saveyourassetsfirst3 |

- Pretium vindicated – over 4,000 gold ounces in first bulk sample result.

- China to start interbank gold swaps trading

- People struggling to find reasons to own gold

- Can't-miss headlines: Pretium bulks up, Batista's bankruptcy woes & more

- AT&T Continues To Trade At Lower P-E Ratio And Higher Yield Than Verizon

- Neurotrope: Intriguing Play On Alzheimer's

- Paulson tells clients he won’t add more to gold fund

- Goldman forecasts at least 15% declines for gold, iron ore

- Gold Capitulation? Not Quite

- THE ONCE IN A LIFETIME GOLD TRADE

- THE ONCE IN A LIFETIME GOLD TRADE

- Chinese gold demand and the World Gold Council’s estimates

- Considering Open Interest

- Gold looks to end week with loss amid central bank buying and selling

- Dollar's 30-year slide may be gold's new life: 2014 outlook

- That Booming Economy

- Forbes Calls for Obama’s Impeachment Over Contempt for Constitution!

- Jim Sinclair Exclusive Interview – The Game Changer

- Have a Merry DeGrowth Christmas–Boycott Black Friday

- Gold looks bearish beneath $1,362: Elliott Wave

- Gold Krugs $35.99, & Gold Buffs $54.99 Over Spot, Any QTY!

- Dollars 30 Year Slide May Be Golds New Life: 2014 Outlook

- Before Gold Can Rise It First Must Bottom

- Money For Nothing: Inside the Federal Reserve

- Gold traders most bearish in 22 weeks on Fed tapering prospects

- Gold and commodities

- Market report: Paper sellers remain in charge

- Dollar’s 30 Year Slide May Be Gold’s New Life: 2014 Outlook

- Bill Bonner: A ponzi scheme needs a Ponzi, so Bitcoin does not qualify (are you listening Peter Schiff?)

- PBOC Says No Longer in China’s Interest to Increase Reserves

- Dollar’s 30 Year Slide May Be Gold’s New Life: 2014 Outlook

- Chinese gold demand and the World Gold Council’s estimates

- 25th Anniversary Silver Maples As Low as $3.79!

- Links 11/22/13

- Silver Certificates and Counterfeit Mobs

- Lawrence Williams: Why Low Gold Prices First Lead to Production Rises Before Falling

- Putin victorious as Ukraine postpones ‘trade suicide’, halts talks with E.U.

- Four King World News Blogs

- Paulson Said to Tell Clients He Wouldn’t Add More to Gold

- Eric Sprott: Could bad data be depressing the gold price?

- Sinclair interviewed on bail-ins, gold market rigging, and a lot more

- India likely to face gold shortage of 135 tons during H2 FY14

- Lawrence Williams: Why low gold prices first lead to production rises before fallin

- Bullion and Energy Market Commentary

- Gold Elliott Wave Technical Analysis

- Dollar Rally Resumes as Expected, Gold Breaks October Bottom

- TECHNICAL Gold Gets a Reprieve before 6/28 Close

- Gold Price Analysis- Nov. 22, 2013

- Final Plunge in Precious Metals is Underway

- Is Gold Money?

| Pretium vindicated – over 4,000 gold ounces in first bulk sample result. Posted: 22 Nov 2013 04:12 PM PST Initial results from the processing of around 80% of the bulk sample from Pretium's Valley of the Kings section at Brucejack has come up with more gold than anticipated as likely to be contained in the full sample. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| China to start interbank gold swaps trading Posted: 22 Nov 2013 02:53 PM PST China will start interbank swaps trading next week in a move to further open up the domestic precious metals market. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| People struggling to find reasons to own gold Posted: 22 Nov 2013 02:45 PM PST "People are finding it hard to find a reason to own gold," the Wall Street Journal quotes one analyst today. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Can't-miss headlines: Pretium bulks up, Batista's bankruptcy woes & more Posted: 22 Nov 2013 02:02 PM PST An important development for Pretium on its bulk sample of the Valley of the Kings. Meantime, gold and silver prices fall. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| AT&T Continues To Trade At Lower P-E Ratio And Higher Yield Than Verizon Posted: 22 Nov 2013 01:07 PM PST On August 30, 2013, the last trading day prior to the VZ-VOD merger announcement Press Release on September 2, the VZ shares closed at $46.85. On that same day, the shares of T closed at $33.38, leaving a spread of $13.07 between the two stock prices. The rise of the equity market in general has helped both stocks move higher since the August 30 close, but VZ has outperformed T since the announcement. At current prices, the spread between VZ and T has widened to over $15. We have charted the VZ-T spread (one/one not equal dollar amount) back to May 23, 2008, and the highest spread value was $16.59 on April 26 of this year, before the VOD announcement. The spread narrowed over the summer to the $12 area before widening to $13+ just prior to the VOD-VZ merger announcement. The current spread reflects the market's view that | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Neurotrope: Intriguing Play On Alzheimer's Posted: 22 Nov 2013 12:58 PM PST (Editors' Note: This article covers a micro-cap stock. Please be aware of the risks associated with these stocks.) Neurotrope (OTC:NTRP) is a potentially interesting & differentiated play on the huge Alzheimer's angle with a unique pathway approach that may prove useful as either combination or monotherapy in a disease where very few agents have "silver bullet" status. Their pedigree of $100mm in R&D over the lifetime of the company, coupled with a seasoned management team and strong IP position potentially warrant a closer look. I believe that given the stage of its latest product, on the cusp of Phase II development (after compelling efficacy data in preclinical models), should warrant a closer look at current levels. Given the massive unmet need in Alzheimer's and other cognitive diseases, plus favorable demographics and no clear SOC winner to date, the market is wide open. While the company is clearly unproven and relatively | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Paulson tells clients he won’t add more to gold fund Posted: 22 Nov 2013 11:12 AM PST A person close to the matter says the billionaire hedge fund manager has told his clients he will not personally invest more money in his gold fund. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldman forecasts at least 15% declines for gold, iron ore Posted: 22 Nov 2013 10:59 AM PST Goldman reckons the price pressures will mostly become visible later in 2014, with bullion, iron ore, copper and soybeans to drop at least 15%. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Nov 2013 10:18 AM PST Would Einhorn and Paulson please hurry up and capitulate? Oh, thought not... CAPITULATION: the act or moment of surrender, of giving up, writes Adrian Ash at BullionVault. In finance, capitulation is when, after watching prices go against them, people finally throw in the towel. And typically, in the big sweep of things, you need capitulation to mark the end of that trend. Because only when the last bull takes all the losses he can and has sold – or the last bear has given up waiting for a crash and bought – can the market turn itself around. London's would-be homebuyers, for instance. Sitting out the surge in prices, a friend who always thought the bubble MUST burst at some point has just given in, and bought a flat. Gulp! On the other side of the hill, and after getting beaten down by months and now years of falling prices, big-name gold investors are finally throwing in the towel, too. Well, kinda. "This year hasn't been good for gold," said David Einhorn, fresh-faced card shark and hedge fund manager at Greenlight Capital, to CNBC on Thursday. Building his fund's gold investment since 2006, Einhorn switched it in 2009 to physical, allocated gold just like you trade on BullionVault. Because "at a minimum" it would save him money compared to ETF trust funds. Today he's not buying more. Which is capitulation of a sort. But Einhorn isn't selling. "Just in case something goes really, really, haywire." Also failing to capitulate, and sticking with gold, is the biggest bull of them all, John Paulson. Head of the imaginatively named Paulson & Co., his hedge funds' owned $4.6bn of the giant SPDR Gold Trust just before gold peaked in mid-2011. Halving his holding in that fund (ticker: GLD) as prices crashed this spring, however, Paulson kept it flat between July and October. He ended the third quarter with GLD stock worth $1.3 billion. And this week, says Bloomberg, he reportedly told clients that he wouldn't personally buy gold right now. Because the inflation story he's expected for the last five and six years simply hasn't shown up. This, we guess, is as good a sign for gold (and by extension, silver) as we've had all year. Because "Gold bugs die hard," as the New York Times said back in June 1999. It's worth re-reading that story today. If only for Jean-Marie Eveillard's close brush with closing his legendary gold fund. That was amid deafening reasons to quit the market. It was also just before gold prices bottomed at $250 per ounce, and turned 7 times higher as the financial world, in Einhorn's phrase above, "went haywire". Today again, "People are finding it hard to find a reason to own gold," one analyst tells the Wall Street Journal. But how about insurance, Lehman Brothers, or record-high peacetime Western debt levels? All you need is an attention span longer than a goldfish's. And deep pockets, of course, to carry the financial loss which all gold and silver bulls who failed also to invest in the stockmarket in 2013 are now wearing. Insurance pays nothing when nothing goes wrong. That doesn't mean you don't need it. But it does make capitulation all the more tempting when stockmarkets are setting new record highs but you missed out. And the thing with insurance, remember, is you also need to own something to insure. Otherwise, you might wind up just paying the premiums. | |||||||||||||||||||||||||||||||||||||||||||||||||||

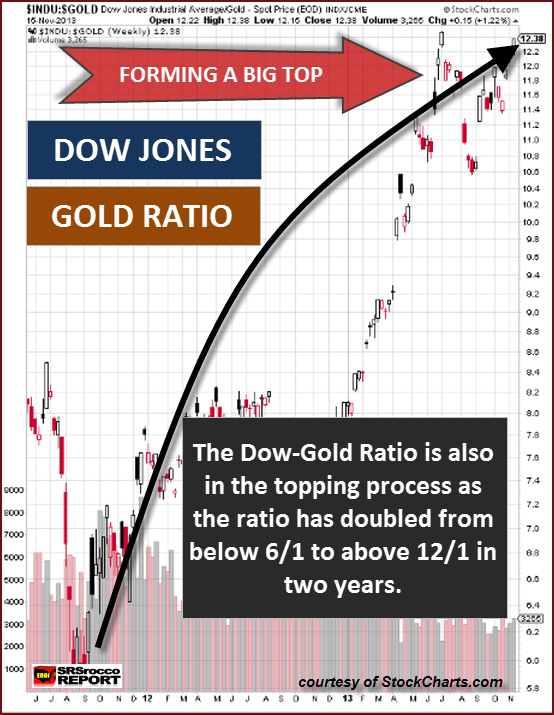

| THE ONCE IN A LIFETIME GOLD TRADE Posted: 22 Nov 2013 10:04 AM PST

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| THE ONCE IN A LIFETIME GOLD TRADE Posted: 22 Nov 2013 10:00 AM PST

The conditions in the market are setting up for a once in a lifetime gold trade. Investors need to realize that when the Fed can no longer prop up the stock indexes, bond markets, and the overall economic system, we will have an implosion of paper assets and explosion in the value of gold (and [...] The post THE ONCE IN A LIFETIME GOLD TRADE appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese gold demand and the World Gold Council’s estimates Posted: 22 Nov 2013 09:43 AM PST There is considerable disagreement about Chinese gold demand, with delivery figures on the Shanghai Gold Exchange and import/export figures for Hong Kong suggesting the real totals are far higher than those published by the World Gold Council and Thompson-Reuters GFMS. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Nov 2013 09:29 AM PST As we approach contract expiration and First Notice Day for the Dec13 gold contract, I thought it would be fun to see where current open interest stands versus recent delivery months. Using this data, can we begin to predict how many might stand for delivery in December? | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold looks to end week with loss amid central bank buying and selling Posted: 22 Nov 2013 09:23 AM PST With a lack of anything else to focus on, the gold price is set to end Friday with its biggest weekly loss in two months due to uncertainty over tapering and improved U.S. economic data. | |||||||||||||||||||||||||||||||||||||||||||||||||||

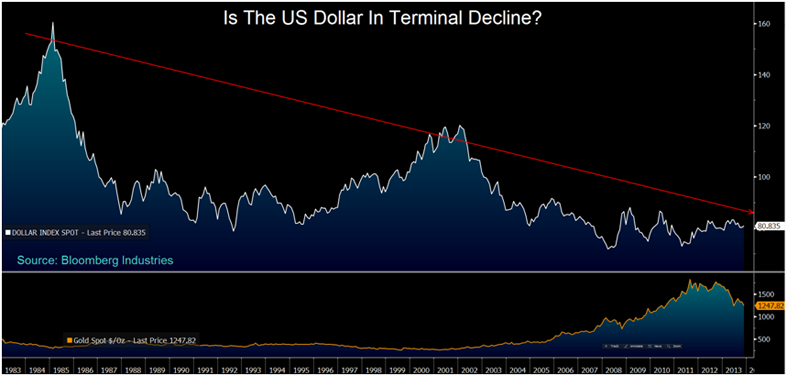

| Dollar's 30-year slide may be gold's new life: 2014 outlook Posted: 22 Nov 2013 09:16 AM PST The U.S. dollar has been on a 30-year slide versus other competing paper currencies, in particular the Chinese yuan. If the dollar's decline, as measured by the DXY Index continues, gold may be the main beneficiary. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Nov 2013 09:00 AM PST This morning, Atlanta Fed President Dennis Lockhardt said, "I assure you, we'll be talking about tapering at future meetings." Well, DUH – given such discussions are what you are paid to do! Of course, CNBC blared this headline as if it actually meant something; which is why its ratings have fallen back to 20-year lows. Subsequently, Lockhardt made the most damning statement possible about the futility the Fed has become, when saying, "We'll taper when the economy is ready, and the market prepared." In other words, admitting the stock and bond markets are primary areas of focus; which is all the more comical, given the Fed's own QE policy purchases 70%+ of all Treasury issuance! Just in the past day, the supposed "recovery" Lockhardt's taper talk is predicated on was contradicted by a Philly Fed survey plunging from 19.8 to 6.5, led by a horrific collapse in the employment component, from 15.4 to 1.1. Meanwhile, the Chinese PMI unexpectedly dropped from 50.8 to 50.4, depicting a barely expanding economy; whilst the European PMI also unexpectedly dropped, led by the imploding French economy, which saw a PMI plunge to a six-month low of 47.8. Even Goldman Sachs admits the overall trend is down, as its "global leading indicator" is collapsing. Meanwhile, while the UK boasts of the housing bubble created by the BOE; it neglects to discuss the impact of such inflation on the average person. The average British family's household debt has doubled in the past decade, to £54,000; while this month, average personal debt hit an all-time high. Which is exactly what is occurring in the States, where "deleveraging" has abruptly ended given the desperate need for cash. And then you have Japan, where the BOJ yesterday said it is considering more QE; as apparently, doubling the money supply in two years – following nine other QE rounds – isn't enough. Take a look at what the Yen has done since that statement two days ago, and it becomes painfully clear what direction Japanese inflation is headed. Finally, we have the upcoming catastrophe of a U.S. holiday season. Yesterday, Target and Ross added to the cacophony of dismal outlooks from low-end retailers; with Target's CEO referring to "an upcoming holiday season we believe will be the most intensely competitive and promotional in recent years.” And oh yeah, did I forget the December 13th deadline for a new Congressional budget; you know, what we haven't had in five years, but is necessary to prevent a second government shutdown on January 15th? As Boehner says the House will simply pass a "stopgap" spending bill of $967 billion if not. Don't worry, there's nothing to see here; that is, so long as the Fed continues to "turboQE" rates down and stocks continue to rise. What could possibly go wrong?

Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Forbes Calls for Obama’s Impeachment Over Contempt for Constitution! Posted: 22 Nov 2013 08:45 AM PST

It is one thing when a fringe blog or right-wing news organization calls for the impeachment of a liberal President. It is another thing entirely when Forbes.com prominently publishes a call for the impeachment of a liberal President, claiming his tyrannical disregard for the US Constitution has sent the US to the brink of a [...] The post Forbes Calls for Obama’s Impeachment Over Contempt for Constitution! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Sinclair Exclusive Interview – The Game Changer Posted: 22 Nov 2013 08:15 AM PST

Legendary gold trader Jim Sinclair discusses “The Game Changer”, how the next banking crisis will be met via bail-in across the West, and explains the method used to achieve his jaw-breaking $50,000 gold prediction in this MUST WATCH interview with Ask the Expert. 25th Anniversary Silver Maples as low as $3.79 over spot- Only [...] The post Jim Sinclair Exclusive Interview – The Game Changer appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Have a Merry DeGrowth Christmas–Boycott Black Friday Posted: 22 Nov 2013 08:00 AM PST

The “aggregate demand is God” Keynesian Cargo Cult fetish of focusing on holiday sales is worse than meaningless–it is profoundly misleading. Counting on strong holiday retail sales to “boost the economy” is like eating triple-paddy cheeseburgers and fries to lose weight. The last thing a debt-dependent economy needs is more borrowing to buy excess consumption, [...] The post Have a Merry DeGrowth Christmas–Boycott Black Friday appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold looks bearish beneath $1,362: Elliott Wave Posted: 22 Nov 2013 07:21 AM PST Gold reversed sharply to the downside at the start of September through the rising trend line of a corrective channel. That's an important signal for a change in trend. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Krugs $35.99, & Gold Buffs $54.99 Over Spot, Any QTY! Posted: 22 Nov 2013 07:08 AM PST

ANY QUANTITY! Flash Sale! Gold Krugerrands only $35.99 over spot, and Gold Buffs only $54.99 Over Spot, Today only! Click or call 614.300.1094! The post Gold Krugs $35.99, & Gold Buffs $54.99 Over Spot, Any QTY! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars 30 Year Slide May Be Golds New Life: 2014 Outlook Posted: 22 Nov 2013 07:01 AM PST gold.ie | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Before Gold Can Rise It First Must Bottom Posted: 22 Nov 2013 07:00 AM PST Since the financial crisis in 2008, the central banks in the US, Japan and elsewhere have added more than $9 trillion. That was the stimulus for gold, which was trading around $830 an ounce prior to Bernanke's announcement of Q1 in November 2008. Gold gained favor as a hedge against inflation and as a store of wealth amid the debasement of paper currencies. But with inflation showing few signs of re-emerging in developed economies and the dollar strengthening, important factors stopping the gold price from sliding lower have now been removed from the equation. At least that's how Wall Street and the mainstream views it. We, on the other hand, see things quite different. We agree with Shadowstats that inflation is closer to 9% than to 1%. We believe the only positives on the economy and employment are the spin put on them by the BLS. We also believe that truth will prevail, which is why we are patient and buy the dips. We will not be surprised or disappointed if gold drops even lower. Before gold can rise, it first must bottom. We know that the bottom is not far off and when gold starts to rise off the bottom, even if it is in the $1100s, the long wait will be over. Gold is down 26% since the start of the year and looks set to end its unbroken 12-year bull run in 2013. It's been a difficult year for gold bulls, but we are a hardy lot. A good friend of mine who is in our industry told me, "I'm hanging on by my fingernails, but I have strong fingernails." Here are a few comments from Money and Markets (Mike Bumick) that I am featuring today below:

Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Money For Nothing: Inside the Federal Reserve Posted: 22 Nov 2013 07:00 AM PST

MONEY FOR NOTHING is a feature-length documentary about the Federal Reserve – made by a Team of AFI, Sundance, and Academy Award winners – that seeks to unveil America's central bank and its impact on our economy and our society. Current and former top economists, financial historians, and investors and traders provide unprecedented access and [...] The post Money For Nothing: Inside the Federal Reserve appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold traders most bearish in 22 weeks on Fed tapering prospects Posted: 22 Nov 2013 06:53 AM PST Traders have become the most bearish on gold prices for next week since June 21. Should the Fed be able to find ways to dampen the market volatility when it exits QE, the gold market should calm down. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Nov 2013 06:28 AM PST The relationship between gold and commodities is essentially a simple one. If you look at long-term charts of oil priced in gold for example, you find that they have been more constant than oil priced in paper currencies. In 1965, gold was at $35 and oil was priced at $2.90 per barrel, so priced in gold oil was 0.083 ounces. Today gold is $1250 and oil is $95, so oil is 0.076 ounces. Therefore the price of oil in terms of gold has hardly changed over nearly forty years compared with it rising 33 times measured in US dollars.What has happened is the purchasing power of the dollar has fallen. Since 1965 the quantity of gold in above ground stocks has doubled, which other things being equal explains a rise in the price of oil in gold terms. At the same time, the Fiat Money Quantity (a measure of total dollar cash and deposits in the banking system) has increased 33 times, which again is broadly consistent with the price of oil measured in USD increasing substantially. There are significant fluctuations in price from the oil side as well. Before the Lehman crisis in mid-2008, oil peaked at $140 before collapsing to under $40by the year-end, or in gold terms, 0.14oz to 0.05oz, so there is no precision in these relationships. However, so long as economic conditions are roughly stable, over time it will be true that gold, in paper currency terms, will tend to move in line with commodity prices. For this reason many analysts make the mistake of tying gold closely to the general commodity cycle. This trend assumption ignores the monetary role of gold at a time of great currency inflation and systemic risk. It is hardly surprising, since so far as I'm aware not one commodity analyst even considers the possibility that changes in commodity prices might be due to changes in the purchasing power of the currency. For this reason, they will either use technical analysis or will focus on prospective demand for commodities in the light of the global economic outlook. Both these approaches are inherently subjective. The monetary situation today is at an extreme for which the consensus is not prepared. Let us take two simple facts: governments are being funded by their central banks at wholly artificial interest rates; and the global banking system, exposed to government bonds, interest rate swaps and highly-indebted customers, would face a renewed crisis if interest rates and bond yields were suddenly normalised. Not only has there been significant deviation between gold and commodity prices in the past, but the past is no guide to the current position. Currency inflation is now a significant and escalating problem, and those that think gold will continue to act like any other commodity are almost certainly mistaken. | |||||||||||||||||||||||||||||||||||||||||||||||||||

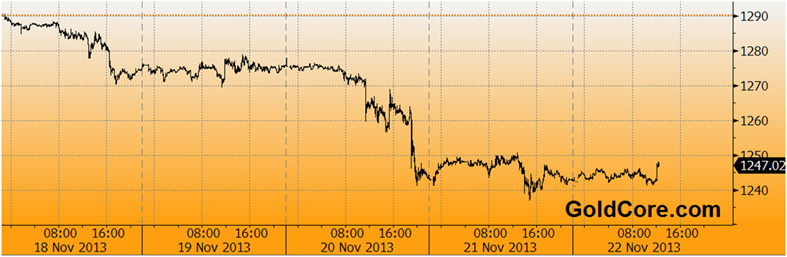

| Market report: Paper sellers remain in charge Posted: 22 Nov 2013 06:00 AM PST This week has been very uncomfortable for long-term gold investors. Trading in derivative markets has become thin, as evidenced by sustained intraday periods of little price movement, with a tendency to drift lower.This relative calm was shattered on Thursday ahead of the release of the Fed's FOMC minutes when a sale of only 1500 futures contracts (4.67 tonnes) was sufficient to eliminate all bids in the market. The subsequent fall drove the gold price below the October lows, as shown in the chart below.

The consensus in the investment community is uniformly bearish. Closer questioning boils it down to everyone agreeing for the same reason: the trend is down, the charts are terrible, and therefore one has to be a bear. This level of consensus, long on herd instinct and devoid of any solid reasoning, is however typical of extremes of market sentiment. The event of the week for which the bears were praying was the release of the FOMC minutes. They actually said nothing new, beyond reaffirming both the desire to reduce asset purchases as and when circumstances permit, and the contradictory commitment to current ultra-low interest rates. Of greater relevance perhaps is the threat to "twist" that tapering implies: in other words yields on bonds might be free to rise relative to close-to-zero overnight rates. And if bond yields rise, that is bad for gold, or so the bears argue. This simple logic is blind to two overriding facts: adjusted for the increase in fiat currency, gold is now at a discount of 34% to where it was pre-Lehman crisis, and things have if anything become far worse since then (see the chart below). Furthermore, we must be rapidly approaching the point where there is very little gold left in the West to supply the voracious Asian appetite. So both valuation and physical demand are totally ignored.

There are many similarities between today's market sentiment and that of September 1999, when the gold price jumped 27% in just two weeks. The bullion banks were bearish with gold at $255. The consensus then was that it was going to go lower perhaps to $220, stock markets were hitting new highs with the dot-com boom, and price inflation was not a problem. The bear squeeze in September 1999 would have been more dramatic had the Bank of England and the Fed not used their still considerable bullion stocks to intervene and rescue the bullion banks from their short positions. If a similar bear squeeze develops today, it is unlikely the Western central banks will have enough gold available to control the market. Next week The following list is of expected statistics for next week. Monday UK: Nationwide House Prices, BBA Mortgage Approvals. Tuesday US: Building Permits, Housing Starts, S&P Case-Shiller Home Price Index, Consumer Confidence. Wednesday UK: GDP (2nd est.), CBI Distributive Trades. Thursday Eurozone: M3 Money Supply, Business Climate Index, Consumer Sentiment, Industrial Sentiment. Friday Japan: Construction Orders, Housing Starts. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar’s 30 Year Slide May Be Gold’s New Life: 2014 Outlook Posted: 22 Nov 2013 05:47 AM PST

THE U.S. DOLLAR has been on a 30 year slide versus other competing paper currencies, in particular the Chinese yuan. If the dollar’s decline, as measured by the DXY Index continues, gold may be the main beneficiary. The dollar may be printed in unlimited quantities, though the global stock of gold increases by just 2% [...] The post Dollar’s 30 Year Slide May Be Gold’s New Life: 2014 Outlook appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Nov 2013 05:40 AM PST

We are really enjoying these posts from Bill Bonner (author of “Empire of Debt” and other must-reads). Bill is a ‘sound money’ guy who is doing lots of due diligence right now on Bitcoin – as you would expect from a highly successful investor. I recommend all ‘Libertarians’ ‘Ayn Rand’ types, Anarcho-capitalists, Gold bugs and Peter Schiff to follow what Bill is doing now investigating bitcoin. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| PBOC Says No Longer in China’s Interest to Increase Reserves Posted: 22 Nov 2013 05:35 AM PST The People's Bank of China said the country does not benefit any more from increases in its foreign-currency holdings, adding to signs policy makers will rein in dollar purchases that limit the yuan's appreciation... Read | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar’s 30 Year Slide May Be Gold’s New Life: 2014 Outlook Posted: 22 Nov 2013 05:26 AM PST And yet gold still seems to be stuck in a downtrend. This week’s sell off may have been due to trading shenanigans on the COMEX and many, including the UK Financial Regulator are asking questions as to whether gold price rigging is taking place. Today's AM fix was USD 1,241.75, EUR 918.59 and GBP 766.75 per ounce. Gold fell $1.50 or 0.12% yesterday, closing at $1,243.20/oz. Silver climbed $0.14 or 0.71% closing at $19.99/oz. Platinum rose $4.60 or 033% to $1,389.50/oz, while palladium climbed $3.78 or 0.53% to $714.75/oz. Many traders and investors are still scratching their heads at the peculiar gold trading Wednesday which pushed gold below the important technical level of $1,250/oz. Support at $1,250/oz has been breached and gold is vulnerable of a fall to test support at $1,200/oz and the June 28th low of $1,180/oz (see charts below).

Gold's falls come despite there being many compelling reasons for gold to rally. These include uber dove Yellen at the Fed’s helm, the near certainty that the Eurozone debt crisis will erupt early in the New Year, signs ETF outflows are stabilizing and China picking up the slack with regard to physical demand, after India's demand fell from near record levels.

THE U.S. DOLLAR has been on a 30 year slide versus other competing paper currencies, in particular the Chinese yuan. If the dollar’s decline, as measured by the DXY Index continues, gold may be the main beneficiary. The dollar may be printed in unlimited quantities, though the global stock of gold increases by just 2% to 2.5% annually. Irrespective, of the huge increase in money supplies globally today. Indeed, should gold prices fall more, gold production is likely to begin falling. This is seemingly lost on Janet Yellen and central banks, who continue to print money at record rates. The smart money who understand gold's importance as a diversification continue to accumulate gold. The very poor state of the U.S. economy bodes badly for the U.S. dollar in 2014 which should help gold resume its multi year bull market.

DATA FROM THE INTERNATIONAL MONETARY FUND today shows that central banks continued to diversify into gold in October. Turkey’s holdings rose the most, with the central bank adding a large 12.994 tonnes – 16.18 million oz vs. 15.762 million oz. Kazakhstan's gold reserves rose 2.4 tons and Azerbaijan's gold reserves increased 2 tonnes last month. Germany, the world’s second biggest holder of gold reserves, cut its bullion holdings by a tiny amount in October for the second time in five months. Germany’s gold holdings dropped to 108.9 million ounces from 109.01 million ounces in September. The reduction was likely for domestic gold coin sales.

GOLDMAN SACHS Inc. has come out with another of their widely covered market predictions. Gold, iron ore, soybeans and copper will probably drop at least 15% next year as commodities face increased downside risks even as economic growth in the U.S. accelerates, according to Goldman. As we noted before, Goldman's gold calls and crystal gazing have been poor at best. Indeed, some suspect that while Goldman is advising clients to sell, they may be on the other side of the the trade going long. News This Week * China’s planned crude oil futures may be priced in yuan China, which overtook the United States as the world’s top oil importer in September, hopes the contract will become a benchmark in Asia and has said it would allow foreign investors to trade in the contract without setting up a local subsidiary. * Germany Lowers Gold Reserves in October, IMF Data Show * Gold-Put Options Surge as Futures Slump to Lowest in Four Months Puts giving the owner the right to sell at $1,250 jumped to $15.10, the highest in a month, on estimated volume of 2,206 contracts, the most-active option * China Oct. Silver Imports 230.8 Tons, Customs Says * UBS Estimates 36% of South Africa Gold Industry is Losing Money * CME Lowers Gold and Silver Margins Conclusion In South Africa, no longer the world’s largest producer, (which is now China) but still a major producer, there are estimates that 36% of the South African gold industry are loss making even at today’s spot prices – $1,250/oz. In 3Q, 28% of the South African gold industry was loss making, based on a gold price of $1,330/oz. The short term technicals remain poor and the trend remains lower so we remain bearish for next week despite the strong seasonals. November, December and January are traditionally strong months for gold due to year end fund allocation and in recent years Chinese New Year demand. It remains prudent to ignore short term noise and day to day price movements. Instead focus on physical gold's importance, either in your possession or in allocated gold accounts, as financial insurance and as a vital diversification for investors and savers today. Click Gold News For This Week's Breaking Gold And Silver News | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese gold demand and the World Gold Council’s estimates Posted: 22 Nov 2013 05:19 AM PST There is considerable disagreement about Chinese gold demand, with delivery figures on the Shanghai Gold Exchange and import/export figures for Hong Kong suggesting the real totals are far higher than those published by the World Gold Council and Thompson-Reuters GFMS.Recently Eric Sprott of Sprott Global Resource Investments Limited tackled this issue and wrote an open letter to the WGC pointing out that import/export figures show far higher levels of gold demand than the WGC's estimates for Asia, particularly China, Hong Kong, Thailand, India and Turkey. The response is not on the WGC website, though it appears to be partially quoted elsewhere. It seems that Sprott and the WGC are trying to do two different things. Sprott is interested in how much gold is actually taken into a country net of exports, irrespective of its use category, taking the view that there can be no more accurate estimate of overall gold demand, irrespective of how it is used. The WGC is trying to identify how much gold is used for specific purposes, which given the opaqueness of the market means they will never track all of it down. Crudely put it is top-down versus bottom-up. To see how different the results can be let's look at the solid figures for China and Hong Kong for the first nine months of 2013 which are set out in the table below, before comparing the result with that of the WGC.

All these are published figures which we can assume to be accurate. Mainland China does not release import/export statistics for gold but we know what has been physically delivered through the Shanghai Gold Exchange, the monopoly physical market, and we know what Hong Kong imports exports and re-exports. We can also be reasonably certain that these figures exclude off-market government transactions, such as direct purchases from the mines of all China's gold production, given that Chinese-refined bars are never seen in circulation. Exports from Hong Kong refer to gold processed into a materially different form from that imported, typically jewellery; so exported to the Mainland they are additional to SGE deliveries. Re-exports refers to imports re-exported with no material processing, and therefore can be assumed to be bullion trans-shipped and destined for the SGE, ignoring for simplicity's sake that some may have bypassed the SGE and been sent directly to private buyers. Exports and re-exports to the rest of the world obviously must be deducted. The conclusion is that between them gold absorbed by private sector purchases in Hong Kong and China amount to at least 2,130.7 tonnes in the first nine months of this year, or 2,841 tonnes annualised. This compares with the WGC's estimates from their quarterly Gold Demand Trends of only 818.6 tonnes for the same period, or 1,091.5 annualised. Given the hard evidence of Hong Kong and SGE statistics it appears that the WGC's figures substantially understate the true position. Furthermore, any analysis of gold demand will fail to account for the increase in gold ownership not constrained by national boundaries. Estimates of China's demand also exclude government purchases of gold in foreign markets, and gold that may have been acquired and imported by wealthy Chinese from foreign locations without going through Hong Kong or the SGE. So without taking into account these extra factors China and Hong Kong's combined imports from the rest of the world exceeds all other mine supply by at least 580 tonnes on an annualised basis. It now becomes clear that without significant leasing by Western central banks total Asian demand could not be satisfied at current prices, because there is no evidence of material selling by existing holders of above-ground stocks, with the exception of ETF liquidation which is minor compared with the amounts involved. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 25th Anniversary Silver Maples As Low as $3.79! Posted: 22 Nov 2013 05:00 AM PST

25th Anniversary Silver Maples as low as $3.79 over spot- Only at SDBullion! Click or call 614.300.1094 to secure your limited edition Silver Maple today! The post 25th Anniversary Silver Maples As Low as $3.79! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Nov 2013 03:55 AM PST Flock of feral turkeys causing chaos in New York Daily Mail Pure manure: City uproots FL couple's 17-year-old garden Florida Watchdog (JL) Dow Closes Above 16000 Online WSJ. Wun’erful, wun’erful! Stock Funds Lure Most Cash in 13 Years as Market Rallies Bloomberg WTO on verge of global trade pact FT Drop in Traffic Takes Toll on Investors in Private Roads Online WSJ. If the owners of the private roads are foreign, could they sue the government for lost profits under TPP? Boeing’s Massive 777X Order Book: Is It Partly a Shell Game? The Street U.S. to Consider Cellphone Use on Planes Online WSJ. Anybody want to make book on the first assault case? I give it 30 days, tops. Crash Families Channel Rage to Outlobby Airlines on Rules Bloomberg The strange convergence of Bernanke, Hayek and Bitcoin Reuters Brookfield's Looking-Glass World Southern Investigative Reporting Foundation. There seem to be rather a lot of Brookfields, including the one that owns Zucotti Park, which Mike “Mayor for Life” Bloomberg cleared, naturally and entirely not on behalf of his paramour, who at the time sat on a Brookfield board. Couldn’t happen to et cetera. Fed Minutes Reveal a Dangerous Power Grab by New York Fed Wall Street on Parade Filibustergasm

Obama holds off-record meeting with MSNBC hosts, liberal pundits Politico. The Long-Term Unemployment Is Associated with Short Telomeres in 31-Year-Old Men: An Observational Study in the Northern Finland Birth Cohort 1966 PLOS. So disemployment shortens life expectancy. Of course, the elites already knew this from the collapse of the Soviet Union, which is why they adopted the policy, but it’s good to have academic confirmation. SNAP Spending Has Started Falling CBPP Behind the Scenes of Rahm Emanuel’s Poor Mayoral Strategy Alternet (OIFVet) ObamaCare Launch

A perspective on the relationship between national and state single-payer efforts PNHP (hipparchia) Big Brother Is Watching You Watch

The US Renounces the Monroe Doctrine? The Diplomat Israel’s growing gang violence leads to calls for anti-terror tactics Guardian Ukraine drops EU plans and looks to Russia Al Jazeera America United States gives Afghanistan year-end deadline for crucial security deal Reuters India Confronts the Politics of the Toilet Bloomberg Japan's Losing Battle Against 'Goldman Sachs With Guns' Bloomberg The Winners of the ‘Chase Twitter Fail’ Haiku Contest Matt Taibbi, Rolling Stone. Since this is a family blog, I’ll quote only one of the two winners:

Readers, anyone up for a haikus? Propose and propound in comments! Buddhist Extremist Cell Vows To Unleash Tranquility On West America’s Finest News Source (AbyNormal) A Neuroscientist's Radical Theory of How Networks Become Conscious Wired Why I Make Terrible Decisions, or, poverty thoughts KillerMartinis (Marianne J) Antidoted du jour (via): | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Certificates and Counterfeit Mobs Posted: 22 Nov 2013 02:39 AM PST A timely speech from JohnF from 1961. There is plenty in it that is as timely now as it was then, if not more. It contains as many, if not far more, potential offenses against the then-PTB (who are very likely the same as or very similar to the current PTB). When thinking about men like JohnF, I am reminded of the need for inspiring, thoughtful and honest leadership. The increasingly declining quality of the 'facsimilies' thereof that are served up to us (as opposed to rising up from among the people), has gotten to be alarming as the decades rolled on. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Lawrence Williams: Why Low Gold Prices First Lead to Production Rises Before Falling Posted: 22 Nov 2013 02:32 AM PST "JPMorgan et al took a tiny slice off of three of the four salamis again." ¤ Yesterday In Gold & SilverIt was pretty much a "nothing" sort of day in gold on Thursday. The price rallied a hair in the early going in the Far East, and then traded flat until shortly before 1 p.m. in London. Then some selling pressure appeared that lasted until the London p.m. gold fix, and the gold price quietly set a new low for this move down at that point. The subsequent rally ran into a willing seller minutes after 12:30 p.m. in New York, and then sold off a few dollars going into the 5:15 p.m. EST close of electronic trading. The CME recorded the high and low ticks as $1,250.00 and $1,235.80 in the December contract. Gold closed at $1,242.40 spot, down 40 cents from Wednesday. Gross volume was a hair over 270,000 contracts, but once the spreads and roll-overs were subtracted out, net volume fell all the way down to 126,000 contracts. The silver price didn't do much until about 1 p.m. Hong Kong time, and then it quietly rallied to a bit over $20 the ounce by shortly after 10 a.m. in London. From there the price rolled over and hit its low the same time as gold did at the p.m. fix, also setting a new low for this move down. The rally that followed got cut off at the knees the same time as gold's rally was brought to an end, a few minutes after 12:30 p.m. in New York. After that, the price chopped sideways into the close. The December high and low, as recorded by the CME, was $20.045 and $19.705. Silver finished the Thursday session at $19.985, which was up 13.5 cents from Wednesday. Gross volume was pretty chunky as well, but net volume was only 24,500 contracts. Both platinum and palladium rallied for a few hours starting at the London open, but that was pretty much it, as they both sold off quietly for the rest of the day. Here are the charts. The dollar index closed on Wednesday at 81.06 and then proceeded to chop sideways for the entire Thursday session. The index close on Thursday at 81.01. Nothing to see here. The gold stocks gapped down, and then hit their low of the day at gold's low, which came at the London p.m. gold fix. That event occurred a few minutes before 10 a.m. Eastern Standard Time. The subsequent rally didn't get far, and the shares traded sideways for the remainder of the Thursday session, with the HUI finishing down 1.69%. Despite the fact that the price of the metal finished in the green, the same can't be said for the equities, as Nick Laird's Intraday Silver Sentiment Index closed down 1.28%. The CME Daily Delivery Report showed that zero gold and zero silver contracts were posted for delivery on Monday. November deliveries have been a bigger yawner than even I imagined they would be. Well, another day, and another withdrawal from GLD. This time it was 115,780 troy ounces. And as of 9:56 p.m. last evening, there were no reported changes in SLV. Joshua Gibbons, the "Guru of the SLV Bar List" updated his Web site with the goings-on over at SLV for the reporting week, and here is what he had to say: "Analysis of the 20 November 2013 bar list, and comparison to the previous week's list -- 3,370,836.0 troy ounces were removed (all from Brinks London), 385,030.8 troy ounces were added (all to JPM London V), and no bars had a serial number change." "The bars removed were from: Russian State Refineries (0.7M oz.), Degussa (0.6M oz.), Kazakhmys (0.6M oz.), and 23 others. The bars added were from: Russian State Refineries (0.3M oz.) and 3 others. As of the time that the bar list was produced, it was overallocated 174.8 troy ounces." The link to Joshua's Web site is here. The good folks over at Switzerland's Zürcher Kantonalbank updated their Web site with the activity in both their gold and silver ETFs as of Wednesday, November 20, almost two weeks since their previous report on November 8. Their gold EFT showed a smallish decline of 2,313 troy ounces over that period, but their silver ETF declined by a chunky 835,566 troy ounces. The U.S. Mint had a tiny sales report. They sold 2,500 troy ounces of gold eagles, along with 500 one-ounce 24K gold buffaloes. Once again there was very little gold activity over at the Comex-approved depositories on Wednesday. They reported receiving 1,929 troy ounces and shipped out 578 troy ounces. Nothing much to see here. It was somewhat more interesting in silver, but only just, as nothing was reported received, and 159,319 troy ounces were shipped out. The link to that activity is here. I don't have much in the way of stories today, but I hope you find some of interest in what few I have. ¤ Critical ReadsJobless benefits for 1.3 million people expire this year, will Congress change that?Jobless workers will face an unpleasant shock at the end of the year: More than 1.3 million out-of-work Americans will lose their unemployment insurance on Dec. 28 unless Congress extends an emergency aid program that's set to expire. So far, few lawmakers have paid much attention to this looming deadline — but Rep. Sander Levin (D-Mich.) is trying to change that. The ranking member of the House Ways and Means Committee plans to introduce a bill on Wednesday to extend the federally funded Emergency Unemployment Compensation program for another year. The cost? About $25.2 billion. If the program isn't extended, then the maximum amount of time that states can provide unemployment insurance will drop from 73 weeks down to 26 weeks. Some 1.3 million jobless workers will lose their unemployment insurance that January, and hundreds of thousands more will see benefits cut off in the months thereafter. This Washington Post story from Tuesday afternoon EST has had a headline change by TWP 'thought police'. It now reads a much less harmful "Rep. Sandy Levin on why Congress should talk to more unemployed workers". I found today's first story embedded in yesterday's edition of the King Report. U.S. to Sell Rest of GM Shares by Year-End, May Lose $10 Billion The U.S. government expects to sell the last of its stake in General Motors by the end of the year, bringing an end to a sad chapter in the 105-year-old auto giant's history. Morgan Stanley Said in Discussions to Sell Oil Unit to RosneftMorgan Stanley is in talks to sell its global oil business to OAO Rosneft, Russia’s largest petroleum producer, a person briefed on the discussions said. The talks are in early stages and a deal may not be reached, said the person, who asked not to be identified because the matter is private. The bank hasn’t discussed selling its entire commodities unit to Rosneft and may remain in some oil derivative businesses even with a sale, the person said. Morgan Stanley Chief Executive Officer James Gorman has been exploring options for the commodities business for more than a year as the unit faces lower revenue and scrutiny from regulators who are reviewing banks’ activities in the sector. Gorman, 55, also has been trying to shrink the amount of capital dedicated to the fixed-income and commodity division in his quest to boost the bank’s return on equity. Godfrey Bloom Quotes Murray Rothbard - The State is an Institution of TheftThis 1:24 minute video is of Godfrey Bloom at his absolute finest in front of the European Parliament on Thursday, and is an absolute must watch. It's also the absolute truth as well. I thank reader Dennis Meredith for bringing this video clip to our attention. It was posted on the youtube.com Internet site yesterday. Ambrose Evans-Pritchard: There is talk of revolution in the air.Russell Brand is more right than wrong. Pre-revolutionary grievances are simmering in half the world, openly in France and Italy, less openly in Russia and China. The Gini Coefficient measuring income inequality has been rising for 25 years almost everywhere, thanks to the deformed structure of globalisation. Companies can hold down wages in the West by threatening to decamp to the East. “Labour arbitrage” boosts the profit share of GDP and eats into the share of workers. That is how Volkswagen extracted pay cuts at German plants in 2005. The German reforms now being exported to Club Med are why Germany’s Gini index has soared and why German life expectancy is falling for the poor. This very interesting commentary from AE-P was posted on the telegraph.co.uk Internet site very late on Wednesday evening GMT...and it's the first contribution of the day from Roy Stephens. Listening Sector: Berlin Makes Easy Target for Spies The center of Berlin has become a playground for spies. Phone calls in the dense German government district can be monitored with basic equipment and even by allies. German counter-espionage agents are alarmed. Putin victorious as Ukraine postpones 'trade suicide', halts talks with E.U.Facing its most important economic crosswords since the collapse of the Soviet Union, Kiev has aligned itself closer to Russia, and has suspended preparations to sign an E.U. trade deal. Russia has warned a step west towards Europe would be "trade suicide" and result in billions in lost trade revenue and that joining the Russia-led Customs Union is more beneficial. Ukraine will “restore an active dialogue” with the Customs Union and the CIS, and economic and foreign ministers proposed Ukraine, Russia, and the EU create a tri-party commission to improve and strengthen trade relations. Putin's spokesman Dmitry Peskov said Russia welcomed Ukraine's decision to actively develop ties with Moscow, and Putin added he wasn't completely against Ukraine's association with E.U. This article was posted on the Russia Today website Thursday afternoon Moscow time, which was early in the morning in New York. It's another contribution from Roy Stephens...and it's definitely worth reading, especially for all students of the the New Great Game. Ukraine Just Made a 'Civilization Defining' Decision — and it Picked Russia Over the WestUkraine just made what geopolitical expert James Sherr called "a civilizational choice": On the table sat an Association Agreement and trade pact with the E.U. — an open invitation to integration with the West — as well as a Russian offer to join the Belarus-Kazakhstan-Russia customs union. Last month John Lloyd of Reuters wrote that if the Ukraine signed the E.U. pact, "a major state will move into the West's sphere of influence." That didn't happen. Ukraine has chosen to decline the EU's offer after Russia imposed trade sanctions on the Ukraine and threatened other economic consequences if Kiev signed the deal. Iran says 'no progress' in nuclear talks so farIran and world powers locked horns in an intense second day of nuclear talks Thursday, with Tehran saying "no progress" was made towards clinching a long-awaited breakthrough deal. Both sides, seeking to end the standoff over Iran's nuclear programme after a decade of rising tensions, stressed however that the talks in Geneva were detailed, serious and constructive. Speculation swirled that US Secretary of State John Kerry and other top diplomats were gearing up to fly to Switzerland to join the talks for the second time in two weeks but this was not confirmed. Raising the pressure, US Senate Majority Leader Harry Reid said in Washington that lawmakers would move to impose new sanctions on Iran in December if there is no deal. This must read story AFP story was posted on the Australia Internet site au.news.yahoo.com Internet site early yesterday morning Australia Eastern Daylight Time. I thank Manitoba reader Ulrike Marx for bringing it to our attention. China's planned crude oil futures may be priced in yuan - SHFEThe Shanghai Futures Exchange (SHFE) may price its crude oil futures contract in yuan and use medium sour crude as its benchmark, its chairman said on Thursday, adding that the bourse is speeding up preparatory work to secure regulatory approvals. China, which overtook the United States as the world's top oil importer in September, hopes the contract will become a benchmark in Asia and has said it would allow foreign investors to trade in the contract without setting up a local subsidiary. "China is the only country in the world that is a major crude producer, consumer and a big importer. It has all the necessary conditions to establish a successful crude oil futures contract," Yang Maijun, SHFE chairman, said at an industry conference. This short Reuters piece, filed from Shanghai, was posted on their website early yesterday morning EST...and is certainly worth reading. I thank Ulrike Marx for her second contribution to today's column. Four King World News Blogs1. William Kaye [#1]: "War in Gold Intensifies as Massive Battle Rages in London". 2. Tom Fitzpatrick: "4 Fantastic Charts Showing Gold is Nearing a Major Turn". 3. Rick Rule: "The End Game, Gold...and What I'm Doing With My Own Money". 4. William Kaye [#2]: "People to Lose Confidence in Dark Forces Ruling West and Japan". Putin victorious as Ukraine postpones ‘trade suicide’, halts talks with E.U. Posted: 22 Nov 2013 02:32 AM PST Facing its most important economic crosswords since the collapse of the Soviet Union, Kiev has aligned itself closer to Russia, and has suspended preparations to sign an E.U. trade deal. Russia has warned a step west towards Europe would be "trade suicide" and result in billions in lost trade revenue and that joining the Russia-led Customs Union is more beneficial. Ukraine will “restore an active dialogue” with the Customs Union and the CIS, and economic and foreign ministers proposed Ukraine, Russia, and the EU create a tri-party commission to improve and strengthen trade relations. Putin's spokesman Dmitry Peskov said Russia welcomed Ukraine's decision to actively develop ties with Moscow, and Putin added he wasn't completely against Ukraine's association with E.U. This article was posted on the Russia Today website Thursday afternoon Moscow time, which was early in the morning in New York. It's another contribution from Roy Stephens...and it's definitely worth reading, especially for all students of the the New Great Game. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Nov 2013 02:32 AM PST 1. William Kaye [#1]: "War in Gold Intensifies as Massive Battle Rages in London". 2. Tom Fitzpatrick: "4 Fantastic Charts Showing Gold is Nearing a Major Turn". 3. Rick Rule: "The End Game, Gold...and What I'm Doing With My Own Money". 4. William Kaye [#2]: "People to Lose Confidence in Dark Forces Ruling West and Japan". | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Paulson Said to Tell Clients He Wouldn’t Add More to Gold Posted: 22 Nov 2013 02:32 AM PST Billionaire hedge-fund manager John Paulson told clients he wouldn’t personally invest more money in his gold fund because its not clear when inflation will accelerate, according to a person familiar with the matter. Paulson, who has been betting that gold would rally as a hedge against inflation as central banks flood the global economy with money, has lost 63 percent year-to-date in the PFR Gold Fund, said the person, who was briefed on the returns and asked not to be identified because the information in private. The fund, which has shrunk to $370 million, with most of that John Paulson’s own money, fell 1.2 percent in October, the person said. The hedge-fund firm will maintain the fund’s positions in gold stocks and let options related to bullion expire, Paulson said at the firm’s annual meeting yesterday in Paulson & Co.’s New York office, according to the person. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Eric Sprott: Could bad data be depressing the gold price? Posted: 22 Nov 2013 02:32 AM PST Sprott Asset Management CEO Eric Sprott addresses gold market manipulation in an interview with J.T. Long at Resource Investor that begins with a discussion of Sprott's complaint about the World Gold Council's gold demand data. Sprott also repeats his speculation that central banks engineered the plunge in the gold price in April to prompt liquidation of the gold held by the exchange-traded fund GLD and thereby relieve a shortage of metal. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Sinclair interviewed on bail-ins, gold market rigging, and a lot more Posted: 22 Nov 2013 02:32 AM PST Sprott Money News' Nathan McDonald has done an excellent and wide-ranging interview with gold advocate and mining entrepreneur Jim Sinclair, covering the probability of the expropriation of depositors at insolvent banks, the chance of hyperinflation, and gold market manipulation. About the latter, Sinclair says: "It's so easy to manipulate gold right now. If you've got the courage and a few dollars behind you, you can enter into the marketplace and offer multiple years of production for sale. If you do that in a period of illiquidity, as you've noticed, right before the first session of the Comex, generally around 8 in the morning U.S. time, or in Asia overnight, when you see those straight lines down, that's because some huge offer has been made when there are no bids in the marketplace indicative of wanting to take it. Therefore it really wasn't because of liquidation; it was because of manipulation. That will go on as long as paper gold goes on." The interview runs for just under 42 minutes...and was posted on the sprottmoney.com Internet site yesterday...and the above two paragraphs of introduction are courtesy or Chris Powell as well. It's definitely worth your while. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| India likely to face gold shortage of 135 tons during H2 FY14 Posted: 22 Nov 2013 02:32 AM PST The latest research report published by HDFC Securities- one of the leading financial service providers, has predicted immense gold supply constraints in India during the second half of the current fiscal year. According to the report, gold availability may continue to suffer with no signs of easing of gold import norms in the near future. According to the report, the 20-30% lower sales witnessed during current festive season was primarily due to a combination of slowdown in discretionary spends and higher gold premiums. The strict restrictions on gold imports had taken gold premiums in the country to record high during the festive season. Further, restriction on import of gold coins has also impacted investment demand. As a result, overall gold demand is likely to be muted on a YoY basis. This short story, filed from Mumbai, was posted on the scrapmonster.com Internet site early yesterday morning GMT...and I thank reader U.D. for bringing it to my attention, and now to yours. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Lawrence Williams: Why low gold prices first lead to production rises before fallin Posted: 22 Nov 2013 02:32 AM PST Investors may become a little puzzled when they see reports prepared by respectable analytical bodies that suggest that annual mined gold output this year is likely to beat last year’s total. Surely, continuing low gold prices, with perhaps half the world's mires at or close to breakeven or below on an all-in-sustaining costs basis have led to mine closures (we have already seen some) and a slowdown in expansions and in new projects being developed? All the above is true! Ultimately a prolonged period of low gold prices will indeed likely see a fall in global output of the precious metal. Mines will close and new projects will be put on hold, but it would have taken time for these to come on stream anyway Natural wastage will take effect as old mines close through depletion of reserves while the new project delays will mean the production from the closures will not necessarily be replaced. However, whether annual gold production rises or falls by what would in any case be a relatively small percentage, is probably irrelevant to the path of the gold price. It is not supply and demand which is currently driving the gold price – if it were the very movement of the huge volume of gold from west to east, which has been so well documented in recent months, would have been sufficient to drive the price far higher – even taking into account the outflows from the ETFs, which have been way more than countered by the eastwards gold flow. There are other bigger forces at play here, forces that are also responsible for changing sentiment with regard to gold and thus persuading weak holders to offload their holdings. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Bullion and Energy Market Commentary Posted: 22 Nov 2013 01:05 AM PST oilngold | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Elliott Wave Technical Analysis Posted: 22 Nov 2013 01:00 AM PST fxstreet | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Rally Resumes as Expected, Gold Breaks October Bottom Posted: 22 Nov 2013 01:00 AM PST forextv | |||||||||||||||||||||||||||||||||||||||||||||||||||

| TECHNICAL Gold Gets a Reprieve before 6/28 Close Posted: 22 Nov 2013 01:00 AM PST dailyfx | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Analysis- Nov. 22, 2013 Posted: 22 Nov 2013 01:00 AM PST dailyforex | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Final Plunge in Precious Metals is Underway Posted: 21 Nov 2013 11:15 PM PST The Daily Gold | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Nov 2013 10:30 PM PST 24hgold |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment