saveyourassetsfirst3 |

- Traders lack conviction in gold going into 2014

- Eyes on gold equities, price, after US jobs data – Pre-bell notes

- Why Long-Term 401(k) Investing Doesn't Need Dollar-Cost Averaging

- Gold remains in a tight consolidation mode

- Dubai gold bourse benefitting from Indian import rules

- Averting The Dollar Crash With Historically Discounted Gold And Silver Junior Miners

- TDG Free Newsletter: Weekend Update

- Silver To Hit New Highs Despite Bearish Forecasts

- How Far Will the American Standard of Living Fall?

- Romania parliament delays gold mine report to Nov. 10

- Crude Oil and Its Connection with the U.S. Dollar

- The US Dollar: A Run on the Bank

- U.S. Finished As a Super Power and Not Credible Anymore- Karen Hudes

- India's festival demand likely to sparkle 'November rally' in Gold

- Traders lack conviction in gold, India reports conflict over festive demand

- The US Dollar: A Run on the Bank

- Peter Schiff: Is this the green light for gold?

- 3 essentials to look for in junior mining equities - Macpherson

- [KR513] Keiser Report: Bandits, Bankers & Brokers

- Silver Bull Market Gaining Strength – Mind The 3 Signals

- Peter Schiff: The Collapse Of The Dollar Is Unavoidable

- Gold premiums in India advance to record as shortage widens

- Record Surge in Treasury Debt

- Gold’s Next Phase in Its Bull Market Are Aligned

- Gold really does grow on trees, researchers discover

- Faber: "1 Trillion Dollars A Month" Money Printing Coming

- Gold price smashes back above its 100 day moving average on bad but ‘good’ US unemployment data

- Silver price now back above its 55 day moving average – ‘breakout’ confirmed?

- Buying Gold as a Mouthguard

- Hyperinflation Is Good For The Stock Market

- Precious Metals Bullion Banks Making a Killing by Killing Sentiment

- Gold price smashes back above its 100 day moving average on bad but ‘good’ US unemployment data

- I Had No Idea

- Federal Reserve, Stock Market & Gold

- Terrible Non-Farms Payrolls Sends Gold & Silver Vertical

- LBMA Gold forward rates go negative again

- Faber: “1 Trillion Dollars A Month” Money Printing Coming

- The Ridiculous “Jamie Dimon as Victim” Meme on the Pending JP Morgan Mortgage Settlement

- The Rise of an American Debtcropper System for the Young

- French Officialdom Now Discussing Eurozone Exit

- U.K.‘s Swiss Gold Exports Surge on ETF Selling

- China aiming for 'de-Americanised world’ with renminbi replacing dollar

- Ten King World News Blogs/Audio Interviews

- Jeff Clark: Silver's Message -- The Bull is Alive and Well

- 2014 -- Helicopter Money is Coming! Jim Rickards, Currency War Update

- Ron Paul: gold, dollar, debt ceiling and the Fed

- Lower Nevada mining output impacts U.S. gold production - USGS

- U.K.'s Swiss gold exports surge on ETF selling

- William Engdahl: China, gold prices and U.S. default threats

- Gold Fundamental Analysis October 22, 2013 Forecast

| Traders lack conviction in gold going into 2014 Posted: 22 Oct 2013 02:56 PM PDT Amongst Western traders, "market participants lack conviction that gold could stage a decent performance going into 2014," says a note from VTB Capital. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eyes on gold equities, price, after US jobs data – Pre-bell notes Posted: 22 Oct 2013 01:36 PM PDT A morning wrap on metals and news. Today gold steady with eyes on critical data out of the US, which will surely have an impact on base metals too. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Long-Term 401(k) Investing Doesn't Need Dollar-Cost Averaging Posted: 22 Oct 2013 12:59 PM PDT Dollar-cost averaging is a well known term across the investment community, however, for those not familiar with this investment strategy, Investopedia.com defines dollar-cost averaging as:

Therefore, dollar-cost averaging reduces risk and potentially increases return by averaging into equity market prices over time. The most common dollar-cost averaging decision for many investors is whether to contribute 401(k) savings at the beginning of the year vs. dollar-cost averaging evenly throughout the year. The best way to validate a long-standing theory is to look at the data. Therefore, I ran a Monte Carlo simulation (400,000 iterations) using two different 401(k) contribution approaches over a 40-year projected period:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold remains in a tight consolidation mode Posted: 22 Oct 2013 12:54 PM PDT US sellers made quite an effort to, not just sell their gold but also try force down the price, says Julian Phillips. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dubai gold bourse benefitting from Indian import rules Posted: 22 Oct 2013 12:46 PM PDT The increase in purchases on the Dubai gold bourse has been helped by the run up to the festival season in India, and economic uncertainty in the US. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

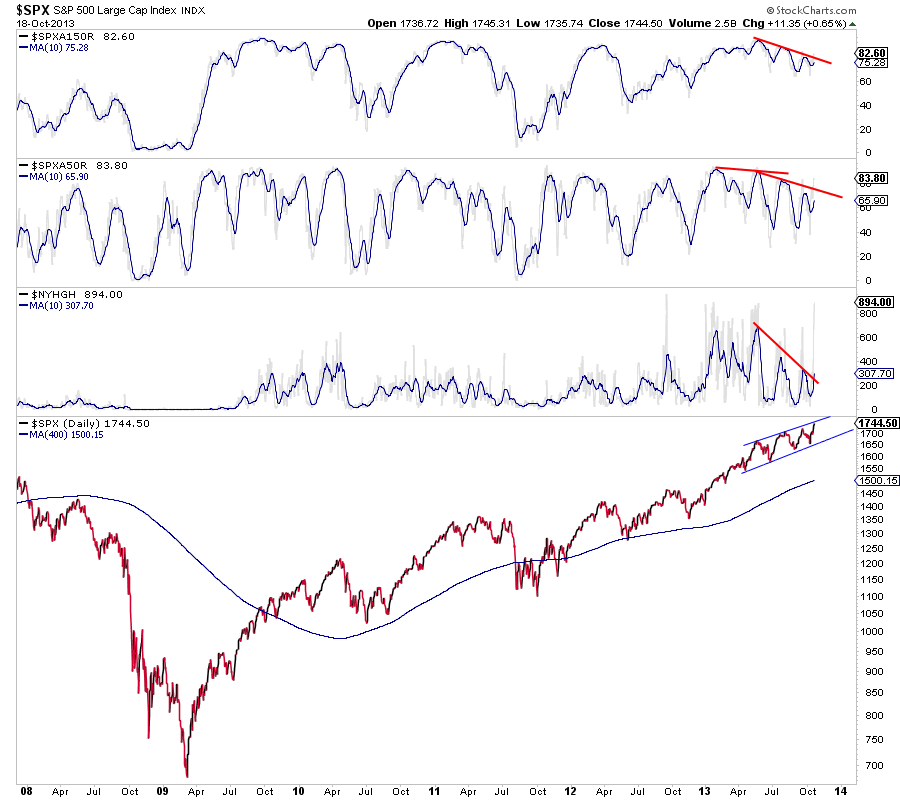

| Averting The Dollar Crash With Historically Discounted Gold And Silver Junior Miners Posted: 22 Oct 2013 12:36 PM PDT U.S. stocks are rallying on hopes of the recent budget deal coming out of Washington. Just like we have witnessed over the past several years, lawmakers came to some sort of last minute deal to kick the debt can down the road. I expected this sort of move to avert a default. The markets could rally short term on such a deal, but over the longer term the equity (SPY) and housing markets (XHB) appear to be ready for a major correction after rallying for two years. We are witnessing bubbles in certain areas of the market which I encourage investors to steer clear from especially banks (XLF), housing, social media and biotech (IBB) as these are very crowded trades filled with promoters, snake oil salesman, charlatans and day traders. PE ratios are hitting sky-high levels like Facebook (FB) at a PE of 245. Some of the high quality mid | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TDG Free Newsletter: Weekend Update Posted: 22 Oct 2013 12:27 PM PDT

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver To Hit New Highs Despite Bearish Forecasts Posted: 22 Oct 2013 12:15 PM PDT

The big "V" correction in the precious metals back in 2008-2009 did not persuade investors from buying gold and silver at severe lows. Matter-a-fact, it actually motivated huge retail buying of physical bullion. This time around the monetary authorities got smarter. They engaged a new "SLASH & BURN" tactic by bleeding the gold and silver [...] The post Silver To Hit New Highs Despite Bearish Forecasts appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Far Will the American Standard of Living Fall? Posted: 22 Oct 2013 12:00 PM PDT Ah, the September jobs report. It's the perfect backdrop for today's topic – the rapid, inexorable decline of the American standard of living; or as we have been brainwashed to believe for generations, the "American Dream." Sadly, said "dream" was but a mirage, created by a historical confluence of events that will NEVER again repeat. The reason Americans have lived "charmed lives" since the Baby Boomer generation was because the rest of the world nearly destroyed itself in two World Wars; then, handed over the keys to the "reserve currency" printing press – initially in 1944, but more so in 1971, when it collectively allowed America to renege on the Bretton Woods agreement and abandon the gold standard. Since then, America has "fooled itself" – and the world at large – by creating artificial booms based entirely on its "printing press power"; first, when Alan Greenspan sparked the 1990s internet bubble with easy money; second, when Ben Bernanke fueled the 2000s housing bubble with easier money; and finally, today's bastardized "boom" in which global economies plunge while stock markets surge – care of the most maniacal, worldwide scheme of MONEY PRINTING, MARKET MANIPULATION, and PROPAGANDA in global history. And no, such a statement is not hyperbolic in the least. The only thing I see as hyperbolic these days are government LIES (wait till you see what I'm about to write of) and DEBT; and sadly, they will worsen dramatically until the entire fiat Ponzi scheme implodes of its own weight. Yesterday, I opined that the consensus estimate that 185,000 jobs were created in September was utterly RIDICULOUS. Frankly, I don't know what planet these so-called genius analysts come from; as absolutely NOTHING in the (government-massaged) data I've seen even remotely suggests September was a strong month. And voila, an utterly abysmal report; with the only "positive" being yet another decline in the official "unemployment rate." Yep, you guessed it, that darn labor participation rate again, whose inexorable decline may well take unemployment to zero – while the number of workers also drops to zero!

As usual, the job quality could not have been worse; and don't forget that EVERYTHING the government reports is "massaged" to look better than it actually is. To wit, the horrific LIE I mentioned above; which frankly, is so blatant, it's hard to believe ANYONE can't see it. To wit, recall the unstoppable trend of American employers firing full-time workers and replacing them with part-time workers. This inexorable trend has gone parabolic in the past year due to Obamacare, which imposes onerous, business-killing taxes on firms with too many full-time, benefits-eligible employees. As you can imagine, such talk is politically damaging; and thus, the Obama Administration will not allow it. And thus, just as they started cooking the "unemployment rate" just before the 2012 elections, they this month cooked historical data regarding the mix of full and part-time employment. This travesty is so transparent; I can hear the Chinese laughing all the way from Colorado. I urge you to read about it here; and subsequently, realize that EVERYTHING we are told by the government – and its fascist corporate partners – are LIES; particularly relating to the actual amount of PHYSICAL gold and silver in their coffers. Of course, per the early stages of hyperinflation I wrote of yesterday – and last week – stocks, bonds, and commodities are all higher this morning. With the Fed pumping endless money into banks that no longer lend, but speculate with the full backing of its government "partners," equities are commencing a dangerous period – both in the U.S. and worldwide. I somehow doubt they will nominally crash with the Fed's printing presses squarely behind them. However, it's only a matter of time before they plunge in real terms – a la Weimar Germany, or 2013 Venezuela; and FYI, the dollar is plummeting this morning, despite signs that Greece may be ready to implode; and with it, the entire Eurozone. As for PMs, they have fought through every conceivable capping algorithm this morning; with gold finally breaking through the nearly two-month $1,320 and $1,330 "lines in the sand," and silver decisively breaching its $22 "line in the sand," en route to $23 and beyond. Remember when the ENTIRE world said "tapering" would occur in September; that is, other than me and a tiny handful of others? Well guess what? The ENTIRE world now expects tapering no sooner than March; which is to say, NEVER! My view: it CANNOT, and WILL NOT, EVER happen; with the more likely scenario being the announcement of "QE5" sometime in the first half of 2014. On that hyperinflationary note, back to today's topic; i.e., the American nightmare I wrote of last year, and death of the middle class earlier this month. Actually, when including the "lower middle" and "lower" classes, it's "the 99%" that's dying, at the expense of the 1% that destroy our lives – creating a "dependency nation" that increasingly relies on entitlements for its very survival. Part of this horrific, nation-killing trend results from the natural migration of jobs from the high-cost West to the low-cost East; and would have occurred whether corporate enrichment programs like GATT and NAFTA were signed or not. The fact that lobbyists took over the U.S. government only accelerated the process; a process, I might add, created by the temporary "geopolitical window" noted at the beginning of today's article. When the world nearly destroyed itself – and in its weak state, abdicated global leadership to the tiny United States – America abused the privilege by not only overprinting its currency and becoming an imperialist bully, but allowing industry-killing unions to make its manufacturing cost structure unnaturally high. The resulting wage gains created a mirage of prosperity dubbed the "American Dream." However, such nominal gains have been ENTIRELY eroded by Fed-generated inflation since the gold standard was abandoned in 1971 – except for "the 1%," of course. This "real wage gap" was entirely filled by global willingness to lend to Americans at ridiculously cheap terms, thanks to the U.S. holding it "hostage" via its "reserve currency" – which tragically, will soon be a distant memory. As I write, the global economy is in its worst condition of our lifetimes; and not getting better, but inexorably worse each day. Citizens of the "fragile five" nations – among countless others – will see dramatic worsening of the horrific inflation they are experiencing today. However, it is Americans that will experience the biggest drop in overall living standards; as the dollar loses its "reserve currency status," causing import prices to explode, employment to plunge, and government regulation to become increasingly draconian. Amidst the so-called recovery that has been hyped all summer – one in which even a modest amount of "tapering" wasn't even attempted, the U.S. standard of living index has been in FREEFALL – to the point that even McDonalds is warning of weak demand. And now that the global economy is again rolling over – as the U.S. prepares for its next budget crisis, and trading partners accelerate their flight from Treasury bonds, the only reasonable prognosis is significant decline. Even the government's own accountants – i.e., the Congressional Budget Office – anticipate exploding entitlement spending over the coming decade, which will only put further pressure on the Fed to monetize the TRILLIONS of Treasuries necessary to fund such profligacy.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold really does grow on trees, researchers discover Posted: 22 Oct 2013 08:26 AM PDT Experts find that Eucalyptus trees growing above gold deposits have the precious metal in their leaves. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Faber: "1 Trillion Dollars A Month" Money Printing Coming Posted: 22 Oct 2013 08:01 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold price smashes back above its 100 day moving average on bad but ‘good’ US unemployment data Posted: 22 Oct 2013 07:50 AM PDT goldmadesimplenews | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver price now back above its 55 day moving average – ‘breakout’ confirmed? Posted: 22 Oct 2013 07:46 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Oct 2013 07:43 AM PDT Everyone has a plan until they get punched in the mouth... MIKE TYSON isn't famed for his eloquence, writes Miguel Perez-Santalla at BullionVault. But while he's no Mohammed Ali perhaps, he did a stage tour this year to promote his autobiography, out next month. And Tyson's best boxing tip – that "Everyone has a plan until they get punched in the mouth" – is much deeper a comment than the former world heavyweight champion may have intended. Remember when everyone you spoke to was heavily invested in the stock market? What about housing? A decade ago I thought that my friends should consider putting a percentage in cash, or perhaps buying some gold. Because the equity and real estate markets just seemed over heated to me. It was just a general observation of course, and one that many other people made at the same time. But the old axiom that what goes up, must come down kept coming to my mind. My friends and acquaintances ignored me though. Their investing was brilliant and they knew better. Who needed to worry about buying gold when stocks and housing kept going up? During the 2008 market meltdown, I remember speaking to one friend who had been convinced of his golden touch in stocks. He admitted that he was so full of himself and his success that he was not prepared for what happened. He took a big hit. Essentially he got punched in the mouth. Yes, my friend had a plan (buy stocks) but it was one without any precautions (buy some insurance, too). He only saw one future and did not prepare for other outcomes. Or as Iron Mike might put it, he thought he could box, but he didn't even wear a mouthguard. Even the biggest, heaviest-hitting investors are diversified. They own companies outright, plus other assets away from the stock market as well. Failing to diversify is the same as taking your car on a long road trip without having prepared. What are the preparations you must make for a long trip, whether by road or investing?

Now, there are several ways to protect oneself from a punch in the mouth in the financial markets. But one must consider the flexibility of any non-correlated asset – meaning an asset which is unlikely to move in the same direction as the rest of your portfolio if things turn bad. And it has been commonly held by many professional investment advisors that a five to 10% investment in gold should be part of the long term investor's strategy. In times of greater insecurity and confidence that number is often raised to higher levels. In a recent radio interview on New York Markets Live, I asked Mickey Fulp, the Mercenary Geologist and an expert in the mining industry, about his thoughts on the gold market. His comment?

Insurance is good word when it comes to gold. The only difference is that once you've buy it, your gold never becomes worthless or expires. No, you don't plan on needing it. But you don't want to get punched in the mouth without. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hyperinflation Is Good For The Stock Market Posted: 22 Oct 2013 07:30 AM PDT Andy Hoffman joins Kerry Lutz of the Financial Survival Network to discuss the debt ceiling debate is gone for good. And the deficit went up a staggering $328 billion in just a few days. There's nothing quite like the discipline that a fiat currency imposes on the political system. To listen to the interview, please click link below: Andy Hoffman – Hyperinflation Is Good For The Stock Market Similar Posts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Bullion Banks Making a Killing by Killing Sentiment Posted: 22 Oct 2013 07:15 AM PDT

On the surface, the mechanism by which the bullion banks accumulate metal appears to be hatched by geniuses — if it were not so completely illegal and immoral. Just because is it not “prosecutable” does not make it right. Using their concentrated short position or corner on the short side of the market, the 4 [...] The post Precious Metals Bullion Banks Making a Killing by Killing Sentiment appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold price smashes back above its 100 day moving average on bad but ‘good’ US unemployment data Posted: 22 Oct 2013 07:01 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Oct 2013 06:26 AM PDT That Florida had gold mines. Yes, somewhere in that flat (and swampy) state they must have gold mines ….somewhere. Maybe the gold is lying under the Everglades or in the sand on the beautiful beaches? I just can’t imagine where though because every mine that I’ve ever seen was located in hilly or mountainous regions where some past epithermal event must have occurred. But Florida must somehow…somewhere have a (plural) gold mine(s). So what the heck am I talking about? Did you know that Florida’s #1 export last year was $8 billion worth of gold? Their “goldmine” must really be ramping up production because they exported $50 million worth in 2010, $7 billion in 2011 and now $8 billion in 2012. Apparently most of this gold was shipped to their new trading partner, Switzerland! Yes, I know, this gold was either “vaulted gold” that was shipped overseas or of the “cash for gold” type. My point is that $8 billion is a lot of gold. This works out to something like 150 tons or more. So why would this gold be shipped to Switzerland? I can only speculate. But maybe this gold needed to be refined? Or because the Swiss have more demand than they can meet and they needed “product?” In any case, gold as opposed to oranges or sugar cane as the largest export was certainly a surprise to me. Another little “surprise” and again it relates to gold was the fact that JP Morgan took in for delivery to their “eligible” (customer) vault 2 large deposits. They took in 192,900 ounces on Friday and exactly 96,450 ounces today. Do you notice anything strange about these numbers? Anything? First off, Friday’s deposit was “exactly” double the size of the deposit on Monday. So far, not so strange…but wait there’s more! 192,900 ounces is exactly 6 tons…which makes 96,450 ounces exactly 3 tons. Quite the coincidence huh? But the word “exactly” occurs too many times here, I’ll explain. If you have ever held a physical COMEX bar in your hand then you know that they are almost NEVER “exactly” 100 ounces. They are either short a fraction or heavier by a fraction of an ounce. The odds of getting a bar that is “exactly” 100 ounces is 1 in 1,000 since these bars are weighed out to 3 decimal points. The odds of it happening 2 days in a row are 1 in 1,000 times 1,000…or 1 in 1 million! No way, didn’t happen and in my mind an absolute impossibility that “exactly” 6 tons was received one day followed by a second “round number day.” I would ask you this (and please don’t e-mail me telling me that I’m a conspiratorial nut because the “odds” surely favor my conclusion), do you believe that JP Morgan received a whole lot of physical bars that just so happened to amount to “exactly” 6 tons followed by another round number of “exactly” 3 tons…or do you believe that they received pieces of paper that added together and equaled these amounts? Heck, the odds of them receiving 2 pieces of paper, one stamped “6 tons of gold” and the other on “3″ is even a better bet. My point? Do you really believe that these deposits actually “weighed” 9 tons or could they be mailed through the post office with a .43 cent stamp? My point “exactly.”Similar Posts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Reserve, Stock Market & Gold Posted: 22 Oct 2013 06:06 AM PDT SunshineProfits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terrible Non-Farms Payrolls Sends Gold & Silver Vertical Posted: 22 Oct 2013 06:02 AM PDT

After consolidating overnight around $22 and $1300, gold and silver have gapped up on this morning’s NFP which massively disappointed printing at +148k on expectations of +180, with the unemployment rate dropping to 7.2%. The miss resulted in silver exploding nearly $1 higher from $22.00 to $22.90, and gold bursting over $20 higher from $1314 [...] The post Terrible Non-Farms Payrolls Sends Gold & Silver Vertical appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LBMA Gold forward rates go negative again Posted: 22 Oct 2013 05:03 AM PDT The demand for alternatives to the US dollar as a reserve asset has intensified possibly because the US debt issue has not been resolved but only delayed. This is possibly causing central banks and private investors to flock to gold as one of the alternatives, ETFS said. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Faber: “1 Trillion Dollars A Month” Money Printing Coming Posted: 22 Oct 2013 04:35 AM PDT In January, in response to a question from Yale University's Robert Shiller querying the recommendation to hold gold, Faber said: "I'm prepared to make a bet, you keep your U.S. dollars and I'll keep my gold, we'll see which one goes to zero first." Today's AM fix was USD 1,311.75, EUR 959.51 and GBP 813.24 per ounce. Gold rose $1.10 or 0.08% yesterday, closing at $1,315.20/oz. Silver climbed $0.31 or 1.42% closing at $21.19. Platinum rose $2.64 or 0.2% to $1,433.74/oz, while palladium increased $8.50 or 1.2% to $747/oz. Gold hovered in a tight range today between $1,310/oz and $1,330/oz. Traders await the release of U.S. jobs data to gauge the health of the struggling U.S. economy. A poor U.S. nonfarm payrolls number should lead to safe haven buying that could lead to a breach of resistance at $1,330/oz and gold soon testing $1,380/oz. A good jobs number could see gold weakening below short term support at $1,310/oz and a possible retrenchment to $1,280/oz. The U.S. September jobs data has been postponed for 16 days due to the partial U.S. government shutdown that began on October 1st. U.S. Fed Bank President of Chicago, Charles Evans, commented in an interview yesterday that the fiscal discord in D.C. will probably delay the decrease in the Fed’s monthly bond buying which is gold positive. The market continues to digest the continuing fall in the holdings of the biggest gold exchange-traded-holdings fund dropped the most in 15 weeks as gold flows from London to Switzerland and on to Asia. Holdings in SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, fell 10.51 tonnes to 871.72 tonnes on Monday — its biggest fall since early July. It is believed that this gold is flowing East to willing and eager buyers in China particularly. Gold bullion dealers in India are struggling to get gold bullion and are paying record premiums just ahead of the peak festival season next month. Marc Faber the author of “The Gloom & Doom Report” was interviewed on CNBC’s Squawk Box today. Faber commented, “The question is not ‘tapering’, the question is at what point will they increase the asset purchases to say $150 billion, $200 billion, or a trillion dollars a month.” Faber was one of the few investment advisers to clearly warn of the coming global financial and economic crisis in the months and years pre-Lehman. His company Marc Faber Limited provides investment advisory services to financial institutions, corporate clients, family offices and high net worth individuals around the world.

Simply put, “The Fed has boxed itself into a position where there is no exit strategy,” and while inflation may not be present in the ‘chosen’ indicators, Faber trumpets, there’s been incredible asset inflation – “we are the bubble. We have a colossal asset bubble in the world [and] a leverage or a debt bubble.” There will be massive wealth destruction, he concludes, “one day this asset inflation will lead to a deflationary collapse one way or the other. We don’t know yet what will cause it.” Last April, Faber said the world will face “massive wealth destruction” in which “well to-do people will lose up to 50% of their total wealth.” In this morning’s Squawk Box appearance, he said that could still happen but possibly from higher levels because of the “asset bubble” caused by the Fed. Faber, whose advice has protected millions of investors in recent years, warned of a global systemic crisis possibly due to the massive size of the global derivatives market which is now worth over an incredible $700 trillion. He warned "when the system goes down," and only plastic credit cards are left, "maybe then people will realize and go back to some gold-based system." He wisely said that, "I advise everyone to have some gold."

In January, in response to a question from Yale University's Robert Shiller querying the recommendation to hold gold, Faber said: "I'm prepared to make a bet, you keep your U.S. dollars and I'll keep my gold, we'll see which one goes to zero first." GoldCore's 10th Anniversary Gold Sovereign & Storage Offer Click For Details: Gold Sovereigns | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Ridiculous “Jamie Dimon as Victim” Meme on the Pending JP Morgan Mortgage Settlement Posted: 22 Oct 2013 04:11 AM PDT Nothing like having a credulous, leak-dependent media to carry your messages. There’s been a remarkable hue and cry about the pending JP Morgan settlement, as if the amount is somehow too high. As we’ve discussed repeatedly, the director of financial stability for the Bank of England, Andrew Haldane, already ascertained that a mere 1/20th of low-end estimate of what the banks ought to pay for all the damage they did would wipe our their market capitalization. So even if you think JP Morgan is only half as culpable as other banks (a point we will debunk in a post tomorrow) it would only be half as dead. In other words, Dimon and all his crew should thank their lucky stars that they got off so well and didn’t have their banks turned into utilities. But that moment passed, so now we are haggling over price with ingrates. The overwhelming cost of the settlement is representation and warranty liability. There are well established parameters for that. Once the settlement is final and terms are disclosed, we should have a clearer idea of what JPM paid relative to the dollar value of loans at issue. But the idea that JP Morgan would pay more than the prevailing rate is spurious. There would be every incentive for the bank to fight in court otherwise. As a New York Times story points out:

And remember, JP Morgan is likely to try to stick the FDIC for the WaMu loans, and the estimates are that that could be as much as $3.5 billion. And then we have the $4 billion in borrower relief, which as we stressed is junk credits with little economic value:

I would bet “general mortgage practices” = predatory servicing. Oh another “the Feds are being mean to JP Morgan” canard is the idea that the bank was being fined for conduct of Bear and WaMu, after it was so

Translation: Jamie Dimon, one of the most experienced financial acquirers on Wall Street, neglected to get a waiver for liability for bad mortgage origination practices from two known predatory originators. But he bullshitted his way out of that lapse after the fact. Now why is the press running these “Oh, JP Morgan is being maltreated” disinformation pieces (aside from the obvious, that the bank is calling in favors?). First, the false idea that the government was overreaching means that those big numbers were supposedly not Dimon’s fault. Second, the Administration has every reason to quietly promote this PR campaign. It benefits from looking tough. Promoting that myth will discourage close examination of the details of the deal. As our resident mortgage maven, MBS Guy, said in an e-mail:

I’m fully expecting this take to be accurate. Stay tuned. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Rise of an American Debtcropper System for the Young Posted: 22 Oct 2013 03:44 AM PDT Readers have often been using the term “neofeudalism” to describe the outlines of the new economic order, in which the uber wealthy and a thin cadre of their advisors, managers, and other elite professionals do well, with a network of less lofty managers helping oversee and orchestrate the provision of services to the broad base of the public, and they struggle to eke out a meager existence. Debt appears to be the “one ring that rules them all” of this emerging order. And if that is the case, it’s likely to be much more like the old sharecropper system of the post Civil War era, where poor whites and blacks were kept on a debt treadmill that turned them into slaves in all but name. As Matt Stoller wrote in 2010:

Even though readers of this blog recognize the individual pieces of the hardships facing young people, I’m not certain older people can readily grasp the totality. For instance, going to college is seen as being for people who grew up with college educated parents as a basic requirement; it’s a marker of accomplishment, a necessary but no longer sufficient condition for entry into the middle class, and at least in some circles, still seen as desirable in and of itself (as in an opportunity to gain knowledge and culture, as quaint as those ideas may be). High school kids face a decision they are not well equipped to make. Most people suffer from optimism bias, and teenagers may feel not going to college is an admission of failure. And it’s not as if they have great prospects if they go into the job market with only a high school degree. So the short form is the system is increasingly set up to load young people up with debt. And it’s not just student loans. This comes from a post by EshaC, a college student who traveled to seven cities across the country at the behest of her credit union employer to talk to students about student loans, credit cards, credit scores, and budgeting. The article is written cautiously, but the author casts doubt on claims like “nearly 50% of students know how to use a credit card effectively”. What is “effectively”? They can swipe and sign?

I find the discussion of ignorance about student loans particularly distressing. The media has reported regularly about how reassuring college officials are when signing up kids for loans. This is pure and simple predatory behavior (and where are their parents????). And while the college staffers who are directly responsible for the lending are most culpable, it’s not as if the rest of the people in the university deserve a free pass. How many tenured faculty members are decrying what is going on? I can guarantee in five to ten years, they will be targets of resentment the same way teachers in public schools are if they don’t get on the right side of this issue. So colleges and financial firms are targeting ignorant, uninformed borrowers, and for at least the student loan part, they perceive it to be for an important, if not essential service. And you can see the clear signs of lender recklessness in the default rates. From the Department of Education (hat tip Bill H):

Remember, these are default rates, not delinquency rates. Ugly. Consider what happens as they graduate and their debt payments kick in. The difficulty most young people have and will continue to have in buying a house puts them at the mercy of landlords. If they can afford to live in one of the few cities where tenants have decent property rights, like New York or San Francisco, that might not be terrible. But in most places in the country, it really does put you in a vulnerable position, although buying with a mortgage with a predatory servicing industry still unreformed isn’t so hot either. And that’s before you factor in a third issue: that those who have the hardest time landing a decent job in this downturn have the longest lag in catching up. From NBER:

So bad economic times increase income disparity even among the young, and that will also make it even harder for them to contend with debt. I’ll return to this topic, because I think this recitation isn’t adequate to convey how the pieces are being put in place to put bigger and bigger swathes of the public under the debt yoke. And officials act as if this sort of thing is desirable as long as they can pretend it’s “affordable”. This cheery statement comes from that Department of Education release:

This is completely nonsense unless the Department is working to lower tuition costs on a widespread basis, and I see no evidence of that. All we have is yet another “transparency” initiative, to treat college, like Obamacare, as a shopping experience. While one part of the push is to provide “bigger grants” and “more affordably loans” to “better” colleges, this means they get more tuition dollars. This does nothing to address the underlying cause of price inflation and gold plated administrators. This is a slow road to penury for young adults, save for those who manage to get on the really big ticket career paths or have parents who can pay for college and buy them a house. We can’t pretend to address the problems of the economy unless we include the increasing debt enslavement of the young along with the pauperization of the old. Otherwise, the Petersons and the Druckenmillers of the world will play them off against each other and keep them both under their boot. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| French Officialdom Now Discussing Eurozone Exit Posted: 22 Oct 2013 02:36 AM PDT Just because a taboo has been broken does not necessarily mean that more radical action is in the offing. But the flip side is that, while we’ve been busy following debt ceiling and budget hijinx in the US, there are some surprising developments on the other side of the pond. One is that, as anti-Euro candidate Marine Le Pen is leading in polls in France, respected members of its ruling bureaucracy are deeming the Euro as a failed experiment and presenting detailed plans as to how an breakup could be executed. Mind you, the Eurozone has been limping from crisis to crisis for so long that it’s hard to take new signs of trouble seriously. And the latest sighting, the publication of La Fin du Rêve Européen (The end of the European dream) by François Heisbourg describes the euro as a cancer imperiling the European Union, has more symbolic than practical importance. But it does mean that the idea of leaving the eurozone is no longer relegated to the lunatic fringe in France, one of the cornerstones of the currency union. In addition, there are are more credible proposals being floated for how to effect a dissolutions. Ambrose Evans-Pritchard of the Telegraph, who provides a detailed write-up of the Heisbourg plan, is not wild about it, particularly since Heisbourg calls for a second go at a monetary union in ten years after Eurozone members have put the needed Federal architecture in place. After an ugly breakup, it’s hard to see how citizens can be rallied to take up an initiative that failed a second time. There is one reason to pay attention to the French divorce talk: it’s a sign of festering political discontent with Germany. And remember, the French-German alliance is the backbone of the eurozone. Evans-Pritchard tells up:

Heisbourg also reminds reader of how grim the fundamentals are:

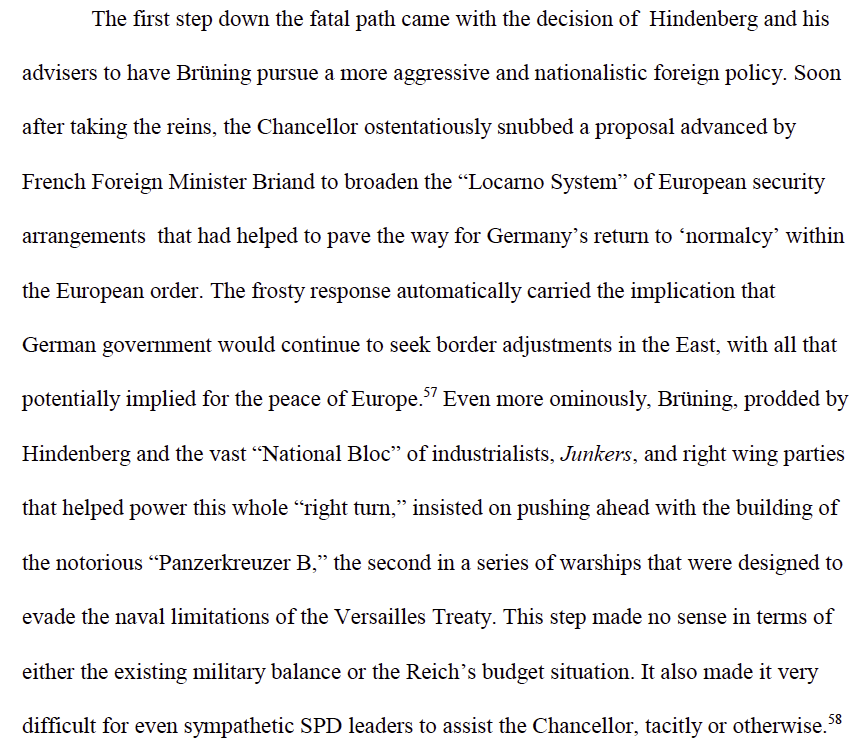

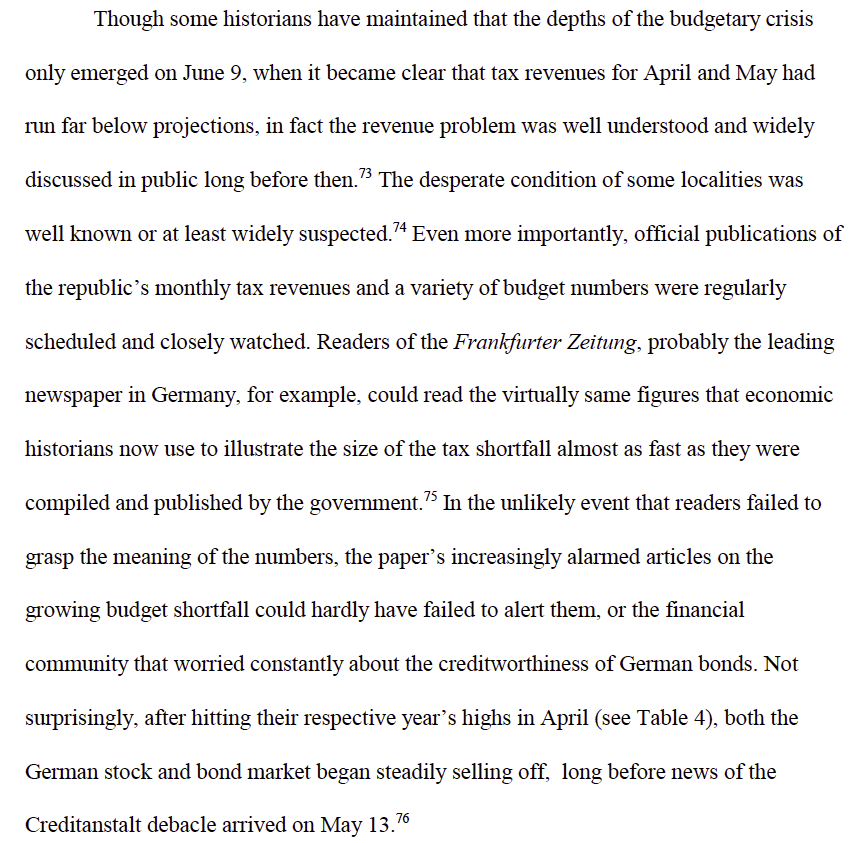

There’s a tendency, particularly in recent years, to discount the political component of economic crisis, particularly since the recent record is that government officials eventually prostrate themselves before the Bond Gods. The hated TARP was eventually passed. The US debt ceiling was increased, with altogether more high drama than international observers thought was necessary. The Trokia has repeatedly stumbled through crises and debt restructurings. Yet these patch-ups are still fraught, and every time the principals come to the table, it seems that tempers and trust are wearing more and more thin. It no doubt will seem like an extreme comparison, but I keep thinking about the set of circumstances that led to the collapse of Creditanstalt in 1931, which produced an international financial crisis and bank failures all across Europe. Mind you, I’m not predicting a Creditanstalt-type collapse, but to make the point that the trigger was political, not economic, and so it is important not to underestimate the possibility that political frictions can be the detonator for major financial dislocations. I think it’s separately worth discussing this episode because it is a critically important bit of economic history that is still not well understood. I’m attaching the best analysis I’ve seen of Creditanstalt failure, but will hazard to provide a relatively short summary: 1930: Germany is a complete mess. It’s 2-3 years into the Depression. Unemployment is high, people are hungry, and society is on the verge of breakdown in the hardest-hit areas. President von Hindenberg offers Bruning of the Catholic party the Chancellorship. Hindenberg has emergency powers to rule by decree (although they could still be overruled in Parilament). He hasn’t allowed Bruning’s predecessor from the Social Democratic Party to use them. Bruning judged the key coalitions (the army, industrialists, landed aristocracy) and his own party as ready to move to the right. The government was continuing to run deficits (which were funded just about entirely internally). Bruning’s efforts to reach a budget agreement simply made everyone unhappy: the right wanted deeper cuts, the left thought where the burden fell was unfair (sound familiar). Von Hindenberg and Bruning dissolved the government in September 1930. Oops! The Nazis made huge gains and became the #2 bloc in the Reichstag. Foreign investors freaked out. The mark fell and the central bank had to raise interest rates a full point. Von Hindenberg had Bruning formed a new government. Despite the repudiation by voters, Mr. Market had temporarily cowed the opposition. Bruning reappointed his old cabinet and talked up austerity. The government was able to sell an international syndicated loan. Bruning talked up a plan to buy the government more breathing room by refinancing short-term government debt into longer maturities. Weak improvements in the domestic economy bolstered international confidence. The Nazis left the Reichtsag in protest, giving Bruning more leeway and he was able to pass a budget. But possibly the biggest development of February 1931 was that the French signaled that they might make long term loans to Germany. France was the second largest creditor nation of the era. They had, not surprisingly, been taken aback by the September election. But the conservative French government fell in December and a more liberal and internationalist coalition took over. This vote of confidence was more important than the actual amount of money committed. The halting improvement in key economic figures and the change in French posture led to a rise in the stock market. The bond market rallied strongly for the first four months of 1931. So why with Germany seeming to be starting to be on the mend, did everything come unravelled? The article sets forth, in a meticulous way, that the collapse was not a classic bank run. Even weeks after the Creditanstalt failure, German deposits at its major banks that failed were at largely the same level. What did deteriorate was not demand deposits, but time deposits. The withdrawals thus weren’t to escape a bank collapse (although that’s what resulted), it was a run on the currency. Von Hindenberg and Bruning, implausibly, were also implementing a right turn on the international front: To make matters worse, the Parliament approved a plan for a customs union with Austria, which became public on March 21. This violated the spirit, and potentially the letter of the Versailles Treaty, which barred German and Austrian integration. France immediately threatened to stop lending to Germany. Bruning was caught between the need to make even deeper budget cuts as the economy continued to deflate, and persuading the countries to which Germany owed reparations to provide relief in order to prevent social upheaval The French and resulting financial market reaction aborted the possibility of a long-term loan’ Bruning tried squeezing harder while engaging in an international charm offensive. But it was too late: Bruning then attempted to work up a deal that would inflict enough additional pain on domestic constituencies to enable him to win some concessions on reparations. A domestic bond issue had failed before the Creditanstalt collapse, proof of deteriorating confidence. Talks over how to fill the budget gap were fraught. Bruning repudiated reparation payments on June 6. The article details the further unraveling. And the real trigger was the final recognition that austerity would not work: “Underneath it all, however, ran the wrenching fear that the government could not make its colossal budget cuts stick.” But the immediate trigger was the bone-headed, politically driven effort to prioritize military spending and poke a stick in the eyes of other European countries in the form of the customs union with Austria. This looked necessary from the perspective of domestic politics. Now Germany was such a basket case that the odds it could have limped though its mess are questionable. But the point is that the proximate cause of the European bank failures that delivered a huge blow to the global economy, was set off by political, not economic, events. It now seems that any big upheaval as a result of the festering aftermath of the financial crisis is unlikely. But a Eurozone breakup would be hugely disruptive and very detrimental to growth. While the odds are not all that high, they are still higher than a mere tail event, and political tensions continue to escalate. It’s still more likely than not that the Eurozone will hang together, but the widely accepted idea that politicians know better than to defy the Bond Gods may prove to be unduly optimistic. Ferguson/Temin: Made in Germany: The German Currency Crisis of July 1931 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.K.‘s Swiss Gold Exports Surge on ETF Selling Posted: 22 Oct 2013 02:33 AM PDT "The sellers of last resort haven't gone away." ¤ Yesterday In Gold & SilverGold didn't do a whole heck of a lot in Far East trading on their Monday. Once again it rallied a bit in the final hour of trading before the London open and, as I get tired of saying, the rally [such as it was] got dealt with in the usual manner. The low of the day acme around 11 a.m. BST in London, and the tiny rally at the Comex open got dealt with at 9 a.m. in New York, and that was pretty much it for the day. The CME recorded the low and high ticks as $1,312.00 and $1,323.90 in the December contract. Gold closed in New York yesterday at $1,316.60 spot, down 80 cents from Friday's close. Volume, net of October and November, was unbelievably light at only 79,000 contracts, so I wouldn't read much into Monday's price action, although it was obvious that a not-for-profit seller was ever watchful. It was more or less the same chart pattern in silver, except for the fact that the rally at the Comex open was far more obvious. But it, too, got smacked a minute or so after 9 a.m. EDT, just like like the gold price. After that it quietly sold down a hair going into the 5:15 p.m. EDT electronic close. The low, which came at or just before the noon BST London silver fix, was recorded by the CME as $21.85, and the high was 22.335. Both numbers are for the December contract. Silver closed on Monday at $22.235 spot, above the $22 spot mark again, and up 28 cents from Friday's close. Except for the willfully blind, it should be obvious that silver would have finished materially higher if a seller of last resort hadn't been dicking with the price. Volume in silver was light [but not that light] at 30,000 contracts net of October and November. Platinum didn't do much yesterday, and palladium had a tiny rally once trading began at 8:20 a.m. EDT in New York. Here are the charts. The dollar index closed late on Friday afternoon in New York at 76.62, .and chopped slightly higher as the Monday trading session moved along. There was a tiny up/down rally for a few hours between 7 a.m. and 1:40 p.m. EDT, but that was all the 'action' there was. The high tick came about 9:15 a.m. in New York, about 10 minutes after the not-for-profit seller showed up in both gold and silver. The index finished at 79.69, up a whole 7 basis points. Nothing to see here. The gold stocks gapped up and rallied until shortly after 11 a.m. EDT. From there they chopped sideways until the last 30 minutes of trading. Then they had a little spurt at the close, and the HUI finished the Monday trading session up 2.33%. It was more or less the same chart pattern in silver, but Nick Laird's Intraday Silver Sentiment Index closed up only 1.66%. The CME's Daily Delivery Report showed that 131 gold and 42 silver contracts were posted for delivery within the Comex-approved depositories on Wednesday. In gold, the largest short/issuer was HSBC USA with 128 contracts. It should come as no surprise that JPMorgan was the biggest long/stopper with 130 contracts. In silver, Jefferies issued 40 contracts, and JPMorgan stopped 30 of them as well. The link to yesterday's Issuers and Stoppers Report is here. There was a chunky withdrawal from GLD yesterday, as 337,814 troy ounces was shipped off for parts unknown. This had nothing to do with the price activity of the prior week, as the gold price rose $65 during that time period, so it's obvious that this gold was more urgently needed elsewhere. China perhaps. And as of 10:22 p.m. EDT yesterday evening, there were no reported changes in SLV. Since yesterday was Monday, and not a holiday like last week, the U.S. Mint had a sales report. They sold 3,000 ounces of gold eagles; 1,500 one-ounce 24K gold buffaloes; and 416,500 silver eagles. There was decent movement in gold over at the Comex-approved depositories last Friday. They reported receiving 96,450 troy ounces, and shipped out only 225 troy ounces. The big receipt was over at JPMorgan Chase. The link to that activity is here. In silver, these same depositories reported receiving 416,679 troy ounces, all of it into HSBC USA's vaults. Only 27,963 troy ounces were reported shipped out. The link to that action is here. I don't have all that many stories today, but some of the interviews in the precious metal section will take up a fair chunk of time if you decide to listen to all of them. And, as usual, the final edit is up to you. ¤ Critical ReadsJPMorgan agrees $13bn settlement with U.S. Justice DepartmentThe settlement, which has yet to be made official, is part of a broader investigation by the US authorities into the industry’s mortgage activities in the years before the crisis of 2008. Banks are alleged to have lied about the quality of the sub-prime mortgage securities sold to investors at the time. The JP Morgan settlement – the largest ever by a US company with the government – is expected to resolve civil claims against the bank, but will leave it open to criminal charges. Of the $13bn (£8bn), around $9bn is expected to cover fines or penalties and $4bn will go to consumer relief for struggling homeowners. The final cost to JP Morgan, the US’s largest bank by assets, could yet rise. A criminal investigation into its mortgage selling activities in Sacramento, California is ongoing. That case may result in charges against individuals, and an increase in the fine. This story appeared on the telegraph.co.uk Internet site on Friday evening BST, but has obviously been updated since, as the dateline has changed. I thank South African reader Bob Visser for today's first story. U.S. Deal With JPMorgan Followed a Crucial CallOn Sept. 24, four hours before the Justice Department was planning to hold a news conference to announce civil charges against the bank over its sale of troubled mortgage investments, Mr. Dimon personally called one of Attorney General Eric H. Holder Jr.’s top lieutenants to reopen settlement talks, people briefed on the talks said. The rare outreach from a Wall Street C.E.O. scuttled the news conference and set in motion weeks of negotiations that have culminated in a tentative $13 billion deal, according to the people briefed on the talks. An account of the negotiations, based on interviews with these people, pulls back a curtain on the private wrangling to illuminate how the bank and the government managed to negotiate what would be a record deal. It also sheds new light on the hands-on role that Mr. Dimon and Mr. Holder played in the talks. And it highlights how Mr. Dimon has so far maintained the support of the bank’s board when other Wall Street chiefs were derailed by the financial crisis. Much of the deal came down to dollars and cents. Mr. Dimon, the people said, signaled during that Sept. 24 call that he was willing to increase JPMorgan’s offer to settle an array of state and federal investigations into the bank’s sale of troubled mortgage securities before the financial crisis. The government, these people said, had already balked at the bank’s two initial offers: $1 billion and $3 billion. And so that same week, Mr. Dimon traveled to the Justice Department in Washington for a meeting with Mr. Holder that underscored how expensive the healing process had become. At the meeting, the people briefed on the talks said, JPMorgan executives raised the offer to $11 billion, $4 billion of which would serve as relief to struggling homeowners. This longish news item was posted on The New York Times website on Sunday...and it's courtesy of U.A.E. reader Laurent-Patrick Gally. Fed could up Q.E. to $1 Trillion a month: Marc FaberMarc Faber, publisher of The Gloom, Boom & Doom Report, told CNBC on Monday that investors are asking the wrong question about when the Federal Reserve will taper its massive bond-buying program. They should be asking when the central bank will be increasing it, he argued. "The question is not tapering. The question is at what point will they increase the asset purchases to say $150 [billion] , $200 [billion], a trillion dollars a month," Faber said in a "Squawk Box" interview. Faber has been predicting so-called "QE infinity" because "every government program that is introduced under urgency and as a temporary measure is always permanent." He also said, "The Fed has boxed itself into a position where there is no exit strategy." This short piece, with an embedded video clip, was posted on the CNBC website mid-Monday morning...and the first reader through the door with it was Ken Hurt. Fresh Leak on U.S. Spying: NSA Accessed Mexican President's EmailThe NSA has been systematically eavesdropping on the Mexican government for years. It hacked into the president's public email account and gained deep insight into policy making and the political system. The news is likely to hurt ties between the US and Mexico. The National Security Agency (NSA) has a division for particularly difficult missions. Called "Tailored Access Operations" (TAO), this department devises special methods for special targets. That category includes surveillance of neighboring Mexico, and in May 2010, the division reported its mission accomplished. A report classified as "top secret" said: "TAO successfully exploited a key mail server in the Mexican Presidencia domain within the Mexican Presidential network to gain first-ever access to President Felipe Calderon's public email account." According to the NSA, this email domain was also used by cabinet members, and contained "diplomatic, economic and leadership communications which continue to provide insight into Mexico's political system and internal stability." The president's office, the NSA reported, was now "a lucrative source." This news item was posted on the German website spiegel.de late Sunday morning Europe time...and my thanks go out to reader Norbert Wangnick. It's definitely worth reading. Then 24-hours later, spiegel.de had a follow-up story on this headlined "Unacceptable": Mexico Slams U.S. Spying on President. That story is courtesy of Roy Stephens. Frexit fever reaches heart of French establishmentCalls for EMU break-up are spreading into the upper echelons of the French foreign policy establishment, and the pro-European core. An astonishing new book by François Heisbourg – La Fin du Rêve Européen (The end of the European dream) – argues that the "euro cancer" must be cut out to save the rest of the EU Project before it is too late. "The dream has given way to nightmare. We must face the reality that the EU itself is now threatened by the euro. The current efforts to save it are endangering the Union yet further," he writes. This longish Ambrose Evans-Pritchard commentary was posted on The Telegraph's website on Sunday sometime...and is worth reading if you have the time. France reacts to NSA spying: old revelations, new outrageFrench authorities have long known that the US National Security Agency (NSA) has been intercepting phone calls in France. So why have they reacted so forcefully to Monday’s revelations by a leading French newspaper? France’s official reaction to a newspaper report on Monday that the US National Security Agency (NSA) spied on millions of French phone calls was swift and forceful. French Foreign Minister Laurent Fabius immediately summoned US Ambassador to France Charles Rivkin, while Interior Minister Manuel Valls said he was "shocked" that 70.3 million pieces of French telephone data were recorded by the NSA between December 10, 2012 and January 8, 2013. The report – which was published in the leading French daily, “Le Monde” – threatens to turn into a diplomatic row as US Secretary of State John Kerry arrived in Paris for the start of a European tour on the Syrian crisis. This news item was posted on the france24.com Internet site yesterday, and is the second contribution of the day from Bob Visser. Martin Walker: Why Europe's banks trembleEurope's banks and financial officials are all awaiting, in a mix of hope and trepidation, to learn just how the European Central Bank proposes to assess the solvency of Europe's banks. The procedure goes by the name of the Asset Quality Review, which will judge whether the assets and capital of Europe's 130 leading banks are worth what the banks say they are or whether they are a great deal more vulnerable than the banks want to admit. The background is important. Europe's banks have performed pitifully since the financial crisis began in 2007, in part because they didn't undergo the cuts and reforms of their U.S. counterparts. The difference was that the U.S. banks were subjected to a strenuous and transparent stress test that wrenched a lot of skeletons from many cupboards. The Europeans, by contrast, were put through much gentler and less open stress tests that barely deserved the name, largely because of political interference by various national governments. European banks that "passed' the test have since gone under. This commentary, filed from Dusseldorf in the wee hours of Monday morning Europe time, was posted on the upi.com Internet site...and I thank Roy Stephens for his second offering in today's column. RBS 'bad bank' due in weeks, says George OsborneThe Royal Bank of Scotland is to be broken up by the Government into a "good bank" and a "bad bank" with the go-ahead to be given within the next few weeks, the Chancellor has disclosed. George Osborne said the future of RBS was his "priority for the next two or three weeks" and there was no chance the bank could be left in its current form. He added: "RBS was a much more complex bank. To be fair to management past and present it was a bank that was in a lot more trouble. The clean-up job has been more difficult but we have got to make these decisions now about the future for RBS." This interesting story was posted on the telegraph.co.uk Internet site late on Friday evening BST...and I thank Roy Stephens once again for sharing it with us. Merkel wants to reform E.U. with more powers for BrusselsAngela Merkel's domestic policy in her third term will likely be confined to higher spending. But she has grand plans for Europe. SPIEGEL has learned she wants Brussels to have far more power over national budgets. It's a risky move that EU partners and the Social Democrats are likely to oppose. Officials at the Chancellery are forging plans for Europe that are practically visionary for someone like Merkel. If she prevails, they will fundamentally change the European Union. The goal is to achieve extensive, communal control of national budgets, of public borrowing in the 28 EU capitals and of national plans to boost competitiveness and implement social reforms. The hope is that these measures will ensure the long-term stability of the euro and steer member states onto a common economic and fiscal path. This would be the oft-invoked and ambitious political completion of Europe's monetary union -- a huge achievement. It isn't a new goal, but what is new is the thumbscrews Brussels will be allowed to apply if Merkel has her way, including sooner and sharper controls and veto rights, as well as contractually binding agreements and requirements. In short, this would amount to a true reconstruction of the euro zone and a major step in the direction of an "economic government" of the sort the SPD too would like to see put in place. This article was posted on the spiegel.de website yesterday afternoon Europe time...and it also sports a friendlier-sounding headline..."Angela's Agenda: A Grand, Controversial Plan for Europe". It's another contribution from Roy Stephens. China aiming for 'de-Americanised world' with renminbi replacing dollarChina has overtaken the US as the world’s largest oil importer and goods trading nation. Over the next five years, it will surpass the rest of the world combined in its consumption of base metals. Given the scale of the country’s consumption of fossil fuels and raw materials, it is only a matter of time before the renminbi replaces the dollar as the primary currency for trading commodities and resources such as crude oil and iron ore. The debt ceiling farce in Washington and China’s growing reluctance to continue underwriting the US economy by buying up its bonds and adding to America’s near $17 trillion (£10.5 trillion) debt mountain suggests that this tectonic shift in the global trade syste | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China aiming for 'de-Americanised world’ with renminbi replacing dollar Posted: 22 Oct 2013 02:33 AM PDT China has overtaken the US as the world’s largest oil importer and goods trading nation. Over the next five years, it will surpass the rest of the world combined in its consumption of base metals. Given the scale of the country’s consumption of fossil fuels and raw materials, it is only a matter of time before the renminbi replaces the dollar as the primary currency for trading commodities and resources such as crude oil and iron ore. The debt ceiling farce in Washington and China’s growing reluctance to continue underwriting the US economy by buying up its bonds and adding to America’s near $17 trillion (£10.5 trillion) debt mountain suggests that this tectonic shift in the global trade system could be just around the corner. This commentary was posted late Sunday evening BST on The Telegraph's website...and I found it in a story that GATA's Chris Powell filed from Ho Chi Minh City yesterday. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ten King World News Blogs/Audio Interviews Posted: 22 Oct 2013 02:33 AM PDT 1. John Embry [#1]: "We Are Looking at a Frightening End Game". 2. Art Cashin: "The Financial System Was Within Hours of Absolute Collapse". 3. Grant Williams: "People In Asia Are Staggered at What's Happening in the West". 4. Egon von Greyerz: "How to Survive the Coming Financial Chaos in the U.S." 5. Eric Sprott: "Stunning Surprise in the Silver Market". 6. Robert Fitzwilson: "The Shocking Reality of the World Today". 7. John Embry [#2]: "Collapsing Global Financial System Now in a Terminal State". 8. Richard Russell: "This Has the "Money Masters" of the World Truly Terrified". 9. The first audio interview is with Grant Williams...and the second audio interview is with Eric Sprott. [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jeff Clark: Silver's Message -- The Bull is Alive and Well Posted: 22 Oct 2013 02:33 AM PDT There's nothing really new in this short piece from Jeff, as Ted Butler has spoken about all this at length already, and I've stolen most of for this column. But it is nice to see it all in one place...and there are some good charts. For that reason alone it's a worthwhile read. It was embedded in yesterday's edition of the Casey Daily Dispatch. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 -- Helicopter Money is Coming! Jim Rickards, Currency War Update Posted: 22 Oct 2013 02:33 AM PDT This 22-minute interview with Jim was posted on the futuremoneytrends.com Internet site last Friday...and a lot of the discussion towards the end of the interview centers around gold. I've watched it already, and it's worth your time if you have it. I thank reader Harold Jacobsen for tracking this video clip down for us. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul: gold, dollar, debt ceiling and the Fed Posted: 22 Oct 2013 02:33 AM PDT This interview with Ron, both in audio and transcript from, was posted on the birchgold.com Internet site. I would assume from the comments that it's fairly recent, but there's no dateline. I thank reader Andy Klein for sending it our way. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lower Nevada mining output impacts U.S. gold production - USGS Posted: 22 Oct 2013 02:33 AM PDT At 110,000 kilograms (3,536,582 troy ounces), U.S. gold production was 8% lower for the first half of 2013, compared to the first half of last year, the U.S. Geological Survey reported. Domestic gold output dropped from 20,400 kg (655,875 ounces) on June 2012 to 19,400 kg (623,724 ounces) on June 2013. The average daily gold production for U.S. mines was 647 kg (20,801 ozs) in June 2013. This short story was posted on the mineweb.com Internet site yesterday. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.K.'s Swiss gold exports surge on ETF selling Posted: 22 Oct 2013 02:33 AM PDT A surge in gold exports from the United Kingdom to Switzerland this year may largely be the result of metal sold out of exchange-traded funds being shipped for re-refining before making its way to Asia, according to Australian bank Macquarie. U.K. gold exports to Switzerland, Europe's major bullion refining hub, jumped to 1,016.3 tonnes in the first eight months of this year, data from European Union statistics agency Eurostat shows, from 85.1 tonnes in the same period of 2012. Investor withdrawals from gold ETFs, which issue securities backed by physical bullion, have totalled nearly 670 tonnes so far this year, according to Reuters data, a sharp reversal from average inflows of 332.3 tonnes over the previous five years. As of yesterday's withdrawal from GLD, you can add another ten tonnes of gold to the pile that is heading east. This must read Reuters piece was posted on the mineweb.com Internet site yesterday...and my thanks go out to California reader Ray Wiberg for bringing it to our attention. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| William Engdahl: China, gold prices and U.S. default threats Posted: 22 Oct 2013 02:33 AM PDT In the very days when a deep split in the US Congress threatened a US government debt default, the gold price should normally jump through the roof, yet the opposite was the case. It is worth a closer look why. Since August 1971, when US President Richard Nixon unilaterally tore up the Bretton Woods Treaty of 1944 and told the world that the Federal Reserve ‘gold window’ was permanently closed, Wall Street banks and US and City of London financial powers have done everything imaginable to prevent gold from again becoming the basis of trust in a currency. On Friday, October 11, when there was no sign of any deal between US Congress members and the Obama White House that would end the government shutdown, the Chicago CME Group, which operates Comex - the Chicago Commodity Exchange, where contracts in gold derivatives are traded - announced that at 8:42am Eastern time the trading was halted for 10 seconds after a safety mechanism was triggered because a 2-million-ounce (56.7 million grams) gold futures sell order was executed. This commentary was posted on the Russia Today website yesterday. William Engdahl is an award-winning geopolitical analyst and strategic risk consultant whose internationally best-selling books have been translated into thirteen foreign languages. I thank reader Tolling Jennings for sharing it with us. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Fundamental Analysis October 22, 2013 Forecast Posted: 22 Oct 2013 01:15 AM PDT fxempire | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment