Gold World News Flash |

- Gerald Celente – Independent Living Bullion

- Markets Bipolar, Wal-Mart, Kohls, Gold/Silver

- Welcome to the Third World, Part 14: Homeowners Become Renters

- BARBAROUS RELIQUARY: Holding The Metals In A Post-Western World – Part ONE

- Silver Report; Gold in a Lackluster Trading Environment

- The Precious Metal Rally that Just Won’t Stick

- Narendra Modi: The Good, The Bad, & The Ugly

- The Gold Price Rose $6 This Week, Needs to Clear $1,315 Next Week

- The Gold Price Rose $6 This Week, Needs to Clear $1,315 Next Week

- "Feeding The Homeless" Is A Crime In Increasingly More US Cities

- Where the World's Unsold Cars Go To Die

- Are Silver Prices Set Up for Another Heartbreak?

- Gold Is Forming A Golden Triangle. Major Breakout Coming?

- Silver Stealth Buying

- Gold Daily and Silver Weekly Charts - How Long Can Phase II of the Gold Pool Be Sustained

- Gold Daily and Silver Weekly Charts - How Long Can Phase II of the Gold Pool Be Sustained

- Harry Dent -- The Fake Casino Economy Bubble Is About To Burst: Financial Expert Predicts

- Amazingly Deceptive Headlines, Part 1

- Prepare for the Death of the Petrodollar

- Richard Russell - Shorts May Get Crushed In The Silver Market

- Gold and Silver Important Price-Volume Link

- Something Very, Very Bad Will Happen Very, Very Soon | Andy Hoffman

- Alasdair Macleod: Technical analysis vs. value in gold

- A Precious Metal Rally that Just Won’t Stick

- Strong US Housing Data See Gold Prices Erase Last of Week's Gain as BJP's Modi Wins Landslide in India

- Gold, Oil And S&P500 Elliott Wave AnalysisÂ

- Firmer Tone for Gold and Silver Prices

- Are Silver Prices Set Up for Another Heartbreak?

- Gold Insiders Buying at Record Clip

- Gold Insiders Buying at Record Clip

- Gold Mining Rebound: No Hurry

- Gold Mining Rebound: No Hurry

- Potential Catalyst for Gold and Silver Stocks

- Fall Of the U.S. Dollar Based Monetary System: Russia Puts The Avalanche In Motion

- So How Goes the War on Gold?

- Gold Standard - How the U.S. Government Created the Dollar

- Russia’s Dollar Reserves and Putin’s Visit to China

- No War in Year Four (So What’s Next for Gold)

| Gerald Celente – Independent Living Bullion Posted: 16 May 2014 10:00 PM PDT from trendsjournal: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Markets Bipolar, Wal-Mart, Kohls, Gold/Silver Posted: 16 May 2014 09:00 PM PDT from CrushTheStreet: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Welcome to the Third World, Part 14: Homeowners Become Renters Posted: 16 May 2014 08:40 PM PDT by John Rubino, Dollar Collapse:

Dig just a little deeper and it's still huge, though in a different way. Turns out that all the increase was in apartment building, while single family homes — the linchpin of what used to be thought of as the American Dream — actually fell yet again. Here's a brief but on-point analysis from the New York Times: Housing Is Recovering. Single-Family Homes Aren't The headlines in the new report on home building activity — which is being closely watched, after many other kinds of data point to a softening in housing — are pretty terrific. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BARBAROUS RELIQUARY: Holding The Metals In A Post-Western World – Part ONE Posted: 16 May 2014 08:20 PM PDT by Steven St. Angelo, SRS Rocco:

Yes. Bernake got it right! Gold has all the attributes of a primitive thing – and as such belongs in essence to a different cycle in humankinds' journey. In fact, it's the very primitive nature of gold[&silver] which renders it a potentially deadly kryptonite to the modern financialized world. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Report; Gold in a Lackluster Trading Environment Posted: 16 May 2014 08:00 PM PDT from Merit Gold: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Precious Metal Rally that Just Won’t Stick Posted: 16 May 2014 07:00 PM PDT by Greg Guenthner, Daily Reckoning.com:

Gold's going nowhere fast. In fact, it's boring me to death. Compared to the insane meltdowns in biotech and momentum stocks that have ripped traders to shreds over the past couple months, gold's just standing around in its slippers staring at the birds in the backyard. That's a complete 180-degree turn from the action we saw from gold earlier this year… Back in early March, gold had left $1,350 in the dust. Miners were breaking out to new year-to-date highs. Nothing interesting was happening with stocks. But precious metals looked primed for a move. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Narendra Modi: The Good, The Bad, & The Ugly Posted: 16 May 2014 06:54 PM PDT Given the surge in India's stock market, echoing the reflexive pro-business exuberance of last year's Japanese stock market, the similarities between India's newly-elected PM Narendra Modi and Japan's Shinzo Abe are coming thick and fast... some good (pro-business), some bad (potential dislike of the US) and some potentially ugly (strong nationalist tendencies).

Via Brahma Chellaney via The Diplomat,

But it's not all silver linings... (as The Diplomat's Ankit Panda notes)

Overall, these elections demonstrate that Indian democracy is functional where it counts: holding a government accountable for poor political, economic, and social outcomes. It remains to be seen if the BJP will deliver what India’s voters want, but for now, the party seems to have won the broadest mandate of any single party in Indian politics in decades.

And, from Morgan Stanley, Reforms Are Critical... The two key variables that will be critical in reviving India’s growth trend are: (a) improvement in the external environment and (b) a pickup in the pace of structural reforms. Our global economics team expects that global growth will improve further to 3.7% in 2015, moving closer to the last 30 years’ average, giving us the confidence that the external environment will be supportive of India’s growth recovery. Policy reforms at home will be even more critical. Over the past five years, the government’s policy was focused more on redistribution and less on boosting productive income growth. Moreover, bureaucratic hurdles and corruption-related investigations have exacerbated the challenges of weak demand and low corporate confidence. This has held back the much needed capex cycle and has been a drag on economic growth. And Imperative Overhauling bureaucratic processes and enacting reforms to lift sustainable growth is imperative. The macro stability risks of higher inflation, a wide current account deficit and asset quality issues in the banking system associated with such a policy approach has forced a recognition among policy makers of the need to pay greater attention to reviving the productive dynamic. Higher economic growth rates are needed to generate the productive employment opportunities for India’s large and growing working age population. Moreover, India’s literate and well-connected middle class is now reaching critical mass.

It seems the visa issues have been cleaned up (having sacrificed the ambassador):

We assume the US needs all the friends it can right now. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Rose $6 This Week, Needs to Clear $1,315 Next Week Posted: 16 May 2014 05:59 PM PDT

The week's scoreboard says it all. New all time highs in the Dow and S&P500? Yes, but they ended the week lower. Silver and GOLD PRICES slapped in mid-week? Yes, but closed the week higher. White metals higher, and all this in the teeth of a higher dollar that clearly reversed upward. Today the GOLD PRICE closed down 20 cents at $1,293.30. Silver backed up 15.5 cents to 1929.2c. For the week both metals rose, silver 1.1%, gold 0.5%. Something stinks in all markets. They simply aren't behaving as markets do. They show hardly any trading range. They jump on the open, then do nothing. In the last 30 days silver and gold prices have both made three dramatic key reversals, confirmed with higher closes the next day, but then fallen back. 'Tain't natural. Markets just don't keep acting that way. They break out or they break down. This points to "management" by the Nice Government Men, but I hate to be forever pulling that out as the explanation for everything. Behold, this much is sure! No matter how much the NGM manipulate, they can only do it at the margin, and not for long. As proof I point to the gold price rise from $252 and silver's from $4.01 since 2001. Soon, probably this month, silver and gold will stage a big rally that soars past the straggling highs of the last two years. And they are both out of their usual seasonal sync, so they should rise into June and July. Morale in the silver and gold markets has been so beaten down and bloodied that it's hard for most folks to see that THE LOWS ARE BEHIND US. Then I look at the lunatic monetary and financial system. Give a roomful of teenage boys cases of gin, car keys, and free passes to a stripper club. That's about what central banking and finance looks like today: the adults have disappeared. The Fed has had a long string of good luck and breaks that have made its money creation and lies look valid. "Luck" is not a firm foundation for an economy or a currency. Technically both the SILVER PRICE and the gold price are barely above the downtrend lines on their weekly charts. On daily charts they are in three week uptrends, and pushing the upper boundaries. Momentum indicators are generally positive. Look for the gold price clearing $1,315 next week, which will be the bell starting the race. Silver still needs to clear 2000c, then 2060c. I know y'all probably think I'm Johnny One Note, but I can't sing any note but the one I see in front of me. Now is the time to buy while prices are low and before silver and gold begin rallying. Mathematically the stock market does not have to tank for the Dow in Gold (or Silver) to fall. Gold only needs to outperform stocks, so both might be rising, but gold rising faster. During the 1920-1923 German hyperinflation, stocks soared, but in the end they fell far behind the hyperinflation, which brings me to my point. In an age of inflation when evaluating any asset becomes like trying to shoot skeet off the back of a bass boat in a thunderstorm: the only thing that counts is purchasing power. Nominal gains mean nothing, only purchasing power gains. Stocks today tried without success to climb to positive territory until about 3:00 as closing time drew near and suddenly buyers appeared out of nowhere. Yeah, sure. Dow rose 44.5 (0.27%) to 16,491.31, no more than a dead cat bounce after losing 268.63 the previous two days. S&P500 clawed back 7.03 (0.38%) to 1,877.86. Since end-December stocks have tried and failed three times to break through 16,500-16,600. This week they collapsed and fell back to the 50 DMA. Can they rally from here? I tend to picture the top as behind us, but that's possible. Dow and S&P500 weekly charts show markets that have traded up to overhead trend line and bounced back, too. Dow in gold and Dow in silver are a little confused. At its 12.75 oz close today (G$263.57 gold dollars) the Dow in gold remains below its 12.77 oz 20 DMA, and right atop its rising uptrend line. Dow in silver rose 1.13% to 853.19 oz (S$1,103.11 silver dollars), above its 20 DMA (849.67 oz or S$1,098.56). Both are trying to break down but haven't yet. Mercy, the 10 year treasury note yield took a beating this week, from 2.656% on 12 May to 2.518% today. Sounds insignificant, but smashed the support line and gapped down. This and the likewise tumbling yield on 30 year bonds imply investors are crowding into bonds as they flee from stocks. (Bond prices rise when bond yields fall.) Doesn't bode bouquets for stocks. US dollar index showed unaccustomed gumption since its turn upwards a week ago Thursday. Shot straight up of 78.93 low but could not pierce its overhead downtrend line and stopped cold at 80.40 and fell back. Today rose two (minute) basis points to 80.11. Must yet validate last week's upward reversal by closing over 80.40, really, over the 200 DMA at 80.53. Likely will. Euro is a wreck. Closed today down 0.11% at $1.3695, and soon will fall below its 200 DMA ($1.3617). Yen is seeking to break out, and has broken out above its downtrending range upper boundary, but above stands the 200 DMA at 99.04. Can it punch through that? Good chance, but the yen must prove it next week. Yen closed today up 0.04% at 98.50. But what do I know? I'm just a nacheral born durn fool from Tennessee who only wears shoes when he has to show up in church. I ain't got no more sense than to believe that gravity always works. I have been nudging everyone here at the Top of the World Farm toward Holistic Management for a number of years. Usually you have to travel to New Mexico or Canada to attend the training sessions, but one was offered a couple of years ago at Summertown, about half an hour from us. I sent my sons Justin and Wright and it changed the way they thought and farmed. Holistic Management (see the book by Alan Savory) is a management technique that takes the whole-under-management into account for every decision. The results have astounded even me, in animals, costs, and quality of life. In 25 years, all agriculture will be conducted this way, and nobody will be able to believe that anybody in America ever used pesticides, herbicides, and high cost inputs and debt. On 17-19 June 2014 they're offering another Introduction to Holistic Management Whole Farm/Ranch Planning and Holistic Planned Grazing. Owen Hablutzel is the teacher. You'll find full description and registration at Spiral Ridge Permaculture, http://bit.ly/1iucANl On 20-22 June they're offering Keyline Design: Whole Farm/Ranch Planning for Water Abundance and Soil Fertility all about Keyline Plowing. Keylining slices deep into the earth to capture water flowing off the contour and creates drought resilience and maximum water harvest. Read about it and register here, http://bit.ly/1mB9VHV Yes, I eat my own cooking. We use Holistic Management on our own Farm and have extensively used Keyline Plowing. If you apply these techniques you will recoup the cost of the courses many times over and bring more order and peace into your life and operation. Y'all enjoy your weekend! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Rose $6 This Week, Needs to Clear $1,315 Next Week Posted: 16 May 2014 05:59 PM PDT

The week's scoreboard says it all. New all time highs in the Dow and S&P500? Yes, but they ended the week lower. Silver and GOLD PRICES slapped in mid-week? Yes, but closed the week higher. White metals higher, and all this in the teeth of a higher dollar that clearly reversed upward. Today the GOLD PRICE closed down 20 cents at $1,293.30. Silver backed up 15.5 cents to 1929.2c. For the week both metals rose, silver 1.1%, gold 0.5%. Something stinks in all markets. They simply aren't behaving as markets do. They show hardly any trading range. They jump on the open, then do nothing. In the last 30 days silver and gold prices have both made three dramatic key reversals, confirmed with higher closes the next day, but then fallen back. 'Tain't natural. Markets just don't keep acting that way. They break out or they break down. This points to "management" by the Nice Government Men, but I hate to be forever pulling that out as the explanation for everything. Behold, this much is sure! No matter how much the NGM manipulate, they can only do it at the margin, and not for long. As proof I point to the gold price rise from $252 and silver's from $4.01 since 2001. Soon, probably this month, silver and gold will stage a big rally that soars past the straggling highs of the last two years. And they are both out of their usual seasonal sync, so they should rise into June and July. Morale in the silver and gold markets has been so beaten down and bloodied that it's hard for most folks to see that THE LOWS ARE BEHIND US. Then I look at the lunatic monetary and financial system. Give a roomful of teenage boys cases of gin, car keys, and free passes to a stripper club. That's about what central banking and finance looks like today: the adults have disappeared. The Fed has had a long string of good luck and breaks that have made its money creation and lies look valid. "Luck" is not a firm foundation for an economy or a currency. Technically both the SILVER PRICE and the gold price are barely above the downtrend lines on their weekly charts. On daily charts they are in three week uptrends, and pushing the upper boundaries. Momentum indicators are generally positive. Look for the gold price clearing $1,315 next week, which will be the bell starting the race. Silver still needs to clear 2000c, then 2060c. I know y'all probably think I'm Johnny One Note, but I can't sing any note but the one I see in front of me. Now is the time to buy while prices are low and before silver and gold begin rallying. Mathematically the stock market does not have to tank for the Dow in Gold (or Silver) to fall. Gold only needs to outperform stocks, so both might be rising, but gold rising faster. During the 1920-1923 German hyperinflation, stocks soared, but in the end they fell far behind the hyperinflation, which brings me to my point. In an age of inflation when evaluating any asset becomes like trying to shoot skeet off the back of a bass boat in a thunderstorm: the only thing that counts is purchasing power. Nominal gains mean nothing, only purchasing power gains. Stocks today tried without success to climb to positive territory until about 3:00 as closing time drew near and suddenly buyers appeared out of nowhere. Yeah, sure. Dow rose 44.5 (0.27%) to 16,491.31, no more than a dead cat bounce after losing 268.63 the previous two days. S&P500 clawed back 7.03 (0.38%) to 1,877.86. Since end-December stocks have tried and failed three times to break through 16,500-16,600. This week they collapsed and fell back to the 50 DMA. Can they rally from here? I tend to picture the top as behind us, but that's possible. Dow and S&P500 weekly charts show markets that have traded up to overhead trend line and bounced back, too. Dow in gold and Dow in silver are a little confused. At its 12.75 oz close today (G$263.57 gold dollars) the Dow in gold remains below its 12.77 oz 20 DMA, and right atop its rising uptrend line. Dow in silver rose 1.13% to 853.19 oz (S$1,103.11 silver dollars), above its 20 DMA (849.67 oz or S$1,098.56). Both are trying to break down but haven't yet. Mercy, the 10 year treasury note yield took a beating this week, from 2.656% on 12 May to 2.518% today. Sounds insignificant, but smashed the support line and gapped down. This and the likewise tumbling yield on 30 year bonds imply investors are crowding into bonds as they flee from stocks. (Bond prices rise when bond yields fall.) Doesn't bode bouquets for stocks. US dollar index showed unaccustomed gumption since its turn upwards a week ago Thursday. Shot straight up of 78.93 low but could not pierce its overhead downtrend line and stopped cold at 80.40 and fell back. Today rose two (minute) basis points to 80.11. Must yet validate last week's upward reversal by closing over 80.40, really, over the 200 DMA at 80.53. Likely will. Euro is a wreck. Closed today down 0.11% at $1.3695, and soon will fall below its 200 DMA ($1.3617). Yen is seeking to break out, and has broken out above its downtrending range upper boundary, but above stands the 200 DMA at 99.04. Can it punch through that? Good chance, but the yen must prove it next week. Yen closed today up 0.04% at 98.50. But what do I know? I'm just a nacheral born durn fool from Tennessee who only wears shoes when he has to show up in church. I ain't got no more sense than to believe that gravity always works. I have been nudging everyone here at the Top of the World Farm toward Holistic Management for a number of years. Usually you have to travel to New Mexico or Canada to attend the training sessions, but one was offered a couple of years ago at Summertown, about half an hour from us. I sent my sons Justin and Wright and it changed the way they thought and farmed. Holistic Management (see the book by Alan Savory) is a management technique that takes the whole-under-management into account for every decision. The results have astounded even me, in animals, costs, and quality of life. In 25 years, all agriculture will be conducted this way, and nobody will be able to believe that anybody in America ever used pesticides, herbicides, and high cost inputs and debt. On 17-19 June 2014 they're offering another Introduction to Holistic Management Whole Farm/Ranch Planning and Holistic Planned Grazing. Owen Hablutzel is the teacher. You'll find full description and registration at Spiral Ridge Permaculture, http://bit.ly/1iucANl On 20-22 June they're offering Keyline Design: Whole Farm/Ranch Planning for Water Abundance and Soil Fertility all about Keyline Plowing. Keylining slices deep into the earth to capture water flowing off the contour and creates drought resilience and maximum water harvest. Read about it and register here, http://bit.ly/1mB9VHV Yes, I eat my own cooking. We use Holistic Management on our own Farm and have extensively used Keyline Plowing. If you apply these techniques you will recoup the cost of the courses many times over and bring more order and peace into your life and operation. Y'all enjoy your weekend! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Feeding The Homeless" Is A Crime In Increasingly More US Cities Posted: 16 May 2014 05:37 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, Have you ever given food to a homeless person? Well, if you do it again in the future it might be a criminal act depending on where you live. Right now, there are dozens of major U.S. cities that have already passed laws against feeding the homeless. As you will read about below, in some areas of the country you can actually be fined hundreds of dollars for just trying to give food to a hungry person. I know that sounds absolutely insane, but this is what America is turning into. Communities all over the country are attempting to "clean up the streets" by making it virtually illegal to either be homeless or to help those that are homeless. Instead of spending more money on programs to assist the homeless, local governments are bulldozing tent cities and giving homeless people one way bus tickets out of town. We are treating some of the most vulnerable members of our society like human garbage, and it is a national disgrace. What does it say about our country when we can't even give a warm sandwich to a desperately hungry person that is sleeping on the streets? A retired couple down in Florida named Debbie and Chico Jimenez wanted to do something positive for their community during their retirement years, so they started feeding the homeless in Daytona Beach. But recently the police decided to crack down on their feeding program and slapped everyone involved with a $373 fine...

Don't the police down in Daytona Beach have something better to do with their time? Sadly, more than 50 major cities have passed laws against feeding the homeless at this point. It appears that "cleaning up the streets" has become a big point of emphasis all over the nation. And what the city of Camden, New Jersey just did is even worse than what happened in Daytona Beach. Camden just bulldozed an entire tent city and dumped all of the belongings of the homeless people living there into the trash...

But for most of the people that were living in that tent city, there is no place else for them to go. The homeless shelters in the area are at max capacity, and so many of them will end up sleeping in the streets without any shelter at all...

Camden has got to be one of the most mismanaged communities in the entire country. Why is Camden spending time and money bulldozing homeless communities when it has so many other problems? For much more on the nightmare that Camden has become, please see my previous article entitled "Camden, New Jersey: One Of Hundreds Of U.S. Cities That Are Turning Into Rotting, Decaying Hellholes". Other big cities that are a little bit more "progressive" are attempting to get rid of their homeless populations by giving them one way tickets out of town. Some of the major cities that are doing this include San Diego and San Francisco...

As shocking as everything that you just read is, what one lawmaker out in Hawaii is doing tops it all. In a previous article, I described how a state representative named Tom Brower has actually been using a sledgehammer to destroy shopping carts used by homeless people. Just check out the following short excerpt from an RT article that was published a few months ago...

Is this how our society is going to treat those that are down on their luck from now on? Where is the love? Where is the compassion? Why can't we seem to be able to take care of these people? The federal government sure seems to have plenty of money to waste on other things. For example, it is being reported that workers at an Obamacare processing facility in Missouri are being paid to do nothing but stare at their computers...

So we have millions upon millions of dollars to waste on that, but we can't take care of our homeless population? And without a doubt, the need to help the homeless is greater than it ever has been before. Right now, there are 1.2 million public school students in America that are homeless. That number is an all-time record, and it has grown by 72 percent since the start of the last recession. In addition, there are 49 million Americans that are dealing with food insecurity. Even in the midst of this so-called "economic recovery", poverty is absolutely exploding. And it is going to get a whole lot worse. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Where the World's Unsold Cars Go To Die Posted: 16 May 2014 05:02 PM PDT In the past several years, one of the topics covered in detail on these pages has been the surge in such gimmicks designed to disguise lack of demand and end customer sales, used extensively by US automotive manufacturers, better known as "channel stuffing", of which General Motors is particularly guilty and whose inventory at dealer lots just hit a new record high. But did you know that when it comes to flat or declining sales and stagnant end demand, channel stuffing is merely the beginning? Presenting... Where the World's Unsold Cars Go To Die (courtesy of Vincent Lewis' Unsold Cars)

Above is just a few of the thousands upon thousands of unsold cars at Sheerness, United Kingdom. Please do see this on Google Maps....type in Sheerness, United Kingdom. Look to the west coast, below River Thames next to River Medway. Left of A249, Brielle Way. Timestamp: Friday, May 16th, 2014. There are hundreds of places like this in the world today and they keep on piling up... THE WORLDS UNSOLD CAR STOCKPILE Houston...We have a problem!...Nobody is buying brand new cars anymore! Well they are, but not on the scale they once were. Millions of brand new unsold cars are just sitting redundant on runways and car parks around the world. There, they stay, slowly deteriorating without being maintained. Below is an image of a massive car park at Swindon, United Kingdom, with thousands upon thousands of unsold cars just sitting there with not a buyer in sight. The car manufacturers have to buy more and more land just to park their cars as they perpetually roll off the production line.

There is proof that the worlds recession is still biting and wont let go. All around the world there are huge stockpiles of unsold cars and they are being added to every day. They have run out of space to park all of these brand new unsold cars and are having to buy acres and acres of land to store them. NOTE: The images on this webpage showing all of these unsold cars are just a very small portion of those around the world. There are literally thousands of these "car parks" rammed full of unsold cars in practically every country on the planet. Just in case you were wondering, these images have not been Photoshopped, they are the real deal! Its hard to believe that there are so many unsold cars in the world but its true. The worse part is that the amount of unsold cars keeps on getting bigger every day. It would be fair to say that it is becoming a mechanical epidemic of epic proportions. If anybody from outer space is reading this webpage, we here on Earth have too many cars, why not come and buy a few hundred thousand of them for your own planet! (sorry but this is all I can think of) Below is shown just a few of the 57,000 cars (and growing) that await delivery from their home in the Port of Baltimore, Maryland, U.S.A. With Google Maps look South of Broening Hwy in Dundalk for the massive expanse of space where all these cars are parked up.

The car industry would never sell these cars at massive reductions in their prices to get rid of them, no they still want every buck. If they were to price these cars for a couple of thousand they would sell them. However, nobody would then buy any expensive cars and then they would end up being unsold. Its quite a pickle we have gotten ourselves into. Below is shown an image of the Nissan test track in Sunderland United Kingdom. Only it is no longer being used, reason...there are too many unsold cars parked up on it! The amount of cars keeps on piling up on it until its overflowing. Nissan then acquires more land to park up the cars, as they continue to come off the production line.

UPDATE: Currently May 16th, 2014, all of these cars at the Nissan Sunderland test track have disappeared? Now I don't believe they have all suddenly been sold. I would guess they may have been taken away and recycled to make room for the next vast production run. Indeed next to that test track and adjacent to the Nissan factory, they are collating again as shown on the Google Maps image below. So where did the last lot go? This is not an employees car park by the way.

None of the images on this webpage are of ordinary car parks at shopping malls, football matches etc. Trust me, they are just mountains and mountains of brand spanking new unsold cars. There is no real reason why you should be driving an old clunker now is there? The car industry cannot stop making new cars because they would have to close their factories and lay off tens of thousands of employees. This would further add to the recession. Also the domino effect would be catastrophic as steel manufactures would not sell their steel. All the tens of thousands of places where car components are made would also be effected, indeed the world could come to a grinding halt. Below is shown just a small area of a gigantic car park in Spain where tens of thousands of cars just sit and sunbathe all day.

They are also piling up at the port of Valencia in Spain as seen below. They are either waiting to be exported to...nowhere or have been imported...to go nowhere.

Tens of thousands of cars are still being made every week but hardly any of them are being sold. Nearly every household in developed countries already has a car or even two or three cars parked up on their driveway as it is. Below is an image of thousands upon thousands of unsold cars parked up on a runway near St Petersburg in Russia. They are all imported from Europe, they are all then parked up and they are all then left to rot. Consequently, the airport is now unusable for its original purpose.

The cycle of buying, using, buying using has been broken, it is now just a case of "using" with no buying. Below is an image of thousands of unsold cars parked up on an disused runway at Upper Heyford, Bicester, Oxfordshire. They are seriously running out of space to store these cars.

It is a sorry state of affairs and there is no answer to it, solutions don't exist. So the cars just keep on being manufactured and keep on adding to the millions of unsold cars already sitting redundant around the world. Below are parked tens of thousands of cars at Royal Portbury Docks, Avonmouth, near Bristol in the United Kingdom. If you look on Google Maps and scan around the area at say 200ft you will see nothing but parked up unsold cars. They are absolutley everywhere in that area practically every open space has unsold cars parked up on it.

Below is that same area in Avonmouth, UK, but zoomed out. Every gray space that you see is filled with unsold cars. Anyone want to hazard a guess at how many are there...

As it is, there are more cars than there are people on the planet with an estimated 10 billion roadworthy cars in the world today. We literally cannot make enough of them. Below are seen just a few of the thousands of Citroen's parked up at Corby, Northamptonshire in England. They are being added to daily, imported from France but with nowhere else to go once they arrive.

So there they sit, brand spanking new cars, all with a couple of miles on the clock that was consummate with them being driven to their car parks. Below is the latest May 2014 Google Maps image of unsold cars in Corby, Northamptonshire.

Manufacturing more cars than can be sold is against all logic, logistics and economics but it continues day after day, week after week, month after month, year in year out. Below is shown a recent (April 2014) screen grab from Google Maps of the Italian port of Civitavecchia. All those little specks are a few thousand brand new unsold Peugeots. Just collecting dust and maybe a bit of salty sea spray!

Below, all nice and shiny but with nowhere to go. Red and white and black and silver, purple, pink and blue, all the colors of the rainbow and be they all brand new. Indeed all the colors of the rainbow are down there on those cars, making pretty mosaics, montages of color and still life. Maybe that is all they will now ever be, surreal urban art of the techno production age. Magnificent metal boxes, wasting space and saving grace, all sitting still, because its business at mill.

All around the world these cars just keep on piling up, there is no end in sight. The economy shouts out quite loud that nobody has the money anymore to spend on a new car. The reason being that they are making their "old" cars go on a lot longer. But we cannot stop making them, soon we will run out of space to park them. We are nearly running out of space to drive them that's for sure! Below, more cars mount up in the port of Valencia in Spain. They will not be exported as there is nowhere for them to go, so they just sit and rot in their colorful droves.

Gone are the days when the family would have a new car every year, they are now keeping what they have got. It may be fair to say that some families still get a new car every year but its the majority that now do not. The results are in these images, hundreds of thousands if not millions of cars around the world are driven from their factories, parked up and left.

Could we say that these cars have been left to rot! Maybe, as these cars will certainly rot if they are not bought, driven and cared for. It does not look like they will be sold any day soon, many of them have been standing for over 12 months or even longer and this is detrimental to the car. Below, as far as the eye can see, right into the background, cars, cars and more cars. But what's beyond the horizon? Have a guess...Yes that's right...even more cars! All brand new but with no homes to go to. Do you think they will ever start giving them away, that may be the only radical solution. Who knows, you could soon be getting a free car with every packet of cornflakes.

When a car is left standing idle, all the oil sinks to the bottom of the sump, and then corrosion begins to set in on all the internal engine parts where the oil has drained away. Cold corrosion is when condensation builds up in the cylinders and rust forms in the bores. The engines would then start to seize and would need to be professionally freed before they could be started. Also the tires start to lose air and the batteries start to go flat, indeed the detrimental list goes on and on.

So the longer they sit there the worse it slowly becomes for them. What is the answer to this? Well they need to be sold and that just isn't happening. The epidemic is not imporving, it is getting worse. Car manufactureres are constantly coming out with new models with the latest technology in them. Hence prospective buyers of, for example, a new Citroen Xsara Picasso want the latest model, not last years model. Hence all the unsold Citroen Xsara Picasso cars from the previous year will now have even lesser chance of being sold. The problems then just keep on mounting up. In the end, the unsold cars that are say 2 years old will have no alternative but to be either crushed up, dismantled and/or their parts recycled. Some car manufacturers moved their production over to China, General Motors and Cadillac are examples of this. They are then shipped over in containers and unloaded at ports. However they are now being told to put a big halt in their import into the U.S.A. as they just can't sell them in the quantities they would desire. Consequently Chinese car parks are now filling up with brand new American cars. Well nobody in China can afford them on their meagre pittance wages, so there they will stay until our economy improves...which it might do in a few generations. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are Silver Prices Set Up for Another Heartbreak? Posted: 16 May 2014 04:45 PM PDT Jeffrey Lewis | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Is Forming A Golden Triangle. Major Breakout Coming? Posted: 16 May 2014 02:44 PM PDT This is a technical view on the gold price, written by analyst Matt Weller. He sees a chart pattern arising, better known as the golden triangle. We reported a similar finding earlier this week in Gold Price About To Break Higher Or Lower. Gold rallied from below $1,200 to nearly $1,400 over the first 10 weeks of the year. Next, the yellow metal pulled back to 1,300 in late March and has been consolidating in that area ever since. Despite the exasperating trading conditions of late, a developing technical pattern suggests a breakout and possible new trend could form as soon as next week. As the daily chart below shows, the yellow metal has been putting in a series of lower highs and higher lows over the last month, creating a textbook symmetrical triangle pattern. This pattern is analogous to a person compressing a coiled spring: as the range continues to contract, energy builds up within the spring. When one of the pressure points is eventually removed, the spring will explode in that direction. Beyond the symmetrical triangle in the price of gold itself, the RSI indicator is also forming its own corresponding triangle pattern. As a general rule of thumb, a breakout in an indicator tends to lead, or at least confirm, a breakout in price, so traders may want to keep a close eye on the RSI heading into next week. While it's notoriously difficult to determine the breakout direction in advance, knowledge that a strong continuation is likely is still valuable for gold traders. For instance, more aggressive traders could consider a "straddle" trade (looking to go long on a break above resistance or short on a break below support), whereas more conservative traders may want to wait for a confirmed breakout before trying to take advantage of a continuation in the same direction. If we see a bullish breakout above the top of the triangle and the 50-day MA next week, Gold could quickly rise to the top of the triangle at $1,330 or Fibonacci retracement resistance around $1,345 or $1,365. On the other hand, a bearish break would likely target the 3-month low near 1,270, followed by longer-term Fibonacci support at $1262 (61.8%) or $1230 (78.6%).  gold price

About the author: Matt Weller has actively traded various financial instruments including stocks, options, and forex since 2005. Each day, Matt creates research reports focusing on technical analysis of the forex, equity, and commodity markets. In his research, Matt utilizes candlestick patterns, common indicators, and Fibonacci analysis to predict market moves. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 May 2014 01:50 PM PDT Silver has suffered as a market pariah this year, dragging along doggedly near major lows. Investors have seemingly abandoned it to chase the Fed’s general-stock-market levitation, an affliction plaguing most of the alternative-investment realm. But rather provocatively, silver buying remains quite strong even in this dreary sentiment wasteland. This stealth buying will likely explode once gold starts running. After silver plunged 35.6% in 2013 and hit 2.8-year lows, it’s easy to understand why it remains deeply out of favor today. With the Fed’s extreme money printing and jawboning dramatically catapulting general stocks higher, mainstreamers forgot about alternative investments including silver. But for the brave contrarians who would rather buy low than buy high, silver remains an incredibly alluring investment. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - How Long Can Phase II of the Gold Pool Be Sustained Posted: 16 May 2014 01:39 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - How Long Can Phase II of the Gold Pool Be Sustained Posted: 16 May 2014 01:39 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harry Dent -- The Fake Casino Economy Bubble Is About To Burst: Financial Expert Predicts Posted: 16 May 2014 01:03 PM PDT Alex is joined by economic forecaster and author Harry Dent on what people can do to protect themselves from a future economic collapse. On this Wednesday, May 14 edition of the Alex Jones Show, Alex breaks down the latest Obama scandal after thousands of immigrant murderers, rapists,... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amazingly Deceptive Headlines, Part 1 Posted: 16 May 2014 12:46 PM PDT Reporters and their editors (and the corporations that employ them) have the power to shape readers’ perceptions by, for instance, choosing what fact to put first in a story or which expert to quote in what context. But the most powerful tool is the simplest: the headline. Because many people read only that, and many others have their perception of an article shaped by the first words they see, this sentence fragment is frequently as important as everything that comes after. Consider this, from the Associated Press:

Now, let’s tease out a few facts: Trading powers China and Japan cut their Treasury holdings, while superpower wannabe Russia dumped fully one-fifth of its dollar-denominated debt. Meanwhile, Belgium and Luxembourg and a few others more than made up the slack, enabling the Associated Press to open with a glowingly-positive message (foreign investors love dollars!). The truth appears to be something else entirely. How could Belgium and Luxembourg (total combined population 12 million) buy enough US debt to offset Russia dumping 21% of its Treasuries? The answer is that it’s highly unlikely they would do this in a single month unless they’re part of an under-the-table deal between Western powers to hide the fact that major holders of dollars appear to be losing faith in the currency and/or bridling at US foreign policy arrogance. So the cover-up is the real story, and a more honest headline would feature Belgium’s purchases and the reasons for this shift in dollar ownership. “Russia sells Treasuries while Belgium buys; analysts wonder why” would be both more honest and more provocative without being sensationalistic. But of course it would also be asking a difficult question, which is apparently no longer the media’s job. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

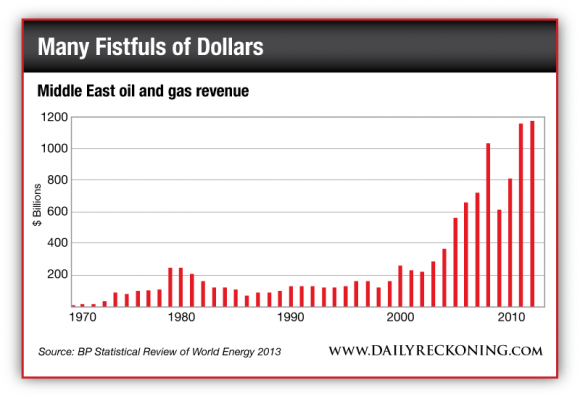

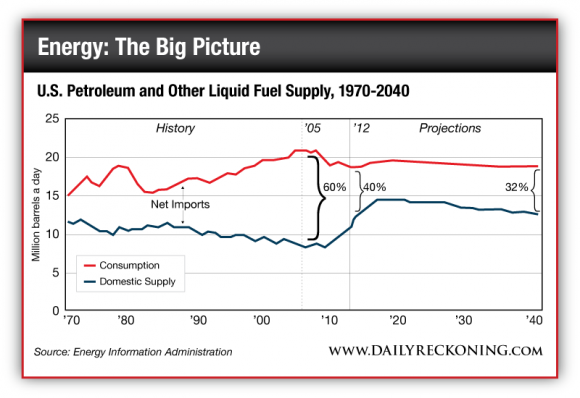

| Prepare for the Death of the Petrodollar Posted: 16 May 2014 12:28 PM PDT [Part I of this essay, The US Energy Boom Will End the Dollar's World Reserve Status, was published in yesterday's Daily Reckoning] "So let's say the U.S. is really not importing much Arab oil anymore," says Erik Townsend in a thought experiment. "Well, if that were the case, it's really hard to see why the Arabs would continue to price their oil in dollars, especially at that point; their biggest customers would be China and Brazil and countries that have no reason to deal in dollars." We're in debt to Mr. Townsend for helping us tease out the petrodollar's endgame here. Erik parlayed the fortune from his first career as a software entrepreneur into a second career as a hedge fund manager who knows the oil futures market inside out. Think about it, he says: Where's the incentive to keep pricing oil in dollars and maintaining large dollar reserves if the U.S. is no longer your biggest customer? "The petrodollar system breaking down, where oil is no longer paid for in dollars internationally, essentially would be the death knell to the U.S. dollar as the reserve currency. It means the U.S. can't borrow with 'exorbitant privilege' anymore, and it means the U.S. Treasury market is set for an out-of-control interest rate spiral." Suddenly, the fact the U.S. needs fewer imports doesn't matter when "the rest of the world won't use dollars for their currency." As it is, the Arab oil sheiks have more dollars than they know what to do with. In the three decades before 2000, total energy export revenue from the Middle East totaled $3.5 trillion. In the 13 years since, the total has swelled to more than $8 trillion. By one expert estimate, some $8–10 trillion in currency balances lie in Middle Eastern hands, much of it in dollars. How long will they want to keep all those dollars lying around? Especially when Asia and the Pacific now account for one-third of global oil consumption and the U.S. only 20%? Meanwhile, the world's leading oil importer — China took that crown from the United States last fall — is doing its part to undermine the petrodollar. In recent years, China has been striking agreements with many of its trade partners to do business using each other's currencies. China and Russia, China and Brazil, China and Australia, even China and its old/new enemy Japan — they all have currency swaps and other arrangements in place to bypass the dollar. Last November brought word the Shanghai Futures Exchange was thinking about pricing its new crude oil futures contract in both yuan and dollars, with the aim of making that contract the new Asian benchmark. "The yuan has become more international and more recognized by the financial market," the head of a Chinese trading firm told Reuters. But while the Arabs fret about the value of their dollars… and the Chinese move actively to diversify away from the dollar… it might be the Russians who deliver the final blow. "Tuesday, March 4, to me, was as big as the Cuban missile crisis in the history of the world," says Erik Townsend, with an eerie portent of future events. On the surface, the worst of the crisis between Ukraine and Russia appeared to be over. Markets were calming down as Russia's President Putin spoke up on the issue for the first time — pledging he would use force in Ukraine only as a "last resort" if the Russian-speaking population was in danger. Two other speeches by lesser Russian officials got much less attention. Kremlin economic aide Sergei Glazyev said if faced with Western sanctions, Russia could figure out how to avoid using the dollar for international transactions. "We would find a way not just to reduce our dependency on the United States to zero but to emerge from those sanctions with great benefits for ourselves. "An attempt to announce sanctions would end in a crash for the financial system of the United States, which would cause the end of the domination of the United States in the global financial system." Hyperbole? Yes. Is Glazyev a junior figure? Sure. But then as if to underscore those remarks, Foreign Ministry spokesman Alexander Lukashevich said hours later, "We will have to respond… if provoked by rash and irresponsible actions by Washington… and not necessarily symmetrically." Yes, he's only a spokesman… but he speaks on behalf of Russia's wily foreign minister Sergei Lavrov. And as we go to press, he still has his job. "That's about the strongest language I've ever heard from a diplomat," says Erik Townsend. "And it sounds to me like Russia is really saying: 'United States, if you want to play this game, come and tell us what we can do in our country, because you're the United States, and you think that ignoring international law is your right because you've got inborn American arrogance or something — if that's what you think, we're going to push a button and we're going to put your country into a bond and currency crisis that ends its economic hegemony over the world, and we have the power to do that.' "I wouldn't be surprised if somebody in China heard him say that and maybe his phone is ringing. "Those two countries controlling the reserve currency, being in charge of it themselves, that would just completely change everything overnight. So if you were them, why wouldn't you be consorting to do that? Imagine if they could make it work, a combination of China and Russia asserting a new currency and saying, 'We're not going to use the Chinese yuan. We're going to create this new currency. It's called the Asiabuck or something, and it's backed by something real, preferably gold.'" Understand that's a possibility, not a forecast. But almost no one noticed. Since that day, there's been little letup in the Russian chest-thumping. The website of the Voice of Russia — the new name for the Radio Moscow of old — featured a commentary in late April titled, "Time Is Running out for the U.S. Dollar." It quoted a Russian economist saying, "The U.S. doesn't have that much time in order to prepare for a serious weakening of the U.S. dollar on the global stage and, conversely, for a serious strengthening of regional currencies' role. The maximum amount of time they can count on is 18 months." From the Russians' standpoint, 18 months might be a little optimistic. "I doubt that a U.S. bond and currency crisis is going to happen on Obama's watch," says Erik Townsend. "He's only got a couple more years; we're getting close. But to go eight more years — assuming the next president gets two terms — to go from 2016 all the way to 2024 without the U.S. bond market blowing up for one reason or another, I can't see it. "That means our next president is going to be the one to preside over the most technically complex, sophisticated financial disaster in history. 2008 will look like a backyard weenie roast compared with what I see coming." Lost jobs, lost homes, lost hope… and then what? That's when U.S. leaders sit down with their "partners" from Europe and elsewhere and tell them China and Russia are about to become the biggest and baddest world powers — unless the West joins forces for a new global reserve currency. "We're going to merge the dollar and the euro and whoever else we can get onboard to do that. "What you do if you're the U.S. is you say, 'Look, we can't have that other new world. It's just too radical. It would mean the end of life as we know it. Therefore, all other countries that are not aligned with China and Russia, you gotta be on our side.' And what we'll do is we'll set it up so that basically the very well-connected political elites always are taken care of, but everybody else is going to get screwed." That is, there will be one conversion rate between the dollar and the new currency for the elites… and another for everyone else. Revolt in the streets? Maybe, maybe not. Mr. Townsend suggests the conversion mechanism will be so complicated few will even realize what's happening — much like the 2008 bailouts. "The government is very good at making things overly complicated for the purpose of obscuring what's really going on from the public." And to think it all began with the newfound American prosperity brought about by abundant made-in-America energy. When does Judgment Day arrive? When might the Saudis or the Russians or the Chinese — or any or all of them in cahoots — pull the plug on the petrodollar? Mr. Townsend says not on Obama's watch. That seems believable. Perhaps the most logical time is when America reaches the point of minimum reliance on foreign oil supply — the moment when petrodollars will be least necessary to grease the wheels of international commerce. That's when the sheiks and the oligarchs and the Central Committee can make their escape. Recall this chart from yesterday: We've gone from importing 60% of our oil needs in 2005 to only 40% now. Within another five years, the amount will shrink further to only 30%. This "30% threshold" might well be your cue that the crisis is nigh. No guarantees, of course… but it's not hard to believe someone in Riyadh or Moscow or Beijing is watching this very data as the U.S. Energy Information Administration posts it online every month. Regards, Addison Wiggin P.S. We don’t blame you if you’re skeptical. It’s a lot to take in. But it’s important to consider this scenario… and foolish to ignore it as a possibility. That’s why you should take steps now, today, to protect and grow your wealth no matter what. And in today’s issue of The Daily Reckoning email edition, we gave readers a chance to do just that – including one opportunity that shows them how to turn $500 into a 7-figure fortune in as little as two months. These kinds of wealth building opportunities are packed into every single issue of The Daily Reckoning - which gets delivered straight to subscribers’ inboxes every afternoon. Don’t miss the next issue, or any of the great potential profit opportunities that come with it. Sign up for FREE, right here, start getting the full story. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell - Shorts May Get Crushed In The Silver Market Posted: 16 May 2014 10:00 AM PDT  Today KWN is publishing another important piece that was written by a 60-year market veteran. At nearly 90 years old, the Godfather of newsletter writers, Richard Russell, discusses the massive short position creating a possible explosion in the price of silver. Russell also looks at a danger signal that is rocketing higher. Today KWN is publishing another important piece that was written by a 60-year market veteran. At nearly 90 years old, the Godfather of newsletter writers, Richard Russell, discusses the massive short position creating a possible explosion in the price of silver. Russell also looks at a danger signal that is rocketing higher.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Important Price-Volume Link Posted: 16 May 2014 09:13 AM PDT Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks. The situation in the currency and precious metals markets developed to a large extent as we had outlined it yesterday. The USD Index paused, but gold, silver, and mining stocks caught up a bit in terms of the reaction to the previous dollar’s moves. Let’s take a closer look (charts courtesy of http://stockcharts.com). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Something Very, Very Bad Will Happen Very, Very Soon | Andy Hoffman Posted: 16 May 2014 09:05 AM PDT On his weekly podcast, Andy Hoffman discusses market manipulation, gold and silver, national debt, food prices increasing, QE, Japan, Obamacare and unemployment.This video was posted with permission from Andy Hoffman media director of Miles Franklin [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Technical analysis vs. value in gold Posted: 16 May 2014 08:34 AM PDT 11:30a ET Friday, May 16, 2014 Dear Friend of GATA and Gold: GoldMoney research director Alasdair Macleod today contrasts technical analysis of financial markets with value analysis and sides with the latter. Of course neither are very good in a market that is as comprehensively manipulated by central bank intervention as the gold market is -- http://www.gata.org/taxonomy/term/21 -- but as happened with the collapse of the London Gold Pool in 1968, eventually the metal available to the market manipulators runs out and value manifests itself, sometimes overnight. Whether "eventually" will cover part of the lifespan of anyone now alive is the big question. GATA continues to do what it can. Macleod's commentary is headlined "Technical Analysis vs. Value in Gold" and it's posted at GoldMoney's Internet site here: http://www.goldmoney.com/research/analysis/technical-analysis-versus-val... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Precious Metal Rally that Just Won’t Stick Posted: 16 May 2014 08:18 AM PDT If the stock market's recent action is a little too crazy for your liking, maybe it's time for you to revisit gold and gold mining stocks. Gold's going nowhere fast. In fact, it's boring me to death. Compared to the insane meltdowns in biotech and momentum stocks that have ripped traders to shreds over the past couple months, gold's just standing around in its slippers staring at the birds in the backyard. That's a complete 180-degree turn from the action we saw from gold earlier this year… Back in early March, gold had left $1,350 in the dust. Miners were breaking out to new year-to-date highs. Nothing interesting was happening with stocks. But precious metals looked primed for a move. This bullish-looking action led up to my worst call so far this year. I thought gold would make a push toward $1,400, and miners would be the best way to play it. So far, my buy signal on the Market Vectors Gold Miners ETF (NYSE:GDX) at $24 has led to nothing but chop. After a failed breakout at $27, this ETF has drifted lower for nearly two months. Every rally since gold's early March push has looked less impressive. "Gold has been driven back from a key long term trendline at $1,310 this morning, ($1,315 last week) that it needs to break to have a chance at sustaining a rally," writes Lee Adler over at Wall Street Examiner. Lee's looking for a weekly close above $1,334 before gold can get jiggy and make another go at $1,400. But it doesn't look like we're going to get there anytime soon. In fact, if gold slips below $1,280, I see the chance for a quick tumble back to its lows near $1,200. The bottom line is I don't want anything to do with miners or the metal anymore. Gold's not cooperating for anyone who it teased into buying earlier this year. It's not reacting strongly to weakness in stocks. And for the past six weeks, the price action could put even the most over-caffeinated insomniac into a coma. Regards, Greg Guenthner P.S. As far as I'm concerned, the GDX trade is dead in the water. But if you just have to get some precious metal exposure, there’s one metal I recommended to my Rude Awakening readers that could definitely wake up their portfolios. To take full advantage of my research – not to mention exclusive offers to discover real stock picks with massive upside potential – sign up for The Rude Awakening email edition, for FREE, right here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 May 2014 06:20 AM PDT GOLD PRICES dropped $5 per ounce from a tight range around $1295 lunchtime Friday in London, erasing the last of the week's earlier 1.5% gains to 1-month highs after new US housing data beat analyst forecasts. The month-long national election in India – the world's No.1 gold consumer market until 2013 – meantime showed a landslide for the pro-business BJP led by Narendra Modi. Giving the strongest reading since November, new US housing starts data for last month were outpaced by new building permits – reported at the best since July 2008 above 1.0 million annualized. "Gold does require some credit for its resilience in recent weeks," analysts at Swiss investment and bullion bank UBS had said earlier in a note Even though UBS now expects gold prices to drop to $1250 per ounce over the next month, "Given weak sentiment, poor physical demand, a stronger Dollar and on balance better US data, gold has in fact performed adequately." Friday morning – and despite the BJP's clear victory – "To say Asia was quiet today would be an understatement," said a note from Swiss refining and finance group MKS. An outspoken critic of how smuggling has leapt following the incumbent Congress party's anti-gold import rules, Modi was backed by the leaders of the India Bullion and Jewellers Association, who led celebrations today in Mumbai's Zaveri Bazaar. India's largest public-sector trading body, MMTC, today saw its joint-venture gold processing plant at Hewat with Pamp of Swizterland accepted onto the London Bullion Market Association's Good Delivery list. Good Delivery accreditation enables a refiner to produce gold bars for the wholesale bullion market centered in London. Ahead the BJP's landslide victory, "Over last two to three weeks, we have seen people coming to the market to sell gold," the Economic Times quotes Mumbai scrap gold director Anish Jitendar Jain. "They feel that gold prices will fall further as the Rupee will get stronger after the elections...[and] want to safeguard any decline in their assets." Gold prices in India – where import duty stands at 10%, and legal imports are effectively banned by the central bank's so-called 80:20 rule – plunged 1.7% on Friday, The Hindu reports, as the Rupee touched new 10-month highs on the currency market. Recovering 17% from last September's all-time low however, the Rupee then eased back, and the Mumbai stockmarket also fell, dropping more than 5% – and erasing the day's earlier gains – after news of Modi's victory was confirmed. Meantime in Russia – where state metals depository Gokhran said it will start buying palladium to rebuild stocks, as suggested since mid-2013 – gold mining over the first 3 months of this year was reported almost 20% higher from Q1 2013, the Gold Industrialists' Union said. The Union had previously forecast Russia's gold-mining output – the world's 3rd largest – would ease back this year from 2013's record. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Oil And S&P500 Elliott Wave Analysis Posted: 16 May 2014 03:43 AM PDT S&P500 has turned bearish in this week and even accelerated lower yesterday. More importantly, prices fell through the channel support line connected from 1803 low, and also moved slightly beneath wave (e) swing low of a wave B triangle. Such price action, especially broken upward channel suggests that market completed a three wave rise from 1803 to 1898. With that said, we assume that market will continue lower now within wave C) that is part of a corrective blue wave (4) that can be a flat. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Firmer Tone for Gold and Silver Prices Posted: 16 May 2014 03:38 AM PDT This week started with a severe markdown in gold and silver prices when markets opened in the Far East on Monday morning, taking gold down $12 to $1278 and silver only 12 cents to $19.03. The clue in this was the resilience of silver, which hardly moved: it was an attack on the gold price presumably designed to take out stop-losses. From there precious metals never looked back. Interestingly, for the first time in a long time, prices advanced in London dealings, indicating they were being driven more by physical demand than trading in US futures. This is hardly a surprise given that GOFO is still negative for up to three months forward and has been in backwardation every day since 3rd April. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are Silver Prices Set Up for Another Heartbreak? Posted: 16 May 2014 03:35 AM PDT For long term investors and precious metals observers, the range-bound price action has rubbed salt into the open wound of short price sentiment. That is, if there is anyone left to remember the move up to $50 in 2011. How long prices can remain relatively quiet and range-bound (in the face of growing fundamentals, geopolitical tension, and the rising awareness of inflation) is anyone's guess. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Insiders Buying at Record Clip Posted: 16 May 2014 01:31 AM PDT Gold mining exec's should know what they're doing. And right now, they're buying stock... SO A BIDDING war irrupted over Osisko Mining (TSE:OSK), an emerging gold mining producer, writes Dan Amoss of the Strategic Short Report in The Daily Reckoning. Osisko owns the attractive, 9.4 million-ounce Canadian Malartic mine in Quebec, plus a few exploration-stage assets. Is it worth the headlines? In January, Goldcorp (NYSE:GG) made a hostile offer to acquire Osisko for C$5.95 per share in cash and stock. Considering the great progress Osisko has made bringing the Canadian Malartic mine into production (and the fact that Osisko traded north of $15 per share in 2011), Goldcorp was offering a bargain-basement price. In early April, Yamana Gold (NYSE:AUY), sensing the value Goldcorp was getting, joined the bidding with a complex (but shrewd) C$7.60 offer for Osisko. It was a friendly offer, so Osisko management clearly preferred merging with Yamana. Yamana's first offer involved financing from Canadian institutional investors through a loan and a gold stream. It also allowed Osisko shareholders to retain a much more concentrated ownership in the Canadian Malartic mine, rather than wind up with a fractional ownership in the Goldcorp empire. Yamana's offer prompted a C$7.60 counteroffer from Goldcorp. Finally, on April 16, Yamana responded with a new strategy: It found a bidding partner in Agnico Eagle Mines (NYSE:AEM). Here are the details of what looks like the final winning offer. Agnico Eagle and Yamana will jointly acquire 100% of Osisko's shares' total consideration of C$3.9 billion, or C$8.15 per share – a 7% premium to Goldcorp's prior. The offer consists of C$1.0 billion in cash, approximately C$2.33 billion in Agnico Eagle and Yamana shares and shares of a new company ("Spinco") with an implied value of approximately C$575 million. Osisko shareholders who choose to hold on to the Spinco would receive the following: a 5% net smelter royalty (NSR) on the Canadian Malartic mine, C$155 million cash, a 2% NSR on the Kirkland Lake assets and Osisko's other development assets and liabilities. AEM stock fell sharply after the announcement, but the offer makes a lot of sense for its shareholders. With employees and assets already nearby the Malartic mine, AEM would bring a lot of expertise and mine-operating cost savings to the new partnership. Earlier this week, Goldcorp let its offer expire. So AUY and AEM have very likely won the bidding. The fight to acquire Osisko reveals the dichotomy between the gold mining stock views of:

Insiders – those in position to know the most about the assets they manage – are as bullish as they've ever been: They're buying shares at a brisk pace. Ted Dixon of INK Research publishes indicators of insider buying. Dixon's indicator for the TSX gold sector shows a ratio of insider buying to insider selling of 2.5:1 – one of the most bullish readings ever. Institutional investors seem to have abandoned the sector. For now, the consensus doesn't want to own gold because it expects the Fed will taper QE and then reverse QE by shrinking the money supply and everything will be dandy. I have my doubts. Since the 2008 crisis, several central banks, including the Fed, have encouraged the development of a highly unstable financial system. Real estate, the collateral for much of the banking system, is now priced on the assumption that low mortgage rates are permanent. And stocks have rallied on the assumption that future earnings should be discounted back to the present at very low rates. Take away the QE and low interest rates and we're supposed to believe these asset values would not fall violently? I don't think so. Asset values might stay high and keep rising if private-sector economies were robust. But they're not! In fact, since 2008, private-sector economies have become ever more intertwined with (and dependent upon) government and central bank stimulus. Investors expecting this Fed tightening cycle to be like the last one will be surprised at how rapidly the economy contracts in response to slight withdrawal of addictive monetary stimulus. Individuals, to the extent that they've held onto gold miners through the carnage (or bought recently), are not likely to sell these stocks anywhere near current prices. This state of affairs describes a sector that's bottomed and has a lot of upside potential. New investors, when they see central banks trapped in states of permanent stimulus, should migrate to gold miners. To acquire shares from strong hands, they'd have to bid aggressively, creating the conditions for a bull market. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Insiders Buying at Record Clip Posted: 16 May 2014 01:31 AM PDT Gold mining exec's should know what they're doing. And right now, they're buying stock... SO A BIDDING war irrupted over Osisko Mining (TSE:OSK), an emerging gold mining producer, writes Dan Amoss of the Strategic Short Report in The Daily Reckoning. Osisko owns the attractive, 9.4 million-ounce Canadian Malartic mine in Quebec, plus a few exploration-stage assets. Is it worth the headlines? In January, Goldcorp (NYSE:GG) made a hostile offer to acquire Osisko for C$5.95 per share in cash and stock. Considering the great progress Osisko has made bringing the Canadian Malartic mine into production (and the fact that Osisko traded north of $15 per share in 2011), Goldcorp was offering a bargain-basement price. In early April, Yamana Gold (NYSE:AUY), sensing the value Goldcorp was getting, joined the bidding with a complex (but shrewd) C$7.60 offer for Osisko. It was a friendly offer, so Osisko management clearly preferred merging with Yamana. Yamana's first offer involved financing from Canadian institutional investors through a loan and a gold stream. It also allowed Osisko shareholders to retain a much more concentrated ownership in the Canadian Malartic mine, rather than wind up with a fractional ownership in the Goldcorp empire. Yamana's offer prompted a C$7.60 counteroffer from Goldcorp. Finally, on April 16, Yamana responded with a new strategy: It found a bidding partner in Agnico Eagle Mines (NYSE:AEM). Here are the details of what looks like the final winning offer. Agnico Eagle and Yamana will jointly acquire 100% of Osisko's shares' total consideration of C$3.9 billion, or C$8.15 per share – a 7% premium to Goldcorp's prior. The offer consists of C$1.0 billion in cash, approximately C$2.33 billion in Agnico Eagle and Yamana shares and shares of a new company ("Spinco") with an implied value of approximately C$575 million. Osisko shareholders who choose to hold on to the Spinco would receive the following: a 5% net smelter royalty (NSR) on the Canadian Malartic mine, C$155 million cash, a 2% NSR on the Kirkland Lake assets and Osisko's other development assets and liabilities. AEM stock fell sharply after the announcement, but the offer makes a lot of sense for its shareholders. With employees and assets already nearby the Malartic mine, AEM would bring a lot of expertise and mine-operating cost savings to the new partnership. Earlier this week, Goldcorp let its offer expire. So AUY and AEM have very likely won the bidding. The fight to acquire Osisko reveals the dichotomy between the gold mining stock views of: