saveyourassetsfirst3 |

- Growth not a dirty word - Goldcorp CEO

- First gold pour at Kibali well ahead of schedule - Randgold

- Manipulation, gold and the decline of the dollar - Sprott

- Gold Investors Become Bullish While Equity Investors Are Mixed, As Global Short And Leverage ETF/ETP Assets Hit Over $51bn

- Gold & Oil: Which Has a Better Upside Potential?

- Gold set to vault up from downturn - Oliver

- At 1300 USD/Oz, Gold Is Only Halfway Through The Bear Market

- First Majestic: A Best-In-Breed Company That Remains Profitable Even At $20 Silver

- AngloGold Ashanti's CEO Presents at Denver Gold Forum 2013 (Transcript)

- Precious Metals Bears: Here Come The Negative Investment Bank Reports

- Agora Commodities ships Gold using USPS express overnight

- Precious Metals and Being Long Gamma

- China overtakes India as no. 1 gold buyer

- How one man took China’s gold

- Doc’s Deal: 90% Silver Only $1.25 Over Spot Any Qty!

- Singapore continues push to become global gold hub

- THE BANKER TAPER CIRCUS: The Greatest Show on Earth

- Fifty shades of gold

- Centerra Gold to look for acquisitions after kumtor resolution

- Too Big To Fail Is Now Bigger Than Ever Before

- The Fed and Gold

- Eric Sprott Exclusive: Severe Carnage Coming in the Bond Market!

- 90% Silver only $1.25 over spot!!!

- Silver becomes the best performing precious metal

- Singapore Continues Push To Become Asian and Global Gold Hub

- Is Europe headed for a rerun of the 1923 German mark collapse?

- Silver and Survival

- China Alone is Buying Enough Gold to Make Prices Soar

- Coeur reports substantial silver reserve increase

- Talk Of Tapering Is Tapering Off

- Singapore Continues Push To Become Asian and Global Gold Hub

- Singapore Continues Push To Become Asian and Global Gold Hub

- Links 9/24/13

- Rupee’s decline a bitter pill for foreign drug firms’ India units

- Why Nouriel Roubini’s views on stocks and gold are a good contrarian indicator

- Jim Rickards Expects New World Monetary System to Be Rebuilt Around Gold

- Seven King World News Blog/Interviews

- Apple Ran Out of Gold iPhones Because it Underestimated How Much Asia Likes Gold

- Chinese Housewives vs. Goldman Sachs: No Contest

- Is This The Start Of China's Gold Miner Buying Spree?

- Sprott's Charles Oliver Sees the Shine Returning to Metals

- Citi: Gold gains will be short-lived; silver also headed south

- JPMorgan Says "Buy Gold"

- Bank of Thailand gets suspicious about paper gold

- Australian academic study admits possibility of gold market rigging but can't confirm it

- Australia's Gold Symposium interviews GATA secretary

- Chris Powell, GATA secretary to speak in Auckland, New Zealand on October 13

- Tom Fischer: Why gold's contango suggests central bank interference

- Rickards expects new world monetary system to be rebuilt around gold

- Will the Fed Ever Taper?

| Growth not a dirty word - Goldcorp CEO Posted: 24 Sep 2013 05:34 PM PDT Speaking on the sidelines of the Denver Gold Group conference, Chuck Jeannes told Reuters the gold digger was not ruling out deals or big capital projects |

| First gold pour at Kibali well ahead of schedule - Randgold Posted: 24 Sep 2013 05:34 PM PDT Randgold's Mark Bristow was able to announce the first gold pour at the massive new Kibali mine in the DRC, within budget and well ahead of original schedule at the Denver Gold Forum today. |

| Manipulation, gold and the decline of the dollar - Sprott Posted: 24 Sep 2013 12:52 PM PDT According to Sprott Asset Management CEO, Eric Sprott, sooner or later the unintended consequences of QE will come into play, the biggest being the decline in the US dollar |

| Posted: 24 Sep 2013 12:12 PM PDT Short & Leveraged ETFs/ETPs Global Report (31 August 2013) Global Assets Under Management

Short & |

| Gold & Oil: Which Has a Better Upside Potential? Posted: 24 Sep 2013 12:05 PM PDT SunshineProfits |

| Gold set to vault up from downturn - Oliver Posted: 24 Sep 2013 12:00 PM PDT According to Charles Oliver, senior portfolio manager with Sprott Asset Management, the fundamentals are in place for gold to move significantly—possibly topping $2,000/oz. An interview with The Gold Report. |

| At 1300 USD/Oz, Gold Is Only Halfway Through The Bear Market Posted: 24 Sep 2013 11:45 AM PDT Given current levels, gold's inflation adjusted performance remains exceptionally strong. At this stage where QE tapering and policy tightening have yet to kick in, gold looks vulnerable. The trajectory of gold's price slump since 2012 is similar to the early 1980s. Having completed half the down trajectory, the pace of gold's slump is expected to slow. Investors who share this sentiment may consider the following short positions on gold (GDL, 3GOS, 2GOS, 1GOS). (click to enlarge) At current, inflation adjusted prices, gold is priced at a level where it was 32 years ago. Then, amidst a severe tightening cycle, gold was only halfway down its path of decline. Gold succumbed to an environment where rising policy rates and long term bond yields suppressed inflation. Now, policy tightening has not even begun and QE taper talk is enough to force gold lower. The tapering delay has failed to stage a convincing |

| First Majestic: A Best-In-Breed Company That Remains Profitable Even At $20 Silver Posted: 24 Sep 2013 11:11 AM PDT Executive Summary First Majestic's (AG) Q2FY13 continued to show that the company is significantly outperforming many of its competitors. The company achieved profitability for the quarter when many of other miners reported large losses and significant write-downs. Additionally, it grew production while maintaining some of the lowest all-in costs in the industry, and even with silver under $20 this company can produce a profit for its investors. But investors should also note that the company does have an extrapolated P/E close to 40 if silver prices hold at current levels. This is much better than its competitors (who are having trouble maintaining profitability at current prices) but it is high when compared to non-mining companies. Despite this, First Majestic remains a best-in-breed company and offers investors a safe silver mining company to invest in if they are looking for diversification in precious metals or want to invest in the best |

| AngloGold Ashanti's CEO Presents at Denver Gold Forum 2013 (Transcript) Posted: 24 Sep 2013 11:05 AM PDT AngloGold Ashanti Limited (AU) Denver Gold Forum 2013 Conference Call September 24, 2013 10:50 AM ET Executives S Venkatakrishnan - CEO Analysts Mike Jalonen - BofA Merrill Lynch Global Research Presentation Mike Jalonen - BofA Merrill Lynch Global Research Okay, moving along. I see our next speaker right there. Very pleased to have from AngloGold Ashanti, Venkat, I apologize I can't say your last name, but Venkat is CEO of AngloGold Ashanti. Has been in that position since May this year, so this is his maiden speech in this role at this conference, but he has been with the company prior being CEO, he was CFO for the prior eight years. So I will pass the podium to yourself. Nice to meet you. S Venkatakrishnan Thank you for that introduction. Most appreciated. And you are right, this is my maiden appearance in Denver. Kicking off with a quick introduction about |

| Precious Metals Bears: Here Come The Negative Investment Bank Reports Posted: 24 Sep 2013 11:00 AM PDT

Analysts at investment banks are a bit like amateur meteorologists. Whatever is the latest trend usually informs the tone of their research reports. Last week TND and Silver Doctors detailed examples of capping efforts by the cartel leading up to and following the "no taper" announcement. With the precious metals complex under wraps, it should [...] The post Precious Metals Bears: Here Come The Negative Investment Bank Reports appeared first on Silver Doctors. |

| Agora Commodities ships Gold using USPS express overnight Posted: 24 Sep 2013 10:58 AM PDT Sending gold by post has always been a point of contention for many investors who would like to buy into the physical gold market but felt it was unsafe to receive gold in the mail. Agora Commodities is addressing this fear by offering overnight delivery. |

| Precious Metals and Being Long Gamma Posted: 24 Sep 2013 10:00 AM PDT

Precious metals are uniquely set up to benefit from the coming volatility, whether it be from fiat demise or outright shortage. When an option trader has a long gamma position it means that they benefit from volatility and can rebalance their portfolios' profitably if the underlying asset moves significantly. The more volatile that precious metals [...] The post Precious Metals and Being Long Gamma appeared first on Silver Doctors. |

| China overtakes India as no. 1 gold buyer Posted: 24 Sep 2013 09:53 AM PDT Traditionally the largest market for buying gold, "[India] this year it looks very likely to be eclipsed by Chinese demand," writes SocGen analyst Robin Bhar in a new note today. |

| Posted: 24 Sep 2013 09:42 AM PDT Given how much we gold commentators report on China's inherent love for gold, it's surprising that very few realize that less than one-hundred years ago the country lost thousands of years' worth of reserves. |

| Doc’s Deal: 90% Silver Only $1.25 Over Spot Any Qty! Posted: 24 Sep 2013 09:15 AM PDT

Doc’s Deal of the Day: 90% Silver Only $1.25 Over Spot ANY QTY! Until 4pm today only while supplies last! *Update- Going fast, only $2,000 face value left! The post Doc’s Deal: 90% Silver Only $1.25 Over Spot Any Qty! appeared first on Silver Doctors. |

| Singapore continues push to become global gold hub Posted: 24 Sep 2013 09:14 AM PDT The wealthy Asian city state of Singapore, which has become one of the world's most important financial centers in recent years, continues its push toward making itself a global gold hub to rival New York and London. |

| THE BANKER TAPER CIRCUS: The Greatest Show on Earth Posted: 24 Sep 2013 09:00 AM PDT

No longer do you have to get tickets to attend the Ringling Brothers and Barnum & Bailey Show, while the real Circus, the Great Banker Taper Spectacle is in town. Today, the "Greatest Show On Earth" does not include a dozen elephants performing amazing stunts, but rather a group of highly educated banker clowns playing [...] The post THE BANKER TAPER CIRCUS: The Greatest Show on Earth appeared first on Silver Doctors. |

| Posted: 24 Sep 2013 08:40 AM PDT Unlike many commodities, there are many shades to gold, such as the Love Trade's buying gold for loved ones and the Fear Trade's purchasing gold as a store of value. An additional "shade" investors need to be aware of is how the Fed interprets the recovery of the U.S. economy. |

| Centerra Gold to look for acquisitions after kumtor resolution Posted: 24 Sep 2013 08:27 AM PDT Centerra will consider development projects and mines that are already in production, Chief Executive Officer Ian Atkinson told Reuters |

| Too Big To Fail Is Now Bigger Than Ever Before Posted: 24 Sep 2013 08:00 AM PDT

The too big to fail banks are now much, much larger than they were the last time they caused so much trouble. The six largest banks in the United States have gotten 37 percent larger over the past five years. Meanwhile, 1,400 smaller banks have disappeared from the banking industry during that time. What this [...] The post Too Big To Fail Is Now Bigger Than Ever Before appeared first on Silver Doctors. |

| Posted: 24 Sep 2013 08:00 AM PDT In 2008, if I told you that the Fed would continue to print trillions of dollars to keep the economy afloat, save the stock market and hold down interest rates, would you have thought geez, this is a great time to buy gold and silver? Of course you would. Because it is a good time to buy gold and silver. Everything is working in favor of the precious metals EXCEPT the price. How can that be? Well, if the markets weren't heavily manipulated, it couldn't be. So draw your own conclusions. Another unexpected event is that the US dollar recently strengthened. Two years ago, it seemed likely that the dollar was at an all time low. Most economists expected it to go even lower. Actually, I still believe it will – but the financial problems with the PIIG's and then Japan's decision to devalue the yen send a lot of foreign investors into the dollar. It's not that the dollar is STRONG; the other currencies that make up the USDX are worse off, or at least that is what the "hot money" crowd thinks. That is another reason WHY the price of gold had to be crushed – after it topped $1900. The Fed panicked. Gold was showing the dollar up for what it was – a basket case. Brad Hoppmann's thesis makes perfect sense to me (see full statement in Today's Quotes section). He said:

Peter Mickelberg said:

Do not be misled by the day-to-day manipulation of gold and silver. In every way but the price (determined by buying and selling on the futures market, not by physical demand), gold and silver are more necessary than ever. Watch the following Kitco video – Daniela Cambone interviews Jim Rickards. Rickards discusses gold, the dollar, the economy and the Fed. A must-see short interview below. Jim Rickards: Fed Knows Gold Has To Go Higher Here are two Zero Hedge articles that are worth reading…

***

Similar Posts: |

| Eric Sprott Exclusive: Severe Carnage Coming in the Bond Market! Posted: 24 Sep 2013 07:57 AM PDT

In his most explosive interview with SD ever, CEO of Sprott Asset Management Eric Sprott discussed his thoughts on the Fed's no-taper, why he believes the cartel took down gold this spring, the evidence that a bail-in is coming to the US and Canada, and the US fiscal debt crisis. Sprott went on to claim that the paper gold market was crushed by the Western Central banks this spring in order to free up gold supply from the ETFs as a massive gold shortage threatened the banking system, and that this is a battle the Western Central banks are doomed to lose as global physical demand will soon overwhelm Central bank supply. This posting includes an audio/video/photo media file: Download Now |

| 90% Silver only $1.25 over spot!!! Posted: 24 Sep 2013 07:36 AM PDT

Offer Valid until 4pm EST The post 90% Silver only $1.25 over spot!!! appeared first on Silver Doctors. |

| Silver becomes the best performing precious metal Posted: 24 Sep 2013 07:30 AM PDT Increasing market volatility risks a potentially greater adverse impact on cyclical assets, with the S&P 500 equity benchmark up about 20% on the year. Investors are increasingly likely to look to gold as a portfolio insurance vehicle if volatility continues to gain. |

| Singapore Continues Push To Become Asian and Global Gold Hub Posted: 24 Sep 2013 07:20 AM PDT gold.ie |

| Is Europe headed for a rerun of the 1923 German mark collapse? Posted: 24 Sep 2013 07:18 AM PDT Recent statistics are confirming "economic recovery" in the U.K. and even in some of the weaker Eurozone states. I put this in quotes because what we are seeing is expanding nominal GDP, which is not the same thing. |

| Posted: 24 Sep 2013 07:00 AM PDT

In his latest video, Silver Bullet/ Silver Shield’s Chris Duane discusses how silver will play a critical role in surviving the coming collapse of the current fiat currency system. Silver Bullet Silver Shield Collection at SDBullion! 2013 Gold Eagles As Low As $51.49 Over Spot at SDBullion! The post Silver and Survival appeared first on Silver Doctors. |

| China Alone is Buying Enough Gold to Make Prices Soar Posted: 24 Sep 2013 07:00 AM PDT Last month, I reported from the "Middle Kingdom" that Chinese retail gold demand was every bit in person what we read on paper. The public DOES NOT STOP buying no matter what the price – as they understand it is REAL MONEY; and now that the Chinese government has been actively encouraging citizens to accumulate Precious Metals – for the past four years – the "proof is in the pudding"; as not only are 2013 Chinese gold imports on the verge of DOUBLING versus 2012…

…but so is PHYSICAL delivery at the Shanghai Exchange; which despite its lack of recognizably, is far larger than the COMEX in this aspect. To wit, for the past two years, roughly ten times more gold has been delivered in Shanghai than New York; and this year, almost as much as has been produced worldwide! In fact, anyone looking at this chart would reasonably conclude that not only should the price be much higher, but the ENTIRE WORLD should be facing a shortage; and not only that, but the global price setting mechanism should not be in the U.S., but CHINA (which it someday soon will)!

This is why the Cartel is so fixated on preventing momentum from building in the PM markets; and thus, today's 82nd visit from "THE 2:15 AM" in the past 91 days – as global stock markets don't budge and Treasury bonds (post "no tapering") continue to rise…

Well, that - and this (and don't forget what's been added since re-election)…

PROTECT YOURSELF, and do it NOW! Call Miles Franklin at 800-822-8080, and talk to one of our brokers. Through industry-leading customer service and competitive pricing, we aim to EARN your business.Similar Posts: |

| Coeur reports substantial silver reserve increase Posted: 24 Sep 2013 06:40 AM PDT Despite the reserve increase, Scotia Capital feels "Coeur remains fundamentally overvalued based on our long-term silver price of $20/oz." |

| Talk Of Tapering Is Tapering Off Posted: 24 Sep 2013 06:15 AM PDT Andy Hoffman joins Kerry Lutz of the Financial Survival Network to discuss tapering, the Fed and money printing. Similar Posts: |

| Singapore Continues Push To Become Asian and Global Gold Hub Posted: 24 Sep 2013 06:10 AM PDT

The wealthy Asian city state of Singapore which has become one of the world's most important financial centres in recent years continues its push towards making Singapore a global gold hub to rival New York and London. Singapore has been trying to persuade Thailand’s top five gold traders to establish footholds in the city-state as [...] The post Singapore Continues Push To Become Asian and Global Gold Hub appeared first on Silver Doctors. |

| Singapore Continues Push To Become Asian and Global Gold Hub Posted: 24 Sep 2013 04:37 AM PDT Singapore has been seeing significant flows of gold into the city state as wealthy investors, ultra high and high net worth individuals and family offices are opting for Singapore as a safe location for gold storage since they removed sales tax on gold and silver in October 2012. Today's AM fix was USD 1,316.50, EUR 976.05 and GBP 823.43 per ounce. Gold fell $4.20 or 0.32% yesterday, closing at $1,321.10/oz. Silver dropped $0.18 or 0.37%, closing at $21.56. At 3:22 EDT, Platinum slipped $9.66 or 0.7% to $1,417.74/oz, while palladium fell $3.23 or 0.5 to $710.97/oz. Gold inched down this morning as the short term trend remains lower after the surprise and unusual price falls seen last Friday dampened renewed positivity after the 'taper caper'. Gold appears likely to test support at the $1,290/oz to $1,300/oz level again this week – possibly today or tomorrow when there is a COMEX futures option expiration. Gold has frequently come under selling pressure in the day or two prior to and on the day of COMEX futures option expiration in recent years and prices have often recorded intermediate lows and offered good buying opportunity to those brave souls who like to try and time the market.

Gold will be supported by physical demand in Asia which should pick up due to China's Golden Week. 'Golden Week' begins October 1, and typically sees increased coin and bar purchases from store of wealth Chinese buyers. Volumes for spot gold of 99.99% purity, the benchmark contract, climbed to a one-week high of 13,952 kilograms yesterday, Shanghai Gold Exchange (SGE) data show. The U.S. Mint sold 12,000 ounces of American Eagle gold coins so far this September, surpassing August's 11,500 ounces. The wealthy Asian city state of Singapore which has become one of the world's most important financial centres in recent years continues its push towards making Singapore a global gold hub to rival New York and London. Singapore has been trying to persuade Thailand’s top five gold traders to establish footholds in the city-state as it aims to become a centre for gold price referencing in Southeast Asia before the ASEAN Economic Community (AEC) takes shape in 2015, according to the The Nation. It reports that the Singaporean government dispatched a team to Thailand to offer relaxed regulations and tax incentives to traders who open offices in that country. It wants to become a reference centre for global gold prices. An executive at a leading Thai gold company said that while ”Thailand’s gold market has become bigger and better known in the past few years. It’s ranked third in Asia. [Thai] gold traders also want to upgrade themselves to international standards.” He continued saying that if the Bank of Thailand "imposes stringent controls on the gold trade, possibly exchange-rate lock-ups and a price-settlement system", his company will "consider the Singapore option". “Several gold traders plan to have offices in Singapore as trading bases instead of in Thailand,” according to another industry source. The very negative treatment of gold by the government in India is encouraging companies involved in offering gold and gold related investments in India, to consider moving to Singapore.

In October 2012, in a shrewd move, the Singapore government removed a sales tax on gold and silver. Already, there are significant flows of gold into the city state as wealthy investors, ultra high and high net worth individuals and family offices are opting for Singapore as a safe location for gold storage.

Singapore is already the fastest growing wealth center in the world with $550 billion in assets under management, according to research firm WealthInsight and now aims to become a gold trading and storage hub. In recent years, industry players have opened storage vaults, started delivery services for precious metals from mints, and opened new trading desks for gold to meet investor demands. Specialist vaulting companies have seen an increase in business and western banks have noticed the trend and are also offering precious metals storage in Singapore. Singapore is catering to the rising demand for bullion coins and bars and for vaulting and storage in Asia. As one of the region’s largest trading hubs and the fastest growing wealth centre in the world, Singapore is well-placed to capture 10% to 15% of world gold bullion trade in the next decade. Singapore is the beneficiary of rising demand for precious metals throughout Asia due to concerns about devaluing paper currencies and a high regard for gold, in particular, as a store of wealth. |

| Posted: 24 Sep 2013 04:01 AM PDT Olympic medal firm in pollution suit Guardian Hackers claim to have bypassed iPhone 5s’ Touch ID fingerprint authentication system Gizmag Slowdown ‘central’ to climate report BBC Kenyan officials claim last push to end mall siege Associated Press Americans among Nairobi mall attackers, Kenyan official says Sydney Morning Herald (furzy mouse) Beijing to Offer Higher Prices for Clean Fuels to Encourage Production OilPrice Two Hundred Bangladesh Factories Shut on Labor Unrest Bloomberg This is the end of GM crops in Denmark Coalition of States for GMO Labeling (furzy mouse) Syria

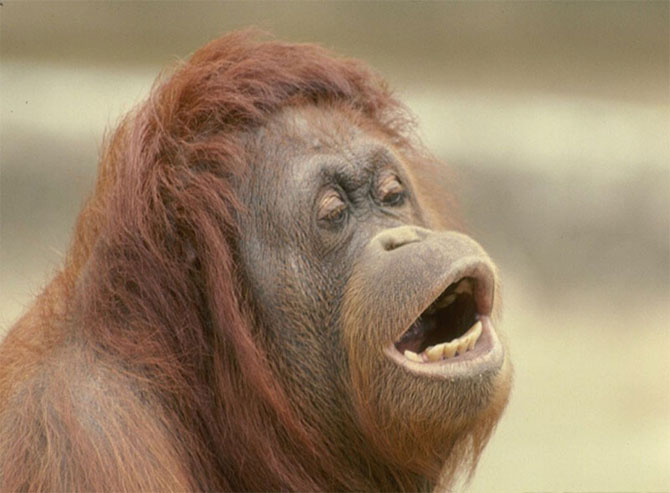

Big Brother is Watching You Watch Are Internet Backbone Pen Registers Constitutional? Just Security Metadata Equals Surveillance Bruce Schneier President Obama speaks out on Trade Promotion Authority Politico. In which Obama comes right out and says Boeing owes him a payoff, um, gold watch. Just a joke, of course. Why the GOP Effort to Shut Down the Government in Order to Kill ObamaCare Is High Risk- 9/22 (Part 1 and Part 2) & 9/23 Fox News. Pat Caddell and the saner folks at Fox are concerned. Lower Health Insurance Premiums to Come at Cost of Fewer Choices New York Times (furzy mouse). And this is not necessary. I have a cheap indemnity plan, which means I can see anyone, even go straight to a specialist. There’s no excuse for all the ripoffs, except of course that they can get away with them. Clinton Global Initiative Is Market For Favor Trading, Credibility Laundering DS Wright, Firedoglake Detroit's Casino-Tax Dollars Become Big Issue in Bankruptcy Case New York Times (furzy mouse) Crash Course in Disequilibrium Economics Steve Keen Do European fines deter price fixing? VoxEU. Wow, says fines ought to be much higher! The idiocy of crowds Felix Salmon CFTC warns over funds to protect public Financial Times Dr Doom says buy shares MacroBusiness Bernanke's Head Fake Sends Stocks Soaring CounterPunch (Carol B) Housing Smoke and Mirrors (18) – "The Mendacity of HOPE (and HARP and HAMP)" Global Economic Intersection Gauging the trajectory of the US housing market Sober Look. I’m not surprised, since Aug home sales are the result of contracts entered into in June and July. I heard a lot of reports of buyers rushing to close deals on the fear that the taper talk/reality would only make matters worse, so they wanted to get through what they thought was a closing window. I had said earlier we wouldn’t get a good reading on the impact of the early summer rate rise before the September data was in. US manufacturing data dips Guardian JPMorgan faces US charges on mortgage-backed securities Financial Times Wal-Mart Hires Workers for Holidays Amid Shelf Complaints Bloomberg Life on a trailer park BBC. At least in Alabama, living in a mobile home is a necessary but not sufficient condition for losing everything in a tornado. 4 Reasons Not to Contribute To Your 401k MoneyMuser (Carol B) Antidote du jour: |

| Rupee’s decline a bitter pill for foreign drug firms’ India units Posted: 24 Sep 2013 03:34 AM PDT The Indian rupee's fall against the dollar appears to be finally hitting the pharmaceutical industry, considered a defensive sector as its earnings remain relatively unaffected by economic downturns... Read |

| Why Nouriel Roubini’s views on stocks and gold are a good contrarian indicator Posted: 24 Sep 2013 03:34 AM PDT Who was the first major commentator to predict another stock market crash after the market rallied in 2009? His record on reading the gold price is no better. In late 2009 when gold was $1,122 an ounce Nouriel Roubini said: ”Since gold has no intrinsic value…there are significant risks of a downward correction… gold at $1,500 is utter nonsense.’ That did not stop the yellow metal hitting $1,923 by October 2011. He gave six reasons ‘why gold prices are likely to move much lower’. Gold bear Then again in June this year Dr. Doom was predicting a crash in the gold price below $1,000 and the precious metal rallied beyond $1,400 before falling back a little. Still he does not give up and is sounding a warning on gold again today and tipping stocks. His rosy view on the US stock markets ought therefore be treated with some alarm because doing the opposite of his predictions has been a surefire way to make money. In October 2009 he said: ‘Investors are hoping for a V, but there are plenty of signs it could be a U-shaped recovery with… a price correction of 10 to 20 per cent.’ US stocks just carried on up regardless thanks to Fed easy money. Contrarian contrarian Every time Nouriel talks about the bear market resuming usually coincides with a market bottom. However this also suggests when Nouriel gets bullish it could be time to head for the exits. So where is he today? Still negative on gold and quite upbeat on the prospects for US equities and negative on emerging markets. From what we’ve noted in Dubai and Russia over the past month he is probably wildly out on them too (see the next issue of our sister newsletter for our quirky view on these markets, click here). The man who got the subprime crisis so brilliantly right does seem to have struggled a lot since then and is now something of a human contrarian indicator. |

| Jim Rickards Expects New World Monetary System to Be Rebuilt Around Gold Posted: 24 Sep 2013 02:31 AM PDT "It's visible for all to see, unless they're willfully blind, that is." ¤ Yesterday In Gold & SilverThe gold price opened flat in New York on Sunday night and then didn't do much until 9 a.m. in Hong Kong when a not-for-profit seller took gold down about fifteen bucks in just a few second. The price struggled back after that, but could never made it above the $1,330 spot price mark before getting sold down. Gold closed at $1,322.30 spot, down $3.30 from Friday's close. Gold's net volume on the day was 144,000 contracts, with 35,000 of that coming before the London open, so you can see that trading was very active in the Far East on their Monday. Silver ran into the same 9 a.m. Hong Kong seller as gold did, but by 10:30 a.m. in New York, the price had struggle back to slightly above unchanged from Friday's close, but once electronic trading began, it got sold down for a small loss on the day. Silver finished the Monday session at $21.64 spot, down 16 cents from Friday. Net volume was very decent at 46,500 contracts and, like gold, 15,000 of those contracts traded before the London open. That's a lot of contracts in both metals for that time of day. Both platinum and palladium had mini spikes down at 9 a.m. Hong Kong time as well. Platinum rallied back until just before the London open before getting quietly sold down for the rest of the day. Palladium traded pretty flat until around 11:30 a.m. BST in London and then gold sold down a bit over ten bucks by 9:30 a.m. in New York. From there it recovered but, like the other three precious metals, it wasn't allowed to close in positive territory, either. Here are the charts. The dollar index closed in New York on Friday at 80.44. It hit its low of the Monday session [80.29] minutes after 2 p.m. in Hong Kong, and then chopped back to basically unchanged into the close, as it finished at 80.45. Nothing to see here. The gold stocks managed to keep their heads above water until the gold price began to sell off shortly after the 1:30 p.m. EDT Comex close, and the shares followed. The HUI closed down 1.57%, virtually on its low of the day. The silver stock headed south even earlier than the gold stocks, and Nick Laird's Intraday Silver Sentiment Index closed down 2.82%. A lot of the silver miners did much worse than that. The silver equities, like their golden brethren, have now given back all their gains from last Wednesday. The CME's Daily Delivery Report for Monday showed that zero gold and 80 silver contracts were posted for delivery within the Comex-approved depositories on Wednesday. There were seven short/issuers, with the biggest being ABN Amro with 47 contracts. The three largest stoppers were Canada's Bank of Nova Scotia with 32 contracts, followed by JPMorgan Chase with 28 contracts in its in-house [proprietary] trading account, and 14 in its client account. The link to yesterday's Issuers and Stoppers Report is here. There was another withdrawal from from GLD yesterday, as an authorized participant took out 19,309 troy ounces. And as of 10:01 p.m. yesterday evening, there were no reported changes in SLV. Since yesterday was Monday, the U.S. Mint had a sales report. They sold 3,000 ounces of gold eagles; 3,500 one-ounce 24K gold buffaloes; and 710,500 silver eagles. There wasn't much in/out movement in gold within the Comex-approved depositories on Friday. They reported receiving 5,353 troy ounces of the stuff, and shipped 385 troy ounces out the door. The link to that activity is here. As usual, there was a lot more activity in silver. They reported receiving 500,272 troy ounces, and 138,665 troy ounces were shipped off to parts unknown. The link to that action is here. Since today is Tuesday, I have a few more stories than normal, so I hope you're able to find the time to read the ones that interest you the most. ¤ Critical ReadsJPMorgan's Legal Hurdles Expected to Multiply The nation’s largest bank is bracing for a lawsuit from federal prosecutors in California who suspect that the bank sold shoddy mortgage securities to investors in the run-up to the financial crisis, according to people briefed on the matter. The case, expected as soon as Tuesday, could foreshadow other actions stemming from the bank’s crisis-era mortgage business. Federal prosecutors in Philadelphia, the people briefed on the matter said, are also investigating JPMorgan’s sale of mortgage securities. Underscoring the breadth of the scrutiny, the people said, JPMorgan and the Department of Housing and Urban Development briefly discussed the possibility of striking a wide-ranging settlement to conclude many of the looming mortgage investigations from federal authorities and state attorneys general. But the housing agency floated a price tag of about $20 billion for the settlement, the people said, effectively derailing settlement talks with JPMorgan lawyers, who were stunned by the size of the proposed penalty and expected to pay a fraction of that sum. $20 billion is a tidy sum! This is a bit more than the standard licensing fee that JPMorgan is used to. I hope the California prosecutors manage to collect a goodly portion of that. This story was posted on The New York Times website at 10:00 p.m. EDT last night...and I thank U.A.E. reader Laurent-Patrick Gally for sliding it into my in-box just before I hit the 'send' button on today's column. Doug Noland: Credit Bubble Bulletin...Financial Conditions The Fed really pushed the envelope too far this time. Alasdair Macleod: Monetary inflation prospectsOn Wednesday last the Fed surprised most people by deciding not to taper. What is not generally appreciated is that once a central bank starts to use monetary expansion as a cure-all it is extremely difficult for it to stop. This is the basic reason the Fed has not pursued the idea, and why it most probably never will. That is a strong statement. But consider this: Paul Volcker faced this same dilemma in 1979, when he was appointed Chairman of the Fed. In raising interest rates to choke off inflation he had two things going for him that his successor has not: rising inflation was already over 10% so was an obvious priority, and importantly private sector debt-to-GDP was at a far lower level than today. It was a tough decision at the time to nearly double interest rates. Today, with official inflation low and private sector indebtedness high it would be extremely difficult. One thing is certain in life, besides death and taxes, and that is if you expand the quantity of money prices eventually rise; or more accurately the purchasing power of debased money falls. The problem is how to measure currency debasement, and this has been a topic of heated debate since fiat currencies first developed. This has led me to propose a new measure of money, which at James Turk’s suggestion I am calling the Fiat Money Quantity (FMQ). The purpose is to gives us a measure of fiat money that enables us to assess the danger of currency hyperinflation. This commentary by Alasdair was posted on the goldmoney.com Internet site last Friday, and I found it embedded in a GATA release over the weekend. Lois Lerner, IRS official at heart of tea party scandal, retiresLoise G. Lerner, the woman at the center of the IRS tea party targeting scandal, retired from the agency Monday morning after an internal investigation found she was guilty of “neglect of duties” and was going to call for her ouster, according to congressional staff. Her departure marks the first person to pay a significant price in the scandal, though Republicans were quick to say her decision doesn’t put the matter to rest, and pointed out that she can still be called before Congress to testify. The IRS confirmed Ms. Lerner's retirement in a statement, but said it couldn’t release any more information because of privacy concerns. Was This Whistle-Blower Muzzled? THE fifth anniversary of Lehman Brothers’ bankruptcy has occasioned one legacy-spinning defense after another. We’ve heard from Ben S. Bernanke, chairman of the Federal Reserve; Henry M. Paulson Jr., the Treasury secretary at the time; and Timothy F. Geithner, then the New York Fed president and later Mr. Paulson’s successor at Treasury, about their historic decisions to use trillions of dollars of taxpayers’ money to bail out the banking system. But will we ever know what really happened behind all those closed doors? The seemingly appalling treatment afforded Richard M. Bowen III, a former Citigroup executive who blew the whistle on years of malfeasance there, shows that we may not. Thanks to political pressure and the revolving door between Washington and Wall Street, the events leading up to the financial crisis remain obscured and may never be fully revealed. Mr. Bowen, who was featured in a piercing “60 Minutes” segment in December 2011, had discovered that for years before the crisis, Citigroup, like many other Wall Street firms, had been purchasing tens of billions of dollars’ worth of risky home mortgages and then packaging and selling them as investments. “When I started screaming,” he told me, “I was just trying to do my job. Silly me.” At wits’ end, on Nov. 3, 2007, Mr. Bowen sent an e-mail to a small group of Citigroup executives, including Robert E. Rubin, a former Goldman Sachs executive and former Treasury secretary who was then chairman of the bank’s executive committee (and who received $126 million during his decade at Citigroup). “The reason for this urgent e-mail concerns breakdowns of internal controls and resulting significant but possibly unrecognized financial losses existing within our organization,” Mr. Bowen wrote. This 3-page op-ed essay was posted on The New York Times website on Sunday, and definitely falls into the must read category. I thank Phil Barlett for bringing this story to our attention. Bridgewater boss Ray Dalio explains how he avoided the financial crisisThere are about 13 billion reasons to listen when Ray Dalio talks about the economy. The Bridgewater hedge-fund star, with a net worth of — you guessed it — almost $13 billion, narrates an animated video that was posted on youtube.com on Sunday, in which he delivers his “simple but practical” take on how the economy works. He sums up his half-hour presentation with three critical rules of thumb that have served him well. This article was posted on the marketwatch.com Internet site late on Sunday evening EDT...and it's courtesy of reader Ken Hurt. ATT, Verizon, Sprint are Paid Cash by NSA for Your Private CommunicationsThe National Security Agency pays AT&T, Verizon and Sprint several hundred million dollars a year for access to 81% of all international phone calls into the US, according to a leaked inspector general’s report, which has been reported by the Washington Post, AP, and the New York Review of Books. In fact., this secret report says that “NSA maintains relationships with over 100 U.S. companies, underscoring that the U/S. has the “home-field advantage as the primary hub for worldwide communications,” the New York Review of Books reported in its August 15 issue. These secret cooperative agreements reveal that NSA pays surveillance fees to telcos and phone companies were first made public by Edward Snowden, the former NSA administrator, now resident in Russia. AT&T charges $325 for each activation fee and $10 a day to monitor the account, according to the AP. Verizon charges $775 per tapping for the first month and then $500 a month thereafter, according to the Associated Press today. The article reported that Microsoft, Yahoo and Google refused to say how much they charged to allow the government to tap into emails and other non-telephonic communications. In a separate report the Washington Post reported that NSA pays the telcos roughly $300 million annually for access to information on their communications; where and when they occurred, the identity of the person called and how long the conversation lasted. This surveillance is accomplished by tapping into “high volume circuits and packet-switched networks.” The ability to obtain this information was authorized by the US Communications Assistance for Law Enforcement Act, passed in 1994 by the Clinton administration. This article was posted on the Forbes website early Monday afternoon EDT...and my thanks go out to Washington state reader S.A. for sending it. Russia Moves Up, US Falls in World Economic Freedom RankingRussia has climbed 10 places since 1995 in a global ranking of economic freedom, while the United States has fallen 13 spots over the same period, according to a report from a Canadian public policy think-tank released Wednesday. Russia ranked 101st out of 151 nations, up 10 places from 1995 and 12 places better than its ranking in 2000, in the “Economic Freedom of the World” report, compiled by Canada’s Fraser Institute. After ranking as the world’s third freest economy behind Hong Kong and Singapore for most of the two decades from 1980-2000, the United States began to lose ground as the new millennium began. The report blames the slippage on “overspending, weakening rule of law, and regulatory overkill on the part of the US government.” “Once considered a bastion of economic freedom,” the United States now ranks 17th in the world,” says the report, which was compiled using data from 2011. The current US ranking puts it 13 places lower than its 4th-place ranking in 1994, and 15 lower than in 2000, when it ranked second overall. This article showed up on the en.rian.ru Internet site very early Thursday morning Moscow time...and it's courtesy of reader "h c". Iceland Borrows European "Template" - Removes Large Deposit Guarantees Following the crisis in October 2008, Iceland's government declared all deposits in domestic financial institutions were 'blanket' guaranteed - an Emergency Act that was reaffirmed twice since. However, according to RUV, the finance minister is proposing to restrict this guarantee to only deposits less-than-EUR100,000. While some might see the removal of an 'emergency' measure as a positive, it is of course sadly reminiscent of the European Union "template" to haircut large depositors. This is coincidental (threatening) timing given the current stagnation of talks between Iceland bank creditors and the government over haircuts and lifting capital controls - which have restricted the outflows of around $8 billion. Next St |

| Seven King World News Blog/Interviews Posted: 24 Sep 2013 02:31 AM PDT 1. Michael Pento: "Dangerous Fed Manipulation, Desperation, Propaganda and Gold". 2. John Embry: "This Will End in Catastrophic Collapse and Tragedy For the West". 3. Robert Fitzwilson: "What the Big Money is Doing After the Fed's Historic Decision". 4. James Turk: "Two Astonishing Charts Show Gold and Silver Now Ready to Soar". 5. Richard Russell: "U.S. Ponzi Collapse and a New Monetary System". 6. The first audio interview is with Dr. Paul Craig Roberts...and the second audio interview is with GATA's Chris Powell. |

| Apple Ran Out of Gold iPhones Because it Underestimated How Much Asia Likes Gold Posted: 24 Sep 2013 02:31 AM PDT One reason supplies of Apple's gold iPhone 5S are backed up is because the company has under-supplied the Asian desire for objects that are gold. While almost all countries and cultures prize gold over other metals and colors, or at least attach special significance to it, gold in Asia is perhaps even more fetishized than in the West. |

| Chinese Housewives vs. Goldman Sachs: No Contest Posted: 24 Sep 2013 02:31 AM PDT Goldman Sachs is once again predicting that gold will fall, setting a new near-term target of $1,050. Never mind the schizophrenic gene that would be required to follow the constantly fluctuating predictions of all these big banks; it's amazing to me that anyone continues to listen to them after their abysmal record and long-standing anti-gold stance. Sure, the too-big-to-fails can move markets—but they say things that are good for them, not us. When I visited China two years ago, guess who no one was talking about? Goldman Sachs. There was news about the US, of course, but the regular diet of journalistic intake consisted of Chinese activity, not North American. And surprise, surprise, the view from that side of the big blue ball was materially different than what we hear and read here—and in some cases, the opposite. This commentary by Casey Research's own Jeff Clark was embedded in yesterday's edition of the Casey Daily Dispatch...and it's a must read. |

| Is This The Start Of China's Gold Miner Buying Spree? Posted: 24 Sep 2013 02:31 AM PDT Back in October of 2012, Hugh Hendry proposed a simple investment thesis: '"I am long gold and I am short gold mining equities. There is no rationale for owning gold mining equities. It is as close as you get to insanity. The risk premium goes up when the gold price goes up. Societies are more envious of your gold at $3000 than at $300. And there is no valuation argument that protects you against the risk of confiscation. And if you are bullish gold why don’t you buy gold ETFs, gold futures or gold bullion." |

| Sprott's Charles Oliver Sees the Shine Returning to Metals Posted: 24 Sep 2013 02:31 AM PDT Has the gold price hit bottom? Charles Oliver, senior portfolio manager with Sprott Asset Management, believes that the fundamentals are in place for gold to vault from its downturn—possibly topping $2,000/oz in the next year. In this interview with The Gold Report, Oliver talks about which small-cap miners he's been adding to his portfolio before the market recognizes the illogical discounts. This interview with Charles was posted on theaureport.com Internet site yesterday...and it's worth reading. |

| Citi: Gold gains will be short-lived; silver also headed south Posted: 24 Sep 2013 02:31 AM PDT The Fed’s surprise decision to kick the tapering can down the road hasn’t changed the direction of gold, which is due south, says Citigroup in a fresh research note on Monday. Jansen said ETF investing will probably rebound some over the next month after the tapering delay, but again, that will only be temporary. As for physical buying, Citi sees a “well stocked” market in China, and predicts that other big market, India, won’t pick up, with import taxes now at a record 10%. Morgan Stanley came out with a similar call on Monday, with analysts there forecasting bullion will average $1,200 to $1,350 an ounce in 2014 before heading lower. This news item was posted on the marketwatch.com Internet site very early Monday morning EDT...and I thank Ken Hurt for sharing it with us. |

| Posted: 24 Sep 2013 02:31 AM PDT The FOMC shocked markets by deciding not to slow its large-scale asset purchase program, after all the signals it had sent out in previous months that it would do so. While increasing policy risk, JPMorgan notes, this puts the asset-reflation trades back on the table. In their view, the main driver of gold’s performance over the past five years has been QE. As QE continued and inflation expectations remained subdued, the demand for an inflation hedge subsided, ETF positions were unwound and gold prices fell. However, JPM now believes, as a result of the Fed's volte-face on tapering, uncertainty about future inflation may pick up and suggest a long position in gold. JPMorgan: "Additionally, positions are much cleaner now, following the unwinding of ETF positions, and physical demand from retail buyers in Asia has been very strong. We open a long position in gold." |

| Bank of Thailand gets suspicious about paper gold Posted: 24 Sep 2013 02:31 AM PDT The Bank of Thailand is looking to regulate gold trading, as it suspects gold imports have been used to speculate on exchange rates. The central bank also want to protect retail investors who buy gold-linked financial papers. "The Bank of Thailand has been consulting with the Finance Ministry and the Securities and Exchange Commission on how to regulate trading of gold-forward contracts in order to make them transparent and protect the interests of ordinary investors," BoT Governor Prasarn Trairatvorakul said. He added that the BOT wanted gold brokers and traders to disclose information about their transactions outside the Thai bourse's futures exchange. The central bank has detected unusual gold imports that may be linked to currency speculation, he said. This story appeared on the nationmultimedia.com Internet site early Monday morning in Thailand...and I found it in a GATA release last night. It's worth reading. |

| Australian academic study admits possibility of gold market rigging but can't confirm it Posted: 24 Sep 2013 02:31 AM PDT What may be the first academic study of the question of gold market manipulation was published this month by Dirk G. Baur, associate professor of finance at the University of Technology in Sydney, Australia. While he writes that he was unable to validate any statistical evidence of manipulation, such as has been presented by GATA's late board member Adrian Douglas, GATA consultant Dimitri Speck, and market analyst Chris Martenson, among others, Baur acknowledges that central banks have a powerful interest in controlling the gold price, that suspicion is raised by the secrecy around central bank gold leasing, that bullion banks involved in both the daily gold price fixing in London and the gold carry trade would have a conflict of interest, and that these issues "may be the basis for future research." Unfortunately Professor Baur's study does not seem to take note of, among so many other things in GATA's documentation file. The link to this study is embedded in this GATA release from yesterday...and it's definitely worth your time. |

| Australia's Gold Symposium interviews GATA secretary Posted: 24 Sep 2013 02:31 AM PDT GATA's secretary/treasurer Chris Powell was interviewed by Kerry Stevenson, the managing director of Gold Investment Symposium in Sydney, Australia, preparatory to his presentation at the symposium, which will be held October 16 and 17. They discuss GATA's work, accomplishments, and difficulties, as well as the mainstream financial news media's failure to question central banks about their involvement in the gold market. The interview is 24 minutes long and can be heard at the symposium's Internet site. I would suspect it's worth listening to. |

| Chris Powell, GATA secretary to speak in Auckland, New Zealand on October 13 Posted: 24 Sep 2013 02:31 AM PDT GATA's secretary/treasurer will speak in Auckland, New Zealand, on Sunday, October 13, at a gathering organized by investment adviser and gold advocate Louis Boulanger and sponsored by our friends at bullion dealer Anglo Far-East Co. The program calls for a 30-minute presentation and an hour for questions and discussion. |

| Tom Fischer: Why gold's contango suggests central bank interference Posted: 24 Sep 2013 02:31 AM PDT Another academic study touching on gold market manipulation has been published this month, this one by Tom Fischer, professor of financial mathematics at the University of Wuerzburg in Germany. Fischer argues that gold's scarcity makes it such a superior currency that backwardation in its market -- when the spot price is higher than the price for future delivery -- should be normal and that contango, when the futures price is higher than the spot price -- should be rare. Fischer argues that the long period of contango preceding the current turbulence in the gold market is evidence of interference in the market by central banks through their leasing of gold. As much as our camp appreciates acknowledgment of central bank interference in the gold market, GATA's secretary/treasurer often disputes the common contention repeated by Fischer -- the contention that "you can't print gold," or, as Fischer puts it, "A central bank cannot necessarily cough up just any needed amount of gold as it cannot simply print it up when required." The above three paragraphs form part of Chris Powell's introduction to this academic study...and it's commentary posted in a GATA release from late last night. It's also worth reading. |

| Rickards expects new world monetary system to be rebuilt around gold Posted: 24 Sep 2013 02:31 AM PDT Geopolitical strategist and fund manager James G. Rickards tells Peak Prosperity's Chris Martenson that he has been advising governments that want to devalue their currencies to buy gold rather than other currencies, since at least they'll end up keeping the gold. Rickards sees the continuing flow of gold from West to East as evidence that the world monetary system eventually will be rebuilt around gold. Having just published his best-selling book "Currency Wars," Rickards says he is working on a book about the collapse of the monetary system, "The Death of Money: The Coming Collapse of the International Monetary System" which is due to be published next year. Rickards' interview with Martenson is 32 minutes long and can be heard at the Peak Prosperity Internet site. The first reader through the door with this interview was Harold Jacobsen, and I borrowed the above paragraph of introduction from another GATA release. I've already listed to it, and it's definitely worth it if you can find the time. Most of the commentary on gold takes place in the last ten minutes or so. |

| Posted: 24 Sep 2013 01:26 AM PDT By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific's leading geo-politics website. Cross posted from MacroBusiness Overnight market action shows that nobody really has a clue about the Fed taper any longer. Stocks fell, suggesting it's on. The US dollar and gold both rose marginally suggesting it's on and off. Treasuries were bid suggesting it's off. One night's action is not the be all and end all but it is indicative of where we are at. The stimulus to these various moves came from three different Fed speeches, which were just as confusing. William Dudley, a voting member and noted dove, spoke and made his intentions very clear:

I've no doubt that Congress will gets its act together sooner or later so that's only a delay. Any further fiscal tightening is likely to be manageable but prevent domestic economy acceleration. The improvement in employment is fundamentally questionable and if it is going to require a fair dinkum fall to lower levels for tapering to begin then it's possible we'll never see it. The current talk of such has already been enough to knock the stuffing out of the US housing recovery and I expect data on that front to continue to deteriorate. We are also likely near the peak in data surrounding the global rebound with China still not producing any self-sustaining growth dynamics and Europe's recovery slowing in the second derivative. Whether a triumphant Merkel steers back towards austerity now is also a vital question. Another Fed president, Dennis Lockhart, added that he already saw signs of slowing in the US jobs market. Meanwhile, non-voting hawk, Richard Fisher declared that the Fed's credibility had been undermined by the failure to tighten, didn't reflect the discussion at the policy table and added uncertainty to markets and the economy. I've backflipped once already on the taper. Originally I saw it as unlikely owing to the blowout in bond yields and effects on the housing recovery. The red hot run in ISM data persuaded me otherwise. Also, it seemed to me, since markets had priced it already, the Fed had nothing to lose in pulling the trigger. Now, the data flow henceforth is increasingly unlikely to support tapering with bond yields very likely to suppress the US recovery and the global bounce approaching its peak as well. It seems likely that the Fed has missed its window. Then there are others, like Martin Feldstein, arguing at the FT that QE is doing nothing now anyway: Although the initial burst of bond-buying may have helped to stimulate demand in 2010 and 2011, the current strategy is now doing very little to stimulate economic growth and employment. At the same time, continuing to buy long-term bonds and promising to keep the real short-term rate below zero even after the economy has returned to full employment have serious costs. They distort the investment behaviour of individuals and institutions, driving them to reach for higher yields by taking inappropriate risks. They lead banks to make riskier loans in order to get higher returns. The longer this process of abnormally low rates continues, the more disruptive will be the return to normal conditions. According to Bernanke some months ago, the taper was designed to prevented a build up of leverage in the cycle. That was code for putting a lid on asset markets. That has been achieved in financial markets and most likely housing as well over the next six months. However, Feldstein is wrong when he says this won't slow growth and the jobs market, and so tapering is off. In other words the confusion is systemic and is the new normal. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment