Gold World News Flash |

- China Gold Imports Surge – Or Fall. You Decide

- GLD and SLV hold constant/Gold and silver hold/Turmoil continues in the Ukraine

- Gerald Celente - Ukraine & WW3 Looming

- One Idea How To Generate 5.8 Million Jobs

- Gold Price Explodes In Ukrainian Currency

- Yellen’s Remarks to Senate Committee Constitute an All Out Buy Signal for Gold and Silver

- THE COMING EASTERN BAILOUT & WHAT TENSIONS IN THE UKRAINE MEAN FOR YOU

- Silver: 4 Innovative Applications in Health, Automotive, Beverage

- GOLD Price Elliott Wave Analysis: Resistance Nearby

- U.S. Dollar Rallies, Gold Declines

- Gold Daily and Silver Weekly Charts - Heart of Gold

- Gold Daily and Silver Weekly Charts - Heart of Gold

- Wayne Root -- Are 9 Dead Bankers A Sign Of Pending Economic Collapse?

- The "Institutional Investor" Housing Bubble Just Burst

- Frank Holmes & Chris Waltzek

- Junior Rare Earth Miner Soars On State of Alaska Support

- The Ripple Effects of the QE Debt Binge

- Grant Williams - This Will Send The Price Of Gold Skyrocketing

- Biggest gold ETF has first monthly inflow in over a year

- World’s largest gold ETF eyes 1st monthly inflow in over a year

- Dubai gold bourse plans four currency contracts

- Dubai refiner fixes shortfalls after audit on conflict gold

- When all other options have failed, gold can be used as collateral

- Three warning signs from higher gold prices

- Opportunities in mid-tier gold miners too good to pass up – Fowler

- MT. GOX BITCOIN EXCHANGE COLLAPSE - 740,000 MISSING BITCOINS

- The Federal Reserve, Janet Yellen, QE and Gold

- In The News Today

- Eric Sprott: We’re Looking For Ways To Survive "[The] Counterfeiting Of Money"

- Investors "Shift Sentiment" to Buy Gold But "Profit-Taking" Surprises Analysts as Ukraine-Russia Tensions Rise

- Gold, QE, The Federal Reserve and Janet Yellen

- Gold Takes an "Unexpected" Turn - Video

| China Gold Imports Surge – Or Fall. You Decide Posted: 27 Feb 2014 03:20 PM PST by John Rubino, Dollar Collapse:

Here's how the mainstream press, in this case Bloomberg, handled it: China's Gold Shipments From Hong Kong Decline as Demand Weakens China's gold imports from Hong Kong fell in January as jewelers and fabricators in the world's largest consumer of the precious metal reduced purchases on expectation demand may weaken after Lunar New Year holidays. |

| GLD and SLV hold constant/Gold and silver hold/Turmoil continues in the Ukraine Posted: 27 Feb 2014 03:19 PM PST by Harvey Organ, HarveyOrgan.Blogspot.ca:

Gold closed up $3.60 at $1331.60 (comex to comex closing time ). Silver was up 6 cents to $21.31 In the access market tonight at 5:15 pm Today, gold and silver held their ground despite the fact that tomorrow is first day notice. We should see both metals rise as we enter into March. The tensions inside the Ukraine continue as early this morning, gunmen entered the parliament buildings of the capital in the Crimea. There was saber rattling between the Russians, the Americans and NATO today. You do not want to miss the huge article written on the Ukraine by Charles Hugh Smith. |

| Gerald Celente - Ukraine & WW3 Looming Posted: 27 Feb 2014 02:52 PM PST Gerald Celente - Gold Core - February 26, 2014 Ukraine, War, ATMs, Runs on Banks and Gold and Silver. Gerald Celente joins GoldCore for a webinar to discuss the various strategies available for protecting one's wealth in 2014 [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| One Idea How To Generate 5.8 Million Jobs Posted: 27 Feb 2014 02:46 PM PST According to the Economic Policy Institute, a Washington think tank supported by organized labor, the answer to generating up to 6 million more jobs is as simple as ending global currency manipulation. But not in the sense of ramping USDJPY or AUDUSD at key market inflection points which mostly benefits such FX-rigging chatrooms as "the Cartel", no: they are thinking more big picture, in the "central bank manipulation sense." The report says that "several foreign countries devalue their currencies to make their products cheaper, making it difficult for U.S. manufacturers to compete, the report said." In essence what the group suggests is that the US currency is overvalued relative to the rest of the world, and that by "realigning exchange rates, U.S. trade deficits would be reduced by up to $500 billion per year by 2015. Such a move would increase U.S. gross domestic product by up to $720 billion per year and create up to 5.8 million jobs, the report said." Said otherwise: stop foreign currency manipulation, but allow and encourage the US to keep pushing its own currency even lower. This is all wonderful, however it appears the unions or their mouthpiece thinktank have never heard of the Fed, whose job over the past 5 years has been, among other things, to keep the dollar weaker than it would normally be. If anything, the rest of the world is merely mimicking the policies of the Fed, which have been adopted first by the Bank of England, next the Bank of Japan, and soon, maybe, the European Central Bank. We can't wait to see how much screaming and yelling will ensue if and when Mario Draghi does indeed engage in unsterilized QE, and sends the Euro plunging (now that there is supposedly no fear of redenomination) and by implication, the USD soaring making exports of US goods and services to Europe even more prohibitive. And don't tell labor unions about the recent collapse in the Chinese Yuan: that would really put their noses out of joint. Because while superficially they are absolutely correct, a weaker dollar would on paper boost US exports and potentially generate a few million extra jobs (assuming there are no robots who can fill those positions at a fraction of the cost and none of the wages), the flip side is that it would crush all export-reliant emerging economies, resulting in many more millions of job losses in countries that unlike the US, have no welfare-state safety nets, and thus send the risk of global revolutions through the roof, which in turn would jeopardize the most precious thing of all: the global stock markets, currently at all time highs, courtesy of precisely the kind of currency manipulation that all the central banks - not just the Fed - are engaging in. The story, as reported by the LA Times, continues as expected:

What was unsaid is that it was currency manipulation by others that is what is at stake here. As for the Fed: why, give us more. But just pray that the pent up inflation doesn't finally crack the Fed's dam door, and floor all these workers who are demanding more of the same, because then they will really see what the side effects of manipulated, artificial global markets truly is. And finally, who cares about trade anyway? Recall what the latest IMF "forecast" (and its previous iterations) have to say about world trade (hint - not much):

A far better option for all the disgruntled workers engaging in such an old normal concept as actually creating exportable goods, is to get an E-trade account, request a few grand from Obama (call it populist bailout venture capital), and bet it all on Tesla. After all, there is just one wealth effect left in the room. |

| Gold Price Explodes In Ukrainian Currency Posted: 27 Feb 2014 02:44 PM PST As we have repeated over and over again, gold should primarily act as an insurance policy which protects your purchasing power during a currency crisis. And despite the fact that most economic pundits want us to believe there is an economic recovery, the truth of the matter is that the recovery is very weak; the economy remains fragile. Apart from that, a global currency crisis is playing out and it will probably hit most of the currencies in the years ahead. Recently, in the heat of the emerging market crisis, we wrote Gold Price Exploding In Emerging Markets. The charts in the article show the explosive price action in local currencies of the emerging markets that were hit hardest. That’s the insurance policy in action. Today, it’s the turn of the Ukrainian currency. From GoldCore:

All jokes aside, if one tries to explain this to the majority of people, the result would be a conversation along these lines: “The gold price up? No, the currency down and gold is helping preserve the purchasing power which is the primary role of a currency. Oh, gold is a currency?” |

| Yellen’s Remarks to Senate Committee Constitute an All Out Buy Signal for Gold and Silver Posted: 27 Feb 2014 02:42 PM PST Fed Chairman Yellen's less than sparkling performance before the Senate Banking, Housing and Urban Affairs Committee on Thursday constitutes a complete affirmation for continued purchases of gold and silver. The Chairman's testimony was so disjointed that two major news organizations published completely contradictory headlines of her stuttering remarks. Tapering – will she or won't she [...] |

| THE COMING EASTERN BAILOUT & WHAT TENSIONS IN THE UKRAINE MEAN FOR YOU Posted: 27 Feb 2014 02:40 PM PST by Jeff Berwick, Dollar Vigilante:

Turkey is experiencing protests and violence due to corruption by the government, and Venezuela is also experiencing protests and violence. The “global political awakening” has gone hot on multiple continents. Although one week ago mainstream press worldwide spoke about the Ukraine as if it were in the midst of a popular uprising, a different picture has become clearer, as communist and fascist sympathizers seem poised to gain the most out of the chaos. “Conspiracy” aside, it is a no-brainer that major powers can have the most influence in these sorts of situations, and we are seeing this develop. Already european-stye bank policies are being implemented in the unstable region. |

| Silver: 4 Innovative Applications in Health, Automotive, Beverage Posted: 27 Feb 2014 02:31 PM PST In its monthly industry release, The Silver Institute reported once again several new applications of silver in products across several industries: health, automotive, food and beverage. The Silver Institute has written extensively how silver has helped product development and industries: read the articles here, here and here. Silver Spark Plugs Enhance Performance What's the difference between spark plugs in your car and those used in race cars? Silver. The electrical spark created by spark plugs can be tough on the center electrode. Because of this, most spark plugs use iridium, a super dense material that is resistant to heat, corrosion and wear. However, iridium doesn't deliver the best performance. Silver does, according to officials of Nology, Bosch, Brisk Racing and Accel, which offer silver spark plugs. Officials note that because silver is the best electrical and thermal conductor of any metal, it produces a cleaner and more powerful spark. Unlike iridium, though, silver spark plugs don't last as long and therefore are mainly suited for race cars or for use by drivers who don't mind changing their spark plugs more often in exchange for greater performance, better gas mileage and easier starting, albeit at a higher price. According to an Accel spokesman: "Silver is the best electrical conductor which allows for a wider heat range and is extremely resistant to fouling. The silver center electrode has low ignition voltage requirements and allows easier starting." LaCie Produces Silver-Plated Hard Drive Sphere For the computer user with style and a bit of cash, French manufacturer of fine silverware and home accessories Christofle has handcrafted LaCie's Sphère, a silver-plated storage ball that holds a terabyte of data. At US$499 each, LaCie promises that the beautifully ensconced hard drive "never fails to turn heads and spark conversation." It was introduced at the recent Consumer Electronics Show. Esthetics aside, the Sphère features high-speed USB 3.0, which makes file transfers and backups nearly three times faster than with USB 2.0. The Sphère gets power through the USB cable, so no power cord is needed. Christofle was founded in 1830, and produces silver pieces in its Haute Orfevrerie workshop in Normandy, France. The company has been commissioned to do work for heads of state including Napoleon III and King Louis-Philippe, and Christofle pieces appear in museum collections throughout the world. It was the first company in France to use electrolysis to silver plate metal. French company LaCie specializes in external hard drives including those for mobile use. U.S. storage company Seagate Technology is expected this year to close on a deal to acquire LaCie. Antimicrobial Coatings Market Expected to Grow The market size for antimicrobial coatings was about $1.5 billion in 2012 by value and is estimated to grow with a compound annual growth rate of about 11.8% from 2013 to 2018, according to a report from RnR Market Research. The major additives considered in this report are silver, copper, zinc oxide, zirconium, titanium dioxide, and zinc omadine. The report, titled Antimicrobial Coatings, divides the market on the basis of major applications such as Indoor air/HVAC, medical, mold remediation, building & "In order to tap the growing market and to gain a competitive advantage in the antimicrobial coatings market, huge investments are made by the major companies such as AkzoNobel, BASF, PPG, Sherwin-Williams and others in developing countries of Asia-Pacific and Latin America. The new R&D facilities and new product developments by the companies are helping to cater to the demand in these developing countries, which are in growing stage and have huge potential in the near future," the report noted. "The companies dealing with antimicrobial coatings are consistently focusing to develop new coatings with different formulations having antibacterial and anti-odor properties with them and which follows the regulatory environmental standards defined by EPA, REACH, and other environment & health care agencies." New Mongolian Vodka Distilled Through Silver Filters A new vodka produced from Mongolian wheat and water from the Khuiten Peak is distilled at least six times through silver and platinum filters to remove any impurities, according to the company's founder. The prime mover behind the new drink is David Solomon, who owns a 20-store Toys "R" Us franchise and founded Redbox, the DVD vending machine. On a trip to Mongolia, a friend asked for his help in bringing brands such as Toys 'R' Us, Starbucks and Redbox to the country, Solomon related in an online interview with The Drink Nation on The Daily Meal. "And I'm thinking, 'OK, in Mongolia what you've got is 3 million people and 20 million goats, and the goats don't buy a lot of toys, drink a lot of coffee, or rent a lot of movies, you know?' At the time we were drinking this vodka, so I said, 'I've got a much better idea. This is the greatest vodka I've ever had, so let's take this vodka to the rest of the world.' That's kinda how it got started." Solomon added: "We distill each batch at least six times through silver and platinum filters. That removes any impurities. In fact, because of that, if you're on a gluten-free regimen, you can still drink our vodka without a problem." Golia Vodka is available in New Jersey and Pennsylvania, but the company is looking to expand distribution throughout the U.S. |

| GOLD Price Elliott Wave Analysis: Resistance Nearby Posted: 27 Feb 2014 02:14 PM PST On gold we have adjusted the wave count after recent acceleration and daily close above 1300 level. We are now tracking an incomplete triangle in wave 4) but bias remains the same; we see move up from 1181 as temporary and corrective retracement that may stop and send prices down in second part of this month. We see resistance for a potential turning pint at 1330, 1362, followed by 1376. |

| U.S. Dollar Rallies, Gold Declines Posted: 27 Feb 2014 02:09 PM PST In short: In our opinion short positions (half): gold, silver, and mining stocks are justified from the risk/reward perspective. The entire precious metals sector declined yesterday, even gold. Has the situation changed enough to double the short position? Let’s take a closer look (charts courtesy of http://stockcharts.com). |

| Gold Daily and Silver Weekly Charts - Heart of Gold Posted: 27 Feb 2014 01:31 PM PST |

| Gold Daily and Silver Weekly Charts - Heart of Gold Posted: 27 Feb 2014 01:31 PM PST |

| Wayne Root -- Are 9 Dead Bankers A Sign Of Pending Economic Collapse? Posted: 27 Feb 2014 01:30 PM PST Prominent bankers are dying in droves. Here's the tip-off that this is a very big story: The mainstream media is not covering it. There are nine dead bankers (and counting), and the story isn't even mentioned in the national news. That itself is a major news story. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The "Institutional Investor" Housing Bubble Just Burst Posted: 27 Feb 2014 01:28 PM PST It is by now well understood that the US housing market over the past year has not benefited from broad consumer participation, exhibited best by the unprecedented, 13 year low collapse in mortgage applications. And since bond yields which recently "soared" to 3.00% only to drop right back have not resulted in a spike in applicants for home mortgages, it is clear that the problem is far more broad and systemic and has to do more with affordability than any other aspect of the market. And yet one thing that did support the elevated, or as some call them, bubble prices, of US houses, was the bid from institutional investors: those "house flippers" who buy a home with the intent of either renting it out or selling it to a greater fool. Alas, just like the rental bubble whose bursting we chronicled here just last week, so the institutional bubble has just popped, which we know courtesy of RealtyTrac data reporting that institutional investors — defined as entities purchasing at least 10 properties in a calendar year — accounted for 5.2 percent of all U.S. residential property sales in January, down from 7.9 percent in December and down from 8.2 percent in January 2013. This was the biggest one month plunge in history. It gets worse: the January share of institutional investor purchases represented the lowest monthly level since March 2012 — a 22-month low.

Some other RealtyTrac findings: Metro areas with big drops in institutional investor share from a year ago included Cape Coral-Fort Myers Fla. (down 70 percent), Memphis, Tenn., (down 64 percent), Tucson, Ariz., (down 59 percent), Tampa, Fla., (down 48 percent), and Jacksonville, Fla., (down 21 percent). Yet, unwilling to give up on this latest bubble craze, institutional investors are still hoping there is some last minute cash to be made in some remaining markets. Counter to the national trend, 23 of the 101 metros analyzed in the report posted year-over-year gains in institutional investor share, including Atlanta (up 9 percent), Austin, Texas, (up 162 percent), Denver (up 21 percent), Cincinnati (up 83 percent), Dallas (up 30 percent), and Raleigh, N.C. (up 15 percent). The rotation from one set of markets to another is shown on the chart below:

The following quote summarizes the situation best, and it also refutes the entire "harsh weather" excuse that has become so popular in recent months: "Many have anticipated that the large institutional investors backed by private equity would start winding down their purchases of homes to rent, and the January sales numbers provide early evidence this is happening," said Daren Blomquist. "It's unlikely that this pullback in purchasing is weather-related given that there were increases in the institutional investor share of purchases in colder-weather markets such as Denver and Cincinnati, even while many warmer-weather markets in Florida and Arizona saw substantial decreases in the share of institutional investors from a year ago." So with retail buyers long out, and cash buyers and institutional investors - which as readers know amount to about 60% of all purchases - on their way out, just what will be the next myth be that will be disseminated to percent the general public from realizing that the artificial housing market "recovery", which was entirely driven by hot money, speculation, and hope of a quick profit? Because with QE also fading, and with it the MBS bid, not to mention the surge in foreclosure exits and the flood of foreclosed properties about to hit the market as we wrote yesterday, things for the US housing market are about to get very messy. |

| Posted: 27 Feb 2014 01:00 PM PST from GoldSeekRadiodotcom:

Click here to Listen |

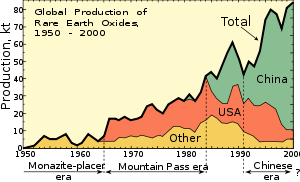

| Junior Rare Earth Miner Soars On State of Alaska Support Posted: 27 Feb 2014 12:36 PM PST In the early nineties, the Chinese became aware of their abundance of rare earths and had the foresight to see the rising demand in high tech and clean energy applications. Although rare earths were discovered by Americans starting with the Manhattan Project and later advanced by General Motors, the Chinese completely co-opted the industry as mining and manufacturing were outsourced overseas in exchange for cheap Chinese labor and raw materials. Twenty years later, the West is finally awakening that the loss of mining and manufacturing has led China to dominate the market which has had drastic repercussions in the loss of domestic manufacturing. Jobs have been lost. The Chinese dominate close to all of the heavy rare earths most crucial for our latest military technologies, high tech and clean energy applications. In order to get the heavy rare earths at a fair cost companies have to move manufacturing facilities to China. This comes at a heavy cost as intellectual property may be compromised. China’s rare earth strategy has led to major growth and lots of jobs. Now the West must support their own domestic mines to have a secure and economic supply chain. For weeks I alerted you to view a potential buypoint for Ucore Rare Metals (UURAF) which controls the heavy rare earth Bokan Deposit in Alaska at four year lows. I believed the price would bottom out at $.20. In fact it broke through that low for a day or two and then reversed higher. That may have marked the major low. Although mostly everyone gave up on Ucore, I did not. The company made many technical advancements in 2013 on the highest grade heavy rare earth deposit in the United States. They are working closely with the U.S. Department of Defense to advance this project. I have been to the property in 2011 and saw the tens of millions of dollars of work that has advanced this asset to the feasibility stage. I also was well aware of the local support from the State of Alaska as the Bokan Project has been vocally supported by the Governor and Senators. Alaska has a great track record of financing mining projects from the famous Red Dog Mine to the Fort Knox Gold Mine. Now only a few weeks later after publishing those premium reports, Ucore soars on news that Alaskan elected officials are proposing the financing of up to $145 million for the Bokan Heavy Rare Earth Project. No other rare earth company I know of has been given the local support like Ucore has received from the State of Alaska. Shareholders and management are very thankful to the state as the value of this asset should continue to soar on this historic and unprecedented local geopolitical support. This is the first time that I have seen a state actually propose financial support to a rare earth mine. A heavy rare earth project like this could be bring huge economic opportunities and jobs to Southeast Alaska and restore U.S. independence. This may signify that Ucore has regained itself as the U.S. leader in heavy rare earth race. Look for a bullish golden crossover after this historic and high volume technical breakout. See my recent interview with Ceo of Ucore Jim Mckenzie below. Disclosure: Author is long Ucore and Company is a website sponsor. Sign up for my free newsletter by clicking here… Sign up for my premium service to see new interviews and reports by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… Please forward this article to a friend. To send feedback or to contact me click here… Listen to other interviews with movers and shakers in the mining industry below or by clicking here… Listen to internet radio with goldstocktrades on BlogTalkRadio

|

| The Ripple Effects of the QE Debt Binge Posted: 27 Feb 2014 12:15 PM PST "Financial crises are not predictable, though the buildup of fragility is observable." — Gary Gorton, economist and author of Misunderstanding Financial Crises: Why We Don't See Them Coming "We have been trying to push down interest rates, particularly longer-term interest rates. Those rates do matter to the valuation of all assets… stocks, houses and land prices. And so I think it is fair to say that our monetary policy has had an effect of boosting asset prices." And thus did Janet Yellen, newly installed head of the Federal Reserve Bank, speak with understated candor before the House of Representatives in her first Humphrey-Hawkins address. She only confirmed what she could not deny. A thoughtful investor has to wonder what will happen when the Fed no longer wants to push down rates anymore. For symmetry, it is hard to beat the idea that everything it goosed up will then come shimmying down. Markets are never so neat. And the specifics matter. What, exactly, has been propped up the most? And what might suffer the most upon a reversal? This morning's letter is an effort to disentangle the effects of QE's unwinding. Be wary of carry trade-driven asset prices… Quantitative easing, or QE, is the silly name the Fed gives its efforts in price fixing of interest rates. The Fed buys Treasury bonds and mortgage-backed securities. As it does so, its balance sheet swells. Many are the asset prices that have risen right along with it, too. A Merrill Lynch report points out some of the asset prices that have moved in step with the Fed's balance sheet. These include U.S biotech stocks as well as the Nasdaq (heavily weighted with many tech stocks). Take a look at this next chart, from Merrill. Remember, a correlation of 1 means the two things move identically. The lower the number, the less the two move together. Here, you see a 0.94 correlation between the Nasdaq and the Fed's balance sheet since easing began, versus only 0.35 before. You find a similar story with biotech stocks — a correlation of 0.92 since Fed easing. But QE's effects are not limited to U.S. stocks. It also has affected global asset prices. And so you find emerging-market gaming stocks and Internet stocks leap to the QE song. So do property prices in Hong Kong, Indonesia, South Africa, Malaysia, Sydney and London. QE has also set off something far more insidious… Low U.S. interest rates provide an incentive to borrow low-yielding U.S. dollars and buy higher-yield foreign currencies and assets. In the next chart, you can see the surge in U.S. dollar loans in emerging markets since QE. Since 2009, U.S. dollar debt issued by emerging markets summed to $724 billion, according to official balance of payments data. But this undercounts the real amount by 44%, says Merrill: "If an Indian firm borrows USD debt from a foreign bank branch in Mumbai, that is counted… but if it raises a USD bond in London, it is not." Correcting for that, the real number is over $1 trillion. This reveals deeper pricing vulnerabilities in the global financial system. It shows a potential credit bubble. We have seen this movie before. As Merrill notes: "Emerging-market banks and corporates have gone on an international leverage binge, yet another carry trade, the third in 20 years." The first one financed an East Asian boom that ended with the Asian Crisis in 1997. The second one was banks and investors supporting massive expansion in the so-called BRICs (Brazil, Russia, India and China). That ended in the financial crisis of 2008. In its essentials, the latest is just a twist on an old story of a credit-driven boom. It can be hard to tease out what is a real growth story and what is simply the result of easy money. Investors get caught up in the apparent prosperity, but forget its unreliable foundations. Credit conditions eventually do turn. And the credit bubble then unwinds. Now we have the Fed telling us it will look to raise rates by mid-2015. An easing cycle seems to be drawing to a close. Be wary of carry trade-driven asset prices is the message here. Not all emerging markets have levitated on an air cushion of QE-driven easy credit, but most have. The above may seem bleak, but I think it is an important to warn you of the fragility in the market. No one can predict the timing of the next financial crisis. And there are ways the party may go on for longer (say, if the Fed renews its QE efforts). Besides, not every asset price has gone up since QE. This morning, I was looking over a list of the cheapest stocks in the U.S. market based on tangible book value. It is a striking list. There are several shippers, gold stocks, coal miners and oddball troubled issues. No QE-driven boom here. These extreme values have extreme risks. But the point is that there are still things to do. In the meantime, thank the Fed for kicking off another asset bubble. Yellen said the Fed "tried to look carefully at whether or not broad classes of asset pricing suggest bubble-like activity." The Fed hasn't found any evidence of that yet, Yellen said. When it does, it will be too late to do anything about it. Regards, Chris Mayer Ed. Note: To make sure you’re well prepared before anything happens, sign up for the FREE Daily Reckoning email edition. In today’s issue, readers were treated to a unique chance to discover Chris’ newest investment opportunity. And it could be just what you need to insulate your wealth from the Fed’s next bubble. Sign up for FREE, right here, and never miss another great opportunity like this. |

| Grant Williams - This Will Send The Price Of Gold Skyrocketing Posted: 27 Feb 2014 09:44 AM PST  Today one of the most highly respected fund managers in Singapore spoke with King World News about exactly what is going to send the price of gold skyrocketing. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also spoke about what this will mean for investors around the world when this historic move unfolds in the gold market. Today one of the most highly respected fund managers in Singapore spoke with King World News about exactly what is going to send the price of gold skyrocketing. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also spoke about what this will mean for investors around the world when this historic move unfolds in the gold market.This posting includes an audio/video/photo media file: Download Now |

| Biggest gold ETF has first monthly inflow in over a year Posted: 27 Feb 2014 09:29 AM PST By Jan Harvey LONDON -- The world's largest gold-backed exchange-traded fund, New York's SPDR Gold Shares, is on track for its first monthly inflow of metal in more than a year after a run of weaker U.S. data boosted investment interest in gold. The SPDR fund, which issues securities backed by physical metal and attracted big inflows in the wake of the financial crisis, has added 10.5 tonnes to its reserves so far this month. That means that, barring a large outflow on Friday, February would be the first month to show an increase since December 2012. ... ... For the full story: http://www.reuters.com/article/2014/02/27/gold-etf-idUSL6N0LW30Q20140227 ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| World’s largest gold ETF eyes 1st monthly inflow in over a year Posted: 27 Feb 2014 08:28 AM PST The SPDR fund, which attracted big inflows in the wake of the financial crisis, has added 10.5 tonnes to its reserves so far this month. |

| Dubai gold bourse plans four currency contracts Posted: 27 Feb 2014 08:28 AM PST The four currency futures contracts will help investors hedge their financial risk in China, Russia, South Korea and South Africa. |

| Dubai refiner fixes shortfalls after audit on conflict gold Posted: 27 Feb 2014 08:28 AM PST An audit by EY found that Kaloti Jewellery didn't report $5.2 billion in 2012 and accepted gold plated in silver without proper paperwork, says Global Witness. |

| When all other options have failed, gold can be used as collateral Posted: 27 Feb 2014 08:28 AM PST Today, desperate nations are likely to use gold in a 'swap' for foreign currencies in such extreme times, says Julian Phillips. |

| Three warning signs from higher gold prices Posted: 27 Feb 2014 08:28 AM PST There are three possible warning signs that gold is currently sending us – a crash in China, the arrival of deflation and a fresh recession in the developed world. |

| Opportunities in mid-tier gold miners too good to pass up – Fowler Posted: 27 Feb 2014 08:28 AM PST Michael Fowler doesn’t typically focus on mid-tier gold companies but the opportunities are just too good to pass. A Gold Report interview. |

| MT. GOX BITCOIN EXCHANGE COLLAPSE - 740,000 MISSING BITCOINS Posted: 27 Feb 2014 07:39 AM PST MT. GOX BITCOIN EXCHANGE COLLAPSE - Mt. Gox Closes & 740,000 MISSING BITCOINS Bitcoin exchange Mt. Gox has received a subpoena from federal prosecutors in New York, the Wall Street Journal reported, citing a person familiar with the matter. Mt. Gox, once the world's biggest bitcoin... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Federal Reserve, Janet Yellen, QE and Gold Posted: 27 Feb 2014 07:31 AM PST The Federal Reserve The formulation of any investment strategy requires the investor to be well aware of the big picture which includes an understanding of the wider economic and political environment. One of the major elements to be considered is the various actions being implemented by our politicians and the central banks. One such central bank is The Federal Reserve who controls the money supply in the United States. The Federal Reserve was formed after its supporters paid for the presidential campaign of US President, Woodrow Wilson. President Wilson went on to sign the bill that transferred the control of US currency to twelve regional private banks. The very same President Wilson later regretted his decision saying the following: "I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the civilized world. No longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and duress of a small group of dominant men." So here we are decades later and the Fed has more power than ever before. They can turn the liquidity tap on and off as they see fit; as evidenced by Ben Bernanke's introduction of Quantitative Easing, which involved the buying of mortgage-backed securities, and Treasury notes. This form of stimulus has been increased to tune of 4 trillion dollars being added the Feds balance sheet over the last few years.

Chart the Federal Reserve Balance sheet 22 Feb 2014 As Ben Bernanke approached the end of his tenure he introduced 'tapering' which is a slow, but steady reduction in the amount of buying the Fed will do on a monthly basis. This decision is largely based on then perception that the US economy is improving, unemployment is falling and inflation is heading towards its 'Fed set' target area. Ben Bernanke has now departed and handed the Chair to Janet Yellen. Janet Yellen If we take a quick look at Janet Yellen's resume we can see that there isn't a mention of real job anywhere on it. This is a person whose career consists of school, university and more university, a pure academic who has spent a lifetime acquiring many academic accolades from within the academic institutions This lady has no experience whatsoever in working or running a real business as she has never ventured into the world of private enterprise. Her theories are just that; theories, backed by not one once of experience. I must admit that it scares the life out of me to think that we can place such an inexperienced person into such a powerful position where her actions, or lack of them, will affect every single one of us. Quantitative Easing (QE) The introduction of QE has provided the market with boat loads of liquidity in an attempt to ensure that there was enough money in the system to oil the wheels of industry, recapitalize the banks and provide financial stimulus to both Wall Street and Main Street. The effect of this stimulus has been to boost the stock markets to all-time highs. Unemployment is coming down, according to government figures, although others would dispute this. Inflation has moved higher, although without much conviction. At this point we ought to be aware that money knows no boundaries so some of these newly manufactured dollars have flowed out of the US and into foreign markets. The additional liquidity has provided easy money to their banking systems and their financial markets, for better and for worse. However, the Fed is now of the opinion that this infusion of cash has served its purpose and so a programme of reducing this stimulus is now in place and is commonly referred to as tapering. The Fed will continue to monitor inflation and the employment figures; should both be considered to be making satisfactory progress then tapering will continue. However the last two monthly reports on employment showed that the creation of new jobs had fallen short of expectations and should this become a trend then the Fed could well suspend tapering and if considered necessary they could reintroduce QE. The ramifications of such an action are too numerous to mention today, but as a gold and silver bug I will take a quick look at what could be in store for this tiny precious metals sector. Gold The introduction of money printing and especially the implementation of QE greatly inflated the money supply and to a large extent provided the oxygen that gold needed to rally to its all-time high of $1900/oz, or so. Gold peaked and then started to fall until QE3 was announced in 2012 which saw gold rally once more to around $1800/oz. Since then it would appear that 'The Law of Diminishing Returns' comes into play as gold drifted lower, all the way down to $1180/oz in June of 2013. At this point gold prices rallied to around $1400/oz before falling back to retest the June lows of $1180/oz in December 2013. Gold stayed above the June lows and rallied to where it stands today at $1329/oz. It is interesting to note that gold appears to have ignored the introduction of tapering and the planned reduction of its oxygen supply. This is knife edge stuff as gold may have disconnected itself from the actions of the Fed, QE and tapering and may well be behaving in accordance with traditional drivers such as supply and demand. It is a tad too early for us to say that this is in fact the case as tapering is in its embryotic phase and should it continue through 2014 then gold's ability to rally could be capped. At the moment we cannot over stress the importance of the Fed and its implementation of monetary policy. If we now take a quick look at the miners we can see that they have had a torrid time over the last few years. The Gold Bugs Index, the HUI, has fallen from a high of 625 in 2011 to today's level of 240 registering a very painful loss of 61%. If we look at 2013, the HUI fell from a January figure of 430 to 200 in December 2013 registering a loss of 53% as the chart below shows:

Chart courtesy of StockCharts Note that the technical indicators are a bit on the high side suggesting that a pullback might be on the cards. Now, if we had purchased a gold mining stock for $100.00 in January 2013 by the end of the year it would be worth just $47.00. The average rise in gold stocks in 2014 is 20%, so our acquisition would now be worth $56.40, hardly a cause to break out the champagne. We have witnessed a number of false dawns over the last few years and this could well be another one. For this rally in gold to be the real deal we would like to see gold form a higher high, which requires gold prices to trade above $1360/oz. We would also like to silver prices to move up in support of gold however, silver's rally has hit resistance at $22.00/oz, failing to form a higher high which requires silver to trade above $22.50/oz. In conclusion we need to see more in the way of all round strength in this sector before we can implement an aggressive acquisitions strategy and so we have the lion's share of our portfolio in cash. However, allocating a small amount of your investment funds to the acquisition of a few good quality gold and silver stocks in order to have a one foot in the precious metals camp might not be a bad idea, but go very gently as these are dangerous times for gold bugs. Got a comment, fire it in, especially if you disagree, the more opinions that we have, the more we share, the more enlightened we become and hopefully the more profitable our trades will be. www.gold-prices.biz | bob@gold-prices.biz |

| Posted: 27 Feb 2014 07:18 AM PST China's January Hong Kong gold imports soar 326% year on year Statistics are how you read them and China both imported 326% more gold from Hong Kong in January than it did a year earlier, or 9% less than in the previous month. Author: Lawrence Williams Posted: Wednesday , 26 Feb 2014 LONDON (Mineweb) - ... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Eric Sprott: We’re Looking For Ways To Survive "[The] Counterfeiting Of Money" Posted: 27 Feb 2014 07:16 AM PST Dear CIGAs, The following interview with Eric Sprott on gold manipulation, miners, and a host of other subjects was put together by CIGA Tekoa Da Silva of www.BullMarketThinking.com. The post Eric Sprott: We’re Looking For Ways To Survive "[The] Counterfeiting Of Money" appeared first on Jim Sinclair's Mineset. |

| Posted: 27 Feb 2014 06:17 AM PST BUY GOLD bids rose $10 per ounce from yesterday's sudden drop on Thursday in London, recovering $1332 as Western stock markets cut earlier losses. Russian Roubles meantime hit 5-year lows vs. the Dollar, and Ukraine's Hryvnia fell almost 10%, as Moscow put jet fighters at the border on high alert, and an armed group of protestors raised the Russian flag over the regional parliament building in Crimea. "Fears that Ukraine may suffer a sovereign debt default following months of political upheaval," the Wall Street Journal reckons, "have lent gold prices support in recent weeks." By lunchtime in London on Thursday, gold was heading for a 5.7% gain in February. Silver stood 11.0% higher despite slipping to 2-week lows near $21 per ounce overnight. "In our view," counters new research from investment bank Morgan Stanley, "[the] four broad themes explain[ing] recent strength" were the weakness in US economic data, strong Asian demand to buy gold, a better technical picture after the breakout above gold's 100-day moving average, and a change to managed-money positioning in gold futures contracts. "With gold holdings in [Western exchange-traded trusts] virtually unchanged this week," adds Bernard Dahdah, precious metals analyst at French bank and bullion dealer Natixis, "February could be the first month of net inflows since December 2012," with ETFs seeing investors buy gold exposure after shedding almost one-third of those positions in 2013. This demonstrates "a clear shift in investor sentiment," Natixis says. With a month to go until end-March, "We have increased our end Q1 target for gold to US$1280 from $1150," says Australia's ANZ Bank in a note. China's central bank was today seen draining funds from the money market as Shanghai's interbank lending rates retreated to 8-month lows. Heavy gold trading in Shanghai saw the most active contract end Thursday 30 cents below London prices to buy. Wednesday's 1.7% drop in gold prices "was doubtless profit-taking" reckons the commodity team at Germany's Commerzbank "following gold's sharp rise in the weeks before." The $20 move was "surprising to most" says David Govett at London brokerage Marex Spectron, because of the "increasing tension between Ukraine and Russia. "Gold has form for this as of late," Govett says of the apparent lack of safe-haven demand to buy gold, adding that the US Dollar is "the preferred haven when things start to heat up." The US Dollar today knocked the Euro down to 2-week lows beneath $1.3650 after new data showed Eurozone bank lending shrinking faster than forecast in the 12 months to January. |

| Gold, QE, The Federal Reserve and Janet Yellen Posted: 27 Feb 2014 03:31 AM PST The Federal Reserve The formulation of any investment strategy requires the investor to be well aware of the big picture which includes an understanding of the wider economic and political environment. One of the major elements to be considered is the various actions being implemented by our politicians and the central banks. One such central bank is The Federal Reserve who controls the money supply in the United States. |

| Gold Takes an "Unexpected" Turn - Video Posted: 27 Feb 2014 02:58 AM PST You should beware when investor sentiment becomes extreme Financial markets often turn just when the majority least expect it. Such was the case when gold hit its all-time high in September 2011, and, at its most recent low in December 2013. Now that the precious metal just hit a four-month high, EWI's Financial Forecast Service tells you what to expect next. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Chinese gold imports are becoming a case study in the power of journalists to control the slant of a story by deciding which facts to highlight. The following chart contains the relevant data.

Chinese gold imports are becoming a case study in the power of journalists to control the slant of a story by deciding which facts to highlight. The following chart contains the relevant data. Good evening Ladies and Gentlemen:

Good evening Ladies and Gentlemen:

The geo-political stakes in the Ukraine have brought us to a quasi Cold War redux, as western powers the European Union and the United States have made it clear their intention to “support” (read: meddle in) the Ukraine. In the meantime, Russia has sent troops to the border of the Ukraine in what are being called exercises.

The geo-political stakes in the Ukraine have brought us to a quasi Cold War redux, as western powers the European Union and the United States have made it clear their intention to “support” (read: meddle in) the Ukraine. In the meantime, Russia has sent troops to the border of the Ukraine in what are being called exercises.

Using proprietary statistical analysis to forecast the markets, the head of

Using proprietary statistical analysis to forecast the markets, the head of

No comments:

Post a Comment