saveyourassetsfirst3 |

- India's pain is UAE's gain - Indian expats buy up gold jewellery

- Goliath Gold in legal wrangle over prospecting rights

- Gold price collapse points to 'engineered' move

- Yesterday’s gold plunge another case of manipulation say some observers

- Fresnillo to meet guidance despite 30% gold output drop

- Torex: $375m loan means Mexican gold project 'fully financed'

- Learn how to fold a dress shirt in less than two seconds... and other travel tips

- Not All Dry Bulk Shippers Are Created Equal

- Doug Casey’s Coming Super-Bubble by Louis James

- Bundy Ranch Shows Necessity of Improving Patriot and or Militia Communications

- As Ukraine Heats up so does Gold

- How the CEO of HFT Firm Virtu Financial is Demanding a Taxpayer Bailout on NHL Investment

- US, China data leads the Gold sell off: Sharps Pixley

- India Govt raises import tariff value of Gold, Silver

- CHARTS - What’s Going on in Gold?

- Jim Willie: Fed Has Lost Control, Systemic Failure Flashing Warning Signals Now!

- Silver and Gold Miners Still Disappoint

- Gold Crash Anniversary Day

- India’s silver export spikes as gold import declines

- Chinese Gold Demand Predicted to Rise

- Sudden drop in gold

- SilverCrest Gold, Silver output rises in Q1

- Bail-Ins Approved By EU Yesterday - Deposits Over €100,000 Vulnerable

- If you're in biotech you better do this FAST...

- Links 4/16/14

- Gold dives 2 pct on heavy stop-loss orders, technicals

- Zero Hedge: Gold Futures Halted Again on Latest Furious Slam Down

- France Is the New Cauldron of Eurosceptic Revolution

- Russian Holdings of Treasuries Fall to Lowest Since 2011

- Four King World News Blogs

- Zero Hedge: Gold Futures Halted Again on Latest Furious Slam Down

- Dave Kranzler Reports on the Latest Manipulation of the Gold Price

- China Gold Demand Rising 25% by 2017 as Buyers Get Wealthier

- Much More to Come in China’s Already "Breathtaking" Gold Story

- Wall Street Journal Spins a Gold-Bullish Report to Bearish

- Lawrence Williams: Chinese Take-Away – WGC Study Leaves Many Questions Unanswered

- Koos Jansen: Shanghai Gold Exchange Withdrawals Equal Chinese Gold Demand, Part 3

- Hardly a Mention of Central Banks in Financial Times Report on London Gold Fix

- Gold attacks the psychological barrier – Analysis - 16/04/2014

- Ichimoku Cloud Analysis: GBP/USD, Gold

- Gold Price Analysis- April 16, 2014

- CHARTS - Gold and Silver Plunge, Crude Oil Vulnerable Ahead Of Inventories Data

- Fresnillo says gold down but on track to meet guidance

- Critical Level For Silver, That Needs To Holds Here Or...

- World Gold Council forecasts 35% growth in Chinese gold demand

- Why shorting the Aussie dollar looks a winning trade on China’s slowdown

- 2014-P Great Smoky Mountains 5 Oz Silver Coin Nears Sellout

- 2014 Proof Gold Eagle Coin Prices May Rise

- Bullion and Energy Market Commentary

- Don Quijones: “Uncreative” Destruction – The Troika’s Hostile Takeover of Europe

| India's pain is UAE's gain - Indian expats buy up gold jewellery Posted: 16 Apr 2014 06:39 PM PDT With a 16% difference per gram of gold between the two countries, Indians line up across UAE's bullion counters to grab their prized metal |

| Goliath Gold in legal wrangle over prospecting rights Posted: 16 Apr 2014 06:35 PM PDT A legal battle brews over Goliath Gold exploration rights it sold to Covenant. |

| Gold price collapse points to 'engineered' move Posted: 16 Apr 2014 04:37 PM PDT The speed of the decline in Asia yesterday pointed to another 'engineered' fall, such as we have seen in the gold market often, says Julian Phillips. |

| Yesterday’s gold plunge another case of manipulation say some observers Posted: 16 Apr 2014 12:24 PM PDT A massive dump of gold futures contracts immediately ahead of U.S. market opening is seen as responsible for much of yesterday's gold price plunge. |

| Fresnillo to meet guidance despite 30% gold output drop Posted: 16 Apr 2014 12:12 PM PDT Fresnillo's production continued to be hit by a ban on the use of explosives at one of its Mexican mines due to a land dispute. |

| Torex: $375m loan means Mexican gold project 'fully financed' Posted: 16 Apr 2014 12:09 PM PDT Torex Gold reports a binding agreement with a group of banks that, assuming it comes through, fully finances its El Limon - Guajes project in Mexico. |

| Learn how to fold a dress shirt in less than two seconds... and other travel tips Posted: 16 Apr 2014 12:00 PM PDT A Holiday Inn efficiency engineer demonstrates his favorite packing tips. He offers out-of-the-box tips so you save time packing. He'll even show you how to fold a button-down shirt in less than two seconds. I guarantee you'll learn something new. 1. Use portable hanging shelves to save on time. The shelves collapse into you suitcase… leaving your clothes folded and organized. 2. Place a belt in the collar of your shirt to save space… and keep the collar's form. 3. Place all of your liquids in travel containers. Wrap the opening of the container in plastic wrap. Then screw the cap on. You will have a spill-proof container. 4. Clamp a bulldog clip over an exposed razor. This will protect your razor… and anything your razor can slice. 5. Use a bulldog clip to keep wires together. You can then put your wires and chargers in a sunglasses case. They'll all be together… and also more easily accessible. 6. If you want to listen to music… place your smart phone in a cup. The cup acts as an amplifier. 7. If you pack a sport coat… turn it inside out and fold it. This will keep you jacket clean and prevent creases.

More travel tips: The 25 best-kept secrets frugal travelers aren't telling you If you can't decide on your next vacation, let millions of others decide for you 5 steps to get the absolute best price on your next dream vacation |

| Not All Dry Bulk Shippers Are Created Equal Posted: 16 Apr 2014 11:53 AM PDT Since the 2009 collapse of the Baltic Dry Index (BDI), and the subsequent slowdown of the global market, investors have seen the weakest of the Dry Bulk Shippers dry off. The massive run up of the BDI and subsequent collapse, along with contracts companies had put on new buildings, proved too much for some companies. In order to stay afloat, some companies issued more debt or equity, sold off assets, or canceled contracts in recent years. The past year showed the BDI still has a heartbeat, and may eventually recover, bringing some of the struggling back to their feet, but those that have been on solid ground offer the most safety and security for investors. The Industry It's helpful to compare companies from different snapshots in time. So starting off, with a five year comparison of the current pack of Dry Bulk Shippers, it's easy to see who has thrived |

| Doug Casey’s Coming Super-Bubble by Louis James Posted: 16 Apr 2014 11:43 AM PDT Doug Casey's Coming Super-Bubble |

| Bundy Ranch Shows Necessity of Improving Patriot and or Militia Communications Posted: 16 Apr 2014 11:00 AM PDT

The US Federal Government has an incredible history of breaking codes and cracking encryption. They have an even greater ability to store an archive all communications, even if they’re seemingly unimportant, so they can analyze them later when suddenly they’re potentially important. They use massive data centers and wire taps supported by every major telecom [...] The post Bundy Ranch Shows Necessity of Improving Patriot and or Militia Communications appeared first on Silver Doctors. |

| As Ukraine Heats up so does Gold Posted: 16 Apr 2014 10:25 AM PDT Gold is being batted back and forth between two opposing forces at the moment. The negative force continues to be the slowing Chinese economy with traders fearing a slackening of demand from that key consumer. The positive is escalating tensions in the eastern part of Ukraine. Separatists, or pro-Russian citizens, are continuing to clash with pro-Western citizens with the Ukranian military getting more involved, although there have been reports of defections over to the Russian side from some Ukranian military units. This is supporting gold, as is the weakness in the US Dollar. Much is being made in certain gold perma-bull websites about rising meat prices as evidence that inflation is here to stay. Such stories are meant to justify claims that gold should be moving significantly higher in anticipation of even further upward price pressures but such stories are inflammatory and not forward looking. Wholesale meat prices have already peaked out. My view is that we have seen the highs for this season for both beef and pork prices. As we move further into the year, particularly towards the end of the 3rd quarter and on into the 4th, look for prices to fall significantly from current levels. What is currently being witnessed is the catch up in the retail price of red meat as it takes a while for the more recently killed, higher priced product to make its way into the food distribution channel. By the end of this year, and certainly by the beginning of next year, beef and pork prices will have come down considerably from current sticker-shock price levels. The same goes for soybean prices ( barring any serious weather event this growing season ). New crop beans are priced a whopping $2.70 below old crop beans as the market is moving on historically tight ending supplies of beans. With record acreage going to beans this growing season, we should also see some relief from these high-priced beans as well, although it will take some time before the market feels comfortable enough to push bean prices lower. Corn prices are pivoting around the $5.00 level. While they have come off the lows near the $4.00 level, they remain far below the historic peak near $7.75 - $8.00. Wheat is reacting to continued dryness in key growing regions of the Plains but some of its premium is also due to the Ukranian situation. Traders fear supply disruptions from this key wheat-growing region and have bid prices higher in anticipation of possible shipment disruptions associated with the unrest over there. The GSCI or Goldman Sachs Commodity Index is trading up near the top of its range as several commodity sectors have been moving higher. If it could clear 680, we might have something in the overall sector indicating some strong upward pressure and a breakout but so far the current board structure in many commodity futures markets is not suggesting SUSTAINED higher prices. If China continues to slacken further, traders are not going to feel comfortable committing large sums of money into the sector in general. The Dollar is basically going nowhere as it remains trendless. When it weakens, commodities, especially gold, tend to get a bid. When it strengthens, the opposite is generally true. Nothing has changed in that regard. We are back to watching geopolitical events and trading around those for the time being. By the way, China's GDP number was a tad bit better than the market was looking for but even one of their officials said that the double digit growth that had marked it for some time was over. Gold popped a bit higher when the number came out last evening expressing a sigh of relief. |

| How the CEO of HFT Firm Virtu Financial is Demanding a Taxpayer Bailout on NHL Investment Posted: 16 Apr 2014 09:30 AM PDT

What the financial crisis, subsequent taxpayer bailouts, zero prosecutions of financial industry participants and further consolidation of the economy by oligarchs has taught us more than anything else is that the super rich and politically connected are not allowed to fail. Apparently, this may also apply to the head of one of the largest firms in what [...] The post How the CEO of HFT Firm Virtu Financial is Demanding a Taxpayer Bailout on NHL Investment appeared first on Silver Doctors. |

| US, China data leads the Gold sell off: Sharps Pixley Posted: 16 Apr 2014 09:10 AM PDT In the U.S., the March Advance Retail Sales jumped more than expected by 1.1% compared to 0.3% in February. The CPI and the core inflation, led by food and rent, rose more than anticipated by 0.2% in March. |

| India Govt raises import tariff value of Gold, Silver Posted: 16 Apr 2014 08:38 AM PDT India had raised the import duty on gold and silver in stages to 10% while it announces the import tariff value on gold and silver from time to time based on global price movements and to prevent under invoicing. |

| CHARTS - What’s Going on in Gold? Posted: 16 Apr 2014 08:35 AM PDT uncommonwisdomdaily |

| Jim Willie: Fed Has Lost Control, Systemic Failure Flashing Warning Signals Now! Posted: 16 Apr 2014 08:12 AM PDT

The US Federal Reserve has been printing money since 2011 to cover USGovt debt securities in a frenetic manner. They have lost control. They call it stimulus, when it is actually the opposite. It does assist the speculators with nearly zero cost money to borrow, but one must be a club member to win loan [...] The post Jim Willie: Fed Has Lost Control, Systemic Failure Flashing Warning Signals Now! appeared first on Silver Doctors. |

| Silver and Gold Miners Still Disappoint Posted: 16 Apr 2014 07:15 AM PDT marketoracle |

| Posted: 16 Apr 2014 07:00 AM PDT

Gold is holding up reasonably well, considering that Indian buyers are so focused on the election. Generally speaking, this is the weak season for gold. Also, the April 12 – 15 period is when the gold market crashed in 2013. As we saw Tuesday, Nervous participants tend to be sellers around the anniversary of such events. [...] The post Gold Crash Anniversary Day appeared first on Silver Doctors. |

| India’s silver export spikes as gold import declines Posted: 16 Apr 2014 06:16 AM PDT As the gold supply struggles to meet its surging demand, the silver jewelry export has made giant leap in India. |

| Chinese Gold Demand Predicted to Rise Posted: 16 Apr 2014 06:04 AM PDT Perth Mint Blog. |

| Posted: 16 Apr 2014 06:01 AM PDT Gold's losses were kept in check by fears of further escalation of tension in Ukraine. |

| SilverCrest Gold, Silver output rises in Q1 Posted: 16 Apr 2014 04:25 AM PDT SilverCrest Mines gold and silver output advanced by 4% and 31% year-on-year, respectively, during the first quarter of this year. |

| Bail-Ins Approved By EU Yesterday - Deposits Over €100,000 Vulnerable Posted: 16 Apr 2014 04:01 AM PDT gold.ie |

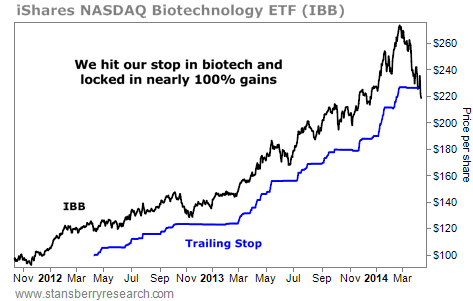

| If you're in biotech you better do this FAST... Posted: 16 Apr 2014 04:00 AM PDT From Dr. Steve Sjuggerud in DailyWealth: My friend, it is time for me – and for my subscribers – to move on from biotech. The ride has been fantastic. But it's now time to go. Let me explain... $10,000 would have turned into $44,000 in just over two years in biotech, if you'd followed my biotech recommendations in my True Wealth Systems letter. (We just sold our biotech fund in TWS two weeks ago.) In my upcoming True Wealth letter, we are also selling our biotech fund... So if you bought biotech when I recommended it, and sold today, you've pocketed an 89% return. Those are huge gains in both letters. Those were great trades. What makes up a great trade? A great trade has a good buy AND a good sell. You haven't completed a great trade until you have both. With a good buy AND a good sell, our great trade in biotech is now complete. The amazing thing is, I admittedly know very little about biotechnology... I am not a doctor. (Doctors are often bad biotech traders, because they don't know when to sell.) I don't have any special medical insights. However, I believed I knew enough to make this trade... I knew the two most important things. I knew that: 1) I wanted to be in any biotech uptrend when it takes hold. Bull markets in biotech can be worth hundreds-of-percent profits – and you want to be a part of that. Also, I knew that... 2) Any bull market today can run higher than anyone can imagine, thanks to the Federal Reserve's "easy money" policies. So you want to stay on board until you can't stand it anymore. I didn't need to be a doctor to make large profits in biotech... I just needed to get onboard at approximately the right time, and stay onboard. At this point, I have done that. The hard part is deciding when to get out. (Again, this is where the doctors often fail.) Since I have no expertise in biotech, I used a "trailing stop" to take me out of my trade... A "trailing stop" is my maximum acceptable loss... It is the point at which I cry "uncle," barring anything else happening before it. When I originally made my True Wealth biotech-fund recommendation, I used a standard "percentage" trailing stop in my newsletter. Since then, I have switched to using Smart Trailing Stops (from our corporate affiliate TradeStops) in my letter. You can see the Smart Trailing Stop for our biotech fund in this graph:

As you can see, while our biotech fund went up in price, our Smart Trailing Stop followed it higher. And now that our biotech moved lower, it triggered our Smart Trailing Stop. Our "point of maximum pain" was hit. It is time to sell. Once again, we are selling with an 89% return. Not too bad. Personally, I believe biotech can go higher from here. However, I'm smart enough to recognize that I have no expertise or special insights here. So the smartest thing I can do is to maximize the value of my good decisions and minimize the impact of my bad decisions. Smart Trailing Stops are a simple way to do that. If you are a True Wealth subscriber or a True Wealth Systems subscriber, I urge you to clear out your biotech positions now. It is time for us to complete what has turned out to be a great trade... We made extraordinary profits – without any extraordinary insights or skills. Congratulations. And now we have hit our trailing stop. Let's move on... I really believe trailing stops are the secret to selling at the right time today – especially in this era where the Fed is printing money and stocks can go higher than you can possibly imagine. So I highly urge you to get up to speed on trailing stops, so you can make great trades, too. Crux note: Dr. Richard Smith has created a trailing stop machine... what some investors have called a "magic calculator." His invention is so powerful it netted him $309,000 in just 48 months. To learn more, click here.

More from Steve Sjuggerud: Steve Sjuggerud: It's official... the gold crash is over Steve Sjuggerud: This is what happens after a stock market crash Steve Sjuggerud: What to do right now if you missed last year's rally in stocks

|

| Posted: 16 Apr 2014 03:55 AM PDT Is that you, Polly? The amazing experiment that proves parrots give their children names Daily Mail Rancher in land dispute is a bully, not a hero Las Vegas Sun 3 reasons the economy has some spring in its step Fortune Flash In the Pan: On 'Flash Boys,' Michael Lewis's Baffling New Book Maureen Tkacik, New York Observer (furzy mouse). Look! Over there! High frequency trading! Wall Street's wily front group: Inside story of a rental scheme's secret facelift David Dayen, Salon Matt Taibbi: ‘Hands Down’ Bush Was Tougher On Corporate America Than Obama (VIDEO) Talking Points Memo. Democratic house organ feints left for the mid-terms. Trillion-Dollar Firms Dominating Bonds Prompting Probes Bloomberg "We are in great danger": Ex-banker details how mega-banks destroyed America Salon Intuit Does Subterfuge To Combat Free-Filing Tax Returns TechDirt NY financial services regulator deepens probe into Credit Suisse FT Cuomo to be 'honorary chair' of pro-charter retreat Capital New York Defending Kickbacks Baseline Scenario C.E.O. Pay Goes Up, Up and Away! Times The lost promise of progressive taxes Reuters Are ATMs the Right Channel for Serving the Underbanked? American Banker Cannabis Goes Corporate The American Conservative Winter Wheat Hit Hard by Widespread Cold Snap AgWeb Why is Involuntary Part-Time Work Elevated? FEDS Notes Losing Benefits Isn't Prodding Unemployed Back to Work FiveThirtyEight. Chattel slavery has its advantages. Private ownership of public infrastructure… A doom of inequality Angry Bear. "Don't be caught without cash." Study: American policy exclusively reflects desires of the rich; citizens’ groups largely irrelevant Boing Boing ObamaCare

Health IT: The Coming Regulation The Health Care Blog In Medical Decisions, Dread Is Worse Than Fear The Atlantic Big Brother Is Watching You Watch

Ukraine

Radioactive Waste Is North Dakota’s New Shale Problem Online WSJ Asian air pollution strengthens Pacific storms BBC Manipulate Me: The Booming Business in Behavioral Finance Bloomberg Struggling Dems waiting for Hillary in 2014 Politico The Warren Brief The New Yorker. A biography. Unlike Obama, Warren’s written just one. Can You Lie in Politics? Supreme Court Will Decide Roll Call Why We're in a New Gilded Age Paul Krugman, NYRB. Piketty. 'Capital in the Twenty-First Century', by Thomas Piketty Martin Wolf, FT. Comprehensive Disobedience: Occupying the Sharing Economy in Spain Shareable (diptherio) Antidote du jour: See yesterday’s Links and Antidote du Jour here. |

| Gold dives 2 pct on heavy stop-loss orders, technicals Posted: 16 Apr 2014 02:25 AM PDT reuters |

| Zero Hedge: Gold Futures Halted Again on Latest Furious Slam Down Posted: 16 Apr 2014 02:22 AM PDT ""Da boyz" could hit gold for another $50 easily if they choose to do so" ¤ Yesterday In Gold & Silver The gold price drifted quietly lower in Far East trading on their Tuesday until around 2 p.m. Hong Kong time---and it was about then that the HFT boyz showed up, with the final kick in the pants coming at 8:27 a.m. EDT---seven minutes after the New York trading session began. Gold futures traded was halted, as gold gapped down $12 in an instant, as 4,000 contracts were dumped in seconds. In less that three minutes it was all over, with the low tick coming a precisely 8:30 a.m. ¤ Critical ReadsDebt Burdens Soar for Major US Companies Large U.S. companies have more than tripled their debt loads in the past three years, enabling them to spend money without dipping into their record-high cash reserves. From 2010 to 2013, the 1,100 companies rated by Standard & Poor's for five years or longer saw their combined cash reserves climb $204 billion to $1.23 trillion, according to the FT. That pales in comparison to the $748 billion jump in gross debt to $4 trillion during that period. This short, but must read news item, was posted on the moneynews.com Internet site early yesterday morning EDT---and today's first story is courtesy of West Virginia reader Elliot Simon. France Is the New Cauldron of Eurosceptic RevolutionBritain is marginal to the great debate on Europe. France is the linchpin, fast becoming a cauldron of Eurosceptic/Poujadist views on the Right, anti-EMU reflationary Keynesian views on the Left, mixed with soul-searching over the wisdom of monetary union across the French establishment. Marine Le Pen’s Front National leads the latest IFOP poll for the European elections next month at 24%. Her platform calls for immediate steps to ditch the euro and restore the franc (“franc des Anglais” in origin, rid of the English oppressors), and to hold a referendum on withdrawal from the EU. The Gaullistes are at 22.5%. The great centre-Right party of post-War French politics is failing dismally to capitalise on the collapse in support for President François Hollande. The Parti Socialiste is trailing at 20.5%. The Leftist Front de Gauche is at 8.5% and they are not exactly friends of Brussels. This Ambrose Evans-Pritchard blog was posted on the telegraph.co.uk Internet site yesterday sometime---and it's the first story of the day from Roy Stephens. Russian Holdings of Treasuries Fall to Lowest Since 2011Russian holdings declined for a fourth straight month, to $126.2 billion, from $131.8 billion in January, according to figures released today in Washington as a part of a monthly report on foreign holders of Treasuries as well as international portfolio flows. Russia might have been selling Treasuries, world’s most liquid assets, as part of an effort to limit a decline in the ruble, which lost 2% versus the dollar in February, the biggest drop that month among 24 emerging-market peers tracked by Bloomberg. The currency weakened amid rising tensions in Ukraine’s Crimean peninsula. “Russia’s been slowly shedding holdings,” said Gennadiy Goldberg, a U.S. strategist at TD Securities USA LLC in New York. “When you try to defend your currency, this is when you really use those Treasury reserves.” Russia's Bond Market Is Achilles Heel as Showdown with West EscalatesRussia is at increasing risk of a full-blown financial crisis as the West tightens sanctions and Russian meddling in Ukraine pushes the region towards conflagration. The country’s private companies have been shut out of global capital markets almost entirely since the crisis erupted, causing a serious credit crunch and raising concerns that firms may not be able to refinace debt without Russian state support. “No Eurobonds have been rolled over for six weeks. This cannot continue for long and is becoming a massive issue,” said an official from a major Russian bank. “Companies have to roll over $10bn a month and nothing is moving. The markets have been remarkably relaxed about this, given how dangerous it is. Russia’s greatest vulnerability is the bond market,” he said. This is another offering from Ambrose Evans-Pritchard. This one was posted on The Telegraph's Web site late on Monday evening BST---and it's the second contribution of the day from Roy Stephens. It's worth skimming. Seven Ukraine/Russia-Related Stories 1. West pressures Russia as separatists tighten grip on east Ukraine: France24 2. Ukraine Falters in Drive to Curb Unrest in East: The New York Times 3. 'We Will Shoot Back': All Eyes on Russia as Ukraine Begins Offensive in East: Spiegel Online 4. Putin: Ukraine’s radical escalation puts it on edge of civil war: Russia Today 5. Those who don’t lay down arms, will be destroyed - Ukrainian military op commander: Russia Today 6. Villagers stop armored column of Ukrainian troops near Lugansk: Voice of Russia 7. Ukraine on brink of civil war as Kiev sends in troops: The Telegraph BRICS Countries to Set Up Their Own IMFVery soon, the IMF will cease to be the world's only organization capable of rendering international financial assistance. The BRICS countries are setting up alternative institutions, including a currency reserve pool and a development bank. The BRICS countries (Brazil, Russia, India, China and South Africa) have made significant progress in setting up structures that would serve as an alternative to the International Monetary Fund and the World Bank, which are dominated by the U.S. and the EU. A currency reserve pool, as a replacement for the IMF, and a BRICS development bank, as a replacement for the World Bank, will begin operating as soon as in 2015, Russian Ambassador at Large Vadim Lukov has said. Brazil has already drafted a charter for the BRICS Development Bank, while Russia is drawing up intergovernmental agreements on setting the bank up, he added. In addition, the BRICS countries have already agreed on the amount of authorized capital for the new institutions: $100 billion each. "Talks are under way on the distribution of the initial capital of $50 billion between the partners and on the location for the headquarters of the bank. This story was posted on the Russia Beyond the Headlines Web site on Monday---and it's courtesy of Elliot Simon. Chinese Economic Growth Continues to SlowChina's Q1 GDP beat expectations rising 7.4% year-over-year. Economists polled by Bloomberg were looking for Q1 GDP to rise 7.3%. But this was down from 7.7% the previous quarter, showing that China's economy continues to slow. Quarter-over-quarter however GDP was up 1.4% or 5.7% annualized. This was also slower than revised 1.7% growth in Q4 2013 and 7% annualized. Meanwhile, year-to-date Chinese retail sales were up 12%, beating expectations for an 11.9% rise. For March, retail sales were up 12.2%. I would expect that China's GDP numbers are massaged to perfection, just as much as the numbers coming out of the United States these days. This business news item was posted on the Bloomberg Web site late yesterday evening MDT---and it's another contribution from Roy Stephens. Japan Risks Public Souring on Abenomics as Prices SurgePrime Minister Shinzo Abe’s bid to vault Japan out of 15 years of deflation risks losing public support by spurring too much inflation too quickly as companies add extra price increases to this month’s sales-tax bump. Businesses from Suntory Beverage and Food Ltd. to beef bowl chain Yoshinoya Holdings Co. have raised costs more than the 3 percentage point levy increase. This month’s inflation rate could be 3.5%, the fastest since 1982, according to Yoshiki Shinke, the most accurate forecaster of Japan’s economy for two years running in data compiled by Bloomberg. The challenge for Abe and the Bank of Japan is to keep the public focused on the long-term benefits of exiting deflation when wages are yet to pick up and, according to BOJ board member Sayuri Shirai, most people still see price gains as “unfavorable.” Any jump in inflation that’s perceived as excessive by a population more used to prices falling could worsen consumer confidence and make it harder to boost growth. A policy of "Inflate or die" is fraught with danger, as the Japanese government is discovering to its dismay. This Bloomberg piece, filed from Tokyo, was posted on their Internet site in the wee hours of Monday morning Denver time. I "borrowed" this story from yesterday's edition of the King Report---and it's worth reading. |

| France Is the New Cauldron of Eurosceptic Revolution Posted: 16 Apr 2014 02:22 AM PDT Britain is marginal to the great debate on Europe. France is the linchpin, fast becoming a cauldron of Eurosceptic/Poujadist views on the Right, anti-EMU reflationary Keynesian views on the Left, mixed with soul-searching over the wisdom of monetary union across the French establishment. Marine Le Pen’s Front National leads the latest IFOP poll for the European elections next month at 24%. Her platform calls for immediate steps to ditch the euro and restore the franc (“franc des Anglais” in origin, rid of the English oppressors), and to hold a referendum on withdrawal from the EU. The Gaullistes are at 22.5%. The great centre-Right party of post-War French politics is failing dismally to capitalise on the collapse in support for President François Hollande. The Parti Socialiste is trailing at 20.5%. The Leftist Front de Gauche is at 8.5% and they are not exactly friends of Brussels. This Ambrose Evans-Pritchard blog was posted on the telegraph.co.uk Internet site yesterday sometime---and it's the first story of the day from Roy Stephens. |

| Russian Holdings of Treasuries Fall to Lowest Since 2011 Posted: 16 Apr 2014 02:22 AM PDT Russian holdings declined for a fourth straight month, to $126.2 billion, from $131.8 billion in January, according to figures released today in Washington as a part of a monthly report on foreign holders of Treasuries as well as international portfolio flows. Russia might have been selling Treasuries, world’s most liquid assets, as part of an effort to limit a decline in the ruble, which lost 2% versus the dollar in February, the biggest drop that month among 24 emerging-market peers tracked by Bloomberg. The currency weakened amid rising tensions in Ukraine’s Crimean peninsula. “Russia’s been slowly shedding holdings,” said Gennadiy Goldberg, a U.S. strategist at TD Securities USA LLC in New York. “When you try to defend your currency, this is when you really use those Treasury reserves.” |

| Posted: 16 Apr 2014 02:22 AM PDT 1. Art Cashin: "The Reason Gold, Silver and Commodities Are Getting Smashed" 2. Dr. Stephen Leeb: "Gold and Silver Smashed as incredible Events Unfold in Europe" 3. Dr. Paul Craig Roberts: "U.S. Now Close to Total Collapse" 4. Gerald Celente: "The Vampire Squid, Gold and the Global Ponzi Scheme" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] |

| Zero Hedge: Gold Futures Halted Again on Latest Furious Slam Down Posted: 16 Apr 2014 02:22 AM PDT It seems the two words "fiduciary duty" are strangely missing from the dictionary of the new normal's asset management community. This morning, shortly before 8:27 a.m. ET, someone decided that it was the perfect time to dump thousands of gold futures contracts worth over half a billion dollars notional. This smashed gold futures down over $12 instantaneously, breaking below the 200-day moving averaged and triggering the futures exchange to halt trading in the precious metal for 10 seconds. |

| Dave Kranzler Reports on the Latest Manipulation of the Gold Price Posted: 16 Apr 2014 02:22 AM PDT Shortly after the Shanghai gold market closed last night, the market manipulators went to work on the gold price. Gold was taken down another $20 during the morning trading in London, primarily in three HFT trading induced “mini flash crashes.” There were not any related news reports or events that would have triggered the relentless selling of paper gold (Comex futures via the Globex system and LBMA forward As soon as the Comex floor trading opened at 8:20 a.m. EST, nearly 4,000 contracts were dropped instantaneously onto the floor and into the Globex system. This is over a half a billion dollars worth of gold – over 10 tonnes of paper gold – in a nanosecond. This amount represents 47% of the amount of actual physical gold that was reported to be available for delivery by the Comex yesterday. The sudden burst in volume halted the Comex computer system for 10 seconds. The contract bomb caused an immediate $16 plunge in the price of gold. Over a period of seven minutes from the time the Comex opened, over 14,000 contracts traded. This represented over 18% of the total volume in Comex contracts that had traded in the previous 14 hours of trading starting at 6 p.m. EST the night before. Obviously this is was intentional and determined selling of paper gold for the purposes of driving the price a lot lower. The news reported over the last 24 hours, if anything, should have caused the price of gold to move higher. This includes the re-escalation of the events in Ukraine, an inflation report released this morning which showed that the rate of inflation in March was double the rate that was expected by Wall Street forecasters and a report of manufacturing activity in the northeast which was significantly lower than expected. This short must read commentary showed up on the paulcraigroberts.org Internet site yesterday---and I thank Brad Robertson for sending our way. |

| China Gold Demand Rising 25% by 2017 as Buyers Get Wealthier Posted: 16 Apr 2014 02:22 AM PDT Gold demand in China, which overtook India as the largest user last year, will rise about 25% in the next four years as an increasing population gets wealthier, according to the World Gold Council. Consumer demand will expand to at least 1,350 metric tonnes by 2017, the London-based council said in a report today. Growth may be limited this year after 2013’s price decline spurred consumers to do more buying last year, it said. China accounted for about 28% of global usage last year, the council estimated in February. Buying accelerated last year as prices slumped 28%, the most since 1981, and the nation became the top buyer in place of India, where import restrictions curbed demand. China’s economy will expand 7.4% this year, economists surveyed by Bloomberg estimate. While that’s set to be the least since 1990, it’s still more than double expected growth in the U.S. This Bloomberg story showed up on their Web site during the Denver lunch hour yesterday MDT---and it's another gold-related story that I found over at the gata.org Internet site yesterday. The World Gold Council's report on which this story is based is linked here. |

| Much More to Come in China’s Already "Breathtaking" Gold Story Posted: 16 Apr 2014 02:22 AM PDT The scale, scope and speed of the development of the gold market in China to date has been “quite breathtaking” – and there is still a lot more to come, World Gold Council (WGC) investor relations manager John Mulligan indicated on Tuesday. Speaking to Mining Weekly Online from London, Mulligan revealed that the WGC was engaged in ongoing discussions to support initiatives to make gold even more accessible in China and that various Chinese gold organisations were simultaneously setting out to modernise the entire gold supply chain from mining through to fabrication and appropriate technologies. In its latest report, titled "China's gold market: progress and prospects," the WGC explains why the Chinese gold market will continue to expand, irrespective of short-term blips in the economy, and calculates that China’s middle class will grow by another 200 million people in the next six years, taking the total in the middle-income bracket to 500 million. This is the same story as the prior Bloomberg piece, but with a slightly different spin. This version, filed from Johannesburg, was posted on the miningweekly.com Internet site yesterday. I thank reader Richard Murphy for finding it for us. |

| Wall Street Journal Spins a Gold-Bullish Report to Bearish Posted: 16 Apr 2014 02:22 AM PDT China's appetite for gold is waning after a decade-long buying spree, suppressed by the country's economic slowdown and constrained credit markets. Demand in the world's biggest gold consumer is likely to stay flat in 2014, according to estimates from the World Gold Council. Gold demand in China has expanded every year since 2002, when it declined, according to the industry group, whose forecasts are closely watched in the gold market. Decelerating Chinese gold demand could threaten the recent recovery in gold prices, some investors and analysts say. |

| Lawrence Williams: Chinese Take-Away – WGC Study Leaves Many Questions Unanswered Posted: 16 Apr 2014 02:22 AM PDT Further, although this report deals specifically with Chinese demand, the general urbanisation and earnings growth prevalent among the whole Asian gold-oriented populace – which hugely exceeds that of China alone – will also have a similar impact. Gold demand will be increasing hugely so where is the supply going to come from? And supply shortfalls will ultimately result in price increases – perhaps very substantial ones, but maybe not quite yet. As gold bulls will be only too aware, such factors may take a long time to come to fruition and gold investment has to be seen as for the long term. It cannot be relied upon for short-term gains. That is very much the way the Asian market views it and ultimately – unless there is a total sea change in the way this sector views it – gold will undoubtedly prove perhaps the best asset class of all, particularly as the East begins to dominate global trade and finance as it surely will. Other assets will wax and wane but gold, which has stood the test of time through all kinds of political and financial upheavals over hundreds of years, will likely continue to do so in the years ahead. Yes, one of these days the gold price will be allowed to rise to something resembling a fair market supply vs. demand price, but as Lawrie is more than aware, it will only happen with the blessing of JPMorgan et al.---and the rest of short sellers of last resort in the paper precious metal market. This commentary was posted on the mineweb.com Internet site yesterday. |

| Koos Jansen: Shanghai Gold Exchange Withdrawals Equal Chinese Gold Demand, Part 3 Posted: 16 Apr 2014 02:22 AM PDT Gold researcher and GATA consultant Koos Jansen tonight provides his most detailed review yet of China's gold demand and explains why he thinks it is not as much as recently estimated by GoldMoney research director Alasdair Macleod. |

| Hardly a Mention of Central Banks in Financial Times Report on London Gold Fix Posted: 16 Apr 2014 02:22 AM PDT The fix remains the global gold benchmark, used by miners, central banks, jewellers and the financial industry to trade gold bars, value stocks and price derivative contracts. The original five bullion dealers have been replaced by five banks: HSBC, Deutsche Bank, Scotiabank, Barclays, and Société Générale. But the process and traditions are little changed; had Rothschild not sold its fixing seat in 2004, the members might still be meeting in its oak-panelled boardroom with small Union Jack flags on their desks, rather than via conference call. To supporters of the gold fixing, its longevity is a mark of its efficiency and utility. To a growing group of critics, however, the benchmark is opaque, old fashioned and vulnerable to market abuse. Pressure to reform is coming from several directions. Since uncovering evidence of alleged abuse by bankers of the Libor and forex benchmarks, regulators have been scrutinising other big financial benchmarks for signs of weakness. The German watchdog BaFin has requested documents from Deutsche Bank, which has put its seat up for sale, as part of a precious metals market review. Academics have questioned the fix's fairness and suggested possible collusion. Smelling blood, US lawyers launched at least three class action suits in March alleging rigging. From being an asset of considerable prestige, a fixing seat may be turning into a liability. This longish Financial Times story from Monday---which is long on drivel and short on substance---was posted in the clear on the gata.org Internet site yesterday---and it's not worth reading, at least in my opinion. |

| Gold attacks the psychological barrier – Analysis - 16/04/2014 Posted: 16 Apr 2014 02:05 AM PDT economies |

| Ichimoku Cloud Analysis: GBP/USD, Gold Posted: 16 Apr 2014 02:00 AM PDT fxstreet |

| Gold Price Analysis- April 16, 2014 Posted: 16 Apr 2014 01:05 AM PDT dailyforex |

| CHARTS - Gold and Silver Plunge, Crude Oil Vulnerable Ahead Of Inventories Data Posted: 16 Apr 2014 01:00 AM PDT dailyfx |

| Fresnillo says gold down but on track to meet guidance Posted: 16 Apr 2014 12:45 AM PDT reuters |

| Critical Level For Silver, That Needs To Holds Here Or... Posted: 16 Apr 2014 12:25 AM PDT investing |

| World Gold Council forecasts 35% growth in Chinese gold demand Posted: 16 Apr 2014 12:10 AM PDT The economic slowdown in China will not hit demand for gold says World Gold Council managing director, Far East Albert Cheng who says demand will grow by 35 per cent over the next four years. He discusses China's gold market and what's driving the country's demand talking to Rishaad Salamat on Bloomberg Television's ‘On The Move Asia’… |

| Why shorting the Aussie dollar looks a winning trade on China’s slowdown Posted: 15 Apr 2014 11:59 PM PDT All of the statistics coming out of China so far this year have been weaker than expected. How can traders short this market? Geoffrey Yu, FX strategist at UBS, discusses why shorting the Aussie dollar is an attractive way to make money out of a weakening Chinese economy… |

| 2014-P Great Smoky Mountains 5 Oz Silver Coin Nears Sellout Posted: 15 Apr 2014 11:50 PM PDT coinnews |

| 2014 Proof Gold Eagle Coin Prices May Rise Posted: 15 Apr 2014 11:50 PM PDT coinnews |

| Bullion and Energy Market Commentary Posted: 15 Apr 2014 11:50 PM PDT google |

| Don Quijones: “Uncreative” Destruction – The Troika’s Hostile Takeover of Europe Posted: 15 Apr 2014 09:50 PM PDT By Don Quijones, a freelance writer and translator based in Barcelona, Spain. His blog, Raging Bull-Shit, is a modest attempt to challenge some of the wishful thinking and scrub away the lathers of soft soap peddled by our political and business leaders and their loyal mainstream media. Originally published at Testosterone Pit After four long years of "service", the Troika's frontline role in sustaining and exacerbating crisis conditions in Southern Europe is finally beginning to attract some of the attention it deserves. In my home city of Barcelona, a coalition of left-wing groups recently held an event to raise awareness about the Troika's "neo-liberalisation" of Southern Europe. Even Europe's shoe-shine institution, the European Parliament, has promised to launch an enquiry into the Troika's operations after the European elections in May. Since its inception at the beginning of Europe's sovereign debt crisis, the unholy alliance between the IMF, the European Central Bank and the European Commission has visited untold damage on the economies and societies of a long and fast-growing list of countries. A Three-Pronged AttackIn many ways, the conditions set by the Troika in the EU bail-out economies resemble those that a conquering army might impose on a country it occupies. The government of Greece, for example, has been reduced to mere vassal status as the country's welfare state and public services are stripped to the bone by corporate vultures. As the Chilean writer and political activist Luís Sepulveda said in an interview for the Greek documentary Catastroika, "What is happening in Greece is terrible. Democracy was born there and the international financial system now decides it should die there as well." As part of that ongoing process, the costs of privatisation have been borne almost exclusively by cash-starved Greek taxpayers, while the profits – initially estimated to be worth some 50 billion euros – go to the international creditors. Entire industries, from rail to water, ports and airports, roads and healthcare – industries that are meant to serve a vital public purpose and have received decades and decades worth of public investment – are now being sold off at car boot-sale prices to private international corporations and investment funds. And it's not just happening in Greece. Even in countries yet to have received a bailout, pressure is building to privatise state assets. In Italy, a referendum on water privatisation was held in June 2011. Fifty-seven percent of the population turned out, with 97 percent of voters rejecting the proposal outright. It was as decisive a statement of the popular will you're likely to find; yet it was also, as is so often the case with national referendums in Europe these days, the wrong answer. Undeterred by the strength of popular opposition, the Troika continued applying pressure on the Italian government to privatise state water companies, but Italy's geriatric playboy-premier Silvio Berlusconi refused to buckle. Not that it mattered: A year later, after becoming too much of a liability to the European project, Berlusconi was toppled in a lightning-fast Brussels-orchestrated coup d'état. His replacement, Mario Monti, a life-long banker with close ties to the European Commission, Goldman Sachs and the elitist think tank the Trilateral Commission, was, as you'd imagine, somewhat more amenable to the Troika's desires. It was a perfect example of Marxist philosopher Slavoj Žižek's maxim that "when things get serious in today's world, the 'experts' take over.'" In short order Monti received a letter from former and current ECB chairmen Jean Claude Trichet and Mario Draghi insisting on the privatisation of Italy's water distribution rights. The fact that such a proposal had already been point-blank rejected by the Italian people and was effectively illegal under the Italian constitution mattered not a jot. Since then, attempts have been made – some successful – to privatise water districts in Italy, including in the country's capital, Rome. In Spain, meanwhile, the Rajoy government has been more than happy to meet the Troika's demands to privatise social housing (selling off huge batches to international investment funds and Wall Street banks) and public hospitals (albeit with somewhat less success, thanks in large part to the strength of public opposition). The government has also removed public subsidies of basic utilities, including gas and electricity, resulting in sharp increases in the basic cost of living. The same story is playing out across Europe's bailed-out nations. The losers are by and large the poor and middle classes, while the beneficiaries are the same as always: the world's largest multinational corporations and (yeah, you guessed it) banks. Protecting the Banks, At All CostThat the Troika should put the banks first (and for that matter, second, third and fourth…) should hardly come as a surprise. After all, two of the Troika partners – the ECB and IMF – are essentially little more than puffed-up bankster henchmen, while the other, the Commission, is in hock to Brussels-based lobbying groups. Through its actions of the last 40 years, the IMF has amply shown on which side its bread is buttered. A perfect case in point was the 1994 bailout it led of Mexico in the wake of the Tequila Crisis. As Lawrence Kudlow, then economics editor of the conservative National Review magazine, asserted in sworn testimony to Congress, the ultimate beneficiaries of the bailout were neither the Mexican peso nor the Mexican economy:

In effect, money lent by the IMF, BIS and US Treasury Department was speedily channeled via the recipient country's government and struggling banks to the coffers of some of the world's largest private financial institutions. The money barely touched Mexican soil, yet the debt remains – indeed, thanks to the wonders of compound interest, continues to accumulate – to this day. This is essentially the financial crisis management model now being applied across almost all Western economies, with the notable exception of Iceland. In Greece, a staggering 300 billion euros worth of unpayable debt has been ploughed into its moribund economy. And just as happened in Mexico, a risible fraction of that money has actually stayed on the ground. According to a paper published by the main Greek opposition party, SYRIZA, titled "The Greek Rescue Plan: A Humanitarian Crisis," a staggering 98.4 percent of the bailout funds have been diverted back to Greece's lenders, rescuing primarily French and German banks. That's right: a pitiful 1.6 percent of the European Stability Mechanism's money is actually making it into the real Greek economy. The money moves to richer shores but the debts grow. What's more, while workers and pensioners are overtaxed and suffer the consequences of severe spending cuts, the Troika and the government have done pathetically little to tackle the real problem of tax evasion. According to SYRIZA, government authorities found that 6,575 offshore companies owed hundreds of millions of euros in taxes. Guess how many off those companies have actually been called by the authorities to settle their accounts? Thirty-four – that is, 0.5 percent of them! In sum, the main beneficiaries of Greece's successive bailouts have been French and German banks, not to mention Greece's own financial, business and political elite. As for Portugal's bailout, the main beneficiaries have been Spanish banks, while in the case of Ireland's "rescue", UK and German banks have taken home the lion share of the spoils. All in all, trillions of euros of new debt — debt that multiple generations of Europeans are now on the tab for — have been conjured out of thin air and pumped through national finance ministries. And for one purpose: to save the continent's biggest banks from the consequences of their own reckless malinvestments. While the people of Europe are told that they cannot afford to pay for even the most basic of public services, including the distribution of water, staggering sums of money are wasted on walking-dead financial institutions. A New Age of TechnocracyIf events proceed as long planned in the backrooms of Brussels, the Troika's role will be a temporary one, consisting primarily of holding the fort whilst the European Union completes its final stage of metamorphosis, from a trading and currency bloc to a fully-fledged banking, fiscal and political union. By then, a new age of technocracy will be upon us as a newfangled system of top-down, heavily centralised political and economic governance, by, of and for the economic elite, is enshrined into law. As Barry Ritholtz recently noted on his blog, one of the most disruptive paradigms of our age has been the ruthless supplantation of the individual in the political process by corporate money, legislative influence, campaign contributions, even free speech rights:

While Ritholtz's argument was made with specific reference to U.S. politics, I believe it has just as much, if not more, bearing on the current European context. After all, European centre-left parties are arguably the strongest cheerleaders of the European project, despite the tremendous harm it is doing to their traditional constituencies. What's more, the pace of neoliberalisation of the European economy is, if anything, even more ferocious than it is in the U.S. As the attention of the Troika begins to shift northwards, to France and beyond, as it inevitably will, traditionally divided Europeans from across the political spectrum face a conundrum of existential proportions: do we unite and fight to save what we have, or do we roll over for the corporate steamroller? With a report just out by Save the Children that 28 percent of European children (in particular those living in countries subject to the Troika's bail-out regimes) are now at risk of poverty and social exclusion, time is of the utmost essence. If the people of Europe want to safeguard European democracy from the Troika's whirlwind of "uncreative" destruction, they will have to act soon. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment