Gold World News Flash |

- Debt mountain to crush major economies in ‘Minsky moment’ warns Saxo Bank

- Gold Daily and Silver Weekly Charts – Non Farm Payrolls On Friday, End of Month Tomorrow

- 9/11 TRUTH GOES NUCLEAR: Massive Download In Progress

- Richard Russell - Financial Meltdown & Once In 600-Year Event

- El-Erian: Damning Gold With a Half-Hearted Nod

- Steve Lonegan: There are no free markets when markets don't set money's value

- Why Coeur Mining Stock Has Plunged 48% in 2014

- The Real Reason Canada Advised Against Carrying Cash Into the U.S.

- Venezuela's "21st Century Socialism": Food Lines For The People, New Cars For The Military

- The Gold Price Remains Oversold Adding $3.40 Closing Today at $1,217.50

- Clinkle is the New Color

- Summarizing The "Long Dollar Trade" In One Chart

- In The News Today

- Embry, Turk tell King World News about completely corrupted markets

- The United States: Police State Today, Martial Law Tomorrow; Part II

- John Embry - Silver Is The Cheapest Asset In The World Today

- Gold Daily and Silver Weekly Charts - Non Farm Payrolls On Friday, End of Month Tomorrow

- The Japanese Deflation Myth and the Yen’s Slump

- Total Corruption In Global Markets & Silver In Backwardation

- Russia’s Gokhran Buying Gold Bullion In 2014 and Will Buy Palladium In 2015

- Gold vs Silver during Precious-Metals Bull Markets

- Geneva group's report predicts low interest rates forever

- Rates on short-term Treasuries go negative

- DAVID CAMERON in UN Speech Says ANYONE QUESTIONING the 9/11 Official Story Is a TERROR EXTREMIST

- Lloyds fires eight over rate manipulation claims

- Technical Analysis: All Metals Weak, Gold Bull Market Over For Now

- Financial writer talks about hangup in publication of report on silver market rigging

- Singapore bourse to start kilobar gold trading to lure investors

- ECB president's strategy for reviving Europe looks like euro devaluation

- John Embry - Silver Is The Cheapest Asset In The World Today

- Koos Jansen: Chinese gold demand 'extremely strong,' even 'astonishing'

- 3rd Quarter Wrap Up

- Gold/Silver Ratio Leading the Dollar

- Gold Bullion "Faces Aggressive Shorting" as Hong Kong Protests Grow Ahead of China's Golden Week Holidays, US Jobs Data Loom

- The Single Most Important Lesson from the Casey Summit

- Silver Price At or Very Close to an Important Low

- Gold Price Very Close to an Important Low

- Gold and Silver Truth, Consequences, and Confiscations

- Jay Taylor Urges Investors to Stay Liquid for the Coming Gold Boom

- Does Surging Demand For Gold and Silver Coins Signal a Bottom?

- First U.S. Stealth Jet Attack on Syria Cost More Than Indian Mission to Mars

| Debt mountain to crush major economies in ‘Minsky moment’ warns Saxo Bank Posted: 30 Sep 2014 12:00 AM PDT by Peter Cooper, Arabian Money:

Debt Mountain Unsustainable debt will be the cause of the crash, according to Mr. Jakobsen, and will occur when the cash returns on assets become insufficient to service the debt taken on to acquire those assets in the first place. He gives no timeframe for his thesis but says that the problem of huge debts has been swept under the carpet by central bankers and policymakers and will come back as low inflation or even deflation… | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts – Non Farm Payrolls On Friday, End of Month Tomorrow Posted: 29 Sep 2014 10:00 PM PDT from Jesse's Café Américain:

Seamus Heaney, The Cure At Troy Today was the first position day for the October metals contracts. First delivery will begin on Wednesday, 1 October. China will go on a one week national holiday for ‘Golden Week’ on 1 October as well. There was nothing of particular interest in the delivery reports on the Comex for Friday, and some minor movements of bullion out of their warehouses and registered categories. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9/11 TRUTH GOES NUCLEAR: Massive Download In Progress Posted: 29 Sep 2014 09:32 PM PDT **Pictured: Huge caverns of "melted granite" were found below the foundations of the Twin Towers. Were they caused by thermo-nuclear explosions detonated to obliterate the steel reinforced, cast concrete, tubular core structure of WTC Buildings 1 & 2? by Michael Thomas, Story Leak:

"This 9/11 data dump is so radioactive the US Government will likely collapse. The world will never be the same when nations everywhere see this report!" – Veteran 9/11 Investigator The evidence is now clear and indisputable that the false flag operation carried out on September 11, 2001 was a multi-nation conspiracy. The USA, Israel, Saudi Arabia and UK have each been proven to be directly involved with the execution and coverup of this crime against humanity. There were other state actors and intelligence agencies involved such as Pakistan's ISI; however, the US Federal Government and Israel Secret Services are by far the most complicit. The voluminous amount of circumstantial evidence alone both indicts and convicts the US Government of crimes against its own citizenry. Likewise, Israel's fingerprints are all over the 9/11 crime scene and directly related criminal activities. Enter Russia … Edward Snowden … and the Alternative News Media

When Edward Snowden opted to stay in Russia after fleeing the USA little did he know that the NSA treasure trove he absconded with would serve as the basis for so much 9/11 revelation. The existence of this extraordinary cache of NSA evidence documenting criminal activity conducted at the highest levels of government has empowered Russia to reveal 9/11 Truth with unimpeachable authority. Hence, the Kremlin now conducts periodic and strategic data dumps concerning the real facts surrounding the events of 9/11. As long as the Anglo-American Axis, the European Union, and NATO continue to antagonize and persecute Russia, why would they not continue their "massive download" of 9/11 evidence which indicts the original accusers. The coup d'état conducted by the CIA, MI6 and MOSSAD in downtown Kiev only served to further inflame an already justifiably angry Russia. Putin Plays Chess While Obama Plays Checkers While the USA & Company issues one sanction after another, it is Putin who owns the critical pieces in the critical places on the ever-changing geopolitical chessboard. Not only can Russia shut down the Ukraine economy in a day and a night, much of Europe can be left out in the cold this coming winter season. Much more importantly, however, Russian social networks can download HUGE amounts of 9/11 evidence about the true false flag perpetrators in a New York Minute. Whereas Russia has yet to do just that, the Kremlin has permitted the release of earth-shattering material which is generally known on the internet as 9/11 Truth. The world is starving for such unvarnished and genuine truth in view of the fact that those false flag attacks have been systematically utilized by the real perpetrators to wage war against nations near and far. That's all about to change in 2014. With the dissemination of the most recent round of 9/11 Truth, the guilty state actors have been painted into the corner … WITH NO WAY OUT. When a nation such as Russia, which possesses an intelligence apparatus second only to the USA, provides high integrity information and data pertaining to the 9/11 false flag operation, and Edward Snowden is backing it up with NSA-generated hard evidence, how can the real perps possibly squeeze out of that corner? The internet has seen to it that no one can hide in 2014 and beyond … not in Paraguay, not in Pine Gap, nor in Punxsutawney, Pennsylvania. What do we mean by this? The following bullet points were extracted from one of the most earth-shaking interviews ever conducted on radio. This truly extraordinary interview took place among a group of 9/11 Truth seekers whose collective knowledge base, unique experience set and access to insider information qualified them "to blow the lid off " the US Government-coordinated conspiracy to commit high treason, mass murder, grand theft and premeditated acts of state-sponsored terrorism. The YouTube video of this unprecedented interview is shown below, as is the original hyper-link. This particular link has also been used for the following bulletized transcription of many of the key points concerning 9/11 Truth that were discussed. Many of those points have the YouTube time posted for ease of referencing. Veterans Today Radio Interview on 9-22-14 With Gordon Duff, Jim Fetzer, Preston James And Stew Webb [youtube_sc url= https://www.youtube.com/watch?v=9yeSX-PBnAE&w=560&h=315] ▶ Veterans Today Radio (9-22-14) Stew Webb, Gordon Duff, Jim Fetzer, Preston James – YouTube Beginning of transcription of key points from the preceding interview:

Is this the Nuclear Blast Hole beneath a WTC Tower that Dimitri Khalizov reported would result from a 150 KiloTon Bomb underground nuclear explosion?

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell - Financial Meltdown & Once In 600-Year Event Posted: 29 Sep 2014 09:01 PM PDT  Today the Godfather of newsletter writers, 90-year old Richard Russell, warned of a coming financial meltdown that he says will totally destroy the current financial system. The 60-year market veteran also discussed the fact that the world may now be witnessing a devastating once in 600-year event. Today the Godfather of newsletter writers, 90-year old Richard Russell, warned of a coming financial meltdown that he says will totally destroy the current financial system. The 60-year market veteran also discussed the fact that the world may now be witnessing a devastating once in 600-year event.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| El-Erian: Damning Gold With a Half-Hearted Nod Posted: 29 Sep 2014 09:00 PM PDT from The Daily Bell:

Dominant Social Theme: Gold is unloved but has its uses … Free-Market Analysis: Mohamed A. El-Erian was basically number two at the bond giant PIMCO until he decided he wasn’t going to wait for Bill Gross to retire. Too bad for him … as Gross quit the other day. El-Erian, meanwhile, is writing over at Bloomberg, among other gigs, and this excerpt is from one of his latest columns. It is typical of El-Erian in the sense that it purveys mainstream wisdom while weakly acknowledging that there is something else. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Steve Lonegan: There are no free markets when markets don't set money's value Posted: 29 Sep 2014 08:59 PM PDT There Ain't No Such Thing as a Free Market By Steve Lonegan Well-meaning conservative and libertarian groups beat the drum for something called "free markets." Liberal groups blame these "free markets" for many of the world's evils. Here's the harsh reality neither side will tell you. There ain't no such thing as a "free market." The free market ceased to exist more than 40 years ago. Nixon drove a stake through its heart by shutting down the Bretton Woods world monetary system, without which free markets cannot exist. It cannot exist in its true form because the very money that is the foundation of our economy now is just pieces of paper: "legal tender for all debts public and private." Money's value is controlled not by the markets but by a federal agency, the Federal Reserve, that thinks it thereby can control the economy ... like tuning a carburetor on a car. ... ... For the remainder of the commentary: http://www.marketwatch.com/story/there-aint-no-such-thing-as-a-free-mark... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Coeur Mining Stock Has Plunged 48% in 2014 Posted: 29 Sep 2014 08:49 PM PDT It's hard to believe that just a few years ago, silver had reached a 30-year high, and the prospects for Coeur Mining (NYSE: CDE ) and other silver miners seemed limitless as the bull market in precious metals extended well beyond the decade mark. Yet the commodity markets are fickle, and with silver prices plunging from their 2011 peaks, Coeur Mining has had to overcome not only challenging conditions in the industry but also some company-specific threats to its long-term success. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Real Reason Canada Advised Against Carrying Cash Into the U.S. Posted: 29 Sep 2014 08:40 PM PDT from The Wealth Watchman:

"Canada Warns Its Citizens Not To Take Cash To The USA" The original story made the rounds via zerohedge, and was taken from an interesting squib written by Martin Armstrong. Here's a few of Armstrong's assertions in the piece: "The Canadian government has had to warn its citizens not to carry cash to the USA because the USA does not presume innocence but guilt when it comes to money. Over $2.5 billion has been confiscated from Canadians traveling to the USA, funding the police who grab it.

If you are bringing cash to the land of the free, you will find that that saying really means they are FREE to seize all your money under the pretense you are engaged in drugs with no evidence or other charges. Now, those are remarkably true statements, but I decided to do a little digging into the reasoning behind the Canadian government's warning. What I found was a little different than what I'd expected to find, but still not too surprising. The Official Reasoning Behind the Warning When I first read that headline, I thought, "Wow, finally a government telling the truth to protect its citizens. Good for you, Ottawa!" Sadly though, the official reasoning for the warning was a little different than what was advertised. Allow me to explain. It was a little difficult to find, but if you go to the "Government of Canada" site, click "Travel", then "United States", and lastly, "Laws and Culture", you can find the warning there. Here it is in its entirety, under the heading "Money", it's only a few paragraphs: The currency is the U.S. dollar (USD). Canadian currency, traveller's cheques in Canadian dollars, and personal cheques drawn on Canadian banks are not widely accepted or easily negotiable in the U.S. All major credit cards are accepted throughout the U.S. There are banking machines that will accept Canadian bank cards, but these may be limited depending on your account access. Despite these difficulties, do not carry large amounts of cash. Non-U.S. residents generally cannot negotiate monetary bank instruments (international bank drafts, money orders, etc.) without having a U.S. bank account. There is no limit to the amount of money that you may legally take into or out of the U.S.. However, if you carry more than US$10,000 in monetary instruments (such as U.S. or foreign coin, currency, traveller's cheques, money orders, stocks or bonds) into or out of the U.S., or if you receive more than that amount while in the U.S., you must file a report (Customs Form 4790) with U.S. Customs. Failure to comply can result in civil and criminal penalties, including seizure of the currency or monetary instruments. Kinda disappointing, isn't it? It's not quite what it was said to be. While technically still a warning not to bring a great deal of cash, basically, the Canadian government is saying that Canadians shouldn't bring it simply because it can't be easily used within the banking system. The remarks about seizure of cash was only in the context of failing to comply with the reporting requirements. "Aha! So that was it, Watchman? It's just the 'hyping' and puffery that the precious metal community does so well! The Canadian government would never accuse the U.S. authorities of blatant abuse and cronyism!" Not so fast, Jack! The Real, Unofficial Reason Shortly after the warning was given, a high profile piece was written at the Canadian Broadcasting Company(CBC). The CBC is Canada's oldest existing broadcasting network, and is about as mainstream as it gets in Canada. Beyond that though, the CBC is what's known as a Crown Corporation of Canada. Crown Corporations are actually owned by the British Crown, and are established through an act of Parliament. The reason I bring this up, is to give context to the piece that was published at the CBC. The piece, by Neil Macdonald, which was published shortly after the government warning, was entitled "American Shakedown: Police Won't Charge You, but They'll Grab Your Money". Sounds good, already, doesn't it? In its lines, the writer lays it down and pulls no punches, going so far as to say that, whether state trooper, federal agent, or sheriff, there is a "vast, co-ordinated scheme to grab as much of the public's cash as they can, 'hand-over-fist'." Mr. MacDonald then spells out in detail, how the 'cash sting operations' work, saying that police will pull American vehicles over for slight infractions, and then proceed to start chatting with the motorist, with the intent of initiating a search of the vehicle. Oftentimes, since the motorist knows they have nothing to hide, they will allow the searches, only to find themselves become victims of theft, of what the officer was looking for all along: cash. Shield brother, let me stop right here to say that what he alleges is true, and it happens all the time. Many police do indeed do routine stops, and seize cash from citizens, using the excuse that the "burden of proof" is on the carrier of the cash, to demonstrate that it wasn't acquired illegally. The program they use(and very often abuse) is called "Equitable Sharing", which is almost never equitable, and has nothing to do with sharing. All the officer has to do is simply say, "How do I know it's not from drugs?" , and bam, brother: you're guilty until you can prove you're innocent. Thankfully, these cash seizures don't always go well for authorities. Some travelers are able to sue to recover their stolen property. One famous incident of this occurred in 2009, when the TSA detained a young man who happened to have a box of cash on him, in the amount of $4,700. They told this young man that he needed to provide proof of why he had it, and where he was going. Unfortunately for them though, the young man they stopped, Mr. Steven Bierfeldt, was Ron Paul's treasurer for the Campaign for Liberty, who just so happened to be recording the entire thing on the iPhone in his pocket. He contacted the ACLU, who sued, and won the case against the TSA. While that was great news for those who may be flying, many of the cases don't end up that way. The reason this is true, is that many of the stops conducted are simply over amounts of cash that are too little to justify the cost and time of litigation. For instance, the Washington Post revealed that although over $2.5 billion has been seized in this way since 2001, at least half the seizures are for amounts under $8,800. Realistically, this makes most cases of abuse simply too costly to fight in court. The sad part is that though only 1 in 6 of such cases ever reach court, nearly half of them end in settlements favoring of the victims: proving that the majority of such seizures are just theft and government over-reach. The Takeaway from the CBC "Ok, Watchman, so theft happens! Why is this story from the CBC a big deal anyway?" Here's why it's a big deal. I took the time to show that the CBC is a state-sponsored, state-owned broadcasting network, for a reason. Government media exists is to present a narrative that is carefully crafted to say exactly the things that governments want them to say. Now, I know that the piece written was just an opinion piece, but it doesn't matter. Can you imagine NPR, running an opinion piece, which warned U.S. citizens not to take cash to Canada for fear of confiscation by "abusive" Canadian police, who were running a legal "shakedown"? Can you imagine NPR telling U.S. travelers, "whatever you do, don't consent to searches if you're carrying legitimate cash" in Canada? Nope, neither can I. I'd have a very difficult time imagining such an abrasive thing being said about Canadian officials from a place like NPR. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuela's "21st Century Socialism": Food Lines For The People, New Cars For The Military Posted: 29 Sep 2014 06:33 PM PDT "Food lines are part of our daily existence," exclaims one member of the Venezuelan public, as people line up for hours outside state-owned supermarkets to buy regulated staple goods, or, as Bloomberg reports, pay three times as much from street hawkers. However, on the other side of the fence in Southern Caracas, President Maduro's "21st Century Socialism" looks a little different as Bloomberg notes 100s of brand new (admittedly Chinese) cars await new owners following the Defense Minister's pledge to purchase 20,000 autos for the armed forces. Simply put, in order to maintain the appearance of utopia, Maduro ensures military personnel don't have to contend with the economic chaos in the rest of the country.

So why no riots? Why no violent uprisings? Simple - Military personnel don’t have to contend with the economic chaos in the rest of the country.

And to ensure their continued confidence...

For some context as to what this means... Cars are particularly prized in Venezuela because they don’t lose value amid the world’s highest inflation as their prices tend to track the dollar... and so...

The problem is... the people are starting to get it...

* * * | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Remains Oversold Adding $3.40 Closing Today at $1,217.50 Posted: 29 Sep 2014 05:11 PM PDT

Well, why don't they break down worse? Silver broke that triple bottom line around $18.60, waterfalled, but now has stopped. The gold price broke its uptrend line from the December 2013 bottom, but has only eased down through September a maximum of $65 at its lowest so far. End of the world seems a long time coming. Gold flirteth still with oversold. Volume is drying up. MACD has turned positive. What if the dollar takes a dip and all those hedge funds who have shorted gold and silver to buy dollars suddenly find themselves losers? They'll back out of those trades faster'n a tom cat out of the Westminster Kennel Club show. The SILVER PRICE remains massively oversold. From today's close it needs to rise $0.50 to break $18.00 and the downtrend line. Get this clear in your mind: neither silver nor the gold price have turned up yet, in spite of all these signs. But when you see the leaves falling off the trees, you don't look for spring. Besides, a thought keeps popping up in my mind. I know of no other asset that can carry and maintain value outside the financial system. Gold and silver don't depend on any corporation to pay a dividend, government to give give a stamp of approval, or anything else. People value them because they are gold and silver, and outside that whole fiat money-central banking system. They've been money for over 6,000 years of human history. I reckon they'll make it a few more years. Well, that cinches it! The CNN Money headline today was, "The US dollar is on top of the world." Anytime a headline like that appears in a general circulation publication, it usually signals the end of a trend, or at least the start of a correction. US dollar today lost nothing, one big basis point, to 85.74, so it is holding on, but at an overbought level that hard to swallow (RSI at 79.73), and it has been overbought for a month and a half. Way overdue for a correction (as I've been saying for days on end.) The yen and the euro are wondering when the Dollar is going to fall, too. Euro today made another new low close for the move, down 0.06% to $1.2685. Yen also made another new low close for the move, 91.34 c/Y100, down 0.22%. Both remain as oversold as the dollar is overbought. Ten year treasury note yield nearly touched its 50 DMA today. If we have been watching no more than a correction and it still intends to rise, this would be the right place to reverse gears. Stocks got roughed up today. Dow opened down 175, losing most everything it had gained on Friday, but worked its way back up to close down only 41.93 (0.25%) at 17,071.22. S&P 500 lost 5.05 (also 0.25%) to 1,977.80. Wonder what will happen with the Dow breaks 17,000 this time? I bet that thought leaves the Nice Government Men sweating scorpions. Now my mind turneth to the Dow measured in metals. The late unpleasantness in stocks has been mirrored by topping/churning in the Dow in Silver and Dow in Gold. Dow in gold looks like a spread turkey wing, all jagged feathers showing, up and down with the wild stock market volatility and relative flatness in gold. It closed today at 14.01 oz (G$289.61 gold dollars), down 0.15%. DiG has fallen and is falling out of its overbought state. MACD has turned down, as have Rate of Change and full stochastics. Next confirmation comes with a close below the 20 day moving average, now at 13.82 oz (G$285.68). 'Nother one of those 200 point down days in stocks will pop that out. Poor, dear silver, the Rodney Dangerfield of precious metals! Dow in silver rose 0.84% to 977.73 oz. (S$1,264 silver dollars). Here, too, a closely jagged graph mirrors the struggle of a market turning over. We've seen the blow-off and are now witnessing the hovering before the plunge. About this date in 1916 John D. Rockefeller became the world's first billionaire. In 1914 Rockefeller hired the founder of public relations, Ivy Lee (born in Cedartown, Georgia) to advise him because he had a public image a little worse than Attilla the Hun but a little better than Beelzebub. Ivy Lee advised him to carry lots of dimes in his pockets and hand 'em out to kids when he went out in public. It worked -- with the kids, at least. Probably didn't fool anybody else. The Muckraker Upton Sinclair nicknamed him "Poison Ivy" after Lee tried to send bulletins saying that coal miners shot in the Ludlow Massacre were "victims of an over- turned stove." On 29 September 2008 as Lehman Brothers and Washington Mutual went bankrupt, the Dow Jones industrial Average fell 777.68 points, largest single day loss in its history. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Sep 2014 04:50 PM PDT Greetings from Palo Alto. Over three years (and thousands of posts......) ago, I wrote Color and the Mania in This Valley. The thrust of my post was: + Color.com had received $41 million to develop an app; Well, fail it did (as I announced in the 4th post I did about the stupid place), and in those three+ years, the bubble has just continued to inflate. 2014 makes 2011 seem downright sensible. Which brings us to Clinkle, which is a firm founded by a 22 year old with no business successes behind him (which at least Color.com's founder could claim, as he sold his firm to Apple for a fortune). Clinkle initially received $25 million (fun fact: the same amount used to fund Google, which went on to bigger successes than building a single app) and has been ostensibly hard at work on this thing for years. Here is the mature and world-changing lad after he landed the funding:

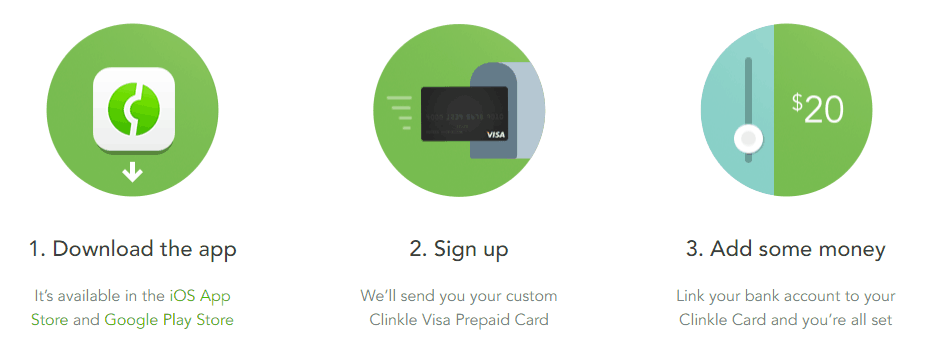

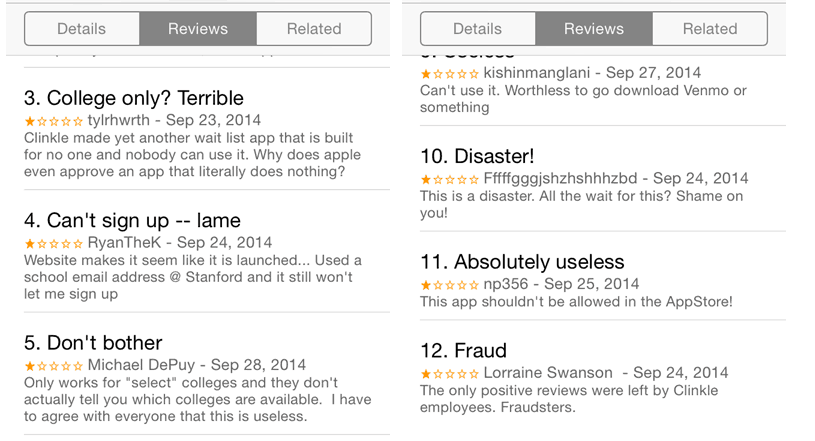

Well, as Clinkle continued to produce nothing, they continued to garner funding, reported to be upwards of $40 million now (a number strangely coincident with Color's). Recently, at long, long last, they launched their app. Here's how they try to explain it: So let me get this straight........I download an app........and then I sign up..........and they send me a Prepaid Visa Card (which I don't need), and then I can put money on the card. The wrinkle to this, apparently, is that if my friends also use Clinkle, I can transmit cash to them if I want. Allow me to express my reaction with three letters: B, F, and D. So this is what $40 million and a crack team of engineers was able to create? (Although the money wasn't entirely wasted - - you can go to this page and check out the team member photos which, as you mouse over them, turn into zany poses - - hilarious! My goodness gracious.) Perhaps I'm just a cranky blogger who likes to pee on the parade of this youngster who has been endowed with so much start-up cash, and in fact Clinkle is an awesome app. Let's check out the reviews on the App Store, shall we? So from what I saw, there were 19 reviews posted: 18 of them were 1-star (the lowest possible), and one of them was 5-star (which, I would wager, was posted by the man-child above clutching the dollar bills). Clinkle has also added an elitist wrinkle to their little product by making it available only at certain colleges (as if the demand for this thing would otherwise overwhelm them). Perhaps they figure since Facebook started that way in 2004 (Harvard, Stanford, etc.) then surely that must be the pathway to billions. What a bunch of feckless douchenozzles. I can't wait for this damned bubble to finally pop, because I'm not sure how much more we can all endure this without becoming irreversibly nauseous. It's not enough for Color.com............or, soon, Clinkle..............to collapse into a pile of worthless ashes. All this overfunded silliness has really got to end, because it's an unsustainable distortion of reality. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Summarizing The "Long Dollar Trade" In One Chart Posted: 29 Sep 2014 04:32 PM PDT With the USD experiencing its longest stretch of weekly gains since Bretton Woods, it appears, as SocGen notes, that recent currency movements have triggered nostalgia of the pre-crisis world when dollar strength was synonymous with a prosperous global economy. However, given the extreme positioning and potential for policy-maker complacency, SocGen warns the paradox is thus that a strong dollar tantrum could be a more worrying scenario than a Fed tightening tantrum.

The Long USD Trade...

If you are a trend follower, the trend is your friend. If you are a contrarian, you might want to go short the USD ... But as SocGen's Michala Marcussen warns, beware the strong dollar paradox.... Recent currency movements have triggered nostalgia of the pre-crisis world when dollar strength was synonymous with a prosperous global economy. Hope today is that a strong dollar will cap US inflation, delay Fed tightening and boost exports to the US. To make an impact on US inflation significant enough to slow the Fed, we estimate, however, that EUR/USD would drop to 1.10, USD/JPY to 120 and USD/CNY to 6.50 to significantly shift Fed expectations. To our minds, moreover, such a scenario would only materialise if the growth gap between the US and the other major economies were to widen further. Should recent dollar appreciation, moreover, breed complacency amongst policymakers elsewhere, this risk scenario could become a very painful reality. The paradox is thus that a strong dollar tantrum could be a more worrying scenario than a Fed tightening tantrum. 1. Dollar not yet strong enough to delay the Fed Dollar close to long run average: Recent dollar movements have been sharper-than-expected and several crosses (including EUR/USD, USD/JPY and USD/GBP) are now at levels that we had initially only expected to see early next year. For all the speed of movement, however, the dollar does not yet qualify as “strong”. Trade-weighted, the dollar is still just below the long run average. Moreover, on the type of horizons that matter for economics, dollar appreciation remains modest; the trade weighted dollar is up just 2% year-to-date over the 2013 average. Looking ahead, we expect further dollar gains and by mid-2015, we look for a gain of just over 6% on a full year basis. US growing well above trend potential: The US economy is on course 3%+ growth rates over the coming quarters, well above the 2.2% at which we estimate trend potential. This week’s numerous data releases, including the key September employment report (we look for +260K on non-farm payrolls) should confirm firm US growth. With each batch of robust data taking the Fed a step closer to the exit, the debate now is just how much dollar appreciation it would take to delay the Fed. The CNY has appreciated (!) against the US dollar: As a rule of thumb, using the OECD growth model, a 10% appreciation of the trade-weighted dollar cuts 0.5pp from GDP growth and 0.3pp from CPI inflation in the first year after the shock. Two points merit note, however. Firstly, by country, we find that China has tended to exert the most significant influence on US import prices. Since this latest dollar rally began in the early summer, the CNY has been one of the rare currencies to appreciate (!) against the dollar, albeit by a modest 1%. Secondly, we note that the narrowing energy deficit, as the result of the shale revolution, suggests reduced elasticities over time. Taking account of these points, we find that to significantly delay Fed rate hikes, we would need to see an additional 10% appreciation of the trade weighted dollar relative to our baseline. That would entail EUR/USD at 1.10, USD/JPY at 120 and USD/CNY at 6.50 (and would require other major currencies such as the CAD and MXP to also depreciate significantly). Such a scenario, however, is most likely if growth disappoints materially in the other major economies relative to our baseline scenario. A significantly weaker outlook for the main trading partners of the US would it itself be a cause for the Fed to delay. 2. A worrying trend on growth gaps ... and capital flows Several EM economies set to growth at a slower pace than the US: While the consensus growth outlook for the US has improved further in recent months, the opposite has been true for several other major economies, including the euro area, Japan and China. Moreover, our own forecasts remain generally below consensus with the exception of the US, where we are above. This view underpins our expectation of further dollar appreciation. Today, moreover, several EM economies are growing at a slower pace than the US. This is a notable difference from the pre-crisis era and has several implications. First, this lower global growth configuration is one reason why we believe that elasticities linking currency depreciation to growth may now be lower. The correlation between commodity prices and the dollar has also shifted. Finally, we note that capital flows are now moving in a very different pattern. Dollar and commodities: The link between the dollar and commodity prices has seen several shifts over time. Already prior to the latest moves in currency markets, commodity prices were trending lower in parallel with Chinese growth forecasts. More recently, it seems that dollar depreciation may have been an additional factor driving prices lower. For commodity importers, this is helpful; for exporters, this marks yet a headwind. Fed tightening may be a better scenario than a very strong dollar: Pre-crisis, in a simplified summary, the strong dollar can be described as having been driven by a global savings glut (mainly from the official sector in emerging economies) seeking a home in US Treasuries and, at the same time, US investors seeking risky capital abroad to profit from strong EM growth. It is also worth recalling that QE1 drove the dollar stronger and supported risky US assets as Treasuries rallied. QE2, on the other hand, saw dollar depreciation as US investors sought return in higher yielding asset abroad, and notably in emerging economies. As discussed above, we believe that a significant appreciation of the dollar relative to our baseline would be consistent with much weaker growth elsewhere. In such a scenario, dollar would equate to further capital outflows, placing further pressure on already vulnerable economies. Indeed, a “dollar tantrum” scenario could well prove more painful than a “Fed tightening tantrum”, assuming the later comes with better growth in the rest of the world. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Sep 2014 04:13 PM PDT Jim Sinclair's Commentary In case you haven't checked it out in a while. http://www.usdebtclock.org/ Jim Sinclair’s Commentary Every step forward for the Yuan is a long term backwards for the dollar. Yuan to Start Direct Trading With Euro as China Pushes Usage By Bloomberg News Sep 29, 2014 5:06 AM MT China will start direct... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Embry, Turk tell King World News about completely corrupted markets Posted: 29 Sep 2014 03:02 PM PDT 6p ET Monday, September 29, 2014 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World News today that the U.S. government now is simply making up economic statistics. He notes the constant algorithmic futures trading smashing the price of silver and says he considers the metal to be the world's most undervalued asset. The interview is excerpted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/9/29_Jo... Also at King World News, GoldMoney founder James Turk says Comex spot silver prices seem to be falsified and that the monetary metal is in backwardation. Turk also notes that the Financial Times has permitted itself to describe the investment world as "distorted," a more polite term than "manipulated." Turk's interview is excerpted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/9/29_To... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The United States: Police State Today, Martial Law Tomorrow; Part II Posted: 29 Sep 2014 01:53 PM PDT Part I of this two-part series detailed the hijacking of the U.S. democracy by a small cabal of ultra-wealthy oligarchs (primarily bankers), best described as the Old World Order. The method for orchestrating this unofficial, bloodless coup was also detailed. a) Create a new, quasi-governmental entity (the Federal Reserve) which is above the government itself, and thus beyond the reach of any of its laws or mandates. b) Hand this quasi-governmental entity (exclusive) control over the printing press of the U.S., allowing the banker oligarchs who control it to create as much currency as they desired – and transfer every new dollar created to themselves. c) With this endless/infinite supply of dirty money (all legal, official currency), they buy-off as many political representatives as necessary to control the government, in perpetuity. d) As outlined in The Bankers Manifesto of 1892; in order to hide this effective dictatorship, they get their political stooges to stage vehement, theatrical squabbles, pretending that the U.S.'s only two political parties are enemies rather than teammates (serving the bankers). To quote the Manifesto: "by thus dividing the voters, we can get them to expend their energies fighting over questions of no importance to us…" Part I concluded by briefly describing how these (banking) oligarchs used their complete control over the U.S. government to transform this oligarchy into a fascist police state, the Fourth Reich. The pretext for this transformation was the farcical/imaginary "War on Terror", and the vehicle used to create this police state was the notorious "Patriot Act". It is beyond the scope of this article to detail all the elements of this police state: the countless "detention centers" spread all over the country, the absurdly Orwellian "Department of Homeland Security", and an infinite array of parallel initiatives. Instead, it can be exposed more effectively through unmasking the phony War on Terror (which led to its creation), and then focusing on particularly revealing aspects of this police state which have emerged during this pseudo-war. As its name suggests; the explicit goal of this pseudo-war is to "fight terrorism". Yet (outside the spotlight of the Corporate media) most of the actual efforts of the U.S. government have been devoted to creating and/or supporting terrorist groups and terrorist regimes. Even here, there is far too much empirical evidence of state-sponsored terrorism (by the U.S.) to engage in any comprehensive discussion. The only starting point for such a narrative can begin with the Godfather of Modern Terrorism: the state of Israel. Anyone familiar with their history knows that Israel is the original "terrorist state". Following World War II; the state of Palestine (home of the Palestinian people) was a British colony. Through a relentless campaign of "ethnic cleansing" and executions by Jewish terrorists (primarily directed against innocent, Palestinian civilians), the British government was persuaded to withdraw from Palestine. However, before departing, the British carved-out a large chunk of the state of the Palestine, and handed it to the terrorists – which the terrorists called (call) "Israel". The leader of the Jewish terrorists became Israel's first prime minister. Far from renouncing its terrorist heritage; the government of Israel (to this day) openly boasts about its terrorist past, characterizing its serial slaughter of innocents as "necessary acts" for "the greater good" (i.e. the creation of Israel). Indeed, all that has changed since 1945 is that this terrorist group is now a terrorist regime. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Embry - Silver Is The Cheapest Asset In The World Today Posted: 29 Sep 2014 01:47 PM PDT

Today a man who has been involved in the financial markets for 50 years spoke with King World News about the Goldman Sachs tapes, and also said silver is the cheapest asset in the world today. John Embry, who is business partners with billionaire Eric Sprott, also discussed the endless stream of propaganda from the U.S. government Embry: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Non Farm Payrolls On Friday, End of Month Tomorrow Posted: 29 Sep 2014 01:37 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Japanese Deflation Myth and the Yen’s Slump Posted: 29 Sep 2014 01:05 PM PDT Brendan Brown writes: The slide of the yen since late summer has brought it to a level some 40 percent lower against the euro and US dollar than just two years go. Yet still Japan’s Prime Minister Shinzo Abe and his central bank chief Haruhiko Kuroda warn that they have not won the battle against deflation. That caution is absurd — all the more so in view of the fact that there was no deflation in the first place. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Corruption In Global Markets & Silver In Backwardation Posted: 29 Sep 2014 01:00 PM PDT  With the Dow still trading above 17,000 and the U.S. Dollar Index holding near 86, today James Turk told King World News that there is total corruption in all global markets and silver is now in backwardation. Turk also discussed gold and the coming "Great Reset." With the Dow still trading above 17,000 and the U.S. Dollar Index holding near 86, today James Turk told King World News that there is total corruption in all global markets and silver is now in backwardation. Turk also discussed gold and the coming "Great Reset."This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia’s Gokhran Buying Gold Bullion In 2014 and Will Buy Palladium In 2015 Posted: 29 Sep 2014 12:53 PM PDT Gokhran, the Russian precious metals and gems repository, said it has been buying gold bullion in 2014 and will likely to start buying palladium bullion in 2015, Interfax news agency reported this morning, citing the head of Gokhran, Andrey Yurin. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold vs Silver during Precious-Metals Bull Markets Posted: 29 Sep 2014 12:00 PM PDT Speculative Investor | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Geneva group's report predicts low interest rates forever Posted: 29 Sep 2014 11:07 AM PDT Which is to say financial repression and gold price suppression by central banks forever. * * * Geneva Report Warns Record Debt and Slow Growth Point to Crisis By Chris Giles http://www.ft.com/intl/cms/s/0/4df99d28-4590-11e4-ab10-00144feabdc0.html A "poisonous combination" of record debt and slowing growth suggest the global economy could be heading for another crisis, a hard-hitting report will warn on Monday. The 16th annual Geneva Report, commissioned by the International Centre for Monetary and Banking Studies and written by a panel of senior economists including three former senior central bankers, predicts interest rates across the world will have to stay low for a "very, very long" time to enable households, companies, and governments to service their debts and avoid another crash. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. The warning, before the International Monetary Fund's annual meeting in Washington next week, comes amid growing concern that a weakening global recovery is coinciding with the possibility that the US Federal Reserve will begin to raise interest rates within a year. One of the Geneva Report's main contributions is to document the continued rise of debt at a time when most talk is about how the global economy is deleveraging, reducing the burden of debts. Although the burden of financial sector debt has fallen, particularly in the US, and household debts have stopped rising as a share of income in advanced economies, the report documents the continued rapid rise of public sector debt in rich countries and private debt in emerging markets, especially China. It warns of a "poisonous combination of high and rising global debt and slowing nominal GDP [gross domestic product], driven by both slowing real growth and falling inflation." The total burden of world debt, private and public, has risen from 160 per cent of national income in 2001 to almost 200 per cent after the crisis struck in 2009 and 215 per cent in 2013. "Contrary to widely held beliefs, the world has not yet begun to delever and the global debt to GDP ratio is still growing, breaking new highs," the report said. Luigi Buttiglione, one of the report's authors and head of global strategy at hedge fund Brevan Howard, said: "Over my career I have seen many so-called miracle economies -- Italy in the 1960s, Japan, the Asian tigers, Ireland, Spain, and now perhaps China -- and they all ended after a build-up of debt." Mr Buttiglione explained how, initially, solid reasoning for faster growth encourages borrowing, which helps maintain growth even after the underlying story sours. The report's authors expect interest rates to stay lower than market expectations because the rise in debt means that borrowers would be unable to withstand faster rate rises. To prevent an even more rapid build-up in debt if borrowing costs are low, the authors further expect authorities around the world to use more direct measures to curb borrowing. The report expresses most concern about economies where debts are high and growth has slowed persistently -- such as the eurozone periphery in southern Europe and China, where growth rates have fallen from double digits to 7.5 per cent. Although the authors note that the value of assets has tended to rise alongside the growth of debt, so balance sheets do not look particularly stretched, they worry that asset prices might be subject to a vicious circle in "the next leg of the global leverage crisis" where a reversal of asset prices forces a credit squeeze, putting downward pressure on asset prices. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rates on short-term Treasuries go negative Posted: 29 Sep 2014 09:56 AM PDT Fed 'Repo' Tests Drive Scramble for Safety By Michael Mackenzie and Tracy Alloway NEW YORK -- Investors are scrambling for safe assets ahead of the end of the financial quarter, with the scrum for securities exacerbated by the Federal Reserve's testing of a key financing tool for an eventual tightening of policy. Yields on short-term Treasury bills, viewed as ultra-safe securities, have dipped below zero as the assets attracted heavy buying in the run-up to the end of the third quarter. Negative yields on the securities mean that money market funds and other big investors are effectively willing to pay the US government for holding their cash over the end of the financial period. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/34fcc25c-44d0-11e4-ab0c-00144feabdc0.html ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/nodBy Frank Tang NEW YORK -- The London Bullion Market Association (LBMA) said on Thursday it appointed Citigroup as a market maker, underscoring the bank's ambitions to expand into the precious metals sector while others are exiting due to regulatory concerns. LBMA said it named Citibank, a unit of Citigroup, as a spot market-making member effective Thursday. Currently, LBMA has 12 market makers that serve in either one, two, or all three of the spot, forwards, and options markets. They make markets by quoting two-way prices in both gold and silver products to other market makers. ... ... For the remainder of the report: http://www.reuters.com/article/2014/09/25/lbma-citigroup-idUSL2N0RQ2A820... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16e/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DAVID CAMERON in UN Speech Says ANYONE QUESTIONING the 9/11 Official Story Is a TERROR EXTREMIST Posted: 29 Sep 2014 09:53 AM PDT 9/11 was brought to us by the CIA, the Neo-Cons in the Department of Defense (most of whom were from Project for the New American Century), which believed that, with the collapse of the Soviet Union, there was a unique historical opportunity for the US to build a world-wide empire that would endure... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lloyds fires eight over rate manipulation claims Posted: 29 Sep 2014 09:51 AM PDT By Martin Arnold Lloyds Banking Group said it had dismissed eight people and recouped L3 million in bonuses after finding they had attempted to manipulate benchmark interest rates, as the long-running probe into rate-rigging continues to claim scalps. The bank was criticised for "highly reprehensible" behaviour by the Bank of England in July after it became the first lender to be fined for rigging rates to cut the cost of a UK financial crisis rescue scheme, in effect costing the taxpayer millions of pounds. It said on Monday that eight employees had been dismissed, pending their right to appeal, after an internal disciplinary process. Four other members of staff who had been suspended were cleared of wrongdoing and have returned to work. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/9ab693a4-47cb-11e4-be7b-00144feab7de.html ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Technical Analysis: All Metals Weak, Gold Bull Market Over For Now Posted: 29 Sep 2014 09:45 AM PDT The following is an excerpt from Yamada’s latest monthly update for premium subscribers, released today. We highly recommend subscribing to the monthly in-depth analysis of Louise Yamada on www.lyadvisors.com. We have wondered whether the slow and tentative movement particularly in the more industrial metals may relate to the closing of so many of the major banks' commodity trading desks, essentially removing a good deal of the speculative aspect of price movement for those metals as well as other commodities including Oil. Nevertheless, the longer-term technical patterns are suggesting major bull market trends of the past decade plus are coming to an end. Gold – The Gold Bull Market is over for the Foreseeable FutureGold Spot price (GOLDS-1,218.38, see Figure 26) has weakened further, as anticipated, and is now testing the 2002 structural uptrend and support at 1,200. The weekly and monthly momentum (neither shown), are both negative, suggesting the support is more likely to be broken. (A Fibonacci 50% retracement, not shown, of the 647% advance comes in near 1,090 and represents a target between our targets of 1,100 and 1,000.) The three-year progression to date has been one of lower highs all the way to current levels. This behavior is very different from the 2008-2009 (see circle) progression in which the 2008 decline was followed by a pattern of higher lows prior to the late 2009 breakout through 1,000 resistance.

Additionally, we know the dollar and Gold move generally in opposite directions (see Figure 27, left). When the ratio is rising, the dollar is outperforming Gold; when the ratio is falling, Gold is outperforming the dollar. One can see in the Dollar / Gold ratio that the 2005 outperformance of Gold (see broken downtrend) has come to an end and now, following a five-year base, the Dollar has initiated a structural outperformance versus Gold.

Additionally, we know historically that structural bull markets in Equities and Gold move in an inverse relationship (see Figure 27, right): That structural bull markets in equities correspond to structural bear markets in Gold and vice versa. This profile of the Dow to Gold is a longer-term profile of that relationship which we have shown also with the S&P 500 over past months. The rising ratio now suggests the bull market for Gold is now over. Additionally, we present again our major observation from last year (see Figure 28) that Gold structural bull markets appear (in the small sample available) to end with or near structural interest rate cycle reversals, whether with inflationary (rising rates) or deflationary (falling rates) environments. Given that we believe the falling interest rate cycle from 1980-1981 is in the process of reversing (transitions to rising interest rate cycles take from 2 to 14 years historically), it follows that the structural bull market for Gold is over.

We reiterate that it is our belief that Gold need not fall back to 2000 levels near 250, but may find a higher level from which to stabilize, perhaps in the 700- 800 range near the 2002 uptrend (see Figure 26, above). We have equally been concerned about the GDX (not shown) which many felt was in a basing mode. Our concern has more been one that the base may prove false, given the profile of Gold itself. The GDX has pulled back toward support at 22 and may well slip to test the last bit of support at 20. A break below 20 would suggest a target toward 15. Silver – Bear MarketSilver Spot price (SILV-17.664) has preceded Gold in breaking the 2013 support, extending the 2011 downtrend and suggesting targets at 15, even 12, may lie ahead. Aluminum – Price Reversal!Aluminum (LA 1- 1,920.75) no sooner tested resistance from what appeared a saucer base depicted herein last month, than price cracked back down to 1,952, below the 50-day MA. The overall commodity declines may infect even some of the better-looking charts. A pullback below 1,920 would suggest the breakout might have been another false breakout. Copper – No Follow ThroughThe Copper Continuous Futures Contract (HG1-303.55), depicted herein last month, still could not follow through on a higher high or a challenge of the 2012 downtrend below 340. Instead, price has fallen to support near 300 and may be poised to break what could be considered the lower level support of a descending triangle over four years. Any breach would suggest risk toward 290 or even 270 from the 2010 low. Resistance is now 330. Platinum: More Flop than FlipPlatinum spot price (PLAT-1,300.25?), continued to weaken all the way toward / through the 2013 low at 1,300 depicted herein last month. Notwithstanding interim bounces, a sustained break below 1,300 could carry weakness toward 1,200 or lower over the months ahead. Resistance is now 1,400. Palladium: PullbackPalladium spot price (PALL-781.10) was unable to hold onto its breakout strength (see Figure 29) and has pulled dramatically back toward the 2008 uptrend at 770. The inability to hold this level would suggest a false breakout for the metal with potential to return toward the price congestion between 800 and 700 from 2013. Weekly momentum has turned down suggesting weakness / consolidation. Resistance now is at 860. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial writer talks about hangup in publication of report on silver market rigging Posted: 29 Sep 2014 09:39 AM PDT 12:39p ET Monday, September 29, 2014 Dear Friend of GATA and Gold: Talk-show host Dave Janda of WAAM-1600AM in Ann Arbor, Michigan, last week interviewed financial journalist William Cohan about complications in arranging publication of a report Cohan has written about silver market manipulation, a report arising from evidence presented by London metals trader Andrew Maguire. Cohan says there is a dispute over what sort of news organization should get the report. The interview is 24 minutes long and can be heard at Janda's Internet site here: http://www.davejanda.com/guests/william-cohan/sunday-september-28-2014 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Singapore bourse to start kilobar gold trading to lure investors Posted: 29 Sep 2014 09:12 AM PDT By Glenys Sim SINGAPORE -- Singapore Exchange Ltd., Southeast Asia's biggest bourse operator, will start trading a kilobar gold contract next month as it joins other nations in the biggest consuming region in a push for new price benchmarks. The wholesale contract for 25 kilograms of 99.99 percent purity will start trading at 8:15 a.m. on Oct. 13, according to a joint statement from the exchange, IE Singapore, the World Gold Council, and the Singapore Bullion Market Association. The group said in June that trading may begin as soon as September. The Shanghai Gold Exchange started bullion trading in the city's free-trade zone on Sept. 18, while CME Group Inc. is planning a physically-delivered futures contract in Hong Kong in the fourth quarter as global demand shifts from the West to the East. Asia accounted for 63 percent of total consumption of gold jewelry, bars, and coins last year, with China overtaking India as the biggest buyer, according to the council. ... ... For the remainder of the report: http://www.bloomberg.com/news/2014-09-29/singapore-bourse-to-start-kilob... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECB president's strategy for reviving Europe looks like euro devaluation Posted: 29 Sep 2014 09:02 AM PDT Draghi Devaluing Euro Cheers ECB as Inflation Seen Fading By Stefan Riecher and Alessandro Speciale FRANKFURT, Germany -- Mario Draghi's strategy for reviving the euro area looks like devaluation. While the European Central Bank president says the exchange rate isn't a policy target, officials aren't secretive about their approval of the currency's almost 10 percent slide. The depreciation increases the cost of imports and boosts exporters' competitiveness, aiding the effort to revive inflation that data tomorrow will probably show is the weakest since 2009. A gauge of economic confidence published today slipped to the lowest since November. The euro dropped from a 2 1/2-year high in May as officials unveiled a medley of stimulus measures, and consolidated below $1.30 when Draghi cut rates this month and signaled a desire to grow the ECB's balance sheet by as much 1 trillion euros ($1.3 trillion). Details of a plan to buy assets will probably come this week after the Governing Council meets in Naples, Italy. "When Draghi mentioned expanding the size of the balance sheet, I think he was secretly thinking of the exchange rate," said Martin Van Vliet, senior euro-area economist at ING Groep NV in Amsterdam. "I'm sure he's happy to see that the euro has been going down. He's well aware that one important channel of policy transmission is the exchange rate." ... ... For the remainder of the report: http://www.bloomberg.com/news/2014-09-28/draghi-devaluing-euro-cheers-ec... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/nodBy Frank Tang NEW YORK -- The London Bullion Market Association (LBMA) said on Thursday it appointed Citigroup as a market maker, underscoring the bank's ambitions to expand into the precious metals sector while others are exiting due to regulatory concerns. LBMA said it named Citibank, a unit of Citigroup, as a spot market-making member effective Thursday. Currently, LBMA has 12 market makers that serve in either one, two, or all three of the spot, forwards, and options markets. They make markets by quoting two-way prices in both gold and silver products to other market makers. ... ... For the remainder of the report: http://www.reuters.com/article/2014/09/25/lbma-citigroup-idUSL2N0RQ2A820... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16e/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Embry - Silver Is The Cheapest Asset In The World Today Posted: 29 Sep 2014 08:55 AM PDT  Today a man who has been involved in the financial markets for 50 years spoke with King World News about the Goldman Sachs tapes, and also said silver is the cheapest asset in the world today. John Embry, who is business partners with billionaire Eric Sprott, also discussed the endless stream of propaganda from the U.S. government. Today a man who has been involved in the financial markets for 50 years spoke with King World News about the Goldman Sachs tapes, and also said silver is the cheapest asset in the world today. John Embry, who is business partners with billionaire Eric Sprott, also discussed the endless stream of propaganda from the U.S. government.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||