Gold World News Flash |

- What If Nations Were Less Dependent on One Another?

- U.S. Total Gold Exports Up 31% In October 2013

- 1 In 20 US Households Has Over A Million In Assets: This Is Where They Are

- This isn't the Alamo but rather Valley Forge

- Daily Nugget – India’s gold exports fall by 30%

- Noonan: The Trend in Gold Remains Down – But For How Long?

- Silver Prices – When Monetary Demand Trumps Industrial Demand

- Russian Police Hunt For Alleged Suicide Bomber On The Loose in Sochi

- Armed Citizen Shoots Gun-Wielding Man in Dollar General

- Gold's decline in 2013 was caused by a central bank attack, Sprott says

- Want Cheap Stocks? Think Frontier Markets

- Gold – Disconnect Between Fundamentals And Price. Perception Rules

- Market Monitor – January 18th

- Gold Disconnect Between Fundamentals And Price - Perception Rules

- Spectacular Gold Demand (79 Tons) on SGE in Week 2, 2014

- Vast Stretches Of Impoverished Appalachia Look Like They Have Been Through A War

- "Two Roads Diverged" - Wall Street's Doubts Summarized As "The Liquidity Tide Recedes"

- Gold - Disconnect Between Fundamentals And Price. Perception Rules

- This Past Week in Gold

- Silver Prices - When Monetary Demand Trumps Industrial Demand

- Dollar Powers Ahead

- Gold Investors Weekly Review – January 17th

- Gold – Disconnect Between Fundamentals And Price. Perception Rules.

- Demographic Cliff Great Deflation - Harry Dent on How to Prosper in the Coming Downturn

- A Glimpse into the Coming Economic Collapse

- Stocks and Bonds Tops, Gold and Silver Bottom Climacterics Now

- Paul Craig Roberts: The hows and whys of gold price manipulation

- China Claims To Already Have the Third Largest Gold Reserves in the World

- Terrifying Technicals: This Chartist Predicts An Anti-Fed Revulsion, And A Plunge In The S&P To 450

- Jim’s Mailbox

- The Formula for Weimar Germany… Showing Up in the US Today?

- "The Hows And Whys Of Gold Manipulation"

- "The Hows And Whys Of Gold Manipulation"

- Bullion banks run 'hurt and rescue' against miners, Maguire says

- The Gold Price Flew Up $11.70 to End the Week at $1,251.70

- The Gold Price Flew Up $11.70 to End the Week at $1,251.70

- Sprott sees likelihood of gold delivery difficulties in February

- Maguire - New Buyer To Create Massive Short Squeeze In Gold

- China & the West View Gold Very Differently – Here’s Why

- Why the West Sells Gold and China Buys It

- Gold Drives Silver Is Key To Where Silver Is Going

- These 10 Charts Suggest the Outlook for Gold Is Good for 2014 and Beyond

- Gold Drives Silver

- A Glimpse into the Coming Collapse

- Something's Afoot in Gold and Silver

- Technicals Finally Reflecting Fundamentals In Resource Sector With Bullish Breakouts

- Gold Daily and Silver Weekly Charts

- Gold Daily and Silver Weekly Charts

- Billionaire Sprott - Expect A Failure To Deliver Gold & Lawsuits

- Economic Collapse 2014 -- Massive HYPERINFLATION Needed to Prop Up Stock Market

| What If Nations Were Less Dependent on One Another? Posted: 18 Jan 2014 11:45 AM PST Autarky is more than a ten-dollar word for self-sufficiency, as it implies a number of questions that "self-sufficiency" alone might not. by Charles Hugh Smith, Peak Prosperity:

The ability to survive without trade or aid from other nations, for example, is not the same as the ability to reap enormous profits or grow one's economy without trade with other nations. In other words, ‘self-sufficiency’ in terms of survival does not necessarily imply prosperity, but it does imply freedom of action without dependency on foreign approval, capital, resources, and expertise. Freedom of action provided by independence/autarky also implies a pivotal reduction in vulnerability to foreign control of the cost and/or availability of essentials such as food and energy, and the resulting power of providers to blackmail or influence national priorities and policies. |

| U.S. Total Gold Exports Up 31% In October 2013 Posted: 18 Jan 2014 11:26 AM PST from SRS Rocco:

According to the USGS Gold Mineral Industry Survey, total gold exports from the U.S. to Hong Kong increased from 12.2 metric tons (mt) in September to 17.8 mt in October. Furthermore, Switzerland had the largest increase as it imported 23.7 mt in October compared to 13.9 mt in September. If we look at the chart below, we can see that total U.S. gold exports increased 31% from 37.6 mt in September to 49.4 mt in October: |

| 1 In 20 US Households Has Over A Million In Assets: This Is Where They Are Posted: 18 Jan 2014 11:23 AM PST Bernanke may be printing the wealth effect to the benefit of the richest 1%, but that only serves to make the already wealthiest even wealthier. When it comes to the creation of new millionaire households, the epicenter of new wealth creation is about as far from Wall Street, West Putnam Avenue or Rodeo Drive as can be. In fact, the state that saw the fastest climb up in millionaire rankings in 2013 doesn't have a single Tiffany or Saks Fifth Avenue, and the closest BMW dealership is a six-hour drive from the capital (stats which are guaranteed to change by the end of the year). Presenting North Dakota: the state which jumped 14 spots in the latest ranking of millionaire households. Per the WSJ, which crunched the the numbers released by Phoenix Marketing International, there were 53,000 more millionaire households in 2013 compared to the year before. "About 6.15 million millionaire households are spread across the U.S., according to the report. That means 1 in every 20 households in the U.S. has more than $1 million in investable assets. Those figures don't include the value of real estate." As expected, the top of the overall millionaire households per capita rankings didn't change much. Maryland was No. 1 for the third consecutive year, with 7.7% of households holding more than $1 million in assets. New Jersey, Connecticut and Hawaii followed. Those four states, in various orders, have led the rankings every year since 2006. The complete breakdown is shown on the map below.

It was the middle and bottom of the ranking that saw most changes, at times quite violent. Judging by the collapse in household wealth, it seems the second Nevada housing bubble has indeed popped.

Nobody was a bigger winner in 2013 than the center of the shale boom: North Dakota.

The main difference, however, between North Dakota and other states: 'its people in the oil patch aren't about to flaunt it. "The only way you know a Bakken millionaire is he'll be driving a The results sorted: by highest number of millionaires per capita: And the states where the creation of new millionaire households was fastest in 2013: |

| This isn't the Alamo but rather Valley Forge Posted: 18 Jan 2014 11:18 AM PST 11:28a PT Saturday, January 18, 2014 Dear Friend of GATA and Gold: Other nonprofit groups are doing their new year's appeals and GATA, already inadequate in fundraising, would be still more negligent in not attempting one too, so here goes. While our exposure of surreptitious rigging of the gold market has produced some pretty good successes over the last year and has encouraged others to examine the subject -- http://www.gata.org/taxonomy/term/21 -- the enemies of free markets and limited and accountable government have intensified their efforts too. While they have been forced to become ever more heavy-handed and to raise suspicions about themselves if not to give themselves away outright, they have also devastated the monetary metals industry and its investors. The industry, largely oblivious to begin with, ignorant of both the monetary nature of its product and the control of the price of its product by central banks, is more cowardly than ever, long having betrayed its fiduciary obligation to its shareholders. And even those of its shareholders who understand what's going on are mostly busted. Financial donations to GATA have dried up and now we're running on fumes -- even as opinion on gold market manipulation is turning in our favor. This is not the Alamo; we're not going to be wiped out until they turn off the lights and the Internet and close the borders, and long before that ever happens the bad guys will be out in the open and will have many more adversaries than little GATA. The situation for us right now is rather more like Valley Forge -- with boots we'll march again. Two very promising expeditions are already planned, and the bad guys are more vulnerable than ever. We're so grateful to those who have stood with us despite the recent adversity. We appreciate and understand the terrible losses suffered by our friends who have fallen away in despair. But we think this struggle is still worth waging -- and insofar as it will determine the method of valuation of all capital, labor, goods, and services in the world, a democratic, market valuation or a totalitarian valuation, it still seems to us the most important struggle in the world. If you believe in this struggle but have not already sent some help our way, please consider doing it now. It will make a difference. It can be accomplished here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT A Personal Touch in Buying Precious Metals If you've not secured your allocation of precious metals and numismatic coins, 2014 may be the last year to get them at affordable and undervalued prices. With huge amounts of gold leaving the West for Asia, the future availability of precious metals is very much in doubt. All Pro Gold has competitive pricing on all bullion and numismatic products -- and offers prompt delivery too. Long-time GATA supporters Fred Goldstein and Tim Murphy are glad to answer any questions or concerns about acquiring the monetary metals. All Pro Gold has an extensive electronic library of articles from the world's top market analysts. Learn more at www.allprogold.com or write to Fred and Tim at info@allprogold.com or telephone them at 1-855-377-4653. Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Jim Sinclair plans seminars in Asheville and Austin Gold advocate and mining entrepreneur Jim Sinclair will hold his next market seminars from 2 to 6 p.m. Saturday, January 25, at the Clarion Inn Asheville, 550 Airport Road, Fletcher, North Carolina, and from 2 to 6 p.m. Saturday, February 8, at the Austin, Texas, Airport Hilton. Advance registration is required. Details for the Asheville seminar are posted at Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/01/07/north-carolina-qa-session-venue-conf... Details for the Austin seminar are posted at JSMineSet.com here: http://www.jsmineset.com/2014/01/02/austin-texas-qa-session-confirmed/ |

| Daily Nugget – India’s gold exports fall by 30% Posted: 18 Jan 2014 11:15 AM PST by Jan Skoyles, TheRealAsset.co.uk

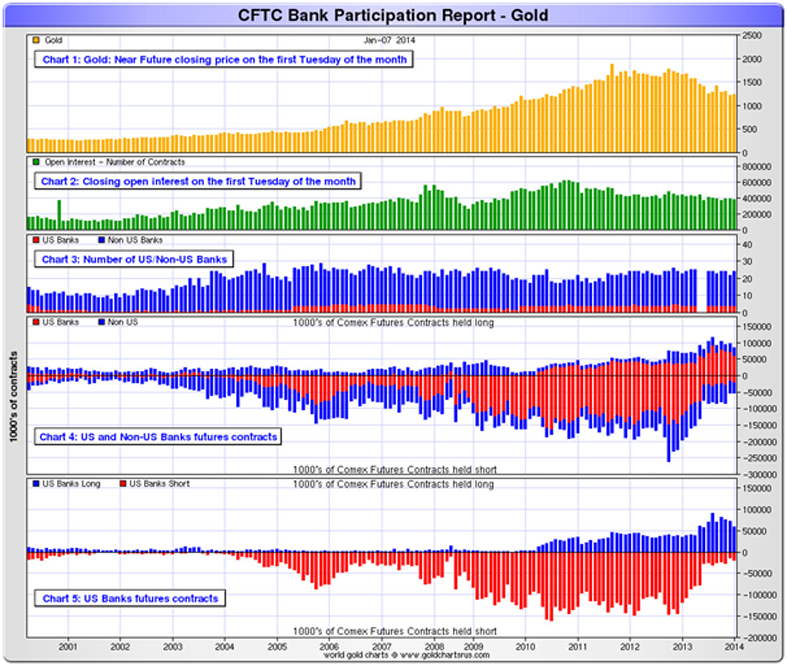

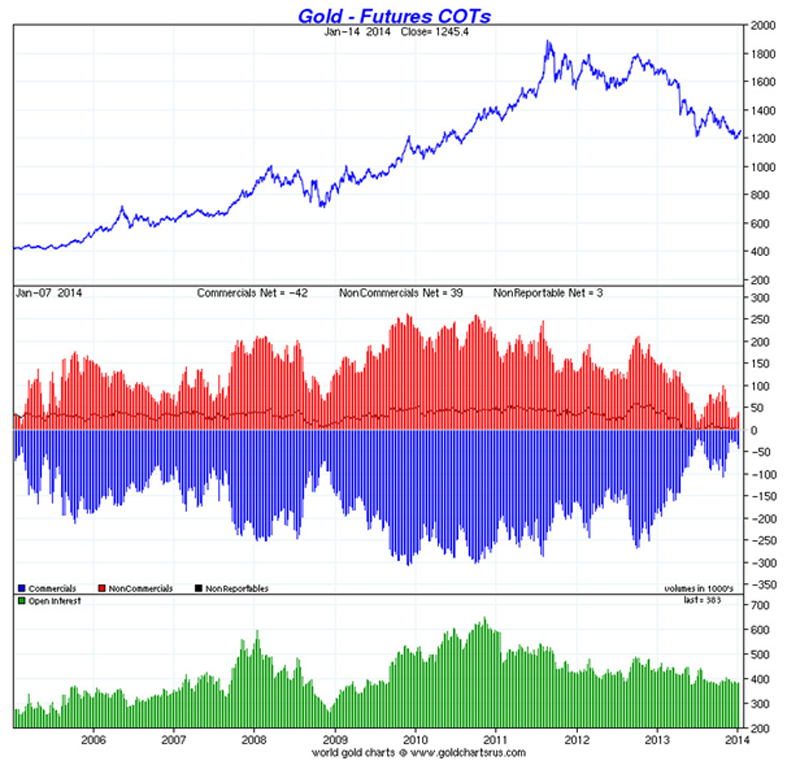

Gold is likely to be treading water ahead of the Fed's first FOMC meeting, when Chairwoman Yellen will take the top seat for the first time. The shocking labour statistics last week, combined with positive economy data and low inflation this week will play a major role in the tapering plan, which many had previously assumed to be aggressive going forward. Gold is likely to see a major move following the meeting, however we are unlikely to see new highs or lows in the preceding days. Institutional buying seems to be ticking up this year, as the number of open positions in COMEX gold futures have increased since the beginning of 2014. This is despite low inflation levels, which suggests ongoing concern over inflation and short-covering. |

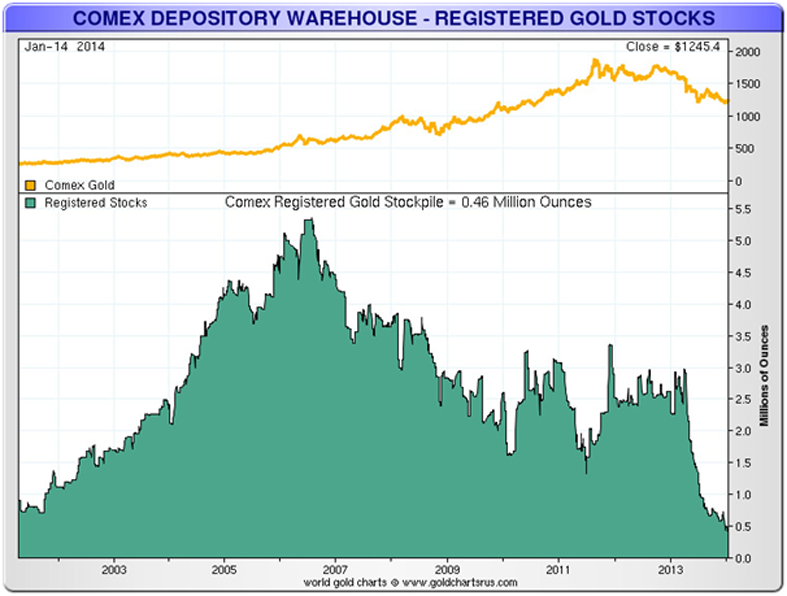

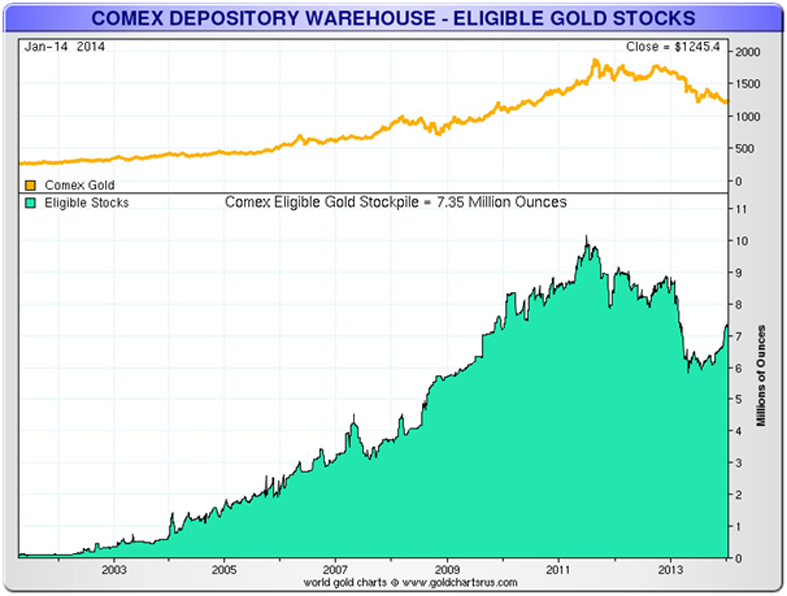

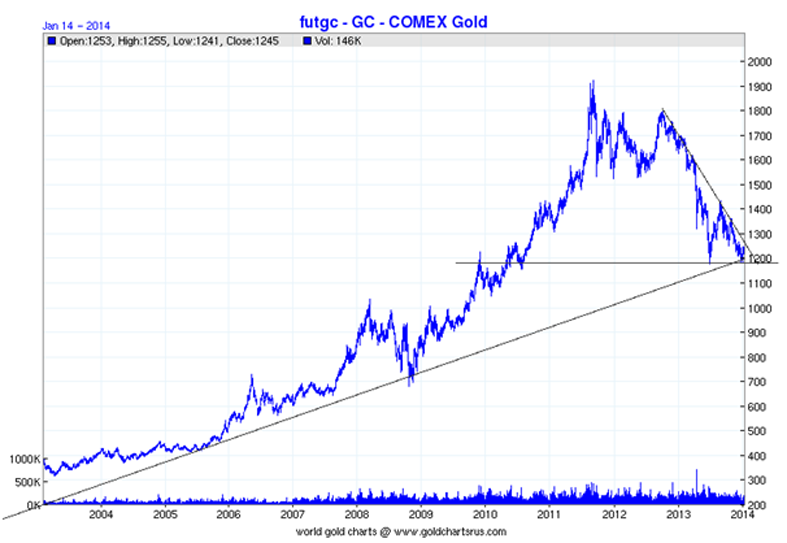

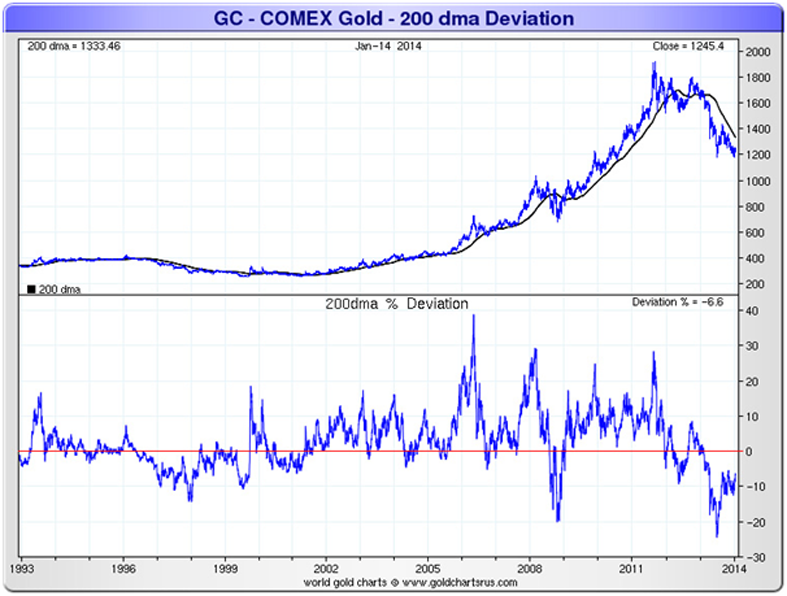

| Noonan: The Trend in Gold Remains Down – But For How Long? Posted: 18 Jan 2014 10:02 AM PST If your perception is focused solely on where the price of gold is, as opposed to where you think or believe it So says Michael Noonan (edgetraderplus.com) in edited excerpts from his original article* entitled Gold – Disconnect Between Fundamentals And Price. Perception Rules. [The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Noonan goes on to say in further edited excerpts: All of the fundamentals are screaming high demand for and a shortage of physical gold, but price keeps on dropping so why is gold not at a higher price? Because fundamentals are not the answer, rather, it is all about perception and the perception that fundamentals should rule is a misplaced one, at least for now. The COMEX & LBMA Vaults Are Bare! Everyone who is even remotely interested in gold knows that the COMEX and LBMA vaults are just about bare. The COMEX has been nursing a default on physical delivery for gold and silver since last summer. There have been none. Those who stood to take delivery received cash, or rolled forward. This is certainly an acknowledgment that there is no gold or silver, yet that fact has not translated into a stampede of customers demanding gold. Even Deutsche Bank cannot get delivery of their own gold! Gold’s On Sale at 35% Off For a Limited Time Only! Keep focused on your objectives and the reality of events. Right now, people can buy gold coins and bars almost at will. If Deutsche Bank has to wait seven years to get just some of its gold back, and they are not an isolated example, if the vaults are nearly depleted, and you can buy gold coins and gold bars from dealers every day, in light of the whole world recognizing a shortage, everyone should be taking advantage of the disconnect between perceived value and the reality of current prices and buying as much as they can and, for right now, there is a 35% off sale going on! Better a Year Early Than a Day Late! This is lock-and-load, fire at will, and not a time to be keeping one's powder dry. If you know all the available physical gold is being shipped East, primarily to China, and you have immediate access to however many ounces you want to buy, why is there anyconcern over the current price of gold? What happens if you cannot buy at any price?! Better a year early than a day late. The reality is, whatever gold is available is relatively cheap. If you can answer the question, for how much longer will you be able to buy it, then plan accordingly. If you cannot answer that question, then plan accordingly for that event, as well. We understand that the charts reflect the bogus COMEX manipulated paper price of gold, but that is all that is available, and the physical market, measured by tonnes going to a variety of mostly BRICS nations, is at a premium to paper. However unreal For further technical analysis on the future for gold, silver, the XAU and HUI check out: No Predictions Here! Despite the fact that others who make predictions draws reader attention, we do not make them. For one, no one knows how the future will develop – just review all of the predictions from 2013 for proof. Secondly, there are utterly unnecessary. The market will indicate when the trend has changed, and there will be ample opportunity to be long paper futures, that is, if there is still a paper futures market in the next year. The trend remains down. Any predictions you may be reading currently are mostly a regurgitation from the same ones who made predictions last year. Is it really necessary to ask how they worked out? One thing we can say about the charts of the market is that Will the current $1,200/ozt. area continue to hold? Odds say no, based only on the current down trend, but things can change. However, it is always best to wait for confirmation of a change before acting contrary to the current trend. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://edgetraderplus.com/market-commentaries/gold-disconnect-between-fundamentals-and-price-perception-rules Other Noonan Articles: 1. Noonan: Charts Suggest Lower Lows for Gold & Silver to Come in 2014 Because the natural laws of supply and demand do not apply to gold and silver, the only way we can track the influence of endless paper supply on the market is through the most reliable source, the market itself, and the best way to track the market is through charts.Let’s take a look at what they are conveying today. Read More » 2. Noonan: "Gold Ain't Going Higher – At Least For the Short Term" – and Here's Why Does the fast-fading world reserve currency [the USD] look like it is collapsing? A look at the performance of the U.S. Dollar Index does not suggest that it is, weak as it is. If the fiat dollar is not in danger of imminent "collapse," or even breaking down, then gold does not have this event as an impetus for rallying higher. [Frankly speaking,] until that changes, gold ain't going higher, at least in the short term. Read More » 3. Noonan: Charts Say "Still No Ending Action to Decline In Gold & Silver" The decline is holding near the last swing low. Will the June low hold? The odds are greater for the low not holding, based on the trend, but there is no way to determine the probability of the June low giving way, for it is possible it will not. Read More » 4. Noonan: Charts Say NO End In Sight for Decline In Gold & Silver Prices No matter what the latest "news" development is for PMs that paints a rosy picture, those in the fundamentalist camp are looking through rose-colored glasses to expect change in the near future. The charts for gold & silver continue to tell a more accurate story that belie all known fundamentals, and the charts shown here depict a market in decline with no apparent end in sight. Read More » 5. Noonan on Gold & Silver: "When Fundamentals Fail, Charts Prevail" & This Is What They're Conveying Fundamentals are relative, charts are absolute. They accurately reflect all that is going on, regardless of reasoning/motivation and…right now, the charts are letting us know that higher PM prices are unlikely to occur anytime soon. Barring some kind of "overnight surprise" that will shock the markets, odds favor lower prices over higher prices unless and until demand shows up in chart activity. Read More » 6. Noonan: Charts are Infallible! Here's Why & What They're Saying About Gold & Silver Some of the finest and most highly regarded minds in the world of PMs have been saying gold and silver are going higher…[but] the charts have "said" otherwise, and that has been the correct read…The fundamentals may be as bullish as can be [but] the charts are sending a different message. Read More » 7. Noonan: Gold & Silver Could Move Sideways for Another 1-2 Years – Here's Why Using past history of how price responds, it is likely that gold, and silver, could move sideways for another year or two. While this flies in the face of so many current, supposedly “expert”, opinions [mine is not based on opinion but, rather, is strictly based on the facts as conveyed by the charts. Take a look and you will see that too!] Read More » 8. Noonan: These Charts Clearly Show What's Happening With Gold & Silver – Take a Look Below is a perfect example of how the charts timed the movement in the price of gold and silver over the past week. Yes, you CAN time the market as this article clearly demonstrates! When the market "talks," we listen.] Read More » 9. Noonan: Window of Opportunity to Buy Physical Gold & Silver Narrowing – Don't Wait, Buy Now! The window of opportunity to buy physical gold and silver continues to narrow. Like the housing market top was known to be coming, when it came, those who waited too long regretted it. When the bottom for the physical PMs is known as a certainty, those who waited for a "better price" may also regret that decision. It is all about choice. Read More » 10. Noonan: The Most Factual Information On Gold & Silver Is Right HERE In an election, it does not matter if voter turnout is high or low, the outcome is determined by the actual votes cast. The same holds true for the markets. Only those who make an actual buy or sell decision determine the outcome of the market trend. The market "voters" turn up in charts, recorded in the price range, close, and volume. Collectively, a "story" unfolds, and it usually is an accurate one as it does not include any opinions. Opinions do not matter. Articles written about fundamentals, pundit declarations, etc., all fall under the category of opinions. The market is the best source for information, and that is a fact. Read More »

The post Noonan: The Trend in Gold Remains Down – But For How Long? appeared first on munKNEE dot.com. |

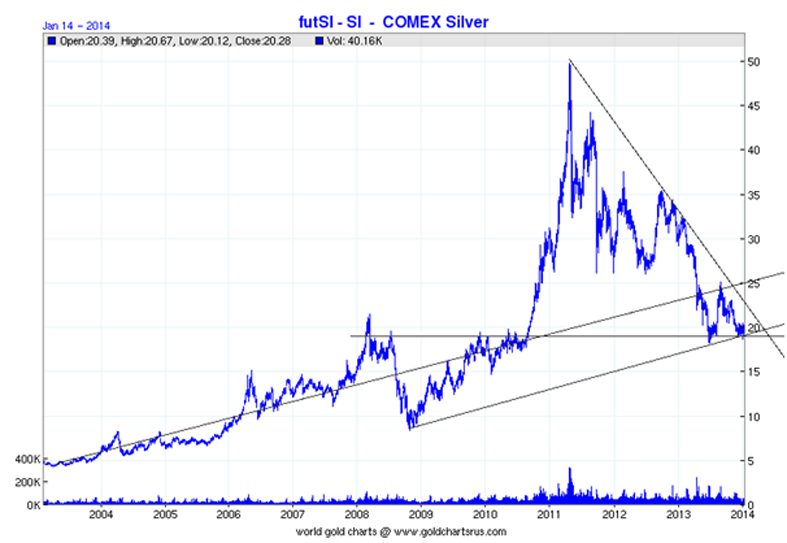

| Silver Prices – When Monetary Demand Trumps Industrial Demand Posted: 18 Jan 2014 10:00 AM PST by Dr. Jeffrey Lewis, Silver-coin-investor:

The catalyst for much higher prices will be of a monetary, rather than an industrial, demand-led series of events. A Parallel to the Current State of Finance The current financial markets are a giant slow motion train wreck that we are living through, slipping along a surface lined with frictionless fiat. |

| Russian Police Hunt For Alleged Suicide Bomber On The Loose in Sochi Posted: 18 Jan 2014 09:46 AM PST Up until now, most terrorist provocations surrounding the Sochi winter olympics set to begin on February 7, had been in the surrounding cities (here is dramatic video footage of the recent suicide bombing in Sochi) while the actual venue has been largely left untouched. Perhaps this is due to the security gauntlet that has wrapped the city under the constant supervision of countless eyes in the sky and about 70,000 police and soldiers. This tenuous peace, however, was disturbed this morning when as Bloomberg reported, Russian police were searching for an alleged terrorist Razmena Ibragimova, according to a wanted poster on display at a security checkpoint in Sochi's airport. Ibragimova, 22, is "currently located on Sochi territory" and may attempt a suicide bombing, according to the poster. According to information from BlogSochi she was spotted on the street outside the foreign ministry building in Sochi. BlogSochi has the photo details: And while so far Sochi has not seen an actual act of terrorism, it seems ticket demand for the games is inversely proportional with the build up in security for what is set to be the most expensive winter olympics in history with over a $51 billion price tag, of which over $3 billion will be spent on security. Bloomberg reports that listings of tickets put up for resale on a "fan to fan" website have soared almost 50 percent over the past week, with more than 3,100 offers now posted. Most offers include multiple tickets, up to a maximum eight per offer. "The U.S. website of CoSport, the exclusive ticket agent for North America and most of Western Europe, still lists seats available for some sought-after events such as the gold-medal match in men's ice hockey. The Sochi 2014 website, the official sales outlet for residents of Russia and many other countries, has tickets available for more than 100 events."

Of course, should a deadly terrorist attack take place, nosediving ticket sales will be the least of Putin's concern, or of Russia, which is still riding high on the reputational gains achieved after the various diplomatic victories in 2013. Which is why security at the games is indeed unprecedetned, as the following 10 minutes review from The National demonstrates.

|

| Armed Citizen Shoots Gun-Wielding Man in Dollar General Posted: 18 Jan 2014 09:45 AM PST by Lily Dane, The Daily Sheeple:

The quick actions of an armed citizen stopped a gun-wielding man in his tracks at a Dollar General store. The gunman walked into the store in Orrville, Alabama, and began waving his pistol around. He ordered a customer and a cashier towards the break room at gunpoint. It was the gunman's unlucky day: that customer happened to be armed. He pulled out his concealed handgun and fired one shot into the gunman's chest. Dallas County Sheriff Harris Huffman Jr. explained the incident to WSFA: |

| Gold's decline in 2013 was caused by a central bank attack, Sprott says Posted: 18 Jan 2014 09:44 AM PST 9:43a PT Saturday, January 18, 2014 Dear Friend of GATA and Gold: Last year's decline in gold was the result of an attack by Western central banks on gold exchange-traded funds as the central banks exhausted their own supplies, Sprott Asset Management CEO Eric Sprott writes in new commentary: http://www.sprott.com/markets-at-a-glance/one-more-sign-of-manipulation-... He is interviewed about his analysis by the Sprott Money weekly wrap-up program here: http://www.sprottmoney.com/sprott-money-weekly-wrap-up In the interview Sprott says the attack seems to have run its course, with gold and gold mining shares already rising again. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Want Cheap Stocks? Think Frontier Markets Posted: 18 Jan 2014 09:30 AM PST People go to a retail store searching for bargains. If an item is priced at a 50% discount, they might buy it or search a nearby store or online to see if they can get it even cheaper. If a store has a closing down sale, crowds often turn up in droves. Others sometimes do extensive searches for niche stores where few people go but there's value for money. It's funny how investors rarely mimic this type of behaviour. Stocks which have gone down in price are viewed with suspicion. Something must be wrong with them. If a company's in distress, most investors will put it in the too-hard basket. As for neglected stocks or markets, well there must be reasons for the neglect and further investigation requires work which many aren't willing to do. So-called frontier markets suffer many of the attributes which put off investors. They're priced well off pre-GFC peaks, they have companies and sectors in distress and they're completed off the radar screens of institutional investors. Add to this that many of these markets are in faraway places, with unfavourable political regimes and hugely volatile stock market price action given thin liquidity - and you have a perfect recipe for investor neglect. In Asia Confidential's eyes though, some of these frontier markets offer the best opportunities for investors over the next decade. And one of the most exciting opportunities is in Indochina. Today, we're going to look at one of these markets, Vietnam, which is starting to attract investor interest after five years in the wilderness. It underwent a massive credit bust and is just coming out the other side. In many ways, Vietnam is 2-3 years ahead of China, which has just started to undergo its own credit bust. Vietnam's classic credit bust I was working at a stock broker in South-East Asia in 2007 and remember the excitement generated then by some of the region's smaller markets. At the time, Vietnam became the "it" market. Asia's top sell-side economists and strategists poured into the country and waxed lyrical about the growth story there. I don't think some of them were quite as bullish as their research reports relayed, but being a bull brought in plenty of money at the time. They were the go-go days prior to 2008 where there was too much cheap money and booming frontier markets got some love. Then the GFC happened and these frontier markets were taken to the cleaners. Vietnam's main stock market went down ~80%. Given its reliance on exports, GDP growth in Vietnam dropped from more than 8.5% in 2007 to close to 5% in 2009. The government tried to revive the massive credit boom through an aggressive stimulus program in 2009. The printed money led to reckless lending, with credit growth of 35% Cagr from 2007-2010 and bank loan to deposit ratios peaking at 136%. Inflation rocketed to 23% in 2011, resulting in foreign investment drying up. The latter was crucial given Vietnam's reliance of foreign direct investment (FDI) to the tune of about US$12 billlion each year (or about 6x that of Indonesia relative to the economy, to put that in perspective). Due to spiking inflation, the local currency, VND, dropped 40% in value from peak to trough. Vietnam's strict capital controls didn't prevent massive capital flight as savers exchanged local currency for gold and U.S. dollars (Vietnamese are estimated to have 50% of their net worth in gold and US$). The government was forced to raise interest rates by 500 basis points and implement significant macro-economic reform. GDP fell to 5% in 2012, its lowest level in 13 years. Much of the reckless lending went into real estate. From 2009-2011, the government implemented several regulations to reduce credit to the sector, such as increasing taxes and restricting the ability of buyers to "flip" properties. From the peak levels of 2010, real estate prices have fallen 60%. The above isn't to suggest that the government was pro-active in initiating reform. Far from it. Like most governments, the ruling Communist Party in Vietnam fiercely resisted reform until they were forced into action by the dramatic bursting of the credit bubble. In fact, the government only just started to restructure the banking sector last year. And it's still largely held off from overhauling other state-owned enterprises (SOEs). This isn't surprising given the vested interests of SOEs which were the biggest beneficiaries of the credit boom via the corruption which flourished at the time (remind anyone of China?). Things are turning around There are several signs though that the worst of the credit crisis may be behind Vietnam:

There's still much work to be done though. As mentioned, banking reform is overdue. Banks have been reluctant to lend due to non-performing loan (NPL) issues as a result of the credit bust. No-one believes the official NPL figure of 4.7%. Most think it's 12-15%. Until NPLs are cleaned up, lending growth can't accelerate to further spur the economy. The government set up the Vietnam Asset Management Company (VAMC) in July last year to buy the banks' bad loans. Well, the VAMC won't exactly buy these loans but act as a conduit to warehouse bad loans until a buyer is found. If there are no buyers, loans will be written down over five years. Without going into all of the details, the setting up of this company isn't a brilliant solution but should incrementally improve the ability of banks to reduce NPLs and start handing out more loans. Attractive long-term prospects There are a number of things to like about the long-term prospects for Vietnam too: 1. The country has one of Asia's most attractive demographic profiles. About 70% of Vietnam's population are under the age of 45. Positive demographics don't guarantee economic success but they help. Remember that GDP growth comprises population growth (more specifically, working-age population) plus productivity growth. 2. Vietnam is becoming a highly attractive destination for foreign companies. The country promises to be the next great Asian exporter of electronics and sophisticated mechanical products, with labor costs less than half those of China and Thailand. For years, Taiwanese and Chinese companies were setting up shop in Vietnam to manufacture footwear and garments. Now the largest FDI contributors are Japanese and Korean, focusing on higher-end tech and mechanical products. The below chart from the World Bank, courtesy of Asia Frontier Capital, shows why Vietnam is attracting significant foreign capital. 3. There's an emerging middle class which should fuel a consumption story. Despite the downturn, anybody who's visited Vietnam of late will notice still packed restaurants, retail shops and so forth. 4. Vietnam should be a primary beneficiary of the rise of neighbours including China, Myanmar and Thailand. I've written previously about the potential for Myanmar to reclaim its former glory as it opens up its economy again (it was Asia's richest country in the 1960s before the current regime took over). The potential of Thailand shouldn't be discounted either despite the political problems (which may soon provide another good buying opportunity). Short-term catalysts Valuations are no longer dirt cheap but remain cheap nonetheless. At around 11x forward price-to-earnings ratio (PER), it's close to the Asia-ex Japan average. But keep in mind that Vietnam earnings are coming off a remarkably low base, unlike the rest of Asia. Also, the PER is deceptive. Using the median PER rather than mean (the former excludes outliers and is a better gauge), the market PER drops to 9x. Moreover, the market is distorted by ETF investment in the very large companies. A third of the stock market is under 7x PER. The market remains very cheap outside the largest stocks. Add to this that the market remains close to 50% below its 2007 peak and it's clear that Vietnam has plenty of room to go higher. For it to do so though will require a few things. First, there needs to be further progress on the NPL issue. Second, the government has to get serious about SOE reform. Third, the government also has to follow through with promises to increase foreign ownership limits from 49% to 60%. As an aside, there are a few ways to invest in the Vietnam stock market. You can do it via an ETF such as Van Eck's Market Vectors ETF (NYSE: VNM). Or you can go through managed funds such Dragon Capital and Asia Frontier Capital, both of which are reputable. Risks The long-term risk is that the economy recovers and a credit boom/bust cycle ensues again. You'd hope that the government has learned the painful lessons of the recent crisis but nothing is guaranteed in this business. And, of course, there's the broader risk of a renewed global economic slump which would hurt Vietnam disproportionately. That said, some of the current positive moves on the economic front would put the country in a better position to withstand such a slump. AC Speed Read - Frontier markets offer some of the best investment opportunities over the next decade. - We particularly like Indochina, including Vietnam. - Vietnam has been through a classic credit bust and is coming out the other side. - Investors are starting to take notice but the Vietnam market remains cheap. This post was originally published at Asia Confidential: |

| Gold – Disconnect Between Fundamentals And Price. Perception Rules Posted: 18 Jan 2014 09:15 AM PST by Michael Noonan, Edge Trader Plus:

The stock market's investment compass was smashed back then, when many once considered solid companies lost half their value, some even more. The investment community was stunned. But that is "ancient" history, as is almost anything that is longer than a few months in time. That has been [nearly] forgotten and replaced by the fiat euphoria levitating the stock market for the past few years. |

| Posted: 18 Jan 2014 09:13 AM PST Top Market Stories For January 18th, 2014: Comex Warehouse Potential Claims Per Deliverable Ounce Rises to Historical High 112 to 1 – Jesse's Café Gold Drives Silver – 321 Gold Fresh wave of gold buying ahead of Chinese New Year – Mineweb Something's afoot in Gold and Silver… – SilverSeek Contrarians' Wildest Dream Coming True [...] |

| Gold Disconnect Between Fundamentals And Price - Perception Rules Posted: 18 Jan 2014 08:58 AM PST What will it take to turn the gold market around? One would think it would be obvious that fundamentals are not the answer, while so many believe that fundamentals rule. We are reminded of the fundamentalists, especially "value investors" whose financial world was literally turned upside down when the stock market crashed in 2008. While "value" and "fundamentals" were considered the economic bedrock of the stock market, it turns out that everything is really steeped in perception, for they changed dramatically. |

| Spectacular Gold Demand (79 Tons) on SGE in Week 2, 2014 Posted: 18 Jan 2014 08:45 AM PST “Gold isn’t condensed fear, it’s condensed labour” by Koos Jansen, In Gold We Trust:

This type of demand puts the physical gold market under severe stress, hence the scramble for gold in London a few days ago. "There is a shortage of big bars, especially good-delivery 400-ounce bars", said Bernard Dahdah from Natixis "One part of the problem is that large quantities of these bars that have come from ETFs, have now been moved to be re-refined into three-nines bars of smaller sizes and are therefore no longer available to the London market." The 1 month Gold Forward Offered Rate has been negative throughout the entire week Chinese demand was this strong. Until January 31 demand for physical could remain elevated, after which it will likely return to its average strong levels. |

| Vast Stretches Of Impoverished Appalachia Look Like They Have Been Through A War Posted: 18 Jan 2014 08:19 AM PST Submitted by Michael Snyder of The Economic Collapse blog, If you want to get an idea of where the rest of America is heading, just take a trip through the western half of West Virginia and the eastern half of Kentucky some time. Once you leave the main highways, you will rapidly encounter poverty on a level that is absolutely staggering. Overall, about 15 percent of the entire nation is under the poverty line, but in some areas of eastern Kentucky, more than 40 percent of the population is living in poverty. Most of the people would work if they could. Over the past couple of decades, locals have witnessed businesses and industries leave the region at a steady pace. When another factory or business shuts down, many of the unemployed do not even realize that their jobs have been shipped overseas. Coal mining still produces jobs that pay a decent wage, but Barack Obama is doing his very best to kill off that entire industry. After decades of decline, vast stretches of impoverished Appalachia look like they have been through a war. Those living in the area know that things are not good, but they just try to do the best that they can with what they have. In previous articles about areas of the country that are economically depressed, I have typically focused on large cities such as Detroit or Camden, New Jersey. But the economic suffering that is taking place in rural communities in the heartland of America is just as tragic. We just don't hear about it as much. Most of those that live in the heart of Appalachia are really good "salt of the earth" people that just want to work hard and do what is right for their families. But after decades of increasing poverty, the entire region has been transformed into an economic nightmare that never seems to end. The following is a description of what life is like in Appalachia today that comes from a recent article by Kevin D. Williamson...

In these kinds of conditions, people do whatever they have to do just to survive. With so much poverty around, serving those on food stamps has become an important part of the local economy. In fact, cases of soda purchased with food stamps have become a form of "alternative currency" in the region. In his article, Williamson described how this works...

I would encourage everyone to read the rest of Williamson's excellent article. You can find the entire article right here. In Appalachia, the abuse of alcohol, meth and other legal and illegal drugs is significantly higher than in the U.S. population as a whole. In a desperate attempt to deal with the pain of their lives, many people living in the region are looking for anything that will allow them to "escape" for a little while. The following is an excerpt from an excellent article by Chris Hedges which describes what life is like in the little town of Gary, West Virginia at this point...

Of course this kind of thing is not just happening in the heart of Appalachia. All over the country there are rural communities that are economically depressed. In fact, according to the Wall Street Journal, economic activity in about half of the counties in the entire nation is still below pre-recession levels...

So what are our "leaders" doing to fix this? Well, they plan to ship millions more of our good jobs overseas. Unfortunately, I am not kidding. Republicans in the House of Representatives are introducing "fast track" trade promotion authority legislation that will pave the way for rapid approval of the secret trade treaty that Barack Obama has been negotiating. The following is how I described this insidious treaty in a previous article...

Once again, our politicians are betraying the American people and millions of jobs will be lost as a result. Not that the economy needs another reason to go downhill. The truth is that our economic foundations have already been rotting away for quite some time. But now the ongoing economic collapse seems to be picking up steam again. For example, the Baltic Dry Index (a very important indicator of global economic activity) is collapsing at a rate not seen since the great financial crash of 2008...

Soon economic conditions will get even worse for Appalachia and for the rest of the country. The consequences of decades of very foolish decisions are rapidly catching up with us, and millions upon millions of Americans are going to experience immense economic pain during the years to come. |

| "Two Roads Diverged" - Wall Street's Doubts Summarized As "The Liquidity Tide Recedes" Posted: 18 Jan 2014 07:25 AM PST From Russ Certo, head of rates at Brean Capital Two Roads Diverged As we know, it has been a suspect week with a variety of earnings misses. Although I have been constructive on risk asset markets generally, equities anecdotally, as figured year end push for alpha desires could let it run into year end. New year and ball game can change quickly. Just wondering if a larger rotation is in order. There is an overall considerable theme of what you may find when a liquidity tide recedes as most major crises or risk pullbacks have been precipitated by either combination of tighter monetary or fiscal policy. Some with a considerable lag like a year after Greenspan departed from Fed helm, or many other examples. I'm not suggesting NOW is a time for a compression in risk but am aware of the possibility, especially when Fed Chairs take victory laps, Bernanke this week. Symbolic if nothing more. Cover of TIME magazine? I happen to think that 2014 is a VERY different year than 2013 from a variety of viewpoints. First, there appears to be a dispersion of opinion about markets, valuations, policy frameworks and more. This is a healthy departure from YEARS of artificiality. Artificiality in valuations, artificiality in market and policy mechanics and essentially artificiality in EVERY financial, and real, relationship on the planet based on central bank(s) balance sheet expansion and other measures intended to be a stop-gap resolution to tightening financial conditions, adverse expectations of economic activity, and the great rollover....of both financial and non-financial debt financing. Boy, what a week in the IG issuance space with over $100 billion month to date, maybe $35 billion on the week. Debt rollover on steroids. Beneath the veneer of market aesthetics, I already see fundamental (and technical) relevance. This could be construed as an optimist pursuit or reality that markets are incrementally transcending reliance and/or dependence on the wings of central bank policy prerogatives. The market bird is trying to fly on its own with inklings of a return to FUNDAMENTAL analysis. A good thing, conceptually, and gradualist development of passing the valuation baton back to market runners. A likely major pillar objective of policy despite more than a few critics worried about seemingly dormant lurking imbalances created by immeasurable policy and monetary and fundamentally skewed risk asset relationships globally. This exercise of summarization of ebb and flow and comings and goings of markets and policy naturally funnels a discussion to what stature of central bank policy currently or accurately exists? Current events. What is the accurate stage of policy? I actually think this is a more delicate nuance than I perceive viewed in overall market sentiment. Granted, we have taken a major step for mankind, which is the topical engagement of some level of scope or reduction of liquidity provisioning," not tightening." Tip of the iceberg communique with markets to INTRODUCE the concept of stepping off the gas but not hitting the break. Reeks of fragility to me but narrative headed in right direction to stop medicating the patient, the global economy. Some markets have logically responded in kind. The highest beta markets as either beneficiaries or vulnerable to monetary policy changes, the emerging markets, have reflected at least the optics of change with policy. More auditory than optics in hearing a PROSPECTIVE change in garbled Fedspeak. The high flyer currencies which capture the nominal flighty hot money flows globally affirmed the Fed message. In literally the simplest of terms, the G7 industrialized, not peripheral; interest rate complex has simply moved the needle in form of +110 basis point higher moves in nominal sovereign interest rates. And there are a bevy of other expressions which played nicely and rightly conformed to the messages coming out of the central bank sandbox. But there are ALSO notable dichotomies, which send a different or even the opposite message. I perceive a deviation in perception of message as some markets or market participants appear to be betting on taper or a return to normalcy in global growth or U.S. growth outcomes??? OR no taper, or conversely QE4 or whatever. Sovereign spreads have moved materially tighter vs. industrial and supposed risk free rates (Tsys, Gilts, Bunds) both last year and in the first three weeks of 2014. Something a new leg of QE would represent, not a taper. A different year!!! There have been VERY reliable risk asset market beta correlations over the last 5 years and sovereign or peripheral spreads have been AS volatile and correlated as any asset class. These things trade like dancing with a rattle-snake. Greece, Spain, France etc. They can bite you with fangs. They have been meaningfully more correlated to high yield spreads and yields and to central bank balance sheet expansion as nearly any asset class. So, the infusion of central bank liquidity into markets has seen "relief" rallies in peripherals and one would think the converse would be true as well. The valuations have represented the flavor and direction of risk on/risk off or liquidity on/liquidity off reliably for many months/years. But I THOUGHT markets were deliberating tapering views and expressions as validated by some good soldier markets BUT that is not necessarily what the rally in riskiest of sovereign "credits" is suggesting. The complex seems to be decoupling with Fed balance sheet correlation and message. Some are OVER 100 standard deviations from the mean! They are rich and could/should be sold. Especially if one was to follow the obvious correlation with the direction of central bank as stated. But look to other arena's like TIPS breakevens which also have been correlated with liquidity and risk on/off and central bank balance sheet expansion. Correlated to NASDAQ, HY, peripherals and the like. BUT this complex COUNTERS what peripherals are doing. They haven't shown up to the punch bowl party yet. Not invited. This is a departure of markets that have largely and generally been in synch from a liquidity and performance correlation view. Like gold and silver which got tattooed vis a vis down 35%+ performance last year MOSTLY, but not exclusively, due to perceptions of winds of central bank change. BUT even within a contrary, the fact that rallies in Spain, France, Greece, and Italy reflect more of central bank easing notions, the opposite of taper. In essence, the complex has gone batty uber-appreciation this year. Sure, many eyeball the Launchpad physical metals marginal stabilization no longer falling on a knife but the miner bonds and the mining stocks are string like bull with significant appreciation. This decidedly isn't the stuff of taper which had the bond daddy's romancing notions of 3% 10yr breaks, 40 basis point Green Eurodollar sell-offs, emerging market rinse, and upticks in volatility amongst other things. Equity bourses appear to be changing hands between investors with oscillating rotations which mark the first prospective 3 week consecutive sell-off in a while. New year. This is taper light. Somewhere in between and further blurs the correlation metrics. So, which is it? Are we tapering or not and why are merely a few global asset classed pointed out here, why are they deviating or arguably pricing in different central bank prospects or scenarios or outcomes? I'm not afraid but I am intrigued as to the fact that there may some strong opinions within markets and I perceive a widely received comfortability with taper or tightening notions, negative leanings on interest rate forecasts, a complacency of Fed call if you will. And all of these hingings occur without intimate knowledge of the most critical variable of all, what Janet Yellen thinks? She has been awfully quiet as of late and there are many foregone conclusions or assumptions in market psyche without having heard a peep from the new MAESTRO. Moreover, looking in the REAR view mirror within a week where multiple (two) Fed Governor proclamations, communicated and implicated notions which arguably would be considered radical in ANY other policy period of a hundred years. How to conduct "monetary policy at a ZERO lower bound (Williams) " and "doing something as surprising and drastic as cutting interest on excess reserves BELOW zero (Kocherlakota)." This doesn't sound like no stinking taper? A tale of two markets. To be or not to be. To taper or not to taper. Two roads diverged and I took the one less traveled by, and that has made all the difference. Robert Frost. Which is it? Different markets pricing different things. Right or wrong, the market always has a message; listen critically. Russ |

| Gold - Disconnect Between Fundamentals And Price. Perception Rules Posted: 18 Jan 2014 07:04 AM PST The stock market's investment compass was smashed back then, when many once considered solid companies lost half their value, some even more. The investment community was stunned. But that is "ancient" history, as is almost anything that ... Read More... |

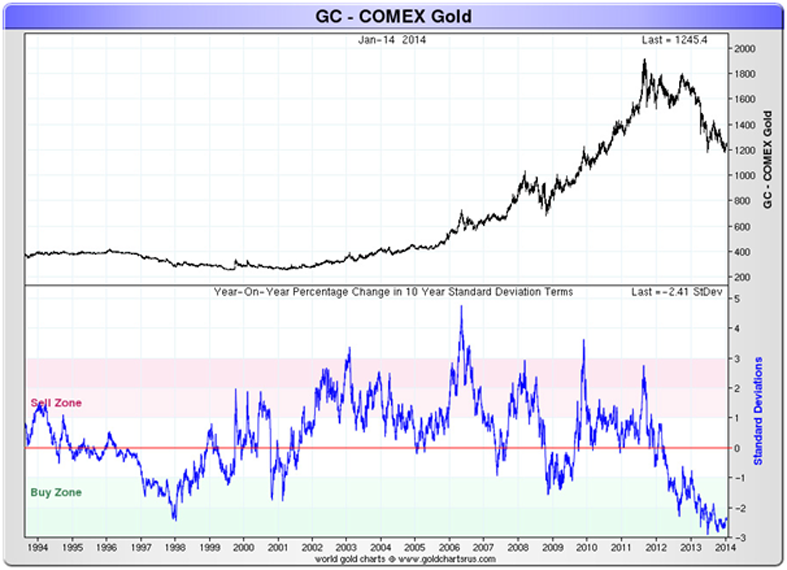

| Posted: 18 Jan 2014 07:03 AM PST Summary: Long term - on major sell signal since Mar 2012. Short term - on buy signals. Gold sector cycle - up as of 12/27. COT data is favorable for a bear market rally. Read More... |

| Silver Prices - When Monetary Demand Trumps Industrial Demand Posted: 18 Jan 2014 05:18 AM PST Jeffrey Lewis |

| Posted: 18 Jan 2014 05:06 AM PST The US dollar finished last week well bid. It is at six week highs against the euro. It recovered from the brief dip at the start of the week below JPY103 and finished the week above JPY104.00. The Australian dollar fell to new multi-year lows, as did the Canadian dollar. Most emerging market currencies also fell.

The notable exception to this general pattern was sterling. Strong retail sales helped ease some anxiety that had been creeping in about sustainability of the UK's expansion.

It was the apparent resiliency of the UK and US economies that was the main fundamental development in recent days. The poor US jobs data had sparked some speculation that the economy was sufficiently fragile that the Federal Reserve would have to re-think its tapering tactics that it just had unveiled last month. The combination of the healthy gain in a key component of retail sales (excluding autos, gasoline and building materials), stronger than expected regional Fed surveys (Empire and Philly) and a Beige Book that seemed to slightly upgrade the economic assessment, pointed in the direction of continued exit from QE. A number of Fed officials, not of all who are voting members on the FOMC, encouraged this conclusion by investors.

Before the weekend, the euro slumped to almost $1.3500. It finished the North American session below its 100-day moving average (~$1.3665) for the first time since September. A break of this area could open trigger a new wave of long liquidation that could carry the single currency toward $1.3450. The euro's technical condition has deteriorated and the five days average is trending below that 20-day average.

As poor as the euro's technical readings are, sterling's are positive. The RSI an MACD are turning higher. Sterling stalled in front of the $1.6460 area, which corresponds to a 50% retracement of the losses seen since the multi-year high above $1.6600 was seen briefly on the first trading session of the year. A move above $1.6500-20 is needed to signal the resumption of the uptrend. Support has been established in front of $1.6300.

The greenback also finished last week above its 100-day moving average against the Swiss franc (~CHF0.9075), an area it has been flirting with, but for which it was unable to sustain a convincing break. The CHF0.9130 area offers immediate resistance.

The dollar finished the week little changed against the yen, but this overlooks the ride it took. It first fell to JPY102.85 in follow through selling after the US employment report, but proceeded to recover back to almost JPY105 as the dollar buying strategy on pullbacks continues to be seen. The RSI and MACDs are still pointing lower, but rather than signal a new leg down in the dollar, we suspect a consolidation phase is more likely.

The technical condition of the dollar-bloc currencies is poor and the Canadian dollar is challenging the Australian dollar for leadership of decline. Economic data from both countries have encouraged rate cut speculation. The Bank of Canada meets next week. A rate cut is highly unlikely, though dovish comments by the central bank are likely. This could trigger a bout of short-covering, perhaps on a sell-the-rumor-and-buy-the-fact type of activity. Key support for the US dollar is seen in the CAD1.0880-CAD1.0900 area.

Australia reports Q4 CPI figures and a subdued report could fan rate cut expectations. The Australian dollar traced out a big outside down week and many market participants are looking for $0.8500 in the coming weeks. Ironically, the New Zealand dollar was dragged lower, even though the market sees a growing risk of a rate hike at the end of the month. The $0.8500 area now marks important resistance and the Kiwi can make its way toward $0.8100.

The US dollar trended higher against the Mexican peso last week and reached its best level since September. It has approached the upper end of the Q4 '13 trading range. Although the technical indicators are not generating strong signals, we suspect the market has moved too far too fast. The dollar closed marginally above its Bollinger Band (+/- 2 standard deviations around the 20-day moving average). Support is seen near MXN13.15. The top of the range appears to be around MXN13.3450.

Outside of the currencies we usually review here, we observe among the clearest technical signal may be that the euro is poised to weaken against the Swedish krona. It has traced out a large head and shoulders pattern and finished last week below the neckline. The left shoulder was carved in mid-November near SEK9.00. The head was put in place in mid-December near SEK9.10. The right shoulder was formed in the first half of this month. The neckline can be found around SEK8.82. If this is indeed a valid pattern, the measuring objective is near last summer lows around SEK8.55.

Observations from the speculative positioning in the CME currency futures:

1. The net speculative position switched from long to short Swiss francs. It is the first net short position in 5 months. It was more the result of longs being cut (6.2k contracts) than shorts being added (+1.5k contracts).

2. The net speculative Canadian dollar position stands at a new record short of 67.3k contracts. Gross shorts rose 10.5k contracts to 101.6k. As noted above, we suspect the Canadian dollar is vulnerable to a short squeeze after the central bank meeting on January 22.

3. In three of the seven currency futures we review here, there was a reduction of both gross shorts and longs (yen, Australian dollar and Mexican peso). In the previous reporting period, there were four currencies were subject to such position adjustments (yen, sterling, Swiss franc and Australian dollar).

4. There net long euro position fell for the third consecutive week. The net short yen position was reduced for a third week as well.  |

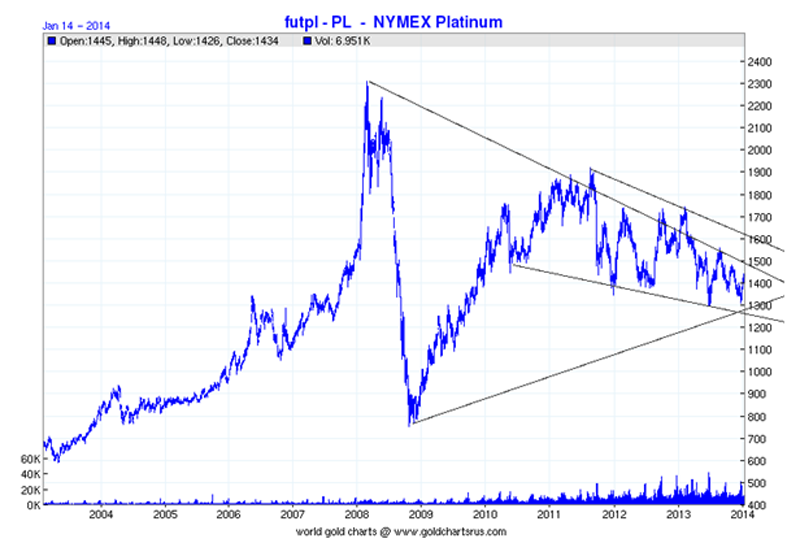

| Gold Investors Weekly Review – January 17th Posted: 18 Jan 2014 03:39 AM PST In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. The price of the yellow metal went lower after two consecutive weeks of gains. Gold closed the week at $1,254.02, up $5.57 per ounce (0.45%). The NYSE Arca Gold Miners Index went 5.85% higher on the week. This was the gold investors review of past week. Gold Market StrengthsGold strengthened $5.60 this week, with its price increasing $48.40 per ounce so far this year. As the chart above shows, the yellow metal continues to form its technical double bottom and is now breaking away from the 50-day moving average. Normally, as U.S. economic prospects improve, gold retreats. However, so far this year the negative correlation between the dollar and gold is at the lowest since October of last year. Gold received a boost this week as a government report showed the cost of living in the U.S. increased by the most in six months, boosting gold's appeal as a hedge against inflation. The consumer price index (CPI) rose 0.3 percent in December from the previous month, putting inflation back on everyone's radar. Gold Market WeaknessesMining companies continue to slash exploration expenditures as budgets tumble. The massive cuts in exploration in 2013 are being extended this year. Last year, exploration spending plunged by roughly $10 billion, or 30 percent, and may drop an additional 10 percent this year as major producers and junior explorers alike trim budgets, according to MinEX Consulting. Colossus Minerals, a former star of the junior mining sector, announced it will seek creditor protection after failing to make an interest payment due at the end of 2013. The fall of this name was predictable earlier last year when its dewatering process proved unsuccessful. However, Colossus continued to be a component of the GDXJ ETF up until the latest rebalancing in December. This is yet another reminder for investors of the risks posed by passive gold ETFs and their stock selection lacking fundamental analysis. Gold Market OpportunitiesThe U.K. Financial Authority gold price setting investigation has claimed its first casualty as Deutsche Bank announced it will withdraw from participating in setting gold and silver benchmarks in London. The bank justified the move as a means of scaling back its commodities business. UBS sees platinum outperforming gold, pulled by higher economic growth in developed nations. The metal could see upward pressure in the near term as Lonmin Plc and Impala Platinum Holdings, two of the world's largest producers, will start to receive strike notices after a South African union called for yet another stoppage. Gold Market ThreatsThe Precious Metals Research team at BMO published a report that seeks to debunk some of the misconceptions about the outlook for the gold mining industry. According to the analysts, production is not likely to decline short term the way many have speculated, which will remove one of the positive supply tailwinds for gold. In addition, it asserts that companies will have a harder time cutting costs than is being assumed, and that the enforcement of the cost-cutting measures will be harder than it may appear. Goldman Sachs' Head of Commodities Research Jeffrey Currie remains bearish on virtually all commodities, but particularly on gold, reiterating his prediction of last year that gold will fall to $1,050 per ounce by the end of this year. Currie noted that not one commodity has a bullish supply story; not even gold after the recent cuts to exploration and development budgets across the industry. The Indian Government on Thursday announced a hike in import tariff value for gold and silver. The import tariff value of gold was hiked by 3.83 percent, and that of silver was hiked by 3.92 percent, in tandem with the precious metal prices in the international market. The move shows the Indian Government sees no urgency to remove or decrease the import burden that led to a dramatic decrease in legal gold imports. |

| Gold – Disconnect Between Fundamentals And Price. Perception Rules. Posted: 18 Jan 2014 03:18 AM PST What will it take to turn the gold market around? One would think it would be obvious that fundamentals are not the answer, while so many believe that fundamentals rule. We are reminded of the fundamentalists, especially "value investors" whose financial world was literally turned upside down when the stock market crashed in 2008. While "value" and "fundamentals" were considered the economic bedrock of the stock market, it turns out that everything is really steeped in perception, for they changed dramatically. The stock market's investment compass was smashed back then, when many once considered solid companies lost half their value, some even more. The investment community was stunned. But that is "ancient" history, as is almost anything that is longer than a few months in time. That has been [nearly] forgotten and replaced by the fiat euphoria levitating the stock market for the past few years. What does this have to do with gold? Like everything else, it is all about perception, even in the Precious Metals, [PM]. It gold a commodity, it is money? [History proves that only fools consider it a "barbaric metal.'] It has been the most consistent barometer of value for many centuries. This is but one perception that many in the PM camp have forgotten to hold fast, and they only focus on current price relative to its peak of a few years ago. A few years out of over 5,000, and some wonder about the validity of gold as a safe haven? Oh, ye of little faith comes to mind. It is a misplaced hand-eye coordinated thought. "All of the fundamentals are screaming high demand for and a shortage of physical gold, but price keeps on dropping." Or any close variation that captures price insecurity in the minds of "gold bugs," or as we call them, smart people. If your perception is focused solely on where the price of gold is, as opposed to where you think or believe it ought to be, the elites would like to sell you a renewable subscription to their "Fiat Is Better" newsletter. Why is gold not at higher price levels? An excellent question, and we repeat, the perception that fundamentals should rule is a misplaced one, at least for now. Everyone who is even remotely interested in gold knows that the COMEX and LBMA vaults are just about bare. The COMEX has been nursing a default on physical delivery for gold and silver since last summer. There have been none. Those who stood to take delivery received cash, or rolled forward. This is certainly an acknowledgment that there is no gold or silver, yet that fact has not translated into a stampede of customers demanding gold. Even Deutsche Bank cannot get delivery of their own gold! Keep focused on your objectives and the reality of events. Right now, people can buy gold coins and bars almost at will. If Deutsche Bank has to wait seven years to get just some of its gold back, and they are not an isolated example, if the vaults are nearly depleted, and you can buy gold coins and gold bars from dealers every day, in light of the whole world recognizing a shortage, everyone should be taking advantage of the disconnect between perceived value and the reality of current prices and buying as much as they can! One thought to keep in mind is, if fundamentals are not what is moving the markets, then what is? If the perceived catalyst of fundamentals is wrong, then there must be some unseen forces at work. If we can perceive what those forces are, we may better understand why PMs are priced where they are. We will have a related article on silver, tomorrow, to address that one. For right now, there is a 35% off sale going on. This is lock-and-load, fire at will, and not a time to be keeping one's powder dry. If you know all the available physical gold is being shipped East, primarily to China, and you have immediate access to however many ounces you want to buy, why is there any concern over the current price of gold? What happens if you cannot buy at any price?! Better a year early than a day late. The reality is, whatever gold is available is relatively cheap. If you can answer the question, for how much longer will you be able to buy it, then plan accordingly. If you cannot answer that question, then plan accordingly for that event, as well. We understand that the charts reflect the bogus COMEX manipulated paper price of gold, but that is all that is available, and the physical market, measured by tonnes going to a variety of mostly BRICS nations, is at a premium to paper. However unreal the COMEX and LBMA pricing mechanism may be, it is all that is available, at least for now. Despite the fact that others who make predictions draws reader attention, we do not make them. For one, no one knows how the future will develop, just review all of the predictions from 2013 for proof. Secondly, there are utterly unnecessary. The market will indicate when the trend has changed, and there will be ample opportunity to be long paper futures, that is, if there is still a paper futures market in the next year. The trend remains down. Any predictions you may be reading currently are mostly a regurgitation from the same ones who made predictions last year. Is it really necessary to ask how they worked out? One thing we can say about the charts of the market is that they do not mislead. They can be misread, at times, but overall, the trend is accurate. Will the current 1200 area continue to hold? Odds say no, based only on the current down trend, but things can change. However, it is always best to wait for confirmation of a change before acting contrary to the current trend. Compare how quickly price rallied from the late June low, and the wider bar ranges relative to how price has been "hugging" that support line for the past several weeks. Also, the ranges are smaller and volume is less. The difference is what suggests that price can still go lower, or do more retesting of the 1200 area, at a minimum. Can price, or will price rally further into next week? Odds say yes, based upon the upper range close, Friday, but how much and for how long, given the trend line resistance is not highly promising. This does not mean price cannot rally $50 next week, but that we have to make judgments based on what is known, at this time. Just look at the chart and ask yourself, how many longs are making money since 2011? To be clear, this pertains to the futures only. We have been constantly advocating the purchase of physical PMs throughout the decline, but for a vastly different reason. October and November saw 1260 as support in gold. Once broken, in November, 1260 has become resistance. Proof of that was when price was rebuffed near mid-December on a retest. We saw the small range bars, 2nd and 3rd from the end, as weak demand, especially after price declined on a wider range bar, 4th from the right. Friday's ability to rally came as a surprise, but the overall picture is still one of weakness. Maybe 1260 will be tested again this coming week. It will be important to observe how price reacts to get an idea of the current strength of weakness for gold futures. |

| Demographic Cliff Great Deflation - Harry Dent on How to Prosper in the Coming Downturn Posted: 18 Jan 2014 01:10 AM PST There's little happy talk in Harry Dent's new book, "The Demographic Cliff: How to Survive and Prosper During the Great Deflation of 2014â€"2019," yet the author sees incredible opportunities for the investors and businesses that see this crisis coming. The founder of Dent Research relies strongly on demographic statistics and trends to predict a crash starting in early 2014 and lasting into 2015 or 2016, which will make 2008 look like a mere tumble. In this interview with The Gold Report, he delves into the economic implications of Baby Boomers aging around the world, and discusses strategies for investors to protect themselves. |

| A Glimpse into the Coming Economic Collapse Posted: 18 Jan 2014 01:04 AM PST By Jeff Thomas, International Man Beginning in 1999, we predicted a systemic economic collapse that would take place in the First World and would impact all other economies. We began to list some of the "dominoes" that would fall as the collapse evolved and described that the "Great Unravelling," as we termed it, would take roughly ten years. At that time, we guesstimated that the first two of the dominoes, a real estate crash and subsequent stock market crash in the US, would begin in about 2005. |

| Stocks and Bonds Tops, Gold and Silver Bottom Climacterics Now Posted: 18 Jan 2014 12:56 AM PST “We view prospective near-term and multi-year returns as strongly unfavorable, and prospective market risk as unusually elevated.”John Hussman, January 2014 Choppy, decidedly Unbullish Equities Market Action thus far in 2014 is one Major Clue the Climacterics we earlier forecast have arrived in Key Markets. They may take a few days to a few weeks to fully develop, but they have arrived. |

| Paul Craig Roberts: The hows and whys of gold price manipulation Posted: 17 Jan 2014 10:09 PM PST 10:06p PT Friday, January 17, 2014 Dear Friend of GATA and Gold: Assisted by fund manager Dave Kranzler, former Assistant U.S. Treasury Secretary Paul Craig Roberts gives an excellent summary of the U.S. government's suppression of the price of gold. Their commentary is headlined "The Hows and Whys of Gold Price Manipulation" and it's posted at Roberts' Internet site here: http://www.paulcraigroberts.org/2014/01/17/hows-whys-gold-price-manipula... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and safeguards more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| China Claims To Already Have the Third Largest Gold Reserves in the World Posted: 17 Jan 2014 10:00 PM PST Le Cafe Américain |

| Terrifying Technicals: This Chartist Predicts An Anti-Fed Revulsion, And A Plunge In The S&P To 450 Posted: 17 Jan 2014 07:31 PM PST Via Walter J. Zimmermann Jr. of United-ICAP,