Gold World News Flash |

- Potential Catalyst for Gold and Silver Stocks

- Fall Of the U.S. Dollar Based Monetary System: Russia Puts The Avalanche In Motion

- So How Goes the War on Gold?

- Gold Standard - How the U.S. Government Created the Dollar

- Can A Nation $17 Trillion In Debt Afford Higher Interest Rates & Will This Change Our Retirements?

- Daily Nugget – Silver Demand Reaches Record Highs

- Full-Blown Currency Wars, Gold, World War III & Serious Panic

- Unprecedented Wealth Confiscation & The Disastrous Endgame

- The Gold Price Lost $12.20 Closing at $1,293.50

- The Gold Price Lost $12.20 Closing at $1,293.50

- Koos Jansen: Are the London gold vaults running empty?

- Mike Kosares: So how goes the war on gold?

- The Lightbulb Goes Off In China: "If You Don't Pay Me And I Pay Others, I Am The Sucker"

- RIP Silver Price Fix

- The Fall Of The Dollar Based Monetary System: Russia Puts The Avalanche In Motion

- Silver to Average $19 per Ounce in 2014: Thomson Reuters GFMS

- A Gold Shortage Is Coming Says Eric Sprott

- Time Is Running Out To Prepare Before The Next Global Crisis

- Gold Daily and Silver Weekly Charts - What If?

- Gold Daily and Silver Weekly Charts - What If?

- Government striving to devalue and super-rich are hedging against it, Kaye says

- High Tide for the U.S. Dollar: Revenge of the Sith

- The US Energy Boom Will End the Dollar’s World Reserve Status

- The world's real rulers: central banks operating in secret

- High Tide for the Dollar: Revenge of the Sith

- High Tide for the Dollar: Revenge of the Sith

- What the Inflation Report Could Mean for Gold

- Tiny Machines That Produce Massive Returns

- What The Elites Are Secretly Doing Ahead Of Coming Collapse

- Silver shone in 2013, but will it continue to?

- Forget Stocks… Buy Taxi Medallions?

- 5 Critical Questions About the Strength of the US Economy

- Gold Prices Drop $15 in 5 Minutes After Strongest US Jobs Data in 7 Years

- Are Russia and China About To Announce The End Of The US Dollar Era?

- High-Grade Gold, Safe Jurisdictions

- High-Grade Gold, Safe Jurisdictions

- Gold Discovery of the Decade, On Sale

- Silver Investing Hits Record, Scrap "Exhausted" on 2013 Price Crash

- Silver Investing Hits Record, Scrap "Exhausted" on 2013 Price Crash

- ALERT -- Russia Holds 'Kill the Dollar' Meeting with China and Iran!

- The Trough of the Turning Point

- The Trough of the Turning Point

- The End (of the Silver Fix) Is Nigh

| Potential Catalyst for Gold and Silver Stocks Posted: 16 May 2014 12:33 AM PDT Precious Metals continue to be in a long bottoming process that began last summer. Though many quality juniors have already bottomed and while GDX, GDXJ and SIL probably won’t see new lows, the broad sector as a whole is struggling to push out of this long bottoming process. Traders always say price is all that matters and who cares about fundamentals or the why. However, the most astute traders and investors look beyond a simple tool or single sphere of analysis. With respect to precious metals, negative real rates and the direction of inflation are the driving forces. Deflation is a catalyst for precious metals because policy makers react by suppressing real rates. Rising inflation is a catalyst and especially when it causes real rates to go negative or more negative. I will explain why this could be the catalyst for the revival of precious metals sector. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fall Of the U.S. Dollar Based Monetary System: Russia Puts The Avalanche In Motion Posted: 16 May 2014 12:24 AM PDT It is truly astonishing how much trust people have in the establishment. Almost everyone believes that central planners are focused on defending the best outcome for society. In the same respect, almost everyone nowadays believes that “things are contained.” Looking under the hood, it appears that several worrisome trends are going on. Examining those trends, one can only conclude that they are building up momentum. But make no mistake, momentum, in this case, is not in the right direction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 May 2014 12:18 AM PDT “I can’t remember the exact quote but when I used to trade and Mr. Volcker was Fed chairman, he said something like ‘gold is my enemy, I’m always watching what gold is doing’, we need to think why he made a statement like that. If you’re a central banker or one of the congressmen or senators, watch what gold is doing because this is a no-confidence vote in fiscal and dollar policy.”– Rick Santelli, CNBC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Standard - How the U.S. Government Created the Dollar Posted: 16 May 2014 12:11 AM PDT By Robert Prechter The Government's Disastrous Reign Over U.S. Money Very few people know that the United States did not create a monetary unit pegged to 'buy' some amount of metal, as if the dollar were some kind of money independent of metal. In 1792, Congress passed the U.S. Coinage Act, which defined a dollar as a coin containing 337.25 grains of silver and 44.75 grains of alloy. Congress did not say a dollar was worth that amount of metal; it was that amount of metal. A dollar, then was a unit of weight, like a gram, ounce or pound. Since the alloy portion of the coin was nearly worthless, a dollar was essentially defined as 1 Troy ounce.) In a nutshell, a dollar was equal to a bit more than 3/4 of an announce of silver; or, in reverse, an ounce of silver was equal to $1.293. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Can A Nation $17 Trillion In Debt Afford Higher Interest Rates & Will This Change Our Retirements? Posted: 15 May 2014 11:30 PM PDT by Daniel R. Amerman, Gold Seek:

Clearly, the federal government cannot afford substantially higher interest rates. At the very same time, because of the current extremely low interest rate environment, tens of millions of retirees and long term investors have seen their returns slashed, with potential reductions in their standard of living as well. Could it be there is a fundamental clash between the financial interests of the federal government and the financial well-being of long term retirement investors? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Daily Nugget – Silver Demand Reaches Record Highs Posted: 15 May 2014 09:40 PM PDT by Jan Skoyles, TheRealAsset.co.uk

We have previously commented on the impact tensions in Ukraine will have on the price of gold and the silver price. We believe that until there is a civil war or energy supplies for Europe are threatened, then the impact of the current events will be minimal on the gold price. Should war or gas shortages come into play, then we will see real safe-haven demand kick in. However, with US data continuing to portray a brighter picture it is likely that gold-buying will pick up on the dips, but there will be little to drive it significantly above $1,300 should the situation in Ukraine not change significantly. Holdings in the SPDR Gold Trust were yesterday at their lowest since January 2009, at 780.46 tonnes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full-Blown Currency Wars, Gold, World War III & Serious Panic Posted: 15 May 2014 09:01 PM PDT  Today an outspoken hedge fund manager out of Hong Kong warned King World News that the world is eventually headed into full-blown currency wars and serious panic. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed what this will mean for the gold and silver markets, and why we may be stumbling into World War III. Today an outspoken hedge fund manager out of Hong Kong warned King World News that the world is eventually headed into full-blown currency wars and serious panic. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed what this will mean for the gold and silver markets, and why we may be stumbling into World War III.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unprecedented Wealth Confiscation & The Disastrous Endgame Posted: 15 May 2014 08:20 PM PDT from Merit Gold: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Lost $12.20 Closing at $1,293.50 Posted: 15 May 2014 06:19 PM PDT

It was disappointing to see the GOLD PRICE lose $12.20 to $1,293.50 and silver give back 28.8 cents to 1944.7c. Disappointing, but hardly fatal. Take silver first. Somewhat suspiciously massive selling appeared about 9:30 Eastern Time, massive enough to smash silver down from 1968c to 1943c in about ten minutes. I pass over this event in silence, since the Nice Government Men might take umbrage if I point the finger at them, although they are the most likely suspect. The SILVER PRICE rebounded in a couple of hours to 1963c, but faded off the rest of the day for that 1944.7c close. Stepping back a bit, silver remains in an uptrend (higher highs, higher lows) that began with the 1868.5c low on 1 May. It touched back today to the 20 DMA. If it seriously intends an uptrend, it ought to cross above 2000c in the next two or three days. Like silver the GOLD PRICE got clobbered by mysterious but deep pocketed forces about 9:30, knocking it from $13,04 to $1,290.90 in less than a quarter hour. Comex closed below $1,295 at $1,293.50 but the day ended at $1,296.10. The gold price has been trending up since $1,268.40 low on 24 April 2014: higher lows, higher highs, except it must yet better $1,315.80, the very last high. Rising above $1,309 will also give gold escape speed from the even-sided triangle formation, and should lead to a much longer run. I didn't like higher volume today on a falling price, but other indicators keep on pointing their fingers up. Let's take stock of stocks. Since the last days of 2013 the Dow has been attempting, lo, hath tried thrice, to break through 16,500 - 16,600 resistance, but has failed. Last try was a new all time high on 13 May at 16,613.97, but two days later the Dow is 268 points (1.7%) lower. Thus 'twas not a breakout, but a fake out. S&P500 hath tried thrice since 1 March to break through 1880 - 1900, but it, too, hath failed. Today both it and the Dow bumped into their 50 day moving averages below. Meanwhile, the Nasdaq Composite and Russell 2000 have been lagging and dragging -- leading the way down, as it turns out. Today the Dow lost 167.16 (1.01%) to close at 1,6446.81. S&P500 lost 17.88 (0.94%) and ended at 1,870.85. All this constitutes, until and unless the market gainsays with higher prices, a plain downward reversal.

The rising flat-topped triangle (Mercy, that's clumsy!) formed AFTER the 31 December 2013 peak at 13,80 oz (G$285.27), the high for the move. Other indicators point down. Dow in silver rose 0.47% today to 844.12 oz (S$1,091.39 silver dollars), but only after falling through its 20 day moving average yesterday, and after twice bumping through its uptrend line. Indicators signaling a trip downhill. That rotten US dollar index today touched its downtrend (from February) line and clean fainted. Lost 4 basis points to close 80.08. That's probably not too surprising for a first try at punching through. Meanwhile the 10 year treasury not yield plunged yet again, down 1.61% to 2.502%, back at November 2013's low. This bodes bad indigestion for stocks. Money is fleeing stocks into government securities. Euro lost 0.2% to $1.3711. That was up off the low at $1.3648. Euro has a long way yet to fall. This is only beginning. Yen definitively broke above its reigning trading range boundary to close at 98.47 cents per Y100, up 0.31%. 200 DMA stands above at 99.06, ready to stop it. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Lost $12.20 Closing at $1,293.50 Posted: 15 May 2014 06:19 PM PDT

It was disappointing to see the GOLD PRICE lose $12.20 to $1,293.50 and silver give back 28.8 cents to 1944.7c. Disappointing, but hardly fatal. Take silver first. Somewhat suspiciously massive selling appeared about 9:30 Eastern Time, massive enough to smash silver down from 1968c to 1943c in about ten minutes. I pass over this event in silence, since the Nice Government Men might take umbrage if I point the finger at them, although they are the most likely suspect. The SILVER PRICE rebounded in a couple of hours to 1963c, but faded off the rest of the day for that 1944.7c close. Stepping back a bit, silver remains in an uptrend (higher highs, higher lows) that began with the 1868.5c low on 1 May. It touched back today to the 20 DMA. If it seriously intends an uptrend, it ought to cross above 2000c in the next two or three days. Like silver the GOLD PRICE got clobbered by mysterious but deep pocketed forces about 9:30, knocking it from $13,04 to $1,290.90 in less than a quarter hour. Comex closed below $1,295 at $1,293.50 but the day ended at $1,296.10. The gold price has been trending up since $1,268.40 low on 24 April 2014: higher lows, higher highs, except it must yet better $1,315.80, the very last high. Rising above $1,309 will also give gold escape speed from the even-sided triangle formation, and should lead to a much longer run. I didn't like higher volume today on a falling price, but other indicators keep on pointing their fingers up. Let's take stock of stocks. Since the last days of 2013 the Dow has been attempting, lo, hath tried thrice, to break through 16,500 - 16,600 resistance, but has failed. Last try was a new all time high on 13 May at 16,613.97, but two days later the Dow is 268 points (1.7%) lower. Thus 'twas not a breakout, but a fake out. S&P500 hath tried thrice since 1 March to break through 1880 - 1900, but it, too, hath failed. Today both it and the Dow bumped into their 50 day moving averages below. Meanwhile, the Nasdaq Composite and Russell 2000 have been lagging and dragging -- leading the way down, as it turns out. Today the Dow lost 167.16 (1.01%) to close at 1,6446.81. S&P500 lost 17.88 (0.94%) and ended at 1,870.85. All this constitutes, until and unless the market gainsays with higher prices, a plain downward reversal.

The rising flat-topped triangle (Mercy, that's clumsy!) formed AFTER the 31 December 2013 peak at 13,80 oz (G$285.27), the high for the move. Other indicators point down. Dow in silver rose 0.47% today to 844.12 oz (S$1,091.39 silver dollars), but only after falling through its 20 day moving average yesterday, and after twice bumping through its uptrend line. Indicators signaling a trip downhill. That rotten US dollar index today touched its downtrend (from February) line and clean fainted. Lost 4 basis points to close 80.08. That's probably not too surprising for a first try at punching through. Meanwhile the 10 year treasury not yield plunged yet again, down 1.61% to 2.502%, back at November 2013's low. This bodes bad indigestion for stocks. Money is fleeing stocks into government securities. Euro lost 0.2% to $1.3711. That was up off the low at $1.3648. Euro has a long way yet to fall. This is only beginning. Yen definitively broke above its reigning trading range boundary to close at 98.47 cents per Y100, up 0.31%. 200 DMA stands above at 99.06, ready to stop it. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: Are the London gold vaults running empty? Posted: 15 May 2014 05:31 PM PDT 8:28p ET Thursday, May 15, 2014 Dear Friend of GATA and Gold: British gold exports, which long have been feeding Swiss refineries for reprocessing into kilobars for export to Asian markets and China particularly, collapsed 85 percent in March even as gold imports into China remain strong, gold researcher and GATA consultant Koos Jansen reports tonight. This prompts Jansen to wonder if the bullion banks in London are starting to run out of metal. Jansen's commentary is headlined "Are the London Gold Vaults Running Empty?" and it's posted at his Internet site, In Gold We Trust, here: http://www.ingoldwetrust.ch/are-the-london-gold-vaults-running-empty CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: So how goes the war on gold? Posted: 15 May 2014 05:06 PM PDT 8:05p ET Thursday, May 15, 2014 Dear Friend of GATA and Gold: While gold investors may be frustrated that the Western central bank gold price suppression scheme has not yet collapsed, Mike Kosares of Centennial Precious Metals in Denver writes today that gold's opponents are probably just as frustrated with the persistence of strong demand for the monetary metal. Kosares' commentary is headlined "So How Goes the War on Gold?" and it's posted at Centennial's Internet site, USAGold.com, here: http://www.usagold.com/cpmforum/2014/05/15/so-how-goes-the-war-on-gold/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Lightbulb Goes Off In China: "If You Don't Pay Me And I Pay Others, I Am The Sucker" Posted: 15 May 2014 05:03 PM PDT Just last month we highlighted how the collapse in China's shadow-banking system, it's concomittant credit crunch, and vicious circle of commodity-financed credit creation could spread contagiously to the rest of the world - through refusal to pay. It seems we were prophetic as Reuters confirms that money owed to Chinese firms by their customers has reached a record high. As China's economy continues to cool, companies are waiting longer and finding it harder to get paid for goods and services they've already sold, leading to record amounts of receivables - and potential write-offs - on corporate balance sheets. As one Chinese business owner exclaimed: "If you don't pay me and I pay others, aren't I just a sucker? I'm not that stupid." Receivables on average (across 2300 firms) reached $160.49 million at the end of last year, more than double the $65.9 million average at the end of 2009 and median collection time for billings crawled up from 71.4 days to 90.42 days (the first time above 90 days). "It's a pretty loud warning bell," warns a Peking professor.

The details are ugly...

And even uglier for some industries...

But don't worry - it will all be fixed in 3 to 5 years...

As we explained previously,

And sure enough that is what Reuters reports above is happening... which means only one thing... We explained precisely this a few days ago in "What Is The Common Theme: Iron Ore, Soybeans, Palm Oil, Rubber, Zinc, Aluminum, Gold, Copper, And Nickel?" As briefly noted above, these are all the commodities that serve as conduits in China's numerous Commodity Funding Deals. Only no more. Which means that far form merely crushing exporters who suddenly are dealing with Chinese importers who have torn apart contracts, obviously with no recourse, suddenly China's entire "hot money" laundering infrastructure (which as explained over the weekend, has gold performing an even greater role than copper) is about to collapse. And when the counterparties of China's hundreds of billions in CCFDs decide to also get out of Dodge and unwind these deals (amounting to hundreds of billions in notional), only to find the underlying commodity has not only been re-re-rehypotecated countless times and has been sold, then there is truly no way of saying what happens next. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 15 May 2014 03:42 PM PDT Goldsilver | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fall Of The Dollar Based Monetary System: Russia Puts The Avalanche In Motion Posted: 15 May 2014 02:58 PM PDT It is truly astonishing how much trust people have in the establishment. Almost everyone believes that central planners are focused on defending the best outcome for society. In the same respect, almost everyone nowadays believes that “things are contained.” Looking under the hood, it appears that several worrisome trends are going on. Examining those trends, one can only conclude that they are building up momentum. But make no mistake, momentum, in this case, is not in the right direction. We are talking about our monetary system, one of the most invisible and misunderstood concepts related to money and markets. The dollar hegemony, which has held for more than 4 decades, is showing serious cracks. At the center of this trend is Russia. Do not confuse cause and effect. Although mainstream media tries to paint a different picture of things, sharp observers understand that Russia is simply the trigger that will, very likely, set an avalanche in motion. The outcome, in this context, is the fall of the dollar as a world reserve currency. Trends that are breaking the backbone of the dollar based monetary systemWe have detected three different trends by analyzing the events and announcements in the last couple of months. Do not confuse ongoing with imminent. These trends are so fundamental in nature that it takes a long time till they have run their course; so don’t expect an immediate fall of the dollar (although we should never exclude anything). Trend 1: Russia and China are becoming very strong allies Both Russia and China have been growing fast in the last decade, at least economically. Combining the forces of both countries is really a global economic powerhouse, with several unique strengths, in particular in natural resources, energy, aerospace and defence. The world simply cannot ignore this, and the US cannot simply eliminate this duo by tactics and diplomacy. As several sources have reported lately, one of which being RT, Russia and China have been growing economically closer towards each other.

Trend 2: BRICS countries are forming a new block, also monetary With a very strong core being formed by Russia and China, the BRICS have economic power and are able to operate more independantly than ever before. Together, they are able to change the global order with the United States as the hegemonic power. Peter Birle, head of research at the Ibero-American Institute (IAI) in Berlin, says: “”The BRICS countries are a group of nations unsatisfied with the international order. The importance of BRICS could rise if Russia remains permanently excluded from the G8.” According to Birle, the five emerging countries seek to permanently upend the power constellations established in 1945 and relativize the US position. “All these countries view themselves as emerging powers with a great future ahead of them,” he said at the 15th Stuttgarter Schlossgespräch, an annual conference involving a panel of international social science, culture and politicis expert. This year’s talks focused on the relationship between Brazil and Europe. From DW in Germany:

China plans to set up a stable long term partnership with Brazil and other Latin American countries for oil and natural gas projects. China's Foreign Affairs Minister, Wang Yi said recently that "Cooperation with Brazil and other Latin American countries has great potential as China imports a large amount of oil and natural gas, for which demand is long term." To facilitate the increased trade between emerging countries, it should not come as a surprise that those countries are working on their own monetary system. The BRICS countries have made significant progress in setting up structures that would serve as an alternative to the International Monetary Fund and the World Bank, dominated by the U.S. and the EU (source):

Trend 3: Yuan is gaining trust on a global level, bypassing the dollar Very recently, Germany started trading bonds backed by the Chinese currency, the Yuan. Frankfurt is joining London, Singapore and Hong Kong in the fast-moving market for bonds denominated in the Chinese currency. From DW in Germany:

Furthermore, some analysts observe that the Yuan IS already a reserve currency. That conclusion is based on the fact that at least 40 central banks have invested in the yuan. Twenty-three countries have publicly declared their holdings in yuan, in either the onshore or offshore markets, yet the real number of participating central banks could be far more than that, said Jukka Pihlman, Standard Chartered’s Singapore-based global head of central banks and sovereign wealth funds. According to SCMP, Pihlman, former advisor to the International Monetary Fund advising central banks on asset-management issues, said at least 17 central banks had invested in yuan assets without declaring they had done so. Also, as reported by Testosteronpit, Germany and China closed an agreement which spelled out how the two central banks would cooperate on the clearing and settlement of payments denominated in renminbi – to get away from the dollar's hegemony as payments currency and as reserve currency.

Saudi Arabia has the power to make or breakAs we pointed out in Signs of A Cracking Dollar Hegemony, confidence is the basis of the dollar based world reserve currency. Each sign of loss of confidence will be critical in the deterioration of the dollar's leading role. According to Ron Paul, we should particularly watch for the relationship between the US and Saudi Arabia. The Saudis, with their unprecedented language towards the US, could become a turning point. As soon as we hear US officials talking about the "need" to transform the monarchy in Saudi Arabia into a "democracy" it could really mark the end game. This view was recently confirmed by Jim Rickards, who explained it as follows:

Gold, being the antidote against the falling dollar, is a must have for every investor who is serious about his future. Ideally, as we have said for a long time, precious metals should be held in physical form outside the banking system.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver to Average $19 per Ounce in 2014: Thomson Reuters GFMS Posted: 15 May 2014 02:23 PM PDT Silver’s average price in 2013 was $23.79 per ounce, 23.6 percent lower than the previous year, Thomson Reuters GFMS states in its World Silver Survey 2014, released yesterday. That’s the metal’s largest year-on-year percentage decrease since 1985, when it sank by 25 percent, and its second double-digit decline in a row. Those numbers raise the question of | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Gold Shortage Is Coming Says Eric Sprott Posted: 15 May 2014 02:13 PM PDT Eric Sprott, with more than 40 years of experience in the investment industry, has been speculating since late 2012 that Western central banks could be running out of gold. He attributes the sell-off in gold and silver in 2013 to the fact that the Western banks needed a way to generate physical gold supplies. The metals prices were going down while there was a lot of liquidation of gold which increased the supply by an estimated 900 tonnes last year. Driven by data, Eric Sprott explains in this article the case for a gold shortage. The basic figures are centered around the following:

Looking back to the price smash of April 2013, it resulted in a tsunami of buying:

Sprott believes that the volume of gold being exchanged must be much higher than the official number of 4,300. Being one of the pieces of the puzzle, it all points to central banks surreptitiously supplying gold to China. Gold from central banks, held in LBMA-sized bars, is being recast into kilogram-sized bars, which are preferred in Asia. It all points to this: gold is flooding out of central banks in the West and into Asia's coffers. Another piece to the puzzle is Germany's current effort to repatriate its gold supposedly held by the U.S. So far, it has only received 5 tonnes back from the U.S. Treasury. They've asked for 300 tonnes back over 7 years. That would imply around 3.6 tonnes per month. It's worth noting that the U.S. is supposedly the largest holder of physical gold in the world. Its books should contain 1,500 tonnes held for Germany and 8,100 metric tonnes of its own. So why have they only delivered 5 tonnes over the last year? We now get monthly data from Switzerland about where its gold imports come from. In February, 114 metric tonnes came from the UK10 – a country which does not produce any gold. So where did that gold come from? Who did it belong to? The most obvious answer would be the Bank of England, or ETF holdings. Data from the U.S. offers a similar problem. The U.S. Geological Survey showed that the U.S. exported 80 tonnes of gold in January11. The U.S. only mines 20 tonnes a month12, and imports another 20. So where did the extra 40 tonnes of exports come from? Who supplied it? The answer is most likely the U.S. Treasury. The whole reason for Western central banks, particularly the U.S. to supply gold to Asia is to suppress the price of physical gold. Most people realize that low interest rates and printing money will eventually be very bad for the U.S. dollar. One thing that would tip people off to imminent danger to the U.S. dollar would be a much higher gold price. Keeping gold's price low is just part of the financial policy. All this money printing is designed to help the U.S. address its massive obligations, which include its current debts and off-balance sheet obligations of around 80 trillion dollars. Their annual revenues are only around 2.8 trillion dollars and their expenditures are 3.5 trillion. Everyone knows there's no way they can afford to keep going and cover their obligations. This leaves money printing to cover the gap. Ultimately, we will find out the extent of manipulation in the gold market when someone finally fails – most probably the U.S. running out of gold to supply the market. And I don't think we are far off here. Eric Sprott on the argument that other sources of gold exist that could explain how so much gold is being delivered to China: Well, I don't think that is likely. The Chinese government controls all exports of gold and since they are a net buyer, they probably would not allow any exports. The amounts of gold involved are so large that clandestine sources seem unlikely. There is only one government in the world that even owns 4,000 tonnes – that's the U.S., supposedly. I think it comes down to the powers that be simply trying to keep things under control. The dollar is coming under extreme pressure here, and it looks to have broken down here, in fact. That should have people going into gold. The U.S. GDP growth, which was expected to be around 0.1%, will probably be revised even lower for the first quarter of 201414. I do not believe that any economic recovery is really occurring, because the middle class is simply being routed. We are seeing no real wage gains and inflation is well beyond reported CPI numbers, which are just a joke. In the real world, we all know inflation is much higher. There's no rational explanation, in my opinion, of where the gold is coming from apart from central banks. The impact of the situation in the Ukraine on gold: Well, I imagine that people in the area – in countries like Romania or Bulgaria, or in the Ukraine itself – would be thinking about putting some of their money in gold right now. Obviously it does bring people into the gold market. I prefer not to fall back on these sorts of possibilities as reasons to own gold. These are 'black swans' for gold. I prefer to focus on the physical shortage argument for owning gold, because I believe the case there is black and white. The means and motive for suppressing the price of gold are well-known. And the physical will win the day. Now, gold will benefit from black swans – a war, governments going broke or the recession getting worse. These could happen, but things are changing in the precious metals markets regardless of these events. Sprott on the physical shortage argument applied to platinum and palladium: Absolutely. In fact, I find the case for platinum and palladium even more compelling than anything else right now. When you think that the top supplier of these metals is Russia, and that the second biggest is South Africa, which is on strike, I find it surprising that the price of platinum and palladium has not exploded. I also see what goes on in the paper markets, however. The commercials are taking on an increasing short position in both of these metals, which is pushing the metals lower. A recovery in platinum and palladium would certainly help all precious metals move higher, including gold and silver. I think that there's a great case to be made in platinum and palladium. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time Is Running Out To Prepare Before The Next Global Crisis Posted: 15 May 2014 01:39 PM PDT  Today one of the legends in the business warned King World News that time is running out for people to prepare before the next global crisis erupts. Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also predicted that chaos is about to take hold in Europe once again. Today one of the legends in the business warned King World News that time is running out for people to prepare before the next global crisis erupts. Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also predicted that chaos is about to take hold in Europe once again.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - What If? Posted: 15 May 2014 01:26 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - What If? Posted: 15 May 2014 01:26 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government striving to devalue and super-rich are hedging against it, Kaye says Posted: 15 May 2014 01:06 PM PDT 4p ET Thursday, March 15, 2014 Dear Friend of GATA and Gold: Interviewed today by King World News, Hong Kong fund manager William Kaye says all major countries are trying to devalue their currencies and the super-rich are getting their assets out of government-issued money and the financial system: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/5/15_Wh... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| High Tide for the U.S. Dollar: Revenge of the Sith Posted: 15 May 2014 12:53 PM PDT I have certainly considered this scenario many times, of how the dollar regime might evolve, and the one discussed below remains one possible outcome. There is an intense international discussion going on about the future of the international currency system, and relations in general. I have referred to this generally as the 'currency wars' for some time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The US Energy Boom Will End the Dollar’s World Reserve Status Posted: 15 May 2014 12:39 PM PDT Austria, 1920-21: The government printed money to cover its debts from World War I. Food and fuel costs exploded. Banks urged their customers to convert Austrian kronen into a more stable currency… even though it was against the law. A law-abiding widow is wiped out on the day of a bank run. Her diary entry is reproduced in Adam Fergusson's book When Money Dies…

We've recounted the tale before. We tell it again now for two reasons. First as a reminder that most of the imbalances that caused the Panic of 2008 remain woefully out of balance. But you already knew that. There's extra urgency to our telling now: The one "X factor" the pundit class touts as the U.S. dollar's savior? It might prove the dollar's final undoing. Bank runs, capital controls, an effective default on the national debt — and all because of the "prosperity" we're enjoying now. Our suspicions were first raised in January… when two "opposing" politicos held hands and sang in sweet harmony about America's energy boom. "Cheap natural gas is going to allow us to basically reshore manufacturing," says Chicago Mayor and former Obama chief of staff Rahm Emanuel. As a result, manufacturing will be "coming back in ways we can barely anticipate," says former Republican presidential contender Steve Forbes. Together they were on CNBC to pitch an event called the "Reinventing America Summit." Not that we disagree: It all sounds very familiar if you were following the "Re-Made in America" thesis of our own Byron King more than two years ago. Then it was radical. Now it's conventional wisdom. Leave it to us to throw a cat among the pigeons: For as much prosperity as the U.S. energy boom is creating now… it will ultimately set off the next major economic crisis. Indeed, it will tank the U.S. dollar's status as the world's "reserve currency" once and for all. We say this knowing we court the wrath of conventional wisdom…

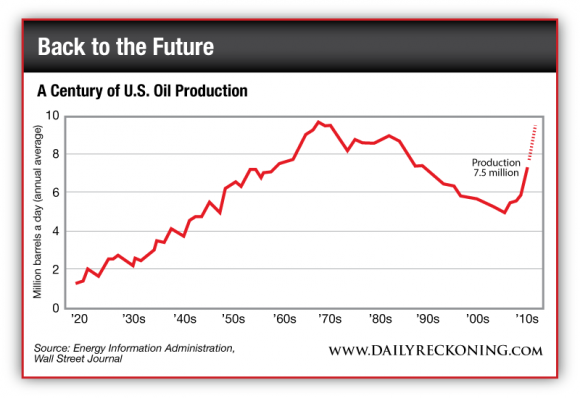

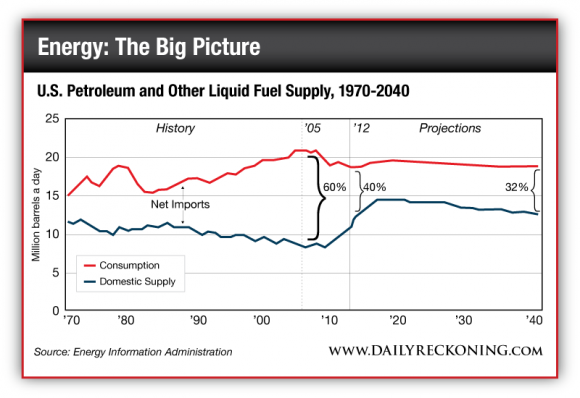

Right. Until it doesn't. The very thing helping to prop up the U.S. dollar now will ultimately kick out all those props and topple the greenback from its status as the world's reserve currency. Not tomorrow or even next year. But the destination is set… and our arrival is certain. It won't look exactly like Vienna in 1921… but it will feel just as awful. So strap in: Some of the ground we're about to cover might sound like old hat to you… but we promise you've never seen the dots connected in this way before. U.S. oil production averaged 7.5 million barrels per day during 2013. The increase over 2012 marked the biggest in U.S. history. Indeed, it's the fourth-biggest annual increase by any country ever… and Saudi Arabia holds the top three spots. And it only gets better from here. The peak year for U.S. crude production was 1970 — a little shy of 10 million barrels per day. As you see from the "Back to the Future" chart, the U.S. Energy Department projects the nation will once again equal that number by 2019. In 2005 — only nine years ago — the United States imported 60% of its oil needs. By 2012, that number collapsed to 40%. Check out the chart nearby and you'll see the percentage is set to shrink even more over the next quarter-century. And make a mental note — we'll be coming back to this chart later. As we go to press, a barrel of oil fetches $100, give or take. So every 1 million barrels per day of new supply means $100 million less imported oil every year. Lower import costs, a lower trade deficit, fewer dollars flowing overseas — great news for the dollar, huh? It's all good, right? Well, yes… except that now the entire structure that's supported the global financial system for 40 years is starting to come unglued. Since 1974, the world has run on "petrodollars." The petrodollar arose from the ashes of the Bretton Woods system after President Nixon cut the dollar's last tie to gold in 1971. In the immediate post-World War II years, Bretton Woods made the dollar the world's reserve currency — the go-to currency for cross-border transactions. If you were a foreign government or central bank, the dollar was as good as gold — for every $35 you turned in to the U.S. Treasury, you received one ounce of gold. Chances are you know the rest of the story: Foreigners recognized Washington was printing too many dollars, the French wanted more gold than Washington was willing to give up and Nixon "closed the gold window." But without gold, what would continue to cement the dollar's position as the world's reserve currency? After the "oil shock" of 1973–74, in which oil prices shot up from $3 a barrel to $12, Nixon's Secretary of State Henry Kissinger got an idea and convinced the Saudi royal family to buy in. The deal went like this: Saudi Arabia would price oil in U.S. dollars and use its clout to get other OPEC nations to do the same. In return, the U.S. government agreed to protect Saudi Arabia and its allies against foreign invaders and domestic rebellions. The appeal for the House of Saud was obvious — the weight of the U.S. military would keep the family's 7,000 princes living in the style to which they'd become accustomed. The appeal for Washington was more subtle — but no less important. Anyone who wanted to buy oil now needed dollars to do so. That meant perpetual demand for dollars and a cycle that goes like this…

"This gave the dollar a special place among world currencies, and in essence 'backed' the dollar with oil," explained Rep. Ron Paul in a prescient speech on the floor of the U.S. House in 2006. "The arrangement gave the dollar artificial strength, with tremendous financial benefits for the United States. It allowed us to export our monetary inflation by buying oil and other goods at a great discount as dollar influence flourished." Then came his forecast: "The economic law that honest exchange demands only things of real value as currency cannot be repealed. The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil, rather than dollars or euros." Strange as it might be to imagine… the great American energy boom is hastening that day's arrival. More to come tomorrow… Regards, Addison Wiggin P.S. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The world's real rulers: central banks operating in secret Posted: 15 May 2014 12:31 PM PDT EU Officials Plotted IMF Attack to Bring Rebellious Italy to Its Knees By Ambrose Evans-Pritchard http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100027284/eu... The revelations about EMU skulduggery are coming thick and fast. Tim Geithner recounts in his book "Stress Test: Reflections on Financial Crises" just how far the EU elites are willing to go to save the euro, even if it means toppling elected leaders and eviscerating Europe's sovereign parliaments. The former US Treasury Secretary says that EU officials approached him in the white heat of the EMU crisis in November 2011 with a plan to overthrow Silvio Berlusconi, Italy's elected leader. "They wanted us to refuse to back IMF loans to Italy as long as he refused to go," he writes. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Geithner told them this was unthinkable. The US could not misuse the machinery of the IMF to settle political disputes in this way. "We can't have his blood on our hands." This concurs with we knew at the time about the backroom manoeuvres, and the action in the bond markets. It is a constitutional scandal of the first order. These officials decided for themselves that the sanctity of monetary union entitled them to overrule the parliamentary process, that means justify the end. It is the definition of a monetary dictatorship. Mr Berlusconi has demanded a parliamentary inquiry. "It's a clear violation of democratic rules and an assault on the sovereignty of our country. The plot is an extremely serious news which confirms what I've been saying for a long time," he said. There has been a drip-drip of revelations. Italy's former member on the ECB's executive board, Lorenzo Bini-Smaghi, suggested in his book last summer that the decision to topple Berlusconi (and replace him with ex-EU commissioner Mario Monti) was taken after he started threatening a return to the lira in meetings with EU leaders. I have always found the incident bizarre. Italy had previously been held up an example of virtue, one of the very few EMU states then near primary budget surplus. It was not in serious breach of deficit rules. It was in crisis in the autumn of 2011 because the ECB had raised rates twice and triggered what was to become a deep double-dip recession. Yet the blame for this disastrous policy error was displaced on to Italy's government. Fresh details emerged this week in a terrific account of the crisis by Peter Spiegel in the Financial Times. The report recounts the hour-by-hour drama at the G20 Summit in Cannes as the euro came close to blowing up. It culminates in the incredible scene when President Barack Obama takes over meeting and tells the Europeans what to do, causing Chancellor Angela Merkel to break down in tears: "Ich bringe mich nicht selbst um" -- "I won't commit suicide." That particular spasm of the crisis -- and there have been three episodes (May 2010, November 2011, and July 2012) when the would have splintered without drastic action -- was set off by the shock decision of Greek premier Georges Papandreou to call a referendum on the austerity terms of his country's bailout. He thought a vote was needed to stop Greece from spinning out of control and to pre-empt a possible military coup (as he saw it). Papandreou was hauled before the star chamber and literally crushed into silence by French leader Nicolas Sarkozy, who was waving his "Position commune sur la Grece" like an indictment sheet. The FT report then reveals that the Commission's Jose Manuel Barroso took charge of the executive details, orchestrating the Putsch that ousted Papandreou in Greece. In this case the EU picked ECB veteran Lucas Papademos to take over. Parliamentary formalities were upheld in both Italy and Greece. The presidents appointed the new leaders in each of the two countries. Both Monti and Papademos are honourable and dedicated public servants. Yet these were clearly coups d'etat in spirit if not in constitutional law. David Marsh from the financial body OMFIF has called for a "Truth and Reconciliation Committee" to expose the abuses that have occurred in EMU affairs from the beginning. Something must be done to hold accountable those responsible for the fateful error of launching monetary union, and for the chronic mismanagement of the project thereafter. We are told that the euro crisis is now over. I do not see how one can safely reach that conclusion when Italy and Portugal are contracting again and France is back to zero growth, or when lowflation/deflation is causing the debt trajectories of southern Europe to spiral ever higher; all against a background of G2 monetary tightening in the US and China. There will be another spasm to this crisis. So whom will Europe's elites topple next, and what other conspiracies will they hatch to perpetuate a monetary venture that serves no worthwhile moral purpose? They must be stopped. The FT's Peter Speigel has a follow-up in today's edition, with lots more details. These include confirmation that EU leaders not only broached the subject of Greek exit/expulsion from the euro at Cannes but that this was followed up by a secret Plan Z. A GREXIT task-force under Germany's ECB's board member Jorg Asmussen worked on emergency plans with four clandestine teams and EU lawyers in Brussels. They were careful enough not to reveal anything in emails, which could be leaked. Merkel's advisers in Germany were split into the "domino" camp that feared contagion from GREXIT, and the "infected-leg" camp headed by finance minister Wolfgang Schauble that pushed for amputation. It seems as if Angela Merkel was finally persuaded by Jorg Asmussen that kicking Greece out of the system might snowball and lead all too quickly to a "eurozone of 10." Greece got its E34 billion bailout in the nick of time. Though I should not say this about a competing newspaper, it is worth spending L2.50 today on the pink sheet for the story. Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| High Tide for the Dollar: Revenge of the Sith Posted: 15 May 2014 11:22 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| High Tide for the Dollar: Revenge of the Sith Posted: 15 May 2014 11:22 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What the Inflation Report Could Mean for Gold Posted: 15 May 2014 10:11 AM PDT As noted earlier today, in Consumer Prices Jump 0.3% in April, two key takeaways from the latest inflation data are that annual price gains have again reached the two percent level and recent increases have been very broad-based. When combined with what is now generally seen as an improving U.S. economy [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

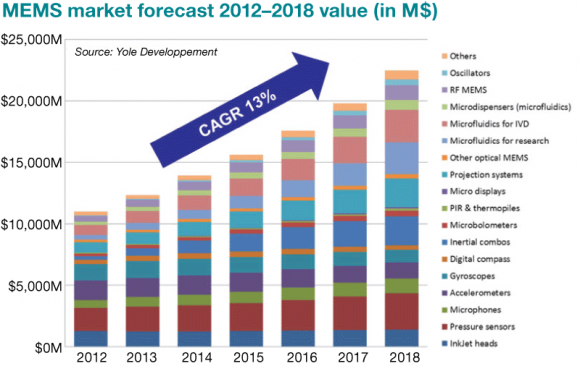

| Tiny Machines That Produce Massive Returns Posted: 15 May 2014 09:55 AM PDT I want to build a billion tiny factories, models of each other, which are manufacturing simultaneously… The principles of physics, as far as I can see, do not speak against the possibility of maneuvering things atom by atom. It is not an attempt to violate any laws; it is something, in principle, that can be done; but in practice, it has not been done, because we are too big. — Richard Feynman, Plenty of Room at the Bottom Most of the 19th and the first half of the 20th century were all about building things bigger. Bigger buildings, bigger ships and bigger planes. They required big power sources, from engines to electrical power plants. In just about everything, from the launch of a new transoceanic steam-powered cruiser… to a skyscraper towering over a city… Bigger meant better. But not anymore. Now, computing power that would have required an entire room to house it can fit in your pocket. From about the second half of the 20th century until now, smallness became more important. Most of the greatest engineering advances since that time appear to be happening in the realm of the very small. One really good example is electronics. In the middle of the past century, bulky vacuum tubes were the state of the art. Big glowing tubes filled radios, TV sets and computers the size of office buildings. Then we discovered how to use semiconductors to build transistors. These replaced the big bulbs. And a new level of miniaturization became possible. Radios that were formerly to be considered pieces of living room furniture could now be shrunk to a size that fit into your pocket. By the late '50s, engineers and inventors had figured out how to integrate many transistors onto a single circuit board. New manufacturing techniques meant that many tiny components could be fit on a single silicon chip. By the 1960s, the improvement in the miniaturization of semiconductors had become so obvious that Intel co-founder Gordon Moore was able to map the trend and extrapolate based upon it. This so-called "Moore's law" has since proven prophetic. Almost like a clock, improving miniaturization means we can pack twice as many components on a given area every couple of years. This growth has been exponential! In the early '80s, for example, a typical computer microprocessor had a transistor count in the tens of thousands. Today, microprocessors found in popular consumer products have transistor counts in the billions. Furthermore, as transistor density goes up, the cost per transistor drops. With each iteration, performance improves and uses less electricity. Tiny and cheap to make, these microcircuits have changed everything. Now, computing power that would have required an entire room to house it can fit in your pocket. There is a new revolution brewing that brings the advantages of smallness to a new field: microelectricalmechanical systems (MEMS). Many of the same discoveries that made the semiconductor revolution possible are now also enabling MEMS. Such tiny machines were a dream of physicist Richard Feynman, and the subject of a famous 1959 presentation to the American Physical Society, considered by many to be the conceptual beginnings of nanotechnology. But today we’re at an inflection point with tiny machines. They’re already inside of products we use, from video game controllers to cellphones and more. Many video game controllers also use MEMS sensors — gyroscopes and accelerometers — to sense a player's movements as part of a game's interface. And your smartphone screen’s ability to reorient based on how it is held, for example, is thanks to MEMS technology. There's a reason for this: MEMS technology turns out to be a great way to build tiny sensors. These miniscule machines have become a useful way to sense the environment, including position, attitude and motion. Since MEMS technology brings compact, inexpensive and low-energy sensing capabilities, it will benefit from demand in multiple fields. Then there’s the mother of all networks… A new world of smart, cloud-connected devices, the "Internet of Things," will require superior MEMS-based sensing technology. Automation of all kinds — drones and robots — also needs to be able to sense these things in order to interact with the outside world and perform programmed tasks. Along with smarter cellphones, these are fast-growing industries. MEMS is one of the fastest-growing segments of the semiconductor industry. Already a multibillion-dollar industry, double-digit growth is expected to continue from about $12 billion last year to over $22 billion by 2018. Now is the time to invest in MEMS, before we hit the inflection point. Keep your eyes on this space! Ad lucrum per scientia (toward wealth through science), Ray Blanco Ed. Note: MEMS technology is simply one of the "pick and shovel" plays that fit into innovation's broad ecosystem. If you want specific investment ideas on how to play these trends, check out the daily Tomorrow in Review email edition, for which you can sign up for FREE, right here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What The Elites Are Secretly Doing Ahead Of Coming Collapse Posted: 15 May 2014 09:05 AM PDT  Today an outspoken hedge fund manager out of Hong Kong warned King World News about what the elites are secretly doing with their own money ahead of the coming collapse. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed how he sees the frightening endgame playing out as the world nears the end of this historic cycle. Today an outspoken hedge fund manager out of Hong Kong warned King World News about what the elites are secretly doing with their own money ahead of the coming collapse. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed how he sees the frightening endgame playing out as the world nears the end of this historic cycle.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver shone in 2013, but will it continue to? Posted: 15 May 2014 09:04 AM PDT The Real Asset Co | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forget Stocks… Buy Taxi Medallions? Posted: 15 May 2014 08:21 AM PDT The price of a New York City (NYC) taxi medallion, or a “tin”’ as the industry has taken to calling them, has risen from $10 when originally issued in the 1930s to well over $1 million today. That’s about a 15.5% annualized return over the last 80 years, a solid five points better than the S&P 500’s total return (including dividends) over the same period. And that’s just on face value. Rented to a driver, the return is even higher. According to NYC’s Taxi and Limousine commissioner in a recent Bloomberg interview, the rental rates are around 3 or 4% of face value these days. Those combined returns are enough to make even Warren Buffett blush. Source: 2014 New York City Taxicab Fact Book Does that mean we’ve all been doing everything wrong with stocks and bonds? Is the taxi medallion really the perfect investment? In the back of a cab on the way to JFK airport Monday night after a busy day hustling around the city meeting with start-ups and industry partners, I got to chatting about taxi medallions—a subject about which I knew far less than I realized until my wife started asking lots of questions. That quickly evolved into a discussion about the characteristics of a great investment. Why invest in biotech start-ups? Why risk money on 100-gigabit fiber-optic equipment providers? Why buy venture debt when I could just buy a taxi medallion or two instead? Her ability to get right to the center of things is one of the reasons I love her… but it drives me up a wall too. So, I got to explaining… making such decisions involves understanding that any investment is only as good or bad as your alternatives. So how does the medallion do, comparatively? Let’s check a few of the criteria we look for in any investment and see how it stacks up against another of my favorite investments in the current climate of weakening stock returns (the average S&P 500 company was down 9.3% this year as of last week, even though the Index has been buoyed by three or four mega-caps) and less-certain interest rates: venture debt. The growth capital market, as it’s also called, is just a twist on the classic game of mezzanine financing, where you lend money to businesses stuck between the worlds of smallish bank loans and having enough of a presence to make the public bond or stock markets work. These mid-tier companies are often most in need of working capital and yet have the hardest time getting it, which opens up an opportunity for mezzanine lenders to provide money on very lender-friendly terms (usually on a variable rate basis with equity kickers or convertibility). The problem is, these particular mezzanine lenders focus very specifically on the technology markets, where their detailed understanding of the industry and close connection to venture capital firms provide them with an advantage in finding good quality borrowers. Both of our prospective investments obviously have a compelling economic value. The medallion is an option on running a constrained business with high built-in demand. Venture debt is a promissory note against the revenues of a fast-growing company, with its equity as collateral. But just how easy would it be for us investors to get involved with either game? Scarcity: One of the reasons that taxi medallions have proven so valuable is that right at a time when demand escalated as New York’s business economy and tourism draw were both increasing, the supply of taxi medallions has been relatively static. There are only 13,473 medallions authorized in the city, a number that has barely changed since inception eight decades ago, and is actually down from the original 16,900 issued. (Interestingly, the population of NYC itself has edged up only 1.2 million since 1930.) However, a taxi medallion isn’t like a bar of palladium. Its scarcity isn’t determined by a random collision of celestial bodies a few billion years ago, but is largely controlled by artificial constraints, namely government regulation. The New York state government, which issues the licenses to the city, has had to resist the urge to increase the volume of taxis as a way of raising revenues—remember that it gets a percentage of all taxi fares in the form of taxes—for over 80 years now. Very easily during that time, regulations could have changed to make the medallions far less valuable. But it hasn’t happened… yet. So far, the supply of taxi medallions has badly trailed demand, and thus prices and yields have remained strong. In contrast, venture debt is more driven by market forces than the medallion industry. For many years now, deterred by their own cascading series of bubble blunders, banks have been getting progressively less aggressive in their loan portfolios. That means many companies in many industries have had a harder and harder time borrowing money to grow their businesses. As that has happened, the demand for mezzanine lending has steadily grown. A cottage industry that once only served really obscure and risky markets has morphed into dozens of sector-specific companies with a deep understanding of their customer bases. But when you closely examine any one sector, as we’ve done with technology, you find what is still a very small market, with only half a dozen companies serving only a few hundred customers every year. And the demand always far outstrips the supply, just like with medallions. So, the lenders have the ability to be very choosy about the terms they offer and whom they offer them to. This has allowed the industry to command high interest rates—well above 10% on average—even in today’s low-rate climate. Not only that, in most portfolios the notes are 95% or more in senior secured positions and often have convertibility to equity at preferred prices if the stock of the borrower takes off. Those kinds of terms are available because what’s on offer is scarce in a high-demand environment. So we have to call this first category a draw, methinks:

Scale and Diversification: When I was about 13, I wanted to get a new video game, so I sold one of my baseball cards—a Jose Canseco rookie card—for about 100x the dollar I paid for it just a short time earlier. Unfortunately, the rest of my cards were worth exactly zip. Apparently no one was interested in a Jim Palmer rookie card at the time; if only I’d waited until he ran out of money and starting flogging loans on TV, so someone would have known who he was… So there I was, flush with $100 in cash and no other options to raise the balance. Dreams dashed. That’s because there was a limited market for my inventory. Taxi medallions are similar. Yes, the prices are high, but there are only so many investable areas, and only so much quantity. Cities like San Francisco charge a fixed price for their medallions, and haven’t changed it in years. If you had significant money to invest, it would take a lot of time to gain any level of diversification. Venture debt, on the other hand, is pretty global. Most companies in the business have hundreds or thousands of different loans in their portfolios, and are always out looking for more. There are choices for multiple managers to invest in, and within their portfolios, there’s a good deal of diversification. Plus, the industry has the ability to absorb tens of millions in fresh money at a time, which it frequently does with new capital raises. Altogether, the opportunity for scale is much larger in venture debt:

Cost of Access/Barrier to Entry: Buying taxi medallions is a pretty simple process, at least in New York, since they all must be sold through the central intermediary of the New York City Taxi and Limousine Commission. When there’s enough inventory, it schedules an auction and posts the details online. Interested parties submit bids in advance and await the auction result. (In order for a bid to be valid, it has to include financing or asset verification for at least 80% of the purchase price from a NY licensed bank or credit union.) In the last auction of mini-fleet medallions (which are sold only in pairs), the lowest winning bid was over $2.2 million. (The individual medallions go for less, as most have a restriction that the owner must be the operator, which makes them worthless for an investor.) So, unless you have access to a multimillion-dollar credit facility, it can be tough to get into this market. But there’s at least one way for the average investor to get to it: Medallion Financial (TAXI), a publicly traded company whose primary business is lending money for the purchase of taxi medallions. However, the company has been diversifying of late and only 56% of its managed loan portfolio is in medallions these days, down from 63% at the end of the previous year. Medallion Financial is organized as a business development company (BDC), which is a corporate-tax-exempt, publicly traded stock. Because it pays greater than 90% of its income as dividends, those dividends are not double taxed. BDCs are usually financial companies, often in the business of loaning money for various purposes. They raise capital from public market investors via sales of stock and deploy that capital into funding loans—often in niche industries that are unserved or underserved by more traditional banks. That’s why the BDC is a perfect format for something like Medallion Finance: it allows investors to access this high-barrier market much more easily. This is the path we take into the venture debt markets, which have been vastly underserved. When companies are pre-IPO and need capital to buy servers and expand operations but don’t want to further dilute shareholders, they turn to the venture debt markets. Specifically, they look to a handful of specialized lenders, companies like Hercules Technology Growth Capital (HTGC), which provide funding to companies that are otherwise ignored by the banks. All such publicly traded companies are BDCs too, managing their loan portfolios and distributing the earnings right back to shareholders without any corporate tax. Share prices are low and dividend yields quite high, as this largely undiscovered sector has chugged along nicely since inception a few years ago. But unlike the medallion market, there are a number of choices in the technology growth capital markets for average investors, and even more for the accredited crowd. That’s because the loan portfolios of just the public BDCs total more than 10x that of Medallion. That market is still very small in the grand scheme of things, but it’s big enough to provide a lot of different opportunities for investors to choose from—not just one company. So I have to give this category to our venture debt investments too, based on the sheer amount of choice available in easily traded BDC stocks.

Liquidity: As many a former Antiques Roadshow guest can probably attest, an investment whose value cannot be realized is not worth anything. No matter how much the market or some expert says your asset is worth, it doesn’t matter if you can’t actually sell it. Taxi medallions, for a million-dollar-plus market, are actually surprisingly liquid. Looking at the NYC market again, approximately 300 medallions, or 2% of the float, are sold each year. And as the auction participation and high watermarks for price have shown, it’s not for lack of bidders that the number is low. It’s that most owners see the value and are holding, driving prices higher and higher. As for TAXI’s stock in the BDC, it’s a relatively thinly traded equity for being a $13 stock. Only about 190,000 shares trade on average every day, which means there’s about $2.5 million in daily liquidity. If you’re looking at a relatively small investment, that’s sufficient to make it easy to buy and sell near the market. Even if you were planning to put a few million dollars into the category, over a few weeks you could easily do so without affecting the market price—something that cannot be said for the medallions themselves. The public venture debt investments, however, are far more liquid, with Hercules alone trading 4x more shares and value per day than Medallion on average. Add in the volume of other players and you’ll find about 10x the market for venture debt as you will for TAXI. So that’s one more for venture debt: