Gold World News Flash |

- Miles Franklin Q & A: Silver’s Price In 1980 vs. Today’s Price

- The Gold Price Lost $4.90 Today Closing at $1,224.30

- Debt must be inflated away or repudiated, Steer tells Sprott Money News

- Fireworks Fly As Peter Schiff Warns "An Economy That Lives By QE, Dies By QE"

- Markets will start testing Fed to see if QE is really over, former Fed aide tells KWN

- Hugo Salinas Price: The fall in international reserve assets

- Peak Empire 2.0

- The Fed's "Other" Taper: Printing Of New $100 Bills Tumbles By 85% In 2014

- Modern Monetary Theory (MMT): How Fiat Money Works

- Gold Daily and Silver Weekly Charts - FOMC and the Usual Shenanigans

- QE Finished, Gold Fans Clearly Crackpots

- Don't Get Bullish on Gold Below $1350

- Now, About That October 2014 S&P Crash

- Why Lower Gas Prices Are NOT “Bullish Indicators”

- Flock of Black Swans Points to Imminent Stock Market Crash

- Gerald Celente - Goldseek Radio - October 27, 2014

- Risk Management - Why I Run “Ultimate Trailing Stops†on All My Investments

- Gold and Silver Junior Miners Buying Opportunity Comes Once Every Six Years

- Axel Merk: Greenspan admitted that Fed is not politically independent

- Debt must be inflated away or repudiated, Steer tells Sprott Money News

- Russia buys most gold for reserves since financial crisis of 1998

- Why You Need to Pay Attention to the Swiss Gold Initiative

- If You Want To Know How Wild Things Can Get - Look At This

- MineWeb's Lawrence Williams: Large supply deficit in gold is likely ahead

- Greenspan: Gold Price Will Rise

- Mysterious Death od CEO Who Went Against the Petrodollar

- Government Gold-Plating

- Bob Moriarty: Flock of Black Swans Points to Imminent Stock Market Crash

- Fast, Furious, and Prone to Failure

- Greenspan: Price of Gold Will Rise

| Miles Franklin Q & A: Silver’s Price In 1980 vs. Today’s Price Posted: 29 Oct 2014 08:40 PM PDT from Miles Franklin:

| ||||||||||||||||||||||||||||||||

| The Gold Price Lost $4.90 Today Closing at $1,224.30 Posted: 29 Oct 2014 08:28 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||

| Debt must be inflated away or repudiated, Steer tells Sprott Money News Posted: 29 Oct 2014 08:00 PM PDT by Chris Powell, GATA:

Dear Friend of GATA and Gold: The world economy is declining under the burden of too much debt and only inflating it away or repudiating it will change anything, financial letter writer and GATA board member Ed Steer tells the Sprott Money News weekly wrapup with Jeff Rutherford. Steer adds that the futures markets in New York are suppressing commodity prices and distorting all prices. The interview is six minutes long and can be heard at the Sprott Money News Internet site here: | ||||||||||||||||||||||||||||||||

| Fireworks Fly As Peter Schiff Warns "An Economy That Lives By QE, Dies By QE" Posted: 29 Oct 2014 07:15 PM PDT Ahead of tomorrow's decision by the FOMC, Peter Schiff ventured on to CNBC to discuss the economy, the fed, and gold... among other things. Schiff rightly fears that while the Fed may well stop QE3 tomorrow, QE4 will not be too long behind it as he notes, rather eloquently, that "an economy that lives by QE, will die by QE" as the Fed's total lack of willingness to allow stocks to fall (see Bullard 2 weeks ago) or a 'cleansing' recession leaves the nation's economy in far worse shape than it was before the Fed's intervention. Schiff calmly replies to the anchor's questions (as she proclaims "I am not on the side of the Fed but..."), gently explains his view on gold when challenged about his 'wrongness', but when a guest starts hounding him for being dangerous to CNBC viewers wealth... Schiff (rightly) loses it - must watch!

A well reasoned discussion of the Fed's manipulation of markets and mal-investment hangovers is well worth the price of admission... but at around 6:35 when Scott Nations unleashes his tirade on Schiff, the fireworks start to fly... and Schiff (while being shouted over) reminds guests, anchors, and viewers alike "Go to YouTube, I am wrong a lot less often than most people on this program... and all you do is hassle me" that he was among the very few appearing on CNBC before the crash who foresaw it and the cataclysmic shift that has occurred (no matter what the perception of short-term memory traders)..."Think of all the bulls you paraded out here when Nasdaq was 5,000" Absolute must watch... We can't help but feel the timing of this tirade against Schiff is spookily prophetic and will be in its own YouTube class in a few years... * * * Ironically, here is Scott Nations in 2008 getting "Schiff'd" by the CNBC anchors (Liesman) and some other guest muppet when he dares to suggest the Fed is intervening and that the President's Working Group (i.e. Plunge Protection Team) is hard at work... "look at the market action on the 10th and 28th and tell me what else might have generated a 100 point rally in the S&P under that situation?" Liesman fobs him off as some conspiracy wonk... Yep looks normal to us... 10/10/2008

and 10/28/2008

Those are 100 point moves on a 700/800 S&P!! Nothing to see here eh Liesman, Kiernan, Quick? | ||||||||||||||||||||||||||||||||

| Markets will start testing Fed to see if QE is really over, former Fed aide tells KWN Posted: 29 Oct 2014 06:19 PM PDT 9:15p ET Wednesday, October 29, 2014 Dear Friend of GATA and Gold: Former Federal Reserve official Andrew Huzsar tells King World News tonight that the markets are likely to start testing the Fed's commitment to end the bond monetization of "quantitative easing." "I see a tug of war between the Fed and the market," Huszar says, "because the Fed ultimately does want to disengage from being so active in key markets. Today the Fed used language that implied that they may raise interest rates sooner. I strongly believe that the market will effectively push back against the Fed and this will create bouts of enormous volatility." An excerpt from Huszar's interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/29_M... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sinclair's Next Market Seminar Is Nov. 15 in San Francisco Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar from 10 a.m. to 3 p.m. on Saturday, November 15, at the Holiday Inn at San Francisco International Airport in South San Francisco, California. Admission will be $100. For more information and to register, please visit: http://www.jsmineset.com/2014/10/10/san-francisco-qa-session-announced/ Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Hugo Salinas Price: The fall in international reserve assets Posted: 29 Oct 2014 06:07 PM PDT 9p ET Wednesday, October 29, 2014 Dear Friend of GATA and Gold: Hugo Salinas Price, president of the Mexican Civic Association for Silver, writes tonight that the international reserve assets of central banks, having long increased steadily, have been declining in recent weeks, apparently for the first time in 18 years. He's looking for explanations. His commentary is headlined "The Fall in International Reserve Assets" and it's posted at the association's Internet site, Plata.com, here: http://www.plata.com.mx/mplata/articulos/articlesFilt.asp?fiidarticulo=2... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Posted: 29 Oct 2014 05:43 PM PDT Originally posted at Club Orlov blog, Based on the lessons of history, all empires collapse eventually; thus, the probability that the US empire will collapse can be set at 100% with a great deal of confidence. The question is, When? (Everyone keeps asking that annoying question.)

Of course, all you have to do is leave the US, go some place that isn't plugged into the US economy in non-optional ways, and you won’t have to worry about this question too much. Some people have made guesses but, as far as I can tell, no one has come up with viable methodology for calculating the date. In order to provide a remedy for this serious shortcoming in collapse theory, I once tried to outline a method for figuring it out in an article titled “Peak Empire,” which was based on Joseph Tainter’s theory of diminishing returns on complexity—or diminishing returns on empire. It’s a perfect problem for differential calculus, and all those microeconomics students who are busy calculating marginal cost vs. marginal revenue, so that they can look for work in the soon-to-be-defunct shale gas industry, might take it up, to put their math talents to better use. In the meantime, here is an update, and a revised estimate. US Empire of BasesJust to review, as the brilliant analyst Chalmers Johnson explained, the US is an “empire of bases,” not an empire of colonies. It is not considered politically correct to annex other countries anymore. Witness the reaction to Russia taking back Crimea, even though its population has a right to self-determination, and voted 98% in favor of the idea. But, had things turned out differently, putting a NATO base in Crimea would have been just fine. Still, there are quite a few US “territories” (read “colonies”) listed in the Pentagon Base Structure report, including American Samoa, Guam, Johnston Atoll, Marshall Islands, Northern Mariana Islands, Puerto Rico, US Virgin Islands and Wake Islands. We should probably include Hawaii, since in 1993 the US Congress “apologized” to Hawaii for kidnapping the Queen and illegally annexing the territory. They are not giving it back, mind you, but they don't mind saying we’re sorry, because they stole it fair and square. The same could be said for Texas, California—the whole bloody continent for that matter. But they don’t do that sort of thing any more—not too much. Sure, the US stole Kosovo from Serbia just to set up a huge NATO base there, but in general there has been a shift to controlling other countries through economic institutions—like the IMF, the WTO, and the World Bank. There has also been plenty of political subterfuge, assassinations and coups d’états, as explained by John Perkins in Confessions of an Economics Hit Man, or in Michael Hudson’s work. William Blum writes: “Since the end of the Second World War, the United States of America has…

Only a few of these actions—such as Iran in 1953, Guatemala in 1954, Nicaragua in the 1980’s, Ukraine 2014, etc.—are well known in the US. Now here is the key point: all of this “democracy-building” requires the US to have plenty of foreign military bases. Much of the military is outsourced, so there is no need for consent of the governed any more—just their tax money. Marching in the streets in protest is a complete waste of time. Millions of people marched against the Iraq War in 2003. Did it make any difference? Secretary of State Alexander Haig remarked during a peace march in the 1980’s: “Let them protest all they want as long as they pay their taxes”; Kissinger explained that “Soldiers are dumb, stupid animals for the conduct of foreign policy”; and CIA director William Casey made sure the US public remains completely in the dark with his famous dictum, “We'll know our disinformation program is complete when everything the American public believes is false.” (This is from his first staff meeting in 1981; it’s not a secret.) The US is completely open about its desire to subjugate the entire world—if this weren't already obvious from its behavior. Pentagon Base Structure ReportAnd so, maintaining US hegemony requires an empire of bases. How many bases? Every year the Pentagon publishes a “Base Structure Report,” which lists all the property of the military including land, buildings and other infrastructure. The latest Pentagon Base Structure report lists 4169 domestic military bases, 110 in US territories, and 576 in foreign countries, for a total of 4855. But it turns out to leave out a lot: Nick Turse of TomDispatch calculated that in 2011 the number of foreign military bases was closer to 1075. But even though a lot is left out of the Pentagon report, it is still a good data source for us to use because, for the purpose of calculating our estimate, all we are interested in is trends, not absolute numbers. Trends require that data from year to year be reported consistently, and the Pentagon appears to be very consistent in what it reports and what it keeps secret from one year to the next. So this is a very good source by which to measure trends. Since the US public is completely in the dark, zombified and terrified by the mass media and traumatized by psy-ops like 9/11, the empire will have to collapse on its own, without their help. I’m sorry to say this, but the American sheeple are not going to rise up and help it collapse. But when will it collapse on its own? Do we all want to know when? Ok, here goes... Peak EmpireTotal US Military acreage peaked in 2007 at 32,408,262 acres, and has been declining ever since, including a precipitous drop in 2014. This curve of military acreage follows peak oil and peak empire theory generally quite well. I haven’t done the curve-fitting exercise, but it looks a bit like a Hubbert curve from peak oil theory. The important point is, according to total acreage the US empire has already peaked and is in decline. Note that global conventional crude oil production peaked at around the same time; you may consider that a pure coincidence if you wish.

Looking at the data from 2003-2014, we see shows a bit more detail, including a sharp downturn in 2014. The drop in total bases in 2006 and 2007 seems like a bit of an anomaly, but the trend in acreage follows the peak theory. What is even more noteworthy is the decline in foreign military bases and acreage. The US may still have control of its domestic and territorial bases, but it has suffered huge losses of foreign military bases and acreage. Since reaching “peak foreign military bases” in 2004, the US now has just 64% of them—a loss of over a third in a decade! In the case of acreage the US retains 69% of its peak acreage in 2006, so it has lost 31% of its foreign military acreage—also close to a third. If you want to guess at what's behind these numbers, you might want to look at them as the fallout from disastrous US foreign policy, as described by Dmitry in his article, “How to start a war and lose an empire.” Perhaps the people to whom we are bringing “freedom and democracy” are getting sick of being occupied and murdered? But, whatever the explanation, the trend is unmistakable. But we still haven’t addressed Tainter's central thesis of diminishing returns on empire. Ok, let's do that next next.

I previously showed military acreage divided by military spending declining since 1991 in constant 2008 dollars. Bringing this up to date in constant 2014 dollars, we see that return on spending leveled off in 2010, but in 2014 the trend of decreasing returns on spending has resumed.

At the same time, US Government debt, which fuels much of this military spending, continues to climb at a steady rate, and the military acreage/debt ratio shows negative returns on debt. That is, the empire is getting negative returns in military acreage from increasing its debt burden. In their prime, empires are massively profitable ventures. But when the returns on government spending, debt and military spending all turn negative—that is when we enter the realm of diminishing returns on empire—that, according to Tainter's theory, sets them on a trajectory that leads directly to collapse. The collapse does not have to be precipitous. It could be gradual, theoretically. But the US economy is fragile: it depends on international finance to continue rolling over existing debt while taking on ever more debt. This amounts to depending on the kindness of strangers—who aren't in a particularly kind mood. To wit: numerous countries, with Russia, China, India, Brazil and South Africa leading the way, are entering into bilateral currency agreements to avoid using the US dollar and, in so doing, to avoid having to pay tribute to the US. Just like Rome, the US empire is being attacked all over the world by “barbarians,” except the modern barbarians are armed with internet servers, laptops and smartphones. And just like Rome, the empire is busy spending billions on defending its fringes while allowing everything on the home front to fall apart from malign neglect. Meanwhile, the US has been struggling to avoid a financial panic through lies and distortions. The US Federal Reserve has been printing $1 trillion a year just to keep US banks solvent, while selling naked shorts on gold in order to suppress the price of gold and to protect the value of the US dollar by (see Paul Craig Roberts for evidence). In truth, US employment has not recovered since the financial panic and crash of 2008, and wages have actually gone down since then, but the US government publishes bogus economic data to cover this up (See John Williams' Shadow Stats for details). Meanwhile, there are signs that the militarized police state is getting ready to face open rebellion. Two paths downAs we have shown, return on investment in empire has turned negative: the empire has to go further and further into debt just to continue shrinking its foreign presence by a third from its peak every decade. There are two ways out of this situation: quick and painful, or slow and even more painful.

But a moment may arrive well before empire is all gone when the suspension of disbelief that is required to keep US government finances from cratering ceases to be achievable—regardless of the level of propaganda, market distortion, or US officials smiling, waving and lying in front of television cameras. Thus, we have two estimates. The first estimate is objective and based on US government's own data: two decades or less. But we also have room for an estimate that is subjective yet bracketed: anywhere between later today and two decades (or less) from now. Based on these estimates, you can be as objective or subjective as you like, but if you are “long empire,” holding dollar-denominated assets and such, and if your horizon extends beyond 2034 (or less), then there is a reasonably high likelihood that you are just being silly. Likewise, if you think that NATO will come to your defense more than a decade from now, you should start reconsidering your security arrangements now, because NATO will cease to be functional on the same time scale as the US empire. Some time ago Pres. Obama issued what for him sounded like a pretty good order: “Don't do stupid stuff.” You should probably try to follow this order too, and I am here to try to help you do so. | ||||||||||||||||||||||||||||||||

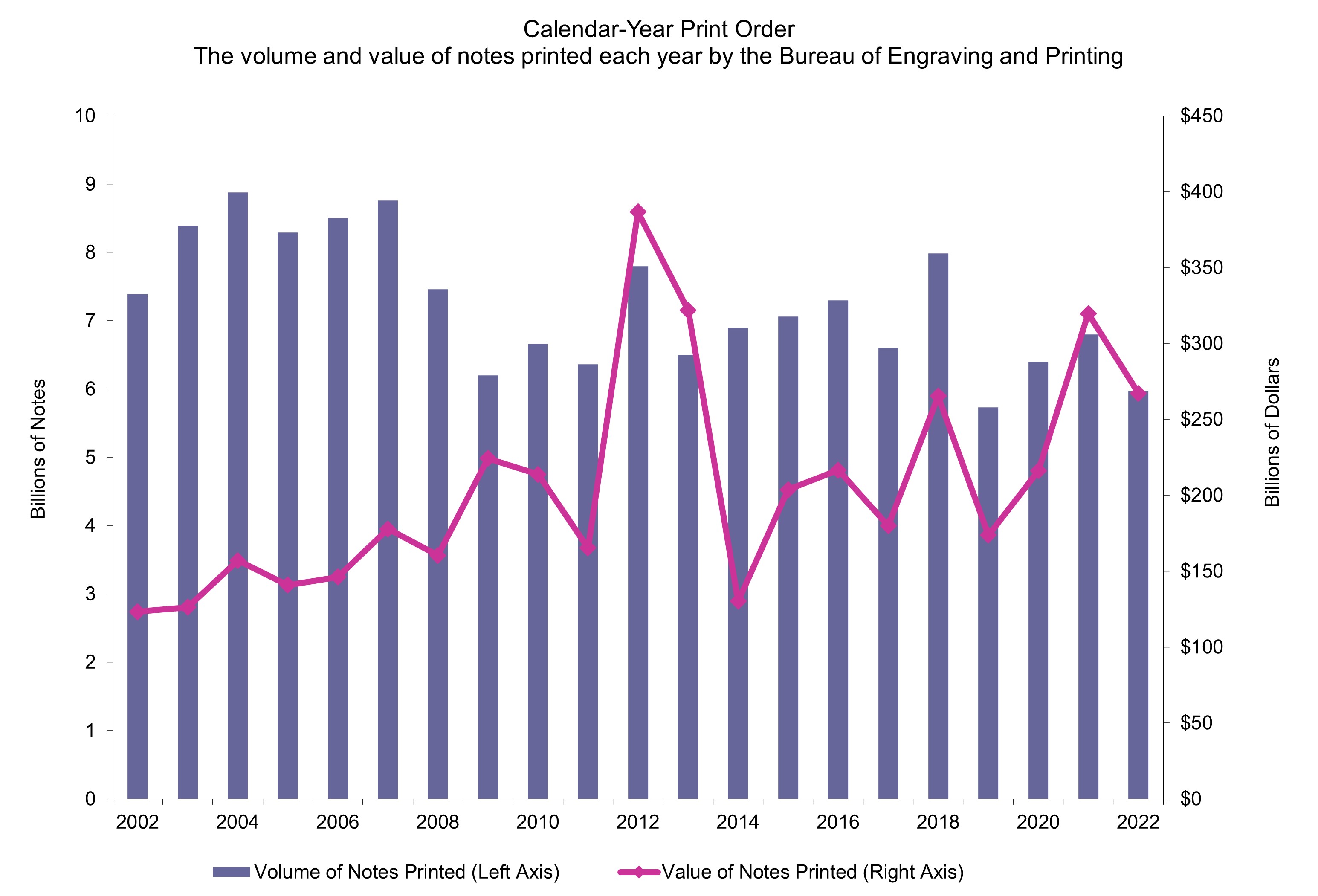

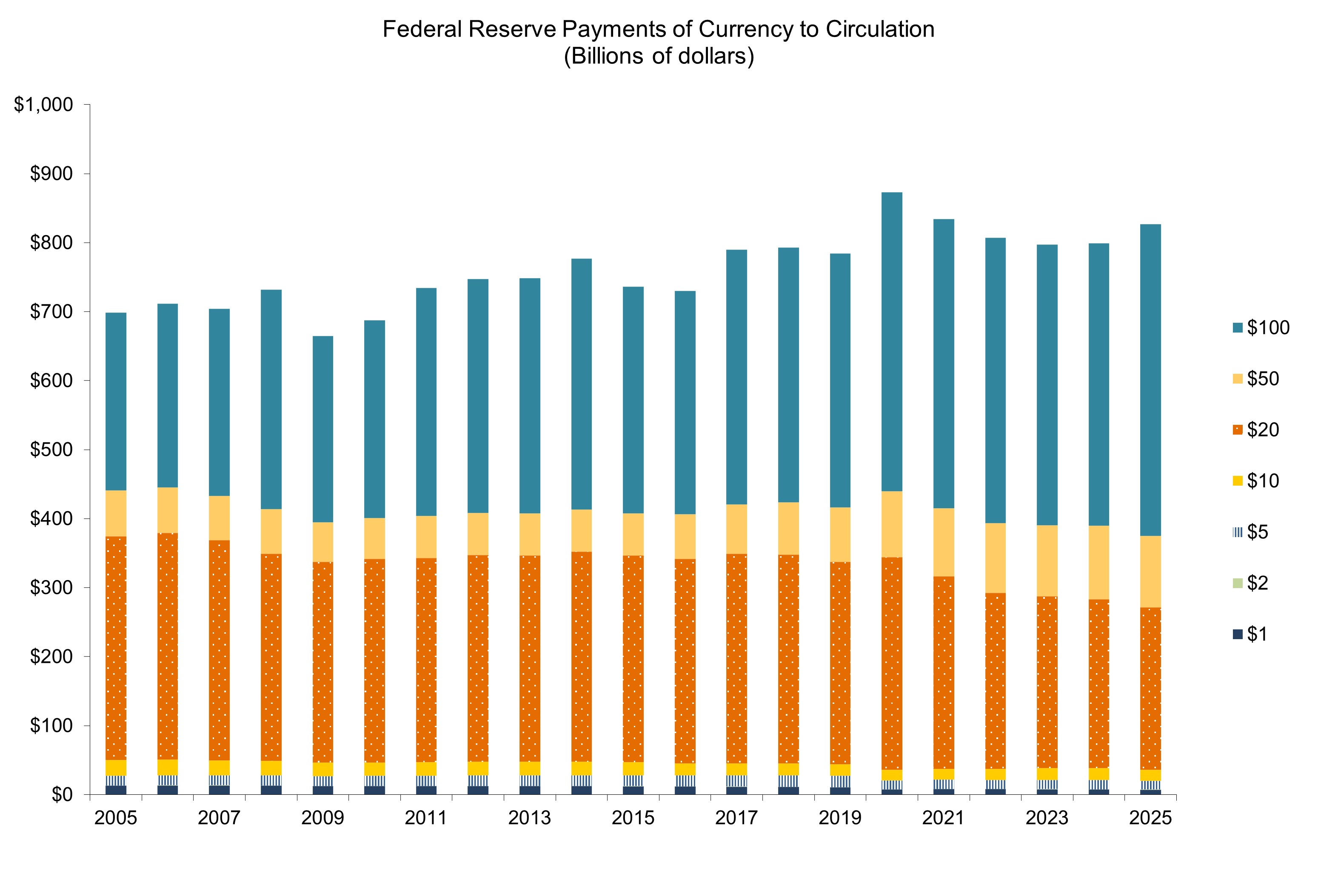

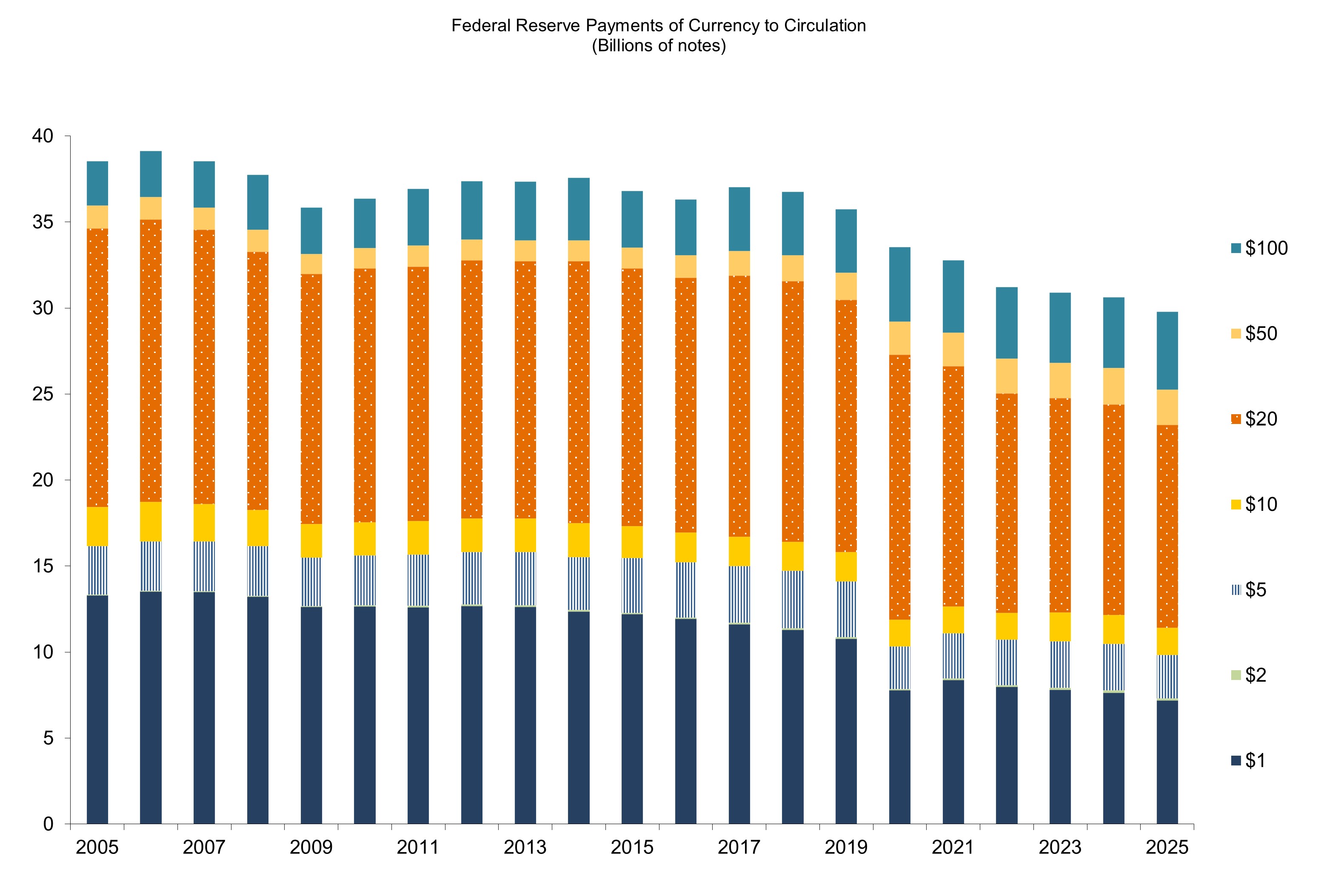

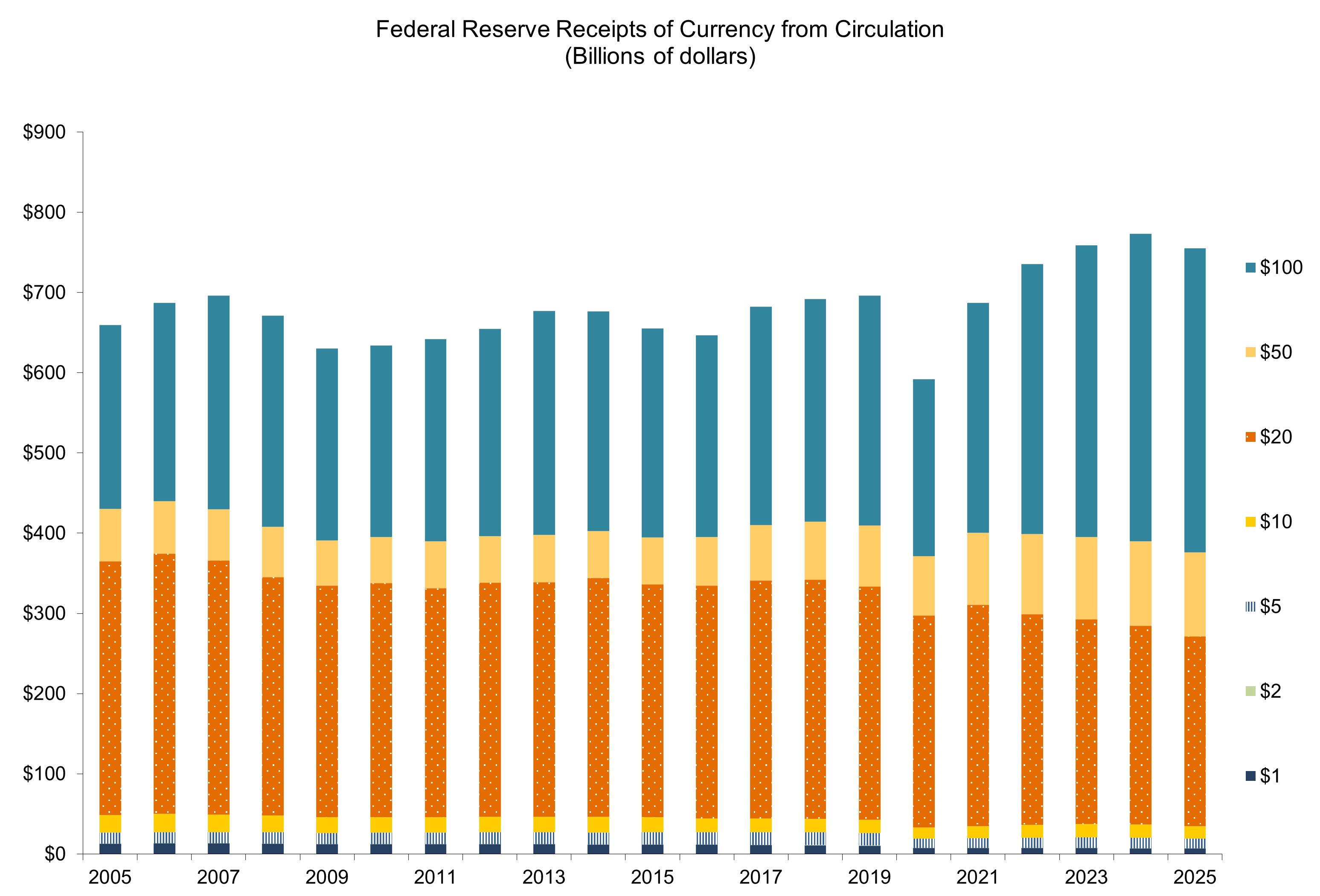

| The Fed's "Other" Taper: Printing Of New $100 Bills Tumbles By 85% In 2014 Posted: 29 Oct 2014 04:49 PM PDT When we last looked at the amount of $100 bills printed by the Treasury's Bureau of Engraving and Printing, we were a little concerned because it appeared that the Fed's infatuation with growing bank reserves had finally spilled over into the physical money printing arena, after a record 4.4 billion $100 bills were printed just a year after the Treasury had, at the Fed's request, printed another 3 billion of the new banknotes. In retrospect this wasn't a case of the Fed wishing to unleash Weimar upon the US - at least not yet - but merely part of the ongoing process of replacing old $100 bills with the new "plastic" ones. This amounted to over $750 billion in new $100 bills alone being unleashed on the market, well over half of the entire amount of US paper currency in circulation. Whatever the reason for the surge, it now appears that the Fed's wanton money printing hit a brick wall in 2014, and together with the transitory end of QE earlier today, the Treasury's literal printing of money also tumbled, with just 650 million of the brand new banknotes issued, an 85% plunge from the year before. In fact, the number of $100 bills printed in 2014 was the lowest amount of this higher denomination unleashed into broad circulation since 2004!

Curiously, it is also over 70% less than what the 2.4 billion $100 notes the Fed has originally ordered from the Treasury. Alas, those seeing in this data a reason for the plunge in money velocity will have to look elsewhere (well, maybe). Here, according to the Fed, is the reason for the drop in the highest denomination US currency:

Sounds like yet another velocity of money problem to us, and this one is quite literal. Oddly enough, the Fed has no problem accomodating "surplus inventory" when there is clearly too much supply of paper currency and yet when it comes to electronic currency, i.e., Fed reserves it will fill banks to the gill with reserves for which there is also no demand, and so banks have no choice but to buy stocks with the electronic money presented them by the Fed. Philosophical issues aside, while the $100 bill may have hid a tranistory stumbling block in its clearance rollout, be it due to excess supply or insufficient demand, the fate of the paper that carries the face of the first American president is becoming clearer with every passing year: at this rate, the US may still have pennies in circulation but it sure won't have dollar bills for much longer.

2014 being a bad year for paper currency aside, here is the full recent history of money print orders by the Fed:

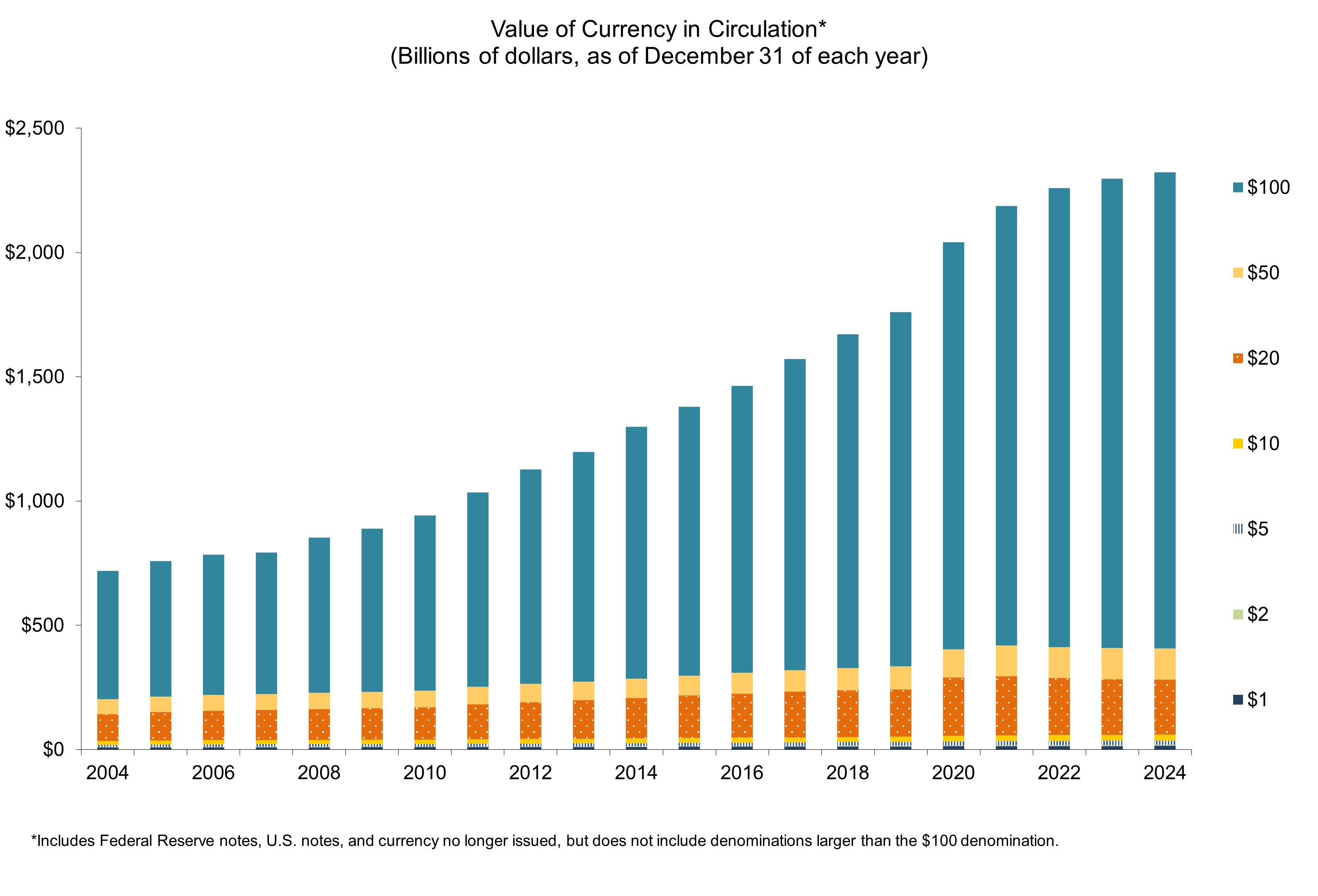

And while everyone is an expert these days on the Fed's creation of electronic money, here is the full history of US paper money over the past 20 years: Currency in Circulation: Value

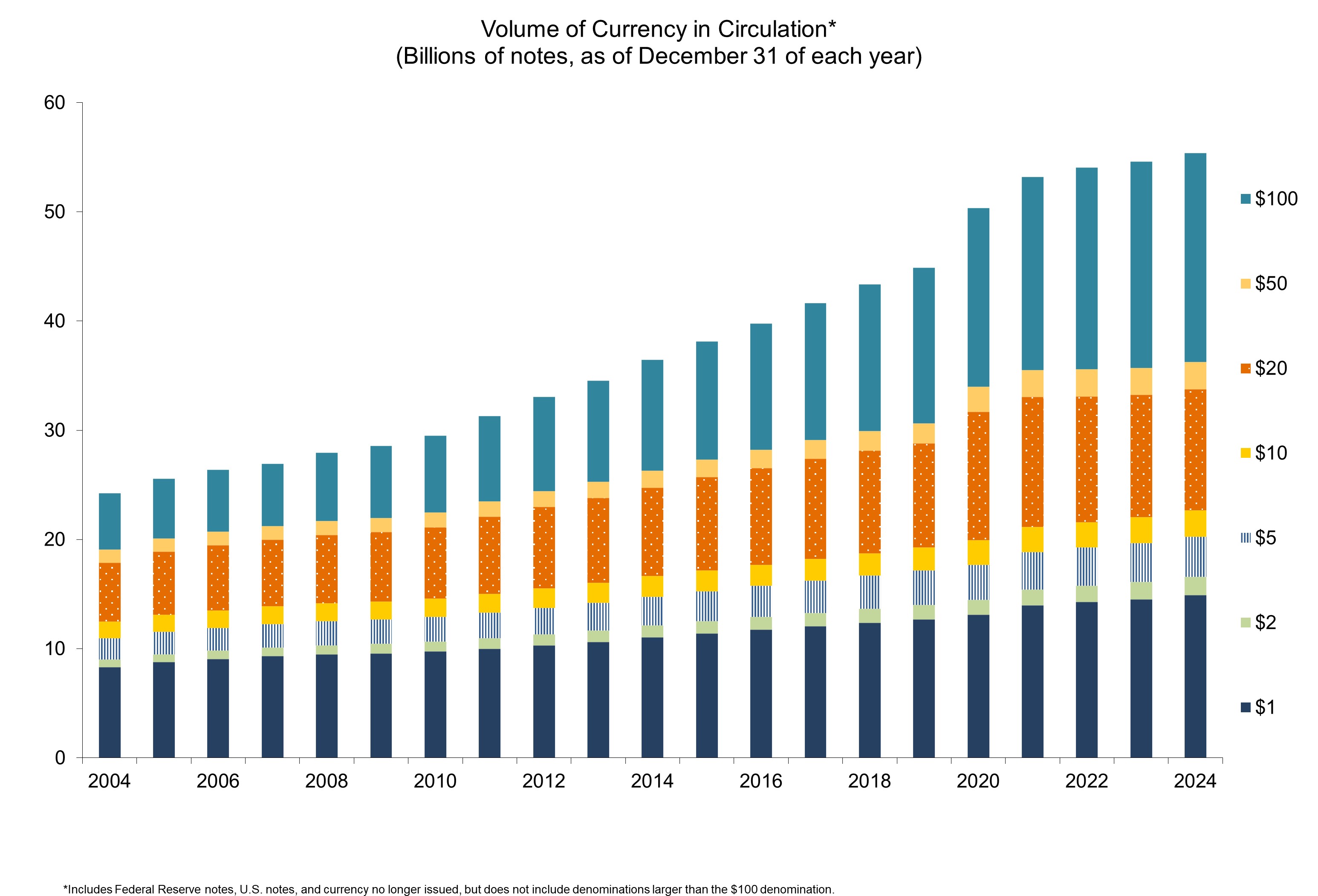

Currency in Circulation: Volume

Calendar-Year Print Order: Volume and Value

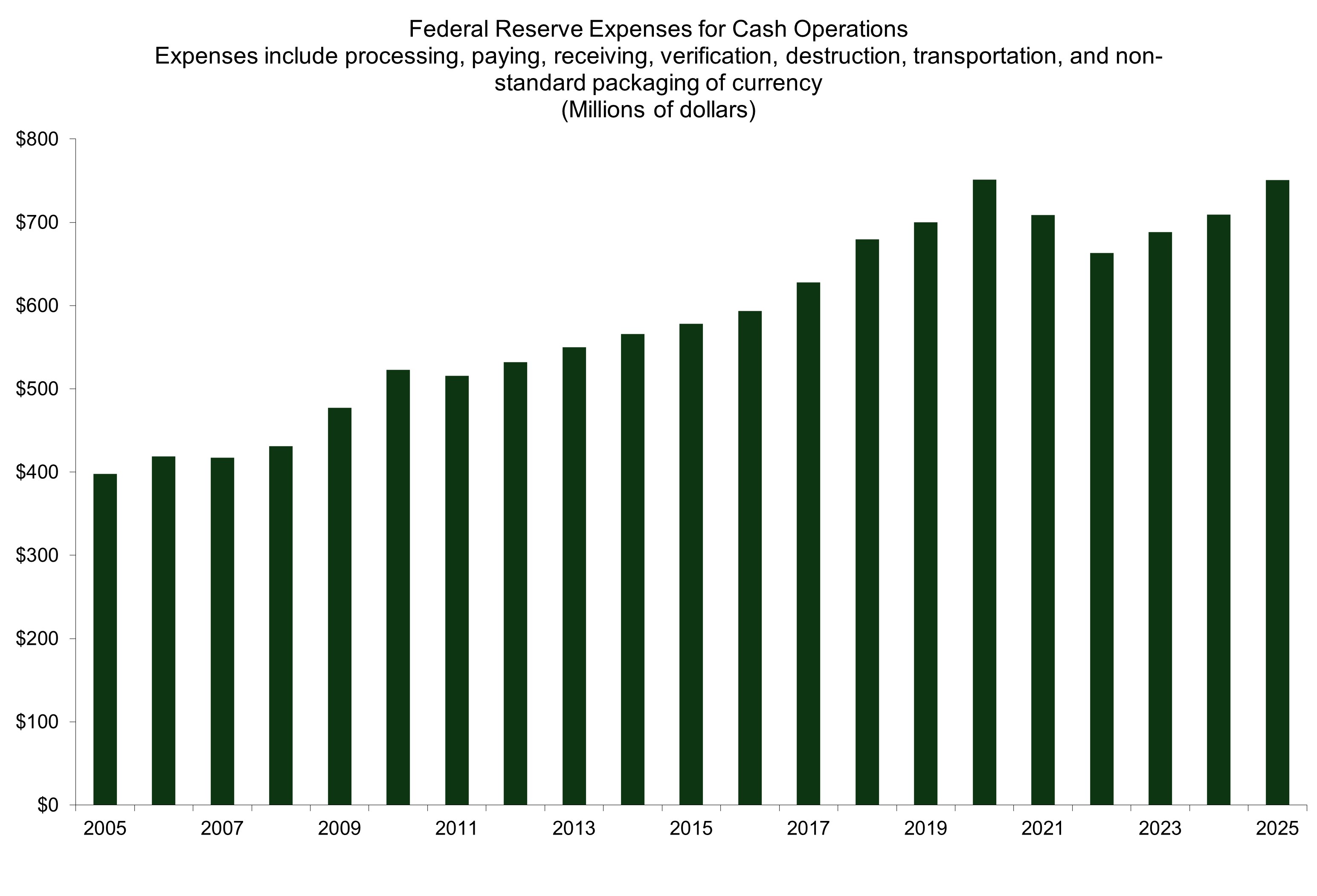

Federal Reserve Expenses for Cash Operations

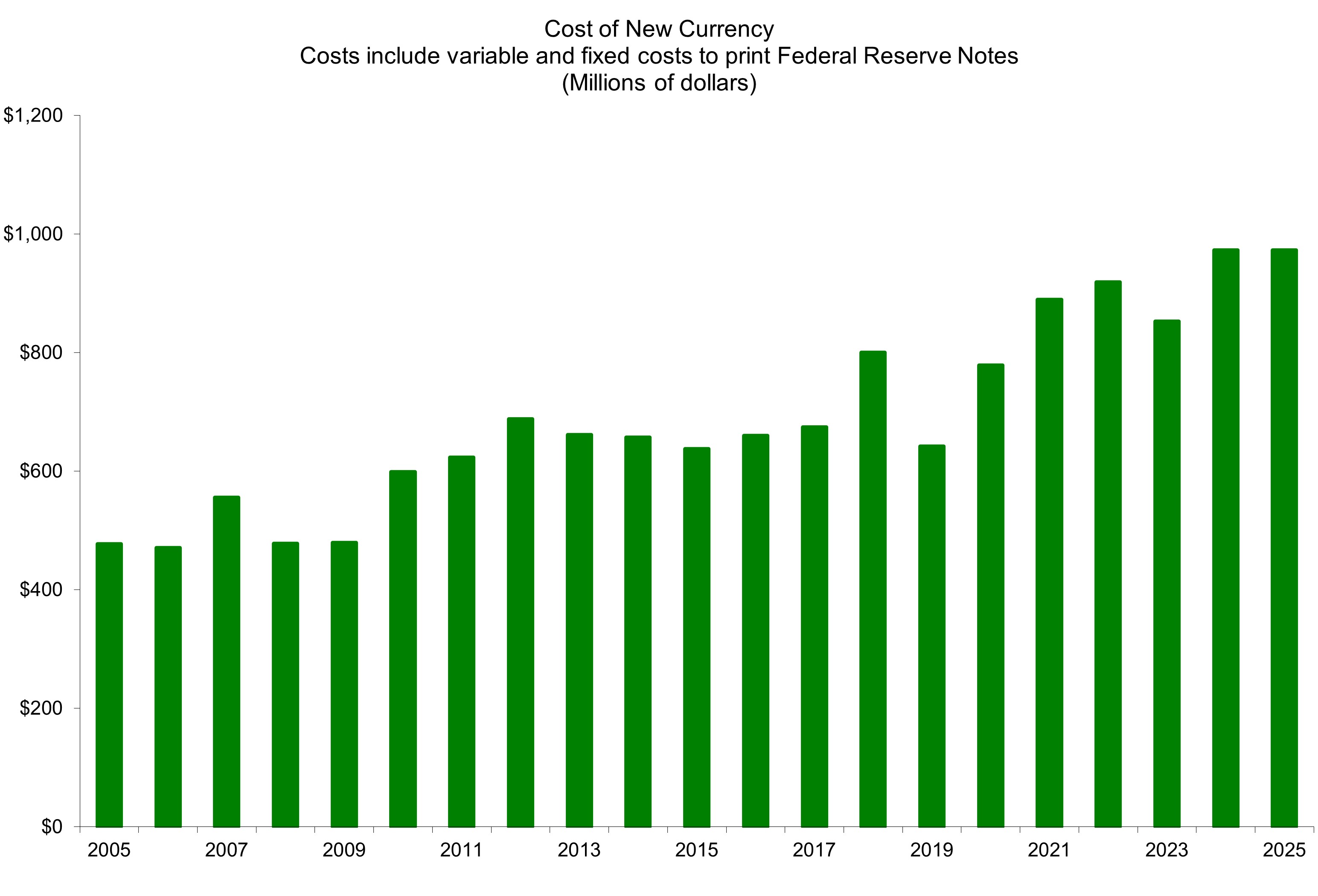

Cost of New Currency

Payments of Currency to Circulation: Value

Payments of Currency to Circulation: Volume

Receipts of Currency from Circulation: Value

Source" Federal Reserve, US Bureau of Engraving and Printing | ||||||||||||||||||||||||||||||||

| Modern Monetary Theory (MMT): How Fiat Money Works Posted: 29 Oct 2014 03:35 PM PDT This post Modern Monetary Theory (MMT): How Fiat Money Works appeared first on Daily Reckoning. [Ed. Note: There are plenty of theories out there that seek to explain the intricacies of money and its role within the economy. The problem is, "money" today looks an awful lot different than it did several years ago. That's why, for the last year or so, Chris Mayer has been extolling the virtues of the Modern Monetary Theory (MMT). We gave readers of our email edition an inside look at some of his thoughts on Monday (if you missed it, you can read them here.) Below, is his assessment of why MMT is the best explanation of how fiat money works. Read on...] Warren Mosler tells a good story that shows how our economy works at its most basic level. Imagine parents create coupons they use to pay their kids for doing chores around the house. They "tax" the kids 10 coupons per week. If the kids don't have 10 coupons, the parents punish them. "This closely replicates taxation in the real economy, where we have to pay our taxes or face penalties," Mosler writes. So now our household has its own currency. This is much like the U.S. government, which issues dollars, a fiat currency. (Meaning Uncle Sam doesn't have to give you something else for it. Say, like a certain weight in gold.) If you think through this simple analogy, all kinds of interesting insights emerge. For example, do the parents have to get coupons from their kids before they can pay them to do any chores? Obviously not. In fact, the parents have to spend their coupons first by paying their children to do chores before they can collect the tax. "How else can the children get the coupons they owe to the parents?" Mosler writes.

The government creates dollars. It doesn't even have to print them. The vast majority of spending is simply done by adding electronic dollars to bank accounts. Therefore, the U.S. government can't go bankrupt. It pays all its bills in U.S. dollars, of which it is the sole issuer. the state is… at best, bumbling and incompetent and wasteful. At worst, it is an evil force on society. This sounds really obvious, but it is amazing how many people — even very smart people — forget this simple fact. They get hysterical about the fiscal deficit or the national debt. (This is not to say there aren't bad consequences from issuing too many coupons, or from government spending in general.) The only way the U.S. government can default is if it chooses to do so. Going back to Mosler's example, let's ask another question: How can the kids "save" coupons in excess of the weekly tax? Well, they can only do that if the parents spend more than they tax. There is no other way to hoard coupons. In the real economy, the same is true. The private sector can save dollars only if the government spends more than it taxes. Spending pours fiat money into an economy; tax payments drain it away. Another question: Do the parents have fewer coupons if they spend more than they tax? No. The parents make the coupons. They don't even need physical coupons. They can simply track them on a piece of paper or in a spreadsheet. Likewise, the U.S. government doesn't have any fewer dollars after running deficits. It can't run out. (There are real-world restraints on how much government spends.) To borrow from another Mosler analogy, the U.S. government can no more run out of dollars than a scorekeeper can run out of points. You don't have to like this. (I don't.) It's merely a description of how a fiat currency system works. That's the world we live in. Too many people tackle economic questions ideologically. I can be as guilty of this as anyone. My own view of the state is that it is, at best, bumbling and incompetent and wasteful. At worst, it is an evil force on society. (My sympathies lie with those old American radicals, such as Lysander Spooner [1808–87]. If you don't know who he is, look him up. He was a great American. I have his six-volume collected works here on my bookshelf.) Nonetheless, after much reading and thought, I agree with Mosler: The state's ability to enforce tax liabilities, fines and fees drives the demand for money. Or as Mosler says, "Taxes drive money." This is a view of money called "chartalism" and it is one I subscribe to. It has been around a long time. And it forms one of the building blocks of a school of thought Mosler helped to found, called Modern Monetary Theory (MMT). It's hard to talk about MMT with people, because they are often quick to draw hasty cartoonish conclusions about what MMT is or represents. (I have to admit, I choked on MMT a bit at first, too.) Over the last several months, I've read a handful of books and perhaps a dozen academic papers on MMT. So I believe I can speak by the card. On one level, MMT is simply a description of how a fiat currency system works. On another level, there are policy prescriptions that flow from this understanding. My only advice on the latter is this: Don't let your politics deter you from making sense of MMT. (MMT itself is politically agnostic.) I'd recommend both of Mosler's books. Start with The 7 Deadly Innocent Frauds of Economic Policy. It's a short book, just over 100 pages and written in plain English. Mosler has a gift for making complex things simpler. If you try to think through the issues in an honest way, you'll come away with some "Ah-a!" moments. Then you can move on to Soft Currency Economics. Believe me, these books will challenge your long-held views on money. (Always a good thing, in my mind. What's the point of only reading things you know you'll agree with? Challenge yourself… or ossify.) If you want more, pick up Randall Wray's primer Modern Money Theory. Mosler himself is an interesting character. Unlike most economists, he is no armchair theorist. Mosler made a lot of money in markets. And in markets, you get paid to be right, which is where all too many economists fail. For an investor, macroeconomics has limited uses most of the time. Mosler's career shows this can be otherwise. Warren Mosler is, like me, a former banker. He began his career in banking in 1973, working to collect on bad loans. After a year of that, he became a lender. And I can tell you: This is great training for an investor. As Mosler recounts, he had ongoing discussions with his boss about the "logic of banking" and the "theory of lending." As every lender learns, you want to make loans where the odds are heavily in your favor so that profits easily make up for small (but expected) losses. Investing is not much different. Anyway, Mosler was a good banker with a head for the odds and the payoffs. Eventually, he would move on to manage the bank's $10 million investment portfolio. He came up with a bunch of good, if unconventional, ideas. He made the bank a lot of money pursuing no-risk trades. Mosler had a knack for smoking out mispricing in the market for things like bonds and CDs. He went on to join the Wall Street broker Bache & Co., followed by Bankers Trust and then the investment-banking firm of William Blair & Co. in Chicago. (In his books, he recounts his adventures at these places.) He made each firm a bunch of money with his "free lunch" trades, just as he did in his banking days. In 1982, he co-founded his own fund, Illinois Income Investors (III). Over the next 15 years, III would rack up a remarkable record with only one losing month — and that was a 0.1% loss due to a timing issue that reversed the next month. Managed Account Reports ranked III No. 1 in the world through 1997, when Mosler left the firm. One great story Mosler tells in both books is how he cleaned up on another free lunch in lira-denominated bonds in the early '90s. This was before the euro and back when there was worry over a default by Italy's government. Italy's national debt was 110% of GDP and interest rates were high on its bonds. But Mosler knew that it was the sole issuer of lira. Italy could not default unless it wanted to. Mosler actually met with senior officials in Rome to let them in on the "secret." Long story short, Italy didn't default. Mosler's fund made over $100 million. For an investor, macroeconomics has limited uses most of the time. Mosler's career shows this can be otherwise. But then again, you have to study economics that actually describe the real world. And Mosler's economics, or MMT, does that rather well. Regards, Chris Mayer Ed. Note: Knowing the theory is one thing. Understanding how it can help you improve your investing skills is something else entirely. Lucky for you, Chris has spent countless hours researching just how to use this theory to make great investment decisions. And readers of The Daily Reckoning email edition are often in a unique position to benefit directly from his research. Don’t miss your chance to do the same. Click here to sign up for The Daily Reckoning email edition, for FREE, before you do anything else today. The post Modern Monetary Theory (MMT): How Fiat Money Works appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - FOMC and the Usual Shenanigans Posted: 29 Oct 2014 01:32 PM PDT | ||||||||||||||||||||||||||||||||

| QE Finished, Gold Fans Clearly Crackpots Posted: 29 Oct 2014 12:50 PM PDT The US Fed just ended quantitative easing. Anyone thinking history or gold worth a look must be a crackpot for worrying... TIME WAS the Gold Standard simply existed...like rain or snooker tables, writes Adrian Ash at BullionVault. Zero rates and quantitative easing are the monetary equivalents today. Doing anything else puts a cental bank into the "hall of shame" according to Bloomberg. The Financial Times gasps that today the US Fed's "grand experiment is drawing to a close..." Oh yeah? The world hasn't yet seen the last of US quantitative easing, we think. Not by a long chalk. QE is getting new life after 15 years in Japan, the world's fourth largest economy, and it has barely begun in the single largest, the Eurozone. Only China to go, and the QE Standard will be truly global. But financial markets and pricing mechanisms the world over are already through the looking glass. After $3 trillion of US Fed asset purchases, climbing back to the other side will take more than a month's rest from extra money printing. The Gold Standard, meantime, now exists only to fill space when financial hacks run out of other silly things to talk about. Take this classic Phil Space nonsense, for instance, from the Washington Post. To recap... Over a week ago, billionaire tech-stock investor and former PayPal boss Peter Thiel appeared on right-wing shock jock Glenn Beck's TV show. He mumbled something about the value of money...reality...and the virtual world of monetary politics we've all lived in since 1971. Nothing to see or hear in that. Even the laziest gold bug can see US president Nixon's decision to end the Dollar's gold link changed nothing and everything all at once. Metaphysical mumblings are the best anyone's since managed in trying to understand how humanity got beyond itself in that moment. Yet on Friday, Thiel's comments were picked up by a right-leaning think tank blogger...and finally last night, this "unthink" piece appeared at the Washington Post online. So what? Well, George Selgin, new Cato Institute director, said earlier this month that anyone challenging the way money currently works must do better if they want to be taken seriously. Amateur bug-o-sphere stuff only makes things worse. But Selgin underplayed the task ahead, I fear. QE, zero rates and unlimited money-supply growth are big, important issues. Today's US Fed meeting proved that once again. On the other side of the debate however, even the most qualified and serious economist daring to doubt the sanity of printing money to buy up government debt, mortgages, stocks or other nation's currencies now looks like a "crackpot" to most politicians, financiers and reporters today. Because, hey! Nothing bad has happened. No inflation, currency destruction or financial apocalypse fuelled by money-from-nowhere. Not yet. And now the Fed is turning off the taps. For now. What could possibly go wrong? We must be crazy to bother owning gold as financial insurance, never mind worrying about how money itself...as basic to civilization as the written word...is being bent and remade in the latest central-bank experiments. | ||||||||||||||||||||||||||||||||

| Don't Get Bullish on Gold Below $1350 Posted: 29 Oct 2014 12:19 PM PDT This month's "triple bottom" is not, repeat NOT, confirmed says this technical analyst... WAYNE KAUFMAN is chief market analyst at Phoenix Financial in New York. Regularly quoted in the media and interviewed on Fox, CNBC and the BBC, Kaufman produces a daily report for Phoenix, is a member of the Market Technicians Association, and has taught level 3 of the MTA's three-level online course for Chartered Market Technician candidates. Here Kaufman speaks to Mike Norman on behalf of Hard Assets Investor about how he sees the big picture right now... Hard Assets Investor: We've seen some crazy gyrations in gold, in the Dollar, in oil, even in stocks. Summarize how it looks to you. Wayne Kaufman: In terms of US equities, we've been watching a deterioration of underlying market breadth, that hasn't shown up, or had not shown up in the major indexes until the last couple of weeks. But for the last three or four months, we've been watching small-caps get decimated. And then the midcaps followed. And then the large-caps, S&P 500, had a peak recently. But the breadth was terrible. And now the stocks have rolled over. It's to the point where you've only got about 18% of S&P 1500 stocks over their own 50-day moving average, less than one in five. About one in three are still over their 200-day moving average. So that underlying deterioration came through and pulled down the majors. HAI: Now with small stocks weak like that, wouldn't that suggest general economic weakness, or at least a tipoff to that effect, that we're seeing basically small, medium-sized businesses not doing very well? Kaufman: Definitely. You're right. You're talking about changes taking place. The question in the mind of investors right now is, we're seeing the weakness in China, in Europe, in Germany suddenly rolling over. You've got the price of oil. It's all of these things that are turning dramatically. Is this a long-term trend change? Or is this just going to be short term? Is it just typical October stuff, in the case of equities? That's what we're going to find out over the next few weeks. HAI: But is there really a downside, when people know the central banks are going to be there, push comes to shove? Kaufman: There, at a point, is only going to be so much that the central banks can do. I was recently asked by a news outlet to give my projections for the S&P, and my reasoning. My No. 1 reason for being bullish is central banks around the world will do everything possible to prevent a global recession. Are they really able to do much more? We know they'll try. Are they going to wait too long before they do? How effective can they be? HAI: Last time you were here, you were negative on gold. And that play worked out pretty well. How do you see things panning out from this point? Kaufman: I see short-term, over-sold and over-bearish sentiment. So a bounce is definitely in the cards, especially if there's some short covering by people who are short the futures. But when I was here last time, I said I couldn't get bullish unless gold broke $1400 or so. Now that number is a little lower. HAI: Where is it? Kaufman: $1300. I need to see $1350 at least, because you do have a potential triple bottom. A lot of people say, "Oh, triple bottom." It's a potential triple bottom that doesn't get confirmed until you break unimportant resistance. Unless we can get above $1350, I'm not going to start thinking about getting bullish, except for oversold, over-bearish bounces. HAI: We had a guest recently talking about the death of gold. Reminds me of the death of equities back on the infamous 1979 Business Weekcover. What do you make of that? Kaufman: I agree. That's why I'm saying I could see a bounce here, because it's oversold, and it's over-pessimistic. Levels of pessimism are extreme. And when you see that, that's a good time to take the other side of that trade. The question is, how much staying power? You're talking about commodities going down. The Dollar has been strong, which is a little too much bullishness in the Dollar. That certainly can be capped here. But oil is just amazing. For years, you always said that the Saudis controlled the price of oil. You were 100% right. Because they're the only country that really has significant excess capacity. Right now, are the Saudis purposely trying to drive the price of oil down, so that they can try and put a cap on fracking and energy exploration and production here in the States? HAI: The shale guys, the shale producers. Kaufman: Potentially an amazing tactical war going on between the Saudis and the US, in terms of oil production. HAI: I saw an example of that back in the '80s, when I was an oil trader on the floor of this very exchange, when they crashed the price down. That was a message sent to the non-Opec producers, the North Sea guys in particular. So I think you're absolutely right. You mentioned the Dollar. That was a surprise to most people, because we had this narrative, for a long time, about money printing, and central banks, and quantitative easing, and hyperinflation and the Fed doing all this. Yet, look at the Dollar. Kaufman: I don't want to seem like I'm complimenting you because you're the host, but you said this a long time ago. HAI: Don't hold back... Kaufman: You said a long time ago, all the inflation guys, that they were wrong, they were going to be wrong. You were 100% right. So it was a big surprise. Now, as a technician, I called the Dollar going up at a point when I saw it giving me buy signals. I don't do it the intuitive or the economist way. It's extremely overbought. And it's extremely over-bullish. It has been taking a pause. I think it'll continue to pause here. It's just too many people on that side of the trade at this point. HAI: We heard comments recently from New York Fed President William Dudley, to the effect that a Dollar that's too strong might hinder our ability to achieve our goals. Hint, hint, a little bit of code words there... Kaufman: You're right. But the problem they have is that the strong Dollar is going to hurt exports, obviously. But you've got S&P 500 companies due in the neighborhood of 40% of revenues, 50% of profits overseas. So, whether it's from the strong Dollar or just because the economies overseas are very weak right now, no matter how you go on that, it's going to be a problem. And the world economy needs to clear up. We're not an island unto ourselves; it will affect us. And I think that's what equities are starting to show. HAI: Good points. Wayne, always great to have you here. Thanks very much. | ||||||||||||||||||||||||||||||||

| Now, About That October 2014 S&P Crash Posted: 29 Oct 2014 12:01 PM PDT Not quite the shake-out needed, but just the "correction" the Fed wanted... JESSE Livermore is considered to be one of the greatest traders who ever lived, writes Gary Dorsch, editor of Global Money Trends newsletter. Also known as the "Boy Plunger" and the "Great Bear of Wall Street", Livermore was famous for making and losing several multi-million Dollar fortunes and short-selling during the stock market crashes in 1907 and 1929. Most notably, he reportedly pocketed $3 million during the Crash of 1907 and made a $100 million profit during the Crash of 1929. He subsequently lost both fortunes. Livermore learned that the big money was not made by day trading on short-term price fluctuations, but instead, greater success comes from determining the direction of the overall market.

Before his death, Livermore wrote a book titled, How to Trade in Stocks, in which he famously warned his readers that "the stock market is designed to fool most of the people, most of the time." Yet...

And in regards to the latest "Bear Raid" operation on Wall Street – ie, the near 10% sell-off in the S&P500 index – we have all seen this movie before and it usually ends the same way. In a typical Bear Raid, the US stock market begins to gradually lose its footing and then there is a sudden, sharp downturn that climaxes in a scene of panicked capitulation selling. Stop losses are hit below the 200-day moving average, and weak handed investors are flushed out at the bottom. What follows next is a sudden quick rebound from the lows, followed by an eventual recovery of all the previous losses that were engineered by the Bear Raiders. Once investors begin to realize that they were hoodwinked, they begin to pile into stocks again at higher prices. Long-term investors, that is to say, the Richest 10% of US households that own 82% of the listed shares, are happy the shakeout was brief and rather painless, and that the rally can continue, fueled by corporate buybacks. Livermore had also seen this type of "Bearish Raid" during his days on Wall Street...

The long awaited downturn in the S&P500 index finally began on Sept 19th and ended on October 15th. The S&P500 index topped out at an all-time high of 2,015 and briefly fell to as low as 1,820 for a decline of 9.7%, or just shy of the 10% requirement to be regarded as a bona-fide correction. Such shakeouts are part of the normal cyclical movements in the stock market, and they are regarded as a healthy exercise that shakes out the speculative froth from the market, and thus prevents the emergence of unsustainable bubbles that can burst into bear markets later on. What was unusual this time however, was the extraordinary length of time that the S&P500 Oligarch index has avoided a correction of 10% or more. The Dow Jones Industrial index has gone 725 trading days without a correction, the fourth-longest streak since 1929. (In the 1990s the Dow went more than twice this long without falling 10%). However, a correction in the S&P500 index typically occurs about once every 18 months. But it's been 38 months since the last bona-fide correction of more than 10%...  As Livermore famously warned: "The stock market is designed to fool most of the people, most of the time." Prior to Sept 19th, 15 top strategists on Wall Street had raised their year-end targets for the S&P500 index. Goldman Sachs chief US equity strategist predicted the S&P500 index would reach 2,050 by year-end. Deutsche Bank raised its year-end projection to 2,050 and Stifel Nicolaus's went wild, forecasting a rally to 2,300. Wells Fargo raised its view to 2,100. On Sept 3rd the chief US-market strategist at RBC Capital Markets told The Associated Press, "What usually stops bull markets? It's almost always a recession," adding he sees no indications of a downturn looming. Following the S&P500's relentless rise to above the psychological 2,000-level, the percentage of newsletter writers that were bearish on the US stock market had dropped to 13% as of Sept 3rd, the lowest percentage since October of 1987, according to a survey of more than 100 writers, and taken by Investors Intelligence report. In sharp contrast, the percentage of bullish writers was 56%, or about 4.5 times as many as the bears. Contrarians said the extreme readings might be an ominous sign, but the optimists were unbowed. "A great many investors and analysts are wasting their time trying to prove that stocks have formed a new bubble, which they claim must soon pop," a newsletter writer told Investors Intelligence. "I think they are right about the bubble, but wrong about which market is in danger of a crash. It is much easier to make the case that the Treasury bond market is the real bubble these days." However, just the opposite scenario would unfold in the weeks ahead. Shockingly, the yield on the 10-year US T-note briefly plunged from as high as 2.65% on Sept 19th as low as 1.87% on October 15th. Traders were buying Treasury notes as a temporary safe haven while fleeing from the stocks markets. Contrary to widespread expectations, the S&P500 index fell nearly 10% from its all-time high, before hitting a panic bottom low at the 1,820-level. What was the cause of the unexpected downturn in the S&P500 index from Sept 19th through October 15th? There are many moving parts that can move the markets at any given point in time. But in the view of Global Money Trends, top Federal Reserve officials and other G-7 central bankers wanted to see a shakeout in the stock markets. Inter-market technical analysts can point to several factors that were rattling the S&P500 index during this 4-week period, in what could be described as a perfect storm. There was;

Hiking short term interest rates would require draining excess liquidity, which in turn, could puncture liquidity addicted markets. However, the "Dots Matrix,' is mostly a psychological weapon that is used by the Fed to influence expectations about the future, without actually doing anything to turn its rhetoric into a reality. Thus, the Fed can talk about hiking interest rates, as a mechanism to influence currency exchange rates, for example, without actually draining liquidity that could undermine the value of the stock market. Eventually, however, empty rhetoric would lose its potency in the markets, if not backed up by complimentary actions. Failure to act would tarnish the Fed's reputation even more. | ||||||||||||||||||||||||||||||||

| Why Lower Gas Prices Are NOT “Bullish Indicators” Posted: 29 Oct 2014 11:58 AM PDT This post Why Lower Gas Prices Are NOT “Bullish Indicators” appeared first on Daily Reckoning. [Ed. Note: Our resident currency maven, Jim Rickards was recently interviewed on RT's Boom and Bust by Erin Ade, to discuss supposed "bullish indicators" in the U.S. economy, the need for another financial crisis in Europe, and why central banks are mostly "impotent." Below is a summarized transcript on some of his main points...] I don't think the data is bullish at all. Lower gas prices put more money in consumers’ pockets. But there's an alternative to spending… Which is saving or reducing debt – which is the same thing. I don't consider these bullish indicators. They tell me an economy is running out of steam. An economy is nothing more than two things: How many people are working and how productive are they? Labor force participation is going down – which means fewer people are working. And productivity is also going down. Real wages are stagnant. 50 million people are on food stamps. 7 million people have part-time jobs who wish they had full-time jobs. These data points are not bullish indicators. We're in a global depression. There's a slow down in Japan, China, Europe and the U.S. — the whole world is in a global depression. There's enough fights to go around, but in a fight between the ECB (European Central Bank) and Germany, Germany wins. The ECB is only doing $2.5 billion worth of asset buying, while the FED has been doing almost $1 trillion a year. So the ECB is going through the motions but they're not doing anything like QE. They're not buying soveirgn debt. They're buying some asset-backed securities, but there aren't even enough of those to have much of an impact. The ECB's Mario Draghi is the best Central Banker in the world. He understands that Central Banks are essentially impotent. When you're impotent you have to talk a good game — so Draghi says little and does less. The U.S. FED is the opposite. They don't understand how impotent they. China is the biggest credit bubble in the world. The U.S. has created a bubble in housing and stocks with easy money, but there's no bigger bubble in the world than China. They have a greater capacity to keep it going because their investors have fewer alternatives. Chinese middle class investors/savers, are not allowed to invest in foreign stocks. They don't like to invest in their own stock market because it's had it's own problems and is very weak. They have invested in real estate, but they've created a bubble and they are now backing away from that. They don't want to leave their money in the bank because they only get something like 25 basis points (0.25%) . The only two alternatives are: 1. Gold They are buying gold in enormous quantities. Purchases coming out of the Shanghai Exchange are astounding. They're in the thousands of tonnes per month. 2. Wealth Management Products These are just CDOs, but they're not guaranteed bank deposits, and the banks that sponsor them take the money and invest it in worthless real estate. The investor thinks they're getting a 5-6% yield but doesn't realize that the bank doesn't stand behind it and the money is being put into worthless real estate that can't pay off the debt. That's a Ponzi scheme waiting to collapse. So, in China you have a real estate bubble ready to collapse and a Wealth Management Product Ponzi that's ready to collapse. China has enormous reserves which they can use to bail out their banking system, but they tend to be very slow decision makers. In a financial crisis, slow decision making is fatal. It allows the panic to spread before you can get on top of it. Probably what Chinese banks will do if the depositors are banking on the doors asking for their money back, is to look at their dead real estate in China that they can't sell and then at maybe some U.S. stocks and bonds they own, and they'll sell the U.S. stocks and bonds because they're liquid. That's how the contagion will go from China to the U.S. and spread around the world. Jim isn't sure which is going to collapse the system first — something in China or something in the U.S. — either one is a possibility. There's also a few wild cards in the deck. The Swiss referendum coming up in November is one of the wild cards that could collapse the system. The post Why Lower Gas Prices Are NOT “Bullish Indicators” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||

| Flock of Black Swans Points to Imminent Stock Market Crash Posted: 29 Oct 2014 11:43 AM PDT Between a rising U.S. Dollar Index and black swan events around the world, it's looking like bunker time for Bob Moriarty. In his latest interview with The Gold Report, the 321gold.com founder delivers a frank overview of U.S. international policy and lambasts commentators who look to their tea leaves in search of the next market moves. But it's not all gloom and doom: Moriarty also discusses metals companies with "no-lose deals," where resource investors can take advantage of more than favorable odds. | ||||||||||||||||||||||||||||||||

| Gerald Celente - Goldseek Radio - October 27, 2014 Posted: 29 Oct 2014 11:24 AM PDT Gerald Celente thinks gold has limited downside risk but enormous upside potential, as investors gear up for the next big precious metals bull market. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||

| Risk Management - Why I Run “Ultimate Trailing Stops†on All My Investments Posted: 29 Oct 2014 10:42 AM PDT You’ve spotted an unstoppable, trillion-dollar trend. You’ve identified the stock that’s set to benefit most and made a trade using the tactics that will squeeze the most profit out of it. Nicely done. Now it’s time for the final piece of the Total Wealth strategy. | ||||||||||||||||||||||||||||||||

| Gold and Silver Junior Miners Buying Opportunity Comes Once Every Six Years Posted: 29 Oct 2014 10:36 AM PDT Risk taking is a natural part of life, especially in the capitalist system where the greater the risk, the increased potential reward. The TSX Venture Index which is made of the Canadian start ups in junior mining and high tech is hitting lows not seen since 2002 and the 2008 Credit Crisis. Investors are now risk adverse, but as the charts shows below that could change. | ||||||||||||||||||||||||||||||||

| Axel Merk: Greenspan admitted that Fed is not politically independent Posted: 29 Oct 2014 10:22 AM PDT 1:20p ET Wednesday, October 29, 2014 Dear Friend of GATA and Gold: Fund manager Axel Merk of Merk Investments today calls attention to a few comments made Saturday by former Federal Reserve Chairman Alan Greenspan at the New Orleans Investment conference -- including acknowledgment that the Fed is not politically independent, as is often claimed, and his expectation that the price of gold will rise. Merk's commentary is headlined "Greenspan: Price of Gold Will Rise" and it's posted in the "Insights" section of the Merk Investments Internet site here: http://www.merkinvestments.com/insights/2014/2014-10-29.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Debt must be inflated away or repudiated, Steer tells Sprott Money News Posted: 29 Oct 2014 10:01 AM PDT 1p ET Wednesday, October 29, 2014 Dear Friend of GATA and Gold: The world economy is declining under the burden of too much debt and only inflating it away or repudiating it will change anything, financial letter writer and GATA board member Ed Steer tells the Sprott Money News weekly wrapup with Jeff Rutherford. Steer adds that the futures markets in New York are suppressing commodity prices and distorting all prices. The interview is six minutes long and can be heard at the Sprott Money News Internet site here: http://www.sprottmoney.com/sprott-money-weekly-wrap-up CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Russia buys most gold for reserves since financial crisis of 1998 Posted: 29 Oct 2014 09:41 AM PDT By Nicholas Larkin LONDON -- Russia boosted gold reserves by the most since defaulting on local debt in 1998, driving its bullion holdings to the largest in at least two decades. The country expanded its stockpile, the world's fifth-biggest, by 37.2 metric tons in September to 1,149.8 tons, according to data on the International Monetary Fund's website. The increase, valued at about $1.5 billion, was the biggest since November 1998. Russian reserves, which overtook those of Switzerland and China this year, almost tripled since the end of 2005 and are at the highest since at least 1993, the data show. ... ... For the remainder of the report: http://www.bloomberg.com/news/2014-10-29/russia-buys-most-gold-for-reser... ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Why You Need to Pay Attention to the Swiss Gold Initiative Posted: 29 Oct 2014 08:30 AM PDT This post Why You Need to Pay Attention to the Swiss Gold Initiative appeared first on Daily Reckoning. [Ed. Note: The Swiss could soon be responsible for sending the gold price on a tear. As we've been discussing in the Daily Reckoning email edition, the upcoming Swiss Gold Initiative could create a "demand shock" that reverses gold's steady decline over the past two years. What's more, our newest analyst Jim Rickards believes it could be one of the many "snowflakes" that triggers the biggest financial crisis the U.S. has ever seen. Bottom line: you NEED to pay attention to the Swiss Gold Initiative. Grant Williams has more, below...] About 18 months ago, I had a very pleasant chat with a gentleman by the name of Luzi Stamm. You may detect some measure of surprise in my words, and the reason for that is quite simple: Luzi Stamm is a politician; and, as regular readers of mine will know, I am no fan of that particular class. But Herr Stamm was different. An MP representing the Swiss People's Party, Stamm was spearheading a federal popular initiative which needed 100,000 signatures in order to comply with the Swiss parliamentary system's rigid framework regarding referendums. (OK all you "referenda" people out there, I know, OK? But I'm going with "referendums," so pipe down). That initiative was one of three being pursued: firstly, a motion to limit immigration into Switzerland to 0.2% per year; secondly, a drive to abolish the flat tax system and for resident, nonworking foreigners to be taxed based instead on their income and their assets; and thirdly, Stamm's initiative… Well, we'll get to that shortly; but before we do, we need to understand a little about how Swiss democracy works.

In Swiss law, any popular initiative which achieves the milestone of 100,000 signatures MUST be put to the citizens of the country as a referendum, and in a country of just 8,061,516 people (according to the July 2014 count — never let it be said that the Swiss aren't precise), that's a pretty big ask; but the Swiss do love their votes — so much so that, since 1798, there has been a seemingly never-ending procession of issues which the Swiss people have been entrusted by their leaders to decide: In 2014 alone there have already been three referendums concerning such diverse issues as the minimum wage, abortion, and the financing and development of railway infrastructure. (For those of you just dying to know the outcomes, the abortion referendum, which would have dropped abortion coverage from public health insurance, failed by a large margin, with about 70% of participating voters rejecting the proposal. The railway financing was approved by 62% of the voters, and the motion that would have given Switzerland the highest minimum wage in the world — 22 francs ($23.29) an hour — was soundly defeated, with 76% of the voters saying "nein.") One wonders what the outcome would be of a similar motion to hike the minimum wage to such lofty heights in the US. Or in Great Britain. The bottom line? The Swiss just think (and, importantly, vote) differently. But back to Luzi Stamm and the SPP initiative. Immigration and taxes aren't uppermost in Stamm's mind. What he IS concerned about is gold. When we spoke on the telephone last year, Stamm explained to me that he hadn't really properly understood the part gold played in the Swiss monetary equation until he'd had it explained to him by a friend more versed in finance (Stamm is a lawyer by background but with an economics degree from the University of Zurich); but once he understood how it all worked, Stamm realized that the changes to Swiss monetary prudence which had occurred in just a few short years were (a) potentially disastrous for the country and (b) not remotely understood by his countrymen (and women). So Stamm decided he ought to do something about it. The Swiss had accumulated a significant gold reserve the old-fashioned way — through seemingly constant current account surpluses — over many decades, but in May 1992 they finally joined the IMF. Once THAT little genie was unleashed, things began to change. In November of 1996, the Swiss Federal Council issued a draft for a new Federal Constitution, and contained within that draft was an amended position on monetary policy (article 89, in case you're wondering) which severed the Swiss franc's link to gold and reaffirmed the SNB's constitutional independence:

Spiffy. In April 1999, the revision of the Federal Constitution was approved (how else than through a referendum?), and it came into effect on January 1, 2000. Oh… sorry… I almost forgot to mention that in September 1999 — after the revision had been adopted but before it had been officially enacted — the SNB became one of the signatories to the Washington Agreement on Gold Sales, meaning that all that lovely Swiss gold which had been sitting there, steadily accumulating and making the Swiss franc one of the last remaining "hard" currencies on the planet, was eligible to be sold. A single line in the Swiss National Bank's own history of monetary policy identifies the beginning of the demise of one of the world's great currencies:

And there you have it. "No longer required for monetary policy purposes." That's what happens when you finally embrace the beauty of fiat. Not only do you get to sell gold, you get to call the proceeds of those sales "profits." The absurdity borders on breathtaking. At the beginning of 2000, the Swiss National Bank (SNB) held roughly 2,600 tonnes of gold in its reserves. That equated to approximately 8% of total global central bank gold reserves. After the revised constitution became law, the Washington Agreement took over and… Bingo!: Swiss gold reserves were Now, does anyone notice anything particular about the period when the Swiss gold sales were at their highest? Yessss… that's right (as with the UK's sales), the bulk of Swiss sales were made at the lows in the gold price (between $300 and $500 per ounce — blue shaded area). To look at it another way, the Swiss National Bank went from being one of the soundest central banking institutions on Earth to just another in the morass of apologist financial institutions that lost sight of their mandates while grasping for a Keynesian free lunch, egged on by a new breed of politicians who knew nothing of the principles of sound money or, if they did, were happy to put them to the back of their minds as they extended their hands. Sadly, as went the soundness of the SNB, so went the soundness of the Swiss franc itself. As you can see from the chart above, the SNB has, over the last two decades, oustripped its nearest rival in gold sales by a factor of three. Adding to the fun and games was the decision in September 2011, at the height of the euro crisis, to peg the Swiss franc to the euro (something that obviously couldn't have been done prior to breaking the gold peg) in order to stop it appreciating. How? Why through literally unlimited printing of Swiss francs to stop the exchange rate breaking 1.20. At the time, the SNB was unequivocal:

All this talk of "massive overvaluation of the Swiss franc" is Between 1970 and 2008, the strength of the Swiss franc was legendary. During that time, it appreciated by 330% against the US dollar and by 57% versus the Deutsche mark/euro. Consequently, a strong currency went hand-in-hand with a strong economy. How awful. The problem was NOT in the OVERvaluation of the Swiss franc, as the SNB would have you believe, but rather in the UNDERvaluation of the competition; and the only thing the SNB could do was to join in the great devaluation race. That move weakened the currency by about 9% in 15 minutes, and the immediate effect on the SNB's balance sheet was obvious:

Note that the rise in value of Swiss gold by CHF 1 billion wasn't enough to counter the destructive nature of overt and unchecked money printing. Like the Fed, the BoJ, and the BoE before them, the SNB became, at a stroke, another previously sound institution that unhesitatingly ripped its balance sheet to shreds: Since 2009, the SNB has quintupled its balance sheet, making it (on a relative basis) the most prolific of the central bank printing machines. Not bad for the world's 96th-largest nation. Since the EUR peg was instituted just three years ago, the SNB's balance sheet has more than doubled. So, with the Swiss franc's soundness under attack from within its own borders, Luzi Stamm decided to try to use the Swiss love for referendums and the rigidity of the Swiss political process to try to reinstate the Swiss franc as a sound currency. To that end, Stamm proposed the Swiss Gold Initiative ("Save Our Swiss Gold"). Funnily enough, the proposal was rejected by lawmakers, but Stamm gathered three like-minded MPs and, more importantly, enough signatures on his petition (100,000) to ensure that a referendum on the proposal would take place; and that vote will happen on November 30th — six weeks from now. Much more to come on this developing story. Keep an eye on this space… Regards, Grant Williams Ed. Note: As mentioned above, the Swiss Gold Initiative is one of the many “snowflakes” James Rickards points to as a potential catalyst for a massive financial collapse. In addition, a chance to secure his full free report was made available to readers of the FREE Daily Reckoning email edition. For a unique chance to secure your copy, click here now to sign up for The Daily Reckoning, for FREE. Click here to continue reading this article from Things That Make You Go Hmmm… – a free newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore. The post Why You Need to Pay Attention to the Swiss Gold Initiative appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||

| If You Want To Know How Wild Things Can Get - Look At This Posted: 29 Oct 2014 08:12 AM PDT  Today King World News is highlighting a piece by one of the greats which discusses total collapse of the markets. Below is the powerful piece which all KWN readers around the world must read. Today King World News is highlighting a piece by one of the greats which discusses total collapse of the markets. Below is the powerful piece which all KWN readers around the world must read.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||

| MineWeb's Lawrence Williams: Large supply deficit in gold is likely ahead Posted: 29 Oct 2014 05:22 AM PDT 8:23a ET Wednesday, October 29, 2014 Dear Friend of GATA and Gold: While the mainstream financial news media are determined to overlook it, MineWeb's Lawrence Williams writes, China and India alone appear to be taking each month more gold than is being produced. "All indicators suggest that there could indeed be a very large supply deficit building," Williams writes. He adds: "One day gold will surely take off but whether it's this week, next week, next month, next year, or 10 years' time remains open to question. It just depends on how long the big money, and perhaps governments, can keep playing the futures markets to keep commodity prices working to their advantage." Williams' commentary is headlined "Hong Kong Gold Exports to China Pick Up Strongly But. ..." and it's posted at MineWeb here: http://www.mineweb.com/mineweb/content/en/mineweb-gold-news?oid=257958&s... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Greenspan: Gold Price Will Rise Posted: 29 Oct 2014 05:18 AM PDT Any doubts about why I own gold as an investment were dispelled last Saturday by the maestro himself: former Fed Chair Alan Greenspan. It's not because Greenspan said he thinks the price of gold will rise - I don't need his investment advice; it's that he shed light on how the Fed works in ways no other former Fed Chair has ever dared to articulate. All investors should pay attention to this. Let me explain. | ||||||||||||||||||||||||||||||||

| Mysterious Death od CEO Who Went Against the Petrodollar Posted: 29 Oct 2014 02:55 AM PDT Last month in these pages, I wrote: Patrick de la Chevardière, CFO of Total SA (which is France’s largest energy company), has publicly announced that Total is looking to finance its share in the $27-billion Yamal LNG project using euros, yuan, Russian rubles, and any other currency but US dollars. “The effect of US sanctions was that Yamal LNG will be prevented from raising any dollar financings,†Patrick de la Chevardière stated in London at a news briefing. | ||||||||||||||||||||||||||||||||