saveyourassetsfirst3 |

- Samira Hill deal dies, forcing reversal of financing by month's end

- Tracing the Chinese gold rush

- Gold Fields completes acquisition of Barrick mines

- Swiss gold refiner Metalor delays Singapore launch

- Gold hits 8-week low, loses steam built on US govt. shutdown

- Politicians Around The World Are Sure To Sink The US Dollar

- Alasdair Macleod: The Unstoppable Growth of US Money Supply

- Macro Market View - End Of September 2013

- Microsoft Will Eventually Get It Right

- Ron Paul just wrote the best thing on the government shutdown you'll read this month

- US gold market digests the government shutdown

- Biotech: Let's Make A Billion-Dollar Deal, Part 2

- The Economy Is Dying

- Why Don Coxe expects gold to soar on good economic news

- Another Day, More Algo Silver Manipulation: SD Dissects Today’s PM Smash

- Gold & mining stocks: Outlook remains bearish

- Would Gold Go “Down” If

- Speculators return to buy gold futures - CFTC

- India jewellery association to help mobilise 1500 tons of unused gold in households

- Did Bart Chilton Predict Today’s Gold & Silver Smash?

- Breaking Bad With Big Bank CEOs: How Bad Bank CEOs Use the Bystander Effect to Dupe Good People Into Working For Them

- How China is taking over the world, one gold bar at a time

- Central banks favor gold as diversification: LBMA

- Alaska's zombie gold mine to nowhere

- India current account gap below estimates as gold imports curbed

- PBOC mulls expansion of qualified gold importers list

- Chinese gold demand on track to hit 1,000T: WGC

- Gold & Silver Waterfall Smash in Progress!

- The most incredible silver chart you’ve ever seen

- The Pattern Re-Emerges

- Gold & Silver Waterfall Smash in Progress!

- Karl Denninger Goes John Galt!

- TOP GOLD PRODUCERS: Yields Falling, No High Grading Yet

- Once Again, the Adage of Destruction Rings True

- Silver attractive for investors at current levels: ETFS

- First Majestic Silver files appeal against Hector Davila appeal in $93.84 mn judgment

- Central Banks Favour Gold As Diversification - LBMA

- Gold's safe haven appeal rises on US debt ceiling issue: ETFS

- Central Banks Favour Gold As Diversification – LBMA

- Chaos in Rome: Berlusconi Tricks Spark Fear in Europe

- Eight King World News Blogs/Audio Interviews

- Gold Bulls Raise Wagers Most in Month on Stimulus

- Why Don Coxe Expects Gold to Soar on Good Economic News

- Ground Control to Major Tom: Reserves Are in Jeopardy

- Gold, Silver Bullion Premiums Close to Normal

- Dutch pension fund defeats central bank, wins right to invest in gold

- Banca d'Italia says gold reserves key to central bank independence

- India's regulators said to confirm that the nation's gold ETFs have their metal

- Gods forbid: India's temples guard their gold from government

- China to ease gold trade restrictions - central bank

| Samira Hill deal dies, forcing reversal of financing by month's end Posted: 01 Oct 2013 06:45 PM PDT Niger government implicated in evaporating deal over the sale of the Samira Hill gold mine. |

| Posted: 01 Oct 2013 06:17 PM PDT According to Jan Skoyles, 2013 will be remembered by the gold market as the year of China, but the Asian giant's domination, while quick hasn't happened overnight. |

| Gold Fields completes acquisition of Barrick mines Posted: 01 Oct 2013 04:34 PM PDT The acquisition of Barrick's Granny Smith, Lawlers and Darlot mines will add about 400,000 ounces of output to its portfolio. |

| Swiss gold refiner Metalor delays Singapore launch Posted: 01 Oct 2013 04:30 PM PDT The refinery is set to be first in Singapore, and is expected to have a combined manufacturing and refining capacity of 150 t/y. |

| Gold hits 8-week low, loses steam built on US govt. shutdown Posted: 01 Oct 2013 03:31 PM PDT Gold slid below $1,300/oz on Tuesday, unwinding much of the steam built up as investors had anticipated a partial US government shutdown. |

| Politicians Around The World Are Sure To Sink The US Dollar Posted: 01 Oct 2013 01:18 PM PDT The U.S. government has begun a partial shutdown for the first time in 17 years, after the two houses of Congress failed to agree a budget. The Republican-led House of Representatives insisted on delaying Mr Obama’s healthcare reform – dubbed Obamacare – as a condition for passing a bill. More than 800,000 federal employees face unpaid leave with no guarantee of back pay once the deadlock is over. The Senate is to meet again at 09:30 (13:30 GMT) on Tuesday, Democratic Senate Majority Leader Harry Reid said. The news prompted a sell-off in gold on the opening of the US session on Comex. Possibly, traders see this as a short-term opportunity to knock the price down as the possibility of a total shut-down and a US default is practically impossible. However, this latest clown show will undoubtedly cast a shadow of doubt on the value of the US dollar. Several Federal agencies have been instructed to reduce services after US lawmakers could not break a political stalemate. But spending for essential functions related to national security and public safety will continue, including pay for U.S. military troops. The fiasco has sparked new questions about the ability of a deeply divided Congress to perform its most basic functions. At this stage, it is unclear how long the shutdown may last and so far there is no clear plan to break the impasse. The Senate has planned to recess today until 9:30 a.m., at which time Democrats expect to formally reject the House of Representatives’ latest offer for funding the government. The shutdown will continue until Congress resolves its differences, which could be days or months. But the conflict could spill over into the more crucial dispute over raising the federal government’s borrowing authority. The current disagreement is over Obamacare – Obama’s health care initiative. The goal of Obamacare is to increase the number of Americans with insurance. In short, everyone is now eligible for insurance. And not just eligible… it is compulsory. All Americans must carry a minimum level of insurance by January 1. If you don’t, you will be fined the greater of $95 or 1% of your annual income. The launch of Obamacare comes at a time when the official national debt of the United States is about $17 trillion and the national deficit is some $1 trillion per year. When Obama was elected in 2008, the official national debt stood at only $10 trillion. That means the Obama Administration has added more than $7 trillion in debt in only five years.

The question remains is how is this going to be funded. The total revenue from taxes won't be sufficient. So, what about foreign treasury investment? At this time it seems that investors are more likely to sell their holdings of US debt than buy more. U.S. Treasury holdings by foreign creditors witnessed a record sell-off in June of this year.

Meanwhile, what I find absolutely fascinating, is while these political clowns can't agree on some major issue, threatening their own government, they are all quick to agree on a policy that does not pose such a serious threat and which is pretty much meaningless to the average US individual. For now, that issue has disappeared, but for a few weeks it was in the headlines. If you haven't already guessed what I am on about, it is the situation in Syria. Recently the price of gold was pushed upwards due to the possibility of a US military strike against Syria. As US Secretary of State, John Kerry, and US President, Barack Obama, tried to convince the world that for humanitarian reasons, it was necessary to punish the Assad regime for their alleged involvement in a chemical attack that took place in Syria, much of the rest of the world did not share their point of view. In their speeches, both the US President and the US Secretary of State often pointed out to the senseless killings of some 1400 innocent victims. Yet, while they publicly condemn this atrocious act of violence, thy remain silent about the on-going political strife that exists in Africa that results in the brutal killings of thousands of individuals, and the displacement of hundreds of thousands of innocent individuals. This lack of consistency in their policy leads me to think that it has nothing to do with human rights at all. Surely, if their concern was really the safety of individuals and in order to have a consistent meaningful policy, most of their attention should be focused on the African countries where a lot more than 1400 individuals including women and children have been massacred. Obviously, the US government has an ulterior motive and they are merely using the killings of innocent citizens as a smoke screen. It is evident, that the killings of innocent individuals are not really the major issue, but rather the potential of a disruption of the flow of oil is the main problem. For without oil, the US economy will sink and the massive military machine of the US will be put in jeopardy. Also, without the flow of oil, the US petrodollar is at risk. A petrodollar is a United States dollar earned by a country through the sale of its petroleum (oil) to another country. The term was coined in 1973 by Georgetown University economics professor, Ibrahim Oweiss, who recognized the need for a term that could describe the dollar received by petroleum exporting countries (OPEC) in exchange for oil. And, of course a collapse in the petrodollar will ultimately lead to the end of the US dollar being the reserve currency of world. In such an instance, the price of gold will soar. So, whether the US government uses peace or aggression in the Middle East, I maintain that their sole objective is to ensure the flow of oil and thus the survival of the greenback as well as other fiat currencies. Meanwhile, while the US government feel it necessary to flatten Syria, despite the fact that Syria has not made any direct threat against the US in any way, after some thirty years of a freeze in relationships between their two countries the US President Obama and Iranian President Hassan Rouhani spoke by phone in the first conversation between an American and Iranian president since 1979. On Friday, the US president revealed that the two leaders had spoken. He said he believes the two countries can reach a "comprehensive solution" on Iran's nuclear program, and said he and Rouhani had both directed their diplomats to pursue an agreement. In a press conference, and before talking about the US government funding that needs to be approved before Tuesday, he gave an update on the relations between the U.S. and Iranian governments. "Just now I spoke on the phone with President Rouhani,” Obama said. “The two of us discussed our ongoing efforts to reach an agreement over Iran’s nuclear program. I reiterated to President Rouhani what I said in New York: While there will surely be important obstacles to moving forward, and success is by no means guaranteed, I believe we can reach a comprehensive agreement.” The call came after Secretary of State John Kerry met on Thursday in New York with his Iranian counterpart on the side-lines of the United Nations session. The White House had apparently floated the possibility of Obama meeting, casually, with Rouhani in New York, but U.S. officials said the Iranians nixed the idea. While many U.S. lawmakers, as well as Israeli leaders remain sceptical about Obama's claim that Rouhani represented "new leadership" in Iran, the conversation has resulted in many complaints that Obama is ignoring Republicans while engaging America’s adversaries. Kevin Smith, a spokesman for House Speaker John Boehner, tweeted: “[Obama] negotiates with Iran, Putin but not Congress #shocking.” However, it appeared the two countries still have a long way to go resolving their relations. On Friday the Wall Street Journal reported that U.S. officials alleged Iran have hacked unclassified Navy computers in recent weeks. If true, it would mark one of the most serious infiltrations of government computer systems by the Iranians. The countries’ disagreements are grave and plentiful. Relations have experienced few ups and countless downs since the 1979 Islamic Revolution and subsequent hostage crisis at the U.S. Embassy in Tehran.

If the Fed continues to print money at the current rate of $85 billion a month and does not announce cuts to its quantitative easing program when it meets in October, the US central bank’s balance sheet will exceed some $4 trillion by the end of the year. But the US has not been the only government in the world to print more money and together with the Bank of Japan, the European Central Bank and the Bank of England, more than $9 trillion has been pumped into the financial system.

Thanks to our politicians in most countries, in my opinion the US dollar will end in a collapse. In addition to all this money being printed, the U.S. Treasury is holding more than $2 trillion in short-term debt that must be refinanced within the next 12 months. And, the only way the government will be able to finance this debt will be to continue to print more money. This will only delay the day of reckoning while debasing the value of this fiat currency. According to the American Institute for Economic Research, the purchasing power of the dollar has already decreased by more than 95% since 1913. As geopolitical tensions come and go, the consequence of this unprecedented money printing experiment will have far dire implications. It is for this reason that it is important for individuals to diversify some of their assets into physical gold and silver. Technical picture

Gold prices continue to trade sideways, holding well above the support of $1300/oz. However, they will need to break back above $1345/oz. to gain some upward traction.

About the author: David Levenstein is a leading expert on investing in precious metals . Although he began trading silver through the LME in 1980, over the years he has dealt with gold, silver, platinum and palladium. He has traded and invested in bullion, bullion coins, mining shares, exchange traded funds, as well as futures for his personal account as well as for clients. For more information go to www.lakeshoretrading.co.za |

| Alasdair Macleod: The Unstoppable Growth of US Money Supply Posted: 01 Oct 2013 01:00 PM PDT

After all the fuss about tapering, it is worth remembering that central banks can and do expand the money quantity without quantitative easing. Put simply, so long as a central bank decides to hold interest rates at a chosen level and is prepared to provide liquidity to any bank that requires it, the central bank [...] The post Alasdair Macleod: The Unstoppable Growth of US Money Supply appeared first on Silver Doctors. |

| Macro Market View - End Of September 2013 Posted: 01 Oct 2013 01:00 PM PDT As we all know the goal of market analysis is to identify trends and critical turning points that can help us make better investment decisions. However, we typically see these measurements scattered among various professionals but rarely put together in an organized manner. I felt it would help to put together a macro analysis of different aspects of the U.S. economy. There is a mix of proprietary indicators that I have used over the years plus indicators I have found very accurate and useful from other professionals.

1. The Big Picture - Shiller P/E In the "decades" timeframe, we are in a Secular Bear Market which began in 2000 when the P/E ratio (using Shiller's Cyclically-Adjusted P/E, or "CAPE") peaked |

| Microsoft Will Eventually Get It Right Posted: 01 Oct 2013 12:54 PM PDT Just a short while ago Microsoft (MSFT) took a $900 million dollar charge against inventory, because no one wanted to buy its Surface tablet. And before the whole incident was forgotten, Microsoft rolls out two new tablets codenamed Surface 2 and Surface Pro 2. This time around Microsoft probably got the message, and has delivered a much better tablet for the money. In addition, Microsoft is giving something to everyone. The entry level Surface 2 starts at $450 and the high end Surface Pro 2 goes all the way up to $1800. Generally speaking reviews have been good and the new Surface 2 tablets now run up to 10 hours, according to Microsoft. For me, the only reason to have a tablet or a portable PC device is for the independence. Anything with less than 5 hours of uptime is not worth buying. So the fact that Microsoft has made |

| Ron Paul just wrote the best thing on the government shutdown you'll read this month Posted: 01 Oct 2013 12:52 PM PDT From Ron Paul on LewRockwell.com: As I write this, it appears that the federal government is about to shut down because the House and Senate cannot agree on whether to add language defunding or delaying Obamacare to the "Continuing Resolution." Despite all the hand-wringing heard in DC, a short-term government shut down (which doesn't actually shut down the government) will not cause the country to collapse. And the American people would benefit if Obamacare was defeated or even delayed. Obamacare saddles the American health care system with new spending and mandates which will raise the price and lower the quality of health care. Denying funds to this program may give Congress time to replace this bill with free-market reforms that put patients and physicians back in charge of health care. Defunding the bill before it becomes implemented can spare the American people from falling under the worst effects of this law. As heartened as we should be by the fight against Obamacare, we should be equally disheartened by the fact that so few in DC are talking about making real cuts in federal spending. Even fewer are talking about reductions in the most logical place to reduce spending: the military-industrial complex. The U.S. military budget constitutes almost 50 percent of the total worldwide military spending. Yet to listen to some in Congress, one would think that America was one canceled multi-million dollar helicopter contract away from being left totally defenseless... Under sequestration, military spending increases by 18 percent instead of by 20 percent over the next ten years. Yet some so-called conservatives are so opposed to these phony cuts in military spending that they would support increased taxes and increased welfare "military" spending. This "grand bargain" would benefit the DC political class and the special interests, but it would be a disaster for the American people. Instead of grand bargains of increased spending and taxes, those of us who support limited government and free markets should form a coalition with antiwar liberals to reduce spending on both the military industrial complex and domestic welfare programs. Instead of raising taxes on "the rich" we should also work to reduce all corporate subsidies. This "grand bargain" would truly be a win-win for the American people... More on the "shutdown": |

| US gold market digests the government shutdown Posted: 01 Oct 2013 12:09 PM PDT Julian Phillips says if there is no resolution within the next 17 days, we see the potential for an impact on the global system equal to the mid-2007 credit crunch. |

| Biotech: Let's Make A Billion-Dollar Deal, Part 2 Posted: 01 Oct 2013 12:00 PM PDT In the biotechnology world time and money is well spent as long as the end game becomes closer at hand. It's been a very productive few months for both Mannkind (MNKD) and Peregrine Pharmaceuticals (PPHM) the two companies I focused on in my previous article. With great progress made in each respected company and more milestones achieved the end game moves near for both. For Mannkind investors the goal now is FDA approval of AFREZZA, and for Peregrine Pharmaceuticals investors the goal line is partnership and or buyout. Value in a biotechnology company's pipeline is not seen in current price per share but rather in projected value of the biotechnology company's intellectual property. What is most intriguing to investors of Peregrine Pharmaceuticals besides holding what may be the greatest discovery ever in oncology with its immunotherapy bavituximab, is the fact that Peregrine Pharmaceuticals owns one hundred percent of their |

| Posted: 01 Oct 2013 12:00 PM PDT When I went all in to the Precious Metals sector in May 2002, I knew very little of the nefarious forces attempting to control its ascent. It didn't take long; and thankfully, I found Bill Murphy's GATA website in short order; as well as Richard Russell, Jim Sinclair, and a handful of other "freedom fighters." Back then, Russell empowered me by teaching the history of fiat currencies; emblazoning the term "INFLATE OR DIE" on my conscience. Sinclair's knowledge of the gold market's inner workings strengthened my resolve further, and Murphy's commentary on the Cartel's machinations inspired my revelation that the END GAME of fiat currency inflation was on the horizon. Each day, I read their commentaries hungrily – particularly on major PM "attack days"; and quickly, I parlayed such knowledge into not only an investment strategy, but a career and lifelong cause. I long ago stopped reading Russell – although his big picture analysis remains spot-on; and only refer sporadically to Sinclair and Murphy's work. Each of these great men continues to teach us about economics and Precious Metals; but in my mind, the Miles Franklin Blog does it better – and does so for FREE. David Schectman, Bill Holter, and I write tirelessly every day to empower you as to the REAL reasons "markets" move; the REAL state of the global economy; and the HISTORY supporting our predictions. Personally, I feel compelled to "comfort" PM holders during times like these – and by "these," I mean this entire year of Cartel oppression; and thus, you can count on my commentaries through thick and thin. On that note, I'll address this morning's PM "smack down" prior to the article's principle topic. I already wrote of the government's horrific failure to avoid shutdown four hours ago – just after 4 AM MST; but given what the Cartel has since done – making an utter MOCKERY of financial markets – I'll add a few words now. Clearly, TPTB were intent on preventing the "barometers of bad tidings" – i.e., gold and silver – from suggesting "alarm" on such an historic day. After all, it's been 17 years since the government last shutdown; except in 1995, the economy was structurally healthy and the national debt "just" $5 trillion. The REAL economy has never been weaker; and thus, the furloughing of 800,000 government workers – despite their cumulative lack of productivity – will only reduce spending and investment further. Worse yet, the ramifications for a Treasury market already under immense pressure – and thus, unable to withstand even modest QE "tapering" – are incalculable; particularly as the U.S. dollar itself is notably sagging despite the so-called "recovery" the MSM incessantly speaks of. By the way, I rarely speak of the "dollar index" itself; as frankly, I view the relationship between the dollar and the index's largest component – the Euro – as immaterial compared to both currencies' relationship to REAL ITEMS OF VALUE. However, if EVER a market was being blatantly supported at a KEY ROUND NUMBER, it's the dollar index at 80. It plunged below that level during the Summer 2011 debt ceiling crisis; and since then, has been maniacally supported at 80 – as it is today, trading at 80.02 as I write. Given the U.S. is supposedly in a rip-roaring "recovery" – whilst Europe reports an all-time high unemployment rate, negative GDP, falling real estate prices, and non-existent lending activity – one would think the dollar would be raging. Heck, the Yen – the second largest component of the dollar index – is having its supply doubled by the Bank of Japan, amidst the backdrop of a moribund economy; and yet, the dollar index is still near a two-year low, whilst Treasury yields hover around two-year highs. What does that tell you of the global opinion of – and demand for – the "almighty dollar?"

Anyhow, for the 86th time in 96 days, the 2:15 AM algo arrived at the London PAPER opening to reverse Asia's overnight gains. Subsequently, gold and silver sat right around their month-long "lines in the sand" at $1,330/oz. and $22/oz., respectively, until EXACTLY the 7:00 AM EST open of New York PAPER trading. At 8:00 AM EST, with utterly NOTHING going on in any other market; gold suddenly collapsed by $10/oz. in a ridiculous 30 seconds. Of course, this set up massive "stop-loss" selling at the 8:20 AM COMEX opening; and suddenly, gold and silver were down $40/oz. and $1.00/oz., respectively – amidst perhaps the most PM-bullish news imaginable!

Things have gotten so ridiculous since the Cartel went BERSERK in April; it calls into question whether the mining industry will even survive the carnage of prices so far below the cost of production. I have been very vocal in my view that PM production will fall an incredible 15%-25% in the next 2-3 years; and each day, more and more evidence supports my conclusion. Meanwhile, Chinese gold demand is on pace to DOUBLE this year alone, with further growth expected as global debt increases – particularly given yesterday's news its government plans to significantly deregulate the gold import market. And thus, the total dislocation of some of the most reliable historic valuation metrics cannot be lost on the billions suffering from Central-bank fostered inflation. The chart alone tells it all; and with gold trading at $1,289/oz. as I write – with the "debt ceiling" likely to be increased to at least $18 trillion in the next two weeks – what do you think gold's next big move will be?

Anyhow, today's article was supposed to focus on the sorry state of the "dying economy"; but don't worry, I'm back on track following the necessary "hand holding" resulting from this morning's blitzkrieg attack. I can't say I'm feeling my best – I sense a fever coming on; and possibly, it's because I'm feeling like Haley Joel Osment's character in the Sixth Sense; you know the boy who "saw dead people" that no one else could. True, the average layperson sees the "dead economy" plain and clear. But then again, they are rarely asked for their opinions. Instead, the "evil troika" of Washington, Wall Street, and the MSM simply reports the "recovery" is strengthening – as they have for five years running –ignoring REAL economic data telling a different story. The same is the case nearly anywhere one looks overseas; particularly in hard-hit areas like the European PIIGS. Today alone, whilst "diffusion indices" like the PMI Manufacturing Index depict "growth" (paradoxically, as its employment component declined), General Motors reported an 11% collapse in vehicle sales – and an associated inventory surge. Which do you believe, the HARD DATA or statistically questionable, potentially doctored surveys? Meanwhile, corporate earnings warnings have risen to their highest level in 12 years – even at banks receiving unlimited government support; while "economic pessimism" hasn't just risen, but surged to two-year highs. Last week, the nation's largest PRIVATE employer – Wal-Mart – admitted it too is seeing weak retail demand; while today, the largest PUBLIC employer – the government – is SHUTTING DOWN. Last week, "consumer sentiment" plunged to five-month lows – whilst food stamp participation continued to skyrocket; and yet, despite the Fed two weeks ago withholding tapering due to a weak economic environment, we're bombarded DAY AFTER DAY with PROPAGANDA of a mythical "recovery." Student loan defaults are headed "off the charts"; while even corporate titans like Merck are announcing layoffs – in this case, of 20% of its entire global workforce. Yet, day after day MSM lackeys like Reuters, Bloomberg, and CNBC tell us things are not only fine, but improving. Yes, the same CNBC who's ratings have plunged to 20-year lows; to nearly the same level as when it went on air in 1991. Can you imagine the top stock market promoter having no viewership amidst a record high stock market? I certainly couldn't; but then again, when retail participation has been replaced by government algorithms and Fed-supported bank proprietary desks, it makes such analysis much easier. Finally, here's a "real-time" depiction of the economic "recovery" in action. Last weekend, I flew to Las Vegas for the International Living conference. To start, I took Frontier Airlines – historically one of the better airlines I fly – from my Denver home. After enduring not one, but three pre-boarding announcements asking if anyone would like to upgrade to "extended room" seating for $20, I learned on board that "complimentary drinks" are no longer complimentary. Thus, unless you bought a "classic" (i.e., more expensive) ticket, you must pay $1.99 for a cup of coke, juice, or coffee. Once in Vegas, it couldn't be more apparent how the casinos are dealing with collapsing gaming revenues; and I do mean collapsing, as "the Strip" has seen a 14% year-over-year decline. You know, the kind of spending that defines current economic trends. And thus, as lines at all-you-can-eat buffets grow like bread lines in the 1930s – while penny slots take up more and more floor space – high-end amenities and attractions have seen some of the most outrageous price increases imaginable. How long can this last before even jaded Vegas travelers say no mas? I don't know, but TRUST ME, its coming. Many shows are sporting minimum ticket prices in the $80+ range, and high-end golf courses no longer offer water for the $300 cost of a measly 18 holes. Many conferences – like the one I attended – are being held in casinos way off the beaten path; but they, too, are experiencing declining revenue trends. And thus, for the first time EVER in my long travelling history, I was asked to pay $10 to work out in their below average gym. Cumulatively, these ugly trends depict a business model in crisis; and thus, despite endless traffic to see the world's entertainment capital, such trips are being done on shoestring budgets. The majority of the nation's population is struggling to make ends meet; and thus, when they travel, they do it as cheaply as possible. Amidst such an economic environment – WORLWIDE – you can see why the Fed and other Central banks will continue PRINTING MONEY ad infinitum. Moreover, even the slightest increase in interest rates will make things exponentially worse; and thus – particularly if the government shutdown lasts any material amount of time, causing budget deficits and potentially bond yields to spike – the odds of "QE5" being announced before "tapering" appear higher than ever. Consequently, I'd argue gold and silver have NEVER been more inexpensive in financial market history; and thus, if EVER there was a time to protect one's assets from the inevitable HYPERINFLATION that ends all fiat currency regimes, it is NOW.Similar Posts: |

| Why Don Coxe expects gold to soar on good economic news Posted: 01 Oct 2013 11:42 AM PDT The standard wisdom on gold is that it does well in times of economic bad news such as in the 1970s. But this time, Don Coxe believes things are different. In this interview, he explains why gold will rise when the economy improves. |

| Another Day, More Algo Silver Manipulation: SD Dissects Today’s PM Smash Posted: 01 Oct 2013 11:30 AM PDT

This morning's trade in silver demonstrates a pattern regular observers of this market will instantly recognize. This pattern happens so frequently that any claim by the CFTC that they couldn't get to the bottom of this sort of crap is just nonsense. But we have a pretty good idea why the CFTC closed it's investigation. [...] The post Another Day, More Algo Silver Manipulation: SD Dissects Today’s PM Smash appeared first on Silver Doctors. |

| Gold & mining stocks: Outlook remains bearish Posted: 01 Oct 2013 11:28 AM PDT After three quarters of declines prompted by fears over U.S. stimulus tapering, gold posted a near 8% gain for the September quarter. However, this improvement didn't last long and gold declined as buying slowed. |

| Posted: 01 Oct 2013 11:00 AM PDT The government really shut down? If (when) the Treasury does actually default, will the value of the dollar increase and thus the value of gold in dollars decrease? Not that the government shutdown is a default, it’s not but it does point out how poor our finances are and does illustrate that we cannot go forward without borrowing more. So why then is gold down $40 today? Is it because China is opening up their banking system to allow them to trade gold for their nearly 2 billion customers? Does going from allowing 7 banks to all 23 banks decrease demand or somehow increase supply? Could it be that gold is down because after only 2 days the amount of gold standing for Oct. delivery is 1/3 of what all bullion banks combined purport to have? Could it be because France and Italy announced that they have no plans to sell their gold? Or as Zero Hedge quipped this morning, are all of the furloughed government workers at home today with nothing better to do than sell “all of their gold?” All the way back in the middle 1990′s, I noticed the strange trading in gold. Whenever anything “bad” happened or was announced, gold would go down. In almost perfect fashion, any negative financial news would be reacted to by a drop in the gold price. Anytime the President, Treasury secretary or Federal Reserve chairman spoke the price of gold would drop. This has changed somewhat over the last 5 years or so as occasionally gold will rise when either of these 3 is speaking…but not often. “Games” have been played and price has been “made” with these waterfall incidents. Ask yourself, who would be selling gold today in panic fashion? It can’t be margin calls in other markets as stocks are just fine and dandy. Could it be that traders believe a budget deal will be done…that actually fixes something? Anything? Is it because the economy will do so much better now that higher interest rates are here or because Obamacare will suck the last remaining life out of the economy? Is it anything other than outright and blatant manipulation? Don’t ask the CFTC about this because it is pointless as the silver whitewash has already proved. Don’t ask “good cop” Bart Chilton because he has nothing to say. We thought that he’d say something in Sept. because HE SAID HE WOULD! He didn’t and I doubt he will EVER say anything about silver again. Do I think he lied to us? Actually no I don’t. I think that he now fully understands that it is not illegal for the “presidents working group on financial markets” (the President and Secretary of the Treasury) to “manage” markets. They can legally (though not morally) do anything they’d like with any market they’d like…whenever they’d like. Why? Because it is law and in the “best interest of National Security.” So, don’t expect anything out of Bart Chilton as I believe he has been “silenced” and cannot say boo one way or the other. Out of curiosity I turned on CNBC to hear whether even a convoluted explanation for gold’s drop in price was being offered. Nope, nothing…other than “it was reported that a large trader sold on the market open and sort of got things going to the downside.” Imagine that? “A large trader.” Umm, if this “large trader” has such a large “stash” to sell, why wouldn’t they go directly to Asia to sell? This “large trader” could sell at a premium price and all in one lot without shooting himself in the foot by depressing price. There is an answer to this question…and it’s a simple one! Because Asia, when they “buy gold”…they want GOLD not some piece of paper saying that “we’ll send it to you!” So this is what we have to deal with, fundamentals won’t matter, technical won’t matter, nothing will matter…until it does. It doesn’t matter that supply is already decreasing. It doesn’t matter that just between China and India alone nearly ALL global production is spoken for. JP Morgan’s “long corner,” sovereign nations repatriating their gold…nothing. Nothing will matter until it matters the most. The only course of action is to sit tight and purchase more metal whenever you have funds available to do so. If you know for a fact that something is undervalued or that the price is artificially suppressed, buy it and sit on it because the day will come when the “rig” finally fails. I would not have imagined that the “rig” could have lasted nearly as long as it has. I guess that was naive on my part as I never believed the government would divest all of its gold in an effort to prolong a system (power) that is mathematically flawed.Similar Posts: |

| Speculators return to buy gold futures - CFTC Posted: 01 Oct 2013 10:44 AM PDT For the week ended Sept. 24, speculators in the CFTC's weekly commitment of traders report continued to not only cover previously sold positions, but also established new bullish trades in gold. |

| India jewellery association to help mobilise 1500 tons of unused gold in households Posted: 01 Oct 2013 10:42 AM PDT The All India Gems and Jewellery Federation (GJF) launched the Rashtriya Swarna Nivesh programme at its 8th Anual General Meeting recently. The scheme is meant to bring the idle gold back into ciruculation. |

| Did Bart Chilton Predict Today’s Gold & Silver Smash? Posted: 01 Oct 2013 10:42 AM PDT

Bart Chilton on today’s metal’s smash: You’re on your own. Chilton’s prediction that the “do-badders” would attack due to lack of any gov’t oversight of the markets in light of the gov’t shutdown is below: 2013 Silver Maples As Low As $2.09 Over Spot at SDBullion! CFTC Commissioner Bart Chilton on September 20th: On [...] The post Did Bart Chilton Predict Today’s Gold & Silver Smash? appeared first on Silver Doctors. |

| Posted: 01 Oct 2013 10:15 AM PDT

Fractional reserve banking is a criminal, deceitful and wealth-destroying platform, and perhaps the greatest contributor to economic in-stability in existence today. Usually when there is smoke, there is a good chance there is fire. A really good chance. Except if you work for the commercial banking industry. When there is smoke, deny, deny, deny is [...] The post Breaking Bad With Big Bank CEOs: How Bad Bank CEOs Use the Bystander Effect to Dupe Good People Into Working For Them appeared first on Silver Doctors. |

| How China is taking over the world, one gold bar at a time Posted: 01 Oct 2013 10:12 AM PDT In the last 100 years China's gold mine productivity has climbed from just 4 tons of gold in 1949 to an expected 440 tons this year, none of which is exported. Hong Kong imports have been more than 600 tonnes this year alone, but still more gold is demanded. |

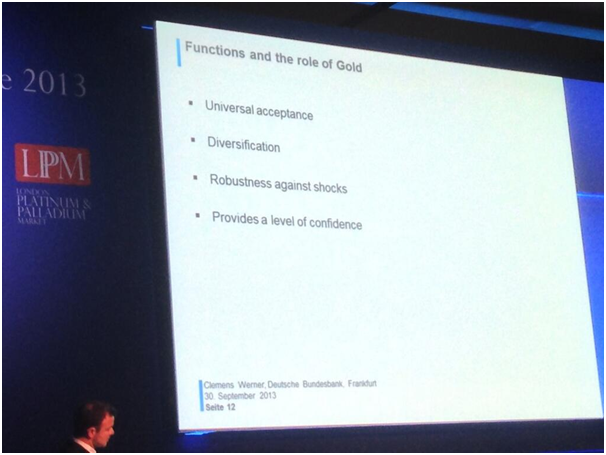

| Central banks favor gold as diversification: LBMA Posted: 01 Oct 2013 10:01 AM PDT The LBMA conference heard from participants that emerging market central banks, with large foreign exchange reserves, are likely to continue diversifying into gold and remain net buyers of gold in the coming years. |

| Alaska's zombie gold mine to nowhere Posted: 01 Oct 2013 08:48 AM PDT What happens when the main financial backer pulls out of a project? The answer is usually clear: The deal fails, which is what the foes of a gigantic gold and copper mine in Alaska are counting on. But in this case the mine has only been dealt a setback and... |

| India current account gap below estimates as gold imports curbed Posted: 01 Oct 2013 08:24 AM PDT The deficit was $21.8 billion in April through June, compared with $18.1 billion in the previous quarter, the Reserve Bank of India said. |

| PBOC mulls expansion of qualified gold importers list Posted: 01 Oct 2013 08:22 AM PDT Under draft rules released by the central bank yesterday, financial institutions and companies that produce more than 10 metric tons of gold a year, may be considered for the list. |

| Chinese gold demand on track to hit 1,000T: WGC Posted: 01 Oct 2013 08:00 AM PDT

The World Gold Council’s Albert Cheng joins Kitco’s Daniella Cambone poolside in Rome to discuss the Asian markets and the future of physical demand in the region as Chinese gold demand is on track to smash previous records and top 1,000 tons in 2013. 2013 Gold Eagles As Low As $51.49 Over Spot at SDBullion! [...] The post Chinese gold demand on track to hit 1,000T: WGC appeared first on Silver Doctors. |

| Gold & Silver Waterfall Smash in Progress! Posted: 01 Oct 2013 07:48 AM PDT

*Update: 2nd wave in progress as cartel smashes silver towards $20.50 Click here for more on the cartel’s latest waterfall smash of gold and silver: |

| The most incredible silver chart you’ve ever seen Posted: 01 Oct 2013 07:41 AM PDT |

| Posted: 01 Oct 2013 07:29 AM PDT February, April and June were Comex delivery months that saw the price of gold get hammered. August was a delivery month that saw the price of gold rally. October is a delivery month and gold is getting hammered again. What's the difference? Do you really want to know or does all of this make YOU want to go get hammered? |

| Gold & Silver Waterfall Smash in Progress! Posted: 01 Oct 2013 07:05 AM PDT

Gold and silver have been crushed this morning on the COMEX open, with silver down over $1 from its overnight highs near $22, plunging to $20.85, and gold is down nearly $50 from Monday, breaking through support at $1300 down to $1290. Apparently the ESF has not been furloughed… *Update: 2nd wave in progress as [...] The post Gold & Silver Waterfall Smash in Progress! appeared first on Silver Doctors. |

| Karl Denninger Goes John Galt! Posted: 01 Oct 2013 07:01 AM PDT

Economist Karl Denninger has gone John Galt. The Market Ticker founder has released a statement that he is shutting down active market reports and updates at The Market Ticker, as he no longer wishes to actively fund the abuses of our fascist government and banking sector, and says in two words: “I’m done.” I refuse [...] The post Karl Denninger Goes John Galt! appeared first on Silver Doctors. |

| TOP GOLD PRODUCERS: Yields Falling, No High Grading Yet Posted: 01 Oct 2013 07:00 AM PDT

The evidence shows that as the price of gold declined substantially in the second quarter of 2013, the top 5 gold producers did not change their strategy by mining higher grade ore. One way a mining company can remain profitable while dealing with much lower gold prices is by "High Grading." However, this does not [...] The post TOP GOLD PRODUCERS: Yields Falling, No High Grading Yet appeared first on Silver Doctors. |

| Once Again, the Adage of Destruction Rings True Posted: 01 Oct 2013 06:45 AM PDT Perhaps it's not an adage, but when defined as a "proverb or short statement expressing a general truth," I'm not sure there's a better way of describing what I wrote last year about the typical U.S. government decision. That is, EVERYTHING they do ends up being "WORST FOR AMERICA, BUT BEST FOR PRECIOUS METALS." Like fate – or as Stephen King calls it, ka – it's almost as if Congress and the President are pre-determined to make wrong decisions. Of course, amidst the terminal phase of a dying fiat currency regime, such decisions are typically unavoidable. As I wrote yesterday, at some point "big government" passes the point of no return; after which, it MUST grow exponentially larger – consuming ALL of the legitimate economy – until it implodes of its own weight. Thus, while "theoretically" best for the nation, last night's decision to "shut down" the government arguing about a law that was already passed – and deemed Constitutional by a Republican-dominated Supreme Court – can only have CATASTROPHIC circumstances. The economy is already in disarray – as I will be writing of later this morning; and thus, furloughing ONE MILLION workers will only make things vastly worse. Moreover, confidence in the dollar – down sharply this morning – and the Treasury market will be shaken to its core, particularly if the shutdown becomes cantankerous and lasts for any material amount of time. And oh yeah, the debt ceiling debate must go on simultaneously, as a SHUT DOWN government will run out of money on October 17th! Meanwhile, REAL MONEY sits inertly on the sidelines, gaining "intrinsic value" with each passing minute. The Central banks of both Italy and France admitted so much yesterday; and with the former's government on the verge of collapse itself, methinks demand to PROTECT one's assets with gold and silver may increase a tad in the coming weeks and months. TPTB can fight REALITY all they want; by supporting the Dow or capping PAPER gold with the 86th visit from the 2:15 AM algorithm in the past 96 days. However, worldwide PHYSICAL demand will continue to rise, while PHYSICAL supply will continue to plunge. Sooner or later, this "perfect storm" of fundamental factors will yet again re-assert itself – as it has for 5,000 years of human history. Will it be this month? I guess we'll know soon.Similar Posts: |

| Silver attractive for investors at current levels: ETFS Posted: 01 Oct 2013 05:15 AM PDT At the same time, its relatively high correlation to gold due to its historical use as an alternative “hard currency†means that ultimately Silver should benefit if sovereign debt and currency debasement concerns continue to rise. |

| First Majestic Silver files appeal against Hector Davila appeal in $93.84 mn judgment Posted: 01 Oct 2013 05:04 AM PDT Hector Davila and MMM appealed the April 24, 2013 decision of the Supreme Court of British Columbia. On June 27, 2013 the Court of Appeal of British Columbia ordered Hector Davila and MMM to post security or provide a letter of credit in the amount of US$79 million by September 25, 2013. |

| Central Banks Favour Gold As Diversification - LBMA Posted: 01 Oct 2013 05:01 AM PDT gold.ie |

| Gold's safe haven appeal rises on US debt ceiling issue: ETFS Posted: 01 Oct 2013 04:50 AM PDT Gold had rallied back on US government turmoil and lack of progress in negotiations between Congressional Republicans and Democrats last week, ETSF Weekly report said. |

| Central Banks Favour Gold As Diversification – LBMA Posted: 01 Oct 2013 04:30 AM PDT Other European central banks including the Bank of France and the Bundesbank said at the LBMA conference that they will not sell their gold reserves, as they can provide a level of confidence, an element of diversification and can absorb some volatility from the central bank’s balance sheet. Today's AM fix was USD 1,332.25, EUR 983.14 and GBP 819.85 per ounce. Gold fell $8.20 or 0.93% yesterday, closing at $1,327.80/oz. Silver dropped $0.05 or 0.23%, closing at $21.72. Platinum fell $12.04 or 0.9% to $1,401.06/oz, while palladium slipped $6.25 or 0.9% to $721.75/oz. The LBMA conference heard from participants that emerging market central banks, with large foreign exchange reserves, are likely to continue diversifying into gold and remain net buyers of gold in the coming years. Gold edged upward as the first U.S. government shutdown in 17 years began, increasing safe haven demand to protect wealth on concerns that a prolonged impasse will impact the U.S. economic recovery. The yellow metal gained almost 8% for the third quarter, thanks to a sharp rebound rally following a record 23% drop in Q1 where it posted a $225 two-day drop in mid April. It was also gold’s first quarterly rise since the third quarter of 2012.

Central Banks have long been buyers of gold bullion and there was a marked increase in central bank bullion activity post the Lehman collapse. Central banks bought 534.6 tons of gold in 2012, the most since 1964, and continue to accumulate. At the London Bullion Market Association conference in Italy, an official from Banca d’Italia said that keeping gold reserves is a key support to central banks’ independence, squashing rumors that it might sell some of its holdings. Banca d’Italia has the fourth largest gold reserves among the world’s central banks and the market heard whispers that it may sell off reserves to help its economy. Regulations covering central bank independence inhibit them from using bullion reserves this way, but concerns increased after the EU Commision assessed Cypriot financing needs and showed Cyprus may be under pressure to sell gold to raise almost 400 million euros to help finance its bailout. During Banca d'Italia's keynote address Salvatore Rossi the director general told delegates how gold plays a key role in the central bank reserves: “Not only does it have the vital characteristic of allowing diversification, in particular when financial markets are highly integrated, in addition it is unique among assets in that it is not issued by any government or central bank, so its value cannot be influenced by political decisions or by the solvency of any institution,” he said. “These features, coupled with historic … and psychological reasons, stand in favour of gold’s importance as a component of central bank reserves,” he said. “Gold underpins the independence of central banks in their ability to (act) as the ultimate bearer of domestic financial stability.”

Other European central banks including the Bank of France and the Bundesbank said at the conference that they will not sell their gold reserves, as they can provide a level of confidence, an element of diversification and can absorb some volatility from the central bank’s balance sheet. In other news from the conference, the London Bullion Market Association could charge its member banks more or even disband its Gold Forward Offered Rates (GOFO) after a string of new financial regulations, the chairman of the industry body told Reuters yesterday. Additionally, the U.S. Fed's next policy meeting is Oct. 29-30th. |

| Chaos in Rome: Berlusconi Tricks Spark Fear in Europe Posted: 01 Oct 2013 02:33 AM PDT Silvio Berlusconi has plunged Italy into another political crisis. It's a wake-up call for Europe and a reminder that, despite what the recent German election campaign suggested, the euro crisis is by no means over yet. When Silvio Berlusconi was still prime minister of Italy, a telephone call was recorded between him and a TV starlet whose company he liked to keep. In it, the prime minister sighed that being the Italian leader and a politician was little more than a bothersome side job and that he would much prefer to just spend his time with babes. |

| Eight King World News Blogs/Audio Interviews Posted: 01 Oct 2013 02:33 AM PDT 1. John Embry: "This Will Create a Horrific Collapse That Will Shock the World". 2. Egon von Greyerz: "3 Disasters Now Threaten to Collapse the World Economy". 3. Jim Grant: "The Fed is a Danger to the U.S. and to the World". 4. Robert Fitzwilson: "Poker End Game - JP Morgan, Fed, U.S. Treasury, China and Gold". 5. James Turk: "Catastrophic Collapse to Unleash Unprecedented Chaos". 6. Richard Russell: "Expect Massive, Radical Change in the Future". 7. The first audio interview is with Gerald Celente...and the second audio interview is with James Grant. [Although I post all of Eric King's interviews, I wish to go on the record as saying that I don't necessarily agree with everything that's said by some of his guests. - Ed] |

| Gold Bulls Raise Wagers Most in Month on Stimulus Posted: 01 Oct 2013 02:33 AM PDT Hedge funds’ combined holdings in gold futures rose the most this month as continued U.S. monetary stimulus spurred investors to sell short contracts and sent prices toward the first quarterly advance in a year. Gold rose 8.4 percent this quarter after a slump into a bear market in April spurred sales of coins, jewelry and bars. The Federal Reserve refrained from trimming bond buying this month, surprising investors. The pace of purchases could remain steady at $85 billion a month into January as policy makers wait for more signs of economic recovery, Fed Bank of Chicago President Charles Evans said Sept. 27. Bullion rose 70 percent from December 2008 to June 2011 as the central bank bought debt. “The Fed has made it clear that the economy is weak, and the stimulus spigot will be open full-bore,” said John Stephenson, who helps oversee about C$2.7 billion ($2.6 billion) at First Asset Investment Management Inc. in Toronto. “That means they’re continuing to inject more into the money supply, and that is a bullish argument for gold.” This Bloomberg story was posted on their website early yesterday afternoon Denver time...and I thank Elliot Simon for sending it our way. |

| Why Don Coxe Expects Gold to Soar on Good Economic News Posted: 01 Oct 2013 02:33 AM PDT The standard wisdom on gold is that it does well in times of economic bad news such as in the 1970s, a period of stagflation and recessions, when the yellow metal rose from $35/oz to peak at $850/oz in 1980. But this time, Don Coxe, a portfolio adviser to the BMO Asset Management, believes things are different. In this interview with The Gold Report, Coxe explains why gold will rise when the economy improves. I certainly don't agree with everything that Don has to say in this interview posted on theaureport.com Internet site yesterday, but you can make up your own mind about it. |

| Ground Control to Major Tom: Reserves Are in Jeopardy Posted: 01 Oct 2013 02:33 AM PDT When you hear about the "gold reserves" a mining company has in the ground, the natural assumption would be that they're talking about a fixed number of ounces. After all, gold doesn't decay, and neither does it grow legs and move someplace else. But assumptions are dangerous. In fact, industry-wide, reserves are likely to fall fairly significantly in the near future. When the gold price falls, it doesn't just have a short-term impact on producers—slashed earnings and forced write-downs—it can affect the number of economically mineable ounces a company carries on its books, or even what it can mine in the future. This commentary by Casey Research's Senior Precious Metals Analyst Jeff Clark, was posted in yesterday's edition of the Casey Daily Dispatch...and it's definitely worth reading. On precisely the same subject is this Sprott's Thoughts commentary posted yesterday. It's headlined "Raiding the "Jewel Box - Michael Kosowan". It, too, is worth your time...and the link to that is here. |

| Gold, Silver Bullion Premiums Close to Normal Posted: 01 Oct 2013 02:33 AM PDT After gold and silver prices plunged in mid-April, buyers swarmed to dealers to purchase bullion-priced physical coins and ingots. The frenzy was almost as strong as in late 2008, after prices fell sharply in the second half of the year. Speaking from personal experience, I can tell you that the mints turn into real pathological monsters when demand exceeds supply. No more Mr. Nice Guy, as they turn from Mr. Hyde to Dr. Jekyll virtually overnight...and to hell with good business/customer relations. I've seen this happen a couple of times from inside the retail bullion trade over the last three years, and it ain't a pretty sight. This commentary by Patrick Heller was posted on the numismaster.com Internet site last Friday...and it's worth reading. My thanks go out to Elliot Simon for bringing it to our attention. |

| Dutch pension fund defeats central bank, wins right to invest in gold Posted: 01 Oct 2013 02:33 AM PDT Tuesday, September 10, saw the final ruling of the Board of Industry Appeals (College van Beroep voor het Bedrijfsleven) on the gold case brought by the Dutch pension fund Vereenigde Glasfabrieken against De Nederlandse Bank (DNB, the Dutch central bank) in 2011. The pension fund objected to an earlier directive of DNB. This ruling is in favor of the pension fund, because the judges of this college, following an earlier decision in March 2012, not only ruled that a fund may decide how to implement its investment policy, but also ruled that DNB failed to underpin its concerns as expressed in the directive imposed [onto the pension fund]. By contrast, the underpinning of the pension fund was so clear that the judges fully agreed. They agreed with the pension fund that there may be circumstances that justify deviation from ordinary investment policies. Such circumstances included the financial crisis that began in 2008 and the euro crisis that was an extension of this financial crisis. This story, translated from Dutch, was posted in this GATA release that Chris Powell filed from Hong Kong earlier this morning local time. |

| Banca d'Italia says gold reserves key to central bank independence Posted: 01 Oct 2013 02:33 AM PDT Keeping gold reserves is a key support to central banks' independence, an official from Banca d'Italia told a bullion industry conference on Monday, dampening talk that it might sell some of its holdings. Speculation has emerged since the financial crisis hit the euro zone that Banca d'Italia might be pressured to leverage or even sell some of its huge gold reserves, the fourth largest among the world's central banks, to help prop up its economy. "Not only does it have the vital characteristic of allowing diversification, in particular when financial markets are highly integrated, in addition it is unique among assets in that it is not issued by any government or central bank, so its value cannot be influenced by political decisions or by the solvency of any institution," he said. "These features, coupled with historic ... and psychological reasons, stand in favour of gold's importance as a component of central bank reserves," he said. "Gold underpins the independence of central banks in their ability to (act) as the ultimate bearer of domestic financial stability." This Reuters item, filed from Rome, was posted on their Internet site early yesterday afternoon EDT...and I found it embedded in a GATA release. |

| India's regulators said to confirm that the nation's gold ETFs have their metal Posted: 01 Oct 2013 02:33 AM PDT The Securities and Exchange Board of India (SEBI) recently conducted a series of checks to ascertain whether the mutual fund industry had the requisite quantum of physical gold to back the units of their gold exchange-traded funds (ETFs) floated on the exchanges. The investigation assumes significance in the aftermath of the National Spot Exchange Ltd. crisis where it has emerged that entities were trading on the spot exchange without adequate physical commodities to back the trades. "Given the backdrop of the NSEL crisis, SEBI had sent a team to verify if the fund houses had the required quantity of physical gold assets with them. The team concluded that the amount of physical gold with the fund houses was in fact slightly more than the value of ETF units they had," said a senior fund official, on condition of anonymity. "The regulator has expressed satisfaction that things are in order." Every fund house has to sell or buy physical gold and store it with a custodian bank based on the units of gold ETFs it issues. "Technically, it is not possible for fund houses to trade in ETF units without the requisite backing of physical gold. But, I guess, the regulator felt it was better to be safe than sorry and went ahead with the verification," said another senior fund official, who also didn't want to be named. This news item, filed from Mumbai, was posted on the financialexpress.com Internet site late Saturday evening IST...and it's another news item I picked out of a GATA release yesterday. |

| Gods forbid: India's temples guard their gold from government Posted: 01 Oct 2013 02:33 AM PDT India's temples are resisting divulging their gold holdings - perhaps nearly half the amount held in Fort Knox - amid mistrust of the motives of authorities who are trying to cut a hefty import bill that is hurting the economy. The Reserve Bank of India (RBI), which has already taken steps that have slowed to a trickle the incoming supplies that have exacerbated India's current account deficit, has sent letters to some of the country's richest temples asking for details of their gold. It says the inquiries are simply data collection, but Hindu groups are up in arms. "The gold stored in temples was contributed by devotees over thousands of years and we will not allow anyone to usurp it," said V Mohanan, secretary of the Hindu nationalist Vishwa Hindu Parishad organisation in Kerala, in a statement. Indians buy as much as 2.3 tonnes of gold, on average, every day - the weight of a small elephant - and what they don't give to the gods is mostly hoarded. Jewellery is handed down as heirlooms and stored away with bars and coins as a hedge against inflation or a source of quick funds in an emergency. I've posted stories similar to this one before, but this one's definitely a must read anyway...and I thank Manitoba reader Ulrike Marx for digging it up for us. |

| China to ease gold trade restrictions - central bank Posted: 01 Oct 2013 02:33 AM PDT China's central bank is planning to increase the number of firms allowed to import and export gold and will also ease restrictions on individual buyers of the precious metal, according to a draft policy document issued on Monday. The proposed policy change could boost imports by China, which is expected to overtake India this year as the world's top gold consumer, and where gold normally trades at a premium to London spot prices. "If it comes into effect, supply into China could increase and (local) prices could ease depending on demand," said a Hong Kong-based precious metals trader, who declined to be named. This Reuters article, filed from Beijing, was posted on their Internet site very early yesterday morning EDT...and I thank Ulrike Marx for her second offering in a row, and today's last story. It's definitely worth reading. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment