saveyourassetsfirst3 |

- BCSC calls out questionable resource report claiming massive gold-silver resource in Nevada

- Gold endures worst November since 1978

- Wherever the gold price goes, silver is sure to follow

- ASX Wrap: Whitehaven takes over henhouse, as Newcrest cash bleed continues

- China Is On A Debt Binge And A Buying Spree Unlike Anything The World Has Ever Seen Before

- Dollar, Euro and Their Influence on Precious Metals

- Metallic Money (Gold/Silver) vs. Credit Money: Know the Difference

- SBSS Consumerism (Santa Slave) & Peace on Earth – Available Now at SDBullion!

- China's Gold Appetite Gets Bigger

- Jeff Berwick on Why Bitcoins for Transactions & Gold for Preserving Wealth

- Iran to resume gold trade with Turkey

- Silver may rise as moving averages converge

- Chaos Is Coming To The Streets Of America

- "Is This The Right Time To Get ...

- Iran says gold trade with Turkey to resume

- Pound Steady Despite Weak U.K. Consumer Indicators

- The Ultimate Tail Event: The Inevitable Reversion Back to a Commodity Money Standard

- 5 Facts You Should Read Before Buying Bitcoins

- Turkey may export more gold to Iran

- Bitcoin Passes Price of Gold

- 10 Major Volcanoes Along The Ring Of Fire Have Suddenly Roared To Life

- Russia's VTB group begins Gold, Silver export to India

- Venezuela Denies Goldman’s Gold Deal As Inflation Tops 54%

- “Is This The Right Time To Get Into Gold?”

- Bitcoin vs. Gold: The Future of Money – Peter Schiff Debates Stefan Molyneux

- Netherlands Goes Greek

- Are You Ready?

- Bullion and Energy Market Commentary

- Gold Price Analysis - Nov. 29, 2013

- China on course to overtake India as the largest buyers of gold on the planet as purchases increases a staggering 30% in 2013

- State Dept. minutes confirm that whoever has the most gold makes the rules

- Is Money The Root Of All Evil?

- SDBullion.com’s Black Friday Midnight Madness Begins…NOW!

- Ron Paul vs Paul Krugman: Who Is The True Prophet, Who Is The False?

- Venezuela denies but doesnt rule out gold transaction with Wall Street

- China’s Gold Rush Continues, Imports Another 131 Tonnes In October

- Silver Elliott Wave Technical Analysis – 27th November, 2013

- TECHNICAL - Price & Time: Gold Refusing to Join the "Party"

- China Gives Thanks For Cheap Gold

- Venezuela Denies Goldmans Gold Deal As Inflation Tops 54%

- Chinese Gold Imports From Hong Kong in October a Massive 131 Tonnes

- Iran oil minister in talks with western energy firms: FT

- Two King World News Blogs/Audio Interviews

- Consensus on gold equities suggests buy now before the great reversal

- Dimitri Speck: The Double Face of Gold [Part 2]

- Mike Kosares: Gold's organized retreat -- who benefits?

- Poor, stupid Venezuela doesn't understand its leverage

- Turkey may export more gold to Iran

- Call to rollback gold import duty to 5% gathers momentum in India

- October Chinese gold imports from Hong Kong a massive 131 tonnes

| BCSC calls out questionable resource report claiming massive gold-silver resource in Nevada Posted: 29 Nov 2013 05:21 PM PST Few exploration details back a Nevada company's claim it holds 2.6 billion ounces silver and 370 million ounces gold in a NI 43-101 resource estimate. |

| Gold endures worst November since 1978 Posted: 29 Nov 2013 03:01 PM PST Worst November in 35 years for gold as India's import ban forces jump in recycling, writes Adrian Ash |

| Wherever the gold price goes, silver is sure to follow Posted: 29 Nov 2013 12:33 PM PST For a number of reasons, the supply/demand picture for silver now shares many common denominators with those of gold, says Julian Phillips. |

| ASX Wrap: Whitehaven takes over henhouse, as Newcrest cash bleed continues Posted: 29 Nov 2013 12:09 PM PST Gold miners have endured a torrid week on the ASX, with Beadell Resources (-9.4%), Regis Resources (-2.2%) and Evolution Mining (-4.7%) all losing ground. |

| China Is On A Debt Binge And A Buying Spree Unlike Anything The World Has Ever Seen Before Posted: 29 Nov 2013 12:00 PM PST

When it comes to reckless money creation, it turns out that China is the king. Over the past five years, Chinese bank assets have grown from about 9 trillion dollars to more than 24 trillion dollars. This has been fueled by the greatest private debt binge that the world has ever seen. According to a [...] The post China Is On A Debt Binge And A Buying Spree Unlike Anything The World Has Ever Seen Before appeared first on Silver Doctors. |

| Dollar, Euro and Their Influence on Precious Metals Posted: 29 Nov 2013 11:32 AM PST SunshineProfits |

| Metallic Money (Gold/Silver) vs. Credit Money: Know the Difference Posted: 29 Nov 2013 11:26 AM PST Longtime correspondent Jeff W. succinctly explains the difference between metallic money (gold and silver) and credit money. You’ve probably read many articles about money–what it is (store of value and means of exchange) and its many variations (metal, paper, etc.). But perhaps the most important distinction to be made in our era is between metallic money and credit money. Longtime correspondent Jeff W. succinctly explains the difference between metallic money (gold and silver) and credit money: We use credit money every day. It's the only kind of money we have. But because people in Europe and America have historically used metallic money for over 2,500 years, we still have cultural habits that come from the gold money era. Because the nature of credit money and metallic money are not well understood, and because money is so important in our lives, it is worthwhile to examine and discuss how these two kinds of money are different. 1. Tangible vs. intangible. A gold or silver coin is a physical object that has weight, volume and physical characteristics. Credit money is a record of the existence of a debt. Credit money exists in the intangible world of information and human relationships. Where Mr. A owes Mr. B a specified unit of money, and where that debt is recorded on paper or another recording medium, and where the record of that debt passes from one person's possession to another as a medium of exchange, you have credit money. Gold coins are minted; debts are recorded. The two forms of money could hardly be more dissimilar. 2. Old vs. oldest. Metallic money has been used by people for about 2,600 years. It has been used sporadically and in certain places. Credit money has been used for at least 5,000 years, when people first started recording debts on clay tablets, pieces of wood or ivory, etc., and trading those IOU's as money. Before debts were recorded in writing, they were, in prehistoric times, discussed verbally, remembered, and sometimes traded in verbal transactions. This is how very primitive people still trade using debt today. 3. Persistent vs. ephemeral. Some gold coins more than 2,000 years old are still in existence today. But it would be very rare for any performing loans to be more than 100 years old, and many loans are of very short duration. Much of the U.S. Treasury's debt issue is very short term, lasting only 90 days or one year. Where gold coins can last for thousands of years, debts are constantly coming into existence and going out of existence. The U.S. debt holdings of the Federal Reserve are constantly churning and rolling over, whereas gold holdings in vaults can lie stationary and do not need to be replaced or rolled over. 4. Hard to create vs. easy to create. To create a gold coin, someone has to first mine the gold from the earth, refine it, mill it, stamp it into circular shapes and then stamp the governmental pattern on it. To create a piece of credit money, a debt has to be created and then a piece of paper printed or a record created on a computer. Anyone who has no intention of paying back his debt, such as the Federal government, can potentially issue debt in infinite amounts. There is an issue of whether that debt is worth anything, however. 5. Always good vs. sometimes good. A gold coin that is legal tender will always be accepted as money. With credit money, some of it is good and some of it is bad. In recent years Zimbabwe's credit money went bad. Before that, the Weimar Republic's credit money became worthless. All circulating debt has a mixture of good and bad. When a lot of it goes bad at the same time, it causes a crisis, where the "toxic debt" must be guaranteed or purchased by government or else banks and other financial institutions will go bankrupt. 6. Non-interest bearing vs. interest bearing. Most debt specifies interest payments as part of the loan agreement. The Federal Reserve notes we use as money are claims on interest-bearing debt owned by the Federal Reserve. Credit money has the quality that there is a continuing flow of interest payments away from the users of money in the general population and toward creditors. There is no such continued flow of wealth from debtors to creditors in a gold money system. 7. Does not need money supply expansion vs. needs expansion. Because interest payments are constantly flowing out from families, businesses and communities to financial centers and wealthy creditors, credit money results in economic sluggishness unless there is a constant expansion of the supply of credit money. Under a gold money system, people can function much better with a constant money supply because there is no leakage of interest payments. Each community can continue to circulate its own holdings of gold money without having to pay any of it out in the form of interest payments. 8. Government does not need to enable creating more debt vs. government must enable debt creation. In order to keep a credit money economy going, more debt must be continually created. Government and financial leaders who do not want to be blamed for a downward spiral of slowing economic activity must see to it that more debt is constantly being created. Under a gold money system, there is no pressure to constantly increase the burden of debt. 9. Not as bubble prone vs. more bubble prone. The fractional reserve method of banking encourages asset bubbles because new money is created as borrowers take out new loans. When people borrow money to buy bubble assets (e.g., houses 1981-2006), it creates enormous amounts of new money to feed the asset bubble. Many asset bubbles were also created during the gold money era due to fractional reserve banking, but where the unit of currency is guaranteed by government to be equal to a fixed weight in gold, the inflation threat is taken out of the picture and that restrains bubble creation somewhat. To support the value of their currencies under a gold money system, governments must also often raise interest rates in order to encourage investors to sell gold in exchange for bonds paying good interest. Higher interest rates also discourage the formation of asset bubbles. 10. Does not enable ZIRP vs. enables ZIRP. A zero interest rate policy is impossible under a gold money system. The demand for gold would soon deplete government's gold holdings to zero. Under a credit money system a policy of low interest rates and financial repression can be imposed for an indefinite period of time. 11. Does not increase lending activity vs. increases lending activity. Low interest rates and the ease with which credit money is created lead to increased lending activity and higher debt loads. Under a gold money system, debt will necessarily be created at a slower rate. By stepping up the pace of debt creation, a credit money system serves the interests of the banks. 12. Has no problem with debt saturation vs. has serious problems with debt saturation. Continually increasing debt leads ultimately to debt saturation. When a country's people and businesses are saturated with debt, it makes it much more difficult to continue to increase the debt load. That leads to stagnation and slowing economic activity in a credit money system. A gold money system does not tend to lead to debt saturation and has no similar problems with debt saturation. 13. Increases wealth disparities vs. does not increase wealth disparities. The higher debt load facilitated by a credit money system results in greater flows of wealth from the debtor class to the creditor class. The higher debt load leads to increased disparities in income, more very poor and very rich and fewer of the middle class. 14. Holds its value vs. does not hold its value. Gold-backed currencies have an excellent track record of holding their value. Credit money tends to inflation, the rate of which largely depends on how fast new debt is being created. 15. Government as a guarantor of savings vs. government provides no guarantee. One of the three functions of money is as a store of value. (The others are a medium of exchange and a unit of account.) When the U.S. government guarantees that 35 U.S. dollars will buy an ounce of gold, as it did in the years 1934-67, government aid savers by acting as a guarantor of that store of value. When the U.S. went off the gold standard in 1971, it changed the relationship between citizens and their government when government no longer provided that guarantee. 16. Defaulters are bad vs. defaulters are only partly bad. In a gold money system, a person who takes out a loan and does not repay it is considered a bad person, almost a thief. He has robbed his creditors of the money they were rightfully owed. In a credit money system, however, the creation of new debt is so important that anyone who goes into debt is a hero of the economy. That is why under a debt money system, it is considered more important that new debt be created (e.g., as student loans) than to worry about whether they will ever be paid back or to pin blame and guilt on loan defaulters. Conclusion: As we see, it is no exaggeration to say that the transition from gold money to credit money changes everything. It changes every individual's relationship with his own money, with government, and with banks. It changes the power relationships within society. It changes the patterns of ownership and wealth accumulation. It is very important that citizens and investors understand the credit money system that they are trying to operate within. For people with over 2,500 years of experience with gold money, it is difficult to understand it and get used to it. But anyone who does understand it will be better off because of making better-informed decisions. We might as well get used to it because we shall likely have to live with a credit money system for a very long time. Thank you, Jeff, for an insightful and extremely important overview of the critical differences between credit money and gold/silver. The key distinction of all these important distinctions is the ephemeral nature of credit-money (and any form of fiat currency). History teaches us that a financial-political crisis of sufficient magnitude reveals the underlying value of credit-money–i.e. zero–in a brief but cataclysmic loss of faith/trust. As correspondent Harun I. observed in Why Is Debt the Source of Income Inequality and Serfdom? It’s the Interest, Baby: “Governments cannot reduce their debt or deficits and central banks cannot taper. Equally, they cannot perpetually borrow exponentially more. This one last bubble cannot end (but it must).” When the current bubble bursts, the difference between metallic money and credit money will be starkly visible: no one will trade gold or silver for any amount of paper/credit money, and the ephemeral financial instruments (“assets”) that dominate today’s financial system will be revealed for what they are: phantom promises of value. |

| SBSS Consumerism (Santa Slave) & Peace on Earth – Available Now at SDBullion! Posted: 29 Nov 2013 11:25 AM PST

The Silver Bullet Silver Shield Consumerism (Santa Slave) & Peace on Earth medallions are available now at SDBullion! Click or call 614.300.1094 to order! The post SBSS Consumerism (Santa Slave) & Peace on Earth – Available Now at SDBullion! appeared first on Silver Doctors. |

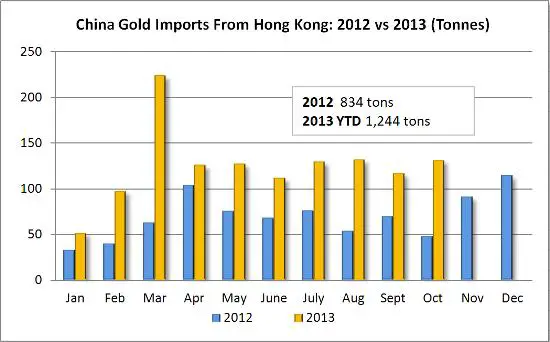

| China's Gold Appetite Gets Bigger Posted: 29 Nov 2013 11:05 AM PST India is to be officially dethroned as the world's biggest purchaser of the "yellow metal" by year-end. Many are forecasting that gold purchases in China will surge to +29% for this year. Physical demand has found some much needed support after Hong Kong reported that China has net imported from the "Special Administrative Region" 131.19 tonnes of gold last month, the second highest level in history. China remains consistent in its appetite. The country has imported more than 100 tonnes of gold each month in the last six-months. The precious metal is heading for its first annual drop in 13 years as the majority of the market has lost faith in the metal as a store of value, fueled by concern that expected reductions in $85b of monthly bond buying by the Fed will ease the risk of accelerating inflation. For some, Chinese demand is too little too late. John |

| Jeff Berwick on Why Bitcoins for Transactions & Gold for Preserving Wealth Posted: 29 Nov 2013 11:00 AM PST

The Chief Editor of DollarVigilante.com, Jeff Berwick, says, "The entire 'Bitcoin' system is a revolution in money and banking." That said, Berwick warns, "Volatility is a major issue with Bitcoin . . . over time, as more and more people use it, it will become more stable. . . . I would not recommend it [...] The post Jeff Berwick on Why Bitcoins for Transactions & Gold for Preserving Wealth appeared first on Silver Doctors. |

| Iran to resume gold trade with Turkey Posted: 29 Nov 2013 10:47 AM PST Iran's ambassador to Turkey says once sanctions on Iran are eased, the gold trade will resume albeit at lower levels than last year. |

| Silver may rise as moving averages converge Posted: 29 Nov 2013 10:27 AM PST A technical analysis by Korea Exchange Bank Futures suggests futures may climb to $22/oz as converging moving averages signal a short-term rebound. |

| Chaos Is Coming To The Streets Of America Posted: 29 Nov 2013 10:00 AM PST

There is a hot new game being played in cities all over America, and it is very simple. You pick out a defenseless person on the street and you try to knock them out. In most areas, it is known as "the knockout game". In some communities it is called by other names such as [...] The post Chaos Is Coming To The Streets Of America appeared first on Silver Doctors. |

| "Is This The Right Time To Get ... Posted: 29 Nov 2013 09:32 AM PST gold.ie |

| Iran says gold trade with Turkey to resume Posted: 29 Nov 2013 09:31 AM PST GATA |

| Pound Steady Despite Weak U.K. Consumer Indicators Posted: 29 Nov 2013 09:15 AM PST GBP/USD is steady on Friday, as the pair traded in the low-1.63 range in the European session. The pound shrugged off some weak consumer indicators, as Consumer Confidence and Net Lending to Individuals were well short of their estimates. In the US, the markets will be closing early on Friday. There are no US releases on the schedule. The pound has enjoyed strong gains this week at the expense of the dollar, but the rally has taken a pause on Friday after some weak data out of the UK. GfK Consumer Confidence continues to look weak, coming in at -12 points, short of the estimate of -8 points. Net Lending to Individuals, an important gauge of consumer borrowing and spending, dropped to 1.7 billion pounds, missing the estimate of 2.1 billion. These weak readings indicate that consumer confidence and spending remain weak, despite the improvement in the British economy. Other |

| The Ultimate Tail Event: The Inevitable Reversion Back to a Commodity Money Standard Posted: 29 Nov 2013 09:00 AM PST

I continue to be excited by the gold and silver market because it simultaneously provides both pro-tection and optionality on what I believe to be the ultimate tail event: the inevitable reversion back to a tangible/commodity money standard. This event is so alien to present avant-garde economics it has been ruled out as a solution [...] The post The Ultimate Tail Event: The Inevitable Reversion Back to a Commodity Money Standard appeared first on Silver Doctors. |

| 5 Facts You Should Read Before Buying Bitcoins Posted: 29 Nov 2013 08:38 AM PST Bitcoin, the infamous cryptocurrency made popular by tech-savvy libertarians and others suspicious of economic centralization, often sparks passionate arguments about the nature of government, money, and markets. Some believe that Bitcoin is a threat to society by creating opportunity for terrorists and criminals. Others believe it's the salvation of the market from government and special interests, redeeming money from centralized political control. The truth, like usual, is a little more nuanced. Once we cut through some of the myths and fallacies, we'll see that cryptocurrencies are imperfect-but-useful currencies that will likely exist alongside other forms of money for some time. 1. Bitcoin is not just an "electronic version" of gold Saying that Bitcoin is an "electronic version" of gold is extremely dangerous, because, while there are similarities between the two assets, there are extreme differences. Bitcoins can be tracked, can't be melted down, and require different logistics for moving than |

| Turkey may export more gold to Iran Posted: 29 Nov 2013 08:05 AM PST Turkey's gold exports to Iran may hike dramatically if western sanctions against Iran are eased, said Ayhan Güner, head of Turkey's Jewelry Exporters Association, via a written statement on Nov. 25... Read |

| Posted: 29 Nov 2013 07:30 AM PST

The Bitcoin mania continues as a single electronic Bitcoin has now passed the price of 1 of of gold. 2013 Gold Maples As Low As $37.99 Over Spot at SDBullion! Bitcoin surged another 15% overnight, and briefly surpassed the price of gold at $1242 (while gold dipped to $1241): Source: ZH Bitcoin’s all-time high [...] The post Bitcoin Passes Price of Gold appeared first on Silver Doctors. |

| 10 Major Volcanoes Along The Ring Of Fire Have Suddenly Roared To Life Posted: 29 Nov 2013 07:00 AM PST

Ten major volcanoes have erupted along the Ring of Fire during the past few months, and the mainstream media in the United States has been strangely silent about it. But this is a very big deal. We are seeing eruptions at some volcanoes that have been dormant for decades. Yes, it is certainly not unusual [...] The post 10 Major Volcanoes Along The Ring Of Fire Have Suddenly Roared To Life appeared first on Silver Doctors. |

| Russia's VTB group begins Gold, Silver export to India Posted: 29 Nov 2013 06:49 AM PST The company successfully delivered its first bullion to New Delhi, Hyderabad, Jaipur and Agra over the past a few weeks. |

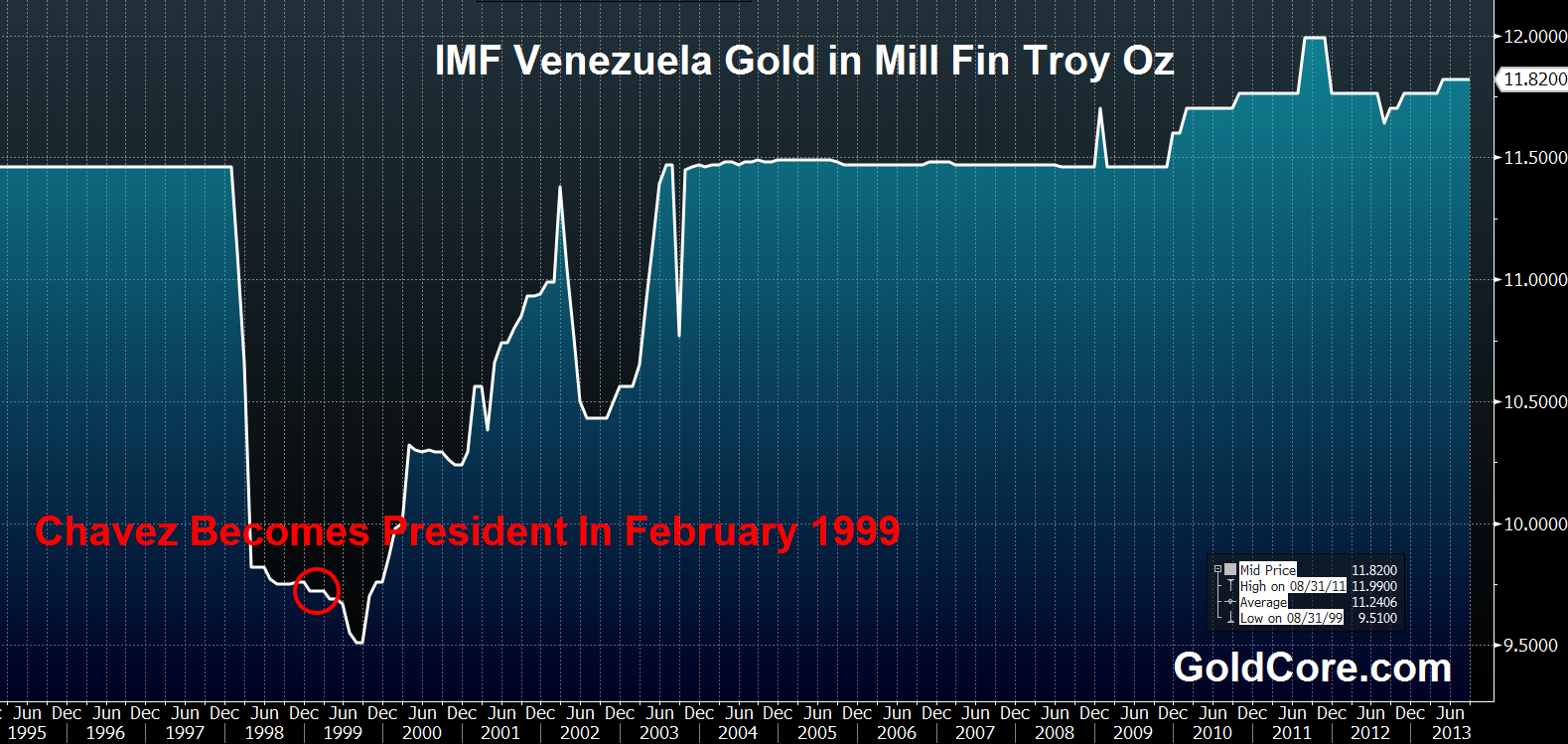

| Venezuela Denies Goldman’s Gold Deal As Inflation Tops 54% Posted: 29 Nov 2013 05:58 AM PST

Never believe anything until it is officially denied… Sunshine Mint Silver Eagles As Low As $.79 Over Spot at SDBullion! From Goldcore: Today's AM fix was USD 1,241.75, EUR 913.11 and GBP 760.45 per ounce. Yesterday's AM fix was USD 1,250.75, EUR 923.88 and GBP 773.69 per ounce. Gold fell $4.10 or 0.33% yesterday, [...] The post Venezuela Denies Goldman’s Gold Deal As Inflation Tops 54% appeared first on Silver Doctors. |

| “Is This The Right Time To Get Into Gold?” Posted: 29 Nov 2013 05:41 AM PST The slow and steady approach of dollar cost averaging in gold accumulation programmes such as GoldSaver remain a prudent and wise way to accumulate gold. Today's AM fix was USD 1,245.25, EUR 915.29 and GBP 763.07 per ounce. Yesterday the markets were closed in the U.S. for the Thanksgiving national holiday. Gold continued its second day of gains in London, narrowing the largest monthly drop since June, as physical demand increased. Gold neared a 34-month low of $1,180.50/oz reached on June 28. There was more irregular price action in trading yesterday between 1800 and 1830 GMT. Gold had trended slightly higher in the afternoon and was trading at $1,244/oz prior to a sharp but very brief spike to $1,254/oz and then sharp concentrated selling saw gold fall by more than $20 to $1,231/oz. The trading was unusual as foreign exchange markets saw no price movements of note, nor did the silver, platinum and palladium markets. Contrary to frequent assertions, recent losses are unlikely to be due to the continual concerns of 'tapering'. The U.S. Fed policy minutes released on November 20 suggested that an improving economy would warrant trimming debt purchases in the coming months. While U.S. economic data this week showed jobless claims unexpectedly decreased, the data has been mixed at best and the U.S. economy continues to struggle. Buying from China, set to become the world’s biggest buyer of gold this year by a long way, picked up this week as prices continued to be under pressure. On Thursday, traded volumes of 99.99 percent purity gold on the Shanghai Gold Exchange hit their highest in seven weeks and Chinese gold premiums closed at $26 with Shanghai gold closing at $1,267.82/oz. Russian bank VTB said overnight that it has begun exporting gold and silver bullion to India to expand its business in the Asia Pacific region. Indian demand for gold remains very robust and is so strong this wedding season that the short supply is forcing families to melt down and recycle family heirlooms. Momentum and technical traders are dominant at the moment and with the short term trend down, gold may incur further losses in the short term. Despite the very poor sentiment after recent price falls, gold’s fundamentals are actually quite sound. Global physical demand is set to be very high again this year and may even reach a new record, despite the 25% price fall. This is especially the case, as Chinese demand is set to have new record this year despite the recent slight decline in demand. China's net imports of gold from Hong Kong alone in October reached the second-highest level on record last month. This does not include direct imports from Australia, Africa, Vietnam and other countries. Despite what is likely to prove short term weakness, the smart money is gradually accumulating on the dips. Dollar cost averaging remains prudent for buyers who wish to have an allocation to bullion but are concerned about further price falls. “Is This The Right Time To Get Into Gold?” “Prices have gone up too much. I’ve missed the boat” was frequently how many of the public answered their own question. This was often the refrain, especially in the period from 2006 to 2010 when gold prices rose from $500/oz to $1,400/oz. We first heard those concerns in late 2005 when gold prices rose to over $500/oz. One caller was adamant and said "I am not buying gold after its price has doubled in just 5 years".

More recently, the frequent refrain has been "prices are falling as the gold bubble has burst and gold is a bad investment." And indeed, "I am not buying as gold prices are down 25% this year and 35% since the record high in August." These are understandable concerns. People do not want to lose their hard earned cash buying something that will fall in value. However, there is a way that one can invest in or buy gold and sleep easy at night knowing that you do not have to be concerned about price falls. There are rarely free lunches in life, and that is particularly true when it comes to investing and saving. However, there are two free lunches when it comes to investing. They are diversification or not having all your eggs in one basket and secondly a less well known but important strategy - Once you have learned about the power of dollar cost averaging you will be a better investor and a better gold investor and buyer. Dollar-cost averaging or pound or euro cost averaging means putting the same amount of dollars, pounds or euros each month into an investment or asset, such as equities or gold. That is all it is. Why put your hard earned cash into physical gold every month? Because gold, while having bad days — even bad years as we see this year — goes up over time. When you accumulate a set amount — say 100 dollars, pounds or euros per month — your paper currency will buy you fewer ounces of gold when gold prices have risen, and more ounces of gold when gold prices are lower. When you put dollar-cost averaging to work, you can relax, knowing that you don’t have to track or time the market – which even the professionals consistently fail to do. In fact, the gold market like many traded markets is the only place where people seem to get more interested when the prices are rising sharply. They are less interested when gold is “on sale” after falls in price. This was graphically shown in 2011, when despite gold becoming overvalued when it surged from $1,500/oz on July 1st to over $1,900/oz on August 28th or 26.6% in less than two months.

August 2011 was a time to be cautious and not "pile in" after huge price gains. A strategy of dollar cost averaging at this time would have protected buyers from the subsequent price falls and the price falls of recent years. Dollar-cost averaging is easy to understand and even easier to do with gold in gold accumulation programmes. It will have a positive long-term effect on your portfolio by helping you to achieve diversification with safe haven gold. The slow and steady approach of dollar cost averaging in gold accumulation programmes such as GoldSaver remain a prudent and wise way to accumulate gold. GoldSaver was the first gold accumulation programme in western markets. While Gold Accumulation Programmes are popular in Asia – in Japan and more recently China and India, they were not known in European and American markets. Some argue that using dollar cost averaging is the sensible approach to investing in precious metals, because for many investors jumping headfirst into gold seems like a risky strategy. What do you want from this strategy? The objective of dollar cost averaging is to avoid a sudden fall in the value of your investment or asset soon after purchase. The thinking behind it is that by gradually moving your money into an investment, you can avoid large losses. This is a good idea, as all markets including the precious metal markets are volatile – and they look set to get more so. Often it is argued that the logic behind dollar cost averaging is turned on its head when it comes to investing in precious metals. Because gold and silver are purchased mainly for portfolio diversification and as a long run inflation hedge, many believe the best strategy is to buy your protective metal in one go, and then forget about it – you know it will rise to the occasion when you need it most. True, but since the whole idea behind holding gold in the first place is to protect against a market crash, systemic crisis or currency devaluation, any steps you have taken to shield your wealth will be beneficial. Think of it this way: if there was a high possibility that contents of your house were about to be robbed, does it matter whether you pay your home insurance in instalments or as a once off lump sum? This is especially the case for smaller investors who cannot afford a large lump sum investment. Also, it is better to have some insurance rather than none. With gold, you can purchase a small lump sum and then dollar cost average with the rest of your position. However, dollar-cost averaging can also be used in conditions where the market is expected to go down. Precious metals move in the opposite direction from the market, which is the precise reason why investors should hold them in a portfolio. When it comes to moving your money into this asset, it's not about the traditional taking on of more risk for a higher reward; rather, it's about building up the protection you need if stock or bond markets take a nosedive. Most of our pensions remain allocated almost exclusively to just equities and bonds. The greatest benefit of using dollar-cost averaging with precious metals is that it allows less sure or confident investors to advance carefully into new territory. However, dollar cost averaging is not just for smaller investors or buyers. We have wealthy clients who we have advised to gradually accumulate a position over a period of months. One client bought $100,000's worth of gold bars on the 7th of each month for 7 months. He likes the number 7. With markets chugging along on a veritable life support system, and each round of QE prolonging this degenerative condition at the expense of us all, there has never been a better time to gradually move your wealth into the best financial insurance out there – gold. Click Gold News For This Week's Breaking Gold And Silver News |

| Bitcoin vs. Gold: The Future of Money – Peter Schiff Debates Stefan Molyneux Posted: 29 Nov 2013 05:00 AM PST

After skyrocketing nearly 10 fold to $1,000 in under a year, Bitcoin is all the hype and rage as speculators join those convinced in the fundamentals, but is it a viable alternative to gold and silver for preserving one’s wealth, or is the e-currency a shooting star that will burn out and scorch investors? Peter [...] The post Bitcoin vs. Gold: The Future of Money – Peter Schiff Debates Stefan Molyneux appeared first on Silver Doctors. |

| Posted: 29 Nov 2013 02:09 AM PST |

| Posted: 29 Nov 2013 01:54 AM PST |

| Bullion and Energy Market Commentary Posted: 29 Nov 2013 01:40 AM PST oilngold |

| Gold Price Analysis - Nov. 29, 2013 Posted: 29 Nov 2013 01:35 AM PST dailyforex |

| Posted: 29 Nov 2013 12:36 AM PST |

| State Dept. minutes confirm that whoever has the most gold makes the rules Posted: 29 Nov 2013 12:31 AM PST GATA |

| Is Money The Root Of All Evil? Posted: 28 Nov 2013 09:00 PM PST Dollar Daze |

| SDBullion.com’s Black Friday Midnight Madness Begins…NOW! Posted: 28 Nov 2013 08:59 PM PST

Unbeatable Sales. Extremely Low Shipping Prices. SD Bullion. The Home of the Silver Stacker. SDBullion Phone Lines will Open Early at 7am and will remain open till 5pm est! Sales start 11/29/2013! 12am-1am 2014 Maples at 1.99 over spot and only $1.99 shipping (Pre-sale) 1am-7am 100 oz JM Bars at [...] The post SDBullion.com’s Black Friday Midnight Madness Begins…NOW! appeared first on Silver Doctors. |

| Ron Paul vs Paul Krugman: Who Is The True Prophet, Who Is The False? Posted: 28 Nov 2013 04:22 PM PST Isn't it strange? We are living in the 21st century, a period of time in which people buy land on the moon, humanity has dozens of satellites providing GPS services and real time traffic information, internet brings people and information as close as one click, science and technology are making historic break throughs … but economists cannot agree on the real cause of the latest financial crash (2008). Generally speaking, there are two schools of thoughts when it comes to diagnosing the 2008 crash. One is based on free market principles and is detailed in Austrian economics. The other is based on central planning and is centered around Keynes (hence, Keynesian economics). As noted by Barrons, journalist Jeremy Hammond had the ingenious idea of contrasting the Austrian, free-market school of economics with the Keynesian, pro-government school on the recent financial crisis through a close examination of the words of two commentators: former Congressman Ron Paul, schooled in the Austrian perspective, versus the Nobel Prize–winning Keynesian and New York Times columnist Paul Krugman. You might think a mere politician would be no match for a Nobel laureate, but in this case, think again. As forecaster, diagnostician, and prescriber, Ron Paul offers rich insights, while Krugman, true to his Keynesian perspective, gets things wrong at virtually every turn. Hammond's book "Ron Paul vs. Paul Krugman: Austrian vs. Keynesian Economics in the Financial Crisis" reviews the records of Ron Paul and Paul Krugman on the question of the housing bubble. Who correctly predicted it? Who has offered the more reasonable explanation as to its cause? Who has offered the more sensible response to the bursting of the housing bubble and the financial crisis its precipitated? Most importantly, whose admonitions should we now be regarding as we move into the future? In short, who is the true prophet, and who the false? To illustrate the objective analysis of the book, we show one of the many quotes that the author has used. This example is a quote from Paul Krugman a couple of days before the NASDAQ implosion:

Another illustrative example is a quote from Ron Paul after the NASDAQ crash who more or less predicts the next financial crisis based on the Fed's monetary policy:

|

| Venezuela denies but doesnt rule out gold transaction with Wall Street Posted: 28 Nov 2013 04:01 PM PST GATA |

| China’s Gold Rush Continues, Imports Another 131 Tonnes In October Posted: 28 Nov 2013 02:51 PM PST It was a month ago when we discussed the September gold import statistics from Hong Kong to China. Net imports (after deducting flows from China into Hong Kong) were 109.4 metric tons in September and 110.2 tons in August. In our article China Imports 0.7% Less Gold Than August, Bloombergs Says Slowdown we showed that Bloomberg reported a "slowdown” for September. We showed the real facts: “since the year 2000, only two months saw significantly higher imports than September, i.e. March and July of this year. August and September (with a minor difference of 0.7%) were the third best months ever when it comes to gold imports to China through Hong Kong.” The latest statistics show that China imported another 131 tonnes of physical gold in October through Hong Kong. It appears Bloomberg could not be further from the truth. It is yet another confirmation that readers should not (only) rely on traditional media outlets for correct precious metals news as those channels are biased. Admittedly, in the precious metals blogosphere the bias is significant as well. Picking the right sources for precious metals news and analysis is key. Courtesy of Mineweb, the year to date net gold imports from Hong Kong to China total 967 tonnes. That is an astonishing amount. To put this figure in perspective: the global production in 2012 was close to 2500 tonnes and the US (having the highest gold reserves in the world) has 8133 tonnes of gold reserves.

The above table shows the official statistics. But there is more. Earlier this week, it became official that China had been importing gold directly from other countries throughout the world. In China Imported An Additional 133 Tonnes Of Gold Directly in 2013 we discussed that the official figures are just partly reflecting reality and that China has already (largely?) surpassed 1000 tonnes of gold imports in the first 3 quarters of 2013. It should not come as a surprise that “the People's Bank of China said the country does not benefit any more from increases in its foreign-currency holdings, adding to signs policy makers will rein in dollar purchases that limit the yuan's appreciation.” China has started to decrease its dollar holdings and is seeking for monetary safety which the country undoubtedly sees in physical gold. |

| Silver Elliott Wave Technical Analysis – 27th November, 2013 Posted: 28 Nov 2013 09:00 AM PST fxstreet |

| TECHNICAL - Price & Time: Gold Refusing to Join the "Party" Posted: 28 Nov 2013 09:00 AM PST dailyfx |

| China Gives Thanks For Cheap Gold Posted: 28 Nov 2013 08:30 AM PST Just a quick Thanksgiving morning update on China’s gold imports, which continued at extraordinary levels in October. To put the 131 tons in perspective:

|

| Venezuela Denies Goldmans Gold Deal As Inflation Tops 54% Posted: 28 Nov 2013 07:02 AM PST gold.ie |

| Chinese Gold Imports From Hong Kong in October a Massive 131 Tonnes Posted: 28 Nov 2013 05:13 AM PST "When this seminal event might occur, I haven't a clue. But it's out there somewhere." ¤ Yesterday In Gold & SilverNo sooner I had I hit the send button on yesterday's column when the selling pressure showed up in London. The low of the day for gold came around 3:30 p.m. in electronic trading in New York, and the price traded sideways from there. The CME recorded the high and low ticks as $1,254.80 and $1,235.50 in the December and February contracts. Gold finished the Wednesday trading session at $1,238.00 spot, down an even $4.00 from Tuesday. Net volume, once December was subtracted out, was very decent at 163,000 contracts. The top of the rally in silver that began shortly after the London open, ended a few hours later at 11 a.m. GMT. Most of the subsequent price decline was done by 12:30 p.m. in New York, and the rally that followed wasn't allowed to get far. The absolute low came a few minutes before the 5:15 p.m. EST electronic close. The high and low ticks in the December month were reported by the CME as $20.08 and $19.585. Silver closed on Wednesday at $19.665 spot, down 15 cents, and safely back under the $20 spot price for the second day in a row. And also for the second day in a row, platinum got sold down for a loss. Yesterday's sell off began shortly after 11 a.m. Zurich time, and most of the engineered price decline was done shortly before the Comex close. This was another new low for platinum in this move down. Palladium rallied a bit in overnight trading, but obviously ran into a price ceiling in Zurich trading before it, too, succumbed to selling. Palladium closed lower for the last two days, but only by a dollar or so each day. Here are the charts. The dollar index closed in New York on Tuesday at 80.75, but began chopping lower as soon as Far East trading began on their Wednesday. The index got as low as 80.50, but at precisely 9 a.m. EST a rally developed that took it back to almost unchanged on the day, as it closed at 80.73 on Wednesday, down a couple of basis points. The gold stocks spiked up over a percent at the open, but then got sold down to almost unchanged by 10:30 a.m. in New York. After that they chopped sideways for the remainder of the trading session. The HUI finished up 0.79%. It was pretty much the same story with the silver stocks, but they got sold down into negative territory by 10:30 a.m. EST, but recovered to close in the black by day's end. Nick Laird's Intraday Silver Sentiment Index closed up 0.40%. The CME Daily Delivery Report yesterday for the last day of November drew a blank, as there was no data to report; so the November delivery month was obviously done as of Tuesday. The First Day Notice numbers for delivery into the December contract were a bit of a surprise, as only 68 gold and 786 silver contracts were posted for delivery on Monday. In gold, the short/issuers were RCG with 40 contracts, and R.J. O'Brien with 24 contracts. JPMorgan stopped 45 contracts in its in-house [proprietary] trading account and another 5 for its client account. I expect the next few days will bring much more delivery action in gold, and it will be interesting to see who the issuers and stoppers are. But if I had to guess, it would be "all the usual suspects." In silver, it was Canada's Bank of Nova Scotia, Jefferies, and in distant third, Barclays as the biggest short/issuers; with 393, 326 and 46 contracts respectively. Of course the tallest hog at the trough as long/stopper was JPMorgan Chase with 360 contracts in its proprietary trading account and 81 for its client account. In distant second was BNP Prime Brokerage with 105 contracts. The rest of the contracts were divided up between twenty or so of the smaller commercial brokerage houses. Yesterday's Issuers and Stoppers Report is definitely worth skimming, and the link is here. There was another big withdrawal from GLD yesterday, as an authorized participant shipped out 183,306 troy ounces for parts unknown. And as of 9:54 p.m. EST there were no reported changes in SLV. The U.S. Mint had a small sales report yesterday. They sold 5,000 troy ounces of gold eagles and 1,500 one-ounce 24K gold buffaloes, and that was all. It was a very quiet in/out day in gold over at the Comex-approved depositories on Tuesday, as only 257 troy ounces were reported received, and nothing was shipped out. But, as it almost always is, it was a totally different story in silver, as 300,586 troy ounces were reported received and 608,227 troy ounces were shipped out. All of the activity was at Brink's, Inc. and the link to that action is here. I have the usual number of stories for a mid-week column, and I'm sure there are several posted below that you'll find to your liking. ¤ Critical ReadsSprott's Thoughts: Double, double toil and trouble. 'Treasuries' burn and 'markets' bubble The Federal Reserve has created an economic problem worthy of a Shakespearean tragedy. On the one hand they have worked tirelessly to support the markets and prevent an economic depression while on the other hand, they have also created a problem for which is no clear solution. The bond buying program instituted by the Fed has been similar to casting economic spells over global markets, convincing them that all is well. However, deciphering their next move has been an exercise in reading economic entrails for forward guidance. David Stockman Fears "Panic" When the "Lunatic" Fed "Loses Control""It's only a question of time before the central banks lose control," David Stockman warns a shocked CNBC anchor, "and a panic sets in when people realize that these values are massively overstated." The outspoken author of The Great Deformation rages "the Fed is exporting its lunatic policies worldwide," as central banks around the world have followed the Fed's lead, "for either good reasons of defending their own currency and their trade and their exchange rate, or because they're replicating the Fed's erroneous policies." If one cares to look, Stockman adds, "there are bubbles everywhere," citing Russell 2000 valuations of 75x LTM earnings as an example, "that makes no sense. It's up 43% in the last year, but earnings of the Russell 2000 companies have not increased at all." This is dangerous, he strongly cautions, "I haven't seen too many bubbles in history" that haven't ended violently. This short Zero Hedge piece from yesterday afternoon has a 3-minute CNBC video clip embedded in it...and it's worth your time as well. I thank Manitoba reader Ulrike Marx for her first offering in today's column. Simon Black: The most rapidly depreciating currency in the worldDo you remember the days when travel used to be glamorous and sexy? The mere prospect of getting on an airplane was tremendously exciting. Friends and family would come with you to the gate to see you off and pick you up. Today, millions of passengers in the Land of the Free will take off their shoes and assume the “I surrender” pose inside a radiation machine that provides negligible benefit and maximal cost to taxpayers. Our modern security theater is a stark contrast to the past. But there’s been something else happening over the last several decades that is even more insidious… and far less obvious. This very interesting commentary by Simon was posted on the sovereignman.com Internet site yesterday...and I thank reader M.A. for pointing it out. Money managers at Reuters conference expect Q.E. foreverThe message is sinking in: Economies of the rich world face super-easy money far into the future and central banks are now convinced it's the least of all policy evils. Despite rumblings of dissent about the financial bubbles and iniquities associated with zero interest rates and money printing, 2013 is ending with a remarkable certainty among global investors that cheap money is around for the long haul. That's not to say money managers are all cheer leading this. Many who spoke at Reuters Investment Outlook summit last week doubted its long-term efficacy and feared its social and political fallout even as waves of cheap cash continue to push stock markets to new records. This Reuters piece, filed from London, was posted on their website in the wee hours of yesterday morning EST...and I found it embedded in a GATA release. The real headline reads Analysis: Surfing central banks in a benign 'QE trap'. It's well worth reading in my opinion. Putin slams E.U. criticism over stalled Ukraine dealRussian President Vladimir Putin dismissed European leaders’ criticism of Ukraine's decision to delay a key EU pact, as thousands rallied in Kiev in a third day of protests. Kiev announced last week it was halting efforts to integrate with the European Union, saying the economy could not afford to sacrifice trade with Russia and would rather focus on restoring ties with Moscow. The EU accused Russia of pressuring its smaller neighbour not to sign the deal. EU President Herman Van Rompuy and European Commission head Jose Manuel Barroso said they "strongly disapproved" of Russia's actions, prompting Putin to urge European leaders to tone down their criticism. This story, filed from Kiev, was posted on the france24.com Internet site yesterday...and it's the first contribution of the day from Roy Stephens. Berlusconi Expelled From Italian Parliament After 19-Year TenureFormer Italian Prime Minister Silvio Berlusconi was expelled from parliament for violating an anti-corruption law, ending a 19-year tenure that spanned four recessions that did little to dent his personal popularity. The Senate voted to strip the 77-year-old billionaire of his seat, Speaker Pietro Grasso said today. The decision ends a three-month process begun after Berlusconi, who won three general elections and spent nine years as premier, lost his final appeal against a 2012 tax-fraud conviction. The expulsion completes the downfall of Italy’s most influential politician. Berlusconi, who presented himself as a tax-cutter with the managerial talent to spur the economy, was hampered as head of government by criminal trials and squabbles within his parliamentary coalitions. In the last two years, as a member of the ruling alliances led by Mario Monti and Enrico Letta, he supported, and then criticized, austerity policies. This Bloomberg news item, filed from Rome, was posted on their website yesterday morning Denver time...and it's courtesy of Roy Stephens as well. Iran oil minister in talks with western energy firms: FTIran has begun talks with potential investors in its energy industry, oil minister Bijan Zanganeh told the Financial Times, after Tehran struck a nuclear deal that may help western oil giants move back into the country someday. Iran is home to some of the world's largest oil and gas reserves, but U.S. energy firms have been barred by Washington from Iran for nearly two decades. Many of Europe's biggest oil and gas companies had planned multi-billion dollar investments to help develop Iranian reserves. But U.S. pressure drove them away from Iran in the late 2000s for fear of jeopardizing their U.S. interests. This Reuters story, filed from Dubai, was borrowed from a Financial Times article yesterday...and I thank Casey Research's own Laurynas Vegys for bringing it to our attention. Iran Seizes Saudi Fishing Vessels, Arrests 9 Sailors It didn't take long to escalate Iran-Saudi relations, or the lack thereof, following this weekend's nuclear (non) deal. Moments ago Iran's Fars news agency reported that Iran’s coast guards have seized two Saudi fishing vessels after they entered the Islamic Republic's territorial waters, a provincial official announced on Wednesday. Pentagon chief reaffirms U.S.-Japanese treaty covers disputed islandsDefense Secretary Chuck Hagel, in a phone call on Wednesday with his Japanese counterpart, reaffirmed that the U.S.-Japanese defense treaty covers a small island group where China established a new airspace defense zone last week. Hagel, in a call with Defense Minister Itsunori Onodera, "commended the Japanese government for exercising appropriate restraint" following China's announcement and pledged to consult closely with Tokyo to avoid unintended incidents around the islands, a Pentagon spokesman said. China and Japan both claim possession of the islands. Those above three paragraphs are all there is to this Reuters piece that was posted on their website late yesterday morning EST...and it's another contribution from Ulrike Marx. China-Japan rearmament is Keynesian stimulus, if it doesn't go horribly wrongAsia is on the cusp of a full-blown arms race. The escalating clash between China and almost all its neighbours in the Pacific has reached a threshold. All other economic issues at this point are becoming secondary. Beijing's implicit threat to shoot down any aircraft that fails to adhere to its new air control zone in the East China Sea is a watershed moment for the world. The issue cannot easily be finessed. Other countries either comply, or they don't comply. Somebody has to back down. The gravity of the latest dispute should by now be obvious even to those who don't pay attention the Pacific Rim, the most dangerous geostrategic fault line in the world. This Ambrose Evans-Pritchard blog was obviously posted on the telegraph.co.uk Internet site before the U.S. Air Force flew two B-52 bombers through the disputed air space now claimed by China. I posted a ZH story about that incident yesterday. This AE-P commentary is an absolute must read...and I thank Roy Stephens for bringing this critical news item to our attention. Is Shinzo Abe's 'new nationalism' a throwback to Japanese imperialism?The escalating standoff in the Pacific is seen by Beijing and Seoul as proof that |

| Iran oil minister in talks with western energy firms: FT Posted: 28 Nov 2013 05:13 AM PST Iran has begun talks with potential investors in its energy industry, oil minister Bijan Zanganeh told the Financial Times, after Tehran struck a nuclear deal that may help western oil giants move back into the country someday. Iran is home to some of the world's largest oil and gas reserves, but U.S. energy firms have been barred by Washington from Iran for nearly two decades. Many of Europe's biggest oil and gas companies had planned multi-billion dollar investments to help develop Iranian reserves. But U.S. pressure drove them away from Iran in the late 2000s for fear of jeopardizing their U.S. interests. This Reuters story, filed from Dubai, was borrowed from a Financial Times article yesterday...and I thank Casey Research's own Laurynas Vegys for bringing it to our attention. |

| Two King World News Blogs/Audio Interviews Posted: 28 Nov 2013 05:13 AM PST 1. Investors Intelligence: "We Haven't Seen Shocking Numbers Like This in Years". 2. Louise Yamada: "Still The Fed's Party - Melt Up?". 3. Tom Fitzpatrick: "Fantastic Chart Shows Key Commodity That May Help Gold". 4. The audio interview is with William Kaye. [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] |

| Consensus on gold equities suggests buy now before the great reversal Posted: 28 Nov 2013 05:13 AM PST Judging by the keynote presentations at the San Francisco Metals and Mining Investment Conference, there seems to be a bit of a consensus developing among the pro-gold mining analysts. They all do seem to feel that now may well be the time to take the plunge back into gold stocks, although one needs to be highly selective when it comes to the juniors – perhaps less so if going for the Tier 1 producers. Never mind that some have been preaching similar views throughout the way down, but seldom has there been such close correlation in their opinions. What does also seem to have been of particular note about the recent event is the big fall in numbers of attendees and in participating junior mining companies. Even a year ago when the industry was depressed already, numbers of both at this event remained reasonable, although far from breaking any records. What will be really interesting now is how much lower the attendances will be at the Minerals Exploration roundup in Vancouver in January and at the PDAC in Toronto in March. While both these events see major participation from the manufacturers and the Canadian provinces, one suspects that overall numbers will likely be down – perhaps quite severely and there will be many juniors staying away altogether given they are in cash preservation mode and the cost of attending these events, particularly when one adds in time and accommodation as well as exhibit and booth design costs, starts becoming significant when the treasury may be down to a few thousand dollars. While not many quoted companies have yet fallen off the exchanges as unable to meet requirements, the attrition rate is likely to start to increase strongly in the next few months if the gold price, in particular, stays at around current levels – or, horror of horrors, dips further. This commentary by Lawrence Williams was posted on the mineweb.com Internet site yesterday...and it's worth reading if you have time for it. It's another story courtesy of Ulrike Marx. |

| Dimitri Speck: The Double Face of Gold [Part 2] Posted: 28 Nov 2013 05:13 AM PST In the second part of this exclusive 18-minute video interview for Matterhorn Asset Management, independent financial journalist Lars Schall talked with book author Dimitri Speck about, inter alia: the prime virtues of gold as the antagonist of the fiat money/credit system; the notable central bank arrangement between the U.S. Fed and the Deutsche Bundesbank in 1967 preparing the terrain for the dollar standard; the asset price inflation phases that followed ever after; the rising importance of gold in the central banking system; and last but not least Speck’s views on the rigging of the silver market in light of intraday statistics. This video interview arrived in my in-box in the wee hours of this morning, and I haven't had the time to watch it yet. |

| Mike Kosares: Gold's organized retreat -- who benefits? Posted: 28 Nov 2013 05:13 AM PST Mike Kosares of Centennial Precious Metals in Denver muses on the question of who is benefiting from the recent retreat in the gold price. Kosares seems inclined to think that it has had something to do with the need to repatriate Venezuela's and Germany's foreign-vaulted gold reserves. Whatever the cause, Kosares writes, the gold price suppression perpetrated by the London Gold Pool in the 1960s...and by the gold sales of the United States and the International Monetary Fund in the 1970s "collapsed in a heap and gold rose in multiples, and both events represented the calm before a major monetary storm." GATA doesn't know if any of us will live to see that day. All we can do is try to hasten it and thereby restore free markets, liberty, democracy, fairness, and progress. This commentary was posted on the usagold.com Internet site yesterday...and I borrowed "all of the above" from Chris Powell's GATA release, for which I thank him. |

| Poor, stupid Venezuela doesn't understand its leverage Posted: 28 Nov 2013 05:13 AM PST Goldman Sachs Group Inc. and Bank of America Corp. are among Wall Street firms that offered deals to help Venezuela obtain U.S. dollars amid a plunge in the nation’s foreign reserves. A swap proposed by Goldman Sachs would provide $1.68 billion in cash and be backed by $1.85 billion of the central bank’s gold, documents obtained by Bloomberg News show. Bank of America said it could be an intermediary for $3 billion in payments to firms seeking U.S. dollars, documents show. Neither deal has been completed, a government official with direct knowledge of the matter said, requesting anonymity because the talks are private. Dollars are becoming scarce in Venezuela, limiting the supply of products from medicine to toilet paper in a nation that imports about three-quarters of goods it consumes. Foreign reserves dropped 28 percent this year, touching a nine-year low of $20.7 billion this month, largely because 70 percent of the assets are in gold. The metal plunged 26 percent in the period. This Bloomberg news item was posted on their website early yesterday morning MST. I found this story in a GATA release whose headline reads "Goldman to BofA Pitch Venezuela Deals to Drum Up Dollars." Chris made the comment that..."Instead of pawning its gold, Venezuela should try demanding gold as payment for its oil. The banks would start paying Venezuela monthly protection money just for the country's refraining from doing that." |

| Turkey may export more gold to Iran Posted: 28 Nov 2013 05:13 AM PST Turkey’s gold exports to Iran may hike dramatically if western sanctions against Iran are eased, said Ayhan Güner, head of Turkey’s Jewelry Exporters Association, via a written statement on Nov. 25. This short story, filed from Istanbul, was posted on the hurriyetdailynews.com Internet site on Tuesday...and I thank Ulrike Marx once again for finding it for us. |

| Call to rollback gold import duty to 5% gathers momentum in India Posted: 28 Nov 2013 05:13 AM PST Jewellers across India are in a quandary. Even as gold prices jumped by $3.52 (Rs 220) to $509 (Rs 31,720) per ten grams in Mumbai on November 27, given the ongoing marriage season demand and amidst a firm global trend, large jewellers across the nation are struggling given their severe inventory crunch. "We have stocks that would last only ‘til the year end. A major worry has been that debt has been rising because we now have to pay the cost of gold upfront, whereas earlier, gold was available on lease," said Suman Mehta, bullion retailer at Mumbai's Zaveri Bazaar. "There is a severe inventory crunch. While big jewellery houses have a large inventory bank and would not have been impacted with the government's norms, smaller jewellers have been caught off guard by RBI’s strictures," said Manoj Kedia, another jeweller. This mineweb.com story, filed from Mumbai yesterday, is worth reading...and it's also courtesy of Ulrike Marx. |

| October Chinese gold imports from Hong Kong a massive 131 tonnes Posted: 28 Nov 2013 05:13 AM PST Far from slowing down, net Chinese gold imports through Hong Kong accelerated in October to 131.2 tonnes according to figures sent to Reuters today - the seventh month this year that China has imported over 100 tonnes of gold and the sixth in a row. Imports appear once again to be being stimulated by the lower gold prices currently prevailing. A Bloomberg comment suggests the figure was slightly lower at 129.9 tonnes and that this demand strength is also due to jewellers and retailers purchasing gold to build up stocks ahead of what is usually the peak demand season for gold purchases on the Chinese mainland and in Hong Kong itself. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment