Gold World News Flash |

- 2014 – The Year to Invest in Gold

- Massive Short Squeeze In Gold Will Be Historic & Crush Shorts

- Here It Comes - More Leading Economists Call For Capital Controls

- Like Hathaway, Turk sees a massive short squeeze in gold

- Eric Lemieux: What Does 2014 Hold for Metals?

- Shorts Covering In Resource Sector Rally

- Conspiracy Fact?

- Your Front Row Seat To Argentina's (Latest) Currency Collapse

- Massive Short Squeeze In Gold Will Be Historic & Crush Shorts

- Louis Navellier & Chris Waltzek

- And The Best Performing Sector In 2014 Is...

- Knocking The Nikkei: Japan Down 500 From Yesterday's Highs

- Silver Breakout Ahead?

- Is The China Bank Run Beginning? Farmers Co-Op Unable To Pay Depositors

- A Stunning 63% Of Florida December Home Purchases Were "All Cash"

- Kosares on gold in disinflation; TF Metals Report on mining shares

- Koos Jansen: An open letter to CPM Group on Chinese gold demand

- Professional gold market ‘obsessed’ with tapering issues – GFMS

- Can’t-miss Headlines: Platinum strikes, Petra results and silver-rich resource estimates

- Morgan Stanley cuts 2014 gold target, sees ‘more pain to come’

- ETF sales restrain gold in thin trade

- Mali gold production rise to 51 tonnes in 2013

- Russian gold miners to cut 2014 output after price slump

- The Fed’s Equation for Stock Market Gains

- Economic Collapse 2014 -- Global Currency Reset in 2014

- Bank Of America: "Gold Squeeze Gets Explosive Above 1270"

- Japan Sees Net Gold Buying for 1st Year in 10

- Japan Sees Net Gold Buying for 1st Year in 10

- Silver 'Bullets' - Not just about Vampires and Werewolves

- The Commodities That Just Won’t Go Away

- Gold Investors Buy Signal Patience is Required

- Gold Prices Jump on India Import Debate, But Investing Demand Falls to 10% of Market from 40% Peak

- India plans no easing of gold restrictions, finance minister says

- Gold Slam-Dunk Sell or Buy Trade of the Year?

- Feds Unfettered

- Feds Unfettered

- The Ultimate Irony – Gold Bullion Is a Poor Investment According to “Too Big To Fail Banks”

- Simple Secret to Gold Stock Success

- Simple Secret to Gold Stock Success

- Gold Price's Next Big Test

- Gold Price's Next Big Test

- 14 Tough Questions Gold Investors Have for the Federal Reserve

- Silver Bullets - Not just about Vampires and Werewolves

- Fed Preparing To Shock The World As Global Collapse Unfolds

- The Gold Price Lost $3.30 Closing Today at $1,239

- The Gold Price Lost $3.30 Closing Today at $1,239

- Patience Required

- Are Wealthy Chinese Short Sellers A Source Of Future Demand?

- Gold, Money, Markets – Key Questions for 2014

- Understanding the London Gold Fix

| 2014 – The Year to Invest in Gold Posted: 23 Jan 2014 12:00 PM PST by ProfitConfidential.com, Gold Silver Worlds:

2013 was the first time in more than a decade that the gold prices headed south. Unsurprisingly, the major stock markets in the US did exceptionally well, and the economy also showed signs of revival. Considering the poor performance of gold in 2013, the general perception in the market today is that the era of investing in gold is over, and the yellow metal will continue to lose its value in the coming years. There is no denial that gold has always been viewed as a safe haven by the investors during times of economic crisis. However, it is also true that gold prices take a beating when the investor confidence in the economy improves. There is little surprise that gold lost about a quarter of its value last year and Dow Jones Industrial Average and S&P 500 offered returns in the excess of 25%. |

| Massive Short Squeeze In Gold Will Be Historic & Crush Shorts Posted: 23 Jan 2014 11:38 AM PST from KingWorldNews:

As I described on Monday, gold is like a rocket getting ready to go to escape velocity. Once gold shows it is going to stay above $1,250 for two consecutive trading days, with a little bit more upside momentum, that's going to be the signal to the major entities in gold that the downtrend which has been in place for the past two years is over — the mid-cycle correction is over. |

| Here It Comes - More Leading Economists Call For Capital Controls Posted: 23 Jan 2014 11:27 AM PST Submitted by Simon Black via Sovereign Man blog, As the saying goes, ‘desperate times call for desperate measures.’ The phrase is bandied about so frequently, it’s generally accepted truth. But I have to tell you that I fundamentally disagree with the premise. Desperate times, in fact, call for a complete reset in the way people think. Desperate times call for the most intelligent, effective, least destructive measures. But these sayings aren’t as catchy. This old adage has become a crutch– a way for policymakers to rationalize the idiotic measures they’ve put in place:

But hey… desperate times call for desperate measures. I guess we’re all just supposed to be OK with that. One of those desperate measures that’s been coming up a lot lately is the re-re-re-introduction of capital controls. It started in late 2012, when both the European Central Bank and the International Monetary Fund seperately endorsed the use of capital controls. For the IMF, it was a staunch reversal of its previous position, and Paul Krugman lauded the agency’s “surprising intellectual flexibility” a few days later. The IMF then followed up in 2013 with another little ditty proposing a global wealth tax. The good idea factory is clearly working ’round the clock over there. Lately, two more leading economists– Harvard professors Carmen Reinhart and Ken Rogoff– have joined the debate. In a speech to the American Economic Association earlier this month, the pair suggested that rich economies may need to resort to the tactics generally reserved for emerging markets. This is code for financial repression and capital controls. The idea behind capital controls is simple: create barriers to restrict the free flow of capital. And if you’re on the receiving end, capital controls can be enormously destructive. But for politicians, capital controls are hugely beneficial; once they trap funds within their borders, the money can be easily taxed, confiscated, or inflated. Historically, capital controls have been used in ‘desperate times’. Too much debt. Too much deficit spending. Wars. Huge trade deficit. Intentional currency devaluation. Etc. Does any of this sound familiar? It’s no surprise that policymakers have once again turned to this ‘desperate measure’. They’re already here. Iceland has capital controls, over five years after its spectacular meltdown. We can also see capital controls in Cyprus, India, Argentina, etc. I’ve been writing for years that capital controls are a foregone conclusion. This is no longer theory or conjecture. It’s happening. And every bit of objective evidence suggests that the march towards capital controls will quicken. This is a HUGE reason to consider holding a portion of your savings overseas in a strong, stable foreign bank where your home government won’t as easily be able to trap your savings. Other options including storing physical gold (even anonymously) at an overseas depository. Or if you’re inclined and tech savvy, you can also own digital currency. But perhaps the best way to move some capital abroad is to own foreign real estate, especially productive land. Foreign real estate is not reportable. It’s a great store of value. It generates both financial profits and personal resilience. It’s a LOT harder to forcibly repatriate. And it ensures that you always have a place to go in case you need to get out of Dodge. Even if nothing ‘bad’ ever happens, you won’t be worse off for owning productive land in a thriving economy. Like I said– desperate times don’t call for desperate measures. More than ever, it’s time for a complete reset in the way we look at the most effective solutions. These options are certainly among them. |

| Like Hathaway, Turk sees a massive short squeeze in gold Posted: 23 Jan 2014 11:17 AM PST 2:15p PT Thursday, January 23, 2014 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk, interviewed today by King World News, concurs with the Tocqueville Gold Fund's John Hathaway that a massive short squeeze is under way in gold: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/1/23_Ma... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Eric Lemieux: What Does 2014 Hold for Metals? Posted: 23 Jan 2014 11:00 AM PST By Peter Schiff, Gold Seek:

The Mining Report: Eric, your top stock pick in 2013 outperformed the S&P/TSX SmallCap Index. What’s your recipe for picking stocks in 2014? Eric Lemieux: The secret to success in picking stocks in 2014 will be simple: management. The senior vice president of Laurentian Bank Securities, who recruited me, asked me a question during my interview way back in 2007: What was the most important element when I was looking at a company? I started to talk about some financial ratios, etc. He began to laugh. He said there are three things: management, management and management. I know that’s easy to say, but it is true. It is the team that’s behind the company. That’s the most important secret for success. |

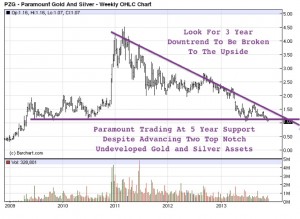

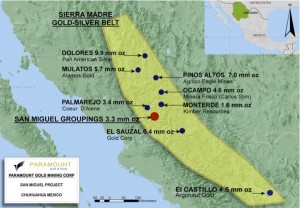

| Shorts Covering In Resource Sector Rally Posted: 23 Jan 2014 10:55 AM PST Edited and Updated Reprint Based on Premium Report from 12-3-13. The time to accumulate undervalued resource assets is waning as prices rebound. The time to buy is when they are priced at major lows with massive short positions. Now the public is concerned about declining gold prices. But that concern may be coming to an end. The shorts may have already begun to cover. Gold has broken above the 50 day moving average and appears to head higher. The recent decline of the Canadian Dollar and rise in both the TSX Big Board and Venture Index is positive for resource investors. Already many of our recent recommendations such as Enterprise (E.TO), Corvus Gold (KOR.TO), NuLegacy Gold (NUG.V), Canamex (CSQ.V), Lakeland (LK.V), Pele Mountain (GEM.V), Wellgreen Platinum (WG.V), Laramide Resources (LAM.TO), Big North Graphite (NRT.V), and Uranerz (URZ) have made significant breakouts and golden crossovers. This may be signaling the confirmation of my recent prediction of a major rally in the resource sector which could possibly last 3-5 years and be extremely powerful. Already some of these stocks are gapping higher like in the case of Zimtu Capital (ZC.V). Zimtu is a proxy for the early stage exploratory miners and its market cap was extremely undervalued compared to its Net Asset Value of equity being held. Zimtu may be an example for many of the early stage junior and this is typical of short covering rallies in extremely beaten down sectors. Gold and silver may make a double bottom off of these lows and the record amount of shorts may begin to cover as we are in the midst of major rally and as the momentum players turn positive. Keep a close eye on Paramount Gold and Silver (PZG) as there is a large short on it that may soon run for cover. The stock has recently made a 50% move from $.80 to $1.20 as the short position decreased from 13.27 million shares to 12.49 million shares. That is a decrease of 750,000 shares. I expect significant moves higher as the short position covers. The stock may break above the 200 day moving average as they publish positive news on both their high grade San Miguel Project and the large Sleeper Project in Nevada. Paramount has a large resource base of close to 7 million ounces of gold and around 150 million ounces of silver. Smart resource investors already know about their high grade San Miguel Project surrounding Coeur’s Palmarejo Mine in the Sierra Madre’s but they tend to forget the Sleeper Project in Nevada, which may be one of the largest undeveloped resources in Nevada. These world class assets in Mexico and Nevada provide great leverage to a rising gold and silver price. Paramount Gold and Silver (PZG) is one of the top tier junior miners with management, money, institutional support and some of the top mining assets in the world. Chris Crupi, CEO of Paramount Gold and Silver (PZG) has just come back from meetings with Asian investors where there is major demand for gold and silver mining assets in North America. Asian investors should continue diversifying away from U.S. and Canadian dollars and bonds into real wealth in the earth which is trading at multi-year lows. In addition, the majors such as Barrick, Newmont, Goldcorp, Fresnillo and Coeur D’alene may start looking for low cost projects with the ability to produce at least 100-200k ounces a year. Paramount may be one of the best junior miners out there today that fits that profile. Between the San Miguel Project in the heart of the famous Sierra Madre District and the Sleeper Project in the center of mining friendly Nevada, Paramount Gold and Silver should be an acquisition target on the radar of the intelligent mid-tier producers looking for low capex assets in stable jurisdictions. The 12 million+ shares of shorts combined with tax loss selling is driving the price down to five year lows. They should soon cover which could spark a major move in the price. Who knows…maybe the shorts may be driving it down so savvy investors can acquire a major position? We think this could be one of the worst stocks to short as it is on the radar screen of the majors who have been buying assets all around Paramount in the Sierra Madre’s, Alamos, Goldcorp, Carlos Slim…etc. The shorts may soon cover as some of the mid-tiers or majors may start bidding for Paramount which owns some of the best undeveloped assets in Mexico and Nevada, which are in the top five mining jurisdictions in the world. In the next few years Paramount could be producing 250k ounces a year at pretty low cash costs in stable jurisdictions. Analysts are applauding the recent metallurgical results from their 100% owned San Miguel Project in Mexico where Paramount is neighbored by major miners Coeur D’alene and Fresnillo. These results were excluded from the earlier PEA and proves now that additional deposits are amenable to using the lower cost heap leach process. The PEA will now be updated and Paramount will then move into Pre Feasibility. Paramount recently announced two core drilling rigs are now operating on San Miguel. Watch as the company may add some new high grade discoveries as the geological team has identified a 4 km vein called San Isidro and the La Bavisa target adjacent to the high grade Don Ese Resource. Paramount should have a steady flow of drill results, news and PEA updates in 2014. Paramount is currently trading at a major five year support level near $1. We think PZG could find a major bottom here. Look for the 3 year downtrend to be broken to the upside. See a recent new interview with PZG's CEO Chris Crupi below… Disclosure: Author Is Long Paramount and the company is a sponsor on my website. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Sign up for my premium service to see new interviews and reports by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… Please forward this article to a friend. To send feedback or to contact me click here… Listen to other interviews with movers and shakers in the mining industry below or by clicking here… Listen to internet radio with goldstocktrades on BlogTalkRadio

|

| Posted: 23 Jan 2014 10:48 AM PST by Bill Holter, Miles Franklin:

1. It will be understood that the central banks have far less gold than they had claimed 2. The true "fractional reserve" nature of the paper gold markets will become common knowledge I'd like to do a couple of things here, first use a little common sense to show that these will become "conspiracy fact" and then how might the "reaction" be. |

| Your Front Row Seat To Argentina's (Latest) Currency Collapse Posted: 23 Jan 2014 10:30 AM PST As those who follow Zero Hedge on twitter know, we have recently shown a keen interest in the collapse of the Argentine currency reserves - most recently at $29.4 billion - which have been declining at a steady pace of $100 million per day over the past week, as the central bank desperately struggles to keep its currency stable. Actually, make that struggled. Here is what we said just yesterday: As of today it is not just the collapse in the Latin American country's reserves, but its entire currency, when this morning we woke to learn that the Argentina Peso (with the accurate identifier ARS), had its biggest one day collapse since the 2002 financial crisis, after the central bank stopped intervening in currency markets. The reason: precisely to offset the countdown we had started several days back, namely "an effort to preserve foreign exchange reserves that have fallen by almost a third over the last year" as FT reported. As the chart below shows, the official exchange rate cratered by over 17% when the USDARS soared from 6.8 to somewhere north of 8. But as most readers know, just like in Venezuela, where the official exchange rate is anywhere between 6.40 and 11, and the unofficial is 78.85, so in Argentina the real transactions occur on the black market, where they track the so-called Dolar Blue, which as of this writing just hit an all time high of 12.90 and rising fast. What happens next? Nothing good. "The risk of capital flight is rising by the minute. This will be very hard to control," wrote Dirk Willer, strategist at Citigroup, adding that liquidity had "largely disappeared" with a risk of Venezuela-style capital controls. Ah Venezuela - that socialist paradise with a soaring stock market... even if food or toilet paper are about to become a thing of the past. Some other perspectives via the FT:

However, with the "currency run" having once again begun, absent a wholesale bailout and/or backstop by "solvent" central banks of Argentina, a country which has hardly been on good speaking terms with the western central banks, there is little that the nation can do. So for all those morbidly curious individuals who are curious what the slow-motion train wrecked death of yet another currency will look like, below is a link to the DolarBlue website, aka the front row seats where the true level of the Argentina currency can be seen in real time. If and when this number takes off parabolically, that's when the panic really begins - first in Argentina, then elsewhere. |

| Massive Short Squeeze In Gold Will Be Historic & Crush Shorts Posted: 23 Jan 2014 10:01 AM PST  With the price of gold soaring past the key $1,250 level, today James Turk warned King World News that this short squeeze in gold will be truly historic and crush the gold shorts. Turk also spoke about some price targets and predicted this advance will get very disorderly to the upside as the shorts panic. With the price of gold soaring past the key $1,250 level, today James Turk warned King World News that this short squeeze in gold will be truly historic and crush the gold shorts. Turk also spoke about some price targets and predicted this advance will get very disorderly to the upside as the shorts panic.This posting includes an audio/video/photo media file: Download Now |

| Louis Navellier & Chris Waltzek Posted: 23 Jan 2014 10:00 AM PST from GoldSeekRadiodotcom:

Gerald Celente & Chris Waltzek on GoldSeek Radio Louis Navellier manages over $8 billion in bonds and equities; he recently turned bullish on the precious metals, adding a new fund to the repertoire: Navellier Gold. He expects corporate earnings to improve all year causing discouraged bond holders to redirect capital into equities. Stock investors are cautioned to avoid overheated sectors, focussing instead on industries with the strongest fundamental scores. |

| And The Best Performing Sector In 2014 Is... Posted: 23 Jan 2014 09:59 AM PST |

| Knocking The Nikkei: Japan Down 500 From Yesterday's Highs Posted: 23 Jan 2014 09:43 AM PST With the ongoing strength in JPY, Japanese stocks (the highest beta to the previous collapse in the Yen) are crumbling. The Nikkei 225 is now down over 500 points from yesterday's highs and at its "cheapest" to the Dow this week... Still think it's all about China?

Fun-durr-mentals...

Charts: Bloomberg |

| Posted: 23 Jan 2014 09:40 AM PST by Ryan Jordan, Silver News Blog:

It looks as though last year's low of roughly 18.30 or so, will provide powerful support against shorts trying to take the market price to new depths. This support, in my mind, is all the stronger when you remember how at the end of December the paper pushers were able to knock gold right down to its June 2013 low—but they could not do the same thing to silver. All of the negative sentiment, the gloomy calls from investment banks, and talk of silver surpluses and gluts on the market still could not break the market for the white metal. I should also add the same was true for many of the leading silver mining stocks out there—when they were pressured lower in December, they too did not break down. |

| Is The China Bank Run Beginning? Farmers Co-Op Unable To Pay Depositors Posted: 23 Jan 2014 09:29 AM PST While most of the attention in the Chinese shadow banking system is focused on the Credit Equals Gold #1 Trust's default, as we first brought to investors' attention here, and the PBOC has thrown nearly CNY 400 billion at the market in the last few days, there appears to be a bigger problem brewing. As China's CNR reports, depositors in some of Yancheng City's largest farmers' co-operative mutual fund societies ("banks") have been unable to withdraw "hundreds of millions" in deposits in the last few weeks. "Everyone wants to borrow and no one wants to save," warned one 'salesperson', "and loan repayments are difficult to recover." There is "no money" and the doors are locked. The locked doors of one farmers' co-op...

Shadow Banking has grown remarkably...

As savers are promised big returns...

But recently things have turned around...

Rough Google Translation:

One depositor blames the government (for false promises):

But don't worry - this should all be settled by 2016...

So, for the Chinese, their bank deposits have suddenly become highly risky 2 year bonds... |

| A Stunning 63% Of Florida December Home Purchases Were "All Cash" Posted: 23 Jan 2014 09:12 AM PST Back in August, when we wrote that "A Stunning 60% Of All Home Purchases Are "Cash Only" - A 200% Jump In Five Years" based on Goldman data, many laughed, unable to fathom that the majority of the US housing market has become a flippers' game played by institutions and the uber wealthy, who don't need a stinking mortgage to buy that South Beach mansion. The implication of course being that housing is not effectively shut for that part of the population - the vast majority - that relies on credit to be able to purchase a home (a finding confirmed by the ongoing collapse in mortgage applications). As it turns out we were just a little ahead of the curve as usual, and as real estate company RealtyTrac reported overnight, with data that naturally is delayed due to the delayed impact of houses coming out of the much delayed foreclosure pipeline, "All-cash purchases accounted for 42.1 percent of all U.S. residential sales in December, up from a revised 38.1 percent in November, and up from 18.0 percent in December 2012." That's a 10% increase in one month for a 6-9 month delayed series, which means that in reality, roughly about 60% of all homes are now purchased with cold, hard cash. The chart below shows how in June and July the data finally started reflecting the Fed's September 2012 QEternity reality. As we said: 6-9 month lag. Incidentally, broken down by states, this is already confirmed in places like Florida, Wisonsin and Alabama. From RealtyTrac:

And rising fast. At this pace the entire US housing market will be at the mercy of flippers who have access to unlimited funding and are only buying a home, with zero regard for cost, in hopes of selling it to an even greater fool. Obviously, that has endless cheap credit happy ending written all over it. As for everyone else: please pay your landlord, Blackstone, at the end of the month. |

| Kosares on gold in disinflation; TF Metals Report on mining shares Posted: 23 Jan 2014 09:10 AM PST 12:05p ET Thursday, January 23, 2014 Dear Friend of GATA and Gold: Mike Kosares of Centennial Precious Metals in Denver today continues his analysis of how gold performs in various economic environments, this time disinflation, in which he finds gold does pretty well: http://www.usagold.com/cpmforum/2014/01/23/gold-as-a-disinflation-hedge And the TF Metals Report's Turd Ferguson is beginning to take renewed interest in gold and silver mining shares: http://www.tfmetalsreport.com/blog/5411/miner-possession CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and safeguards more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Koos Jansen: An open letter to CPM Group on Chinese gold demand Posted: 23 Jan 2014 09:04 AM PST 12:01p ET Thursday, January 23, 2014 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen today addresses an open letter to metals consultancy CPM Group, rebutting criticism of his calculation of Chinese gold demand and citing the rules of the Shanghai Gold Exchange in support of his calculation. Jansen's rebuttal is headlined "Open Letter to CPM Group" and it's posted at his Internet site, In Gold We Trust, here: http://www.ingoldwetrust.ch/open-letter-to-cpm-group CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans seminars in Asheville and Austin Gold advocate and mining entrepreneur Jim Sinclair will hold his next market seminars from 2 to 6 p.m. Saturday, January 25, at the Clarion Inn Asheville, 550 Airport Road, Fletcher, North Carolina, and from 2 to 6 p.m. Saturday, February 8, at the Austin, Texas, Airport Hilton. Advance registration is required. Details for the Asheville seminar are posted at Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/01/07/north-carolina-qa-session-venue-conf... Details for the Austin seminar are posted at JSMineSet.com here: http://www.jsmineset.com/2014/01/02/austin-texas-qa-session-confirmed/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT A Personal Touch in Buying Precious Metals If you've not secured your allocation of precious metals and numismatic coins, 2014 may be the last year to get them at affordable and undervalued prices. With huge amounts of gold leaving the West for Asia, the future availability of precious metals is very much in doubt. All Pro Gold has competitive pricing on all bullion and numismatic products -- and offers prompt delivery too. Long-time GATA supporters Fred Goldstein and Tim Murphy are glad to answer any questions or concerns about acquiring the monetary metals. All Pro Gold has an extensive electronic library of articles from the world's top market analysts. Learn more at www.allprogold.com or write to Fred and Tim at info@allprogold.com or telephone them at 1-855-377-4653. |

| Professional gold market ‘obsessed’ with tapering issues – GFMS Posted: 23 Jan 2014 08:55 AM PST Thomson Reuters GFMS has just published Update 2 for its 2013 gold survey and it doesn't hold out much comfort for the gold bulls, but is this analysis unduly pessimistic? |

| Can’t-miss Headlines: Platinum strikes, Petra results and silver-rich resource estimates Posted: 23 Jan 2014 08:55 AM PST The latest morning headlines, top junior developments and metal price movements. 70,000 platinum miners have downed tools in South Africa, Pilot Gold reports a "silver-rich" resource estimate and Petra looks forward to H2. |

| Morgan Stanley cuts 2014 gold target, sees ‘more pain to come’ Posted: 23 Jan 2014 08:55 AM PST The 2014 target was cut 12% to $1,160 an ounce and the prediction for 2015 reduced 13% to $1,138, analysts Peter Richardson and Joel Crane wrote in a report today. |

| ETF sales restrain gold in thin trade Posted: 23 Jan 2014 08:55 AM PST Sales from the SPDR gold ETF restrained the gold price from its expected rise but little more as trade in gold bullion was thin, says Julian Phillips. |

| Mali gold production rise to 51 tonnes in 2013 Posted: 23 Jan 2014 08:55 AM PST Output rose 2% to 51 tonnes last year, beating a government forecast of 49 tonnes, data from the country's mines directorate showed on Thursday. |

| Russian gold miners to cut 2014 output after price slump Posted: 23 Jan 2014 08:55 AM PST Petropavlovsk and Nord Gold plan to cut production this year as they focus on cost reduction after a slump in the gold price. |

| The Fed’s Equation for Stock Market Gains Posted: 23 Jan 2014 08:41 AM PST We put in a good-citizen call to the SEC the other day. "There's a massive scheme to manipulate stock prices," we told the friendly agent. "I have to tell you that your call is being monitored so that we can better serve the public," he replied. "Oh, don't worry about that. The NSA is tapping our call anyway." "Are you talking about a specific stock?" "Oh, no… I'm talking about all of them." "You mean a Madoff-style scandal?" "No… no… This is much, much bigger than the Madoff scandal. We're talking major manipulation. Intentional. Knowledge aforethought. Pumping up all stock prices. Trillions of dollars." "Who is doing this?" the agent asked… a certain tone creeping into his voice. He was starting to suspect he had a lunatic on the line. "The Fed, of course." Look at a stock chart… and you will see that the Fed's QE = U.S. stock market gains. "Uh… thank you…" "You gotta go after those bastards." "Uh… yes… we'll look into it." "OK, thanks. I just thought you should know." Wall Street shook the sleep from its head and rubbed its eyes last week. Investors shrugged off the bad news from Japan and Europe. As for the bad news from the U.S. itself… it hardly mattered. Yes, the economy was weaker than had been thought — with the worst jobs report in two years. No, there was not much good news coming from corporate earnings, either. But hey — asset values no longer depend on the performance of the Main Street economy. This is a manipulated market. The Dow rose more than 100 points, reversing a worrying trend. Since the start of the year, U.S. stocks have been selling off. But last Tuesday, investors found their footings… and recovered their delusions… Yes! The only thing that matters is that the Fed is on the case. Stocks are being manipulated to the upside. Willfully. Knowingly. Intentionally. Janet Yellen can talk about tapering quantitative easing (QE). But she can't do it. The economy needs more support from the Fed. But the Fed doesn't put more money into ordinary household budgets. You can see that just by looking at jobs, wages, or consumer prices. The U.S. CPI is barely going up at all. That's because the Fed's intervention stays in the financial economy — where the EZ money and credit as a result of ZIRP and QE feeds directly into stock, bond and real estate markets. Look at a stock chart… identify the episodes of QE… and you will see that the Fed's QE = U.S. stock market gains. Liquidity mainly drives asset prices, not the real economy. Asset prices do not reflect the genuine "facts on the ground" for businesses or consumers. They are jimmied and jived by the authorities. Last week, we noted that stocks, bonds and real estate have added $21 trillion to the nation's balance sheets since 2009. But at the rate the economy is adding real wealth, it will take 70 years to catch up with those asset prices. Stocks, bonds, and real estate are all counting on growth that will never happen. Or at least it won't happen soon enough to justify such high prices. What made stocks go up so much last year was that the Fed made a lot of liquidity available — while the federal government used less of it than it had the year before. This left a lot of excess liquidity wandering around looking for a home. What did it find? Stocks and housing! Most likely, this will continue. Stick with me now…

On the evidence… they're right! Without Fed support, the economy would probably be in recession. U.S. GDP went up about $350 billion last year. The Fed offset it with $1.2 trillion worth of QE. Even so, the economy only limps along. Without it, the economy slumps. The Fed can't tolerate a slump. So, it has to continue with QE. Meanwhile, the federal government is absorbing $400 billion less capital this year than last as a result of lower budget deficits. This leaves a lot of excess stray kittens in need of adoption. Who will take them in? Stocks! Real estate! Yes, dear reader, we will most likely see more gains in 2014. This is blatant manipulation of the markets. The Fed is open about it. Even proud of it. C'mon, SEC, you put the petty, two-bit manipulators in jail. A few million here and there. BFD! How about the big boys? How about a trillion-dollar conspiracy to raise stock prices? Arrest Janet Yellen! We want to see her do the perp walk. Bill Bonner Ed. Note: So if the Fed is manipulating the market to keep the politicians on Capitol Hill happy, where does that leave you as a saver? Not anyplace you'd choose to be. It's clear you can't depend on your elected officials to protect the value of your money. That's akin to allowing the fox to guard the hen house. Whether through inflation or taxes, they'll take what they want. So what is a self-reliant person to do? Find a loophole, of course. And readers of today’s Laissez Faire Today email edition were given a chance to discover a BIG one for themselves. One that could deliver them dozens of tax-free income checks every year. If you didn’t get today’s Laissez Faire Today, not to worry… You can sign up for FREE, right here, to ensure you never miss another great opportunity like this. So don’t wait. You’re next issues is always just a few hours away. Sign up for FREE, right here. This article originally appeared here. This article was also prominently featured in Laissez Faire Today. |

| Economic Collapse 2014 -- Global Currency Reset in 2014 Posted: 23 Jan 2014 08:30 AM PST Are Currencies Going To Be Reset In 2014? Spain's unemployment has now been above 25% for 6 quarters in a row with no signs of a recovery. Italian bad loans hit an all time new high and the situation in Spain, Italy, Greece, Cyprus, France is getting worse. Threats in Sochi are getting... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Bank Of America: "Gold Squeeze Gets Explosive Above 1270" Posted: 23 Jan 2014 08:26 AM PST Just out from Bank of America's head technician MacNeill Curry:

|

| Japan Sees Net Gold Buying for 1st Year in 10 Posted: 23 Jan 2014 07:44 AM PST Gold buying through No.1 retailer exceeds consumer sales, grows by two-thirds... TANAKA KIKINZOKU, which operates the largest gold retail chain in Japan, said this week that gold buying through its stores in 2013 exceeded customer selling for the first time since 2004. Gold trading on the Tokyo Commodity Exchange also rose last year, again bucking a long trend of falling volumes. Tocom gold trading peaked by weight in 2003, shortly after the price for buying gold in Japanese Yen turned higher from multi-decade lows. The Yen price of gold bullion has since trebled, hitting 30-year highs in the winter of 2012-2013. Japan's consumer price inflation rose to 1.2% by the end of last year, having been flat or falling for almost two decades. Economists point to the so-called Abenomics policies of new prime minister Shinzo Abe, plus aggressive quantitative easing by the Bank of Japan. It plans to double Japan's base-money supply by 2015, killing deflation and driving annual inflation up to 2.0%. "Investors have become concerned as Abenomics weakens the Yen," says brokerage Fujitomi's analyst Kazuhiko Saito, commenting to Bloomberg on the Tanaka data. Record Yen gold prices at the start of 2013 dented demand to buy gold, and "encouraged further dishoarding", says the new Gold Survey 2013 Update from metals consultancy GFMS, part of the Thomson Reuters group. But the nation's gold buying "returned to net demand, the first time since 2008," as prices then fell in line with global quotes amid the sharp sell-off by Western fund managers. Furthermore, says GFMS, Japan's private gold buying "may have also [been] encouraged" in late 2013 by the coming sales-tax hike, set for April 2014 and taking the levy on new purchases from 5% to 8% by value. Overall, Japanese gold jewelry demand rose 8% last year from 2012. So-called "scrap" sales in contrast, meaning old or unwanted items sold back by households to raise cash, plus metal reclaimed from waste electronics, fell by almost one-eighth. |

| Japan Sees Net Gold Buying for 1st Year in 10 Posted: 23 Jan 2014 07:44 AM PST Gold buying through No.1 retailer exceeds consumer sales, grows by two-thirds... TANAKA KIKINZOKU, which operates the largest gold retail chain in Japan, said this week that gold buying through its stores in 2013 exceeded customer selling for the first time since 2004. Gold trading on the Tokyo Commodity Exchange also rose last year, again bucking a long trend of falling volumes. Tocom gold trading peaked by weight in 2003, shortly after the price for buying gold in Japanese Yen turned higher from multi-decade lows. The Yen price of gold bullion has since trebled, hitting 30-year highs in the winter of 2012-2013. Japan's consumer price inflation rose to 1.2% by the end of last year, having been flat or falling for almost two decades. Economists point to the so-called Abenomics policies of new prime minister Shinzo Abe, plus aggressive quantitative easing by the Bank of Japan. It plans to double Japan's base-money supply by 2015, killing deflation and driving annual inflation up to 2.0%. "Investors have become concerned as Abenomics weakens the Yen," says brokerage Fujitomi's analyst Kazuhiko Saito, commenting to Bloomberg on the Tanaka data. Record Yen gold prices at the start of 2013 dented demand to buy gold, and "encouraged further dishoarding", says the new Gold Survey 2013 Update from metals consultancy GFMS, part of the Thomson Reuters group. But the nation's gold buying "returned to net demand, the first time since 2008," as prices then fell in line with global quotes amid the sharp sell-off by Western fund managers. Furthermore, says GFMS, Japan's private gold buying "may have also [been] encouraged" in late 2013 by the coming sales-tax hike, set for April 2014 and taking the levy on new purchases from 5% to 8% by value. Overall, Japanese gold jewelry demand rose 8% last year from 2012. So-called "scrap" sales in contrast, meaning old or unwanted items sold back by households to raise cash, plus metal reclaimed from waste electronics, fell by almost one-eighth. |

| Silver 'Bullets' - Not just about Vampires and Werewolves Posted: 23 Jan 2014 06:12 AM PST The idea that bullets made from silver offered an effective (sometimes only) means of dispatching evil entities from vampires to werewolves, has been around in popular mythology for quite some time. A Brothers Grimm fairy tale called The Two Brothers, features a supposedly conventional bullet-proof witch being given an attitude adjustment via the use of silver bullets. According to Bulgarian legend, Delyo, a 17th century rebel who led forces against the Ottoman Empire, was immune to injury from either swords or guns, so his enemies cast a silver bullet in order to dispatch him from the scene. |

| The Commodities That Just Won’t Go Away Posted: 23 Jan 2014 06:00 AM PST I hope you’re hunkered down from the big chill this month. Wow, we've seen some cold. It was so cold a few weeks ago that one of my cats stuck his face outside one morning and literally jumped back into the house. Cold, right? And here we are with another polar vortex breathing down our neck. It’s “historic cold,” said the weather guy on television. Something to look forward to, I suppose. Meanwhile, let’s take a look at a metals sector that's still poised to heat up… Earlier this month, The Wall Street Journal ran an article by a member of its staff, Joseph Sternberg, entitled “How the Great Rare Earth Metals Crisis Vanished.” The article was on the editorial page. Then again, the WSJ doesn’t do horoscopes and astrology. Still, my question is why the WSJ ran an article that’s so off base and misleading. Here’s my take on this "rare" metals sector… Mr. Sternberg began by describing China’s rare earth (RE) export embargo against Japan in 2010. Mr. Sternberg basically got that part correct. The Chinese 2010 embargo was due to a disputed boundary with Japan — and really, are there any other kinds of China-Japan boundaries? The two countries are arguing over everything. Now, if you follow East Asia news, that set of China-Japan boundary issues is ongoing. Right off the bat, I believe that we could still see future Chinese RE embargoes. But that’s not really my focus here. The Chinese still hold the trump card when to comes to RE production – they still produce over 95% of the world's supply. My beef with Mr. Sternberg began when he wrote, “Global [RE] prices rose dramatically [in 2010], creating an incentive for new miners to start production, and an opportunity for them to profit.” Well, yes and no. Prices rose in 2010 and 2011, to be sure. Then prices fell dramatically over the next two years, for a variety of reasons. Meanwhile, today, in 2014 — three years later — there’s almost no new, non-Chinese RE production on the global market. There’s certainly nothing much from new miners in the West. Moving along, it’s accurate to say that nobody in the new miner RE arena is making any money. In fact, most new, Western (i.e., non-Chinese) RE plays that are still in business are cash burners. Most are far from cash flow, let alone profitability. Mr. Sternberg also writes that “New supplies for most rare earths are coming online, as uncertainty over China’s reliability and a period of higher prices stimulated investment in new mining projects elsewhere.” No, that’s not what happened or what’s happening. New supplies for most RE are NOT “coming online.” This is especially the case for heavy RE elements (i.e., RE elements with high atomic numbers). These RE are used as lighting phosphors and in high-end electronics. Even the magnet-oriented RE elements are still in tight long-term supply. Western RE users remain nervous about China’s reliability as a long-term supplier. But contrary to Mr. Sternberg’s positive implication for the future, the RE crisis is not resolving, let alone has it somehow “vanished.” The Chinese still hold the trump card when to comes to RE production – they still produce over 95% of the world's supply. Any new RE project makes for very hard, expensive work. Indeed, most non-Chinese RE projects of recent vintage are barely past the drilling and assay stage. There are a number of Canadian-compliant 43-101 resource estimates floating around, and the odd pre-feasibility study. But the industrial world is a long way from banking and building any new mining projects outside China. They’re not there. Not even close. This last point barely scratches the surface of what happens after a Western firm receives permission to open or build a mine — from a long list of flinty government entities, I must add, among whom many players can say no. Along the way, mining company managers have to multitask and juggle financing, design, pilot-scale testing, construction, build-out and final testing. Perhaps some day, one or more RE wannabes will even process some ore and make what’s called a concentrate. Then after that, there’s complex downstream chemistry, which is a combination of Ph.D.-level industrial effort, innumerable trade secrets and just plain metallurgical black art. There’s nothing easy about any of this, at any stage. Through it all, there’s very little in the way of a non-Chinese RE supply chain, in any sense of the word. There are very few Western companies with the actual background, engineering skill and know-how to design and build RE systems. There are almost no universities in the U.S. or Canada with dedicated RE educational pipelines. (Colorado School of Mines started a focused RE program all of two years ago.) Any Western RE business wannabe has to kick down doors (figuratively, but maybe literally in some instances) to convince potential users/customers to take significant risks and make an early-stage deal. Whatever the frustrations, however, it’s necessary for the upstream miner to work with the eventual downstream RE user early on to determine exactly what kind of end-product to supply. Why must miners and customers/users get together so early? Because iron ore is iron ore, copper is copper and gold is gold. But almost every application for RE is different and unique. That is, every light bulb maker has a different approach to specifying its RE phosphor. Every electronics maker has a different approach to what it wants. Every magnet maker has its own secret formula. In short, things get down to the molecular shape of the RE oxide or salt coming out of a metallurgical process, and there’s much that’s simply unknown to early-stage developers. You just have to start early or you’re wasting time and money. So no, contrary to the WSJ, the RE crisis has not resolved, let alone “vanished.” The market is still poised for a 2010-style melt up. Here in the Western world, there’s generally more awareness of how RE fit into modern industry and defense applications. It’s better now than just a few years ago. But today, there’s virtually no more physical RE product — not from a non-Chinese supply chain, that is. There are opportunities to play this monopolized market, if you know where to look. But rest assured these are specialized plays. I'd steer clear of the market darlings, like Molycorp, and look to smaller, focused opportunities. Looking ahead, Western RE users had better hope that any number of these small, focused mineral and processing plays can make it through the next few years, after a totally miserable 18 months in the junior resource market. Because right now, that’s what’s out there. Otherwise, we had all better brush up on our Mandarin. Best wishes… Byron W. King Ed. Note: Global demand for rare earths is high as ever. And as long these elements are needed to produce things like cell phones, TVs and light bulbs, that’s not likely to change. The question is, how do you play the trend? To learn more – including how to get the opportunity to discover real, investable stock picks – sign up for the FREE Daily Resource Hunter email edition. Original article posted on Daily Resource Hunter |

| Gold Investors Buy Signal Patience is Required Posted: 23 Jan 2014 05:59 AM PST In my last post I noted that gold could give a major buy signal in the next 2-3 weeks. Let me stress again that patience is required right here. Gold has to confirm the intermediate rally first. That means it needs to break above $1268 and make a higher high. If it doesn't do that then no buy signal will be generated. Without a reversal of the pattern of lower lows and lower highs then this is just another weak bear market rally destined to roll over and break the bulls hearts again. |

| Gold Prices Jump on India Import Debate, But Investing Demand Falls to 10% of Market from 40% Peak Posted: 23 Jan 2014 05:52 AM PST GOLD PRICES jumped more than $20 from last night's 2-week lows at $1231 per ounce Thursday lunchtime in London, rising sharply after Sonia Gandhi, leader of India's ruling Congress Party, asked the government to relax its anti-gold import rules ahead of this May's election. Finance minister P.Chidambaram, being interviewed today at the Davos World Economic Forum in Switzerland, said there will be no change before next month's budget. Opposition leader Narendra Modi of the BJP, who claimed this weekend that May's election is already won, has aligned himself with the gold and jewelry industry, repeatedly calling for the import restrictions to be lifted. "Gold prices should be underpinned by strong physical demand in Asia, especially if Indian import restrictions are relaxed," says Jonathan Butler of Japanese conglomerate Mitsubishi, writing in this week's new LBMA 2014 forecasts contest. "Should trade restrictions be relaxed," agrees Suki Cooper at London market-makers Barclays, "prices are more likely to find a stronger floor." But reviewing 2013's market action, "The defining factor," says the new Gold Survey 2013 Update from Thomson Reuters GFMS, the leading data consultancy in physical gold flows, "[was] the investor sell-off and subsequent gold price declines." Despite record levels of "gold bar hoarding" by Asian households (up 49% on 2012 despite the effective ban on Indian imports), plus a 33% surge in gold-coin minting to a new annual record, total investment demand worldwide fell by two-thirds to 458 tonnes on GFMS' data. Down below 10% of the total market, that compares with a peak at 40% of global gold demand in 2011. "While the private investor once again demonstrated a near-voracious appetite for gold in the wake of a sharp weakening in prices," says GFMS head of metals research & forecasting Rhona O'Connell, "the key story in 2013 was that of the professional investor's loss of interest in the metal." Looking ahead, "Improving economic fundamentals [will] likely militate against hefty gold investment...but physical demand is expected easily to be robust enough to defend any test of the $1000 level." Comparing last year's supply and demand – which ended with the balancing item of "implied disinvestment" equal to 8% of identifiable demand at 383 tonnes – "the underlying market surplus is likely to narrow in 2014," says GFMS new update. "Indeed the fundamentals point to a gold market more or less in balance...lead[ing] to an expected price upturn in the final four months of the year" towards $1300. Gold mining supply rose 4% for the year, says GFMS new update, but that was outweighed by a sharp fall in so-called "scrap" supplies from the cash-for-gold market worldwide. Scrap gold sold by US households fell to a 5-year low. Middle East scrap flows dropped to a 12-year low as prices fell at the fastest pace since 1982. |

| India plans no easing of gold restrictions, finance minister says Posted: 23 Jan 2014 05:45 AM PST No Plans to Roll Back Gold Import Curbs -- Chidambaram By Suvashree Choudhury & Siddesh Mayenkar MUMBAI -- India is not planning any changes to its record import duty on gold and other restrictions on imports until the current account deficit is firmly under control, Finance Minister P. Chidambaram told CNBC TV18 in Davos. "Until we have a firm grip on the current account deficit I do not contemplate any roll back in any measure. We will have a full idea of the current account deficit only when the budget is presented and when the year comes to an end," Chidambaram said. He was answering a question about an earlier TV report that Sonia Gandhi, the leader of the ruling Congress party, had written to the government asking for gold import restrictions to be eased. Chidambaram said he had not read the letter. ... ... For the full story: http://in.reuters.com/article/2014/01/23/gold-india-chidambaram-idINDEEA... ADVERTISEMENT A Personal Touch in Buying Precious Metals If you've not secured your allocation of precious metals and numismatic coins, 2014 may be the last year to get them at affordable and undervalued prices. With huge amounts of gold leaving the West for Asia, the future availability of precious metals is very much in doubt. All Pro Gold has competitive pricing on all bullion and numismatic products -- and offers prompt delivery too. Long-time GATA supporters Fred Goldstein and Tim Murphy are glad to answer any questions or concerns about acquiring the monetary metals. All Pro Gold has an extensive electronic library of articles from the world's top market analysts. Learn more at www.allprogold.com or write to Fred and Tim at info@allprogold.com or telephone them at 1-855-377-4653. Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Jim Sinclair plans seminars in Asheville and Austin Gold advocate and mining entrepreneur Jim Sinclair will hold his next market seminars from 2 to 6 p.m. Saturday, January 25, at the Clarion Inn Asheville, 550 Airport Road, Fletcher, North Carolina, and from 2 to 6 p.m. Saturday, February 8, at the Austin, Texas, Airport Hilton. Advance registration is required. Details for the Asheville seminar are posted at Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/01/07/north-carolina-qa-session-venue-conf... Details for the Austin seminar are posted at JSMineSet.com here: http://www.jsmineset.com/2014/01/02/austin-texas-qa-session-confirmed/ |

| Gold Slam-Dunk Sell or Buy Trade of the Year? Posted: 23 Jan 2014 05:42 AM PST Mohammad Zulfiqar writes: Demand for gold bullion remains high. Each day there’s a new piece of information that continues to attest to this phenomenon. With this, I remain bullish on the yellow shiny metal. But one thing should be noted: I am not saying the bottom has been placed in, but that all the indicators are suggesting a bottom may be in the making. |

| Posted: 23 Jan 2014 02:25 AM PST Hold onto your gold. You're going to need it... HOW DO YOU like those pols? asks Bill Bonner in his Daily Reckoning. The shackles of sequester were beginning to chafe their ankles. So, what do they do? Get out the files and bolt cutters, of course! Yes, dear reader, we can stop worrying. The feds have no intention of cutting back the zombies. The Fed has no intention of tapering off. And the big crisis that was on the horizon has no intention of going away. So yes, hold onto your gold. You're going to need it. The problem is too much spending and too much debt. It's a problem that gets worse every day. The US federal government has made promises to the voters that it can't keep. If it honors its commitments, spending will outstrip tax receipts from here to kingdom come. Or until lenders come to their senses. Whichever comes first. Then, there will be only one source of funding left – the Fed. The Fed already provides enough to fund the entire US deficit, and more, with the excess pushing up asset prices. If it keeps buying assets at the present rate, by about 2080, it will own everything in America...every house, every bond, every company, every shopping mall, and every baby stroller. In short, the feds are on a crash-course with reality. They can't spend more than they take in forever. And they can't fund the deficit with printing press money forever either. Forever is still a long way off. But eventually, someone, somewhere, sometime, somehow will have to come to grips with it. There are two ways to do so. Voluntarily. Or involuntarily. The Fed took a baby step towards a voluntary solution when it began to taper off its QE program. You already know our opinion: it won't continue. Congress also took a small step in the right direction, when it voted to stop spending so much money by automatically 'sequestering' part of its outlays. But last week, the pols got together and made a $1.1 trillion deal that effectively undoes the sequester provisions. Veronique de Rugy of George Mason University reports in the Washington Examiner:

Of course, the zombies at the Pentagon aren't the only winners:

Thank you, dear Congress. You've reaffirmed our faith in cronyism. |

| Posted: 23 Jan 2014 02:25 AM PST Hold onto your gold. You're going to need it... HOW DO YOU like those pols? asks Bill Bonner in his Daily Reckoning. The shackles of sequester were beginning to chafe their ankles. So, what do they do? Get out the files and bolt cutters, of course! Yes, dear reader, we can stop worrying. The feds have no intention of cutting back the zombies. The Fed has no intention of tapering off. And the big crisis that was on the horizon has no intention of going away. So yes, hold onto your gold. You're going to need it. The problem is too much spending and too much debt. It's a problem that gets worse every day. The US federal government has made promises to the voters that it can't keep. If it honors its commitments, spending will outstrip tax receipts from here to kingdom come. Or until lenders come to their senses. Whichever comes first. Then, there will be only one source of funding left – the Fed. The Fed already provides enough to fund the entire US deficit, and more, with the excess pushing up asset prices. If it keeps buying assets at the present rate, by about 2080, it will own everything in America...every house, every bond, every company, every shopping mall, and every baby stroller. In short, the feds are on a crash-course with reality. They can't spend more than they take in forever. And they can't fund the deficit with printing press money forever either. Forever is still a long way off. But eventually, someone, somewhere, sometime, somehow will have to come to grips with it. There are two ways to do so. Voluntarily. Or involuntarily. The Fed took a baby step towards a voluntary solution when it began to taper off its QE program. You already know our opinion: it won't continue. Congress also took a small step in the right direction, when it voted to stop spending so much money by automatically 'sequestering' part of its outlays. But last week, the pols got together and made a $1.1 trillion deal that effectively undoes the sequester provisions. Veronique de Rugy of George Mason University reports in the Washington Examiner:

Of course, the zombies at the Pentagon aren't the only winners:

Thank you, dear Congress. You've reaffirmed our faith in cronyism. |

| The Ultimate Irony – Gold Bullion Is a Poor Investment According to “Too Big To Fail Banks” Posted: 23 Jan 2014 02:24 AM PST Analysts at the "Too Big To Fail" banks are unanimously predicting lower gold prices and telling their clients to dump gold. On January 12, 2013 Goldman Sachs predicted that gold could fall to as low as $1,000 this year due to a less expansive monetary policy by the Federal Reserve. In a report to clients [...] |

| Simple Secret to Gold Stock Success Posted: 23 Jan 2014 02:21 AM PST Picking gold mining stocks isn't simple, but the key secret is... MINING STOCK analyst Eric Lemieux joined Laurentian Bank Securities in 2008. Having worked for nine years as a consultant responsible for applying Regulation NI 43-101, Lemieux has also worked at the Montreal Exchange, and also managed exploration projects for Cambior, Noranda and Soquem. Holding two masters degrees (in mineral economics and in metamorphic-structural geology) Lemieux explains to The Gold Report how the big secret to successful gold stock investing in fact starts with people... The Gold Report: Eric, your top stock pick in 2013 outperformed the S&P/TSX SmallCap Index. What's your recipe for picking stocks in 2014? Eric Lemieux: The secret to success in picking stocks in 2014 will be simple: management. The senior vice president of Laurentian Bank Securities, who recruited me, asked me a question during my interview way back in 2007: What was the most important element when I was looking at a company? I started to talk about some financial ratios, etc. He began to laugh. He said there are three things: management, management and management. I know that's easy to say, but it is true. It is the team that's behind the company. That's the most important secret for success. The Gold Report: You're predicting an average gold price of $1400 per ounce in 2014. That's down from the previous estimate of $1750 per ounce. Nonetheless, most observers would call $1400 per ounce optimistic given the current spot price. What gives you confidence that the gold price will rise in 2014? Eric Lemieux: I'm fairly optimistic. The price of gold is gravitating around $1200 per ounce, so there's a substantial difference. I'm looking at the global picture. Yes, the price of gold has gone down, but it's approaching a floor of production costs. By mid-year the price of gold will be higher. The Gold Report: Many of the companies you cover operate in Québec, which just passed a new mining act. Is that good news for investors? Eric Lemieux: By and large, all this is good news for companies operating in Québec. It's not perfect. There are a few irritants, but it is a middle ground – a relatively well-balanced law. The Gold Report: An application for a mining lease now requires a feasibility study. What do you make of that? Eric Lemieux: Well, feasibility studies are necessary. A company needs to go through the steps of a feasibility study for the normal process of calling a mineral reserve and getting financing, etc. The industry has to realize certain levels of obtainment and it is a normal process to have feasibility studies to receive the proper permits to achieve the proper level. The new act (as amended) states that an application for a mining lease must be accompanied with a scoping study and market study; note that previous Bill 43 had proposed a feasibility study for securing second and third transformation. The new dispositions are fair and less burdensome. The Gold Report: Does Québec remain the best jurisdiction in Canada in which to operate a junior mining exploration company? Eric Lemieux: I would simply say no, but I would point out the positive is that Québec has stopped dropping in the standings. We've gained clarity with the Québec mining law and royalty revisions. All in all, we're not the best jurisdiction anymore, but at least we're not falling down the slope. The Gold Report: What would you say is the best jurisdiction? Eric Lemieux: This is an ever-evolving element. What is considered the best jurisdiction today could not be so a year from now. Québec is a case-in-point. It was one of the best jurisdictions a few years ago and it slid down. At least with the passage of the royalty and mining law, the worst is over. The Gold Report: Despite your optimism for precious metals, you've rolled back almost all of the target prices on the companies you cover, some by as much as 35%. What prompted that action? Eric Lemieux: General market sentiment has obliged me to remove or decrease substantially my exploration goodwill, which was a proxy of the quality of the teams, the quality of the projects and the general market sentiment. I had to bring that goodwill down, and for certain explorers I had to completely remove it. Having said that, companies that are well managed, have a good portfolio of projects and are able to sustain a minimum of activities will be poised to bounce back eventually. Although I brought down the target price, I kept my recommendations. That's a powerful statement. I just needed to effectively downsize some of the expectations. The Gold Report: What's going to keep you optimistic in 2014? Eric Lemieux: I'm optimistic. It was a difficult year for the mining industry in 2013. The fundamentals are still strong and the long-term story is solid. I believe that this will be able to set in during 2014. Companies have been tightening their belts and streamlining operations. Juniors are going back to the basics. There's no more waste. There's been a reality check. The companies that have been able to survive and sustain a minimum of operations and activities are going to be set for 2014. The mining industry is a necessity. There's always a reason to go out and search for metals and commodities because the population continues to grow and needs resources. It may be through electronic devices. It may be through food or infrastructure. The overall portrait is interesting and positive. I'm optimistic for 2014. The Gold Report: Thanks for chatting today. I've enjoyed it. Eric Lemieux: You're certainly welcome and as we say in French – merci! |

| Simple Secret to Gold Stock Success Posted: 23 Jan 2014 02:21 AM PST Picking gold mining stocks isn't simple, but the key secret is... MINING STOCK analyst Eric Lemieux joined Laurentian Bank Securities in 2008. Having worked for nine years as a consultant responsible for applying Regulation NI 43-101, Lemieux has also worked at the Montreal Exchange, and also managed exploration projects for Cambior, Noranda and Soquem. Holding two masters degrees (in mineral economics and in metamorphic-structural geology) Lemieux explains to The Gold Report how the big secret to successful gold stock investing in fact starts with people... The Gold Report: Eric, your top stock pick in 2013 outperformed the S&P/TSX SmallCap Index. What's your recipe for picking stocks in 2014? Eric Lemieux: The secret to success in picking stocks in 2014 will be simple: management. The senior vice president of Laurentian Bank Securities, who recruited me, asked me a question during my interview way back in 2007: What was the most important element when I was looking at a company? I started to talk about some financial ratios, etc. He began to laugh. He said there are three things: management, management and management. I know that's easy to say, but it is true. It is the team that's behind the company. That's the most important secret for success. The Gold Report: You're predicting an average gold price of $1400 per ounce in 2014. That's down from the previous estimate of $1750 per ounce. Nonetheless, most observers would call $1400 per ounce optimistic given the current spot price. What gives you confidence that the gold price will rise in 2014? Eric Lemieux: I'm fairly optimistic. The price of gold is gravitating around $1200 per ounce, so there's a substantial difference. I'm looking at the global picture. Yes, the price of gold has gone down, but it's approaching a floor of production costs. By mid-year the price of gold will be higher. The Gold Report: Many of the companies you cover operate in Québec, which just passed a new mining act. Is that good news for investors? Eric Lemieux: By and large, all this is good news for companies operating in Québec. It's not perfect. There are a few irritants, but it is a middle ground – a relatively well-balanced law. The Gold Report: An application for a mining lease now requires a feasibility study. What do you make of that? Eric Lemieux: Well, feasibility studies are necessary. A company needs to go through the steps of a feasibility study for the normal process of calling a mineral reserve and getting financing, etc. The industry has to realize certain levels of obtainment and it is a normal process to have feasibility studies to receive the proper permits to achieve the proper level. The new act (as amended) states that an application for a mining lease must be accompanied with a scoping study and market study; note that previous Bill 43 had proposed a feasibility study for securing second and third transformation. The new dispositions are fair and less burdensome. The Gold Report: Does Québec remain the best jurisdiction in Canada in which to operate a junior mining exploration company? Eric Lemieux: I would simply say no, but I would point out the positive is that Québec has stopped dropping in the standings. We've gained clarity with the Québec mining law and royalty revisions. All in all, we're not the best jurisdiction anymore, but at least we're not falling down the slope. The Gold Report: What would you say is the best jurisdiction? Eric Lemieux: This is an ever-evolving element. What is considered the best jurisdiction today could not be so a year from now. Québec is a case-in-point. It was one of the best jurisdictions a few years ago and it slid down. At least with the passage of the royalty and mining law, the worst is over. The Gold Report: Despite your optimism for precious metals, you've rolled back almost all of the target prices on the companies you cover, some by as much as 35%. What prompted that action? Eric Lemieux: General market sentiment has obliged me to remove or decrease substantially my exploration goodwill, which was a proxy of the quality of the teams, the quality of the projects and the general market sentiment. I had to bring that goodwill down, and for certain explorers I had to completely remove it. Having said that, companies that are well managed, have a good portfolio of projects and are able to sustain a minimum of activities will be poised to bounce back eventually. Although I brought down the target price, I kept my recommendations. That's a powerful statement. I just needed to effectively downsize some of the expectations. The Gold Report: What's going to keep you optimistic in 2014? Eric Lemieux: I'm optimistic. It was a difficult year for the mining industry in 2013. The fundamentals are still strong and the long-term story is solid. I believe that this will be able to set in during 2014. Companies have been tightening their belts and streamlining operations. Juniors are going back to the basics. There's no more waste. There's been a reality check. The companies that have been able to survive and sustain a minimum of operations and activities are going to be set for 2014. The mining industry is a necessity. There's always a reason to go out and search for metals and commodities because the population continues to grow and needs resources. It may be through electronic devices. It may be through food or infrastructure. The overall portrait is interesting and positive. I'm optimistic for 2014. The Gold Report: Thanks for chatting today. I've enjoyed it. Eric Lemieux: You're certainly welcome and as we say in French – merci! |

| Posted: 23 Jan 2014 02:11 AM PST Gold prices face a testing week as the US Federal Reserve votes again on QE taper... The U.S. FED may taper its quantitative easing again on Wednesday next week, writes Sumit Roy at Hard Assets Investor. This will be the next big test for gold bulls. Gold prices were little changed over the past week, as the rally that began at the start of the year lost steam. The current rebound off December's low near $1180 hasn't been that powerful, which is in contrast to when prices first bottomed at $1180 last June. Following that initial bottom, prices zoomed higher over the next two months, hitting $1350 in July and $1450 in August. This time around, prices reached as high as $1260. Granted, it's only been about three weeks since the December bottom. But at this point, we don't necessarily see any specific positive catalysts to send prices higher. Rather, it will be gold's ability to shrug off bad news that will be most telling, and dictate whether we see continued gains in prices. Gold ETF holdings rose by 0.1 million over the last week, or 0.24%, to recover a little of their late-2013 losses at 56.2 million ounces. Silver ETF holdings rose more quickly, however, up by 1.9 million (some 0.31%) to 621.7 million ounces.  The next test got gold prices will come on January 29, when Ben Bernanke and the Federal Open Market Committee make the last monetary policy decision in which he is at the head of the central bank. Bernanke is set to retire at the end of the month. Currently, expectations are that the FOMC will go ahead and taper its bond-buying program by another $10 billion, bringing monthly purchases down from $75 billion to $65 billion. If that happens, we will look to see gold's reaction. Following the first taper in December, gold bounced off $1180. Will the yellow metal test that level again? Or will it shrug off the news and build on the current rally? In our view, if gold can break $1275 on the upside, it will indicate the rally has legs, and prices may continue higher to above $1300, even $1400. On the other hand, a move back below $1200 will put the bears in charge once again. |

| Posted: 23 Jan 2014 02:11 AM PST Gold prices face a testing week as the US Federal Reserve votes again on QE taper... The U.S. FED may taper its quantitative easing again on Wednesday next week, writes Sumit Roy at Hard Assets Investor. This will be the next big test for gold bulls. Gold prices were little changed over the past week, as the rally that began at the start of the year lost steam. The current rebound off December's low near $1180 hasn't been that powerful, which is in contrast to when prices first bottomed at $1180 last June. Following that initial bottom, prices zoomed higher over the next two months, hitting $1350 in July and $1450 in August. This time around, prices reached as high as $1260. Granted, it's only been about three weeks since the December bottom. But at this point, we don't necessarily see any specific positive catalysts to send prices higher. Rather, it will be gold's ability to shrug off bad news that will be most telling, and dictate whether we see continued gains in prices. Gold ETF holdings rose by 0.1 million over the last week, or 0.24%, to recover a little of their late-2013 losses at 56.2 million ounces. Silver ETF holdings rose more quickly, however, up by 1.9 million (some 0.31%) to 621.7 million ounces.  The next test got gold prices will come on January 29, when Ben Bernanke and the Federal Open Market Committee make the last monetary policy decision in which he is at the head of the central bank. Bernanke is set to retire at the end of the month. Currently, expectations are that the FOMC will go ahead and taper its bond-buying program by another $10 billion, bringing monthly purchases down from $75 billion to $65 billion. If that happens, we will look to see gold's reaction. Following the first taper in December, gold bounced off $1180. Will the yellow metal test that level again? Or will it shrug off the news and build on the current rally? In our view, if gold can break $1275 on the upside, it will indicate the rally has legs, and prices may continue higher to above $1300, even $1400. On the other hand, a move back below $1200 will put the bears in charge once again. |