saveyourassetsfirst3 |

- [KR527] Keiser Report: Gold, Silver, Bitcoin FTW!

- Trend Analysis of Gold

- Jim Sinclair Dedicated To Realize “Free Gold”

- Sentiment on Metals

- A MAJOR TURNING POINT MAY HAVE OCCURRED

- The Dark Heart of Centralized Power

- Gold Investors Weekly Review – November 22nd

- SD Weekly Metals & Markets: Is a Re-Test of the June Lows Dead Ahead?

- Low-Priced Stocks To Avoid: Round 8

- Diverging Dollar Performance Set To Continue

- GoldCore’s O’Byrne Notes Continuing Signs of Gold Market Manipulation

- Three King World News Blogs

- Gold Option Wagers on Surge to $3,000 Was Most-Active on Wednesday

- Gold Analysts Most Bearish Since June on Fed Taper

- Germany cuts gold holdings for second time in 5 months

- China to start gold swaps trading on Nov. 25

- CME Group Lowers Gold, Silver, Copper Margins

- GoldCore's O'Byrne notes continuing signs of gold market manipulation

- Alasdair Macleod: Paper sellers still in charge of gold market

- Gold traders plan benchmark code of conduct

- Alasdair Macleod: Sprott's right, WGC is wrong on gold demand data

- Where Did All The Gold Go?

- Jim Sinclair: My mission on our behalf

- Gold Investors Weekly Review – November 22nd

- Gold And Silver Price – Charts Tell The Story. Decline Not Over.

- Randgold Not Cutting Exploration

- Tracking Physical Silver Prices

- Gold Long-Term: Nowhere To Go But Down

- SD Weekly Metals & Markets: Is a Re-Test of the June Lows Dead Ahead?

- Yanis Varoufakis: The Emerald Isle Remains in Chains

- GLD loses a rather large 4.5 tonnes. GLD down to 852.21 tonnes/SLV loses 1.445 million oz/The comex dealer inventory down to 18.33 tonnes/Ukraine breaks away from Europe and turns to Russia/China limits its reserves of USA dollars/.

- Silver eagle sales hit new record as silver price loses 4% in a week

- Why gold and silver are having a tough time

- Physical Silver and Personal Empowerment

- THE ONCE IN A LIFETIME GOLD TRADE

- Precious Metals: The Long-Term Perspective

- CAPITULATION?: This could be the first sign of a significant bottom in gold

- Next month, you could get the chance to see something that hasn't happened since the year 1680

- Dow/Gold Ratio Jumps Back to 2008

- Inaugural Interview With Chris Waltzek of Goldseek Radio

- Gold Squeaks Out only a Meager Bounce

- Doc Eifrig: Don't apply for a credit card, car loan, or mortgage without doing THIS first

- How to find the world's best low-risk, high-reward trading ideas

- Jim Sinclair Exclusive Interview – The Game Changer

- Silver Certificates and Counterfeit Mobs: The Assassination of JFK & Silver

- “Bad News Bias” Sees Gold Near 3-Year Low as Fed “Trapped by QE”, China Ends Dollar Hoarding

| [KR527] Keiser Report: Gold, Silver, Bitcoin FTW! Posted: 23 Nov 2013 10:16 AM PST We discuss QE as the meals on wheels for over-leveraged, consum-oholic debt addicts with Ben Bernanke as the pusher with a story to tell which is that ‘cheap money is good’ for buying depreciating assets like cars and where ‘gold slamdowns’ are meted out to those who refuse to stay intoxicated on that cheap money. In the second half, Max interviews Barry Silbert of Second Market and BitcoinTrust.co about the future of bitcoin in terms of regulation, market dominance and how the transaction network will change the way people think of money. | |

| Posted: 23 Nov 2013 10:04 AM PST As we draw near to the close of November, I thought it fitting to provide a look at the gold chart over several time frames, near-term, intermediate and long term, in regards to the trend of the market. For this purpose, I am using an old but reliable indicator known as the Directional Movement Index, which is as good as any others out there when it comes to determining whether a market is in a trending phase or is moving sideways within a range. Let's start with the Daily Chart first.... Notice, Negative Directional Movement ( the Red Line) continues to remain ABOVE Positive Directional Movement ( the Blue Line ) indicating that the bears are in control of this market. Further, the ADX line is rising indicating the presence of a STRONG TRENDING MOVE. Because -DMI is above +DMI, we know that the trend is therefore DOWN. Let's now shift out to the intermediate or weekly time frame. There is one very noteworthy item that immediately stands out to any technician: Negative Directional Movement has been ABOVE Positive Directional Movement since late November of LAST YEAR. In other words, the Bears have had control of this market for a full year now. That is why it particularly distresses me to read so much of the foolishness that keeps coming out of some quarters of the gold community talking about such things as BACKWARDATION, GOFO rates, COIN DEMAND, etc. It makes for interesting reading and such but is of no value when it comes to interpreting the language of the gold market itself. Furthermore, the ADX line had been steadily rising since the beginning of this year indicating the presence of a strong trending move lower until the middle of July when the line turned lower indicating a disruption in the ongoing downtrend. As the price of gold recovered from the spike low near $1180, it rallied up to near $1420 relieving the downward pressure for a bit. However, and this is important to note, the -DMI remained above the +DMI during this time frame. That means the rally was merely a pause in the ongoing downtrend and that the bears still had control of the market. What gives me reason for concern with gold is the fact that the ADX is showing signs of turning higher once again. It is likely, not guaranteed, that line will show a definite turn higher if gold cannot close higher this next week. Also, the market is moving down into a dangerous area. If it cannot attract the same kind of buying that it did back in the summer of this year, when demand soared higher, chart support will not be able to hold. It is imperative for this market that demand for the physical metal ramps up significantly right away or there is the danger that gold could start yet another leg down in price. The last time frame we want to look at is the monthly chart. Something that stands out to me on this chart is the fact that the ADX has never yet ( since 2001 ) moved higher while gold was in a corrective phase lower. In other words, on the monthly chart, we have not yet had a period during which the market was in a DOWNTRENDING PHASE. All corrections lower in price were just that, corrections, not changes in the ongoing UPtrend. As you can see, the Negative Directional Movement line remained BELOW the BLUE or Positive Directional Movement Line even in 2008 when we had the debacle in the market. Bulls were remained in control of the market, even if they did just barely manage that. However, in March of this year, for the first time since the bull market in gold began back in 2001, the Red line or Negative Directional Movement crossed ABOVE the Blue Line or Positive Directional Movement. The BEARS had seized control of the gold market. Shortly thereafter, the ADX line began to rise for the first time in over a decade while the price of gold moved lower, indicating what looked to be an incipient trending move lower. However the price recovery off of that spike low when gold moved up some $240 or so in price, dented the downtrend and the ADX began moving lower once again showing that the market was going into a consolidative phase. Significantly, with the fall in the price of gold from $1400 to its current $1242, the ADX is threatening to turn higher once again. It is not yet there but it is certainly not falling. Translation - gold is flirting with indicating a trending move lower on the LONG term chart. This is the reason I have been bearish on gold now for some time - the charts are indicating that bearish pressure is building in the market and is hinting at building across all three time frames. It is imperative for gold bulls that the price recovers strongly before the end of this year to prevent heading into the New Year with a strong bearish bias. Index fund rebalancing might help somewhat but with hedge funds plowing money into the short side of the gold market, Asian and middle East physical offtake is going to have to be large enough to absorb Western-based selling. What worries me about gold is that the hedge funds still remain NET LONG, even if that position has shrunk to relatively low levels. That means that there remains more than enough firepower to take this market lower if those remaining long positions have to be jettisoned in the event of a breach of downside chart support. Keep in mind that the first chart to respond to any upside movement in the metal will be the daily time frame. Thus we will continue to closely monitor the price action so look for any signs of a market turn higher first on that chart. | |

| Jim Sinclair Dedicated To Realize “Free Gold” Posted: 23 Nov 2013 09:50 AM PST In a written update to his subscriber yesterday night, Jim Sinclair expressed his dedication to “Free Gold.” It should not come as a coincidence that this week gold had seen two trading halts on the same day, as reported in great detail by Zerohedge in “Gold Market Halted For 2nd Time Today Following FOMC Minutes Monkey-Hammering“. Jim Sinclair explains that gold price setting is too dependent on the paper market, to such an extent that it has continued to live as the means of manipulating the paper price of gold. What is “Free Gold.” It is the decoupling of the gold paper market influences on the gold price setting, or in other words freeing physical gold from price slavery to paper gold. The mechanism he describes is through the present time deletion of future exchange warehouse supply. To achieve his target, Jim Sinclair has visited six locations in Singapore where cash and physical only exchanges for silver and gold were to be established. With his staff, he has tried to determine which of the six held the best promise for the gold market transition phase for price discovery away from paper gold and to physical gold material. He would put his shoulder behind the exchange that offers the global window to the real price of gold. That exchange appears to be the Singapore Physical Precious Metals Exchange. Jim Sinclair writes:

| |

| Posted: 23 Nov 2013 09:44 AM PST The chart below focuses on various metal prices and hedge fund positioning. Gold, majority of the time is a precious metal with little industrial use. Silver is a hybrid, with industrial use as well as precious nature. Interestingly enough, throughout history Silver has been associated with the use of currency even more then Gold. Finally, we have Copper, a metal that is mainly of industrial use and a great barometer of economic conditions (particularly in emerging economies that are industrialising).

Source: Short Side of Long Interestingly, Copper was the first to peak in February 2011, due to its sensitive economic nature. This reflected a slowdown in China and emerging economies quite well. Silver followed soon thereafter, in May 2011. Last but not least, Gold finally topped out in September 2011, a handful of months later. Even more interesting is the fact that while Copper and Silver already corrected modestly into 2012, Gold continued to consolidate just below its all time highs. In 2013, Copper (down 12%) has outperformed precious metals like Gold (down 26%) and Silver (down 35%). None of the metals have broken towards new lows just yet, but are very close to doing so if the selling continues. Simultaneously, hedge funds and other speculators are once again cutting positions in these metals rather rapidly. Cumulative positioning remains well below levels witnessed during the 2008 panic selling, but not as low during the June 2013 panic sell off – when hedge funds turned net short. | |

| A MAJOR TURNING POINT MAY HAVE OCCURRED Posted: 23 Nov 2013 09:02 AM PST Something happened on Friday that I didn't expect. And it has the potential to signal a major turning point. On Friday the dollar continued to drop. Why is this important you ask? It's important because it probably confirms that the daily cycle low has now begun and we are not going to get one more push up in the dollar index like I was expecting. We needed that next push up to clearly form a right translated cycle. As of Friday the dollar cycle has topped on day 10. That isn't blatantly left translated, but it's certainly not right translated. Let's put it this way, it has the potential to become a left translated cycle. And I needed to see a clear right translated daily cycle out of an intermediate bottom to confirm the strength of the rally. We are not getting it. To read the rest of the weekend report and see my views on how this will affect commodities and gold click here for a $1.00 two day trial subscription to the SMT premium newsletter. | |

| The Dark Heart of Centralized Power Posted: 23 Nov 2013 09:00 AM PST

All centralized power carries the same pathology: those with the authority are never exposed to the consequences of their authority, nor do they have any responsibility for the consequences. This pathology is not the result of individual psychology or character; it is the result of centralized, concentrated power itself. It’s little wonder so many sociopaths [...] The post The Dark Heart of Centralized Power appeared first on Silver Doctors. | |

| Gold Investors Weekly Review – November 22nd Posted: 23 Nov 2013 08:16 AM PST In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. The price of the yellow metal went lower after two consecutive weeks of gains. Gold closed the week at $1,244.33 which is $45.87 per ounce lower (3.56%). The NYSE Arca Gold Miners Index fell 7.83% on the week. This was the gold investors review of past week. Gold Market StrengthsDemand for gold bars, coins and jewelry hit a record during the third quarter, according to the World Gold Council. The strong demand comes from both China and India, accounting for about 60% of total demand. Central bank gold demand also continues to move higher. Russia now holds the second-largest reserves in the world, with over 400 million ounces. Finally, we are now entering a time of seasonal strength for consumer gold purchases due to the Christmas holidays (US and Europe), the Lunar New Year (Asia), and Valentine's Day (US). Although somewhat delayed, billionaire hedge fund manager John Paulson maintained his gold holdings unchanged in the third quarter of 2013, according to his filling on November 14. This parallels what we have seen from other major gold funds in third-quarter filings, reflecting the fact that redemptions were very subdued, as across-the-board selling of top holdings did not repeat the mass liquidations seen in the second quarter. In addition, George Soros' third-quarter filings revealed that he has moved back into gold stocks and has been decidedly bearish of the broader equity market recently. Gold Market WeaknessesCiti Research, in its annual commodities forecast for 2014, suggests that we will have strong physical buying (much from Asia) over the next year, limiting the downside for gold prices. However, the western buyers who are getting out of the market will likely continue to do so. Citi Research specifically pointed to two reasons why these buyers are getting out of the gold market, resulting in funds moving out of gold and into other asset classes:

Organized price manipulators are still trying to panic investors into selling off their gold holdings, after the market potentially recorded the biggest part of its correction. On November 20 the COMEX had to suspend trading of December gold futures for about 20 seconds after the contract's price fell about $11 within a minute. This happened before normal trading hours in the U.S. As often as this has occurred in recent weeks, it's amazing that regulators ignore these multibillion-dollar speculative trades. Shareholders' wealth in some of these publicly-listed firms could be quickly wiped out should the gold price rise. Gold Market OpportunitiesTD Securities, in its Precious Metals Outlook from November 19, outlined some positive data points summarizing third-quarter results. Earnings were generally better than expected despite the gold price posting its lowest average quarterly price since the third quarter of 2010. TD noted that 21 out of 27 producers that it covers met or exceeded consensus earnings per share estimates. Cash costs are declining faster than expected and all-in sustaining cost is declining. Finally, production growth is picking up, and on a 12-month rolling basis it is up 3 percent among the large cap producers. Duan Shihua, a partner at Shanghai Leading Investment Management, says that gold demand will remain strong in China. There are very few places to put money in China. With the share market down and the government nudging people away from real estate, gold should remain a favored investment choice. Gold consumption should surge by 29 percent to a record 1,000 metric tonnes in 2013, based on estimates provided by 13 analysts. The ratio between the NYSE Arca Gold Bugs Index and the gold price dropped last month to its lowest level since January 2001, when the first of 12 straight annual gains for the precious metal was beginning. The November 20 ratio reading was 3.2 percent above the low. Gold Market ThreatsGoldman Sachs again reissued its negative forecast on gold, predicting at least 15 percent in losses next year for the precious metal, as well as iron ore, soybeans and copper. This gloomy report suggests a drop in the gold price to $1,050 for 2014. Goldman believes that commodities will face increased downside risks even as economic growth in the U.S. accelerates. The largest U.S.-based gold ETF holdings dropped to 863.01 metric tonnes, the lowest since February 2009. Selling from the ETF has been a major headwind this year as the Federal Reserve indicated it was considering an exit strategy from its accommodative policies. According to a Bloomberg survey, Fed policy makers will likely slow the pace of monthly asset purchases to $70 billion from $85 billion at the March meeting. | |

| SD Weekly Metals & Markets: Is a Re-Test of the June Lows Dead Ahead? Posted: 23 Nov 2013 07:24 AM PST On this week's show, we'll cover: This posting includes an audio/video/photo media file: Download Now | |

| Low-Priced Stocks To Avoid: Round 8 Posted: 23 Nov 2013 06:30 AM PST Overview Previously, I wrote Round 7 of this article in which I listed and reviewed three low-priced stocks that I believed should be avoided. The stocks I reviewed in Round 7 were Emerald Oil, Inc. (EOX), Seabridge Gold Inc. (SA) and Turquoise Hill Resources Ltd. (TRQ). For Round 8, I will once again focus on stocks that are currently priced at under $10. In determining why I find that these stocks should be avoided, I will be looking at each company's financial performance, current valuation, recent trading activity, dividend policy, earnings and future outlook. Stock No. 1 Arch Coal, Inc. (ACI) is a coal mining and processing company that mines, processes, and markets bituminous and sub-bituminous coal throughout the United States, selling mainly to power plants, steel mills, and industrial facilities. ACI was founded in 1969 and is headquartered in St. Louis, Missouri. Financial Performance

| |

| Diverging Dollar Performance Set To Continue Posted: 23 Nov 2013 06:18 AM PST The market seemed to get confused last week between the noise and the signal and this confusion gave the dollar a bit of a reprieve. However, by the end of the week, the market seemed to be back on message. Specifically, market sentiment swung from what was perceived as dovish comments at Yellen's confirmation hearing to Fed can taper in December after reading the FOMC minutes. Similarly, speculation of a negative deposit rate in Europe triggered a quick decline in the euro. Surveys suggest that the perceived odds of Fed tapering this year are still low and Draghi and other ECB officials played down the likelihood of a negative deposit rate (though they did not take it off the table entirely). The divergent performance of the US dollar makes it difficult to talk about in general. The Dollar Index itself is really mostly Europe, which accounts for almost 80% of | |

| GoldCore’s O’Byrne Notes Continuing Signs of Gold Market Manipulation Posted: 23 Nov 2013 05:20 AM PST "We are at another major low in gold and silver prices" ¤ Yesterday In Gold & SilverExcept for a slight bump up in price beginning at the noon silver fix in London and ending 10 minutes before the Comex open, there was no price activity worthy of the name anywhere on Planet Earth yesterday, and the highs and lows aren't worth mentioning. Gold finished the Friday session at $1,243.70 spot, up $1.30 from Thursday's close in New York. Gross volume was big, but was irrelevant, as once the roll-overs and spreads out of the December delivery month were subtracted out, the net volume was a microscopic 53,500 contracts. It was virtually the same story for the silver price, including the price bump at the London silver fix, and the price was never allowed to stray too far above the $20 spot price mark. Silver traded in a two bit price range for all of Friday. Silver closed yesterday at $19.83 spot, down 15.5 cents from Thursday. Net volume was an even more microscopic 16,500 contracts. Platinum was slightly more interesting, rallying in fits and starts until shortly after 9 a.m. in London. A willing seller showed up at that point and took the price below its Thursday close in New York. But once the noon silver fix was in, another rally began that got capped as soon as the Comex began trading. Then down went the price once again, with a final kick in the pants just before the 5:15 p.m. electronic close. Palladium traded flat until 2 p.m. Hong Kong time, and then rallied a bit into the noon silver fix, before blasting skyward. But a seller of last resort put in an appearance 10 minutes before the Comex open, and the price was firmly back under control an hour before the Zurich close. From there it traded sideways for the rest of the Friday session. The dollar closed on Thursday a hair above the 81.00 mark, with the top [81.08] coming shortly after 11:30 a.m. Hong Kong time. From there, it was a long gentle slide into the end of the trading day in New York. The index closed on its absolute low of that day, which was 80.70, down 31 basis points from the prior day. The gold stocks gapped up a hair at the open, hitting their high of the day less than 10 minutes later, and it was all down hill until 2 p.m. EST. From there the HUI traded more or less sideways before closing virtually on its low of the day, down 0.94%. Despite the fact that the silver price finished in the red, the equities actually eked out a small gain, as Nick Laird's Intraday Silver Sentiment Index closed up a smallish 0.18%. The CME's Daily Delivery Report showed that 26 gold and zero silver contracts were posted for delivery within the Comex-approved depositories on Tuesday. The only short/issuer was Jefferies, and the biggest long/stopper was JPMorgan Chase with 14 contract for its in-house [proprietary] trading desk. The link to yesterday's Issuers and Stoppers Report is here. There with withdrawals from both GLD and SLV yesterday. In GLD, an authorized participant withdrew 144,723 troy ounces, and in SLV it was 1,444,584 troy ounces. The U.S. Mint did not have a sales report on Friday. The in/out activity in gold on Thursday over at the Comex-approved depository is hardly worth writing about, as only 64 troy ounces were reported received, and 98 ounces shipped out. But there was big activity in silver, as 2,554,353 troy ounces were received, and 18,335 troy ounces shipped out. The big receipt was 1.954 million ounces at HSBC USA. The link to that action is here. Yesterday's Commitment of Traders Report showed improvements in both gold and silver far bigger than I was expecting. Ted Butler said it probably included some catch-up numbers from the prior reporting week as well. And whether that omission was deliberate or accidental is hard to say, but whether or it was or not, the report was impressive. In silver, the Commercial net short position declined by a chunky 20.7 million troy ounces. It's now down to 17,464 contracts, or 87.3 million ounces. That's not the lowest number we've seen, but it's within spitting distance of it. Of course the brain dead technical funds and small traders did their Pavlovian thingy; pitching longs and/or going short in a big way. JPMorgan Chase et al happily stood by and bought all the longs they were selling, and took the long side of all the short positions that were put on. Ted says that JPMorgan Chase's short position in silver is back down to the 12,000 contract mark once again, and that represents 64% of the entire Commercial net short position in silver. JPMorgan's short-side corner in the silver market is about 11% of the entire Comex futures market on a net basis. In gold, the Commercial net short position declined by 1.43 million ounces, and is now down to 5.15 million ounces. Once again JPMorgan et al feasted on the long positions being sold by the technical funds and small traders, and also took the long side of every short position these same traders were putting on. It's the same old routine. Ted figures that JPMorgan's long-side corner in gold now sits at 7.5 million ounces. That being the case, the other commercial traders [other than the collusive raptors] must be net short the gold market to the tune of 12.65 million ounces to make the Commercial net short position work out to the number shown in this week's COT Report. The numbers for copper are even more mind-boggling, and JPMorgan is the big long there as well. You couldn't make this stuff up. Of course, since the Tuesday cut-off, there's been another big decline in the prices of both gold and silver, especially the hammering they took on Wednesday, the day after the cut-off. And not to be forgotten are the carefully placed new low ticks in both metals that was engineered at the London p.m. gold fix on Thursday. Both these events are clearly visible on the Kitco charts at the top of this column, so take another look at them. If we survive Monday and Tuesday without any major price rally, then next Friday's COT Report should show even more improvement in the Commercial net short position in both metals and, of course, in conjunction with new shorting/long selling by the technical funds and small traders. Since we are down to the final days of the roll-over out of the December delivery month in silver and gold, I'm not expecting much to happen to the upside as far as prices are concerned. But as I've said many times in the past, one should always be on the look out for "in your ear" regardless. Despite my best editing efforts, I have too many stories today that I didn't have the heart to delete, so I'll wimp out and let you do it for me. A lot of them are centered around the New Great Game. ¤ Critical ReadsA Trading Tactic Is Foiled, and Banks Cry FoulWhat country are you in? Where is your business located? In what country did your trade take place? Those were once questions whose answers were so obvious that no one asked them. Now they are questions that can drive financial regulators and tax collectors to distraction. Lawyers can get rich proving that under one definition or another, the person, company or transaction was somewhere with more convenient rules. Earlier this year, we learned about Apple’s disappearing subsidiary, an extremely profitable one that had no employees and — for tax purposes — was located nowhere. Under United States tax law, it was based in Ireland. Under Irish law, it was based in the United States. So it paid taxes to no one. Presumably, if Congress ever overhauls the tax code, that will be dealt with. Now we learn of the vanishing swaps market. This very interesting 2-page essay showed up on The New York Times website on Thursday. I would have posted it in yesterday's column, but U.A.E. reader Laurent-Patrick Gally sent it to me long after I'd filed yesterday's missive...so here it is now. And it's not only very interesting, it's worth reading as well. Doug Noland: Plosser's Limited Fed...A Statesman Takes a Stand The stock market melt up continues. Meanwhile, intrigue only grows at the Fed. Dr. Paul Craig Roberts: The Kennedy Assassination 50 Years LaterNovember 22, 2013, is the 50th anniversary of the assassination of President John F. Kennedy. The true story of JFK’s murder has never been officially admitted, although the conclusion that JFK was murdered by a plot involving the Secret Service, the CIA, and the Joint Chiefs of Staff has been well established by years of research, such as that provided by James W. Douglass in his book, JFK And The Unspeakable, published by Simon & Schuster in 2008. Ignore Douglass’ interest in the Trappist monk Thomas Merton and Merton’s prediction and focus on the heavily documented research that Douglass provides. Or just turn to the contemporary films, taken by tourists watching JFK’s motorcade that are available on YouTube, which show clearly the Secret Service pulled from President Kennedy’s limo just prior to his assassination, and the Zapruder film that shows the killing shot to have come from President Kennedy’s right front, blowing off the back of his head, not from the rear as postulated in the Warren Commission Report, which would have pushed his head forward, not rearward. I am not going to write about the assassination to the extent that the massive information permits. Those who want to know already know. Those who cannot face the music will never be able to confront the facts regardless of what I or anyone else writes or reveals. The public b.s. around the Kennedy assassination is still with us...just like the b.s. around the events of 9/11. As Paul so correctly says in the last paragraph above..."Those who want to know already know. Those who cannot face the music will never be able to confront the facts regardless of what I or anyone else writes or reveals." Amen to that! This falls into the absolute must read category...and I thank Brad Robertson for sending it our way. Mario Draghi: ECB needs "safety margin" against deflationThe European Central Bank has fought back against harsh German criticism, insisting that it had to cut rates to near zero to head off deflation risks and stabilize debt burdens in the crisis states. Mr Draghi told an audience in Berlin that the bank acted to secure a “safety margin against deflationary risks”, acknowledging that last week’s rate cut to 0.25pc had set off a political storm and raised fears over an erosion of savings. Both German members of the ECB’s council opposed the cut. The German media has described it as a Latin coup to seize control of the ECB’s policy machinery. Hans Werner Sinn, head of Munich's IFO institute, accused Mr Draghi of misusing the ECB to bail out Italian debtors. This Ambrose Evans-Pritchard offering was posted on the telegraph.co.uk Internet site very early yesterday evening GMT...and it's the first offering of the day from Roy Stephens. Apple repealed: German politicians to use encrypted phones to block NSA spyingMembers of the German government will use encrypted phones as part of ‘urgent’ guidelines to protect against NSA snooping. The encryption software is not compatible with Apple, so Germany will phase out the use of iPhones at government level. Germany’s two main political parties - the Christian Democratic Union and the Social Democratic Party – have agreed on new guidelines to ensure ministers are protected from having their communications intercepted by spy agencies. As part of the new regulations, politicians and high-ranking officials will be required to make calls on encrypted phones. A small step against the American Empire is better than no step at all. This Russia Today story showed up on their website yesterday morning Moscow time...and it's the second offering in a row from Roy Stephens. World from Berlin: Ukraine's Complaints Are 'Insolent' German newspapers have reacted harshly to Ukraine's decision to call off plans to sign a trade deal with the European Union. Critics argue that the pull away from Europe is another sign of corruption in the Ukrainian regime, and of Russian President Vladimir Putin's strategy of using threats to maintain power over former members of the Soviet Union. The announcement came in the wake of the Ukrainian parliament's rejection of several bills that would have allowed the country's imprisoned former prime minister, Yulia Tymoshenko -- whose jail sentence is widely seen as politically motivated -- to leave the country for medical treatment. The trade deal had been contingent on Tymoshenko's release. The headline originally read "German press: Ukraine influenced by Russian pressure and corruption". I have five stories in a row on this subject, as it's a really big deal. This, along with the other four are must reads for all serious students of the New Great Game. This one was posted on the German website spiegel.de yesterday...and this makes three in a row from Roy Stephens. E.U. and U.S. warn Ukraine it risks going bustBrussels and Washington have told Kiev it is unlikely to get International Monetary Fund (IMF) aid after it binned plans to sign an EU treaty. EU foreign relations chief Catherine Ashton said in a statement on Thursday (21 November) the EU pact was a chance for Ukraine to show it "is serious about its modernisation pledge and becoming a predictable and reliable interlocutor for international markets." She added: "It would have … given momentum to negotiations on a new standby arrangement with the IMF." Ah, yes...if it were only that simple. But, as you already know dear reader, it ain't! This article was posted on the euobserver.com Internet site yesterday morning Europe time...and it's yet another contribution from Roy Stephens. Putin: E.U. blackmailing Ukraine over halt in trade dealRussian President Vladimir Putin has accused the E.U. of "blackmailing" and “ | |

| Posted: 23 Nov 2013 05:20 AM PST 1. Andrew Maguire: "Gold War Heats Up As Shocking Events Taking Place". 2. Michael Pento: "Money Supply Skyrocketing as China Abandons U.S. Dollar". 3. Egon von Greyerz: "Man Who Predicted No Tapering Now Says 50% Increase in Q.E.". | |

| Gold Option Wagers on Surge to $3,000 Was Most-Active on Wednesday Posted: 23 Nov 2013 05:20 AM PST Wagers betting that gold prices will rally 141 percent in about two years were the most-traded option in New York bullion on Wednesday. Call options giving owners the right to buy gold at $3,000 an ounce by December 2015 traded 7,250 contracts yesterday on the Comex in New York, more than double the amount of the next most-active option, data compiled by Bloomberg show. Futures for December delivery slumped 1.1 percent to $1,243.60 on the Comex in New York today. Prices reached a record $1,923.60 in September 2011. “This looks like a trade with a bank on one side and a very bullish investor buying a lottery ticket on the other,” James Cordier, founder of Optionsellers.com in Tampa, Florida, said in a telephone interview. “It’s a big bet.” This Bloomberg article was posted on their website Thursday afternoon MST...and it's another story from Laurent-Patrick Gally that arrive long after I'd filed Friday's column. | |

| Gold Analysts Most Bearish Since June on Fed Taper Posted: 23 Nov 2013 05:20 AM PST Gold analysts are the most bearish since June as the Federal Reserve signaled it may ease stimulus “in coming months” as the economy expands, cooling demand for an investment haven. Nineteen analysts surveyed by Bloomberg News expect prices to drop next week, nine are bullish and three neutral, the largest proportion of bears since June 21. Gold fell to a four-month low and the dollar strengthened after Fed minutes released Nov. 20 showed U.S. policy makers expected enough improvement in labor markets to warrant slower debt purchases. “For safe-haven assets, there’s no point because the economy is recovering,” said Andrey Kryuchenkov, a commodity strategist in London at VTB Capital, a unit of Russia’s second-largest lender. “The dollar should remain strong, and that’s what should cap any upside in gold anyway. Consumer demand is slowing down. It will recover, but not at the moment.” This "bah humbug" piece is another Bloomberg commentary. This one was posted on their Internet site just before midnight on Thursday Denver time. I thank reader Ken Hurt for digging it up for us. | |

| Germany cuts gold holdings for second time in 5 months Posted: 23 Nov 2013 05:20 AM PST Germany, the world's second-biggest holder of gold reserves, cut its bullion holdings in October for the second time in five months, data from the International Monetary Fund showed on Friday. The Bundesbank said it had sold 3.421 tonnes of gold for coin minting. It now holds 3,387.247 tonnes of gold, according to the IMF website. Gold holdings by central banks are keenly watched since the group became net buyers in 2010 after two decades as net sellers. The 2008 global economic crisis triggered a wave of official-sector interest in gold. Germany sells 0.10 percent of its gold holdings to make gold coins...and that's the headline. The gold bashing from the main stream media is reaching a crescendo. This Reuters article, filed from Singapore, was posted on the mineweb.com Internet site yesterday...and is another contribution from Ulrike Marx. | |

| China to start gold swaps trading on Nov. 25 Posted: 23 Nov 2013 05:20 AM PST China, set to overtake India this year as the world's top gold consumer, will start gold swaps trading on the interbank market next week, giving more hedging tools for banks dealing in bullion. The Shanghai-based China Foreign Exchange Trade System will start gold swaps trading on November 25th, with the Shanghai Gold Exchange responsible for related settlement and delivery, the National Interbank Funding Center said in a statement on Friday. The start of gold swaps trading comes as China is taking steps to open up its gold market and increase financial investments. This short Reuters story, filed from Shanghai, was posted on their website yesterday...and is definitely worth reading. I thank Ulrike Marx for her final offering in today's column. | |

| CME Group Lowers Gold, Silver, Copper Margins Posted: 23 Nov 2013 05:20 AM PST The new margins, announced late Thursday, will go into effect after the close of business on Friday, CME Group said. The changes were the result of “the normal review of market volatility to ensure adequate collateral coverage,” according to the notice. Margins act as collateral and are a sum of money traders must put up to back futures trades. The notice also includes changes in margins for a number of other markets besides metals, including ethanol, crude oil, gasoline, coal, natural gas and currency futures. This short new item was posted on the kitco.com Internet site yesterday...and it's courtesy of West Virginia reader Elliot Simon. Ted Butler says it doesn't mean anything in the grand scheme of things. | |

| GoldCore's O'Byrne notes continuing signs of gold market manipulation Posted: 23 Nov 2013 05:20 AM PST Mark O'Byrne's daily market commentary at GoldCore yesterday noted that "the peculiar trading action" in gold "suggests that certain banks may be manipulating the gold price in the same way that they rigged LIBOR and are alleged to have rigged foreign exchange markets." | |

| Alasdair Macleod: Paper sellers still in charge of gold market Posted: 23 Nov 2013 05:20 AM PST This week has been very uncomfortable for long-term gold investors. Trading in derivative markets has become thin, as evidenced by sustained intraday periods of little price movement, with a tendency to drift lower. This relative calm was shattered on Thursday ahead of the release of the Fed's FOMC minutes when a sale of only 1500 futures contracts (4.67 tonnes) was sufficient to eliminate all bids in the market. The subsequent fall drove the gold price below the October lows. There are many similarities between today's market sentiment and that of September 1999, when the gold price jumped 27% in just two weeks. The bullion banks were bearish with gold at $255. The consensus then was that it was going to go lower perhaps to $220, stock markets were hitting new highs with the dot-com boom, and price inflation was not a problem. The bear squeeze in September 1999 would have been more dramatic had the Bank of England and the Fed not used their still considerable bullion stocks to intervene and rescue the bullion banks from their short positions. If a similar bear squeeze develops today, it is unlikely the Western central banks will have enough gold available to control the market. This commentary by Alasdair was posted on the goldmoney.com Internet site yesterday...and is definitely worth reading. It's another article I found hiding in a GATA release yesterday. | |

| Gold traders plan benchmark code of conduct Posted: 23 Nov 2013 05:20 AM PST The group of banks and traders that runs the London gold market is planning to tighten procedures to protect against manipulation in the wake of the Libor scandal. The London Bullion Market Association, whose members include Barclays, Goldman Sachs, and JPMorgan Chase, has hired lawyers to review whether the benchmarks it publishes conform to principles set out by the International Organisation of Securities Commissions. The banks and traders discussed the results of the review at a meeting this week and are working on a code of conduct for banks contributing to the benchmarks, according to three people familiar with the discussions. They are also working on plans to keep more detailed historical records of trading in the market. One doesn't know whether to laugh or cry, dear reader. You wonder how they can even say this stuff with a straight face. This Financial Times of London story was posted on their website yesterday...and posted in the clear in this GATA release. | |

| Alasdair Macleod: Sprott's right, WGC is wrong on gold demand data Posted: 23 Nov 2013 05:20 AM PST The economist Alasdair Macleod, GoldMoney's research director, today analyzes the controversy over the World Gold Council's gold demand estimates and sides with Sprott Asset Management CEO Eric Sprott, concluding that the gold council vastly underestimates gold being imported into China. Macleod calculates that imports by China and Hong Kong "exceed all other mine supply by at least 580 tonnes on an annualized basis." Macleod concludes: "Without significant leasing by Western central banks, total Asian demand could not be satisfied at current prices, because there is no evidence of material selling by existing holders of above-ground stocks, with the exception of exchange-traded fund liquidation, which is minor compared with the amounts involved." The link to this commentary Alasdair is embedded in a GATA release from yesterday...and is worth the read as well. | |

| Posted: 23 Nov 2013 05:20 AM PST The last twenty years have seen an acceleration of real wealth transfer from the west to the east. Nowhere is that more evident than the change in gold stock piles since 1993 with Russia and China gorging and Holland, Belgium, and most notably Switzerland selling it all. That's all there is to this tiny commentary posted over at the Zero Hedge website yesterday. However, the embedded chart is worth the trip...and I thank Phil Barlett for sending it our way. | |

| Jim Sinclair: My mission on our behalf Posted: 23 Nov 2013 05:20 AM PST Gold advocate and mining entrepreneur Jim Sinclair writes from Singapore about his efforts to have physical gold exchanges replace the paper futures markets in which manipulation is suppressing prices. Sinclair writes: "There has been a clarion call from the long-suffering holders of gold shares and investment gold for the chief executive officers of gold companies to identify and take definitive action to end the slavery of the gold price to the mechanism of manipulation, the paper gold market. The advent of global platforms for and the true revelation to the gold public of the real gold price, the physical cash price on a 24-hour basis, is the answer." Just this morning GATA's secretary/treasurer Chris Powell wrote to the CEO of a major gold mining company to request an audience at which GATA might make a presentation about these issues. Sinclair's commentary today emphasizes the necessity of mobilizing the gold mining industry, which for the most part is clueless about both the monetary nature of its product and the suppression of its product's price. This must read commentary, with an introduction by Chris Powell, was posted on the gata.org Internet site yesterday. | |

| Gold Investors Weekly Review – November 22nd Posted: 23 Nov 2013 04:02 AM PST In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. The price of the yellow metal went lower after two consecutive weeks of gains. Gold closed the week at $1,244.33 which is $45.87 per ounce lower (3.56%). The NYSE Arca Gold Miners Index fell 7.83% on the week. This was the gold investors review of past week. Gold Market StrengthsDemand for gold bars, coins and jewelry hit a record during the third quarter, according to the World Gold Council. The strong demand comes from both China and India, accounting for about 60% of total demand. Central bank gold demand also continues to move higher. Russia now holds the second-largest reserves in the world, with over 400 million ounces. Finally, we are now entering a time of seasonal strength for consumer gold purchases due to the Christmas holidays (US and Europe), the Lunar New Year (Asia), and Valentine's Day (US). Although somewhat delayed, billionaire hedge fund manager John Paulson maintained his gold holdings unchanged in the third quarter of 2013, according to his filling on November 14. This parallels what we have seen from other major gold funds in third-quarter filings, reflecting the fact that redemptions were very subdued, as across-the-board selling of top holdings did not repeat the mass liquidations seen in the second quarter. In addition, George Soros' third-quarter filings revealed that he has moved back into gold stocks and has been decidedly bearish of the broader equity market recently. Gold Market WeaknessesCiti Research, in its annual commodities forecast for 2014, suggests that we will have strong physical buying (much from Asia) over the next year, limiting the downside for gold prices. However, the western buyers who are getting out of the market will likely continue to do so. Citi Research specifically pointed to two reasons why these buyers are getting out of the gold market, resulting in funds moving out of gold and into other asset classes:

Organized price manipulators are still trying to panic investors into selling off their gold holdings, after the market potentially recorded the biggest part of its correction. On November 20 the COMEX had to suspend trading of December gold futures for about 20 seconds after the contract's price fell about $11 within a minute. This happened before normal trading hours in the U.S. As often as this has occurred in recent weeks, it's amazing that regulators ignore these multibillion-dollar speculative trades. Shareholders' wealth in some of these publicly-listed firms could be quickly wiped out should the gold price rise. Gold Market OpportunitiesTD Securities, in its Precious Metals Outlook from November 19, outlined some positive data points summarizing third-quarter results. Earnings were generally better than expected despite the gold price posting its lowest average quarterly price since the third quarter of 2010. TD noted that 21 out of 27 producers that it covers met or exceeded consensus earnings per share estimates. Cash costs are declining faster than expected and all-in sustaining cost is declining. Finally, production growth is picking up, and on a 12-month rolling basis it is up 3 percent among the large cap producers. Duan Shihua, a partner at Shanghai Leading Investment Management, says that gold demand will remain strong in China. There are very few places to put money in China. With the share market down and the government nudging people away from real estate, gold should remain a favored investment choice. Gold consumption should surge by 29 percent to a record 1,000 metric tonnes in 2013, based on estimates provided by 13 analysts. The ratio between the NYSE Arca Gold Bugs Index and the gold price dropped last month to its lowest level since January 2001, when the first of 12 straight annual gains for the precious metal was beginning. The November 20 ratio reading was 3.2 percent above the low. Gold Market ThreatsGoldman Sachs again reissued its negative forecast on gold, predicting at least 15 percent in losses next year for the precious metal, as well as iron ore, soybeans and copper. This gloomy report suggests a drop in the gold price to $1,050 for 2014. Goldman believes that commodities will face increased downside risks even as economic growth in the U.S. accelerates. The largest U.S.-based gold ETF holdings dropped to 863.01 metric tonnes, the lowest since February 2009. Selling from the ETF has been a major headwind this year as the Federal Reserve indicated it was considering an exit strategy from its accommodative policies. According to a Bloomberg survey, Fed policy makers will likely slow the pace of monthly asset purchases to $70 billion from $85 billion at the March meeting.

| |

| Gold And Silver Price – Charts Tell The Story. Decline Not Over. Posted: 23 Nov 2013 03:33 AM PST However important underlying fundamentals are, in terms of supply v demand, they have been and continue to be of little to no use in determining when reality will reenter the market. When that happens, price will adjust and reflect the true picture of gold and silver's record [demand] accumulation. All that matters for now is the political situation involving the moneychangers and their puppet government regimes giving them cover during the end game of their world-wide theft. Just last Thursday, we saw once again another "smash-down" in gold futures. At one of the best possible times to assure liquidity and excellent execution, 1,500 contracts were sold around 5:30 a.m., CST. Who needs to worry about getting good fills when the only objective is to intentionally move the market lower? In the past few months, we have acknowledged leaning to any price turn taking a year, or more, rather than sooner, and market activity continues to bear that out. No matter what the latest "news" development is for PMs that paints a rosy picture, those in the fundamentalist camp are looking through rose-colored glasses to expect change in the near future. The charts continue to tell a more accurate story that belie all known| fundamentals, and the charts shown here depict a market in decline with no apparent end in sight. The month is not yet over, and anything can happen before the 30th. A monthly chart is presented to show how the last three months have had overlapping bars. This means there is a greater battle between buyers and sellers at a level where sellers should be in total control. Contrast the last three bars with the two preceding, and the other two rally bars show less overlap, indicating greater EUM, [Ease of Upward Movement]. The ranges of the two rally bars are also larger than the last three decline bars which supports the conclusions made. It takes more time and greater effort to turn a monthly trend than a weekly or a daily one. While there is no evidence of a turn in trend, the fact that price is hugging the upper down channel line is more positive. In a down market, one would expect to see price hugging the lower channel line. The weekly shows a slightly different picture with price nearer the lower channel line. We can infer price is closer to a potential support area, and volume increased in the process. The significance of the increase in volume is addressed on the daily chart, and again on the silver weekly/daily charts.

The daily is a more complicated read, yet revealing about that 1,500 contract sale, seen on the third bar from the end with a sharp volume increase. One would expect a big "win" for the bears, with all that unopposed selling, yet the location of the close, mid-range the bar, tells us buyers were equally present, keeping price from closing lower. It is the nest two trading days that make the read more complicated. Thursday, 2nd bar from the end, only went marginally lower than Wednesday's low and closed higher than the opening. Volume was much higher than average, of late, so buyers were again present, keeping price from extending lower. Friday's activity is the coin toss. After two days of showing some presence, buyers could not take advantage and rally price higher. At the same time, sellers could not take advantage of the trend momentum and press price lower. This makes Friday an inside day, and the range was small. From small ranges, a form of market balance, we can expect imbalance to follow. Note the small bar, 4th from the end. It led to a wide-range imbalance sell-off, next day The advantage of reading developing market activity, as we are doing, is you do not have to know in advance in which direction price will move. Instead, we assess the situation and prepare accordingly, following the market is it moves directionally. This analysis is all about the paper futures market, and there is no reason to be on the long side. As to the physical, continued buying is always recommended, especially at these low levels. The reason for buying is to own and hold the physical in opposition to the central banker's worthless fiat issue, as the most effective means of preservation/protection of one's capital. Monthly silver is holding better than gold by virtue of the last three bars contained in the range of the 4th bar. Gold's 4th bar has already been exceeded, downside. The message is one of effort v result. The 4th bar shows EUM, and the next three down bars are labored, by comparison. Price is staying closer to the upper channel line, [resistance], and not reacting away from it. Plus, all the activity is occurring at an Axis line, a line that acts as support in one area, then becomes resistance, or vice versa, as here. The trend has not ended, but it is showing potential for change as much for continuation. Volume is the market's energy indicator. The greater the volume, especially at an area of support, [and resistance, as well], the greater one needs to pay attention. It is "smart money" that creates volume and moves markets. It is the public that responds, almost always at the wrong time, [selling lows, buying highs]. If smart money wants to move a market lower, it sells, [creating greater volume] at higher price levels, in anticipation of buying in at lower levels. Look at the high volume low in June. Weak hands were selling, sell stops being triggered, while smart money was on the other side, buying. Then note the high volume at the swing high at the end of August, the reverse effect. Will the same hold true for this past week? We do not know. Volume was not as great, but we do not need to know, in advance. If a swing low develops, there will be evidence of one on the lower time frames that may afford a low-risk entry. That, in turn, depends on ones' trading style. The point is to see how it is the market that provides the most reliable information. The daily chart appears as the weakest in position of the three time frames. It is closer to a potential turnaround, or ready to head for new lows. The increase in volume on Wednesday, and slightly higher on Thursday tell of a potential story as the daily gold chart. It is always best to let the market show its hand, and then follow. Examples of that were given on the weekly chart with the June low and August high. These signs work on all time frames. Buyers, or Stackers, should continue unabated. Those looking to trade paper futures have no reason to buy. We have not been advocates of the short side, just because we do not like the company and refuse to be a party to their efforts. | |

| Randgold Not Cutting Exploration Posted: 23 Nov 2013 02:09 AM PST Randgold (GOLD) is a gold mining company operating in Africa. The company is managing assets in some high-risk jurisdictions but has been able to reap the rewards associated with these risks to build a business that has remained profitable even in times of declining gold prices. Randgold reported on a very successful third quarter emphasizing operational excellence which manifested itself in very attractive financial results. In this article we will summarize Randgold's third quarter accomplishments and take a look at the financial position of the company. Operations The Loulo Gounkoto complex made an extraordinary contribution increasing gold production significantly due to an increase in grades and recovery improvements. The Morila mine is winding down but still producing some gold from mineralized waste. Tongon saw a significant increase in throughput and most importantly, improvements in utilisation of grid power where for the first time the feasibility target was reached. Recoveries | |

| Tracking Physical Silver Prices Posted: 23 Nov 2013 01:00 AM PST Charleston Voice | |

| Gold Long-Term: Nowhere To Go But Down Posted: 23 Nov 2013 12:56 AM PST In my article relating to QE, I enumerated that at least $10 trillion were injected into respective economies through central bank actions in the US, England, Europe and Japan. If you are a gold bull and did the same math, you may be thinking $2000/ounce. Yet, I strongly argued in that article that prospects of hyper-inflation are little to none. The reason being that this money injection process is a highly-engineered operation, with multi central bank collusion, and with the money injected destined to return where it came from: Central Bank oblivion. As such, it is my belief that precious metals in general, and gold in particular, have nowhere to go but down. In this article I will try to expand on that point by looking into more aspects of gold pricing and not only QE related. My arguments here relate to gold even though I believe the logic | |

| SD Weekly Metals & Markets: Is a Re-Test of the June Lows Dead Ahead? Posted: 22 Nov 2013 10:56 PM PST

On this week’s show, we’ll cover: - Gold & silver smashed on Fed minutes TAPER MOPE Wednesday – same old story – Caution for next week as metals close near the week’s lows- is a retest of the June lows dead ahead? – China’s policy shift on currency reserves; most miss angle about Chinese growth [...] The post SD Weekly Metals & Markets: Is a Re-Test of the June Lows Dead Ahead? appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now | |

| Yanis Varoufakis: The Emerald Isle Remains in Chains Posted: 22 Nov 2013 09:04 PM PST By Yanis Varoufakis, a professor of economics at the University of Athens. Cross posted from his blog A conversation with Phil Pilkington on Europe's disgraceful triumphalism regarding Ireland's 'exit' from its 'bailout.' Contrary to conventional wisdom, Ireland was never bailed out and, moreover, it is nowhere near escaping the debt prison to which it was confined by its, supposed, 'bailout'. After the burst of the property market bubble, following the post-2008 credit crunch, Europe's Central Bank demanded that the government shift the losses of five Irish banks, worth €60 billion, onto the shoulders of the taxpayers. Of citizens that had neither a legal nor a moral duty to burden this load. Why? So as to shield the fragile German banking system from the repercussions of taking large losses. The Irish took their wrath out on their government and elected another one which, nonetheless, saw as its priority the full implementation of the savage austerity program that came attached to the huge loans that the government accepted in order to repay the banks' losses. The result was a catastrophic downward spiral for Ireland's social economy and its people. But now the newspapers and the electronic media are full of the 'good news' that this 'fiscal consolidation' program has 'succeeded'. That Ireland has returned to the markets. That we have the first, tangible proof that the bailout worked. That Ireland is about to regain its sovereignty and the Irish can, once more, look at the Germans, the French, the Dutch proudly in the eye, restored to the land of the free and the creditworthy. Alas, a far as I can see, all that has happened is that, after five years of a continuous comedy of errors, Europe's leadership has now decided to declare victory, with Ireland as Exhibit A that the combination of bailout loans and severe austerity work. And if this required being economical with the truth, so be it. For those who do not wish to be economical with the truth, let's look at some numbers:

How can anyone claim that this economy constitutes a 'success story' and a cause to celebrate the end of the debt-deflationary spiral? Two are the arguments on which EU triumphalism is built. First, Ireland's spectacular export performance (annual exports exceeding the nation's GDP!) and, secondly, the collapse of its 10 year government bond yields to levels that make it possible for Dublin's return to the money markets, rather than a return to the ESM for more bailout loans. Let's unpick these two great success stories, beginning with exports. Ireland is the largest, floating tax haven on the planet. Companies like Google and Apple famously launder their revenues via Dublin in a manner that reduces massively their tax payments while bolstering to ridiculously fictitious levels Ireland's GDP. Anyone who disputes this must offer an alternative explanation of the fact that each of Ireland's Google employees produces €4.8 million of revenues annually! All this means that the wonderful export statistics translate neither in corporate taxes nor in a significant number of jobs from the which the government can claim income and indirect taxes so as to service its debts. Turning to the government bond yields, an interesting question arises: Why are they so low when the data above reveals that Ireland, in view of the sluggish domestic economy, remains perfectly incapable of refinancing its gargantuan public debt? Why are bond dealers no longer dumping Irish government bonds (like they were doing in 2011 and until June of 2012)? The answer is simple: Because they gathered that the ECB and Berlin will never let Dublin default given Europe's desperate need to proclaim Ireland as 'proof' that their policies are working. Bond dealers, put simply, trust that the ECB, via Mr Draghi's OMT or otherwise, will find ways of allowing Dublin to redeem its bonds even if the Irish people and their government remain firmly lodged in debt prison. With these thoughts in mind, I turned to Phil Pilgington for his views on the matter. Have I missed something crucial here? Here is his answer to me question: "Phil, what is your reaction to 'news' that Ireland has exited successfully from its troika program?" Phil Pilkington's perspective: Ah, Ireland's return to the land of the markets… Let's divide your question into two parts: economics and politics: ECONOMICS First of all, 10 year government bond yields. They were around 5% in Ireland until early 2010 in the lead up to the 2010 bailout. They then spiked around the beginning of 2011 due to the bailout and the uncertainty surrounding that action. But they quickly came down as investors realised that the country wasn't going to go bust due to its access to said bailout funds. By 2012 the interest rates were close to 6%. And with the announcement of the OMT in that year they crawled down to under 4% in the beginning of 2013. What does this mean? My reading of it is this: Investors are convinced that (i) the Troika/ECB would back the country so long as they adhered to the rules and (ii) Ireland would indeed adhere to those rules. If we assume that these two hypotheses are true, which they probably are, then investors are looking at a 4% yield for almost no risk in an environment where yield is completely dead. Let me stress: this has NOTHING to do with recovery in Ireland, as the government is falsely proclaiming. Quite the opposite, in fact. The recent growth figures, for what they are, are totally skewed by foreign profits being washed through the country. I show this clearly here: In summary: The claim of a successful Irish Program is complete rubbish. The Irish government has gotten its interest rate down through a mix of Troika/ECB backing and confidence in the government's ability to follow the rules, but all the underlying economic problems are still there and will not go away. The Irish debt-to-GDP will continue to rise in the foreseeable future. Will the inevitable rising stock of debt prove problematic politically in the EU? No one can predict the political repercussions at the moment the Irish and German electorates realise the truth of the matter. Now, onto the politics… POLITICS The problem here has become ever more clear to me as time moves forward. But in order to understand it I think you need to understand the Irish political style. Since the 1980s Ireland has tried basically to run its economic policy by appealing to the rest of the world. That is, by "sucking up". Whatever everyone else is saying, Ireland will do with gusto. Mix this with a little bit of clever behind-the-scenes diplomacy and you have Irish economic policy. After the crisis, the new government basically followed the formula that (supposedly) worked so well in the 1990s and 2000s. So, when the IMF/Troika/ECB said gGet your bond yields down through compliance…" the Irish government did exactly that. There is a widespread belief in Ireland that this will automatically lead to economic growth. This belief is, of course, entirely irrational, but that matters little. The politicians have convinced themselves that, as long as they achieve this target, all else will be well. This is the typical delusion of politicians who are given an arbitrary target of some form. So, what will happen in Irish politics now that this target has been reached and nothing changes? That is an interesting question and difficult to answer, but I shall have a go. I think that leftwing parties like Sinn Fein and former right-wing parties like Fianna Fáil, who have re-branded themselves as center-left, are going to gain massively. I think that people will come to ask questions now that the government's target, which has been pursued ruthlessly for nearly five years, has been reached. They will ask: Why has it made no difference to the real economy? They are bound to become agitated. As a result they will switch parties and throw those in government out. What will happen then? I have no idea. But the seeds have been sown. So, it seems that Phil's view from Dublin is not that different to mine. The Emerald Isle remains in the same prison of the original debt-deflationary cycle. And what seems to be a bright light shining through the cell's cracks is just the neon light of Europe's propaganda. | |

| Posted: 22 Nov 2013 08:48 PM PST | |

| Silver eagle sales hit new record as silver price loses 4% in a week Posted: 22 Nov 2013 07:52 PM PST It’s not only the Chinese aunties buying gold who are racking up retail sales of precious metals this year. Sales of silver eagle coins by the US Mint this year are already at a record high. Numismatic News reports that by mid-November total purchases had reached 40,175,000. That’s more than in the whole of 2011 when 39,868,500 were sold. Record sales The journal comments: ‘Silver eagle demand is now snapping up four times the number of coins that were sold by the mint in 2007, before the economic crisis upended the financial world. Sales in 2007 were 9,887,000 pieces, which was still below the 1987 production record of 11,442,335 pieces.’ Silver eagle sales doubled in 2008 to 19,583,500 as the financial crisis hit. In 2009 the US Mint sold 28,766,500 coins. How well have the buyers done? Well from a bottom of $8.40 in October 2008 investors won big time up until prices almost passed the 1980 peak of $50 in April 2011. It’s been downhill for two-and-a-half years since then. The question then is whether silver will now bounce back. ArabianMoney has been expecting this now for two years. That is always the problem with market timing: you can be wrong for sometime before you are right. So long as you don’t need the money and can stick it out then things will come right, assuming silver is still basically in an uptrend. No other basic commodity sells for less than half it did 33 years ago. You might imagine that makes silver a slam-dunk buy. Longer term that might well be right. But we all have to live in the short term. Last week silver prices fell four per cent and that puts them on a downtrend. What could happen to break this fall? It is the same story for gold, silver’s less volatile older sister. The assumption now is that QE will carry on to infinity and that stock markets will continue to merrily ride upwards, bond markets will be stable and precious metals decline. What is this consensus proves to be wrong? Everybody was enjoying the party in 2007-8 until it went horribly wrong. That party was also organized by the Fed who everybody assumed would be able to keep it going. Insurance policy Silver and gold investors are taking out an insurance policy against a known risk that is guaranteed to reoccur at an unspecified future date. That’s why people continue to buy silver eagles when the price of silver is falling. They are buying their insurance policy at a discount with the disaster coming closer. The truth is that the Fed will not be able to stop printing money or by the time it does there will be so much money in the system that any economic recovery will be accompanied by horrendous inflation. The weak holders of precious metals exiting now for the final stages of a stock market bubble are going to be horribly burnt. That’s for certain, we just can’t say exactly when. | |

| Why gold and silver are having a tough time Posted: 22 Nov 2013 04:00 PM PST Clif Droke | |

| Physical Silver and Personal Empowerment Posted: 22 Nov 2013 03:30 PM PST Andy speaks to Chris Duane of Silver Bullet Silver Shield on his weekly podcast to discuss the economy, federal debt, excessive money printing, interest rates, precious metals, Bitcoin, Dow and Obamacare. To listen to the interview, please click below: Physical Silver and Personal Empowerment Similar Posts: | |

| THE ONCE IN A LIFETIME GOLD TRADE Posted: 22 Nov 2013 02:45 PM PST

The conditions in the market are setting up for a once in a lifetime gold trade. Investors need to realize that when the Fed can no longer prop up the stock indexes, bond markets, and the overall economic system, we will have an implosion of paper assets and explosion in the value of gold (and [...] The post THE ONCE IN A LIFETIME GOLD TRADE appeared first on Silver Doctors. | |

| Precious Metals: The Long-Term Perspective Posted: 22 Nov 2013 02:10 PM PST

Based on the November 22nd, 2013 Premium Update. Visit our archives for more gold & silver articles. In our latest free essay, we focused on silver. We wrote: “the outlook for silver remains bearish and further declines should not surprise us.” On the same day, after the essay was posted, silver declined sharply moving very close to the declining support line that we had featured in that essay. On a side note, it was actually a long-term support line that stopped the decline (for now).

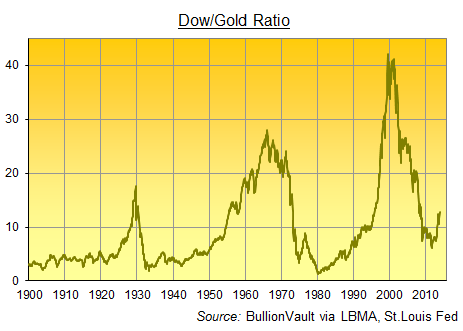

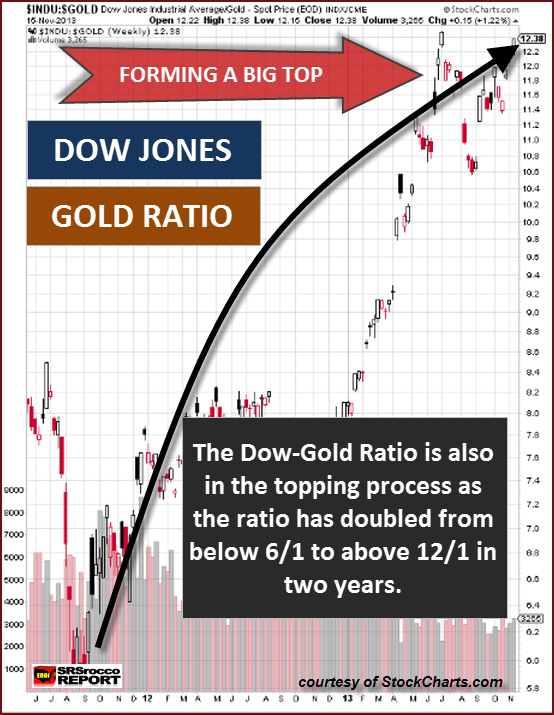

With so much volatility this week, we have decided to zoom out a bit and take a look at the markets from the long-term perspective. Is the final bottom in for gold, silver and mining stocks? We have prepared 3 charts for you today that should help us deal with this issue. Let's start with the Dow-to-gold ratio (charts courtesy of http://stockcharts.com). That's one of the most important and useful ratios there are as far as long- and medium-term trends are concerned. In particular, the big price moves can be detected before they happen (note the breakout in the first months of the year that heralded declines in gold).

In Tuesday's Market Alert, we wrote the following:

The Dow-to-gold ratio moved above the 12.5 level – to 12.56. The breakout is small and unconfirmed by the moment, but we are one step closer to the next (and probably final) plunge in the precious metals sector.

With the ratio even higher today, we have a good possibility that the breakout will be confirmed and that we will see a big drop in the price of gold in the coming weeks or months.

Having discussed the above, let's move on to the chart featuring junior mining stocks. This is actually the only somewhat bullish chart that we feature today. This might seem encouraging, until you consider the fact that the previous small breakouts turned out to be fake moves and led to even bigger declines. In our essay on mining stocks from Nov. 8, we wrote the following:

Although the juniors sector moved above the declining resistance line, we think that it's still too early to say that the breakout has been truly confirmed – especially when we take into account the position of the RSI.

Please note that the last two times when the indicator reached these levels, major medium-term tops were formed. Therefore, we would need to see a verification of the breakout first to view it as an important medium-term signal. This would be the case in any other breakout as well, but in case of the above chart, waiting for a verification seems particularly justified because we have already seen a false breakout at the beginning of this year – one which was followed by a significant decline in the entire precious metals sector.

Since we wrote the above, juniors have declined (in the preceding two weeks and also this week) and they look like they are about to invalidate the previous breakout, which would – naturally – have bearish medium-term consequences for the entire precious metals sector.

If the decline that we are likely to see in the precious metals sector takes juniors back below their declining red support/resistance line, we will have one more indication that the next major move will be to the downside.

Please note that in case of the junior mining stocks the next significant support is much below the current value of the TSX Venture Index, so the coming decline will likely be very significant.

Finally, we would like to discuss the current situation with the gold-stocks-to-gold ratio. On the above chart, we see that the situation has deteriorated in recent days. Since the beginning of the week, the HUI-to-gold ratio has declined and hit a fresh monthly low on Thursday. Despite this drop, the gold-stocks-to-gold ratio is still above its previous 2013 lows.

From this perspective, the downtrend remains in place, and it will remain in place as long as the HUI-to-gold ratio stays below the declining resistance line. Since the ratio is not that close to it, it doesn't seem that we will see a breakout soon. In fact, we don't expect to see one before another major plunge in the precious metals sector.

Summing up, the final bottom for the decline in gold, silver and mining stocks doesn’t seem to be in just yet. Consequently, jumping in with both feet into the gold market might not be the best idea right now. Still, when and how that bottom is reached is a different matter and we encourage you to keep an eye out for technical signs that could help you not only enter the market at the right moment, but perhaps make money also while metals and miners decline.

To make sure that you are notified once the new features are implemented, and get immediate access to our free thoughts on the market, including information not available publicly, we urge you to sign up for our free gold newsletter. Sign up today and you’ll also get free, 7-day access to the Premium Sections on our website, including valuable tools and charts dedicated to serious Precious Metals Investors and Traders along with our 14 best gold investment practices. It’s free and you may unsubscribe at any time.

Thank you for reading. Have a great and profitable week!

Przemyslaw Radomski, CFA Founder, Editor-in-chief Gold Price Prediction Website – SunshineProfits.com * * * * * About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing. Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. | |