saveyourassetsfirst3 |

- Ressurection of a gold mine in Nova Scotia?

- Can't-miss headlines: Gold gains on good physical, Las Bambas bidders? & more

- Gold price flat despite ytd gold import records for China and Turkey

- Is gold company cost cutting mainly a detrimental fudge?

- Forget what you've heard about turkey... This is why you get sleepy after Thanksgiving dinner

- Doc Eifrig: How YOU can make money just like a Vegas casino

- On the Trail of Juniors with Blue-Sky Potential: Eric Coffin

- Is An Economic Collapse on the Doorstep?

- GBP/USD - Strong British GDP Boosts Pound

- Unexpected gold price rise despite poor technical picture

- Call to rollback gold import duty to 5% gathers momentum in India

- USD/CAD - Strong Greenback Pushes Above 1.06

- Corvus Gold Announces Closing of Strategic CAD $5.23M Non-Brokered Private Placement

- Silver Sentiment is Becoming Extremely Pessimistic

- Thoughts For Those Who Buy Or Bought The Precious Metals Thesis

- Gold 2nd Attempt at Follow Through on Reversal Fails

- The 5 Massive Economic Lies The Government is Telling You

- Expo 2020 win today should add 15% to Dubai house prices and local stocks but should you sell into this rally or buy?

- Silver Algo Active This Morning, Telegraphing Holiday Gold & Silver Smash?

- Gold: Brief pause, or final bottom?

- “Wave Of Disaster” Threatens U.S. Mortgage Market; OECD & IMF Warn UK

- Mercenary Links Nov 27th: Shoppers Unite

- Why Is Debt the Source of Income Inequality and Serfdom? It’s the Interest, Baby

- Quantitative Easing: Hazardous to Your Retirement

- Andy Hoffman Answers Questions

- Don’t Underestimate the US Dollar

- Monsanto, the TPP, and Global Food Dominance

- Thanksgiving gold volumes "thin,” China & Turkey import record tonnages

- CRITICAL FACTOR: The Real Reason To Own Gold

- UBS short-term gold target downgraded to $1,180/oz

- U.S. copper production up 10% YTD, gold up 6% - USGS

- Rand Paul Slams the Surveillance State: “Enough Is Enough, We Want Our Freedoms Back”

- China Has Quietly Accumulated 20,000 Metric Tons of Gold!

- S&P 500 & Gold Stocks, Mirror Manias

- Bitcoin Explodes Past $1,000

- Chinese Gold Imports Surpass 1,000 Tons for 2013!

- “Wave Of Disaster” Threatens U.S. Mortgage Market; OECD & IMF Warn UK

- “Wave Of Disaster” Threatens U.S. Mortgage Market; OECD And IMF Warn UK

- Wednesday Morning Report

- Gold Miners Look To Break Below June Low

- Insight: A new wave of U.S. mortgage trouble threatens

- German Watchdog Starts Probe Into Gold Price-Fixing

- Three King World News Blogs

- Chow Tai Fook Profit Almost Doubles on Higher Gold Demand

- Gold Trade in Thailand: Bullion Backwash

- The State Bank of Vietnam will buy bullion gold to increase foreign currency reserves

- Arab gold being reprocessed for Chinese standard, Macleod tells Keiser

- Rick Rule: Best gold issues may start to melt up rather than down

- Patrick Heller: Will Gold Hit $3,000 by End of 2015?

- German watchdog starts probe into gold price-fixing: report

| Ressurection of a gold mine in Nova Scotia? Posted: 27 Nov 2013 07:02 PM PST Ressources Appalaches says it could start mining in 2014 with an Industrial Permit in hand, and $7.5m in funding set for release to refurbish a mill. |

| Can't-miss headlines: Gold gains on good physical, Las Bambas bidders? & more Posted: 27 Nov 2013 05:20 PM PST The latest morning headlines, top junior developments and metal price movements. Today, gold goes up on physical demand and the latest buy by hedge fund Geologic Resource Partners. |

| Gold price flat despite ytd gold import records for China and Turkey Posted: 27 Nov 2013 04:34 PM PST London Gold Market report: Thanksgiving Gold Volumes "Thin", China & Turkey Import Record Tonnages |

| Is gold company cost cutting mainly a detrimental fudge? Posted: 27 Nov 2013 02:17 PM PST Mining companies are being pushed into making huge cost cuts, but often these are too far too fast for the long term future of the industry. |

| Forget what you've heard about turkey... This is why you get sleepy after Thanksgiving dinner Posted: 27 Nov 2013 01:20 PM PST From LiveScience: Contrary to popular belief, eating turkey isn't the main reason you feel sleepy after a Thanksgiving feast. The oft-repeated turkey myth stems from the fact that turkey contains the amino acid tryptophan, which forms the basis of brain chemicals that make people tired. But turkey isn't any more sleep-inducing than other foods. In fact, consuming large amounts of carbohydrates and alcohol may be the real cause of a post-Thanksgiving-meal snooze, experts say. Tryptophan is... More Cruxallaneous: |

| Doc Eifrig: How YOU can make money just like a Vegas casino Posted: 27 Nov 2013 01:20 PM PST From Dr. David Eifrig, Jr., MD, MBA, editor, Retirement Trader: Editor's note: Below you'll find an exclusive, free "sneak peak" at Dr. David Eifrig's new book, Doc Eifrig's Retirement Solution: High Income Retirement. Some folks around the S&A offices are already calling it "the most dangerous book ever written." We think you'll understand why by the bottom of this page… A few pages ago, we learned about "call options" by pretending we owned a house... and then sold someone the right to buy our house for an agreed-upon price at an agreed-upon time in the future. Most people don't realize this, but these sorts of transactions happen every single day the stock market is open. But these transactions don't involve houses. They involve stocks. A share of stock represents the ownership of a small slice of a business. Some businesses chop their ownership structure into hundreds of millions of these "shares." These shares fluctuate in value every day the financial markets are open. In addition to the big market for stocks, there is also a big market for stock options. Each day the market is open, millions of stock options are bought and sold. And a huge number of the participants in the stock-options market are hopeless gamblers. We can use this market and its participants to produce steady income streams from the stocks we own in retirement accounts (and any other brokerage account). Here's an example of how it works in the stock market...

Let's say you own 300 shares of stock in the hypothetical company Magnum Enterprises. A few years ago, you bought the stock for $20 per share. Its current market value is $40 per share. Your holdings are worth $12,000. One day, you look at the market and see that a group of stock market gamblers believe Magnum is about to experience a price rally. They believe shares could hit at least $44 per share within six months (a 10% gain). They are willing to enter into contracts that give them the right, but not the obligation, to purchase shares of Magnum at $44 within six months. They will pay $1 per share for the right to enter into these contracts. Just like our house example, these contracts, which allow people to buy an asset (in this case a stock) for a certain price at a certain time in the future, are named "call options." The standard size of an options contract

covers 100 shares. However, these

contracts are quoted and priced in terms of just one share. For example, if the quoted price of a call option contract is $4 per share, the call buyer would pay a total of $400 to acquire the contract. If the quoted price of an options contract is $6, the call buyer would pay a total of $600 to acquire it. One more time, for emphasis: Option contracts cover 100-share blocks of stock. But they are quoted and priced in terms of just one share. A call buyer who buys a contract for the quoted price of $4 will actually pay a total of $400 for that contract. Options trade in bundles of 100 shares.

Option prices are in dollars per share.

Thus a $4 option price equates to $400 of option premium. In the case of the stock market gamblers and Magnum Enterprises, the gamblers are paying $1 per share for the right, but not the obligation, to buy Magnum for $44 within six months. If Magnum experiences a big rally, it could rise to $50 per share. In this case, the gamblers win. They can use their call option contract to buy Magnum shares for $44. They can then turn around and sell the same shares in the general market for $50 per share. They would make $5 for every $1 invested. Why just a $5 profit and not a $6 profit? Remember... in this case, the gambler paid $1 for the right to buy Magnum Enterprises for $44 per share. Thus, his "all in" cost in the stock purchase is $45 per share. When he sells his shares for $50, he makes a $5 profit, rather than a $6 profit. Turning every $1 invested into $5 is an incredible gain in just six months. This type of gain would turn a $10,000 investment into $50,000. It's this type of gain that attracts thousands and thousands of gamblers to the options market every day. But just like big hits at a Las Vegas casino, big hits in the options market are extremely rare. Most stock option gamblers lose their money... just like most casino gamblers lose their money in Las Vegas. Still, the allure of "one big hit" draws huge amounts of people into the market... just like it draws them to Las Vegas. No matter how many times people lose, they keep coming back. They keep gambling. It's just a quirk of human nature. Thus, the vast majority of "call option" contracts that gamblers buy end up worthless. The sellers of these contracts almost always keep the money the gamblers paid them. In Las Vegas, casinos occasionally have to pay out money to gamblers. But the odds are so stacked against the gamblers that casinos make billions of dollars a year. The casinos make so much money that they can afford to build stupendous, lavish hotels. Their owners become millionaires and billionaires. They make that money by taking the other side of foolish bets. You can probably see where I'm going with this... and why my advice to investors is... TAKE THE OTHER SIDE OF THE FOOLISH BETS... AND SELL CALL OPTIONS! It's one of the safest, easiest ways to generate large sums of cash on your savings. In the next chapter, I'll show you how… Crux note: "Doc" has used the technique above to rack up the greatest winning record in investment newsletter history. Take a look…  Crux note (continued): We don't understand why more people don't try Doc's service. It's the closest thing to "free money" we've ever seen. His record speaks for itself. So S&A is about to do something unprecedented… We're so sure you will love his service that we're going to send you a "bribe" to try it. We're talking about Doc's elite video training DVD… exclusive access to the first printing of The Black Book of Retirement Trading Secrets… fine wine and chocolate… even gold bullion. It's unlike any offer we've ever made before… and it won't last long. To learn more, click here. More investment wisdom from Doc Eifrig: |

| On the Trail of Juniors with Blue-Sky Potential: Eric Coffin Posted: 27 Nov 2013 01:02 PM PST TICKERS: CXO, GQC, MRZ, MUN, RMC, ROG, SMN, SVL; SVLC, TGM Source: Kevin Michael Grace of The Gold Report (11/27/13)

COMPANIES MENTIONED: COLORADO RESOURCES LTD. : GOLDCORP INC. : GOLDQUEST MINING CORP. : MIRASOL RESOURCES LTD. : MUNDORO CAPITAL INC. : RESERVOIR MINERALS INC. : ROXGOLD INC. : SAN MARCO RESOURCES INC. : SILVERCREST MINES INC. : TRUE GOLD MINING INC.

The Gold Report: Federal Reserve of Dallas President Richard Fisher gave a speech in Australia declaring that quantitative easing (QE) must end or it would “fuel the kind of reckless market behavior that started the global financial crisis.” If the Fed isn’t going to end QE until employment improves, how will this end? Eric Coffin: Fisher gets to voice his opinion at Federal Open Market Committee (FOMC) meetings, but he won’t be a voting member until January. He hasn’t been comfortable with QE from the start and has said so repeatedly. There isn’t any news in that quote. I don’t think you’ll see much change when the FOMC gets four different members next year. Janet Yellen, who will become chairman, is more dovish than Ben Bernanke. I think she was the right choice, not because she loves creating money from nothing but because she’s probably been the most accurate forecaster of the bunch. TGR: What about the bubble that Fisher fears? EC: If you want to be cynical, you can make the argument that a bubble is exactly what the Fed has been trying to create. It wanted to get equity markets to go up because that increases wealth and raises consumer confidence. About half of the Fed’s QE program is buying mortgage bonds. It is trying to keep mortgage rates down and resuscitate the housing sector.

Fisher is right in a sense, but I don’t think we’re at the point where I’d be terribly concerned about things running out of control. I have to admit, though, that based on the growth of the economy, the U.S. equity markets are probably getting a little bit ahead of themselves. Most consumer inflation measures have been trending down, not up. Personally, I’m more worried about deflation, which is far harder for a central bank to fight than inflation. TGR: The Q3/13 gross domestic product (GDP) report shows 2.8% growth. EC: Right now, I’m kind of neutral on the economy. The data quality is going to be crappy for a month or two because of the government shutdown. The economy grew 2.8% because there was big growth in inventories, which is not the reason you want. Without that it came in at 2%, which was the expected number. You’re probably going to see production cut a little bit this quarter because more stuff was made than could be sold. TGR: Karl Denninger pointed out that the gross change in GDP from Q2/13 to Q3/13 was $196.6 billion ($196.6B), but the Fed’s QE program injected $255B. So the economy actually shrank during Q3/13. EC: I think he’s oversimplifying a little bit. QE is really swapping paper, creating money out of thin air and using that to buy bonds that inject money into the economy. But the velocity of money has been very low since the crash. It’s not as if the banks are taking that $85B/month and lending it all. That’s where the real multiplier effect is. Right now a lot of the money created through QE has ended up in bank’s excess reserves, not in the wider economy. Karl is a bit of a permabear, but I would agree with him that it wasn’t that great a report. TGR: Let’s assume that QE continues at its present rate until June 2014. How will that affect gold and silver? EC: When the Fed starts tapering, we have to assume gold and silver prices will get hit. Of course, if it doesn’t actually start tapering until well into next year, we could see gold and silver go up for two or three months before that. That doesn’t preclude later increases in the gold price based on physical demand, but the short term traders are completely fixated on QE (or lack thereof) and will be sellers once the taper starts, and the market will have to get past that before recovering. TGR: What if it becomes clear we are going to get QE forever? EC: Then I think gold goes to $2,000/ounce ($2,000/oz). TGR: At the Subscriber Investment Summit in Vancouver last month, you compared the 10-year chart for gold to the 10-year chart for junior resources. The first chart looks good, but the second looks terrible. Why?

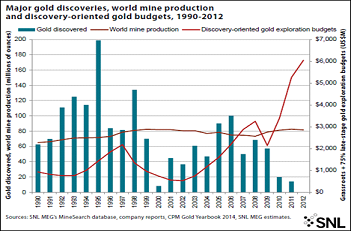

EC: For all the money thrown at exploration—and, of course, that number has been tumbling dramatically for the past two years—not many good discoveries resulted, especially in the last couple years. That’s one reason. The chart below shows the amount of gold discovered each year since 1990, counting only new gold discoveries above 2 million ounces (2 Moz). You can see how few discoveries there have been in the past couple years. Compared to the 1990s the numbers are tiny.

The other reason is that when the gold price was rising continuously many companies were looking for what I referred to in Vancouver as “crappy ounces.” Their intentions were good. They weren’t trying to hoodwink anybody. They made the reasonable assumption that with gold going up and up, economic cutoff grades would keep dropping. But you can’t produce gold at ever-lower grades with difficult metallurgy and infrastructure and make more money. As it turned out, costs rose almost in lockstep with the gold price. A lot of the ounces that were marginal at $500 or $700 or $900/oz haven’t been salvaged by the gold price going to $1,300/oz. Many of those resources are still uneconomic and would require more capital expenditures with longer payback periods than larger producers are willing to accept. TGR: You said that juniors have a major credibility issue, specifically, that preliminary economic assessments (PEAs) and feasibility studies do not match production realities. EC: There are a couple reasons for that. I’ve already mentioned costs. And when the sector recovered after 2000, there was a real capacity issue. There weren’t enough geologists or engineers. There weren’t even enough people who make truck tires.

Many NI 43-101s, PEAs and feasibility studies have been written by people who lacked experience. To be fair to the engineering companies, miners can have cost overruns of 20% and still be within the stated margin of error, but people never read the fine print. They just look at the production cost, so when it comes in $100–200/oz higher, everybody freaks out. TGR: Juniors chased lousy projects because gold was soaring, and money flooded into the market. Now that gold has fallen 30%, will this engender the return of old-fashioned values? EC: I think it already has. The large mining companies, having spent huge amounts of money on capital expenses (capexes) that didn’t add to their bottom line, are now saying, “Show me margin.” Large and medium companies will now pick up deposits smaller than what they would have touched 10 years ago because they have the grades, the geometry and the metallurgy to enable low-cost production. TGR: So is margin now more important than grade? EC: Grade is king, but margin is the key. Majors are focused on margin per ounce produced. You can get high margins with a lower-grade deposit if everything goes right but, by and large, the higher grade the better the margin should be. It comes down to net present value (NPV) and internal rate of return (IRR). Companies now want gold projects that can be built for $100–150 million ($100–150M) with NPVs of $300M or $400M and all-in cash costs of $600-800/oz—assuming they’re big enough. They don’t want to go too small because they can spread themselves only so thin. I don’t see majors like Barrick Gold Corp. (ABX:TSX; ABX:NYSE) picking up 50,000-ounce-per-year (50 Koz/year) deposits, but we might see them picking up 100–150 Koz/year projects, when a few years ago few majors would look at a deposit unless it was capable of generating 250 Koz/year or more. In Sonora, Mexico, half a dozen mines that began production in the last five years don’t have grade. They’re 0.8, 0.7 or 0.6 grams per ton (0.6 g/t), but they have fantastic combinations of logistics, costs, workforces, metallurgy and geometry, and they produce at $500–700/oz cash costs. TGR: Why are new discoveries so important to the junior sector? EC: That’s what the juniors exist for. The market wants something new, with blue-sky potential. The companies with really big runs in the last year or two are, almost without exception, companies that made discoveries. They don’t always work out, but that’s the risk you take.

If you go back to the pretty spectacular bull market in the mid-1990s, it was driven by companies going international for the first time in a long time, juniors going to South America and Africa and finding 3, 5 and 10 Moz deposits. Gold prices rose in the mid-1990s, but discoveries drove the bull market. TGR: You called Reservoir Minerals Inc. (RMC:TSX.V) a “classic discovery story.” Why? EC: Most of its exciting concessions surround the Bor mine in Serbia. It’s a big camp. Reservoir has a joint venture with Freeport-McMoRan Copper & Gold Inc. (FCX:NYSE), with Freeport holding 55% of the Timok project and Reservoir 45%. It’s a high-sulfidation epithermal system. One of the first holes was 5.13% copper and 3.4 g/t gold over 291 meters (291m). A real back-of-the-envelope calculation (because the holes are still pretty widely spaced) is that Timok has 30–40 million tons (30–40 Mt) of quite strong-grade gold-copper material. Freeport is a great partner. It has lots of money, and it has direct experience operating bulk tonnage and also block-cave underground mines, which Timok would probably end up being. TGR: Reservoir’s Sept. 9 Timok press release announced 260m of 3.93% copper equivalent. Is the early promise being fulfilled? EC: It’s a fantastic discovery, definitely one of the best of the last few years. Assuming Freeport goes all the way to feasibility—and I’d be pretty shocked if it didn’t now—Reservoir essentially gets carried until then at 25%, which would still be significant value, considering the deposit. TGR: What about other companies near Timok? EC: The one that got my attention is Mundoro Capital Inc. (MUN:TSX.V). The company had originally gone into China and picked up a gold project that it expanded to 8 or 9 Moz with pretty good grades. Unfortunately, one of the state gold miners liked it even more, so Mundoro was shown the door and given $20M on the way out. It has lots of cash. Teo Dechev is the president; her family comes from Eastern Europe and the VP of Exploration is based there. Mundoro picked up concessions there. Mundoro wasn’t chasing Reservoir; it just liked the geology. The initial drill program at its Borsko Jezero property didn’t come up with a Reservoir-style discovery, but its Savinac property has had some pretty interesting trench assays. TGR: As high as 30 g/t gold and 171 g/t silver over 12m. EC: I’m not assuming every trench is going to look like that, but it’s a good start. The other two trenches were pretty decent, too. Mundoro may actually have something there, probably an epithermal system. The company has another project in Bulgaria I’m expecting to see results from it soon and a lot of other ground near Bor that has targets at earlier stages. The story is by no means over. It’s trading at only $0.24/share but has about $0.30/share in cash, enough for three years. So there’s lots of leverage, if it makes a discovery. TGR: You mentioned in Vancouver other companies with discoveries that are not as “classic” as Reservoir’s but still have potential. EC: I gave two examples. The first is GoldQuest Mining Corp. (GQC:TSX.V) in the Dominican Republic. It’s trading at $0.29/share. It had a high of $2/share, and I’d be much happier if it traded closer to that, but it was $0.07/share before it discovered Romero. GoldQuest just released an initial resource estimate: 2.38 Moz gold equivalent Indicated and 790 Koz Inferred. Keep in mind that Bill Fisher, the chairman, and Julio Espaillat, the president—Julio is Dominican—have done this before. They put Cerro de Maimón into production. This is a small but very profitable mine that was taken out for $3.20/share in 2011. Having management with direct mine building experience in country is a huge advantage. TGR: How does GoldQuest stand for cash? EC: About $12M right now, enough to take it most of the way to feasibility. Romero needs some infill drilling and more metallurgical testing. Most of the maiden resource is Indicated already so it shouldn’t need to do a huge amount of additional drilling for the feasibility study. Metallurgical work should improve the economics. The old tests indicated 75% recovery, but those were simple bottle roll tests. Romero will be a sulfide plant and recoveries in the 90% range for both copper and gold are more common for that sort of operation. TGR: What was the other company? EC: Colorado Resources Ltd. (CXO:TSX.V), which has the North ROK porphyry discovery in northern British Columbia. This is one of those situations where the best hole is the first hole: 0.63% copper and 0.85 g/t gold over 242m. Colorado has since drilled decent intercepts, but none like the first, and the market has punished it. We won’t know for certain until the company puts out the remainder of its pending drill holes, but hole 9 looks as if it has hit a structure. If the zone doesn’t continue SE of Hole 9 North ROK could still contain 100–300 Mt, and 300 Mt happens to be the size of Imperial Metals Corp.’s (III:TSX) Red Chris mine, which is going into production down the road. Colorado’s president, Adam Travis, told me in Vancouver that the company is still figuring out the controls on the mineralization. But its logistics are really good, the best in the area, so this is a legitimate discovery, which may well be economic. TGR: How much cash does Colorado have? EC: It should have $5–7M after drilling. The company will probably get the rest of the holes and an initial resource estimate out before worrying about raising more money. Porphyries take a lot of drilling. If North ROK turns out to be a moderate-size, moderate-grade resource, Colorado may look for a partner. TGR: Which discovery stories do you like in Africa? EC: I like a couple. Actually, the first, True Gold Mining Inc. (TGM:TSX.V) in Burkina Faso, is now long past being a discovery story. It also has quite good logistics. The deposit is probably about 3 or 4 Moz, but right now the company is focusing on the oxides. The idea is to get a heap-leach operation into production, because that’s a much lower capex, and leverage that to build a sulfide plant later. I expect to see a feasibility study early next year. True Gold has very strong management. Mark O’Dea ran Fronteer Gold before it was taken out by Newmont Mining Corp. (NEM:NYSE). He’s done something I hope we see more of—he brought in a completely unrelated company, an insurance company, which put a large placement into True Gold. O’Dea has done a good job of funding, admittedly with more dilution than I would have liked, but that’s just the market we’re in. The company certainly has enough to get through feasibility. We’re probably looking at a $100–120M capex for a mine that should be able to do, say, 100+ Koz/year for 10 years. A feasibility study should be out within a couple months. TGR: And the second African discovery? EC: Roxgold Inc. (ROG:TSX.V), also in Burkina Faso. The 55 Zone of its Yaramoko project is a high-grade, steep-vein setting. It put out a PEA and mineral resource in September: 850 Koz gold at 13.88 g/t. This will be a small but very high-margin operation. TGR: What other companies with new discoveries do you think have potential? EC: Mirasol Resources Ltd. (MRZ:TSX.V) is a very successful explorer and project developer. It sold a high-grade silver discovery in Argentina to Coeur Mining Inc. (CDM:TSX; CDE:NYSE). Thanks to that, Mirasol has about $40M in cash and Coeur shares, which, coincidentally, is the same as its market cap. For political reasons, no one is a fan of Argentina these days, but the company also has large projects in northern Chile that look pretty interesting—early stage but big.

San Marco Resources Inc. (SMN:TSX.V) is focused on northwest Mexico, an area I’ve always liked and still do. The company is not cash rich but has strong joint-venture agreements with Exeter Resource Corp. (XRC:TSX; XRA:NYSE.MKT; EXB:FSE) on its Angeles and La Buena projects. Exeter has to spend $10M on Angeles and $15M on La Buena to get 60% of each. La Buena is just north of Goldcorp Inc.’s (G:TSX; GG:NYSE) Peñasquito mine and a lot of the geochemistry and geophysics are similar. San Marco has started drilling the Julia zone, and I hope we’ll see drill results sometime this month. It is a riskier play but has a $3M market cap, so if it makes a discovery, there’s a lot of upside. TGR: What other companies do you want to talk about? EC: SilverCrest Mines Inc. (SVL:TSX.V; SVLC:NYSE.MKT) announced a silver resource of 199 Moz at La Joya. It’s a low-grade, polymetallic skarn: silver, co |

| Is An Economic Collapse on the Doorstep? Posted: 27 Nov 2013 12:30 PM PST

Society’s veneer is down to rice paper. After Christmas, it’ll be gossamer. So what happens when interest rates revert to reality and spike up, destroying even the ability to pretend all is well? That’s when the fun starts. Submitted by Truth in Gold: As I have been saying would happen, the housing market bounce [...] The post Is An Economic Collapse on the Doorstep? appeared first on Silver Doctors. |

| GBP/USD - Strong British GDP Boosts Pound Posted: 27 Nov 2013 12:16 PM PST By Kenny Fisher The British pound continues to look sharp and has posted more gains against the U.S. dollar in Wednesday trading. The pound was buoyed by a solid Second Estimate GDP reading for Q3. The pound shrugged off a weak Realized Sales release, which posted another weak reading in October. Over in the U.S., Unemployment Claims looked sharp, but Core Durable Goods disappointed with a decline. In the U.S., Unemployment Claims continues to look sharp, as the key indicator dropped to 316 thousand, its lowest level in two months. This figure easily beat the estimate of 331 thousand. However, the news was not as good from the manufacturing sector, as Core Durable Goods Orders posted a drop of 0.1% for the third month running. The key indicator has not posted a gain since May. Durable Goods was awful, posting a decline of 2.0%, well below the estimate of a |

| Unexpected gold price rise despite poor technical picture Posted: 27 Nov 2013 12:14 PM PST As China reports another month of very high gold imports through Hong Kong, gold has seen a small price recovery although perhaps not sufficient to allay a weaker technical picture. |

| Call to rollback gold import duty to 5% gathers momentum in India Posted: 27 Nov 2013 12:11 PM PST Though demand for gold continues to be high in India, jewellers run out of stock given the government's many import restrictions resulting in 25% price differential which cannot be borne by the trade. |

| USD/CAD - Strong Greenback Pushes Above 1.06 Posted: 27 Nov 2013 12:08 PM PST By Kenny Fisher The U.S. dollar continues to push higher on Wednesday, as USD/CAD is trading close to the 1.06 line. The U.S. dollar got a boost as Unemployment Claims dropped to its lowest levels in two months. However, Core Durable Goods Orders posted a decline and fell short of the estimate. There are no Canadian releases on Wednesday. In the U.S., Unemployment Claims continues to look sharp, as the key indicator dropped to 316 thousand, its lowest level in two months. This figure easily beat the estimate of 331 thousand. However, the news was not as good from the manufacturing sector, as Core Durable Goods Orders posted a drop of 0.1% for the third month running. The key indicator has not posted a gain since May. Durable Goods was awful, posting a decline of 2.0%, well below the estimate of a 1.5% drop. The Canadian dollar continues to struggle |

| Corvus Gold Announces Closing of Strategic CAD $5.23M Non-Brokered Private Placement Posted: 27 Nov 2013 12:02 PM PST Participants Include: Tocqueville Asset Management L.P, AngloGold Ashanti (U.S.A) Exploration Inc., Euro Pacific Gold Fund, Peter Schiff and Corvus Gold Management November 26, 2013 Vancouver, B.C……..Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces the closing of a CAD $5,230,000 non-brokered private placement (the "Offering") on November 26, 2013. Under the terms of the Offering, the Company issued 5,230,000 common shares at a price of CAD $1.00 per share, which represents a 15% discount to the 5-day volume weighted average price from October 29 through November 4, 2013 of CAD $1.18. Insider participants in Offering, which did not include the issuance of any warrants, include: Tocqueville Asset Management L.P. (1,000,000 shares); AngloGold Ashanti (USA) Exploration Inc. (3,000,000 shares); and Corvus management & directors (385,000 shares) including Jeffrey Pontius, Dr. Russell Myers, Catherine Gignac, Steve Aaker, Quentin Mai, Peggy Wu and Lawrence Talbot. Full insider transaction details can be found on SEDI (www.sedi.ca). Corvus now has approximately CAD $8M in working capital as at the closing of the Offering. Jeff Pontius, Corvus CEO, stated "The closing of this strategic financing on terms that minimize shareholder dilution in a challenging market highlights the confidence and commitment of our major shareholders. It is also exciting to have Euro Pacific Gold Fund and Peter Schiff join the Corvus shareholder group with their insightful view on our sector. Management firmly believes that an integral part of maximizing the upside potential of the North Bullfrog project is the continued drilling and expansion of our newly discovered Yellowjacket high-grade gold-silver system. The impact of the results from this high-grade gold and silver system on the existing global project resource and preliminary economic assessment ("PAE") should be apparent in the updated resource estimate and PEA scheduled for release following the end of the 2013 drill season in Q1 2014. As a result of this financing, Corvus will be able to continue with an aggressive drill program at Yellowjacket and other high-grade targets as well as proceed towards initial permitting work next year." The Company paid a finder's fee to each of Euro Pacific Capital, Inc. and Scarsdale Equities LLC in the amounts of $8,500 and $12,500, respectively, in connection with the portion of the Offering raised through such firms. The finder's fee is equal to 5% of the gross proceeds raised from investors introduced to the Company by such firms. All common shares issued in the Offering have a hold period in Canada of four months from the closing of the Offering. In addition, all common shares issued in the Offering are subject to resale restrictions under U.S. federal and state securities laws. The Company has determined that there are exemptions available from the various requirements of Multilateral Instrument 61-101 for the issuance of the common shares in the Offering to insiders. There is no change of control, and no new insiders have been created, as a result of the Offering. The common shares issued in the Offering have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "1933 Act") or any applicable state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) or persons in the United States absent registration or an applicable exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the foregoing securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. On behalf of (signed) Jeffrey A. Pontius Contact Information: |

| Silver Sentiment is Becoming Extremely Pessimistic Posted: 27 Nov 2013 12:00 PM PST Source: SentimenTrader (edited by Short Side of Long) Regular readers of this blog will remember that the overwhelming part of my fund is invested in precious metals, and in particular Silver. The rest of the executed positions have been small traders, because the biggest conviction I hold is that all of this money printing from US to Europe and Japan will end in a total disaster. As far as the blog posts are concerned, I’ve started buying Silver publicly (posted on the blog in real time) in December 2011 as the priced neared a 50% correction from its peak (May 2011 Silver was @ $50 and by late December 2011 it was at $26). Major purchases of similar scale were also executed in July 2012 when Silver was slightly above $26, followed by May 2013 around $22 per ounce and the final one in the chart below $19 in July 2013. These major purchases focus on my long term holdings and do not include times I’ve shorted Silver from a shorter term trading perspective, including the recent triangle setup discussed several weeks ago. After all, at times, hedging is a good tool to protect main investments when you see your investment going lower in the near term and use proceeds to reinvest at lower prices, averaging down the cost. With Public Opinion sentiment dropping below 30% bulls, and furthermore in recent weeks below 25% bulls, I have started paying attention to Silver again as a potential buying opportunity (by the way… there are many other indicators I track including COT futures positioning, option positioning, Gold miners breadth, annualised performance, premium / discount in popular ETFs, fund flows, bear market analogues and so forth). For awhile now, I have maintained that Gold and Silver could make a lower low and create a fabulous buying opportunity (and possibly a final low), so it remains to be seen whether or not bears have the power to push lower in coming days, weeks and/or months. Even though this is a Portfolio Update, I want to make it clear that I am not buying yet, however… I am definitely getting ready! |

| Thoughts For Those Who Buy Or Bought The Precious Metals Thesis Posted: 27 Nov 2013 11:58 AM PST Investors in PMs (precious metals) were not foolish to study and accept the thesis that PMs can hedge your wealth in an era of fudged stats, digital dazzle and de-valuation. This article will try to explain why the PM thesis remains intact, indeed, stronger than ever, but also why one must be cautious in investing in this sector, diversify within it and see the tendency of socio-economic trends. PMs are partly a hedge against fiat currencies whose intrinsic nature is debt and loss of real wealth. The various socio-economic forms in which this imposed devaluation expresses itself lead some people toward traditional stores of value that cannot be photo-shopped or obscured with "lies, damned lies and statistics" as the proverb goes. The fundamental appeals in PMs persist. Silver is a vital industrial commodity far more necessary to the world than most consumer goods or social media. Gold is essential to |

| Gold 2nd Attempt at Follow Through on Reversal Fails Posted: 27 Nov 2013 11:36 AM PST |

| The 5 Massive Economic Lies The Government is Telling You Posted: 27 Nov 2013 11:15 AM PST

At this point it is incredible that there are any Americans that still trust anything that comes out of the administration’s collective mouth. And of course it is not just Obama that has been lying to us. Corruption and deception are rampant throughout the entire federal government, and this has been the case for years. [...] The post The 5 Massive Economic Lies The Government is Telling You appeared first on Silver Doctors. |

| Posted: 27 Nov 2013 10:26 AM PST Dubai Financial Market is the best performing bourse in the world this year and the emirate’s house prices are also up by the most in the world. Has the local market already priced today’s victory in the contest to stage the Expo 2020 or is the best yet to come? That is what Dubai investors will be asking themselves as they celebrate the success of the Expo 2020, a bid that has made young Ali a superstar in its award-winning TV commercial and will trigger a multi-billion dollar spending spree to prepare futuristic local infrastructure for the event. Recovery story But the Dubai recovery story is far from being all about the staging of Expo 2020. It’s been more about high oil revenues in the region and a surge in trade that has benefited Dubai most as its trading hub. Huge investments like the 39 A380s now in service with Emirates Airline have also helped to boost the aviation and tourism sectors. There’s also been a strong cyclical recovery from the real estate crash of 2009 with money pouring in from sources as diverse as Westerners fleeing high tax regimes, Chinese pulling capital out before their economy collapses and of course the rich of the Arab Spring nations seeking a safe place to live and invest. Is this trend going to continue or are we ripe for a correction at these levels? Selling at a point of maximum euphoria like the Expo 2020 win has a certain logic to it. Indeed, perhaps it is already too late if too many conclude the same thing at the same time. Then again it is hard to believe any downturn would be for long or be sustained given the long-term growth dynamics for a city like Dubai, recently named along with Singapore and Miami as the cities with the best wealth improvement prospects for the next decade. Any sell-off would be a buying opportunity and widely seen as one too. Discounted asset prices Besides local asset prices are simply not expensive and still trade at substantial discounts to the highs of the last boom. House prices are an average of 30 per cent lower. Local stocks are still 60 per cent lower than the rebased peak valuations of early 2006. Emerging markets, and the UAE officially joins the MSCI emerging markets index in mid-2014, are notoriously cyclical. It could be that 2020 is a natural top with the Expo focusing the attention of the world and investors on Dubai. Still that is seven years away and markets are unlikely to go up in a straight line. Stay ahead of the game with the ArabianMoney subscription-only investment newsletter that has the inside story on what you should be buying that we dare not print on this website (subscribe here). |

| Silver Algo Active This Morning, Telegraphing Holiday Gold & Silver Smash? Posted: 27 Nov 2013 09:44 AM PST

I took one look at this morning's silver trade and just shook my head. Here for the entire world to see are the footsteps of algorithm trading capping the upside. The capping job shows the cartel is active, and the algo pattern signals to traders with eyes to see that the cartel is expressing its [...] The post Silver Algo Active This Morning, Telegraphing Holiday Gold & Silver Smash? appeared first on Silver Doctors. |

| Gold: Brief pause, or final bottom? Posted: 27 Nov 2013 09:43 AM PST Are forces tryiing to push gold down to the 2008 C-wave top? |

| “Wave Of Disaster” Threatens U.S. Mortgage Market; OECD & IMF Warn UK Posted: 27 Nov 2013 09:31 AM PST gold.ie |

| Mercenary Links Nov 27th: Shoppers Unite Posted: 27 Nov 2013 09:29 AM PST Mercenary Links Nov 27th: Watching teens shop… a new boom in subprime loans… bubbles in a balance sheet recession… 10 things billionaires won’t tell you, why smart people are stupid, and more. ~~~

~~~ ~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~ Recent Mercenary Links (scroll for archives)

p.s. Like this article? For more, visit our Knowledge Center! p.p.s. If you haven't already, check out the Mercenary Live Feed! |

| Why Is Debt the Source of Income Inequality and Serfdom? It’s the Interest, Baby Posted: 27 Nov 2013 09:13 AM PST “Governments cannot reduce their debt or deficits and central banks cannot taper. Equally, they cannot perpetually borrow exponentially more. This one last bubble cannot end (but it must).” I often refer to debt serfdom, the servitude debt enforces on borrowers. The mechanism of this servitude is interest, and today I turn to two knowledgeable correspondents for explanations of the consequences of interest. Correspondent D.L.J. explains how debt/interest is the underlying engine of rising income/wealth disparity: “Here is a table of the growth rate of the GDP. If we use $16T as the approximate GDP and a growth rate of, say, 3.5%, the total of goods and services would increase one year to the next by about $500B. Meanwhile, referencing the Grandfather national debt chart with the USDebtClock data, the annual interest bill is $3 trillion ($2.7 trillion year-to-date). In other words, those receiving interest are getting 5-6 times more than the increase in gross economic activity. Using your oft-referenced Pareto Principle, about 80% of the population are net payers of interest while the other 20% are net receivers of interest. Also, keep in mind that one does not have to have an outstanding loan to be a net payer of interest. As I attempted to earlier convey, whenever one buys a product that any part of its production was involving the cost of interest, the final product price included that interest cost. The purchase of that product had the interest cost paid by the purchaser. Again using the Pareto concept, of the 20% who receive net interest, it can be further divided 80/20 to imply that 4% receive most (64%?) of the interest. This very fact can explain why/how the system (as it stands) produces a widening between the haves and the so-called ‘have nots’.” Longtime correspondent Harun I. explains that the serfdom imposed by debt and interest is not merely financial servitude–it is political serfdom as well: “As both of us have stated, you can create all of the money you want, however, production of real things cannot be accomplished with a keystroke. Then there is the issue of liberty. Each Federal Reserve Note is a liability of the Fed and gives the bearer the right but not the obligation to purchase — whatever the Fed deems appropriate. How much one can purchase keeps changing base on a theory-driven experiment that has never worked. Since the Fed is nothing more than an agent of the Central State, the ability to control what the wages of its workers will purchase, is a dangerous power for any government. If a Federal Reserve Note is a liability of the central bank, then what is the asset? The only possible answer is the nations productivity. So, in essence, an agent of the government, the central bank, most of which are privately owned (ownership is cloaked in secrecy) owns the entire productive output of free and democratic nation-states. People who speak of liberty and democracy in such a system only delude themselves. Then there is the solution, default. That only resolves the books, the liability of human needs remain. Bankruptcy does not resolve the residue of social misery and suffering left behind for the masses who became dependent on lofty promises (debt). These promises (debts) were based on theories that have reappeared throughout human history under different guises but have never worked. More debt will not resolve debt. The individual's liberty is nonexistent if he does not own his labor. A people should consider carefully the viability (arithmetical consequences) of borrowing, at interest, to consume their own production. The asset of our labor cannot simultaneously be a liability we owe to ourselves at interest.” Thank you, D.L.J. and Harun. What is the alternative to the present system of debt serfdom and rising inequality? Eliminate the Federal Reserve system and revert to the national currency (the dollar) being issued by the U.S. Treasury in sufficient quantity to facilitate the production and distribution of goods and services. Is this possible? Not in our Financialized, Neofeudal-Neocolonial Rentier Economy; but as Harun noted in another email, “Governments cannot reduce their debt or deficits and central banks cannot taper. Equally, they cannot perpetually borrow exponentially more. This one last bubble cannot end (but it must).” What we are discussing is what will replace the current system after it self-destructs. |

| Quantitative Easing: Hazardous to Your Retirement Posted: 27 Nov 2013 09:00 AM PST

The Fed, through ZIRP and QE, has created $Trillions of benefits for the financial industry and much of that benefit has been created at the expense of government pension plans and individuals who depend upon interest earnings. This has a direct and negative consequence to many retirement plans, especially city and state public pensions. It [...] The post Quantitative Easing: Hazardous to Your Retirement appeared first on Silver Doctors. |

| Andy Hoffman Answers Questions Posted: 27 Nov 2013 08:59 AM PST Andy Hoffman answers reader’s questions on his weekly podcast to discuss COMEX delivery and inventory, employment numbers, gold and silver, China, December contracts, margin debt. To listen to the podcast, please click the link below: Andy Hoffman Answers Questions Similar Posts: |

| Don’t Underestimate the US Dollar Posted: 27 Nov 2013 08:50 AM PST The US dollar is the currency traders love to hate. “Everybody knows” that the greenback is perpetually weak, a fiat currency made for shorting. This viewpoint is almost inevitably attached to hand-waving notions of money printing vis a vis the Federal Reserve, how America is going down the tubes, and so on. But this is faulty logic and faulty economics. For one thing, quantitative easing (QE) is not money printing. It is an $85-billion-per-month asset swap, in which one form of bank reserves is switched with another. Having $85B worth of electrons added to the digital ledgers of electronic bank vaults — the ‘cash’ sitting in those vaults like stagnant pools of water — is not in the same vicinity as printing money directly. It’s not the same league, or even the same sport. So QE itself is not actually inflationary in a “money printing” sense… except in terms of psychological impact on risk asset values. The primary effects of QE are “wealth effect” driven, via the inflation of risk assets as investors grow more aggressive in a central bank dominated, risk-neutered, low return world. It’s possible that QE will eventually prove inflationary above and beyond risk assets, sort of, on an extreme lag basis when banks finally start lending again. But the people who have been predicting QE as inflationary should not get credit for their predictions if inflation does finally turn up on a broad basis. Why? Because they badly misunderstood the transmission mechanism (it’s about monetary velocity, not direct ‘printing’)… they got the timing spectacularly wrong (inflation was expected years ago, and is still nowhere in sight, other than financial assets)… and if banks start lending vigorously again, they will do so against the backdrop of an improving economy. There are a lot of huge misconceptions when it comes to macroeconomics. The idea that the US government is “broke” is another one, but we won’t delve into that now. (If you would like to read much more in-depth treatment of these topics, along with directly actionable long / short ideas, check out our Strategic Intelligence Report.) Let’s go back to the dollar though, the asset so many love to hate — and short… The US dollar shows clear sign of having bottomed out in mid-2011. For nearly all of 2012 and 2013 the USD (as proxied by the US dollar index) has been putting in a massive sideways base. This lines up with multiple macro drivers, all of which disfavored the dollar circa 2011 and are now in the process of transition: The introduction and embrace of QE highlighted dovish US policy vs hawkish European policy — which is now shifting. Even as the US Federal Reserve took steps to stimulate via QE and keep interest rates at zero, the European Central Bank (ECB) remained dominated by hawkish Germans who, being Weimar-obsessed, really didn’t give a crap if Spain, Greece, et al were put through soft depression conditions via too-tight monetary policy. That dynamic is visibly shifting now, with the Fed sounding more hawkish, and the ECB sounding more dovish, by the day. In the event of a real deflationary global growth threat, the German’s objections to ECB action, even a Europe-wide QE, will be overridden. US investors sent large quantities of capital abroad to invest in emerging market equities and debt — now not so much. The attractiveness of EM assets relative to US assets is a dollar-weakening phenomenon as capital flows away from US shores and into various countries with patterns of fast growth and heavy infrastructure spending. Now, though, emerging markets are in turmoil as “taper talk” gains volume. What’s more, some countries (like Brazil) are already showing destructive consumer debt trends (high annual percentage rates, maxed out credit cards) surprisingly early in the cycle. All of this means a general souring of emerging market attractiveness, which means capital repatriating to US shores and again strengthening the USD. The US deficit is contracting due to forced budget cuts and curtailed government spending. The ‘sequester’ and other budget restriction measures have led to a falling (contracting) US deficit, which means government spending is falling relative to a broad pickup in economic growth. This is a currency strengthening backdrop, especially in comparison to countries where emergency stimulus spending is likely to accelerate meaningfully (Europe, Japan) in order to avoid the deflationary sand trap. A low return, slow-growth world favors mature assets and mature companies (like US blue chips), in turn favoring the USD. To the degree that global growth is slowing, emerging market equities become less attractive in light of “hot money” problems, fallout from wasteful infrastructure spending (which only comes to light when things slow down), and backlash from trying to juice economic growth rates (instead of allowing slower, but healthier and more stable, organic rates of growth). As investors adjust to this sea change, they will increasingly favor safety and solidity over sexy returns, which means a migration to blue chips and large US multinationals (which in turn favors the dollar via capital flows). The Australian dollar (AUDUSD) is an example of an excellent shorting opportunity created by a shift in long-term drivers toward US dollar strength. We are short AUDUSD with size (and will pyramid more given the opportunity), with our rationale laid out publicly via Australian dollar could hit low 80s on October 31st. We also see substantial opportunity going long dollar / yen (a bet that the Japanese yen will decline), coupled with long Japanese equities. As the yen depreciates — a development encouraged by the Bank of Japan (BOJ) in the name of positive inflation and getting corporations to spend their cash hordes — Japanese exports become more competitive, the velocity of money increases, and PE multiples on Japanese stocks expand. (If you would like to see full details on our currency positions, including position sizing, risk points, and real time adjustments, check out the Mercenary Live Feed.) To the degree that the US dollar may be done falling, and setting up for a secular period of strength, that could be a negative for US equities on the whole. The dollar’s managed decline in years past, far from being a sign of disaster, was actually a positive for US exports and multinational balance sheets (as profits accrued overseas look bigger when converted back into cheaper dollars). Indeed part of the reason we expect a transition in 2014 is the need for other large players (like Europe and Japan) to embrace the stimulative aspects of cheaper currencies even as the United States, the growth leader of the Western world, makes a net transition to tightening (at least in comparison to others).  Similar articles you might like: |

| Monsanto, the TPP, and Global Food Dominance Posted: 27 Nov 2013 08:49 AM PST “Control oil and you control nations,” said US Secretary of State Henry Kissinger in the 1970s. “Control food and you control the people.” Global food control has nearly been achieved, by reducing seed diversity with GMO (genetically modified) seeds that are distributed by only a few transnational corporations. But this agenda has been implemented at grave cost to our health; and if the Trans-Pacific Partnership (TPP) passes, control over not just our food but our health, our environment and our financial system will be in the hands of transnational corporations. Profits Before Populations According to an Acres USA interview of plant pathologist Don Huber, Professor Emeritus at Purdue University, two modified traits account for practically all of the genetically modified crops grown in the world today. One involves insect resistance. The other, more disturbing modification involves insensitivity to glyphosate-based herbicides (plant-killing chemicals). Often known as Roundup after the best-selling Monsanto product of that name, glyphosate poisons everything in its path except plants genetically modified to resist it. Glyphosate-based herbicides are now the most commonly used herbicides in the world. Glyphosate is an essential partner to the GMOs that are the principal business of the burgeoning biotech industry. Glyphosate is a “broad-spectrum” herbicide that destroys indiscriminately, not by killing unwanted plants directly but by tying up access to critical nutrients. Because of the insidious way in which it works, it has been sold as a relatively benign replacement for the devastating earlier dioxin-based herbicides. But a barrage of experimental data has now shown glyphosate and the GMO foods incorporating it to pose serious dangers to health. Compounding the risk is the toxicity of “inert” ingredients used to make glyphosate more potent. Researchers have found, for example, that the surfactant POEA can kill human cells, particularly embryonic, placental and umbilical cord cells. But these risks have been conveniently ignored. The widespread use of GMO foods and glyphosate herbicides helps explain the anomaly that the US spends over twice as much per capita on healthcare as the average developed country, yet it is rated far down the scale of the world’s healthiest populations. The World Health Organization has ranked the US LAST out of 17 developed nations for overall health. Sixty to seventy percent of the foods in US supermarkets are now genetically modified. By contrast, in at least 26 other countries–including Switzerland, Australia, Austria, China, India, France, Germany, Hungary, Luxembourg, Greece, Bulgaria, Poland, Italy, Mexico and Russia–GMOs are totally or partially banned; and significant restrictions on GMOs exist in about sixty other countries. A ban on GMO and glyphosate use might go far toward improving the health of Americans. But the Trans-Pacific Partnership, a global trade agreement for which the Obama Administration has sought Fast Track status, would block that sort of cause-focused approach to the healthcare crisis. Roundup’s Insidious Effects Roundup-resistant crops escape being killed by glyphosate, but they do not avoid absorbing it into their tissues. Herbicide-tolerant crops have substantially higher levels of herbicide residues than other crops. In fact, many countries have had to increase their legally allowable levels–by up to 50 times–in order to accommodate the introduction of GM crops. In the European Union, residues in food are set to rise 100-150 times if a new proposal by Monsanto is approved. Meanwhile, herbicide-tolerant “super-weeds” have adapted to the chemical, requiring even more toxic doses and new toxic chemicals to kill the plant. Human enzymes are affected by glyphosate just as plant enzymes are: the chemical blocks the uptake of manganese and other essential minerals. Without those minerals, we cannot properly metabolize our food. That helps explain the rampant epidemic of obesity in the United States. People eat and eat in an attempt to acquire the nutrients that are simply not available in their food. According to researchers Samsell and Seneff in Biosemiotic Entropy: Disorder, Disease, and Mortality (April 2013):

More than 40 diseases have been linked to glyphosate use, and more keep appearing. In September 2013, the National University of Rio Cuarto, Argentina, published research finding that glyphosate enhances the growth of fungi that produce aflatoxin B1, one of the most carcinogenic of substances. A doctor from Chaco, Argentina, told Associated Press, “We’ve gone from a pretty healthy population to one with a high rate of cancer, birth defects and illnesses seldom seen before.” Fungi growths have increased significantly in US corn crops. Glyphosate has also done serious damage to the environment. According to an October 2012 report by the Institute of Science in Society:

Politics Trumps Science In light of these adverse findings, why have Washington and the European Commission continued to endorse glyphosate as safe? Critics point to lax regulations, heavy influence from corporate lobbyists, and a political agenda that has more to do with power and control than protecting the health of the people. In the ground-breaking 2007 book Seeds of Destruction: The Hidden Agenda of Genetic Manipulation, William Engdahl states that global food control and depopulation became US strategic policy under Rockefeller protégé Henry Kissinger. Along with oil geopolitics, they were to be the new “solution” to the threats to US global power and continued US access to cheap raw materials from the developing world. In line with that agenda, the government has shown extreme partisanship in favor of the biotech agribusiness industry, opting for a system in which the industry “voluntarily” polices itself. Bio-engineered foods are treated as “natural food additives,” not needing any special testing. Jeffrey M. Smith, Executive Director of the Institute for Responsible Technology, confirms that US Food and Drug Administration policy allows biotech companies to determine if their own foods are safe. Submission of data is completely voluntary. He concludes:

Whether or not depopulation is an intentional part of the agenda, widespread use of GMO and glyphosate is having that result. The endocrine-disrupting properties of glyphosate have been linked to infertility, miscarriage, birth defects and arrested sexual development. In Russian experiments, animals fed GM soy were sterile by the third generation. Vast amounts of farmland soil are also being systematically ruined by the killing of beneficial microorganisms that allow plant roots to uptake soil nutrients. In Gary Null’s eye-opening documentary Seeds of Death: Unveiling the Lies of GMOs, Dr. Bruce Lipton warns, “We are leading the world into the sixth mass extinction of life on this planet. . . . Human behavior is undermining the web of life.” The TPP and International Corporate Control As the devastating conclusions of these and other researchers awaken people globally to the dangers of Roundup and GMO foods, transnational corporations are working feverishly with the Obama administration to fast-track the Trans-Pacific Partnership, a trade agreement that would strip governments of the power to regulate transnational corporate activities. Negotiations have been kept secret from Congress but not from corporate advisors, 600 of whom have been consulted and know the details. According to Barbara Chicherio in Nation of Change:

Food safety is only one of many rights and protections liable to fall to this super-weapon of international corporate control. In an April 2013 interview on The Real News Network, Kevin Zeese called the TPP “NAFTA on steroids” and “a global corporate coup.” He warned:

Return to Nature: Not Too Late There is a safer, saner, more earth-friendly way to feed nations. While Monsanto and US regulators are forcing GM crops on American families, Russian families are showing what can be done with permaculture methods on simple garden plots. In 2011, 40% of Russia’s food was grown on dachas (cottage gardens or allotments). Dacha gardens produced over 80% of the country’s fruit and berries, over 66% of the vegetables, almost 80% of the potatoes and nearly 50% of the nation’s milk, much of it consumed raw. According to Vladimir Megre, author of the best-selling Ringing Cedars Series:

In the US, only about 0.6 percent of the total agricultural area is devoted to organic farming. This area needs to be vastly expanded if we are to avoid “the sixth mass extinction.” But first, we need to urge our representatives to stop Fast Track, vote no on the TPP, and pursue a global phase-out of glyphosate-based herbicides and GMO foods. Our health, our finances and our environment are at stake. |

| Thanksgiving gold volumes "thin,” China & Turkey import record tonnages Posted: 27 Nov 2013 08:33 AM PST With good U.S. economic news and higher confidence worldwide, gold might be taking the holiday. |

| CRITICAL FACTOR: The Real Reason To Own Gold Posted: 27 Nov 2013 08:22 AM PST

The U.S. and world are heading towards serious trouble. The financial markets are being kept alive due to the monetization of debt on a massive scale. This has produced a huge dislocation in the fundamental valuation of assets. Currently, stocks, bonds and paper assets are on the receiving end of this monetary stimulation, while the [...] The post CRITICAL FACTOR: The Real Reason To Own Gold appeared first on Silver Doctors. |

| UBS short-term gold target downgraded to $1,180/oz Posted: 27 Nov 2013 08:04 AM PST UBS has downgraded the bank's short-term gold price targets to $1,180 an ounce for one month and $1,100 for three months. |

| U.S. copper production up 10% YTD, gold up 6% - USGS Posted: 27 Nov 2013 08:03 AM PST Average daily smelter and electronic refinery copper production increased by 76% and 9%, respectively for the month of July, said the U.S. Geological Survey while gold output up 6%. |

| Rand Paul Slams the Surveillance State: “Enough Is Enough, We Want Our Freedoms Back” Posted: 27 Nov 2013 08:00 AM PST

Rand Paul has issued an impassioned video address demanding that our current surveillance state be returned to the land of the free: "We were once outraged and dismayed and spurred to resist when British soldiers came knocking at our door with illegitimate warrants seeking taxes on our papers. Today, your government responds that there is [...] The post Rand Paul Slams the Surveillance State: "Enough Is Enough, We Want Our Freedoms Back" appeared first on Silver Doctors. |

| China Has Quietly Accumulated 20,000 Metric Tons of Gold! Posted: 27 Nov 2013 07:31 AM PST

Click here for more on whether China has already accumulated 20,000 tons of gold: |

| S&P 500 & Gold Stocks, Mirror Manias Posted: 27 Nov 2013 07:31 AM PST Biwii |

| Posted: 27 Nov 2013 07:15 AM PST

After Bitcoin surged nearly 100% in 24 hours last week to $900, and promptly crashed 50%, many thought the Bitcoin bubble was over. They would be wrong. Bitcoin has just placed a new all-time record high of $1030, surging another 10% this morning, and exploding through the $1,000 level. Nothing like a little salt rubbed [...] The post Bitcoin Explodes Past $1,000 appeared first on Silver Doctors. |

| Chinese Gold Imports Surpass 1,000 Tons for 2013! Posted: 27 Nov 2013 07:00 AM PST

China increased the import of gold through Hong Kong last month, with gross gold imports for the month of October coming in at 147.92 tonnes, of which 131,19 tons remained as net import. China has imported more than 100 tonnes of gold each month in the past six months. Gross imports in the first ten [...] The post Chinese Gold Imports Surpass 1,000 Tons for 2013! appeared first on Silver Doctors. |

| “Wave Of Disaster” Threatens U.S. Mortgage Market; OECD & IMF Warn UK Posted: 27 Nov 2013 05:59 AM PST

U.S. borrowers are increasingly missing payments on home equity lines of credit they took out during the housing bubble, a trend that could deal another blow to the country’s biggest banks according to Reuters Insight. It would likely also deal another blow to the U.S. property market and the fragile U.S. economy. Bank of America, [...] The post "Wave Of Disaster" Threatens U.S. Mortgage Market; OECD & IMF Warn UK appeared first on Silver Doctors. |

| “Wave Of Disaster” Threatens U.S. Mortgage Market; OECD And IMF Warn UK Posted: 27 Nov 2013 04:33 AM PST It would likely also deal another blow to the U.S. property market and the fragile U.S. economy. JP Morgan, Bank of America and Wells Fargo appear to be the most exposed – meaning that either taxpayers will again be asked to bail out banks or more likely the coming bail-in regime will confiscate cash from depositors. Today's AM fix was USD 1,250.75, EUR 919.80 and GBP 767.99 per ounce. Gold fell $6.70 or 0.54% yesterday, closing at $1,242.10/oz. Silver slid $0.17 or 0.85% closing at $19.85/oz. Platinum fell $16.94 or 1.2% to $1,367.30/oz, while palladium dropped $3.25 or 0.5% to $715.47/oz. Gold is higher today in London. There is speculation that lower prices, which fell to a four-month low, will lead to increased physical demand. Prices fell to $1,225.55/oz on Monday after another massive sell order led to trading being suspended for 20 seconds for the third time in less than a week. $1,225.55/oz was the lowest since July 8.

The German regulator has joined the British Financial Regulator and is opening up an examination of the gold and silver price 'setting' at banks. The German financial markets regulator is scrutinizing gold and silver price setting operations at individual banks alongside other benchmark processes including Libor and Euribor, Bafin spokesman Ben Fischer told media. Bafin declined to elaborate on the status of the investigation or the banks involved. Despite the very poor sentiment after recent price falls, gold’s fundamentals are actually quite sound. Global physical demand is set to be very high again this year and may even reach a new record, despite the 25% price fall. This is especially the case, as Chinese demand is set to be a new record this year despite the recent slight decline in demand. China's net imports of gold from Hong Kong alone in October reached the second-highest level on record last month. This does not include direct imports from Australia, Africa, Vietnam and other countries. Indeed, Chinese demand this year looks set to be a new record for the highest gold demand from one country in one year ever. It is important to look at the aggregate annual demand figures rather than the ebb and flows of weekly and monthly data which can mislead. Momentum and technical traders are dominant at the moment and with the short term trend down, gold may incur further losses in the short term. However, the smart money is gradually accumulating on the dips. Dollar cost averaging remains prudent for investors who wish to get exposure to bullion but are concerned about further price falls. U.S. borrowers are increasingly missing payments on home equity lines of credit they took out during the housing bubble, a trend that could deal another blow to the country’s biggest banks according to Reuters Insight. It would likely also deal another blow to the U.S. property market and the fragile U.S. economy. Bank of America, JP Morgan and Wells Fargo appear to be the most exposed – meaning that either taxpayers will again be asked to bail out banks or more likely the new bail-in regime will confiscate cash from depositors. From Reuters: More than $221 billion of these loans at the largest banks will hit this mark over the next four years, about 40 percent of the home equity lines of credit now outstanding. For a typical consumer, that shift can translate to their monthly payment more than tripling, a particular burden for the subprime borrowers that often took out these loans. And payments will rise further when the Federal Reserve starts to hike rates, because the loans usually carry floating interest rates. At a conference last month in Washington, DC, Amy Crews Cutts, the chief economist at consumer credit agency Equifax, told mortgage bankers that an increase in tens of thousands of homeowners’ monthly payments on these home equity lines is a pending “wave of disaster”.

The Paris-based group said, in its semi-annual Economic Outlook, that it was urgent to continue to relax the barriers to housing supply to prevent overheating in the property market. It ignored the fact that the nascent new bubble is in a large part due to near zero percent interest rates leading to renewed property speculation by buy to let investors. The UK government's Help to Buy program that aids buyers with smaller deposits has been criticized by the International Monetary Fund and politicians for potentially stoking a property bubble as it boosts demand. Given the very fragile recovery, despite near zero percent interest rates in the UK and the U.S. and the uncertain international backdrop, property prices in both countries look vulnerable. Click Gold News For This Week's Breaking Gold And Silver News

|

| Posted: 27 Nov 2013 04:32 AM PST Because it's my birthday today I'm going to publish the Wednesday morning report. It's time for a pep talk. Folks bear market bottoms are the single greatest opportunities one ever gets in investing. The initial move out of a bear market bottom is where the really big moves occur, and occur fast. Look at what happened as miners came out of the last bear market. Folks we've got everything on our side. We have an intermediate cycle that is 22 weeks long. That is smack in the timing band for a bottom. We have a daily cycle that ran long at 29 days. We have sentiment that is at levels typical of intermediate bottoms. We have a dollar cycle that has rolled over in a left translated pattern and a three year cycle that has topped. We have a massive volume spike in NUGT. A sure sign that smart money is positioning for an impending bear market bottom. And now we have insiders buying. All of our tools have lined up to give a buy signal. This is why we sat on the sidelines, so we would have the mental capital to pull the trigger when the time came. The time has arrived. It's time to pull the gym bag out of the trash can and get back to work. Gary The $1 two day trial is still active. Click here to sign up for the trial and read the latest daily report. |

| Gold Miners Look To Break Below June Low Posted: 27 Nov 2013 03:39 AM PST I’m looking for the miners to break below the June Low, but for Gold to hold above it. A decline by miners below the low should trigger exhaustion selling, but if Gold doesn’t confirm, it should mark a significant bear trap for investors in miners. If Gold holds above the June low, additional weakness in miners should be short-lived…and a final bottom in miners will become more likely.

Investor Cycle Trading Strategy – Gold/Silver Last week, I wrote that I did not want to trade Gold Long until it dropped toward the $1,220 area. I wanted to see the current Daily Cycle step-down into a sharper decline before I had the confidence to buy an oversold Cycle. Waiting, I believed, would provide a good trade setup with a much tighter stop, with the June low of $1,179 just below the expected DCL/ICL. Last week’s strategy is still on play, with Gold having done as we expected. It is now much closer to our target and a week deeper in the timing band. Patience has allowed the setup to come to us. One last drop early next week will create an ideal entry point. Expected Trade: Within 1-3 Sessions. I’m preparing to buy a 35% position Long Gold/Silver/miners. Related Posts: Euro’s New High Negates H&S Pattern |

| Insight: A new wave of U.S. mortgage trouble threatens Posted: 27 Nov 2013 03:21 AM PST U.S. borrowers are increasingly missing payments on home equity lines of credit they took out during the housing bubble, a trend that could deal another blow to the country's biggest banks. The loans are a problem now because an increasing number are hitting their 10-year anniversary, at which point borrowers usually must start paying down the principal on the loans as well as the interest they had been paying all along. More than $221 billion of these loans at the largest banks will hit this mark over the next four years, about 40 percent of the home equity lines of credit now outstanding. The number of borrowers missing payments around the 10-year point can double in their eleventh year, data from consumer credit agency Equifax shows. When the loans go bad, banks can lose an eye-popping 90 cents on the dollar, because a home equity line of credit is usually the second mortgage a borrower has. If the bank forecloses, most of the proceeds of the sale pay off the main mortgage, leaving little for the home equity lender. It's 2007 all over again, dear reader! This Reuters news item was filed on their Internet site very early yesterday morning EST...and I thank Manitoba reader Ulrike Marx for today's first story. |