saveyourassetsfirst3 |

- Confusion over mine permitting 'rejection' in Spain

- Gold prices jump 2.9% from 3-month lows

- Canada’s Northwest Territories seeks to raise debt ceiling

- This could be your only legitimate chance to turn a tiny $99 investment into life-changing money

- More Federal Reserve Failure – Graphically!

- Japan Reflation Update

- Gold, Trust & Independence, Part 2

- Philip Morris' Earnings Face Headwinds From Anti-Tobacco Measures, Strengthening U.S. Dollar

- Jim Rickards – Why China is Buying Gold & Calling for a De-Amercanized World

- Gold to have another go at overhead resistance

- GEAB N°78 is available! The de-Americanisation of the world has begun – emergence of solutions for a multipolar world by 2015

- Stock market appears ready for new high — what about gold?

- Indian gold jewellery exports up to August collapsed 57.1% y/y

- T minus 1 for U.S. downgrade, gold jumps 2.9% from 3-month low

- Gold surged 17% in 15 trading days after last debt ceiling extension in 2011

- 22 Reasons To Be Concerned About The U.S. Economy As We Head Into The Holiday Season

- Forget the short term – gold is for the long run

- Boehner Folds, Full Details of Debt “Deal”

- First Majestic Produces a New Record of 3.37 million Ag-Eq Oz

- Hold On a Second There

- ECB Head Mario Draghi On Gold & Banking; Admits “Central Bankers Are Powerful—They Are Also Not Elected”

- Argonaut Gold Announces Q3 Gold Production of 26,690 Oz

- Virtual Currencies: Gold Rush or Fools’ Gold, The Rise of Bitcoin in a Digital Economy

- Alasdair Macleod: Valuing Gold

- Gold premiums jump 150% in a week – hit a new record high in India

- Shanghai Gold Exchange VS. Obamacare: FREE MARKET VS. TYRANNY

- Guest Post: Gold Market Sunk to Keep Bond Market Afloat

- Gold Will Be the Bedrock of the New Currency

- SDB’s Lowest Price EVER on Silver Rounds!

- The Myth of China’s Financial Time Bomb

- Gold Surged 17% In 15 Trading Days After Last Debt Ceiling Extension In 2011

- Embry scoffs at Lassondes claim that central bankers ignore gold

- Gold Surged 17% In 15 Trading Days After Last Debt Ceiling Extension In 2011

- Is Sugar Once Again Signaling the Next Big Move in Gold & Silver?

- Sprott's Thoughts: Is Gold Still a Safe Haven?

- Jim Rickards predicts how gold price suppression will end

- Jim Rickards Predicts How Gold Price Suppression Will End

- Just how ugly would a default be for the dollar? Very.

- Doug Casey: Lack of confidence -- U.S. government and the American dollar

- JPMorgan Expected to Admit Fault in 'London Whale' Trading Loss

- Watch what China does with U.S. debt, not what it says

- Peter Grandich: The gold mining industry is pretty useless, Grandich laments

- Alasdair Macleod: Valuing gold

- Mysterious Gold Seller Is Back With Periodic High Volume Slams, Fails To Break Market

- Gold premiums hit record in India

- India needs a national gold policy

- Indian sage dreams of gold to save economy, government starts digging

- Chinese gold output to August up 8% year on year

- Silver Forecast October 16, 2013, Technical Analysis

- Gold Prices October 16, 2013, Technical Analysis

| Confusion over mine permitting 'rejection' in Spain Posted: 16 Oct 2013 07:26 PM PDT Edgewater Resources was in damage control mode after headlines in Spain suggest its gold project had been rejected. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold prices jump 2.9% from 3-month lows Posted: 16 Oct 2013 05:05 PM PDT With gold rallying 2.9% at one point from yesterday's sudden 3-month low, world stock markets slipped. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canada’s Northwest Territories seeks to raise debt ceiling Posted: 16 Oct 2013 03:13 PM PDT The territory says it needs more borrowing to fund a hydro-electric grid expansion to link remote diamond, gold and rare-earth mines. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This could be your only legitimate chance to turn a tiny $99 investment into life-changing money Posted: 16 Oct 2013 01:22 PM PDT From Jeff Clark in Growth Stock Wire: In today's essay, I'm doing something I don't normally do... Instead of telling you about what's going on in the markets, I'm going to tell you about an opportunity that ends tonight. Now I know I'll get complaints that this sounds like an advertisement. And in a sense, it is. But I'm not going to apologize for it. This is something I think you absolutely MUST take advantage of. It's something I have paid for with my own money. And most importantly, it ends today. Let me explain... As a trader, research is everything. You're only as good as your ideas. And your ideas are only as good as the research that goes into them. I spent more than 20 years in the stock brokerage industry. During that time, I subscribed to dozens of newsletters... I paid for some of the most expensive research on Wall Street. I'm telling you... the best stuff came from Stansberry & Associates. I was so impressed with the quality of S&A's research that when I decided to retire from the brokerage business, I contacted S&A about publishing my own research. I didn't even consider writing for anybody else. Prior to that, though, I was an S&A Alliance member. I had access to just about everything S&A published. And I paid a hefty price for it. But I still view my Alliance membership as one of the best investments I ever made. For example, I think my colleagues Dan Ferris and Porter Stansberry are two of the best business analysts in the world. They do a great job of finding safe, cheap companies. When they find great businesses trading for great prices, I structure my own option trades around those companies. I've used their research dozens of times to structure safe, triple-digit winning trades for my readers... my clients... and myself. It might sound odd if you've never used this approach, but their fundamental stock research is some of the most useful option-trading material you can get anywhere, for any price. Today, the Alliance membership – which gives you access to all the research published by Dan, Porter, me, and half a dozen of our colleagues – costs $14,000. That may seem steep... and I know it's out of reach for a lot of investors and traders. But it's worth every penny. And today, I'm going to show you how you can get all of S&A's research for just $99. Yes, you can get access to $14,000 worth of research for only $99. S&A is holding an "Open House." All of our research is on display. If you've ever wanted to take a peek at some of the best research on Wall Street, now is your chance. Through this Open House, you'll get full access – for 45 days – to everything we publish... all the current newsletter issues... all the research... all the educational videos and investment manuals – including my eight-part video series on option trading. You'll get all of our trading recommendations... all of our favorite long-term plays... and our best gold and silver investments. You'll get access to EVERYTHING we publish, without paying the normal subscription fees. All it will cost you is $99. You can't even buy a nice dinner for four for 99 bucks anymore. But you can get access to all of my option-trading services. You can check out Porter's new Stansberry Alpha service. You can read Doc Eifrig's Retirement Trader, Steve Sjuggerud's True Wealth Systems, Dan Ferris' Extreme Value, and even Frank Curzio's $5,000-a-year Phase 1 Investor. You're going to get hundreds of investment and trading ideas... for just $99. But there's a catch... the Open House closes tonight. If you want access to all of this research for the next 45 days, you need to sign up today. So you can't waste a bunch of time thinking about it. Really, though, what is there to think about? If you're a serious investor or a serious trader, this is an absolute, no-brainer deal. To register for the Open House, just click here. More from Stansberry Research: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More Federal Reserve Failure – Graphically! Posted: 16 Oct 2013 01:00 PM PDT Over the years, whenever I'm asked if the CFTC will crack down on gold and silver manipulation, my answer has unwaveringly been the same – NOT A CHANCE. My reasoning is as simple as can be; that is, the government's steadfast goal of maintaining the status quo – no matter how many suffer as a result – will NEVER be ended by a self-inflicted gunshot. After all, the CFTC is a government agency; and thus, why would anyone expect it to contradict government plans? The same goes for the government at large; which care of a recently successful "policy" of MONEY PRINTING, MARKET MANIPULATION, and PROPAGANDA, actually believes it can "sustain the unsustainable" indefinitely. In their eyes, if they can convince people a higher stock market signifies imminent "recovery," the masses will continue to listen to their lies; no matter how much they contradict REALITY. Similar efforts have been attempted throughout history, and ALL have failed. It will be no different this time around – no matter how many derivatives are utilized. Using such tools, they create "straw men" to tear down; such as the meme that stocks are terrified of government shutdowns and debt ceiling impasses, whilst Precious Metals "love" them. The fact the Dow Jones Propaganda Average sits just below its all-time high (not adjusted for inflation or survivor bias, of course), while gold and silver have already been torched, is immaterial when preaching to a population resigned to misery, which cares only when its next EBT card will be filled. Not that they really care in the first place; as aside from those actually on furlough, few have any clue what the "government shutdown" or "debt ceiling" mean. And sadly, the same goes for Europeans; who given their sorry, sordid history of war, corruption, and inflation, should know better. Then again, they too are living a hopeless existence where "1%" owns everything, and the rest rely on them for survival. That said, how ANYONE can believe rising European stocks are indicative of ANYTHING other than "intervention" is beyond me. Spain's IBEX index, for instance, has nearly doubled in the past year; despite a PMI business activity index below 50 until this month, when it barely turned positive. GDP remains negative, unemployment at an ALL-TIME HIGH; and per below, home prices and bank loans remain in FREEFALL.

Remember, when Spain's banking sector was bailed out with €100 billion of freshly printed ECB money last summer, it was the morbid housing sector that was its main cause. Fast forward to today – when the housing market is in MUCH worse shape; yet, we're to believe a freely-traded stock market is nearly twice the price? Even the ECB admits the banking sector is in trouble; and yet, such a catastrophe has been largely ignored by the MSM. The same goes for Greece, which yet again is on the verge of another bailout; and, for that matter, the United States of Fraud – where yet another bank, in this case Bank of America – reported "earnings" so fraudulent, they're an utter embarrassment; i.e., another blaring signal for the rest of the world to SELL, SELL, SELL dollar-denominated assets. Back to my point, the odds of the game ending with the U.S. government shutting itself down are practically ZERO, in my opinion. And no, I'm not speaking of the past two weeks faux shutdown – in which roughly 90% of government jobs were unscathed, under the guise of being "essential" to national security; but instead, a real shutdown triggered by failure to raise the debt limit. Not to mention, the associated default on U.S. Treasury bonds – which theoretically, is impossible given the Fed's unlimited printing press capability. In other words, there is NO WAY a tiny group of 536 people – who rely on public confidence to keep their jobs – would allow a generational tragedy to occur due to procedural squabbling. And not to mention, such an event would forever cast them as pariahs in global history books. No, instead they'll most certainly come up with a "deal" similar to the "fiscal cliff deal" of last New Year's Eve, or subsequent debt ceiling delay that brought us to tomorrow's "deadline." The new deal will simply create another "deadline" in January; and in the process, dramatically worsen America's financial condition and global standing. However, TPTB will – as usual – attempt to manipulate markets to create the perception something positive has occurred. Whether it will succeed or not is another matter entirely; but until such attempts fail, you can bet they will attempt EVERY fraudulent trick in the book. To wit, we're told that yesterday, after being violently attacked up until late in the day, gold and silver "soared" because the latest Senate debt ceiling negotiations fell apart; while comically, the Dow's losses were stopped shy of the "PPT ultimate limit down" of minus 1.0%. Yes, gold was $9/oz. on the day, or just 0.7%, and silver a whopping $0.07/oz.; in the process, capped by every suppressive algorithm imaginable. And thus, we're supposed to believe the world has ended. Conversely, today we are told Senate and House leaders are optimistic – not un-coincidentally, just after the New York Stock Exchange opened; and thus, gold declined by more than it gained yesterday, whilst the Dow – naturally – gained more than it lost. No matter that worldwide PHYSICAL demand is off the charts – per the below quote from a Miles Franklin Blog reader; so long as the MSM prints "gold down $10/oz."

As you can see, the 2:15 AM algorithm emerged for the 95th time in the last 107 trading days; followed by PAPER raids at EXACTLY the 7:00 AM EST open of the New York "pre-market" session and the 10:00 AM EST "PM Fix"; i.e., "KEY ATTACK TIME #1"…

In other words, no different than any other day over the past six months, no matter what the day's "news"; which, by the way, consisted of the following, MASSIVELY PM-bullish, – items. One, extremely weak retail sales, and two, an imploding NAHB Housing Index – you know, the one supposedly symbolizing the "recovery" we are expected to be so giddy about. Yes, "tapering" is off the table for the foreseeable future; and with "uber-dover" Yellen taking the Fed's reins in February, it's entirely possible my forecast of QE5 will become a reality MUCH sooner than most could imagine.

In other words, the current PAPER attacks are inconsequential to the long-term outlook for PM prices; which, with each passing day of suppression, become more bullish. This is why I bought more PHYSICAL gold yesterday morning, and why I will continue to do so with every free penny I receive. The fact remains that, aside from the deleterious effect on supply due to the Cartel's inadvertent destruction of the mining industry, the worldwide demand outlook grows brighter at an exponential pace. The "debt ceiling deal," that will surely be signed before midnight will simply increase the balance on the government's blank checkbook, enabling it to further spend the nation – and world – into DEBT and INFLATION oblivion. Furthermore, the diminishing returns on such spending have become so acute, there now exists a negative "return on equity." In other words, the more they spend, the more real GDP plunges – notwithstanding increasingly fraudulent accounting methods. I wrote of this failure last week; and thought I'd follow up on the topic today, given the need to refute the inevitable PROPAGANDA of how a "debt ceiling deal" is somehow a positive development. Frankly, to do so, one only needs to present the two charts below – demonstrating just how futile TPTB's attempts to "reflate" the system have been, other than the stock market, that is. The first depicts the amount of DEBT created since 2008's Global Meltdown I, creating an embarrassingly paltry amount of real GDP. Of course, the debt increase doesn't include the assumption of $5 trillion of "off balance sheet" debt owed by Fannie Mae and Freddie Mac; tens of trillions of incremental "unfunded liabilities"; or, for that matter, "shadow banking" liabilities such as off-balance sheet "swaps" to undisclosed European banks. Not to mention, if REAL inflation accounting were utilized, the level of real GDP would be negative…

Last but not least, how about the below chart depicting how overall economic leverage has not budged since its 2008 all-time highs? Yes, government and GSE (government-sponsored entities) leverage appear to have blipped lower; but only because the government fraudulently changed its GDP calculation earlier this year to make the economy appear larger. Even so, the impact is barely perceptible on this graph; whilst corporate and household leverage have also barely changed. And by the way, household leverage only appears slightly lower due to the manipulated increase in real estate prices; which as I wrote of above, are already rolling over due to the miniscule rate increases of the past four months.

To conclude, no matter what occurs by midnight tonight, it will be the "worst for America, but best for Precious Metals." Any Congressional "deal" will simply mean more debt and inflation; and irrespective, the dramatically weakening economy MUST receive "QE to Infinity" lest it will instantaneously collapse. Conversely, if heaven forbid these fools fail to avert the debt ceiling with such a deal, the last remaining shred of American credibility will be gone forever. Frankly, I think it's already gone; but then again, even our creditors likely could not conceive America destroying itself with the aforementioned self-inflicted gunshot. Use this, and ANY remaining opportunities to purchase subsidized REAL MONEY while you still can; as one day soon, there's a good chance you'll NEVER get another chance – at any price. PHYSICAL gold and silver have been immemorially utilized as money, with good reason. They are the only substances to possess all the requisite properties; and as of today, there are still no viable choices. No fiat scrip has ever survived, but PMs remain after five millennia of human existence; in both the REAL world, and in fiction - per the below quote from Stephen King's Wind through the Keyhole…

Similar Posts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Oct 2013 12:55 PM PDT Last January I noted that "one of the biggest things happening on the margin is the decline of the Japanese yen." The Bank of Japan was effectively pressured into a serious relaxation of monetary policy. After being extremely tight for many years - as reflected in zero/negative inflation, a relentless appreciation of the yen against virtually all other currencies, a very weak stock market and a moribund economy - the Bank of Japan has completely reversed course. This has had predictable and impressive results. (click to enlarge) The above chart shows just how impressive the increase in Japan's bank reserves has been. Reserves are up 137% in the year ending September. (click to enlarge) A genuine easing of monetary policy ought to result in a weaker currency, and that is exactly what has happened in Japan. The yen has gone from 78 to 99 vs. the dollar in the | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

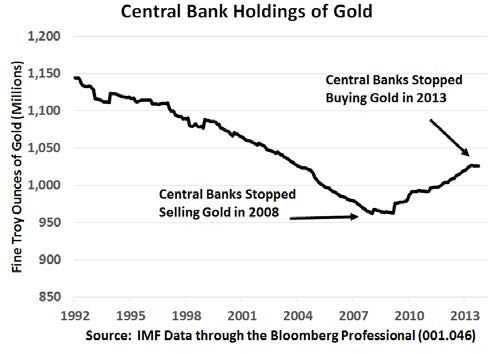

| Gold, Trust & Independence, Part 2 Posted: 16 Oct 2013 12:51 PM PDT Buying gold was all the rage for central banks net-net during the crisis. But now...? BUYING GOLD typically signals a lack of confidence in other people, writes Adrian Ash at BullionVault. (Read part 1 of this little series on the LBMA 2013 conference here...) Yet even as governments everywhere give investors and central banks new reasons to lose trust, the trend is no longer for central banks to keep buying. Not according to analysis of the latest IMF gold data. "Central bank activity in 2013 suggests the appetite for buying gold has been whetted," notes Blu Putnam, chief economist at CME Group, in his latest Markets Insights on Gold. More than that, says the commodities team at French investment bank and bullion dealers Natixis, central bank gold buying – "which two years ago was the driving force behind the price of gold – has not only slowed but actually turned to net selling", albeit of 20 tonnes from this spring's 10-year record aggregate holdings of 31,940 tonnes. And little wonder... Rather than buying gold, as the CME's chart shows, central banks as a group were net sellers for two decades starting in the late 1980s. Asian and other emerging-market banks then raised their demand as prices rose (and the US Dollar fell). Former sellers in Western Europe then paused their divestment, as the global financial crisis bit hard. Now, in contrast, "We don't feel comfortable with gold's volatility," said Juan Ignacio Basco, deputy general manager at the Central Bank of Argentina, at this month's London Bullion Market Association conference in Rome. "Even though it's only a small part of the [reserves] portfolio." This year's volatility in prices has "definitely changed" attitudes, Basco went on, amongst central bankers towards buying gold. Argentina's experience makes a signal example. Basco's central bank cut its gold bullion reserves as prices fell in the 1990s from 120 tonnes to pretty much zero. But as prices rose, Argentina then bought back some 62 tonnes. The last 8 tonnes were bought at gold's all-time highs in late summer 2011. Since then? Buying gold at $1800 per ounce has resulted in a 30% loss over the last two years. Spring 2013's waterfall price drops represented "greater than two standard deviation" moves, said Basco. So "we're using options to smooth volatility," he went on. Because with gold so volatile, but falling instead of rising, "We have to do something." This little titbit – plus a comment from Banque de France director Alexandre Gautier on the same panel – would seem to confirm a point which Natixis flagged 6 months ago, before gold's first sharp decline in April. Which was that, after buying gold to achieve their desired allocation whilst prices were rising, many smaller central banks "have become hedgers rather than accumulators, selling at higher gold prices and buying at lower prices in order to maintain gold holdings within their target benchmark ranges." Such activity – known to financial wonks as "dynamic hedging" – involves options and other derivatives contracts. No metal is being added, even as prices fall. Because those falling prices, plus the achievement of target levels at the peak in 2011, have spooked emerging-market central banks from buying more gold bullion in 2013. Paper contracts will do nicely, thank you, for fine-tuning the portfolio's allocation to gold. Hard times can make dynamic hedging less urgent, however. Because as IMF data gathered by the World Gold Council show, Argentina's official gold holdings have remained pretty constant as a proportion of its total foreign reserves. Sticking around 6.5% by value, gold has held steady even as prices fell thanks to the Latin American basket-case's latest economic crisis, which has seen it sell other currencies in a bid to buoy the Peso on the international currency markets. Even so, the Banque de France – reputedly a big player in the gold sector's lending, hedging and forward selling of the late 1990s – is now "active [again] for other central banks and official institutions" the LBMA conference learnt from M.Gautier. Certainly, European central banks are sitting tight on their hoards. So those government bodies now keeping the Banque busy, and whether buyers, sellers or hedgers, must be elsewhere. The big issue, then? China. If only because it stood out by its absence. For the first LBMA conference in five, in fact, China's gold reserves weren't a hot topic of debate in Rome this month. Perhaps because everyone just assumes more gold buying by the People's Bank is par for the course. China hasn't reported its official gold reserves to the world since 2009. That update added 450 tonnes to the 600 tonnes already declared. Within 6 months, near neighbor and arch-rival for Asian leadership India snapped up 200 tonnes, buying gold from the International Monetary Fund at what soon looked like a bargain price of $1050 per ounce. And while India's private gold demand has since helped tip its trade deficit into a tailspin – leading the government to put a ban on gold imports in all but name – China's demand has continued to surge. The world's largest gold-mining producer, China's gold buying is likely to overtake India as the largest consumer in 2013 as well. Add up the numbers, and the gap between supply and private demand looks so huge, it's hard not to put the People's Bank right in the frame as the world's gold buyer of last resort today. Why might that be? Freer to speak than the West European central bankers on the LBMA's panel in Rome, Argentina's Basco still agreed with the Bundesbank and Banque de France's key point. Even if a little less diplomatically. "Gold is a strategic matter, okay?" he told the conference. No doubt he meant from a portfolio view. But politically, gold is plainly highly strategic as well. Beijing knows it. So does the Indian government. Yet this year's key themes at the LBMA conference – of trust and confidence – were most yoked together by Indian households, weirdly absent from the discussion even as they presented the hottest topic for the 700-odd market professionals gathered in Rome. Third and final part to come... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Philip Morris' Earnings Face Headwinds From Anti-Tobacco Measures, Strengthening U.S. Dollar Posted: 16 Oct 2013 12:39 PM PDT Philip Morris International (PM) is set to report its third quarter earnings on October 17. We expect the results to be negatively impacted by lower volumes from Philippines where a sharp hike in indirect taxes implemented earlier this year has disrupted an otherwise flourishing tobacco industry. We also expect Philip Morris' earnings from the European Union to continue to be under pressure from the growing illegal trade of cigarettes and increasing consumption of cheaper tobacco alternatives. The company's performance in Russia where the new anti-tobacco law came into effect this June will also be interesting to note. Furthermore, the strengthening U.S. dollar against international currencies is also expected to dent the company's financial performance. Philip Morris International is a leading international tobacco company with its products sold in more than 180 countries worldwide. Until its spin-off in March 2008, Philip Morris International was an operating company of Altria Group (MO). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards – Why China is Buying Gold & Calling for a De-Amercanized World Posted: 16 Oct 2013 12:30 PM PDT

Tangent Capital Partners Senior Managing Director Jim Rickards was interviewed by Bloomberg’s Deirdre Bolton and discussed China and world reaction to the U.S. debt ceiling debacle. Rickards discussed this week’s op-ed in which China’s government newspaper openly called for the world to move away from the dollar: Nothing gets printed there that they are not [...] The post Jim Rickards – Why China is Buying Gold & Calling for a De-Amercanized World appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold to have another go at overhead resistance Posted: 16 Oct 2013 11:53 AM PDT The rest of the week should be tense and potentially explosive either way for the gold and silver prices, as many bet on a resolution in the US, says Julian Phillips. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Oct 2013 11:48 AM PDT - Public announcement GEAB N°78 (October 16, 2013) -  It's one of those times when history accelerates. Whatever the outcome of the negotiations on the shutdown and debt ceiling, October 2013 is one of them. It's the deadlock too far which has opened the eyes of those who still support the United States. A leader is followed when he is believed, not when he is ridiculous. "Building a de-Americanised world": this statement would have raised a smile a few years ago. At most it would have passed for provocation by Hugo Chavez. But when we are seeing the United States' bankruptcy in real-time and it's an official Chinese press agency that says so (1), the impact isn't the same. In reality, it's describing out loud a process which is already well underway: simply, it's now allowed to speak about it in public. At least US government deadlock has the merit of loosening tongues (2). Let there be no mistake, this analysis hasn't appeared in the Chinese media by chance, and it reflects Beijing's hardening tone. In fact, if the whole world is holding its breath before this pathetic game of the US elite; it's not out of compassion, it's to avoid being swept away in the fall of the world's first power. Everyone is trying to free itself from American influence and let go of a United States permanently discredited by recent events over Syria, tapering, shutdown and now the debt ceiling. The legendary US power is now no more than a nuisance and the world has understood that it's time to de-Americanise. This perspective and speaking the unspeakable (3) is finally freeing-up a whole range of solutions which, until now, were simply signs, even still repressed by some. These solutions are speeding-up the construction of the world afterwards and opening on a multipolar world organised around major regional blocs. After a review of American setbacks, in this GEAB issue our team will analyse the forces which are shaping this changing world. In the "Telescope" section we also take a look at the actual state of US society which, behind the mirror of the stock market and finance, explains the collapse of the American way of life and take part in this look with hindsight at the US model. Finally, we update our annual country-risk assessment to complete the global picture and, of course, give our traditional recommendations and the GlobalEurometre. Layout of the full article: 1. "No we can't" 2. A succession of crises 3. Shutdown: the laughing stock of the world, but a forced laugh 4. De-Americanisation at all levels 5. The petrodollar is dead, long live the petroyuan 6. China shows Euroland the way 7. Russia, South America: following de-westernisation This public announcement contains sections 1, 2 and 3 "No we can't" How times change. The whole world has forgotten the words freedom, hope and the famous saying "Yes we can" representative of US society in the eyes of previous generations to now only speak of taper, shutdown or ceiling. This isn't exactly the same dynamic and the positive image has become outright negative. It's striking to see the extent to which the current US situation confirms the old adage that trouble never comes alone. In a six-week period, first of all humiliation by Russia over Syria, then its central bank which admits it's impossible to reduce quantitative easing (4); the inability to pass a budget which means federal government shutdown, a shutdown lasting well beyond what is reasonable (5). Negotiations on the debt ceiling at a standstill two days from the deadline; the United States ordered by the G20 to ratify the IMF reform which it has been blocking for the last three years, and by the World Bank and the IMF to put its finances in order (6). And now the Chinese shot across the bows. A succession of crises This succession of crises is quite worrying for the country and demonstrates unprecedented acceleration and an impending shock. There is some fatality in these crises. But there is also a dose of strategic recovery. Thus, the shutdown has been exploited by Obama to put pressure on the Republicans into voting for raising the debt ceiling, a much more important deadline for the United States. This is obviously only a partial success, but we can still expect a temporary raising, which postpones all the problems for a few weeks (7); however, it's still possible that the tragic path is chosen, because it's no more the domain of a rational decision and therefore cannot be forecast.  In fact, whilst observers are focusing on the Tea Party which, in the same way as minority shareholders are able to control a company through a holding, has managed to hijack the Republican Party and American society; it could be read another way. Many Americans see the reality in front of them: their country is bankrupt. Consequently, is it better to postpone the confrontation with reality, at the risk of amplifying the problems, or is it better to resolve them now? The majority of the population don't take a dim view of a payment default (8). Besides, what other solution is there ultimately? Is there no desire amongst Republicans to precipitate the crisis? It's the ideal situation because they can blame the Tea Party which has stated unequivocally that "no agreement is better than a bad agreement" (9). What we mean is that, this time, or probably on another occasion in the near future, they might well be tempted to cut the Gordian knot. Likewise, a strategic recovery certainly took place when the Fed backtracked on reducing its quantitative easing. Why did it let everyone believe right up to the last minute that it would reduce QE3 without doing so in the end? It's the first time that it has taken investors by surprise, all 100% convinced of a tapering given in the forward guidance, a well-established principle. Is there no connection between the gross insider trading proved to have taken place at the time of the Fed's announcement (10), which had to be worth billions of dollars to the perpetrators? All this supports our theory of desperate US financial institutions which must be bailed out discreetly by such operations, at the risk of undermining the Fed's credibility. Again, short-term solutions which make the situation worse but which push back the fatal deadline a little further. We are no longer the only ones to ring the alarm bell on these American banks: the Bank of England is expecting major banks to fail which, according to it, have lost the status of "too big to fail" (11). We therefore repeat our warning on this subject. Like a boxer, all these blows that the country has taken has made it groggy and it only lacks the last one to floor it. If it doesn't come from a US payment default in October, it will be another deadline which has been pushed back which, this time, won't yield. Shutdown: the laughing stock of the world, but a forced laugh When we wrote in the GEAB N° 77 on the budget vote: "no doubt a compromise will be found at the last minute or, more likely, a few hours or even a few days after the deadline", one cannot help but notice that we still underestimated the political differences in Washington since the "several days" which we had in mind have turned into weeks. The daily newspaper, Le Monde, had the headline on its website of "Washington's sorry spectacle" (12). But, in the end, this shutdown hasn't had a disproportionate impact on the financial markets (13), so it's all for the better which many Republicans seem to think who are adapting well to a federal government paralysis and the cuts in public spending which follow. This isn't the opinion of countries with large holdings of US Treasury bonds , which feel held hostage by the United States (14). They are stunned by the US' indefensible casualness and by the irresponsible attitude of who, until recently, was "the boss". If the country defaults on its debt the shockwaves will certainly be terrible. However, this wouldn't be the end of the world because a possible default could simply take the form of delayed payment for the few days; moreover different parts of the world would be unequally affected according to the extent of their de-coupling from the US economy. No, the country that will suffer most from this solution (and any other for that matter) will really be the United States itself. For the record it holds two thirds of its own public debt.  This is why the best governed countries have already begun this major de coupling, with China in the lead which knows from Sun Tzu that "when it thunders, it's too late to cover one's ears." (15) --------- Notes: (1) Sources : Xinhuanet (Chinese news agency, 13/10/2013), RFI (13/10/2013). (2) Even the Financial Times gets involved (02/10/2013) : « Dollar-based system is inherently unstable ». An incredible statement from an Anglo-Saxon financial newspaper. (3) The world feedback that the Chinese article mentioned above received shows the interest in this statement from the world's second power, and confirms that it breaks a taboo which will help implement solutions long awaited by a majority of countries. Read, for example, the excellent analysis in the Asia Times, 15/10/2013. (4) Source : Bloomberg, 18/09/2013. (5) Source : CNN, 14/10/2013. (6) Source : for example PressAfrik, 12/10/2013. (7) Source : New York Times, 15/10/2013. (8) 58% of Americans would vote against raising the debt ceiling. Source : Fox News, 08/10/2013. (9) Source : Le Monde, 15/10/2013. (10) Source : USA Today, 24/09/2013. (11) Source : The Telegraph, 12/10/2013. (12) Le Monde, 14/10/2013. (13) Obviously, since the Fed is continuing its unbridled quantitative easing. (14) All the same they are willing hostages because they massively and voluntarily financed the country... (15) Sun Tzu, The Art of War, 6th century BC. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock market appears ready for new high — what about gold? Posted: 16 Oct 2013 11:43 AM PDT The rally in stocks seems to have triggered a decline in the precious metals sector and the following stocks' moves could further contribute to metals' performance. Will the stock indices keep rallying? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indian gold jewellery exports up to August collapsed 57.1% y/y Posted: 16 Oct 2013 11:37 AM PDT Gold exports from India declined sharply during the first five months of the current fiscal. According to trade data, the country's gold jewellery exports during the period from April to August this year plunged by 57.1% over the previous year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| T minus 1 for U.S. downgrade, gold jumps 2.9% from 3-month low Posted: 16 Oct 2013 11:35 AM PDT London gold moved in a $10 range Wednesday morning around $1,281 per ounce as both the U.S. House and Senate were due to meet in what headline writers called "a last ditch attempt" to resolve the government's debt-limit deadline, set for tomorrow. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold surged 17% in 15 trading days after last debt ceiling extension in 2011 Posted: 16 Oct 2013 11:26 AM PDT It is interesting to note that in 2011, gold rose in the months prior to the debt ceiling agreement. Then in the immediate aftermath of the debt ceiling extension agreement on August 2nd 2011, gold surged another 17% in 15 trading days after the agreement was reached. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 22 Reasons To Be Concerned About The U.S. Economy As We Head Into The Holiday Season Posted: 16 Oct 2013 11:15 AM PDT

Are we on the verge of another major economic downturn? In recent weeks, most of the focus has been on our politicians in Washington, but there are lots of other reasons to be deeply alarmed about the economy as well. Economic confidence is down, retail sales figures are disappointing, job cuts are up, and American [...] The post 22 Reasons To Be Concerned About The U.S. Economy As We Head Into The Holiday Season appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forget the short term – gold is for the long run Posted: 16 Oct 2013 10:32 AM PDT Gold's recent poor performance has somewhat dampened the outpourings of the out and out gold bulls, but as a long term wealth protector then its prospects remain undiminished. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boehner Folds, Full Details of Debt “Deal” Posted: 16 Oct 2013 10:28 AM PDT

Speaker John Boehner has reportedly folded, and will give in to essentially all of Obama’s demands according to reports. While the media reports that the deal is a 3-month can-kicking, the reality of the “deal” is far worse. Full details of the debt limit and gov’t re-opening “deal” are below: Silver Bullet Silver Shield Collection [...] The post Boehner Folds, Full Details of Debt “Deal” appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First Majestic Produces a New Record of 3.37 million Ag-Eq Oz Posted: 16 Oct 2013 10:03 AM PDT First Majestic Silver Corp. (“First Majestic” or the “Company”) is pleased to announce that total production at its five operating silver mines in Mexico for the third quarter ending September 30, 2013, reached a new quarterly record of 3,370,457 equivalent ounces of silver, representing a 38% increase compared to the same quarter in 2012. Total silver production for the quarter consisted of 2,689,237 ounces of silver, representing an increase of 22% compared to the same quarter in 2012. In addition, 8,543,551 pounds of lead and 2,232,881 pounds of zinc were produced representing an increase of 158% and 164%, respectively, compared to the same quarter of the previous year. Also, 2,942 ounces of gold were produced, representing an increase of 91% compared to the third quarter of 2012. Keith Neumeyer, President & CEO of First Majestic, states, “While the third quarter was another volatile period for silver prices, we continue to make progress with our growth strategy in Mexico. The San Martin mill expansion, which is now complete, marks the third major project completed by First Majestic in 2013, following the recent production start-up of Phase 1 at the Del Toro Silver Mine and the completion of the mill expansion at the La Guitarra Silver Mine. Our operations team deserves to be recognized for a job well done.” Production Details Table:

Operational Review: The total ore processed during the quarter at the Company’s five operating silver mines, La Encantada, La Parrilla, San Martin, La Guitarra and Del Toro, amounted to 641,345 tonnes milled, representing a slight decrease of 4% over the previous quarter primarily due to the continued optimization at the La Encantada mine in addition to the effects of two major hurricanes which hit Mexico in the month of September. Silver grades in the quarter for the five mines remained relatively unchanged from the previous quarter at 202 g/t of silver. Combined silver recoveries averaged 65% in the quarter and remained in line with the second quarter average of 64%. The Company’s underground development in the third quarter consisted of 10,923 metres, a 19% decrease compared to 13,479 metres completed in the previous quarter. This decrease is part of a planned reduction of capital expenditures aimed at reducing costs due to the lower metal price environment. During the quarter, six diamond drill rigs were operating at the Company’s five operations. The Company completed 7,823 metres of diamond drilling in the quarter, compared to 25,469 metres in the prior quarter, representing a 69% decrease resulting from the previously announced exploration budget cuts. At the Del Toro Silver Mine:

At the La Encantada Silver Mine:

At the La Parrilla Silver Mine:

At the San Martin Silver Mine:

At the La Guitarra Silver Mine:

Outlook: With San Martin’s mill expansion to 1,300 tpd now complete and ramping up to 1,200 tpd immediately, and with the addition of the new 1,000 tpd cyanidation circuit at Del Toro, the Company expects silver production in the fourth quarter to be very robust. Furthermore, with year-to-date production totaling 9.4 million silver equivalent ounces, the Company expects to meet or exceed its 2013 guidance of producing 12.3 million to 13.0 million silver equivalent ounces. Silver production for the first nine months in 2013 has totaled 7.9 million ounces and remains in line with annual guidance of 11.1 to 11.7 million ounces of silver. First Majestic is a mining company focused on silver production in México and is aggressively pursuing its business plan of becoming a senior silver producer through the development of its existing mineral property assets and the pursuit through acquisition of additional mineral assets which contribute to the Company achieving its aggressive corporate growth objectives. FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll free number 1.866.529.2807. FIRST MAJESTIC SILVER CORP. Cautionary Note Regarding Forward Looking Statements | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Oct 2013 10:00 AM PDT “Conspiracy theorists.” They are all over the place. They are nuts. They are just a bunch of “disgruntled’s” because they either didn’t get their way or they are a bunch of idealists who think the world should fit their crazy theories. But hold on there just a second, many of the past "theories" has already been proven as absolute fact. In the words of Tyler Durden when describing the at market volume dumps in the gold market had this to say:

Many of these “theories” were not even “out there” or even close to off the wall, many were just of the plain Occam’s razor common sense sort that was pretty obvious in retrospect. My point is that “conspiracies” do exist, many have been proven factual and few even take any stretch of the imagination to understand or believe. The above leads me to another area currently in the news, the debt ceiling. What in the world or how could anything to do with the debt ceiling have even a remote possibility of being “conspiratorial?” Someone mailed me a second hand word of a “friend” who supposedly has worked in Washington DC for some 40 years and says that the current circus saga over the debt ceiling was “planned.” He said it was planned 6-8 months ago. Should we believe this? Should we believe the second hand word of someone we don’t even know? Who is this guy and how could he know this? Does he have an agenda or is he just messin’ with us? I must confess that subconsciously I thought the same thing but I didn’t really know why. Just as with other “events” that I’ve watched with my own eyes that didn’t make sense initially, and then I figured out what was wrong eventually. I think I’ve figured this one out. Please stay with me; this is so simple that it’s stupid. We are now living through a “government shutdown” where parks and memorials are shut down across the country. This is kind of stupid because there really is no expense to keep a bike path, cemetery or open air memorial open. In fact it takes even more expense to kick people out (and to give them tickets as penalty for law breaking). But this is what is happening and has been happening since day 1. So where is the “funny business?” Signs! Where did all of the signs come from? The signs that say that the park is closed or the memorial or the walking trail (or “closing the ocean”)… where did they come from? Who ordered them? How long ago were they ordered? Why were they ordered? Were signs ever erected in past government shutdowns? I’ll bet that never in the past when we had one of these Congressional pushing matches that parks etc. were not closed. I don’t know this for a fact but I don’t ever remember it. In any case, these signs (since they were ordered by Washington) were not ordered a day or 2 before the shutdown, Washington doesn’t work like that. The graphics, wording, size and materials (not to mention the awarding of “non bid” contracts to printers) all had to be chosen ahead of time. The signs had to be fabricated and shipped all over the country to arrive “in time.” Is this a big deal? Well, not really except for the fact that to me this whole government shutdown/debt ceiling debate seems “staged” or made for public consumption. I smell a rat, what sort of rat I don’t know…but, at least we know that gold and silver are still free and fair markets? I wrote the above late yesterday and since then have seen where the USDA has told states not to forward their Nov. issuance files and to delay transmission of “electronic benefit transfers” EBT (food stamps) …until further notice. I read this at Zero Hedge and have not found it yet anywhere else. If this turns out to be true and no debt deal is arrived then I guess we will have the answer (the rat that I smell?) to another one of those crazy conspiracy theories. You know, those “crazies” who have said that the only reason that over 2 billion rounds of hollow point ammunition have been delivered to domestic government agencies…is to… use them. 50 million hungry, angry and eventually rioting people might be a reason? As I have said all along, silver will spend when nothing else will.Similar Posts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Oct 2013 10:00 AM PDT

When asked by Tekoa da Silva his thoughts on gold as a reserve asset, the European Central Bank’s Mario Draghi responded: "Well you're asking this to the former Governor of the Bank of Italy, and the Bank of Italy is the fourth largest owner of gold reserves in the world, which is out of all [...] The post ECB Head Mario Draghi On Gold & Banking; Admits "Central Bankers Are Powerful—They Are Also Not Elected" appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Argonaut Gold Announces Q3 Gold Production of 26,690 Oz Posted: 16 Oct 2013 09:59 AM PDT Toronto, Ontario – (October 16, 2013) Argonaut Gold Inc. ("Argonaut", "Argonaut Gold" or the "Company"; TSX: AR), announced today that the Company had gold production of 26,690 ounces during the 3rd quarter ended September 30, 2013. This included 22,756 ounces at its 100% owned El Castillo Mine ("El Castillo") located in Durango, Mexico and 4,234 ounces of gold at its 100% owned La Colorada Mine ("La Colorada") located in Hermosillo, Mexico. Argonaut Gold is also pleased to announce that it has entered into a surface and mining rights exchange agreement with Richmont Mines Inc. (“Richmont”; TSX:RIC). Pursuant to this agreement, Argonaut Gold will expand land access associated with its Magino Gold Project by obtaining both surface rights and mining rights up to 400 meters in depth on certain Richmont claims surrounding the project. Argonaut Gold will transfer its interest in certain claims to Richmont, to enable it to expand its exploration potential at its Island Gold Deep project. The terms of this agreement provide a $2 million payment from Argonaut to Richmont. THIRD QUARTER 2013 HIGHLIGHTS: El Castillo

La Colorada

Magino

THIRD QUARTER 2013 El CASTILLO OPERATING STATISTICS

Richard Rhoades, Chief Operating Officer of Argonaut Gold, said "Q3 gold production at El Castillo was impacted by the seasonal monsoon rainfall, while this impacted quarterly results full year production will meet our guidance. Permits were received at El Castillo for construction of the new overburden deposit areas, which will provide a shorter haulage of overburden at the south end of the pit. Also, the new west side crushing and overland conveying system was completed in August and is now fully operational. Argonaut anticipates El Castillo will continue to produce 100,000 ounces a year. At La Colorada, we continue to open the Gran Central/La Colorada pit and are now mining ore grade material. The mining contractor is in the process of a planned expansion of the fleet which will increase tonnage. This should allow for 60,000 tonnes per day to be mined, which will lead to future production growth. By year end, La Colorada will be operating at approximately a 50-60,000 ounce run rate. THIRD QUARTER 2013 LA COLORADA OPERATING STATISTICS

Pete Dougherty, President and CEO said, "Despite some operational challenges we remain on target to produce 100,000 ounces at El Castillo and 24,000 ounces at La Colorada, which will meet our 2013 guidance of 120,000 – 140,000 ounces of gold. The capital expansion programs at both sites should pay dividends in Q4 and set the standard for 2014 production." In referencing the recent land acquisition agreement with Richmont, Mr. Dougherty added "It now allows for future pit expansion and provides additional exploration upside for the project. Our teams are now looking at the potential changes the land expansion may have on the project." Argonaut Gold Q3 Financial Results Conference Call and Webcast: Q3 Conference Call Information: Toll Free (North America): 1-866-223-7781 Q3 Conference Call Replay: Toll Free Replay Call (North America): 1-905-694-9451 The conference call replay will be available from 10:30 a.m. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virtual Currencies: Gold Rush or Fools’ Gold, The Rise of Bitcoin in a Digital Economy Posted: 16 Oct 2013 09:56 AM PDT Stacy Summary: There are many ways to look at virtual currencies! This is a long discussion looking at bitcoin and other digital currencies from many different angles. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Valuing Gold Posted: 16 Oct 2013 09:00 AM PDT

Before Lehman collapsed, there was a general lack of awareness of the risk that the whole financial system was in danger. In this context, a gold price of less than $918 was perhaps justifiable. After the event, while the Fed struggled to stabilise the banking system, the gold price initially fell to $656, or to [...] The post Alasdair Macleod: Valuing Gold appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold premiums jump 150% in a week – hit a new record high in India Posted: 16 Oct 2013 08:01 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shanghai Gold Exchange VS. Obamacare: FREE MARKET VS. TYRANNY Posted: 16 Oct 2013 08:00 AM PDT

Koos Jansen and Jan Skoyles, writer and researcher for TheRealAssetCo join the SGTReport to compare the REAL DEMAND for PHYSICAL GOLD at the Shanghai Gold Exchange VS. the manufactured (or non-existent) demand for paper gold on the COMEX, and for the fascist monstrosity known as 'Obamacare' — the REAL reason behind the current US Federal [...] The post Shanghai Gold Exchange VS. Obamacare: FREE MARKET VS. TYRANNY appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: Gold Market Sunk to Keep Bond Market Afloat Posted: 16 Oct 2013 07:00 AM PDT

Gold and silver prices are being deliberately and criminally destroyed by bankers hoping to keep the financial system alive a little longer as the wealth of the economy is transferred to bankers in the form of interest payments. Keeping the financial system functioning while manipulating gold and silver prices (and other schemes, such as interest [...] The post Guest Post: Gold Market Sunk to Keep Bond Market Afloat appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Will Be the Bedrock of the New Currency Posted: 16 Oct 2013 06:45 AM PDT We have been in Florida for two weeks. When we arrived, our Comcast system was down – no TV, no phones and no Internet. The problem was in the wiring, not the Comcast signal, and it could not be fixed. We immediately placed an order for Uverse, an AT&T service that was wireless to replace Comcast. It was installed today and I am just beginning to navigate my way around it. I will start to write my column again in a day or two. I am comfortable with the quality of information that we have been sending out from Andy Hoffman and Bill Holter. They are two of the top writers in our industry. They have kept you up to date in my absence. One thing I do want to call your attention to today is a commentary by Peter Mickelberg on Jim Sinclair's website. Peter answers most of Jim's Emails for him. He wrote the following:

The Great Reset, as Sinclair calls it, spells the end of the US dollar as the world's reserve currency. That is THE reason you own physical gold, never sell it unless you are out of other assets to dispose of, and pay no attention to the day-to-day price. It doesn't matter. All that matters is if you have it or you don't when the Great Reset takes place. The bottom line is, either you believe this is where we are headed or you don't. If you don't, then reading this newsletter is not of much value to you. If you do, then what we write about, Bill Andy and I is priceless. So many people are influenced by the "price" of gold and silver. When the price falls, as is the case now, then gold and silver become bad "investments." If you want to "invest," try the ETFs or mining shares and take your chances. If you understand that gold will be the bedrock of the new currency that is launched in the Great Reset. I think the following graph speaks volumes about whether it is worth buying and holding gold now. One thing you can say about the Chinese; they are probably the world's shrewdest investors. Here is what they think about gold…

Here is the latest from Richard Russell on King World News… Russell has a wonderful "feel" for gold. I have followed his writing for the last 30 years and he understands gold better than most people. He understands the Federal Reserve and what they have done and are doing to our currency. Make sure you have a golden parachute.

Similar Posts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SDB’s Lowest Price EVER on Silver Rounds! Posted: 16 Oct 2013 06:07 AM PDT

3 Day Mega Sale on Sunshine Silver Eagles! Wed, Thurs, Fri 9am- 5pm Est Only! 10/16-10/18 The post SDB’s Lowest Price EVER on Silver Rounds! appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Myth of China’s Financial Time Bomb Posted: 16 Oct 2013 05:45 AM PDT The role of China's "shadow banking" sector in financing extravagant local development projects has led financial pundits to warn of a Chinese financial meltdown with global repercussions. Research Fellow Takashi Sekiyama puts the issue into perspective, even while sounding a more measured warning regarding the need to control moral hazard... Read | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Surged 17% In 15 Trading Days After Last Debt Ceiling Extension In 2011 Posted: 16 Oct 2013 05:02 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Embry scoffs at Lassondes claim that central bankers ignore gold Posted: 16 Oct 2013 05:02 AM PDT GATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Surged 17% In 15 Trading Days After Last Debt Ceiling Extension In 2011 Posted: 16 Oct 2013 04:22 AM PDT It is interesting to note that in 2011, gold rose in the months prior to the debt ceiling agreement. Then in the immediate aftermath of the debt ceiling extension agreement on August 2nd, 2011, gold surged another 17% in 15 trading days after the agreement was reached. Then from August 1st to August 22nd, gold rose from $1,619/oz to over $1,900/oz. Today's AM fix was USD 1,278.25, EUR 944.75 and GBP 797.71 per ounce. Gold climbed $8.60 or 0.68% yesterday, closing at $1,281.30/oz. Silver rose $0.07 or 0.33% closing at $21.33. Platinum climbed $2.99 or 0.2% to $1,380.49/oz, while palladium fell $7.78 or 1.1% to $704.72/oz.

Gold came under pressure in early Asian trading prior to turning around and rising to $1,290/oz. Gold was capped at these levels and then gave up those gains to trade flat in European trading despite Fitch placing the United States triple A rating on credit watch. U.S. lawmakers are scrambling to come up with an agreement to increase the federal debt ceiling before tomorrow's deadline. Gold has not priced in a U.S. default – which could result from failure to raise the borrowing limit – on expectations that Congress will reach a deal at the last minute. A default remains unlikely but should it happen it would roil global markets, hamper economic recovery and lead to another wave of safe haven gold buying. More likely, is that politicians once again raise the debt limit to over $17 trillion – thereby eliminating the short term crisis but increasing the likelihood of a far bigger crisis in the coming months and years. Physical buying remains robust particularly in China and India where premiums are rising again as gold is snapped up by canny Asian value buyers. Gold premiums in India, the world’s biggest buyer of gold along with China, hit a record $100 an ounce due to a shortage of bullion to meet festival demand. In China, premiums in the Shanghai Gold Exchange climbed to over $20 an ounce from about $7 two weeks ago. Gold has fallen about 4% since the government shutdown began on October 1, leading many to believe that if there is no debt deal, the price could shoot up, particularly should we get a significant bout of "risk off" in markets.

It is interesting to note that in 2011, gold rose in the months prior to the debt ceiling agreement. Then in the immediate aftermath of the debt ceiling extension agreement on August 2nd 2011, gold surged another 17% in 15 trading days after the agreement was reached. From August 1st to August 22nd, gold rose from $1,619/oz to over $1,900/oz. The United States lost its important AAA credit rating from Standard & Poor’s late on Friday August 5th, 2011, in a dramatic vote of no confidence for the world’s largest economy and the U.S. dollar. This was a catalyst for the surge to the record nominal high of $1,920/oz two weeks later.

How Fitch has not downgraded the U.S. already is a mystery to analysts looking at the U.S. fiscal position and the lack of political will to tackle it. It seems likely that significant political pressure is being put on credit ratings agencies regarding their credit rating of the U.S. The very poor fiscal position of the U.S. will gradually erode confidence in the dollar which will see it continue to lose value against gold. The continuing depreciation of the dollar and the further downgrading of the U.S. credit rating from AAA will contribute to higher prices again. The question is when, rather than if. GoldCore's 10th Anniversary Gold Sovereign & Storage Offer | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is Sugar Once Again Signaling the Next Big Move in Gold & Silver? Posted: 16 Oct 2013 04:00 AM PDT

The financial condition of the government of Japan is much worse than most other governments. That means that money printing, in the form of QE, can get out of control much more easily than in other nations. If the current volume of Japanese QE continues for another year or two, or even accelerates, I expect [...] The post Is Sugar Once Again Signaling the Next Big Move in Gold & Silver? appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sprott's Thoughts: Is Gold Still a Safe Haven? Posted: 16 Oct 2013 02:28 AM PDT With the deadline for a U.S. default looming this Thursday night, hopes were high Monday evening that the legislative impasse could be breached. What is more puzzling than elected officials ‘playing with fire’ over a potential US debt default is the performance of gold during the recent period of uncertainty. This would seem to be a crisis custom made for gold, but the price action of late is telling a different story – since the government shutdown on October 1st, the gold spot price has fallen $50. So while the US government has closed down and the potential for a historic default exists, gold has delivered a negative return to investors. Owning an asset that is no-one’s obligation and has no ties to the financial system would seem to be prudent at a time like this, so why hasn’t gold performed better? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards predicts how gold price suppression will end Posted: 16 Oct 2013 02:28 AM PDT Interviewed by Fabrice Drouin Ristori for the Goldbroker Internet site, fund manager and geopolitical strategist James G. Rickards predicts how the Western central bank gold price suppression scheme will end and what signs likely will precede it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||