking about – the bridge in America that exists between the very wealthy and the very poor. That bridge began to open 40 years ago… the chasm underneath it has grown deeper and deeper every year… and right now, as I’m writing these words to you… the gates are coming down and the bridge is beginning to move faster. You have to decide what side of the bridge you’re going to be on. You have to move quickly… because getting across that bridge will soon be impossible. Historically, the key to advancement in America was education. But the cost of a high-quality college education in America has risen 12 times over the past 30 years. Today, Harvard costs $50,000 a year in tuition. Very few people from the wrong side of the drawbridge can afford these costs. Likewise, the real costs of everything associated with the “normal” middle class in America are fast becoming out of reach. The costs of quality housing, health care, and education are now far beyond the reach of most Americans. The drawbridge is opening… wider and wider. There are two core reasons this has happened in our country. Both are easy to understand. One was a critical mistake of the rich and the powerful. The other has been a critical mistake of those claiming to represent the poor. First and foremost, the central reason that wages have become disconnected from productivity gains is because our currency – which was tied to gold, a resource of limited elasticity – was unlinked to any natural commodity. The result has been unlimited credit for our banking system and our government. The bailouts of 2008 and 2009 were financed (like earlier bailouts in 1974, 1981, 1990, and 1998) by a massive expansion of the money supply. The way to understand this is simple. Today in America, the risks of capitalism and bankruptcy have been socialized. Even though he owned several of the country’s biggest banks, Warren Buffett didn’t go broke in 2008. He didn’t go broke because the Fed printed $4 trillion and bailed out the banking system. Meanwhile, the rewards of capitalism are still reserved for those who own and control the assets of our economy. Who pays? Wage earners and savers, who depend on the value of the dollar. Who profits? Leveraged capitalists and the owners of great assets. If the dollar was still tied to gold, the government and the Federal Reserve would not have the power to create unlimited amounts of new reserves. To garner capital to bail out a failing bank, the government would have to actually attract additional capital by offering a high interest rate. Historically, that’s exactly what happened during market corrections. These high rates would reward savers and wage earners, while punishing capitalists and leveraged owners of assets. The balance was maintained between those who earned and saved and those who borrowed and speculated. Today, there is no balance whatsoever. Earning and saving now means being on the wrong side of the drawbridge. Author Ayn Rand famously said of the poor, “They have always been with us, don’t be one of them.” By that, she meant that there is no real solution to poverty, because most people end up poor because of their poor choices. That may no longer be true in America today, which is a sobering thought. America has become a country of soaring income inequality. For decades, America was not only the richest nation, but also the most middle-class – sitting right in the middle of the world’s nations in terms of income inequality. That’s no longer true. Over the last 40 years, income inequality has soared. We now trail Brazil (land of a million slums) and Mexico (land of narcotics) as the G20 nations with the widest amount of income inequality. The drawbridge is going higher and higher… That has led to an entire industry that exists to exploit the poor. Consider the recent union-backed move to raise the minimum wage. I could explain, using a million examples, why minimum-wage laws are terrible for poor people. That isn’t in doubt. When wages rise above the marginal value of labor, there is no longer a reason for employment. Thus, minimum-wage laws destroy jobs. Why, then, are the politicians so determined to raise minimum-wage laws? Consider the new law in Los Angeles, where city council passed a $15.37 minimum-wage law for large hotels. (There goes room service…) However, the law contains a provision that allows unions to waive the requirement in collective bargaining. The law is actually a cudgel designed to benefit unions. If you’re a hotel, you have a choice: pay an uneconomic wage… raise your prices to compensate and watch as all of your business goes elsewhere… or partner with the union to force your employees into a collective bargaining agreement that will see them earn less and force them to pay union dues. Guess where those union dues go? Directly to Democrat politicians. This is just one example out of thousands that show how promises to help America’s middle class and poor end up simply empowering the political class. Folks who think Obama was going to give them free health care should see what actually happens when they try to call a doctor. Meanwhile, have you seen the huge rise in managed care stocks? Have you seen the drug company stocks? One more example… Obama says he will help you pay for college. A law passed last year that allows students to avoid paying back their student loans or strictly limiting the payments to only 10% of their discretionary income. There are now 1.9 million Americans enrolled in the program, sheltering $101 billion in loans. Surely this is the way over the drawbridge, right? It’s a way for student loans – even people with hundreds of thousands of dollars in debt – to be financed by “poor” students. Maybe. But the loans are only forgiven if the students work for 10 years in government or for a nonprofit – like a “community organizer,” perhaps. Imagine your career potential if you spent the years between 25 and 35 working in government or politics. Who does this really empower, the students or the politicians? There’s a drawbridge opening in America. It’s a bridge that’s being forced open by economic policies that favor the rich and the powerful rather than the wage earners and savers. And on the side of the poor, there are a bunch of people who claim to help… but who really just exploit. What should you do? Follow Ayn Rand’s advice and don’t be one of them. Don’t get into debt. Don’t believe that spending $100,000 on college will save you. Don’t believe that working for the government is the answer. Realize that in America today, you’re not going to become wealthy being a wage earner. You must – must – find a way to acquire assets. That’s the only way across the bridge. You can do so by starting a business of your own. You can do so by getting into a job (like sales) where your earnings can vastly exceed the average earner. And you can do so by learning to invest wisely. Saving by itself is no longer enough. That’s where we can help… We’ve now posted more than 100 different – and completely free – articles about investing on our website. Spend some time at our investor education center. The secret to wealth in America is sitting right there… Start with our “11 Steps” manifesto… These are the ideas we wish we had learned before we invested a single dollar. Step 3, for example, teaches you the No. 1 factor in your investment success. If you don’t understand this idea, you’re almost sure to destroy your chances of financing your retirement with your savings. Step 5 shows you what you’re actually buying when you purchase shares of a stock. This will forever change the way you view your investments. Step 8 is often the hardest for new investors to practice. But it’s one of the most powerful tools at your disposal. Read through the “11 Steps” right here. Once you’ve gone through all 11 steps, spend time this weekend reading through the “Secrets of Financial Insiders” section of the education center. There are 15 essays… They’ll take about five minutes each to read. In less than two hours, you’ll understand more about how the market works than any of your friends, family, or neighbors. In particular, don’t miss editor in chief Brian Hunt’s essay on why your broker knowingly gets you into losing trades… Extreme Value editor Dan Ferris’ essay on why you, as an individual shareholder, just aren’t that important… and my essay detailing the only chance you have at becoming a successful investor. Once you have that as your foundation, you can explore the rest of what the education center has to offer, including… A Private Letter from Warren Buffett There’s No Secret to Investment Success… Except This One The 5 Magic Words Every Trader Says Over and Over, All the Time Never Retire One last thing… If you would like to glean insight from some of the brightest political and financial minds in the world, I strongly encourage you to join us online tomorrow, October 18. You’ll hear from former Congressman and leading libertarian Dr. Ron Paul. Currency expert Jim Rickards will also tell you what the government is doing to destroy the U.S. dollar – and accelerate this widening income disparity. You’ll also hear from Agora founder Bill Bonner, me, and a host of other bright minds. Crux note: To reserve your space, click here now. PLEASE NOTE: This is your last chance to register. This must-see event takes place tomorrow, October 18. | ||||||||||||

| 5 Bills in the Land of the Free that are straight out of Atlas Shrugged Posted: 17 Oct 2014 09:50 AM PDT With each new piece of legislation being proposed in the Land of the Free, Atlas Shrugged seems to be ever more prophetic. While even the most terrifying elements of the book are coming true, so are the reactions. People and companies are leaving, refusing the put up with the looting of their efforts any longer. Despite politicians' […] The post 5 Bills in the Land of the Free that are straight out of Atlas Shrugged appeared first on Silver Doctors. | ||||||||||||

| Posted: 17 Oct 2014 09:15 AM PDT If the top 1/100th of 1% crowding airports with their private jets isn’t afraid of impoverished, disenchanted debt-serfs with pitchforks, they should be. Submitted by Charles Hugh Smith, Of Two Minds: By End of the Empire I refer not to the collapse of American Imperial power but to the excesses and anxieties that characterize the decay […] The post End of the Empire appeared first on Silver Doctors. | ||||||||||||

| SD’s AGXIIK Ready For Ebola (Or Thanksgiving Turkey) Posted: 17 Oct 2014 09:00 AM PDT AGXIIK is ready for Ebola: AGXIIK (aka TND’s Prepper Jack) admits the suit is probably not the be all and end all protection against Ebola. But hey, that meat thermometer will come in handy this Thanksgiving. Just imagine the talk around the Prepper Jack table this Thanksgiving. The post SD’s AGXIIK Ready For Ebola (Or Thanksgiving Turkey) appeared first on Silver Doctors. | ||||||||||||

| Steve Sjuggerud: It’s official… The U.S. dollar has topped Posted: 17 Oct 2014 08:15 AM PDT From Dr. Steve Sjuggerud, editor, True Wealth: Earlier this week, risky assets tanked… and “safe haven” assets soared… But one traditional safe-haven asset didn’t follow the script – the U.S. dollar. As investors fled Italian bonds, Greek bonds, and Japanese stocks, they poured money into U.S. government bonds as a safe-haven play. A huge amount of dollars was needed yesterday to buy all those bonds. In a single day, the interest rate on 10-year government bonds fell from about 2.2% down below 2.0% (before settling at 2.1%). That might not sound like much, but it is a massive move. So you would think the U.S. dollar would have gone up. It didn’t. What that tells me is that everyone who wants to own a U.S. dollar already owns it… This fits with the numbers from my friend Jason Goepfert of www.SentimenTrader.com. Jason’s sentiment data shows that the U.S. dollar is more loved than it ever has been. It can’t go higher, because there’s nobody out there left to fall in love with it. So it can only go down. After doing nothing for a while, the U.S. dollar started taking off in July. And it’s been a one-way ride to the start of October… Take a look: That smooth one-way ride created the dollar love-fest. It lulled traders to sleep. It was practically Groundhog Day, as currency traders woke up each morning to the same thing – a higher dollar. Those days are now over. The U.S. dollar just peaked. Trade accordingly… Good investing, Steve Crux note: The market’s recent dips have investors scared… and they’ve pushed many different asset prices to extremes. But Steve says this is exactly what he wants to see… In his latest True Wealth newsletter – out today – he uncovers all kinds of bargains in stocks… real estate… and commodities… including a new and better way to own gold stocks. To be one of the first to get Steve’s new recommendations, click here now. | ||||||||||||

| San Francisco Pension Fund Asks Hedge Fund Manager Whether it Should Invest in Hedge Funds Posted: 17 Oct 2014 08:00 AM PDT The San Francisco pension fund has been soliciting advice on whether to invest $3 billion in hedge funds from a consultant who himself is a hedge fund manager. You just can't make this stuff up. Submitted by Michael Krieger, Liberty Blitzkrieg: Most readers will be familiar with the common fee structure for hedge funds known as […] The post San Francisco Pension Fund Asks Hedge Fund Manager Whether it Should Invest in Hedge Funds appeared first on Silver Doctors. | ||||||||||||

| Ebola delaying Liberia’s first modern gold mine Posted: 17 Oct 2014 05:04 AM PDT Logistical problems could delay initial gold production from Aureus' New Liberty - West Africa's newest developing gold mine. | ||||||||||||

| “Save Our Swiss Gold ” - Game Changer For Gold? Posted: 17 Oct 2014 05:02 AM PDT gold.ie | ||||||||||||

| “Save Our Swiss Gold ” – Game Changer For Gold? Posted: 17 Oct 2014 05:01 AM PDT We believe that the "Save Our Swiss Gold" campaign has the potential to be a game changer in the gold market – both in terms of the ramifications for the current global monetary system and in terms of higher gold prices. There has been a lack of coverage of this important story and there is therefore a lack of awareness about the possible implications for the gold market. Thus, in the weeks prior to the referendum on November 30th, we are going to analyse the referendum, the important context to the referendum and the ramifications of a yes or a no vote. Mark O'Byrne, Head of Research GoldCore (Essential Guide To Gold and Silver Storage In Switzerland)

"Save Our Swiss Gold " – Game Changer For Gold?by Ronan Manly, GoldCore Consultant Contents Swiss Flag in the Swiss Alps Foreword There has been a lack of coverage of this important story and there is therefore a lack of awareness about the possible implications for the gold market. Thus, in the weeks prior to the referendum on November 30th, we are going to analyse the referendum, the important context to the referendum and the ramifications of a yes or a no vote. Introduction If it passes it will force the Swiss National Bank to substantially increase Switzerland's monetary gold reserves and make it harder for Swiss monetary policy to informally peg the value of the Swiss Franc to the Euro below 1.20. Even if it does not pass, it has the potential to be a "wedge issue" and lead to a fractious debate about gold and monetary policy in a leading industrial nation. This has the potential to create a new found awareness of gold's importance as a monetary asset and as a safe haven asset. The upcoming referendum on Switzerland's gold has evolved via a Swiss popular initiative, which is a form of direct democracy campaigning by citizens in Switzerland. In this case, the initiative is called the "Save Our Swiss Gold (Gold Initiative)". To really understand the "Save Our Swiss Gold (gold Initiative)" and the upcoming Swiss gold referendum on 30 November, it's important to understand how this initiative arose and what its motivations are. It's also important to understand the Swiss political system, since this provides a framework to explain how the initiative proceeded through the Swiss political system to a referendum, and how the referendum voting system works in the Swiss Confederation. Success of Swiss People's Party (SVP) Ideologically, the SVP is nationalist, conservative, Eurosceptic and against mass immigration. The SVP were the party that successfully brought the anti-immigration popular initiative to a successful referendum outcome in Switzerland in February 2014. This happened despite the majority of the Swiss body politic and Switzerland's other political parties calling for a 'no' vote in that referendum. This highlights the fact that popular referendum results in Switzerland do not necessarily follow party voting lines. The SVP grew to be the largest political party in Switzerland in the late 1990s, with a notably strong power base in German speaking Zurich, and it continued to strengthen across Switzerland in the 2000s. Currently, the SVP has one elected representative on Switzerland's seven member governing Federal Council, 5 representatives in the upper house of parliament, and 54 representatives (the largest grouping) in the lower house of parliament. Direct Democracy and Popular Initiatives In Switzerland, a 'popular initiative' is a form of initiative that can be activated by Swiss citizens to propose a change to a law. According to the Swiss Federal Administration, popular initiatives are the driving force behind direct democracy. Since the Swiss political system is structured along federal, cantonal, and communal (municipal) lines, there can be federal popular initiatives, as well as popular initiatives on a canton and commune level [1]. Federal popular initiatives aim to change an aspect of the Federal Constitution. Cantonal popular initiatives aim to change an aspect of that canton's constitution (each canton has its own constitution in addition to the Federal Constitution). Switzerland is a Confederation made up of 26 cantons and half-cantons and over 2,600 communes (local communities) [2]. A canton is analogous to a state of the Confederation. On the cantonal level, there are 20 full cantons and 6 half-cantons, a point which comes into play in federal referendums under the concept of 'double majority', which is explained below. The 6 half-cantons were created at various times in Swiss history when three previous full cantons each split in half. The requirement of a federal popular initiative calls for the collection of more than 100,000 signatures among the Swiss electorate over an 18 month period in order to advance the popular initiative to a federal referendum [3]. Petition Filing As part of the legal process for federal popular initiatives, the text of the initiative was then published on 20 September 2011 in an official government publication called the Federal Gazette. At that time, the Federal Chancellery listed 17 creators and authors of the initiative, namely: Toni Bortoluzzi, Yvette Estermann, Hans Fehr, Sylvia Flückiger, Patrick Joyous, Oskar Freysinger, Thomas Fuchs, Andrea Geiss Buhler, Alfred Army, Hans Kaufmann, Lukas Reimann, Ernst Shibli, Ulrich Schlüer, Jürg Stahl, Luzi Stamm, Christoph von Rotz, and Walter Wobmann [4]. Initiative Launch The title of the initiative was, at that time, stated to be "Gold Initiative: A Swiss Initiative to Secure the Swiss National Bank's Gold Reserves", although the official name of the initiative was filed as 'Save Our Swiss Gold initiative'. Luzi Stamm stated that there were three parts of the initiative, namely: Motivation for the Initiative Firstly, given that the European Central Bank and Federal Reserve had rapidly expanded their money supplies, thereby devaluing the Euro and the US dollar, this impacted the relative strength of the Swiss Franc, and put pressure on the Swiss Franc to also devalue. To counteract these pressures, holding a certain percentage of reserves in gold would allow the Swiss Franc to act as a strong, gold-backed currency, and constrain its devaluation. Secondly, according to the SVP, Switzerland's gold had always been considered to be the "property of the Swiss people". This historical right was severed in 2000 via a Constitutional change, after which the Swiss National Bank proceeded to sell 1,550 tonnes of the country's original 2,590 tonnes of gold reserves. The SVP maintain that selling these gold reserves was a mistake and that the Swiss National Bank and Swiss politicians should not have this right to sell the nation's gold. Lastly, to increase transparency, the SVP reasoned that the Swiss National Bank should be forced to reveal where the Swiss gold reserves are located and to repatriate any gold reserves held abroad back to Switzerland (since at that time in 2011 the Swiss National Bank would not comment on the locations of the remaining gold reserves). In summary, the SVP said that having transparency and a currency which does not continually devalue would become a model example to other countries and central banks around the world [5]. Gathering the People's 100,000 Signatures Initiative campaigners request a revision via collecting signatures on an official form, and can collect signatures anywhere, for example in households, workplaces, public places, and at public events. The signatures are then verified locally by local government offices who issue certificates of authenticity for the signature lists [6]. The signatures and their certificates are then handed in to the Federal Chancellery for 'verification of petitions'. Gold Initiative Gets Over 107,000 Signatures The gold initiative committee and their campaigners managed to collect 107,380 signatures. Of the 107,380 signatures submitted, 106,052 were said to be valid and on 16 April 2013, the Chancellor Corina Casanova deemed that the "Save Our Swiss Gold (gold Initiative)" had arrived at 100,000 valid signatures in accordance with Article 139. This information was then also published in the Federal Gazette. Given the specific wording of the suggested constitutional change, the initiative was classified as a specific draft as opposed to a general proposal. This is important since a specific draft initiative has to attain a double majority of voters and cantons if it is to pass. The signatures were collected across all 26 cantons and represent just over 2% of the most recent total electorate figure of 5.22 million Swiss voters. Over 27,000 signatures were collected in Zurich, representing 3% of the Zurich electorate, over 15,000 signatures from Bern, representing 2.1% of the Bern electorate, and over 13,300 from Aargau, representing 3.25% of the Aargau electorate. Aargau is a canton in the north of Switzerland between Basel and Zurich. In total these three cantons represent 40% of the Swiss electorate. Overall the signature total per canton was in the range of 0.22% to 3.32% of the canton electorate total [7]. Selling The Swiss Family's Gold The gold sales between 2000 – 2005 are especially contentious since they arose after a substantial series of legal changes were introduced between 1997 – 1999 by the Swiss government and parliament with substantial advice and planning by the Swiss National Bank. In 1997 the previous requirement that the Swiss Franc be 40% backed by gold was replaced with a 25% backing, as a precursor to the demonetisation of gold. An 'Expert Group' compromising Swiss National Bank and Swiss Federal Administration staff then recommended in 1997 that Switzerland should sell 1,300 tonnes of gold. They did this by revaluing the gold reserves from a historical fixed price to a higher market related price, and then argued that the 2,590 tonne gold holdings was excessive as part of the SNB's reserve portfolio. In April 2000, further legal changes occurred for the Swiss currency, when constitutional amendments were passed by the Swiss electorate which severed the link between the Swiss Franc and gold, and dropped the 25% gold backing for the currency. The Swiss parliament also passed new Federal currency laws which demonetised gold. Taken together, all of these changes then left the door open for the Swiss National Bank to begin gold sales. The SNB sold 120 tonnes of gold over a six month period from May 2000 until September 2000. This was followed by a sale of 200 tonnes over the following 12 months from October 2000 until September 20)1. The majority of these sales (220 tonnes) were conducted by the Bank for International Settlements on behalf of the SNB. The SNB then began direct gold sales, selling 980 tonnes over four years from October 2001 until September 2005. In total, this amounted to 1,300 tonnes. Of the total, 730 tonnes were sold to 25 counterparties, with the physical gold sale trades settling at the Bank of England. The other 350 tonnes were sold using derivative overlays in tranches of approximately 50 tonnes each. These Swiss gold sales formed part of the first and second Central Bank Gold Agreements on coordinated gold sales. The proceeds of the Swiss gold sales were paid out as distributions in the ratio of one third for the Swiss Confederations and two thirds for the cantons. The additional 250 tonnes gold sales over the years 2007 and 2008 were said by the Swiss National bank to be due to a need to rebalance the reserve portfolio between currencies and gold. In total, these sales between 2000 and 2008 amounted to 1550 tonnes of Swiss gold. End of Part 1 by Ronan Manly, GoldCore Consultant [1] http://www.iniref.org/swiss-dd.html

GOLDCORE MARKET UPDATE Gold climbed $1.70 or 0.14% to $1,239.50 per ounce and silver slipped $0.05 or 0.29% to $17.38 per ounce yesterday. Gold in U.S. Dollars – 2 Years (Thomson Reuters) Gold edged higher on Friday and was poised for a second straight week of gains as growing Platinum and palladium were the biggest precious metal gainers of the day, recovering about 2% from sharp overnight losses. Gold is up about 1.4% for the week after reaching a one-month high of $1,249.30 on Wednesday. Gold has seen safe haven buying along with U.S. Treasuries on increasing concerns over financial markets, the Eurozone, the emergence of Ebola and the global economy Weak data from China and Europe have in particular badly spooked markets, though U.S. jobless claims and industrial output data on Thursday were slightly better than expected. Dollar weakness has also supported gold and silver as the sluggish data stoked worries that the U.S. Federal Reserve would have to delay the long threatened increase in higher rates. SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings rose 0.24 percent to 760.94 tonnes yesterday. In the world's largest gold buyer China, premiums recovered to $2-$3 an ounce from $1-$2 overnight, showing higher demand and lending support to global prices. SGE gold withdrawals were very high this week and saw a very large rise for the week of 68.4 tonnes with most of the buying after their Golden Week holiday. Get Breaking News and Updates On Gold and Markets Here See Essential Guide To Gold and Silver Storage In Switzerland | ||||||||||||

| Gold making cat-like moves, is it about to pounce? Posted: 17 Oct 2014 04:52 AM PDT Gold is holding higher levels, moving slightly down before recovering to hold the highest levels seen recently, observes Julian Phillips. | ||||||||||||

| Gold rebound thwarted by positive US data, equity gains Posted: 17 Oct 2014 04:39 AM PDT Despite hitting a resistance at $1250 levels, gold is still on track for second weekly gains. Changing rate expectations are driving gold and US dollar, analysts said. | ||||||||||||

| Gold price upside limited in 2015 - Scotiabank Posted: 17 Oct 2014 04:00 AM PDT Patricia Mohr advises that copper will drift lower in 2015, as zinc prices remain steady at "lucrative levels" this year. | ||||||||||||

| LBMA names Morgan Stanley as gold/silver market maker Posted: 17 Oct 2014 02:27 AM PDT Just three weeks ago, the LBMA named Citigroup as a spot market-making member. | ||||||||||||

| Anglo Asian set for 29% annual increase in Azerbaijan Posted: 17 Oct 2014 01:59 AM PDT The miner plans to reach its target of between 62,000 and 67,000 gold ounces for the year. | ||||||||||||