saveyourassetsfirst3 |

- October Market Breadth

- Serious Financial Trouble Is Erupting In Germany And Japan

- Gold and Federal Funds Rate

- Looking for a new car? Save yourself some time and click here

- Will Bitcoin Be Treated Like Online Piracy?

- Exploration & Development Company Index

- Suddenly, We Have Problems

- Building an Ark: How to Protect Public Revenues from the Next Meltdown

- Technical Trading: Gold Vulnerable To Near Term Backing And Filling

- U.S. MINT RECORD SILVER EAGLE SALES: Best All Year

- Precious metals get a reprieve?

- Market update: U.S. stocks just did something they haven't done in two years

- Real interest rates lead gold market

- Jim Willie: The Economic ENDGAME Has Arrived

- BANKERS MANIPULATION OF GOLD & SILVER: Proof In The Demand Data

- Gold trades near four-week high

- Metals market update for October 13

- Gold demand in India peaks

- Precious Metals Monthly Bank Participation Report: October 2014

- 5 reasons gold hit most recent near-term bottom

- Indian gold import curbs to stay, advises former Finance Minister

- The US Ranks #36 in the World for Respecting Property Rights

- David Morgan's secret to being grateful, even at $17 silver

- Gold trades above $1200 on return of physical demand in India, China

- U.S. and UK Test Big Bank Collapse - Risk Of Bail-ins

- Gold price climbs as equity markets stumble

- U.S. and UK Test Big Bank Collapse – Risk Of Bail-ins

- Gold: ‘near-term outlook uncertain…long-term prospects glorious’

- BO POLNY: Triple Bottom a Prelude to Runaway Gold & Silver Bull Markets

- Village Main approached with acquisition offers

- Gold rises to $1230, Silver to $17.69: Monex Precious Metals Review

- Must Read: 10 Companies Adrian Day Sees as Stable in a World that Is Not

- US Dollar Technical Analysis: Selloff Finds Interim Support

- Gold (XAU/USD) – Is this a Bullish Channel or Flag Pattern?

- Gold Extends Recovery, SPX 500 Dips Sub-1900 After Breaking Uptrend

- Gold the Commodity or Gold the Currency?

- Gold Finds Bids On Diversification Demand

- Glossary of Terms in Precious Metals

- Is the bull run for the US dollar now over?

- Jim Willie: The Economic ENDGAME Has Arrived

- The Implementation of the Coming Totalitarian Regime Will Rival the Third Reich

- *Breaking: Dallas Hospital Worker Tests Positive For Ebola After Fully Protected Contact With Ebola Pt

- Bull Riders – The Doc, Turd Ferguson, Claudio Grass, & Andy Hoffman Break Down the PM Markets

- CHINA sees rapid growth in gold leasing

- Alasdair Macleod’s Market Report: Market Turbulence

| Posted: 13 Oct 2014 12:39 PM PDT Post Source: Short Side of Long There has been quite a lot of market action in stocks as of late, so it is time for another Market Breadth Summary. Most market participants would look at the chart of S&P 500 and conclude that some kind of trouble only started several days ago as selling intensified and the volatility index jumped. However, the internal market breadth for the US equities has been deteriorating since at least June of this year. Let us look at a few charts. Chart 1: Market conditions are changing as bears take control from bulls Source: Short Side of Long

Before I start, there is an important point I would like to make. According to the price behaviour and various indicators I track, market conditions are changing as bulls lose control to the bears. In other words, probability is quite high that the central bank sponsored rally, which has lasted for the better part of two years, has probably come to an end and the prevailing trend right now is bearish. Why is this important? Because a lot of market participants fail to trade with the trend. Since I'm not that smart nor experienced, I will quote Jesse Livermore on this subject:

Chart 2: Percentage of stocks trading above 20 day moving average… Source: Index Indicators (edited by Short Side of Long)

With that in mind, let us now focus on the various internals and breadth readings. The recent sell off has pushed the S&P 500 broad index into a short term oversold condition. The percentage of stocks within the index that are trading above short term moving averages like 20 day and 50 day stands at 17% and 24% respectively (refer to charts above and below). These are rather minimal numbers that usually indicate that some kind of a rebound could occur. But it is worth saying as a side note that just because the index is oversold, does not mean selling could not continue for awhile longer and become even more oversold. During an uptrend, we saw markets become overbought and yet they kept making higher highs for months on end. While I am not predicting this, there is no reason as to why something similar could not occur on the downside.

Chart 3: …as well as 50 day moving average has dropped into oversold! Source: Short Side of Long

If and when markets do decide to turn around for a rebound, the nature and strength of the rally should be judged with a microscope. Chart 3 clearly shows that the current price action signals technical damage in form of a breakdown from a recent two year uptrend. And while the index is oversold in the short term, keep in mind that the percentage of stocks trading above 200 day moving average is not yet oversold (longer term and more meaningful perspective).

Chart 4: New highs vs new lows ratio is most oversold since mid 2011! Source: Short Side of Long

With quite a number of stocks breaking down, it shouldn't be a surprise that the NYSE new highs vs new lows ratio is now very close to oversold conditions as well (refer to Chart 4). We haven't seen a condition like this occur since middle of 2011, when majority of the market participants panicked during the US Debt Ceiling saga. Whether we are in a bull market or a bear market, oversold conditions in this indicator usually produce some kind of a rebound or a relief rally. Therefore, a further fall towards 20% or lower in the HL Ratio could produce a rebound soon enough.

Chart 5: Advance decline line and down volume is becoming oversold! Source: Short Side of Long

Furthermore, both the advance decline line and down volume averaged over 21 days (or one trading month) is now turning towards extremely oversold level as well. We have seen this type of a condition in May 2010 during the flash crash, in August 2011 during the US Debt Ceiling saga and in May 2012 during the last leg of the Eurozone Crisis, before Draghi's "whatever it takes" speech. For more then two years, breadth in the US has not become extremely oversold, at least based on this indicator. But today we find ourselves with a condition where selling has turned a bit extreme, in particular with the down volume.

Chart 6: One third of the S&P is trading in short term oversold territory Source: Index Indicators (edited by Short Side of Long)

So what is next for the stock market? I understand that most traders would claim that S&P 500 might find some support at its previous trough from early August at around 1900 level. So therefore, one might assume that a rebound could occur soon enough as the price sits at this important support. However, instead of talking about how the market is oversold from the short term, I think the more important point to make here is the breadth deterioration between the August trough at 1900 and the current internals as S&P trades at 1900. In August about 20% of S&P stocks became oversold with RSI below 30 and about 10% of S&P stocks traded at 6 month new lows. Fast forward to today and while S&P 500 finds itself at the same level of about 1900, we now have 30% of S&P stocks with RSI below 30 and 32% of stocks making new 6 month lows. So what does this mean?

Chart 7: One third of the S&P 500 is breaking down to 6 month new lows Source: Index Indicators (edited by Short Side of Long)

For me, it is plain and simple: a growing number of stocks are breaking down towards lower lows (definition of a downtrend), while the index itself gives the appearance of still respecting support. My view is that the market is trying to trick majority into buying this oversold dip, as if it is the same as every other dip since November 2012. However, with Federal Reserve changing its policy, the up-and-coming rebound from oversold cod notions discussed in this article could end up being a bull trap. Therefore, instead of buying a potential rebound, I would actually consider selling the coming rally.

The post October Market Breadth appeared first on The Daily Gold. |

| Serious Financial Trouble Is Erupting In Germany And Japan Posted: 13 Oct 2014 12:15 PM PDT The next great financial crash may not not begin in the United States. Many are convinced that a financial crisis that begins in Europe or in Japan (or both) will end up spreading across the globe and take down the U.S. too. Time will tell, but signs are emerging that financial trouble is already starting to erupt […] The post Serious Financial Trouble Is Erupting In Germany And Japan appeared first on Silver Doctors. |

| Posted: 13 Oct 2014 12:00 PM PDT SunshineProfits |

| Looking for a new car? Save yourself some time and click here Posted: 13 Oct 2014 11:43 AM PDT From Eric Peters at Eric Peters Autos: Going for a test drive is smart policy. The problem for most people is that test-driving all the available cars is not unlike visiting every Starbucks in the country. It’s not easy – and it would take a lot of time. I, on the other hand, test drive new cars every week. And by dint of that, have test-driven pretty much every car on the market. I’ve distilled all that down to the following recommends – for this year – which I hope will save you some time or at least get you pointed in a good direction! * 2015 Honda Fit Yes, technically, it’s next year’s model. But as is common practice in the car business, the next model year is often made available in the preceding calendar year. Anyhow, what makes the Fit a great fit? Though it’s very small on the outside – and so, very easy to park and maneuver – it has more room inside than much larger cars. How about more backseat room in this compact-sized car than in a mid-sized car like the Honda Accord? And 41 MPG on the highway, too.

But it’s not purely about practicality. The Fit – like the Civic CRX of the ’80s – is also a fun car, with a typically Honda rev-happy engine and an also typically Honda shifter (in manual equipped versions) that’s pure pleasure to play with. Oh, and there’s no fuel economy penalty to going with the manual over the optionally available (CVT) automatic – as is usually the case these days. Well, in the competition’s cars. Full review is here. * 2014 Mercedes E250 Luxury cars are many things, but rarely economical to operate. And the few that have been easy on gas have typically been hard on the soul – being embarrassingly slow.

The E250 up-ends all that via a devastating two-punch of diesel power and (for the first time ever in a big Benz) four-cylinder diesel power. Just 2.1 liters – in a 4,200 pound car. But with 369 ft.-lbs. of torque available right now ( from about 1,500 RPM on up) you still get to 60 MPH in less than 8 seconds. And you’ll also get 45 – or better – on the highway. The Benz also costs thousands of dollars less than its less efficient rivals from BMW (5 Series diesel) and Audi (A6 TDI). As they say in Germany, ausgezeichnet! Full review is here. * 2014 Jeep Cherokee This mid-sized crossover actually crosses over. It has – can be ordered with – the equipment necessary to actually go off-road. Yet it’s not a beast on the road.

Unlike every other so-called crossover – all of which are functionally just cars in SUV drag – the Cherokee is available with a serious four-wheel-drive system with Low range gearing… as opposed to the car-esque all-wheel-drive that’s typically found underneath other crossovers. Another thing you’ll find in the Jeep that you won’t find in many if any of its rivals is a big V-6 engine – paired with a nine-speed automatic transmission. Result? Big hp numbers – and not-bad EPA fuel-economy numbers. Full review is here. * 2014 Kia Soul

For once, the name fits. This little “box car” has it. Soul. It makes me smile – and I think you will, too. But it also makes sense – and that may be even more persuasive. Though it’s positioned in the econo-car class – and priced accordingly – the Soul can be ordered with a variety of engine/transmission combos and amenities that are hard if not impossible to find in the econo-car class. Among them – a heated steering wheel, heated rear seats, three-mode driver-selectable steering feel, a built-in fridge, a panorama glass roof and a big-screen (eight inch) touch-screen control interface. All for less than $30k, without even haggling. Full review is here. * 2014 VW Touareg You know what’s hard to find? An SUV with a diesel engine that’s not too big – or too small – and which doesn’t make a big deal about itself and how much it cost you. The only one that fits that bill is the VW Touareg. It’s the softer-spoken version of the Porsche Cayenne and in between (size-wise) its Audi cousins, the Q5 and Q7 TDIs. It also costs many thousands less than the very nice – but very expensive – BMW X5 diesel. The Mercedes ML350 matches the Touareg’s moves (and price) but – being a Benz – is the far flashier of the two.

If you want everything the Benz offers – except the attention it will get you – take a look at the VW. It’s as luxurious – and even longer-legged, with a highway range of almost 800 miles on a full tank. That’s best in class. Also its hulky max tow rating: 7,700 pounds, or 1,000-plus pounds more than its rivals. Full review is here. * 2015 Hyundai Genesis

Those old enough to remember what the car market was like before 1990 will recognize the history being repeated. Just as Lexus changed everything when the first LS sedan appeared back in ’89, so also Hyundai is changing everything – only this time, it’s mainly the Japanese in the crosshairs. The Genesis is aimed squarely at Japanese luxury sedans like the current Lexus LS – which costs $20k more to start and still isn’t as powerful (or as roomy) and arguably less luxurious than the audacious Hyundai. Even the base model shames its name-brand rivals. And what’s in a name? Don’t forget that back in ’89, “Lexus” was by no means the blue chip brand it is now. But the smart money knew it would be – and bought in early. Full review is here. Also praiseworthy: * The 2015 Chevy Corvette Stingray

Costs $20k less than a new Z28 – and delivers better performance than Porsches that cost nearly twice as much. Wildest looking ‘Vette since 1967, too. * The 2015 Mustang “Ecoboost” The first four-cylinder-powered Mustang since the ’80s out-performs the V-8 Mustangs of the ’90s – and gets better mileage than both of them courtesy of “Ecoboosted” turbocharging. It’s like having an old SVO Mustang – and a Five-oh GT – in the same package. * The 2015 Mitsubishi Mirage Three cylinder-powered cars are back (see here) but only one of them isn’t turbocharged – and doesn’t cost $16k and up. That car is the Mitsubishi Mirage – which starts just over $12k (making it about the most affordable new car you can buy) and delivers better-than-40 on the highway (making it one of the most efficient cars you can buy. Combine the low cost to buy – and feed – and you’ve got one one of the least expensive cars to drive you can buy. |

| Will Bitcoin Be Treated Like Online Piracy? Posted: 13 Oct 2014 11:24 AM PDT Originally appeared at Bitcoinomics.Net Banks are aware of Bitcoin. One CEO doesn't think it is long for this world. Bitcoin developers "are going to try and eat our lunch," Jamie Dimon, chairman and CEO of JPMorgan Chase said last week. "And that's fine. That's called competition, and we'll be competing." Dimon sees the point in Bitcoin. But there are some problems he sees on the horizon. "I agree with real-time digitization," Dimon agreed. "The issue I have with Bitcoin is that it's not about the technology, it's about governments. When people form nations, one of the first things they do is form a currency. Are regulators and governments really going to foster Bitcoin over a long period of time? I think the answer is no." James Gorman, CEO of Morgan Stanley, echoed Dimon's sentiment. "You have to be respectful in the face of new technologies like Bitcoin, but you don't capitulate," he said. "You adjust and take advantage. Consumers feel better putting their money with a brand they recognize. We have capabilities and resources that are very powerful." PRECEDENT IN PIRACY? For fourteen years Hollywood has tried to undermine torrents. Each year it seems the industry doubles down their efforts. In 2013 Google and other search engines were accused of being a gateway for pirated content online. "Search engines bear responsibility for introducing people to infringing content, even people who aren't actively looking for it," according to MPAA chairman Chris Dodd. Other efforts to combat piracy include The Stop Online Piracy Act (SOPA), the well-known legislation. Proponents said the bill would protect intellectual property, while critics said it impacted free speech laws. This bill was combated in 2012 when Wikipedia, Google, and 7,000 other smaller websites blacked out their services in protest against the bill. Wikipedia said over 162 million people viewed its anti-SOPA banner. The Recording Industry Association of America (RIAA) stated, "It's a dangerous and troubling development when the platforms that serve as gateways to information intentionally skew the facts to incite their users and arm them with misinformation",[5] and "it's very difficult to counter the misinformation when the disseminators also own the platform." Despite so many efforts, piracy remains a popuar internet activity. Game of Thrones, in fact, recently set online piracy records with its season premiere. Semetric, which monitors online media consumption, claims that Game of Thrones, at peak popularity, made up over half of all television-related downloads on piracy websites. When the show ended its fourth season, fans downloaded the last episode 2 million times within 24 hours. So, as Jamie Dimon says, he doesn't expect Bitcoin to be viewed keenly by government and regulators. Dimon says banks, at least his, will compete. But, does he mean compete via legislation and lobbying like Hollywood? That has yet to be seen. It seems already, hinting towards the way of the future, the regulatory agencies treat Bitcoin differently than it does the banks. How will regulators, and those wanting to treat bitcoin like online piracy, achieve this? One might assume they will treat it like piracy. Users of torrent sites have been the ones targeted in that arena. Bitcoiners can possibly expect the same. There's the story of the 32-year-old Minnesota mom who was found "liable for willfully infringing the copyrights of 24 songs she downloaded off the Web and awarded record labels $1.92 million. That's about 80,000 per song. Earlier this year, Prince fined 22 individuals $22 million for copyright infringement. The UFC sued one man $32 million for piracy. There's no shortage of examples. It appears to me, despite this fight against it, pirating music is more popular than ever. The truth of the matter is, in this day-and-age, you don't even need to download the albums. All you need is a link, like this one here.* Originally appeared at Bitcoinomics.Net Justin O'Connell is the Chief Executive Officer of GoldSilverBitcoin. He is also the author of the bitcoin book, Bitcoinomics, and administrator of the Bitcoinomics website. Justin is also a co-host at Our Very Own Special Show, a lifestyle podcast about music, news, life and other topics, and head researcher at The Dollar Vigilante. He lives in San Diego, California. |

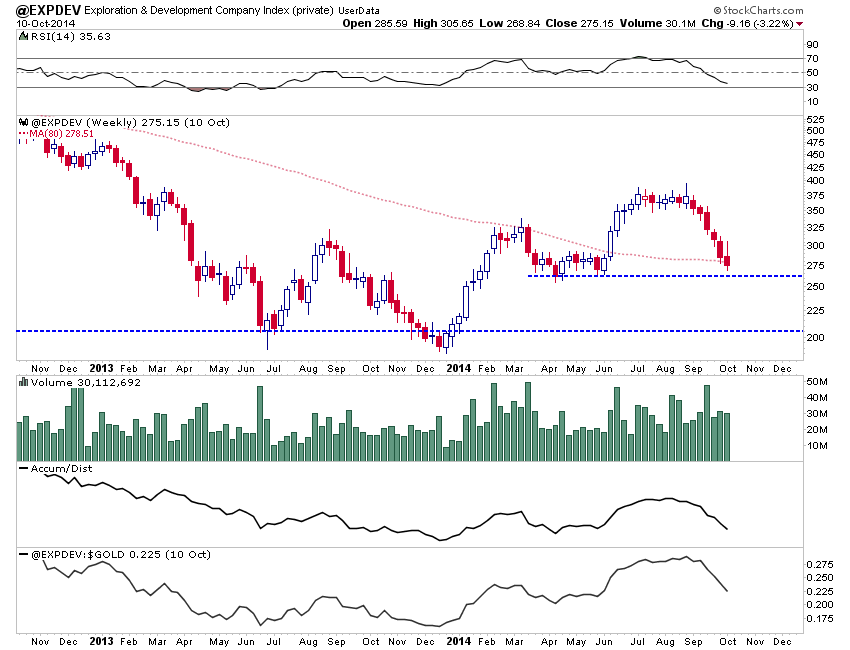

| Exploration & Development Company Index Posted: 13 Oct 2014 11:11 AM PDT By some statistics, exploration and development companies have performed better than junior producers over the past 10 months. Companies with deposits in good jurisdictions that can earn a good return at $1200 Gold are favored by the market and should outperform during the next bull market. The index charted below contains 15 stocks which are equal weighted. The index is currently holding around the spring lows. The problem is that there is little support between the 2013 lows and the spring 2014 lows. A break below this current support could potentially coincide with a break in Gold back below $1200/oz.

There are a handful of exploration and development companies we think will be tremendous buys in the coming weeks and months. Consider learning more about our premium service.

The post Exploration & Development Company Index appeared first on The Daily Gold. |

| Posted: 13 Oct 2014 10:54 AM PDT A rising stock market, like a rising tide, can cover a multitude of interesting and/or scary things. The thinking seems to be that if the finance guys who really know what’s going on are buying, then the disturbing stories that lead each evening’s news must be manageable. So, in general, we’re okay. But let the market fall a bit and those headlines suddenly begin to seem both oppressive and really, really numerous. And maybe we’re not okay after all. To take just a few of the issues that, in the wake of the recent equity correction, now loom large: Islamic State, the tiny band of religious crazies that the US armed to do its bidding in the Syrian civil war is now threatening to take Baghdad, capital of Iraq and home to a US embassy that will live forever in the annals of hubristic excess. Actually a small, self-contained city, the embassy contains all kinds of sensitive equipment, documents and personnel, and will be defended with (thousands of) boots on the ground if an Islamic State victory appears imminent — which it now seems to be. In other words, we’re getting ready to dump another trillion or so dollars into the hole where we previously dumped two trillion with nothing to show for it but chaos. Ebola, a nasty virus that was previously polite enough to stay in Africa, has escaped and is now touring Europe and the US. Either it has mutated to become more communicable or the West’s protocols for dealing with it are inadequate. Either way, there is now talk of the disease breaking free and causing a First World pandemic. See Ebola pandemic spreading across Europe is ‘unavoidable,’ WHO warns. The strong dollar, meanwhile, has had the same effect on the world as would higher US interest rates, slowing growth and causing hot money to leave emerging markets and pour into US Treasuries. So while everyone is waiting for the Fed to raise interest rates and court the traditional “taper tantrum” liquidity crisis, the foreign exchange markets have done the heavy lifting already. See Why a strong dollar is scarier than taper tantrum. Japan and Europe are dropping into recessions that could easily become system-threatening depressions. While US stocks were rising it was possible to view America as an island of stability in a chaotic world. But when US stocks start to fall it’s much easier to envision an interconnected world where everyone feels everyone else’s pain. Which is the accurate viewpoint, because who will buy our stuff — including the bonds that finance our deficits — if the other major economies grind to a halt? Junk bonds, typically a canary in the financial-bubble coal mine, began selling off in September, just as the dollar started to spike. This was also easy to ignore while equity prices were rising, but now looks like the first of many dominoes to fall in a financial panic. And it’s October! All of the above happening simultaneously would be scary anytime, but coming in the month when some of the most dramatic stock market crashes have for some reason occurred, this must feel like deja vu all over again for folks with a sense of financial history. It’s impossible, of course, know whether something is a crisis until it becomes one. So this might turn out to be nothing more than a hic-up in the permanent new normal of ever-rising financial asset prices. We’ll know soon enough. |

| Building an Ark: How to Protect Public Revenues from the Next Meltdown Posted: 13 Oct 2014 10:52 AM PDT

Concerns are growing that we are heading for another banking crisis, one that could be far worse than in 2008. But this time, there will be no government bailouts. Instead, per the Dodd-Frank Act, bankrupt banks will be confiscating (or “bailing in”) their customers' deposits. That includes local government deposits. The fact that public funds are secured with collateral may not protect them, as explained earlier here. Derivative claims now get paid first in a bank bankruptcy; and derivative losses could be huge, wiping out the collateral for other claims. In a September 24th article titled "5 U.S. Banks Each Have More Than 40 Trillion Dollars In Exposure To Derivatives, Michael Snyder warns:

The too-big-to-fail banks have collectively grown 37% larger since 2008. Five banks now account for 42% of all US loans, and six banks control 67% of all banking assets. Besides their reckless derivatives gambling, these monster-sized banks have earned our distrust by being caught in a litany of frauds. In an article in Forbes titled "Big Banks and Derivatives: Why Another Financial Crisis Is Inevitable," Steve Denning lists rigging municipal bond interest rates, LIBOR price-fixing, foreclosure abuses, money laundering, tax evasion, and misleading clients with worthless securities. Particularly harmful to local governments have been interest rate swaps misrepresented as protecting government agencies from higher rates. Yet as Michael Snyder observes:

Sidestepping the Steamroller California Governor Jerry Brown sees it coming. Rather than rebuilding the state's crumbling infrastructure, rehiring teachers and other public employees, and taking other steps to restore the Golden State to its former prosperity, he has proposed a constitutional amendment requiring all excess state revenues to go into a rainy day fund to prepare for the next crisis. But there is a better way forward. In North Dakota – the only state to post a budget surplus every year since 2001 – the state owns its own bank. When the state last went over-budget in 2001 due to the Dot.com crisis, it merely issued itself an extra dividend through the Bank of North Dakota – the only state-owned depository bank in the country – and the next year it was back on track. Other local governments would do well to follow suit, not just for the promising profit potential, but as protection against a "bail in" of public deposits. Forming their own banks can also protect local governments from a looming and unaffordable rise in municipal bond interest rates. State treasurers fear that the Fed's September 2014 exclusion of municipal bonds from the category of "high quality liquid assets" that big banks must hold will drive up bond rates, as it shrinks the market for those bonds and drives up the interest required to attract buyers. There is also the big money local governments lose to Wall Street just in fees. A 2013 study found that the city of Los Angeles spends over $200 million annually on big bank fees and management – more than its budget to maintain its extensive streets and highways.

In a recent press conference, Mayor Javier Gonzalez of Santa Fe raised provocative questions facing all elected officials today:

Addressing these concerns, Mayor Gonzalez has launched a formal process to study the feasibility of a city-owned bank of Santa Fe. Public banking efforts are also underway in other cities and states.

How to Start a Bank Overnight Forming a state or municipal public bank need not be slow or expensive. An online bank could be run out of the Treasurer's office and operational in a few months. And the bank could be turning a profit immediately – without spending the local government's own revenues. How? The way Wall Street does it with our public deposits and investments: by leveraging. We could reclaim those funds and put them to work for our local economies. The bank could be capitalized with a bond issue (borrowing from the public), and this capital could be leveraged into a loan portfolio that is about eight times the capital base. The bond issue could be financed with 1/8th of the interest accruing from this portfolio. The remaining 7/8th could be pocketed as profit. This profit could be earned immediately and without risk, by buying municipal bonds rather than issuing loans. That move could also help municipalities, by guaranteeing that their bond rates remain low in the face of threatened interest rate rises on the private market. How to Start a Bank at Virtually No Cost or Risk To demonstrate the safety and viability of the model, the bank can start small and build from there. For startup capital, a new bank needs anywhere from a few million to $20 million nationwide. (The amount varies from state to state.) To be cautious and conservative, however, let's say $40 million. Many cities have this money available in "rainy day" or reserve funds. Many others have substantial investments, often underperforming, that could be more responsibly invested as an equity position in a bank. In California, for example, a whopping $55 billion is languishing in the Treasurer's Pooled Money Investment Account, earning a mere 0.23% interest. Moving a portion of those funds into the state's own bank would just be good portfolio management. State pension funds are another investment option. If surplus funds are not available, capital can be raised with a bond issue. (That is how the Bank of North Dakota got its start in 1919.) Assume the interest due on these bonds is 3%. The local government's cost of funds will be $1.2 million annually. At a 10% capital requirement, $40 million is sufficient to capitalize $400 million in loans. But again assume the bank is started conservatively at a 20% capitalization, for a loan portfolio of $200 million. To make those loans, the bank will need deposits. These can be acquired without advertising or other costs, by moving $200 million out of the local government's existing deposit account at JPMorgan Chase or another Wall Street bank. (In North Dakota, all of the state's revenues are deposited by law in its state-owned bank.) Assume the new bank pays 0.3% interest on these deposits, or $0.6 million annually as its cost of funds. To satisfy the 10% reserve requirement for deposits (something different from the capital requirement), $20 million of this deposit pool would be held in reserve. The remaining $180 million are counted as "excess reserves," which can be used to make an equivalent sum in loans or bond purchases. Assume the excess reserves are used to buy local municipal bonds paying 3% annually. The return to the bank will be $5.4 million less $0.6 million in interest on the deposits, for a total of $4.8 million annually. To recoup the cost of the bond issue, $1.2 million can be paid from these profits as a dividend to the local government. The bank will then have a net profit of $3.6 million annually; and this profit will have accrued to the local government as the bank's owner, without needing to advance any money from its own budget. What if the state needs its deposits for its budget? That is the beauty of being a bank rather than a revolving fund: banks do not actually lend their deposits, as the Bank of England recently acknowledged. Rather, they create deposits when they make loans. If the state or local government needs more cash for its operating expenses than the bank has kept in reserve, the bank can do what all banks do: it can borrow. And if it has grown to be a large bank, it can borrow quickly and cheaply – from other banks through the Fed funds market at 0.25%, or from the money market at 0.15%. A smaller public bank might want to keep a larger cushion of deposits in reserve for liquidity purposes. If it keeps 30% in reserve, in the above example $140 million would be left to invest in bonds, generating $4.2 million annually in interest. Deducting $1.8 million as the cost of servicing deposits and capital, the bank would still generate $2.4 million in profit, while providing a safe place to park public revenues. What of the bank's operating costs? These can be kept quite low. The Bank of North Dakota operates without branches, tellers, ATMs, retail services, mega-salaries or mega-bonuses. All those saved costs fall to the bank's bottom line. Ballpark operating expenses for a small but growing public bank with a President, Chief Financial Officer, Chief Lending Officer, Chief Credit Risk Management Officer, Compliance Officer, and the systems required to support a banking function are estimated at under $1 million per year. A start-up focused on municipal bonds could be operated for even less. This expense could come out of the initial $40 million in capitalization, again without impairing the local government's own operating budget. Manifesting the Bank's Full Potential Once a charter has been obtained and sound banking practices have been demonstrated, the capital ratio can be dropped toward 10%. When the bank has built up a sufficient capital cushion, it can begin to work with community banks and other financial institutions for the broad range of commercial lending that creates jobs and prosperity and generates profits as non-tax revenue for the municipality, following the Bank of North Dakota model. The public bank can also invest in infrastructure loans to the state or local government itself. Interest now composes about half of capital outlays for public projects. Since the local government will own the bank, it will get this interest back, cutting infrastructure costs in half. These are just a few of the possibilities for a publicly-owned bank, which can provide security from risk while generating a far greater return on the local government's money than it is getting now on its Wall Street deposit accounts. As we peer into the jaws of another economic meltdown, moving our public funds into our own banks is an investment we can hardly afford not to make.

|

| Technical Trading: Gold Vulnerable To Near Term Backing And Filling Posted: 13 Oct 2014 10:20 AM PDT forbes |

| U.S. MINT RECORD SILVER EAGLE SALES: Best All Year Posted: 13 Oct 2014 09:30 AM PDT After the recent price smash in silver, investors purchased a record amount of Silver Eagles. In the past week, the U.S. Mint sold a great deal more Silver Eagles than it did during the same time period in every other month of the year. Not only are first week sales of Silver Eagles stronger than […] The post U.S. MINT RECORD SILVER EAGLE SALES: Best All Year appeared first on Silver Doctors. |

| Precious metals get a reprieve? Posted: 13 Oct 2014 09:17 AM PDT Gold closed last week below $1,200 for the first time but has since rebounded from support at $1,180. |

| Market update: U.S. stocks just did something they haven't done in two years Posted: 13 Oct 2014 08:31 AM PDT From Bloomberg: U.S. stocks fell, sending the Standard & Poor’s 500 Index below its 200-day (SPX) moving average for the first time in two years. Brent crude headed toward a four-year low, while the dollar dropped and gold climbed. The S&P 500 fell 0.7 percent to 1,893.62 at 10:42 a.m. in New York, after a rout that wiped $1.5 trillion from shares worldwide last week. The gauge slid below its average level for the past 200 days for the first time since November 2012. The Nasdaq 100 Index declined 1.1 percent. Brent crude tumbled 2.1 percent after sliding into a bear market last week. The dollar weakened against most of its 16 major counterparts. Gold gained 0.8 percent. Federal Reserve Vice Chairman Stanley Fischer said at the weekend that U.S. rate increases could be delayed by slowing growth elsewhere. Chicago Fed President Charles Evans is due to discuss economic conditions and monetary policy in Indianapolis today. China reported stronger-than-estimated trade data. “We’re right below the 200-day moving average,” Robert Pavlik, who helps oversee $4.5 billion as chief market strategist at Banyan Partners LLC in New York, said by phone. “I think a lot of people are focused on whether or not that’s going to hold. What the market is missing is economic reports that will support the markets and a substantial number of earnings reports.” The S&P 500 has fallen 5.8 percent from its Sept. 18 record as the Fed contemplates when to raise interest rates. The U.S. equity gauge retreated 3.1 percent last week, the most since 2012. The Chicago Board Options Exchange Volatility Index rose 13 percent on Friday. International Slowdown Fed officials said over the weekend that the threat from an international slowdown may lead to rate increases being delayed. The remarks highlighted mounting concern over the improving U.S. economy’s ability to withstand foreign weakness and a strengthening dollar. The International Monetary Fund cut its forecast for global growth last week and said the euro area faces the risk of a recession. The IMF also said that the chances of equity losses in 2014 have risen and stock valuations may be “frothy.” European Central Bank President Mario Draghi said last week that there are signs the euro-area’s economic growth is slowing and policy makers must lift inflation from an “excessively low” level. “Investors had seen the global growth scare as an excuse to sell the rally,” said James Butterfill, the London-based head of global equity strategy at Coutts & Co., a unit of Royal Bank of Scotland Group Plc. “This has all been a little bit overdone at this juncture. We see U.S. growth as becoming much more sustainable over the long term.” Earnings Season Investors are also watching earnings reports after Alcoa Inc. unofficially kicked off the U.S. results season last week. JPMorgan Chase & Co., Citigroup Inc., BlackRock Inc. and Google Inc. are among S&P 500 members posting earnings this week. Profit for companies in the index probably rose 4.8 percent and sales gained 4.2 percent in the third quarter, analysts projected. A gauge of mining shares climbed the most among 19 industry groups in the Stoxx 600 after data showed Chinese exports increased the most since since February 2013 last month. Synergy Health Plc (SYR) jumped 32 percent after Steris Corp., an Ohio-based maker of hospital sterilization products, agreed to buy it for about 1.2 billion pounds ($1.9 billion). Luxottica Group SpA (LUX) tumbled 8.9 percent after the world’s largest eyewear company’s chief executive officer quit following a dispute about appointments to the board. The dollar declined amid bets the Fed will keep interest rates lower for longer. The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 trading partners, dropped 0.5 percent after climbing 0.7 percent in the previous two trading sessions. The gauge hit a four-year high on Oct. 3. Dollar Drops The greenback declined 0.4 percent to 107.26 yen after touching 107.06, the weakest level since Sept. 16. The dollar slid 0.5 percent to $1.2692 per euro. The Securities Industry and Financial Markets Association recommends there be no trading in cash Treasuries today due to holidays in the U.S. and Japan. Brent crude oil for November settlement slid 2.1 percent to $88.32 a barrel, poised for the lowest close since November 2010. West Texas Intermediate crude for November delivery was at $84.51 a barrel, down 1.5 percent, after also tumbling into a bear market last week. Iraq, OPEC’s second-biggest producer, will sell its Basrah Light crude to Asia at the biggest discount since January 2009, the country’s State Oil Marketing Co., known as SOMO, said yesterday. Iran last week said it will sell oil to Asia in November at the biggest discount in almost six years, matching cuts by Saudi Arabia. Gold, Copper Gold for immediate delivery advanced as much as 1.2 percent to $1,237.86 an ounce in London trading, the highest price since Sept. 17, before trading at $1,230.90, up 0.8 percent. Silver gained 0.5 percent. Copper rose 1.5 percent to $6,802 a metric ton on the London Metal Exchange. Nickel gained 0.6 percent to $16,470 a ton. The MSCI Emerging Markets Index climbed 0.2 percent after touching a six-month low. The gauge has retreated 10 percent from this year’s Sept. 8 high, a level signaling a correction to some investors. The Hang Seng China Enterprises Index of mainland companies traded in Hong Kong declined 0.2 percent, paring earlier losses, and the Shanghai Composite Index slipped 0.4 percent even as data showed exports rose. China Exports China’s exports increased 15.3 percent in September from a year earlier, exceeding the 12 percent median estimate in a Bloomberg News survey of analysts. Imports also unexpectedly climbed, rising 7 percent, against projections for a 2 percent decline, leaving a trade surplus of $31 billion. Russian stocks rebounded from a two-month low, with the Micex index rallying 1.5 percent, as the government said it was pulling back forces from Ukraine’s borders. The ruble weakened 0.2 percent, after a fifth week of declines. Russia’s currency interventions exceeded $4 billion last week as falling oil prices exacerbated the ruble’s longest rout in seven months. |

| Real interest rates lead gold market Posted: 13 Oct 2014 08:29 AM PDT Many investors believe that the federal funds rate is adversely related to the gold price. However, it seems that real interest rates are more important than nominal ones. |

| Jim Willie: The Economic ENDGAME Has Arrived Posted: 13 Oct 2014 08:26 AM PDT

|

| BANKERS MANIPULATION OF GOLD & SILVER: Proof In The Demand Data Posted: 13 Oct 2014 08:00 AM PDT The Banking Cartel needs to keep investors away from buying gold and silver because they are the BLINKING RED LIGHT that indicates something is very wrong with the financial system. To keep the public and investor demand limited in gold and silver, the Banking Cartel is using price suppression tactics, including negative press via the financial […] The post BANKERS MANIPULATION OF GOLD & SILVER: Proof In The Demand Data appeared first on Silver Doctors. |

| Gold trades near four-week high Posted: 13 Oct 2014 07:46 AM PDT |

| Metals market update for October 13 Posted: 13 Oct 2014 07:45 AM PDT Gold and silver both remained unchanged on Friday at $1,223.70 and $17.35. Last week, gold and silver both climbed 2.7% and 3.2%, respectively. |

| Posted: 13 Oct 2014 07:29 AM PDT The demand for gold in India has peaked with the advent of festive season. |

| Precious Metals Monthly Bank Participation Report: October 2014 Posted: 13 Oct 2014 07:27 AM PDT The CFTC releases at the end of each month the futures positions in precious metals of the large banks. A detailed analysis was provided by Ed Steer in his latest newsletter (click here to subscribe). We want to share his analysis because Ed Steer comes to the following factual conclusion: once again, it’s Citigroup, HSBC USA, Scotiabank, along with the ring leader JPMorgan Chase, that run the show in all four precious metals. From Ed Steer's daily gold and silver newsletter: Along with the Commitment of Traders Report came the companion October Bank Participation Report. This report strips out the Comex long and short positions for all the banks on Planet Earth that hold positions in the Comex futures market. There were improvements in the Comex net short positions of all the world’s banks in all four precious metals, from big changes to small ones. Don’t forget that this BPR data is extracted directly from the current COT Report data, so for this one day a month we can compare apples to apples—and see what the bullion banks have been up to versus the rest of the traders. In gold, ‘3 or less’ U.S. banks were net short 2,633 Comex contracts. In the September BPR, these same ‘3 or less banks’ were net short 10,064 Comex contracts, so there has been an improvement of about 8,400 contracts during the reporting month. Since Ted puts JPMorgan’s long-side corner in the Comex gold market at 21,000 contracts, this means that the other ‘2 or less’ U.S. bullion banks—which would be HSBC USA and Citigroup—have to be net short about 18,400 Comex contracts between them to make the math work out properly. Also in gold, ’19 or more’ non-U.S. banks held 49,887 Comex contracts net short. In the September report, these same banks were short 60,925 Comex contracts. I would be prepared to bet a decent amount of money that Canada’s Scotiabank is short a third of those 60,925 contracts all by itself. That would make the remaining 40,000 contracts or so, divided up between the remaining 18 non-U.S. banks, are more or less immaterial. Below is the BPR chart for gold going back to 2000. Note the blow-out in the short position in gold in the U.S. banks [red bars on Charts 4 and 5] in August of 2008. This is when JPMorgan took over the Comex short positions of Bear Stearns. Also note the blow-out in gold in the non-U.S. banks [the blue bars on Chart #4] when Scotiabank got ‘outed’ in October of 2012. The net Comex short position there blew out by almost double. The net long position also increased. The ‘click to enlarge’ feature really helps here. In silver, ‘3 or less’ U.S. bullion banks were net short 9,867 Comex contracts. [In the September report, the same number of banks were short 15,953 Comex contracts] Since Ted pegs JPM’s short position in silver at 10,500 contracts, this means that the other U.S. banks must be net long the Comex futures market to the tune of 700 contracts or so. Obviously JPMorgan holds the largest silver short position of all the U.S. banks. Also in silver, ’11 or more’ non-U.S. banks are net short 19,585 Comex silver contracts. [In the September BPR these same banks were short 22,298 Comex silver contracts] Just like in gold, I’d bet money that the lion’s share of the non-U.S. banks’ short position in silver is held by Canada’s Scotiabank—approaching 90 percent, if not higher. It’s my opinion that their short position in the Comex silver market now dwarfs that of JPMorgan. It’s almost not worth mentioning, but the Comex short positions in silver held by the other 10 bullion banks are totally immaterial. Below is the BPR chart for silver and, once again, cast your eyes on the events of August 2008 on charts #4 and #5—and October 2012 in chart #4—to see where JPMorgan took over the silver short position once held by Bear Stearns—and where Canada’s Scotiabank was ‘outed’ by the CFTC. Both events stand out like the proverbial sore thumbs that they are. In platinum, ‘3 or less’ U.S. bullion banks are net short 6,196 Comex contracts, which is a huge decrease compared the prior three reports. Note on chart #5 the tiny long positions held by these U.S. banks, compared to their massive short positions. This is proof positive that these positions are held solely for price management purposes. I would bet that JPMorgan is the proud owner of the lion’s share of these positions as well. Also in platinum, ’14 or more’ non-U.S. banks are net short 4,453 Comex contracts, which is also a massive improvement from prior months. As a ‘for instance’ these same banks were short 8,880 Comex platinum contracts in the July BPR, which was the low before the last rally in gold and silver began. Divided up more or less equally, which they probably aren’t, most of the positions held by these 14 banks approach immaterial as well, at least compared to the outrageous short positions held by the U.S. bullion banks, principally JPMorgan Chase. In palladium, ‘3 or less’ U.S. bullion banks are net short 8,687 Comex contracts, which is down from the 10,643 contracts they were net short in September, but virtually the same as they were short back in the July BPR. So even though JPMorgan et al engineered the price down by about $150 during the reporting month, to its lowest level since mid April, that’s the best they could do. The non-technical traders on the long side in the Managed Money category flatly refused to puke up their positions, or go short by much. That situation holds true to a certain extent in platinum as well. Also in palladium, ’13 or more’ non-U.S. banks were net short 3,765 Comex contracts, which is down big from the 5,937 Comex contracts they held net short in September’s BPR. But it’s only a marginal improvement in their 4,694 short position they held back at the end of June. Try as they might, da boyz can’t get any traction in palladium—and that’s certainly obvious over the last 18 months in the chart below. And as an aside in Chart #5, look at the obscene short positions compared to their puny long positions held by the ‘3 or less’ U.S. banks. It’s so grotesque, one doesn’t know whether to laugh or cry. So, once again, it’s Citigroup, HSBC USA, Scotiabank—along with the ring leader JPMorgan Chase that run the show in all four precious metals. And it’s a good bet that they, at least the U.S. banks, have their little piggy noses in the copper, crude oil and dollar index troughs as well. Chart courtesy: Sharelynx. |

| 5 reasons gold hit most recent near-term bottom Posted: 13 Oct 2014 07:23 AM PDT Five reasons gold may have reached a near-term bottom at $1,180. |

| Indian gold import curbs to stay, advises former Finance Minister Posted: 13 Oct 2014 07:14 AM PDT India's former Finance Minister, P. Chidambaram, has advised not to lift gold import curbs earlier imposed by his government. |

| The US Ranks #36 in the World for Respecting Property Rights Posted: 13 Oct 2014 07:00 AM PDT Rather than floundering in its rubble in the aftermath of the Civil War, the United States became the wealthiest and most powerful country in the world in the fifty years that followed. Indeed, the latter part of the 19th century was an extraordinary time to be alive. Economic freedom abounded in the US. There was […] The post The US Ranks #36 in the World for Respecting Property Rights appeared first on Silver Doctors. |

| David Morgan's secret to being grateful, even at $17 silver Posted: 13 Oct 2014 06:44 AM PDT David Morgan tells The Gold Report why he is grateful for his balanced approach to investing and life. |

| Gold trades above $1200 on return of physical demand in India, China Posted: 13 Oct 2014 05:33 AM PDT In a weekly update, Barclays said that the bounce could be shortlived amidst not so favourable macro environment. On the other hand festival and wedding season in India could present short covering rallies and therefore an uptrend in gold. |

| U.S. and UK Test Big Bank Collapse - Risk Of Bail-ins Posted: 13 Oct 2014 05:03 AM PDT gold.ie |

| Gold price climbs as equity markets stumble Posted: 13 Oct 2014 05:02 AM PDT Spot gold was last above the all-important $1,230 level on Monday, up $7 on the pre-weekend close. |

| U.S. and UK Test Big Bank Collapse – Risk Of Bail-ins Posted: 13 Oct 2014 04:55 AM PDT It is now the case that in the event of bank failure, your deposits could be confiscated. Let’s be crystal clear: The EU, UK, the U.S., Canada, Australia and New Zealand all have plans for bail-ins in the event of banks and other large financial institutions getting into difficulty. Are your deposits safe?

Regulators from the U.S. and the UK will get together in a "war room" next week to see if they can cope with any possible fall-out when the next big bank topples over, the two countries said on Friday according to Reuters. Treasury Secretary Jack Lew and the UK’s Chancellor of the Exchequer, George Osborne, on Monday will run a joint exercise simulating how they would prop up a large bank with operations in both countries that has landed in trouble. Also taking part are Federal Reserve Chair Janet Yellen and Bank of England Governor Mark Carney, and the heads of a large number of other regulators, in a meeting hosted by the U.S. Federal Deposit Insurance Corporation. “We are going to make sure that we can handle an institution that previously would have been regarded as too big to fail. We’re confident that we now have choices that did not exist in the past,” Osborne said at the International Monetary Fund’s annual meeting. Six years after the financial crisis, politicians and regulators around the globe are keen to prove they have created rules that will allow them to let a large bank go under without spending billions in taxpayer dollars. They have forced banks to ramp up equity and debt capital buffers to protect taxpayers against losses, and have told them to write plans that lay out how they can go through ordinary bankruptcy. The plans are so-called living wills. Yet salvaging a bank with operations in several countries – which is the norm for most of the world’s largest banks such as Deutsche Bank, Citigroup Inc and JPMorgan – has proven to be a particularly thorny issue. Because the failure of a big bank is such a rare event, regulators may not be used to talking to each other. There have also been suspicions that supervisors would first look to save the domestic operations of a bank, and would worry less about units abroad. The exercise comes as regulators are about to bring to fruition further initiatives to make banking safer. The first would force banks to have more long-term bonds that investors know can lose their value during a crisis, on top of their equity capital, to double their so-called Total Loss-Absorbing Capacity (TLAC). A second measure, expected to be announced this weekend, will force through a change in derivative contracts, which in their current form protect investors, and complicate the winding down of a bank across borders. Gold in U.S. Dollars (Thomson Reuters) It is now the case that in the event of bank failure, your deposits could be confiscated. Are your deposits safe? Are you prepared for Bail-Ins? Special Report on Bail-ins Here GOLDCORE MARKET UPDATE Gold and silver both remained unchanged on Friday at $1,223.70 and $17.35. Last week, gold and silver both climbed 2.7% and 3.2%, respectively.

Gold jumped sharply in the early Asian trading Monday as a safe haven bid came into the market. Gold in Singapore rose as high as $1,235 an ounce prior to concentrated selling in London pushed prices lower again. At the open in London, gold climbed to $1,237.30 an ounce, near a 4 week high, prior to selling saw gold fall back to $1,225/oz. Last week gold bullion saw its largest weekly gain in 4 months as safe haven buying was seen due to concerns about the Eurozone and continuing ultra loose monetary policies. Poor economic data from Europe, slow growth in China and concerns about Ebola have prompted investors to sell equities. Asian stocks stumbled to seven-month lows on today while crude oil prices were pinned near a four-year trough. Stocks in Dubai fell 6.5% on Sunday, the biggest drop in four months to bring the Dubai Financial Market General Index to its lowest level since July 20. Most notably, Fed Vice Chairman Stanley Fischer said the effort to normalise radical U.S. monetary policy after years of extraordinary stimulus may be hampered by the global outlook. Today, Japanese markets are closed and the U.S. and Canada will be partially, or fully, shut for holidays as well. Singapore launched physically-settled kilobar gold trading today or contracts for 25kg or 804 ounces each. Singapore has stated its intent to become an Asian gold hub with a goal of setting a regional benchmark price. The contract which expires tomorrow was priced at $39.685/gram at close of trade. The contracts trade at 830-1130 am Singapore time. RECEIVE GOLDCORE'S AWARD WINNING RESEARCH HERE |

| Gold: ‘near-term outlook uncertain…long-term prospects glorious’ Posted: 13 Oct 2014 04:43 AM PDT Precious Metals analyst, Jeff Nichols, reaffirms his strongly bullish predictions for gold in the medium to long term. |

| BO POLNY: Triple Bottom a Prelude to Runaway Gold & Silver Bull Markets Posted: 13 Oct 2014 04:15 AM PDT silverdoctors |

| Village Main approached with acquisition offers Posted: 13 Oct 2014 02:27 AM PDT The South African gold miner is considering selling its assets after receiving approaches by third parties it didn't identify. |

| Gold rises to $1230, Silver to $17.69: Monex Precious Metals Review Posted: 13 Oct 2014 02:11 AM PDT Monex spot gold prices opened the week at $1,196 . . . traded as high as $1,230 on Thursday and as low as $1,196 on Monday . . . and the Monex AM settlement price on Friday was $1,222, up $26 for the week. |

| Must Read: 10 Companies Adrian Day Sees as Stable in a World that Is Not Posted: 13 Oct 2014 01:00 AM PDT |

| US Dollar Technical Analysis: Selloff Finds Interim Support Posted: 13 Oct 2014 12:00 AM PDT dailyfx |

| Gold (XAU/USD) – Is this a Bullish Channel or Flag Pattern? Posted: 12 Oct 2014 11:50 PM PDT forexminute |

| Gold Extends Recovery, SPX 500 Dips Sub-1900 After Breaking Uptrend Posted: 12 Oct 2014 11:45 PM PDT forextv |

| Gold the Commodity or Gold the Currency? Posted: 12 Oct 2014 11:35 PM PDT dailyfx |

| Gold Finds Bids On Diversification Demand Posted: 12 Oct 2014 11:30 PM PDT dailyfx |

| Glossary of Terms in Precious Metals Posted: 12 Oct 2014 09:30 PM PDT CMI Gold and Silver |

| Is the bull run for the US dollar now over? Posted: 12 Oct 2014 08:50 PM PDT Is the recent bull run for the US dollar finally over? Is all the good news for the dollar now in the exchange rate? The picture is by no means clear. ADS Securities’ Mathieu Ghanem discusses the outlook for the global economy and currencies with Bloomberg’s Rishaad Salamat on ‘On The Move Asia’… |

| Jim Willie: The Economic ENDGAME Has Arrived Posted: 12 Oct 2014 06:00 PM PDT In this MUST LISTEN interview with Finance & Liberty’s Elijah Johnson, Hat Trick Letter editor Jim Willie explains why gold & silver futures prices were smashed over the past 2 weeks, advising that the Economic ENDGAME HAS ARRIVED, and systemic failure is DEAD AHEAD. Willie breaks down the logical conclusion to the rejection of the […] The post Jim Willie: The Economic ENDGAME Has Arrived appeared first on Silver Doctors. |

| The Implementation of the Coming Totalitarian Regime Will Rival the Third Reich Posted: 12 Oct 2014 02:30 PM PDT There is a collapse coming – it's just a matter of time. But have fun and don't worry about what you can't prevent. And get ready accept the implementation of a totalitarian regime that rivals that of the Third Reich. Submitted by PM Fund Manager Dave Kranzler, Investment Research Dynamics: When I spoke with […] The post The Implementation of the Coming Totalitarian Regime Will Rival the Third Reich appeared first on Silver Doctors. |

| Posted: 12 Oct 2014 02:18 PM PDT Patient Zero is now Patient Zero + 1. Dallas County Judge Clay Jenkins, Mayor Mike Rawlings and Dr. Daniel Varga held a news conference Sunday, informing the public that a Texas Health Presbyterian Hospital hospital worker has tested positive for the Ebola virus after coming in close contact with Ebola patient Thomas Eric Duncan- despite the […] The post *Breaking: Dallas Hospital Worker Tests Positive For Ebola After Fully Protected Contact With Ebola Pt appeared first on Silver Doctors. |

| Bull Riders – The Doc, Turd Ferguson, Claudio Grass, & Andy Hoffman Break Down the PM Markets Posted: 12 Oct 2014 02:15 PM PDT Internet Rodeo: Bull riders Turd Ferguson, The Doc, Claudio Grass, & Andy Hoffman stopped by for a round table interview, discussing the Switzerland Gold Initiative, direct democracy, & what's happening right now in both the equities and precious metals markets. Sit back, relax and enjoy the conversation. The post Bull Riders – The Doc, Turd Ferguson, Claudio Grass, & Andy Hoffman Break Down the PM Markets appeared first on Silver Doctors. |

| CHINA sees rapid growth in gold leasing Posted: 12 Oct 2014 02:00 PM PDT wantchinatimes |

| Alasdair Macleod’s Market Report: Market Turbulence Posted: 12 Oct 2014 10:00 AM PDT In the US, while much is made of an improving jobs scene, the fact remains that in relation to the size of the workforce there is a greater percentage of working-age people not employed since the 50's era of the male dominated workplace. This is creating a two-way pull for gold and silver. Declining commodity […] The post Alasdair Macleod’s Market Report: Market Turbulence appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment