Gold World News Flash |

- Big Question: Have We Have Seen The Bottom In Gold & Silver?

- This Will Change The World & Make Gold & Silver Prices Soar

- EBOLA SERIES 3

- Will World Governments Confiscate Gold?

- Fireworks Fly As Peter Schiff Warns “An Economy That Lives By QE, Dies By QE”

- "Stop Thanking Me For My Service" – Former US Army Ranger Blasts American Foreign Policy

- People Of Libya On The Verge Of Capturing Oilfields, Central Bankers Making Their Move

- Things That Make You Go Hmmm... Like The Swiss Gold Status Quo Showdown

- The Gold Price Ranged from $1,222.20 to $1,235.50 Ending Up at $1,229.20

- Investor Alert: Disinflation And Slowing Monetary Growth

- Gold: Minor Weakness Is Nothing To Fear

- Infographic: Worlds Highest Gold Producing Countries

- The Many Ways The State Taxes The Poor

- Gold Daily and Silver Weekly Charts - Quiet Option Expiration, Markets In Lockdown

- "Peak Gold" Here to Stay

- Why Gold and Silver Are the Good News Metals

- Modern Money: Just a Way of Keeping Score

- The Big Question: Have We Seen The Bottom In Gold & Silver?

- Robust Demand for Physical Gold Support Prices

- Don’t Miss The Biggest Biotech Market EVER!

- Grant Williams: This little piggy bent the market

- James Turk - 2 Key Charts, Gold & The Destruction Of Money

- Gold vs Paper - A Tale of Two Cities

- Omniscient Federal Reserve Captures The Capital Market, For Now. Gold Beckons

- The End of QE and the Price of Gold

- U.S. Economic Snapshot - Strong Dollar Eating into corporate Profits

- Oliver Gross Says Peak Gold Is Here to Stay

- Money is free in Sweden, if the central bank likes you

- Does Gold Price Always Respond to Real Interest Rates?

- CEO Went Against the Petrodollar and Dies a Mysterious Death. Who Holds a Monopoly on the Truth?

- This Will Change The World & Make Gold & Silver Prices Soar

| Big Question: Have We Have Seen The Bottom In Gold & Silver? Posted: 28 Oct 2014 11:30 PM PDT from KingWorldNews:

Remember, these are major gold and silver miners — some of the largest producers in the sector — and if they are at a major turning point, the whole sector is at a turning point, including the gold and silver markets. Could this be the bottom for the sector? From a technical perspective there's a high probability that the answer is yes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Will Change The World & Make Gold & Silver Prices Soar Posted: 28 Oct 2014 09:40 PM PDT from KingWorldNews:

Over time I expect these agreements between India and China to broaden out and become very, very extensive. They may reach the level of agreements we are seeing between China and Russia, and that is already nearing one trillion dollars. What intrigues me about China and India is that trains, which were definitely agreed to, will make travel between China, India, and the Middle East much easier. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Oct 2014 08:40 PM PDT from roypotterqa: An update on events with ebola. The alternative media seems to be responsibly reporting what is going on, even tapping into professional sources like Dr. Boyle and medical doctors who are either openly or anonymously giving information. This ebola is capable of bonding (in some way I cannot explain, but the MDs call it something like a “glue” gene”) to other viruses like the flu and common cold. So far, it mainly targets Negroes, with other races getting more minor symptoms if they get it at all. I am specific about “NEGROES” and not being PC about it because the issue is so important about this initial target group as they were with HIV and other tests on bioweapons and vaccines. Sorry, the truth is just that, no excuses. I saw a comment about studies on colloidal silver. I hesitate to offer any definitive advice on preventative measures for supposed cures for a number of reasons. Other than mentioning the common sense approaches, anything more I ask you to go to places like Natural News, or other informed health sites that can speak authoritatively. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will World Governments Confiscate Gold? Posted: 28 Oct 2014 08:20 PM PDT by Dan Popescu, Gold Broker:

We know that the U.S. government confiscated its citizen's gold, allowing them to retain only $100 worth of gold, in 1933. Once confiscation was completed, two years later, the U.S. government devalued the dollar against gold from $20.67 to $35.00. This represented a 41% devaluation. Since the devaluation of the dollar was not reflected in foreign exchange markets in 1935, gold continued to be sold at $20 an ounce in countries outside the U.S. while the U.S. was paying $35. Treasury holdings of gold in the U.S. tripled from 6,358 tonnes in 1930 to 8,998 tonnes in 1935 (after the Act), and then to 19,543 metric tonnes of fine gold by 1940. Can it happen again? It certainly can. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fireworks Fly As Peter Schiff Warns “An Economy That Lives By QE, Dies By QE” Posted: 28 Oct 2014 08:05 PM PDT from ZeroHedge:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Stop Thanking Me For My Service" – Former US Army Ranger Blasts American Foreign Policy Posted: 28 Oct 2014 07:29 PM PDT Submitted by Mike Krieger via Liberty Blitzkrieg blog,

I have to admit, whenever I find myself in the midst of a large public gathering (which fortunately isn’t that often), and the token veteran or two is called out in front of the masses to “honor” I immediately begin to cringe as a result of a massive internal conflict. On the one hand, I recognize that the veteran(s) being honored is most likely a decent human being. Either poor or extraordinarily brainwashed, the man or woman paraded in front of the crowd is nothing more than a pawn. Even if their spouse hasn’t left them; even if whatever conflict they were involved in didn’t result in a permanent disability or post traumatic stress disorder, this person has been used and abused, and thirty seconds of cheering in between ravenous bites out of a footlong hotdog from a drunk and apathetic crowd isn’t going to change that. I don’t harbor negative sentiments toward the veteran. On the other hand, the entire spectacle makes me sick. I refuse to participate in the superficial charade for many reasons, but the primary one is that I don’t want to play any part in the crowd’s insatiable imbecility. It’s the stupidity and ignorance of the masses that the corporate-state preys upon, and that’s precisely what’s on full display at these tired and phony imperialist celebrations. As Aldous Huxley noted poignantly in Brave New World Revisited (for more see my post, Brave New World Revisited…Key Excerpts and My Summary).

While I have felt many of the sentiments expressed in the paragraphs above for a while, I never publicly wrote them down since I didn’t feel like it was my place to do so. Such sentiments carry far more weight when expressed by a veteran, and thanks to an incredible letter by ex-U.S. Army Ranger Rory Fanning, we now have such a voice. What follows is an amazingly brave and powerful piece of prose originally posted at Tom’s Dispatch. Read it and heed his words carefully.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| People Of Libya On The Verge Of Capturing Oilfields, Central Bankers Making Their Move Posted: 28 Oct 2014 07:28 PM PDT Consumer confidence surged on the hope incomes will rise. Durable order declined. Pending home sales disappoint as Realtors say clients cannot get financing. US home ownership dropped back down to 1983 levels. China is allowing direct trade between yuan and Singapore dollar. 214000 doctors opt out... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Things That Make You Go Hmmm... Like The Swiss Gold Status Quo Showdown Posted: 28 Oct 2014 06:52 PM PDT Authored by Grant Williams, via Mauldin Economics, About 18 months ago, I had a very pleasant chat with a gentleman by the name of Luzi Stamm. You may detect some measure of surprise in my words, and the reason for that is quite simple: Luzi Stamm is a politician; and, as regular readers will know, I am no fan of that particular class. But Herr Stamm was different. An MP representing the Swiss People’s Party, Stamm was spearheading a federal popular initiative which needed 100,000 signatures in order to comply with the Swiss parliamentary system’s rigid framework regarding referendums. (OK all you “referenda” people out there, I know, OK? But I’m going with “referendums,” so pipe down). That initiative was one of three being pursued: firstly, a motion to limit immigration into Switzerland to 0.2% per year; secondly, a drive to abolish the flat tax system and for resident, nonworking foreigners to be taxed based instead on their income and their assets; and thirdly, Stamm’s initiative... Well, we’ll get to that shortly; but before we do, we need to understand a little about how Swiss democracy works.

In Swiss law, any popular initiative which achieves the milestone of 100,000 signatures MUST be put to the citizens of the country as a referendum, and in a country of just 8,061,516 people (according to the July 2014 count — never let it be said that the Swiss aren’t precise), that’s a pretty big ask; but the Swiss do love their votes — so much so that, since 1798, there has been a seemingly never-ending procession of issues which the Swiss people have been entrusted by their leaders to decide:

In 2014 alone there have already been three referendums concerning such diverse issues as the minimum wage, abortion, and the financing and development of railway infrastructure. (For those of you just dying to know the outcomes, the abortion referendum, which would have dropped abortion coverage from public health insurance, failed by a large margin, with about 70% of participating voters rejecting the proposal. The railway financing was approved by 62% of the voters, and the motion that would have given Switzerland the highest minimum wage in the world — 22 francs ($23.29) an hour — was soundly defeated, with 76% of the voters saying “nein.”) One wonders what the outcome would be of a similar motion to hike the minimum wage to such lofty heights in the US. Or in Great Britain. The bottom line? The Swiss just think (and, importantly, vote) differently. But back to Luzi Stamm and the SPP initiative. Immigration and taxes aren’t uppermost in Stamm’s mind. What he IS concerned about is gold. When we spoke on the telephone last year, Stamm explained to me that he hadn’t really properly understood the part gold played in the Swiss monetary equation until he’d had it explained to him by a friend more versed in finance (Stamm is a lawyer by background but with an economics degree from the University of Zurich); but once he understood how it all worked, Stamm realized that the changes to Swiss monetary prudence which had occurred in just a few short years were (a) potentially disastrous for the country and (b) not remotely understood by his countrymen (and women). So Stamm decided he ought to do something about it. The Swiss had accumulated a significant gold reserve the old-fashioned way — through seemingly constant current account surpluses — over many decades, but in May 1992 they finally joined the IMF. Once THAT little genie was unleashed, things began to change. In November of 1996, the Swiss Federal Council issued a draft for a new Federal Constitution, and contained within that draft was an amended position on monetary policy (article 89, in case you’re wondering) which severed the Swiss franc’s link to gold and reaffirmed the SNB’s constitutional independence:

Spiffy. In April 1999, the revision of the Federal Constitution was approved (how else than through a referendum?), and it came into effect on January 1, 2000. Oh... sorry... I almost forgot to mention that in September 1999 — after the revision had been adopted but before it had been officially enacted — the SNB became one of the signatories to the Washington Agreement on Gold Sales, meaning that all that lovely Swiss gold which had been sitting there, steadily accumulating and making the Swiss franc one of the last remaining “hard” currencies on the planet, was eligible to be sold. A single line in the Swiss National Bank’s own history of monetary policy identifies the beginning of the demise of one of the world’s great currencies:

And there you have it. “No longer required for monetary policy purposes.” That’s what happens when you finally embrace the beauty of fiat. Not only do you get to sell gold, you get to call the proceeds of those sales “profits.” The absurdity borders on breathtaking. At the beginning of 2000, the Swiss National Bank (SNB) held roughly 2,600 tonnes of gold in its reserves. That equated to approximately 8% of total global central bank gold reserves. After the revised constitution became law, the Washington Agreement took over and... Bingo!:

Swiss gold reserves were Now, does anyone notice anything particular about the period when the Swiss gold sales were at their highest? Yessss... that’s right (as with the UK’s sales), the bulk of Swiss sales were made at the lows in the gold price (between $300 and $500 per ounce — blue shaded area). To look at it another way, the Swiss National Bank went from being one of the soundest central banking institutions on Earth to just another in the morass of apologist financial institutions that lost sight of their mandates while grasping for a Keynesian free lunch, egged on by a new breed of politicians who knew nothing of the principles of sound money or, if they did, were happy to put them to the back of their minds as they extended their hands. Sadly, as went the soundness of the SNB, so went the soundness of the Swiss franc itself.

As you can see from the chart above, the SNB has, over the last two decades, oustripped its nearest rival in gold sales by a factor of three. Adding to the fun and games was the decision in September 2011, at the height of the euro crisis, to peg the Swiss franc to the euro (something that obviously couldn’t have been done prior to breaking the gold peg) in order to stop it appreciating. How? Why through literally unlimited printing of Swiss francs to stop the exchange rate breaking 1.20. At the time, the SNB was unequivocal:

All this talk of “massive overvaluation of the Swiss franc” is Between 1970 and 2008, the strength of the Swiss franc was legendary. During that time, it appreciated by 330% against the US dollar and by 57% versus the Deutsche mark/euro. Consequently, a strong currency went hand-in-hand with a strong economy. How awful. The problem was NOT in the OVERvaluation of the Swiss franc, as the SNB would have you believe, but rather in the UNDERvaluation of the competition; and the only thing the SNB could do was to join in the great devaluation race. That move weakened the currency by about 9% in 15 minutes, and the immediate effect on the SNB’s balance sheet was obvious:

Note that the rise in value of Swiss gold by CHF 1 billion wasn’t enough to counter the destructive nature of overt and unchecked money printing.

Like the Fed, the BoJ, and the BoE before them, the SNB became, at a stroke, another previously sound institution that unhesitatingly ripped its balance sheet to shreds:

Since 2009, the SNB has quintupled its balance sheet, making it (on a relative basis) the most prolific of the central bank printing machines. Not bad for the world’s 96th-largest nation. Since the EUR peg was instituted just three years ago, the SNB’s balance sheet has more than doubled. So, with the Swiss franc’s soundness under attack from within its own borders, Luzi Stamm decided to try to use the Swiss love for referendums and the rigidity of the Swiss political process to try to reinstate the Swiss franc as a sound currency. To that end, Stamm proposed the Swiss Gold Initiative (“Save Our Swiss Gold”). Funnily enough, the proposal was rejected by lawmakers, but Stamm gathered three like-minded MPs and, more importantly, enough signatures on his petition (100,000) to ensure that a referendum on the proposal would take place; and that vote will happen on November 30th — six weeks from now. Stamm pulled off a masterstroke in securing the involvement in the Swiss Gold Initiative of Egon von Greyerz who, along with being one of the most highly respected figures in the gold industry, happens to be one of the world’s nicest human beings. We’ll get to Egon’s involvement shortly, but first let’s take a look at the motions that make up the Swiss Gold Initiative, which are threefold:

(NB. Before we get to the part of this story where the SNB tell us how big a nightmare it would be to force them to hold 20% of their reserves in gold (come on, you KNEW that was coming), I’d point you back to the chart on page 8. Remember? The one that showed the Swiss held 18% of their reserves in gold just five short years ago?) Addressing the motions in order, let’s begin with number 1, that all Swiss gold be physically stored in Switzerland. Switzerland has made its name over centuries as being one of the safest places on the planet to store gold. That reputation has been good enough to convince people from all over the world to entrust their gold to the Swiss for safe-keeping. However, like many other central banks, the SNB stores a certain proportion of its gold overseas. How much? We don’t know. Where exactly is it held? We have no idea (other than “in the UK & Canada”). In fact, when the finance minister was asked, in parliament, where Switzerland’s gold was stored, his answer was something of a head scratcher:

Riiiight... Call me old-fashioned, but if I were a Swiss national I’d want a better answer than that. Anyway, the Number 2 on the initiative’s wishlist is that the SNB be prohibited from selling their gold reserves. Now, THAT might be a problem for the SNB in times to come in the “ordinary conduct of monetary policy,” but as we are some ways away from a world in which “ordinary” features in any way, shape, or form where monetary policy is concerned, I don’t think this prohibition is going to matter much. However, if you think this initiative isn’t being taken seriously, you just have to look at an excerpt from a speech given by the governor of the SNB, Thomas Jordan, a matter of days after the Swiss Gold Initiative achieved the 100,000 signatures it required to qualify as a referendum. If you lean in real close, you can smell the fear:

Thomas, if I may? The SNB’s desire to “maintain currency and price stability” can be summed up by this chart, which will be all too familiar to those who have studied the fiat currencies of the world, but it obviously needs trotting out one more time:

The Gold Price Ranged from $1,222.20 to $1,235.50 Ending Up at $1,229.20 Posted: 28 Oct 2014 05:05 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investor Alert: Disinflation And Slowing Monetary Growth Posted: 28 Oct 2014 04:34 PM PDT We released earlier this year the minutes of the first two Advisory Board meetings by Incrementum Liechtenstein in these two articles: Will Inflation Make A Comeback In 2014 When The Consensus Worries About Deflation and Outlook for Gold, Stocks, Economy. Incrementum Liechtenstein is running the "Austrian Economics Golden Opportunities Fund," a fund that takes investment positions based on the level of inflation based on their proprietary "Incrementum Inflation Signal." Incrementum Liechtenstein has Ronald Stoeferle, author of In Gold We Trust, as managing partner, and Mark Valek as partner. In the latest Advisory Board which took place earlier in October, the investment landscape driven by the disinflationary forces were discussed. Based on the Incrementum Inflation Signal, it seems that the inflation/deflation-tug-of-war is very intense these days. The signal switched to "neutral" at the beginning of August and then very quickly it indicated "disinflation" once again. A rather dramatic move in the USD, commodities, gold and silver followed. As can be seen on the following chart, the signal works well in real-time. Development of Incrementum Inflation Signal and HUI Mining Index: The second chart is the Commodity index (based on Incrementum Inflation Signal and Bloomberg Commodity Index): Growth of monetary inflation is currently slowing down dramatically, as can be seen in the next chart. The bars in the chart represent the combined balance sheets of the Federal Reserve, European Central Bank, Bank of England, Swiss National Bank, People's Bank of China and the Bank of Japan.

One can also see that monetary inflation is losing momentum in the broader monetary aggregates:

Finally, High Yield spreads are actually widening.

These are all signs that this current disinflationary move is fully intact right now. The pace of monetary inflation is cooling down, according to several metrics. Could there be a significant correction/crash looming for asset markets? Heinz Blasnik thinks that, by its very nature, a crash is a very low probability event. However, if we look at what central banks have done since 1987, they have become much more activist and have continually increased the size of their interventions. This means: Not only has the amplitude of asset bubbles increased, but also the probability of crash-like events. The money supply metric that is most important is US money supply. Every other market is – to some extent – following the US. If we look at the broader money supply growth, it has slowed quite a lot recently but it is still historically high. In detail, narrow money supply (AMS) has actually increased recently, as banks have increased their lending, while the Fed has tapered QE. Therefore, US money supply growth is not that negative.

Investor sentiment is extremely bullish. However, we do not have a situation like in 2000 when everyone became a day trader, simply because retail investors have been hurt too much by the bubbles. First, they lost a lot of money in stocks in 2000 and then in stocks and houses combined in 2008. So they are not as easily enticed to invest in stocks anymore. However, investor sentiment amongst professional traders is very positive at the moment. I think this is a very strong warning signal, but definitively not a timing indicator. With regards to leverage of investors, it's at a record high. The likes of margin debt and hedge fund leverage are at record highs. Having a look at the Shiller P/E, valuations are at the 93rd percentile since 1870. In terms of price/sales, the market is the most overpriced ever. Regarding the recent weakness in high yield bonds: central bank policy has led to another yield-chasing rally. These bonds pay interest that is not really rewarding the holders for the risk that is taken. But investors are taking these risks anyway, as according to rating agencies, the expected default rate is at an all-time low! So investors feel that they are actually not taking too much risk. The most important point: banks are no longer making the market anymore, because of legislation, the likes of Frank Dodd, etc. Banks do not do any prop trading in high yields anymore. This means that it has become a very vulnerable market. While there has been a huge amount of issuance, liquidity levels have fallen. This will have a major influence if the market goes down. And the last point; the market internals. Small cap stocks (Russell 2000) have started to underperform and break down and this suggests that market liquidity is not high enough anymore to lift all boats. So, the danger of a severe market correction has increased further. This is clear. When it is going to happen, I am not sure. But it's probably not too far away. Currency wars update in the current disinflationary trend(by Jim Rickards) The market expects interest rates to be raised by mid 2015. This leads to all kinds of dynamic outcomes, including a strong dollar, capital outflows from emerging markets, unwinding of the carry trade, weak commodities and so on. So those are the expectations. We are seeing growing deflationary pressure in the Incrementum Inflation Model and in my own model. From my point of view, the only reasonthe Fed will raise rates is inflationary pressure. We don't have to agree with her opinion, and my opinion is irrelevant, but I try to think like Janet Yellen does. She wants to address the labour issues in the US. If there would be one economic number that is most important for the Fed at the moment, it would be real wages. She looks at real wages as the thermometer of inflation. If labour markets are tight, wage pressure should increase and this would be a leading indicator for the Fed. Right now, real wages are not going up and labour market participation continues to decline. So let us put all that together: the market is discounting that the Dollar will continue to strengthen, deflationary pressure is increasing and the data suggests that the Fed has tightened into weakness. Remember, Janet Yellen didn't start the taper. Ben Bernanke started to taper as he wanted to leave with a legacy. Right now, we have the most hawkish FOMC in a very long time, but in January this will change. The two hawks Fisher and Plosser come off the FOMC and will be replaced by super-doves Evans and Lockhart. So hawks will be replaced by doves among the presidents. Moreover, president Obama will replace the vacancies with Stanley Fischer, who was Janet Yellen's mentor. And, lastly, Yellen will have been in the job for one year in January and she will feel that she's in charge and that it's her board.

So, you have a very hawkish FOMC today and we will have a very dovish FOMC starting in January. So the whole world is set up for a stronger dollar, a strengthening US economy and rising rates. The data and politics are showing deflation, a very weak recovery, a dovish board. So my expectation is that the Fed will launch QE4 in spring 2015 or little later. That will not only be a reversal of policy, but it will come as a shock! This will result in a rally in US stocks and emerging market stocks, a weakening USD and rising commodities. There is no chance that they will raise interest rates in 2015. Tapering has failed twice and it will fail again. For the next four months, I would expect a continuation of the current trend: very weak gold, higher rates, strong dollar, weak emerging markets and further deflationary trend. But at the first meeting in January 2015, the FOMC will signal for the next two or three meetings that they might reverse their strategy. This may come as a shock to the market, as the market will realize that the Fed has no way out. They will not rest until they get inflation. Therefore, they will have to print a lot more, which will be quite positive for gold. Gold updateIf gold goes back to the 1,200 level a fourth time, then it could get dangerous as it might fall to 1,050. This should bring in some major support. But currently gold is still in an ongoing bear market. It is not given that gold has found its bottom yet. There is a seasonal correction. Is it going to develop into a major crash? Fact is, that money is parked, malinvestments are built up and if the economy weakens, then the "magic hand" will come up and help us to some more malinvestments further down the track. So it's a very kaleidoscopic world, where the mixture of technical and fundamentals makes absolute return investors think that having lots of cash is not the worst idea. If you don't find a decent risk-return, don't do it. Read the full transcript

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Minor Weakness Is Nothing To Fear Posted: 28 Oct 2014 04:00 PM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Infographic: Worlds Highest Gold Producing Countries Posted: 28 Oct 2014 03:31 PM PDT Perth Mint Blog. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Many Ways The State Taxes The Poor Posted: 28 Oct 2014 03:18 PM PDT Submitted by Julian Adorney via the Ludwig von Mises Institute, Most defenders of the state assume that government services help the poor. And, sometimes, some poor people do benefit financially from government programs. But there’s a hidden cost: taxation and mandatory programs (Social Security, for instance) that hurt the needy by restricting their choices. Government taxes away income that low-income households could invest in improving their lives. At the same time, state-sponsored benefits create incentives that keep the poor trapped in poverty. Many assume that government barely taxes the poor, but the reality is otherwise. The poorest fifth of Americans pay 16 percent of their incomes in taxes (including federal, state, and local). One in six dollars they earn goes straight to the government. For a family living at the margin, those taxes can be the difference between food on the table and hungry children. Admittedly, a big chunk of government expenses is for programs designed to help the poor. But even when this money actually helps — and it rarely does — it’s important to note the pernicious effects of taxation. Consider: every dollar of taxes is one dollar that a worker must give to the government first, regardless of whether that dollar could help him feed his family or improve his livelihood. If a poor man is faced with the choice of paying taxes or starting a business, he had best choose the former, otherwise he’ll go to jail. This is true for the wealthy as well. But poor people live closer to the margin. More of their money is taken up with fixed bills like rent and food. This leaves them less discretionary income to, for instance, invest in a business. Because their pool of discretionary income is smaller, taxes cut deeper into it. Mandatory government programs, such as Social Security and Medicare, compound the choice-restricting effects of taxation. Social Security, for instance, forces people to save for retirement regardless of whether or not that money could be better spent in another way. Saving for retirement is generally a good idea; most people anticipate needing a monetary cushion to see them through their golden years. But it’s not the best approach for everyone. The young woman with terminal cancer, for instance, probably won’t be around to enjoy the fruits of Social Security. She can best maximize her happiness by spending that money now, whether it’s on fun experiences, or on taking care of her children, or on better medical treatment. Similarly, for the destitute man who can afford to either save for retirement or feed his children, it takes a heartless bureaucrat indeed to force him to do the former. Yet that is precisely what Social Security does. Many poor people eventually want to start a business or learn new skills. Both take start-up capital. Imagine that John, a retail worker barely making ends meet, wants to learn to code so that he can find a better job. Most learn-to-code programs, such as Code School, aren’t free. Investing in such a program could significantly increase Johdn’s value and salary, allowing him to improve his finances both now and later. But faced between paying 7 percent of his paycheck to Social Security, or investing that 7 percent in learning new skills to build a career, John has to choose the former or go to jail. Each individual has his or her unique circumstances. For some, saving for retirement right now might be smart. For others, that money could be better spent on something else. By mandating retirement savings, government robs individuals of the freedom to make their own decisions. I’ve focused on Social Security, but other government programs have the same effect. Obamacare requires that people buy insurance or pay a fine, even if insurance isn’t in their best interests. Medicare forces the poor to put aside part of their money today to pay for their health care costs in old age — regardless of whether or not that decision is best for the man or woman in question. But what about programs that give the poor money, like the Supplemental Nutrition Assistance Program and unemployment benefits? Even these programs create perverse incentives, trapping men and women who use them in poverty. Because government assistance has built-in cutoff points, it creates de facto high marginal tax rates for the poor. If Jane makes $10,000 per year at McDonald’s, she might rely on programs like Medicare and welfare to make ends meet. But imagine she has the option to switch industries and take an entry-level job in a new career (for example, marketing) that pays $25,000 per year. If she takes the new job, she could end up bringing in $2,540 less on net. She might get $15,000 more from her employer, but she’ll lose $17,540 through a combination of higher taxes and reduced government benefits. For Jane, the economically rational decision is to keep flipping burgers and not move to a new position. Government incentives reward her for staying in a dead-end job. By obeying these incentives, she misses out on all the promise inherent in a real career. People in marketing tend to be in demand in almost every company, and have more choice in where they want to work. They can earn promotions and climb the corporate ladder. These options aren’t available for a fast-food worker. Government programs give Jane the financial incentive to stay in her current position, restricting her long-term options. Government programs, well-meaning or not, serve to trap the already downtrodden. By contrast, the market creates freedom and options and promotes upward mobility. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Quiet Option Expiration, Markets In Lockdown Posted: 28 Oct 2014 01:33 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Oct 2014 12:31 PM PDT But that won't deflect a possible dip to $1000 per ounce first, says this leading German newsletter analyst... OLIVER GROSS is a passionate resource expert, prudent investor and adviser with more than 10 years of experience in the mining and junior sector. Chief editor and analyst of the newsletter Der Rohstoff-Anleger – which is published by Germany's online GeVestor Financial groupm, and specializes in the global junior resource sector – Gross here tells The Gold Report why gold prices could get washed down to $1000 per ounce before the fundamental fact of "peak gold" drives a new bull market... The Gold Report: Earlier this month, the broader equities markets suffered huge losses as gold made significant gains. Then, after the broader markets recovered, gold fell. Is there now an inverse relationship between the health of the broader markets and the price of gold? Oliver Gross: This kind of inverse relationship between gold and the broader equity markets isn't really new. It has been observed since fall 2011, when the price of gold peaked. Since then, gold has fallen more than 35%, while the S&P 500 has risen 70%. The current situation resembles the early 2000s, when the broader equity markets were in the final phase of the dot-com bubble, while gold traded as low as $340 per ounce ($340 per ounce). Then, of course, the broader equities markets collapsed, while gold rose above $1900 per ounce. TGR: Some analysts believe that the broader equities market is dangerously overvalued. To give one example, Netflix was recently trading at 144 times earnings. What do you think? Oliver Gross: After a 5-year bull run leading to new all-time highs in the broader equity markets, there are many signs of bubble formations in the Internet, high-tech and biotechnology sectors. Again, this feels like the early 2000s. The extremely high price-to-earnings ratios in stocks such as Netflix indicate investor euphoria and huge amounts of speculative capital provided by the central banks. It is shocking to compare valuations in the broader sectors of the equity markets to valuations in the precious metals space. TGR: How should investors react to this bubble? Oliver Gross: Speaking for myself, as one who follows an anticyclical strategy, I like to invest when there is blood in the streets, and that is certainly what is happening with precious metal equities. Today, investors can buy gold and silver stocks at decade-low valuations and historically low bullion-to-equity valuations. Nobody cares about precious metals equities today, but when the bubble in the broader markets bursts, we will see a massive shift in market sentiment and in the behavior of investors. That said, investors must stick to best-in-class stories and must demonstrate constancy and patience. TGR: Could the collapse of the bubble lead to a crisis similar to that which occurred in 2007-2008? Oliver Gross: Yes, the possibility of another Lehman Brothers event is there. When the largest and most influential players in the financial industry want to exit this market, we could see a 2008-like selloff very, very fast. I also think that it is only a matter of time before a further big player in our financial industry will go the same way as Lehman. TGR: Geopolitical turmoil today is greater now than it has been for quite some time: Gaza, ISIS, Ukraine and now Ebola. Traditionally, this would have resulted in a significantly higher gold price, which has not happened. Is what we have seen this year an anomaly, or is the price of gold no longer affected by external events? Oliver Gross: That is a question not easily answered. Traditionally, gold has been regarded as the ultimate crisis protection, so geopolitical turmoil usually resulted in a higher gold price. What has changed is the incredible power of the central banks. They have changed the rules of the game. This is a major financial experiment with no historical precedent. The combination of unlimited liquidity, historically low interest rates and historically high debt levels has, for the moment, mitigated geopolitical risk factors and guaranteed faith in the US Dollar as the world's reserve currency. Gold has fought incredible odds since fall 2011. It is the most hated asset class, the official enemy of the US Dollar reserve and our global monetary system. And so the biggest financial institutions have no interest in higher gold prices. They still control the gold futures and the paper-gold market, so it is easy for them to attack the gold price. But this can't continue forever, and it's just a matter of time before all the money created since 2008 will no longer simply inflate asset bubbles. Inflation will return, and gold will again respond positively to external crises. TGR: Where do you see gold and silver prices going in the short term? Oliver Gross: I see a 50% chance of a final panic selloff across the gold and silver space. In this scenario, gold could fall to $1000 per ounce, and silver could fall as low as $12 per ounce. TGR: Wouldn't such prices lead to widespread curtailment of bullion production? Oliver Gross: The current all-in costs of gold producers are now above $1150 per ounce, even after massive cost reductions and a focus on higher-grade mining. Such expedients can have only a temporary effect. At a gold price of $1000 per ounce, there will be many shutdowns. We need a gold price of at least $1400 per ounce to support sustainable production, and that number will rise, as early as 2015 or 2016. We have reached Peak Gold, and it's here to stay. The highest-grade and most-profitable deposits are gone. The bear market in the gold mining space has been so long and painful that the major producers have their backs to the wall. Most discoveries of the last five years need a far higher gold price to be mined. In addition, many recent discoveries are located in jurisdictions with high country or environmental risks and lack infrastructure, resulting in multibillion-Dollar capital expenditures (capexes). TGR: As a result of the factors you've mentioned, can we now expect a big increase in mergers and acquisitions (M&As)? Oliver Gross: Not so much among the majors. Most of them have weak balance sheets and too many in-house projects to risk expensive and dilutive takeovers. TGR: What are the attributes possessed by those companies likely to be taken out? Oliver Gross: When the influential players in the gold mining space think that the gold price bottom is in, and a new bull market is likely, M&A interest will grow big time. Such a consolidation could create a perfect storm for the strongest junior gold producers and quality gold developers with robust, competitive projects. Specifically, takeover targets will have financeable mine capexes with a good relation to the discounted net present value (NPV) of their projects. They will be profitable with gold at $1100 per ounce, and at least break even at $1000 per ounce. Their projects will be in pro-mining jurisdictions with stable laws, the sustainable support of regional and local communities, and solid infrastructure. TGR: What about management? Oliver Gross: Takeover targets must have managements with strong track records, or, failing that, existing investment from the larger precious metals companies or previously successful strategic investors. And, of course, healthy financials. There are many evaluations to be made, and there aren't any "no brainers" here. Due diligence and continuous research are critical. When you think you haven't spotted any weaknesses, you've likely missed something. TGR: You are now more bullish on uranium companies, correct? Oliver Gross: Uranium prices have just enjoyed their first recovery in years. We may have seen the bottom here, so I think investors should put uranium stocks back on their watchlists. TGR: Finally, given that so many current investors in gold companies want out, does the M&A flurry you've suggested offer a special opportunity for contrarians? Oliver Gross: Absolutely. Both specific and general valuations are among the lowest for the last 30 years, so this could be the most attractive environment for contrarian investors in a couple of generations. TGR: Oliver, thank you for your time and your insights. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Gold and Silver Are the Good News Metals Posted: 28 Oct 2014 12:30 PM PDT Analysts and some precious metals' sellers tend to focus on the "insurance" aspect of owning precious metals. They point out that having some in your possession helps protect your wealth in case of inflation, political unrest, or for use as an "alternate currency" during a natural disaster, war, etc. Of course, these are all valid reasons for purchasing and holding "the precious metals four" – gold, silver, platinum, and palladium. But the benefits go far beyond the insurance and assurance aspects. It just makes all around good sense. For you see, each of these are in their own way, "good news" metals. As the developing world's wealth increases, hundreds of millions of people have more disposable income – money left over after covering life's basic expenses. For millennia, a significant portion has always been directed and will continue to find its way into precious metals' ownership. In Asia, Indians regard gold and silver as "bank accounts in your hand," dowries for exchange upon marriage, or the raw material for the creation of jewelry having lasting beauty. In China, where the savings rate can be as high as 40% of income, precious metals fulfill the timeless role of asset preservation. In North America, Eagle and Maple Leaf sales continue to set records. Through September of this year, roughly 26 million American Silver Eagles have been purchased – on track to set an annual record – the most since their introduction in 1986. When my daughter graduated from high school in 2000, my gift to her was a one-ounce gold Krugerrand – for which I paid $275. When America's first pure gold coin, the 24 carat American Buffalo was introduced in 2006, I bought one for $800 for each of my children. All of these coins are absolutely beautiful. They speak of our nation's past. They bring a smile to the face of someone who holds them in their palm. They are a store of (increasing) value. They are a "physical reality" by which only the person who owns them can lay claim. They are a direct and enduring link to 5,000 years of history. Industry Loves These Metals Too!Governments are mandating phasing out of incandescent bulbs for supposedly more efficient fluorescent lighting. But fluorescents turn on slowly, produce a different quality of light, and still contain mercury – a neurotoxin harmful to both people and the environment. At the same time, the Light-Emitting Diode (LED) is revolutionizing the lighting industry. It contains no mercury, generates little heat, lights instantly, and can last for 25 to 100 years! A 60 watt LED uses just 10 watts of power – 85% less than a traditional bulb. Continuing to decline in cost, they are replacing older methods in traffic intersection lights, residential and commercial lighting, flashlights, and headlamps. Small amounts of gold and silver compounds are used in the soldering process. This is critical in forming a chemical bond with the gallium on the wafer's surface of every LED, enabling the semiconductor to conduct electricity so it can function like an electronic device. Each year over half of silver's global production is earmarked for (mostly unrecoverable) use in hundreds, if not thousands of silver industrial applications which make our lives more productive, enjoyable, and safe. Add robust investment and jewelry demand, and you get a sense of where prices are headed over the next few years. This is good news! Many of the world's largest cities suffer from life-threatening levels of pollution generated by cars, trucks, and engines of all kinds. Catalytic converters use platinum and palladium to reduce these harmful emissions. But auto makers are now working to create emission-free vehicles. These fuel cell vehicles (FCVs) use platinum as a catalyst to split hydrogen fuel into ions and electrons – virtually eliminating carbon monoxide emission – replacing it with water vapor! It is reported that each FCV produced will require at least one ounce of platinum. With supplies of platinum and palladium moving into multiple-year deficit territory, it's not hard to see that their cost will rise as the forces of demand and supply collide. More good news. Across cultures and historic time periods, anywhere in the world, precious metals have always been instantly accepted as money – unlike the eventual fate of virtually every artificially-created paper currency that has ever been circulated. Yes, the "paper promises" in our wallet still buy us things, but consider this: In the United States since 1971, inflation has caused the dollar to lose 83% of its purchasing power – and that's using the federal government's own statistics that understate the real number. That means the greenback is barely worth 17 cents. Meanwhile, during that time, an ounce of gold or an ounce of silver has increased in value by well more than 1000%! (This new Money Metals infographic tells the story.) Frank Holmes has popularized the "2 doors" nature of gold's attraction for buyers. He calls them the "fear trade" and the "love trade" – both powerful motivators. Stu Thomson understands what the future portends for owners, telling us, "The fear trade got you into gold. The love trade will make you richer with it." Yes, buy and hold the 4 precious metals to help protect your family from unexpected financial dislocations and perhaps earn a substantial profit. But do it also because of their timeless beauty, their abundant utility in industry, the warm feeling you get holding them in your hand… and the love exchanged when you share them with others. For all of the above reasons, make sure you own one or more of these four increasingly precious metals. Don't consider their purchase to be an expense. You're simply exchanging a paper currency that continues to lose purchasing power, for real money which not only holds onto its value, but tends to increase over time. Now that proposition is good news in anyone's book! About: David Smith is Senior Analyst for www.TheMorganReport.com and is a regular contributor to www.MoneyMetals.com. For the last 15 years, he has investigated precious metals mines and exploration sites all over Argentina, Chile, Mexico, China, Canada, and the U.S. and shared his findings and investment wisdom with readers, radio listeners, and audiences at North American investment conferences. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Modern Money: Just a Way of Keeping Score Posted: 28 Oct 2014 12:24 PM PDT Or so MMT would have you believe. Which most people can't... "WE CAN'T run out of money," economist L.Randall Wray said, writes recent modern monetary theory convert Chris Mayer in The Daily Reckoning. The US government spends through keystrokes that credit bank accounts, he continued. The money comes from nowhere. The government doesn't need to finance itself with taxes. And it doesn't borrow its own currency. It can afford all that is for sale in Dollars. Despite laying out an incontrovertible set of facts, Wray's audience often is aghast. He says he gets four reactions when he tells people about how the government spends:

Wray is one of the architects of Modern Monetary Theory, or MMT. In essence, it is a description of how our monetary system works. The implications are profound. And Wray is very good at explaining it simply. Below are some notes from a talk he gave at the Post Keynesian Conference in Kansas City, which I attended. To begin, I like how Wray emphasized he's not really saying anything people at the Federal Reserve Bank don't already understand. First, there is a great quote from Ben Bernanke when, as Fed chief, he was on 60 Minutes:

Bernanke gets it. "The Fed can't run out of money," Wray said. "As long as someone at the Fed has a finger and they have a key to stroke, they can't possibly run out of money." Second, there is this statement from the St. Louis Fed:

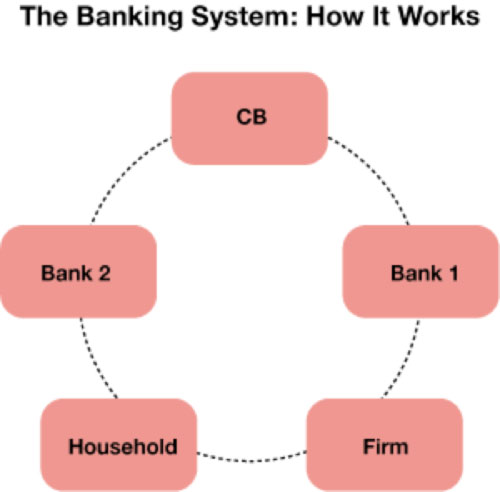

And yet it is not uncommon to hear people say the US is bankrupt or that the Fed itself is somehow in trouble. People on the inside know differently. As Wray emphasized: Government can never run out of Dollars. It can never be forced to default. It can never be forced to miss a payment. It is never subject to whims of "bond vigilantes". Money...is simply the way we keep score in a modern economy. Banks are the scorekeepers. Thus, there is no need to balance the budget, heresy of heresies! As Wray says, "The necessity of balancing the budget is a myth, a superstition, the equivalent of old-time religion." "Whoa!" I hear you say. Let's back up. To understand how modern money works, it may be best to start with the banking system. Wray began with a simple model of a bank, a firm and a household. "So a firm approaches a bank and says it would like a loan," Wray says. "Where does the bank get the money?" It creates it out of thin air, out of nothing. It keystrokes it into existence. It creates a loan (an asset for the bank) and offsets it with a deposit (a liability for the bank). The firm gets a credit (an asset) and an offsetting debit (the loan). No prior deposits needed. As Wray says: "Loans create deposits. The bank lends its own IOUs. Can they run out?

This is important. If you don't get this, banking will forever remain a mystery to you. To get back to our example: The firm then takes the loan and uses the proceeds to hire people from our household. People then use the funds to buy the product from the firm, and the firm uses the money to repay the loan. It's a super-simple model. So let's add another bank and a central bank to make it more realistic. Now the firm and the household use different banks. The banks have to clear with one another. They do this through the central bank by using the IOUs of the central bank – called reserves. "What happens if Bank 1 is short reserves to clear the account?" Wray asked. "The central bank creates reserves so that Bank 1 can clear with Bank 2.  "Can the central bank run out of reserves? The answer is no," Wray says...

Now, how about the government? The US government spends it currency into existence. This is important, too. The government spends first and then collects taxes. (Logically, this is how it began, or else how would people get the money to pay taxes?) Taxes are what give the Dollar value. As Alfred Mitchell-Innes, a diplomat and credit theorist, once put it: "A Dollar of money is a Dollar, not because of the material of which it is made, but because of the Dollar of tax which is imposed to redeem it." In the old days, this was obvious. A government would, for example, raise a tally. It got a bunch of hazel wood sticks and made tallies and spent them. Or it stamped coins or printed notes. Then it collected taxes in whatever it claimed as money. Today, it is more complicated. The Treasury spends Dollars into existence through the central bank. The central bank credits the accounts of banks, and banks credit whoever is getting paid. Taxes reverse the process. Banks then debit accounts, and the central bank debits the banks. The government cannot run out of credits. Money, then, is simply the way we keep score in a modern economy. Banks are the scorekeepers. They can no more run of credits than the Fenway scorekeeper can run out of runs. Taxes don't finance the government any more than taking runs off the scoreboard replenishes Fenway's scorekeeper. And the scorekeeper certainly doesn't need to borrow runs. True, there are operational constraints to how much the government can spend. There is the budgeting process, which is a real constraint. There are other technicalities that Wray says are not effective constraints. For example, technically, the Treasury must have the balance in their central bank account before they write a check, but practically, it makes no difference. This is because the central bank, Treasury and special private banks have always developed procedures to allow the Treasury to get deposits into the central bank before it writes the check. Another example is that the central bank can't buy Treasury securities directly from the Fed. But again, in practice, this makes no difference. There are special banks standing ready to buy new issues and then sell them to the central bank. To sum up MMT's findings: Government spending credits bank accounts. Taxes debit bank accounts. And deficits mean net credits to bank accounts. (If the government never ran a deficit, the nongovernment sector could not have a positive net balance of Dollars.) The main conclusions to keep in mind are that the US government cannot go bankrupt in its own currency. It can always afford to buy whatever is for sale in its own currency. And the only economic constraints it faces are full employment of existing resources and inflation (by spending too much). Other constraints are political. Wray ended with a slide about what he did not say, since people are apt to jump to absurd conclusions:

Now you have some understanding of modern money. And so when someone says the country is bankrupt or that it relies on the Chinese to finance it, you'll know that simply isn't true. Just these ideas alone put you ahead of most everyone else, including most professional economists. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Big Question: Have We Seen The Bottom In Gold & Silver? Posted: 28 Oct 2014 11:43 AM PDT  Today KWN is putting out a special piece which features two fascinating charts that help to answer the question on many people's minds: Have we seen the bottom in gold and silver? These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the two key charts which help to answer that all-important question. Today KWN is putting out a special piece which features two fascinating charts that help to answer the question on many people's minds: Have we seen the bottom in gold and silver? These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the two key charts which help to answer that all-important question.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Robust Demand for Physical Gold Support Prices Posted: 28 Oct 2014 11:22 AM PDT Gold prices climbed to their highest level since Sept. 10 last week, breaking above the $1,250 an ounce level. Gold’s outlook this week will depend largely on the Federal Reserve policy meeting, when the U.S. central bank is widely expected to end its bond-buying stimulus. The Fed’s two-day meeting, which begins today will also be watched for clues on whether any slowdown in Europe or elsewhere could affect the central bank’s monetary policy. On Monday, October 27, some of the biggest financial news of the year made huge waves all over Asia. Yet in the Western press, this hugely important event was barely even been mentioned. The Chinese government announced that the Renminbi or Yuan will become directly convertible with the Singapore dollar effective Tuesday, marking another step toward internationalizing the Chinese currency. The announcement by China Foreign Exchange Trading System (CFETS) extended the yuan’s list of direct onshore trade to more major currencies, including the U.S. dollar, the euro, British sterling, Japanese yen, Australian dollar, New Zealand dollar, Malaysian ringgit and Russian rouble. With direct trading of their currencies, China and Singapore will be less dependent on the U.S. dollar to settle bilateral trade and investment deals. Previously, the exchange rate between the two currencies was calculated based on the yuan-U.S. dollar central parity rate and the Singapore dollar-U.S. dollar rate. Now that the two currencies can be directly traded, the yuan-Singapore dollar rate will be set based on the average prices offered by market makers before the opening of the interbank foreign exchange market. The Chinese government is gradually relaxing its hold over the yuan and making it a global reserve currency. China is also under pressure to diversify its foreign exchange reserves, which stood at 3.89 trillion U.S. dollars at the end of June. According to the Society for Worldwide Interbank Financial Telecommunication (SWIFT), international bank payments denominated in yuan have nearly tripled in value in the past two years. Physical buying ahead of the Indian Diwali holiday helped push gold to its upper levels, along with some short-term technical-chart related buying, but gold's inability to build on those gains caused the market to retreat. Gold imports into India surged more than four-fold last month on expectations that declining prices would boost festival demand. Purchases have been estimated at about 95 metric tons compared with 15 tons to 20 tons in September last year, said Bachhraj Bamalwa, a director at the All India Gems & Jewellery Trade Federation. Buying and gifting of gold is considered auspicious and the most favorable time is the festival of Dhanteras, two days before Diwali which occurs on Oct. 23. Festivals run through November and the wedding season follows to early May. Sales of gold increased by around 20% this Dhanteras when compared with last year. In Ahmedabad, as many as 60 jewellers that belong to the Ahmedabad Jewellers’ Association launched the grand shopping festival “Swarna Utsav” with the primary objective of recouping the losses incurred by them in the past six months due to lack of business. In Ahmedabad the local jewellers expected the business to cross Rs 250-300 crore till Diwali (October 23). “During Dhanteras the sales of gold and silver has been significantly higher than last year. We expect sales to rise by 15-20% this year over last season,” said Shantibhai Patel of the Ahmedabad Jewellers’ Association. He said that this was due to lower price of the precious metals. “We expect sales of Rs 250-300 crore this Diwali season,” he added. Explaining the buying trend Patel said that people seemed to prefer coins, bars and lightweight jewellery this year for investment. “Compared to last year more people are going for gold coins and lightweight jewellery. This is also because the marriage season is a little late this year,” he said. In Rajkot people crowded local jewellery stores. The Rajkot Gold Dealers’ Association president Bhayabhai Sholiya said that in Rajkot city dealers expected to see an increase in sales of around 15%-20% compared to the previous Diwali season. Haresh Soni of the All India Gem and Jewellery Trade Federation also expects to see higher sales this season. Meanwhile, jewellery sales jumped by at least 30% this Dhanteras in the popular Zaveri Bazaar. According to MMTC-PAMP-the country's leading gold and silver refining and minting facility, its entire inventory of gold and silver coins minted for sale during Diwali has been sold out. The total sales of gold and silver coins increased by 40% over last year. MMTC-PAMP is a joint venture between state-owned Metals and Minerals Trading Corporation of India (MMTC) and Switzerland-based world's leading bullion brand PAMP SA. It is the country's first and only LMBA accredited gold and silver refinery. “Diwali sales across the country were very good. It was about 20% higher compared with last year,” Bachhraj Bamalwa, director at the All India Gems and Jewellery Trade Federation, told Reuters. The trade body represents more than 300,000 jewellers. Diwali, known as the festival of lights, is a five-day celebration with fireworks, candles, sparklers, and other lighting displays by millions of Hindus, Sikhs and Jains across the world. The first day this year is October 23, and it usually falls between the last two weeks of October and the first two of November. During the five-day festival, people dress in their best new clothes, and of course, gold jewellery. Nearly 20% of annual jewellery sales are attributed to the holiday. “This year prices were low, sentiment was good and we have a stable government at the centre; all of these helped boost sales,” Bamalwa said, referring to this year’s election of Narendra Modi as the prime minister. Although the major gold buying festivals of the year are over, the wedding season is set to begin in the third week of November. Bamalwa said sales could continue to be strong due to the wedding season that will extend until early next year. “The gold demand this Diwali mirrors the general optimism that has set in the economy, reinforcing the traditional faith in gold for the average household saver and the increased economic relevance of this asset class due to various uncertainties on the horizon. Policy restrictions have had little impact on demand for gold, though sources of supply have increasingly shifted to unauthorised channels. It is time for a long term approach to gold in India. As a nation we need to focus on measures that will unlock the potentially transformative value of the gold stored in millions of private households in order to fund the nation’s growth.” Somasundaram PR, Managing Director, India, World Gold Council. The World Gold Council forecasts India will import 850 to 950 tons of gold in 2014. According to the China Gold Association, China’s gold off-take in 2013 reached 2,200 tons, substantially more than the 1066 reported by the World Gold Council. According to GATA consultant Koos Jansen, the amount would constitute most of world gold mine production and the figure apparently does not include purchases by the People’s Bank of China, which remain the most sensitive state secret. And, on Monday October 27, China’s net gold imports from main conduit Hong Kong jumped to a six-month high in September . Net imports from Hong Kong to the mainland rose to 68.641 tons last month from 27.477 tons in August, according to data e-mailed to Reuters by the Hong Kong Census and Statistics Department. Total gold imports from Hong Kong totalled 91.745 tons. Meanwhile, The Central Bank of the Russian Federation added a whopping 1.2 million troy ounces to their holdings in September. This is the biggest one-month purchase they’ve ever made. The previous biggest addition was 1.1 million ounces back in May of 2010. Russia’s Central bank reserves now stand at 37.0 million troy ounces. No asset has had as much history of purchasing power as gold. Fiat currencies are unreliable – they aren’t tied to any asset of value. Their worth comes from government regulations and laws, which are subject to crumble over time. Physical gold coins or bars are an unequalled safe haven, due to their liquidity and lack of counterparty risk. (This does not include limited edition medallions and numismatic items which are not to be confused with bullion products). Frankly, I believe limited edition medallions are not of any value to investors. Both gold and silver are a liquid, universally recognized form of transportable wealth that is not simultaneously someone else’s liability. That’s what makes them so desirable. Technical pictureAlthough gold prices pierced the $1250/oz. level, they failed to rally further. Prices may correct before the next leg to the upside.

For more information go to: www.lakeshoretrading.co.za | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Don’t Miss The Biggest Biotech Market EVER! Posted: 28 Oct 2014 10:15 AM PDT This post Don’t Miss The Biggest Biotech Market EVER! appeared first on Daily Reckoning. [Ed. Note: You've probably heard a lot of noise this year about the dangers of investing in biotech stocks. Just Google the words "biotech bubble" and you get just shy of a million hits. But for a handful of investors who've followed this market very closely, the word "bubble" has no business in the conversation. To those who know better, this is a raging bull market -- one that's going to make a few savvy investors a lot of money before it's all over. So, to continue a theme we've been discussing in The Daily Reckoning e-letter this week, this essay from our biotech analyst, Paul Mampilly, seems as timely as ever... even though it was originally published in April of this year.] The ducks are quacking: Biotech bubble. Biotech collapse. Biotech, blah, blah, blah. Quack! Quack! Quack! Here's what you should do when you hear the ducks. Forget them. Forget the ducks, forget the quacks. I want you to focus on one thing, and one thing only: how you are going to make money from what I believe is going to be the biggest biotech market ever. Yes, I said EVER. Why am I so optimistic about investing in biotechnology and the life sciences? Biotechnology in its current form really didn't even exist until 1980. That's when scientists were able to reproduce interferon using recombinant DNA. Interferon is a protein that cells make when viruses (like hepatitis C), bacteria (like E. coli), parasites (like malaria) or cancer cells attack our bodies. And recombinant DNA is just a fancy way of saying that we were able to make interferon outside our bodies in a way in which we could produce it and give it to people as medicine. My point in telling you this is not to school you in Biotech 101. The point I am trying to make is that biotechnology is still a pretty young field. You should understand that we have barely scratched the surface of what we can do with the things we now know about the human body and cells and genes. That's why I firmly believe that we are in a golden age of biotechnology investing. And if you make the right moves at the right time, you are going to have a chance to make a lot of money. …the Nasdaq Biotechnology Index has gone up 306%, even after a steep drop in the early part of 2014. Now, that does not mean that biotech stocks won't go down from time to time. Or that biotech stocks won't go through periods in which the ducks won't stop quacking about it being a bubble or that these stocks are going to crash. Now let's just go back to the ducks. You know, the people quacking on TV, on the Internet, in your ear nonstop about how you should be afraid of biotech stocks. You know the one thing all these people share? Every single one of them has completely missed the huge run-up in biotech stocks. It's typical human behavior to put down and criticize what you don't understand and rationalize it as being stupid. But I want you to understand, because it's going to be key to making money in biotechnology now and in the future, that these people I call ducks are quacking only because they didn't own any biotech stocks. And these people have been wrong for two years straight as biotech stocks as measured by the Nasdaq Biotechnology Index have soared by 117%. One Hundred Seventeen percent!! If you look back five years, the Nasdaq Biotechnology Index has gone up 306%, even after a steep drop in the early part of 2014. And what's been driving this success? This is a question you need to ask. The answer is lifesaving products for cancer, like Gleevec. Gleevec has transformed one particular kind of cancer called chronic myeloid leukemia (CML). CML used to be a death sentence. But today, if you have CML, it's a chronic disease. What's a chronic disease? It means that people who have this form of cancer pop a pill once a day. And then they go about their lives just like everyone else. Gleevec has almost no side effects. So I am not exaggerating when I say that these people just pop a pill and keep living just like you and me. And I can tell you that there are at least 20 companies looking for similar pills that can make every type of deadly cancer into a chronic disease. In 2013, biotech companies as a group generated sales growth of 12% and earnings growth of 22%. In 2014, sales are expected to grow 16% and earnings 24%. These numbers I am citing come from a JP Morgan report. JP Morgan also says that biotech companies generated $73 billion in cash flow from operations between 2008-13. In 2013, the FDA approved 26 drugs. Among the drugs approved are potential blockbuster drugs for cancer, which I believe are going to make investors come back to invest in biotechnology stocks, sooner, rather than later. So the next time you hear quacking about biotech, I want you to understand that this person is a sore loser. These people have missed out on the huge gains of the last five years. This person is lazy and, unlike you, who is reading this because you want to learn more and understand what's going on, never going to lift a finger to read or learn anything. So don't be surprised when biotechnology stocks start going up and these ducks are still quacking the same about bubbles and crashes. Blah, blah, blah. Now, I don't want to sugarcoat what's going on right now in biotechnology. Some investors have been dumping biotechnology shares left, right and center. And stocks that I have picked for readers of my service Agora Financial's FDA Trader have not been spared. No one likes seeing the value of a stock they bought go down. No one. Not even me, despite having 25 years of experience which includes a 5 year stint at a huge hedge fund in New York. But you know you'll never make the big money in biotechnology if you can't withstand a bit of volatility. Regards, Paul Mampilly Ed. Note: This article was prominently featured in the email edition of The Daily Reckoning. But it actually included a lot of things you won’t find here… like additional, up-to-the minute analysis of the biotech sector… how to distinguish a bubble from normal market… and even an easy way to access the world’s best biotech plays. The only way to access that material is by signing up for the Daily Reckoning email edition, which you can do for FREE, right here. The post Don’t Miss The Biggest Biotech Market EVER! appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Grant Williams: This little piggy bent the market Posted: 28 Oct 2014 10:01 AM PDT 1p ET Tuesday, October 28, 2014 Dear Friend of GATA and Gold: In his latest "Things That Make You Go Hmmm. ..." letter Singapore-based fund manager Grant Williams examines the history, objectives, and prospects of Switzerland's gold initiative referendum proposal, along with the duplicity and hypocrisy of the Swiss National Bank. Williams' letter is headlined "This Little Piggy Bent the Market" and it's posted at the Mauldin Economics Internet site here: http://www.mauldineconomics.com/ttmygh/this-little-piggy-bent-the-market CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| James Turk - 2 Key Charts, Gold & The Destruction Of Money Posted: 28 Oct 2014 10:00 AM PDT Goldmoney | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold vs Paper - A Tale of Two Cities Posted: 28 Oct 2014 09:44 AM PDT This is a work of fiction with a few similarities to the reality we all know and trust, or … the reality that we think we know. City A in a Paper World: A financial genius had a plan! He and his offspring implemented the plan over several hundred years. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Omniscient Federal Reserve Captures The Capital Market, For Now. Gold Beckons Posted: 28 Oct 2014 09:40 AM PDT A cursory glance at the various financial news media this morning shows nothing particularly unusual for these unusual times. The ECB have paraded a list for stress tested banks and the market shrugged. However, there is a disturbing thread running through most of the stories to which we have become immune but which would have been considered highly unusual at almost any time in the twentieth century. And that thread is the influence of the Federal Reserve in practically every key market in the world. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The End of QE and the Price of Gold Posted: 28 Oct 2014 07:19 AM PDT Background The programme known as Quantitative Easing is due to be halted at the end of October, coinciding with the next meeting of the Federal Open Market Committee which is scheduled for 28/29 October 2014. Monetary policy plays a big role in gold’s fortunes and so the strategies put in place by the central banks around the world need to be watched very carefully. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Economic Snapshot - Strong Dollar Eating into corporate Profits Posted: 28 Oct 2014 06:47 AM PDT Our view has been that a stronger US dollar would eventually start to eat away at corporate results, especially in the manufacturing sector and at US based companies with a global customer base. The decline in revenues thus far is something to be watched because where revenues go, earnings eventually follow. [edit: the segment previous to this one reviewed a contrast between strong earnings and sagging revenues with companies that have reported earnings thus far] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oliver Gross Says Peak Gold Is Here to Stay Posted: 28 Oct 2014 06:31 AM PDT The wave of zero-interest liquidity washing over the financial world could result in a short-term gold bottom of $1,000 per ounce, reports Oliver Gross of Der Rohstoff-Anleger (The Resource Investor). The good news is that Peak Gold is here to stay, which means that midtier producers will soon be desperate to buy low-cost, high-quality deposits. In this interview with The Gold Report, Gross argues that this could be the opportunity of a lifetime for contrarian investors, and suggests a half-dozen best bets to be taken out. The Gold Report: Earlier this month, the broader equities markets suffered huge losses as gold made significant gains. Then, after the broader markets recovered, gold fell. Is there now an inverse relationship between the health of the broader markets and the price of gold? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||