Gold World News Flash |

- The Dark Side Of The Silver Mining Industry

- How To Predict an Economic Collapse

- U.S. Dollar is Going to Die

- SPX Topping Valuations 3

- Goldman Sachs Is Highly Motivated To Low-Ball Gold Price

- Russia, China likely to stop buying Treasuries, ex-White House financial aide says

- Merger talks between gold giants Barrick and Newmont break down

- Hyper-Sensitive Illinois Mayor Orders Police Raid Over Parody Twitter Account

- 18 Stats That Prove That Government Dependence Has Reached Epidemic Levels

- How To Predict an Economic Collapse -- Mark Skousen

- How to Predict an Economic Collapse

- How to Invest in China’s Middle-Class Boom… on the Nasdaq

- Former presidential aide acknowledges causes for gold price suppression

- From Monroe to the Bush-Obama Doctrines, American KARMA is Long Overdue

- Silver Conspiracy Fact Versus Conspiracy Theory

| The Dark Side Of The Silver Mining Industry Posted: 18 Apr 2014 11:00 PM PDT by Steven St. Angelo, SRS Rocco:

There is an insidious Dark Side to the silver mining industry that goes unnoticed by the majority of investors and analysts. Actually, I haven't come across one miniyng analyst who puts out comprehensive data on this very subject for the silver mining industry. According to my figures for 2013, the top primary silver miners suffered the lowest average silver yield ever. That's correct… another year of declining ore grades and yields. Looking at the chart below, the top 6 primary silver miners average yield for 2013 was 7.6 ounce a tonne (oz/t) compared to the 8.1 oz/t recorded in 2012. Thus, the top miners shed another half ounce of silver yield… falling 6% in 2013. |

| How To Predict an Economic Collapse Posted: 18 Apr 2014 10:30 PM PDT from DailyReckoning: |

| Posted: 18 Apr 2014 09:40 PM PDT from FinanceAndLiberty.com: |

| Posted: 18 Apr 2014 08:40 PM PDT by Adam Hamilton, Gold Seek:

Investing is all about buying low then selling high. So the price paid for any particular stock is the most-important and often dominating factor in its ultimate price-appreciation success. The surest way to grow rich in the stock markets is to buy good companies at low prices, the prudent contrarian approach. Even buying great companies at high prices leaves little room for those stocks to run higher, so they rarely do. |

| Goldman Sachs Is Highly Motivated To Low-Ball Gold Price Posted: 18 Apr 2014 08:34 PM PDT The distinguished analysts from Goldman Sachs reiterated their 2014 forecast for gold to hit $1,050 by the end of the year. They believe the paper price of gold will continue to decline as the supposed "Powerhouse" U.S. economy picks up speed and accelerates growth. If someone recently had a frontal lobotomy... this forecast might make perfect sense. On the other hand, if a person belongs to the 95-99% group of Americans who believe everything coming from the Boob Tube, this forecast is exactly what the doctor ordered. |

| Russia, China likely to stop buying Treasuries, ex-White House financial aide says Posted: 18 Apr 2014 05:58 PM PDT 9p ET Friday, April 18, 2014 Dear Friend of GATA and Gold: Former Bush administration financial aide Philippa Malmgren tells King World News that Russia and China are likely to stop buying U.S. Treasuries altogether and that separatism is rampant around the world, not peculiar to Ukraine: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/18_Ex... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: |

| Merger talks between gold giants Barrick and Newmont break down Posted: 18 Apr 2014 05:51 PM PDT By Gillian Tan, Alistair MacDonald, and Dana Mattioli Barrick Gold Corp. and Newmont Mining Corp. recently held abortive talks over a deal that would have combined the world's two largest gold producers at a time when they are battling a sharp drop in the price of gold, according to people familiar with the matter. The two companies had intended to announce a deal as early as Tuesday, one of the people said. They have discussed combining a number of times before, people familiar with the matter have said, and it is possible they could do so again. The deal talks come as the companies try to adapt to lower gold prices. The precious metal's futures fell 28 percent last year, their biggest annual price drop since 1981. ... ... For the full story: http://online.wsj.com/news/articles/SB1000142405270230462630457950983405... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. |

| Hyper-Sensitive Illinois Mayor Orders Police Raid Over Parody Twitter Account Posted: 18 Apr 2014 03:24 PM PDT Submitted by Mike Krieger of Liberty Blitzkrieg blog, Just yesterday, I wrote a post about how a South Carolina construction worker was fined $525 and lost his job for not paying $0.89 for a drink refill while working at the Ralph H. Johnson VA Medical Center in downtown Charleston. The point was to emphasize how the law comes down with a devastating vengeance when an average citizen commits a minor crime, yet allows the super rich to loot and pillage with zero repercussions. There is now a systemic two-tier justice system operating in these United States, and the result will unquestionably be tyranny if the trend continues unabated. The latest example of a lowly citizen being subject to a disproportionate use of the law, is Jon Daniel of Peoria, Illinois. Jon was behind a parody Twitter account that mocked Peoria mayor Jim Ardis, and his biggest mistake was not making it clear that it was a parody. As a result, Twitter had already suspended the account weeks ago. Problem solved, right? Wrong. The tough guy mayor was so offended that a plebe would dare criticize his royal highness that he ordered a police raid on the home of Jon Daniel and his roommates. Peoria native, Justin Glawe wrote an excellent article on the subject for Vice. He writes:

Fortunately, this story does have a silver lining. Daniel’s original Twitter account was actually pretty unsuccessful, with only 50 followers by the time it was shut down. Mayor Jim Ardis should’ve just left well enough alone, but he couldn’t do that, and as a result of all the attention this story has received in the blogosphere, new parody accounts have emerged. The most successful one is @NotPeoriaMayor and the avatar is Jim Ardis with a Hitler mustache. See below: The best part is this account already has 7x the followers of the other one. Lesson Learned: Don’t fuck with the Internet. Full Vice article here. The LA Times also covered the story, here. |

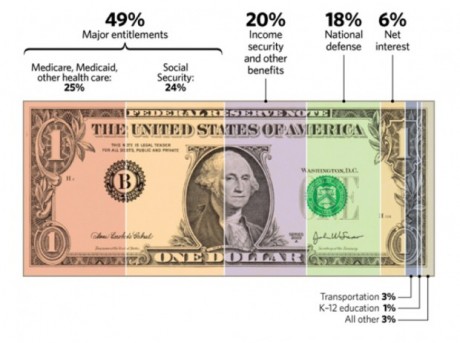

| 18 Stats That Prove That Government Dependence Has Reached Epidemic Levels Posted: 18 Apr 2014 12:21 PM PDT Submitted by Michael Snyder of The American Dream blog, Did you know that the number of Americans getting benefits from the federal government each month exceeds the number of full-time workers in the private sector by more than 60 million? In other words, the number of people that are taking money out of the system is far greater than the number of people that are putting money into the system. And did you know that nearly 70 percent of all of the money that the federal government spends goes toward entitlement and welfare programs? When it comes to the transfer of wealth, nobody does it on a grander scale than the U.S. government. Most of what the government does involves taking money from some people and giving it to other people. In fact, at this point that is the primary function of the federal government. Just check out the chart below. It comes from the Heritage Foundation, and it shows that 69 percent of all federal money is spent either on entitlements or on welfare programs… So when people tell you that the main reason why we are being taxed into oblivion is so that we can “build roads” and provide “public services”, they are lying to you. The main reason why the government taxes you so much is so that they can take your money and give it to someone else. We have become a nation that is completely and totally addicted to government money. The following are 18 stats that prove that government dependence has reached epidemic levels… #1 According to an analysis of U.S. government numbers conducted by Terrence P. Jeffrey, there are 86 million full-time private sector workers in the United States paying taxes to support the government, and nearly 148 million Americans that are receiving benefits from the government each month. How long can such a lopsided system possibly continue? #2 Ten years ago, the number of women in the U.S. that had jobs outnumbered the number of women in the U.S. on food stamps by more than a 2 to 1 margin. But now the number of women in the U.S. on food stamps actually exceeds the number of women that have jobs. #3 The U.S. government has spent an astounding 3.7 trillion dollars on welfare programs over the past five years. #4 Today, the federal government runs about 80 different “means-tested welfare programs”, and almost all of those programs have experienced substantial growth in recent years. #5 Back in 1960, the ratio of social welfare benefits to salaries and wages was approximately 10 percent. In the year 2000, the ratio of social welfare benefits to salaries and wages was approximately 21 percent. Today, the ratio of social welfare benefits to salaries and wages is approximately 35 percent. #6 While Barack Obama has been in the White House, the total number of Americans on food stamps has gone from 32 million to nearly 47 million. #7 Back in the 1970s, about one out of every 50 Americans was on food stamps. Today, about one out of every 6.5 Americans is on food stamps. #8 It sounds crazy, but the number of Americans on food stamps now exceeds the entire population of the nation of Spain. #9 According to one calculation, the number of Americans on food stamps is now greater than the combined populations of “Alaska, Arkansas, Connecticut, Delaware, District of Columbia, Hawaii, Idaho, Iowa, Kansas, Maine, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Oklahoma, Oregon, Rhode Island, South Dakota, Utah, Vermont, West Virginia, and Wyoming.” #10 According to a report from the Center for Immigration Studies, 43 percent of all immigrants that have been in the United States for at least 20 years are still on welfare. #11 Back in 1965, only one out of every 50 Americans was on Medicaid. Today, more than 70 million Americans are on Medicaid, and it is being projected that Obamacare will add 16 million more Americans to the Medicaid rolls. #12 The number of Americans on Medicare is projected to grow from a little bit more than 50 million today to 73.2 million in 2025. #13 Medicare is facing unfunded liabilities of more than 38 trillion dollars over the next 75 years. That comes to approximately $328,404 for each and every household in the United States. #14 If the number of Americans enrolled in the Social Security disability program were gathered into a single state, it would be the 8th largest state in the entire country. #15 In 1968, there were 51 full-time workers for every American on disability. Today, there are just 13 full-time workers for every American on disability. #16 It is being projected that the number of Americans on Social Security will rise from about 62 million today to more than 100 million in 25 years. #17 Overall, the Social Security system is facing a 134 trillion dollar shortfall over the next 75 years. #18 According to the most recent numbers from the U.S. Census Bureau, an all-time record 49.2 percent of all Americans are receiving benefits from at least one government program each month. Back in 1983, less than a third of all Americans lived in a home that received direct monetary benefits from the federal government. Many will read this and will assume that I am against helping the poor. That is completely and totally not true. There will always be people that are impoverished, and this happens for many reasons. In many cases, people simply lack the capacity to take care of themselves. It is a good thing to take care of such people, whether the money comes from public or private sources. In every society, those that are the most vulnerable need to be looked after. But it is a very troubling sign that the number of people on government assistance is now far, far greater than the number of people with full-time jobs. This is not a sustainable situation. The federal government is already drowning in debt, and yet more people become dependent on the government with each passing day. The long-term solution is to get more Americans working or starting their own businesses, but the federal government continues to pursue policies that are absolutely killing the creation of jobs and the creation of small businesses in this country. So our epidemic of government dependence is going to continue to get worse. And many of these programs are absolutely riddled with fraud and corruption. Just check out the following excerpt from a recent Natural News article…

Instead of fixing their own problems, they want us to help them do it. Just great. And of course they always want more of our money to help fund these programs. In fact, according to Americans for Tax Reform, Barack Obama has proposed 442 tax increases since entering the White House…

The more we feed the monster, the larger and larger it grows. And yet poverty is not decreasing. In fact, the poverty rate has been at 15 percent or greater for three years in a row. That is the first time that has happened in decades. Barack Obama promised to “transform” America, and yet poverty and government dependence have just continued to grow during his presidency. Not that anyone really believes anything that he has to say at this point. In fact, one recent survey found that only 15 percent of Americans believe that Barack Obama always tells the truth and 37 percent believe that he lies “most of the time”…

So what do you think? |

| How To Predict an Economic Collapse -- Mark Skousen Posted: 18 Apr 2014 12:10 PM PDT Do you think the current economic recovery is sustainable or a collapse waiting to happen? Mark Skousen shares his views In his recently released book, A Viennese Waltz Down Wall Street, Mark Skousen explains what triggered 2008 financial crisis, why you should be wary of the artificial boom... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| How to Predict an Economic Collapse Posted: 18 Apr 2014 11:05 AM PDT Well, I think you have to look at it in the context of how it all got started and you look back at the financial crisis of 2008, and the Austrian School would say that was inevitable. We may not have been prescient in picking the exact top or when it was gonna happen. Certain Austrian economists did do a good job of selecting. And I talk about some of those people. The Austrian School, Mises and Hayek for example, predicted the 1929 crash and the Great Depression, and got quite a bit of notoriety as a result of that. And in 2008, a number of economists like Peter Shiff, who uses Austrian economics, or Harry Veryser, who has written a book recently – he’s an economist at the University of Detroit Mercy, who used some Austrian tools on the interest rates and money supply figures to figure out when the top was being reached – recognized that the government, the Federal Reserve in particular, but also the federal government encouraging excessive home ownership created an elixir, a combination that was – it blew up on us, to create this artificial boom, followed by collapse. So the Keynesians and the Monetarists, the standard neoclassical model was inject liquidity. You have this collapse. Inject liquidity. Keep it from turning into a Great Depression. And they were successful in doing that, but it’s been a very slow recovery, and the – most of the new money that’s being created – see the Ludwig von Mises always said who gets the money first? You have this new money coming in, the easy money; where is it going? And it appears it’s going into the stock market, and it’s creating this artificial boom in the recovery, and it’s largely going into the stock markets, gone into treasuries. It’s gone into gold and silver to some extent, although the last couple of years haven’t been very good on gold, but there has been a renewed interest in gold at these lower prices. So the Austrians are looking at that, saying this is an artificial bubble. You can play that bubble. I’ve been fully invested. But at some point, this market is going to top out and probably when interest rates rise sharply, this should be a critical factor as interest rates is something the Austrian School really looks at very closely. We look at the money supply, which is what the Chicago School does. They have a fairly simple system. But the Austrian School has a little more sophisticated system, and we would argue, yes, it’s artificial; we’ve been playing that market, but at some point, we’ve got to use our stop orders. We’ve got to protect our profits, and we have to recognize that there could be another crash, another bear market sometime down in the future. I’m not predicting it any time right away. Yes, we’ve had a five-year recovery in the market. But until interest rates really spike, I just don’t think you’re going to see an end to it. |

| How to Invest in China’s Middle-Class Boom… on the Nasdaq Posted: 18 Apr 2014 09:15 AM PDT Dear Reader, It was an abject failure. In 2006, after conquering the US home improvement market, Home Depot (NYSE:HD) ventured into China to claim its share of the Chinese middle class’s exploding growth. It bought 12 stores from local Chinese firm The Home Way, turned them into Home Depots, and waited for voracious middle-class consumers to swarm its aisles, just like they had in the US. But they never came. By 2012, Home Depot had closed its last big box store in China and retreated with its tail between its legs. The business merits of expanding to China seemed ironclad. Hundreds of millions of Chinese people were climbing into the middle class. Homeownership rose from virtually nil 15 years ago to 70% today. Who doesn’t like to personalize their brand-new digs? What Home Depot’s management didn’t understand is that Chinese people aren’t do-it-yourself types. Almost no one in China owned their own home until recently, so furnishing a home was a new concept. They’d never done it before. They needed guidance. Which is exactly why Ikea has been so successful there. The Swedish furniture giant arranges its stores into model rooms that showcase furniture combinations and color schemes. Chinese people love it because it helps them visualize how components fit together to make a complete room. To a home improvement novice, that’s much more useful than the stacks of lumber and 47 varieties of faucets that Home Depot offers. Plus Ikea’s merchandise is easy to buy and put together. No caulk, molding, or power tools necessary. All you need are the instructions, an Allen wrench, and a few hours. Having spent the last two months studying China’s booming smartphone market in search of an investment opportunity for The Casey Report, I appreciate that subtle cultural differences can make or break a company’s bid to transfer its business model to a foreign country. Every smartphone maker wants a piece of China’s huge pie, but the mighty international brands like Apple, Nokia, and LG are struggling to capture it. Tiny upstart Chinese manufacturers, with just a fraction of the resources but a huge advantage in local knowledge, are kicking their butts. I’ll let Adam Crawford, Casey Research technology analyst, elaborate. How to Invest in the Great UpgradeAdam J. Crawford, Analyst Most people think the smartphone was an overnight success made possible by a sudden technological leap from Apple. Not so. Eddie Cantor had it right 50 years ago when he said, “It takes 20 years to be an overnight success.” |

| Former presidential aide acknowledges causes for gold price suppression Posted: 18 Apr 2014 05:12 AM PDT 8:12a ET Friday, April 18, 2014 Dear Friend of GATA and Gold: Philippa Malmgren, financial counselor to President George W. Bush, tells King World News today that it's easy for governments to influence the gold price, that they have motive to suppress it, and that governments that hold U.S. dollars and fear their devaluation have motive to accumulate gold to hedge their dollar exposure. Malmgren says she finds it "extraordinary" that countries seeking to hedge their dollar exposure "can increase their holdings of gold so dramatically and yet the price goes down." Her comments are posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/18_Fo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. |

| From Monroe to the Bush-Obama Doctrines, American KARMA is Long Overdue Posted: 18 Apr 2014 03:04 AM PDT I wait for the first domino to fall on Empire. Will it be a bond collapse? Another total market meltdown? A right-wing/NRA/neo-Confederate fight to the finish against "central government" (Washington) and subsequent martial law? A cathartic race war in New York or Chicago or Detroit or LA against police violence, corrupt politicians, angry white men, phony liberals and decades of exploitation by the middle and upper classes who salute themselves for electing the first African-American president while continuing to institutionalize racism and poverty? |

| Silver Conspiracy Fact Versus Conspiracy Theory Posted: 18 Apr 2014 12:45 AM PDT “The few who understand the system will either be so interested from its profits, or so dependent on its favors that there will be no opposition from that class.” -Rothschild Brothers of London, 1863 The mainstream is on an academically-driven mission to politicize conspiracy theories and lump them all into the same category. While gold and silver manipulation is an ancient conspiracy fact, eyes are wide shut to the general awareness in the face of one revelation after another. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The lofty stock markets are starting to wobble, with selloffs' frequency and sharpness increasing. The dominant reason the Fed's stock levitation is running out of steam is severe overvaluation. Stocks are just far too expensive today compared to historic precedent, a dangerous state seen when bull markets are topping. Rampant overvaluation is a glaring warning sign to investors that selling is just beginning.

The lofty stock markets are starting to wobble, with selloffs' frequency and sharpness increasing. The dominant reason the Fed's stock levitation is running out of steam is severe overvaluation. Stocks are just far too expensive today compared to historic precedent, a dangerous state seen when bull markets are topping. Rampant overvaluation is a glaring warning sign to investors that selling is just beginning.

No comments:

Post a Comment