Gold World News Flash |

- The Rationale for Owning Gold and Silver Is Stronger Than Ever

- West’s weak response to Crimea annexation knocks gold

- Gold Bull Market Corrections Then and Now

- Gold Bull Market Corrections Then and Now

- Richard Russell - Silver Is The Greatest Buy In The World Today

- ‘Real Treat’ for Michelle Obama to Take Her Mom and Daughters to China

- Gold Price Lost 1 Percent Closing at $1,359

- Gold Price Lost 1 Percent Closing at $1,359

- Signs of Inflation in China… And What They Mean For the Markets

- Metals market's next phase is for stock pickers, Sprott's Rule tells KWN

- So You Want To Be A Speculator

- Things That Make You Go Hmmm... Like Every New Fed Chair Gets A Test

- What Is The Common Theme: Iron Ore, Soybeans, Palm Oil, Rubber, Zinc, Aluminum, Gold, Copper, And Nickel?

- ATMs Open to Hacking

- Gold And Silver Pull Back Slightly As Crimea Tensions Ease

- Fishing for Gold?

- Gold Daily and Silver Weekly Charts - FOMC Meeting Day One

- Gold Daily and Silver Weekly Charts - FOMC Meeting Day One

- Silver & Gold Volatility: Calm Before Storm Over

- Silver & Gold Volatility: Calm Before Storm Over

- Silver & Gold Volatility: Calm Before Storm Over

- Zero Hedge: U.S. government just makes up the debt holders report on the fly

- China Buying World's Entire New Gold Supply - Mike Maloney

- America’s “Secret” Export Boom

- New York attorney general to investigate high-frequency trading

- Interest Rates - Is Yellen Fishing for Gold?

- Are You Mainstream Or Deviant?

- Gold and the Brave New Deviant World

- Under new scrutiny, gold manipulators changing tactics, Sprott says

- US Silver Jewelry Sales Exceptionally Strong in 2013

- The Federal Reserve’s Financial Big Bang Theory

- Gold Market Fear Is Unnecessary

- West’s weak response to Crimea annexation knocks gold

- Russia/Ukraine/Crimea crisis likely to be gold neutral

- Can Barrick Gold overcome Peter Munk’s painful legacy?

- Analysts raise spectre of 2012 platinum rush as gold corrects

- Taiwan to allow banks to sell gold/silver coins from China

- REVISED: Is renewed Indian demand driving gold prices higher?

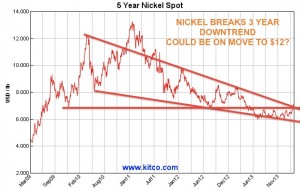

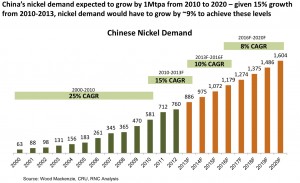

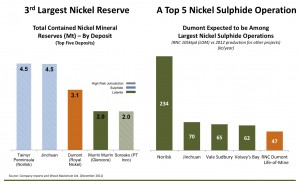

- Nickel Price Breaking Into New 6 Month Highs On Crimean Crisis and Indonesian Export Ban

- Me Again

- Gerald Celente: Banker Suicides the Prequel to Global Collapse

- A Stock Market Crash is Not Inevitable

- Russia Examines Its Options for Responding to Ukraine

- On RT's 'Boom/Bust,' fund manager Tice endorses GATA's work

- Russia planned bear raid on Wall Street, former treasury secretary tells BBC

- Investors Follow the Money to Asia's Tech Hub

- Benjamin Fulford, March 18, 2014, Cabal backs down after threat of blockade of cabal controlled countries

- Gold Prices Sink to "Immediate Support" as Moscow Mocks Sanctions Over Ukraine, Stock Markets Rise

- Putin understood currency market rigging 5 years ago, as Mozhaiskov did 10 years ago

- China's Copper Credit Bubble

| The Rationale for Owning Gold and Silver Is Stronger Than Ever Posted: 19 Mar 2014 01:03 AM PDT By: GE Christenson Consider our economic world from two perspectives: The Deviant View – as represented by those who visit deviantinvestor.com, read alternate media, are skeptical of the "official" news, and who critically examine the financial world. or The others – call it the mainstream media view. Deviant readers are more likely to believe: The [...] |

| West’s weak response to Crimea annexation knocks gold Posted: 18 Mar 2014 09:40 PM PDT by Lawrence Williams, MineWeb.com

|

| Gold Bull Market Corrections Then and Now Posted: 18 Mar 2014 09:12 PM PDT |

| Gold Bull Market Corrections Then and Now Posted: 18 Mar 2014 09:12 PM PDT |

| Richard Russell - Silver Is The Greatest Buy In The World Today Posted: 18 Mar 2014 09:02 PM PDT  With continued chaos and uncertainty in global markets, today KWN is publishing another incredibly important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, just purchased more physical gold and silver himself, and said that silver is the greatest buy in the world today. He also discussed stocks, China, inflation, and dared the U.S. Treasury to audit the United States' gold reserves. With continued chaos and uncertainty in global markets, today KWN is publishing another incredibly important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, just purchased more physical gold and silver himself, and said that silver is the greatest buy in the world today. He also discussed stocks, China, inflation, and dared the U.S. Treasury to audit the United States' gold reserves. This posting includes an audio/video/photo media file: Download Now |

| ‘Real Treat’ for Michelle Obama to Take Her Mom and Daughters to China Posted: 18 Mar 2014 08:00 PM PDT by Susan Jones, CNS News:

“You know, the first lady has talked about the importance of young people here in the United States learning about other cultures. She believes that about her own children, and has seen this as a really unique opportunity to share a very different part of the world with her two daughters and with her mother as well,” Mrs. Obama’s Chief of Staff Tina Tchen told a conference call on Monday. |

| Gold Price Lost 1 Percent Closing at $1,359 Posted: 18 Mar 2014 07:50 PM PDT Gold Price Close Today : 1359.00 Change : -13.90 or -1.01% Silver Price Close Today : 20.836 Change : -0.413 or -1.94% Gold Silver Ratio Today : 65.224 Change : 0.614 or 0.95% Silver Gold Ratio Today : 0.01533 Change : -0.000146 or -0.94% Platinum Price Close Today : 1461.20 Change : -6.60 or -0.45% Palladium Price Close Today : 771.75 Change : -4.45 or -0.57% S&P 500 : 1,872.25 Change : 13.42 or 0.72% Dow In GOLD$ : $248.49 Change : $ 3.86 or 1.58% Dow in GOLD oz : 12.021 Change : 0.187 or 1.58% Dow in SILVER oz : 784.04 Change : 19.43 or 2.54% Dow Industrial : 16,336.19 Change : 88.97 or 0.55% US Dollar Index : 79.530 Change : 0.010 or 0.01% The GOLD PRICE lost $13.90 (1%) and closed at $1,359.00 Spot silver lost 41.3 cents (2%) to 2083.6c. Ratio rose to a new high for this move at 65.224. The GOLD PRICE traded along above $1,360 until New York opened, when it dropped from 8:30 to 10:00 down to $1,351.10. After that it climbed steadily until 2:00 p.m,, when it began dropping off and ended the day sulking around $1,355. That takes gold back to the support/resistance level where this latest breakout began, and within stumbling distance of the 20 DMA ($1,344). Bottom boundary of there rising trading channel lies today about $1,340, so the area from $1,344 to $1,339 stands ready to catch gold. Another possibility is a fall back to the neckline where gold broke out in February, now about $1,290, near the 50 DMA ($1,293). That would have all the gold bugs puking in their wastebaskets and prove again the proverb's truth, "The Market is not benevolent." MACD flashed a sell signal today. Pendulum is swinging back to the downside. O Woe! The SILVER PRICE fell back into its downtrend trading channel and below its 200 DMA (2096c). Not far below it will strike the top of that trading range it escaped in February -- that line stand about 2050c, right at the 50 DMA (2054c), a good place to halt a correction. Up or down, I don't get too excited. The Fed and the yankee government are the truest friends silver and gold have. They will surely keep on flooding the market with money, and sure as they do, silver and gold will remain in a bull market and we will see greater gains from here than we saw from 2001 - 2011. Hide and watch. Can we talk about something other than markets today? It's just the same old back and forth, and I'm afraid y'all are going to get tired of hearing about it. Take those sorry fiat currencies, sorrier than gully dirt. They're gyrating back and forth like one of those old black GE fans on low, not doing a bit of good. US Dollar Index was practically petrified today. Had a 25 basis point range from 79.68 to 79.43, and closed up one lone basis point at 79.53. That does nothing and says nothing, except that nobody's interested in the dollar. Euro gained 0.7% to $1.3932. If it intends to rally it's not in any big hurry, I'll say that. Yes, it's out there above the old top resistance, but why is it stuck? Yen today gained 0.33% to 98.61, invalidating the exhaustion gap made yesterday, because those are never filled. Momentum is up. STOCKS climbed again today. Dow bolted on a new 88.97 (0.55%) to 16,336.19. That's above the 20 day moving average, and below the last top, which was lower than the top before and the one before that. In other words, still technically in a down trend. But it if gets a leg over that last top at 16,505, we might see the last and final new all-time high, one that will hold for a couple of centuries. S&P500 rose 13.42 (0.72%) to 1,872.25. Dow in metals reversed today. Dow in gold rose 1.44% to 12.05 oz (G$249.10 gold dollars) and cut through and above its 200 DMA and the Downtrend line. Whispers of a bigger upward correction coming. Dow in silver rose 2.31% to 785.45 oz (S$1,015.53 silver dollars), rising over its 20 DMA and smack up to its downtrend line. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Gold Price Lost 1 Percent Closing at $1,359 Posted: 18 Mar 2014 07:50 PM PDT Gold Price Close Today : 1359.00 Change : -13.90 or -1.01% Silver Price Close Today : 20.836 Change : -0.413 or -1.94% Gold Silver Ratio Today : 65.224 Change : 0.614 or 0.95% Silver Gold Ratio Today : 0.01533 Change : -0.000146 or -0.94% Platinum Price Close Today : 1461.20 Change : -6.60 or -0.45% Palladium Price Close Today : 771.75 Change : -4.45 or -0.57% S&P 500 : 1,872.25 Change : 13.42 or 0.72% Dow In GOLD$ : $248.49 Change : $ 3.86 or 1.58% Dow in GOLD oz : 12.021 Change : 0.187 or 1.58% Dow in SILVER oz : 784.04 Change : 19.43 or 2.54% Dow Industrial : 16,336.19 Change : 88.97 or 0.55% US Dollar Index : 79.530 Change : 0.010 or 0.01% The GOLD PRICE lost $13.90 (1%) and closed at $1,359.00 Spot silver lost 41.3 cents (2%) to 2083.6c. Ratio rose to a new high for this move at 65.224. The GOLD PRICE traded along above $1,360 until New York opened, when it dropped from 8:30 to 10:00 down to $1,351.10. After that it climbed steadily until 2:00 p.m,, when it began dropping off and ended the day sulking around $1,355. That takes gold back to the support/resistance level where this latest breakout began, and within stumbling distance of the 20 DMA ($1,344). Bottom boundary of there rising trading channel lies today about $1,340, so the area from $1,344 to $1,339 stands ready to catch gold. Another possibility is a fall back to the neckline where gold broke out in February, now about $1,290, near the 50 DMA ($1,293). That would have all the gold bugs puking in their wastebaskets and prove again the proverb's truth, "The Market is not benevolent." MACD flashed a sell signal today. Pendulum is swinging back to the downside. O Woe! The SILVER PRICE fell back into its downtrend trading channel and below its 200 DMA (2096c). Not far below it will strike the top of that trading range it escaped in February -- that line stand about 2050c, right at the 50 DMA (2054c), a good place to halt a correction. Up or down, I don't get too excited. The Fed and the yankee government are the truest friends silver and gold have. They will surely keep on flooding the market with money, and sure as they do, silver and gold will remain in a bull market and we will see greater gains from here than we saw from 2001 - 2011. Hide and watch. Can we talk about something other than markets today? It's just the same old back and forth, and I'm afraid y'all are going to get tired of hearing about it. Take those sorry fiat currencies, sorrier than gully dirt. They're gyrating back and forth like one of those old black GE fans on low, not doing a bit of good. US Dollar Index was practically petrified today. Had a 25 basis point range from 79.68 to 79.43, and closed up one lone basis point at 79.53. That does nothing and says nothing, except that nobody's interested in the dollar. Euro gained 0.7% to $1.3932. If it intends to rally it's not in any big hurry, I'll say that. Yes, it's out there above the old top resistance, but why is it stuck? Yen today gained 0.33% to 98.61, invalidating the exhaustion gap made yesterday, because those are never filled. Momentum is up. STOCKS climbed again today. Dow bolted on a new 88.97 (0.55%) to 16,336.19. That's above the 20 day moving average, and below the last top, which was lower than the top before and the one before that. In other words, still technically in a down trend. But it if gets a leg over that last top at 16,505, we might see the last and final new all-time high, one that will hold for a couple of centuries. S&P500 rose 13.42 (0.72%) to 1,872.25. Dow in metals reversed today. Dow in gold rose 1.44% to 12.05 oz (G$249.10 gold dollars) and cut through and above its 200 DMA and the Downtrend line. Whispers of a bigger upward correction coming. Dow in silver rose 2.31% to 785.45 oz (S$1,015.53 silver dollars), rising over its 20 DMA and smack up to its downtrend line. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Signs of Inflation in China… And What They Mean For the Markets Posted: 18 Mar 2014 07:38 PM PDT A growing concern for the global economy is inflation.

We’ve recently detailed this issue for the US economy here and here.

Global Central Banks, concerned with a potential deflationary collapse, have allowed inflation to seep into the financial system. In developed nations like the US, this puts a squeeze on consumers. But in emerging markets like China, inflation is outright disastrous.

Nearly 40% of China lives off of $2 a day. Your average college graduate in China makes just $2,500 per year. In an economy such as this, a rise in prices in costs of living can be devastating for the population.

Why are we not seeing this in the Chinese stock market?

In China, the banking monetary mechanism tends to funnel cash directly into the economy, rather than stocks (note that bank lending remains anemic in the US, while the stock market roars higher).

Indeed, China’s shadow banking (financial transactions outside of formal banks) has expanded to over 200% of China’s GDP or well north of $18 trillion in dollar terms.

This situation favors the well-connected Chinese political elite and lends itself to corruption on an epic scale.

Consider the following:

1) In 2010 alone, 146,000 cases of corruption were launched in China (that’s 400 PER DAY).

2) How much these officials stole is unknown. But… of the 14 cases that were actually reported in the Chinese media, the average amount stolen was 18 MILLION RMB (for perspective, the average college graduate in China earns 2,500 RMB per year).

3) Between 1995 and 2008, it’s estimated that between 16,000-18,000 Chinese officials fled China taking 800 BILLION RMB (roughly $125 BILLION) with them. Bear in mind China’s entire GDP was just 2.1 trillion RMB in 1991.

4) It’s believed that $100 billion in corrupt money fled China through Government officials in 2012 alone.

Corrupt officials favor real estate as a means of acquiring assets because they can put properties in relatives’ names. Between this and the fact that stock investing has yet to become a cultural phenomenon in China as it is in the US, China’s stock market has languished while its real estate market has boomed.

However, the fact that so much “funny money” has moved into the Chinese economy via so many shadowy conduits makes the Chinese economy a potential inflationary nightmare.

The “official” Chinese inflation data won’t show this, but you can see the clear signs:

1) Wage protests have become commonplace in China (a clear sign that the cost of living has outpaced wage growth). 2) Wage increases have grown to the point than numerous US factories have begun moving their manufacturing bases back to the US (the profit differential is no longer big enough that it’s worth the expenses in shipping). 3) China’s Government has made an official show of clamping down on inflation.

Inflation is already present in the financial system. The signs are there if you know where to look. The question now is how the markets will adjust as it spreads.

For a FREE Special Report on how to protect your portfolio from inflation, swing by

Best Regards Phoenix Capital Research

|

| Metals market's next phase is for stock pickers, Sprott's Rule tells KWN Posted: 18 Mar 2014 07:37 PM PDT 10:38p ET Tuesday, March 18, 2014 Dear Friend of GATA and Gold: Metals prices lately have been rising not because of great demand but because of constrained supply, Sprott Asset Management's Rick Rule tells King World News today. The next phase of the metals market will be one for stock pickers, Rule adds. His interview is excerpted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/3/18_Ri... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| So You Want To Be A Speculator Posted: 18 Mar 2014 06:43 PM PDT Submitted by Louis James via Casey Research, Doug Casey's 9 Secrets for Successful Speculation When I started working for Doug Casey almost 10 years ago, I probably knew as much about investing as the average Joe, but I now know that I knew absolutely nothing then about successful speculation. Learning from the international speculator himself—and from his business partner, David Galland, to give credit where due—was like taking the proverbial drink from a fire hose. Fortunately, I was quite thirsty. You see, just before Doug and David hired me in 2004, I’d had something of an epiphany. As a writer, most of what I was doing at the time was grant-proposal writing, asking wealthy philanthropists to support causes I believed in. After some years of meeting wealthy people and asking them for money, it suddenly dawned on me that they were nothing like the mean, greedy stereotypes the average American envisions. It’s quite embarrassing, but I have to admit that I was surprised how much I liked these “rich” people—not for what they could do for me, but for what they had done with their own lives. Most of them started with nothing and created financial empires. Even the ones who were born into wealthy families took what fortune gave them and turned it into much more. And though I’m sure the sample was biased, since I was meeting libertarian millionaires, these people accumulated wealth by creating real value that benefited those they did business with. My key observation was they were all very serious about money—not obsessed with it, but conscious of using it wisely and putting it to most efficient use. I greatly admired this; it’s what I strive for myself now. But I’m getting ahead of myself. The reason for my embarrassment is that my surprise told me something about myself; I discovered that I’d had a bad attitude about money. This may seem like a philosophical digression, but it’s an absolutely critical point. Without realizing that I’d adopted a cultural norm without conscious choice, I was like many others who believe that it is unseemly to care too much about money. I was working on saving the world, which was reward enough for me, and wanted only enough money to provide for my family. And at the same instant my surprise at liking my rich donors made me realize that—despite my decades of pro-market activism—I had been prejudiced against successful capitalists, I realized that people who thought the way I did never had very much money. It seems painfully obvious in hindsight. If thinking about money and exerting yourself to earn more of it makes you pinch your nose in disgust, how can you possibly be effective at doing so? Well, you can’t. I’m convinced that while almost nobody intends to be poor, this is why so many people are. They may want the benefits of being rich, but they actually don’t want to be rich and have a great mental aversion to thinking about money and acting in ways that will bring more of it into their lives. So, in May of 2004, I decided to get serious about money. I liked my rich friends and admired them all greatly, but I didn’t see any of them as superhuman. There was no reason I could not have done what any of them had done, if I’d had the same willingness to do the work they did to achieve success. Lo and behold, it was two months later that Doug and David offered me a job at Casey Research. That’s not magic, nor coincidence; if it hadn’t been Casey, I would have found someone else to learn from. The important thing is that had the offer come two months sooner, being a champion of noble causes and not a money-grubbing financier, I would have turned it down. I’m still a champion of noble causes, but how things have changed since I enrolled in “Casey U” and got serious about learning how to put my money to work for me, instead of me having to always work for money! Instead of asking people for donations, I’m now the one writing checks (which I believe will get much larger in the not-too-distant future). I can tell you this is much more fun. How did I do it? I followed Doug’s advice, speculated alongside him—and took profits with him. Without getting into the details, I can say I had some winning investments early on. I went long during the crash of 2008 and used the proceeds to buy property in 2010. I took profits on the property last year and bought the same stocks I was recommending in the International Speculator last fall, close to what now appears to have been another bottom. In the interim, I’ve gone from renting to being a homeowner. I’ve gone from being an investment virgin to being one of those expert investors you occasionally see on TV. I’ve gone from a significant negative net worth to a significant nest egg… which I am happily working on increasing. And I want to help all our readers do the same. Not because all we here at Casey Research care about is money, but because accumulating wealth creates value, as Doug teaches us. It’s impossible, of course, to communicate all I’ve learned over my years with Doug in a simple article like this. I’m sure I’ll write a book on it someday—perhaps after the current gold cycle passes its coming manic peak. Still, I can boil what I’ve learned from Doug down to a few “secrets” that can help you as they have me. I urge you to think of these as a study guide, if you will, not a complete set of instructions. As you read the list below, think about how you can learn more about each secret and adapt it to your own most effective use. Secret #1: Contrarianism takes courage.Everyone knows the essential investment formula: “Buy low, sell high,” but it is so much easier said than done, it might as well be a secret formula. The way to really make it work is to invest in an asset or commodity that people want and need but that for reasons of market cyclicality or other temporary factors, no one else is buying. When the vast majority thinks something necessary is a bad investment, you want to be a buyer—that’s what it means to be a contrarian. Obviously, if this were easy, everyone would do it, and there would be no such thing as a contrarian opportunity. But it is very hard for most people to think independently enough to risk hard-won cash in ways others think is mistaken or too dangerous. Hence, fortune favors the bold. Secret #2: Success takes discipline.It’s not just a matter of courage, of course; you can bravely follow a path right off a cliff if you’re not careful. So you have to have a game plan for risk mitigation. You have to expect market volatility and turn it to your advantage. And you’ll need an exit strategy. The ways a successful speculator needs discipline are endless, but the most critical of all is to employ smart buying and selling tactics, so you don’t get goaded into paying too much or spooked into selling for too little. Secret #3: Analysis over emotion.This may seem like an obvious corollary to the above, but it’s a point well worth stressing on its own. To be a successful speculator does not require being an emotionless robot, but it does require abiding by reason at times when either fear or euphoria tempt us to veer from our game plans. When a substantial investment in a speculative pick tanks—for no company-specific reason—the sense of gut-wrenching fear is very real. Panic often causes investors to sell at the very time they should be backing up the truck for more. Similarly, when a stock is on a tear and friends are congratulating you on what a genius you are, the temptation to remain fully exposed—or even take on more risk in a play that is no longer undervalued—can be irresistible. But to ignore the numbers because of how you feel is extremely risky and leads to realizing unnecessary losses and letting terrific gains slip through your fingers. Secret #4: Trust your gut.Trusting a gut feeling sounds contradictory to the above, but it’s really not. The point is not to put feelings over logic, but to listen to what your feelings tell you—particularly about company people you meet and their words in press releases. “People” is the first of Doug Casey’s famous Eight Ps of Resource Stock Evaluation, and if a CEO comes across like a used-car salesman, that is telling you something. If a press release omits critical numbers or seems to be gilding the lily, that, too, tells you something. The more experience you accumulate in whatever sector you focus on, the more acute your intuitive “radar” becomes: listen to it. There’s nothing more frustrating than to take a chance on a story that looked good on paper but that your gut was warning you about, and then the investment disappoints. Kicking yourself is bad for your knees. Secret #5: Assume Bulshytt.As a speculator, investor, or really anyone who buys anything, you have to assume that everyone in business has an angle. Their interests may coincide with your own, but you can’t assume that. It’s vital to keep in mind whom you are speaking with and what their interest might be. This applies to even the most honest people in mining, which is such a difficult business, no mine would ever get built if company CEOs put out a press release every time they ran into a problem. A mine, from exploration to production to reclamation, is a nonstop flow of problems that need solving. But your brokers want to make commissions, your conference organizers want excitement, your bullion dealers want volume, etc. And, yes, your newsletter writers want to eat as well; ask yourself who pays them and whether their interests are aligned with yours or the companies they cover. (Bulshytt is not a typo, but a reference to Neal Stephenson's brilliant novel, Anathem, which defines the term, briefly, as words, phrases, or even entire books or speeches that are misleading or empty of meaning.) Secret #6: The trend is your friend.No one can predict the future, but anyone who applies him- or herself diligently enough can identify trends in the world that will have predictable consequences and outcomes. If you identify a trend that is real—or that at least has an overwhelming amount of evidence in its favor—it can serve as both compass and chart, keeping you on course regardless of market chaos, irrational investors, and the ever-present flood of bulshytt. Knowing that you are betting on a trend that makes great sense and is backed by hard data also helps maintain your courage. Remember; prices may fluctuate, but price and value are not the same thing. If you are right about the trend, it will be your friend. Also, remember that it’s easier to be right about the direction of a trend than its timing. Secret #7: Only speculate with money you can afford to lose.This is a logical corollary to the above. If you bet the farm or gamble away your children’s college tuition on risky speculations—and only relatively risky investments have the potential to generate the extraordinary returns that justify speculating in the first place—it will be almost impossible to maintain your cool and discipline when you need it. As Doug likes to say; it’s better to risk 10% of your capital shooting for 100% gains than to risk 100% of your capital shooting for 10% gains. Secret #8: Stack the odds in your favor.Given the risks inherent in speculating for extraordinary gains, you have to stack the odds in your favor. If you can’t, don’t play. There are several ways to do this, including betting on People with proven track records, buying when market corrections put companies on sale way below any objective valuation, and participating in private placements. The most critical may be to either conduct the due diligence most investors are too busy to be bothered with, or find someone you can trust to do it for you. Secret #9: You can’t kiss all the girls.This is one of Doug’s favorite sayings, and though seemingly obvious, it’s one of the main pitfalls for unwary speculators. When you encounter a fantastic story or a stock going vertical and it feels like it’s getting away from you, it can be very, very difficult to do all the things I mention above. I can tell you from firsthand experience, it’s agonizing to identify a good bet, arrive too late, and see the ship sail off to great fortune—without you. But if you let that push you into paying too much for your speculative picks, you can wipe out your own gains, even if you’re betting on the right trends. You can’t kiss all the girls, and it only leads to trouble if you try. Fortunately, the universe of possible speculations is so vast, it simply doesn’t matter if someone else beats you to any particular one; there will always be another to ask for the next dance. Bide your time, and make your move only when all of the above is on your side. Final PointThese are the principles I live and breathe every day as a speculator. The devil, of course, is in the details, which is why I’m happy to be the editor of the Casey International Speculator, where I can cover the ins and outs of all of the above in depth. Right now, we’re looking at an opportunity the likes of which we haven’t seen in years: thanks to the downturn in gold—which now appears to have subsided—junior gold stocks are still drastically undervalued. My team and I recently identified a set of junior mining companies that we believe have what it takes to potentially become 10-baggers, generating 1,000%+ gains. If you don’t yet subscribe, I encourage you to try the International Speculator risk-free today and get our detailed 10-Bagger List for 2014 that tells you exactly why we think these companies will be winners. Click here to learn more about the 10-Bagger List for 2014. Whatever you do, the above distillation of Doug’s experience and wisdom should help you in your own quest. |

| Things That Make You Go Hmmm... Like Every New Fed Chair Gets A Test Posted: 18 Mar 2014 05:35 PM PDT Ordinarily Grant Williams would bet the ranch on this spat being defused diplomatically and everybody leaving the negotiating table a little disgruntled (which would mean the outcome was just about perfect); but he suspects that markets have become dangerously conditioned — by one perfectly executed landing after another in recent years — to expect (and position for) the best. As I was mulling all this over today, a good friend emailed me and asked me my thoughts on exactly this topic. The man in question is one of the very brightest minds it is my pleasure to be able to call on for advice and counsel, and so I thought, what better way to tidy up this week's many questions than by including the culmination of our email conversation (though with the odd expletive removed and certain names changed to protect the innocent): On 15 Mar, 2014, at 12:10 pm, Mr. Big <mrbig@gmail.com> wrote:

On Sat, Mar 15, 2014, at 12:26 AM, Grant Williams <ttmygh@me.com> wrote:

On Sat, Mar 15, 2014, at 12:33 AM, Mr. Big <mrbig@gmail.com> wrote:

On 15 Mar, 2014, at 12:42 pm, Grant Williams <grantwilliams2@icloud.com> wrote:

Every new Fed chair gets a test. Burns had the run on gold that led to Nixon's closing of the window; Miller had the Oil Shock; Volcker had the inflation tiger to wrestle; Greenspan had the '87 crash; and Bernanke had the subprime crisis followed by the 2008 crash. Now it's Yellen's turn. After fifteen months of steady and predictable (thanks largely to the Fed's largesse and Draghi's promise to do "whatever it takes"), we are about to enter a period of extreme unpredictability right at the moment when the Fed is about to demonstrate to the markets that, yes, they really ARE serious about continuing to taper $10 bn every month. The troubles facing the world are far, far broader than just the messy politics of Ukraine; and there is a very real chance that those troubles coalesce into one giant ball of concern that is big enough to shatter the fake sense of calm we've all been lulled into by the passage of time between crises. If they do coalesce, I can't think of a single asset anywhere in the world that is priced correctly for such a situation. Full Grant Williams Letter below... |

| Posted: 18 Mar 2014 04:53 PM PDT If you said a short list of commodities manipulated by the Too Big To Prosecute banks, you are probably right, but the answer we were looking for is that these are all the various, and increasingly more ridiculous, commodities that serve to make up the bulk of China's hot money flow (those flows into China which are not reflected in the current account flows or FDI) facilitating synthetic structures, also known as Chinese Commodity Funding Deals. Of these the copper "monetary metal" funding pathway is best known, and in fact we covered the inevitable end of the Chinese Copper Financing Deals in gruesome detail last May in "The Bronze Swan Arrives: Is The End Of Copper Financing China's "Lehman Event." What happened next was that despite repeated warnings by the PBOC and SAFE that it would end the hot money inflows masked by funding deals, China not only encouraged more CCFDs but aggressively expanded into other commodities, such as iron ore, and as we now learn, weird and wacky commodities such the abovementioned soybeans, palm oil, rubber, zinc, aluminum, gold and nickel. To be sure this was largely precipitated by the near collapse in the overnight lending market in June of 2013 when China's first and so far only real tapering attempt nearly destroyed the domestic financial system. So what has changed since last May, in addition to the realization that virtually every hard asset is now being used by China to mask hot money inflows into the Chinese economy taking advantage of rate differentials between the Renminbi and the Dollar? Well, this time around China may finally be serious about normalizing its epic credit bubble, which as we pointed out before, added a ridiculous $1 trillion in bank assets in just the fourth quarter of 2013 alone. Specifically, as Goldman notes in a just released analysts on the future of CCDS, "the recent managed CNY depreciation is a signal that the government wants to increase FX volatility and reduce the hot money inflow pressure gradually." In other words, the day when the Commodity Funding Deals finally end is fast approaching. Here is Goldman's take on what will certainly be a watershed event - one which will certainly dwarf the recent Chaori Solar default in its significance and scale.

It should now become apparent why the ongoing sharp devaluation of the CNY, far more than merely impacting a few massively levered speculators, and recall that the European Knock In point of maximum vega is about USDCNY 6.20 as discussed previously, will have a far more broad hit to asset levels not just in China but across the world if and when the inevitable moment of CCFD unwind finally begins, and in a reflexive fashion, initial selling begets more selling, more CNY devaluation, greater margin calls, further CCFD unwinds, and so on, until finally the PBOC has no choice but to come in and bail out the financial system one more time. For those unfamiliar with the concept of CCFD, and too lazy to read our previous article on the topic, here is Goldman's Roger Yuan with a succinct summary of just why these key component of China's shadow funding mechanism are so important on the way up... and down. Days numbered for Chinese commodity financing deals As part of a broader shift in China's funding base from domestic to various foreign funding vehicles, Chinese commodity financing deals have become increasingly prevalent, owing to the combination of the relatively high level of Chinese interest rates and the existence of Chinese capital controls. Financing deals use commodities and other goods as a tool to unlock the interest rate differential, with potential implications for Chinese growth, China's linkage with ex-China interest rates, CNY volatility and commodity market pricing. In contrast to some media reports, we find that the bulk of Chinese commodity financing deals are ongoing, facilitating 'hot money' inflows into China and providing a mechanism to import low cost foreign financing. In general, the profitability of most currency and commodity hedged Chinese commodity financing deals remains substantial, owing to a still positive CNY and USD based interest rate differential (>4%), limited depreciation in the CNY over the past month (<2%) and the CNY forward curve (limited cost of hedging the currency exposure), and a lack of tightness in the underlying commodity (i.e. limited cost of hedging the commodity). Returns in copper are still >10% (Exhibit 1), and up to 1mt of physical copper could still be tied up in deals (Exhibit 2). While triggered by concerns about Chinese credit following the Chaori default, an unwind in iron ore financing deals, and concerns about an unwind in copper financing deals, the recent copper price weakness has reflected the combination of sluggish Chinese demand growth and strong global copper supply growth, rather than a financing deal unwind. Supporting this assertion is the fact that nickel (to an even greater extent than copper), and zinc both have a sizeable amount of exposure to financing deals, and their prices have substantially outperformed copper. Further, were this a true copper financing deal unwind, Chinese bonded copper prices would have led the price declines (instead they lagged the domestic Shanghai copper price declines), Chinese bonded stocks would have declined (instead they have risen) and the LME futures curve would likely have moved into contango (it remains in backwardation). More broadly, the main reason why the government has not shut down 'hot money' inflows in an abrupt fashion to date, in our opinion, is that a complete shutdown could have major consequences for China's short-term liquidity. Indeed, China's economic growth is increasingly supported by different types of FX inflows, including those from commodity financing deals, as they can bring in low cost foreign funding and increase China's monetary base, the foundation of both China's rapid credit growth and solid economy growth. In 2013, we estimate that c.42% of the increase of China's monetary base can be attributed to the low cost foreign funding or the 'hot money' inflows (Exhibit 3). These FX / hot money inflows are of substantial size and high volatility (Exhibit 4) and the government attempts to smoothly manage the short-term liquidity cycle in response to these flows. When these flows are very strong China tends to respond (Exhibit 5), as in June and December 2013, as well as February/March 2014, with bearish implications for equities and commodities (Exhibit 6). There are three main drivers of 'hot money' inflows: commodity financing deals, overinvoicing exports, and the black market. In this article, we focus on the Chinese commodity financing deal channel, which has by our estimates facilitated roughly US$81-160 bn of FX inflows since 2010, which is c.31% of China's total FX short-term borrowings (duration < 1 year) (Exhibit 7). Of these deals, gold, copper and iron ore are three leading commodities, followed by soybean, palm oil, natural rubber, nickel, zinc and aluminum. One reason why the range of commodities and the amount of each of those commodities being used for financing purposes has increased since mid-2013 is that the Chinese government moved to reduce the amount of money that can be borrowed per commodity unit. This reduction in apparent financing deal 'leverage'6 (to c.3-10 times the value of the commodity from much higher levels a year ago), has meant that larger amounts of commodities are needed to raise the same amount of low cost foreign funding. In copper's case for example, the amount of copper used in financing deals could have risen from 500kt to 1mt over the past nine months, as shown in Exhibit 2. Looking ahead, our view is that Chinese commodity financing deals will gradually unwind over the medium term (the next 12-24 months), driven by an increase in FX hedging costs, which would slowly erode financing deal profitability and eventually close the interest rate arbitrage. Indeed, we expect that the government will continue to increase FX volatility in order to manage the hot money inflow cycle, thus increasing FX hedging among broader market participants, and raising the cost of hedging the currency for commodity financing deals. This FX policy outlook would be in line with the government's policy targets of gradually increasing the CNY trading band before eventually loosening the nation's capital controls, and is likely to occur before the CNY/USD interest rate differentials close, based on our Economists' forecasts. Finally, an abrupt government crackdown on Chinese commodity financing deals, even with an offsetting monetary stimulus package, is unlikely in our view, given the potential negative impact this could have on credit and thus economic growth. With respect to the impact of an unwind in Chinese commodity financing deals on China's economic growth, we expect that the government will actively manage the impact on domestic credit creation, however we note that this process, if not managed perfectly, will not be without downside risks to Chinese growth. From a commodity market perspective, financing deals create excess physical demand and tighten the physical markets, using part of the profits from the CNY/USD interest rate differential to pay to hold the physical commodity. While commodity financing deals are usually neutral in terms of their commodity position owing to an offsetting commodity futures hedge, the impact of the purchasing of the physical commodity on the physical market is likely to be larger than the impact of the selling of the commodity futures on the futures market (ZH: unless of course momentum algos take offsetting commodity futures hedge selling in, say, gold and boost, or "ignite" the downward momentum to a far greater degree than the offsetting physical buying, making a recursive pattern whereby buying physical ends up resulting in a lower physical price as has been the case with gold over the past year). This reflects the fact that physical inventory is much smaller than the open interest in the futures market (Exhibit 9). As well as placing upward pressure on the physical price, Chinese commodity financing deals 'tighten' the spread between the physical commodity price and the futures price (Exhibit 10).

In this context, an unwind of Chinese commodity financing deals would likely result in an increase in availability of physical inventory (physical selling), and an increase in futures buying (buying back the hedge) – thereby resulting in a lower physical price than futures price, as well as resulting in a lower overall price curve (or full carry) (Exhibit 11). |

| Posted: 18 Mar 2014 04:47 PM PDT Follow ZeroHedge in Real-Time on FinancialJuice Computer programs are obsolete before they even get put on the market and it's been that way for years now. There's also the added bonus of actually making sure that the buyers keep buying and always want the latest. Obsolescence has been part of our lives ever since we went digital, hasn't it? Perhaps even before then. But, back then, things lasted longer than they do today. Or is that just the old folk that reminisce about the past and how good it actually was? Well maybe we will all be harking back to a better time in the next few weeks when Microsoft pulls the plug on the updates to banks' ATMs around the world. Most bank machines (95% of ATMs I the world) use Microsoft XP (OS) in their cash machines, wherever you are in the world. On April 8th 2014, Microsoft will no longer be providing those updates, leaving your and my ATM at the bank far more vulnerable than it was in the past. The software was originally installed in 2001. But, that was when the banks had a lot of money to waste. Since the financial crisis, those updates have been thrown to the wayside. The banks are poor, so we are told. Although, it can't be true when only in February it was announced that the USA's six biggest banks ((JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley) had all made more profit in 2013 than compared to prior to the financial crisis. Net income for the six rose by 21% and reached $74.1 billion. That was all thanks to the rise in the stock market, due to false hopes from the Federal Reserve and virtual booming of the economy. In 2006, when the housing bubble was raking in more money than ever before (right at the peak before it burst), those six earned $84.6 billion and that's the last time those six earned more profits than for 2013. JPMorgan Chase, for example, is expected to make $23 billion in profit alone this year. Wells Fargo is expected to see an increase in profit for the fifth year in a row, hitting $21 billion in 2014. But, ok, let's surmise that the banks don't have enough money to pay for the update in the software. Or they have had enough of being just another cash cow to Microsoft and they don't want tugging on their udders and getting milked for a new software program. There's only one problem with that and that's the fact that the software is like a firewall to your computer and will stop cyber-attacks (or at least, slow them down). Apparently, the banks in the world have agreed to update to a different operating system at some undefined time in the future. Apparently, the banks may not be aware that in the meantime, while the old operating system is no longer being updated and when the brand spanking new (and thus very expensive) software program comes into operation, there will be an open door for cyber-attacks on ATMs. Two thirds of banks in the world will not be upgrading to a newer operating system by the deadline of April 8th. Why would the two thirds worry? Simply because that means that customers' bank details and accounts will be accessible. You can bet your bottom dollar that you will be taking from that ATM down the block that it will be costing the account holder more and more. If banks upgrade or request support from Microsoft, it has been suggested that it will cost millions (passed on to the account holder). 20% of ATMs in the world are in the USA. There are some 2.2 million worldwide with most running on the Microsoft XP OS. Plus, as anyone knows, change the software and the hardware will stop running and that means banks will also be replacing them in coming months and years. More money that the banking sector will have to find in its apparent poverty-stricken state and that it will be more than likely to pass on to the account holder again. ATM? Another Trick by Microsoft (…along with the banks). Originally posted: ATMs Open to Hacking

|

| Gold And Silver Pull Back Slightly As Crimea Tensions Ease Posted: 18 Mar 2014 03:49 PM PDT Gold and silver closed slightly lower today. Tensions in Crimea seem to ease a bit, although the issue between Russia and Ukraine is evolving towards a military rather than a political affair. In addition, the relationship between Russia and the US is deteriorating visibly. Spot Gold in New York closed at $1355,50, slightly lower than the day before. Gold in the London PM Fix traded at $1355.75, €975.92 and $819.03. The gold ETF, GLD, reported holding 812.78 tonnes (26,131,551.33 ounces), a very small increase compared to a week ago. The GLD short interest still stands at 12,277,400 shares outstanding, against the prior GLD short interest 12,919,600 shares. The US Mint updated their gold Eagles sales. In March, the Mint sold 130,00 ounces which is a minor increase of 1.1% compared to the end of past week. Visibly, the demand for gold Eagles has cooled off lately. However, silver Eagles are still in high demand, as evidenced by below figures. Spot Silver in New York closed $20.81. The London Silver Fixing was $20.94, €15.03 and $12.59. The latest data on the silver holdings of the large silver ETF, SLV, showed holdings of 10.164,74 tonnes (326.803.953,400 ounces). The SLV short interest had decreased significantly to 13,635,600 shares outstanding, a 22.73% decrease compared to the prior update of 17,646,200 shares. Those short positions have not changed since last week. An update should be released shortly. The US Mint has sold 3,143,000 ounces of silver Eagles in March, based on the last data of this week. That brings the total Silver Eagles sales to 11,668,000 ounces in 2014, an increase of 8.5% against the 10,749,500 ounces of a week ago. Technically, the gold chart looks much more constructive than silver. Gold’s important 200 day moving average is $1302 and its 50 day moving average $1292. The current spot price, even after today’s slight pullback, is still largely above these important technical levels. By contrast, silver’s 200 day moving average comes at $20,96 and its 50 day moving average at $20,54. Silver trades currently right between both moving averages. Tomorrow is the announcement of the two-day FOMC meeting, scheduled at 19h GMT. Based on the previous FOMC meetings, it is obvious that volatility will be the theme of the day. |

| Posted: 18 Mar 2014 03:30 PM PDT Merk Fund |

| Gold Daily and Silver Weekly Charts - FOMC Meeting Day One Posted: 18 Mar 2014 01:42 PM PDT |

| Gold Daily and Silver Weekly Charts - FOMC Meeting Day One Posted: 18 Mar 2014 01:42 PM PDT |

| Silver & Gold Volatility: Calm Before Storm Over Posted: 18 Mar 2014 01:23 PM PDT Volatility in silver and gold prices just jumped from pre-crisis and pre-crash levels... GOLD PRICES have finally eased back, writes Adrian Ash at BullionVault, capping a rare 6-week run of rising prices – something seen only 65 times in the last 46 years. Silver prices had lagged gold badly during that run, struggling to make 1-month highs. But here on the drop, that relative calm counted for little, sending it back to last Monday's 3-week lows and forcing a spike in silver volatility. Dropping $30 from Monday's new 6-month high, meantime, gold prices first hit $1361 per ounce Tuesday morning – a level seen as key resistance thanks to marking the previous rally's high in October. Gold prices then dropped back to $1350 as volatility rose, taking it right around the various Fibonacci and Elliott Wave "support" levels now identified by technical analysts as marking key "retracement" points in this 2014 rebound to date. Still, no worries, said Reuters as volatility hit and the drop began. This is just "profit taking". The 2014 uptrend "still looks healthy" says bullion bank Scotia Mocatta's technical note. The drop "will be viewed as a corrective phase within a bullish trend," agree Swiss bullion bank UBS. All very reassuring...especially from analysts who said "Sell rallies" back at $1250 in mid-January. Perhaps the lessons of last year really do need learning again. Gold dropped 30% of its Dollar value in 2013. This 2014 uptrend started on New Year's Eve at $1180...a 3-year low when first hit last summer. Next month marks the first anniversary of gold's historic crash...and the 3-year anniversary of silver touching $50 per ounce. It's fallen 60% since then. Stable this ain't. But more recently, both silver and gold have in fact been unusually quiet. And low volatility often marks the calm before a storm.  Late February saw volatility in silver prices, as measured by daily changes over the previous month's trading, turn higher from its lowest levels since June 2007. That was right before the financial crisis got started, with the summer credit crunch blowing up Northern Rock, the over-borrowed UK mortgage lender which played "canary in coalmine" for the Western world's financial system.  As for gold, daily volatility on that same rolling 1-month basis...a statistical measure of how fast prices are moving compared to their standard rate of change over the last year...last week turned higher from its lowest level since Thursday 11 April 2013. The very next day, gold dropped $30 per ounce...ready to dump $140 when trading re-opened after the weekend on Monday morning. So we've had the calm. A storm may be due. But in financial assets or precious metals? |

| Silver & Gold Volatility: Calm Before Storm Over Posted: 18 Mar 2014 01:23 PM PDT Volatility in silver and gold prices just jumped from pre-crisis and pre-crash levels... GOLD PRICES have finally eased back, writes Adrian Ash at BullionVault, capping a rare 6-week run of rising prices – something seen only 65 times in the last 46 years. Silver prices had lagged gold badly during that run, struggling to make 1-month highs. But here on the drop, that relative calm counted for little, sending it back to last Monday's 3-week lows and forcing a spike in silver volatility. Dropping $30 from Monday's new 6-month high, meantime, gold prices first hit $1361 per ounce Tuesday morning – a level seen as key resistance thanks to marking the previous rally's high in October. Gold prices then dropped back to $1350 as volatility rose, taking it right around the various Fibonacci and Elliott Wave "support" levels now identified by technical analysts as marking key "retracement" points in this 2014 rebound to date. Still, no worries, said Reuters as volatility hit and the drop began. This is just "profit taking". The 2014 uptrend "still looks healthy" says bullion bank Scotia Mocatta's technical note. The drop "will be viewed as a corrective phase within a bullish trend," agree Swiss bullion bank UBS. All very reassuring...especially from analysts who said "Sell rallies" back at $1250 in mid-January. Perhaps the lessons of last year really do need learning again. Gold dropped 30% of its Dollar value in 2013. This 2014 uptrend started on New Year's Eve at $1180...a 3-year low when first hit last summer. Next month marks the first anniversary of gold's historic crash...and the 3-year anniversary of silver touching $50 per ounce. It's fallen 60% since then. Stable this ain't. But more recently, both silver and gold have in fact been unusually quiet. And low volatility often marks the calm before a storm.  Late February saw volatility in silver prices, as measured by daily changes over the previous month's trading, turn higher from its lowest levels since June 2007. That was right before the financial crisis got started, with the summer credit crunch blowing up Northern Rock, the over-borrowed UK mortgage lender which played "canary in coalmine" for the Western world's financial system.  As for gold, daily volatility on that same rolling 1-month basis...a statistical measure of how fast prices are moving compared to their standard rate of change over the last year...last week turned higher from its lowest level since Thursday 11 April 2013. The very next day, gold dropped $30 per ounce...ready to dump $140 when trading re-opened after the weekend on Monday morning. So we've had the calm. A storm may be due. But in financial assets or precious metals? |

| Silver & Gold Volatility: Calm Before Storm Over Posted: 18 Mar 2014 01:23 PM PDT Volatility in silver and gold prices just jumped from pre-crisis and pre-crash levels... GOLD PRICES have finally eased back, writes Adrian Ash at BullionVault, capping a rare 6-week run of rising prices – something seen only 65 times in the last 46 years. Silver prices had lagged gold badly during that run, struggling to make 1-month highs. But here on the drop, that relative calm counted for little, sending it back to last Monday's 3-week lows and forcing a spike in silver volatility. Dropping $30 from Monday's new 6-month high, meantime, gold prices first hit $1361 per ounce Tuesday morning – a level seen as key resistance thanks to marking the previous rally's high in October. Gold prices then dropped back to $1350 as volatility rose, taking it right around the various Fibonacci and Elliott Wave "support" levels now identified by technical analysts as marking key "retracement" points in this 2014 rebound to date. Still, no worries, said Reuters as volatility hit and the drop began. This is just "profit taking". The 2014 uptrend "still looks healthy" says bullion bank Scotia Mocatta's technical note. The drop "will be viewed as a corrective phase within a bullish trend," agree Swiss bullion bank UBS. All very reassuring...especially from analysts who said "Sell rallies" back at $1250 in mid-January. Perhaps the lessons of last year really do need learning again. Gold dropped 30% of its Dollar value in 2013. This 2014 uptrend started on New Year's Eve at $1180...a 3-year low when first hit last summer. Next month marks the first anniversary of gold's historic crash...and the 3-year anniversary of silver touching $50 per ounce. It's fallen 60% since then. Stable this ain't. But more recently, both silver and gold have in fact been unusually quiet. And low volatility often marks the calm before a storm.  Late February saw volatility in silver prices, as measured by daily changes over the previous month's trading, turn higher from its lowest levels since June 2007. That was right before the financial crisis got started, with the summer credit crunch blowing up Northern Rock, the over-borrowed UK mortgage lender which played "canary in coalmine" for the Western world's financial system.  As for gold, daily volatility on that same rolling 1-month basis...a statistical measure of how fast prices are moving compared to their standard rate of change over the last year...last week turned higher from its lowest level since Thursday 11 April 2013. The very next day, gold dropped $30 per ounce...ready to dump $140 when trading re-opened after the weekend on Monday morning. So we've had the calm. A storm may be due. But in financial assets or precious metals? |

| Zero Hedge: U.S. government just makes up the debt holders report on the fly Posted: 18 Mar 2014 12:27 PM PDT 3:26p ET Tuesday, March 18, 2014 Dear Friend of GATA and Gold: Zero Hedge today mocks the U.S. Treasury Department's new report on the holders and holdings of U.S. government debt, suggesting that the government simply makes up anything it wants on the fly. Zero Hedge's commentary is headlined "Meet the Brand-New, and Shocking, Third-Largest Foreign Holder of U.S. Treasurys" and it's posted here: http://www.zerohedge.com/news/2014-03-18/meet-brand-new-and-shocking-thi... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1 302 635 1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| China Buying World's Entire New Gold Supply - Mike Maloney Posted: 18 Mar 2014 12:25 PM PDT Chinese aren't stupid, ... they're going to have their CASH in a mix of SGD's, CHF's USD, ... EUROS...China isn't going to announce shit about its gold holdings so long as the flow of gold into the country continues to accelerate at steady or declining prices. When the amount of gold getting... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| America’s “Secret” Export Boom Posted: 18 Mar 2014 12:02 PM PDT America's shale boom rages on — and we've got the exports to prove it. However, from the outside looking in — with the Keystone pipeline approval in limbo, natural gas exports slow to come online and a U.S. ban on raw crude exports — you'd think the U.S. isn't exporting much in the way of energy these days. But if you think the U.S. energy export scene is waiting for a government approval, you better have a look at this chart… Since 2007, U.S. energy exports (shown above) have been booming! The U.S. is exporting the equivalent of nearly 4.5 million barrels per day. At a low-ball estimate that these refined products command $50 a barrel, that represents over $82 billion in exports per year. But that's only half the story! Since January 2007, U.S. imports of crude oil and petroleum products are down 4.2 million barrels per day. Add it all up and over the past seven years, the U.S. is up nearly 8 million barrels per day, net. That's an enormous turnaround — to the tune of $146 billion a day! Talk about a shale stimulus plan! It's America's secret export boom. And while the talking heads and naysayers continue to pooh-pooh America's outlook, a boom like this will add steam to our economic recovery and create even more opportunity for the energy names in our portfolio. Last month in our resource newsletter, Outstanding Investments, I penned the "5 Hot Buys" section. There I discussed the difficulty of predicting the future. "We can connect dots, plan and forecast," I wrote. But "there's no telling what the economy will do," I concluded. Of course, last month, there were many dots to connect around Ukraine — a country in turmoil, with riots in the streets. Few envisioned the government of Ukraine simply collapsing. And did anyone foresee the country's pathetic president high-tailing it from his opulent palace to exile in Russia? It's bizarre and tragic. Now Ukraine is under new management, after a fashion. Plus, for all we know, Ukraine is splitting up along ethnic lines — Ukrainian versus ethnic Russian, with Russian Federation military forces nearby, preparing to pounce. Indeed, it reminds me of an old Russian saying, "Russians take their time to saddle up, but then they ride fast." Why bring up Ukraine and Russia in an article about resources — particularly oil? Because we have a full-blown geopolitical crisis on our hands, and that affects you as a resource investor. In terms of front lines and boots on the ground, the lineup is faraway Russia versus faraway Ukraine. But the European Union (EU) and U.S. are deeply engaged as well, in political commitment and strategic credibility. Now, after years of peace and relative stability in Europe, we have a new version of the old Cold War confrontation. Overall, this isn't good for economic growth, growing trade and/or improved investment. Looking ahead, how will the Ukraine showdown resolve? Perhaps sane heads will sit down and work out a deal. I hope so. Then again, Ukraine might fall apart, in many senses of the word. The Russian "Anschluss" of Crimea, to use a famous old German term, is all but finalized. And maybe we'll see worse, Ukraine might break up along the lines of, say, Yugoslavia in the 1990s. Even worse, one has to wonder if Ukraine is the next Syria. Again, what does this have to do with "hot" resource buys? Well, first, don't expect central banks in Europe or the U.S. to tighten the money spigots. Interest rates will likely stay low, and monetary "easing" will continue. That is, it's bad enough that Western leaders have to figure out how to deal with Russia and its ambitions toward Ukraine. There's no sense for central banks to add an economic slowdown to the mix of issues. I've said this again and again… but you must own physical precious metals. Meanwhile, EU governments and the U.S. must bite the bullet (so to speak) and beef up defense budgets. No one can undo the past with respect to Ukraine. And Ukraine's future will unfold in its own way, whatever that may be. But looking ahead, expect Western governments to revisit spending priorities for new aircraft, submarines and much more. It's going to be expensive. My investment point is that in times of political uncertainty like this, bet on inflation. For all the problems, there's looming support for precious metals and strong hard assets like energy plays. I've said this again and again here in The Daily Reckoning and other forums, but you must own physical precious metals. If you don't own precious metal, or if you don't own very much (say, 5-10% of your portfolio), then use the current price environment to acquire gold and silver. Buy real metal and take delivery! Gold and silver prices strengthened in the first part of 2014, after being in the dumps for about 18 months. Looking back, precious metal prices topped out in 2011 and 2012 and then started drifting down. There may still be a downside for precious metal prices from here too, but I don't envision a crash or prices staying down for long. When it comes to the Russia-Ukraine standoff and how it will impact the EU and U.S., we're still in the early innings. This will drag out over time. There's much uncertainty for everyone on every side. Many wheels have yet to turn. One never knows what the morning headlines will bring. The Internet is filled with links for all manner of companies that will gladly sell you gold and silver coins, ingots, etc. Shop around to get the best deal on the lowest markups and good service. And did I mention this?: Take! Delivery! Regards, Matt Insley P.S. In today’s issue of The Daily Reckoning, I gave readers a chance to get in on an exclusive live event that will tell them everything they need to know about the current energy markets – and how to make huge gains because of them. These kinds of great opportunities appear every day, in every single issue of The Daily Reckoning. If you want to know the best ways to beat the markets, sign up for the FREE Daily Reckoning, right here. |

| New York attorney general to investigate high-frequency trading Posted: 18 Mar 2014 10:28 AM PDT High-Speed Trading Faces New York Probe into Fairness By Keri Geiger and Sam Mamudi NEW YORK -- New York's top law enforcer has opened a broad investigation into whether U.S. stock exchanges and alternative venues provide high-frequency traders with improper advantages. Attorney General Eric Schneiderman said today that he's examining the sale of products and services that offer faster access to data and richer information on trades than what's typically available to the public. Wall Street banks and rapid-fire trading firms pay thousands of dollars a month for these services from firms including Nasdaq OMX Group Inc. and IntercontinentalExchange Group Inc.'s New York Stock Exchange. ... High-frequency activity represented more than half of all U.S. stock trading in 2012, according to Rosenblatt Securities Inc. ... ... For the full story: http://www.bloomberg.com/news/2014-03-18/high-speed-trading-said-to-face... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Interest Rates - Is Yellen Fishing for Gold? Posted: 18 Mar 2014 10:08 AM PDT If interest rates are supposed to be on the rise, why has the price of gold gone up so much this year? Is it merely because it is bouncing back after a sharp decline in 2013? We have a closer look at the link between gold and interest rates to gauge how investors may want to approach the bait provided by the Fed. |

| Are You Mainstream Or Deviant? Posted: 18 Mar 2014 10:04 AM PDT Consider our economic world from two perspectives:

Deviant readers are more likely to believe:

MAINSTREAM MEDIA VIEW (a simple summary):

And there you have it – a simple summary of the Deviant view versus the Mainstream view. IMPLICATIONSSuppose that 50% to 80% of the gold in Fort Knox and the NY Fed is either gone, leased, or rehypothecated. Suppose that China has amassed the largest horde of gold in the world. Do these suggest the price of gold is likely to increase over the next few years? Suppose that the Federal Reserve is forced via market conditions (interest rates rising, the S&P crashing, war, dollar collapse, financial melt-down or other possibilities) to expand the QE program and to "print and purchase" $100,000,000,000 or more per month of distressed paper, damaged derivatives, flaky mortgage backed securities, and increasingly large quantities of dumped T-bonds and notes. Do you think this will support the price of gold over the next few years? Suppose that gold double bottomed in June and December 2013 after being crushed by the naked short sales in April and June of 2013. Suppose that the unintended consequence of that market take-down was increased demand for physical gold, particularly from Asia and the Middle East. Does the new uptrend and increasing world-wide demand for gold suggest higher prices in the next few years? Suppose that, for whatever reason, the world launches into another cycle of war, several countries send troops to various spots around the world, and the US engages in one or several hot wars. Will this increase the deficit, increase the national debt, increase financial and social anxiety, upset the stock market, and suggest higher gold prices? SUMMARY |

| Gold and the Brave New Deviant World Posted: 18 Mar 2014 10:03 AM PDT Consider our economic world from two perspectives: The Deviant View - as represented by those who visit deviantinvestor.com, read alternate media, are skeptical of the "official" news, and who critically examine the financial world. |