Gold World News Flash |

- Financial Repression Starts Showing Its Ugly Head

- Strange Day

- Rising Number of Americans See China as Dominant World Power in 2020

- Gold is More Than Money

- Filling the China Closet

- Which America Do You Live In? – 21 Hard To Believe Facts About 'Wealthy America' And 'Poor America'

- Guest Post: Is America Being Deliberately Pushed Toward Civil War?

- Who Needs Gold Really?

- UBS Warns The Fed Is Trapped

- Silver and Gold Prices Held Support with the Gold Price Closing at $1,308.40

- Silver and Gold Prices Held Support with the Gold Price Closing at $1,308.40

- Obama: "I Am Sorry" Americans Will Lose Their Existing Health Plan Because Of Obamacare

- Marc Faber Warns "Karl Marx Was Right"

- Why Gold?

- Why Gold?

- Why Gold?

- GATA Chairman Murphy interviewed by TF Metals Report

- Gold Daily and Silver Weekly Charts - ECB Surprise Cut, Non-Farm Payrolls Tomorrow

- Gold Daily and Silver Weekly Charts - ECB Surprise Cut, Non-Farm Payrolls Tomorrow

- How to Be Your Own Central Bank

- Nolan Watson: “Institutional, Generalist & Value Funds Are Now Preparing To Jump In On Gold & Miners”

- Trust Gold & Silver, Not Governments

- Trust Gold & Silver, Not Governments

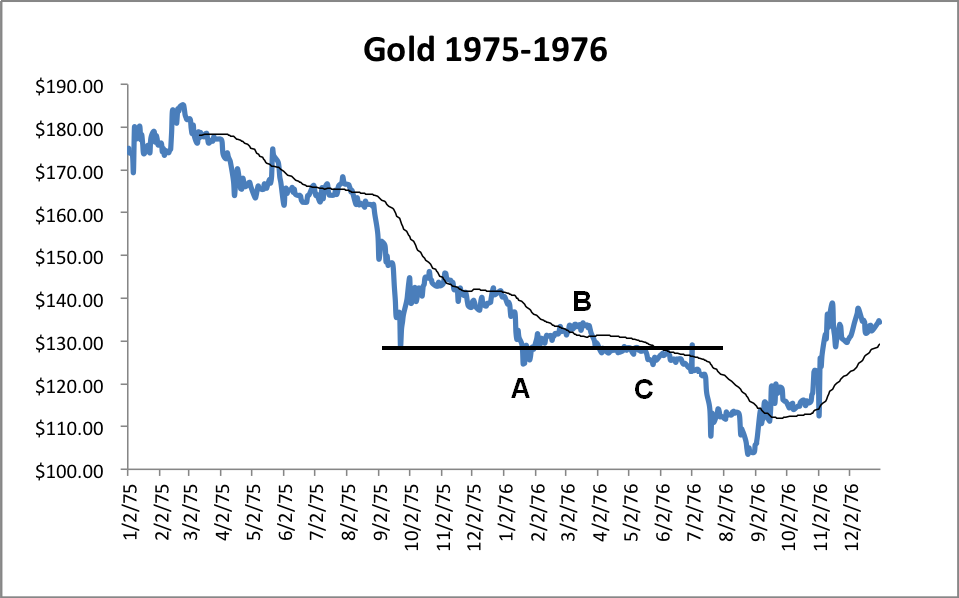

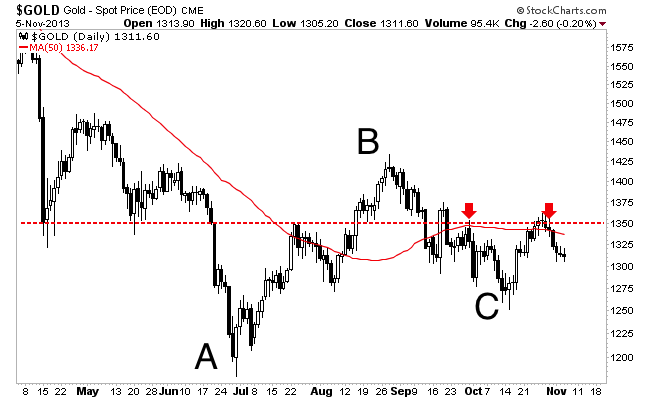

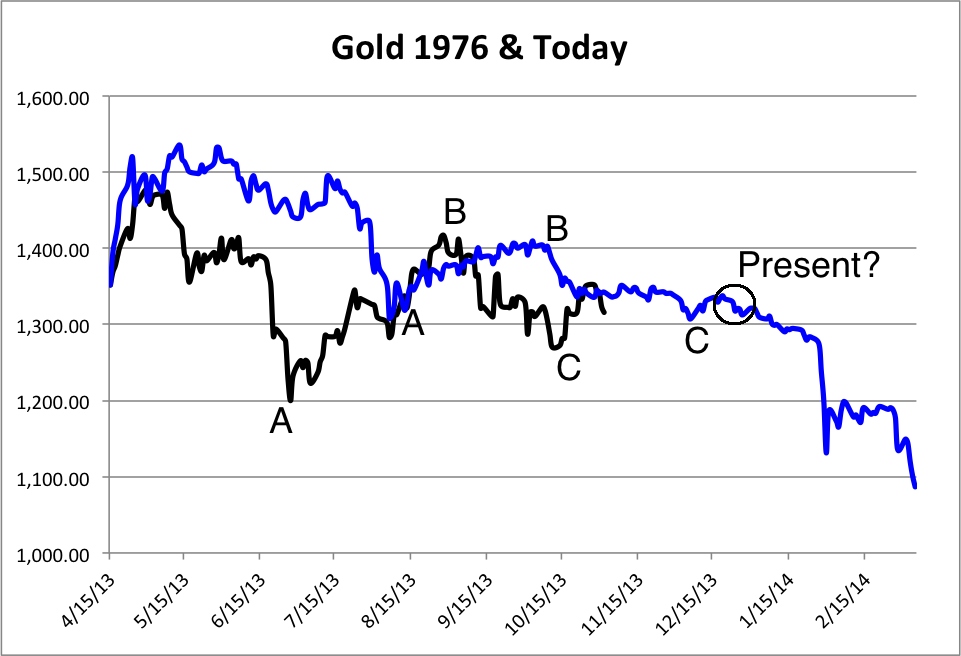

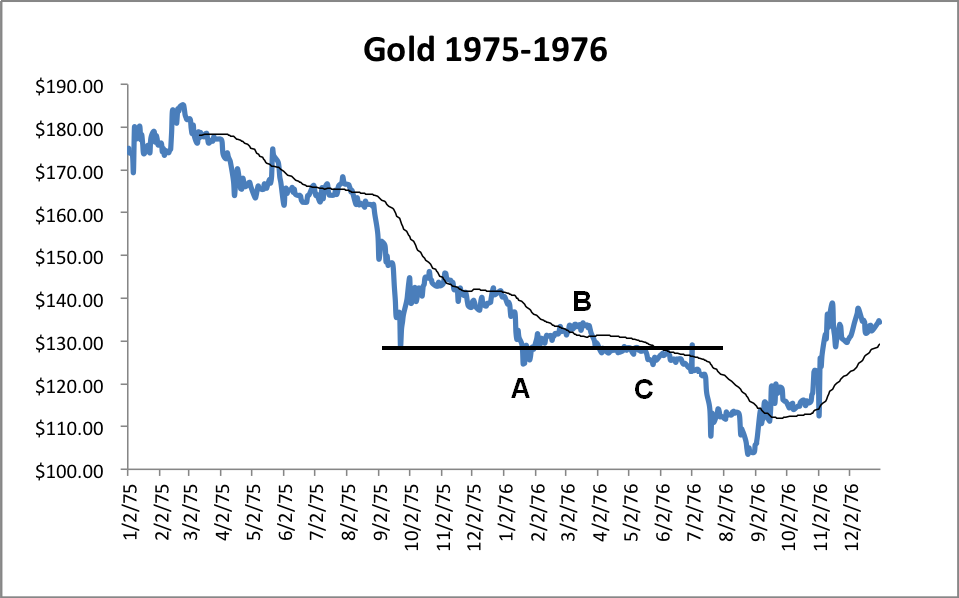

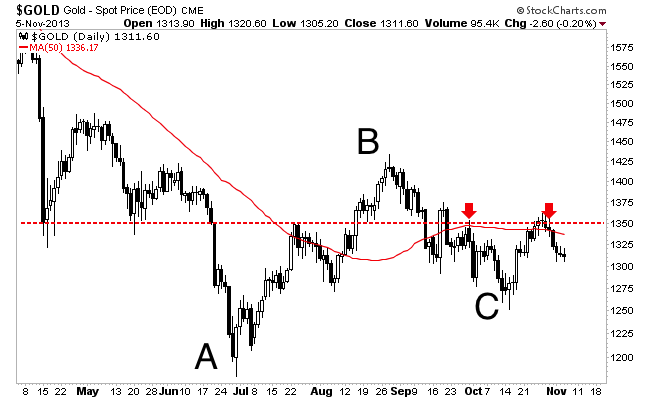

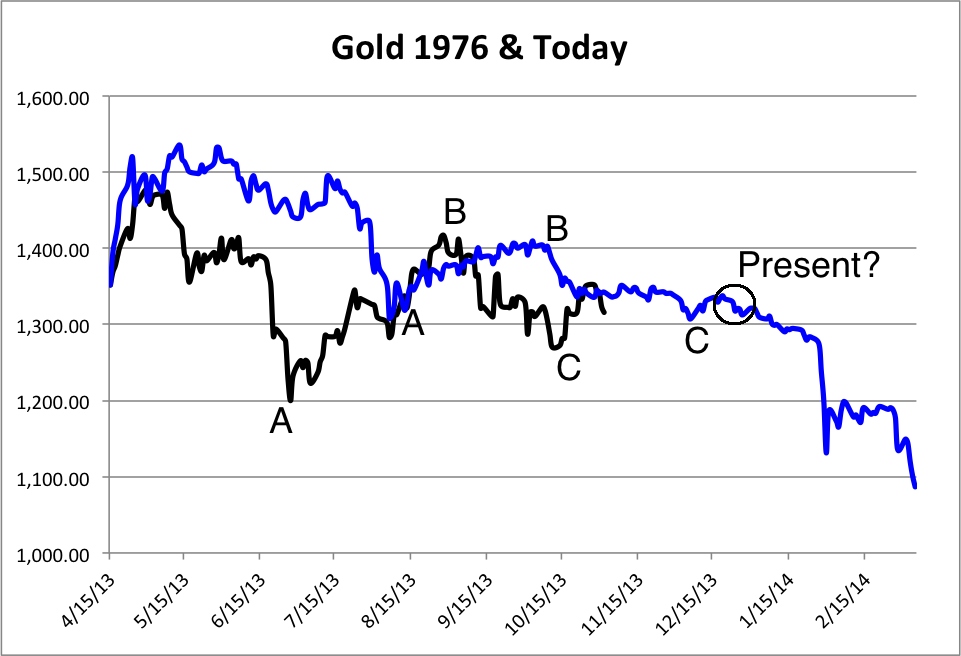

- Gold Chart's Low Rhymes with History

- Gold Chart's Low Rhymes with History

- 7 Years to New Gold Price Highs

- 7 Years to New Gold Price Highs

- Energy Commodity Cycle Turns

- Energy Commodity Cycle Turns

- Slavery in the Digital Age

- Market Monitor – November 7th

- End Game - “They Don’t Want People Protecting Themselves”

- London Metal Exchange increases power to shorten warehouse queues

- The Daily Market Report: Gold Retreats on ECB Rate Cut, US GDP Beat

- Gold Solution to The Biggest Fear in Retirement

- Gold Markets are not Efficient, Don't Reflect Fundamentals and Understate Gold's Market Value (Part 7)

- Silver – Major Advances In Industrial Applications

- China National Gold weighs investing in Ivanhoe assets

- Surprise ECB rate cut helps lift gold

- German bullion retailer Degussa buys Sharps Pixley

- Fresh money is needed for gold equities to recover

- Amara taps Amway family wealth to boost gold prospects

- ECB Surprise Interest Rate Cut & US Growth Whip Soporofic Gold Market

- Gold Price Forecast to Fall to $1180

- 2 Miner Developments in the Big Gold Sector

- Gold Bear to End with a Bang

- Gold slides to new low for the week as Q3 advance GDP beat heightens taper expectations.

- Gold Prices Volatile, Dip Below $1300 on ECB Rate Cut, Strong US GDP Data

- Financial Repression Starts Showing Its Ugly Head

- People's Bank of China "Buying Gold, Supports Prices"

| Financial Repression Starts Showing Its Ugly Head Posted: 07 Nov 2013 11:00 PM PST by Taki, Gold Silver Worlds:

During the first years after the financial crisis of 2008, the markets reacted in line with what one would expect from additional liquidity: stocks recovered from the crash, interest rates were pushed down, most commodities have gone up, and precious metals were the best performers. Most currencies have been whipsawing. |

| Posted: 07 Nov 2013 10:00 PM PST from Dan Norcini:

As mentioned in today’s earlier post, gold has been all over the place. If you look at the 12 hour chart posted below, you can see one big candle with a large upper shadow and a large lower shadow. Would you like me to translate what this means in trader lingo? Here we go:” What in the hell is going on in this market?” |

| Rising Number of Americans See China as Dominant World Power in 2020 Posted: 07 Nov 2013 09:00 PM PST by George Leong, Investment Contrarians:

Anti-Chinese real estate pundits were saying to sell. "Chinese companies are crooks," was a common theme and the communist regime there was not to be trusted by anyone, especially Americans, according to these talking heads. While I do believe China has its issues and faults (heck, we all do!), the opportunity there for growth investors cannot be ignored; the country will continue to become a bigger influence in the global economy. I'm not saying the renminbi will become the go-to currency, but the economic influence of the country will only grow, especially in Africa and other emerging markets where capital is needed—we all know China isn't hurting for cash. |

| Posted: 07 Nov 2013 08:49 PM PST There are many Keynesian guys that state that gold isn't money. However, it's more than money. It represents freedom and enables the govt to live within their means. [[ This is a content summary only. Visit http://goldbasics.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 07 Nov 2013 07:32 PM PST Nichols on Gold |

| Which America Do You Live In? – 21 Hard To Believe Facts About 'Wealthy America' And 'Poor America' Posted: 07 Nov 2013 06:24 PM PST Submitted by Michael Snyder of The Economic Collapse blog, Did you know that 40 percent of all American workers make less than $20,000 a year before taxes? And 65 percent of all American workers make less than $40,000 a year before taxes. If you work on Wall Street, or have a cushy job with the federal government, or work for a big tech firm out on the west coast, life is probably pretty good for you right now. But the truth is that most Americans are not living the high life. In fact, most Americans are just trying to figure out how to survive from month to month. For many Americans, making a choice between buying food for your family and paying the light bill is a common occurrence. But if you don't live in that America, hearing that people actually live like that may sound very strange to you. After all, if everyone around you has expensive cars, the latest electronic gadgets and million dollar homes, the notion that America is in the midst of a very serious "economic decline" may seem very bizarre to you. On Wednesday, the Dow hit a brand new record high, and Wall Street celebrated. Since the financial crisis of 2008, stocks have been on an unprecedented run. The top performers in the market have not just made millions of dollars - they have made billions of dollars. Luxury apartments in Manhattan and beachfront homes in the Hamptons are selling for absolutely astronomical prices, and it seems like life in the good parts of New York City is one gigantic endless party these days. Meanwhile, life is quite good down in Washington D.C. as well. The wealth is spread more evenly, but on average the D.C. region actually has the highest standard of living of any major U.S. city. The reason for this is the obscene growth of the federal government. Over the past couple of decades, the U.S. government has ballooned in size and so have government salaries. During one recent year, the average federal employee living in the Washington D.C. area received total compensation worth more than $126,000. Out in the San Francisco area, Internet money is flowing like wine right now. As I wrote about yesterday, top employees of companies such as Facebook and Twitter can make millions of dollars a year. And if you were lucky to get a piece of the ownership of one of those companies at a very early stage, you are essentially set for life. And with the Twitter IPO coming up, Internet euphoria is once again reaching a fever pitch. For example, just check out what a 56-year-old administrative assistant said this week about why she is going to buy Twitter stock...

Is that how we should make our investment decisions from now on? Just buy a stock because everybody's talking about it? That is the kind of insanity that is going on in "wealthy America" right now. Unfortunately, the gap between "wealthy America" and "poor America" is greater than ever before. If you live in "wealthy America", what you are about to hear next will probably sound very strange. CNN recently profiled a 44-year-old overnight prison guard named Delores Gilmore. She works really hard, but a lot of times she simply does not have enough money to pay all of her bills...

Her life consists of going to work, taking care of her children, going to sleep, and then getting back up and repeating that same cycle once again...

Sadly, the truth is that tens of millions of Americans can identify with what she is going through on a daily basis. In millions of families, both the husband and the wife work multiple jobs and it is still not enough. If we truly did have a free market capitalist system, the entire country would be a land of opportunity and things would be getting better for everybody. Unfortunately, that is not the case at all. The following are 21 facts about "wealthy America" and "poor America" that are hard to believe... #1 The lowest earning 23,303,064 Americans combined make 36 percent less than the highest earning 2,915 Americans do. #2 40 percent of all American workers (39.6 percent to be precise) make less than $20,000 a year. #3 According to the Pew Research Center, the top 7 percent of all U.S. households own 63 percent of all the wealth in the country. #4 On average, households in the top 7 percent have 24 times as much wealth as households in the bottom 93 percent. #5 According to numbers that were just released this week, 49.7 million Americans are living in poverty. That is a brand new all-time record high. #6 In the United States today, the wealthiest one percent of all Americans have a greater net worth than the bottom 90 percent combined. #7 Household incomes have actually been declining for five years in a row and total consumer credit has risen by a whopping 22 percent over the past three years. #8 According to Forbes, the 400 wealthiest Americans have more wealth than the bottom 150 million Americans combined. #9 The homeownership rate in the United States is at an 18 year low. #10 The six heirs of Wal-Mart founder Sam Walton have as much wealth as the bottom one-third of all Americans combined. #11 18 percent of all food stamp dollars are spent at Wal-Mart. #12 According to the U.S. Census Bureau, the middle class is taking home a smaller share of the overall income pie than has ever been recorded before. #13 It is hard to believe, but right now 1.2 million students that attend public schools in America are homeless. That number has risen by 72 percent since the start of the last recession. #14 One recent study discovered that nearly half of all public students in the United States come from low income homes. #15 In 1980, CEOs at S&P 500 companies made 42 times as much as their employees did on average. Today, CEOs at S&P 500 companies make 354 times as much as their employees do on average. In fact, there are many CEOs that make more than 1000 times what the average employees in their companies make. #16 U.S. families that have a head of household that is under the age of 30 have a poverty rate of 37 percent. #17 At this point, one out of every four American workers has a job that pays $10 an hour or less. #18 Today, the United States actually has a higher percentage of workers doing low wage work than any other major industrialized nation does. #19 Approximately one out of every five households in the United States is now on food stamps. #20 The number of Americans on food stamps has grown from 17 million in the year 2000 to more than 47 million today. #21 At this point, the poorest 50 percent of all Americans collectively own just 2.5 percent of all the wealth in the United States. So which America do you live in? |

| Guest Post: Is America Being Deliberately Pushed Toward Civil War? Posted: 07 Nov 2013 05:28 PM PST Submitted by Brandon Smith of Alt-Market blog, In 2009, Jim Rickards, a lawyer, investment banker and adviser on capital markets to the Director of National Intelligence and the Office of the Secretary of Defense, participated in a secret war game sponsored by the Pentagon at the Applied Physics Laboratory (APL). The game’s objective was to simulate and explore the potential outcomes and effects of a global financial war. At the end of the war game, the Pentagon concluded that the U.S. dollar was at extreme risk of devaluation and collapse in the near term, triggered either by a default of the U.S. Treasury and the dumping of bonds by foreign investors or by hyperinflation by the private Federal Reserve. These revelations, later exposed by Rickards, were interesting not because they were “new” or “shocking.” Rather, they were interesting because many of us in the field of alternative economics had ALREADY predicted the same outcome for the American financial system years before the APL decided to entertain the notion. At least, that is what the public record indicates. The idea that our government has indeed run economic collapse scenarios, found the United States in mortal danger, and done absolutely nothing to fix the problem is bad enough. I have my doubts, however, that the Pentagon or partnered private think tanks like the RAND Corporation did not run scenarios on dollar collapse long before 2009. In fact, I believe there is much evidence to suggest that the military industrial complex has not only been aware of the fiscal weaknesses of the U.S. system for decades, but they have also been actively engaged in exploiting those weaknesses in order to manipulate the American public with fears of cultural catastrophe. History teaches us that most economic crisis events are followed or preceded immediately by international or domestic conflict. War is the looming shadow behind nearly all fiscal disasters. I suspect that numerous corporate think tanks and the Department Of Defense are perfectly aware of this relationship and have war gamed such events as well. Internal strife and civil war are often natural side effects of economic despair within any population. Has a second civil war been “gamed” by our government? And are Americans being swindled into fighting and killing each other while the banksters who created the mess observe at their leisure, waiting until the dust settles to return to the scene and collect their prize? Here are some examples of how both sides of the false left/right paradigm are being goaded into turning on each other. Conservatives: Taunting The Resting Lion Conservatives, especially Constitutional conservatives, are the warrior class of American society. The average conservative is far more likely to own a firearm, have extensive tactical training with that firearm, have military experience and have less psychological fear of conflict; and he is more apt to take independent physical action in the face of an immediate threat. Constitutional conservatives are also more likely to fight based on principal and heritage, rather than personal gain, and less likely to get wrapped up in the madness of mob activity. What’s the greatest weakness of conservatives? It’s their tendency to entertain leadership by men who claim exceptional warrior status, even if those men are not necessarily honorable. Constitutional conservatives are the most substantial existing threat to the establishment hierarchy because, unlike dissenting groups of the past, we know exactly who the guiding hand is behind economic and social calamity. In response, the overall conservative culture has come under relentless attack by the establishment using the Administration of Barack Obama as a middleman. The goal, I believe, is to misdirect conservative rage toward the Democratic left and away from the elites. The actions of the White House have become so absurd and so openly hostile as of late that I can only surmise that this is a deliberate strategy to lure conservatives into ill-conceived retaliation against a puppet government, rather than the men behind the curtain. Department of Defense propaganda briefings with military personnel have been exposed. These briefings train current serving soldiers to view Tea Party conservatives and even Christian organizations as “dangerous extremists.” Reports from sources within Fort Hood and Fort Shelby confirm this trend. The DOD has denied some of the allegations or claimed that it has “corrected” the problem; however, Judicial Watch has obtained official training documents through a Freedom of Information Act request that affirm that extremist profiling is an integral part of these military briefings. The documents also cite none other than the Southern Poverty Law Center (SPLC) as a primary resource for the training classes. The SPLC is nothing more than an outsourced propaganda wing for the DHS that attacks Constitutional organizations and associates them with terrorist and racist groups on a regular basis. (Check pages 32-33.) This indoctrination program has accelerated since January 2013, after Professor Arie Perliger, a member of a West Point think tank called Combating Terrorism Center (and according to the sparse biographical information available, a man with NO previous U.S. military experience), published and circulated a report called “Challengers From The Sidelines: Understanding America’s Violent Far Right” at West Point. The report classified “far right extremists” as “domestic enemies” who commonly “espouse strong convictions regarding the federal government , believing it to be corrupt and tyrannical, with a natural tendency to intrude on individuals’ civil and constitutional right." The profile goes on to list supporting belief in "civil activism, individual freedoms, and self government” as the dastardly traits of evil extremists. Soldiers have been told that associating with “far right extremist groups” could be used as grounds for court-martial. A general purge of associated symbolism has ensued, including new orders handed down to Navy SEALs that demand that operators remove the “Don’t Tread On Me” Navy Jack patch from their uniforms. The indoctrination of the military also follows on the heels of a massive media campaign to demonize Constitutional conservatives who fought against Obamacare in the latest debt ceiling debate as “domestic enemies” and “terrorists.” I documented this in my recent article “Are Constitutional Conservatives Really the Boogeyman?” Obama and his ilk have been caught red-handed in numerous conspiracies, including Fast and Furious, which shipped American arms through the Bureau of Alcohol, Tobacco, Firearms and Explosives into the hands of Mexican drug cartels. And how about the exposure of the IRS using its bureaucracy as a weapon to harass Tea Party organizations and activists? And what about Benghazi, Libya, the terrorist attack that Barack Obama and Hillary Clinton allowed to happen, if they didn’t directly order it to happen? And let’s not forget about the Edward Snowden revelations, which finally made Americans understand that mass surveillance of our population is a constant reality. To add icing to the cake, a new book called Double Down, which chronicles the Obama campaign of 2012, quotes personal aides to the President who relate that Obama, a Nobel Peace Prize winner, when discussing his use of drone strikes, bragged that he was “really good at killing people.” Now, my question is, why would the Obama Administration make so many “mistakes,” attack conservatives with such a lack of subtlety, and attempt to openly propagandize rank-and-file soldiers, many of whom identify with conservative values? Is it all just insane hubris, or is he serving his handlers by trying to purposely create a volatile response? Liberals: Taking Away The Cookie Jar Many on the so-called “left” are socially oriented and find solace in the functions of the group, rather than individualism. They seek safety in administration, centralization and government welfare. Wealth is frowned upon, while “redistribution” of wealth is cheered. They see government as necessary to the daily survival of the nation, and they work to expand Federal influence into all facets of life. Some liberals do this out of a desire to elevate the poverty-stricken and ensure certain educational standards. However, they tend to ignore the homogenizing effect this strategy has on society, making everyone equally destitute and equally stupid. Their faith in government subsidies also makes them vulnerable to funding cuts and reductions in entitlements. The left normally fights only when their standard of living and comfort to which they have grown accustomed plummets below a certain threshold, and mob methods are usually their fallback form of retaliation. Austerity cuts, which the mainstream media calls the “sequester,” are beginning to take effect. But, they are being applied in areas that are clearly meant to create the most public anger. Reductions in welfare programs are also being implemented in a way that will certainly agitate average left-leaning citizens. The debt debate itself revolved around those who want the government to spend within its means versus those who want the government to spend even more on welfare programs no matter the consequence. The loss of subsidies is at bottom the greatest fear of the left. A sudden and inexplicable shutdown of electronic benefit transfer cards (EBT cards or food stamps) occurred in more than 17 States while the debt debate just happened to be climaxing. This month, cuts to existing food stamp funds have taken effect, and food pantries across the country are scrambling against a sharp spike in demand. Remember, about 50 million Americans are currently dependent on EBT welfare in order to feed themselves and their families. The response to the relatively short EBT shutdown last month was outright fury. Imagine the response in the event of a long-term shutdown, or if extraneous cuts were to occur? And where would that anger be directed? Since the entire debt debacle has been blamed on the Tea Party, I suspect conservatives will be the main target of welfare mobs. The left, once just as opposed to government stimulus and banker bailouts as the right, is now unwittingly throwing its support behind infinite stimulus in order to cement the continued existence of precious Federal handouts. The issue of Obamacare has utterly blinded liberals to fiscal responsibility. Universal healthcare, perhaps the ultimate Federal handout, is a prize too titillating for them to ignore. Democrats will now go to incredible lengths to defend the Obama White House regardless of past crimes. They are willing to ignore his offenses against the 4th Amendment and personal privacy. They are willing to look past his offenses against the 1st Amendment, including the Constitutional right to trial by jury for all Americans, and Obama’s secret war against the free speech of whistle-blowers. They are willing to shrug off his endless warmongering in the Mideast, his attempts to foment new war in Syria and Iran, and his support for predator drone strikes in sovereign nations causing severe civilian collateral damage. They are willing to forget Snowden, mass surveillance and executive assassination lists — all for Obamacare. And the saddest thing of all? It is likely that Obamacare was never meant to be successful in the first place. Does anyone really believe that the White House, with billions of dollars at its disposal, could not get a website off the ground if it really wanted to? Does anyone really believe that Obama would launch the crowning jewel of his Presidency without making certain that it was fully operational, unless this was part of a greater scheme? And how about his promise that pre-existing health care plans would not be destroyed by Obamacare mandates? Over 900,000 people in the state of California alone are about to lose their health care insurance due to the Affordable Healthcare Act. Why would Obama go back on such a vital pledge unless he WANTED to piss off constituents? Already, liberal websites and forums across the blogosphere are abuzz with talk of sabotage of the Obamacare website by “the radical right” and the diabolical Koch Brothers (liberals had no idea who they were a year ago, but now, they the go to scapegoat for everything). Once again, conservatives are presented as the culprits behind all the left’s troubles. As I have stated in the past, Obamacare is designed to fail. The government has no capacity to fund it, and never will. Its only conceivable purpose is to further divide the country and excite both sides of the false paradigm into attacking each other as the reason the system is failing, when both sides should be questioning whether the current system should exist at all. As the situation stands today, at least 50 million welfare recipients and who knows how many others exist as a resource pool for the establishment to be used to wreak havoc on the rest of us. All they have to do is take away the cookie jar. Who Would Win? Who would prevail in a second American civil war? Tactically speaking, conservatives have the upper hand and are far better prepared. Food rioters wouldn’t last beyond three to six weeks as starvation takes its toll, and mindless mobs would not last long against seasoned riflemen. The military, though suffering purges by the White House, still contains numerous conservatives within its ranks. Outside influences, including NATO or the United Nations, are a possibility. There are numerous factors to consider. But I would point out that the most dangerous adversary Constitutional conservatives face is not the left, Obama, or a Federal government gone rogue. Rather, our greatest adversary is ourselves. If lured into a left/right civil war, would most conservatives be able to see beyond the veil and recognize that the fight is not about Obama, or the Left, or tyrannical government alone? Could we be co-opted by devious influences disguised as friends and compatriots? Will we end up following neocon salesmen and military elites who materialize out of the woodwork at the last minute to "lead us to victory" while actually leading us towards globalization with a slightly different face? If a civil conflict has been war gamed by the establishment, you can bet they have contingency plans regardless of which side attains the upper hand. In the end, if we do not make the fight about the bankers and globalists, the Federal Reserve, the International Monetary Fund, the Council On Foreign Relations, etc., then everyone loses. Who wins in a new American civil war? If we become blinded by the trespasses of a certain White House jester, only the globalists will win. |

| Posted: 07 Nov 2013 04:28 PM PST Four reasons to waste your time with the deeply historic, deeply human value ascribed to gold. People love to debate, but sadly sometimes it crosses a line and turns argumentative. That's what is happening right now with the debate over gold. Read More... |

| Posted: 07 Nov 2013 04:04 PM PST The Fed seems to be facing two major risks: first, premature tapering disrupting markets and triggering global turmoil across asset classes, thereby threatening the fragile economy recovery; second, delayed tapering further fuelling asset price bubbles, which could burst eventually and do major damage. UBS' Beat Siegenthaler notes the September decision suggested a Fed more worried about the fragile recovery than about the potential for asset bubbles and other longer-term problems associated with extended liquidity injections. Whereas it had originally assumed that a gradual tapering would result in a gradual market reaction, Siegenthaler explains it is now clear that the situation is much more binary; and as such, the hurdles for tapering might be substantially higher than originally thought. Via UBS, Central bankers seem more powerful than ever, yet also more divided and confused than for a long time. This may be particularly true for the Fed, as it struggles with how to exit unconventional policies without creating major global market turmoil. In September it shied away from reducing monthly QE purchases, surprising both markets and central bank colleagues around the world. UBS Economics now expects tapering to start in Q1 2014 with the January meeting seen as somewhat more likely than the March meeting. The risks to this call, though, seem almost entirely on the dovish side as a December move would be tantamount to admitting that September was a mistake given the likely lack of decisive data until then. For the dollar, this could keep things difficult for some time. Looking back... Why did the Fed decide to hold back in September, deeply puzzling investors who had very widely expected a move, and thereby putting the credibility of its communication strategy at risk? It appears that two arguments were decisive:

Relatively soft economic data since the decision have so far seemed to vindicate the decision as has the subsequent political turmoil in Washington. However, many observers, particularly in Europe, have been critical on the political aspect of the decision as the FOMC seemed to 'bail out' the politicians and thus risk creating moral hazard. It would seem fair to say that the ECB, for example, would have acted rather differently in similar circumstances. President Draghi's pledge in summer 2012 to do 'whatever it takes' was the exception to the general ECB rule that monetary policy is not there to address structural problems that are the politicians' responsibility. In Frankfurt, nonconventional policies are seen as something to get rid of as soon as possible rather than something to retain as an insurance policy. It was no coincidence that in June this year Draghi said with quite some satisfaction that 'we, unlike other central banks, can gradually downsize our balance sheet without having to take any decisions that would, or could, create volatility'. This, clearly, is not a luxury the Fed has. ...and looking forward The Fed is facing two major but opposing risks:

The emerging market collapse in early summer may have been just a harbinger of what could come once central bank liquidity injections end. Some observers have argued that the market will react in a more relaxed manner to the next round of taper talk as the issues would be familiar. However, this might be too optimistic a view. Equity markets have continued to rally with the S&P reaching new record highs while 'carry' currencies such as the Australian dollar have regained lost ground, even though the advance has since been capped by the October FOMC statement not shutting the window on early tapering. Given that it has generally been a lacklustre year for most investors, the pressure is to jump back into riskier trades and generate some more performance before year end, even if the tail risk of early tapering might continue to loom. In this situation, any piece of weak data and any dovish communication could push tapering expectations further out and lure investors back into risk, thereby increasing the cost of the inevitable exit. Linear vs. binary Ideally, the Fed would gradually exit QE as the recovery gradually gains ground. Indeed, this seems to have been the idea behind the tapering talk in early summer, trying to prepare markets for an initial step later in the year. The belief had been that what investors cared about was the stock of QE purchases, i.e. the overall size of the Fed's balance sheet. As it turned out, however, investors seem to care about the flow of QE purchases instead. Or even worse, they seem to hold a binary view, equating the start of tapering to the end of QE, which means positioning does not adapt in linear, but an abrupt way. It therefore does not matter much whether the initial reduction would be $10bn or $20bn as the market would read any move, whatever the number, as a signal that the monetary policy super tanker had started to turn. Or as St. Louis Fed President Bullard put it last week, "changes in the pace of asset purchases have a very similar financial market effect as changes in the policy rate during more normal times", meaning that any tapering acts very much like a conventional rate hike. "The Committee needs to either convince markets that the two tools are separate, or learn to live with the joint effects of tapering on both the pace of asset purchases and the perception of future policy rates". Bullard seems to believe that the Fed has to live with the joint effects, which would suggest that the hurdle for tapering is much higher than initially thought. A clash of central banking traditions So what should the Fed do? Few central bankers would dispute that there are risks to keeping nonconventional policy measures in place for an extended period of time. In fact, the marginal benefits in terms of the economic impact seem to be declining, while the risks in terms of asset bubbles and other distortions seems to be increasing. Many would also argue that keeping 'emergency measures' in place beyond the actual 'emergency' sends out a bearish signal to investors, keeping confidence down. Central bankers in the European, or more specifically the Bundesbank tradition, would thus argue that given the doubtful benefits of QE together with the increasing longer term risks, the policy should be stopped as soon as possible. The Anglo-Saxon tradition, however, would seem more willing to use asset prices as a tool to support economic activity, and have a higher willingness to accept the risk of bubbles. Indeed, a fear of an asset price shock appears to have been what kept the Fed from taking the plunge in September, and might continue to hold them back for some time. The majority of the FOMC might be seeing propping up asset prices as a second best way to keep sentiment up, in the absence of a convincing economic recovery as the first best solution. Policy trap A pessimist might see the Fed facing a lose-lose situation, a veritable policy trap. The only scenario in which a relatively painless escape from the trap would be possible is one in which the economic recovery gains ground and becomes robust relatively quickly. This seems exactly what equity markets are pricing in, i.e. a world in which global economic activity will seamlessly take over from QE as a driver of risky assets. UBS Economics has been drawing a picture that looks fairly close to such a benign scenario, expecting a slow but steady acceleration of global growth over the next two years. Monetary policy accommodation could then be withdrawn gradually, avoiding substantial market turmoil (UBS Global Economic Outlook 2014-2015, 28 October). Viewed from this perspective, the likelihood of the Fed unduly fuelling asset bubbles might thus be considerably higher than the one of prematurely reducing QE and triggering market turmoil, particularly as the track record of the Bernanke Fed, as well as the reputation of incoming Chair Yellen, would suggest that monetary policy in the US will err on the easy side for some time to come. All of this might continue to support risky assets and weigh on the dollar, but also increase the risk of a crash once QE inevitably comes to an end. Conclusions The Fed seems to be facing two major risks: first, premature tapering disrupting markets and triggering global turmoil across asset classes, thereby threatening the fragile economy recovery; second, delayed tapering further fuelling asset price bubbles, which could burst eventually and do major damage. The September decision suggested a Fed more worried about the fragile recovery than about the potential for asset bubbles and other longer term problems associated with extended liquidity injections. Whereas it had originally assumed that a gradual tapering would result in a gradual market reaction, it now appears that the situation is much more binary. If so, the hurdles for tapering might be substantially higher than originally thought. For investors, the situation is a very challenging one: should they position for a QE world in which risky assets perform well, or for a QE-free world in which risky assets suffer? For the Fed, the ideal scenario might be one where they succeed in keeping the tapering threat alive without actually going there, thereby avoiding both of the above risks. For investors, the resulting low activity and low volatility environment might be challenging. For the dollar, the future of QE seems crucial. A clean exit sometime next year would be a major positive driver and this is what investors generally appear to position for, or at least believe in. However, the danger may be that these hopes will continue to be disappointed by a risk-averse Fed, which could thus extend the dollar's underperformance for quite some time. |

| Silver and Gold Prices Held Support with the Gold Price Closing at $1,308.40 Posted: 07 Nov 2013 03:33 PM PST Gold Price Close Today : 1308.40 Change : -9.30 or -0.71% Silver Price Close Today : 21.639 Change : -0.107 or -0.49% Gold Silver Ratio Today : 60.465 Change : -0.130 or -0.21% Silver Gold Ratio Today : 0.01654 Change : 0.000036 or 0.22% Platinum Price Close Today : 1455.00 Change : -10.60 or -0.72% Palladium Price Close Today : 758.60 Change : -5.70 or -0.75% S&P 500 : 1,747.15 Change : -23.34 or -1.32% Dow In GOLD$ : $246.37 Change : $ (0.66) or -0.27% Dow in GOLD oz : 11.918 Change : -0.032 or -0.27% Dow in SILVER oz : 720.64 Change : -3.49 or -0.48% Dow Industrial : 15,593.98 Change : -152.90 or -0.97% US Dollar Index : 80.850 Change : 0.360 or 0.45% What did the silver and GOLD PRICES do today? Well, for all the bubbling and bloviating about the higher dollar, they did no more than fall back to the bottom of the same range they've been trading in for more than a week. Think about those stock index losses today when you consider that silver fell only 0.5% or 10.7 cents to 2163.9 while the GOLD PRICE fell 0.7% or $9.30 to $1,308.40. Do those numbers sound familiar? Well, I'll be durned. The gold price gained $9.70 yesterday, and lost $9,30 today, and closed near $1,308 again. The SILVER PRICE lost 10.7c today and gained 13.2c yesterday, and is right hear around 2160c again. But take this home: they did not break that support today. They held. Both did sort of puncture my uptrend line, but closed right at it. Pretty good, all things considered. All this monetary folly, this criminal lunacy, will not end well. It's liable to break out in a hyperinflation, and whatever happens the US government will default and after the dust settles, the dollar won't be the reserve of anything anymore. Only protection I know is to convert US dollars to silver and gold. But what do I know? I'm only a natural born durn'd fool from Tennessee. What am I compared to all them Harvard and New York smarties that have never turned a peg or earned a paycheck a day in their lives? Why, I'm so durned ignerunt I can't even understand how they make anvils fly. Every time I look at the stock market, I feel like a tee-totaling celibate at a Roman orgy: I just don't see nothing that interests me. Yesterday I mentioned that the stock index choir was singing out of tune, Dow making new highs and other indices down. Well, today they puked all over their choir robes, to wit: Dow lost 152.90 or 0.97% to 15,593.98 S&P500 lost 23.34 or 1.32% to 1,747.15 Nasdaq lost 74.62 or 1,90% to 3,857.33 Nasdaq 100 lost 63.97 or 1.89% to 3,321.41 Russell 2000 lost 19.54 or 1.78% to 1,079.09. Wilshire 5000 lost 276.11 or 1.47% to 18,548.79. You all can brag about your outsized stock gains and all the pointy-shoe types on Wall Street can puff out their chests, but this market is floating on hot money, not economic outlook, and is as nervous as a lame mouse at a cat convention. And it will probably get worse tomorrow. Andith the twisted logic of a basement full of mouth-foaming, hair-tearing lunatics, reported US GDP rose today and sent the dollar shooting up. Now think about that: back in July the yankee government announced it was "revising" the way it figures GDP, which being translated is, "we're jimmying the numbers so you oafs won't realize how badly we are shafting you." There's only one way you can tell a government spokesman is lying: are his lips moving? GDP numbers have now become as deceptive and meaningless as unemployment numbers or government deficit projections or Viet Nam war casualty reports. Anyway, the press spun it this way: if GDP improves, the Fed can "taper" sooner and stop injecting so much hot new money. Tennessee hogwash. They've got the stock market and economy so addicted to Quantitative Easing right now there's no way they can stop. No way. Remember, I said it, and you can quote me. Write it on the wall, hoping you can get to rub my nose in it later. You won't. The very thought of Fed tapering today gave the entire stock market world the wastebasket heaves. Add to this panic the ECB which lowered its interest rate today to a number nearer zero than it already was: 0.25%. Dollar index jumped to 80.85, up 36 basis points or 0.45%, and it pushed the euro off a cliff. Literally. Euro dropped 0.73% to $1.3416, headed for its 200 Dma ($1.3231) and further infamy and humiliation. After all, the Europeans have the world's second most over-indebted and putrescent economy and most rotten banks (after Japan), and their currency now pays no more interest than the US dollar. What I can't parse because there's something I'm not seeing is that the yen reversed mightily upward, gaining 0.61% to 101.96 cents/Y100, with a high not far from the 102.60 200 DMA. I don't know what drove the yen higher and I don't care, since I wouldn't buy yen with YOUR money. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Silver and Gold Prices Held Support with the Gold Price Closing at $1,308.40 Posted: 07 Nov 2013 03:33 PM PST Gold Price Close Today : 1308.40 Change : -9.30 or -0.71% Silver Price Close Today : 21.639 Change : -0.107 or -0.49% Gold Silver Ratio Today : 60.465 Change : -0.130 or -0.21% Silver Gold Ratio Today : 0.01654 Change : 0.000036 or 0.22% Platinum Price Close Today : 1455.00 Change : -10.60 or -0.72% Palladium Price Close Today : 758.60 Change : -5.70 or -0.75% S&P 500 : 1,747.15 Change : -23.34 or -1.32% Dow In GOLD$ : $246.37 Change : $ (0.66) or -0.27% Dow in GOLD oz : 11.918 Change : -0.032 or -0.27% Dow in SILVER oz : 720.64 Change : -3.49 or -0.48% Dow Industrial : 15,593.98 Change : -152.90 or -0.97% US Dollar Index : 80.850 Change : 0.360 or 0.45% What did the silver and GOLD PRICES do today? Well, for all the bubbling and bloviating about the higher dollar, they did no more than fall back to the bottom of the same range they've been trading in for more than a week. Think about those stock index losses today when you consider that silver fell only 0.5% or 10.7 cents to 2163.9 while the GOLD PRICE fell 0.7% or $9.30 to $1,308.40. Do those numbers sound familiar? Well, I'll be durned. The gold price gained $9.70 yesterday, and lost $9,30 today, and closed near $1,308 again. The SILVER PRICE lost 10.7c today and gained 13.2c yesterday, and is right hear around 2160c again. But take this home: they did not break that support today. They held. Both did sort of puncture my uptrend line, but closed right at it. Pretty good, all things considered. All this monetary folly, this criminal lunacy, will not end well. It's liable to break out in a hyperinflation, and whatever happens the US government will default and after the dust settles, the dollar won't be the reserve of anything anymore. Only protection I know is to convert US dollars to silver and gold. But what do I know? I'm only a natural born durn'd fool from Tennessee. What am I compared to all them Harvard and New York smarties that have never turned a peg or earned a paycheck a day in their lives? Why, I'm so durned ignerunt I can't even understand how they make anvils fly. Every time I look at the stock market, I feel like a tee-totaling celibate at a Roman orgy: I just don't see nothing that interests me. Yesterday I mentioned that the stock index choir was singing out of tune, Dow making new highs and other indices down. Well, today they puked all over their choir robes, to wit: Dow lost 152.90 or 0.97% to 15,593.98 S&P500 lost 23.34 or 1.32% to 1,747.15 Nasdaq lost 74.62 or 1,90% to 3,857.33 Nasdaq 100 lost 63.97 or 1.89% to 3,321.41 Russell 2000 lost 19.54 or 1.78% to 1,079.09. Wilshire 5000 lost 276.11 or 1.47% to 18,548.79. You all can brag about your outsized stock gains and all the pointy-shoe types on Wall Street can puff out their chests, but this market is floating on hot money, not economic outlook, and is as nervous as a lame mouse at a cat convention. And it will probably get worse tomorrow. Andith the twisted logic of a basement full of mouth-foaming, hair-tearing lunatics, reported US GDP rose today and sent the dollar shooting up. Now think about that: back in July the yankee government announced it was "revising" the way it figures GDP, which being translated is, "we're jimmying the numbers so you oafs won't realize how badly we are shafting you." There's only one way you can tell a government spokesman is lying: are his lips moving? GDP numbers have now become as deceptive and meaningless as unemployment numbers or government deficit projections or Viet Nam war casualty reports. Anyway, the press spun it this way: if GDP improves, the Fed can "taper" sooner and stop injecting so much hot new money. Tennessee hogwash. They've got the stock market and economy so addicted to Quantitative Easing right now there's no way they can stop. No way. Remember, I said it, and you can quote me. Write it on the wall, hoping you can get to rub my nose in it later. You won't. The very thought of Fed tapering today gave the entire stock market world the wastebasket heaves. Add to this panic the ECB which lowered its interest rate today to a number nearer zero than it already was: 0.25%. Dollar index jumped to 80.85, up 36 basis points or 0.45%, and it pushed the euro off a cliff. Literally. Euro dropped 0.73% to $1.3416, headed for its 200 Dma ($1.3231) and further infamy and humiliation. After all, the Europeans have the world's second most over-indebted and putrescent economy and most rotten banks (after Japan), and their currency now pays no more interest than the US dollar. What I can't parse because there's something I'm not seeing is that the yen reversed mightily upward, gaining 0.61% to 101.96 cents/Y100, with a high not far from the 102.60 200 DMA. I don't know what drove the yen higher and I don't care, since I wouldn't buy yen with YOUR money. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Obama: "I Am Sorry" Americans Will Lose Their Existing Health Plan Because Of Obamacare Posted: 07 Nov 2013 03:32 PM PST Remember all those YouTube clips (the same medium used to nearly justify World War III) that caught the president lying again and again with promises and assurances everyone would be able to keep their existing insurance plan under Obamacare even though he knew full they wouldn't, until a week ago, thanks to what is left of the non-brownnosing media, as much was revealed to the general public? Well, it's time to come clean, and once again via clip. Moments ago, in an interview with NBC, the charming and very photogenic president said he was "sorry." "I am sorry that they are finding themselves in this situation based on assurances they got from me," Obama told NBC News in an exclusive interview at the White House. "We've got to work hard to make sure that they know we hear them and we are going to do everything we can to deal with folks who find themselves in a tough position as a consequence of this." Surely a good start to make sure "they know they are heard" is for nobody to lose their job over this fiasco, even those who claim full responsibility for the "debacle." As for apologies, perhaps it would be more prudent to wait until 2014 when the true costs of this latest welfare Ponzi scheme are revealed for all to see and experience: then it will be a daily tirade of non-stop apologies. So let's just chalk today down to a general rehearsal. Visit NBCNews.com for breaking news, world news, and news about the economy There, there, Obama. All is forgiven. Just please tell Mr. Chairwoman to keep pushing that Nasdaq to its old time highs. Because who knows - without the daily distraction from the economic collapse this country finds itself in, an apology just may no longer be sufficient... |

| Marc Faber Warns "Karl Marx Was Right" Posted: 07 Nov 2013 03:04 PM PST Authored by Marc Faber, originally posted at The Daily Reckoning, I would like readers to consider carefully the fundamental difference between a "real economy" and a "financial economy." In a real economy, the debt and equity markets as a percentage of GDP are small and are principally designed to channel savings into investments. In a financial economy or "monetary-driven economy," the capital market is far larger than GDP and channels savings not only into investments, but also continuously into colossal speculative bubbles. This isn't to say that bubbles don't occur in the real economy, but they are infrequent and are usually small compared with the size of the economy. So when these bubbles burst, they tend to inflict only limited damage on the economy. In a financial economy, however, investment manias and stock market bubbles are so large that when they burst, considerable economic damage follows. I should like to stress that every investment bubble brings with it some major economic benefits, because a bubble leads either to a quantum jump in the rate of progress or to rising production capacities, which, once the bubble bursts, drive down prices and allow more consumers to benefit from the increased supplies. In the 19th century, for example, the canal and railroad booms led to far lower transportation costs, from which the economy greatly benefited. The 1920s' and 1990s' innovation-driven booms led to significant capacity expansions and productivity improvements, which in the latter boom drove down the prices of new products such as PCs, cellular phones, servers and so on, and made them affordable to millions of additional consumers. The energy boom of the late 1970s led to the application of new oil extracting and drilling technologies and to more efficient methods of energy usage, as well as to energy conservation, which, after 1980, drove down the price of oil in real terms to around the level of the early 1970s. Even the silly real estate bubbles we experienced in Asia in the 1990s had their benefits. Huge overbuilding led to a collapse in real estate prices, which, after 1998, led to very affordable residential and commercial property prices. So my view is that capital spending booms, which inevitably lead to minor or major investment manias, are a necessary and integral part of the capitalistic system. They drive progress and development, lower production costs and increase productivity, even if there is inevitably some pain in the bust that follows every boom. The point is, however, that in the real economy (a small capital market), bubbles tend to be contained by the availability of savings and credit, whereas in the financial economy (a disproportionately large capital market compared with the economy), the unlimited availability of credit leads to speculative bubbles, which get totally out of hand. In other words, whereas every bubble will create some "white elephant" investments (investments that don't make any economic sense under any circumstances), in financial economies' bubbles, the quantity and aggregate size of "white elephant" investments is of such a colossal magnitude that the economic benefits that arise from every investment boom, which I alluded to above, can be more than offset by the money and wealth destruction that arises during the bust. This is so because in a financial economy, far too much speculative and leveraged capital becomes immobilized in totally unproductive "white elephant" investments. In this respect, I should like to point out that as late as the early 1980s, the U.S. resembled far more a "real economy" than at present, which I would definitely characterize as a "financial economy." In 1981, stock market capitalization as a percentage of GDP was less than 40% and total credit market debt as a percentage of GDP was 130%. By contrast, at present, the stock market capitalization and total credit market debt have risen to more than 100% and 300% of GDP, respectively. As I explained above, the rate of inflation accelerated in the 1970s, partly because of easy monetary policies, which led to negative real interest rates; partly because of genuine shortages in a number of commodity markets; and partly because OPEC successfully managed to squeeze up oil prices. But by the late 1970s, the rise in commodity prices led to additional supplies, and several commodities began to decline in price even before Paul Volcker tightened monetary conditions. Similarly, soaring energy prices in the late 1970s led to an investment boom in the oil- and gas-producing industry, which increased oil production, while at the same time the world learned how to use energy more efficiently. As a result, oil shortages gave way to an oil glut, which sent oil prices tumbling after 1985. At the same time, the U.S. consumption boom that had been engineered by Ronald Reagan in the early 1980s (driven by exploding budget deficits) began to attract a growing volume of cheap Asian imports, first from Japan, Taiwan and South Korea and then, in the late 1980s, also from China. I would therefore argue that even if Paul Volcker hadn't pursued an active monetary policy that was designed to curb inflation by pushing up interest rates dramatically in 1980/81, the rate of inflation around the world would have slowed down very considerably in the course of the 1980s, as commodity markets became glutted and highly competitive imports from Asia and Mexico began to put pressure on consumer product prices in the U.S. So with or without Paul Volcker's tight monetary policies, disinflation in the 1980s would have followed the highly inflationary 1970s. In fact, one could argue that without any tight monetary policies (just keeping money supply growth at a steady rate) in the early 1980s, disinflation would have been even more pronounced. Why? The energy investment boom and conservation efforts would probably have lasted somewhat longer and may have led to even more overcapacities and to further reduction in demand. This eventually would have driven energy prices even lower. I may also remind our readers that the Kondratieff long price wave, which had turned up in the 1940s, was due to turn down sometime in the late 1970s. It is certainly not my intention here to criticize Paul Volcker or to question his achievements at the Fed, since I think that, in addition to being a man of impeccable personal and intellectual integrity (a rare commodity at today's Fed), he was the best and most courageous Fed chairman ever. However, the fact remains that the investment community to this day perceives Volcker's tight monetary policies at the time as having been responsible for choking off inflation in 1981, when, in fact, the rate of inflation would have declined anyway in the 1980s for the reasons I just outlined. In other words, after the 1980 monetary experiment, many people, and especially Mr. Greenspan, began to believe that an active monetary policy could steer economic activity on a noninflationary steady growth course and eliminate inflationary pressures through tight monetary policies and through cyclical and structural economic downturns through easing moves! This belief in the omnipotence of central banks was further enhanced by the easing moves in 1990/91, which were implemented to save the banking system and the savings & loan associations; by similar policy moves in 1994 in order to bail out Mexico and in 1998 to avoid more severe repercussions from the LTCM crisis; by an easing move in 1999, ahead of Y2K, which proved to be totally unnecessary but which led to another 30% rise in the Nasdaq, to its March 2000 peak; and by the most recent aggressive lowering of interest rates, which fueled the housing boom. Now I would like readers to consider, for a minute, what actually caused the 1990 S&L mess, the 1994 tequila crisis, the Asian crisis, the LTCM problems in 1998 and the current economic stagnation. In each of these cases, the problems arose from loose monetary policies and excessive use of credit. In other words, the economy — the patient — gets sick because the virus — the downward adjustments that are necessary in the free market — develops an immunity to the medicine, which then prompts the good doctor, who read somewhere in The Wall Street Journal that easy monetary policies and budget deficits stimulate economic activity, to increase the dosage of medication. The even larger and more potent doses of medicine relieve the temporary symptoms of the patient's illness, but not its fundamental causes, which, in time, inevitably lead to a relapse and a new crisis, which grows in severity since the causes of the sickness were neither identified nor treated. So it would seem to me that Karl Marx might prove to have been right in his contention that crises become more and more destructive as the capitalistic system matures (and as the "financial economy" referred to earlier grows like a cancer) and that the ultimate breakdown will occur in a final crisis that will be so disastrous as to set fire to the framework of our capitalistic society. Not so, Bernanke and co. argue, since central banks can print an unlimited amount of money and take extraordinary measures, which, by intervening directly in the markets, support asset prices such as bonds, equities and homes, and therefore avoid economic downturns, especially deflationary ones. There is some truth in this. If a central bank prints a sufficient quantity of money and is prepared to extend an unlimited amount of credit, then deflation in the domestic price level can easily be avoided, but at a considerable cost. It is clear that such policies do lead to depreciation of the currency, either against currencies of other countries that resist following the same policies of massive monetization and state bailouts (policies which are based on, for me at least, incomprehensible sophism among the economic academia) or against gold, commodities and hard assets in general. The rise in domestic prices then leads at some point to a "scarcity of the circulating medium," which necessitates the creation of even more credit and paper money. |

| Posted: 07 Nov 2013 02:37 PM PST Watching this year's price action alone, more commentators say gold holds no investment value... WHY GOLD? Human beings love to debate, but sadly sometimes it crosses a line and turns argumentative, write Miguel Perez-Santalla and Adrian Ash at BullionVault. That's what is happening right now with the debate over gold investing. There have been several high-profile articles, most recently in the Wall Street Journal, saying you should eliminate gold as a worthwhile part of your investment portfolio. Why? Primarily because of this year's lower price. Against that idea, many bloggers and private investors, wondering why gold has fallen in price, say that it shouldn't have dropped. There must be some conspiracy driving down prices when money-printing and our still-weak economy should be driving it higher. But that still puts current price performance front and center in the debate over why gold should or shouldn't feature in your portfolio. So it misses several key points about why gold is uniquely valuable as an investable asset. We'd like to look here at some of the common arguments now offered for why gold should not figure in your investment strategy. Yes, working at BullionVault, the physical gold and silver exchange, we're biased. But there are also people who always say gold doesn't warrant your investment dollars. To have any intelligent understanding of your own position, you need to welcome debate. That way you can challenge your own opinions and, if you find they're correct, improve your arguments too. Such as why gold investing continues – in our view – to warrant investors' attention. #1. Gold Does Not Yield Anything When you buy any commodity outright you can no longer deposit it with a bank or investment company to earn interest. If you are looking to yield a dividend or interest then physical gold ownership will not yield anything. Yet that is only half the story. Gold ownership yields security for the investor, the type of security a person seeks from insurance. It is the only physical form of insurance which both exists to counterweight your investments in bonds and stocks, and which is also a liquid, easily traded asset. Gold is also non-correlated with those more "mainstream" markets. Meaning that its price moves indepedently of where other investment prices are heading. So the goal for most investors in holding gold is first as a safety net for their other assets. This metal has held value for thousands of years, and will hold value for thousands more. #2. Gold Is Worth Only What the Next Investor Will Pay for It This statement is weak from the onset. There are no stocks, bonds, commodities or goods that are worth more than the next person will pay. That being said gold has something that the others do not. Gold is 100% transparent. Why? Gold is unlike other easily traded investments because it is only one thing, a pure and precious rare commodity which requires little space for storing great value. This commodity has acted as money for thousands of years. In fact after World War II, the Bretton Woods agreement used gold to bring brought stability and sanity to the world's currency markets once more. If that history of human use doesn't give intrinsic value to gold, why would you give that title to any other asset? People had their life savings in Lehman Brothers stock. Other people invested in mortgage-backed securities or were holding Argentine bonds or got sold the claims of Bernard L. Madoff Investment Securities LLC. Though data may tell a story it does not always tell the whole truth. Stocks and bonds, though there are many facts available about them, are never 100% transparent. It is much like a hiring a baseball player. You may have his statistics and you may place him in the perfect spot on the best team in the league. Yet he may perform poorly due to an unknown injury or a problem with the change of venue or any other number of unknown reasons. This is the same for stocks and bonds. Though we have their statistics, we never know when some problem may cause some of these instruments to fail. #3. Gold Is Not a Good Hedge for Stocks, Nor Inflation Anyone looking at the 1980s and '90s and concluding that gold is a poor inflation hedge misses the point. You didn't need an inflation hedge when cash-in-the-bank paid 5% above and beyond the rate of inflation each year, as it did on average for US and UK savers for the last twenty years of the 20th century. But why doesn't gold make a good hedge for stock market investments? The frequent comparison is usually to the stock market overall, or the Dow Jones Industrial Average. Never mind that gold and stocks have, over extended periods, gone in opposite directions. That measure is not a just number to use. Because the stock indexes frequently change. This is also true of the overall market where stocks are delisted if they underperform or go bankrupt. If these types of stocks were kept on how would the indexes and averages have changed? The stock market of 1989 did not have the same listed companies as that of 1996, 2000 or 2013. In contrast, the gold of 1989 was the same gold of 1996, 2013 and even 2000 BC. Gold does not change and its supply cannot be expanded (or reduced) at will. This is why gold functions so well as a form of exchange and transfer of value. It holds value due to its permanent unchangeable form. World history has shown us again and again that in the final analysis; only gold out of all investable assets holds value in catastrophic situations. You can lose value owning gold if you buy high and sell lower, but you never lose it all. You could easily pick out a point in any chart of the stock market where an investor could have bought and then another time where you may have sold and lost money. There is no point to this kind of example. Because it never speaks to an individual's overall performance with their assets. They may have liquidated their stock at the low price because they needed the cash to invest in a particular business or real estate opportunity. All assets including gold have to be looked upon as part of a strategy for the investor and not as independent pieces of life's asset management puzzle. #4. Gold is an Article of Faith, Not Rational Investing Some people denigrate gold to a relic of the past in terms of its economic importance. The most recognized of today's detractors is perhaps Nouriel Roubini, the famed NYU economist who repeats John Maynard Keynes' cry of the 1930s that gold is a "Barbarous Relic". Still others go further, saying that choosing to own investment gold is anti-social. The argument is that there is no longer any need for gold as a form of exchange, nor as a store of value. Governments and central banks have done away with the need for gold. Which is why gold's only value today lies in the jewelry and electronics trades. In addition, other analysts write about gold being a faith-based investment and mock it as a type of religion. There are certainly those that invest on faith, and they can be loud, giving the impression that investors in gold are extreme. But this can also be said about the defense of the US Dollar. That currency in the end is only a piece of paper that has no other use than that ascribed by the government. If you put fire to a dollar bill it will turn to ashes and float away. But if you put fire to gold, at the right temperature you get a liquid metal that not only is useful to the arts but important in the electronics and high technology industries. "We may one day become a great commercial and flourishing nation," wrote George Washington, the first President of the United States of America, on the subject of paper money in a letter to Jabez Bowen, Rhode Island, on 9 January 1787. "But if in pursuit of the means we should unfortunately stumble again on unfunded paper money or similar species of fraud, we shall assuredly give a fatal stab to our credit in its infancy.

It is difficult for those in power to try to overcome this truth, embodied by all of recorded economic history. And it becomes more ludicrous as governments also hold gold bullion in vast amounts. The modern central banking system, now more than 100 years old, may seem to shape this perception. Yet in the last decade central bankers themselves, albeit in Asia and other emerging economies, have been significant buyers of the yellow metal. Western governments as a group have stopped selling gold. Why? Economic chaos causes distrust amongst governments and central banks, leading those in power to seek out avenues to strengthen their position with other parties. The position central banks look for to strengthen their balance sheet and ensure their place in the global economy is gold. The United States rose to dominance worldwide alongside its dominant gold reserves. Now becoming a market economy, and hoping to become the next big global economy, China is also building its central bank gold reserves. It becomes obvious that gold has a very deep, very human value, ascribed to it by history and by all major powers today. Value isn't the same as price, of course. Which is why, perhaps, gold investing remains such a mystery to some people. |

| Posted: 07 Nov 2013 02:37 PM PST Watching this year's price action alone, more commentators say gold holds no investment value... WHY GOLD? Human beings love to debate, but sadly sometimes it crosses a line and turns argumentative, write Miguel Perez-Santalla and Adrian Ash at BullionVault. That's what is happening right now with the debate over gold investing. There have been several high-profile articles, most recently in the Wall Street Journal, saying you should eliminate gold as a worthwhile part of your investment portfolio. Why? Primarily because of this year's lower price. Against that idea, many bloggers and private investors, wondering why gold has fallen in price, say that it shouldn't have dropped. There must be some conspiracy driving down prices when money-printing and our still-weak economy should be driving it higher. But that still puts current price performance front and center in the debate over why gold should or shouldn't feature in your portfolio. So it misses several key points about why gold is uniquely valuable as an investable asset. We'd like to look here at some of the common arguments now offered for why gold should not figure in your investment strategy. Yes, working at BullionVault, the physical gold and silver exchange, we're biased. But there are also people who always say gold doesn't warrant your investment dollars. To have any intelligent understanding of your own position, you need to welcome debate. That way you can challenge your own opinions and, if you find they're correct, improve your arguments too. Such as why gold investing continues – in our view – to warrant investors' attention. #1. Gold Does Not Yield Anything When you buy any commodity outright you can no longer deposit it with a bank or investment company to earn interest. If you are looking to yield a dividend or interest then physical gold ownership will not yield anything. Yet that is only half the story. Gold ownership yields security for the investor, the type of security a person seeks from insurance. It is the only physical form of insurance which both exists to counterweight your investments in bonds and stocks, and which is also a liquid, easily traded asset. Gold is also non-correlated with those more "mainstream" markets. Meaning that its price moves indepedently of where other investment prices are heading. So the goal for most investors in holding gold is first as a safety net for their other assets. This metal has held value for thousands of years, and will hold value for thousands more. #2. Gold Is Worth Only What the Next Investor Will Pay for It This statement is weak from the onset. There are no stocks, bonds, commodities or goods that are worth more than the next person will pay. That being said gold has something that the others do not. Gold is 100% transparent. Why? Gold is unlike other easily traded investments because it is only one thing, a pure and precious rare commodity which requires little space for storing great value. This commodity has acted as money for thousands of years. In fact after World War II, the Bretton Woods agreement used gold to bring brought stability and sanity to the world's currency markets once more. If that history of human use doesn't give intrinsic value to gold, why would you give that title to any other asset? People had their life savings in Lehman Brothers stock. Other people invested in mortgage-backed securities or were holding Argentine bonds or got sold the claims of Bernard L. Madoff Investment Securities LLC. Though data may tell a story it does not always tell the whole truth. Stocks and bonds, though there are many facts available about them, are never 100% transparent. It is much like a hiring a baseball player. You may have his statistics and you may place him in the perfect spot on the best team in the league. Yet he may perform poorly due to an unknown injury or a problem with the change of venue or any other number of unknown reasons. This is the same for stocks and bonds. Though we have their statistics, we never know when some problem may cause some of these instruments to fail. #3. Gold Is Not a Good Hedge for Stocks, Nor Inflation Anyone looking at the 1980s and '90s and concluding that gold is a poor inflation hedge misses the point. You didn't need an inflation hedge when cash-in-the-bank paid 5% above and beyond the rate of inflation each year, as it did on average for US and UK savers for the last twenty years of the 20th century. But why doesn't gold make a good hedge for stock market investments? The frequent comparison is usually to the stock market overall, or the Dow Jones Industrial Average. Never mind that gold and stocks have, over extended periods, gone in opposite directions. That measure is not a just number to use. Because the stock indexes frequently change. This is also true of the overall market where stocks are delisted if they underperform or go bankrupt. If these types of stocks were kept on how would the indexes and averages have changed? The stock market of 1989 did not have the same listed companies as that of 1996, 2000 or 2013. In contrast, the gold of 1989 was the same gold of 1996, 2013 and even 2000 BC. Gold does not change and its supply cannot be expanded (or reduced) at will. This is why gold functions so well as a form of exchange and transfer of value. It holds value due to its permanent unchangeable form. World history has shown us again and again that in the final analysis; only gold out of all investable assets holds value in catastrophic situations. You can lose value owning gold if you buy high and sell lower, but you never lose it all. You could easily pick out a point in any chart of the stock market where an investor could have bought and then another time where you may have sold and lost money. There is no point to this kind of example. Because it never speaks to an individual's overall performance with their assets. They may have liquidated their stock at the low price because they needed the cash to invest in a particular business or real estate opportunity. All assets including gold have to be looked upon as part of a strategy for the investor and not as independent pieces of life's asset management puzzle. #4. Gold is an Article of Faith, Not Rational Investing Some people denigrate gold to a relic of the past in terms of its economic importance. The most recognized of today's detractors is perhaps Nouriel Roubini, the famed NYU economist who repeats John Maynard Keynes' cry of the 1930s that gold is a "Barbarous Relic". Still others go further, saying that choosing to own investment gold is anti-social. The argument is that there is no longer any need for gold as a form of exchange, nor as a store of value. Governments and central banks have done away with the need for gold. Which is why gold's only value today lies in the jewelry and electronics trades. In addition, other analysts write about gold being a faith-based investment and mock it as a type of religion. There are certainly those that invest on faith, and they can be loud, giving the impression that investors in gold are extreme. But this can also be said about the defense of the US Dollar. That currency in the end is only a piece of paper that has no other use than that ascribed by the government. If you put fire to a dollar bill it will turn to ashes and float away. But if you put fire to gold, at the right temperature you get a liquid metal that not only is useful to the arts but important in the electronics and high technology industries. "We may one day become a great commercial and flourishing nation," wrote George Washington, the first President of the United States of America, on the subject of paper money in a letter to Jabez Bowen, Rhode Island, on 9 January 1787. "But if in pursuit of the means we should unfortunately stumble again on unfunded paper money or similar species of fraud, we shall assuredly give a fatal stab to our credit in its infancy.