Gold World News Flash |

- Ukraine “More Dangerous Than Cuban Missile Crisis”

- From funds to gold, how will Ukraine affect my investments?

- Economist John Williams: Financial Collapse if Russia Sells U.S. Dollar Holdings

- Ready for a Late-Night Laugh? CPM Group’s Jeff Christian Comments On Allegations of London Gold Fix Manipulation

- Dead Bankers and the Wrath of Khan

- Daily Nugget – Gold is Not Dissuaded by Crimea

- Five Investing Strategy Buckets

- News reports on market rigging are more important to gold than Ukraine, Turk says

- Flight To Safety, Undeniable – Yellow Dog, Wagging

- Mike Kosares: Fed's wisdom only recognizes the ridiculously obvious

- Peter Schiff interviews GATA Chairman Bill Murphy

- Say's Law And The Permanent Recession

- GaveKal Answers "How Low Can The Renminbi Go"

- The Gold Price Dropped 0.91 Percent to Close at $1,337.80

- The Gold Price Dropped 0.91 Percent to Close at $1,337.80

- In The News Today

- Marc Faber: Gold Is One Of The Few Cheap Assets

- Bankers Tell It Like It Is – Top 10 Quotes That Reveal Their Crimes

- Gold Model Calculates Gold Price Of $2400 To $2900 In 2017

- Gold Daily and Silver Weekly Charts - Ebb and Flow - Gresham's Law

- Gold Daily and Silver Weekly Charts - Ebb and Flow - Gresham's Law

- Detailed Strategies to Combat the Tax Man

- Gold’s Second Daily Cycle Is Directly Ahead

- A Historic Event Has Taken Place In The Gold Market

- The Sickness of the 1% | Jesse Ventura Off The Grid

- ECONOMIC COLLAPSE IS INEVITABLE

- Ukraine: An Expensive U.S. Promise

- The London Price Fix Is Rigged - Here's Why Ross Norman Is Full Of It

- The London Price Fix Is Rigged - Here's Why Ross Norman Is Full Of It

- Real Money

- Gold cartel draws line at $1,350, Kaye tells KWN

- Graphite Investors Should Look for Large Flakes, Small Resources

- This Is What Is Happening In Ukraine & The War On Gold

- Big Australian coal handling equipment contract for Sandvik

- …and Pit Vipers ordered for Los Pelambres copper

- Junior mining stocks rising from the ashes – Ballanger

- Crimea, the Fed, China and Gold

- Gold and silver prices slightly muted

- ‘Ethical gold’ aims to curb illegal mining in South America

- India’s trade minister wants gold import curbs eased

- Shilling discovery could rewrite Canadian history

- Gold coin hoard found in California may have been from theft at SF Mint in 1900

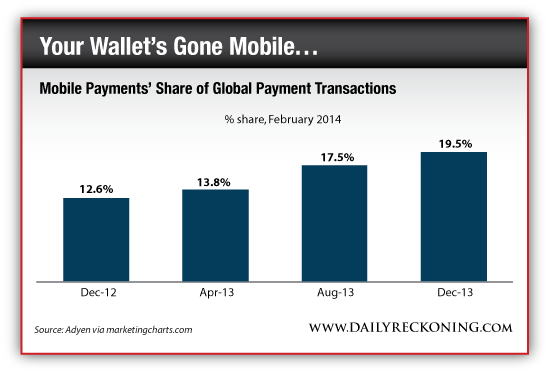

- Make Way for the Mobile Payment Revolution

- Koos Jansen: India's silver imports up 189% even as smuggled gold is abundant

- Russia threatens default to U.S. banks, dumping of U.S. bonds

- Gold Price Drops 3/4 of "Ukraine Crisis" Jump as Russia Moves to Ease Tensions

- WW3 -- Russia And The U.S. Face Off Over The Ukraine

- WW3 UPDATE: US Halts Russia Military Agreements; Russia THREATEN DOLLAR & WARNING SHOTS FIRED

- Gold Buyers Outnumber & Outweigh Sellers in Feb.

- Gold Buyers Outnumber & Outweigh Sellers in Feb.

| Ukraine “More Dangerous Than Cuban Missile Crisis” Posted: 04 Mar 2014 11:00 PM PST from King World News:

Dr. Roberts: "It could be that Washington comes to its senses. On the other hand, it's embarrassed. Washington has lost control and it looks as though the southern and eastern provinces are demanding to go back to 'Mother Russia.' This isn't something the Russians have fomented — It's the people there. So there is a great danger here because to the threats that U.S. Secretary of State John Kerry made to Russia, the Russian foreign minister replied, 'These are unacceptable.'” |

| From funds to gold, how will Ukraine affect my investments? Posted: 04 Mar 2014 10:19 PM PST The effects of the crisis in Ukraine extend beyond the region to influence markets everywhere. Even British investors' Isas may not be immune This posting includes an audio/video/photo media file: Download Now |

| Economist John Williams: Financial Collapse if Russia Sells U.S. Dollar Holdings Posted: 04 Mar 2014 10:01 PM PST Economist John Williams: Financial Collapse if Russia Sells U.S. Dollar Holdings John Williams of Shadowstats.com says, "Don't look for the U.S. dollar as the safe haven." Williams contends, "Historically, the dollar has been the safe haven in a political or financial crisis, but that hasn't... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 04 Mar 2014 10:00 PM PST from KitcoNews: |

| Dead Bankers and the Wrath of Khan Posted: 04 Mar 2014 08:22 PM PST by PTS, SGT Report:

One of the classic movies that sticks in my head growing up in the 80's is Star Trek II – The Wrath of Khan. I was not by any means a huge science-fiction or even Star Trek fan, but the clever plot, the believable acting (notwithstanding the admittedly occasional "over-acting" on the part of William Shatner), the ahead-of-their-time special effects, the dry humor, the quotable lines, and the soundtrack all came together in such a way as to form a masterpiece of early 1980's entertainment. Just a few weeks ago, I was introducing The Wrath of Khan to my kids. While we were watching one of the scenes, I was struck at just what a perfect metaphor one particular clip was to describe the imminent economic and global dangers that are facing our country's citizens and the world in general. While science fiction might not be your thing, this scene does illustrate the danger of failing to put the pieces together in time to react to them. A look at recent headlines gives us all sorts of unsettling stories which clue us in that something is terribly wrong, some of which are new developments, while others have been on our radar for quite a while now: the never-ceasing gun-grab by the liberals, our own NSA constantly spying on its own citizens, Obama’s drone strikes, market manipulation, and lately, the threat of war stemming from the powder keg that is the Ukraine. Certainly bad news is not a recent phenomena; it’s been here for a while, but this spate of 20-some dead bankers over the past few weeks seems such an over-the-top Red Flag indicating that we are facing a potentially disastrous event. So what light can The Wrath of Khan shed on the dead banker stories of the last 3 months?

In case you are not familiar with the storyline of this 1982 classic, Captain (now Admiral) Kirk's old nemesis Khan had escaped from exile on a desert planet. Khan and his followers were able to take over the USS Reliant, a fellow ship in the same fleet as Kirk's USS Enterprise. Furnished with a friendly-appearing vessel, Khan then plots his revenge on Kirk (namely, to destroy him and his ship via sneak attack). Kirk is called to the bridge of the Enterprise when the Reliant suddenly appears out of nowhere. Still not realizing that the Reliant is in enemy hands, Kirk watches Khan's ship drift closer and closer while trying to sift through all the bizarre and conflicting information about this encounter. As he considers the Reliant's surprise appearance, its reduction in speed, and its failure to communicate, Kirk remarks (at about the 2:00 mark in the clip) how "peculiar" this situation looks. But he hesitates, only going to Yellow Alert. Khan's Reliant draws even nearer, raises its shields, and powers up its weapons, but only then does Kirk go to Red Alert, by which time it's too late and he is already under attack. The rest of the movie continues as a chess match between Kirk's badly damaged Enterprise and Khan's faster and more powerful Reliant. I can't help but feel like Kirk, sitting in that chair, trying to make sense of and piece together all the "peculiar" events that are taking place. Each and every day I see story after story that signals a collapse of our personal finances and our way of life as free Americans drawing ever closer, until we morph into a world where the medical industry, the news media, the banks, and politicians have nearly complete control over the choices that we make in our everyday lives. Again, the evidence for this financial destruction mounts by the day. But what has particularly struck me as an extremely unsettling omen is the slew of deaths seen in the banking community. "Peculiar," as Kirk would say sitting in his Captain's Chair. We have 8 JPMorgan bankers between the ages of 22-39 mysteriously die in the last 3 months, that is in addition to the bankster deaths from firms other than JPMorgan. Whether they are actually suicides or assassinations (although I’ve never tried it, I imagine that it’s kinda hard to shoot yourself in the chest and head seven or eight times with a nail gun), without being an alarmist I can't help but feel that it is a grim signal that time is awfully short. I can’t make sense of so many people in the prime of their life making more money than they will ever need, dying (or suicided), unless something very sinister is going on behind the scenes. The odd thing is, that 95% of people have absolutely no idea about the looming threat to life as they know it. They are not on any alert whatsoever. For me, the events of the past few months are a signal that it's time to bypass Yellow and go directly to Red Alert in terms of financial and survival preps. And even if I am off on the timing, how is it going to hurt me that I've ratcheted up my level of preparedness? I must have watched this scene from the Wrath of Khan dozens of times in the past 30 years. And each time I see it, I keep waiting for Kirk to figure it out and take precautions before he is attacked. Of course, it would not be the timeless movie that it is had he done that. But maybe, we can take this as a lesson that it's better to raise shields too early than too late, because, in case you haven't noticed, the occurrences coming together right now are, shall we say, "peculiar." |

| Daily Nugget – Gold is Not Dissuaded by Crimea Posted: 04 Mar 2014 08:20 PM PST by Jan Skoyles, TheRealAsset.co.uk

The action in Ukraine has led to many new forecasts being released, with some calling for $1,400/oz gold. One of these calls come from Mark Keenan, of SocGen. Whilst he remains bearish in the long-term (calling for $1,050/oz) he is confident that events in the short-term could send it above the key $1,350/oz resistance level. |

| Five Investing Strategy Buckets Posted: 04 Mar 2014 08:16 PM PST By: Mark Wallace at http://capitalistexploits.at/

Our friend and colleague Mark Schumacher recently sent a note to his investors that we felt was well worth sharing. Mark of course runs ThinkGrowth.com. He's a sharp analyst and investor and the advice below is timeless in our opinions.

-------- Mark's ideas about following strong macro trends, targeting washouts (blood in the streets), income and diversification, and crisis protection are all core values we share with him as investors. Taking note of the suggestions made above can help you achieve superior returns over the long run and trade or invest with a lot more confidence. - Mark "The only investors who shouldn't diversify are those who are right 100% of the time." - Sir John Templeton |

| News reports on market rigging are more important to gold than Ukraine, Turk says Posted: 04 Mar 2014 07:43 PM PST 10:41p ET Tuesday, March 4, 2014 Dear Friend of GATA and Gold: Mainstream financial news media reports acknowledging suspicion of gold market manipulation are more important to the gold market than the turmoil in Ukraine, GoldMoney found and GATA consultant James Turk tells King World News today: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/3/4_A_H... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1 302 635 1160 in the United States. Or email them at info@goldcore.com. |

| Flight To Safety, Undeniable – Yellow Dog, Wagging Posted: 04 Mar 2014 07:40 PM PST from Jesse's Café Américain:

“Every war when it comes, or before it comes, is represented not as a war but as an act of self-defense against a homicidal maniac…War against a foreign country only happens when the moneyed classes think they are going to profit from it.” George Orwell Gold popped very hard today on what is undeniably a flight to safety out of fiat currencies and into something that is durable in a crisis with less counterparty risk. It was a clear result of the tension in the Crimea. |

| Mike Kosares: Fed's wisdom only recognizes the ridiculously obvious Posted: 04 Mar 2014 07:38 PM PST 10:35p Tuesday, March 4, 2014 Dear Friend of GATA and Gold: Mike Kosares of Centennial Precious Metals in Denver today marvels at what passes for wisdom at the Federal Reserve, the recognition of what is "ridiculously obvious." Kosares' commentary is headlined "Bernanke's Takeaway: 'The U.S. Is Not Invulnerable to Financial Crises'" and it's posted at Centennial's Internet site, USAGold.com, here: http://www.usagold.com/cpmforum/2014/03/04/bernankes-takeaway-the-u-s-is... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1 302 635 1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ |

| Peter Schiff interviews GATA Chairman Bill Murphy Posted: 04 Mar 2014 07:31 PM PST 10:30p ET Tuesday, March 4, 2014 Dear Friend of GATA and Gold: Market analyst and commentator Peter Schiff takes first note of GATA today on his radio show, interviewing GATA Chairman Bill Murphy. They discuss GATA's work exposing gold market manipulation and the interest of central banks and Wall Street in suppressing the gold price. The interview is 20 minutes long and can be heard at the Schiff Radio Internet site here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Say's Law And The Permanent Recession Posted: 04 Mar 2014 06:44 PM PST Submitted by Robert Blumen via the Ludwig von Mises Institute, Mainstream media discussion of the macro economic picture goes something like this: “When there is a recession, the Fed should stimulate. We know from history the recovery comes about 12-18 months after stimulus. We stimulated, we printed a lot of money, we waited 18 months. So the economy ipso facto has recovered. Or it’s just about to recover, any time now.” But to quote the comedian Richard Pryor, “Who ya gonna believe? Me or your lying eyes?” A Martian economist arriving on earth would have to admit the following: the US economy has experienced zero real growth since 2000. This is what I call the permanent recession. Permanent, because, unlike past downturns — there will be no recovery. To make the case for this view, I will rely on the ideas of several classical and Austrian economists: J.B. Say, James Mill, Mises, Rothbard, W.H. Hutt and Robert Higgs. I will begin with the J.B. Say, who is known for the eponymous Say’s Law. To explain I will quote from Say’s Treatise on Political Economy:

Say’s Law can be explained in the following terms:

In the modern economy with division of labor, most of us demand goods when we supply our labor. I work as a software engineer. I supply my labor writing computer software. And from that supply I am able to demand other goods, such as coffee. Say’s ideas were used to settle a debate between the British economists David Ricardo and Thomas Malthus who believed recessions were caused by a general glut. The concept of a glut for a single good is easy enough to understand: there is more supply on the market than demand at the offered price. A glut can be alleviated by a fall in the price of that good. The producers of the good may take a loss if the market price is below their costs, but the market can always clear at some price. The idea of a general glut is that all markets for all goods are in surplus. And for some reason, prices are unable to fix the problem. Ricardo opposed Malthus, arguing that the concept of general glut violates sound economics and clear thinking. He argued this point using Say’s Law: because demand is constituted by supply, aggregate demand, meaning the demand for all goods on the market, consists exactly of all things supplied. Aggregate demand is not only equal to, but identical to, aggregate supply. The two can never be out of balance. And if a general glut is a logical impossibility, then it cannot be the cause of a recession. The idea of aggregate supply and demand in getting out of balance has appeared many times in the history of economic thought. The same idea is either called overproduction or underconsumption, depending on whether the problem is too many goods or not enough purchasing power. Keynesian economics is a form of underconsumption theory. The overproduction/underconsumption theory has been debunked by sound economists, but like a zombie, it refuses to die. It is acknowledged by both sides that, if Say’s Law is true, then Keynes’s entire system is wrong. Keynes knew this, so he took upon himself the task of refuting Say’s Law as the very first thing in his General Theory. Keynes’s argument was that Say’s Law is only valid under the conditions of full employment, but that it does not hold when there are unemployed resources; in that case we are in the Keynesian Zone where the laws of economics are turned upside down. But, as Stephen Kates explains in his book Say’s Law and the Keynesian Revolution (subtitled How Economics Lost its Way), Keynes failed in his attempt to overturn Say’s Law. Kates shows beyond any dispute that Say and his fellow classical economists were well aware that there could be unemployed resources, and that Say’s Law was still valid in that case. To summarize, there is no such thing as a general glut or a demand deficiency, we can have idle resources, and Say’s Law is still valid. So how did classical economists explain recessions? Producer error. Producers had produced the wrong mix of goods. James Mill in his essay “Commerce Defended” explains the meaning of producer error:

Kates and Gerard Jackson have argued that the classical economist had a theory of producer error much like the one later developed by Mises. Mises developed existing ideas and integrated Austrian capital theory and time preference theory to provide an explanation of why many producer errors occur at the same time. We know this as the Austrian theory of the business cycle. Mises called the production errors malinvestment. These errors happen systemically because of fractional reserve banks loan money into existence that is not backed by savings. That misleads producers into thinking that there are more real savings available than society wishes to save. Producers then make both the wrong mix of capital goods of different orders, and the wrong proportion of capital goods in relation to consumption goods. When there is malinvestment there must be a recession, for the following reason: there were never enough real resources to complete all of the capital projects that were started during the boom. The firms that started these projects either over-estimated the demand for their output, or, under-estimated their costs. Somewhere along the way, firms will discover that they cannot obtain all of the factors they need at a price below their costs. They cannot make profits. Many of them fail. I will give an example of how malinvestment leads to a recession. I worked in San Francisco during the tech bubble. There were many tech startups. Each one assumed that they would be able to grow by hiring more employees at the prevailing wage rates. But the prevailing wages did not reflect the true scarcity of skilled technical people because all of these businesses planned to hire more workers over the same time frame. But the number of skilled engineers could not possibly grow that fast. If you think of a software engineer as a form of human capital, a software engineer has a long period of production and requires many inputs (mostly coffee, but some other things as well). And there just weren’t enough engineers to build all of these web sites. One firm could have hired more engineers by paying double the prevailing wage, but it wasn’t in the economics of their business to do so. And in any case, most of the compensation was in imputed value of the stock options, which could be any number that you want if you assumed that the bubble will keep blowing up forever. What this shows is that, while you can fund a new venture with money printing, you cannot print skilled workers or office space. At some point, real factors become the bottleneck, so their price has to rise. And when that happens, some producers get squeezed out because they cannot raise prices. If they over-estimated demand for their output from the start, they would have needed lower, not higher, costs to make profits. And that is the start of the recession. Mises’s theory explains why the boom starts and why it comes to an end. Production errors cannot continue indefinitely because they result in losses. But why do we have a lasting recession? Why doesn’t everyone find a new job tomorrow? To explain, I will turn to the great English Austrian, W.H. Hutt. Hutt used Say’s Law to explain the recession. Hutt observed that when one person becomes unemployed, he stops producing — and supplying. And from Say’s Law he loses his power to demand. Also from Say’s Law, his demand constituted the means for others to supply, and for those others to demand, so the prosperity of others is diminished. The malinvestments are the first ledge in the waterfall. Then, other businesses will see the impact, even those that were not originally part of the malinvestment. Keynes said something like this in his model of the circular flow of spending. Keynes was right that there is an interdependence of all economic activity. But Keynes was wrong about consumption being the driving force of this: it is producing, not consuming. According to Say, the interdependence is constituted by the relationship of all production, not of expenditure. Expenditure of money is only the culmination of the process that began with production:

I will here give another example. When I worked in San Francisco during the tech bubble, I got coffee every day at a café near my office. When the tech bubble burst, this café failed as well. Was that because they made bad coffee? Or because software engineers got tired of drinking coffee? I can assure you that did not happen. It was because customers at the café were part of the bubble. The difference between pets.com and the café is that, had there not been a bubble, the same café would have existed at the same spot, serving coffee to different people working at different jobs producing different things that were demanded by a balanced market, because people who go to work still want their coffee. Hutt also had an economic explanation of how the economy recovers from a recession. He emphasized that any useful good or service can be integrated into the price system, somewhere, and at some price. Once someone is again producing, he can supply, and then he can demand, and by demanding, he creates a market for the supply of other producers. And so on. But that requires two things: time and flexibility. It takes time for entrepreneurs to sort through the broken shards of the boom to figure out what is really in demand, and what the supplies of factors are. But the recovery will occur because eventually entrepreneurs see all of those unemployed resources as a bargain. Productive assets and labor won’t stay on sale forever. When prices of some factors get low enough, then the people who held on to some cash will see attractive yields. Either people will move around, or just take the best job that they can in order to get by until things improve. The empty offices will get leased out. The key is that profit margins must open up. Hutt argued that can happen even in a depression if prices are flexible because there is always some way to combine inputs into outputs at a profit, if prices will cooperate. When confidence is low, entrepreneurs will make more conservative estimates of the market for their outputs, and they may require wider profit margins. You can think of it as a risk premium. And that means that the prices for some types of labor and capital must fall considerably not only from their bubble values, but in relation to other prices. During the tech bubble, many small companies were formed. Every one of them required a director of engineering, a CEO, a CFO, and several other key management positions. People got hired into these jobs who lacked the experience to get such a job in an established company, or people at established companies were hired away and less experienced people were promoted. This process could be described as job title inflation: high level job titles were debased. When the recession hit, a lot of these positions simply went away, and the people who held them had to seek new jobs. Some of these people rose to the level of their new responsibilities and advanced their career, but others had to take a step back and accept a lower paying job with a less important-sounding title. And if they were unwilling to do so, then that prolonged the duration of their unemployment. When there is no recovery, or it is long in coming, what got in the way? Hutt had an answer to this: the price system is blocked from working. Hutt emphasized wage rigidities caused by labor unions. Unions are cartels that attempt to create a monopolistic price by legally raising wages above labor’s marginal value product. When the price of something increases we move along the demand curve to a lower quantity demanded. Less quantity means less labor is hired into those jobs, and the displaced workers must find some other work, which is by definition lower paid or otherwise less preferable. Hutt explained why labor unions decrease aggregate demand rather than increase it. When workers shift from a higher-valued occupation to a lower-valued one, they produce less, and therefore supply less, and by Say’s Law, demand less. And as Hutt showed, by demanding less, they diminish the market for the supply of others. Anything that prevents wages or asset prices or capital market prices from falling moves markets away from clearing. In the modern world, one of the main barriers to recovery is Keynesian stimulus. Stimulus tries to create more demand without creating more supply. We know from Say’s Law that this is doomed to fail because supply and only supply constitutes the demand for other goods. What stimulus is really trying to do is to inflate the fake price system of the boom so that more expenditures can occur at the fake prices producing more of the wrong things for which there was never a real demand in the first place. And that cannot work because it was the breakdown of production under the fake prices that caused the boom to end. For a real recovery to occur, production must be reorganized along the lines of consumer demand. Now I am going to turn to the Great Depression and show the relevance of Hutt’s thinking to that time. Prior to the 1930s, recoveries from a panic, as they were called, took about 12-18 months. The great depression of 1920 (the one that you’ve probably never heard of) lasted about that long. Why? As historian Thomas Woods wrote, “Harding cut the government’s budget nearly in half between 1920 and 1922. The rest of Harding’s approach was equally laissez-faire. Tax rates were slashed for all income groups. The national debt was reduced by one-third.” The Great Depression also began with a stock market crash followed by a downturn. As the price system began to work, a normal recovery had begun by the early 30s. Then the New Deal kicked in, which created a depression within a depression that lasted until the mid-1940s. Ten years later, what could have kept the US economy underwater for 15 years? The price system was blocked, especially in labor markets. Herbert Hoover held to a variation of underconsumption theory called the purchasing power theory of wages[1] According to this theory, high wages in themselves created more purchasing power. And by “high” he meant, above market values. Low wages, thought Hoover, were the cause of the depression because labor did not have enough purchasing power to buy back its own output. Hoover exhorted business leaders not to lower wages, and many of them believed him and followed his advice, or did so because they were clear enough that regulation would follow had they not complied. As explained by standard price theory, Hoover’s policies produced unemployment on a massive scale. Hoover also believed in a strange class warfare doctrine. He thought that by preventing wages from falling, that all of the burden of the adjustment of production could be shifted from labor as a class to capital as a class. In America’s Great Depression, Rothbard quotes Hoover as follows:

Following Hoover was FDR, who made things even worse. One of the New Deal agencies, the National Recovery Administration, employed agents to scour the country looking for stores that were lowering their prices. From Jim Powell’s FDR’s Folly: How Roosevelt and his New Deal Prolonged the Great Depression:

In addition to problems with prices, there was a deeper problem with the New Deal. For that, I will turn to the contemporary economic historian Robert Higgs. Higgs has noted that the Great Depression was characterized by a collapse in capital spending. Austrians know that capital accumulation is what increases real wages. And capital consumption means lower real wages. We also know that a large volume of gross capital investment is required to offset capital simply wearing out from use every year. Net capital investment begins only when gross investment more than offsets capital consumption. And there is nothing to ensure that any volume of gross investment at all must occur during any given year. If investors stop investing, then the capital stock shrinks, and real wages, even under conditions of full employment will fall. The reason for the collapse in investment was, says Higgs, “a pervasive uncertainty among investors about the security of their property rights in their capital and its prospective returns.” Higgs calls this regime uncertainty. This rational fear was based on the ideology of the New Dealers. The New Deal brain trust was full of anti-market ideologues who wanted to restructure the US economy from a free enterprise system to a socialistic-fascistic centrally planned system. Higgs gives several pieces of evidence in support of the regime uncertainty hypothesis. One, qualitative, was the writings of business leaders in which they explained their reasons for |

| GaveKal Answers "How Low Can The Renminbi Go" Posted: 04 Mar 2014 04:28 PM PST From Chen Long of Evergreen GaveKal Renminbi Limbo: How Low Can It Go? As we argued last week, the recent depreciation of the Chinese currency was engineered by the central bank—not as a competitive devaluation, but rather to rout speculators making one-way bets on renminbi appreciation. The People's Bank of China (PBC) acted after January saw roughly US$73bn in net capital inflows, the biggest deluge of inward flows in 12 months. The question now, after a 1.4%fall in the renminbi in 10 trading days (a bigger fall, admittedly, than we anticipated), is just how far will the PBC go to prove its point? In our view, not much farther, because Beijing recognizes the risk of sparking a broader loss of confidence. First, a quick reminder of how Chinese currency management works. Since 2005, the PBC has been managing the renminbi (RMB) gradually upward against the US dollar, at an annual rate of about 5% a year through the end of 2011 (except for a hiatus during the global financial crisis), and a slower pace of around 2-3% since 2012. The RMB is allowed to trade 1% below or above a "central parity rate" which the PBC sets daily. From September 2012 until a week ago, the spot RMB rate continuously traded above the parity rate— usually, quite close to the 1% limit. This limit-up trading reflected the view that the RMB was a one-way appreciation bet. Two weeks ago, the PBC made an unusually large downward adjustment in its parity rate, and this triggered an even steeper selloff in the spot market. The cumulative weakening in PBC's central parity has been 183 pips (from 6.1053 to 6.126), while the spot market adjustment has been 850 pips (from 6.0645 to 6.1495, a decline of 1.4%). In 10 trading days the RMB has erased all its gains since last May, and the spot rate has started to trade below parity for the first time in almost 18 months (see chart on page two). How much farther will the RMB fall? At the outer limit, perhaps as low as 6.24, but probably much less. The reasoning is as follows. Right now the spot market is trading 0.4% weaker than the central parity. So without any further move by PBC to weaken the parity, the limit is 6.18. A move below that would require PBC to adjust the parity further downward. The biggest-ever downward adjustment in the parity was 685 pips, in May 2012. If the PBC matches that move (by adjusting the current parity down another 500 pips), the RMB could fall to 6.24. But we doubt the parity will move anywhere near that far. First, the PBC has already achieved its goal of punishing speculators, as shown by the spot rate trading below parity. Second, more aggressive depreciation risks a backlash from China's trading partners who will complain about beggar-thy-neighbor tactics. Third, the depreciation drive carries costs. Beijing's already massive foreign exchange reserves are building up as state banks have been ordered to purchase dollars. This creates unwanted liquidity in the domestic financial market, at a time when PBC wants to keep liquidity from growing too fast. The final reason is the risk that a controlled depreciation could morph into uncontrolled capital outflows. Most emerging markets have experienced significant outflows since Ben Bernanke's tapering hint last May, and China has not proven itself immune: it had outflows in the first three quarters of 2012 (between QE2 and 3) and then again briefly last summer. China's economic fundamentals are weaker now than in 2012. While it is true that Chinese authorities have enough ammunition to prevent a Turkeystyle meltdown (capital controls and US$3.7 trillion in reserves), sustained outflows can make management of domestic liquidity much more difficult (see [China] Who's Afraid Of Capital Outflows). At the end of the day, the currency moves are about giving the PBC more room to maneuver in the domestic market, and that aim has been largely achieved. |

| The Gold Price Dropped 0.91 Percent to Close at $1,337.80 Posted: 04 Mar 2014 03:53 PM PST Gold Price Close Today : 1337.80 Change : -12.30 or -0.91% Silver Price Close Today : 21.188 Change : -0.260 or -1.21% Gold Silver Ratio Today : 63.140 Change : 0.192 or 0.30% Silver Gold Ratio Today : 0.01584 Change : -0.000048 or -0.30% Platinum Price Close Today : 1463.50 Change : 3.40 or 0.23% Palladium Price Close Today : 763.70 Change : 13.90 or 1.85% S&P 500 : 1,873.91 Change : 28.18 or 1.53% Dow In GOLD$ : $253.35 Change : $ 5.80 or 2.34% Dow in GOLD oz : 12.256 Change : 0.280 or 2.34% Dow in SILVER oz : 773.83 Change : 20.00 or 2.65% Dow Industrial : 16,395.88 Change : 227.85 or 1.41% US Dollar Index : 80.170 Change : 0.070 or 0.09% As I feared yesterday, the GOLD PRICE did not retain its war-inspired gain. It held on to part of it, but dropped $12.30 (0.91%) to $1,337.80. Silver lost 26 cents (1.2%) to 2118.8c. Intraday gold retraced all its gains yesterday but in the end closed off the day's lows. Believe it or not, the GOLD PRICE has quite a ways to fall just to intersect its rising trend line, now at $1,303.66. It could fall to the neckline where it broke out, now about $1,280, and make only a routine correction in a rally. The SILVER PRICE kissed its 200 DMA (2102c) but climbed above that to close at 2118.8c. If it minds to keep rising, a likely place for silver to stop first would be 2075c, the upper boundary of the range it broke through on 14 February. Silver has more humiliating work to do below, as does gold. Platinum rose $3.40 today to $1,463.50 while palladium jumped $13.90 to $763.90. Why? Because almost all the platinum and palladium in the world comes from just two places, Russia and southern Africa. About 75% of the platinum comes from southern Africa and 25% from Russia, while 25% of the palladium comes from Africa and 75% from Russia. The world didn't end last night so the stock touts crawled out and went to work with re-doubled efficiency. Dow made back all yesterday's losses and then some. Closed up 227.85 (1.41%) to 16,395.88. S&P500 outdid the Dow, rising 28.18 (1.53%) to another new all-time high at 1,873.91. The non-confirmation continues. Nasdaq Composite, Nasdaq 100, Russell 2000, and Wilshire 5000 all made new highs but the Dow did not. Stocks' big jump knocked the Dow in metals back. After touching its 200 Day Moving Average headed down yesterday, the Dow in Gold today touched its 20 DMA headed up. Probably about to see a correction of that long fall from December. DiG closed up 2.35% at 12.25 oz (G$253.23 gold dollars). Dow in silver crossed above its 20 DMA (764.93). Rose 2.47% to 772.59 oz. (S$998.95 silver dollars). Here, too, expect an upward correction. The US Dollar Index barely improved its gains by rising 7 basis points (0.08%). Nothing inspiring here and it remains in a downtrend since 1 February, which has only traded in the same range prevailing since September. The euro reclaimed yesterday's losses during the day, but ingloriously lost all that, closing up 0.01% (Can y'all see that? Maybe I've got a hair in my eye.) to $1.3736. Long as trouble brews in Ukraine, euro will have a hard row to hoe. Somebody shot the yen with a silver bullet today. It dropped -- gapped down -- 0.81% to 97.79 cents/Y100. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Gold Price Dropped 0.91 Percent to Close at $1,337.80 Posted: 04 Mar 2014 03:53 PM PST Gold Price Close Today : 1337.80 Change : -12.30 or -0.91% Silver Price Close Today : 21.188 Change : -0.260 or -1.21% Gold Silver Ratio Today : 63.140 Change : 0.192 or 0.30% Silver Gold Ratio Today : 0.01584 Change : -0.000048 or -0.30% Platinum Price Close Today : 1463.50 Change : 3.40 or 0.23% Palladium Price Close Today : 763.70 Change : 13.90 or 1.85% S&P 500 : 1,873.91 Change : 28.18 or 1.53% Dow In GOLD$ : $253.35 Change : $ 5.80 or 2.34% Dow in GOLD oz : 12.256 Change : 0.280 or 2.34% Dow in SILVER oz : 773.83 Change : 20.00 or 2.65% Dow Industrial : 16,395.88 Change : 227.85 or 1.41% US Dollar Index : 80.170 Change : 0.070 or 0.09% As I feared yesterday, the GOLD PRICE did not retain its war-inspired gain. It held on to part of it, but dropped $12.30 (0.91%) to $1,337.80. Silver lost 26 cents (1.2%) to 2118.8c. Intraday gold retraced all its gains yesterday but in the end closed off the day's lows. Believe it or not, the GOLD PRICE has quite a ways to fall just to intersect its rising trend line, now at $1,303.66. It could fall to the neckline where it broke out, now about $1,280, and make only a routine correction in a rally. The SILVER PRICE kissed its 200 DMA (2102c) but climbed above that to close at 2118.8c. If it minds to keep rising, a likely place for silver to stop first would be 2075c, the upper boundary of the range it broke through on 14 February. Silver has more humiliating work to do below, as does gold. Platinum rose $3.40 today to $1,463.50 while palladium jumped $13.90 to $763.90. Why? Because almost all the platinum and palladium in the world comes from just two places, Russia and southern Africa. About 75% of the platinum comes from southern Africa and 25% from Russia, while 25% of the palladium comes from Africa and 75% from Russia. The world didn't end last night so the stock touts crawled out and went to work with re-doubled efficiency. Dow made back all yesterday's losses and then some. Closed up 227.85 (1.41%) to 16,395.88. S&P500 outdid the Dow, rising 28.18 (1.53%) to another new all-time high at 1,873.91. The non-confirmation continues. Nasdaq Composite, Nasdaq 100, Russell 2000, and Wilshire 5000 all made new highs but the Dow did not. Stocks' big jump knocked the Dow in metals back. After touching its 200 Day Moving Average headed down yesterday, the Dow in Gold today touched its 20 DMA headed up. Probably about to see a correction of that long fall from December. DiG closed up 2.35% at 12.25 oz (G$253.23 gold dollars). Dow in silver crossed above its 20 DMA (764.93). Rose 2.47% to 772.59 oz. (S$998.95 silver dollars). Here, too, expect an upward correction. The US Dollar Index barely improved its gains by rising 7 basis points (0.08%). Nothing inspiring here and it remains in a downtrend since 1 February, which has only traded in the same range prevailing since September. The euro reclaimed yesterday's losses during the day, but ingloriously lost all that, closing up 0.01% (Can y'all see that? Maybe I've got a hair in my eye.) to $1.3736. Long as trouble brews in Ukraine, euro will have a hard row to hoe. Somebody shot the yen with a silver bullet today. It dropped -- gapped down -- 0.81% to 97.79 cents/Y100. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Posted: 04 Mar 2014 03:51 PM PST Jim Sinclair’s Commentary Today’s battle in the virtual dollar pit. (5 day chart) Jim Sinclair’s Commentary What did she say? Lagarde: ECB must fight inflation with more stimulus March 3, 2014, 10:06 a.m. EST A prolonged period of low inflation in the euro zone may derail the currency area's fragile economic recovery and must... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Marc Faber: Gold Is One Of The Few Cheap Assets Posted: 04 Mar 2014 02:58 PM PST => first 6:15 minutes + as of 17:10 minute If there was a recession in China, would people still buy gold?

On the ongoing Asian conflicts and the impact on natural resources:

On the fundamentals of gold in the light of the 2 year downtrend:

On current bull and bear markets:

|

| Bankers Tell It Like It Is – Top 10 Quotes That Reveal Their Crimes Posted: 04 Mar 2014 02:38 PM PST This is a guest post by Liberty Gold and Silver. The alternate financial media has been abuzz of late with bizarre stories of the alleged suicides of prominent members of world banking and finance. Over recent weeks, between eight and twelve (some say as many as twenty) successful traders and managers involved with FOREX trading and other derivative currency speculation, have conveniently "decided" to throw themselves from the roof tops of a variety of JP Morgan Chase banks in London, Hong Kong, and New York. Another top banking official, William Broeksmit, former executive at Deutsche Bank, was found hanged in his London home. And others with strong connections to investment banking and the Federal Reserve itself have likewise met unusual deaths. Michael Dueker, former vice president of the St. Louis branch of the Federal Reserve, was found at the bottom of a fifty foot embankment below where he had just parked his car in Tacoma, Washington. The cause of death is still undetermined. The strangest of these deaths was Richard Talley, a former investment banker with Drexel Burnham Lambert who was alleged to have shot himself with a nail gun at least ten times in his Centennial, Colorado, home. The keen observer will note that a great number of these deaths have occurred in tandem with the extensive multinational regulatory agency investigations of egregious fraud, price fixing, and "front run" trading in the FOREX markets and in the LIBOR index. These markets are gigantic and it is hard for the novice to comprehend the magnitude of money that is involved in daily transactions for both of these. The weekly volume on the FOREX market alone is excess of $20 trillion. As of two weeks ago, no less than ten global banking giants including JP Morgan Chase, Royal Bank of Scotland, Deutsche Bank, Goldman Sachs, Credit Suisse, Lloyds Banking Group, and others, have found themselves the object of a litany of criminal probes that undoubtedly have created tension and fear, bordering on "flight or fight" panic within these banking conglomerates. Only the extremely naïve could find it hard to believe that the banking world, in order to cover up and protect itself from prosecution of the greatest financial crimes and frauds in history, would not resort to measures of extreme prejudice to eliminate potential material witnesses. The key point to understand here, however, is that this is not at all a new phenomenon. The history of banking in the modern era (since the establishment of the Bank of England in the late 17th century), has been nothing but an ugly cavalcade of theft of sovereign national treasuries too vast to calculate. From the beginning, these large private central banks (the Bank of England, the Federal Reserve, the Bank of Japan, etc.), were intentionally designed to operate freely above the rule of law in their respective nations. They have been the financiers of most of the conflicts and wars in the last two centuries and are continuing to do so unabated to the present. Countless millions have died in these bankers' wars in service to the unbridled greed of these financiers. Through the massive inflation of each nation's currency they dominate, the bankers have robbed the citizens of the purchasing power of their money and with it, their life savings. Since the establishment of the Federal Reserve in 1913, for example, the purchasing power of the US dollar has been eroded to nearly 1/100th of its original value. This has not been accidental. This was planned from the beginning. Private fractional reserve central banking is the greatest criminal conspiracy that continues to this day to hide in plain sight. But please, don't just think this is only our opinion. Fascinatingly, the bankers themselves have throughout the decades, clearly revealed their purpose and intent. At this juncture, we would like to offer some quotes for you by the highest ranking members of the banking elite, past and present.

So there it is in their own words. The arrogance, elitism, and condescension of bankers towards the common citizen are starkly revealed. These brilliant criminals have created the Ponzi scheme of all Ponzi schemes and so far, protected it from any form of criminal prosecution. However, that might be about to change. Awareness of their criminality is growing throughout the world at a rapid pace but never doubt that this group will fight tenaciously and be willing to go to any extremes to protect their centuries' old scam. We predict there will undoubtedly be more strange banker deaths ahead of us in the ensuing weeks, months, and years. The next time you walk into your local bank, please ask yourself this question, "Do I really want to entrust my hard earned wages and savings to a centuries' old criminal scheme?" If you don't, please consider gold and silver for protection of your wealth." To learn more about the rewards of precious metals investing, including how to fund your existing IRA with gold or silver, call Liberty Gold and Silver seven days a week at 888.751.3330. |

| Gold Model Calculates Gold Price Of $2400 To $2900 In 2017 Posted: 04 Mar 2014 02:24 PM PST In this article, contributor Gary Christenson presents the results of his intense efforts to work out a model for the gold price. This “gold model” is not meant to predict short term gold prices, nor is it intended to act as a target price for investors. The aim of the gold model is to derive a “fair value” for gold in a longer term context, based on a fundamental basis. Such a fair value should act as an objective measure to calculate the deviation with gold’s spot price. As an example, the gold price crash of 2013 was said by mainstream media and financial pundits to bring the gold price back to “acceptable” levels as gold had been in a bubble. While it was true that the gold price was getting ahead of itself in 2011, it was nowhere near a bubble. The “gold model” from Gary Christenson confirms that the gold price was rising too fast, but it’s fair value was nowhere near the levels of its 2013 bottom. In that respect, it is interesting to note what several famous bankers have said about the gold price. Consider the following quotes. Paul Volcker once said “Gold is my enemy.” Ben Bernanke recently said “Nodoby really understands gold prices and I don’t pretend to understand them either.” Janet Yellen her recent quote was “I don’t think anybody has a very good model of what makes gold prices go up or down.” So here you have it, a gold model that has been 98% accurate in the past four decades, worked out by an individual who looked at the fundamentals and the big picture, in an unbiased way. Admittedly, we believe bias is the main issue for bankers. Gold persistently rallied from 2001 to August 2011. Since then it has fallen rather hard – down nearly 40%. This begs the question: “Did the gold bull market end at the top in August 2011 as many mainstream analysts believe?” OR “Was the decline during the past 2.5 years merely a correction in the ongoing bull market?” The answer, in my opinion, can be found in my gold pricing model that has accurately replicated AVERAGE gold prices after the noise of politics, news, high frequency trading, and day to day "management" have been purged. I presented the specifics of my model at the Liberty Mastermind Symposium in Las Vegas on February 22, 2014. A detailed presentation would be much too long for this article so the following is a quick summary. OBJECT:

VARIABLES:

PROCESS:

MODEL RESULTS:

GRAPH NOTES:

FUTURE PRICES FOR GOLD per the EGP Model Assume:

I plan to publish the details of this model, including variables, graphs, analysis, and the calculation formula in a paperback book. Until then you may find value in these articles: Bill Holter Jim Sinclair in Austin, Texas

GE Christenson | The Deviant Investor |

| Gold Daily and Silver Weekly Charts - Ebb and Flow - Gresham's Law Posted: 04 Mar 2014 01:48 PM PST |

| Gold Daily and Silver Weekly Charts - Ebb and Flow - Gresham's Law Posted: 04 Mar 2014 01:48 PM PST |

| Detailed Strategies to Combat the Tax Man Posted: 04 Mar 2014 01:43 PM PST Frankly, the president’s tax proposal should be a major concern for everyone who has carefully planned for their retirement. Any tax benefits you've counted on in your retirement plans could soon suddenly disappear just because you fit into some made-up definition of "wealthy." Luckily, there is something you can do to secure some retirement income that can't be touched by the feds. And it's perfectly legal, too. In fact, the Supreme Court has declared this income off-limits to the IRS again and again. I'll tell you all about these investments that pay big, regular checks the IRS can't touch in just a second. And I'll introduce you to three of my favorite ways to use this strategy. Your checks will come monthly — not annually or even quarterly — meaning you can look forward to 36 tax-free checks a year. And they won't be small checks, either. The three picks I've researched recently yielded an average of 6.75%. That's the equivalent of a 10.8% taxed dividend, assuming you're in the 35% tax bracket. You'll also have a chance to score capital gains, too. Over the past decade — through stock market disasters, credit crises, wars, terrorist attacks, rioting around the globe — this strategy has returned 75%. That means an average annual return of 7.5%. (Just keep in mind you may have to pay capital gains taxes when you sell.) You won't need any special brokerage account, and it has nothing to do with options or anything beyond just telling your broker to simply buy them right from the New York Stock Exchange. But first, let me explain how big a deal this tax-free income really is. Over the long term, the municipal bond market is one of the most lucrative and safest around. You're no doubt aware that the average S&P 500 stock barely pays a dividend at all — on average, you can expect a lousy 2.1% quarterly payout. Then Uncle Sam adds insult to injury by taking his cut of 35% or more from investors. Factor that in and you're left with an after-tax yield of a measly 1.4%. And that hasn't even factored in the 3.8% tax that Obamacare has added to your bill. Ouch! So to balance things out, I'm suggesting you venture into the municipal bond market. Municipal bonds are simply bonds issued by local governments to fund construction projects. The government pays the bondholder back from collected taxes or even the proceeds from whatever the money helped build. They've been a part of American history since 1812, when New York City sold bonds to help build a canal. It was a novel idea, and it paid off. The people who got in on the ground floor of this new market enjoyed great profits. That success led to a municipal bond boom, with New York's Erie Canal bonds being some of the most celebrated. One of the defining features of a municipal bond is that you don't have to pay federal taxes on the income. In fact, the IRS has a space for it on its 1099-INT (Interest Income) form, box 8: tax-exempt interest. (Hence why I sometimes call them "Box 8 dividends.") Of course, being tax-free hasn't stopped the feds from trying to get at it. The first time it happened was in 1895. But the Supreme Court shut that notion down, declaring the income generated by these bonds is, indeed, off-limits for arbitrary taxation by Uncle Sam. The feds most recently took a swing at this income in 1988. But once again, the Supreme Court stopped them in their tracks. Congress and the White House haven't tried since, and even if they float the idea of taxing this income to fix the budget problems or punish the "wealthy," the Supreme Court will likely swat them down. So your dividend income is safe. But the real question is whether your income stream is safe. If you listen to the news, you know that some city budgets are in comparatively worse shape than Washington's. In fact, that's a reason some doom-and-gloom pundits say to avoid municipal bonds. They prognosticate a tsunami of defaults. However, the reality is quite different… The start of the overhyped risks of munis really took hold with the 60 Minutes interview of banking analyst Meredith Whitney in December 2010. Whitney predicted that the muni market was going to be in full Armageddon mode, with defaults running into the hundreds upon hundreds of billions of dollars. It made for great press, and some of the underlying reasons were correct. Yes, some municipalities have gone bankrupt — a small handful of outliers that made some particularly bad financial decisions. Places like Detroit, Mich.; Harrisburg, Pa.; and Jefferson County, Ala. But despite the fear those places caused, they really are just anomalies. Over the long term, the municipal bond market is one of the most lucrative and safest around. It is so safe that the $3.7 trillion worth of the muni bonds that make up the market has seen a trifling amount of bankruptcies. In fact, a leading think tank that follows and advises state and local governments reports that out of the universe of general obligation muni bonds, only one in every 2,710 issues has filed bankruptcy since 2008. Moreover, if you look at the long-term averages including during times of deep recessions over the past many, many years — the default rates for munis are not only very low, they're much, much better than for most other bond markets… and light-years better than for corporate bonds. And if you look well beyond just the past several challenging years — according to reviews by the leading rating agencies — the average for defaults for muni bonds is very low. In fact for the entire muni market, the fail rate is less than 0.20% of all issues. But the real paydirt of understanding muni bond defaults involves recovery. Just because a muni issue defaults and goes into bankruptcy doesn't mean that investors lose out. In fact, for most muni issues that have defaulted, the recovery rate for decades is running at 100%. That's right — 100% of principal was returned to investors, despite defaulting. You know what corporate bond investors have been getting over the decades when their bonds default? The long-term average is running at only 40%, or 40 cents on the dollar. But even more proof of the safety of the muni bond market isn't just how well it's done, but how well it's supposed to do in the years to come. To avoid default, the municipalities issuing the bonds need a steady inflow of cash to pay to the bond holders. According to the Center on Budget and Policy Priorities, we're in good shape here, because tax revenues are up big around the nation. Thirty-three states saw increases in their tax rates post-recession. Overall, states saw average revenue gains of 17% in sales taxes, 13% in income taxes, 17% in business taxes, 22% in excise taxes (fuel, booze and tobacco) and other general tax revenue gains of 24%. Consider the case of California. Not so long ago, the state's budget deficit problems were front-page news. Now the state is enjoying a budget surplus — and many other states, cities and municipalities are following suit. That's not all. At the annual Davos, Switzerland, global economic forum, 72% of the 477 economists and market leaders surveyed were upbeat on the U.S. economy and its finances. That's up from 53% in last year's survey. So with tax revenues growing around the nation, and experts convinced the trend will continue, muni bond issuers from coast to coast are better able to keep paying their muni bond interest and principal. And not only are the bonds safer, but they pay more than the U.S. Treasury, and in many cases are rated higher than the U.S. Treasury. There has been a slight hiccup, though, as the Federal Reserve has spooked the income markets with talk over interest rates and ending their bond-buying. But investors are slowly realizing that any fears about rising interest rates are overblown in the current market environment, and the Fed slowing its "quantitative easing" program hasn't been the disaster most have been expecting. That's pushed the muni market as tracked by Standard & Poor's up over 5% from recent lows. And that's just a small setback in the overall trend for munis, which even after all of the hardships of late are still up 32% over the past five years. Regards, Neil George P.S. As good as this market is, I have a muni strategy that could do better — much better — than the rest of the market. It's a collection of three municipal bond funds that will pay you three big checks every month — for a total of 36 a year — that Uncle Sam can't touch! And in today’s email edition of The Daily Reckoning, I gave readers a unique access code to learn how to discover these three funds for themselves. Don’t miss another great opportunity like this. Sign up for The Daily Reckoning email edition, for FREE, right here. Your next issue just a few hours away. |

| Gold’s Second Daily Cycle Is Directly Ahead Posted: 04 Mar 2014 01:35 PM PST The rally in Gold was strong, but the expected test of $1,380-$1,400 never materialized. Gold simply did not have enough buying behind it to reach that level. Since the Cycle did manage to add $100 from the low, the failure to test $1,380 is not necessarily a negative development. With a current Day 14 high, the current 2nd DC will likely form as Right Translated, the 2nd straight Daily Cycle to do so. And from the perspective of a new IC, two Right Translated Daily Cycles and the addition of $175 from the low is a very good start to what we hope will be a big Investor Cycle. Last week's report was titled "Bear Tracks" because I wanted to highlight that Gold was not out of the woods yet. To date, the move higher has been encouraging, but we must keep in mind that the rally has still not broken the bear market down-trend. The early rally in any Investor Cycle can be mistaken for underlying strength in an asset, but in a down-trend (bear market), these rallies fizzle to become counter-trend bounces. When a Cycle rallies out of an ICL, it is propelled initially by a significant amount of Short covering. This buying-to-cover can create an illusion of strength. When the covering is exhausted, the asset can retrace back toward the mean. But that retracement eventually runs out of steam, leaving the asset to be influenced by the true underlying supply and demand. And the dominant trend will usually regain control. Gold is attempting to break a 2.5 year down-trend, and the longer term Cycles are at crossroads. Trading at these sorts of junctures is difficult, because there are several possibilities in play. And capturing a big upside move means going against the established trend, which is always a risky move. It requires exposing a trade to the possibility of being caught in a continuation of the dominant trend. And this is where Gold finds itself at present. The energy accumulated at the last ICL 8 weeks ago has been exhausted, and the underlying strength Gold showed is already a distant memory for traders. Short positions have been long-since covered, and traders are positioning themselves for the next leg of the Cycle. It's at the current point – midway between the 2nd and 3rd Daily Cycles (Weeks 8 through 12) – that Gold will determine where it's ultimately headed. If Gold is going much higher – as I continue to believe – then the coming 2nd DCL should be shallow and the 3rd DC should form as Right Translated. We have not seen a Right Translated 3rd Daily Cycle in over 2.5 years – each Investor Cycle since the 2011 peak has been Left Translated. In the current bear market, every IC has topped before week 10, meaning that it has spent less time rising than declining. And since there are normally 4 Daily Cycles in each Investor Cycle, the 3rd Daily Cycle is pivotal. If the 3rd Daily Cycle is Right Translated, the Investor Cycle must also be Right Translated. In every bull market, it's the presence of RT Cycles that create and maintain an uptrend. So if Gold's trend has changed, the upcoming 3rd Daily Cycle will be critical – it must be Right Translated. Gold's 2nd DCL is directly ahead. Gold struggled mightily on Friday while the dollar fell sharply. I believe this was an important tell. If Gold had further upside in it, the dollar's drop would have propelled it higher by $20 or more. Instead, dollar's drop served to mask heavy selling in Gold. There is little doubt that the 2nd Daily Cycle has topped, so we need to be patient with the decline. The timing for a top is acceptable, and the oscillators have clearly turned and are headed lower. The upward Cycle trend-line has been broken and Gold closed below the 10dma. At this point, we should assume that we have 2-7 sessions lower, with an target of between $1,290-$1,300. |

| A Historic Event Has Taken Place In The Gold Market Posted: 04 Mar 2014 01:16 PM PST  With continuing tensions in Ukraine, today James Turk spoke with King World News what is happening around the world, including a historic event in the gold market. Turk also compared the manipulation taking place in the gold market to what happened when the manipulators of the British pound were taken down by Soros. With continuing tensions in Ukraine, today James Turk spoke with King World News what is happening around the world, including a historic event in the gold market. Turk also compared the manipulation taking place in the gold market to what happened when the manipulators of the British pound were taken down by Soros.This posting includes an audio/video/photo media file: Download Now |

| The Sickness of the 1% | Jesse Ventura Off The Grid Posted: 04 Mar 2014 12:30 PM PST The Illuminati Bankers (mobsters, no different) are covering their tracts on the derivatives collapse, which they will pull at a time of their choosing, but these murders are making it look sooner rather than later. JP Morgan Chase is the TOP Criminal Illuminati bank, owned by the top Illuminati,... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| ECONOMIC COLLAPSE IS INEVITABLE Posted: 04 Mar 2014 12:13 PM PST ECONOMIC COLLAPSE IS INEVITABLE...But Not Imminent | Daniel Ameduri The Federal Reserve Bank is a legal mafia bank cartel. They money launder drug cartel money for big profits. Money launder pedophilia porn money! They racketeer and use extortion to black mail politicians with the NSA, the... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Ukraine: An Expensive U.S. Promise Posted: 04 Mar 2014 11:48 AM PST In the year 410, barbarians started to overrun Great Britain — then a far-flung province of the Roman Empire. British leaders sent a request for aid to the emperor Honorius. "We do not know exactly what the letter to Honorius contained," writes Martin Skold from the Center for International Maritime Security, "but Honorius' response, now referred to by historians as the Reply of Honorius, essentially told the Britons — theoretically Roman citizens who could count on the protection of the Empire — that they would have to make do on their own; Rome had troubles of its own and could not send help this time." Months later, Rome itself was sacked… and after another couple of generations, the Western empire was history. Hold that thought… Secretary of State John Kerry is in the Ukrainian capital Kiev today, offering $1 billion in loan guarantees to the new anti-Russian government. Kerry is relieving himself on a bonfire; Ukraine's government says it needs $35 billion to tide itself over for the next two years. President Obama, meanwhile, is threatening sanctions against Russia for taking de facto control of the Crimean peninsula — which was Russian territory until the Soviet leader Nikita Khrushchev decided to hand it to Ukraine one day in 1954. (By some accounts, Khrushchev was hammered at the time.) Russia's response? Maybe we can figure out a way to avoid using the dollar for international transactions. Or as Kremlin economic aide Sergei Glazyev put it, "We would find a way not just to reduce our dependency on the United States to zero but to emerge from those sanctions with great benefits for ourselves. "An attempt to announce sanctions would end in a crash for the financial system of the United States, which would cause the end of the domination of the United States in the global financial system." OK, that's clearly overblown. But Russia already bypasses the dollar with its No. 2 trading partner China. And Russia has leverage with some of the countries within its No. 1 trading partner, the European Union. Consider this: Over the weekend, Obama thought one of the ways he might "punish" Russia was by kicking Russia out of the G-8 club of industrial democracies. "Nein," said German Chancellor Angela Merkel. Now, why would she say that? Maybe it has something to do with this chart and the big orange wedge on the right? The media generally ignore the energy angle in the Ukraine story, but we do not. All told, Germany gets 36% of its gas from Russia. And it's going to need even more if Merkel is serious about shutting down all of her country's nuclear power plants. "U.S. Increasingly Isolated on Russia Sanctions," said a dispatch last night at the website of Foreign Policy magazine. Yep. How different the world looked only last week to the blinkered Beltway crowd. A week ago yesterday, Foreign Affairs editor Gideon Rose was on The Colbert Report all but running a victory lap for the Ukrainian regime change effectively engineered from Washington while the Olympics were still underway in Russia… Rose: We want to, basically, distract Russia. Oh, look, you have the highest medal count, oh, you did really well… Colbert: Here's a shiny object, we'll just take an entire country away from you! Rose: Basically. Easy-peasy, right? "There are a lot of bad comparisons made between America's worldwide defense posture and the Roman Empire," writes the aforementioned Mr. Skold, bringing us back full circle. "The two do, however, have one obvious thing in common: In both cases, a powerful state made promises to defend far-flung territories. As with Rome, the U.S. is finding out how expensive such promises can be to keep… "The U.S. is in danger of issuing its own Reply of Honorius — those whom we have promised protection may have to rely on their own resources." Of which Ukraine has precious few… Regards, Dave Gonigam Ed. Note: To stay informed on the world’s most important news and investment stories, sign up for the FREE Daily Reckoning email edition, right here. |