saveyourassetsfirst3 |

- Gold clear benefactor should US, EU and Russia wage financial war

- ECB to weaken Euro – gold should benefit

- Shocking Facts About The Deindustrialization Of America That Everyone Should Know

- Will Sunridge Gold Be Able To Emulate Nevsun's Success?

- The outlook for gold and its place in the global economy

- What's Next For The Kiwi?

- Jason Hamlin Interview with Kerry Lutz – Correction Is Ending: Gold And Miners To Go Higher

- Asset Prices Can Collapse at Any Time-Axel Merk

- Faber On Gold Manipulation, Fed Gold and Importance Of Not Storing Gold In U.S.

- Faber suspects gold is manipulated; Martenson itemizes the case for owning it

- An Update on Gold

- Why Was China Carrying Gold?

- "Disappointing" Payrolls Number Spurs Gold Buying

- Natixis sees bearish Gold, Silver prices in 2014

- Natixis sees bearish Gold, Silver prices in 2014

- Short-Covering Fuels Gold Rally

- Inverse Head & Shoulders for Gold Miners in play

- JIM WILLIE: GOLD STANDARD WILL RETURN- IT IS COMING. IT WILL SHAKE THE WORLD

- Jim Willie: Gold Standard Will Return- It is Coming. It Will Shake the World

- An Average Joe Asks: Should I Bet the House on Silver?

- Middle Class Extinction: 9 Of The Top 10 Occupations In US Pay An Average Of Less Than $35k A Year

- Market Report: Quarter-end distortions in the gold market

- Underground Commerce is the Real Economy

- Faber: Gold Good Value, Diversify With All Precious Metals – Safest To Store In Singapore

- Increased gold ATMs in India will boost gold trading

- Faber On Gold Manipulation, Bitcoin Risk and Importance Of Not Storing Gold In U.S.

- Alasdair Macleod: China is taking far more gold than Western analysts think

- SDB’s Lowest Silver Premiums Ever! 100 oz Silver OPM Bars 59 Cents Over Spot, ANY QTY!

- 2014: Another case of the runs?

- Gold pares weekly decline in London before U.S. jobs data

- Pakistan Rejects IMF’s Call to Sell Its Gold Reserves For FX Cash

- ECBs deflation paralysis drives Italy, France and Spain into debt traps

- Four King World News Blogs

- Mark Hulbert: Gold Hasn't Hit Bottom Yet

- Marc Faber: "How Could you NOT Own Gold?"

- The dirt on India's latest gold-smuggling seizures

- Pakistan rejects IMF's call to sell its gold reserves for FX cash

- Pakistan rejects IMFs call to sell its gold reserves for FX cash

- Gold moved lower after finding resistance at 1295 (R1)

- How to Get Beyond Private Equity’s Parasite Economy

- Gold Price Analysis- April 4, 2014

- Comex Gold (GC) Futures Technical Analysis – April 3, 2014 Forecast

- Gold Prices See no Relief in Sight as Further Lows likely

- Gold Holding on to 1280 for Dear Life

- Gold Chart Setup Hints at Bounce Ahead, US Dollar Drifting to Range Top

- Commodities trading outlook: gold, silver and copper futures

- Metals Pack Fundamental Analysis April 4, 2014 Forecast – Silver ...

- King Ibn Saud’s 35,000 British sovereigns – Gold’s historic undervaluation versus oil

- April 4, 1944 : Nazi Gold: The Merkers Mine Treasure

- The Gold short term cycle direction is not so clear going into NFP on Friday morning

| Gold clear benefactor should US, EU and Russia wage financial war Posted: 04 Apr 2014 12:29 PM PDT Julian Phillips looks at the potential consequences of an economic war over Crimea and Ukraine, and while deemed unlikely, says investors should take precautions nonetheless. |

| ECB to weaken Euro – gold should benefit Posted: 04 Apr 2014 12:12 PM PDT Expect a falling Euro – not to be confused with a rising dollar. Traditionally, traders move the gold price with the euro and contrary to the dollar. This is set to change and is doing so today. |

| Shocking Facts About The Deindustrialization Of America That Everyone Should Know Posted: 04 Apr 2014 12:00 PM PDT

How long can America continue to burn up wealth? How long can this nation continue to consume far more wealth than it produces? The trade deficit is one of the biggest reasons for the steady decline of the U.S. economy, but many Americans don’t even understand what it is. Basically, we are buying far more [...] The post Shocking Facts About The Deindustrialization Of America That Everyone Should Know appeared first on Silver Doctors. |

| Will Sunridge Gold Be Able To Emulate Nevsun's Success? Posted: 04 Apr 2014 11:52 AM PDT In following the remarkable success story of Nevsun Resources (NSU) and its Bisha mine we have certainly also become aware of Sunridge Gold (OTCQX:SGCNF) who is developing a very similar project in Eritrea. Our readers have asked for our opinion on this junior developer on several occasions, and we are happy to comply with the present article. In order to provide some context we will be making frequent comparisons betweeh Nevsun's Bisha mine and Sunridge Gold's Asmara project. Sunridge Gold is currently in the process of organizing financing for the proposed operation near the capital city of Asmara in Eritrea. A feasibility study on the Asmara project was published in May 2013 outlining the technical and financial boundary conditions for the project, followed by an update containing clarifications on the tax regime and associated improvements on the post-tax value of the project. Permitting is also ongoing. The share |

| The outlook for gold and its place in the global economy Posted: 04 Apr 2014 11:47 AM PDT An examination of recent technical, political and economic factors affecting the gold price and its future. |

| Posted: 04 Apr 2014 11:00 AM PDT The New Zealand Dollar, otherwise known as the Kiwi, has rallied smartly, up about 650 pips between February and April 1. Since achieving the high on April 1, the NZDUSD has retreated. It is currently trading around .8540. During this period, there was significant growth in the outstanding OI. From a low of 23K contracts at the beginning of the period, it went to 33K in the last report. Money flowed into the market, expanded the total OI, and took the market higher. During this time frame, there was continued negativity toward the other commodity currencies, and short positions were taken in the Australian and Canadian Dollars. The largest NZ exports are comprised of milk and milk products, sheep and goat meat, crude oil, butter and wool, which are all commodities. Though the Kiwi is a commodity currency, the specs bought rather than sold the Kiwi. During this period there |

| Jason Hamlin Interview with Kerry Lutz – Correction Is Ending: Gold And Miners To Go Higher Posted: 04 Apr 2014 10:57 AM PDT I had the pleasure to chat with Kerry Lutz of the Financial Survival Network yesterday. We spoke about precious metals, technical support levels, improving fundamentals, the battle over Ukraine, increasing exposure of the gold price manipulation, price discovery moving from West to East, strong demand from China, the rise of Bitcoin and much more. Click [...] This posting includes an audio/video/photo media file: Download Now |

| Asset Prices Can Collapse at Any Time-Axel Merk Posted: 04 Apr 2014 10:55 AM PDT

Money manager Axel Merk thinks new Fed Chief Janet Yellen can't do much to improve the labor market even though she claims she's most interested in helping Main Street, not Wall Street. Merk says, "Yellen is from Berkley, our neighborhood, and it's all about warm and fuzzy feelings. Ultimately, of course, there is only so much [...] The post Asset Prices Can Collapse at Any Time-Axel Merk appeared first on Silver Doctors. |

| Faber On Gold Manipulation, Fed Gold and Importance Of Not Storing Gold In U.S. Posted: 04 Apr 2014 10:32 AM PDT gold.ie |

| Faber suspects gold is manipulated; Martenson itemizes the case for owning it Posted: 04 Apr 2014 10:32 AM PDT GATA |

| Posted: 04 Apr 2014 10:12 AM PDT It's been a while since we looked at Gold in a vacuum. We've focused on the gold stocks as they have led the sector. We covered Silver last week. Gold is more interesting because in its current state its more difficult to draw a strong conclusion. One could look at the evidence and go either way. Today Gold is back above $1300. Is this the start of a run to and past $1400? I don't know. My gut says more range bound activity is ahead. First lets take a look at the Gold bear analog chart. This includes the major bears of the past 35 years, excluding a super long (1987-1993) bear that was very mild in its price decline. The Gold bear analog isn't quite as black and white as the previous analogs shown for Silver and the gold stocks. One could look at this chart and surmise that the bear has longer to go while others could say it has gone far enough and deep enough already.

At the June 2013 and December 2013 lows, Gold was very close to plunging to that final low as it did in 1982 and particularly in 1976 and 1985. The fact that it didn't happen and the fact that this bear has dragged on renders it less likely that we get a final plunge. The longer a bear market is, the less severe it tends to be in price and the less likely it terminates with a final plunge. For example, the 1996-1999 bear declined only 3% in its last 11 weeks. In other words, if this bear is to make a new low and break $1200 on a weekly basis, I doubt it plunges from there as much as people would think. There aren't as many players left in this market as there were a year ago, two years ago and three years ago. Aside from the typical Gold in US$ chart it's always important to consider Gold in the context of various currencies and the equity market. In the chart below we plot Gold against a foreign currency basket and against the S&P 500. The first plot shows that Gold hasn't made a double bottom but is still in a series of lower lows and lower highs. The positive is Gold is has rallied up to trendline resistance several times already. I think Gold will be in position to break the trendline by the end of summer. If that happens, the bear market is over.

Meanwhile, Gold has obviously struggled against the S&P 500. We all are aware of the negative correlation between the two markets which started just after Gold peaked in August 2011. If Gold is to begin a new bull market in earnest then it really needs to reverse itself against the S&P 500. The ratio has clear resistance at 0.75 which is important resistance dating back to July 2013. The ratio has traded below 0.75 for the past five months, a period in which many stocks rebounded strongly. If the ratio can move back above 0.75 it would make a very strong case for Gold's bottom being in place. We just don't have enough evidence to know at this point. I continue to maintain that the mining stocks (and definitely the juniors) have bottomed. GDXJ and SILJ would have to decline 24% to test their daily lows. GLDX would have to decline 27%. The mining stocks led the move down and have led this fledgling recovery. I think they continue to lead. However, it appears that they won't sustain a rebound and push much higher until after the metals have bottomed. My conclusion on Gold is if it breaks to a new low then a final bottom is imminent. If it breaks above $1400 and the resistance in the aforementioned charts, then it has bottomed. Yet, Gold and the mining stocks could continue to be range bound for several months and deny us an immediate answer. At worst it would bring us much closer to the end and the start of a new bull market. Rick Rule, who was very prescient during the recent downturn recently stated that he thinks we are seeing a saucer type bottom and that 12 to 18 months from now we will be in a rip roaring bull market. Consider that it takes an uptrend to develop to create the momentum that leads to the rip roaring part. I believe we have no more than several months left to accumulate the best stocks which are positioned to benefit from the coming resumption of the secular bull market. If you'd be interested in learning about the companies poised to outperform, then we invite you to learn more about our service. Good Luck! Jordan Roy-Byrne, CMT The post An Update on Gold appeared first on The Daily Gold. |

| Posted: 04 Apr 2014 09:45 AM PDT

As with copper, the Chinese are using gold as a convenient way to work around an obstacle imposed by their government. They just want to borrow at the best interest rate. Gold works even better than copper, especially as it may have a more reliable contango once you get past the front-month. The fact of [...] The post Why Was China Carrying Gold? appeared first on Silver Doctors. |

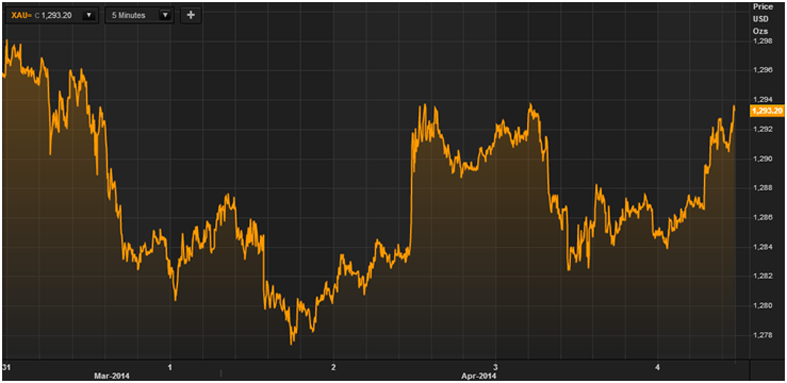

| "Disappointing" Payrolls Number Spurs Gold Buying Posted: 04 Apr 2014 09:28 AM PDT And the number of new jobs created for the month of March is... drum roll please... Disappointing. With the market looking for something north of 200K, it didn't get it. Up started the talk of a halt to any interest rate rise next year. And with that, gold was off to the races as back down went interest rates with buyers coming back into the Treasury markets. The yield on the Ten Year note fell to 2.737% as I type these comments. For me, it is really a rather simple concept - gold will move north as US interest rates move south and gold will move south as US interest rates move north. That, for the immediate moment, is what is driving the gold price even more so than the actual movements of the US Dollar. The Dollar was initially weaker on the employment number news but after traders began attempting to decipher exactly what ECB President Draghi was saying about the lack of inflation pressures over there and the possibility of the ECB's own version of Quantitative Easing, the Euro came under some pressure. That floated the Dollar a bit higher against the Euro but it is basically sitting here doing nothing at the moment. The strength in the forex markets was more among the Yen ( here we go with that safe haven trade again???) and the Canadian Dollar. The Aussie was also higher. Traders seem to have mixed feelings about the greenback with some yapping about the employment numbers, while disappointing, were not that bad. What to take away from all this? - more uncertainty as once again each piece of economic data will dictate the day to day price action across so many of these markets. There is just not much in the way of conviction. This is what we get when we have near constant interference from Central Bankers. I have said it in the past and will say so again, the source of so much of the wild volatility we are seeing in the market place these days is Central Bank activity. When the investment/trading world spends most of its time parsing statements from Central Bankers rather than studying real world fundamentals, the result is extreme sensitivity to comments from these monetary masters. Then again, trying to understand the fundamentals in an economic world created by Central Bank actions ( QE/bond buying programs) or government stimulus programs ( think China) is at times an exercise in futility. Another side note, the much respected analytic firm Economic Cycle Research Institute released their US future inflation gauge numbers this morning. It showed a decline to 103.1 in March from a 104.4 reading in February. Interpretation? There are no concerns about inflation pressures. This is what makes me expect any rallies in gold to attract selling pressure. Back to the jobs number and the impact on the gold price in today's session. Gold is currently trading up 1.6% at $1305 as I type this. It has surged through psychological resistance at the $1300 and recaptured that handle. Of course, do not look for any talk about manipulation of its price today even though a small drop in interest rates in the US and a weak but relatively stable Dollar hardly justifies a move of this extent in the yellow metal. A short covering rally due to nervous weak-handed bears is pretty exciting but a key factor for SUSTAINED higher gold prices is whether or not NEW LONGS/BULLS want to commit in size to this market. So far that has not been the case. These occasional short covering rallies are exciting and stir up the "gold is going to the moon" talk every single time they occur but as we have seen, they do not tend to last. Only if gold can generate more new buying than short covering does it have a chance at starting any kind of sustained uptrend. It is still a traders' market and that means short-term oriented guys can work this market and take advantage of the price swings but beyond that, extrapolating about lofty upside price targets is premature in my view. Incidentally, I am sure most of the readers have seen or are aware of all the chatter about the HFT crowd as a result of that "60 Minutes" interview last Sunday and the subsequent dust up we have all had the pleasure of watching over at CNBC. Many in the GIAMATT crowd ( Gold is Always Manipulated All The Time) have seized about this story to justify their contention that gold is a rigged market just like they have been saying for many years. Here is the problem with that rationale - on the surface, yes, it looks like they have been vindicated. But this is important - it is a FAR, FAR cry to rightly discuss the impact from the HFT crowd, a crowd which I feel has no useful purpose whatsoever in our markets other than, like ticks, to suck the juices out of the host and enrich themselves in the process - than - to draw the illogical conclusion that therefore the gold price is rigged by the US government and the Fed and Treasury. After all, the claim is that every single stupidly named "flash crash" lower in gold is the result of nefarious government forces colluding to artificially shove the price of gold lower and prop up the US Dollar. But, these folks, some of whom I count as friends, always point to the BULLION BANKS, the JP Morgans, the Goldman Sachs, etc. as the forces suppressing the gold price at the behest of the feds. In their mind, they, not the HFT crowd, are the enemy of all common decency. They are the evil market riggers. The report about market rigging that is currently the talk of trading town is the High Frequency Traders doing their thing, not the bullion banks, but proprietary funds especially those front running orders and getting an unfair advantage in the markets. I wanted to go on record about that because it seems to me that one cannot have it both ways. Here it is in a logical form: PREMISE: The gold market is manipulated by the government using their proxies, the bullion banks, especially JP Morgan and Goldman Sachs to regularly "bomb" the gold market lower and artificially suppress the price. AXIOM: The HFT funds engage in activities that involve front running orders coming into the electronic pit and skimming pennies out of every market and doing so thousands of times over and over again. CONCLUSION or INFERENCE: Gold is manipulated by the federal government. Do you see the fallacy in this argument being made by the GIAMATT crowd? Now, if you want to talk about gold prices getting slammed lower by big orders coming in from hedge fund computers, which do not employ, scale up or scale down tactics but rather are seemingly all in or all out, then we can talk about that but to infer a manipulated gold price based on well-needed exposure of HFT activity is a big stretch. It's more faith than logic. Back to the charts however... Notice that gold bounced right near the critical $1280 level. It needed to hold there to prevent a much sharper fall and it has done so. That is what has spooked some of the shorts and why they are furiously covering. At this point, the market is maintaining its strength of the day and looks poised to end up near the session highs ( that could obviously change ) but if it can hold above $1300 to end the week, the bulls will have dodged a bullet and can thank that disappointing payrolls number for bailing them out. Going into next week, with this strong close, it should set up a test for the next resistance level WITHIN THIS BROAD TRADING RANGE near the $1320 level. The ADX remains heading lower, again, revealing the lack of a definitive trend in this sideways moving market. While bears recently were able to seize control within this range, the +DMI is threatening an upside crossover of the -DMI signaling the bulls might be back in the driver's seat for a while. Back and forth we go. More later as time permits... |

| Natixis sees bearish Gold, Silver prices in 2014 Posted: 04 Apr 2014 08:58 AM PDT In 2014, Natixis believes that economic improvement in the US along with a slow-down in central bank and western investment demand will help drive the average price of gold and silver to lower levels than in 2013. |

| Natixis sees bearish Gold, Silver prices in 2014 Posted: 04 Apr 2014 08:58 AM PDT In 2014, Natixis believes that economic improvement in the US along with a slow-down in central bank and western investment demand will help drive the average price of gold and silver to lower levels than in 2013. |

| Short-Covering Fuels Gold Rally Posted: 04 Apr 2014 08:50 AM PDT fxempire |

| Inverse Head & Shoulders for Gold Miners in play Posted: 04 Apr 2014 08:50 AM PDT wallstreetsectorselector |

| JIM WILLIE: GOLD STANDARD WILL RETURN- IT IS COMING. IT WILL SHAKE THE WORLD Posted: 04 Apr 2014 08:43 AM PDT  An important backlash is coming to the perverse USFed monetary policy. An urgent call for global action has been seen in the G-20 and BRICS nations. An important backlash is coming to the perverse USFed monetary policy. An urgent call for global action has been seen in the G-20 and BRICS nations.The Iran sanction workarounds are to serve as the prototype for gold trade settlement. Shanghai will set the oil price in Yuan terms. China will insist on making oil payments in their own Yuan currency. Russia will service the oil demands to Europe and Asia The Saudis will comply with Yuan payments and any other major currency in payment. OPEC will fade while the NatGasCoop will rise under Gazprom leadership Europe is caught in the middle, but will eventually turn to Yuan and Ruble payments for oil shipments. The death of the Petro-Dollar is in progress. Shock waves will force a new Split Scheiss Dollar. The birth of the Eurasian Trade Zone is nigh. The Gold Standard will return, not in bank transfer platforms or currency trading platforms, but in peer-to-peer transactions made in settlement. The world demands a new payment system, an alternative to the deeply flawed USD-centric current system. Even effective viable barter systems are to emerge. It is coming. It will shake the world. Click here for the latest Hat Trick Letter on The Return of the King Gold Standard: |

| Jim Willie: Gold Standard Will Return- It is Coming. It Will Shake the World Posted: 04 Apr 2014 08:37 AM PDT

An important backlash is coming to the perverse USFed monetary policy. An urgent call for global action has been seen in the G-20 and BRICS nations. The Iran sanction workarounds are to serve as the prototype for gold trade settlement. Shanghai will set the oil price in Yuan terms. China will insist on making [...] The post Jim Willie: Gold Standard Will Return- It is Coming. It Will Shake the World appeared first on Silver Doctors. |

| An Average Joe Asks: Should I Bet the House on Silver? Posted: 04 Apr 2014 08:01 AM PDT

Should I literally bet the house on silver? I was recently faced with this decision. Here is what I chose and why: By BILL RICE, JR. March 26, 2014 A life event recently tested how strong my convictions are on the question of where silver and gold prices are headed in the [...] The post An Average Joe Asks: Should I Bet the House on Silver? appeared first on Silver Doctors. |

| Middle Class Extinction: 9 Of The Top 10 Occupations In US Pay An Average Of Less Than $35k A Year Posted: 04 Apr 2014 08:00 AM PDT

According to stunning new numbers just released by the federal government, nine of the top ten most commonly held jobs in the United States pay an average wage of less than $35,000 a year. When you break that down, that means that most of these workers are making less than $3,000 a month before taxes. And [...] The post Middle Class Extinction: 9 Of The Top 10 Occupations In US Pay An Average Of Less Than $35k A Year appeared first on Silver Doctors. |

| Market Report: Quarter-end distortions in the gold market Posted: 04 Apr 2014 07:30 AM PDT Finance and Eco. |

| Underground Commerce is the Real Economy Posted: 04 Apr 2014 07:00 AM PDT

As the deadline for filing yearly income taxes is rapidly approaching, businesses especially hard pressed to make a profit in a depressed economy struggle with their tax compliance. Reporting legitimate deductions and costs is the easy part. When you are losing money, disclosing a diminished income stream based upon lower margins, is not a difficult [...] The post Underground Commerce is the Real Economy appeared first on Silver Doctors. |

| Faber: Gold Good Value, Diversify With All Precious Metals – Safest To Store In Singapore Posted: 04 Apr 2014 06:59 AM PDT Faber discussed the importance of not owning gold stored in the U.S., why Singapore is safest for gold storage, the risks of bitcoin & how small countries should revert to national currencies. The interview can be watched here … Gold fell $3.70 or 0.29% yesterday to $1,286.30/oz. Silver slipped $0.12 or 0.6% yesterday to $19.84/oz.

Gold trimmed a weekly decline as investors await the U.S. payrolls data. A good jobs number could lead to further gold weakness. A disappointing number should lead to safe haven demand on concerns about the U.S. economy. Spot gold was up 0.4 % or $7 to $1,293.00 in afternoon trade in London. It is on track for a third straight week of losses, its longest losing streak since September. It hit a seven-week low of $1,277.29 on Tuesday and remains marginally lower for the week despite the gains today.

Bullishly for gold, U.S. Fed Chair Janet Yellen said this week that sluggish growth in labour markets mean accommodative policies will be needed for some time. Last month, she had said that the Fed may end bond buying this fall and raise borrowing costs six months after that. While speculators continue to play games with the paper or digital price of gold at quarter, half year and year end, physical demand continues to be robust globally and especially in Asia. ANZ Banking Group said yesterday its gauge of demand in China increased last month. China, the world's biggest buyer continues to import huge quantities of gold on a monthly basis and will likely have another record year of imports and total demand in 2014.

Middle Eastern demand remains firm too. Iraq's central bank is diversifying into gold and also has plans to process 11 metric tons for public sale, and will import gold bars to sell to goldsmiths. Video: Dr Marc Faber On The Manipulation Of Gold Prices, Bitcoin Risk, Precious Metal Allocations and Safe Gold Storage In Singapore Why he now believes that gold manipulation is a strong possibility The interview was as informative as ever and Dr Faber took the time to answer some questions from participants. Key thoughts from Dr Faber: On outlook for gold prices: "Gold price essentially should move higher, compared to all these factors I have mentioned, the price is relatively low at the current time." On gold manipulation: "I can believe it. Something is funny. If the U.S. cannot deliver the gold that Germany want to repatriate within one week, the question arises do they actually have the gold or not?" On national currencies versus monetary unions: "I believe the best system in the world would be to have small countries and avoid large sovereign states. If you look at which are the most prosperous countries – they are Singapore, Norway, Finland, Sweden, Switzerland, basically small sovereign states and democracy functions in a small society rather than a large society … I would recommend to any small country to leave the eurozone." On cryto currencies and bitcoin: "I don't know the value of a bitcoin. I own gold because when the system breaks down, I want to have some cash. With a bitcoin, there is a scenario where the system breaks down and you have no internet access and then what is the value of your bitcoin?" The interview can be watched here "Gold Bullion Stored In Singapore Is Safest – Marc Faber"

|

| Increased gold ATMs in India will boost gold trading Posted: 04 Apr 2014 06:35 AM PDT Strategic partnership between Gold Arab Emirate and Gold To Go is likely to strengthen gold and silver trade in the UAE region. |

| Faber On Gold Manipulation, Bitcoin Risk and Importance Of Not Storing Gold In U.S. Posted: 04 Apr 2014 06:02 AM PDT gold.ie |

| Alasdair Macleod: China is taking far more gold than Western analysts think Posted: 04 Apr 2014 06:01 AM PDT GATA |

| SDB’s Lowest Silver Premiums Ever! 100 oz Silver OPM Bars 59 Cents Over Spot, ANY QTY! Posted: 04 Apr 2014 06:00 AM PDT

FRIDAY ONLY *While Supplies Last! SDBullion’s Lowest Silver Premiums EVER! 100 oz Silver OPM Bars 59 Cents Over Spot ANY QTY at SDBullion! Click or call 800-294-8732 to place your order! The post SDB’s Lowest Silver Premiums Ever! 100 oz Silver OPM Bars 59 Cents Over Spot, ANY QTY! appeared first on Silver Doctors. |

| 2014: Another case of the runs? Posted: 04 Apr 2014 05:02 AM PDT Bank of England warns of trillion dollar asset management ‘run’ risk  Will asset managers get the runs in 2014?

|

| Gold pares weekly decline in London before U.S. jobs data Posted: 04 Apr 2014 04:30 AM PDT Gold pared a weekly decline in London after prices held above a technical level. |

| Pakistan Rejects IMF’s Call to Sell Its Gold Reserves For FX Cash Posted: 04 Apr 2014 02:32 AM PDT "We're still at the mercy of JPMorgan et al. This will continue until we aren't" ¤ Yesterday In Gold & SilverThe gold price didn't do much during Far East trading on their Thursday, but was up a couple of bucks by the London open. The selling began at the point---and the low of day came shortly after 12 o'clock noon BST. The gold price rallied a bit from there until a few minutes after the London close---and didn't do much after that. Volume was very light. The high and lows are barely worth mentioning---$1,294.20 and $1,281.90 in the June contract. Gold closed in New York on Thursday at $1,286.80 spot, down $3.10 from Wednesday's close. Volume, net of April and May, was only 95,000 contracts. It was more or less the same chart pattern in silver, as it's brief foray back above the $20 spot price mark got smacked the moment that London opened as well---and that was that. The high and low ticks were recorded by the CME as $20.08 and $19.66 in the May contract. Silver finished the Thursday session at $19.815 spot, down 16 cents from Wednesday. Net volume was pretty light at 28,500 contracts. Both platinum and palladium got sold off a bit as well, but rallied a hair starting late in the morning in London---and both closed up a few bucks on the day. Here are the charts. The dollar index closed in New York on Wednesday afternoon at 80.22---and traded pretty flat until its spike low of 80.16 which came at exactly 8:30 a.m. in New York. The subsequent rally was mostly done by 9:15 a.m. EDT---and the index didn't do much after that. It closed at 80.46---which was up 24 basis points on the day. The gold stocks gapped down a bit at the open, hit their low of that day a minute or so after 10 a.m. EDT---and didn't do much until 2 p.m. Then they rallied into the close---and the HUI cut its loses---finishing down only 0.50%. However, the silver equities got sold down harder, but with a very similar chart pattern---and at their low, were down 2%. But, like the gold shares, the silver shares rallied a bit into the close as well---and Nick Laird's Intraday Silver Sentiment Index closed down 1.54%. The CME's Daily Delivery Report for Day 5 of the April delivery month showed that 60 gold and zero silver contracts were posted for delivery within the Comex-approved depositories on Monday. The link to yesterday's Issuers and Stoppers Report is here. There were no reported changed in GLD---but after a small withdrawal from SLV on Wednesday, there was a deposit of 672,909 troy ounces yesterday. Based on the price action over the last few days, I'd guess that the deposit was made to cover a short position, a fact that won't be known for sure until late this month when the good folks over at shortsqueeze.com issues their report that covers the current reporting period. Over at Switzerland's Zürcher Kantonalbank for the ten day period ending March 31, they reported declines in both their gold and silver ETFs. Their gold ETF was down 4,864 troy ounces---and their silver ETF declined by 134,422 troy ounces. The U.S. Mint had a small sales report yesterday. They sold 1,000 troy ounces of gold eagles---and 3,000 one-ounce 24K gold buffaloes. There wasn't much in/out activity in gold over at the Comex-approved depositories on Wednesday, as only 3,200 troy ounces were reported shipped in---and 208 troy ounces were shipped out. The link to that activity is here. But, as is usually the case, there was much more in/out activity in silver as 591,718 troy ounces were received---and 700,629 troy ounces shipped out. Most of the action was at the CNT Depository---and the link to that is here. It was another day when there weren't that many stories floating around. I have a few more than I did yesterday, but not by a lot. ¤ Critical ReadsGrowing Demand for U.S. Apartments Pushing up RentsThese are good times for U.S. landlords. For many tenants, not so much. With demand for apartments surging, rents are projected to rise for a fifth straight year. Even a pickup in apartment construction is unlikely to provide much relief anytime soon. That bodes well for building owners and their investors. Yet the landlord-friendly trends will likely further strain the finances of many renters. That's especially true for the 50 percent of them who already spend more than one-third of their pay on rent. A 6 percent rise in apartment rents between 2000 and 2012 has been exacerbated by a 13 percent drop in income among renters nationally over the same period, according to a report from search portal Apartment List, which used inflation-adjusted figures. This news item appeared on the moneynews.com Internet site early yesterday afternoon EDT---and I thank West Virginia reader Elliot Simon for today's first story. World Food Prices Jump Again in MarchGlobal food prices rose to their highest in almost a year in March, led by unfavorable weather for crops and political tensions over Ukraine, the United Nations food agency said on Thursday. The Food and Agriculture Organisation's price index, which measures monthly price changes for a basket of cereals, oil seeds, dairy, meat and sugar, averaged 212.8 points in March, up 4.8 points or 2.3 percent from February. The reading was the highest since May 2013. While weather was the most important factor affecting crops, Russia's annexation of Crimea introduced fear into grain markets and the wheat market in particular, and risked damaging trade patterns, a FAO senior economist told Reuters. In March, FAO's cereal price index rose significantly for the second month in a row, jumping 5.2 percent to its highest value since August 2013 due to unfavorable weather in the south-central United States and Brazil, along with uncertainty over grain shipments from Ukraine. This Thomson/Reuters piece is the second article in a row from the moneynews.com Internet site. This one was posted their Internet site very early Thursday morning EDT---and it's also courtesy of Elliot Simon. It's worth reading. Venezuela issues I.D. cards to curtail food hoardingBattling food shortages, the government is rolling out a new ID system that is either a grocery loyalty card with extra muscle or the most dramatic step yet toward rationing in Venezuela, depending on who is describing it. President Nicolas Maduro's administration says the cards to track families' purchases will foil people who stock up on groceries at subsidized prices and then illegally resell them for several times the amount. Critics say it's another sign the oil-rich Venezuelan economy is headed toward Cuba-style dysfunction. Registration began Tuesday at more than 100 government-run supermarkets across the country. Working-class shoppers who sometimes endure hours-long lines at government-run stores to buy groceries at steeply reduced prices are welcoming the plan. "The rich people have things all hoarded away, and they pull the strings," said Juan Rodriguez, who waited two hours to enter the government-run Abastos Bicentenario supermarket near downtown Caracas on Monday, and then waited another three hours to check out. This AP story, filed from Caracas, was posted on their website mid-afternoon EDT on Tuesday---and I thank Casey Research's own Nick Giambruno for passing it around yesterday. ECBs deflation paralysis drives Italy, France and Spain into debt trapsThe European Central Bank has let it happen. Deflation has been running at an annual rate of -1.5pc in the eurozone over the past five months, when adjusted for austerity taxes. Prices have been falling at a pace of 6.5pc in Greece, 5.6pc in Italy, 4.7pc in Spain, 4pc in Portugal, 3pc in Slovenia and nearly 2pc in Holland since September, based on my rough calculations (annualised) of Eurostat monthly data. The rise of the euro against the dollar, yen, yuan and the currencies of Brazil, Turkey and developing Asia, account for some of this imported deflation. Euroland's trade-weighted index has risen 6pc in a year. It is hard to judge at what point deflation becomes embedded in the system. Factory gate prices have been slipping since mid-2012. The pace quickened to -1.7pc in February, the steepest decline since the Lehman crisis. But this time it is not the one-off effect of a financial crash. It is chronic, and more insidious. Ambrose Evans-Pritchard acts like he's attempting to get a job as economic advisor to the E.U. the way he's going on in this column. It was posted on the telegraph.co.uk Internet site late on Wednesday evening BST---and it's the first offering of the day from Roy Stephens. It's worth reading as well. ECB considers printing more moneyThe European Central Bank over the next months will consider various options of 'quantitative easing' - also known as money printing - to counter a very low inflation rate, ECB chief Mario Draghi said Thursday (3 April) in a press conference. "The ECB Governing Council is unanimous in its commitment to using all unconventional instruments within its mandate, in order to cope effectively with risks of a too prolonged period of low inflation," he said. Draghi said quantitative easing was part of a "rich and ample discussion" on Thursday among the central bankers from all 18 eurozone countries on what to do to counter the lower-than-expected inflation. Quantitative easing, popularly known as money printing, is the purchase of financial assets from banks to increase the amount of money in circulation when there is a risk of deflation. Well, it's nice to see the media call a spade a shovel, as money printing it is. This article appeared on the euobserver.com Internet site very early yesterday evening Europe time---and it's the second contribution in a row from Roy Stephens. France sparks E.U. row by asking for more time to make budget cutsFrance sparked a row on Thursday by suggesting Paris renegotiate the “pace” at which it cuts its budget deficit - leading to stark warnings that it was “undermining trust” in the continent’s ability to reform. The European Commission last year granted Paris an extra two years - until 2015 - to reduce its deficit to three per cent of domestic output and said in return the EU expected serious reforms of labour markets, pensions and the welfare state. But in his first day in office after a reshuffle, Michel Sapin, the new finance minister, said that the timetable should yet again be up for discussion. “It is the path, the timing itself which will be discussed, with common interests in mind - this is not about France begging on its knees,” he said. Yes it is, dear reader, as France is already a card-carrying member of the PIIGS. The only thing missing is a new acronym that includes the letter "F". This worthwhile read was posted on The Telegraph's website early yesterday evening BST---and I found it all by myself! Italy cracks down on alleged violent secessionists in VeniceItalian special operations forces arrested 24 suspected secessionists Wednesday who were allegedly planning a violent independence campaign for the wealthy northeastern Veneto region. Police said the group had built an armored vehicle that they intended to deploy in St. Mark's Square in Venice — reminiscent of a 7 ½-hour takeover of the piazza's famed bell tower by secessionists in 1997. TV footage showed the vehicle was a bulldozer with firearms that had yet to be mounted. Italian media reported the secessionists intended to deploy the vehicle on the eve of European Parliamentary elections in May. The crackdown comes days after politicians in Veneto started formal proceedings toward independence, despite constitutional prohibitions. This AP story, filed from Milan, was picked up by the news.yahoo.com Internet site on Wednesday afternoon EDT---and it's the second item of the day from Casey Research's Nick Giambruno. Ukraine 'spillover' could wreck world economy - LagardeInternational Monetary Fund (IMF) managing director Christine Lagarde warns the Ukraine situation could have “broader spillover implications” if it is mismanaged. She was talking to Johns Hopkins University students ahead of the IMF’s spring meeting. Ukraine’s ailing economy, combined with fresh geopolitical tension in Crimea and now US-led sanctions against Russia, have Lagarde worried the consequences won’t be contained regionally, but could have an effect on the global economy. “The situation in Ukraine is one which, if not well managed, could have broader spillover implications,” Lagarde said. Ukraine’s economy is forecast to contract 3 percent in 2014 as it recovers from a tumultuous year which has nearly wiped out its Eurobond market, currency, and national reserves. Inflation is expected to continue to rise, with the IMF predicting 12 percent in 2014. This article appeared on the Russia Today website yesterday morning Moscow Time---and it's definitely worth reading. I thank South African reader B.V. for bringing it to our attention. Russia wants answers on NATO troop movement in Eastern EuropeRussia expects detailed explanations from NATO regarding expanding its military presence in Eastern Europe, said Russian Foreign Minister Sergey Lavrov. The statement comes after NATO bloc announced boosting its military presence in the area. "We have addressed questions to the North Atlantic military alliance. We are not only expecting answers, but answers that will be based fully on respect for the rules we agreed on," Lavrov told reports at a joint briefing with Kazakhstan’s FM Yerlan Idrisov. However, NATO chief Anders Fogh Rasmussen said he had not received any questions from Moscow. He denied that NATO was violating the 1997 treaty on NATO-Russian cooperation by boosting its forces in Eastern Europe. This Russia Today news item showed up on their Internet site yesterday afternoon Moscow time---and it's the second offering in row from reader B.V. Putin 1 - Dimon 0: JPMorgan Un-halts Russian Money TransferYesterday when we reported that a "Furious Russia Will Retaliate Over "Illegal And Absurd" Payment Block By "Hostile" JPMorgan", in which we explained that unlike previous responses to Russian sanctions by the West, which were largely taken as a joke by the Russian establishment, this time Russia is furious, we said that "we certainly can not be the only ones looking forward to the epic battle prospect that is Vlad "Shootin" Putin vs. JP "Fail Whale" Morgan." Alas the title fight lasted for just about a day, and was won, with a technical knock out in the first round, by none other than the former KGB spy who can now add the whale which manipulates all markets to its trophy case which includes about 100 statues of a crushed and beaten John Kerry. Because after shocking the world with its unilateral decision to halt Russian money transfers without a direct order from the administration, Reuters reports that JPM has folded and will process said payment from Russia's embassy in Kazakhstan to insurance agency Sogaz, easing tension after Moscow accused the U.S. bank of illegally blocking the transaction under the pretext of sanctions. In other words, Putin 1 - Jamie Dimon 0. This must read news item showed up on the Zero Hedge website late yesterday morning EDT---and I thank reader M.A. for sending it along. 13 years---and $100 billion after U.S. entry, Afghanistan faces total devastationThe Taliban pre-electoral campaign of bloodshed continues in Afghanistan, as six die in an attack on the interior ministry in Kabul. As the first democratic transfer of power approaches, the country is in terrible shape ahead of the 2014 US pullout. A suicide bomber attacked the interior ministry compound in the capital on Wednesday, just three days before polls open, amid months of increasing violence from the country’s extremist Taliban insurgency. The bomber wore military uniform to avoid detection and security checks, local authorities reported. This, after earlier o |

| ECBs deflation paralysis drives Italy, France and Spain into debt traps Posted: 04 Apr 2014 02:32 AM PDT The European Central Bank has let it happen. Deflation has been running at an annual rate of -1.5pc in the eurozone over the past five months, when adjusted for austerity taxes. Prices have been falling at a pace of 6.5pc in Greece, 5.6pc in Italy, 4.7pc in Spain, 4pc in Portugal, 3pc in Slovenia and nearly 2pc in Holland since September, based on my rough calculations (annualised) of Eurostat monthly data. The rise of the euro against the dollar, yen, yuan and the currencies of Brazil, Turkey and developing Asia, account for some of this imported deflation. Euroland's trade-weighted index has risen 6pc in a year. It is hard to judge at what point deflation becomes embedded in the system. Factory gate prices have been slipping since mid-2012. The pace quickened to -1.7pc in February, the steepest decline since the Lehman crisis. But this time it is not the one-off effect of a financial crash. It is chronic, and more insidious. Ambrose Evans-Pritchard acts like he's attempting to get a job as economic advisor to the E.U. the way he's going on in this column. It was posted on the telegraph.co.uk Internet site late on Wednesday evening BST---and it's the first offering of the day from Roy Stephens. It's worth reading as well. |

| Posted: 04 Apr 2014 02:32 AM PDT 1. John Hathaway: "Despite Pullback This is a Game-Changer For Gold" 2. Art Cashin: "Fed Frustrated, ECB---and the Great Struggle in Japan" 3. Gerald Celente: "West Just Pushed The World One Step Closer to War" 4. Keith Barron: "China to Cause Massive Collapse of Second London Gold Pool" |

| Mark Hulbert: Gold Hasn't Hit Bottom Yet Posted: 04 Apr 2014 02:32 AM PDT Gold has dropped 7 percent since hitting a six-month high March 14, leading some market participants to speculate it may be nearing a bottom. But Mark Hulbert, founder of Hulbert Financial Digest, doesn't see it that way. "Some readers have contacted me to ask if enough gold timers have finally thrown in the towel to persuade contrarian analysts that a low is at hand," he wrote on MarketWatch. "No." While the average newsletter editor who market-times gold is more bearish today than last weekend, "he still is not as pessimistic about gold’s prospects as he was on the occasion of past tradable bottoms," Hulbert wrote. This commentary by Mark was embedded in a story posted over at the moneynews.com Internet site on Wednesday evening EDT---and it's the third and final offering of the day from Elliot Simon. |

| Marc Faber: "How Could you NOT Own Gold?" Posted: 04 Apr 2014 02:32 AM PDT Faber said that gold has been in a correction since then, which isn’t unusual in a money printing environment. On gold at today’s prices, Faber said that “the fact is that gold down is a present from God and I wish it would go lower so I could buy more,” he said. The big proviso Faber added was that he had to physically own coins and bars. He also warned that people would be ‘mad’ to own any asset, including gold, in the U.S. Previously, Faber has said that he favors owning gold in fully allocated gold accounts in Singapore and Switzerland. Jim Rickards said that gold should remain an essential part of diversified portfolios and Mark Faber pointed out that the question should be “how could you NOT own gold?” This commentary includes comments from Jim Rickards as well---and it's worth reading. It was posted on the goldseek.com Internet site on Wednesday---and I thank reader Ken Hurt for sending it our way. |

| The dirt on India's latest gold-smuggling seizures Posted: 04 Apr 2014 02:32 AM PDT Editor's note: Gold smuggling continues to plague India despite official efforts to curb it with reduced tariffs and new enforcement initiatives. Looking back over the past week our correspondent in India reports a series bold smuggling attempts. These seizures surely represent but a small part of the amount of illegal gold that actually crosses the border... April 2: Security personnel at Mumbai's international airport caught a sweeper trying to exit the airport with 5 kilograms of gold. The man was exiting with five gold bars weighing one kilogram each, wrapped inside a plastic bag with a tape over it. Further investigations unearthed a passport and some cash. Since the man was an airport employee, he did not need a passport to gain access to the airport, leading investigators to determine that the man was involved in a gold smuggling cartel, which were using him as a carrier. This very interesting story, filed from Mumbai, was posted on the mineweb.com Internet site yesterday---and it's worth reading as well. |

| Pakistan rejects IMF's call to sell its gold reserves for FX cash Posted: 04 Apr 2014 02:32 AM PDT Pakistan has refused to sell gold worth $2.7 billion, citing national security reasons, as the International Monetary Fund pushes Islamabad to convert the precious metal into cash to build foreign currency reserves, the global lender's report revealed Friday. The report, prepared by IMF staff led by its Washington-based mission chief to Islamabad, Jeffrey Franks, also spills the beans on the "$1.5 billion gift" to Pakistan by "Saudi Arabia" -- the name Prime Minister Nawaz Sharif's government has so far refused to officially share with parliament. According to the report, the State Bank of Pakistan holds more than 2 million troy ounces of monetary gold, having $2.7 billion of value at the market rate. It is not counted in gross international reserves as it is not deemed to be liquid by the State Bank of Pakistan, the IMF says. This must read story, filed from Islamabad last Saturday, was posted on the expresstribune.com Internet site---and I found it embedded in a GATA release that Chris Powell dispatched from Vietnam on their Friday morning. |

| Pakistan rejects IMFs call to sell its gold reserves for FX cash Posted: 04 Apr 2014 02:31 AM PDT GATA |

| Gold moved lower after finding resistance at 1295 (R1) Posted: 04 Apr 2014 01:20 AM PDT invezz |

| How to Get Beyond Private Equity’s Parasite Economy Posted: 04 Apr 2014 01:10 AM PDT Reader Lance N pointed me to an article on private equity by Eric Garland, a trend maven. I must confess that I’m skeptical of that breed (too many of them rely on devising clever buzz phrases to describe leading edge conventional wisdom), but even people who knew the transactions Garland discusses in his post were impressed with his grasp. Garland uses the story of how the tender ministrations of Bain Capital pushed the music big box retailer Guitar Center into the bankruptcy-equivalent of a restructuring as a window into, as he puts it:

We’ve been focusing on the investor side of private equity in our recent posts because its influence and its ability to maintain unheard-of levels of secrecy depends on the belief that long-term investors like pension funds can’t afford not to invest as much as they possibly can, after allowing for liquidity and diversification needs, in PE, because it is widely believed to deliver superior returns. But life insurers who also have long-term investment horizons, are for the most part not large investors in this strategy, because the rating agencies regard it as too risky for them to tie up all that much capital in it (as in they need more liquidity). So if the ratings agencies discourage investment in PE, and life insurers manage to do without it, pray tell why is it perceived to be necessary? The answer, of course, lies in pricing, or more precisely, the aggressive return assumptions that are widely used in defined benefit plans.* And while we continue digging into the details that the private equity industry has worked so hard to shroud in secrecy, it’s important not to lose sight of the real economy consequences of this well-orchestrated wealth transfer scheme. By Eric Garland, a writer and speaker who deals with the megatrends that affect society, economics and national security, with a special focus on the impact on ordinary people. Cross posted from his blog It is the middle of the night between Friday and Saturday, and I am thinking about Guitar Center.

I never paid too much attention to the musical instrument (MI) business in my profession of strategic analysis; it simply does not represent enough cash flow to have significance in national economies. For example, the global MI industry is around $13 billion a year. I used to do high-level analysis of the market for antipsychotic medication, something most people know nothing about, which has the same annual sales revenue in the US alone. My only interest in musical instruments was for pleasure, so when I was suddenly elected The People's Analyst of the Industry, (current salary: $0) I had a lot of catching up to do. After much deliberation, I see the MI industry as a microcosm of every other problem in the global economy. To borrow from the analysis of Thomas Piketty in his brilliant "Capital in the 21st Century," the monied interests of society have expanded their reach such that they can concentrate and dominate almost every area of human endeavor, and the deleterious effects are now evident to all. In the end, this story isn't about a big box music chain, but how a small number of citizens can subvert every product made, every job offered, and every purchase decision – and how we can regain control of our lives, starting with the musical instrument industry. News on Guitar Center's Finances – and What it MeansIf you are a regular reader you know that I have been keeping close tabs on the finances of the Westlake, CA-based retail behemoth. Had their executives never made visits to my Facebook page, I never would have thought that it was worth any research, but my experience is that if you see unusually emotional behavior from technocrats, a bigger story lurks. Confirming my instincts, a perfunctory analysis of the company's finances showed gargantuan debt structure and a liquidity crisis (also known as being broke.) Because the company is/was owned by a holding company created by private equity firm Bain Capital, it was impossible for me to deduce exactly the structure of their ownership and debt covenants. To summarize the story for those who don't have a taste for corporate finance, just imagine you had $65,000 in credit card debt financed at a crappy rate, and that you made around $80,000 a year. Things on the horizon would look bleak, and you would be forced to either change your lifestyle or declare bankruptcy and get a fresh start. As such, irrespective of the contradictions inherent in the big box model and the general draining of wealth from their supposed middle class customers, I figured that these guys would be lucky to make it a few more months. The other shoe dropped a few weeks back when the main holder of Guitar Center's debt, Ares Capital Management, stepped up to take ownership in place of future bond payments. The business media reports this arrangement as an alternative to bankruptcy, which sounds about right. I expected as much, because this model is in a slow death spiral, and the only way to extract the millions of dollars owed will be to run the Bain playbook, only harder and faster. As such, my forecast is for the $500 – 600 million of inventory to be sold at cheap prices while employees and vendors get squeezed for every nickel. This is no different than the past six years of company management, according to my sources, it's just that this time, there is a time-sensitive goal – to get the most money out before the whole thing collapses. The latest update: More details about the Bain-Ares handoff came out around 48 hours ago. They revolve, unsurprisingly, around a restructuring of senior PIK (payment in kind) notes that offered money up front with huge balloon payments on the back end. Under the current deals, GC would owe over $950 million in 2017 alone, an amount that would be impossible to pay off. I was skeptical about any form of refinancing, since the ratings agencies have compared their debt to scratchers tickets. But Ares is charging ahead and is preparing a bond offering to the market despite all the hullaboo:

So Moody's is still calling GC's debt "subprime," for those of you who remember that term from a little financial crisis a few years back – but that doesn't mean that it won't find a buyer. In fact today I saw news of GC's bond issuance tucked in between some other deals from an online publication that follows the corporate bond market for traders:

Then, it hit me. I think I threw my head back and laughed. Chances are, Ares Capital Management will find buyers for Guitar Center debt at 6 – 9% interest, because for financiers today, higher risk just means higher returns, not actual risk - just like back in the mid-2000s. Because of wealth concentrated in the financial sector, the dynamic is almost identical to what destroyed the mortgage market: Complexity obfuscated the true risk of financial instruments, which was being fobbed off onto other parties until the whole thing blew up. Complexity: the financial structure of this operation seems absurdly complex given their business of selling guitar amps. To truly understand the structure of the Guitar Center business, I have had to consult professionals with a much deeper expertise – CEOs, CFOs, people with masters degrees in finance. Almost every one has looked at various details of the company and said, "That's a pink zebra right there," or, "Wow, I've maybe heard of that kind of thing one other time." To understand some of their SEC filings, I had to drag up papers from the finance department of the Wharton School of Business. When you look up the corporate structure from which Bain Capital invested in Guitar Center, you find it (as of 2009) located as 3.34% of a billion-dollar investment corporation based offshore in the Cayman Islands, wedged into a financial partnership structure with a dozen other corporations. In my experience, complexity of this sort is meant to keep casual analysts, regulators and journalists guessing – not unlike what we saw with the mortgage market eight years ago. And just so I had a good active comparator, I pulled the annual report for ExxonMobil, a company with a $290 billion market cap. Compared to GC, its filings are a relative oasis of simplicity and clarity, with the whole business laid out and finances making basic sense without enormous leaps of logic. Then again, it's easier when you're profitable. Risk: None of the guys behind this deal have what Nassim Nicholas Taleb calls "skin in the game." Nobody making decisions will lose their family fortune if it goes badly, and everybody in management stands to make substantial fees, bonuses and salaries. You see, Guitar Center used to be a musical instrument company, but now it is just one more imperial outpost for the spare financial capital of the top 0.1% of the population. For the people now supplying GC with liquidity, risk is a tool for cash flow, not a concern for survival. When I recognized how much the financial markets have become like 2006, I finally figured out why some other financier could shell out $50 or $100 or $300 million for Guitar Center junk bonds. For the customers of private equity, a few million isn't that much money. These investors actually need some higher-risk assets in their portfolio, rather than let their money sit around in a zero-interest rate environment. They might be like Warren Buffett and already have huge stakes in sensible things like Too-Big-To-Fail banks, railroads or Coca-Cola. This just rounds out their overall position. Make 6-9% with the chance that the company could finally go tits-up? Why not! If it pays out, then great, and if it doesn't – tax write off! You know who else thought like that? The people who set the mortgage market on fire just a few years ago. They made a fortune by structuring finance in such a way that investments produced income irrespective of their true value. They could not have cared less about whether the end result was old people thrown out of their homes or eight million unemployed – that was someone else's risk. Their risk got hedged by the taxpayer who would bail out the industry so long as the collapse was big enough, so building a decent, functional economy was besides the point. This is the logic at play with Guitar Center. Financial parasites have taken over the host company and could not care less about the industry itself. They install some CEO who used to be selling DVD players. They swap private equity firms in and out. It doesn't matter – it's just another place for loose capital to suck out a few extra dollars or a tax break. After all, the entire value of the company is less than what JPMorgan paid in fines last year without breaking a sweat. In the final analysis, this is less about business sense and more about business domination. There are dozens of industries that have been locked up by a few players in this way: mortgages, cars, pharmaceuticals, retail, you name it. Since the chances of antitrust suits under "leaders" like George W Bush and Barack Obama are so low, the tiny tranche of society with all the money can run a time-worn playbook – consolidate companies, squeeze vendors, push manufacturing overseas, lower wages, wash, rinse, repeat, discard. The numbers of the business – which suck in GC's case – do not matter as much as control of yet another industry. As long as you have dominance over an industry, your positions are hedged for risk automatically because there is no other game in town – or at least people believe that. In the meantime, you get management fees, income from bonds, the occasional IPO payout. And if not, you move on to the next group of suckers. Time to Return the Musical Instrument Business to its Human RootsAll of this cold-blooded nonsense stands in stark contrast to the amazing people I have met in every other corner of the industry, including the actual long-time employees of Guitar Center who have reached out to me. I have had the tremendous honor to speak with inventors, entrepreneurs, retailers and fellow musicians about current events and I have been astonished by their intelligence, kindness, creativity and overall sense of humanity. All of this is diminished by the presence of these rapacious colonialists and it is time for them to take their leave of our economy, starting with the musical instrument industry. Music, you see, is about about way more than just money – it is about a crazy, primal, uncontrollable passion. Most people who have dedicated their lives to music realize that it is an irrational thing – a little unhealthy but strangely fulfilling. The "industry" is actually a culture built by men and women who obsess over the rich sound of analog synthesizers; the warm thud of Leo Fender's Precision bass; the sublime beauty of the sunburst on a vintage Les Paul; the roar of a Marshall amplifier; the silky vocals behind Neumann tube microphones. Note the prevalence of family names in these company names – the real industry was built on the artistic endeavors of individual geniuses who acted out of pure inspiration, not banks. Financial return represents but a small fraction of the motivation behind the involvement of the vast majority of people in the musical instrument business. Yet for Bain Capital and Ares Capital, it is 100% of the reason for their involvement – and that is not good enough for the rest of civilization. As the weeks have worn on, I find myself resolute in what should be done. It is time to convince the financial parasites to leave us alone. Massive changes to the tax code need to make labor and entrepreneurship more valuable than financial trickery, but in the meantime, you can help as an individual. I recommend that you refuse to buy as much as a guitar pick from any company currently owned by a private equity firm, or any financial entity that does not come from the music industry itself. Your purchasing decisions will decide whether these financiers will continue to dominate this industry, because if they cannot achieve a return on these bonds, they will move on. The revenue that has been consolidated through complex debt structures will return to the rest of the industry. It will mean new businesses and new jobs. In just one small way, life will get better. This is not about size; there are big companies that are great to work with. It isn't about corporations; that is just a legal structure. And while it is great to work with local retailers, there are online vendors run by real people with something special to offer who simply choose not to pay rent every month to a physical space. This is simply a movement against parasites. It is about taking the tiny fraction of society with the spare capital to ruin people's lives in exchange for a few bucks and telling them that enough is enough. It will require considerable effort to reform critical sectors of the economy such as financial services, manufacturing, and healthcare. The musical instrument industry is small enough that we can return it to health and use it as an example of the authentic economies that we can create in the future. What happens next is up to you. ____ The funds hire pension fund consultants who provide the return assumptions and advise them on their asset allocation strategies. And it is also critical to note that public pension funds and the remaining private defined benefit plans have pretty much the same return assumptions…..because they hire the same fund consultants. And why might fund consultants have an incentive to provide high return assumptions? High return assumptions are popular, for they lead to lower current funding costs. High return assumptions also require that the pension funds participate as much as possible in risky strategies. Risky strategies are more complex and varied, which gives the fund consultants more to do in evaluating them and thus justifies higher fees. |

| Gold Price Analysis- April 4, 2014 Posted: 04 Apr 2014 01:10 AM PDT dailyforex |

| Comex Gold (GC) Futures Technical Analysis – April 3, 2014 Forecast Posted: 04 Apr 2014 01:05 AM PDT fxempire |

| Gold Prices See no Relief in Sight as Further Lows likely Posted: 04 Apr 2014 01:05 AM PDT dailyfx |

| Gold Holding on to 1280 for Dear Life Posted: 04 Apr 2014 01:05 AM PDT dailyfx |

| Gold Chart Setup Hints at Bounce Ahead, US Dollar Drifting to Range Top Posted: 04 Apr 2014 12:55 AM PDT dailyfx |

| Commodities trading outlook: gold, silver and copper futures Posted: 04 Apr 2014 12:40 AM PDT binarytribune |

| Metals Pack Fundamental Analysis April 4, 2014 Forecast – Silver ... Posted: 04 Apr 2014 12:40 AM PDT fxempire |

| King Ibn Saud’s 35,000 British sovereigns – Gold’s historic undervaluation versus oil Posted: 04 Apr 2014 12:11 AM PDT USA Gold |

| April 4, 1944 : Nazi Gold: The Merkers Mine Treasure Posted: 03 Apr 2014 10:53 PM PDT US Archives |

| The Gold short term cycle direction is not so clear going into NFP on Friday morning Posted: 03 Apr 2014 10:48 PM PDT Commodity Trader |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment