saveyourassetsfirst3 |

- March gold imports jump to 10-month high in India

- Sibanye Gold platinum gambit 'risky'

- Gold price steady near $1,300 after Friday’s gains

- Gold manipulation – ex US Treasury top gun tells us how and why

- Precious Metals: 6 Degrees of Separation as HFT Goes Mainstream

- High-Frequency Trading and the Shrinking Trust Horizon

- SPROTTs John Embry: Gold And Silver Making A Bottom?

- Gold’s Historical Performance Signals Current Buying Opportunity

- USD/CAD - Steady After Strong Canadian Employment Data

- J.S. Kim: High-frequency tradings bigger offense is gold and silver price suppression

- Koos Jansen: A close look at gold and silver demand in India

- Indias central bank eases gold import restrictions and their repeal is expected

- 9 Exciting Gold And Money Charts

- Higher 10-Year Yield Ahead - Not According To These Charts

- The Real Reason Why Platinum And Palladium Prices Will Rise

- Commodities Today: Geopolitical Risks, LNG And Aluminum Bright Spots In Market

- CEO Of Liechtenstein Bank Frick Shot Dead in Parking Garage

- GOFO Turns Negative AGAIN: The Consequences

- Russia has not yet seen how Bitcoin, like Gold, gives them a huge opportunity

- The End of The U.S. Dollar & Collapse of Civilization as We Know It!

- 'COMEX Gold to trade b w $1250 1330 Oz range in April'

- Doc Eifrig: Some news on the economy you may not believe

- Jim Willie: It’s All Breaking!

- Russia could soon push us one step closer to the "End of America"

- NFP: The Art of Deception

- Gold & silver; Where is the Chinese demand?

- UK Government Powers To Confiscate Deposits Faces Backlash

- India's gold imports rise in March

- Gold premiums tumble in India

- Steve Sjuggerud: You may not believe where interest rates could be headed next

- Monex Precious Metals Review: Gold hits low of $1280, Silver trades high of $20.20

- Japan's Gold bars, coins investment demand up by five fold ahead of tax hike

- UK Government Powers To Confiscate Deposits Faces Backlash

- Alasdair Macleod: Quarter-end distortions in the gold market

- Private Equity’s Lake Wobegon Fallacy: All Investors Are Above Average

- You Won’t Believe What These 10 Democrats Said About ObamaCare!

- Gold / Silver / Copper futures - weekly outlook: April 7 - 11

- Gold price remains around $1300 as Dubai gold exchange introduces spot gold contract

- Jason Hamlin Interview with Kerry Lutz – Correction Is Ending: Gold And Miners To Go Hig

- 6102 (1933) : Requiring Gold Coin, Gold Bullion and Gold Certificates to Be Delivered

- Gold’s Historical Performance

- Speculators mistime bearish gold bets before rally

- Analog analysis in the gold market

- Looking for contrarian opportunities in gold stocks

- Jim Willie: Gold Standard Will Return- It is Coming. It Will Shake the World

- This Is What Employment In America Really Looks Like…

- Venezuela Enforces Fingerprint Registry to Buy Groceries: What to Do Before Rationing Starts in America

| March gold imports jump to 10-month high in India Posted: 07 Apr 2014 06:48 PM PDT As imports hit a high, it also seems likely baby steps towards easing restrictions on gold import will be taken as elections near. |

| Sibanye Gold platinum gambit 'risky' Posted: 07 Apr 2014 06:38 PM PDT While the gold producer sees opportunity to succeed where others haven't, analysts highlight some challenges Sibanye faces in the platinum sector. |

| Gold price steady near $1,300 after Friday’s gains Posted: 07 Apr 2014 04:15 PM PDT The gold price remained steady near $1,300 in quiet early European trading while China is absent for a holiday. |

| Gold manipulation – ex US Treasury top gun tells us how and why Posted: 07 Apr 2014 12:32 PM PDT Former U.S. Treasury Under Secretary, Paul Craig Roberts, asserts that the Fed and its banker allies do indeed manipulate the gold price to their own ends and describes how this is achieved. |

| Precious Metals: 6 Degrees of Separation as HFT Goes Mainstream Posted: 07 Apr 2014 12:00 PM PDT

A recent 60 Minutes television show interview revealed the long established electronic trading mechanism used to front run and carry out price management and profit schemes across trading seconds. In the wake of the interview, one cannot help wonder how many degrees of separation exist between public awareness of this and its connection to futures [...] The post Precious Metals: 6 Degrees of Separation as HFT Goes Mainstream appeared first on Silver Doctors. |

| High-Frequency Trading and the Shrinking Trust Horizon Posted: 07 Apr 2014 11:57 AM PDT The list of markets where big players are cheating the rest of us (and each other) keeps growing. First there was the Libor interest rate, then foreign exchange, then gold. And now comes high-frequency trading (HFT), where Wall Street banks use supercomputers to monitor incoming stock market orders, analyze their likely impact on prices, and place orders ahead of those trades to capture a bit of the price impact. In an HFT-dominated market, individual investors get fractionally-less-favorable prices, which they seldom notice, while in the aggregate billions of dollars are siphoned each year from retail investors, pension funds and even some hedge funds to big Wall Street banks. Since this practice adds absolutely nothing to the efficiency of the equity markets, and since “front running” is clearly illegal, HFT is a crime without offsetting social benefits. But Wall Street gets away with it — and will continue to get away with it — because the major banks and exchanges make a lot of money from it and donate sufficiently to both major parties to buy a degree of immunity. Because HFT is the topic of Michael Lewis’ best-selling book Flash Boys, and Lewis is showing up on mainstream outlets like CNN and Good Morning America where he explains the con in layman’s terms, the powers that be now feel compelled to appear to investigate it. Like the ongoing probes of Libor, foreign exchange and gold, the result will be more show than substance. A few fines will be paid and possibly a few mid-level quants will be sacrificed, while Wall Street’s bonus pool stays deep and wide. So HFT’s exposure, rather than being that big a deal in and of itself, should be seen as part of a pattern of systematic corruption, yet another brick in the wall that separates the financial/political/con artist class from the vast bulk of people who are being harvested. But the fact that this scandal is being explained on mainstream outlets by a best-selling author means that it is reaching a much broader audience. Lewis isn’t preaching to the choir; he’s bringing the idea that the financial system is a rigged casino to people who hadn’t previously given it much thought. In so doing, he’s accelerating the shrinkage of the trust horizon. This last term comes from Nicole Foss at Automatic Earth and refers to the process by which people gradually realize that their country’s big systems — the government, banks, national currency, etc. — have been captured/corrupted by people who now run those systems for their rather than the public’s benefit. Seeing this, individuals stop trusting those big systems and shift their attention and resources to people and institutions that they can see and judge face-to-face. They start buying local food rather than national brands, home school their kids, stop identifying with the two major political parties, put their money in local rather than money center banks, and buy hard assets like precious metals and farmland rather than financial assets like stocks and bond. When a critical mass of people start behaving this way the big systems are starved for capital and begin to fail. Banks go bust, governments run out of money, the currency collapses, etc. That day appears to be coming, and HFT may have given the trend a little added momentum. |

| SPROTTs John Embry: Gold And Silver Making A Bottom? Posted: 07 Apr 2014 11:50 AM PDT seekingalpha |

| Gold’s Historical Performance Signals Current Buying Opportunity Posted: 07 Apr 2014 11:40 AM PDT investing |

| USD/CAD - Steady After Strong Canadian Employment Data Posted: 07 Apr 2014 11:35 AM PDT By Kenny Fisher The Canadian dollar continues to trade below the key 1.10 line, as USD/CAD trades in the mid-1.09 line in the North American session. On the release front, the Bank of Canada released its quarterly BOC Business Outlook Survey. Today's sole release out of the US is Consumer Credit. On Friday, Canadian Employment Change posted an outstanding gain of 42.9 thousand, crushing the estimate of 21.5 thousand. This was the best showing since last August. The strong data continues to weigh on USD/CAD, as the Canadian dollar remains under the 1.10 level. For the first time in four months, the unemployment rate dropped below the 7.0% level, coming in at 6.9%. Over in the US, the markets eagerly awaited the release of Non-Farm Payrolls, one of the most important economic indicators. The indicator rose nicely last in March, climbing to 192 thousand, compared to 175 thousand a month |

| J.S. Kim: High-frequency tradings bigger offense is gold and silver price suppression Posted: 07 Apr 2014 11:32 AM PDT GATA |

| Koos Jansen: A close look at gold and silver demand in India Posted: 07 Apr 2014 11:32 AM PDT GATA |

| Indias central bank eases gold import restrictions and their repeal is expected Posted: 07 Apr 2014 11:32 AM PDT GATA |

| 9 Exciting Gold And Money Charts Posted: 07 Apr 2014 11:20 AM PDT goldsilverworlds |

| Higher 10-Year Yield Ahead - Not According To These Charts Posted: 07 Apr 2014 10:42 AM PDT The fear, or concern, that interest rates might move higher is healthy. It suggests that some of the lessons from the stagflation of the 1970's have been remembered. The 1970's inflation spiral had a number of factors. Energy prices spiked as a source of supply was cut without a reduction in demand. Gold price surged as a new source of demand hit the market, the legalization to own gold in the US, while the supply growth lagged. Today the U.S. has undergone a change with the growth in energy supply matching or exceeding the growth in demand. This has kept energy prices somewhat stable. History would suggest, (see chart), that for the 10-year U.S. Treasury yield to move higher that the trend in MZM money supply growth must improve, or maybe stabilize. The MZM velocity has been falling for many years, as have interest rates. The trend in the velocity |

| The Real Reason Why Platinum And Palladium Prices Will Rise Posted: 07 Apr 2014 10:39 AM PDT Palladium prices have remained stable in the last few weeks, platinum prices have come down slightly. We have discussed the breakout on the charts recently; since our last update, we have not detected any meaningful change. In the bigger picture, both less shiny metals are trending in a wide trading trend. Although both metals are highly correlated, the intensity of the trending moves can differ. As a result, it is clear that palladium looks stronger on the chart than platinum, as evidenced by the following charts. Courtesy of Sharelynx.com. Recently, strikes at South African mines have caused a massive drop in platinum and palladium production. In addition, the global palladium supply could collapse with 41% overnight if the West would impose export sanctions on Russia (source). What does this mean for the price? Rick Rule, Chairman and Founder of Sprott Global Resource Investments, believes that platinum and palladium could go lower in the near-term, as fears of a sudden crunch dissipate. However, the real reason why platinum and palladium should rise longer term has nothing to do with geopolitics or (South African) labor issues. He explains:

Rick Rule believes that labor disputes in South Africa mines will continue until some big miners will be forced to shut down. Platinum and palladium mines simply have to mine ever deeper to produce ore. These miners still generate insufficient cash flow to pay their workers well. Miners simply cannot earn a living wage. In Rule his view, the strikes are an illustration of the industry itself. “If platinum and palladium prices do not rise, mines will close down and workers will be unemployed. There is no way to maintain production rates without sustaining capital investments, but you can't make those investments without being profitable. Thus, the price has to go up to maintain current production.” The real reason why platinum and palladium prices will rise is not related to the supply side. As has been the case in other metals the past, a rise in demand will lead to a short squeeze. Rick Rule explains:

Follow Rick Rule via SprottGlobal.com. |

| Commodities Today: Geopolitical Risks, LNG And Aluminum Bright Spots In Market Posted: 07 Apr 2014 10:12 AM PDT Tensions appear to be heating up between Russia and Ukraine with Ukraine complaining that Russia is stirring up trouble in order to give it a reason to deploy its troops to Ukraine once again. This all centers around an eastern town on the border, Donetsk, having a provincial building seized by pro-Russian forces and their proclaiming the region to be independent (see article here). This could spark another geopolitical storm and rile markets so readers need to pay careful attention to events in Ukraine and its border with Russia over the next 24-48 hours. We have been on the sidelines of the gold market for some time now, having long called for readers to sell their holdings in the SPDR Gold Shares (GLD) and close their shorts of the gold miners. Since a near perfectly timed call, which did have a bit of luck involved, on gold we have |

| CEO Of Liechtenstein Bank Frick Shot Dead in Parking Garage Posted: 07 Apr 2014 09:23 AM PDT

The unprecedented recent string of banker “suicides” (which now includes the former CEO of ABN Amro) now has the first incident which even the MSM are describing as a murder, as the CEO of Liechtenstein Bank Frick has just been shot dead in broad daylight in the bank’s parking garage. The media is initially reporting [...] The post CEO Of Liechtenstein Bank Frick Shot Dead in Parking Garage appeared first on Silver Doctors. |

| GOFO Turns Negative AGAIN: The Consequences Posted: 07 Apr 2014 09:15 AM PDT

As recently as a few weeks ago the GOFO rates were easily accessible on the LBMA website. This site, however, recently suffered a makeover. The GOFO rates are now extremely inaccessible, and unable to be downloaded in any form. Upon my inquiry to the LBMA, this was their response: The LBMA do not own the [...] The post GOFO Turns Negative AGAIN: The Consequences appeared first on Silver Doctors. |

| Russia has not yet seen how Bitcoin, like Gold, gives them a huge opportunity Posted: 07 Apr 2014 09:15 AM PDT |

| The End of The U.S. Dollar & Collapse of Civilization as We Know It! Posted: 07 Apr 2014 09:00 AM PDT

In this interview with Finance & Liberty, the International Forecaster’s James Corbett discusses why the U.S. or Europe are unlikely to announce significant sanctions on Russia, whether you should expect to ever be able to utilize any funds held in a 401k or an IRA, and why we are witnessing the beginning states of the End of [...] The post The End of The U.S. Dollar & Collapse of Civilization as We Know It! appeared first on Silver Doctors. |

| 'COMEX Gold to trade b w $1250 1330 Oz range in April' Posted: 07 Apr 2014 08:02 AM PDT INTL FCStone thought COMEX gold prices are expected to trade in between $1,250-$1,330 an ounce range in this April. |

| Doc Eifrig: Some news on the economy you may not believe Posted: 07 Apr 2014 08:01 AM PDT Winter Storm Pax blew through Augusta, Georgia in February... It also blew three tree limbs straight through the top of my house. It wasn't a total disaster. No one was hurt. The interior damage was minimal. But I have tenants renting my house for the famous Masters golf tournament next week, so it needs to be fixed. My experience with the whole thing speaks volumes about America... and what is potentially coming for investors. My conclusion might sound crazy to you... and that's a good thing. Although the storm hit six weeks ago, the holes in my roof are still there. It took weeks to get a contractor to just come and look at it... and even longer for him to schedule the work. Meanwhile, I cringe every time the Georgia weather report calls for rain. I thought I'd have no problem getting someone to come see the house. Though places like Florida, Las Vegas, and California took the brunt of the real estate bust of 2008, Georgia wasn't far behind. It's a Sun Belt state with beautiful wilderness, a growing population, and delicious (if a bit unhealthy) food. Had you tried to get a contractor during the boom of 2007, you'd have likely waited months. But after the bust, things were different. It became a "buyer's market"... not just for housing, but for contractors, plumbers, and anything else that had to do with the local economy. Even the rental rate on my house for the Masters dropped by half. So when that tree fell through my roof, I expected to see several competing offers from anxious roofers looking for work. I had no idea I'd have to wait more than a month for repairs. One company said it would be three weeks just to get an estimate. What changed? Everything. The economy is simply better. Not perfect. Not booming. But if you look at any economic chart since 2009, activity of all kinds is picking up (I showed you some interesting ones last week in this essay). Now, the economy is starting to hit the "second level," where not only are things getting better, but people are starting to believe that the economy is improving. For years now, whenever I shared my optimistic view of the economy, my inbox would flood with naysayers telling me to "open my eyes" and "prepare for the collapse." Needless to say, I've been right so far. The market is at new highs. Readers of my Retirement Millionaire newsletter have made a fortune with their U.S. stock and bond investments. Investors who allowed their fear to get the better of them were left behind. Some are still wondering whether it's safe to invest in stocks. Earlier this month, I sent a letter to subscribers of my Retirement Millionaire newsletter showing them a flurry of positive economic indicators. This time... I received hardly any critical feedback. You can see it in the data, too. Consumer sentiment has consistently been hitting new highs since the 2009 lows. It just reached five-year highs in January before falling back a bit in February.

People are feeling better. And this is a critical point... A rising economy is a "virtuous cycle." People feel good and spend money. That allows other people to make more money, which makes them feel good and encourages them to spend. Up until now, the economy has been chugging along. But the re-emergence of consumer confidence could lead to a stronger wave, even a serious boom in the markets. Remember, the consumer accounts for around 70% of the U.S. economy. If people simply stop feeling less gloomy... and start to realize the economy is showing clear signs of improvement, and it will create a heck of a lot more demand for things like cars, vacations, and homes. Demand here has already improved from 2010 and 2011 levels. But it could grow much, much stronger. Again... I know it might sound crazy to you. An economic boom? If it does, just remember people thought I was crazy in 2011 to say the economy was recovering... and would continue to recover. Yet here we are. Stocks and real estate are up big. The economy is improving. Now, the word is getting out... and people are starting to feel better. That's why I'm urging Retirement Millionaire readers to hold on to blue-chip businesses like Intel and McDonald's... and I encourage you to do the same. Crux note: While Doc isn't worried about stocks or the economy right now, he is extremely concerned about a mistake many readers are making today. To see exactly what he's worried about – and find out the simple, inexpensive steps he urges everyone to take immediately – click here.

More from Doc Eifrig: Doc Eifrig: If you're worrying about the economy, you need to see this now MUST-SEE: This is the secret behind Doc Eifrig's incredible 98.8% win rate Doc Eifrig: How to "disaster-proof" your money |

| Jim Willie: It’s All Breaking! Posted: 07 Apr 2014 08:01 AM PDT

Financial newsletter writer Dr. Jim Willie thinks 2014 will be a pivotal year for the U.S. Dr. Willie says, "We're going to end this year with no resemblance to the beginning. We spent a lot of years trying to hold this thing together. . . . Now all the QE and bond purchases are causing some major [...] The post Jim Willie: It’s All Breaking! appeared first on Silver Doctors. |

| Russia could soon push us one step closer to the "End of America" Posted: 07 Apr 2014 08:00 AM PDT Zero Hedge reports the U.S. "petrodollar" is at risk… and it seems to have started with U.S. sanctions against Russia. The U.S. dollar is world's "reserve" currency – meaning other countries trade and hold their reserves in U.S. dollars. Because of this, it's also the standard currency for global energy trading, aka the "petrodollar." If Japan wants to buy a barrel of oil from Saudi Arabia… they transact in U.S. dollars. This creates a consistent demand for U.S. currency... and means the U.S. can accumulate massive debts without defaulting. Countries have been trying to replace the U.S. "petrodollar"… but the latest U.S. "sanctions war" with Russia is causing them to try even harder. Russian Economic Minister Alexei Ulyukaev recently told Russian energy companies "they must be braver in signing contracts in rubles and the currencies of partner-countries." The CEO of Russian bank VTB said the largest Russian energy companies don't mind switching exports to rubles… they only need a mechanism to do that. This mechanism is being established right now. The head Russia's largest oil company, Igor Sechin, is working on a commodities exchange. He said, "It was advisable to create an international exchange for the participating countries, where transactions could be registered with the use of regional currencies." This means he's calling for an international exchange where Russian oil and natural gas is priced in rubles… not U.S. dollars. This would hit the U.S. "petrodollar" hard… and possibly position Russia to start a "petroruble." Russia is also working with another country with U.S. sanctions... Iran. Russia and Iran are close to signing a goods-for-oil contract. Russia would receive 500,000 barrels of oil per day in exchange for goods. If the tide turns against the U.S. petrodollar, America would be one big step closer to the loss of its reserve currency status – and what our colleague Porter Stansberry calls the "End of America."

More on Russia: The crisis in Ukraine could have a silver lining for these investors This is one of the cheapest markets in the world. It could soon get much cheaper. Crisis update: Russia is now preparing for "Iran-style retaliation" |

| Posted: 07 Apr 2014 07:00 AM PDT

The monthly non-farm payroll report has become perhaps one of the biggest tragicomedies manufactured by our completely fraudulent Government/Wall Street/financial media fairy tale factory. The report generates as much anticipation, speculation and discussion as any of the economic reports released. The week leading up to the release of the report is spent discussing and analyzing [...] The post NFP: The Art of Deception appeared first on Silver Doctors. |

| Gold & silver; Where is the Chinese demand? Posted: 07 Apr 2014 06:46 AM PDT Chinese whispers on a potential strong demand from mainland China, but that demands remain elusive and countered with further selling. |

| UK Government Powers To Confiscate Deposits Faces Backlash Posted: 07 Apr 2014 06:32 AM PDT gold.ie |

| India's gold imports rise in March Posted: 07 Apr 2014 06:25 AM PDT Indian gold import mounts nearly 50 tones in March. |

| Posted: 07 Apr 2014 06:11 AM PDT The easing of import norms are likely to deflate high gold premiums in India. |

| Steve Sjuggerud: You may not believe where interest rates could be headed next Posted: 07 Apr 2014 05:57 AM PDT From Dr. Steve Sjuggerud, editor, True Wealth: Would you pay a bank to hold your money for you? That's what happens when interest rates are negative. The idea of negative interest rates sounds insane... Who would put their money in the bank to earn a NEGATIVE interest rate? Could we really see negative interest rates? And if we did, what would that mean? I will try to answer these questions today... When you think about it, the immediate results of negative interest rates are pretty obvious...

This is what happens when interest rates are "artificially" lowered below zero. (When I say "artificially," I mean when the central bank sets rates below zero.) The trouble comes – of course – when the policy is reversed. Then all those assets that were bought with borrowed money fall in price, and everyone that borrowed too much goes bankrupt. You might think that no country in its right mind would move interest rates below zero... You would be wrong... Denmark moved interest rates below zero in 2012. They are still below zero today. Guess what? The people of Denmark are the most indebted people on the planet. Now the rest of Europe is thinking of following Denmark's lead and cutting interest rates below zero... Switzerland talked about lowering interest rates below zero last week. And the European Central Bank last week explained that negative interest rates were a pretty attractive option. In short, much of Europe could see negative interest rates – soon. What will happen then? You already know... Savers will get clobbered. People will borrow money. And asset prices will go up. So what should you do? Own assets. Own stocks and real estate, both in Europe and in the U.S. Know that you will sell those assets someday. You know that the rise in asset prices will be built on ultra-low (and potentially negative) interest rates around the globe. And you know that those ultra-low interest rates will have to end someday. You don't want to go down with the ship. We may have a long time before we have to sell... Last week, The Economist magazine wrote that "markets don't anticipate the European Central Bank [raising interest rates] back to 2% until at least 2020." So don't worry just yet. I could be wrong of course. But I believe that this is still a time to be playing offense, not defense. There will be a day to play good defense. But we're not there yet... In my opinion, now is a time to make money. Central banks around the world have interest rates at zero (like the U.S.) or less (like Denmark... and potentially the rest of Europe). Let's take advantage of it! Crux note: If you've ever considered trying Steve's research, you need to see this... For a limited time, you can "test drive" Steve's fantastic True Wealth service, absolutely risk-free for four full months... and you'll get special gift valued at $100, for free. Click here for the details.

More from Steve: Steve Sjuggerud: This was the worst mistake of my career... and it's happening again right now Steve Sjuggerud: It's official... the gold crash is over Steve Sjuggerud: This could be the biggest mistake you make this year |

| Monex Precious Metals Review: Gold hits low of $1280, Silver trades high of $20.20 Posted: 07 Apr 2014 05:25 AM PDT Monex spot gold prices opened the week at $1,294 . . . traded as high as $1,306 on Friday and as low as $1,280 on Tuesday . . . and the Monex AM settlement price on Friday was $1,303, up $9 for the week. Gold support is now anticipated at $1,297, then $1,274, and then $1,238 . . . with resistance anticipated at $1,318, then $1,338, and then $1,380. |

| Japan's Gold bars, coins investment demand up by five fold ahead of tax hike Posted: 07 Apr 2014 05:12 AM PDT Japanese gold bars and coins investment demand rose sharply by five-fold ahead of nation's consumption tax hike that went into effect this month. |

| UK Government Powers To Confiscate Deposits Faces Backlash Posted: 07 Apr 2014 04:12 AM PDT "George Osborne is facing a backlash over plans to give HM Revenue & Customs unprecedented powers to dip into taxpayers' bank accounts to seize unpaid tax debts." The surreptitious and somewhat underhand manner in which the legislation was slipped in should give pause for concern. In that way, the measures are similar to the developing bail-in legislation in the UK which is gradually coming into place without any public debate or informed discussion. Gold climbed $17.20 or 1.34% Friday to $1,303.50/oz. Silver rose $0.10 or 0.5% yesterday to $19.94/oz. Gold and silver were both up for the week 0.84% and 0.76% respectively. Gold added to gains on Monday following its biggest one-day jump in over three weeks on Friday, on investor concern after the poor jobs number Friday.

Gold surged 1.3% on Friday – its biggest percentage increase since March 12. Gold is not far from a one-week high of $1,306.50 hit in the previous session. Iraq’s central bank said on Friday its gold reserves had reached 90 tonnes, after buying 60 tonnes over the past two months to support the Iraqi dinar. Federal Reserve Chair Janet Yellen said last week that slack in labor markets showed accommodative policies will still be needed for some time which is also bullish for gold.

Silver for immediate delivery declined 0.7% to $19.83 an ounce in London. Platinum fell 0.8% to $1,438.50 an ounce. Palladium lost 0.6% to $786 an ounce. Palladium prices climbed above $800 on March 24, the highest since August 2011, due to concerns about Russian supply. Platinum and palladium had both gained in the previous six sessions. Gold is 8.2% higher this year, rallying from its 28% fall in 2013 – its biggest annual decline since 1981. UK Government Powers To Confiscate Deposits Faces Backlash On Saturday the Financial Times covered the story and the fact that the hitherto unnoticed measures are now facing scrutiny and a backlash. "George Osborne is facing a backlash over plans to give HM Revenue & Customs unprecedented powers to dip into taxpayers' bank accounts to seize unpaid tax debts," according to the FT. MPs, banks and charities want robust safeguards over powers that will allow the Revenue to order banks to pay outstanding debts from taxpayers' bank accounts, following fears that the measure could be used inappropriately and cause hardship. Andrew Tyrie, who chairs the Treasury select committee, said the MPs intended to hold further hearings into the new powers, which he said could set a worrying precedent. Many banks want judicial oversight to apply to the new powers, as they worry about being caught between irate customers and the tax authorities. "HMRC doesn't have the best record of getting things right," a banking source told the FT. The idea was previously floated in a 2007 consultation, but it was dropped after widespread criticism over the adequacy of the safeguards, the possibility of creating hardship and the risk of HMRC error. John Thurso, a Liberal Democrat MP on the Treasury select committee, criticised Mr Osborne for slipping the measure out in the Budget in just two paragraphs. "Any advance of powers by the state needs to be resisted unless they can justify it," he said. Patrick Stevens, director of tax policy at the Chartered Institute of Taxation, was sceptical that the legislation could be drafted in a way that would apply only to the wealthy. He said: "There are lots of very unsophisticated people out there with more than £5,000 in a bank account. We are truly worried about the vulnerable." Robin Williamson, of the Low Incomes Tax Reform Group charity, said he was very concerned about the risk of hardship: "As always the financially savvy ones will find ways around this. The ones that will be caught are the vulnerable." "The victims will be people with just enough money to go after but not enough to hire lawyers to fend it off"- said Liberal Democrat MP, John Thurso. The surreptitious and somewhat underhanded manner in which the legislation was slipped in should give pause for concern. In that way, the measures are similar to the developing bail-in legislation in the UK which is gradually coming into place without any public debate or informed discussion. Preparations are being put in place by the international monetary and financial authorities, including the Bank of England for bail-ins. The majority of the public are unaware of these developments, the risks and the ramifications. Download our Bail-In Guide: Protecting your Savings In The Coming Bail-In Era (11 pages) |

| Alasdair Macleod: Quarter-end distortions in the gold market Posted: 07 Apr 2014 04:00 AM PDT

The gold price continued last week’s fall into Monday, which was the end of the first quarter of 2014. Since then having reached a low point of $1278 in New York trading, gold rallied to a high of $1294 on Tuesday before weakening on Thursday morning. The biggest influence was not stories and announcements, but [...] The post Alasdair Macleod: Quarter-end distortions in the gold market appeared first on Silver Doctors. |

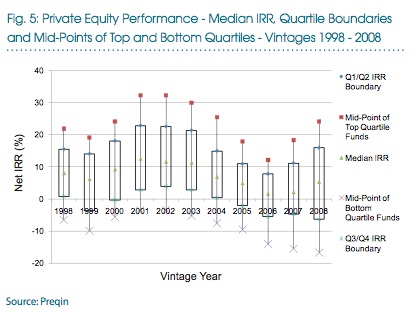

| Private Equity’s Lake Wobegon Fallacy: All Investors Are Above Average Posted: 07 Apr 2014 03:50 AM PDT Reader Greg Hill sent us a letter he wrote to the Seattle Mayor and City Council questioning its decision to triple its commitment to private equity when they’ve not only consistently underperformed their benchmark for that strategy, but even done less well than if they had simply invested in US equity. That letter led us to look at a request for proposal (RFP) that the City of Seattle Retirement System issued just a few weeks ago, where it is seeking an advisor to manage its private equity program. We’ve embedded it at the end of this post. On page 7, The RFP sets forth a requirement for the to-be-hired private equity advisor to achieve (emphasis ours):

This statement is revealing, and not in a good way. Mind you, it’s not because the City of Seattle is unusual for expecting that it can consistently out-invest more than 75 percent of private equity limited partnership investors. It’s the opposite. Seattle’s investment objective is revealing because it’s the stated goal of almost all LP investors in private equity, who almost universally believe the mathematical impossibility that all of them can assemble a portfolio of PE funds that will beat the performance of three quarters of their peers. This is a typical graph that investment consultants use to justify the barmy goal that all private equity LP investors must achieve above-average results:This graph is more straightforward than it might seem at first glance. It shows the dispersion of private equity fund returns (referred to as “IRR” as in “internal rate of return”) by year, broken out by quartiles. The bar in the middle portion of each year’s line represents the returns of funds between the 25th and 75th percentiles (the convention is that higher percentile means better returns, so if a fund is 75th percentile, it did better than 75 percent of other funds). So the top of the bar is the 75th percentile, and the bottom is the 25th percentile. The line extending above the bar stops at a red square that is the mid-point of returns for top quartile funds in a given year, presumably 87.5th percentile of performance. Similarly, the line extending below the bar stops at the X that is the mid-point of bottom quartile performance, presumably 12.5th percentile of performance. Finally, the green triangle is the median fund performance for a given year. The main thing you can see from this graph is that median performance (the green triangle) in private equity isn’t all that hot, barely beating 10% in the three best years from 1998 to 2008, and the rest of the time hovering below that level. Moreover, if you performed moderately worse than median, say 40th percentile, your performance looked like a bond return at best, and if you only achieved 25th percentile, this chart says that you could have lost money investing in private equity over this period. By contrast, if you achieved “in excess of top-quartile” returns, the stated goal of Seattle, and landed on the red square, private equity was very generous to you, providing annual returns approaching 20 percent or better every year but one. When you boil it down, this graph illustrates the ugly truth of investing in private equity: it’s not attractive unless you can outrun most of your peers investing in the asset class. Rather than question the logic of investing in private equity at all, everyone in the industry has convinced themselves that it is reasonable to believe that they can be the Warren Buffett of private equity. The investment consultants go through the shooting-fish-in-a-barrel exercise of convincing their institutional clients that each of them is prettier, smarter, and more charming than average, and therefore capable of achieving sparking results. Needless to say, flattery is an easy sell. This dynamic is similar to another practice we’ve discussed regularly, namely, how CEO pay is set. Compensation consultants tell public company boards that all of them deserve above-average CEOs who must be paid above-average wages compared to their public company peers, thereby fueling ever-escalating CEO pay. Fundamentally, this is an intellectually dishonest exercise, and diametrically opposed to the way many public pension funds construct other parts of their investment portfolios. With public equity in particular, it’s almost certain that a significant majority of U.S. pension fund assets are invested in index funds. That’s because pension funds have recognized that, collectively, they cannot do better than average, and that after paying active management fees, actively managed public equity portfolios typically perform worse than the market average. So it’s not as if these investors are so clueless that they can’t grasp the point that all of them cannot achieve above average results, let alone significantly above average results. Instead, with private equity, there is a desperate desire to be in the asset class for reasons that probably reflect a combination of intellectual capture by the PE managers, political corruption in legislatures that control public fund board appointees, and the need to have a strategy that could conceivably solve the pension underfunding problem over time. Finally, let’s flag a couple of other absurdities in the Seattle RFP. First, as you can see from the excerpt above, Seattle is seeking an advisor who can generate both above top-quartile returns and do so consistently. It violates the laws of financial physics to embrace these two goals simultaneously. It is a bedrock principle of investing that higher returns comes with more risk, which means more volatility. In other words, even when high returns are achieved, they’ll probably be bumpy. An intellectually honest reaction to this RFP would point out this inconsistency of goals and say: “I can aim for high returns, or I can aim for consistent returns. Neither I nor anyone else can plausibly promise to aim for both simultaneously.” Now, dear readers, how likely do you think it is that the City of Seattle will hear this sort of thing from the consultants competing for this gig? Finally, the RFP requires that the advisor must have been in business for at least five years and have at least three other clients. There’s a clear logical inconsistency between, on the one hand, a stated goal of becoming an outlier in terms of returns compared to one’s peers and, on the other hand, hiring an advisor to achieve this who has a significant business giving the same advice to one’s peers. The largest firms who are likely to respond to this RFP, firms like Cambridge Associates or Hamilton Lane, each advise a meaningful percentage of private equity investors. If Cambridge Associates advises 20 percent of PE investors, a reasonable guess, that’s presumably 20 percent of investors whom Seattle presumably won’t outperform. Put another way, a mainstream advisor means mainstream returns, by definition. It just can’t add up. Seattle Retirement System Request for Proposal for Private Equity Consultant |

| You Won’t Believe What These 10 Democrats Said About ObamaCare! Posted: 07 Apr 2014 12:55 AM PDT By Lambert Strether of Corrente. Barack Obama, President of the United States (June 23, 2007).

I have made a solemn pledge that I will sign a universal health care bill into law by the end of my first term as president that will cover every American and cut the cost of a typical family’s premiums by up to $2500 a year. That’s not simply a matter of policy or ideology – it’s a moral commitment. The facts: The PPACA (“ObamaCare”) does not cover “every American,” as was known when the law was passed. In 2017, as many as 40 million could still be uncovered. And the PPACA does not save the “typical family” “$2500 a year” in premiums (see also). Barack Obama (March 3, 2010).

The facts: Single payer was not put “on the table” in hearings. And in White House health care town hall transcripts, what single payer advocates had “to say” was censored. Barack Obama (March 23, 2010).

Once this reform is implemented, health insurance exchanges will be created, a competitive marketplace where uninsured people and small businesses will finally be able to purchase affordable, quality insurance. They will be able to be part of a big pool and get the same good deal that members of Congress get. The facts: Far from being “affordable,” quality” insurance, PPACA plans are marked by high co-pays, high deductibles, narrow networks, and narrow formularies. And the PPACA marketplaces establish one Federal pool and many state pools, not “a big pool.” Finally, “members of Congress and designated congressional staff will choose from 112 options in the Gold Metal tier” to retain the “Government contribution … for their health insurance coverage” for plan year 2014 (Office of Personnel Management). This is not the deal “uninsured people and small businesses” get, since they choose between Bronze, Silver, Gold, and Platinum tiers, where only Silver (not Gold) can be subsidized. Barack Obama (July 24, 2013).

[S]tarting on October 1st … you’ll be able to comparison-shop online. There will be a marketplace online, just like you'd buy a flat-screen TV or plane tickets or anything else you’re doing online. The facts: “What we're also discovering is that insurance is complicated to buy,” most unlike “a flat-screen TV” (Barack Obama, November 14, 2013). Joe Biden, Vice President of the United States (March 23, 2010).

You have turned, Mr. President, the right of every American to have access to decent health care into reality for the first time in American history. The facts: The PPACA regards health care not as a “right,” but as a “shared responsibility” between “the federal government, state governments, insurers, employers and individuals” (IRS, “Questions and Answers on the Individual Shared Responsibility Provision”; see also 42 U.S. Code Chapter 157, Subchapter V – SHARED RESPONSIBILITY FOR HEALTH CARE). And the PPACA does not cover “every American,” as was known when the law was passed. In 2017, as many as 40 million could still be uncovered. Nancy Pelosi, Speaker of the House of Representatives (March 22, 2010).

And we are here now to be — along with the Congresses that — enacted Social Security, Medicare, Civil Rights Act, health care for all Americans. All of that on a par. The facts: The PPACA does not cover “all Americans,” as was known when the law was passed. In 2017, as many as 40 million could still be uncovered. Kathleen Sebelius, Secretary of the Department of Health and Human Services (April 6, 2010).

So here are the facts: if you like your doctor, you can keep your doctor. If you like your health plan, you can keep your health plan. The facts: “They might have to end up switching doctors in part because they're saving money” (Barack Obama, March 14, 2014). And “with respect to the pledge I made that if you like your plan you can keep it … the way I put that forward, unequivocally, ended up not being accurate” (Barack Obama, November 14, 2013). Kathleen Sebelius (March 7, 2010).

Every cost cutting idea that every health economist has brought to the table is in this bill. The facts: Single payer wasn’t “on the table,” and single payer’s “cost cutting idea” adds up to $400 billion a year in savings, conservatively. Todd Park, United States Chief Technology Officer and Assistant to the President (October 10, 2013).

These bugs were functions of volume. Take away the volume and it works. The facts: The “bugs” that appeared when the Federal website was launched were caused by poor system architecture, poor implementation, and management failure by the White House team (Time). Nancy-Ann DeParle, Assistant to the President and Deputy Chief of Staff for Policy (March 23, 2010).

The facts: “Access” will be limited by high co-pays, high deductibles, narrow networks, and narrow formularies. Paul Krugman, Op-Ed columnist for The New York Times (February 27, 2010).

So will reform seriously hurt people who would have had insurance coverage anyway? No. The facts: Those who lose cancer coverage because of the PPACA’s narrow networks will be “seriously hurt.” Union members with multi-employer Taft-Hartley plans are being “seriously hurt.” Those who could not “keep their plans” because their individual plans were cancelled would have been “seriously hurt,” had not the White House backed off. Ezra Klein, creator of the Washington Post blog Wonkblog (March 21, 2010).

The facts: “Capricious” is exactly what the PPACA is, as NC has exhaustively documented here, here, here, here, here, and here. The provision to claw back costs from the estates of over-55s forced into Medicaid by ObamaCare’s income eligibility formula is especially “capricious,” because it discriminates against poor elders. Kevin Drum, Democratic blogger at Mother Jones (March 29, 2010).

The facts: “Anything”? Universities cutting hours for adjunct professors is not a “positive development. The public sector cutting hours for “police dispatchers, prison guards, substitute teachers, bus drivers, athletic coaches, school custodians, cafeteria workers….” is not a “positive development.” Jonathon Chait, Democratic blogger at The New Republic (March 21, 2010).

Historians will see this health care bill as a masterfully crafted piece of legislation. The facts: “ObamaCare is a Rube Goldberg device” (Paul Krugman, April 5, 2014). |

| Gold / Silver / Copper futures - weekly outlook: April 7 - 11 Posted: 07 Apr 2014 12:30 AM PDT investing |

| Gold price remains around $1300 as Dubai gold exchange introduces spot gold contract Posted: 07 Apr 2014 12:29 AM PDT |

| Jason Hamlin Interview with Kerry Lutz – Correction Is Ending: Gold And Miners To Go Hig Posted: 06 Apr 2014 11:00 PM PDT Gold Stock Bull |

| 6102 (1933) : Requiring Gold Coin, Gold Bullion and Gold Certificates to Be Delivered Posted: 06 Apr 2014 10:30 PM PDT Executive Orders |

| Posted: 06 Apr 2014 09:07 PM PDT Chart 1: Gold's annualised performance worst since 1982 bear market! Source: Short Side of Long After looking into Silver's performance last week, I've been asked to do the same with Gold. Today's chart focuses on Gold's annualised (12 month rolling) performance. As we can see in the chart above, relative to the 1970s bull market, recent decade long gains have not occurred too fast, in a bubble type manner (think Silver late 70s, Nikkei late 80s, Nasdaq late 90s). The chart also shows that Gold did not rise with parabolic (vertical) velocity usually linked to manias and public frenzy buying like we saw in 1970s. Therefore, if I am correct in predicting the continuation of the Gold's bull market towards its climax late in the decade, then we can assume the current under-performance (worst since 1982) is a great buying opportunity. As stated many times on this blog (despite various rallies), I remain of an opinion that Gold will break below $1190, and closer towards testing $1000 per ounce, before the final low is in. Nevertheless, I continue to add towards my PMs positions on every major sell off.

The post Gold’s Historical Performance appeared first on The Daily Gold. |

| Speculators mistime bearish gold bets before rally Posted: 06 Apr 2014 08:50 PM PDT Hedge funds and other speculators misjudged gold prices for a second time in three weeks. |

| Analog analysis in the gold market Posted: 06 Apr 2014 08:42 PM PDT Range-bound or ready to run? Here's a look at the current state of the gold market. |

| Looking for contrarian opportunities in gold stocks Posted: 06 Apr 2014 08:37 PM PDT Gold stocks have lapsed back to despised status after late March's sharp selloff. |

| Jim Willie: Gold Standard Will Return- It is Coming. It Will Shake the World Posted: 06 Apr 2014 04:00 PM PDT

An important backlash is coming to the perverse USFed monetary policy. An urgent call for global action has been seen in the G-20 and BRICS nations. The Iran sanction workarounds are to serve as the prototype for gold trade settlement. Shanghai will set the oil price in Yuan terms. China will insist on making [...] The post Jim Willie: Gold Standard Will Return- It is Coming. It Will Shake the World appeared first on Silver Doctors. |

| This Is What Employment In America Really Looks Like… Posted: 06 Apr 2014 03:02 PM PDT

Below I have posted a chart that you never hear any of our politicians talk about. It is a chart that shows how the percentage of working age Americans with a job has steadily declined since the turn of the century. Just before the last recession, we were sitting at about 63 percent, but now we have been below 59 percent since the end of 2009... We should be thankful that things have stabilized at this lower level for the past few years. At least things have not been getting worse. But anyone that believes that "things have returned to normal" is just being delusional. And nothing is being done about the long-term trends that are absolutely crippling our economy. One of those trends is the offshoring of middle class jobs. As I mentioned above, Fruit of the Loom (which is essentially owned by Warren Buffett) has made the decision to close their factory in Jamestown, Kentucky and lay off all the workers at that factory by the end of 2014...

This isn't being done because Fruit of the Loom is going out of business. They are still going to be making t-shirts and underwear. They are just going to be making them in Honduras from now on...

So what are those workers supposed to do? Go on welfare? The number of Americans that are dependent on the government is already at an all-time record high. And doesn't Warren Buffett already have enough money? In business school, they teach you that the sole responsibility of a corporation is to maximize wealth for the shareholders. And so when business students get out into "the real world", that is how they behave. But the truth is that corporations have a responsibility to treat their workers, their customers and the communities in which they operate well. This responsibility exists whether corporate executives want to admit it or not. And we all have a responsibility to our fellow citizens. When we stand aside and do nothing as millions of good paying American jobs are shipped overseas so that the "one world economic agenda" can be advanced and so that men like Warren Buffett can stuff their pockets just a little bit more, we are failing our fellow countrymen. Because so many of us have fallen for the lie that "globalism is good", we have allowed our once great manufacturing cities to crumble and die. Just consider what is happening to Detroit. It was once the greatest manufacturing city in the history of the planet, but now foreign newspapers publish stories about what a horror show that it has become...

Of course this kind of thing is not just happening to Detroit. The truth is that it is happening all over the nation. For example, this article contains an incredible graphic which shows how the middle class of Chicago has steadily disappeared over the past several decades. Once again, even though we have never had a "recovery", it is a good thing that things have at least stabilized at a lower level for the past few years. But now there are all sorts of indications that we are rapidly heading toward yet another economic downturn. The tsunami of retail store closings that is now upon us is just one sign of this. The following is a partial list of retail store closings from a recent article by Daniel Jennings...

And the following are some more signs of trouble for the retail industry from one of my recent articles entitled "20 Facts About The Great U.S. Retail Apocalypse That Will Blow Your Mind"...

But it isn't just the retail industry that is deeply troubled. All over America we are seeing economic weakness. In this economic environment, it doesn't matter how smart, how educated or how experienced you are. If you are out of work, it can be extremely difficult to find a new job. Just consider the case of Abe Gorelick...

So what does Abe need in order to find a decent job? More education? More experience? No, what he needs is an economy that produces good jobs. Sadly, the cold, hard reality of the matter is that the U.S. economy will never produce enough jobs for everyone ever again. The way that America used to work is long gone, and it has been replaced by a cold, heartless environment where the company that you work for could rip your job away from you at a moment's notice if they decide that it will put a few extra pennies into the pockets of the shareholders. You may have worked incredibly hard for 30 years and been super loyal to your company. It doesn't matter anymore. All that matters is the bottom line, and in the process the middle class is being destroyed. But by destroying the middle class, those corporations are destroying the consumer base that their corporate empires were built upon in the first place. |

| Posted: 06 Apr 2014 03:00 PM PDT

What if you were forced to "register" in order to buy groceries? And what if, through that registration, the food you bought could be tracked and quantities could be limited? That's exactly the plan in Venezuela right now. Last year in Venezuela, it became a crime to "hoard" food, and the country's Attorney General called upon [...] The post Venezuela Enforces Fingerprint Registry to Buy Groceries: What to Do Before Rationing Starts in America appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment