Gold World News Flash |

- Richard Russell – I Saw Bread Lines, Babe Ruth & The Graf Zeppelin

- Liberal Silver Bullet Millionaires for Higher Taxes

- Silver Was Not In a Bubble in 2011!

- Bank Of Japan Prepares To Blame El Nino For Spending Collapse

- Dissecting Silver LIES and LIARS

- Daily Nugget – Gold ETF Outflows Resume

- The Gold Price Eased Off One Dollar to Close $1,294.60 on the Comex

- Financial Destruction & The Last Great Systemic Earthquake

- Corrections Are the Way Markets Work

- The Gold Price Eased Off One Dollar to Close $1,294.60 on the Comex

- The True Parasites Of Finance

- Gold Confiscation & Its Consequences | Mike Maloney & James Turk

- Rupert Murdoch's Drop Boxes: Where Central Bankers Post Front-Runners On When To "Buy"

- Cuba – The Economy

- If Economic Cycle Theorists Are Correct, 2015 To 2020 Will Be Devastating For The US

- Traders may have gained early word on Fed policy, study finds

- New York Sun: The dwindling Fed

- Venezuela Sets New "Fair" Prices For Chicken, Sugar, Rice & Coffee

- Guest Post: How "Hyperpalatable" Foods Could Turn You Into A Food Addict

- Marc Faber’s Contrarian Play: Cash Is The Most Underappreciated Asset

- The Dollar 15-Year Cycle Decline Should Favor Gold

- One Index Finally Makes Water a Great Investment

- Gold Daily and Silver Weekly Charts - B-O-R-I-N-G

- Gold Daily and Silver Weekly Charts - B-O-R-I-N-G

- The Great Enabler

- Your Personal Gold Standard

- Getting Comfortable With Gold

- Big Problems for America’s Worst Energy Source

- In The News Today

- China, Russia, Germany And Soaring Gold & Silver Prices

- Paulson-backed Detour Gold plots supersizing mine

- Gold’s pent-up demand

- Gold set for another strong move – Phillips

- Demand for Indian gold jewellery to rise – analysts

- How to Play the Coming China Collision

- Chinese fund offers 46% premium for Laotian gold miner

- U.S. Dollar 15-Year Cycle Decline Should Favor Gold

- Gold Price Rallies as Euro Falls on Bundesbank "Euro Stimulus" Rumor, But ETF Holdings Hit New 5.5-Year Low

- Gold and Silver Big Picture

- The U.S., the U.S. Dollar, and Gold at a Critical Crossroad

- What Will Shake Retail Investors Out of Their Shell Shock?

- What Will Shake Retail Investors Out of Their Shell Shock?

- Top 5 Mexico silver miners increase Q1 output

| Richard Russell – I Saw Bread Lines, Babe Ruth & The Graf Zeppelin Posted: 14 May 2014 12:30 AM PDT from KingWorldNews:

Russell: "Here we are in the negative six months of the year — May through October. This is also the negative time for the "Presidential cycle." So should we "sell in May and go away?" I think we’ve already done that, since I’m assuming that my subscribers are already safely on the sidelines. As for the main trend of the stock market — the D-J Industrial and Transportation Averages recently set new record highs, thus indicating that the primary trend of the market is bullish. But wait — One thing I learned from my old mentor, the brilliant E. George Schaefer, is that valuations trump everything else as far as investing in the stock market. Looking back over history, valuations have identified the high risk areas in bull markets, and valuations have identified the bottom areas in bear markets. Charles Dow and E. George Schaefer believed that return on investment was the key to valuations, and both men used the dividend yield as a gauge of valuations. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liberal Silver Bullet Millionaires for Higher Taxes Posted: 14 May 2014 12:00 AM PDT from AdamKokesh: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Was Not In a Bubble in 2011! Posted: 13 May 2014 11:05 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank Of Japan Prepares To Blame El Nino For Spending Collapse Posted: 13 May 2014 10:30 PM PDT from ZeroHedge:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dissecting Silver LIES and LIARS Posted: 13 May 2014 10:00 PM PDT Silver Investor | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Daily Nugget – Gold ETF Outflows Resume Posted: 13 May 2014 09:40 PM PDT by Jan Skoyles, TheRealAsset.co.uk

The silver price also reached a recent high, climbing by 1.9% yesterday to before falling to $19.426/oz. Outflows from gold-backed ETFs and stronger equities hurt the gold-price yesterday, undoing any safe-haven price climbs. For the first time since May 2nd the SPDR Gold Trust reported outflows, of 2.39 tonnes. ETF holdings are seen as an indicator of Western gold investor sentiment and ongoing outflows suggest there is not enough bullish demand outside of the East, to push prices back above $1,315 at the moment. Some strength in gold prices was found not only on the back of tensions in Ukraine but also thanks to rumours that gold import restrictions may be eased in India. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Eased Off One Dollar to Close $1,294.60 on the Comex Posted: 13 May 2014 09:12 PM PDT

The GOLD PRICE eased off one thin paper dollar to $1,294.60 on Comex. Silver emerged victorious with one-quarter cent between its teeth to close at 1950.4c. Silver's range was a colossal 26 cents. Gold ran into selling at its 200 DMA ($1,299.86) but refused to fall lower than $1,289.10. Gold will explode one way or the other soon. What appears to be no interest is more likely balanced force on either side. When one or the other gives way, 'twill move far. The SILVER PRICE spent a day inchworming sideways in a tiny range. It remained today above its 20 DMA (1946c), and continues to trade in a narrow range of 1990c to 1900c. Here, too, silver is coiling for a big move one direction or another. Because both silver and GOLD PRICES keep edging up and pop back every time they are slammed down, my money says they will break out to the upside, and soon. Complacent investors are missing one of this century's magnificent buying opportunities. Today was about like yesterday, only more so, & my concentration is waning because of the rambling roses and my dear wife. Stocks continued to levitate today. Dow and S&P500 both made new highs. Dow rose a tee-tiny 19.97 (0.12%) to 16,715.44 while the S&P500 added an infinitesimal 0.8 (0.04%) to 1,897.45. Meanwhile the Nasdaq Comp, Russell 2000, & Wilshire 5000, nowhere close to all time highs, all fell. Participation is not, as they say, "across the board." This breakout so far does not prove itself as a breakout, and could easily stop here -- or the Dow might add another 100 points. Ultimate high will likely be seen this week or next. I make no prediction, I only watch. Dow in gold rose marginally, up 0.17% to 12.91 oz (G$266.87 gold dollars). This changeth not the chart. Dow in silver rose 0.03% to 855.14 oz (S$1,105.64 silver dollars), but changed nothing there, either. Jumping my bar for confirmation, the US dollar index today leapt 24 basis points (0.30%) to close at 80.19, well above the last high and internal support/resistance. Next barrier is 80.40. Weak economic news from Germany and rumors the German Bundesbank (the former German central bank) would support the ECB in easing sent the euro tanking 0.4% to $1.3689, gapping down again. Methods mentioned to further inflate the euro were paying banks negative interest rates on reserves (in other words, the ECB charging banks to hold reserves) & massively buying packages of bank loans. We suspicious, non-bank yokels recognize this as a method to move rotten loans off the banks' books & onto the ECB's books. I want y'all to push back a minute, take a deep breath, roll your eyes at the ceiling, and think about these ECB easing measures. These are actually adults (chronologically, at least), talking seriously about performing these loony acts with the money supply of a continent. Nothing but goofs & adolescents in charge. Teenagers with nuclear weapons & car keys. Speaking of goofs & adolescents, Little Timmy Geithner has published a book explaining how the 2008 crash was everybody else's fault & his part as O'Bama's pretend Treasury Secretary was perfectly executed. Now little Timmy never worked a day in his life (unless you count a high-level government job working), never met a payroll, never ran a bank, but because he had worked for Henry Kissinger & then Bob Rubin & Larry Summers as a Step-and-Fetch-It in the Treasury Department, was appointed head of the NY Fed just in time to ignore the Big Banks' shenanigans that spawned the 2008 global financial crisis. Little Timmy never noticed anything wrong on Wall Street, imagine that! And Little Timmy was responsible for the "Too-Big-To-Jail" policy that ensured none of his cronies got prosecuted for their roles in the frauds that brought on the 2008 crisis. To such doafs is entrusted the financial well-being of your family. Ain't central banks and government economic control jus' grand? I took my wife Susan to her cardiologist at Vanderbilt in Nashville yesterday because after two heart surgeries (2008 & 2012) she still is plagued with atrial fibrillation, a very fast heartbeat in her heart's upper chambers. Drugs have not solved the problem, so we left yesterday with the verdict that she must either go to the Big Bertha of drugs, amiodarone, or have an ablation. In an ablation they cut the firing fibers in the heart which solves the atrial fibrillation but leaves her dependent on her pacemaker. Better make sure that battery's good. This morning her cardiologist called to tell her that she had called a pacemaker expert who allowed that reprogramming her present pacemaker might give Susan some relief. That she has performed tomorrow. I deeply appreciate your prayers for Susan -- please don't stop yet! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Destruction & The Last Great Systemic Earthquake Posted: 13 May 2014 09:01 PM PDT  Today a legendary trader and investor spoke with King World News about the catastrophic endgame and the gold market. Victor Sperandeo has been in the business 45 years, and has worked with famous individuals such as Leon Cooperman and George Soros. Another legend, hedge fund manager Paul Tudor Jones, said, "Victor Sperandeo is gifted with one of the finest minds I know. No wonder he's compiled such an amazing record of success as a money manager." Today a legendary trader and investor spoke with King World News about the catastrophic endgame and the gold market. Victor Sperandeo has been in the business 45 years, and has worked with famous individuals such as Leon Cooperman and George Soros. Another legend, hedge fund manager Paul Tudor Jones, said, "Victor Sperandeo is gifted with one of the finest minds I know. No wonder he's compiled such an amazing record of success as a money manager." Incredibly, Sperandeo was interviewed in Barrons in September of 1987, where, with astonishing accuracy, he predicted that the stock market would crash. The market crash took place one month later and it just added to his legendary reputation. Below are the warnings issued by Sperandeo regarding the end game and gold. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corrections Are the Way Markets Work Posted: 13 May 2014 08:00 PM PDT by David Schectman, MilesFranklin.com:

The key point here is that this is just a correction and not the end of the bull market. I believe that what has occurred up until now is just the early stages of a bull market that will astonish even the most optimistic of our readers. Most of us will be guilty of selling out way too early, me included. That will be a consequence of holding on through this correction and posturing that we won't let it happen again. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Eased Off One Dollar to Close $1,294.60 on the Comex Posted: 13 May 2014 07:40 PM PDT

The GOLD PRICE eased off one thin paper dollar to $1,294.60 on Comex. Silver emerged victorious with one-quarter cent between its teeth to close at 1950.4c. Silver's range was a colossal 26 cents. Gold ran into selling at its 200 DMA ($1,299.86) but refused to fall lower than $1,289.10. Gold will explode one way or the other soon. What appears to be no interest is more likely balanced force on either side. When one or the other gives way, 'twill move far. The SILVER PRICE spent a day inchworming sideways in a tiny range. It remained today above its 20 DMA (1946c), and continues to trade in a narrow range of 1990c to 1900c. Here, too, silver is coiling for a big move one direction or another. Because both silver and GOLD PRICES keep edging up and pop back every time they are slammed down, my money says they will break out to the upside, and soon. Complacent investors are missing one of this century's magnificent buying opportunities. Today was about like yesterday, only more so, & my concentration is waning because of the rambling roses and my dear wife. Stocks continued to levitate today. Dow and S&P500 both made new highs. Dow rose a tee-tiny 19.97 (0.12%) to 16,715.44 while the S&P500 added an infinitesimal 0.8 (0.04%) to 1,897.45. Meanwhile the Nasdaq Comp, Russell 2000, & Wilshire 5000, nowhere close to all time highs, all fell. Participation is not, as they say, "across the board." This breakout so far does not prove itself as a breakout, and could easily stop here -- or the Dow might add another 100 points. Ultimate high will likely be seen this week or next. I make no prediction, I only watch. Dow in gold rose marginally, up 0.17% to 12.91 oz (G$266.87 gold dollars). This changeth not the chart. Dow in silver rose 0.03% to 855.14 oz (S$1,105.64 silver dollars), but changed nothing there, either. Jumping my bar for confirmation, the US dollar index today leapt 24 basis points (0.30%) to close at 80.19, well above the last high and internal support/resistance. Next barrier is 80.40. Weak economic news from Germany and rumors the German Bundesbank (the former German central bank) would support the ECB in easing sent the euro tanking 0.4% to $1.3689, gapping down again. Methods mentioned to further inflate the euro were paying banks negative interest rates on reserves (in other words, the ECB charging banks to hold reserves) & massively buying packages of bank loans. We suspicious, non-bank yokels recognize this as a method to move rotten loans off the banks' books & onto the ECB's books. I want y'all to push back a minute, take a deep breath, roll your eyes at the ceiling, and think about these ECB easing measures. These are actually adults (chronologically, at least), talking seriously about performing these loony acts with the money supply of a continent. Nothing but goofs & adolescents in charge. Teenagers with nuclear weapons & car keys. Speaking of goofs & adolescents, Little Timmy Geithner has published a book explaining how the 2008 crash was everybody else's fault & his part as O'Bama's pretend Treasury Secretary was perfectly executed. Now little Timmy never worked a day in his life (unless you count a high-level government job working), never met a payroll, never ran a bank, but because he had worked for Henry Kissinger & then Bob Rubin & Larry Summers as a Step-and-Fetch-It in the Treasury Department, was appointed head of the NY Fed just in time to ignore the Big Banks' shenanigans that spawned the 2008 global financial crisis. Little Timmy never noticed anything wrong on Wall Street, imagine that! And Little Timmy was responsible for the "Too-Big-To-Jail" policy that ensured none of his cronies got prosecuted for their roles in the frauds that brought on the 2008 crisis. To such doafs is entrusted the financial well-being of your family. Ain't central banks and government economic control jus' grand? I took my wife Susan to her cardiologist at Vanderbilt in Nashville yesterday because after two heart surgeries (2008 & 2012) she still is plagued with atrial fibrillation, a very fast heartbeat in her heart's upper chambers. Drugs have not solved the problem, so we left yesterday with the verdict that she must either go to the Big Bertha of drugs, amiodarone, or have an ablation. In an ablation they cut the firing fibers in the heart which solves the atrial fibrillation but leaves her dependent on her pacemaker. Better make sure that battery's good. This morning her cardiologist called to tell her that she had called a pacemaker expert who allowed that reprogramming her present pacemaker might give Susan some relief. That she has performed tomorrow. I deeply appreciate your prayers for Susan -- please don't stop yet! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2014 06:44 PM PDT This morning I saw an article by Barry Ritholtz on Bloomberg that got my few remaining active neurons going (or I think it was them). The title alone, The Parasites of Finance, did that, actually. I sort of knew, since I’ve known Barry’s work at the Big Picture site for quite some time, what he would talk about, and I knew I wouldn’t – fully – agree. Or rather, it’s like this: I have nothing against Barry, and he does make some valid points in the article, but in my view his focus is too narrow for the title he’s chosen, willingly or not. But then Barry works in finance, and I don’t. For me the parasites of finance form a much larger group than for him. And that is the direct result of government policies, such as the promotion of creative fantasy accounting and the refusal to restructure debt, multiplied by the tens of trillions of dollars of future wealth that have been pumped into the financial system in the form of QE and other stimuli, lest the system collapse on the spot. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Confiscation & Its Consequences | Mike Maloney & James Turk Posted: 13 May 2014 06:27 PM PDT In this video Mike Maloney of GoldSilver.com tells James Turk his thoughts on the likelihood of the US confiscating gold again. I can't see Feds going door 2 door in places like TN, KY, WV, etc trying to take anything, much less taking gold - after they lost a few hundred men they'd either... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rupert Murdoch's Drop Boxes: Where Central Bankers Post Front-Runners On When To "Buy" Posted: 13 May 2014 06:17 PM PDT Submitted by David Stockman via Contra Corner blog, The Wall Street Journal appears to be saving money by dispensing with journalists and using human drop boxes instead. Thus in the New York markets the “Hilsenramp” signal is already a well-known event which occurs at approximately 3pm on/during/after Fed meeting days, and is posted under the byline of “Jon Hilsenrath”. In simple packaged form it provides fast money speculators with a message from the B-Dud, otherwise known as William Dudley, President of the New York Fed, on why the Fed will back-up another run at still higher record highs. So today comes a drop box message with respect to ECB policy posted under the byline of “Brian Blackstone”. Self-evidently, the staff of the Bundesbank is negotiating with Mario Draghi in public. The latter backed himself into a corner last meeting by committing to a dramatic new easing round in June in order to avoid being finally called on his 2012 promise to do “whatever it takes”, which so far has been nothing. But the ECB is still not ready to bend over for outright bond-buying Bernanke/Yellen style—so it has kindly deposited in Murdoch’s drop box alternative measures that would be acceptable. These apparently include negative deposit rates, a year’s extension of the so-called fixed rate full allotment loan facility, a new long-term fixed rate loan program for commercial banks and some purchases of asset-backed securities. In other words, the Bundesbank is splitting teutonic hairs on the matter of money printing. It resolutely opposes buying government debt directly—least it encourage the demonstrably and incorrigibly debt-addicted politicians of the EU to become even more fiscally enebriated. Instead, it will inject freshly minted funds into EU banks so that they can do the dirty work with the newly opened space on their balance sheets—that is, buy the government debt. So the Germans are not going make a stand for monetary sanity, either. They are just negotiating the terms of surrender by using Murdoch’s drop box. Specifically, they are painting a bright marker on the ECB staff’s upcoming inflation forecast—the very same marker that Draghi laid-out in his recent post-meeting statement. In that regard, the ECB staff like all central bank forecasting outfits professes to know the path of European inflation to the decimal point. To wit, 1.0% this year and reaching exactly 1.7% in about 30 months from now by the end of 2016. But according to today’s drop box message from the Bundesbank that forecast just won’t do. Only if the ECB staff peers more deeply into its crystal ball and finds a more significant shortfall from the ECB’s presumably wholesome target of 2.0% inflation is it willing to bless more oomph on the printing presses:

The answer is thus reasonably evident. The ECB staff needs to re-set the inflation path so that the year-end 2016 number does not exceed 1.255%. Presumably then even the historically inflation-phobic bubba would call for moooar money and inflation. Needless to say, in a world pregnant with geo-political, financial and economic disorder—including the accelerating slide toward meltdown in China, old-age bankruptcy in Japan, and cold war resumption on the Ukrainian front—-the idea that the ECB staff can forecast CPI inflation 30 months down the road to the third decimal place is farcical; it’s the central bankers equivalent to counting the angels on the head of a pin. But that doesn’t matter because today’s drop box messages are not actually about the distant and unknowable economic future. They are about the need for another surge of front-running by the fast money traders in order to sustain the utterly lunatic condition under which Spain’s 10-year bond is trading at a lower yield than its equivalent US treasury note. Obviously, the promise of a new round of easing by the ECB in June is just what the doctor ordered. And today’s drop box messages are just what is needed to “build confidence” among fast money traders so that their current heavily long positions in peripheral government debt will be maintained and enlarged. Just to make sure that signals are clear, Murdoch’s drop box carried a second message today under the by-line of “Richard Barley” . After a lot of sophistry as to why five year Spanish debt yielding under 2% (“inflation-adjusted”) is actually a bargain due the fact that headline inflation has computed lower than trend for a few months now, the post gets to the meat of the matter. Spanish, Italian and even Greek bonds are a “buy” because the German’s are caving and the Draghi’s money machine is fixing to crank into a higher gear:

Once upon a time markets processed real world information and there was a need for independent financial journalists with actual investigative and analytical skills. But Murdoch did not become a multi-billionaire for nothing. In today’s central bank dominated financial markets he has apparently learned that human drop boxes will do just fine. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2014 05:12 PM PDT By: Chris Tell at http://capitalistexploits.at/ From Zimbabwe to Myanmar we've personally had the pleasure of witnessing totalitarian government at its finest. The results are stunning and we've spoken about them before in these pages. Cuba, however is arguably the epitome of a totalitarian state if ever there was one. It's important to understand Cuba for a number of reasons, not the least of which is that the Western world from the great US of A to the British Empire (yes many Brits still actually think they're an empire) is now besieged by militarized police forces, body scanners, security cameras, drones, and the all seeing eye of the homeland "protectors" themselves. Pathetic! It all starts with good intentions of course, like those of our deceased friend Fidel. Today Kuppy delves into the economy of Cuba. Enjoy! -----

----- Fascinating to say the least... More to come. - Chris

"I come from Cuba. Taxes for me are no big thing." – Tony Oliva | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| If Economic Cycle Theorists Are Correct, 2015 To 2020 Will Be Devastating For The US Posted: 13 May 2014 05:05 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, Does the economy move in predictable waves, cycles or patterns? There are many economists that believe that it does, and if their projections are correct, the rest of this decade is going to be pure hell for the United States. Many mainstream economists want nothing to do with economic cycle theorists, but it should be noted that economic cycle theories have enabled some analysts to correctly predict the timing of recessions, stock market peaks and stock market crashes over the past couple of decades. Of course none of the theories discussed below is perfect, but it is very interesting to note that all of them seem to indicate that the U.S. economy is about to enter a major downturn. So will the period of 2015 to 2020 turn out to be pure hell for the United States? We will just have to wait and see. One of the most prominent economic cycle theories is known as "the Kondratieff wave". It was developed by a Russian economist named Nikolai Kondratiev, and as Wikipedia has noted, his economic theories got him into so much trouble with the Russian government that he was eventually executed because of them...

In recent years, there has been a resurgence of interest in the Kondratieff wave. The following is an excerpt from an article by Christopher Quigley that discussed how this theory works...

So what does the Kondratieff wave theory suggest is coming next for us? Well, according to work done by Professor W. Thompson of Indiana University, we are heading into an economic depression that should last until about the year 2020...

But of course the Kondratieff wave is far from the only economic cycle theory that indicates that we are heading for an economic depression. The economic cycle theories of author Harry Dent also predict that we are on the verge of massive economic problems. He mainly focuses on demographics, and the fact that our population is rapidly getting older is a major issue for him. The following is an excerpt from a Business Insider article that summarizes the major points that Dent makes in his new book...

According to Dent, "You need to prepare for that crisis, which will occur between 2014 and 2023, with the worst likely starting in 2014 and continuing off and on into late 2019." So just like the Kondratieff wave, Dent's work indicates that we are going to experience a major economic crisis by the end of this decade. Another economic cycle theory that people are paying more attention to these days is the relationship between sun spot cycles and the stock market. It turns out that market peaks often line up very closely with peaks in sun spot activity. This is a theory that was first popularized by an English economist named William Stanley Jevons. Sun spot activity appears to have peaked in early 2014 and is projected to decline for the rest of the decade. If historical trends hold up, that is a very troubling sign for the stock market. And of course there are many, many other economic cycle theories that seem to indicate that trouble is ahead for the United States as well. The following is a summary of some of them from an article by GE Christenson and Taki Tsaklanos...

So does history repeat itself? Well, it should be disconcerting to a lot of people that 2014 is turning out to be eerily similar to 2007. But we never learned the lessons that we should have learned from the last major economic crisis, and most Americans are way too apathetic to notice that we are making many of the very same mistakes all over again. And in recent months there have been a whole host of indications that the next major economic downturn is just around the corner. For example, just this week we learned that manufacturing job openings have declined for four months in a row. For many more indicators like this, please see my previous article entitled "17 Facts To Show To Anyone That Believes That The U.S. Economy Is Just Fine". Let's hope that all of the economic cycle theories discussed above are wrong this time, but we would be quite foolish to ignore their warnings. Everything indicates that a great economic storm is rapidly approaching, and we should use this time of relative calm to get prepared while we still can. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Traders may have gained early word on Fed policy, study finds Posted: 13 May 2014 04:43 PM PDT By Matthew Boesler Some investors between 1997 and 2013 may have gotten early word of changes to Federal Reserve policy and profited by trading before the Fed announced the policy shifts, according to Singapore-based researchers. Trading records show abnormally large price movements and imbalances in buy and sell orders that are "statistically significant and in the direction of the subsequent policy surprise," according to a paper by Gennaro Bernile, Jianfeng Hu, and Yuehua Tang at Singapore Management University. The moves occurred before and during the time that reporters were given the Federal Open Market Committee statement in so-called media lockups. On days the FOMC policy decision deviated from market expectations, "back-of-the-envelope calculations indicate that the aggregate dollar profits" from early access to the statement ranged between $14 million and $256 million, the authors said in the study titled, "Can Information Be Locked Up? Informed Trading Before Macro-News Announcements." ... ... For the rest of the story: http://www.bloomberg.com/news/2014-05-13/traders-may-have-gained-early-w... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York Sun: The dwindling Fed Posted: 13 May 2014 04:21 PM PDT 7:20p ET Tuesday, May 13, 2014 Dear Friend of GATA and Gold: The Federal Reserve Board has many vacancies, the New York Sun observes today, but Kentucky Sen. Rand Paul is threatening to delay appointments to the board unless the Senate permits a vote of his proposed Federal Reserve Transparency Act, the legislation championed by his father, former Rep. Ron Paul. The Sun writes: "The Federal Reserve fears this audit. It fears the private businesses. It fears the Congress that is its creator. It claims that an audit of the kind the House wants would interfere with its 'independence.' What independence? The staff of the Sun dissolved the entire text of the United States Constitution in a chemical solvent and then put the solution through a Hamilton-brand high-speed, rotary separator. Yet we were unable to detect even a particle of a requirement that monetary policy be independent of the Congress of the United States. ... "There is no need to rush to fill the board of the Fed. Better for Congress to look to the substance and see what share of the blame the Fed itself deserves for the Great Recession that destroyed the presidency of Barack Obama, stranded millions without work, and forced us into retreat overseas." The Sun's editorial is headlined "The Dwindling Fed" and is posted here: http://www.nysun.com/editorials/the-dwindling-fed/88707/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuela Sets New "Fair" Prices For Chicken, Sugar, Rice & Coffee Posted: 13 May 2014 04:03 PM PDT It should hardly come as a surprise for a nation such as the US that is used to being told what a "fair" price for interest rates is... and a "fair" price for housing is... and a "fair" price for stocks is... that Venezuela (perhaps a few years ahead of America in the socialism stakes) has seen its 'price regulator' declare today its new "fair" prices for various foods. Coming to a Safeway near you any day now... (as US food price inflation soars - especially ahead of the barbecue season).

As Bloomberg reports: Venezuela price regulator publishes list of food prices on its website.

This follows Venezuela President Nicolas Maduro signing law to adjust prices to "fair" levels and limit profit margins to 30% back in January. Think it won't / can't happen here... Bloomberg notes, consumers in the U.S. will probably pay the most ever for meat this grilling season as costs for pork and beef surge, according to the American Farm Bureau Federation.

Seems "Unfair"? on a minimum wage? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: How "Hyperpalatable" Foods Could Turn You Into A Food Addict Posted: 13 May 2014 03:24 PM PDT Authored by George Dvorsky, originally posted at io9.com, Over a third of the global population is now overweight, and the percentages are increasing. Some neuroscientists have suggested that the rise of so-called "hyperpalatable foods" may partially explain the unprecedented rates of obesity. Above: The Taco Bell Taco Waffle. Credit: Taco Bell. Our food environment has changed dramatically over the years, most notably through the introduction of so-called "hyperpalatable" foods. These foods are deliberately engineered in such a way that they surpass the reward properties of traditional foods, such as vegetables, fruits, and nuts. Food chemists achieve this by suffusing products with increased levels of fat, sugar, flavors, and food additives. Conditioned hypereating David A. Kessler, author of The End of Overeating: Taking Control of the Insatiable American Appetite and former head of the FDA, claims that the food industry has combined and created foods in a way that taps into our brain circuitry, thus stimulating our desire for more. On their own, these ingredients aren't particularly potent, but when combined in specific ways, they tap into the brain's reward system, creating a feedback loop that stimulates our desire to eat and leaves us wanting more — even when we're full. As Kessler told the New York Times, restaurant chains like Chili's cook up "hyper-palatable food that requires little chewing and goes down easily," while a Snickers bar is "extraordinarily well engineered." As we chew it, he says, the sugar dissolves, the fat melts and the caramel traps the peanuts so the entire combination of flavors is blissfully experienced in the mouth at the same time. Eventually, the experience of eating impossibly delicious foods results in what Kessler describes as "conditioned hypereating." When we consume enjoyable sugary and fatty foods, it stimulates endorphins in our brains — chemicals that signal a pleasurable experience. In turn, and in Pavlovian fashion, these chemicals stimulate us to eat more of that type of food, while also calming us down and making us feel good. But is it really addiction? Conditioned hypereating sounds suspiciously similar to what we might call food addiction. And indeed, studies have shown that hyperpalatable foods may be capable of triggering an addictive process — one that's been postulated as a possible cause of the obesity epidemic. But is it fair or reasonable to categorize food — something we need to keep us alive — alongside such things as illicit drugs, alcohol, and gambling? Some scientists say yes. Last year, for example, neuroscientists from Connecticut College claimed that Oreo cookies are more addictive than cocaine. The researchers came to this conclusion after measuring a protein called c-Fos in the brains of rats. They found that the cookies activated more neurons in the accumbens — a region of the brain associated with pleasure, and studied for its role in addiction and reward-processing — than addictive substances like cocaine. Not surprisingly, the researchers were harshly criticized for suggesting that something as apparently benign as an Oreo cookie could be compared to a notorious party drug. These concerns aside, evidence is mounting in support of the idea that food addiction is actually a thing. It's known, for example, that food cues and consumption activates neurocircuitry, such as the meso-cortico-limbic pathways, implicated in drug addition. In addition, work done in Bart Hoebel's lab at Princeton University have shown that rats overeating a sugar solution develop many behaviors and changes in the brain that are consistent with the effects of drug abuse, including withdrawal symptoms. Other studies support these findings, suggesting a reward dysfunction linked to addiction in rats who overeat hyperpalatable foods. Importantly, much of this compares reasonably well to humans, including cravings, continued use despite negative consequences, and diminished control of consumption. On the face of it, food addiction certainly exhibits all the hallmarks of conventional forms of addiction.

If it looks like a duck... As noted by Nicole Avena and Mark Gold in a short-paper on the effects of sugars and fats on hedonic overeating, many of these "studies are supported by clinical research showing similarities in the effects of increased body weight or obesity and abused drugs on brain dopamine systems, as well as the manifestation of behaviors indicative of addiction." Importantly, a relationship has been found to exist between binge eating-related disorders and addiction-like eating habits facilitated by the consumption of hyperpalatable foods. As summarized by addiction expert Adrian Meule:

In light of this evidence, some researchers are suggesting that "food addiction' join other non-drug addictions, such as sexual compulsivity and gambling. Tackling the Problem Though the addictive potential of foods continues to be debated, a number of strategies have been proposed to address the situation. Back in 2011, Ashley Gearhardt and colleagues reviewed some policy and public health strategies that have proven effective in reducing the impact of addictive substances. They concluded that:

Amongst their many recommendations, the researchers proposed that hyperpalatable foods be taxed like cigarettes, have their accessibility reduced (e.g. removal of vending machines from specific locations), and that manufacturers be limited in terms of marketing and sales (e.g. by not allowing certain products to alter the food environments of developing nations). It has been shown, for example, that obesity rates in countries such as France and the United Kingdom have been rising in parallel with increases in the availability of highly processed foods and fast-food chains. Lastly, by recognizing and appreciating the neurological underpinnings of overeating, researchers will be encouraged to find new ways of improving treatments, while policy makers will have added support for implementing broader and more impactful health policies. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marc Faber’s Contrarian Play: Cash Is The Most Underappreciated Asset Posted: 13 May 2014 02:58 PM PDT Admittedly, Faber his call to hold cash is contrarian, and not the type of tip you would expect from a gold bull. Still, thinking about it, he has a valid point. His belief is not to hold cash for the long term. His point is that stocks and bonds are overvalued and not attractive as long term investment. As the markets are likely to be shaken up thoroughly in the coming months, it is wise to hold cash in order to jump on the opportunities that will pass by. Faber on his contrarian play, via CNBC:

Faber on (the absence of) inflation:

He continues:

Faber also explains that we are 30% more levered than during the financial crisis. Total credit, including government debt, corporate debt and consumer debt, is higher than in 2008/2009. It is really a smart view if you think about.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Dollar 15-Year Cycle Decline Should Favor Gold Posted: 13 May 2014 02:53 PM PDT Submitted by Trader MC, Cycles Expert & Market Timer (more about Trader MC): The Dollar is following an accurate 15-Year Cycle which is made of five 3-Year Cycles. On the following chart you can see that we are currently in the 15-Year Cycle that began in 2008. The current 3-Year Cycle that began in 2011 did not make new highs above the previous 3-Year Cycle that began in 2008 which puts the 15-Year Cycle in decline. As a result the current 15-Year Cycle has probably already topped and the following 3-Year Cycles should make lower highs and lower lows. The Dollar Index should therefore decline during the next ten years until the next 15-Year Cycle Low due in 2023. The current 15-Year Cycle topped in 2010, only two years after it began in 2008. It is the first time that the primary 15-year Cycle topped so early as the primary 15-Year Cycle from 1978 topped seven years later in 1995 and the 15-Year Cycle from 1992 topped eight years later in 2001. This shows that the debasement of the Dollar is strongly accelerating with the Fed quantitative easing policy and the massive debt accumulation. The 15-Year Declining Cycle means that a sharp drop in the value of the Dollar will continue in the coming years and the U.S. government debt needs to be monetized as no one will buy it except the Fed. A closer view shows that the Dollar is currently in the second 3-Year Cycle which failed to print a higher high. We can also see that the Dollar is probably making a Complex Head and Shoulders pattern with dual heads. I expect the Dollar to break below the neckline of the Head and Shoulders pattern as it is time for the Dollar to print a 3-Year Cycle Low. Once the Dollar breaks below 2011 low, the setup of lower highs and lower lows will be in place. With the Dollar getting weaker and weaker, the Fed is buying Treasury Bonds with newly created money. Here you can see that Bonds are also following a 3-Year Cycle and for the first time since thirty years the Bonds made a failed 3-Year Cycle last year (the price broke below the previous 3-Year Cycle Low) which is characteristic of a down trending asset. Therefore Bonds entered a bear market last year and I expect several years of downtrend. The declining Dollar and the bear market in Bonds should be very bullish for Gold. Gold is following an 8-Year Cycle which is composed of a 5-Year and a 3-Year Cycle. You can see on the following chart that Gold did not break below its 8-Year Cycle Low and the secular bull market is still intact. The Dollar has entered its 15-Year Cycle decline which should send the next major up leg for Gold. The primary Cycles are showing that Gold is still in an uptrend and the Dollar should decline in the coming years and will be seriously devaluated. Cycles and market timing research > more info. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Index Finally Makes Water a Great Investment Posted: 13 May 2014 02:09 PM PDT “Water Shortages Pose Growing Risk for American Companies,” warns the Financial Times. According to the article, now nearly a month old, iconic firms like AT&T and Hershey say one of the key factors in deciding where to build new facilities… is access to water. “I think water is becoming the next big issue,” said John Schulz, assistant vice president of sustainability operations at AT&T. “There is a rising awareness from a business risk perspective that if we don’t start getting control of this, it could become a real business-impacting issue.” In everyday life, California has been in dire straits too — with no relief in sight this spring from a paltry Sierra Nevada snowpack. Drought in Texas is prompting the state government to explore desalination, the removal of salt from seawater. Important locations overseas are parched as well — drought in Brazil has driven coffee prices to a record high. You’d think water would be a compelling investment theme. And you’d be right. Unfortunately, you’d also be early. Truth be told, water’s been a compelling investment theme for nearly a decade. The entire time, we’ve been regaled with alarmist factoids:

But investing in water has been, at best, a hit-or-miss proposition. The big water ETF, the PowerShares Water Resources Portfolio (PHO), underperforms the S&P 500. Ditto for supposedly slam-dunk stocks with California water rights, like the pricey and closely held J.G. Boswell Co. (BWEL). Our own Chris Mayer made it work after issuing his readers a report on “Blue Gold” in 2006, recommending a basket of five obscure water stocks. Three of them doubled within 18 months. “But all investment themes eventually play out or expire,” he says. He sold them and moved on. Which leaves a dangling question: When will water investing’s moment arrive… and fulfill its immense potential? To date, water’s been a mostly unattractive investment because no one has a clue how much it really costs to bring new supply online. “The oil industry will tell you that $100/barrel oil is the value below which capital allocation can earn a return,” writes Scott Rickards, CEO of Waterfund and son of Currency Wars author Jim Rickards. “Given its critical importance in our lives, why does the water industry not have a similar fast answer to the question?” Whatever the reason, we’re living with the consequences: Water “has taken a back seat to virtually every other resource in the battle for private investment dollars,” Rickards says. Result: A place like Uganda can have abundant water… but only 7% of the country has indoor plumbing. To help channel more investment dollars into water, Rickards’ firm teamed up last year with IBM to help shed light on water production costs. Together, they now publish the Rickards Real Cost Water Index (below). Nearby, you see the global composite cost — up about 24% in the last five years. Of course, water is a local market, so Rickards and IBM have separate figures broken out for dozens of locations around the world. The idea is to make this information form the basis of new financial instruments that can help investment banks and private equity firms hedge their risk — so they’ll no longer shy away from funneling capital into the sector. “At one end of the spectrum, you have housing, the most overfinancialized sector of our economy,” Rickards told Yahoo Finance last year. “At the other end, you have water — there’s not a single financial product. Investors, Wall Street have pretty much ignored water. What we’re doing is using derivatives and insurance products to link to the index and enable risk management to actually take place for the first time in the water industry.” Regards, Addison Wiggin P.S. In time, Rickards anticipates one of the new financial products will be an ETF — giving you a chance to “go long the cost of water.” And in today’s email edition of The Daily Reckoning, readers were treated to a first-hand look at what Jim Rickards considers one of his “best investments” when it comes to investing in water. If you didn’t get it, you missed out on half the story – and all the profit potential that comes with it. Don’t let that happen again. Sign up for the Daily Reckoning email edition, for FREE, right here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - B-O-R-I-N-G Posted: 13 May 2014 01:08 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - B-O-R-I-N-G Posted: 13 May 2014 01:08 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2014 12:23 PM PDT Commentaries about World War I frequently talk about causes and consequences but almost never mention the enablers. At best, they might mention them approvingly, as if we were fortunate to have had the Fed and the income tax, along with the ingenuity of the Liberty Bond programs, to finance our glorious role in that bloodbath. Economist Benjamin Anderson, whose Economics and the Public Welfare has contributed greatly to our understanding of the period 1914-1946, and is a book I highly recommend, nevertheless takes as a given that the Fed and income tax had a job to do, and that job was supporting U.S. entry into World War I. After citing figures purporting to show how relatively restrained bank credit expansion was during the war, he writes: We had to finance the Government with its four great Liberty Loans and its short-term borrowing as well. We had to transform our industries from a peace basis to a war basis. We had to raise an army of four million men and send half of them to France. We had to help finance our allies in the war, and above all, to finance the shipment of goods to them from the United States and from a good many neutral countries. [p. 35] We had to do none of these things. Only the government made them necessary, and the government was not acting on behalf of its constituents when it formally entered the war in April, 1917. The U.S. was not under serious threat of attack. The population at large, Ralph Raico tells us, "acquiesced, as one historian has remarked, out of general boredom with peace, the habit of obedience to its rulers, and a highly unrealistic notion of the consequences of America's taking up arms." [p. 33] Later on he reports that In the first ten days after the war declaration, only 4,355 men enlisted; in the next weeks, the War Department procured only one-sixth of the men required. [p. 40] Bored with peace they may have been, but it was hardly reflected in the number of volunteers. Winners and Losers While the war industries were poised to rake in record profits, Marine Major General Smedley Butler, who was awarded his second Congressional Medal of Honor in 1917, provides details of the fighting men's share in this bonanza. For the soldiers, it was decided to make them help pay for the war, too. So, we gave them the large salary of $30 a month. All they had to do for this munificent sum was to leave their dear ones behind, give up their jobs, lie in swampy trenches, eat canned willy (when they could get it) and kill and kill and kill . . . and be killed. But wait! Half of that wage (just a little more than a riveter in a shipyard or a laborer in a munitions factory safe at home made in a day) was promptly taken from him to support his dependents, so that they would not become a charge upon his community. Then we made him pay what amounted to accident insurance -- something the employer pays for in an enlightened state -- and that cost him $6 a month. He had less than $9 a month left. Then, the most crowning insolence of all -- he was virtually blackjacked into paying for his own ammunition, clothing, and food by being made to buy Liberty Bonds. Most soldiers got no money at all on pay days. We made them buy Liberty Bonds at $100 and then we bought them back -- when they came back from the war and couldn't find work -- at $84 and $86. And the soldiers bought about $2,000,000,000 worth of these bonds! Thomas Woodrow Wilson was not only a disaster to freedom and free markets, this "near-great" president awarded domestic government workers inflation compensation in 1917-1918 but omitted the men in the trenches overseas doing the fighting. Harding and Coolidge were no different, vetoing versions of what became known as the World War Adjusted Compensation Act, which would grant a benefit to veterans. Congress finally overrode Coolidge's veto in May, 1924. The "bonuses" awarded the veterans were silver certificates that came with a catch — although the men could borrow against them, they couldn't redeem them until 1945. (!) When the Depression deepened in 1932, a so-called Bonus Army of veterans, family members, and friends marched on Washington to demand immediate payment of their promised compensation. After a clash with police that left two protestors dead, General Douglas MacArthur led a tank assault that drove the Bonus Army out of Washington. In 1936 the government decided to replace the silver certificates with Treasury bonds that could be redeemed immediately. The Cunning Enabler One could argue that the existence of states is the true enabler of hell on earth, since only states had entrenched systems of wealth predation and could employ kidnapping (conscription), propaganda, and other means to create a world war. But is working for a stateless world a worthwhile use of one's time? If two and a half million veterans of the war to end all wars couldn't get the government to pony up a bonus until 19 years after they paid stay-at-home bureaucrats, how could we possibly get rid of government itself? Given that states have the power to wipe out all life on the planet, we should at least consider them an alien presence. That they haven't reduced the would to ashes already is not a sign of caring and careful leadership. Combine their monopoly on force, nuclear arsenals, a rabid foreign policy, and monumental bureaucratic bungling, along with the steady hum of printing presses and withholding taxes, and you have a formula for turning Mother Earth into a ghost town. If we can't rid the earth of states, we can at least try to disempower them. Whatever belligerent aspirations U.S. and other world leaders might have, they would be mere pipe-dreams without the wealth-sucking arms of the state. States that can't get money for war can't go to war, or as Pat Buchanan might put it: No money, no war. And if we had avoided WW I, what might the world look like today? Conclusion In a footnote to Rights of Man, Thomas Paine wrote: It is scarcely possible to touch on any subject, that will not suggest an allusion to some corruption in governments. Given his proposals for government involvement in our lives, modest though they were, Paine seems to have forgotten his own profound observation. We would do well never to forget it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

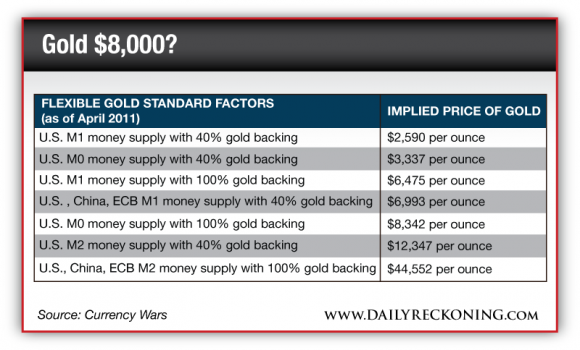

| Posted: 13 May 2014 11:00 AM PDT There isn't a central bank in the world that wants to go back to a gold standard. But that's not the point. The point is whether they will have to. I've had conversations with several of the Federal Reserve Bank presidents. When you ask them point-blank, "Is there a theoretical limit to the Fed's balance sheet?" they say no. They say there are policy reasons to make it higher or lower, but that there's no limit to the amount of money you can print. That is completely wrong. That's what they say; that's how they think; and that's how they act. But in their heart of hearts, some people at the Fed know it's wrong. Luckily, people can vote with their feet. I always tell people who say we're not on the gold standard that, in a way, we are. You can put yourself on a personal gold standard just by buying gold. In other words, if you think that the value of paper money will be in some jeopardy, or confidence in paper money may be lost, one way to protect yourself is by buying gold, and there's nothing stopping you. The typical rejoinder is, "What's the point of owning gold? They're just going to confiscate it, like Roosevelt did in 1933?" …if gold is a "stupid" investment, then why do the Chinese have 5,000 tonnes? I find that extremely unlikely. In 1933, we'd just come through four years of the Great Depression, and Roosevelt was new in office. People talk about the first hundred days, but he closed the banks right after he was sworn in. And he confiscated gold only a few weeks later. And it wasn't as if Elliot Ness was going door to door, breaking into your house and taking gold. They wanted to get a small number of people who had 400-ounce bars in bank vaults. And they got those people because they were able to close the banks and use them as intermediaries to confiscate that gold. But now, it's far more dispersed, and there's far less trust in government. If the government tried to confiscate gold today, there would be various forms of resistance. The government knows this. So they wouldn't issue that order, because they know it couldn't be enforced, and it might cause various kinds of civil disobedience or pushback, etc. As long as you can own gold, you can put yourself on your own gold standard by converting paper money to gold. I recommend you do that to some extent. Not all in, but I recommend having 10% of your investable assets in gold for the conservative investor, and maybe 20% for the aggressive investor — no more than that. Those are pretty high allocations relative to what people have. Most people own no gold, and all the institutions combined have an allocation to gold of about 1.5%. So even if you take the low end of this range, you're still nowhere near 10%. In fact, institutions could not double their gold allocation even to 3%. There's not enough gold in the world — at current prices — to satisfy that demand. So it's got this huge upside associated with it. Still, central banks don't want to go to a gold standard. But if gold is a barbarous relic, if gold has no role in the monetary system, if gold is a "stupid" investment, then why do the Chinese have 5,000 tonnes? Are they stupid? If some scenarios play out, you are going to see the price of gold go up… a lot. And it may go up a lot in a very short period of time. It's not going to go up 10% per year for seven years and the price doubles. It's going to chug along sideways, maybe in an upward trend, with a lot of volatility. It will have a kind of a slow grind upward… and then a spike… and then another spike… and then a super-spike. The whole thing could happen in a matter of 90 days — six months at the most. When that happens, you're going to have two Americas. You're going to have an America that was not prepared. Paper savings will be wiped out; 401(k)s will be devalued; pensions, insurance and annuities will be devalued through inflation… Because remember, it's not just the price of gold going up. It's like putting a thermometer in a patient, getting a 104-degree temperature and blaming the thermometer. The thermometer's not to blame; it's just telling you what's going on. Likewise, the price of gold is not an economic object or aim in itself; it's a price signal. It tells you what's going on in the economy. And gold at the levels I'm talking about would mean that you've now verged into hyperinflation, or something close to it, because nothing happens in isolation. At that point, you have to give more credence to gold. Now you've crossed the threshold. The minute you think of gold and paper money side by side, or having some relationship, you get to these price levels of $7,000-8,000 an ounce. They're not made up. They're not there to be provocative. They're actually the math. Those are the numbers you get when you simply divide the money supply by the amount of gold in the market. People are going to have to pay attention to that. And either the Chinese are dopes — which they're not — or people will start to get gold, which they will. But if there's a run on paper currencies (which is entirely possible) and there's borderline hyperinflation (which is entirely possible), they may have to go to a gold standard… Not because they want to, but because they find it necessary to calm the markets. I suggest you buy your gold at current levels — around $1,300 — and ride the wave up to these much higher levels ($4,000-5,000 an ounce) and then assess the situation. Be nimble. You can't just write a game plan today and follow it step by step. That's nonsense. You have to be nimble; you have to be following developments; you have to be prepared to change your mind based on new news. Regards, James Rickards Ed. Note: Readers of The Daily Reckoning email have regular chances to expand their gold holdings at substantial discounts, thanks to a variety of partnerships. If that's something that interests you, we suggest you sign up now for free and start receiving The Daily Reckoning email straight in your inbox, every day around 4 p.m. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2014 11:00 AM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Big Problems for America’s Worst Energy Source Posted: 13 May 2014 09:44 AM PDT Last November, when the Environment Protection Agency (EPA) proposed moderating years of escalating mandates by reducing the amount of ethanol that must be mixed into gasoline, a top ethanol lobbyist seemed perplexed. “We’re all just sort of scratching our heads here today and wondering why this administration is telling us to burn less of a clean-burning American fuel,” Bob Dineen, head of the Renewable Fuels Association, told The New York Times. Here are a few possible reasons why: America’s ethanol requirement destroys the environment, damages car engines, increases gas prices, and contributes to the starvation of the global poor. It’s an unmitigated disaster on nearly every level. [E]thanol requirements have few serious defenders except the people who profit from its production… Start with the environment. After all, when the renewable fuel standard (RFS), which since 2005 has set forth a minimum annual volume of renewable fuels nationwide, was first set, one of the primary arguments for mandating ethanol use was that it was a greener, more environmentally friendly source of fuel that released fewer greenhouse gasses into the atmosphere. This turns out to be complete hogwash. Researchers have known for years that, when the entire production process is taken into account, most supposedly green biofuels actually emit more greenhouse gasses than traditional fuels. Some proponents of the ethanol mandate have argued that the requirement was nonetheless necessary in order to spur demand for and development of more advanced, environmentally friendly biofuel like cellulosic ethanol, which is converted into fuel from corn-farm leftovers. But there are two serious problems with cellosic ethanol. The first is that cellulosic ethanol turns out to be rather difficult to produce; despite EPA projections that the market would produce at least 5 million gallons in 2010 and 6.6 million in 2011, the United States produced exactly zero gallons both years — and just 20,069 gallons in 2012. The second is that cellulosic ethanol is also bad for the environment. At least in the short-term, the corn-residue biofuels release about 7% more greenhouse gases than traditional fuels, according to a federally funded, peer-reviewed study that appeared in the journal Nature Climate Change last month. The environmental evidence against ethanol seems to mount almost daily: Another study published recently in Nature Geoscience found that in São Paulo, Brazil, the more ethanol that drivers used, the more local ozone levels increased. The study is particularly important because it relies on real-world measurements rather than on models, many of which predicted that increased ethanol use would cause ozone levels to decline. To make things worse, ethanol requirements are bad for cars and drivers. Automakers say that gasoline blended with ethanol can damage vehicles by corroding fuel lines and injectors. An ethanol glut caused by a misalignment of regulatory quotas and demand has helped drive up prices at the pump. And the product is actually worse: ethanol blends are less energy dense than regular gasoline, which means that cars relying on it significantly worse mileage per gallon. American drivers have it bad, but the global poor have it far worse. Ethanol requirements at home have helped drive up the price of food worldwide by diverting corn production to energy, which dramatically reducing the available calorie supply. A 25-gallon tank full of pure ethanol requires about 450 pounds of corn — roughly the amount of calories required to feed someone for a year. Some 40% of U.S. corn crops go to ethanol production, which in effect means we’re burning food for automobile fuel rather than eating it. Studies by economists at the World Bank have found that a one% increase in world food prices correlates with a half-percent decrease in calorie consumption amongst the world’s poor. When world food prices spiked between 2007-2008, between 20-40% of the effect was attributable to increased global reliance on biofuels. The effect on world hunger is simply devastating. Ethanol lobbyists are still pretending the renewable fuels mandate is a success, and Senators from corn-friendly states in the Midwest are still urging the agency not to proceed with the proposed reduction to the mandate. But at this point, ethanol requirements have few serious defenders except the people who profit from its production and the politicians who rely on those people for votes and campaign contributions. Judging by the cut it proposed last November, even the EPA seems to be wavering. A final regulation has yet to be submitted, but the proposal would reduce the amount of renewable fuels the agency requires this year from 18.15 billion gallons to 15.2 billion gallons. That’s if the EPA sticks to its original plan. The agency is under heavy pressure to moderate its proposed cuts, or avoid them entirely. Those cuts, if approved, would represent a productive step forward. But they wouldn’t be enough. Congress should vote to repeal the renewable fuel standard entirely. The federal government shouldn’t be telling people to burn less ethanol; it shouldn’t be telling anyone to burn any of it at all. Peter Suderman Ed. Note: The age of ethanol might be over, but that doesn't mean you can't make money off the energy boom here in America. If you were a subscriber to Laissez Faire Today, you would have learned about an exclusive opportunity to profit off the real energy boom that's reshaping the U.S. economy right now. Click here to sign up for Laissez Faire Today, for FREE, to make sure you don't miss out on future updates. This article originally appeared here on Reason.com. This article was also prominently featured in Laissez Faire Today, right here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2014 09:01 AM PDT Dear CIGAs, April retail sales disappoint. There is no weather factor in April, further questioning the strength of the recovery. Gold was off five dollars and moved to plus one on this report. Gold’s Bottom Coming – Charles Nenner Research May 12, 2014 Guest(s): David Gurwitz Managing Director Kitco News catches up with David... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China, Russia, Germany And Soaring Gold & Silver Prices Posted: 13 May 2014 08:58 AM PDT  On the heels of continued global turmoil, today an acclaimed money manager spoke with King World News about China, Russia, Germany, and soaring gold and silver prices. Leeb also discusses the move to a new reserve currency for the East and the Middle East. On the heels of continued global turmoil, today an acclaimed money manager spoke with King World News about China, Russia, Germany, and soaring gold and silver prices. Leeb also discusses the move to a new reserve currency for the East and the Middle East.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paulson-backed Detour Gold plots supersizing mine Posted: 13 May 2014 08:28 AM PDT The company is currently exploring ways to make its Detour Lake mine, Canada's largest gold mine, even bigger. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 May 2014 08:28 AM PDT The gold price has been rising and falling with the changing perceptions of what is happening, or likely to happen in the Ukraine – but there should be other factors at play too which are just as relevant. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold set for another strong move – Phillips Posted: 13 May 2014 08:28 AM PDT Julian Phillips of the Gold Forecaster also notes that the price of silver is “discounting an upward move in the gold price.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demand for Indian gold jewellery to rise – analysts Posted: 13 May 2014 08:28 AM PDT India Ratings & Research suggests gold price, demand abroad, and domestic demand will benefit jewellers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

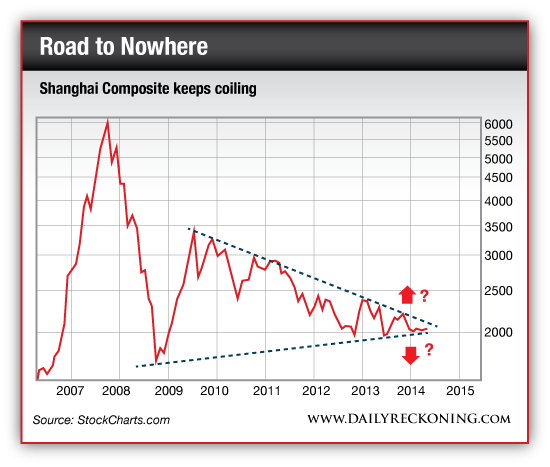

| How to Play the Coming China Collision Posted: 13 May 2014 08:06 AM PDT China has a problem. Wait, maybe that's a little too generous. Let's try that again… China has a lot of problems. Pollution, dubious data, and government debt lead the list. Oh yeah, and there's also the issue of that pesky property bubble. "China's middle-class consumers have huge chunks of their personal wealth wrapped up in the housing market," reads a report from Quartz. "So, a disastrous bust would severely impact consumer confidence and undermine China's effort to rebalance its economy toward domestic demand." No matter where you turn today, you'll find someone who expects the Chinese economy to grind to a halt. Economists cut growth forecasts. Then, they slashed them again. In fact, the ruling party has even admitted that slower growth is the new normal. "A combination of a huge oversupply of housing and a shortage of developer financing is producing a housing market downturn that could drive China's GDP to less than 6% this year," reports the Wall Street Journal. "Falling investment leads to falling levels of construction and sales. And given the property market's huge role in the Chinese economy, declining growth in the property sector means declining growth in GDP." The downturn in the property sector looks pretty ominous at this point. But here's the trillion-dollar question: How will the unwinding housing market affect Chinese stocks? The truth of the matter is the Shanghai Composite has trended lower for a long, long time. Yes, the Shanghai rose more than 2% yesterday. But it's down nearly 5% over the past six months. Over the past year, it has dropped nearly 9%. In fact, Chinese stocks are down more than 21% since the financial crisis ended in 2009. Aside from a brief pop in early 2009, the Shanghai has been unable to find its mojo for the past five years… Chinese stocks have steadily fallen for the past five years. The Shanghai is coiled like a spring. Something has to give… Regards, Greg Guenthner P.S. Whether this breaks higher or lower is irrelevant at this point. Either an upside or downside breakout will most likely produce a dramatic move. Traders willing to play either side of this move stand to make a killing. To learn about specific investments you can make to take advantage of markets just like this, sign up for my FREE Rude Awakening email edition, right here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||