saveyourassetsfirst3 |

- Koos Jansen: Unprecedented high gold demand in China in 2013

- Metals & Markets: Gold & Silver Open 2014 With a Bang!

- Forex: Position Adjustment Or Trend Reversal?

- DID WE JUST SEE THE HIGHS FOR THE YEAR IN THE STOCK MARKET?

- Gold And Silver – In East v West Gold War, Both Are Still Winning

- Ted Butler: 2013—The Year of JPMorgan

- Five King World News Blogs/Audio Interviews

- Frank Holmes: Gold Stocks...and What to Expect in the New Year

- Gold has its S.O.S. moment, and it’s bullish

- It may soon be time to go for the gold

- Rickards: Gold Could Ultimately Surpass $9,000 an Ounce

- Gold smuggling at Mumbai airport surpasses that of narcotics, it's 3 percent of all seizures

- Gold purchases surge in China as prices slump in run-up to Spring Festival

- China Gold eyes Canadian purchase but says prices still steep

- Ted Butler: 2013 -- The Year of JPMorgan

- The Good, The Bad and The Ugly: Gold in 2013 and the Outlook for 2014

- [KR545] Keiser Report: Pickpockets Rule UK?

- Super Force Signals

- Gold and silver on the turn?

- Time-preference and gold

- Metals & Markets: Gold & Silver Open 2014 With a Bang!

- Gold and Guns

- Economic Aspects Of The Pension Problem

- The GLD Is A Short-Term No-Brainer, But You Must Be Nimble

- Ditch stocks and buy gold is the new buzz on the street

- Barrick pulls away from top 3 peers

- Gold surrenders 12-year winning streak

- India beefs up customs in a bid to slow smuggling

- jan 3.2013:GLD holds firm/SLV holds firm/ Comex gold declines/ Gold and silver rise

- Silver Producers Index Update

- Can't-miss headlines: Colossus down, Mediterranean facelift, gold up & more

- Making Friends With The U.S. Dollar (Continued)

- Von Greyerz: Gold has moved out of central bank vaults to private vaults

- Gold Daily and Silver Weekly Charts - Release from the Year End Clamp Down

- Andy Hoffman Discusses the Comex Default

- This is exactly how the world's best investors made fortunes last year

- If You Want To Make Money This Year, You Have To Think Different

- Ted Butler: 2013 – The Year of JPMorgan

- Great performance from Terratec raise drill at Patagonian gold/silver mine

- Japanese Hyperinflation, Coming Right Up!

- Fill or Kill: The Mechanics of Precious Metals Price Manipulation

- Alasdair Macleod: Gold and Silver on the turn?

- Alasdair Macleod: Time-preference and gold

- China Gold eyes Canadian purchase but says prices still steep

- A Silver Short Squeeze Could Ignite A Major Rally

- Don’t get too carried away by gold’s good 2014 start

- Doug Casey: “We’re Extremely Close To The Edge of The Precipice!”

- GoldCore Review of 2013 and Outlook for 2014

- Death Tsunami: Toxic Food, Toxic Water And Toxic Vaccines

- Gold working higher

| Koos Jansen: Unprecedented high gold demand in China in 2013 Posted: 04 Jan 2014 09:01 AM PST GATA | ||

| Metals & Markets: Gold & Silver Open 2014 With a Bang! Posted: 04 Jan 2014 08:44 AM PST Podcast: Play in new window | Download

Click here for the SD Weekly Metals & Markets With The Doc & Eric Dubin: This posting includes an audio/video/photo media file: Download Now | ||

| Forex: Position Adjustment Or Trend Reversal? Posted: 04 Jan 2014 08:07 AM PST Last week, which straddled the New Year holiday, saw a reversal in the trends seen in second half of Q4 13. These trends were characterized by the strength of the euro, sterling and the handful of currencies that move in their orbit, like the Swiss franc, and Danish krone and the weakness of the yen and dollar bloc currencies. Full participation will return for an event-packed week that features the non-manufacturing PMIs, ECB and BOE policy meetings, the minutes from the December FOMC that saw the Fed announce the beginning of the end of QE3+, and the December US non-farm payrolls. We had expected some backing and filling after the dramatic moves on December 27, the thinness of market conditions last week likely exacerbated the price action. The price action that saw the euro drop around 1% on the week, and sterling shed about half as much, | ||

| DID WE JUST SEE THE HIGHS FOR THE YEAR IN THE STOCK MARKET? Posted: 04 Jan 2014 06:56 AM PST I believe we have now come to an inflection point, and I think the next 2 weeks have the potential to determine the economic direction in 2014. I believe that if stocks had been allowed to trade freely they would have moved down after the last FOMC meeting and continued the failed daily cycle that was already in progress. However, it's my opinion that the Fed rescued the market immediately after the meeting as they saw it was beginning to plunge. Let's face it if the market had sold off hard right after the FOMC announcement of tapering then their only choice would have been to immediately reverse their decision. So I think the Fed was prepared to rescue the market if it showed any signs of weakness after the announcement. That explains the large reversal candle on December 18. I think it was their intent to create a momentum move to try and prevent the market from correcting very similar to what they did in June 2011 as QE 2 was coming to an end. The bullish seasonality and typical Santa Claus rally helped the Fed keep this market propped up into year end. But now it looks like the momentum is running out of gas, just like the momentum in June 2011 ran out of gas. I think the next two weeks are very important, and if the Fed loses control of the stock market it's going to put into motion unintended consequences that have the potential to push the economy back into recession. To begin with the Fed has created a parabolic advance in stocks. Parabolas always collapse. If this parabolic move is about to overwhelm the Fed and collapse then we can expect in the not-too-distant future that this silly notion of tapering will quickly go away and instead the Fed will frantically increase quantitative easing to try to rescue the stock market. This may be what the rally in the dollar is signaling. That a hard selloff in the stock market is imminent. This is the consequences of not allowing the stock market to correct naturally in 2013. You take away all fear for market participants and create an unsustainable parabolic advance. When that parabola collapses you have a major catastrophe on your hands. This is no different than 2005 when the Fed allowed real estate prices to climb into the Stratosphere. We should know within the next two weeks whether or not this parabolic move is coming to an end | ||

| Gold And Silver – In East v West Gold War, Both Are Still Winning Posted: 04 Jan 2014 04:58 AM PST China represents the East, as its insatiable demand for buying physical gold continues unabated, while in the West, the elite's central banks have pretty much depleted their physical holdings. In the war for gold, both are still winning, but for vastly different reasons. China and every other BRICS nation importing gold have been doing so at cheaper and cheaper price levels, as the Western central bankers have been conducting a clearance sale. Even the fixtures are being sold, like JP Morgan's fire sale of 1 Chase Plaza for $750 million, about half of its value. The building also happens to house the world's largest gold vault, and it also located across the street from the Federal Reserve gold vault. This gives China a "two-fer.". Now it can store the gold in Manhattan and save shipping costs, and should the NY central bank have any left, it just gets rolled across the underground tunnel. The moneychangers have run their centuries old scam of storing private gold and issuing gold receipts, in exchange, making it easier for the holders of gold to carry paper, convertible into gold upon demand, instead of the physical gold itself. The moneychangers noted that the owners did not demand their gold back, preferring to keep the receipts, instead. The moneychangers began issuing receipts many times more than the actual gold backing the receipts, creating "new money" and the assumption of gold backing.

China loaned Mao's gold to the NY central bank, and it would not [could not] return it The gold was gone, loaned out, sold, we will not likely know the true story, but it was gone. Paper was the name of the game for the West. Physical gold, silver, and natural resources was, and still is the name of the game for China and Russia. Both have been dumping US Treasury bonds in exchange for gold, silver, and any other asset that is not a derivative of paper. Because of the NY central bank experience, China is out for revenge. Russia has always been a known adversary and is winning against the US by default, simply waiting for the US to self-implode, which it is doing. Where China holds the majority of physical gold, Russia holds energy trump cards over the US and its faltering scheme of the petro-dollar. It is fast being replaced by sounder forms of collateral and trade outside of the Western fiat scheme. The US has become isolated. Russia has vast amounts of natural gas to supply Europe, replacing, in part, oil.

We have pretty much stopped announcing "gold news," as in record sales for silver and gold coins by the public, record imports of physical gold by China and other countries to a much lesser degree, disappearing gold reserves by COMEX and LBMA, how the demand for physical ounces of gold by paper holders is at its highest number ever, etc, etc, etc. All of the very valid demand side numbers that has had zero impact on the price of gold. Most of this article is presented in generalities, on purpose. There are any number of other sites that go to great effort to present graphs, details about gold and silver depletion, the number of coins bought and sold by various countries, the number of tonnes China has imported, guesses on how much gold China owns, predictions on where the price of silver and gold will be next week, next month, pick a price, pick a time frame, they are all over the place. The graphs are presentable, the facts/figures are accurate, but the results are of no practical use and have not been for the past two years.

Because the natural laws of supply and demand does not apply to gold and silver, the only way we can track the influence of endless paper supply on the market is through the most reliable source, the market itself, and the best way to track the market is through charts. As an important aside, when we reference charts, we are not talking about traditional technical analysis that uses artificial tools like moving averages, RSI, endless broken trend lines, Bollinger Bands, whatever. Instead, we apply the most important factors that best capture market activity: price and volume. Both of the larger time frames, the Annual and Quarterly on the left side, below, suggest a lower low is more than likely. One does not have to happen, but odds favor at least a nominal lower low in 2014. The Quarterly chart looks bottom heavy for the past 3 Qtrs, and the last Qtr shows a lower high, lower low, and lower close. The monthly chart, on the right side, shows a labored decline over the past 5 months, and the last 6 months have all been inside June's wide range. We often mention how a wide range bar will often contain subsequent bars, for whatever time frame, this one monthly. The lower end close for December also increased the probability of a lower low, next month, January. Here are two separate forms of market activity that provide for reasonable expectations into the future, not predictions, but expectations. The wide range bar of June was the market telling us to expect price containment over the next several months, and that is what developed for the past half-year. There was also a wide range bar in April, when a similar supply of paper contracts was dumped onto the market, just as happened in June. Price was contained for only 1 month, but the trend carried the market lower. The second piece of market information is the location of the close on the Annual, the Quarterly, and the monthly. All indicated a higher degree of probability for a lower low in the next time period. With this information, one would know not to be in a hurry to establish a long position in futures because a lower price was likely. It does not matter what the fundamentals say. The market is providing a clue or clues in what to expect. It may not always happen, but we are dealing in probabilities that tend to be fairly consistent. Gold annual returnsGold annual returns Price did make a nominal low on the weekly, and it held the support area established in June. With the close located in the middle of the down channel, while price can still rally, it is unlikely to break upside, at this juncture. Last week, given the market structure, we said a nominal low was likely. One occurred on both the weekly and daily, but we confined our comment to the daily, [See Sharply Higher Prices? Be Careful What You Wish For, first paragraph after first chart]. The down channel has been broken on the daily chart, but of all the time frames discussed, the higher time frames are more controlling than the daily. It could turn out that the daily activity will lead to change on the weekly, then from weekly to monthly, etc, but what we know most about market trends is that they take time to change direction. Friday's bar was the smallest of the last three rally bars, and that tells us demand has weakened. With the location of the close near high-end on the bar, sellers were weaker than buyers. What needs to be watched closely, next week, is how price reacts on any pullback. If the bars are wide range lower on increased volume, expect more continuation to the downside. If the bars are relatively narrow in range and volume is less, then we have a stronger indication to expect the pullback to be brief and lead to another rally attempt. We do not have to know ahead of time, nor do we need to predict. Instead, knowing how price and volume could develop, day by day, we just need to be prepared for how price may develop, and react accordingly. The market will give us the information needed on what to expect.

Silver is a slightly different story, according to the charts. It would not be unreasonable to expect a lower low from the annual chart. The last Quarter, 2013, was the smallest range in the past 4 years. What matters is where it appears: at the lower end of the correction. The reason why the range is small is due to lack of sellers, combined with buyers meeting the effort of sellers sufficiently to prevent the range from extending lower. It does not preclude a lower low, next Quarter, but a rally could occur first. The monthly shows how labored the decline was relative to the wide range August rally. Here, again, we see a wide range that contained the price activity for the next several bars. December was a small range, letting us know, just like the Quarterly, selling was weak, and buyers were meeting the effort of the sellers. The buyers were able to keep the range from extending lower, and also to close just slightly above November. The trend has not changed, but we are seeing little pieces of information that alert us to potential change. The trend being down, and combined with bearish spacing, we know that silver has a lot of overhear resistance that will likely stop initial rally efforts from current levels. Until price moves out of the box, up or down, the TR remains intact. Last week's reversal from lows, with a strong close, did not rally much above the previous week's close. This is a small red flag that the rally could be meeting resistance. There is a cluster of closes over the last 7 weeks. This signals either continuation lower or a reversal of the immediate trend. Until price rallies and closes above the high of the box or declines and closes under, there is no confirmation to be positioned, either way. In the first box, left, it looked like price would rally higher toward the end of October. Price gapped lower, instead, and created a lower box TR, the current one. This is why we said there needs to be confirmation, even though the weekly close in the above chart "appears" as though the rally will continue. The daily chart, below,is an example of why one needs to wait and let the market be the best guide, eliminating guesswork and having to predict. The conclusion we reach from the gold and silver charts is that price may be forming a bottom, but it will take more time before a change will take place, and that could take weeks, months, even Quarters. | ||

| Ted Butler: 2013—The Year of JPMorgan Posted: 04 Jan 2014 04:58 AM PST "The precious metals became a national security issue for the U.S. at some point" ¤ Yesterday In Gold & SilverThere were three tiny rallies in gold yesterday. The first once ended/got capped at 9 a.m. Hong Kong time---and the second one ended at 3 p.m. Hong Kong time. The last one ended about five minutes before the Comex close. A cursory glance at the Kitco chart below shows that, in most ways, the price action in gold on Friday was virtually a carbon copy of the price action on Thursday. The only real difference was that the morning rally in Far East trading didn't get as far. The CME recorded the low and high ticks at $1,221.30 and $1,239.60 in the February contract. Gold closed in New York on Friday afternoon at $1,238.00 spot, which was up $15.00 from Thursday's close. Gross volume was 124,000 contracts and, like Thursday, a big chunk of that came before the London open to squash the rallies that occurred during the Far East trading day. Volume was about 30% lower on Friday than it was on Thursday The price action in silver was somewhat similar to gold's. The rally during morning trading in the Far East obviously got dealt with in the usual manner by a not-for-profit seller at 9 a.m. Hong Kong time, as no "for profit" seller ever sells into a rally like that---ever! The second rally got turned back minutes before 11 a.m. in London---and the final sell-off came moments before the Comex close. Silver's lows and highs were $19.985 and $20.325 in the March contract. Silver closed yesterday at $20.145 spot, which was up 13.5 cents from Thursday and, like Thursday, would have finished considerably higher if the sellers of last resort hadn't been lurking about. Volume on Friday was around 32,000 contracts, a third lower than Thursday's volume. Platinum and palladium price chopped sideways without much conviction on Friday everywhere on Planet Earth. Here are the charts. The dollar index closed at 80.60 late on Thursday afternoon in New York. From there it chopped sideways in a very tight range up until 9 a.m. in New York on their Friday. The subsequent rally lasted right up until the close---and the index finished the Friday session at 80.87---which was up 27 basis points on the day. Despite the fact that the gold price was up a decent amount by 9:30 a.m. in New York, the equities barely opened in positive territory---and the moment that the gold price began to head south just before the 1:30 p.m. EST Comex close, the equities were quick to follow. The HUI closed down 0.89%. I was underwhelmed. The price action in the silver equities was even less impressive---and the sell-off at 1:25 p.m. EST was even more pronounced in the silver stocks than in the gold stocks. Nick's Intraday Silver 7 Index closed down 1.29%. The CME Daily Delivery Report on Friday was a yawner, as zero gold and 4 silver contracts were posted for delivery within the Comex-approved depositories on Tuesday. Just glancing at the CME's volume/open interest data, I note that there's not much left to be delivered in either gold or silver in January anyway, so the rest of the month could just about as quiet. For a change, there was no withdrawal from GLD yesterday, but the SLV ETF made up for it, as an authorized participant withdrew 1,580,143 troy ounces. Based on the recent price action, this was not "plain vanilla" liquidation. It was obvious that this silver was more urgently needed elsewhere. There was no sales report once again from the U.S. Mint, as they have yet to update their website to include the 2014 calendar year. There was very little in/out movement in gold on Thursday at the Comex-approved depositories, as only 2,154 troy ounces were reported received---and 2,700 troy ounces were shipped out. The link to that activity is here. And as is virtually always the case, it was much busier in silver, as 475,204 troy ounces were reported shipped in---and 61,635 troy ounces were shipped off to parts unknown. The link to that action is here. I'm happy to report that I don't have a lot of stories for you today, so I hope you have the time to read the ones you like. ¤ Critical ReadsTaxing Relations: Ex-UBS chairman slams 'brutal' U.S.The United States legal system combines great expertise with ‘absurd, imperialistic brutality’, warns former UBS bank chairman Peter Kurer in an interview in the Die Zeit newspaper. Europeans need to have respect for the U.S. legal system, Kurer told the German weekly paper, as “it’s a mix of great expertise but also absurd, imperialistic brutality”. The Empire is taking no prisoners---and to hell with international law. Today's first story is courtesy of South African reader B.V...and it was posted on the Swiss website swissinfo.ch late yesterday morning Europe time. Sean Fieler: How to challenge Yellen---and big government"I want to come back as the bond market. You can intimidate everybody." That was James Carville, President Clinton's chief political consultant, talking to this newspaper in February 1993. When President Clinton backed away from HillaryCare and the rest of his big-government agenda, it wasn't just Democratic losses in the 1994 midterm elections that forced his hand. It was the power of the bond market, a point Mr. Carville understood but Republicans seem to have forgotten. If today's Republicans are going to roll back President Obama's massive expansion of government, they will need the muscle of a bond market free from the Federal Reserve's manipulation. History suggests that only the prospect of higher and increasingly painful financing costs chastens committed big spenders. A liberated, and consequently less docile, bond market would not only restrain Washington's profligacy, it would also free the Republican Party to refocus on the big ideas and positive vision that made it a global force in the 1980s. It's refreshing to see a manipulation story show up in the hallowed halls of The Wall Street Journal. This news item appeared on their Internet site yesterday sometime---and is posted in the clear in this GATA release. It's definitely worth reading. In wake of Q.E. taper, Fed's Plosser dusts off inflation warningThe Federal Reserve faces "immense" challenges now that it has reduced bond-buying, and needs to be cognizant of a rapid rise in future inflation, a top U.S. central banker said on Friday. Philadelphia Fed President Charles Plosser, a voter on monetary policy this year, said the central bank's balance sheet is still growing at "a fairly rapid clip" despite the $10-billion (6 billion pounds) reduction in monthly asset purchases, which started this month. Dusting off arguments he and other hawkish officials made before the recent bout of low inflation, Plosser said he was less concerned about disinflation and more concerned about too-high inflation if banks start to quickly release the $2.4 trillion in excess reserves they now hold. Those three paragraphs are all there is to this tiny Reuters piece that was posted on their website very early yesterday afternoon EST...and it's courtesy of U.A.E. reader Laurent-Patrick Gally. Doug Noland: Issues 2014 Not the most bullish looking start to 2014. Doug's Credit Bubble Bulletin was posted on the Prudent Bear website late yesterday evening...and I thank reader U.D. for sliding it into my in-box. His commentaries are always must reads in my opinion. Deadly clashes erupt in EgyptAt least eleven people were shot dead in Egypt on Friday as supporters of the Muslim Brotherhood clashed with police, defying an ever-widening state crackdown on the movement, which ruled the country until six months ago. Islamists opposed to the army’s overthrow of former president Mohammed Morsi in July have been holding daily demonstrations, even after the military-backed government declared his Brotherhood a terrorist group last week, increasing the penalties for dissent. The government is using the new classification to detain hundreds of Brotherhood supporters. Thousands more, including top leaders of the group, have been in jail for months, arrested in the aftermath of the army takeover. This news item showed up on the france24.com Internet site yesterday sometime...and it's the lone offering of the day from Roy Stephens. Indo-U.S. relations: A big chill descendsThe Barack Obama administration seems to be losing the plot on India. Otherwise why would it burn India-U.S. relations over a nanny’s wages? But that in a nutshell is the current state of play. It threatens to destroy years of hard work behind this important relationship, one that was meant to reconfigure the geopolitics of Asia. The public arrest and strip-search of Devyani Khobragade, India’s deputy consul general in New York, on December 12 last year has the Indian establishment fuming. And for good reason. A diplomat embodies the sovereignty of a country and must be treated with dignity. More so because the US diplomats in India and other countries enjoy benefits far in excess of what they grant in return. But their complete disregard for diplomatic conventions, norms and courtesies in Khobragade’s case has put a knife through bilateral relations. They have ensured that 2014 will be spent mostly fixing what should never have been broken. This follow-up story was posted on the aljazeera.com Internet site early yesterday morning EST...and it's the second offering of the day from reader B.V. Are we on the brink of war? Academic sparks debate by drawing comparisons between 1914 past and 2014 presentA century ago, a simple assassination was enough to topple a tenuous balance between the old and new worlds. The resulting war killed millions and spanned the globe. Is history about to repeat itself? The year was 1914. The world was experimenting with economic globalisation. There was friction between the industrial and military powers of the "old" world and the ambitions of the revitalised "new" economies. Add a century to the date and ask yourself: does this scenario sound familiar? According to Oxford professor of international history Margaret MacMillan, it does. Her essay addressing China's recent flexing of its economic and military muscles has sent ripples around the world. This longish commentary, with an even longer essay linked at the end, was posted on the Australian website news.com.au a couple of days ago...and it had to wait for Saturday's column. I thank Australian reader James White for sending it our way...and despite its length, it's a must read---especially so for all serious students of the New Great Game. Global warming scientists forced to admit defeat... because of too much iceThey went in search evidence of the world’s melting ice caps, but instead a team of climate scientists have been forced to abandon their mission because the Antarctic ice is thicker than usual at this time of year. The scientists have been stuck aboard the stricken MV Akademik Schokalskiy since Christmas Day, with repeated sea rescue attempts being abandoned as ice-breaking ships failed to reach them. Australian icebreaker Aurora Australis was unable to reach them because it was not strong enough to break through. A top-of-the-range Chinese icebreaker, the Snow Dragon ('Xue Long'), was deployed earlier in the week, and hoped to reach the ship by Saturday. However just after midnight on Friday it too got stuck just six nautical miles from the ship. This story was posted on the dailymail.co.uk Internet site on New Year's Eve...and I found it in the Thursday edition of the King Report. And here's another story on this from the bbc.co.uk Internet site yesterday...and it's courtesy of reader Bill Busser. Al Gore Forecasted "Ice-Free" Arctic by 2013; Ice Cover Expands 50%Self-styled “global-warming” guru Al Gore and a gaggle of supposed “climate scientists” have egg all over their faces — big time. In 2007, 2008 and 2009, Gore publicly and very hysterically warned that the North Pole would be “ice-free” by around 2013 because of alleged “man-made global warming.” Citing “climate” experts, the government-funded BBC hyped the mass hysteria, running a now-embarrassing article under the headline: “Arctic summers ice-free ‘by 2013’.” Other establishment media outlets did the same. Well, 2013 is almost over, and contrary to the alarmist “predictions” by Gore and what critics refer to as his “doomsday cult,” the latest satellite data show that Arctic ice cover has actually expanded 50 percent over 2012 levels. In fact, during October, sea-ice levels grew at the fastest pace since records began in 1979. Experts predict the expansion to continue in the years to come, leaving global-warming alarmists scrambling fiendishly for explanations to save face — and to revive the rapidly melting climate hysteria. In September, meanwhile, data also showed that sea ice levels in Antarctica had expanded to record levels for the second year in a row. Of course, by now, virtually everyone who has been following news about “global warming” — now more often referred to as “climate change” owing to public-relations concerns — also knows that global temperatures have not risen for some 17 years. The spectacular lack of warming demolished all 73 of the “climate models” used by the United Nations to push its controversial theories. Well, dear reader, as I've said since Day 1 of this "global warming" hysteria, that it was all bulls hit right from the get-go...and that's precisely what has turned out to be the case. I spent almost a decade working in meteorology in the Canadian arctic back in the mid 1960s and the early 1970s...and I do know a thing or two about this, as I still have sources inside Environment Canada even to this day that keep me up to speed on what's happening. This essay is definitely worth reading...and I thank Casey Research's own Jeff Clark for sending it to me yesterday. And while I'm on my soap-box on this issue...here's Canada's own Rex Murphy sounding off on CBC on the Climategate scandal back in 2009 that rocked the "global warming" crowd to its foundation. It was a scandal from which they never really recovered. [Note: There's a chance that this video might be blocked from playing, depending where on Planet Earth you live. - Ed] Five King World News Blogs/Audio Interviews 1. Egon von Greyerz: "Forget IMF's Tax on Deposits, This Will Truly Destroy Savers". 2. Bill Fleckenstein: " Five King World News Blogs/Audio Interviews Posted: 04 Jan 2014 04:58 AM PST 1. Egon von Greyerz: "Forget IMF's Tax on Deposits, This Will Truly Destroy Savers". 2. Bill Fleckenstein: "Historic 2014 Stock Market Crash and Dislocation". 3. Ronald-Peter Stoferle: "War Rages in Gold as Inflation / Deflation Battle Continues". 4. John Mauldin: "Humanity Will Be Radically Transformed in 2014". 5. The audio interview is with Dr. Stephen Leeb. [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] | ||

| Frank Holmes: Gold Stocks...and What to Expect in the New Year Posted: 04 Jan 2014 04:58 AM PST After three years of pain, can gold stocks break their losing streak and see a gain in 2014? History says chances are good. The most recent string of losses in the gold mining industry has been brutal, causing many investors to give up on the sector and sell their holdings. Since the beginning of 2011, the NYSE Arca Gold Miners, the FTSE Gold Mines, and the Philadelphia Gold & Silver Indices all declined more than 60 percent. But ditching this sector may not be the best action to take this year because miners are approaching the historical limits of multi-year declines. This short commentary by Frank was posted on the usfunds.com Internet site yesterday...and it's definitely worth reading. And even if you don't want to read it, the two charts are worth the trip on their own. My thanks to West Virginia reader Elliot Simon for bringing this article to our attention. | ||

| Gold has its S.O.S. moment, and it’s bullish Posted: 04 Jan 2014 04:58 AM PST Gold has been an awful performer since the Summer Crash of 2011, vastly underperforming U.S. markets, with extreme weakness in 2013. Yes, the trend is still down, but it’s worth considering that a tradeable opportunity is coming and soon. Everyone loved gold up until 2011, and everyone hates it now. The contrarian in me says that's why its worth watching carefully. The catalyst likely needs to be negative real rates, and with inflation expectations ticking up a bit, the "Great Convergence of 2014" between reflation and U.S. markets may be precisely why gold's S.O.S. moment gets heard. This short commentary was posted on the marketwatch.com Internet site late yesterday morning EST...and I thank reader Joe Kahan for sending it our way. | ||

| It may soon be time to go for the gold Posted: 04 Jan 2014 04:58 AM PST Something tells me we might be experiencing the give-up phase for gold. By that I mean a point in the gold price cycle when just about everyone gives up on the possibility that gold prices will ever rise again. Which could mean the time to buy is here. For instance, in mid-December, the Wall St. Journal featured a front-page article on the yellow metal in which one money manager opined that "The reasons to own gold have just evaporated." Another, known for his perennially bullish outlook for commodities, has apparently hedged his gold position but told the Journal "I wouldn't buy gold right now under any circumstances." Another strategist at a major French Bank recently commented in a report that "The yellow metal has lost its once-crucial role as a safe haven." From a primary-trend-reversal point of view, this one scores on all three fronts. I think there is a pretty good chance it will be tested early in the new-year because the short-term momentum series in the middle panel has just started to edge higher and has violated a four-month down trend line. Obviously only time will tell, but if the line is penetrated and the price is able to hold the break, I think it will be time to go for the gold. As you already know, JPMorgan et al can paint any chart pattern they wish, but this time I'm guessing that this T.A. is telling the truth. This is another marketwatch.com article...and this one's from Thursday. It's courtesy of Joe Kahan as well. | ||

| Rickards: Gold Could Ultimately Surpass $9,000 an Ounce Posted: 04 Jan 2014 04:58 AM PST Gold will reach $7,000 to $9,000 an ounce or possibly higher in the "intermediate" term, thanks to the dollar's weakness, says James Rickards, senior managing director of Tangent Capital Partners. | ||

| Gold smuggling at Mumbai airport surpasses that of narcotics, it's 3 percent of all seizures Posted: 04 Jan 2014 04:58 AM PST If the data compiled by Directorate of Revenue Intelligence (DRI) is to be believed, gold smuggling has spiralled in the past couple of years. | ||

| Gold purchases surge in China as prices slump in run-up to Spring Festival Posted: 04 Jan 2014 04:58 AM PST Many shops selling gold in Beijing are catering to a steady stream of customers interested in buying the precious metal after gold prices started decreasing. International gold prices were at US$1,696 per ounce at the beginning of 2013, but have fallen by 28% to less than US$1,200 on Dec 31, 2013, the largest drop since 1981. The Chinese-language Beijing News reported that gold sales had surpassed 10 million yuan (US$1.7 million) an hour after Caibai Jewelers in Beijing opened on Jan 1, setting a new record. Many Chinese gold jewelry vendors have launched promotions to further boost sales. This worthwhile read, filed from Beijing, was posted on the wantchinatimes.com Internet site yesterday afternoon local time...and I thank Ulrike Marx for her second contribution in a row to today's column. | ||

| China Gold eyes Canadian purchase but says prices still steep Posted: 04 Jan 2014 04:58 AM PST China Gold International , a mid-sized Canadian-based company with two mines in China, is eager to make an acquisition in Canada, but asset prices remain very high despite a bombed-out mining sector, a company official said on Thursday. At a time when small- and medium-sized miners are struggling to raise funds as investors have cooled on the sector, China Gold is in the enviable position of having ready access to finance through its biggest shareholder, China National Gold, a Chinese state-owned enterprise. China National Gold is China's only state-owned gold mining enterprise and China's biggest gold producer. It owns 39 percent of Vancouver-based China Gold and is perhaps best known for its failed attempt to buy African Barrick Gold a year ago from Barrick Gold Corp. Precious metal mining company share prices are already at rock bottom...and the Chinese know that...but they're such hard bargainers that they're always talking down whatever they're trying to buy. I spent 27 years in residential real estate here in Edmonton...and I'm intimately familiar with their mental processes when they're cash buyers. I'll be interested in the size of their prey when they finally do make a public bid for something. I found this Reuters story, filed from Vancouver on Thursday, posted on the gata.org Internet site yesterday. | ||

| Ted Butler: 2013 -- The Year of JPMorgan Posted: 04 Jan 2014 04:58 AM PST My objective is to understand what really moves the price of silver and gold - no more, no less. I’m not interested in making up stories that can’t be verified or documented; I would not put my name on anything that I did not believe to be factual and accurate. As has been the case for the past five years (since it acquired the concentrated short positions of Bear Stearns), 2013 was the year of JPMorgan in silver and gold. Everything important that transpired in silver and gold can be traced to JPMorgan, just as this bank will dictate what happens in the future. I realize I am being overly specific and that many different factors influence the price of any market; but the circumstances surrounding JPMorgan are so overwhelming as to render all those other factors combined moot when it comes to silver and gold. From the very beginning of the year to the last two days of 2013, JPMorgan has dominated and controlled the price of silver and gold. Here are the documented facts. At the start of 2013, with gold at $1650 and silver at $30, JPMorgan held short market corners in COMEX gold and silver futures. JPM was short 75,000 gold contracts (7.5 million oz) and 35,000 silver contracts (175 million oz). JPMorgan’s short market corners at the start of 2013 amounted to a 21% net share of the entire COMEX gold futures market (minus spreads) and an astounding (but typical) 35% of the entire COMEX silver market. No single entity had ever held such outsized and anti-competitive shares of any important regulated futures market. It is unreasonable not to associate such extreme market corners with what followed in price. This commentary by Ted was posted on his website on New Year's Day for his paying subscribers. I e-mailed him as soon as I read it and stated that it must go up in the public domain, as that's where it belonged...and I'm happy that he saw fit to do so. | ||

| The Good, The Bad and The Ugly: Gold in 2013 and the Outlook for 2014 Posted: 04 Jan 2014 04:17 AM PST Gold and Silver Have a Torrid 2013 – Fall 28% and 36% Respectively. But in 2014 there are far more positives for gold than negatives and the positives include ultra-loose monetary policies, risk of sovereign and banking debt crises………

CONTENTS - Outlook 2014 Conclusion Introduction With 2013 having come to a close, it is important to take stock and review how various assets have performed in 2013, assess the outlook in 2014, and even more importantly, the outlook for the coming years. 2013 was the year of the speculator and the year of the risk asset, such as equities, with global stocks doing well in the sea of liquidity and cheap money created by central banks. The MSCI World Index was up 23% and the S&P 500, the Nasdaq and the FTSE were up 32%, 35% and 14% respectively. MSCI World Index – 1970 to January 3, 2014 – Bloomberg Bond investors did not fare as well as interest rates began to rise from all-time record lows. As bond prices fell, interest rates rose. The bellwether 10-year Treasury note closed the year at 3.028%, which was up from 1.76% at the start of 2013 and the highest since July 2011. US 10 Year Note – 1964 to January 3, 2014 – Bloomberg The Barclays US Aggregate bond index, which is dominated by Treasury, mortgage and corporate bonds and is the leading benchmark followed by institutional money, is set to record its first negative year of total returns since 1999. The bond market's major benchmark registered a total return of minus 2.1% for 2013. It is only the benchmark's third annual negative total return since 1976, according to Barclays. REVIEW OF 2013 Gold and Silver Have a Torrid Year – Fall 28% and 36% Respectively

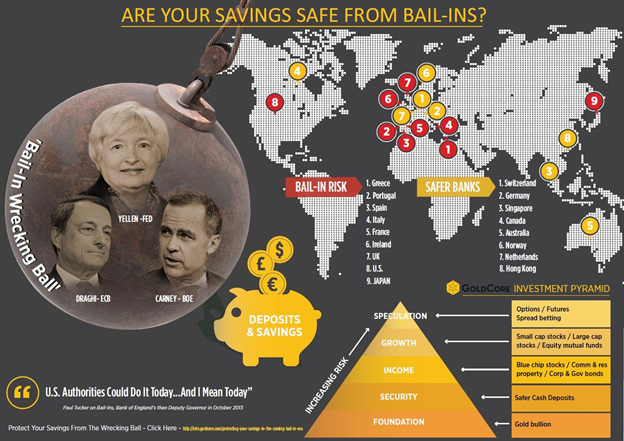

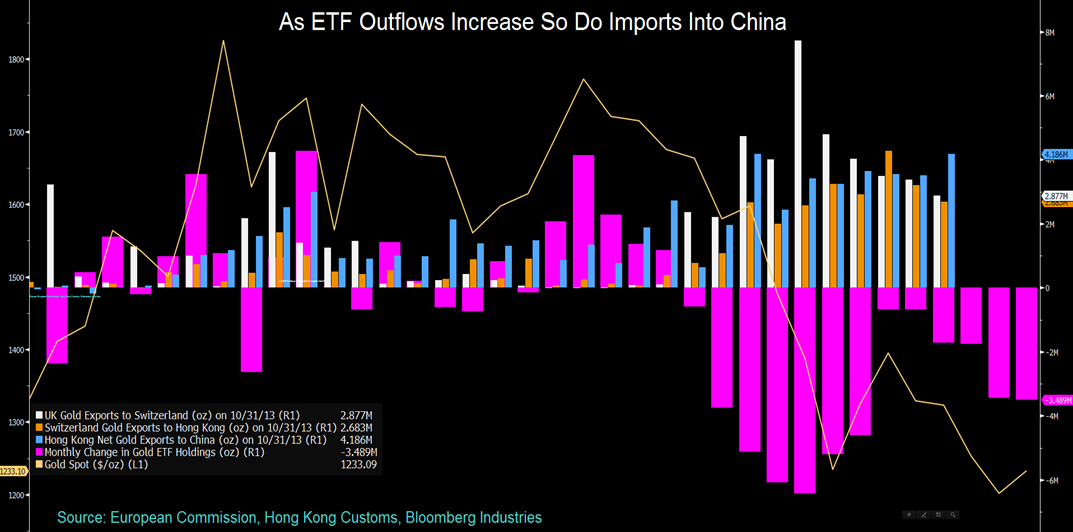

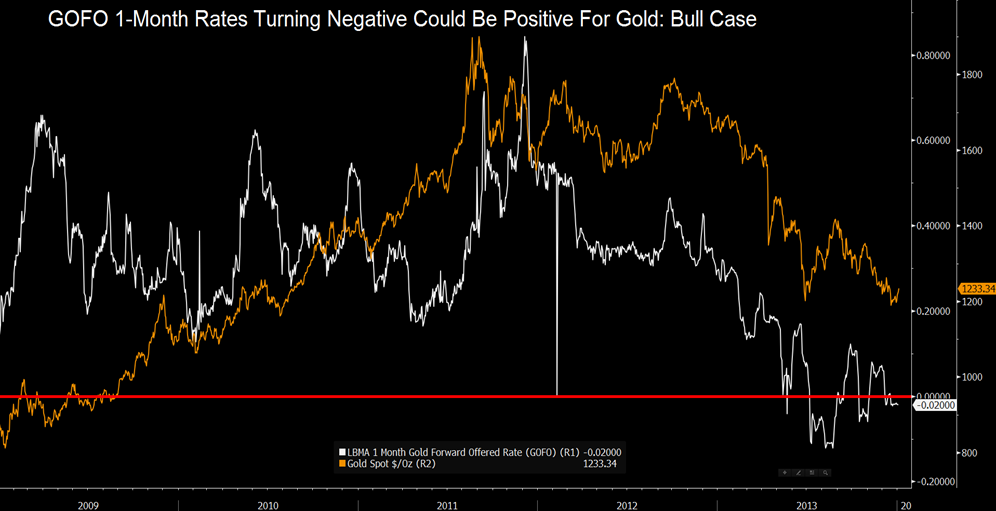

Silver was down by 36% in dollar terms and by more in the other currencies; silver had its poorest annual performance since 1984. Gold came under pressure in the first half of 2013 and saw falls from near $1,700/oz at the start of the year to $1,180/oz by mid-year. Indeed, gold's low for the year took place on June 28th, which was the last day of trading in Q2, and an important time frame for those evaluating gold's longer term performance. The price falls in the first half took place despite a positive fundamental backdrop and despite the risk of contagion in the Eurozone – especially from Spain, Italy and Greece. This risk was so great in the early part of the year that it led George Soros to warn in February that the Eurozone could collapse as the U.S.S.R. had. In March, Cyprus was the first country to experience a bank bail-in of depositors, where both individual and corporate account holders, experienced capital controls and a confiscation of nearly 50% of their deposits. In June and then again two weeks ago, the EU confirmed that depositors will be bailed in when banks are insolvent. International monetary and financial authorities globally, including the ECB, the Bank of England and the Federal Deposit Insurance Corporation (FDIC), have put in place the regulatory and legal framework for bail-in regimes in the event of banks failing again. Click On Image To See ‘Are Your Savings Safe From Bail-Ins Infographic’ Gold saw a bit of a recovery in the third quarter with gains in July and August as gold interest rates went negative, bullion premiums in Asia surged and COMEX inventories continued to fall. Silver surged 12% in 5 trading days in mid August due to record silver eagle coin demand and ETF demand. UK gold ‘exports’ to Switzerland increased greatly during the year due to demand for allocated gold in Switzerland due to Switzerland's tradition of respecting private property throughout the centuries and its strong economy. However, more importantly, UK gold exports to Switzerland were due to the significant increase in store-of-wealth demand from China and many countries in Asia. Institutional gold in the form of London gold delivery bars (400 oz) was exported to Swiss refineries in order to be recast into one kilogramme, 0.9999 gold bars used on the Shanghai Gold Exchange and in the Chinese market. However, this was not enough to prevent further falls in the final quarter and in recent days when gold has again tested support at $1,200/oz. Year Of Technical, Paper Selling But Robust Physical Demand German Gold Repatriation

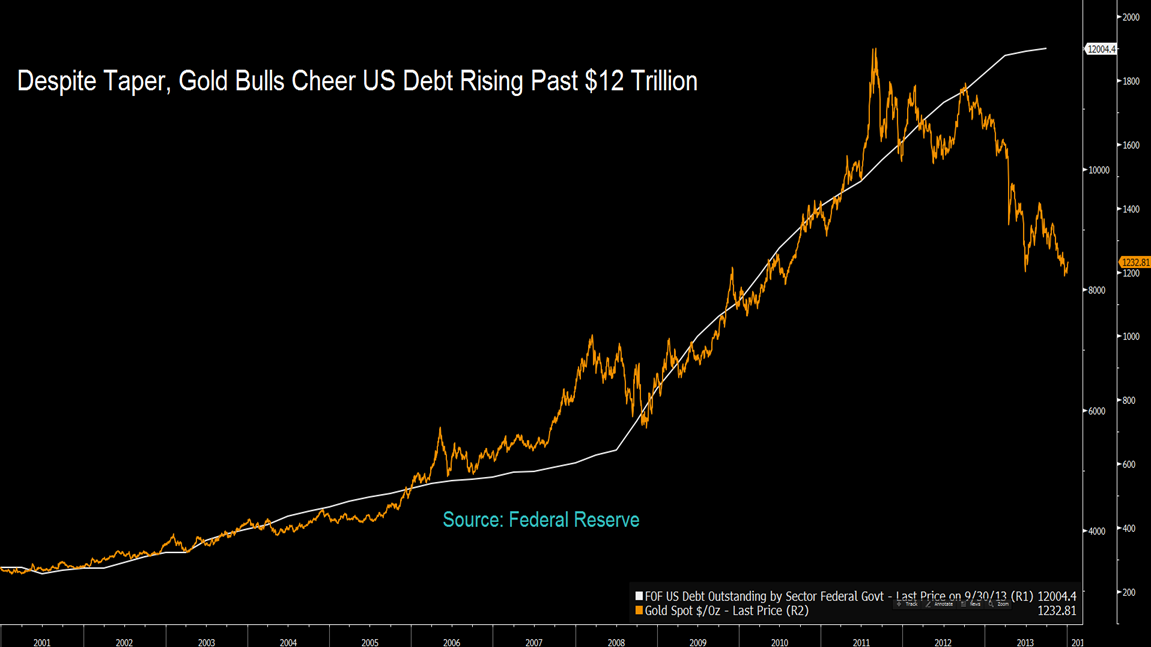

The repatriation of only some 20% of Germany’s gold reserves from the Federal Reserve Bank of New York and the Banque of Paris back to Frankfurt was meant to allay increasing German concerns about their gold reserves. But the fact that the transfer from the Federal Reserve is set to take place slowly over a seven year period and will only be completed in 2020 actually led to increased concerns. It also fueled concerns that the unaudited U.S. gold reserves may be less than what is officially recorded. What was quite bullish news for the gold market, saw gold quickly rise by some $30 to challenge $1,700/oz. The news was expected to help contribute to higher prices but determined selling saw gold capped at $1,700/oz prior to falls in price in February. Paper Selling On COMEX The sell off came as demand in Europe began to pick up due to concerns that the Cypriot deposit confiscation may be a precedent that could be seen in other EU countries. The speed and scale of the sell off was incredible and even some of the bears were surprised by it. Many questioned the catalysts for the $150 two day sell off. The sell off was initially attributed to an unfounded rumour regarding Cyprus gold reserve sales – this was soon seen to be a non-story. The Cyprus rumour did not justify the scale of the unprecedented sell off. Investment banks and hedge fund speculators can manipulate the paper or futures gold price in whichever direction they want in the short term due to the massive leverage they can utilise. The events in April further bolstered the allegations of manipulation by the Gold Anti-Trust Action Committee (GATA). Significant Demand For Physical Gold Globally This demand for physical gold was seen in western markets throughout the year. In April, the US Mint had to suspend sales of small gold coins; premiums for coins and bars surged in western markets due to high demand. Mints, refineries and bullion brokerages were quickly cleared out of stock in April and COMEX gold inventories plummeted. There were gold and silver coin and bar shortages globally. This continued into May as investors and savers globally digested the ramifications of the Cypriot deposit confiscation. The crash of the Nikkei in May also added to physical demand in Japan and by nervous investors internationally. This led to all time record gold transactions being reported by the LBMA at the end of May. Chinese demand remained very robust and Shanghai Gold Exchange volumes surged 55% in one day at the end of May – from 10,094 kilograms to 15,641 kilograms. There were "supply constraints" for gold bars in Singapore and bullion brokers in Singapore and India became sold out of bullion product at the end of May. This, and concerns about a very poor current account deficit and a possible run on the Indian rupee, prompted the Indian government to bring in quasi capital controls and punitive taxes on gold in June. Ironically, this led to even higher demand for gold in the short term and much higher premiums in India. Longer term, it has led to a massive surge in black market gold buying with thousands of Indians smuggling in gold from Bangkok, Dubai and elsewhere in Asia. June saw another peculiar sudden 6% price fall in less than 24 hours. This again contributed to increased and very robust physical demand. U.S. Mint sales of silver coins reached a record in the first half of 2013 at 4,651,429 ounces and the UK's Royal Mint saw a demand surge continuing in June after demand had trebled in April. Despite very high levels of demand for gold, in Asia especially, gold languished and sentiment in western markets continued to be very poor with gold falling to the lows of the year on June 28th. July saw continuing strong demand for gold internationally as volumes surged to records on the Shanghai Gold Exchange (SGE). Premiums rose and feverish buying left many of Hong Kong's banks, jewellers and even its gold exchange without enough gold bullion to meet demand. In August, demand remained elevated and gold forward offered rates (GOFO) remained negative and became more negative. This showed that physical demand was leading to supply issues in the highly leveraged LBMA gold market or the institutional gold bar market. Today, as we enter the New Year gold, forward offered rates (GOFO) remain negative, meaning banks, which had lent their customers gold to obtain a positive return, and therefore increase the “paper” gold supply, will take the gold back. This should limit the amount of gold on the market and increase the gold price. Chinese buyers are of increasing importance but it is important to note that physical demand rose significantly throughout the world in 2013 despite falling prices. This is seen in the levels of demand experienced by leading bullion dealers, refiners and government mints. This is clearly seen in the data released by the Perth Mint and the U.S. Mint which both saw increased demand for physical gold coins and bars in 2013. Other mints have yet to report their numbers. The Perth Mint of Western Australia reported yesterday that they saw a very significant increase in sales in 2013 despite the falling prices. Gold sales from the Perth Mint, which refines most of the bullion from the world's second-biggest producer Australia, climbed 41% last year. Sales of gold coins and minted bars totalled 754,635 ounces in 2013 from 533,333 ounces a year earlier, according to data from the mint. Silver coin sales surged 33% to about 8.6 million ounces from 6.5 million ounces in 2012, according to the Perth Mint. Gold bullion sales expanded 12% to 58,944 ounces in December from 52,700 in November and about 51,778 ounces in December 2012, according to data from the mint. Gold sales fell to as low as 30,430 ounces in August and peaked at about 112,575 in April, when gold was hammered 14% lower on the COMEX in just two days. Silver coin sales were 845,941 ounces last month from 807,246 in November and 452,389 a year earlier, it said. The U.S. Mint also saw an increase in physical gold sales and sold 14% more American Eagle gold coins last year and sales climbed 17% to 56,000 ounces in December from November, according to data on the mint's website as reported by Bloomberg. Syria and the Middle East Only the fact that President Obama and the U.S. were confronted with opposition by people internationally against another war and were outmaneuvered diplomatically, prevented the war with Syria. The war had the potential to destabilise the region with ramifications for oil prices and the global economy. U.S. Government Shutdown and $12 Trillion Default Risk They highlighted the dire U.S. fiscal position and the complete failure of the American political and economic class to deal with their extremely precarious financial position in any meaningful way. The U.S. government is essentially bankrupt with a national debt of over $17 trillion and unfunded liabilities of between $100 trillion and $200 trillion. In the coming months and years, it will lead to a lower dollar and much higher gold and silver prices. However, in the year of paper gold selling that was 2013, even this did not lead to higher gold prices. Continuing Central Bank Gold Demand

Central banks continued to be strong buyers of gold in 2013, albeit the full year data may show demand was at a slightly slower rate than the record levels seen in recent years. Q4 2013 will be the 12th consecutive quarter of net purchases of gold by central banks. Total official central bank demand continued at roughly 100 tonnes every single quarter. However, this does not include the ongoing clandestine and undeclared purchases of gold by the People's Bank of China. Conservative estimates put PBOC demand at 100 tonnes a quarter or at over 400 tonnes for the year. More radical projections are of demand of over 1,000 tonnes from the PBOC in 2013. Regulatory Authorities Investigate Gold Rigging Therefore, those who have diversified into physical gold will welcome the move by the German financial regulator BaFin to widen their investigation into manipulation by banks of benchmark gold and silver prices. In December, the German banking regulator BaFin demanded documents from Germany’s largest bank, Deutsche Bank, as part of a probe into suspected manipulation of the gold and silver markets.

The German regulator has been interrogating the bank’s staff over the past several months. Since November, when the probe was first mentioned, similar audits in the U.S. and UK are also commencing. Precious metal investors live in hope but their experience of such investigations is that they are often very lengthy affairs with little in the way of outcome, disclosure or sanction. The forces of global supply and demand, one anemic, the other very high, are likely to be more important and a valuable aid to gold and silver owners in 2014 and in the coming years. As ultimately, the price of all commodities, currencies and assets is determined by supply and demand.

Janet Yellen Becomes Fed Chair OUTLOOK FOR | ||

| [KR545] Keiser Report: Pickpockets Rule UK? Posted: 04 Jan 2014 03:31 AM PST We discuss the beggar economy in which the biggest pickpockets rule. We also look at the London Gold Fix, in particular, where every day for the past more than twenty years, pockets were picked every single day, according to the data. In the second half, Max interviews precious metals expert, James Turk, about his new book, “The Money Bubble,” and about the dollar, gold and Bitcoin. | ||

| Posted: 03 Jan 2014 11:16 PM PST Super Force Signals A Leading Market Timing Service We Take Every Trade Ourselves! Email: trading@superforcesignals.com

Precious Metals Positive Action Update Morris Hubbartt “Our main format is now video analysis…” Here are today’s videos: Gold Double Bottom Volume Analysis Chart Silver Rounding Bottom Update Chart Gold Stock Wedge Breakout Charts Thanks, Morris Unique Introduction For Web Readers: Send me an email to alerts@superforcesignals.com and I'll send you 3 of my next Super Force Surge Signals free of charge, as I send them to paid subscribers. Thank you!

The Super Force Proprietary SURGE index SIGNALS: 25 Super Force Buy or 25 Super Force Sell: Solid Power. 50 Super Force Buy or 50 Super Force Sell: Stronger Power. 75 Super Force Buy or 75 Super Force Sell: Maximum Power. 100 Super Force Buy or 100 Super Force Sell: "Over the Top" Power. Stay alert for our Super Force alerts, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals: Our Super Force signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successful business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager. Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

Email:

Mail: SFS Web Services 1170 Bay Street, Suite #143 Toronto, Ontario, M5S 2B4 Canada The post Super Force Signals appeared first on The Daily Gold. | ||

| Posted: 03 Jan 2014 11:14 PM PST Weekly Market Report by Alasdair Macleod, Goldmoney's Head of Research ___________________________________________________________________

Ends

NOTES TO EDITOR For more information, and to arrange interviews, please call Gwyn Garfield-Bennett on 01534 715411, or email gwyn@directinput.je GoldMoney is one of the world's leading providers of physical gold, silver, platinum and palladium for retail and corporate customers. Customers can trade and store precious metal online easily and securely, 24 hours a day. Historically gold has been an excellent way to preserve purchasing power over long periods of time. For example, today it takes almost the same amount of gold to buy a barrel of crude oil as it did 60 years ago which is in stark contrast to the price of oil in terms of national currencies such as the US dollar. GoldMoney is regulated by the Jersey Financial Services Commission and complies with Jersey’s anti-money laundering laws and regulations. GoldMoney has established industry-leading governance policies and procedures to protect customers’ assets with independent audit reporting every 3 months by two leading audit firms. GoldMoney has its headquarters in Jersey and also has offices in London and Hong Kong. It offers its customers storage facilities in Canada, Hong Kong, Singapore, Switzerland and the UK provided by the leading non-bank vault operators Brink’s, Via Mat, Malca-Amit, G4S and Rhenus Logistics. Visit www.goldmoney.com. The post Gold and silver on the turn? appeared first on The Daily Gold. | ||

| Posted: 03 Jan 2014 11:13 PM PST Time-preference and gold ___________________________________________________________________

Ends NOTES TO EDITOR For more information, and to arrange interviews, please call Gwyn Garfield-Bennett on 01534 715411, or email gwyn@directinput.je GoldMoney is one of the world's leading providers of physical gold, silver, platinum and palladium for retail and corporate customers. Customers can trade and store precious metal online easily and securely, 24 hours a day. Historically gold has been an excellent way to preserve purchasing power over long periods of time. For example, today it takes almost the same amount of gold to buy a barrel of crude oil as it did 60 years ago which is in stark contrast to the price of oil in terms of national currencies such as the US dollar. GoldMoney is regulated by the Jersey Financial Services Commission and complies with Jersey’s anti-money laundering laws and regulations. GoldMoney has established industry-leading governance policies and procedures to protect customers’ assets with independent audit reporting every 3 months by two leading audit firms. GoldMoney has its headquarters in Jersey and also has offices in London and Hong Kong. It offers its customers storage facilities in Canada, Hong Kong, Singapore, Switzerland and the UK provided by the leading non-bank vault operators Brink’s, Via Mat, Malca-Amit, G4S and Rhenus Logistics. Visit www.goldmoney.com. The post Time-preference and gold appeared first on The Daily Gold. | ||

| Metals & Markets: Gold & Silver Open 2014 With a Bang! Posted: 03 Jan 2014 11:07 PM PST

On this week’s SD Weekly Metals & Markets the Doc and Eric Dubin cover: – New Year’s upside reversal: PMs rise for a change- a sign of things to come in 2014? – Chinese buying remains strong- over 2,000 metric tons of gold withdrawn from Shanghai vaults in 2013! – Did Jon Nadler turn up [...] The post Metals & Markets: Gold & Silver Open 2014 With a Bang! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 03 Jan 2014 11:00 PM PST Mises.org | ||

| Economic Aspects Of The Pension Problem Posted: 03 Jan 2014 11:00 PM PST Gold University | ||

| The GLD Is A Short-Term No-Brainer, But You Must Be Nimble Posted: 03 Jan 2014 09:46 PM PST At the close of the year, we penned a piece entitled Expect January Ill-Effects this Year. You will want to read it, but in summary, we suggested that the great breadth of stock market rise in 2013 meant there was little room for a January Effect this year, especially given the Santa Claus Rally that drove stocks higher to close the year. What we did not say in that piece, is that capital flows out of stocks have to go somewhere, and if it is not going to be other stocks, then beaten down gold and relative securities like the SPDR Gold Shares (GLD), the Market Vectors Gold Miners (GDX) and iShares Silver Trust (SLV) make likely destinations for capital. We believe this is the reason why the GLD has climbed through the first two days of trading in 2014 against the SPDR S&P 500 (SPY) decline, and why | ||

| Ditch stocks and buy gold is the new buzz on the street Posted: 03 Jan 2014 07:54 PM PST The New Year edition of ArabianMoney investment newsletter’s bold call to buy the gold miners is now the talk of the street (subscribe here). Precious metal stocks add leverage to an advancing price of the metal itself and juices returns for investors. Is the trade of 2014 going to be ditching stocks and buying gold, with CNBC’s Melissa Lee and the Options Action traders… | ||

| Barrick pulls away from top 3 peers Posted: 03 Jan 2014 06:38 PM PST Among the top 3 North American gold miners - Barrick, Goldcorp and Newmont - the former made the strongest gains in the past month. | ||

| Gold surrenders 12-year winning streak Posted: 03 Jan 2014 05:21 PM PST While the Standard & Poor's 500 Index surged to a record in the broadest-ever advance and bonds worldwide lost money for the first time since 1999, gold fell 28%. | ||

| India beefs up customs in a bid to slow smuggling Posted: 03 Jan 2014 05:21 PM PST Travel to India has come under heavy scrutiny, with new customs norms checking bullion consignments to curb smuggling. | ||

| jan 3.2013:GLD holds firm/SLV holds firm/ Comex gold declines/ Gold and silver rise Posted: 03 Jan 2014 05:04 PM PST | ||

| Posted: 03 Jan 2014 04:58 PM PST This post includes charts of our silver producers index which contains 14 silver producers and is partially weighted by market cap. A few weeks ago, volume (smoothed) hit a 5-year low as the index was trying to make a new low. Note how the index was supported by a 13-year trendline.

A closer look reveals that the index closed at a 7-week high and on the highest volume since September. The same can be said for the SIL ETF. Our index did not penetrate the June low (unlike SIL). The post Silver Producers Index Update appeared first on The Daily Gold. | ||

| Can't-miss headlines: Colossus down, Mediterranean facelift, gold up & more Posted: 03 Jan 2014 04:39 PM PST The latest morning headlines, top junior developments and metal price movements. Today gold continues its early 2014 gains and Colossus outlines massively dilutive proposal. | ||

| Making Friends With The U.S. Dollar (Continued) Posted: 03 Jan 2014 03:43 PM PST By Ryan Puplava Last week I took a look at two major topics that affect the value of the US dollar index: the trade balance and the safety/risk-on trade. This week I'd like to conclude the discussion with some of the other major topics that affect how the dollar index trades. By looking at these factors, I hope to show that there are a plethora of factors that affect how the dollar index trades and that it is no simple matter. In some cases we can see that some long-existing trading patterns in the U.S. dollar are reversing while some still persist. Chasing Returns Sometimes the grass is greener on the other side. That's the perception one may have had of the financial markets in developed economies last year. Index performance for equities was primarily found in developed economies like Japan, United States and Germany. Performance was severely | ||

| Von Greyerz: Gold has moved out of central bank vaults to private vaults Posted: 03 Jan 2014 03:31 PM PST GATA | ||

| Gold Daily and Silver Weekly Charts - Release from the Year End Clamp Down Posted: 03 Jan 2014 03:31 PM PST Le Cafe Américain | ||

| Andy Hoffman Discusses the Comex Default Posted: 03 Jan 2014 03:00 PM PST On his weekly podcast, Andy Hoffman talks about gold and silver, COMEX, Dow, unemployment, Europe, India and precious metals. To listen to the interview, please click below: Andy Hoffman Discusses the Comex Default Similar Posts: | ||

| This is exactly how the world's best investors made fortunes last year Posted: 03 Jan 2014 02:44 PM PST From The Wall Street Journal: A trader who made more than $100 million from a $10 million bet against gold. A hedge fund that gained 42% after a bullish wager on stocks. A firm that saw returns of 48% thanks in part to soaring Japanese stocks. These were among the winning investors who managed to rack up huge gains forecasting a handful of key shifts in a year that vexed many market gurus. Many of the most lucrative moves required going against the prevailing wisdom, while others relied on bold calls about the impact government policy makers would have on share prices. Chris Tuohy, a senior trader in the London office of Tudor Investment Corp., a $14 billion hedge-fund firm, was one of the few to profit from... More on investing: | ||

| If You Want To Make Money This Year, You Have To Think Different Posted: 03 Jan 2014 02:08 PM PST U.S. markets registered their strongest year since 1997, with the S&P 500 climbing 30% for the year. European markets also did very well, posting their best performance since 2009, as fears of a eurozone breakup abated. 2013 was a very good year for the longs, for they could almost do no wrong. And it was a very bad year for anyone shorting anything, for no matter how ludicrously expensive a stock was, it kept going higher and higher and higher. It was also a very bad year for gold, registering its biggest drop since 1981, and the miners did even worse. However, don't expect this performance to be repeated two years in a row. As I have said in previous articles, my major concern is how the market will react now that the Fed has begun tapering. And personally I think the market will react negative, and at the very | ||

| Ted Butler: 2013 – The Year of JPMorgan Posted: 03 Jan 2014 01:45 PM PST

As has been the case for the past five years (since it acquired the concentrated short positions of Bear Stearns), 2013 was the year of JPMorgan in silver and gold. Everything important that transpired in silver and gold can be traced to JPMorgan, just as this bank will dictate what happens in the future. I [...] The post Ted Butler: 2013 – The Year of JPMorgan appeared first on Silver Doctors. | ||

| Great performance from Terratec raise drill at Patagonian gold/silver mine Posted: 03 Jan 2014 01:11 PM PST A newly delivered Terratec TR 2000 raise borer has been performing extremely well at a silver-gold mining operation in the harsh conditions of Argentinean Patagonia. | ||

| Japanese Hyperinflation, Coming Right Up! Posted: 03 Jan 2014 12:30 PM PST Long-time readers are well aware of our view of Japan's outlook, both short and long-term. Sadly, the days of its post-war "economic miracle" are so far in the rear view mirror, it's difficult to believe Japan was once considered America's chief economic rival. When Mitsubishi Real Estate acquired New York's Rockefeller Center in October 1989, the Nikkei was just two months from peaking at 39,000; while the Japanese real estate index briefly touched 250. Twenty-four years later, the Nikkei is just 16,000, whilst the real estate index is roughly 80, and new housing starts at an all-time low.

Based on such data, one might infer Japan's monetary policy has been highly conservative, and/or its economic fundamentals structurally flawed. Regarding the latter, such a conclusion is spot on; as not only have China and other Southeast Asian economies become lower-cost production hubs, but the "demographic hell" we wrote of 18 months ago is severely crimping the increasingly socialist nation's ability to fund itself. Just last week, it was reported that the Japanese population dramatically declined in 2013; and not only that, a spreading "zeitgeist" of sexual inactivity may well make the world's oldest population significantly older in the coming years. Given Japan's massive debt – at 214% of GDP, versus the global average of 51%; its ability to repay creditors, much less fund the retirement of tens of millions of senior citizens – is for all intents and purposes, ZERO. Conversely, its monetary policy has been as far from "conservative" as possible. Given that ALL fiat currency regimes are Ponzi schemes, it should be no surprise that Japan's population, exactly ten years older than that of the United States (45 versus 35) experienced its standard, Central bank fostered bubble exactly ten years earlier (1989 versus 1999). To wit, the Bank of Japan lowered its benchmark lending rate from 9% in 1980 to 2% in 1989, catalyzing a massive equity and property crash in December 1989 that reverberates to this day. Consequently, Japanese rates were effectively taken to zero in 1996, where they have since stayed; causing Tokyo to be ranked as the world's most expensive city for 14 of the past 20 years. Putting such inflation into perspective, the average price of a loaf of bread in Tokyo is $9.06, and a gallon of milk, $11.10. And oh yeah, the world's second most expensive city is Osaka. However, according to Japanese government propaganda – which frankly, makes U.S. propaganda appear tame, Japan is experiencing the world's worst deflation. Of course, as we wrote two years ago, inflation tends to attack what we "need versus want"; and thus, the fact that Japanese real estate investments are down is immaterial when calculating the comprehensive cost of living. Throw in the catastrophic impact of 2011's Fukushima nuclear incident, and it's quite clear Japan has indeed become the "Land of the Setting Sun." Unfortunately, Japan's "leadership" is engaging in the same, fatally flawed policies that have doomed hundreds of currencies throughout history, and dozens of civilizations. In its view, the only "alternative" is to continue printing money, lest the entire Japanese economy will instantaneously implode. And since it's been at it longer than any other nation, Japan's debt situation is far direr; and thus, its likely lifespan shorter. In re-electing Shinzo Abe to a second stint as Prime Minister last year – after his first stint, in 2006-07, was a miserable failure – the populace sentenced itself to economic death by enabling his suicidal "Abenomics" to be enacted. After ten unsuccessful rounds of "QE," Abe instituted the unprecedented "quantitative qualitative easing" in April 2013; in essence, aiming to double the Japanese money supply in two years – utilizing such funds to monetize not only JGBs, or Japanese Government Bonds, but stocks as well. The Bank of Japan's balance sheet is already much larger than the Fed's (excluding "off balance sheet" transactions, of course); and given that Japan's GDP and population sizes are just 40% of the U.S.'s, one can see just how dangerous the situation has become.

Moreover, Japan is – by far – the third largest holder of U.S. Treasuries, right behind China. And given how the Japanese government desperately needs to fund the retirement of its aging population, its recent halt of Treasury purchases may well morph into a wholesale sales waterfall in the coming years. Hence, the need for the Fed to engage in "QE to Infinity"; until eventually, its balance sheet is as unwieldy as the Bank of Japan's.

Not surprisingly, Abenomics has thus far been an unmitigated failure. Abe has succeeded in pushing the Nikkei up from 8,000 to 16,000. However, it is still 60% below its 1989 peak in nominal terms; and in real terms, at least 80% lower. Moreover, the Japanese CPI hit a fresh five-year high last month, with third quarter GDP growth – utilizing a woefully understated inflation deflator coming it at a paltry 0.5%. Worse yet, with a massive sales tax increase set to take effect in April – from 5% to 8% – it's entirely possible Japan will re-enter recession exactly a year after the commencement of Abenomics. It's no wonder Abe's approval rating is at an all-time low, and that a new $53 billion fiscal "stimulus" program – engendering additional money printing – has just been approved. However, the most worrisome aspect of Japan's descent into the abyss – which may well instigate a war with long-time enemy China – is its target of destroying the value of the Yen. As we wrote a year ago, Japan has been a key instigator of the "final currency war"; as in its goal to maintain jobs at the expense of real income (which has fallen for 17 straight months), it has catalyzed global outrage, and revitalized the "race to debase" like never before. To wit, when the Yen first breached the 103/dollar level to the upside in May, we wrote of how the "Real Yen bomb – starts NOW." Subsequently, the entire world did everything it could to stabilize the Yen's plunge. However, now that calls for increased Japanese QE are growing louder, the Yen has decidedly broken down – surging above 105/dollar as the calendar turned to 2014. As you can see below, such consternation has been caused by but a "blip" from the Yen's all-time high of 75/dollar roughly a year ago. In other words, while the absolute impact of 33% devaluation has been significant, it is immaterial compared to just how far the Yen could possibly fall; and thus, how intense the "final currency war" could get. When Japan's asset bubble burst in 1989, the Yen/dollar exchange rate was much lower than today, at 150/dollar; not to mention, 360/dollar when Nixon abandoned the gold standard in 1971.

This is not to say the Yen will fall that far. However, given the mounting debt, demographic, and inflationary issues, it is entirely possible the "worst-case scenario" befalls it. If this occurs – which frankly, we'd place alarmingly high odds on, there's no doubt Japan would experience a modern day version of hyperinflation – as the government desperately tries to "re-inflate" financial assets and indirectly repudiate debt. No doubt, Japan's $1.1 trillion of U.S. Treasuries would be aggressively liquidated, with demand for PHYSICAL gold and silver skyrocketing worldwide. And even if the Nikkei "pulls a Venezuela" by surging higher, real losses would inevitably dwarf the fleeting nominal gains – just as in Weimar Germany, late 2000s Zimbabwe, modern Venezuela, and countless other fiat cultures; not to mention, what appears to be commencing here in the States. In our view, Japan is one of numerous black swan possibilities in 2014; where unfortunately, the odds of catastrophic failure are rapidly mounting. How long it takes for the Japanese Yen to implode – potentially, like the Kryptonian sun – is beyond our ability to predict. However, there's no doubt it's coming; and if you haven't prepared beforehand, it will be too late when it does. And remember, the ENTIRE WORLD is now inter-twined by the U.S. dollar-based fiat currency standard; and thus, when one major component fails, everything fails.Similar Posts: | ||

| Fill or Kill: The Mechanics of Precious Metals Price Manipulation Posted: 03 Jan 2014 12:30 PM PST

Much confusion persists regarding the method, or mechanics, of how the big banks are able to push the price of precious metals around at will for so long. The confusion comes from declarations that on price drops, the bullion banks are selling. This then triggers the frequent and violent down-drafts we have witnessed over the [...] The post Fill or Kill: The Mechanics of Precious Metals Price Manipulation appeared first on Silver Doctors. | ||

| Alasdair Macleod: Gold and Silver on the turn? Posted: 03 Jan 2014 12:15 PM PST

Encompassing the year end and its holiday on Wednesday, this week has been notable for precious metals. For gold there have been three important features: firstly, Tuesday saw a powerful one-day reversal, with gold falling $22 before recovering by $32; secondly the $1182 low was first tested six months ago before rallying strongly to $1430, [...] The post Alasdair Macleod: Gold and Silver on the turn? appeared first on Silver Doctors. | ||

| Alasdair Macleod: Time-preference and gold Posted: 03 Jan 2014 12:11 PM PST GATA | ||

| China Gold eyes Canadian purchase but says prices still steep Posted: 03 Jan 2014 12:11 PM PST GATA | ||

| A Silver Short Squeeze Could Ignite A Major Rally Posted: 03 Jan 2014 11:53 AM PST Silver is poised for a massive recovery upleg in 2014, a mean reversion from last year's dismal action. The main driver of silver's initial strength will be American futures speculators covering shorts. These bearish bets on silver soared to a bull-record high last month, which will require exceptional buying to unwind. Futures speculators as a herd always bet wrong at major lows, they are a fantastic contrarian indicator. Because futures trading is such a hyper-leveraged zero-sum game, futures traders have a reputation of being smart and sophisticated. And they are to a great extent, futures are so unforgiving that survival of the fittest rules. Capital naturally flows from the poor traders to the good ones. Nevertheless, within their chests thump the same hopelessly emotional human hearts that are such a liability in the markets. Even good futures traders succumb to groupthink, getting too greedy or too scared with the rest of the herd. They flood into silver futures after the metal has already surged in strong uplegs, buying into the popular euphoria. Then they flee silver after it has plunged, waxing bearish with everyone else. This leads to buying high and selling low, the same emotional affliction that torments nearly every trader. Futures trading is one of the purest forms of speculation, making leveraged up-or-down directional bets on underlying prices. When these traders buy silver futures, they expect its price to rise imminently so they are effectively bullish on the metal. When they sell, they expect silver to fall in the near future so they are bearish. Thus looking at their aggregate bets on silver reveals their collective sentiment on it. Thankfully this useful data is readily available. All silver futures buying and selling gets distilled into the famous Commitments of Traders reports from the US Commodity Futures Trading Commission. These weekly reports show how futures speculators as a group are betting on silver. They've always been the most bearish, as evidenced by the most selling, right when silver happens to be carving major bottoms. Futures are a zero-sum game, every contract has a trader on the long side betting a price will rise and an opposing trader on the short side betting that same price will fall. Every dollar won by one trader is a direct dollar lost by the trader on the other side of that contract. The total number of longs and shorts in silver futures always nets to zero. But the classic CoT reports divide traders into three separate groups. They are commonly known as commercial hedgers, large speculators, and small speculators. Of course the first group actually produces or consumes physical silver for business purposes. They are simply trying to lock in future prices to better manage their cashflows. The latter two groups of speculators take the opposing side of those hedging trades, and it is their bets that are a powerful contrarian indicator. This first chart looks at the net-long and net-short positions among these broad categories of traders. The more net-long silver-futures speculators get, the more bullish they are on silver's price. But the opposite extreme is far more interesting today. The less net-long or even net-short speculators become on silver, the more bearish they are on it. And in recent weeks that bearishness has approached record extremes.