saveyourassetsfirst3 |

- Columbus Gold shares surge on Nordgold deal

- Goldman Sachs recommends gold producers hedge their output

- Tapering could remove gold's upside - Ash

- Wash, Rinse, Repeat

- Dollar Outlook: #Taper, #Yellen, #GermanElections

- Highland Gold first-half net profit down almost 65%

- On manipulation in the gold and silver markets

- Dissecting gold's recent fall - futures knock, physical holds

- Coming To a Head

- Corvus Gold Demonstrates Continuity with Continued Expansion of the Yellowjacket High-Grade Zone,

- Volcan’s two new silver projects to raise 2014 output

- Watch Bernanke’s Press Conference LIVE

- USGS Show Gold Mine Supply Dropping Every Single Month In 2013

- QE∞! No Fed Taper! Gold & Silver Go Vertical!

- Why POTUS Allowed Bailouts Without Indictments

- Gold Price in India: Strong Support Zone Reached. Whats Next?

- QE∞! No Fed Taper!

- Five Years After Lehman, It's Business As Usual On Wall Street

- Rise in customs duty on gold jewelry a logical step, say Indian jewelers

- New Chinese Exchange-Traded Products Poised to Boost Gold Demand

- Median Household Income Has Fallen For FIVE YEARS IN A ROW

- Gold "fierce" if Fed surprises, investment banks urge sell as traders spooked

- Gold and the Fed –- what if...

- Is Bernanke about to destroy the gold investment market?

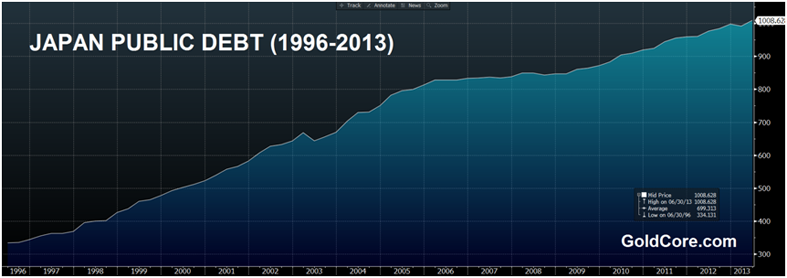

- Gold rush cometh in Japan: ¥1 quadrillion national debt to bankrupt

- The Most Important Interview You’ll Ever See on Gold?

- Interest rates, bubbles and bricks and mortar

- Why the Fed Will Lose

- Collapse Is In Hindsight – It Is A Matter Of Time

- 5 reasons why gold doesn’t care about tapering

- If they do taper, what does it mean for gold investment?

- Max Keiser with Greg Palast on Larry Summers’ Secret ‘End Game’ Memo

- And So We Wait…For The Fed To Announce Their Plans

- Gold prices keep falling while market expects a smaller Fed taper

- Janet Yellen: What A Horrifying Choice For Fed Chairman She Would Be

- Stewart Thomson: Gold Technicals Suggest Dovish Taper

- What Is The Fed Really Printing?

- India hikes Gold, Silver jewellery customs duty to 15%

- Gold Rush Cometh In Japan – 1 Quadrillion Yen National Debt To Bankrupt

- Gold Rush Cometh In Japan - 1 Quadrillion Yen National Debt To Bankrupt

- Fed QE Tapering: Quanticlimax for Gold & Silver Bears?

- Punt the Bernank!!

- Trading Comments, 18 September 2013 (posted 12h45 CET):

- Why You Should Not Be Enthusiastic About Janet Yellen as Fed Chairman

- The World Awaits the End of Q.E…But Will it Happen?

- Charges Could Still Be Coming for Some Close to Madoff

- Three King World News Blogs

- Santelli's peek at FOMC expectations and new Fed head

- Fake 10-Ounce Silver Bars Reported

- Silver & Gold vs. Stocks & Real Estate - Where Are We in the Cycle?

| Columbus Gold shares surge on Nordgold deal Posted: 18 Sep 2013 06:41 PM PDT Nordgold snaps up majority option on Paul Isnard project in return for $30 million in expenditures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldman Sachs recommends gold producers hedge their output Posted: 18 Sep 2013 06:39 PM PDT In addition to its recent falling gold price predictions, Goldman Sachs analysts are suggesting gold miners still profitable at current levels should look to hedge at least a part of their output. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tapering could remove gold's upside - Ash Posted: 18 Sep 2013 06:16 PM PDT Conversely, if the US Fed doesn't announce any tapering, gold prices could shoot up as shorts run for cover. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Sep 2013 12:19 PM PDT That is basically what we got from the Fed today instead of the $10 billion cut in bond buying that the market had priced in. I mentioned yesterday that based on the very benign inflation environment, the Fed might just stand pat due to the recent lousy economic data. They did just that. Personally I think it was two factors which swayed them in this decision - more on that later. Stocks loved it, bonds loved it and gold loved it. The Dollar hated it. What else is new? It is perverse in the sense that interest rates on the long end of the curve had been steadily moving higher for about 3 months now based on the increasing expectations of a tapering move by the Fed. We have been paying close attention to the yield on the Ten Year Treasury and have noted that it just missed hitting the 3% level at the beginning of this month. Here is what I consider perverse about this... consider this... the Fed starts some hawkish talk and begins to prepare the markets for a slowdown in the rate of its bond buying program. The market reacts to this apparent change in policy by bidding up interest rates. This then results in mortgage rates moving higher. The Fed, obviously alarmed at what they believe will negatively impact the very fragile real estate market then backs away from any tapering plans whatsoever sending interest rates on the Ten Year back down to the 2.75% level where they are currently sitting as I type these comments. Where does this leave us? Quite frankly, in an enormous mess the way I see it. The Fed does not have the luxury of doing a surprise sneak-attack on the markets without preparing them for a tapering of the bond buying program. For the Fed to announce out of the clear blue sky, without the least bit of warning, that it was going to scale back its bond buying program, would send the stock market into convulsions and rattle the entire interest rate market as well as the currency markets. They therefore must prep the markets, plowing the ground and giving the markets time to come to terms with any change in monetary policy in order to avoid chaotic market reactions. Here is the catch however - in giving the markets time to prepare, the market response is to sell bonds along the long end of the yield curve thus resulting in rising long term rates. This negatively impacts the real estate market and borrowing in general as the rotten employment picture prevents many people from otherwise qualifying for loans that they might have previously been able to had rates remained at lower levels. Then the times comes for the Fed to make the actual announcement that they have spent so much effort prepping the markets for only to realize that these same markets have pre-empted any need for the Fed to act. The result? - the Fed does nothing whatsoever! In short, I can easily envision a scenario in which the Fed is completely trapped unable to do anything at all well into the foreseeable future. It is going to take STRUCTURAL REFORMS to improve the job market and as long as the current Administration is in power, I do not see that happening any time soon. Thus the status quo continues and goes on and on and on... In regards to gold, it is scooting higher as a large number of shorts were forced out with today's surprise move by the Fed. It did take out that overhead resistance at $1330 which is a positive and is also now trading above $1350, another resistance level. There is $1360 which I am watching right above where it is currently trading to see how it handles that. Beyond that $1380 is the next target. The key to gold will be whether or not the speculative world believes that the continuation of the Fed's QE4 policy unabated will generate any long-anticipated inflation. Obviously the bond market does not expect any or bonds would not be moving sharply higher. Thus far inflation has been tame. It is going to take a change in perceptions in that regard to bring in a brand new wave of hot fund money into gold as well as the rest of the commodity complex. The ironic thing about seeing crude oil and especially gasoline rallying sharply higher today is that rising energy prices, while inflationary in their own right, also have recently tended to be seen more as a brake or drag on economic activity and consumer spending and thus are seen as factors leading to a slowdown in growth rather than a catalyst for higher inflation. If specs begin piling into the energy markets based solely on the lack of tightening from the Fed, then these specs may short-circuit any hopes that the Fed has that its latest NON-MOVE will be stimulatory in nature. Herding cats will prove easier than herding these destructive hedge funds. Oh what a tangled web the Fed has created! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Outlook: #Taper, #Yellen, #GermanElections Posted: 18 Sep 2013 12:17 PM PDT Why are the markets so excited that the smartest guy in the room takes his name out of the running for the (second?) most powerful job in the world? With Larry Summers no longer holding back the markets, what's next for the dollar, currencies and gold? While pundits debated what a Summers Fed would have looked like, the truth is that little was known about his views on monetary policy. Our own take was that given his highly political disposition, he may be more effective in his current role where he can call President Obama any time to offer his advice. Yet the markets rallied because uncertainty is reduced: with Janet Yellen as the front-runner, the odds of continued ultra-loose monetary policy has increased. Indeed, aside from a rallying stock market, the more noteworthy reaction is a global bond rally, especially on short to medium term maturities. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Highland Gold first-half net profit down almost 65% Posted: 18 Sep 2013 12:16 PM PDT The company said Wednesday its first-half net profit fell by almost 65% year on year to $17 million due to a steep fall in the gold price. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| On manipulation in the gold and silver markets Posted: 18 Sep 2013 12:10 PM PDT An interesting commentary on manipulation in all financial sectors with a focus on the gold and silver markets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dissecting gold's recent fall - futures knock, physical holds Posted: 18 Sep 2013 12:09 PM PDT David Levenstein argues the new US Fed chairperson won't be a stabilising force and will erode confidence in the dollar, to gold's benefit. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Sep 2013 12:00 PM PDT There are several events, big events that are directly in front of the financial markets. Of course we still have to hear from the Fed today and my guess is that we do get an announcement of some sort of minor tapering of QE. As I’ve said before, I don’t think the markets will react positively after any knee jerk reactions, especially in the credit markets. I don’t think any real tapering can last more than a month without the financial markets going spastic which will lead to Bernanke coming forward with “I was just kidding, here comes QE 5 to save the day.” The upcoming events include budget talks (when was the last time we actually had a budget?), debt ceiling debate and the Republicans will try to defund Obamacare as part or parcel of the deals. We are maybe 2 weeks out from the “sequester” possibly turning into a government shutdown. Today President Obama is speaking on these subjects and says, “I will not let the ‘full faith and credit of the United States’ to be negotiated over or endangered by the Republicans.” I see all of this as “coming to a head,” collectively and pretty much all at once. All of these negotiations will probably be occurring with the backdrop of the Fed (overtly at least) with less monetization by the Fed (what they are actually doing behind the scenes may be another thing altogether as the monetization may actually increase). One other “backdrop” which has gotten almost no Western press at all is the energy deal recently concluded between Russia and China. In fact, I did not hear anything about this deal last week at all and it purportedly occurred on Sept. 6th. Basically, Russia is offering as much energy as China needs while China has logistically set up a payments system that would allow oil and gas to be purchased using Yuan as payment. This has HUGE ramifications as potential demand of Gulf oil could diminish and demand for dollars will definitely drop…at a time that demand is already dropping as illustrated yesterday by the TIC report showing the 4th month in a row of capital outflows. Interestingly the TIC report showed that the only true foreign buyer of U.S. Treasuries were the Japanese. When I say “interestingly” I am alluding to the fact that the Japanese are printing and monetizing comparably far more than the U.S. is. Think about this for a moment, none of the countries who were buyers in the past are buying now, they are liquidating. The ONLY buyer of any size is Japan which is printing money out of thin air at a rate greater than anyone else on the planet. So, the biggest debtor in the world is borrowing from a nation with 240% debt to GDP, which is printing money to pay interest, printing money to purchase their own bonds and now printing money to buy U.S. Treasuries. They purchased over $52 billion worth of Treasuries in one month…please do the math on this one, annualized this is over $600 billion! …truly insane! Oh, and even with this $52 billion inflow the net was an OUTFLOW! I will leave you with a chart that illustrates just how dirt cheap gold currently is:

Historically the price of gold in U.S. dollars has tracked very closely to the rise in our debt ceiling as a formula between how much gold we “purportedly” have compared to the total debt ceiling. Gold has since the beginnings of QE 4 broken away and far under this ratio. Looking at the chart tells me that one of two things will occur to restore the past relationship. Either the debt ceiling is lowered by some 30% (which would mean paying down debt which we have not done in 53 years since 1960) OR the price of gold will rise well above $1,900 …and then some to account for the raising of the ceiling. As a side note, if this chart has any validity then what the price of gold should be were Congress to do away with the debt ceiling and make it “unlimited?” …Unlimited is a lot! No matter what the outcome of today’s Fed meeting or the upcoming circus events in Washington, gold is now grossly undervalued. A run up to and beyond the old highs of $1,900 is warranted and in my opinion will happen VERY quickly when it begins. Do not be fooled or shaken from your positions no matter what volatility is forced upon gold and silver. Know the true value and refuse to be shaken.Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

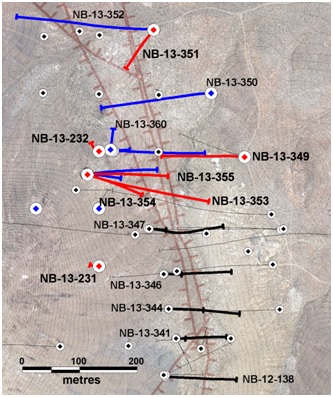

| Corvus Gold Demonstrates Continuity with Continued Expansion of the Yellowjacket High-Grade Zone, Posted: 18 Sep 2013 11:37 AM PDT NB-13-353 - 44 metres @ 2.3 g/t Gold (including 7.9 metres of 10.6 g/t Gold) Vancouver, B.C., Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces assay results from five core holes and two reverse circulation (RC) holes in the Yellowjacket Zone at the North Bullfrog Project, Nevada. The new drill results demonstrate the continuity of broad, high-grade mineralization on a new western structural zone where veining is even more intensely developed. These holes continue to highlight the potential of expanding the high-grade mineralization to the west and to the north and south, thereby potentially significantly enhancing and expanding the possible "starter pit" area of the deposit. The high-grade intercepts in NB-13-353, 354 and 355, approximately 100 metres north of hole 347 (NR13-21, Sept. 5, 2013) and 350 metres north of hole 138 (NR12-20, July 24, 2012) show the significant continuity of veining and high-grade mineralization over broad widths on a new more NW-trending strand of the Yellowjacket fault system (Figure 1). This zone is characterized by broad (50 to 100 metres wide) zones of stockwork veining around a central (5-20 metre wide), high-grade banded vein, a style that is similar to the mineralization previously mined by Barrick in the open pit and underground workings at the Bullfrog Mine, 10 kilometres to the south. Mineralization consists of multistage epithermal quartz veins with native gold and silver sulphides. Similar veining has been intercepted in 6 holes with pending assays, thus extending the system over 100 metres more to the north and remaining open to the north and at depth. In addition, other broad zones of veining have been intersected in ongoing RC resource expansion drilling west of Yellowjacket, suggesting further high-grade potential within and below the current oxide deposit (planned to be followed up with core drilling later this fall). In addition to the high-grade vein mineralization found in core drilling, RC hole NB-13-232 intercepted 248 metres averaging 0.4 g/t gold starting from 18 metres below the surface. This includes four broad intervals averaging greater than 0.5 g/t gold, significantly expanding the resource growth potential to the north (Table 1). RC hole NB-13-231, drilled south of 232 and off the Yellowjacket structural trend, encountered 100 metres @ 0.24 g/t gold, which is typical for the main Sierra Blanca deposit to the south and shows the continuity of mineralization into this area (which is not in the existing estimated resource). Core hole NB-13-349 was drilled on the eastern side of the Yellowjacket Zone along the Liberator structure and continues to expand the higher grade northern extension of the potential bulk tonnage zone with 81 metres @ 0.4 g/t gold. Hole NB-13-351, drilled to test the far northern extent of the Liberator structure, encountered typical disseminated, low-grade mineralization indicating continued potential to the north. This hole also intersected one zone of higher-grade silver suggesting Yellowjacket style high-grade mineralization potential exists in this area. Jeff Pontius, Chief Executive Officer, states: "The continued positive results from the Yellowjacket Zone drilling are highly encouraging. The addition of a higher grade starter pit to the current PEA could have a dramatic impact on the project economics. We see significant potential to expand this type of high-grade mineralization well beyond the current area drilled. With each new high-grade vein intersection in the Yellowjacket Zone, we are building strong support for a major new multi-million ounce, Nevada high-grade discovery with a scale and grade potential similar to the historic Bullfrog mine to the south."

Table 1: Significant intercepts* from recent core holes at Yellowjacket.

*Intercepts are approximate true width and calculated with 0.1g/t cutoff and up to 3.0 metres of internal waste.

About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 70 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold Corporation. The property package is made up of a number of leased patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company's independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in June 2013. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an estimated oxidized Indicated Resource of 36.7 Mt at an average grade of 0.26 g/t gold for 308,000 ounces of gold and an oxidized Inferred Resource of 220.4 Mt at 0.18 g/t gold for 1,289,000 ounces of gold (both at a 0.1 g/t gold cutoff), with appreciable silver credits. Unoxidized Inferred mineral resources are 221.6 Mt at 0.19 g/t for 1,361,000 ounces of gold (at a 0.1 g/t gold cutoff). Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted by structural zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website athttp://www.corvusgold.com/ Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada and Alaska, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Volcan’s two new silver projects to raise 2014 output Posted: 18 Sep 2013 11:33 AM PDT The Peruvian miner expects its two new silver projects to start production early 2014 and add 8 million ounces to its current output. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Watch Bernanke’s Press Conference LIVE Posted: 18 Sep 2013 11:25 AM PDT

With QE∞ now confirmed and the metals exploding out of their recent decline, Watch Bernanke’s FOMC Press Conference LIVE at 2:30pm EST below: Live streaming video by Ustream Silver Bullet Silver Shield Collection at SDBullion! The post Watch Bernanke’s Press Conference LIVE appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USGS Show Gold Mine Supply Dropping Every Single Month In 2013 Posted: 18 Sep 2013 11:12 AM PDT Introduction Every month the United States Geological Survey (USGS) releases reports on the production, use, imports, and exports of most important minerals to U.S. industry and security. These reports are full of important information for investors focused on minerals (in our case precious metals) and they can be found on the USGS website. For this article we will focus on U.S. gold mine production and examine what has been happening with U.S. gold mine production. Obviously the U.S. represents only a segment of world gold mine production, but it is the third largest gold producer and many of the trends we find in U.S. gold production are also occurring in countries around the world. First let U.S. discuss the importance of mine production to gold supply and demand because this is an issue that is misunderstood by many investors in the gold industry. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QE∞! No Fed Taper! Gold & Silver Go Vertical! Posted: 18 Sep 2013 11:06 AM PDT

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why POTUS Allowed Bailouts Without Indictments Posted: 18 Sep 2013 11:06 AM PDT In November 2008, President Obama was elected, and he was sworn in January 2009. The country was promised change and reform. Recently two democrats close to the top of President Obama's administration made excuses to me for the lack of financial reform in the United States. Their separately related versions were remarkably similar, so similar they seemed scripted: The administration made a bargain, and I'm not sure it was the right decision. The world was teetering on the edge of collapse. There was a crisis of confidence. There would have been unimaginable consequences. So bad even your imagination can't handle the truth? Read More… | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price in India: Strong Support Zone Reached. Whats Next? Posted: 18 Sep 2013 11:05 AM PDT SunshineProfits | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Sep 2013 11:02 AM PDT

QE∞! No Fed Taper! Interest rates to remain at zero Gold & silver go vertical! Silver up $1, gold up $50 and spiking! Full FOMC QE∞ statement below: Press Release Release Date: September 18, 2013 For immediate release Information received since the Federal Open Market Committee met in July suggests that economic [...] The post QE∞! No Fed Taper! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Five Years After Lehman, It's Business As Usual On Wall Street Posted: 18 Sep 2013 10:52 AM PDT This week we will reach the fifth anniversary of the Fall of Lehman Brothers and the near collapse of the financial system. Unfortunately, despite being on the brink of catastrophe and the destruction of the retirement savings of millions of American workers, it's business as usual on Wall Street. At the Big Banks responsible for the crisis, bonuses are up, stock prices are soaring and pinstripe suits - rather than orange prison jumpers - remain the rage. Following the collapse of the 2000 tech bubble and Enron, the Justice Department's Corporate Task Force rang up 1,300 corporate fraud convictions, including the conviction of almost 400 CEOs and other high level executives. What does the current DOJ and Securities and Exchange Commission have to show for their enforcement efforts following the financial crisis? A few big fines against some of the banks, conveniently charged back to shareholders, a civil not criminal | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rise in customs duty on gold jewelry a logical step, say Indian jewelers Posted: 18 Sep 2013 10:43 AM PDT The Indian jewelers have hailed the government decision to increase the import duty on gold jewelry from 10% to 15%. According to them, the move was expected and overdue. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Chinese Exchange-Traded Products Poised to Boost Gold Demand Posted: 18 Sep 2013 10:20 AM PDT By Justin Spittler, Hard Assets Alliance Analyst After speculation that the US Federal Reserve would rein in its asset-purchasing program earlier than anticipated, Western investors began exiting gold-back exchanged-traded funds (ETFs) in record numbers, highlighted by $8.7 billion in net outflows during April. While the languishing paper-gold market has many declaring the gold trade dead, demand for bullion has never been greater, as buyers have focused on the big picture that includes endemic debt levels and unsustainable money-printing schemes. This long-term investment approach is most prevalent in the Eastern world, where India and China, the world’s two largest consumers of gold, are pouncing on the opportunity to accumulate gold at bargain prices. Endless ink has been written on the disconnect between the paper and physical gold markets, yet it is a recently captured image courtesy of China Daily that conveys everything that needs to be said about this phenomenon.

In a scene reminiscent of frenzied shoppers on Black Friday, approximately 10,000 Chinese consumers gathered outside of a jewelry store in Jinan city for the opportunity to scoop up gold products at sharp discounts, after speculation in the West helped shave roughly a quarter off the price of gold. The numbers coming out of China tell a similar story. Chow Tai Fook—the world’s largest jeweler in terms of market capitalization—reported a 63% spike in sales during the second quarter. Chinese Investment Demand for Gold Taking OffWhile China’s love affair with gold jewelry burns as bright as ever, more and more Chinese are flocking to the yellow metal as a hedge against currency devaluation just as inflation begins to rear its ugly head after decades of artificially stimulated growth. According to the World Gold Council (WGC), Chinese coin and bar demand jumped 22% during the first three months of 2013 to a quarterly record of 109.5 tonnes, or more than twice the five-year quarterly average of 43.8 tonnes. Demand really skyrocketed following the massive sell-off of Western gold funds as China imported between 160 and 170 tonnes in April alone. By year-end, the WGC projects that net Chinese imports could eclipse 880 tonnes. Chinese Buying Frenzy Leads to Shortages and Sky-High PremiumsWith pent-up demand swelling, Chinese investors will soon have a new avenue to invest in gold, as the Chinese Securities Regulatory Commission recently approved China’s first two gold-backed exchange-traded products (ETPs), which will be introduced by HuaAn Asset Management Company and Guotai Asset Management Company. Both yuan-denominated gold funds will be listed on the Shanghai Stock Exchange (SHCOMP). However, due to stringent regulations, the products will not buy and store bullion on behalf of shareholders, as the SPDR Gold Trust (GLD) does; instead the funds will mirror the domestic spot price by purchasing futures contracts on the Shanghai Gold Exchange. Though merely paper investments, the funds will offer convenient exposure to gold as well as an affordable alternative to price-sensitive buyers facing hefty premiums on physical product. Investors with long-term horizons, however, will likely continue to own physical gold due to the superior security it affords. At this point, the particulars for each fund are still being sorted out, though it is reported that HuaAn is seeking to raise between 2 billion and 3 billion yuan ($326-$489 million) during its initial offering—pennies compared to the more than $60 billion of bullion held by GLD. Certainly, these new products will provide the Chinese investor with another option for adding gold to their portfolios, since restrictions limit Chinese investors from buying international gold ETFs. What remains to be seen is how many investors will sever their longstanding relationship with physical gold for paper instruments. In any case, the announcement of these two new gold funds represents the latest in a steady stream of bullish signals to emerge from China lately. Still, it is important to recognize that physical bullion will continue to drive the international gold market due to the fact that ETF holdings represent just 1% of the entire 175,000 tonnes of the above-ground gold stock. Though paper markets have demonstrated an ability to sway the gold price, the market for bullion will decide gold’s fate over the long term.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Median Household Income Has Fallen For FIVE YEARS IN A ROW Posted: 18 Sep 2013 10:00 AM PDT

If the economy is getting better, then why do incomes keep falling? According to a shocking new report that was just released by the U.S. Census Bureau, median household income (adjusted for inflation) has declined for five years in a row. This has happened even though the federal government has been borrowing and spending money [...] The post Median Household Income Has Fallen For FIVE YEARS IN A ROW appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold "fierce" if Fed surprises, investment banks urge sell as traders spooked Posted: 18 Sep 2013 09:47 AM PDT The wholesale price of gold fell below $1,300 for the first time in six weeks Wednesday morning in Asia, as traders in all markets awaited today's U.S. Fed announcement on QE tapering. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and the Fed –- what if... Posted: 18 Sep 2013 09:41 AM PDT In my previous article I focused on what would be the likely outcome of limiting the QE program on several key markets (gold, real estate, stocks and bonds). Today, we will provide you with an analogous analysis for a completely different scenario. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is Bernanke about to destroy the gold investment market? Posted: 18 Sep 2013 09:25 AM PDT Later this afternoon the Federal Reserve's FOMC is widely expected to announce tapering of QE. Many analysts have stated that should QE be tapered then the gold bull market will almost certainly be over. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold rush cometh in Japan: ¥1 quadrillion national debt to bankrupt Posted: 18 Sep 2013 09:18 AM PDT Japan is set to see gold demand soar in the coming months because of a planned sales tax, concerns about the solvency of the government and a continuing devaluation of the yen. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Most Important Interview You’ll Ever See on Gold? Posted: 18 Sep 2013 09:00 AM PDT

Dan Popescu, a global markets strategist breaks down what’s going on with gold, pulling back the curtain on how he sees a potential explosive move with gold at some point soon. Popescu discusses China’s plans and intentions in the gold market. He states that China is encouraging their citizens to purchase gold which flies in [...] The post The Most Important Interview You’ll Ever See on Gold? appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rates, bubbles and bricks and mortar Posted: 18 Sep 2013 08:41 AM PDT Many think that interest rates will increase sometime, leading to a significant fall in all asset prices. A version of this logic casts all markets as being overdue a collapse. Another school of opinion rides the wave and doesn't think too much. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Sep 2013 08:39 AM PDT When it comes to market manipulation, I'd argue that NO ONE has their finger pressed as firmly on its daily "pulse." A handful of others may be tied with me on that count; but few – if any – spend as much time watching what TPTB are doing. The main driver of my obsession is to empower myself that I am doing the right thing; and of course, to transmit such knowledge to friends, family, colleagues, and readers. Consequently, we are better prepared to handle the upcoming financial Armageddon than more than 99% of the world's population. The TRUTH shall certainly set us free; and in this case, it just may save our "financial lives." It's still Tuesday morning, and Treasury bonds are higher in pre-market trading. In fact, they have been goosed higher EVERY morning since the 10-year yield briefly touched the VERY KEY ROUND NUMBER of 3.0% two weeks ago. In other words, the Fed's "QE" activities have now escalated to levels of desperation akin to the PPT's maniacal, daily support of the Dow and the Cartel's relentless suppression of PAPER gold and silver. Heck, TPTB put on a "full-court press" yesterday; i.e., not only pushing T-bonds up sharply in pre-market trading, but recruiting every MSM lackey imaginable to write of how the withdrawal of "hawkish" Larry Summers was the primary factor behind the recent rate surge. Sadly, by day's end Treasuries were routed; as has been the case in nearly ALL recent efforts to avert the inevitable end of the multi-decade bond bull market. And by the way, since I started writing just 30 minutes ago, Treasuries have already lost half their gains. Anyhow, the reason I bring this up is to demonstrate that on the eve of the Fed's inaugural "tapering" decision, they are working harder than EVER to push interest rates down. In other words, the polar opposite mindset of an organization comfortable with the current level – and trajectory – of the Treasury and mortgage bond markets. It doesn't take a rocket scientist to realize the Fed desperately wants to avoid tapering; as it KNOWS it cannot do so, for reasons I have discussed ad nauseum. Ever since the Fed's CATASTROPHIC decision on June 19th to hint that it "might" taper QE if economic data indicated sufficient upside momentum, essentially EVERY FOMC member has publicly back-tracked – including Helicopter Ben himself, just three weeks later. The FACT remains that even the BEA (Bureau of Economic Analysis) admits that half of 1H 2013 GDP contribution emanated from the housing sector – or offshoots thereof; and thus, given both mortgage applications and refinancing activity have plummeted to mid-2009 levels, it's safe to say that if accurately measured, 2H GDP would clearly depict recession – especially if REAL inflation data was utilized in the GDP "deflator"…

Irrespective of what accounting shenanigans are played by the BLS (Bureau of Labor Statistics), the fact remains that jobs are being shed, losses generated, and confidence weakened. You know it, they know it, and the collapsing Labor Participation Rate will surely reflect it. Throw in the fact that the Bank of International Settlements just warned that interest rate suppression has created credit excesses exceeding those of 2008, and you can see why the Fed is painted in a corner. If they taper – even mildly – they will be sending a signal of reduced support for a market already under tremendous pressure, with essentially ZERO buyers. Conversely, if they don't, they'll essentially admit to LYING – for the umpteenth time – about the mythical "recovery." Call me crazy, but the potentially worst U.S. holiday shopping season since 2009 doesn't suggest "recovery" to me; or, for that matter, a 23-year low in European car sales. Back to the title of today's article, the Fed's eventual loss of control of financial markets is all but a fait accompli. As all fiat currency regimes are Ponzi Schemes by definition, it's only a matter of time before this one implodes under its own weight; either due to its sheer unwieldiness, or a simple loss in the fragile "confidence" holding it up. I'd bet on the latter; but frankly, the two are so inter-related; it makes little difference either way. The FACT remains that all such systems – 599, to be exact – have previously failed; and given the current version is the largest and most vulnerable, it will likely crash the most loudly – and TRAGICALLY. Ironically, the catalyst for today's piece was none other than the Fed's former "mouthpiece" – John Hilsenrath of the Wall Street Journal; who I deem the former mouthpiece because he has been so consistently WRONG in his prognostications, it's difficult to believe anyone still takes him seriously. Sure, the Fed had him write several "HAIL MARY" articles in the final hour of weak trading days; but aside from that, his "knowledge" of upcoming Fed action has been no better than the flip of a coin. In other words, if the topic were "FOMC decisions," I'm not sure he could even win on Are You Smarter than a Fifth Grader?" However, now that he has clearly cut most of his "cord" with the Fed, he is not only showing signs of intelligence; but perhaps, vengeance toward an organization that clearly used him, before throwing him out like smelly trash. There is no doubting his skepticism in this article; in which he highlights the paradox that is the Fed's comical attempt to convince the masses that a significant, sustainable "recovery" on the horizon – as they have erroneously forecast for the past five years; and that accompanying it – amidst the world's most catastrophic debt and inflation problems EVER – will be record low interest rates! Even the dumbed-down, bought-and-paid-for MSM has difficulty justifying the paradox that is historically low interest rates and the "SO-CALLED RECOVERY" that has stock indices trading at record nominal highs. And spinning a yarn of "low inflation" is as dis in genuine as it is moronic; as the U.S. cost of living has NEVER been higher, while around the world, Fed-exported inflation is causing currency collapses, social unrest, and civil war. Even the most "patriotic" Americans no longer believe government-published inflation or employment data; and thus, the heavily discredited – and despised – Fed will have an even more difficult time convincing the masses it has the situation under control. For some time now, I have incessantly written of how higher rates – even marginally so – are NOT possible given the "IRREVERSIBLE, GLOBAL DEBT ADDICTION." The recent implosion of housing, refinance, durable goods, retail sales, and consumer confidence data tell that story LOUD and CLEAR; and don't forget that since such data was published, rates have gone still higher. However, equally ominous is the fact that higher rates render the odds of individual, corporate, municipal, and sovereign insolvency – and ultimately, bankruptcy – dramatically higher. Honestly, it's just plain comical for the U.S. government – among others – to claim its account deficit is falling, when not only is overall economic activity slowing, but rates rising. For example, just the published $17 trillion of national debt requires an additional $170 billion in annual debt service costs for each 1% increase in interest rates. Throw in the $5 trillion of "off balance sheet" debt of Fannie Mae and Freddie Mac, and you're up to $220 billion of incremental, annual interest costs; and god forbid one should consider the roughly $200 trillion of "unfunded liabilities." As it is, this year's reported decline in the budget deficit is due principally to accounting shenanigans utilized to "delay" the debt ceiling breach into mid-October; which, when it finally occurs, should yield an instantaneous debt surge of perhaps $300 billion. And don't forget the outrageous payment of "dividends" from Fannie and Freddie to the Federal government – which simply make these government-owned entities even more insolvent. In other words, "robbing Peter to pay Pau." Moreover, now that the housing market has shifted into reverse, Fannie and Freddie's supposed "profits" will rapidly turn to losses. In other words, the Fed CANNOT afford to stop PRINTING MONEY and MONETIZING Treasury and mortgage-backed bonds. Even the slightest rate increase will torpedo any fleeting semblance of recovery; whilst a MAJOR rate surge would likely, instantaneously; send the ENTIRE WORLD into a 1930's style depression. Only this time, without a gold standard to slow Central banks down, they'll turn up the printing presses and launch history's most virulent-ever HYPERINFLATION. Darned if they do, darned if they don't; and particularly darned if they attempt to be "cute" by announcing a "tiny taper" with accompanying, uber-dovish language – per Jim Sinclair's sage words…

As he suggests – and I have averred for months, the Fed could lose control of its market-rigging operations ANY DAY now. The U.S. Treasury market holds the key to the ENTIRE GLOBAL ECONOMY; and if the Fed can't miraculously find a way to turn it back up, the logical conclusion of economic collapse will be shortly behind. You can take it to your soon-to-be-insolvent bank! Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collapse Is In Hindsight – It Is A Matter Of Time Posted: 18 Sep 2013 08:15 AM PDT As introduced over the summer, our research of 20 different cycle theories has indicated that as of 2013 serious turmoil will reign over markets, metals and money (courtesy: Gary Christenson). Every cycle theory we researched pointed to a collapse in the different financial assets, varying in degree and exact timeframe. The dolldrums are becoming louder. Think about this: either central banks will continue pumping money in the ailing banking system, or they start tapering. In both cases, it is an unsustainable and articial operations. Several observers have commented recently about the near-term / mid-term outlook. The observations are quite unanimous: although the alleged economic experts and mainstream financial media pretend that things are “contained” in reality (under the hood) a mega crisis is boiling and is coming closer. Below “testimonials” confirm our view which we detailed in our piece Sorry, we the people are no machines. The main thesis in there was that our debt based economic and monetary system is reaching its natural limits. Read why and how. The U.S. stock market is near all-time highs, while politicians and economists are blathering about recovery, low inflation, and good timess. To the extent we rely upon the fantasies of ever-increasing debt, money printing, and credit bubbles, we are vulnerable to financial collapses. Perhaps a collapse is not imminent, but it would be foolish to ignore the possibility. Consider what these writers have to say: The Fantasy of Printing "Money" To Solve Problems

Credit Bubble in the Global Economy Will Eventually Collapse

Discussion: Growing and healthy economies mean more people are productively employed. It appears that much of the "growth" in the U.S. economy over the last five years has been in disability income, food stamps (SNAP), unemployment, student loans, welfare, debt, and government jobs – none of which are productive. Examine the following graph of Labor Force Participation Rate – the actual percentage of the populace that is employed. Does this look like a healthy economy experiencing a recovery or a collapse in productive employment?

The damaging effects of 100 years of Fed meddling in the U.S. economy, many expensive wars, 42 years of unbacked debt based currency, and unsustainable growth in credit and debt have left the Western monetary system in a precarious position. Using common sense, ask yourself:

Read: The Reality of Gold and the Nightmare of Paper | What You Think is True Might Be False and Costly GE Christenson | The Deviant Investor | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 reasons why gold doesn’t care about tapering Posted: 18 Sep 2013 08:08 AM PDT Later this afternoon the Federal Reserve's FOMC are widely expected to announce the tapering of QE. This month's meeting has long been eyed as the one where Bernanke will make such an announcement. With this in mind gold's recent declines have been attributed to tapering expectations. Many analysts have stated that should QE be tapered then the gold bull market will almost certainly be over. Here at The Real Asset Company we struggle to see this point of view. Not only has gold responded negatively to the latest round of QE but it is not solely driven by the decision of one committee and the US dollar. As we explain below, there are five good reasons why the long-term gold price will disregard any announcement that is made later today.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| If they do taper, what does it mean for gold investment? Posted: 18 Sep 2013 08:06 AM PDT Tapering will not stop gold buying Our new research suggests that tapering, irrespective of the gold price's response, will not have a negative effect on gold bullion investments.

A month ago we asked our clients and readers how tapering would affect their approach to their gold investments. We gave them five options to choose from with their reply: I will start selling heavily I will sell a little I will not change my holdings I will buy more I will buy lots more

The response was, in a word, bullish. The belief that gold investing will cool-off once the Fed cuts back asset purchases has its roots in the theory that says investors only buy gold as a reaction to the FOMC's decisions. But our data shows that this is a misunderstanding. In fact, this only appears to be the case for just 6% of respondents. It was this small group who told us that they would sell their gold, should tapering begin. We believe this is a fair representation of the general approach to physical gold investment. Just a small minority of investors believe the tapering of QE is not only the equivalent to unwinding but is also a guarantee that the negative repercussions of easy monetary policy will not come to fruition. It also suggests that this small group believe gold will not respond to the developments in other countries and on other central bank sheets. Gold bullsOver 55% of those polled told us that tapering would mean they would buy more gold. These individuals are likely to believe a combination of two factors; the first is that they believe any cut is trivial and that gold will not become irrelevant because of this decision; the second is that they do not just focus on one committee's single decision when choosing their investments. As we had expected our most popular answer, by just 2.17%, was 'I will not change my holdings'. We had expected this as our experience of gold investors is that they pay very little attention to the short-term changes in the economy and statement. These individuals, like those increasing their holdings, believe gold is a long term investment. They are aware that the supply of this investment is stable compared to that of all other currencies in the world and one committee's decision will not affect this simple fact. Unlike the 6% mentioned above, the majority of respondents believe they still need to hold gold regardless of the FOMC's actions. They may believe that the Fed cannot exit, or taper, QE without causing irreparable damage to the markets. The very same markets that the US's QE was designed to prop up. Or they may hold gold because it's what they hold regardless of a central bank's decision. In the last few months this has been perfectly demonstrated. As we reported in earlier research, the nature of gold demand is changing. Rather than responding to new changes in the economy by moving away from gold, investors are instead moving away from paper gold and into physical gold. Blinded by the FedTapering is, like anything, a possibility. But it is not a wind-down of QE. Dollars will still be printed along with pounds, euro and yen. In April, Sprott Asset Management showed that the growth of central bank balance sheets and the gold price are highly (95%) correlated. It seems at present markets and commentators have become blindsided by the Fed and their actions. This is despite the results of those actions are yet to culminate and the decisions of other central banks. Our research shows that the possible tapering by one central bank, is not enough to convince gold investors that their game is up. For starters, there are plenty of others to draw our attentions to. We are now seeing extraordinary decisions being made outside of the US: Mark Carney, of the Bank of England is clearly already adopting many of the Fed's strategies; in Japan they are pursuing an aggressively loose monetary policy; and in the EU they have a 'highly accommodative' approach. Our research shows that when it comes to gold bullion investing the majority of respondents are long-sighted enough to see further issues on the horizon. The attitude of respondents to either maintain or increase their holdings suggests one of two things. They either expect more damage to come from the FOMC's (and other central banks') monetary policy actions or they do not hold gold because of the decision of one committee. Instead, they hold gold because it is a currency, not a commodity, and a relevant alternative at that. Further research is required but I suspect the majority of respondents own gold as an alternative asset. They do not hold it because of a decision a central bank may or may not take, rather they hold gold because it is has endurance, it is a faceless currency with a limited supply and no end of fundamentals of which the Federal Reserve is just one of. Our research shows that gold will not become irrelevant because of a few billion dollars. The Fed and its contemporaries will have to work a lot harder to convince investors that they do not need to hold gold. Get our newsletter here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Max Keiser with Greg Palast on Larry Summers’ Secret ‘End Game’ Memo Posted: 18 Sep 2013 08:00 AM PDT

In the latest Keiser Report, Max interviews author, journalist and filmmaker, Greg Palast about the Larry Summers' secret 'End Game' memo and the decriminalization of what were once financial crimes. The post Max Keiser with Greg Palast on Larry Summers’ Secret 'End Game' Memo appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| And So We Wait…For The Fed To Announce Their Plans Posted: 18 Sep 2013 07:35 AM PDT Gold Sits Right At $1300.

The rest of this decade will be one for the history books – but so were the 70's! Tonight, for the first time, I watched the video of Joe Cocker's band Mad Dogs and Englishmen 1970 concert tour. It transported me back to my late 20s/early 30s. The DVD is much more than the concert footage of the tour, some of which was shot in Minneapolis at The Depot. (Some years later, Prince recorded the movie and LP Purple Rain at The Depot. I used to go there a lot. It's about a lifestyle. For people of my generation, that's the way the world was then. It was so different from today that my two oldest grand daughters (21 and 17) would have a hard time relating to that era at all.

The music was spontaneous and simple. No massive productions, no computer light shows, and no magnificent customs – in short, it was real! The band stayed in Holiday Inns and comparable lodging and they led a not so glamorous life on the road. Well, they did have their drugs sex and rock and roll – plus the adulation of huge crowds across America. I guess it wasn't so bad after all. Back in those days, the press was interested in honest REPORTING. The "big" banks were local. Investing was something left for the rich, and most of us weren't rich. It was a big deal then to own a mutual fund or if you were bold, some shares of IBM or GM. Wealth was being able to afford a small three-bedroom rambler in the suburbs and owned an American made car (practically no one bought a foreign car then – but I was an exception. I had a white Mercedes 250SL, but it had flower decals on the trunk. I was stuck between two worlds). If you were lucky, you would take your family on a week's vacation to Miami or Tucson. (That applies to those of us who lived up North in the winter.) We were sick of war; Vietnam angered a generation – but look at us now. Endless war on terrorism! No protests! No riots (yet). Where are the 20-year olds today? Probably trying to find a job. The government stayed out of our life and no one ever talked about or thought about the Fed. How many of you can name the head of the Fed in the 1970s? (Arthur Burns – replaced in August 1979 by Paul Volcker). I couldn't have told you in those days. No one I knew could have told you. No one gave a darn. I was vaguely aware of "inflation," because the company I worked for at the time started to use "inflation" figures to calculate raises. That's about when the government must have decided they had to "soften" the reported inflation numbers. And so they did. And now things are just the opposite! Music is a production – professionally choreographed, with computerized light shows, hand made customs and over-rehearsed performances with no spontaneity. Today, the only banks that matter are the Too Big to fail banks. Most people own stocks and if they have a high net worth, they also rely on money managers and financial advisors. Being "wealthy" today means a million dollar plus home and a second home to vacation in. There weren't many wealthy people when I grew up, or they lived in small pockets away from the city. Now, wealth is commonplace. Wealth surrounds us – and money has become the most important thing in many people's lives. Everything is so plastic, so orchestrated. We are told what to do in every area of our life. We are told what to eat, what to drink, what not to eat and drink, what to wear, how fast to drive, what medications to take, who to vote for, how to think and how to invest. The amazing thing is that most people go along with this. What ever happened to Love, Peace, Flowers, Rock and Roll and freethinking? Watch this DVD and you will know what I'm talking about. People are caught up in the moment. We are glued to the computer screen and the TV screen. What will the Fed say on Wednesday? What will happen to bonds and gold? Will we invade Syria or not? Who will the next Fed Chairperson be? Will the government shut down in a month or two? All of these questions to ponder or agonize over, but the truth is this is all noise and nonsense. Others would call it BS. The bigger picture – apart from the daily headlines, is where people should focus. I'm not just talking about finances. Life goes by very quickly and it is too precious to let it pass you by. Don't get caught up in the headlines or the daily market moves. In fact, if you were smart, you would stop reading about the markets every day and stop following the price of your investments every day and sit back and enjoy your life. Me, I'm kind of stuck here – I still own and run a business. But I do not let it get in the way of living. I write about gold and silver going up and down every day, but I don't worry about it. I'm cutting back on my writing. I never stopped smelling the flowers, and you can't smell the flowers while typing onto a computer screen. I know how this will play out and it's all that I really need to know. How we get there will be interesting and very unpredictable. I view it with an existential "interested indifference." It will be quite a ride, especially if you have the ability to step back, outside of your direct involvement, in a third-person sort of way, and watch history unfold. The rest of this decade will be one for the history books – but so were the 70's! Check out the following articles from Zero Hedge and Jim Sinclair below:

***

***

Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold prices keep falling while market expects a smaller Fed taper Posted: 18 Sep 2013 07:35 AM PDT The gold futures may have already priced in a $10 billion tapering although gold prices are still very volatile as the path of tapering is uncertain. Investors will also focus on the Fed's economic projections for 2016. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Janet Yellen: What A Horrifying Choice For Fed Chairman She Would Be Posted: 18 Sep 2013 07:13 AM PDT

Sadly, Yellen is not a woman that believes in free markets. She had the following to say back in 1999...

Yellen believes that without the "routine intervention" of the central planners at the Fed, our economy will not produce satisfactory results. So if you thought that Bernanke was an "interventionist", you haven't seen anything yet. In fact, according to Time Magazine, Yellen was continually urging Bernanke to do even more "to help stimulate the economy"...

It is truly frightening to think that Yellen might turn out to be "Bernanke on steroids". Let's hope that she is not the choice. But the media is endlessly hyping her. They keep proclaiming that she has a "good track record" when it comes to forecasting future economic conditions. Oh really? Back in February 2007, before the housing crash and the last financial crisis, she made the following statement...

And during a speech in December 2007 she offered up this gem...

And in front of the Financial Crisis Inquiry Commission in 2010 she openly admitted that she did not see the last financial crisis coming...

So if she didn't see the last crisis coming, will she see the next one coming? Right now, she insists that everything is going to be just fine in our immediate future. Do you believe her? Meanwhile, economic warning flags are popping up all over the place. As Zero Hedge recently noted, perhaps this is why a lot of high profile candidates don't want the Fed job. Perhaps they don't want to be blamed for the giant economic mess that is about to happen...

But we have far bigger worries on our hands than just another recession. Over the past several years, Fed intervention has been systematically destroying confidence in the U.S. dollar and has been making U.S. government debt less desirable. Foreigners are already starting to dump U.S. debt, and it is only a matter of time before the U.S. dollar loses its status as the de facto reserve currency of the world. By "kicking the can down the road", the Fed has created tremendous structural problems which are going to come back to bite us big time in the long run. Recklessly printing money, monetizing debt and driving interest rates down to ridiculously low levels may have had some benefits in the short-term, but in the end this giant Ponzi scheme is going to collapse in spectacular fashion. The following is how James Howard Kunstler puts it...

The American people deserve to know the truth. The Fed is not our "savior". The truth is that the Fed is the primary cause of many of our biggest economic problems. For much more on this, please see my previous article entitled "25 Fast Facts About The Federal Reserve – Please Share With Everyone You Know". Unfortunately, Wall Street and the mainstream media love the Fed and they appear to very much love Janet Yellen. Yellen would be an absolutely horrifying choice for Fed Chairman, but so would any of the other names that have been floated. America has embraced the foolishness of the financial central planners at the Federal Reserve, and in the end we will all pay a great price for that. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stewart Thomson: Gold Technicals Suggest Dovish Taper Posted: 18 Sep 2013 07:01 AM PDT

Gold is wealth itself. Whether you are bullish or bearish, there are still key price areas on the "grid" that should be bought and sold. I'm placing risk capital based on a scenario where the Fed announces a dovish taper today, and then gold & silver stocks begin a strong rally. Submitted by Stewart Thomson: [...] The post Stewart Thomson: Gold Technicals Suggest Dovish Taper appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Is The Fed Really Printing? Posted: 18 Sep 2013 06:35 AM PDT Whilst the Cartel did this to gold in last night's wee hours – as Yahoo! Finance's "Top story" dis in genuinely read "Eerie Calm in Countdown to Fed Conclusion"…

…"Reader J" sent me the following email, pertaining to what the Fed is really up to…

I could not agree more, and have said so for many, many years. The government lies about anything and everything; and in its maniacal quest to "kick the can" as far as possible, no area has witnessed such deception as its financial policy. For example, we know for a FACT that the Fed secretly lent out $16 TRILLION amidst the charred 2008-09 financial landscape; tens of billions to European sovereigns via off-balance sheet "swap agreements"; and likely, utilizes limitless funds to support "favored" markets – like U.S. Treasuries and stocks – and suppress "undesirables" like gold and silver. In my view, there is NO WAY paper markets can be so thoroughly controlled otherwise. The Fed knows its track record of predicting economic growth is abysmal; not to mention, the REAL economy worsens by the minute. And thus, it will do ANYTHING – legal or illegal – to mask the nation's economies frailties, and their own policy failures. Fortunately, their footprints are increasingly transparent to the ENTIRE WORLD; such as in the stock market, where major averages have NEVER veered so far from economic reality; and even more so, the Precious Metals – where PHYSICAL inventories are draining like bathtubs without stoppers, as the production outlook collapses due to the financial damage wrought upon miners…

TPTB will fight their demise "to the death"; but in the end, it will be they who financially die, as their fiat currency Ponzi scheme inevitably implodes. When that day arrives – and arguably, in some nations it already has – either you will own PHYSICAL PMs, and thus be financially saved; or otherwise, worthless fiat "money units" will sentence you and yours to lives of severe economic struggle. And given how dire the current, global financial situation is, that day could be any month, week, or day.Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India hikes Gold, Silver jewellery customs duty to 15% Posted: 18 Sep 2013 06:17 AM PDT The Ministry said that customs duty on gold and silver has been reviewed periodically in the past two years and revised upwards as part of measures to contain the current account deficit. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Rush Cometh In Japan – 1 Quadrillion Yen National Debt To Bankrupt Posted: 18 Sep 2013 06:02 AM PDT

Japan’s soaring national debt is already more than twice the size of its economy. Even at current all time record low interest rates, Japan spends nearly 50% of its tax revenues on interest payments. The Japanese 10 year government bond is trading at just 0.70% today. At borrowing costs of 2% to 3% per annum, [...] The post Gold Rush Cometh In Japan – 1 Quadrillion Yen National Debt To Bankrupt appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Rush Cometh In Japan - 1 Quadrillion Yen National Debt To Bankrupt Posted: 18 Sep 2013 05:02 AM PDT gold.ie | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed QE Tapering: Quanticlimax for Gold & Silver Bears? Posted: 18 Sep 2013 04:31 AM PDT Gold and silver rose on QE. So tapering must drive precious metal prices lower again, right...? SO TODAY's the day, writes Adrian Ash at BullionVault. Ben Bernanke, head of the US central bank, will announce the beginning of the end for quantitative easing at this month's policy meeting in Washington. Everyone thinks so. Gold and silver prices seem to agree, drifting to new multi-week lows Wednesday morning in a reversal of their pattern when QE was ramped up from 2009 to 2012. And Bernanke pretty much said in June that QE's end would start this month. Policy-makers have been talking about it since April. Those two months loom large for anyone trading gold or silver. But looking at this week's 4% drop so far, traders have to ask: Is it a case of sell the rumour, buy the news? It was always the reverse when QE was growing. Acting in what we christened "quanticipation", gold and silver prices tended to rise ahead of the US Fed's various QE launches (you remember - QE1, QE2, and so on). They then fell back once the announcement was made, only to resume their longer-term rise. So the outlook today? The aim of QE is to juice assets which might help boost the economy, or at least make it look that way. So since March 2009, the very depths of the post-Lehmans' banking collapse, the Fed's QE program has created and spent some $2.735 trillion by our maths. That's greater than the sum total of all US cash and household savings in existence only 25 years ago. It's equal to one Dollar in every four held by US savers today. This flood of money, you'll recall, has been used primarily to buy US Treasury bonds. The stated plan was to push up the price of "risk free" government debt investments, pushing down the interest rate they offer. That way, investors would be forced to make riskier bets if they wanted any hope of a decent return. Borrowers could then raise loans at cheaper rates, greasing the wheels of the economy. Did it work? US consumer debt is lower today by 12% from the peak of end-2008, just before QE began. That fall has been driven entirely by a drop in mortgage debt, despite a good chunk of the Fed's electronic cash also going to buy mortgage-backed bonds as well as Treasury debt. Wall Street's own debt has meantime shrunk by one fifth, while corporate borrowing by non-financial firms has risen, but not by much when you account for inflation. What has soared, of course, is the stock market, with the S&P rising to all-time record highs as QE has been piled on QE. As for interest rates, the best the Fed could say is that they didn't soar. Yet. But rather than falling as advertised, 10-year US Treasury yields actually rose over the lifetime of QE1 (up from 2.42% to 3.85%). The start of QE2 saw 10-year yields rise almost one whole percentage point. Interest rates then hit rock-bottom – the very lowest in history – two months before the start of QE3. So far, so bad. QE didn't do what it was supposed to. Other than making the stock market jump. It also failed to raise the rate of inflation in consumer prices, which the Fed hoped would make the value of debt fall in real terms. But what of debt's opposite – physical bullion? Gold and silver are the most sensitive assets to monetary policy. Specifically, people buy silver and gold when they fear the value of money will fall. QE is plainly a campaign to drive money out of cash and lower-risk investments by creating so much of them – at will, from nowhere – that their value sinks. That has driven much of the last 5 years' surge in gold and silver investment demand. So whether or not today's QE tapering is already "priced in" by gold and silver's 2013 plunge, the end of QE would, you might imagine, drive prices down further. But note: Bernanke will still be running his electronic printing press after today's Fed tapering statement and press conference. It's just that, rather than printing $85 billion per month, the Federal Reserve will now create and spend perhaps $75bn or a little less. And from there, says the plan, new quantitative easing will only be slowly reduced. Finishing in 2014 is by no means certain. Nor is this the first taper or pause in new QE flows. It's only the first cut to the un-ending monthly program started 12 months ago. Nor will the trillions created to date be destroyed. That money is here to stay, albeit stuck at the Fed – where it was born – as excess reserves held by the banking sector. Gold and silver bears should watch their stop-losses if that cash ever leaches out into new bank lending. Zero interest rates on short-term money will also persist. And aggressive QE will now sit at the top of the Fed's policy toolbox whenever it rolls up its sleeves and pops open the lid. The world's biggest central bank, in short, isn't done with QE or zero rates yet. The rest of the world is applying the same "remedy" for the long ago financial crisis as well. No, the rate of inflation hasn't leapt yet. But whatever noise today brings for gold and silver prices, the value of cash remains under attack by the very people charged with defending it. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Sep 2013 04:00 AM PDT

Ahead of this afternoon’s September FOMC statement in which the market has been anticipating the Fed to announce a taper to QE for months now (and as we await the imminent gold & silver smash), as tradition here on SilverDoctors, in what might be one of the last opportunities before the Fed Chairman is shown [...] The post Punt the Bernank!! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading Comments, 18 September 2013 (posted 12h45 CET): Posted: 18 Sep 2013 03:45 AM PDT Despite this latest downdraft, which was deeper than I expected, the base in the precious metals is still building nicely. So I continue to believe that gold and silver completed in June a major | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||