saveyourassetsfirst3 |

- China’s HK gold trade hits new annual record, but where’s it all coming from?

- Gold Fields unit named in Australian land claim lawsuit

- How long can gold prices be held down? - Part 2

- Off The Beaten Path Stock Picks

- Gold technically positive – but needs $1,300 plus for real trend change

- Randgold mine adds new flotation section to improve gold recoveries

- Tocquevilles Hathaway cites ever-rising leverage in Comex gold

- Gold Has Found Its Bottom, Is $2000 Possible This Year?

- A Good Question

- Debunking Tapering Mythology

- Why gold stocks are leading gold

- India to reconsider gold import restrictions by March end

- Gold has longest rally in 16 months

- Jim Willie Reveals the SMOKING GUN On US Gold Rehypothecation!

- DOJ Arrests CEO of Bitcoin Exchange, Charges With Money Laundering

- Learn from German central bank and "demand physical gold"

- Jim Willie Reveals the SMOKING GUN On US Gold Rehypothecation!

- So, What Exactly Will You “Win?”

- Germany Demands Broke PIIGS Bail-in Rich Citizens!

- Gold & Silver COT Report: Small Specs Go Short

- Gold Rally stalls at $1280

- 2014 Will Not End Well Other Than Precious Metals

- 30 Day T-Bills Go Negative: Something Ominous is Coming

- Doc’s Deal: Any Qty Blowout on Silver Bars!

- Gold Fundamental Analysis January 28, 2014 Forecast

- Beneath the Surface

- Global Economic Meltdown Near?

- Gold's recent impressive gains may be short lived, may fall to $1155: Barclays

- Monex Precious Metals Review: Gold rises to $1262, Silver support $19.52

- TECHNICAL - Gold Broke Critical Resistance $1,262

- The Financial Times: Learn From German Central Bank and "Demand Physical Gold"

- India admits defeat in gold demand suppression scheme – says will review restrictions on gold imports by the end of March

- Gold price tags $1280 and its 100 day moving average before slipping back

- Is the US Dollar Preparing to Resume its Uptrend?

- Gold Takes Off, Climbs Above Trend

- Gold And Silver – Chart Reading More Accurately Depicts Fundamentals/Technicals

- Are Investors Missing The Bottoming Signs For Gold?

- Gold / Silver / Copper futures - weekly outlook: January 27 - 31

- Silver In Sideways Trend, Resistance 45500-600: Angel

- Gold Market Update

- Links 1/27/14

- David Morgan: 'The Silver Bottom Is In: Time to Hold, Add and Ride It Out'

- The Legend of Chief Namekagons Lost Silver Mine

- Global Dollar-Based Financial Fragility in the 2000s (Part I)

- Alasdair Macleod: Germany’s Gold is the Story de Jour

- Weekly Price Charts of Gold, Silver, Dollar, HUI, Commodities, and SPY

- Tough week ahead for global equities as Asian stocks tumble, VIX rockets and gold jumps

- Hotel Review: Waldorf Astoria brings top five-star luxury to Ras Al Khaimah at prices lower than in Dubai

- Australian law provides for gold confiscation -- and its not unique

- Germany’s gold is the story de jour

| China’s HK gold trade hits new annual record, but where’s it all coming from? Posted: 27 Jan 2014 05:23 PM PST Total Chinese gold imports via Hong Kong reached close on 1500 tonnes last year – 1139 tonnes net – a new record and probably comfortably in excess of India for perhaps the first time. | ||

| Gold Fields unit named in Australian land claim lawsuit Posted: 27 Jan 2014 03:13 PM PST The Ngadju people have launched a lawsuit against St Ives Gold Mining Company, claiming it is among the firms illegally digging on their land. | ||

| How long can gold prices be held down? - Part 2 Posted: 27 Jan 2014 02:16 PM PST The short answer – as long as demand in the traditional markets is either lower or the same as supply – says Julian Phillips. | ||

| Off The Beaten Path Stock Picks Posted: 27 Jan 2014 12:47 PM PST Part of why I enjoy researching stocks is to find hidden gems in the rough before they gain main stream coverage. While Commerzbank (OTCPK:CRZBY) and Rowan Companies (RDC) are very different companies, both are gaining positive momentum going into 2014. Commerzbank is starting to put some of their lingering issues behind them and Rowan has set itself up for strong growth over the next 2 years. Commerzbank Commerzbank is the second largest back in Germany with 1,200 branches, 15 million private clients and 1 million business and corporate clients. Much like the US financial collapse in 2008, Germany suffered a similar collapse and Commerzbank took a €18.2 billion bailout from the German government. As a result of this, the German government took a 25% stake in the company. Commerzbank has repaid the government by using a new share offerings to raise capital. This government bailout along with an ugly merger | ||

| Gold technically positive – but needs $1,300 plus for real trend change Posted: 27 Jan 2014 12:24 PM PST With no sales out of gold ETFs on Friday, and end week price strength, gold is showing positive technical trend but needs to break $1,300 before this can be truly confirmed. | ||

| Randgold mine adds new flotation section to improve gold recoveries Posted: 27 Jan 2014 12:07 PM PST Disappointing gold recoveries at Randgold's Tongon mine in Cote d'Ivoire are being addressed by the addition of a new flotation circuit to recover fine gold associated with arsenopyrite. | ||

| Tocquevilles Hathaway cites ever-rising leverage in Comex gold Posted: 27 Jan 2014 12:02 PM PST GATA | ||

| Gold Has Found Its Bottom, Is $2000 Possible This Year? Posted: 27 Jan 2014 11:56 AM PST Gold had a tough year in 2013. It was down 9.4% in the fourth quarter and 28% for the year. Market analysts like myself who thought the price of gold would be a lot higher than it is right now have been humbled. Despite the overall 2-year decline in the price of gold, the fundamental factors which ignited the bull market back in 2001 become even more powerful over he past 13 years. While there are several such factors, I want to focus on two which are commonly overlooked by most Wall Street gold analysts: the enormous demand for physical gold in Asia, specifically and especially China. In my view, this key fundamental market variable is not being factored into the price of gold by the market and could lead a big upside surprise in the price of gold this year. Much of the gold market analysis focuses generically on | ||

| Posted: 27 Jan 2014 11:45 AM PST I recently came across a very good question that pertains to the “inflation/deflation” question. The question is as follows …Could you shed some light on the Money Velocity vs the Money supply….. Who cares how much the fed print and gives to a big bank like Wells Fargo and they stash it in their vaults to make their balance sheets. You guys and all gold sellers always whine about "Printing Money"…. but who Cares! …if the man on Main Street is living from paycheck to paycheck….and in fact the Money Velocity M2 chart shows a net decrease since 1996 by about 30%? I think that’s why the gold and silver are worth less…who cares about the national debt if the red clicking numbers you print daily are going into a vault…might as well put it in a hole. I’m confused.” The first chart is of the monetary base and the second is of “M2 velocity.” As you can see, the Fed has been cramming money into the system yet the “velocity” (turnover if you will) has been steadily dropping. This situation has always struck fear in the hearts of monetarists because it is an illustration of “pushing on a string” which is really what the above question at its heart was all about. The Fed can print all they want but they can’t make people spend the money or the banks lend it or use it to kick start the economy or credit system. This is true…for now but I think that this is already beginning to change and can also be “forced” to change by the Fed itself, let me explain. First, the Fed can lower deposit rates to zero from the current .25% that they are paying the banks on deposits. This would force the banks to do “something” with their “parked” and idle free reserves. One would have thought that “movement” would have already begun but it has not, maybe because it is “easy money” for the banks or maybe they still remember 2008-2009 and still fear any and all counter party risk? The problem as I see it is that moving to absolute “zero” would be like flipping a light switch, it’s either on or it’s off as there is no “in between.” In this respect the Fed would basically be “all in” with both feet on the gas while throwing the brake pedal out the window. Using this last bullet would basically be an admission of total defeat and the currency itself would collapse in a hyperinflationary seizure as the banks are forced to “use” their tsunami of dollars. Secondly and something that we are already seeing is that “cash” is actually beginning to “move.” No way you say? “There is no money on the streets” and “just look at the velocity chart, there is no evidence of it turning up”…yes I agree but what are foreigners doing with their dollars? Judging by the last 6 months or so, they are spending their dollars on our real estate. That’s right, dollars are coming back home in exchange for real estate. It’s been reported that 40% of all U.S. sales were done with cash; in fact, last month saw 60% of all Florida closings done without any financing! Yes I am sure that much of this activity is simply “washing” some dirty money and making it “clean” but it shows the money being “spent” which is a murmur in velocity. I view this as an “early” act of “getting out” of dollars… I believe that foreigners are spending these dollars “while they still can.” For China’s part, they have done two quite distinctive things over the last few years. They have signed many trade deals that exclude the use of dollars while at the same time done deals where they are the “purchaser” of real assets and in nearly all cases the contracted “payment” is in dollars. Does this sound like a nation hoarding dollars or one that is trying to bleed down their balances? I mention all of the above because velocity which has been declining for over 15 years is a funny duck in that it can change course literally overnight. I don’t believe that it will take any huge event to change the current mindset, “spending, bailing, dumping” dollars by foreigners has already started. You see, the “inflation” (or the fuel for it) has already been created and packed into the system. The hyperinflation that I speak of so often will be a “lack of confidence” event where dollars get spent for anything and everything. This lack of confidence will also be seen on the other side where the acceptance of dollars becomes reluctant…which then will become self-reinforcing. Hyperinflation (which in reality is a panic out of a currency) can literally happen overnight with little or no warning just as stock market crashes occur. Think back to late August 1987, the conditions were ripe for a crash but anyone who called for one was laughed at. Less than 2 months later the market had been cut in half. Now, the conditions are ripe for a dollar panic that cannot nor will be stopped once it begins. We don’t even need any more QE or additional money supply, it has already been created. The only thing lacking for the greatest hyperinflation in all of history to begin is a break in confidence. Put simply, “velocity” (the ‘selling’ of dollars) will turn up once confidence finally breaks. Once turned, velocity will go straight up and the Fed will have no chance at “draining reserves” as the market size of dollars dwarfs their ability to sop up the liquidity. Once confidence breaks…it won’t nor can be restored and the sale of dollars won’t stop until a new substitute currency is introduced. Your job is to get from here…to there…with your wealth still intact.Similar Posts: | ||

| Posted: 27 Jan 2014 11:25 AM PST One could only hope that after nine, nauseating months of lies and half-truths from the U.S. Federal Reserve and mainstream media on so-called "tapering" that we would be spared any more of this nonsense in 2014. Sadly, since the mainstream propaganda machine found this a very fruitful form of lying in 2013, and since it is rapidly running out of any other semi-plausible fiction to use in holding together our smoke-and-mirrors economies; it appears that "tapering" is here to stay – i.e. talk about "tapering". …The improving economy led the Federal Reserve to begin tapering its bond purchases this year. Monthly purchases of government bonds and mortgage-backed securities will be reduced from $85 billion to $75 billion this month, and it is likely that the quantitative easing program will come to a close by the end of 2104. [sic] The delightful "Freudian slip" above by the Conference Board of Canada is the nexus of all this propaganda, and so it is the first point which must be stressed in debunking the lies. There is no "tapering" taking place in the United States, in fact most likely the money-printing has increased. A previously familiar chart (below) demonstrates this.

Where is the supposed "tapering" which took place last year? It's not here, meaning that no reduction in the money-printing ever took place. But regular readers undoubtedly have another question. Why does this chart of the U.S. adjusted monetary base now appear stretched-out, rather than the simple, vertical line that they are used to seeing? Because a chart which used to be scaled in decades is now scaled in years. Throughout the entire (modern) history of the U.S. dollar; changes in the monetary base have been so slow/gradual that the chart which measured the monetary base could be scaled in decades. Today, with the Federal Reserve's virtual "printing press" running white-hot, 24/7; the only way we can still see incremental changes (i.e. anything other than a sheer, vertical line) is by stretching-out the scale of the chart dramatically. The simple fact that this chart has been re-scaled tells us there will be no tapering. No reputable institution would change the scale of a key statistic temporarily, for just a few months. If the Federal Reserve had any serious plans to "taper"; it would have never changed the scale of its own chart measuring the (official) money-printing. Naturally, this necessitates flashing-back to December. After nine months of empty talk, we finally saw some sham-action from the Federal Reserve: an announcement of "tapering" – which could only actually be seen when viewed under a microscope. Why, after month after month of extreme hype from the mainstream media and B.S. Bernanke himself, did we see the Federal Reserve engaging in the tiniest cut it could (supposedly) make? Because the crippled U.S. economy is now so frail that even pretending to have "tapered" the money-printing by any significant amount would have detonated all of its various market bubbles. Indeed, as we observed in 2013; the first six months of talk (alone) caused the interest rate on 10-year Treasuries to practically double. Cumulatively, this had the effect of sucking more than $50 billion per month out of the debt-saturated U.S. economy, in the form of increased interest payments. It was causing such severe economic pain that in September, Bernanke finally confessed there would be no tapering, as the U.S. economy was now a Ponzi-scheme which could no longer afford to pay "market rates" of interest on its debts. So how do we resolve the (supposed) paradox of being told that U.S. money-printing has since been trimmed – by the tiniest of amounts – while the chart which measures this money-printing continues uninterrupted in its near-vertical line? Because there are two pipes carrying the money-printing of the Federal Reserve (to the vaults of Wall Street), and the Cheap Magician running the Federal Reserve never tells us about what is in the other pipe. Prior to the era of "QE" funny-money; all of our new "money" was simply borrowed into existence. This meant that our currencies were units of obligation. This is not as good as having gold-backed, real money – i.e. units of value – but it's better than simply "units". This is what has been accomplished through "QE", but (of course) never explained to the people. All new U.S. dollars (and all of this quantitative-easing funny-money across the Western world) are now neither units of "value" nor "obligation", simply units. As such, there is now no possible basis to impute any value whatsoever in the U.S. dollar, and it is one of three reasons why the dollar is now already completely worthless. But all of this discussion still only revolves around one pipe, the "QE pipe". This is the pipe carrying the units which the Cheap Magician openly/officially discusses and at which he (and now she) points. However there is also a second, (larger?) secret, unofficial pipe leading from the Federal Reserve to the vaults of Wall Street. This is the pipe which carries the endless gravy-train of so-called "0% loans" from the Fed to the tentacles of the One Bank. Of course, with no interest ever attached to it; these 0% loans create no obligation. Thus these new "0% loan" dollars are not units of obligation, but are also mere units -- totally indistinguishable from the "QE" funny-money. Indeed, the "0% loan" is simply a different euphemism for the same thing: utterly worthless currency, from which no possible value could be imputed. No one knows how many trillions of units flow through the second, secret, unofficial pipe leading from the Federal Reserve. Thus it now becomes apparent how the Fed can pretend to "taper" (with one hand) while it actually continues – or even increases – the actual rate of unit-printing (with the other). This is one of the many reasons why the Federal Reserve obsessively refuses the "public audit" which would be necessary if it were to ever become a legitimate institution: to partially conceal the insane extent of its unit-printing. All of the lies about "tapering" are nothing but the act of a Cheap Magician. He (she) gestures openly with one hand to distract the Chumps in the audience, while the second, hidden hand performs "the magic". It is an act which could not possibly deceive an audience of astute 10 year-olds. Yet it is apparently 'clever' enough to fool all of the drones in the mainstream media – and all of the slack-jawed Sheep who continue to lap-up this tripe. One cannot discuss tapering-mythology, however, without briefly relating these lies to the precious metals markets. We're told that "tapering is bad" for gold and silver (even though no tapering is actually taking place) meaning that talk of "tapering" is – supposedly – bad for gold and silver. But not even this fragment of the lying has any rationality to it. As usual; we are provided with nothing but an argument-fragment by the mainstream media, because if we were given the entire (totally flawed) argument it could not even fool the Sheep. There are a litany of hidden assumptions excluded from the lie that "tapering is bad" for precious metals. At the top of this list we have the simplest of premises. "Tapering" could only be bearish for gold/silver if a significant amount of this funny-money was (previously) being invested in precious metals. However, as we all know, this is totally false – and thus the propaganda machine doesn't even attempt to provide any evidence for its argument. None of this "QE" funny-money was ever being invested in gold/silver. In fact; significant amounts of this paper was/is used to short precious metals. This is one of the reasons why "tapering" – if it actually existed – would be clearly bullish for gold and silver. But there is a second (and much bigger) reason why any actual reduction in the unit-printing would be ultra-bullish for gold and silver. It is our Ponzi-scheme economies, themselves. As previously noted; even too much talk about "tapering" is enough to seriously destabilize the U.S. economy. Any actual, significant reduction in the unit-printing must cause a complete implosion of the U.S. economy (and likely all Western dominoes). The chart above is mathematically conclusive proof of this. All economic exponential functions have only two theoretically possible outcomes. Either they simply explode (soon) when the exponential function runs its course, or they implode – the moment the fuel for the exponential function is withdrawn. It is mathematically impossible to ever have a "soft landing" from any exponential curve, as this is the mathematical representation of "out of control". Let me summarize. No "tapering" of any kind has taken place with respect to U.S. unit-printing, and none will ever take place, unless the goal is to deliberately detonate these Ponzi-schemes. Thus if any (real) "tapering" occurred it would be ultra-bullish for gold and silver. However, if no "tapering" takes place; our economies will still explode (and soon) – which is also ultra-bullish for gold and silver. All roads lead to higher gold and silver prices. [Readers are encouraged to join me for The Daily Grind – my daily dialogue on precious metals markets, and the events which drive those markets] | ||

| Why gold stocks are leading gold Posted: 27 Jan 2014 11:21 AM PST At the start of the year we asserted that the mining equities could lead the metals higher. Since then, the shares have roared higher while the metals have remained subdued. Gold has gained a bit but silver has really struggled. Why are the stocks performing so well if the metals... | ||

| India to reconsider gold import restrictions by March end Posted: 27 Jan 2014 11:15 AM PST The Indian finance ministry announced yesterday that they will be reconsidering the import restrictions imposed on gold by March end. The Finance Minister of India, Mr. P. Chidambaram on Monday informed that the Govt. will be taking actions regarding the current gold import restrictions soon. | ||

| Gold has longest rally in 16 months Posted: 27 Jan 2014 11:07 AM PST The gold price came within reaching distance of $1,280 this morning before falling back 0.2%. The $1,279.61 price level is the highest the yellow metal has reached in two months and comes after the longest rally in nearly a year-and-a-half. The gold price is likely to see some swings during... | ||

| Jim Willie Reveals the SMOKING GUN On US Gold Rehypothecation! Posted: 27 Jan 2014 11:00 AM PST

The Doc sat down with the Golden Jackass himself this weekend for an in-depth interview covering the state of the gold market and the Western banking system. Willie discusses the German efforts to repatriate their gold reserves (along with the implications of only receiving 5 tons from the NY Fed in year 1), as well [...] The post Jim Willie Reveals the SMOKING GUN On US Gold Rehypothecation! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now | ||

| DOJ Arrests CEO of Bitcoin Exchange, Charges With Money Laundering Posted: 27 Jan 2014 10:57 AM PST

The DOJ has just announced a full fledged war on the alternative to the Federal Reserve fiat notes known as Bitcoin with the arrest of 24 year old founder and CEO of BitInstant, Charlie Shrem on money laundering charges. Charlie’s crime? Not being Jamie Dimon. Providing $1 million in Bitcoin exchange services to Silk Road [...] The post DOJ Arrests CEO of Bitcoin Exchange, Charges With Money Laundering appeared first on Silver Doctors. | ||

| Learn from German central bank and "demand physical gold" Posted: 27 Jan 2014 10:37 AM PST "There's surely no chance that the Fed's little delivery difficulty has anything to do with the cat's-cradle of pledges based on the gold in its vaults? As has been remarked here before, forecasting the price is for mugs and bugs. | ||

| Jim Willie Reveals the SMOKING GUN On US Gold Rehypothecation! Posted: 27 Jan 2014 09:28 AM PST Podcast: Play in new window | Download

Click here for the transcript of Jim Willie's full MUST LISTEN interview with The Doc: This posting includes an audio/video/photo media file: Download Now | ||

| So, What Exactly Will You “Win?” Posted: 27 Jan 2014 08:45 AM PST As you know, the stock markets took a big hit this past week and emerging markets and currencies were blowing up left and right. I was reading a Zerohedge article regarding subprime home loans (and autos) where Jeff Gundlach is making a repeat call of Kyle Bass’s 2007 housing bubble/subprime implosion call. The article mentioned that 8 million homes are still stuck in the “shadow inventory” and how some homeowners have not even made one payment in 4 years. As I read down into the comments section there were questions and comments regarding this and the dropping equity markets…the question arose, “Will Kyle Bass go short again?” and “Will Jeff Gundlach put his money where his mouth is?” I got to thinking about this and thought to myself “why.” Why would anyone who truly understands what is happening go “short” now? Yes of course, because many of these markets are going to implode and the “shorts” will “win.” But what exactly will they win? What if the markets do actually enter an “unscheduled holiday” because downside momentum picks up and it gets to a point where there are only offers and no bids…and they CAN’T open the markets? Will these shorts be jumping up and down singing “kumbayah we won” and partying like its 1999? I have just a few questions that might enter a few minds. Questions like how will you be settled? If the other side of your trade is broke…who pays you? Most importantly, “what” do you win? Let me put this in perspective for you. Let’s go back in time to 1918 to 1923 Weimar Germany and assume that an astute trader shorted the stock of a bank, German bonds or even the currency itself (if that was even possible back then). Whoever put this trade on was a “winner,” a BIG winner! In some cases the asset actually went to zero and the short never needed to be covered because “zero is zero,” they “won” their bet 100%. But what did they win? They won Reichmarks, lots and lots of Reichmarks! But… there was a small problem with this “BIG win.” When all was said and done, it took something like 2.3 trillion Reichmarks to purchase just one ounce of gold so what were “lots and lots of Reichmarks worth?" Do you see the problem here? Bass, Gundlach, Soros or any of the other great speculators may indeed “short the world” and win but they will be “paid” in dollars or other fiat. If (when) we do hyper inflate which mathematically looks to be assured then what is their “winnings” worth? Even if they do get paid by a counterparty that survives and has the ability to settle, what happens to these winnings when the dollar (or other fiat) is either grossly devalued or even replaced? In the case of Weimar Germany, how well off was the speculator who shorted 1 trillion (an enormous and unthinkable number in 1920) of German bonds and won 100% of the bet? Less than 1/2 ounce of gold…that’s how “well off!” If I’m not mistaken, 1 Reichmark equaled .50 cents in 1918 and an ounce of gold was $20 so it took 40 Reichmarks to purchase 1 ounce of gold before the hyperinflation began. Am I saying that gold is going into the trillions of dollars? No of course not but I do want to caution you that it certainly could happen. Given the current federal debt and future entitlement obligations, couple this with the possibility (odds better than 50%?) that we no longer have a gold hoard in Ft. Knox, an overleveraged economy and financial system that has been driven, steered and buoyed for years by a derivatives market that is over $1 quadrillion …and top it off by a central bank with the ability to print dollars in unlimited quantities means that it is possible for the dollar to actually go to zero. Overly dramatic? Yes most probably but I wanted to illustrate the point that the conditions exist for the dollar to do what every single “pure” fiat currency has done throughout history…on a very grand scale…devalue at a minimum (until changed or altered) and actually die in the end game. If you look at Zimbabwe, Venezuela or Argentina (the hyperinflation poster children) you will see that their stock markets have gone up dramatically, exponentially. Is this because business is so good? No, they are all in a depression where many goods even as simple as toilet paper are unavailable. Their stock markets have gone “up” only in terms of their local currencies…but down versus “REAL THINGS!” This is the crux of what you need to understand, it doesn’t matter if you “win” Zimbabwe dollars, Venezuelan bolivars, Argentine pesos or even U.S. dollars because they will/are devaluing to zero purchasing power. I guess the best way to put this is “it doesn’t matter how much you win…it only matters ‘what’ you win!”Similar Posts: | ||

| Germany Demands Broke PIIGS Bail-in Rich Citizens! Posted: 27 Jan 2014 08:35 AM PST

The Bundesbank has dropped a DIESELBOOM on the European markets Monday morning, calling on Eurozone nations about to go bankrupt (ie Greece, Italy, Portugal, & Spain) to initiate a one-off capital levy bail-in on their wealthiest citizens prior to asking other nations (read Germany) for bail-out help. Yes, you read that correctly, the most powerful [...] The post Germany Demands Broke PIIGS Bail-in Rich Citizens! appeared first on Silver Doctors. | ||

| Gold & Silver COT Report: Small Specs Go Short Posted: 27 Jan 2014 08:00 AM PST

The small speculators are now net short in gold. They sold off over 500 longs and added 1,152 shorts which is considerable for their small numbers. It seems to me they may be of the opinion the bullion banks are getting ready to take down gold. RCM Kilo Gold Bars Only $19.99/oz Over Spot [...] The post Gold & Silver COT Report: Small Specs Go Short appeared first on Silver Doctors. | ||

| Posted: 27 Jan 2014 07:32 AM PST Strong buying overnight in the early part of the Asian trading session took gold into a region of formidable chart resistance near the $1,280 level. At that point sellers entered sensing that the bulls were booking profits and prices needed a breather. With the nervousness surrounding last week's emerging markets currency/credit crisis subsiding somewhat, gold ran out of reasons to keep moving vertical. If you notice, the Japanese Yen and Swiss Franc, the beneficiaries of last week's rush to safety plays, are weaker today. Also, the S&P 500 is trading higher while the US Dollar has managed to obtain a firm bid. With the VIX moving lower as well, it appears that for the moment, the market is less concerned about the emerging market issues that plagued it last week. How long this lasts is anyone's guess but for the immediate moment, gold is being sold and stocks are being bought once again. If anything, last week's price action in response to the emerging markets reinforces in my mind the notion that gold MUST HAVE SOME SORT OF CONFIDENCE SHATTERING event(s) to push it into a sustained uptrend. The recent move up has consisted of a great deal of short covering and while there has indeed been some fresh buying, that has been largely outnumbered by speculative short covering. As I have written many times here at this site, short covering rallies can be quite ferocious and oftentimes spectacular, but by their very nature, they tend to fizzle out as quickly as they start. Markets require the application of THRUST/FORCE to escape the downward pull of gravity and that necessitates SUSTAINED money flows ( new buying ). If that new buying is lacking, gravity will win out and price will back down. When it comes to gold that means any sort of credit/currency crisis must be one which escalates in the minds of traders/investors. Such escalation fans more fear and nervousness and that will drive money into gold. Given the current state of low inflationary expectations, it will take this sort of strong emotion to keep those flows active. At the first sign of stability or easing of tensions, gold will tend to surrender its gains with the more recent pattern of buying stocks/selling commodities coming to the ascendancy once again. What this translates to when it comes to technical price action is selling at resistance zones. Gold thus far has managed to plow through several layers of overhead chart resistance and in the process turned the daily chart positive ( the weekly remains decidedly bearish however). With traders looking for reasons to sell rallies, these resistance zones on the daily chart will take on more importance. Any hesitation by the bulls to extend the rally at these zones will bring in selling as very short term bulls bail out with any paper profits that they might have while longer term oriented bears look to re-enter on the short side. It is always interesting to watch the battle lines being formed on the charts. Right now dips are being bought in gold based on the improving daily chart picture while rallies tend to stall - at least temporarily - at these resistance zones. Translating to numbers - resistance is the zone near $1280 with support being provided by the zone near $1260-$1258. I am watching to see what gold does if equities start moving lower once again and particularly if the Dollar cannot hold any gains. I will provide an update later in the session as the direction towards the pit close becomes evident. | ||

| 2014 Will Not End Well Other Than Precious Metals Posted: 27 Jan 2014 07:15 AM PST JPMorgan has amassed between 100 – 200 million ounces or more of physical silver. Most of it is stored in London. My friend Trader David R would agree. He says he has seen the silver there himself. According to Butler, their plan is to force silver's paper price (Comex) lower and then buy the physical metal as cheaply as possible. They use the same technique on gold. It only takes around $2 billion annually to absorb the available 100 million oz. of silver not used by industry and jewelry fabrication. But it takes over 50 times as many dollars to absorb the 80 million oz. of newly mined gold that is left over for investment purposes. According to Butler, even if it isn't JPMorgan that is the big buyer of physical silver (and he is sure that they are), silver has moved from weak hand to strong hands. Butler wrote…

JPMorgan's short position in Comex is around 80 million oz. If they actually do own 200 million oz., as Butler states, then the CFTC would not have reason to take action on their manipulation. JPMorgan acquires a majority of the (physical) silver that becomes available from mining, recycling and sales from existing holders, including SLV. On the Comex, it's the commercials (especially JPMorgan) vs. the speculators (the hedge funds). Butler believes that JPMorgan is responsible for the large High Frequency Trading smashes of silver. Butler's views are clear – he says, "There is no escaping that silver is manipulated in price by JPMorgan and will be until it isn't any longer." Unlike many in our industry, Butler does not buy into the conspiracy involving the U.S. Government. He says they do it to make profit. The fact that they are very long physical gold and silver is bullish. The commercials are almost always on the right side of the trade with the speculators. Butler says:

It should be clear by now that I have a great deal of respect for Ted Butler and highly recommend his excellent newsletter. But I have always been willing to examine different views and I have a great deal of respect for Trader David R, whose credentials and background are beyond excellent. He has worked for the bullion banks, represented Barkleys Bank setting the gold price in London and is actively trading the precious metals for his own account now. When I bring up JPMorgan as the entity that is causing all of the HFT rapid drops in gold and silver he disagrees. He says it's the hedge funds and their computers working out of Chicago. He told me:

Whether you agree with Butler or Trader David R, the bottom line is both are very bullish on gold and silver. By the end of the month, the Fed will decide whether or not to cut back on QE. If they do, it will be only $10 billion and they will try and tell you that inflation is under control, unemployment is not an issue and the economy is turning around. Hogwash! Read Shadowstats.com and see how the facts are twisted. 2014 will not end well (other than precious metals). You now have all these algo's in Chicago who are trading gold against other commodities or indexes. It's all relative value trades. (For example, long gold short the stock market or vice versa).Similar Posts: | ||

| 30 Day T-Bills Go Negative: Something Ominous is Coming Posted: 27 Jan 2014 07:00 AM PST

Earlier this week 30-day/4-wk T-Bills were auctioned off a 0% rate. Intra-day, after the auction, the rate went negative. Negative short term rates were last observed in 2008, before the Lehman/AIG/Goldman collapse occurred. Of course, Lehman was allowed to implode and Goldman, who’s ex-CEO was the Treasury Secretary, was bailed out. AIG was the beneficiary [...] The post 30 Day T-Bills Go Negative: Something Ominous is Coming appeared first on Silver Doctors. | ||

| Doc’s Deal: Any Qty Blowout on Silver Bars! Posted: 27 Jan 2014 06:35 AM PST

Doc’s Deal of the Day: 100 oz Silver Bar Blowout! 100 oz OPM Bars $0.69 Over Spot, ANY QTY! 100 oz JM Bars $0.79 Over Spot, ANY QTY! 100 oz RCM Bars $0.89 Over Spot, ANY QTY! Click or call 800-294-8732 The post Doc’s Deal: Any Qty Blowout on Silver Bars! appeared first on Silver Doctors. | ||

| Gold Fundamental Analysis January 28, 2014 Forecast Posted: 27 Jan 2014 06:15 AM PST fxempire | ||

| Posted: 27 Jan 2014 06:08 AM PST An accusation of missing gold, a mysterious suicide, vacuous politicians, and a government pretending to be open and honest about the whole thing... this story has it all! | ||

| Global Economic Meltdown Near? Posted: 27 Jan 2014 05:44 AM PST The post Global Economic Meltdown Near? appeared first on Monty Pelerin's World. There is little to add or needed for this new list provided by Michael Snyder. As usual, he has provided a scary view of what likely awaits us: 20 Warning Signs That a Global Economic Meltdown is Near Guest post by Michael Snyder Have you been paying attention to what has been happening in Argentina, Venezuela, […] The post Global Economic Meltdown Near? appeared first on Monty Pelerin's World. | ||

| Gold's recent impressive gains may be short lived, may fall to $1155: Barclays Posted: 27 Jan 2014 05:34 AM PST Next week, market focus will shift to the FOMC meeting where our economists expect additional tapering of $10bn to be announced. While a lack of change has scope to buoy prices further, the downside is likely to become more vulnerable after the Lunar New Year (31 January) where a new buyer to pass the baton to is still missing, Barclays Research said. | ||

| Monex Precious Metals Review: Gold rises to $1262, Silver support $19.52 Posted: 27 Jan 2014 05:18 AM PST Monex spot gold prices opened the week at $1,257 . . . traded as high as $1,262 on Friday and as low as $1,243 on Tuesday and Wednesday . . . and the Monex AM settlement price on Friday was $1,266, up $9 for the week. Gold support is now anticipated at $1,249, then $1,232, and then $1,216 . . . with resistance anticipated at $1,267, then $1,286, and then $1,342. | ||

| TECHNICAL - Gold Broke Critical Resistance $1,262 Posted: 27 Jan 2014 04:35 AM PST investing | ||

| The Financial Times: Learn From German Central Bank and "Demand Physical Gold" Posted: 27 Jan 2014 04:02 AM PST gold.ie | ||

| Posted: 27 Jan 2014 02:31 AM PST | ||

| Gold price tags $1280 and its 100 day moving average before slipping back Posted: 27 Jan 2014 01:49 AM PST | ||

| Is the US Dollar Preparing to Resume its Uptrend? Posted: 27 Jan 2014 01:15 AM PST dailyfx | ||

| Gold Takes Off, Climbs Above Trend Posted: 27 Jan 2014 01:05 AM PST investing | ||

| Gold And Silver – Chart Reading More Accurately Depicts Fundamentals/Technicals Posted: 27 Jan 2014 12:35 AM PST goldseek | ||

| Are Investors Missing The Bottoming Signs For Gold? Posted: 27 Jan 2014 12:35 AM PST investing | ||

| Gold / Silver / Copper futures - weekly outlook: January 27 - 31 Posted: 27 Jan 2014 12:35 AM PST investing | ||

| Silver In Sideways Trend, Resistance 45500-600: Angel Posted: 27 Jan 2014 12:35 AM PST investing | ||

| Posted: 27 Jan 2014 12:35 AM PST goldseek | ||

| Posted: 27 Jan 2014 12:11 AM PST Happy belated Australia Day! Lambert was running the site yesterday, so apologies for not acknowledging the holiday on a timely basis. Dog cancer ‘dates back 11,000 years’ BBC Genetic Engineering Companies Promised Decreased Pesticides … But GE Crops Have Led to a 25% INCREASE In Herbicide Use George Washington Researchers teach old chemical new tricks to make cleaner fuels, fertilizers PhysOrg (Chuck L) Stephen Hawking Thinks Black Holes Don't Exist Smithsonian (furzy mouse) Bletchley Park s bitter dispute over its future BBC Himmler letters and diaries found Guardian Cash pours into Aussie joke virtual currency MacroBusiness Beijing Cracks Down on Pollution, Banning New Refining, Steel, and Coal Plants OilPrice All the less reason Prachatai English (furzy mouse) Ukraine state of emergency warning BBC Afghanistan Exit Is Seen as Peril to Drone Mission New York Times Emerging Markets Meltdown

Big Brother is Watching You Watch 12 privacy-destroying technologies that should scare you Info World (Chuck L) Adviser: Snowden requires amnesty Guardian. This was predictable. Snowden asks ‘how reasonable’ it is to assume only Merkel was tapped DW Debt Collection Industry Poised for Changes Credit Slips. Note that the CFPB has posts a ANPR, which is “advanced notice of proposed rulemaking”. That lets interested parties, including the great unwashed public, chime in. This will also serve to show whether the agency has any guts (and with so many of the incumbents small fry and so much bad press on this topic, they should be able to take significant ground. But I’m not holding my breath). Obamacare Launch

Obama's Plan to Use Executive Action Triggers Republican Criticism Bloomberg States Weigh New Plans for Revenue Windfalls Wall Street Journal Fox News' unique approach to polling MSNBC (furzy mouse) Ezra Klein Is Joining Vox Media as Web Journalism Asserts Itself New York Times Top MBAs' pay doubles in five years Financial Times The Terror of Our Age Greg Grandin, TomDispatch Antidote du jour. Furzy mouse tells us: “Humphrey was a house pet that became too large and was moved to the Rhino and Lion Nature Reserve in South Africa , where he was safe but lonely. Cameroon Pygmy Mountain Goat climbed Humphrey’s enclosure fence and befriended him.” And a bonus (Swedish Lex): | ||

| David Morgan: 'The Silver Bottom Is In: Time to Hold, Add and Ride It Out' Posted: 27 Jan 2014 12:00 AM PST | ||

| The Legend of Chief Namekagons Lost Silver Mine Posted: 26 Jan 2014 10:30 PM PST Atthecreation | ||

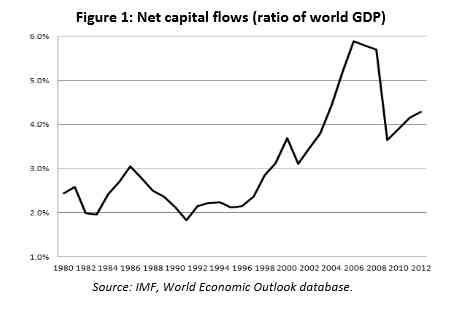

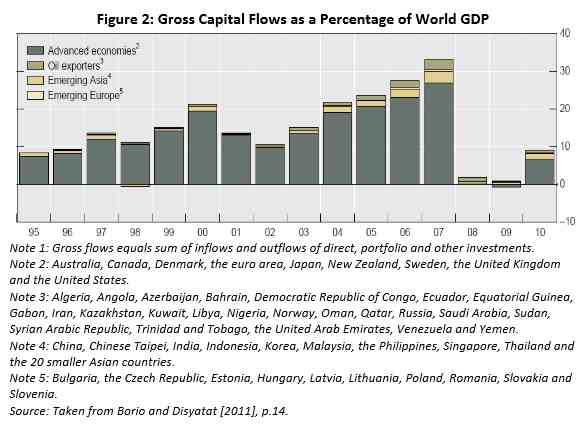

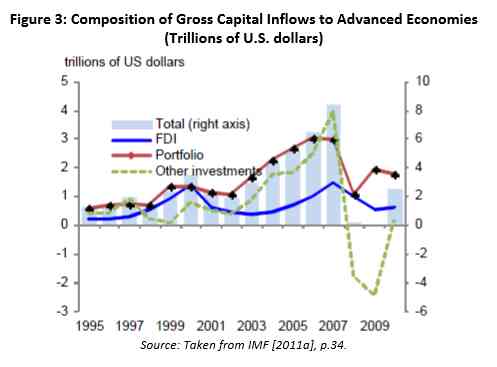

| Global Dollar-Based Financial Fragility in the 2000s (Part I) Posted: 26 Jan 2014 09:15 PM PST Yves here. It’s been frustrating to see orthodox economists continue to invoke the Bernanke “saving glut hypothesis” as a significant driver of the crisis. That view was rebutted in gory detail in a 2010 paper by Claudio Borio and Piti Disyatat of the BIS, “Global imbalances and the financial crisis: Link or no link?” (see Andrew Dittmer’s summary here). Not surprisingly, the orthodoxy has chosen to ignore this paper (which also includes an important discussion about another bit of wrong-headed thinking, the failure to distinguish between the “natural” rate of interest and market rates of interest). The “savings glut” is still routinely mentioned in op-eds and papers by Serious Economists. A new working paper by Junji Tokunaga and Gerald Epstein, "The Endogenous Finance of Global Dollar-Based Financial Fragility in the 2000s: A Minskian Approach," builds on the perspective of the Borio/Disyatat paper and they are recapping it in a four-part series. Readers should find this to be a straightforward, persuasive discussion of an important topic. By Junji Tokunaga, Associate Professor in the Department of Economics and Management, Wako University, Tokyo and Gerald Epstein, Professor in the Department of Economics, University of Massachusetts-Amherst, and Co-Director of the Political Economy Research Institute (PERI) Global financing patterns have been at the center of debates on the global financial crisis in recent years. The global imbalance view, a prominent hypothesis, attributes the financial crisis to excess saving over investment in emerging market countries which have run current account surplus since the end of the 1990s. The excess saving flowed into advanced countries running current account deficits, particularly the U.S., thus depressing long-term interest rates and fueling a credit boom there in the 2000s. According to this view, the financial crisis was triggered by an external and exogenous shock that resulted from excess saving in emerging market countries, not the shadow banking system in advanced countries which was the epicenter of the financial crisis. Instead, we argue that a key cause of the global financial crisis was the dynamic expansion of balance sheets at large complex financial institutions (LCFIs) (Borio and Disyatat [2011] and Shin [2012]), driven by the endogenously elastic finance of global dollar funding in the global shadow banking system. The endogenously elastic finance of the global dollar contributed to the buildup of global financial fragility that led to the global financial crisis. Importantly, the supreme position of U.S. dollar as debt-financing currency, underpinned by the dominant role of the dollar in the development of new financial innovations and instruments, and was a driving force in this endogenously dynamic and ultimately destructive process. Part 1: Global financing patterns in the 2000s The Growth of Global Imbalances In the wake of the global financial crisis, many economists and policymakers have drawn attention to the role of global capital flows as a key factor contributing to the global financial crisis. A prominent view is the global imbalances hypothesis, which focuses on the growing imbalance in world current account position. Since the end of the 1990s, emerging market countries, predominantly in emerging Asian and oil-exporting countries, had run account surpluses, while some advanced countries, such as the U.S., had expanded current account deficits. A growing imbalance in world current account positions emerged in which emerging market countries were consistent providers of net capital flows, and the U.S. was a primary net consistent recipient. Figure 1 demonstrates the absolute value of net capital flows, which mirrors the imbalances in world current accounts, as a percentage of world GDP since the 1980s. A sustained increase in net flows started in the second half of the 1990s, particularly the 2000s, and peaked to around 6.0 percent in 2006 before the start of the financial crisis. The global imbalances view attributes the global financial crisis to a substantial excess of savings over investment in emerging market countries that mirrors their current account surplus.[2] According to this view, these "excess saving" flowed into advanced countries that ran current account deficits, particularly the U.S., thus depressing long-term interest rates and fuelling the credit boom there. Accordingly, this global imbalances view conjectures that the main macroeconomic cause of the global financial crisis is an external and exogenous shock that resulted from excess savings in emerging market countries, not the shadow banking system in advanced countries that was the epicenter of the financial crisis. The Expansion of Gross Capital Flows Recently, some mainstream economists and policymakers suggest that net capital flows, which mirrors the global imbalance, are much less important than gross capital flows (inflows and outflows) for understanding global financial instability in the 2000s, as emphasized by Borio and Disyatat [2011], Dorrucci and McKay [2011], Obstd [2012] and Shin [2012]. Figure 2 plots gross capital flows as a percentage of world GDP since the last half of the 1990s. Gross capital flows, most of which consist of flows among advanced economies, rose from about 10 percent in 2002 to over 30 percent in 2007 prior to the financial crisis, and collapsed during the financial crisis, while net capital flows increased from 3.1% in 2001 to 5.9% in 2007, as shown in Figure 1. Remarkably, gross debt-financing flows have driven the expansion of gross capital flows. Figure 3 demonstrates the composition of gross capital inflows among advanced countries. Portfolio and other investment flows, which mainly reflect banking flows, were extremely volatile in comparison with foreign direct investment (FDI) and equity investment.[3] Thus, it appears from the observations of global financing patterns presented in this section that gross capital flows, particularly gross debt-financing flows, were likely more important than net capital inflows that the global imbalances view draw attention to understanding the global financial crisis in the 2000s.[4] The majority of gross capital flows were conducted by a handful of large, complex financial institutions (LCFIs) at the center of the global financial system.[5] The process of financial deregulation and consolidations among financial conglomerates spurred a growing convergence between the activities of the banks and the other financial institutions since the 1990s. The development led to the emergence of LCFIs in the U.S. and Europe, which dominate the global financial markets for debt and equity securities, syndicated loans, securitizations, structured-finance products and OTC derivatives.[6] Our analysis will suggest how gross capital flows had expanded in the 2000s, emphasizing the key role of the US dollar, as LCFIs increased their balance sheet on a global scale before the financial crisis. Notes [2] Bernake [2005], the most prominent proponent of this view, refers to this phenomenon of excess savings as the emergence of the "global saving glut". The global saving glut consists of excess domestic savings over investments in emerging Asian countries, oil-exporting countries and some advanced countries. [3] IMF [2011a], p.32. [4] The U.S. played a central role in the expansion of gross capital flows. Mainstream economists and policymakers argue that the U.S. has been playing the role of "global financial intermediary" in gross capital flows since the latter 1990s. Gourinchas and Rey [2005] point out that the role of the U.S. changes from a 'world banker' to a 'venture capitalist of the world' since the 1990s. As Milesi-Ferreti, Strobbe, and Tamirisa [2010] analyze, U.S. gross capital inflows and outflows expanded vis-à-vis the euro area and offshore financial centers (OFCs) such as the U.K. and Caribbean offshore financial centers (pp.15-16). [5] IMF [2010b], p.8. [6] Wilmarth [2009], pp.994-95. By 2007, sixteen large complex financial institutions (LCFIs)—including the four largest U.S. banks (Bank of America, Chase, Citigroup and Wachovia), the five largest U.S. securities firms (Bear Stearns, Goldman, Lehman, Merrill and Morgan Stanley), and seven major foreign universal banks (Credit Suisse, Deutsche, Barclays, RBS, HSBC, BNP Paribas and Societe Generale) collectively dominate the global financial system (Wilmarth [2009], p.994). In addition, FSB [2011] identifies an initial group of "Systemically Important Financial Institutions" (SIFIs), namely 29 global systemically important banks (G-SIBs). | ||

| Alasdair Macleod: Germany’s Gold is the Story de Jour Posted: 26 Jan 2014 09:01 PM PST

It transpired last week that of the 43-odd tonnes per annum the Bundesbank expects to be returned from the New York Fed, only 5 tonnes arrived in 2013. Furthermore, of the 373.7 tonnes stored with the Banque de France, only 32 tonnes was delivered. This is little more than a morning’s delivery in the London [...] The post Alasdair Macleod: Germany's Gold is the Story de Jour appeared first on Silver Doctors. | ||

| Weekly Price Charts of Gold, Silver, Dollar, HUI, Commodities, and SPY Posted: 26 Jan 2014 08:19 PM PST Commodity Trader | ||

| Tough week ahead for global equities as Asian stocks tumble, VIX rockets and gold jumps Posted: 26 Jan 2014 07:38 PM PST The VIX index for emerging markets jumped 40 per cent last week, Asian stocks tumbled today following Wall Street’s big sell-off last Friday and precious metals continued to rise with gold now touching $1,280 an ounce. It looks like a tough week ahead for global equity markets unless the Fed changes tack radically on Wednesday and backs off its QE wind-up. Weaning the world off low interest rates was never going to be easy or painless. The pain is also asymetrical. That is to say it will be felt most accutely in one place rather than another, and shift over time. Emerging market losses At the moment it is the once strong emerging markets that are feeling the downside most. They are suffering currency devaluation, capital flight and big stock market losses. If the contagion could be halted in these markets then the Federal Reserve would think this a job well done. However, this is likely only the start of a long unwinding process. There are five years of gains wrapped up in global stock, bond and real estate markets that owe a great deal to artificially low interest rates. Take this crutch away and the recovering patient will fall over. Who will be their to pick him or her up? Where then are the safe havens for investors? At the moment gold, the yen and US treasuries are favored. Shorting equities must also be highly profitable right now. For US stock market investors the time is coming to cut and run, or risk going over the edge with the rest of the madding crowd. Expect to hear a lot of nonsense on financial TV this week as the professionals try to steady the market as they slip out of the backdoor themselves. Crash coming? After rising for over two years without so much as a 10 per cent correction the S&P 500 is due for a fall and a big one. The danger signals like record margin debt, investor sentiment and valuations have been flashing red for so long that people may ignore them now. To do so would be a mistake. Expect the market to feign a recovery after a 10 per cent fall. But watch out the long-term S&P 500 chart shows a 50 per cent sell-off is coming. Worried about what to do next? Our sister monthly investment newsletter warned about this coming and has its own ideas of what to do next that will only be revealed to subscribers (subscribe now!). | ||

| Posted: 26 Jan 2014 07:37 PM PST Ras Al Khaimah is out to under-cut Dubai’s leading hotels on price with its superb new Waldorf Astoria on the Al Hamra beachfront, opposite the Marjan Island, RAK’s answer the Palm Island. This 346-room hotel is incredibly spacious and offers some of the UAE’s largest standard rooms, top-end service, great restaurants and a beautiful private beach. It is hard not to be bowled over by the Hilton chain’s top brand, a knotch above the Conrad that opened in Dubai recently. The reception lobby has a specially commissioned clock tower that cost $400,000 and gives pray times as well as a stylish lounge area known as Peacock Alley. Both a special clock and this themed lounge area are found in every Waldorf Astoria in the world. Peacock Alley The RAK version of Peacock Alley has an outsized water fountain and twin Hollywood staircases and an exquisite marble floor. The other end of this long ground floor has shops and access to the all-day buffet dining restaurant with a fine terrace for an al fresco breakfast. Head up to the 17th floor of the tower in the centre of this hotel and there is a smokey nightclub called 17 Squared, and somewhat lower down is a swish modernist Japanese restaurant. There’s also an excellent steakhouse on the ground floor (review here), an Arabic restaurant on the beach and Azure for light meals by the pool where my wife’s prawn wrap was described as the best she has ever eaten. All the restaurants have private dining rooms and so are particularly convenient for company events or parties of national ladies. If we had to pick one area that the hotel could improve on it would be customer service. It’s not quite as on-the-ball as it is in Dubai, and for this level of hotel could be improved. The rooms are the best part of staying in the hotel. We could not believe the 54 square metre standard room was the lowest rung of the ladder. Apparently the hotel was originally going to be an apartment building but that plan was changed three years ago when it was partly complete. Hence the very large rooms. They have also been beautifully fitted out in a relaxed modernist style with a sea-inspired theme in blending of the colour palate. Choose one of many seafront rooms and you have a large terrace overlooking the Arabian Sea. The black marble and gold bathrooms are also extraordinary complete with locally made suites from RAK Ceramics whose famous factory is just down the road. Imperial Suite Our tour of the hotel took us up to the 442 square metre Imperial Suite on the top two floors of the hotel’s central tower. For the last word in lavish living this would be the place to stay. Arrive by helicopter from Dubai and there are three helipads so that a large family can all land at the same time. For the more average guest the outdoor facilities are of greater interest. You have a huge sprawling pool suitable for families with children and an infinity pool with double-bed loungers and sunshades for adults. The spa and fitness room are also outstanding. We can’t wait to get back to this away-from-it-all haven again for a long weekend. We arrived early because it is only an hour from Downtown Dubai on the Sheikh Mohammed bin Zayed Highway. This hotel could easily become a firm favorite in the UAE. | ||

| Australian law provides for gold confiscation -- and its not unique Posted: 26 Jan 2014 07:31 PM PST GATA | ||

| Germany’s gold is the story de jour Posted: 26 Jan 2014 07:00 PM PST Market Report by Alasdair Macleod, Head of Research, GoldMoney ___________________________________________________________________

Ends NOTES TO EDITOR For more information, and to arrange interviews, please call Gwyn Garfield-Bennett on 01534 715411, or email gwyn@directinput.je GoldMoney is one of the world's leading providers of physical gold, silver, platinum and palladium for retail and corporate customers. Customers can trade and store precious metal online easily and securely, 24 hours a day. GoldMoney has offices in London, Jersey and Hong Kong. It offers its customers storage facilities in Canada, Hong Kong, Singapore, Switzerland and the UK provided by the leading non-bank vault operators Brink’s, Via Mat, Malca-Amit, G4S and Rhenus Logistics. Historically gold has been an excellent way to preserve purchasing power over long periods of time. For example, today it takes almost the same amount of gold to buy a barrel of crude oil as it did 60 years ago which is in stark contrast to the price of oil in terms of national currencies such as the US dollar. GoldMoney is regulated by the Jersey Financial Services Commission and complies with Jersey’s anti-money laundering laws and regulations. GoldMoney has established industry-leading governance policies and procedures to protect customers’ assets with independent audit reporting every 3 months by two leading audit firms. Visit www.goldmoney.com. The post Germany's gold is the story de jour appeared first on The Daily Gold. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment