Gold World News Flash |

- Reuters: Chatroom evidence challenges Bank of England's story in FX probe

- Gold Bull Market Corrections Then and Now

- Gold Bouncing Off The $1390-1400 Barrier

- Man Who Predicted Every Tapering Now Forecasts QE-Infinity

- Kremlin: If The US Tries To Hurt Russia’s Economy, Russia Will Target The Dollar

- The Run On U.S. Gold Continues…

- Economic Collapse 2014 -- The Fed Will Continue With The Economic Recovery Illusion

- How Gold Performs During FOMC Weeks (Spoiler Alert: Not Good)

- Dead Dollar Walking: The Truth About Government Debt

- The Chinese Yuan Is Collapsing

- Government Agency Warns If 9 Substations Are Destroyed, The Power Grid Could Be Down For 18 Months

- India allows more banks to import gold in easing of curbs

- "The Cacophony Of Fed Confusion," David Stockman Warns Will Lead To "Economic Calamity"

- The Gold Price Lost $17.60 by Comex Close at $1,341.40

- The Gold Price Lost $17.60 by Comex Close at $1,341.40

- The Problem With Forward P/Es

- The success of Singapore gold storage

- Fleckenstein - The Fantasy Is Alive & Well But The End Is Near

- US Fed Continues Tapering, Gold Down on Dollar Rally

- John Embry: Stay Strong, Own Gold And Silver, Wait

- Gold Miners: Red Alert Or All Clear?

- Gold Daily and Silver Weekly Charts - Another Triumphant FOMC Day

- Gold Daily and Silver Weekly Charts - Another Triumphant FOMC Day

- Top Economic Collapse Must Haves -- Harry Dent

- Harry Dent -- Timetable For The Next Collapse

- Despite Taper, The Fed Is Setting Up To Shock The World

- China Must Look Abroad For Metals and Energy To Support Growth

- Fukushima Fallout: Sick U.S. Sailors Sue TEPCO After Exposure to Radiation 30x Above Normal

- Gold tipped to hit $1,400 on Russia fears and ETF buying

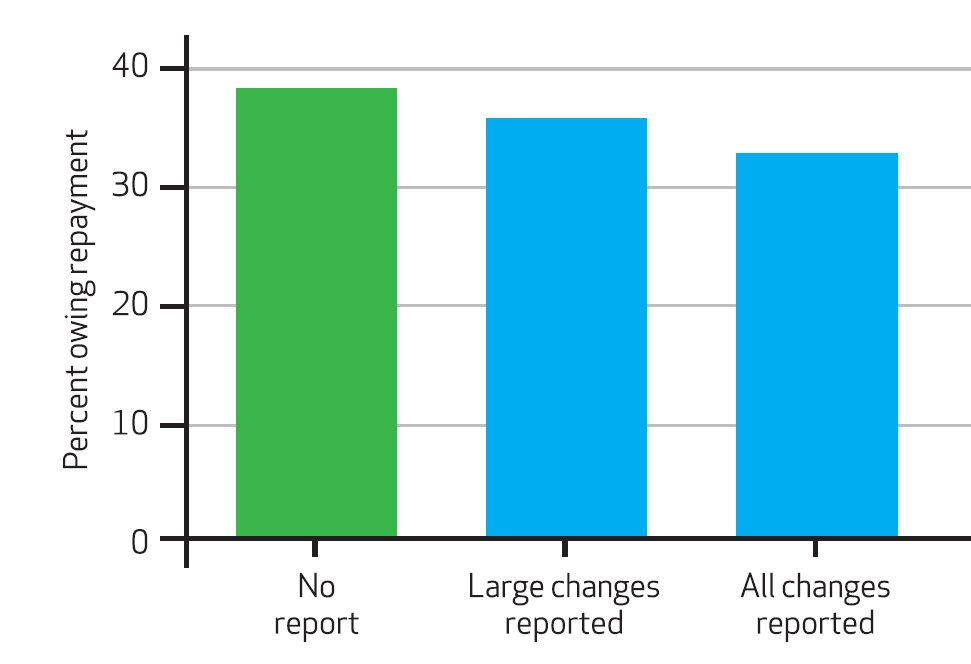

- Obamacare Tax Credit: The Untold Story

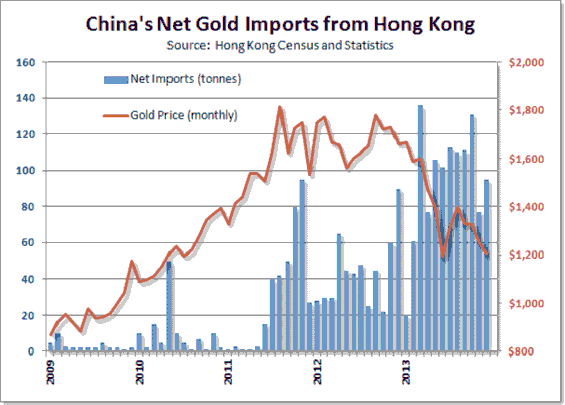

- Gold Price Erases Last Week's 3% Gain as Russia Seizes Ukraine's Naval HQ in Crimea, Shanghai Discount Holds at $7 Per Ounce

- China Economy Isn't Slowing Down, It's Buying Up Resources

- Gold and Silver Price Fall on Huge Volume

- Michael Gray: Is Goldcorp's Bid for Osisko a Harbinger of a Gold Renaissance?

- Michael Gray: Is Goldcorp's Bid for Osisko a Harbinger of a Gold Renaissance?

- Michael Gray: Is Goldcorp's Bid for Osisko a Harbinger of a Gold Renaissance?

- Why Gold Is Unstoppable

- Fishing for Gold?

| Reuters: Chatroom evidence challenges Bank of England's story in FX probe Posted: 19 Mar 2014 11:36 PM PDT By Jamie McGeever LONDON -- British regulators are examining evidence relating to a 2012 meeting of currency dealers and Bank of England officials that potentially challenges the central bank's assertion it had not condoned sharing details of client orders. The practice of sharing details about such orders is at the center of a global rigging probe. Transcripts of a foreign exchange chatroom, now in the hands of Britain's Financial Conduct Authority, reveal that an unnamed senior dealer who attended the meeting told fellow traders the next day that Bank of England officials had agreed that there were advantages to sharing client order information to minimize market volatility around daily reference rates known as "fixings," two sources familiar with their content told Reuters. By sharing information during these fixings, traders are able to match trades and minimize price swings, thereby lessening the risk they take on big transactions. ... ... For the full story: http://www.reuters.com/article/2014/03/20/us-britain-boe-fx-idUSBREA2I21... ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1 302 635 1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Bull Market Corrections Then and Now Posted: 19 Mar 2014 11:30 PM PDT from Jesse's Café Américain:

I think we are in the midst of a generational change in the international currency system. The currency platform will continue to shift, and attempt to restabilize. Change is in the wind, and has been for some time, and flexibility with the ability to learn and adjust will continue to pay a premium. And it is hardly over and done yet. I think we are only at the end of Act I, the realization that the dollar reserve currency system put in place unilaterally by Richard Nixon is unsustainable. But no one knows yet exactly what comes next. |

| Gold Bouncing Off The $1390-1400 Barrier Posted: 19 Mar 2014 10:01 PM PDT from Armstrong Economics:

|

| Man Who Predicted Every Tapering Now Forecasts QE-Infinity Posted: 19 Mar 2014 09:01 PM PDT  Today the man who, astonishingly, correctly predicted every single Fed tapering is now forecasting QE-to-infinity. Gerald Celente, the man many consider to be the top trends forecaster in the world, also predicted that when the Fed reverses course it will have a tremendously negative impact on the U.S. dollar and send the prices of gold and silver soaring. Below is what Gerald Celente, founder of Trends Research, had to say in this remarkable and timely interview. Today the man who, astonishingly, correctly predicted every single Fed tapering is now forecasting QE-to-infinity. Gerald Celente, the man many consider to be the top trends forecaster in the world, also predicted that when the Fed reverses course it will have a tremendously negative impact on the U.S. dollar and send the prices of gold and silver soaring. Below is what Gerald Celente, founder of Trends Research, had to say in this remarkable and timely interview.This posting includes an audio/video/photo media file: Download Now |

| Kremlin: If The US Tries To Hurt Russia’s Economy, Russia Will Target The Dollar Posted: 19 Mar 2014 09:00 PM PDT by Wolf Richter, SilverBearCafe.com:

Last time, it was Sergei Glazyev, an advisor to Vladimir Putin who'd fired the shot. But he wasn't a government official. "Anonymous sources" at the Kremlin claimed he wasn't speaking for the government. As Mândraùsüescu, reported in his excellent article, From Now On, No Compromises Are Possible For Russia: |

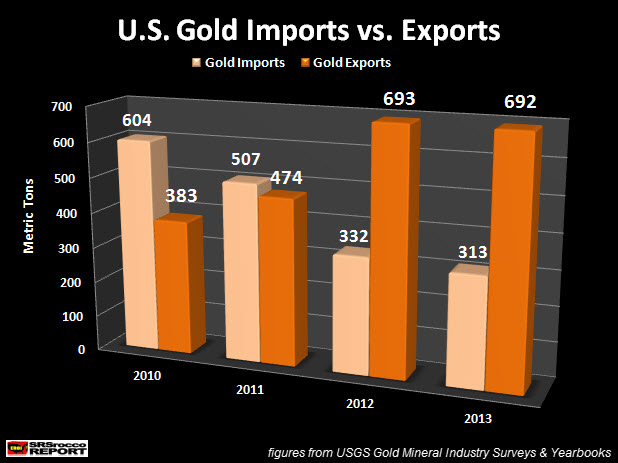

| The Run On U.S. Gold Continues… Posted: 19 Mar 2014 08:20 PM PDT from SRS Rocco:

If we look at the chart below, U.S. gold exports in 2010 were 383 metric tons (mt), however by 2013, they increased 81% to 692 mt. In addition, U.S. gold imports fell 48% from 604 mt in 2010 to 313 mt in 2013. |

| Economic Collapse 2014 -- The Fed Will Continue With The Economic Recovery Illusion Posted: 19 Mar 2014 07:45 PM PDT Greece has struck a deal to take on more debt and push unemployment higher. Mortgage applications declined again sending housing into a death spiral. The Fed Chairman has reported that the economy is recovering because it has a strong underlying base. Obamacare premiums are set to sky rocket,... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| How Gold Performs During FOMC Weeks (Spoiler Alert: Not Good) Posted: 19 Mar 2014 07:30 PM PDT What is more confidence-inspiring in the Fed's ability to manage the world and the continued dominance of the US Dollar as global reserve currency than a falling gold price... and when better to show that than FOMC meeting weeks... welcome to the centrally-planned world where the announcement of ongoing trillions in fiat dilution constantly crushes the price of undilutable money.

|

| Dead Dollar Walking: The Truth About Government Debt Posted: 19 Mar 2014 07:00 PM PDT Global government debt has reached over one hundred trillion dollars. But where has all of that money really gone? There will be no economic recovery. Prepare yourself accordingly. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Chinese Yuan Is Collapsing Posted: 19 Mar 2014 06:57 PM PDT The Yuan has weakened over 250 pips in early China trading. Trading at almost 6.22, we are now deeply into the significant-loss-realizing region of the world's carry-traders and Chinese over-hedgers. Morgan Stanley estimates a minimum $4.8bn loss for each 100 pip move. However, the bigger picture is considerably worse as the vicious circle of desperate liquidity needs are starting to gang up on Hong Kong real estate and commodity prices. For those who see the silver lining in this and construe all this as a reason to buy more developed world stocks on the premise that the money flooding out of China (et al.) will be parked in the S&P are overlooking the fact that the purchase price of these now-unwanted positions was most likely borrowed, meaning that their liquidation will also extinguish the associated credit, not re-allocate it.

While widening the trading bands keeps some semblance of rationality, this is anything but an orderly unwind of the world's largest carry trades:

How Much Is at Stake?

Below we have tried to simplify what is happening as much as possible... (since there are many pathways into and out of all of these positions) to try and enable most to comprehend the problem Virtuous circle... (last few years)

BUT what happens when one of these chains start to break? OR ALL OF THEM? (now!)

And then... (tomorrow)

Remember carry-traders are little more than sophisticated leveraged momentum players - so when the trend is no longer your friend, no amount of carry-arbitrage will cover MtM losses on the notional...

Arguing that the PBOC can defend the currency is moot (they clearly do not wish to); Arguing that the PBOC will manage liquidity via their huge FX reserves is moot (they have done so with the banks - who are awash with liquidity as noted by the low repo rates) - this is about forcing the shadow-banking system to shrink before the bubble becomes totally untenable... unfortunately, we suspect it already has... |

| Government Agency Warns If 9 Substations Are Destroyed, The Power Grid Could Be Down For 18 Months Posted: 19 Mar 2014 05:49 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, What would you do if the Internet or the power grid went down for over a year? Our key infrastructure, including the Internet and the power grid, is far more vulnerable than most people would dare to imagine. These days, most people simply take for granted that the lights will always be on and that the Internet will always function properly. But what if all that changed someday in the blink of an eye? According to the Federal Energy Regulatory Commission's latest report, all it would take to plunge the entire nation into darkness for more than a year would be to knock out a transformer manufacturer and just 9 of our 55,000 electrical substations on a really hot summer day. The reality of the matter is that our power grid is in desperate need of updating, and there is very little or no physical security at most of these substations.

If terrorists, or saboteurs, or special operations forces wanted to take down our power grid, it would not be very difficult. And as you will read about later in this article, the Internet is extremely vulnerable as well. When I read the following statement from the Federal Energy Regulatory Commission's latest report, I was absolutely floored...

Wow. What would you do without power for 18 months? FERC studied what it would take to collapse the entire electrical grid from coast to coast. What they found was quite unsettling...

So what would life look like without any power for a long period of time? The following list comes from one of my previous articles... -There would be no heat for your home. -Water would no longer be pumped into most homes. -Your computer would not work. -There would be no Internet. -Your phones would not work. -There would be no television. -There would be no radio. -ATM machines would be shut down. -There would be no banking. -Your debit cards and credit cards would not work. -Without electricity, gas stations would not be functioning. -Most people would be unable to do their jobs without electricity and employment would collapse. -Commerce would be brought to a standstill. -Hospitals would not be able to function. -You would quickly start running out of medicine. -All refrigeration would shut down and frozen foods in our homes and supermarkets would start to go bad. If you want to get an idea of how quickly society would descend into chaos, just watch the documentary "American Blackout" some time. It will chill you to your bones. The truth is that we live in an unprecedented time. We have become extremely dependent on technology, and that technology could be stripped away from us in an instant. Right now, our power grid is exceedingly vulnerable, and all the experts know this, but very little is being done to actually protect it...

If a group of agents working for a foreign government or a terrorist organization wanted to bring us to our knees, they could do it. In fact, there have actually been recent attacks on some of our power stations. Here is just one example…

Have you heard about that attack before now? Most Americans have not. But it should have been big news. At the scene, authorities found "more than 100 fingerprint-free shell casings", and little piles of rocks "that appeared to have been left by an advance scout to tell the attackers where to get the best shots." So what happens someday when the bad guys decide to conduct a coordinated attack against our power grid with heavy weapons? It could happen. In addition, as I mentioned at the top of this article, the Internet is extremely vulnerable as well. For example, did you know that authorities are so freaked out about the security of the Internet that they have given "the keys to the Internet" to a very small group of individuals that meet four times per year? It's true. The following is from a recent story posted by the Guardian...

If the system that controls those IP addresses gets hijacked or damaged, we would definitely need someone to press the "reset button" on the Internet. Sadly, the hackers always seem to be several steps ahead of the authorities. In fact, according to one recent report, breaches of U.S. government computer networks go undetected 40 percent of the time…

Yikes. And things are not much better when it comes to cybersecurity in the private sector either. According to Symantec, there was a 42 percent increase in cyberattacks against businesses in the United States last year. And according to a recent report in the Telegraph, our major banks are being hit with cyberattacks "every minute of every day"...

For much more on all of this, please see my previous article entitled "Big Banks Are Being Hit With Cyberattacks 'Every Minute Of Every Day'". Up until now, attacks on our infrastructure have not caused any significant interruptions in our lifestyles. But at some point that will change. Are you prepared for that to happen? We live at a time when our world is becoming increasingly unstable. In the years ahead it is quite likely that we will see massive economic problems, major natural disasters, serious terror attacks and war. Any one of those could cause substantial disruptions in the way that we live. At this point, even NASA is warning that "civilization could collapse"...

So let us hope for the best. But let us also prepare for the worst. |

| India allows more banks to import gold in easing of curbs Posted: 19 Mar 2014 05:44 PM PDT By Siddesh Mayenkar and Neha Dasgupta MUMBAI -- India has allowed five domestic private-sector banks to import gold, in what industry officials say could be a significant step toward easing of tough curbs on the metal imposed last year to cut the country's trade deficit. The move could boost gold supplies and bring down premiums for the metal in the world's second-biggest consumer after China. The Reserve Bank of India has allowed gold imports by HDFC Bank, Axis Bank, Kotak Mahindra Bank, IndusInd Bank, and Yes Bank, officials at the respective banks told Reuters. ... ... For the full story: http://in.reuters.com/article/2014/03/19/gold-india-imports-banks-idINDE... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| "The Cacophony Of Fed Confusion," David Stockman Warns Will Lead To "Economic Calamity" Posted: 19 Mar 2014 05:22 PM PDT "We never should have painted ourselves so deep in this QE corner in the first place," chides David Stockman, "because the whole predicate [of Fed policy] is false." The author of The Great Deformation holds nothing back in this brief 3-minute primer of everything is wrong with the American economic system (and the CNBC anchors definitely did not want to hear). "We are already at peak debt and forcing more into the economy didn't work," and won't work as is merely funds Wall Street's latest carry trade to nowhere and fiscal irresponsibility in Washington. Simply put, "the private credit channel of monetary transmission is busted," so the Fed is exploiting the only channel it has left - "the bubble channel."

It's hump-day, grab a wine cooler and listen to 3 minutes of almost uninterrupted truthiness

And here is David on The Keynesian Endgame... Even the tepid post-2008 recovery has not been what it was cracked up to be, especially with respect to the Wall Street presumption that the American consumer would once again function as the engine of GDP growth. It goes without saying, in fact, that the precarious plight of the Main Street consumer has been obfuscated by the manner in which the state’s unprecedented fiscal and monetary medications have distorted the incoming data and economic narrative. These distortions implicate all rungs of the economic ladder, but are especially egregious with respect to the prosperous classes. In fact, a wealth-effects driven mini-boom in upper-end consumption has contributed immensely to the impression that average consumers are clawing their way back to pre-crisis spending habits. This is not remotely true. Five years after the top of the second Greenspan bubble (2007), inflation-adjusted retail sales were still down by about 2 percent. This fact alone is unprecedented. By comparison, five years after the 1981 cycle top real retail sales (excluding restaurants) had risen by 20 percent. Likewise, by early 1996 real retail sales were 17 percent higher than they had been five years earlier. And with a fair amount of help from the great MEW (measurable economic welfare) raid, constant dollar retail sales in mid-2005 where 13 percent higher than they had been five years earlier at the top of the first Greenspan bubble. So this cycle is very different, and even then the reported five years’ stagnation in real retail sales does not capture the full story of consumer impairment. The divergent performance of Wal-Mart’s domestic stores over the last five years compared to Whole Foods points to another crucial dimension; namely, that the averages are being materially inflated by the upbeat trends among the prosperous classes. For all practical purposes Wal-Mart is a proxy for Main Street America, so it is not surprising that its sales have stagnated since the end of the Greenspan bubble. Thus, its domestic sales of $226 billion in fiscal 2007 had risen to an inflation-adjusted level of only $235 billion by fiscal 2012, implying real growth of less than 1 percent annually. By contrast, Whole Foods most surely reflects the prosperous classes given that its customers have an average household income of $80,000, or more than twice the Wal-Mart average. During the same five years, its inflation-adjusted sales rose from $6.5 billion to $10.5 billion, or at a 10 percent annual real rate. Not surprisingly, Whole Foods’ stock price has doubled since the second Greenspan bubble, contributing to the Wall Street mantra about consumer resilience. To be sure, the 10-to-1 growth difference between the two companies involves factors such as the healthy food fad, that go beyond where their respective customers reside on the income ladder. Yet this same sharply contrasting pattern is also evident in the official data on retail sales. * * * That the consumption party is highly skewed to the top is born out even more dramatically in the sales trends of publicly traded retailers. Their results make it crystal clear that Wall Street’s myopic view of the so-called consumer recovery is based on the Fed’s gifts to the prosperous classes, not any spending resurgence by the Main Street masses. The latter do their shopping overwhelmingly at the six remaining discounters and mid-market department store chains—Wal-Mart, Target, Sears, J. C. Penney, Kohl’s, and Macy’s. This group posted $405 billion in sales in 2007, but by 2012 inflation-adjusted sales had declined by nearly 3 percent to $392 billion. The abrupt change of direction here is remarkable: during the twenty-five years ending in 2007 most of these chains had grown at double-digit rates year in and year out. After a brief stumble in late 2008 and early 2009, sales at the luxury and high-end retailers continued to power upward, tracking almost perfectly the Bernanke Fed’s reflation of the stock market and risk assets. Accordingly, sales at Tiffany, Saks, Ralph Lauren, Coach, lululemon, Michael Kors, and Nordstrom grew by 30 percent after inflation during the five-year period. The evident contrast between the two retailer groups, however, was not just in their merchandise price points. The more important comparison was in their girth: combined real sales of the luxury and high-end retailers in 2012 were just $33 billion, or 8 percent of the $393 billion turnover reported by the discounters and mid-market chains. This tale of two retailer groups is laden with implications. It not only shows that the so-called recovery is tenuous and highly skewed to a small slice of the population at the top of the economic ladder, but also that statist economic intervention has now become wildly dysfunctional. Largely based on opulence at the top, Wall Street brays that economic recovery is under way even as the Main Street economy flounders. But when this wobbly foundation periodically reveals itself, Wall Street petulantly insists that the state unleash unlimited resources in the form of tax cuts, spending stimulus, and money printing to keep the simulacrum of recovery alive. Accordingly, the central banking branch of the state remains hostage to Wall Street speculators who threaten a hissy fit sell-off unless they are juiced again and again. Monetary policy has thus become an engine of reverse Robin Hood redistribution; it flails about implementing quasi-Keynesian demand–pumping theories that punish Main Street savers, workers, and businessmen while creating endless opportunities, as shown below, for speculative gain in the Wall Street casino. At the same time, Keynesian economists of both parties urged prompt fiscal action, and the elected politicians obligingly piled on with budget-busting tax cuts and spending initiatives. The United States thus became fiscally ungovernable. Washington has been afraid to disturb a purported economic recovery that is not real or sustainable, and therefore has continued to borrow and spend to keep the macroeconomic “prints” inching upward. In the long run this will bury the nation in debt, but in the near term it has been sufficient to keep the stock averages rising and the harvest of speculative winnings flowing to the top 1 percent. The breakdown of sound money has now finally generated a cruel endgame. The fiscal and central banking branches of the state have endlessly bludgeoned the free market, eviscerating its capacity to generate wealth and growth. This growing economic failure, in turn, generates political demands for state action to stimulate recovery and jobs. But the machinery of the state has been hijacked by the various Keynesian doctrines of demand stimulus, tax cutting, and money printing. These are all variations of buy now and pay later—a dangerous maneuver when the state has run out of balance sheet runway in both its fiscal and monetary branches. Nevertheless, these futile stimulus actions are demanded and promoted by the crony capitalist lobbies which slipstream on whatever dispensations as can be mustered. At the end of the day, the state labors mightily, yet only produces recovery for the 1 percent. |

| The Gold Price Lost $17.60 by Comex Close at $1,341.40 Posted: 19 Mar 2014 04:49 PM PDT Gold Price Close Today : 1641.40 Change : -17.60 or -1.06% Silver Price Close Today : 20.800 Change : -0.036 or -0.17% Gold Silver Ratio Today : 78.913 Change : -0.708 or -0.89% Silver Gold Ratio Today : 0.01267 Change : 0.000113 or 0.90% Platinum Price Close Today : 1451.20 Change : -10.00 or -0.68% Palladium Price Close Today : 768.65 Change : -3.10 or -0.40% S&P 500 : 1,860.77 Change : -11.48 or -0.61% Dow In GOLD$ : $204.30 Change : $ 0.75 or 0.37% Dow in GOLD oz : 9.883 Change : 0.036 or 0.37% Dow in SILVER oz : 779.91 Change : -4.12 or -0.53% Dow Industrial : 16,222.17 Change : -114.02 or -0.70% US Dollar Index : 80.150 Change : 0.620 or 0.78% The GOLD PRICE lost $17.60 (1.3%) by Comex close at $1,341.40, then lost another $10 in the aftermarket after the FOMC's eructations. Silver gainsaid the gold price by dropping only 3.6 (0.2%) to 2080, then dropped another 17 cents in the aftermarket to 2063c. I read several analysts, and had to laugh today that one of them was ruminating a BIG drop in gold and the other was chirping about what a bullish set-up had unfolded in gold and silver. Here's what the charts show: The GOLD PRICE has traded in the selfsame upward trading channel since its December low. Today's fall was the last of three days that have brought gold to touch the channel's bottom boundary. It also closed below its 20 DMA ($1,345). From here gold might (1) bounce off the lower channel boundary and resume its uptrend, or trade down to its 50 DMA ($1,295). The gold price is walking in some heavy boots here, my way of saying a lot of indicators point down. However, silver is gainsaying that weakness, and had a strong day, and that IS bullish. Lo, is the man batty? Nope, he ain't. The SILVER PRICE yesterday traded down to about 2065c, broke that level today and traded as low as 2052c (never quite touched 2050) about noon, then bounced up to 2097c, and fell off again to 2052. A double bottom, and down only 3.6 cents on the day. Trading at 2063 in the aftermarket. Of such days big surprise turnarounds are made. Of course, I might be just a fool spinning cobwebs in my brain, but silver did touch back to its 50 DMA today (2055c), a frequent target of corrections, and on the end of the day chart it closed unchanged. AND that 50 DMA happeneth to coincide, yea, to run atop of, the top boundary of silver's three month trading range, wherefrom it broke away stratosphereward in February. In plain English, silver broke out of that trading range, rallied to 2218c, and now hath fallen back to the breakout point for -- one final kiss good-bye, or to fall lower still? If you like to play guts ball, to take chances when you know the edge is on your side though the risk be great, then it's a ripe place to buy. I may be scalped tomorrow, but I bought this evening. I'm just a durned fool. I'd always rather trust metal in hand than central bank functionaries in Washington. I just don't care for liars much, and never could trust 'em. What if we all got it all wrong? What if the real business of the cosmos isn't work and sweat and tears but joy? What if CS Lewis was right when he said, "Joy is the serious business of heaven." What if joy is the serious business of our world, too, and of all creation? What if instead of the dreary round of self-improvement and economic purpose, the purpose of all creation is joy? Did y'all ever watch a dog? Ever notice how much a dog enjoys being a dog? Acts like a dog just for the fun of it? Ever notice that pigs dance? They do, especially when a storm is kicking up. And when somebody is playing, why do we say he's "horsing around"? What if our whole purpose is just to rejoice in being what we are? To play and write and dance and make music and sing just for the fun of it? To romp for joy in God. Wow. That'd put a lot of economists and politicians out of work, let alone do-gooders. FOMC press conference today demonstrated once more that famous stabilizing effect that central banks were created for. And as usual, the market's reaction followeth not logic. Predictably, the FOMC announced it would "taper" by buying only $55 billion in US treasuries and mortgage backed securities. Yet that was piddling to the announcement that the Fed was only kidding about keeping interest rates low until unemployment hit 6.5%. After all, so many people have given up on ever finding jobs now that 6.5% target is getting right easy to hit. Now the Fed has discovered previously unrecognized "scars" in the economy that won't heal for two more years. Thus the Great Healer, The Fed, must keep interest rates low and raise them only slowly. Rather perversely in the face of the FOMC's resolve to keep repressing the economy with low interest rates, markets interpreted the statement as immediately higher interest rates. Ten year treasury yield shot up 3.39% (bonds dropped) 20 2.772%, well above the 2.708% 20 day moving average, and above the 2.745% 50 DMA as well. -- this despite 15 of the Fed's 16 policy makers believe it will be inappropriate to raise rates this year. I am not a Fed policy maker but only a natural born durn fool from Tennessee, and I believe this is all hogwash, hoakum, and hype. They're lying as fast as their lips can move. They have to keep interest rates down below the inflation rate to inflate away the debt and to keep the US government's borrowing costs low. They've fallen into their own trap, and can't get out. All the rest is lies, and damn the economy, full speed ahead. They are harvesting you like a farmer harvests a herd of pigs, and think no more of you than he does a hanging side of pork. Leaving these disgusting my-honor-is-for-sale-cheap white trash behind, let's look at other markets. Stocks took the FOMC announcement hard, but why I can't guess. Everybody knew the Fed had telegraphed its tapering -- no news there. And if there were a real recovery, rising interest rates really wouldn't slow it down. Actually, rising rates usually accompany recoveries. Makes no sense, but markets have become schizophrenic information junkies, blown from side to side by the latest news without the slightest regard for the next 24 hours. Dow dropped 114.02 or 0.7%to 16,222.17. S&P500 rode the same sled, down 11.48 (0.61%) to 1,860.77. On the charts both indices bounced up to their short term downtrend line, hit it, and bounced down again. Momentum took a hit as the Dow closed below its 16,265.25 20 DMA and the S&P500 closed near its 20 DMA, 1858.43. Both indices are coiling up into a triangle which will break strongly one way or the other. Direction of least resistance is down. The repulsive US dollar index rose 62 basis points to 80.15, clean out of its falling wedge and above its 20 DMA (79.94), both bullish signs. MACD also turned up. The other two scrofulous fiat currencies are fairly mirror images of the dollar. Euro had broken out to the upside from a RISING wedge, above a long standing resistance line about $1.3900 and today fell nearly plumb through the wedge it had left behind. Closed $1.3828, down 0.75%. Yen jumped off a cliff, too, down 0.885 to 97.95 cents/Y100. Pointed itself firmly earthward. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Gold Price Lost $17.60 by Comex Close at $1,341.40 Posted: 19 Mar 2014 04:49 PM PDT Gold Price Close Today : 1641.40 Change : -17.60 or -1.06% Silver Price Close Today : 20.800 Change : -0.036 or -0.17% Gold Silver Ratio Today : 78.913 Change : -0.708 or -0.89% Silver Gold Ratio Today : 0.01267 Change : 0.000113 or 0.90% Platinum Price Close Today : 1451.20 Change : -10.00 or -0.68% Palladium Price Close Today : 768.65 Change : -3.10 or -0.40% S&P 500 : 1,860.77 Change : -11.48 or -0.61% Dow In GOLD$ : $204.30 Change : $ 0.75 or 0.37% Dow in GOLD oz : 9.883 Change : 0.036 or 0.37% Dow in SILVER oz : 779.91 Change : -4.12 or -0.53% Dow Industrial : 16,222.17 Change : -114.02 or -0.70% US Dollar Index : 80.150 Change : 0.620 or 0.78% The GOLD PRICE lost $17.60 (1.3%) by Comex close at $1,341.40, then lost another $10 in the aftermarket after the FOMC's eructations. Silver gainsaid the gold price by dropping only 3.6 (0.2%) to 2080, then dropped another 17 cents in the aftermarket to 2063c. I read several analysts, and had to laugh today that one of them was ruminating a BIG drop in gold and the other was chirping about what a bullish set-up had unfolded in gold and silver. Here's what the charts show: The GOLD PRICE has traded in the selfsame upward trading channel since its December low. Today's fall was the last of three days that have brought gold to touch the channel's bottom boundary. It also closed below its 20 DMA ($1,345). From here gold might (1) bounce off the lower channel boundary and resume its uptrend, or trade down to its 50 DMA ($1,295). The gold price is walking in some heavy boots here, my way of saying a lot of indicators point down. However, silver is gainsaying that weakness, and had a strong day, and that IS bullish. Lo, is the man batty? Nope, he ain't. The SILVER PRICE yesterday traded down to about 2065c, broke that level today and traded as low as 2052c (never quite touched 2050) about noon, then bounced up to 2097c, and fell off again to 2052. A double bottom, and down only 3.6 cents on the day. Trading at 2063 in the aftermarket. Of such days big surprise turnarounds are made. Of course, I might be just a fool spinning cobwebs in my brain, but silver did touch back to its 50 DMA today (2055c), a frequent target of corrections, and on the end of the day chart it closed unchanged. AND that 50 DMA happeneth to coincide, yea, to run atop of, the top boundary of silver's three month trading range, wherefrom it broke away stratosphereward in February. In plain English, silver broke out of that trading range, rallied to 2218c, and now hath fallen back to the breakout point for -- one final kiss good-bye, or to fall lower still? If you like to play guts ball, to take chances when you know the edge is on your side though the risk be great, then it's a ripe place to buy. I may be scalped tomorrow, but I bought this evening. I'm just a durned fool. I'd always rather trust metal in hand than central bank functionaries in Washington. I just don't care for liars much, and never could trust 'em. What if we all got it all wrong? What if the real business of the cosmos isn't work and sweat and tears but joy? What if CS Lewis was right when he said, "Joy is the serious business of heaven." What if joy is the serious business of our world, too, and of all creation? What if instead of the dreary round of self-improvement and economic purpose, the purpose of all creation is joy? Did y'all ever watch a dog? Ever notice how much a dog enjoys being a dog? Acts like a dog just for the fun of it? Ever notice that pigs dance? They do, especially when a storm is kicking up. And when somebody is playing, why do we say he's "horsing around"? What if our whole purpose is just to rejoice in being what we are? To play and write and dance and make music and sing just for the fun of it? To romp for joy in God. Wow. That'd put a lot of economists and politicians out of work, let alone do-gooders. FOMC press conference today demonstrated once more that famous stabilizing effect that central banks were created for. And as usual, the market's reaction followeth not logic. Predictably, the FOMC announced it would "taper" by buying only $55 billion in US treasuries and mortgage backed securities. Yet that was piddling to the announcement that the Fed was only kidding about keeping interest rates low until unemployment hit 6.5%. After all, so many people have given up on ever finding jobs now that 6.5% target is getting right easy to hit. Now the Fed has discovered previously unrecognized "scars" in the economy that won't heal for two more years. Thus the Great Healer, The Fed, must keep interest rates low and raise them only slowly. Rather perversely in the face of the FOMC's resolve to keep repressing the economy with low interest rates, markets interpreted the statement as immediately higher interest rates. Ten year treasury yield shot up 3.39% (bonds dropped) 20 2.772%, well above the 2.708% 20 day moving average, and above the 2.745% 50 DMA as well. -- this despite 15 of the Fed's 16 policy makers believe it will be inappropriate to raise rates this year. I am not a Fed policy maker but only a natural born durn fool from Tennessee, and I believe this is all hogwash, hoakum, and hype. They're lying as fast as their lips can move. They have to keep interest rates down below the inflation rate to inflate away the debt and to keep the US government's borrowing costs low. They've fallen into their own trap, and can't get out. All the rest is lies, and damn the economy, full speed ahead. They are harvesting you like a farmer harvests a herd of pigs, and think no more of you than he does a hanging side of pork. Leaving these disgusting my-honor-is-for-sale-cheap white trash behind, let's look at other markets. Stocks took the FOMC announcement hard, but why I can't guess. Everybody knew the Fed had telegraphed its tapering -- no news there. And if there were a real recovery, rising interest rates really wouldn't slow it down. Actually, rising rates usually accompany recoveries. Makes no sense, but markets have become schizophrenic information junkies, blown from side to side by the latest news without the slightest regard for the next 24 hours. Dow dropped 114.02 or 0.7%to 16,222.17. S&P500 rode the same sled, down 11.48 (0.61%) to 1,860.77. On the charts both indices bounced up to their short term downtrend line, hit it, and bounced down again. Momentum took a hit as the Dow closed below its 16,265.25 20 DMA and the S&P500 closed near its 20 DMA, 1858.43. Both indices are coiling up into a triangle which will break strongly one way or the other. Direction of least resistance is down. The repulsive US dollar index rose 62 basis points to 80.15, clean out of its falling wedge and above its 20 DMA (79.94), both bullish signs. MACD also turned up. The other two scrofulous fiat currencies are fairly mirror images of the dollar. Euro had broken out to the upside from a RISING wedge, above a long standing resistance line about $1.3900 and today fell nearly plumb through the wedge it had left behind. Closed $1.3828, down 0.75%. Yen jumped off a cliff, too, down 0.885 to 97.95 cents/Y100. Pointed itself firmly earthward. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Posted: 19 Mar 2014 04:46 PM PDT Submitted by Lance Roberts of STA Wealth Management, In a recent note by Jeff Saut at Raymond James, he noted that valuations are cheap based on forward earnings estimates. He is what he says:

As a reminder, it is important to remember that when discussing valuations, particularly regarding historic over/under valuation, it is ALWAYS based on trailing REPORTED earnings. This is what is actually sitting on the bottom line of corporate income statements versus operating earnings, which is "what I would have earned if XYZ hadn't happened." Beginning in the late 90's, as the Wall Street casino opened its doors to the mass retail public, use of forward operating earning estimates to justify extremely overvalued markets came into vogue. However, the problem with forward operating earning estimates is that they are historically wrong by an average of 33%. The chart below, courtesy of Ed Yardeni, shows this clearly. Let me give you a real time example of what I mean. At the beginning of the year, the value of the S&P 500 was roughly 1850, which is about where at the end of last week. In January, forward operating earnings for 2014 was expected to be $121.45 per share. This gave the S&P 500 a P/FE (forward earnings) ratio of 15.23x. Already forward operating earnings estimates have been reduced to $120.34 for 2014. If we use the same price level as in January - the P/FE ratio has already climbed 15.37x. Let's take this exercise one step further and consider the historical overstatement average of 33%. However, let's be generous and assume that estimates are only overstated by just 15%. Currently, S&P is estimating that earnings for the broad market index will be, as stated above, $120.34 per share in 2014 but will rise by 14% in 2015 to $137.36 per share. If we reduce both of these numbers by just 15% to account for overly optimistic assumptions, then the undervaluation story becomes much less evident. Assuming that the price of the market remains constant the current P/FE ratios rise to 18.08x for 2014 and 15.84x for 2015. Of course, it is all just fun with numbers and, as I stated yesterday, this there are only three types of lies:

With the continued changes to accounting rules, repeal of FASB rule 157, and the ongoing torturing of income statements by corporations over the last 25 years in particular, the truth between real and artificial earnings per share has grown ever wider. As I stated recently in "50% Profit Growth:"

This is why trailing reported earnings is the only "honest" way to approach valuing the markets. Bill Hester recently wrote a very good note in this regard in response to critics of Shiller's CAPE (cyclically-adjusted price/earnings) ratio which smoothes trailing reported earnings.

If I want to justify selling you an overvalued mutual fund or equity, then I certainly would try to find ways to discount measures which suggest investments made at current levels will likely have low to negative future returns. However, as a money manager for individuals in retirement, my bigger concern is protecting investment capital first. (Note: that statement does not mean that I am currently in cash, we are fully invested at the current time. However, we are not naive about the risks to our holdings.) The following chart shows Tobin's "Q" ratio and Robert Shillers "Cyclically Adjusted P/E (CAPE)" ratio versus the S&P 500. James Tobin of Yale University, Nobel laureate in economics, hypothesized that the combined market value of all the companies on the stock market should be about equal to their replacement costs. The Q ratio is calculated as the market value of a company divided by the replacement value of the firm's assets. Currently, the CAPE is at 25.41x, and the Q-ratio is at 1.01. Both of these measures are currently at levels that suggest that forward stock market returns are likely to be in the low to single digits over the next decade. However, it is always at the point of peak valuations where the search for creative justification begins. Unfortunately, it has never "been different this time." Lastly, with corporate profits at record levels relative to economic growth, it is likely that the current robust expectations for continued double digit margin expansions will likely turn out to be somewhat disappointing. As we know repeatedly from history, extrapolated projections rarely happen. Therefore, when analysts value the market as if current profits are representative of an indefinite future, they have likely insured investors will receive a very rude awakening at some point in the future. There is mounting evidence, from valuations being paid in M&A deals, junk bond yields, margin debt and price extensions from long term means, "exuberance" is once again returning to the financial markets. Again, as I stated previously, my firm remains fully invested in the markets at the current time. I write this article, not from a position of being "bearish" as all such commentary tends to be classified, but from a position of being aware of the "risk" that could potentially damage long term returns to my clients. It is always interesting that, following two major bear markets, investors have forgotten that it was these very same analysts that had them buying into the market peaks previously. |

| The success of Singapore gold storage Posted: 19 Mar 2014 04:04 PM PDT The Real Asset Co |

| Fleckenstein - The Fantasy Is Alive & Well But The End Is Near Posted: 19 Mar 2014 03:01 PM PDT  On the heels of the Fed's announcement of additional tapering, and with stocks, bonds, and gold on the move, today Bill Fleckenstein told King World News the fantasy is alive and well, but the end is near. Below is what Bill Fleckenstein, who is President of Fleckenstein Capital, had to say in this timely interview. On the heels of the Fed's announcement of additional tapering, and with stocks, bonds, and gold on the move, today Bill Fleckenstein told King World News the fantasy is alive and well, but the end is near. Below is what Bill Fleckenstein, who is President of Fleckenstein Capital, had to say in this timely interview. This posting includes an audio/video/photo media file: Download Now |

| US Fed Continues Tapering, Gold Down on Dollar Rally Posted: 19 Mar 2014 02:45 PM PDT All that was required to launch the US Dollar higher away from strong downside chart support near the 79 level on the USDX chart was a hawkish sounding Fed. With the announcement today that they would trim another $10 billion/month off of their bond buys, interest rates shot up on the long end of the curve and with that, so did the Dollar away from support. The rally in the Dollar, along with higher interest rates (the latter is the big deal) resulted in a barrage of selling in gold as bulls rushed for the exits. The result was a clean break of the first level of chart support noted on the chart. The selling did not abate until gold reached the secondary support level noted. This level had better hold or gold is going to fall back closer to $1300. The breakdown in the ADX indicates the uptrend has been halted. I am closely watching those Directional Movement lines to see if we get a downside crossunder of the +DMI below the -DMI. So far the bulls remain in control of the market but if that support level gives way, I would expect to see it reflected in this indicator. That could very well put the bears back in control on the daily chart. Keep in mind, based on the long term monthly chart I posted up the other day, the bears have retained control over this market but their hold was slipping. If the daily chart breaks down further, they are going to be emboldened further and a lot of those who were forced out during this recent rash of short covering, are going to come back in on the short side once again. The jury remains out therefore. Let’s see what we get. We are going to need some positive economic data to confirm the Fed’s rather rosy view of the economic outlook. They are content to place a fair amount of blame for the recent poor data on the record breaking cold temps. That may be true but the warmer months are arriving and we will know very quickly whether or not that is indeed the case. One last thing – the Euro failed to best 1.40. In my view, that will be required for gold to best $1400. (Original source: Dan Norcini’s blog) |

| John Embry: Stay Strong, Own Gold And Silver, Wait Posted: 19 Mar 2014 02:41 PM PDT This article contains highlights from an interview with John Embry, chief investment strategist at Sprott Asset Management who is working alongside Rick Rule and Eric Sprott. What gold and silver investors should look at:

The West is no longer creating real wealth:

Drivers of the big world shift:

The Canadian and European currencies vs the US dollar:

How long it will take to vindicate the case for gold and silver:

The signs of an imminent change in gold and silver to the upside:

The forces driving gold and silver to give way, as well as the expected response of the Federal Reserve:

|

| Gold Miners: Red Alert Or All Clear? Posted: 19 Mar 2014 02:24 PM PDT Its getting really bad when you can’t trust the criminals in power to do what you you think they are going to do!

Above we see on the XAU Chart that When the close of the XAU gets more than 10%(Gold Line) above it’s 50 Day Moving Average (three red circles make that very clear), it becomes vulnerable to a correction, which is where we are now. In the GREEN Box in the lower right hand margin of the XAU Chart we see the entirely unhearalded GOLDEN CROSS (except for a few PM Bulls). Now for those practicing and loving “Hill Billy” TA, that is a perfect indicator EXCEPT that it comes at a time when the close of the XAU has gotten 10% of its 50 Day Moving Average.

Now from Cicero, we have this quote: “The Sinews of War are Infinite Money”, which we know to be true whether it is in the Industrial Stocks or the PM Stocks or whether it comes from Gvt Printing (Counterfeiting) or honest capital. Notice the Speed Resistance Lines (lower ones) 1 & 2, indicating where the capital in-flow rate will slow down before re-asserting itself.

NOW the question becomes WHAT of this Leg & Rally ? The Breadth in this rally has slowed down in both daily and weekly measures and the rally has lost its Momentum, within its Longer Term TREND (which is still UP). A number of logical Support areas are in place by virtue of GAPS that opened on the way up. They are:   KEEPING in mind that certain dates can act like magnets, as I look at this, I recall the Great Gold TAX DAY (US) MASSACRE of April 15, 2013. I also note that on the Anniversary Week of that event, Good Friday of the Christian Easter Season occurs, which to me, given the events associated with it, is never a good time for a rally. In addition, as a Lunar determined occasion, Easter, it is noted that the Full Moon peaks on Mon, April 15. Based on cycles commonly occurring whose combined Nadir occurs during this week, I give weight to probabilities we see very poor market action the Week ending Friday, April 18th. If I were a wagering man, I’d lay odds that, any correction in the PM Complex, under the weight of a correction, would END its Correction in this week. Given as a very general rule that corrections tend to extend their moves to half the TIME of the move they are correcting, another case can be made for it ending in this time frame. So being Skeptic in my approach to Technical Analysis, I will be keeping a weather eye on the XAU, GDX & HUI as they settle back into “Correction” Mode. I ignore no hint or bit of Intell but treat each skeptically as if I were assembling a great puzzle, and thus I include the possible Support & Rebound Zones for the GDX and HUI in these Charts. If you’d like to have this level of Savvy at your fingertips and in your mail box, you may wish to Subscribe to PEAK PICKS.

Find Juniors, Micro-Caps, Break Outs, and some stocks of which you have never heard by SUBSCRIBING to PEAK PICKS, using option #1 or #2. Subscribe using one of the two options below (U$D 33.97/m, no contract, satisfaction guaranteed, immediate refund on request, no questions asked). OPTION #1 OPTION #2 – E-Mail

|

| Gold Daily and Silver Weekly Charts - Another Triumphant FOMC Day Posted: 19 Mar 2014 01:28 PM PDT |

| Gold Daily and Silver Weekly Charts - Another Triumphant FOMC Day Posted: 19 Mar 2014 01:28 PM PDT |

| Top Economic Collapse Must Haves -- Harry Dent Posted: 19 Mar 2014 12:39 PM PDT Economist Harry Dent details the essential ways one must be prepared financially for the coming crash. Alex welcomes the founder of economic forecasting firm Dent Research, Harry S. Dent, Jr. to discuss why he thinks the Dow Jones industrial average may spike at 17,000 then make a rapid... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Harry Dent -- Timetable For The Next Collapse Posted: 19 Mar 2014 12:38 PM PDT Alex Jones has a fascinating conversation with Economist Harry Dent about the timetable of the next Financial collapse. Alex welcomes the founder of economic forecasting firm Dent Research, Harry S. Dent, Jr. to discuss why he thinks the Dow Jones industrial average may spike at 17,000 then... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Despite Taper, The Fed Is Setting Up To Shock The World Posted: 19 Mar 2014 12:21 PM PDT  Today one of the most respected money managers in the world warned King World News that despite the tapering action, the Fed is setting up to shock the world. Michael Pento, who is founder of Pento Portfolio Strategies, also spoke about the impact this will have on major markets, including gold. Below is what Pento had to say. Today one of the most respected money managers in the world warned King World News that despite the tapering action, the Fed is setting up to shock the world. Michael Pento, who is founder of Pento Portfolio Strategies, also spoke about the impact this will have on major markets, including gold. Below is what Pento had to say. This posting includes an audio/video/photo media file: Download Now |

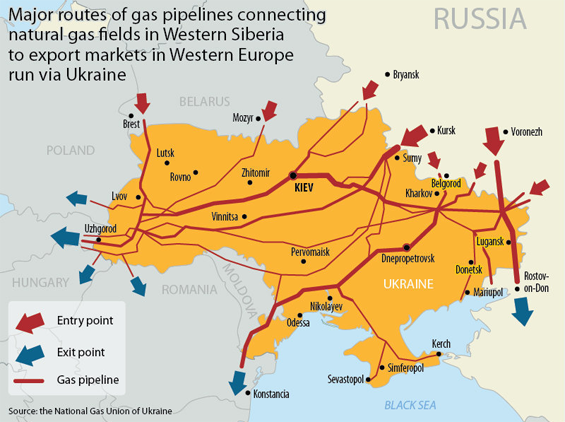

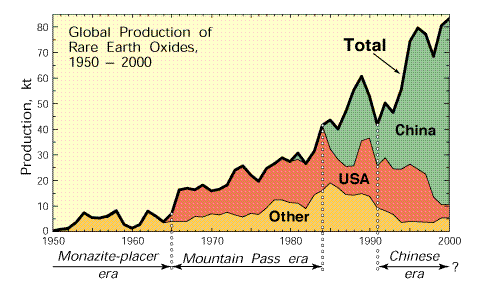

| China Must Look Abroad For Metals and Energy To Support Growth Posted: 19 Mar 2014 11:58 AM PDT Headlines about a Chinese economic slowdown may get good web traffic, but the real story is that China is buying up uranium and other resources around the world, says Gold Stock Trades writer Jeb Handwerger. Meanwhile, tensions in Russia highlight the massive country’s resource dominance in natural gas, oil, uranium, platinum group metals, rare earths and nickel. Handwerger tells The Mining Report that North America is already acting to develop resources that can meet both domestic and international demand—and this global geopolitical uncertainty is an investment opportunity. The Mining Report: Jeb, how will the companies you follow be affected by the crisis in the Ukraine and the growing tensions in East Asia over China’s claims on islands held by Japan and the Philippines? Jeb Handwerger: This is really all about natural resources and the ability to control the trade. There’s a whole list of 10 to 15 strategic minerals that come from China almost exclusively. Russia, on the other hand, has a major control on palladium, platinum group metals and nickel, as well some of the agricultural fertilizers, such as potash. Russia also has a critical supply of uranium; it produces about 3,000 tons of uranium, close to double United States production of uranium. Not only that, but Russia has strategic ties with Kazakhstan, which produces close to 20,000 tons of uranium—over 36% of global supply.

I’ve written for years that these metals and these materials are at risk of critical supply shortfall. It’s even more the case now as these tensions increase. There is greater risk of China or Russia turning off the natural gas pipelines or cutting exports of the rare earths and graphite.

Their control of these critical metals is going to force the West, the European Union and the U.S. to develop their own strategic, secure supplies of these materials needed for the critical technologies. We’re already beginning to see that take place. Many junior miners have made strategic advancements with some jurisdictions in the rare earth sector. For instance, the state of Alaska made a proposal to help fund a rare earth mine in Alaska controlled by Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX). In Canada, there’s a push in the Parliament to look for secure supplies, an effort which may benefit Pele Mountain Resources Inc. (GEM:TSX.V). In Europe, I like Tasman Metals Ltd. (TSM:TSX.V; TAS:NYSE.MKT; TASXF:OTCPK; T61:FSE) as the company could be a strategic supplier of technology metals to the EU, which may be very concerned about supply as tensions increase with Russia over Crimea. If investors are not yet positioned, they should position themselves either through the strategic metal ETFs or even better, the specific REE junior miners that are positioned for upside breakouts. Another angle: In times of war and tension and geopolitical crises, commodities are often a very good hedge against inflationary price rises. We’re already seeing outsized gains in the commodity sectors in 2014. The smart money may be already positioned for the black swans we are currently observing.

TMR: China is a major buyer of uranium. How do the tensions there affect business conditions in the uranium market? JH: China is building more nuclear reactors than ever before, and over the next 10 years it’s going to need a major increase in its supply of uranium. Uranium is one of the few materials that China is not self-sufficient in. Unlike the rare earths, it’s going to have to look abroad for that. China has already tried to go into Africa, which is also one of the largest suppliers of uranium: Niger and Namibia together produce about 14% of global uranium supply, but those areas are not so stable. Last year, AREVA SA’s (AREVA:EPA) Niger uranium facility was the target of an Al-Qaeda terrorist attack, a double-suicide bombing that shut down the plant. We believe that the Chinese trade agreement with the Canadians, Cameco Corp. (CCO:TSX; CCJ:NYSE), is critical. McArthur River in the Athabasca Basin is the world’s largest high-grade uranium mine. Canada provides about 17% of global supply. This is second only to Kazakhstan, but the Athabasca Basin is going to be able to cover the supply gap that may be coming. There are huge discoveries there, with the highest-grade uranium deposits; concentration is more than 100 times the global average. There are other areas within North America with significant resources, such as the Elliott Lake region in Ontario, where Pele Mountain is operating. Meanwhile, companies are coming into production in Wyoming. And there are a lot of uranium assets in Utah and New Mexico, which may benefit from a bounce in the depressed uranium spot price. We think that the U.S. and Canada over the coming years are going to increase production to alleviate the supply shortfall that may be coming from unstable areas. TMR: Can companies like Uranerz Energy Corp. (URZ:TSX; URZ:NYSE.MKT) and Laramide Resources Ltd. (LAM:TSX; LAM:ASX) afford to begin production in their new mines with uranium prices stuck where they are?

JH: Uranerz already has offtake agreements at higher uranium prices. It can afford to begin production. Laramide is still a few years away from production in Australia, which has reversed the uranium ban. The uranium price may be depressed now, but investors realize the price could be significantly higher in two to three years. Uranerz is an in-situ mine so it’s lower cost. It can afford to begin production now because it has offtake agreements. We don’t think uranium prices are going to stick around where they are for much longer. Japan is slowly restarting its reactors. The Russian HEU Agreement has come to an end. There are more reactors being built today than ever before. We think the uranium spot prices are going to reverse higher making an astonishing move. Right now, you can get in at eight-year lows on the top uranium assets that are in the control of the juniors. Uranerz Energy has some of the top assets in the Powder River Basin that are coming into production, and Laramide has one of the top resources with over 50 million pounds (50 Mlb) near surface in Australia, which has now overturned a ban on uranium mining in the district. Now Laramide can go ahead with that Westmoreland project. Laramide has one of the top advanced resources that provides huge leverage for an investor for the uranium price. For investors who are looking for leverage and for advanced assets, Laramide is a good candidate. There are very few candidates in the junior sector that have 100% control of such a large asset. Investors must realize that there are so few high-quality junior uranium miners. When investors and funds return, the move could be dramatic—like an elephant trying to get through the eye of a needle. JH: Before I discuss Enterprise, let me reiterate that the key is trying to understand the long-term trend here: China is going to have to go abroad to support its expanding economy with natural resources over the long term. Short term, we are seeing market weakness in industrial metals as investors fear a slowdown. However, over the long term, commodity mine supply is not able to keep up with demand.

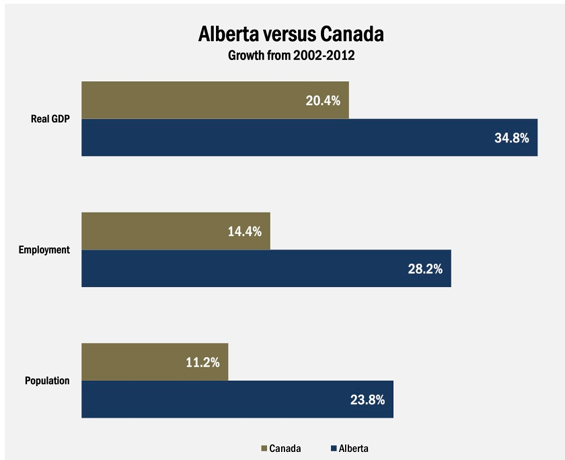

While the media dazzles us with a Chinese slowdown, China’s buying up North American energy resources and precious metals during this pullback. One of the areas that has benefitted the most from this ongoing trend has been Western Canada, most notably Alberta. It may be one of the best economies in the world right now. Hundreds of billions of investment dollars are earmarked for this region to build liquefied natural gas (LNG) facilities and major pipelines to transport petroleum to the growing economies in Asia.

There are already five major pipeline proposals. The major pipeline proposals have been the Enbridge Inc. (ENB:NYSE) Mainline expansion and the TransCanada Corp. (TRP:TSX; TRP:NYSE) Keystone XL pipeline. In addition, there are the proposed LNG facilities with owners such as Apache Corp. (APA:NYSE), Chevron Corp. (CVX:NYSE), Royal Dutch Shell Plc (RDS.A:NYSE; RDS.B:NYSE), Mitsubishi Corp. (MBC:LSE), PetroChina Co. Ltd. (PTR:NYSE; 857:HKSE), Imperial Oil Ltd. (IMO:TSX; IMO:NYSE.MKT) and Exxon Mobil Corp. (XOM:NYSE). This rising demand for electricity in automobiles and emerging Asian nations could continue to support a major boom for Western Canada. TMR: In a January issue of your newsletter, Gold Stock Trades, you expressed very high expectations forEnterprise Group Inc. (E:TSX.V). What do you like about that company, and is it meeting your expectations? JH:

Enterprise Group continues to have a phenomenal year. It’s making several strategic acquisitions in an area that’s going to benefit from this buildout in energy infrastructure. It has a tunneling company, which clears the way for the pipes to run under highways, trains and bodies of waters. It also has a pipeline business, Artic Therm, which has a patent-protected flameless heat technology to assist the operators working in cold weather conditions. It has Backhoe, a directional-drilling company. It has a heavy-equipment rental service for drill sites. Enterprise Group has developed and taken over these specialized hard-margin businesses that are generating earnings for shareholders. It has attracted a blue chip stable of companies, including Apache and Suncor Energy Inc. (SU:TSX; SU:NYSE). This is why it had a major run in 2013, and it may just be the beginning. As Enterprise continues to announce strong revenues, earnings per share and projects that are getting awarded, the story’s just beginning to get noticed in the United States. Enterprise announced that it’s going to become a reporting issuer in the U.S. and so it will hopefully attract a larger audience. It has very strong revenue growth. It has a return on equity over 35% and very strong revenue growth. Revenue is currently at $30M and management wants to grow that to $150M by the end of 2015. This could be a major growth company and could get a lot of attention in the U.S. TMR: You mentioned the possibility of International Tower Hill Mines Ltd. (ITH:TSX; THM:NYSE.MKT)bringing in a partner to open a mine in Alaska. How important is that and what are some good candidates?

JH: Since International Tower Hill Mines released the feasibility study, the stock was sold off and hit a 52-week low. We took a contrarian view of that selloff. The concept behind International Tower Hill Mines is that it’s a low-grade, bulk-tonnage system, which at current prices may not be economic, but as prices begin rising to $1,500, $2,000, $2,500/ounce ($2,500/oz), the company’s Livengood project becomes one of the best deposits in North America, with huge leverage to the price of gold. It has over 20 million ounces (20 Moz) gold, and great leverage to an upward-trending gold price. With this feasibility study and management team, which consists of people who have built major Alaskan mines, such as Teck Resources Ltd.’s (TCK:TSX; TCK:NYSE) Pogo Project and Kinross Gold Corp.’s (K:TSX; KGC:NYSE) Fort Knox, International Tower Hill is one of the better candidates for strategic partners who are looking for large amounts of assets in friendly jurisdictions. We believe that there are strategic partners that want the International Tower Hill type of asset that’s able to produce over 0.5 Moz gold annually. One of its shareholders is AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE). AngloGold may consider it because it may want a mine outside of Africa on its books that can have large production numbers in a stable jurisdiction. International Tower Hill is one of the few projects that have that potential. There’s a reason why the Livengood asset is attracting the people who built Fort Knox and Pogo. This management team makes me more confident that this will be a mine. We believe that there’s a potential for this stock to regain its uptrend and to continue to move and significantly outperform to the upside as the gold market turns higher. Huge optionality and leverage here. TMR: You have had high praise for Comstock Mining Inc. (LODE:NYSE.MKT). What do you like about this company? JH: What I like about it is that there are very few producers that have the strength in the balance sheet that Comstock has. It may be the gem of the entire mining industry. This balance sheet may begin to really start improving this quarter. Comstock recently announced it secured more than 300 acres of land, so there’s expansion opportunity. The company has an expanded mine plan, which includes additional operations, such as the Spring Valley and the Dayton Projects. What it’s demonstrating to the institutional investors, who are increasing their holdings in this stock, is that it may be one of the fastest-growing producers in the entire industry on track to go from 20,000 up to 200,000 ounces annually (20–200 Koz/year). The management of the company continues to seek guidance and build institutional shareholders. Now it’s on the verge of generating free cash flow in the coming quarters because it’s increasing production. It went from 20 Koz to 40 Koz. This brings its average costs down, generating greater profit. I’ve been to the property. This is a historic district, the Comstock district, which in the 1800s produced billions of dollars worth of gold and silver, largely underexplored by modern methods. It’s one of the few companies that’s actually able to generate cash flow, even in a lower cost environment, as most of the ounces are near surface and heap-leach amenable. TMR: Royal Nickel Corp.’s (RNX:TSX) Dumont Nickel project in Québec is getting good press. When will the company begin production?

JH: Royal Nickel’s Dumont Nickel project is one of the best advanced nickel projects under the control of a junior. It could begin construction by the end of this year and start production in 2016. The company has a management team that knows nickel possibly better than any other junior, as it has some of the top Falconbridge Ltd. and Inco Ltd. personnel and management on the board of directors. Dumont is one of the largest nickel deposits in the world. Again, nickel is one of the metals of which Russia is a big producer. Also, Indonesia, one of the largest exporters of nickel, just announced an export ban. We expect the nickel price to start heading higher, and we expect much more interest in the nickel sector. There are very few assets like the Dumont project in the control of a junior. TMR: What do you expect to happen to the share price when it begins production? JH: Royal Nickel has the capability of bringing this production onstream, but I don’t think it’s going to be in control of Royal Nickel by then. I think the project is going to be acquired by a Vale S.A. (VALE:NYSE) or a BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK) as soon as this nickel market starts turning higher. It could be acquired at maybe a 50% to 75% premium from where it is today. TMR: Probe Mines Limited (PRB:TSX.V) has made a major discovery that some are calling a game changer for the company. What can you tell us about that?

JH: In my last interview with The Gold Report in December, I mentioned that I had taken a position in Probe Mines. Since that time there have been a lot of developments. Probe is developing the Borden Lake project in Ontario, another jurisdiction that’s getting a lot of attention. Potential is huge for this. Probe’s stock has already made a dramatic run since our last interview from around $2 to $3.35/share. Again, it’s similar to what we found with some other companies that I’ve invested in, such as Corvus Gold Inc. (KOR:TSX), where it had this low-grade, bulk-tonnage deposit, but then it had this high-grade discovery. Keep a close eye on Canamex Resources Corp. (CSQ:TSX.V; CX6:FSE), which is doing something similar and has made a major high-grade discovery in Nevada from a low-grade historical resource. Canamex has attracted Hecla Mining Co. (HL:NYSE) and Gold Resource Corp. (GORO:NYSE.MKT; GORO:OTCBB; GIH:FSE) as major shareholders during this down bear market. You can be sure they do a lot of due diligence before putting millions of dollars into a junior miner. TMR: Zimtu Capital Corp. (ZC:TSX.V) has been in the $0.50/share doldrums for 16 months, but it has been two or three times higher for most of its history. What does the company need to do to break out?

JH: Zimtu is one of the forces behind some high-quality, early-stage junior mining companies. This provides a great way for investors to participate and profit in the junior, especially d |

| Fukushima Fallout: Sick U.S. Sailors Sue TEPCO After Exposure to Radiation 30x Above Normal Posted: 19 Mar 2014 09:00 AM PDT http://www.democracynow.org - Three years after the triple meltdown at the Fukushima nuclear power plant, scores of U.S. sailors and Marines are suing the plant's operator, the Tokyo Electric Power Company, for allegedly misleading the Navy about the level of radioactive contamination. Many of... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold tipped to hit $1,400 on Russia fears and ETF buying Posted: 19 Mar 2014 08:49 AM PDT German bank says that turmoil in Ukraine and a return of ETFs will push gold prices even higher in 2014 This posting includes an audio/video/photo media file: Download Now |