saveyourassetsfirst3 |

- Gold may get support on US debt ceiling, Middle East issue: ETFS

- Monex Precious Metals Review: Gold support $1308, Silver resistance $22.19

- The Losing Battle to Fix Gold at $35, Part II

- Is this the best way to invest in gold today?

- Silver loses its Chinese premium as industrial demand slows

- Royal Gold Presents at Bank of America Merrill Lynch Canada Mining Conference (Transcript)

- Gold Fever Catches A Cold

- Bill Black: Higher Bank Capital Requirements are Necessary but not Sufficient to Prevent the Next Crisis

- Tuesday charts for Gold and silver before Fomc meeting

- Gold Daily and Silver Weekly Charts - JPM To Pay About $800 Million Fine for London Whale

- A beginners guide to investing in Gold

- JUNIOR FOCUS: Roxgold outlines high-grade gold mine in Burkina Faso

- But How Near Is The Fall?

- Historic Buying Opportunity Coming in Gold Stocks

- Gold Cannot Shrug off Bearish Sentiment

- India's would-be PM 'beacon of hope for the gold industry'

- Summers' Fed exit fails to spur precious metals

- In KWN interview, Turk comments on Summers withdrawal and raids on gold

- Today’s Volatility In Metals & Markets Could Amplify With US Fed Meeting

- Bring Our Gold Campaign Now in Finland, Just 2 Weeks After Poland

- GEAB N°77 ist angekommen! Finanzen, Wirtschaft, Politik und die globale Lage zum Jahresende 2013 : Drei Funken und ein Pulverfass

- Poland Latest To Seek Repatriation of Its Gold

- Five valuable lessons from a true resource "titan"

- Controversial charts say gold could be headed to new lows

- They Act Like It Matters

- Gold and silver price manipulation ends with the death of fiat

- Gold falls on prospects of US Fed tapering

- The CFTC and the sad joke of "Regulation"

- Confessions of a former gold bear

- Jim Rickards on a Return to a Gold Standard: “The Dollar is Definitely Collapsing”

- Bombshell

- Confessions of a former gold bear

- Gold sees damaged weekly charts

- Summers' Fed exit fails to spur precious metals as fundamentals return

- War Is Coming: 10 Reasons Why A Diplomatic Solution To The Syria Crisis Is Extremely Unlikely

- Does the moon control gold and silver prices?

- Chart of the Day: Where Has All the Gold Gone?

- Gold up in Asia after Summers exits Fed race

- JPMorgan in the Manipulation Of The Gold And Silver

- Gold trims gains but still up after Summers news

- Chart of the Day: Where Has All the Gold Gone?

- Out of This World

- What the Orgy of “Lehman Five Years On” Stories Missed

- 90% Silver Sale! Any QTY Only $1.49 Over Spot!

- Gold and Silver Price Manipulation Ends With the Death of Fiat

- Choice For Fed Chairman

- Gold bulls cut wagers as Goldman sees more losses

- Could You Imagine This 25 Years Ago?

- Indian temples to Indian central bank on gold inventory information request: “POKE-IT”

- Poll: Americans Oppose Raising the Debt Ceiling Even If U.S. Defaults and Say Government Wastes 60 Cents of Every Tax Dollar

| Gold may get support on US debt ceiling, Middle East issue: ETFS Posted: 17 Sep 2013 03:38 AM PDT Among the precious metals, palladium has the highest industrial demand exposure at nearly 80%, and thus stands in a particularly strong position to benefit as the global economy improves. |

| Monex Precious Metals Review: Gold support $1308, Silver resistance $22.19 Posted: 17 Sep 2013 03:13 AM PDT Monex spot silver prices opened the week at $23.58 . . . traded as high as $23.81 on Monday and as low as $21.65 on Friday . . . and the Monex AM settlement price on Friday was $21.74, down $1.84 for the week. |

| The Losing Battle to Fix Gold at $35, Part II Posted: 16 Sep 2013 10:45 PM PDT John Paul Koning |

| Is this the best way to invest in gold today? Posted: 16 Sep 2013 10:17 PM PDT Bloomberg profiles an ex-investment banker turned gold broker. You might imagine owning gold as a way to avoid dealing with such people but they have a habit of turning their hands to handle wherever the money happens to flow. In 2008, Savneet Singh was to start his dream job at a hedge fund, but the Lehman Brothers collapse and the failure of the financial system caused him to rethink his path. Bloomberg takes a look at his new ‘golden’ opportunity…. |

| Silver loses its Chinese premium as industrial demand slows Posted: 16 Sep 2013 10:12 PM PDT The slowdown in the huge Chinese economy can be measured in the falling price of commodities like copper and silver. This is bad news for silver speculators but it gives long-term investors a chance to buy what is also a precious metal at bargain prices. In today’s ‘Global Outlook,’ Bloomberg’s Mia Saini takes a look at what’s behind the drop in China’s price premium compared to London’s on Bloomberg Television’s ‘On The Move Asia’… |

| Royal Gold Presents at Bank of America Merrill Lynch Canada Mining Conference (Transcript) Posted: 16 Sep 2013 10:11 PM PDT Royal Gold, Inc. (RGLD) Bank of America Merrill Lynch Canada Mining Conference September 12, 2013 12:00 PM ET Executives Sandip Rana - CFO, Franco-Nevada Corporation Bill Heissenbuttel - VP of Corporate Development, Royal Gold Gary Brown - SVP and CFO, Silver Wheaton Analysts Presentation Unidentified Analyst [Call Started Abruptly] … something new this year for our conference and something I should have done years ago and basically I called the buffet lunch panel presentation with the three major royalty streaming companies. I should note that a certain company called Sandstorm wanted to be part of this but it's just you three. And very pleased all here, all the speakers now then we introduce when they come up but very pleased to have from Franco-Nevada Corporation, Sandip Rana, the CFO standing right there and from Royal Gold, Bill Heissenbuttel, Vice President of Corporate Development and from Silver Wheaton, Gary Brown, Senior |

| Posted: 16 Sep 2013 09:55 PM PDT "Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head." -Warren Buffett GLD Total Return Price data by YCharts On Wednesday, September 18th the Federal Reserve will have a policy meeting discussing the possibility of tapering treasury purchases from $45 billion to $35 billion per month. Both Wall Street and Main Street seem overly concerned on the timing of the taper; however, whether it is September or October, in the end, this is insignificant. The bottom line is that the taper will occur, it is a question of when, not if. We also think in the first half of 2014, the Fed will totally exit the quantitative easing program. We believe that, with rising |

| Posted: 16 Sep 2013 09:11 PM PDT Yves here. Apparently out of reluctance to overburden readers with detail, Black skips over the big reason that Basel II was problematic. It relied on risk weighting of assets. For example, sovereign debt had a risk weight of zero, meaning banks weren’t required to hold equity against it. So guess what Eurobanks, who were subject to Basel II rules shortly before the crisis, loaded up on? As former central banker London Banker put it:

Steve Waldman wrote a classic post on why bank equity isn’t the end all and be all of bank safety that Summers and Geithner would have you believe. From Capital can’t be measured:

By Bill Black, the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of Missouri-Kansas City. Cross posed from Benzinga The last ditch efforts to save Larry Summers' prospective nomination to run the Fed and the comments about his withdrawing from consideration have prompted further discussions of financial regulation. The thrust of the comments is that Summers' big regulatory idea was that capital requirements are the key and other forms of rules are worthless because they are easy to evade. Commercial bank capital requirements during the heights of the bubbles were absurdly low and the capital requirements for investment banks, Fannie and Freddie, sellers of CDS protection, monoline insurers, and mortgage banks were farcical. The capital requirements for U.S. primary dealers and the largest commercial banks were reduced sharply during the expansion phase of the bubble. The reduction in the capital requirements for Europe's largest commercial banks was far more severe than in the United States, so there is a "natural experiment" that can be used to research the effect of reducing capital requirements. The Basel process was originally designed to prevent a regulatory race to the bottom by the "developed" economies through debasing bank capital requirements. The Basel process was supposed to create a more uniform minimum bank capital requirement. Basel II, however, embraced reducing capital requirements and ended up producing a much lower bank capital requirement in Europe than the U.S. Basel II's evisceration of capital requirements proved disastrous. One of the less understood aspects of the mortgage fraud crisis is how the FDIC's successful rearguard action saved us from the Fed's economists' efforts to push the full reduction in capital requirements of Basel II and delayed U.S. implementation of Basel II by two years. Europe had no equivalent to the FDIC fighting the madness of Basel II's sharp reductions in bank capital requirements so it adopted the full reduction and it adopted that reduction two years before the U.S. implemented its considerably less radical reduction in capital requirements. The perversion of the Basel process in Basel II into a device for leading, rather than preventing, a regulatory race to the bottom began in 1998 under the Clinton administration. The perversion was led by the lobbying of the largest banks and the Fed. Basel II was drafted in a manner that was a radical departure from Basel I. The difference was that the industry was invited "inside the tent" by the regulators to participate actively in the rule making process. This invitation went well beyond the input U.S. firms have in "notice and comment" rulemaking. The largest banks were constantly involved – for the better part of a decade – making numerous ex parte presentations to individual government employees and committees. The biggest bank strategy had several components that all favoring reduced capital requirements for the largest banks. The U.S. government's embrace of the regulatory race to the bottom and of a process dominated by the largest banks was consistent with the Clinton administration's embrace of both of those concepts. President Clinton and Vice President Gore's "Reinventing Government" crusade had seven key precepts for financial regulation that I have explained in detail in prior articles.

Bob Rubin and Larry Summers were enthusiastic supporters of the Reinventing Government crusade. I have not been able to find any record of them opposing the effort under the Clinton administration to use Basel II as a means to cause a dramatic reduction in capital requirements for the largest banks. After the Bush administration began, another Rubinite, Timothy Geithner, was made head of the NY Fed on October 15, 2003. The NY Fed's economists played a key role in the Fed's support for the weakest possible Basel II capital requirements under Geithner and his predecessor. The Fed's economists ignored and denigrated their supervisors' objections to the severe reduction in capital requirements. Report of the Financial Crisis Inquiry Commission (FCIC) 2011: 171 (see also the Spillenkothen memorandum to FCIC). The proposed Basel II reduction in capital made a mockery of U.S. law requiring the regulators to take "prompt corrective action" against banks with inadequate capital.

To put this all together, we have a real world test of administration economists' views and integrity. The Basel II rule adopted by the U.S. was very poor, but because of the FDIC's courage and skill it was far less destructive than the version of Basel II that the Fed's economists championed and that Europe adopted. The Fed/European version was indefensible. It was contrary to the express will of Congress, all financial regulatory experience, and sound economic theory. By looking at their contemporaneous positions on Basel II we can judge officials' actual views on capital requirements. For example, Geithner is famous for claiming (now) that the key to regulation is "capital, capital, capital" – by which he means higher capital requirements. Geithner, however, was one of those who led the crusade to lower capital requirements for the largest banks. Summers' supporters claim that he was "long" a supporter of higher capital requirements for banks. Jeremy Bulow wrote that Summers was the best person in the world to replace Ben Bernanke as head of the Fed. Bulow claimed that Summers was a great regulator.

"[H]e's in favor of regulating wisely" and he opposes bad rules – how unique. There's no content to this syrup. The last sentence can be tested. The Clinton Treasury could have killed Basel II's radical reduction in capital requirements for the largest banks. Rubin and Summers (and Clinton and Gore) also could have stopped the biggest banks' constant ex parte ability to structure the rule to radically reduce their capital requirements. We know that Treasury did not kill either the rule or the disgraceful manner in which the largest banks dominated the rule changes. But perhaps Summers did actually write to oppose the rule and the ex parte procedural abuses and was overruled by Rubin or Clinton. If he did, then he deserves considerable praise. The question for Bulow is how long does "long" mean in his second sentence quoted above. Does Bulow know that Summers believed in 1998 that the largest banks needed higher capital requirements? If Summers did believe that in 1998 what did he do to try to stop the disaster that bore bitter fruit as Basel II. Did Rubin and Summers implore Geithner to stop pushing to weaken bank capital requirements in the early-to-mid 2000s? Similarly, after Summers withdrew his name from consideration, Edward Luce wrote to defend Summers' regulatory vigor, arguing that Summers, by 2009, supported "much stricter" bank capital requirements. Luce explains Summers' theory of regulation.

The problem I have is with Summers' assumption that "capital" is not "gameable." Capital is simply an accounting residual: Assets – Liabilities = Capital. If a CEO leading an accounting control fraud can "game" assets (by overstating them) and/or understate liabilities, then the CEO will "game" (overstate) capital (and income) – massively. Banks, and corporations like Enron, that are massively insolvent and unprofitable can through accounting fraud report for many years that they have record profits and "excess" capital. The famous 1993 article by George Akerlof and Paul Romer – "Looting: The Economic Underworld of Bankruptcy for Profit" confirmed the accuracy of what competent regulators and white-collar criminologists had been saying for years. Accounting fraud was a "sure thing" that mathematically guaranteed the ability to report record (albeit fictional) profits for years, which made the controlling officers immediately wealthy through modern executive compensation. The firm might fail, but the controlling officers could walk away wealthy. Summers and many of his supporters still don't understand the most basic aspects of accounting control fraud. Accounting control fraud epidemics have driven our three modern financial crises (the S&L debacle, the Enron-era frauds, and the ongoing mortgage fraud crisis). We cannot afford the continuing unwillingness of neoclassical economists to read the work of a Nobel laureate in economics (Akerlof 2001) because of their primitive tribal taboo and ideological dogmas against taking elite fraud seriously. There would have been a fourth modern crisis had not the S&L regulators driven liar's loans out of the housing industry (on the grounds that they were inherently fraudulent) in 1990-1991 and the S&L debacle would have been massively more expensive had the S&L regulators listened to the economists' claim that fraud by the officers controlling banks was a "distraction." Note that we did increase S&L capital requirements, but we never made what would have been the catastrophic mistake of believing that accounting fraud could not be used to "game" the higher capital requirements that we imposed. Our most effective rule restricted growth – it killed the remaining accounting control frauds even when Congress prevented us from gaining additional funds to close the remaining frauds. Now that we can at least hope that the administration will cease attacking one of its most successful appointees, Janet Yellen, it is my hope that we can have a serious discussion about what it takes to be an effective financial regulator. We know how to do it. We showed how to do it in even more hostile circumstances in which the Reagan administration was virulently opposed to our actions "reregulating" the S&L industry. Indeed, they called us "reregulators" because they considered that term to be the most repugnant, the most redolent of incomprehension, term in their lexicon with which they could insult us. Summers and his supporters and Yellen and her supporters should talk with us at length and take advantage of what we learned, including the mistakes we made. Restoring effective regulation, supervision, and prosecutions of elite bankers is one of the most important tasks our Nation faces. The arrogance of the last three administrations in the regulatory context is staggering. Never have officials boasted so much about their purported "genius" while promoting policies that proved so destructive – and then cashed in and gotten rich through ties with the CEOs that grew wealthy by directing the control frauds that caused the mortgage fraud crisis. My view is that if a "genius" economist cannot maintain the batting average of a journeyman batter (.250) they not only are not a genius, they are the guy that gets cut from the minor league team because they cannot hit a curve. The last three administrations and the Washington, D.C. (non) "think tanks" have been filled with economists with (predictive) batting averages of around .125 and weak gloves and errant arms – all of them supposedly brilliant. There were hundreds of Office of Thrift Supervision examiners whose opinions repeatedly proved vastly superior to the economists' predictions during the S&L debacle. Akerlof and Romer concluded their 1993 article with these sentences in order to emphasize this message to their peers.

Larry and Janet: please listen to the regulators in the field. Please end Ben Bernanke's practice of placing economists in charge of Fed supervision. The Fed's economists are a major source of the Fed's problems. They are not the solution. If they are transformed they can be part of the solution, but the solution needs to come from the people in the field. That is particularly true with regard to detecting systemic risks. End of the glaring conflict of interest in having your examiners and supervisors be employees of the regional Fed banks which are owned by the banks they are supposed to examine and supervise. |

| Tuesday charts for Gold and silver before Fomc meeting Posted: 16 Sep 2013 09:06 PM PDT Commodity Trader |

| Gold Daily and Silver Weekly Charts - JPM To Pay About $800 Million Fine for London Whale Posted: 16 Sep 2013 08:02 PM PDT Le Cafe Américain |

| A beginners guide to investing in Gold Posted: 16 Sep 2013 07:00 PM PDT gold.ie |

| JUNIOR FOCUS: Roxgold outlines high-grade gold mine in Burkina Faso Posted: 16 Sep 2013 05:54 PM PDT Roxgold moves closer to permitting, production decision, and construction with a scoping study out today of the high grade Yaramoko gold project. |

| Posted: 16 Sep 2013 04:45 PM PDT I will resist the temptation, succumbed to by many others, to offer a pithy title turning on some pun involving Larry Summers' name. For example, I did not title this article:

Such tomfoolery is occasioned by the news yesterday that Larry Summers has withdrawn his name for consideration to be the next Fed chairman, succeeding Bernanke. The markets reacted with similar tomfoolery. Although the equity markets hadn't exactly plunged as Summers became the odds-on candidate (at a conference I went to last week, all six of the panelists during one segment said Summers would be the selection), stocks rocketed higher today as this supposedly makes a dovish Chairman more likely. Bonds rallied as well, and the dollar fell -- all of these for the same reason. |

| Historic Buying Opportunity Coming in Gold Stocks Posted: 16 Sep 2013 04:40 PM PDT Recently we've been writing that another opportunity is coming to buy gold stocks. While this is still the case, the facts have changed and we have to tweak our view. The evidence argues that the mining stocks are now likely to retest their lows. Rather than that buying opportunity being days away, we now feel it is weeks away. Investors and speculators need to have more patience. In this missive we discuss why a retest is coming but why it could mark a final bottom and a tremendous buying opportunity. The first reason I expect a retest is the current recovery has veered off historical course. At the current juncture three of the four similar recoveries (chart below) were at a new recovery high and the fourth closed at a new high next week. Simply put, last week was the turning point. This is confirmed by the stocks slicing through their 50-day moving averages rather than holding.

Second, the monthly chart has also veered off course. Until the end of August, the June to August pattern resembled that of the October to December pattern in 2008. However, gold stocks reversed course at the end of August and are down 9% this month. This is not the type of action you see following a major bottom.

The third point is that I made an error in my last editorial. In 1976 Gold made a V shaped bottom because it declined for 18 months without any multi-month interruption. Sure, precious metals have been extremely oversold as the current bear market is two years old. However, I neglected the obvious fact that there was a huge reprieve in 2012. Gold rallied back to $1800 and many stocks reached new all-time highs. From this vantage point, precious metals have been very oversold for less than a year and thus not enough to produce a bottom without a retest. Hours before the late June bottom I penned an editorial discussing why I felt a major bottom was imminent. Bearish sentiment was rampant. The gold stocks were nearing 9-year support. Moreover, the large caps had lost about two-thirds of their value. My historical analysis showed that only one bear market exceeded 70% and that was the cyclical bear which followed the end of the 1980 bubble and a 20-year bull market in gold stocks. Furthermore, the gold stocks had a nearby Fibonacci target that aligned perfectly with the 2011 top, 2012 bottom and the start of the 2013 crash. That target is within 1% of the late June low. See the chart below.

The points mentioned above don't get thrown out the window just because the market has failed to breakout. They are still as valid as they were a few months ago. The fact that a retest is coming doesn't invalidate those points. Below is a sketch of how things could potentially play out over the coming months. I say potentially because no one can predict the future. We can analyze history, tendencies and probabilities to come up with a reasonable guess. Given the evidence, I find it reasonable that the sector is not going to breakout anytime soon. At the same time, I find it unreasonable to expect the equities (especially GDXJ and SIL) to make new lows.

Near-term goals should be to make sure you are hedged if you are heavily long and to make sure you have some cash to take advantage of the final bottom which could occur in the next month or so. Note that the major bottom in 2000 occurred in November while the 2008 low came in late October. I guess the calendar is ripening for another major bottom. Of note is that GDXJ and SIL are in stronger shape than GDX. GDXJ declined 79% and recently rebounded 63%. SIL declined 65% and recently rebounded 55%. Those rebounds occurred in only two months! Just imagine the gains we could see after this retest. Readers are advised to watch closely and spot the companies which show the most strength during this retest. If you'd be interested in our analysis on the companies poised to lead this new bull market, we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT |

| Gold Cannot Shrug off Bearish Sentiment Posted: 16 Sep 2013 04:17 PM PDT Rallies continue to be sold in the yellow metal as the bounce higher ran out of steam near a tough resistance level at $1330. Many traders were watching to see how gold would react on any approaches to this level and whether or not it could maintain its gains having secured a foothold there. It did not... that triggered some long liquidation as well as bringing in fresh short sellers. Bears are trying to break the market down below the $1300 level. Bulls are attempting to hold it above there. We will know very soon which side has the advantage near term. Rallies however continue to be seen, for now, as fresh selling opportunities. It is going to take some more positive performance on the price charts for that to change. The failure to hold above $1330 is not helpful to the bulls in that regard. There seemed to be some strange goings on in the Treasury market today with the long bond soaring to 131' 12 overnight only to puke out most of its gains as the trading session wore on. Treasuries look as unsure of their next move as the gold market does right now. Higher yields seem to be here to stay but no one knows exactly "how high" those yields will be before stabilizing. The truth is that the US economy is in no shape to handle higher interest rates and most bond traders realize that. They are also trying to come to terms however with any Federal Reserve "tapering" or "lack of tapering" to gauge whether they should be buying bonds or selling bonds. Each piece of economic news is therefore having an overexaggerated impact on the long bond as it confirms or denies traders' perspectives. The result is more volatility and herky-jerky type price action as firm convictions are lacking. Markets like these are the realm of the one- three minute bar chart geeks and scalpers. |

| India's would-be PM 'beacon of hope for the gold industry' Posted: 16 Sep 2013 03:58 PM PDT India's new Prime Ministerial candidate Narendra Modi could well be the knight in shining armor for the country's gold, silver and diamond retailers. |

| Summers' Fed exit fails to spur precious metals Posted: 16 Sep 2013 03:55 PM PDT The gold price fell hard Monday morning after earlier spiking to $1,336/oz despite wholesale dealers reporting lacklustre trade. |

| In KWN interview, Turk comments on Summers withdrawal and raids on gold Posted: 16 Sep 2013 03:01 PM PDT GATA |

| Today’s Volatility In Metals & Markets Could Amplify With US Fed Meeting Posted: 16 Sep 2013 02:59 PM PDT A surprising and sharp move higher started the trading day and week. Futures of most equity markets jumped more than 1% at the opening of the Asian trading sessions. Gold and silver started slightly higher. The driver was the news about Larry Summers’ resignation for the function of US Fed Chairman. As Summers would not aim for additional monetary easing, the news was interpreted as positive for the markets (i.e. more money printing coming). Reuters wrote today: “Stocks and bonds on major markets rose on Monday after former U.S. Treasury Secretary Lawrence Summers withdrew from consideration to be the next chairman of the Federal Reserve, leading investors to believe U.S. monetary policy might stay looser for longer.” However, as the trading session continued, all markets started moving south:

Gold and silver short term chartsThe gold and silver price are in corrective mode since past week. The downtrend is clear on the short term price charts:

Gold and silver daily chartsOn the longer term charts, the downtrend remain intact. The August rally did not succeed to break the trend; resistance appeared to be too strong. This week will be “make or break” for the metals. Based on the market reaction on the FOMC meetings, we can expect a decisive short to mid-term move higher or lower. Mind that the very long term view remains positive, as the secular bull remains intact for the time being.

Increased volatility with this week’s FOMC meetingThe importance of this week’s FOMC meeting cannot be underestimated. In a recent article, we quoted Jim Rickards:

Although nobody knows the decision of the US Fed in advance, market commentary from BullionVault emhasized the most anticipated results of this meeting and the impact on gold and silver prices:

Expect a lot of volatility and violent price action in all markets later this week and potentially the coming weeks. Our forecast 2013 – Start of Seismic Shifts in Money, Metals, Markets is likely coming true. |

| Bring Our Gold Campaign Now in Finland, Just 2 Weeks After Poland Posted: 16 Sep 2013 02:42 PM PDT As reported by GATA over the weekend, Finland is launching a campaign to bring its country’s gold back. The initiative is a referendum with the aim to put a deadline on the repatriation of Finland’s gold, being May 2014. The Finish website which leads the campaign is Kansalaisaloite.fi. Finland has 49.1 tons of gold. Most of Finland’s gold is kept outside of Finland. It is in vaults all over the world but mostly at the Bank of England. Earlier this year, Venezuela and Germany decided to bring their gold back. It started a whole movement across the world. Finland is the latest country in this wave. Poland was the one but last, as reported by GATA two weeks ago. The people of Finland have never been asked whether Finland should keep and hold its gold on its own. This is relevant now as the gold markets are changing significantly and the performance of currencies is unsure. The problem that will arise longer term is that probably not all gold will reach its owners, when a critical mass of the owners request a repatriation. The underlying reason is that the gold market is too leveraged: every ounce of gold in the main vaults of the US Fed and Bank of England carry a certain number of claims. There are far more claims to gold than there is available gold. Nobody knows exactly how much is sitting in the vaults and how many claims rest on the metal. But sooner or later the world will probably get to know. Read past articles: Germany's Gold Is Coming Home – Facts & Opinions Gold Is Money: Central Bank Actions Send Investors a Clear Message

|

| Posted: 16 Sep 2013 01:34 PM PDT - Pressemitteilung des GEAB vom 16. September 2013 (GEAB N°77) -  Der Sommer 2013 hat nicht die Beruhigung gebracht, die sich einige erhofft hatten, sondern die Krisenherde an den Finanzmärkten, in der Wirtschaft und vor allen Dingen in der globalen Geopolitik weiterhin befeuert. Der Zankapfel Syrien hat klar vor Augen geführt, dass es eine „Weltgemeinschaft" nicht mehr gibt. Die Wirtschaftsmedien können trotz aller denkbaren Tricks immer noch nicht den so sehnlichst erwarteten Aufschwung ausrufen. Die Währungskriege sind erneut aufgeflammt und wüten nun in den Schwellenländern. Und die Zinsen für Staatsanleihen sind inzwischen außer Kontrolle geraten. Leider ist vom herannahenden Herbst keine Beruhigung der Lage zu erwarten. Vor dem nach der Sommerpause erneut zusammentretenden US- Kongress liegen schwerste Aufgaben, Diskussionen und Entscheidungen: Syrien, Haushaltsverhandlungen, Schuldenobergrenze usw. Die Positionen von Demokraten und Republikanern liegen so weit auseinander und lassen brutale politische Schlagabtäusche vorhersagen. Auch die Finanzmärkte bewegen sich nun auf vermintem Gelände. Denn nun gehen die Diskussionen über das sogenannte tapering weiter, also die progressive Reduzierung der Volumina der Fed-Programme der quantitativen Lockerung, von denen die US – Wirtschaft weitestgehend abhängt. Die die Folgen der Insolvenz Detroits machen sich bemerkbar. Und zuletzt haben die großen westlichen Banken keine Wahl mehr und müssen ihre bedingungslose Unterstützung der US – Regierung einstellen. Auch in der Geopolitik dürfte es ein heißer Herbst werden: Die Schwellenländer werden die spekulativen Angriffe gegen ihre Währungen nicht länger tatenlos hinnehmen, was voraussagen lässt, dass es auch an den Devisenmärkten bald heiß zugehen wird. Weiterhin werden die Schwellenländer ihren Sieg im Syrienkonflikt sicherlich zum Anlass nehmen, einen größeren Einfluss auf der Weltbühne einzufordern. Inhalt der gesamten Veröffentlichung: 1. USA: EINE NEUE STAFFEL DER WASHINGTONER SOAP- OPERA BEGINNT 2. DIE FED VERLIERT DIE KONTROLLE 3. DAS NÄCHSTE ZYPERN WIRD AMERIKANISCH SEIN 4. DIE BANKEN LASSEN DAS FINANZMINISTERIUM IM STICH 5. DER GROSSE BLUFF MIT SYRIEN 6. ZWISCHEN SKYLLA UND CHARYBDIS 7. SCHWINDENDER US-EINFLUSS 8. DER ABKOPPELUNGSPROZESS DER SCHWELLENLÄNDER VON DEN WESTLICHEN VOLKSWIRTSCHAFTEN - FORTSETZUNG UND ENDE 9. JAPAN : REGIONALE RÜCKBESINNUNG 10. EUROPA AM SCHEIDEWEG 11. DAS SCHMERZLICHE FEHLEN EINER GLOBALEN GOVERNANCE In dieser Pressemitteilung stellen wir das 1., 2. und 3. Kapitel vor. USA: EINE NEUE STAFFEL DER WASHINGTONER SOAP- OPERA BEGINNT Angesichts der schwierigen internationalen Lage drohte das Zerwürfnis zwischen Demokraten und Republikanern beinahe in Vergessenheit zu geraten. Aber wer sich für die Verwicklungen und Handlungspirouetten in „Gute Zeiten, schlechte Zeiten in Washington" interessiert, kann sich in den nächsten Wochen noch auf viele spannende Folgen freuen (1). Die wichtigsten Handlungsstränge sind - Die Syrienkrise, auch wenn inzwischen dort eigentlich die Luft raus sein müsste, nachdem sich die Drohungen des Westens als Bluff herausgestellt haben; - Der US- Haushalt 2014 und die Schuldengrenze. Die Republikaner werden ihre Obstruktionsmacht ohne Hemmungen einsetzen, um Obama ein Maximum an Zugeständnissen zu entreißen. Es ist davon auszugehen, dass sie ihre Karten voll ausreizen werden und entweder die Gesundheitsreform kassieren lassen oder bei anderen Sozialausgaben Kürzungen durchsetzen. Vielleicht gelingt ihnen sogar beides (2). Angesichts der Abgründe, die sich auftun würden, sollte es nicht zu einer Einigung bei diesen Fragen kommen (3), kann kein Zweifel daran bestehen, dass in letzter Minute ein Kompromiss gefunden wird, vielleicht auch erst Stunden oder einige Tage nach dem eigentlichen Fristablauf. Dieser Kompromiss wird das Leben für die Menschen in Amerika, die auf Sozialleistungen angewiesen sind, noch schwerer machen (4). Dennoch wird das Spektakel eines Landes, in dem über nichts mehr Konsens besteht, die Vertrauenswürdigkeit der USA noch stärker beschädigen, die Finanzmärkte in Aufregung versetzen (was das letzte ist, was die gerade brauchen) und die Nerven der ausländischen Kreditgeber und Investoren (in erster Linie China) massiv belasten. Es wird die Kakophonie sein, die das Fass zum Überlaufen bringen und das Wenige an Vertrauen, dass die Welt noch in die ehemals globale Supermacht setzt, wegspülen wird. Und Vertrauen der Welt ist doch das einzige, was zur Zeit noch die USA vor dem Zusammenbruch bewahrt. Die US- Politik der folgenden Monate ist, kurz gesagt, der erste der drei Funken, der die Zündschnur in Brand setzen wird, die das Pulverfass der Weltwirtschaft, der es noch immer nicht gelungen ist, sich von den politischen, finanziellen und wirtschaftlichen Entwicklungen in den USA zu emanzipieren, zur Explosion bringen wird. DIE FED VERLIERT DIE KONTROLLE Schlimmer noch ist jedoch, dass inzwischen, wie wir es schon häufig angekündigt haben, sich die Zinsen der US- Staatsanleihen unkontrolliert entwickeln. Obwohl die Fed jeden Monat US- Staatsanleihen mit einem Volumenwert von 45 Milliarden Dollar aufkauft, und obwohl das US- Finanzministerium dank eines reduzierten Defizits der Bundesregierung weniger Anleihen ausgeben muss, steigen die Zinsen weiter an. Wenn lediglich die Gerüchte über die Drosselung des QE dafür der Grund wären, dann hätten die Zinsen doch zum einen unmittelbar nach dem Einsetzen dieser Gerüchte zu steigen beginnen müssen, was aber nicht der Fall war, und zum anderen lässt ein Zinsanstieg um mehr als einen Prozentpunkt für Anleihen mit zehnjähriger Laufzeit allein aufgrund eines Gerüchts über eine Drosselung von QE3 in Höhe von 10% Schlimmes für den Fall erahnen, dass die Fed ihre Währungsstützungsprogramme vollkommen einstellt.  Daraus lässt sich also klar erkennen, dass die Fed die Kontrolle verloren hat; wenn sie sich anschließend die Entwicklungen als von ihr gesteuert und erwünscht zuschreibt, dann versucht sie nur, den Eindruck zu erwecken, sie habe die US- Geldpolitik noch unter Kontrolle. Außerdem ist QE3 für die Realwirtschaft alles andere als hilfreich, denn das leichte Geld speist lediglich eine Spekulationsblase an den Finanz- und Immobilienmärkten (5), was auch der Grund dafür ist, dass die Fed wenig gegen eine Drosselung einzuwenden hat, die sie als natürliche Folge der Konsolidierung der US- Wirtschaft darstellen möchte. Es geht nur noch um die Fassade, die die Fed mit viel Aufwand gerade noch so eben aufrecht zu erhalten vermag. In Wirklichkeit stehen ihr keine anderen Optionen mehr zur Verfügung. Da bläht sich zum einen ihre Bilanz immer weiter auf, zum anderen setzt sich allmählich die Meinung als herrschend durch, dass die Medizin der Fed schädlicher sei als die Krankheit, die damit bekämpft werden soll, weil sie dazu führe, dass die notwendige Konfrontation mit der Wirklichkeit und das unvermeidliche Platzen der bereits erwähnten Blasen immer weiter hinausgeschoben werde. Von dem Druck, den China und andere Länder sicherlich ausüben, wollen wir hier noch nicht einmal schreiben. Vor allen Dingen bleibt wichtigstes Ziel der Fed die Bewahrung der internationalen Leitfunktion des Dollars. Die ist lebensnotwendig für die US- Wirtschaft, die durch eine Verdrängung des Dollars als Weltleitwährung schwer getroffen würde. Dafür muss aber der Dollar seinen Wert behalten und dafür muss es für Anlieger wieder reizvoller werden, in US- Staatsanleihen zu investieren. Es ist daher bemerkenswert, dass - trotz der Gerüchte vom tapering, die im September hochkochten (6), was bedeuten würde, dass jeden Monat weniger Dollar neu auf die Märkte geworfen würden, - trotz der Zeichen für einen Krieg gegen Syrien, was traditionell zu einer Flucht in den Dollar geführt hätte, der Dollar gegenüber dem Euro nicht an Wert zulegen konnte. Das zeigt, dass der Dollar wirklich gestützt werden muss, um nicht massiv abzustürzen, was entsprechend verheerende Konsequenzen für die USA zeitigen würde. Wir werden uns noch detaillierter zum Ausbleiben der üblichen „Flucht in den sicheren Hafen" äußern, die eigentlich aufgrund des Schlagens der Kriegstrommeln gegen Syrien hätte einsetzen müssen. Das ist nichts weniger als ein Zeichen dafür, dass sich die Einstellung gegenüber den USA ändert. Das lässt für das Land nichts Gutes vorausahnen. Dieser Kontrollverlust über die Zinsen ist der zweite Funken, nicht weit vom Pulverfass, ein riesiger Funken ist es sogar, eigentlich schon eher ein Feuerwerk. DAS NÄCHSTE ZYPERN WIRD AMERIKANISCH SEIN Aber nicht nur die US- Staatsanleihen verlieren massiv an Wert. Nach der Pleite Detroits ist auch der Markt für Munis, also der Anleihen von Städten, Gemeinden und Kreisen, in den USA unter massiven Druck geraten7, wie man am folgenden Schaubild ablesen kann. Für viele amerikanische Städte ist dies eine sehr gefährliche Situation, die in den nächsten Monaten unweigerlich zu weiteren schockierenden Städteinsolvenzen führen wird. Wenn man die kommunalen und föderalen Schulden getrennt aufführt, sieht die Statistik sicherlich besser aus, aber die Risiken verdoppeln sich.  Auf der Liste künftigen Opfer der Finanzmärkte steht Puerto Rico ganz weit oben, das bereits horrende Zinsen bezahlen muss8. Die Lage weist große Ähnlichkeiten mit den Ereignissen in Zypern auf, mit lediglich dem Unterschied, dass Puerto Rico von der Bevölkerungszahl drei Mal so groß ist; und dass es nicht zu Europa gehört, sondern zu den USA. Wir wetten aber einiges darauf, dass diese Insel – ganz anders als Zypern – als unbedeutend, als nicht systemrelevant eingestuft werden wird. -------- Noten: (1) Quelle: ABC 7 News, 07/09/2013. (2) Quellen: Fox News (27/07/2013), CNN Money (06/09/2013), Huffington Post (10/09/2013). (3) Vgl. z.B. Fiscal Times (10/09/2013) über die Folgen einer Nichteinigung zur Anhebung der Schuldengrenze. (4) Vgl. z.B. New York Times (05/09/2013) über die Reduzierung der Leistungen aus dem Lebensmittelmarkenprogramm, das von immer mehr Menschen in Anspruch genommen wird. (5) Wobei wir uns bei dieser Anmerkung allein auf die inneramerikanischen Folgen beschränken, die ja auch die einzigen sind, die in den Augen der Amerikaner von Bedeutung sind, trotz der weiterhin noch weltweit dominierenden Rolle des Dollars, was ja eine Verpflichtung für die US- Regierung mit sich bringen sollte, internationale Verantwortung zu übernehmen. Dazu ist es aber 40 Jahre lang nicht gekommen, und das wird auch nun nicht anders sein, wo eine schwere Krise wütet, die das Überleben des Landes gefährdet. (6) Quelle: CNBC, 28/09/2013. (7) Vgl. z.B. The Future Tense, 29/07/2013. (8) Quelle: Wall Street Journal, (09/09/2013). |

| Poland Latest To Seek Repatriation of Its Gold Posted: 16 Sep 2013 01:07 PM PDT Germany, Ecuador, Mexico, Switzerland. Now Poland, if a petition movement is successful, will repatriate its gold bullion reserves, currently held in the vaults of the Bank of England. The group, Oddajcie Nasze Zloto (Give Our Gold Back), seeks the return of Polish gold from the Bank of England to ensure its "safety" and the economic security of Poland. Supported by organizations such as the Mises Institute of Poland, the Business Center Club, the Mint of Wroclaw, and others, the movement has attracted the attention of the Polish parliament. In response, the parliament has asked the president of the Polish central bank to ascertain the status of the gold and conduct an audit of gold assets in England. The group's Polish-language website is http://oddajcienaszezloto.pl. |

| Five valuable lessons from a true resource "titan" Posted: 16 Sep 2013 01:00 PM PDT From Casey Research: A natural-resource insider asking who Lukas Lundin is would be like a Brit asking who the current queen of England is. You just know. Fact is, there is no stronger figure in the resource sector than Lukas, who heads the Lundin Group of Companies founded in 1971 by the late Adolf Lundin, Lukas's father and a veritable legend in the sector. Their website states, "With a mandate to maximize shareholder value, the Lundins have produced consistent, long-term results and have earned unprecedented loyalty among their shareholders." This is no exaggeration – and I believe it's one of the reasons why for three decades the Lundins have reigned supreme in the resource market. In 2011, for example, they sold Red Back Mining for C$7.1 billion to Kinross Gold, and in 2012, Lundin company Africa Oil made a world-class oil discovery in Kenya, handing shareholders a ten-bagger (meaning a profit of 1,000% or more). All in all, the Lundin Group, consisting of 15 companies, has raised over $3 billion in financing to advance its projects. Lundin companies operate in more than 30 different countries, and joint venture partners have included some of the largest companies in the world, such as Gulf Oil, Barrick Gold, BHP Billiton, and Freeport McMoRan. I feel privileged to have been able to spend a lot of time with Lukas Lundin over the years, not just in my role as Casey's chief energy investment strategist and as a full-time investor, but also because I happen to live next door to him. Being a great admirer of successful entrepreneurs, I've recently pondered what it is that separates Lukas from the thousands of wannabe resource titans. Here are the five valuable lessons I learned, lessons that I think any businessman should take to heart... More on resources: |

| Controversial charts say gold could be headed to new lows Posted: 16 Sep 2013 01:00 PM PDT From Gold Scents: As I mentioned in my last post there is a disturbing possibility that gold's intermediate cycle has topped, and done so in a left translated manner. For clarification, left translated cycles often lead to lower lows. In this case, if gold did top on week 9 and the intermediate cycle is now in decline, the odds are high we are going to see the June low of $1179 tested and broken before... More on gold: |

| Posted: 16 Sep 2013 01:00 PM PDT Larry Summers is out…and the markets act like it matters. He sent a short letter to President Obama withdrawing his name from consideration as the replacement for Ben Bernanke. The letter was short, sweet, maybe to the point and maybe not. Summers pointed out that his confirmation would be “acrimonious” which is an understatement to say the least. Could it be that Larry Summers fought through the “delusions of grandeur” and decided that was going down in the history books as the Captain of the Titanic financial system was not such a great idea? The markets have reacted in schizophrenic if not delusional manner. Stocks are up very strong as they anticipate another candidate willing to write higher dose prescriptions of liquidity. Bonds are also up (yields down) in anticipation of slower, lesser or even no “taper.” These 2 markets however are trading in opposite fashion from commodities which are the true beneficiaries of excess liquidity sloshing around. Oil is down better than 1%. This really doesn’t make any sense as oil demand (both real and on paper) should rise if a “Fed Dove” at the helm keeps pushing money and credit. Gold and silver are both down…and both up from Friday. Up from the COMEX close and down from the “cash” close after the Andrew Maguire rally. This stinks to high heaven. The trading action has been that QE (which used to be very bullish) is bearish for the metals (why or how I do not know) and tapering is also bearish. This “portrayal” is bogus and I guess we must wait until supply is gone and the physical markets steam rolls the paper markets as the price mechanism. In any case, Summers, Yellen, Kohn, Geithner or even (no chance) Volcker…it doesn’t matter. The dollar system is entirely a lost cause. No one or no policy can ever “right” the position we find ourselves in. Print, don’t print, QE, don’t QE, raise taxes or lower taxes, cut spending or spend like drunken sailors…it’s over…it’s mathematically over. “New money” is no longer entering the U.S. Treasury market; in fact, old money is exiting the market which leaves ONLY the Fed as buyer of last and ONLY resort. The “market” itself is not “making” interest rates, the Fed is. In the old days the Fed would “influence” short term rates and let the markets fend for themselves and “discover” where rates should be in the 1 yr. and longer maturities, this is no longer so. The Fed has been “making interest rates up” like a bad liar for the last 5 yrs., we know that central planning does not work because we have seen so many failed examples in so many different countries since the beginning of recorded time…and this IS central planning. Since 2008 the “liquidity dump” administered by the Fed has only done one thing, the banks have not failed “publicly.” The “too big to fail” banks have been allowed to mark assets/derivatives to whatever fantasy prices of their choosing which has allowed them to “live.” The liquidity dump and record deficits have not turned the economy up, we are only bottom bouncing. The record low interest rates, record deficits and literally unlimited liquidity stopped the economy from falling any further but have not turned Main Street into one of growing commerce. My point is this, by all rights and history with all of the policy “stimulation” we should have a rip roaring economy 5 years later…we don’t…and we won’t. I guess the analogy boils down to “who cares who is driving the bus if the motor is overheating, it’s leaking oil and water and sparks are flying from the rims?” Does it matter who the chairman of the Federal Reserve is? No. Alan Greenspan was the last chairman who mattered because sometime in the late 1980′s or early 90′s was the last time, last chance…to change or alter policy and take our medicine and accept a full-fledged recession to cleanse the system. Greenspan never did this, Bernanke couldn’t do this and surely his successor has no chance of ever allowing money growth or credit creation to slow down much less turn negative. Like I said, “it doesn’t matter” because this Ponzi scheme is going to hit the wall as sure as the Sun will rise tomorrow. Does one policy cause it to happen tomorrow while another postpones it for another 6 months? Yes, maybe but the further down the road we go the worse it will be when this thing busts. We have more debt, more derivatives and more “players” (which now include many sovereign governments) involved in this bubble than we did 5 years ago. It would have been bad, really bad if we cleansed debt via recession in 2000-2002, it would have been catastrophic in 2008-09. Now? I do not know any words to describe what we face. Whoever is chosen as the next bus driver for the Fed will go down in the history books as the one who was driving when we hit the wall. It matters not who it is; I can only wonder “who in their right mind” would accept the job? If they don’t understand the futility then shame on them, if they take the job because of the “prestige”…well, like I said, “no one in their right mind would even consider taking the job”… That is if they are smart enough to know.Similar Posts: |

| Gold and silver price manipulation ends with the death of fiat Posted: 16 Sep 2013 12:33 PM PDT The silver and gold market has been rife with speculation about ongoing price manipulation. Most investors are now familiar with this concept, and even the mainstream has admitted that undue market influence has occurred. |

| Gold falls on prospects of US Fed tapering Posted: 16 Sep 2013 12:11 PM PDT Despite gold's falling price in face of tapering, Julian Phillips counters that he sees gold rising even with US growth. |

| The CFTC and the sad joke of "Regulation" Posted: 16 Sep 2013 12:05 PM PDT If the allegations are true, there are millions of victims of this ongoing fraud. Any person whose retirement account includes an index fund owning gold or silver mining companies has been defrauded as a result of these actions. Any investor who owns gold or silver has been defrauded by these actions. Any person who, in desperate times, has had to sell gold or silver at a "cash for gold" shop has been defrauded by these actions. What is the CFTC going to do about it? We all know the answer to that question. More importantly, what are YOU going to do about it? |

| Confessions of a former gold bear Posted: 16 Sep 2013 11:48 AM PDT BullionVault's Miguel Perez-Santalla reflects on gold's rise following the collapse of Lehman Brothers and the beginning of QE five years ago. |

| Jim Rickards on a Return to a Gold Standard: “The Dollar is Definitely Collapsing” Posted: 16 Sep 2013 11:30 AM PDT

In this MUST WATCH interview, Currency Wars author Jim Rickards states that the dollar standard is being abandoned by the United States, that it is “definitely collapsing”, and that either the IMF’s SDR, gold, or a combination of the two will become the next global reserve currency in the dollar’s place: “A return to a [...] The post Jim Rickards on a Return to a Gold Standard: “The Dollar is Definitely Collapsing” appeared first on Silver Doctors. |

| Posted: 16 Sep 2013 11:30 AM PDT On yet another day of Fed failure to meaningfully prop up the deteriorating Treasury market – while PIIGS sovereign bonds were "slaughtered into the close" – something incredible occurred, which even I am still in disbelief about. And that something was – drum roll please – an actual sharp increase in PM prices late on a Friday afternoon. Some might say it was due to "short covering"; extreme undervaluation; fears of a weekend turn of events in Syria; the PM-bullish COT report, released at 3:30 PM EST; or even reduced expectations of Fed tapering (personally, I expect no more than a "token taper," if anything at all, which may well BACKFIRE on the Fed's best laid plans). However, such events have occurred on countless Friday's before; yet, NEVER are prices allowed to overcome the Cartel's rote capping algorithms; particularly before weekends – when bullish Friday closes can prompt market participants to "do their homework" while perusing their Sunday New York Times, Barron's, or the like. In other words, the ANSWER to the question of why gold and silver surged late in the day is because a new BOMBSHELL was published at 2:00 PM EST by King World News – regarding new evidence that JP Morgan has indeed been manipulating the gold and silver market for years…

Suffice to say, this will be my dedicated topic tomorrow; but for now, know that Andrew McGuire's revelation that two other JP Morgan whistleblowers submitted detailed evidence of PAPER PM manipulation 15 months ago, but were completely ignored by the CFTC, may well catalyze a run on PHYSICAL metal equivalent to what occurred after the initial McGuire disclosures in March 2010; and thus, just one day after JP Morgan announced it will be spending an additional $4 billion to deal with its exploding legal and regulatory costs! Better yet, enigmatic CFTC Commissioner Bart Chilton; who to this day has been "all bark, no bite," violently lambasted JP Morgan and Goldman Sachs – in particular – in a seething speech titled the Brutality of Reality; stating that not only are PAPER PMs – and many other "paper commodities" – manipulated by banks, but that "it’s time for an intervention. Congress should not only do away with the statutory exemption that has been used by Goldman and Morgan, but also do away with the ability of the Fed to allow any commodity-related ownership by the banks whatsoever.” And “for those paying attention, there will likely be more cases filed by the CFTC in the next few weeks than we’ve seen in a long time. Stay tuned." Perhaps Zero Hedge is just starting to get wind of the daily PAPER manipulation of markets I have been writing of for years, but better late than never. Anas for the world's BIG MONEY, trust me it is already well aware of what's going on. When the PM suppression is finally understood by the "medium money" – and inevitably, the investment community at large – not only will PHYSICAL PM prices be many multiples of the current levels, but supply will be GONE, GONE, GOODBYE. In other words, not only will prices be too high for the average person to afford – and that goes for silver as well – but there will be NONE to purchase at any price. Stay tuned for tomorrow's article on this VERY important development; and get ready for some near-term squirming by TPTB. First, from "Helicopter Ben" after Wednesday's FOMC meeting; and next, Jamie Dimon and company when the silver scandal starts expanding. By the way, I still have little confidence that CFTC will go after JP Morgan specifically this month; however, widespread dissemination of the aforementioned revelations may well prove to be a veritable "Ebola Virus" to those attempting to illegally suppress PM prices. And oh yeah, whether JP Morgan and Goldman Sachs are ensnared in this deadly web or not, don't' forget they have spent 2013 going MASSIVELY LONG the gold market!Similar Posts: |

| Confessions of a former gold bear Posted: 16 Sep 2013 11:10 AM PDT Last Sunday, Sept. 15, marked the five-year anniversary of the collapse of Lehman Brothers. At that time the gold price was trading near the $900 per ounce level. I believed that to be on the high side, actually expecting gold to trade down to around $700. |

| Gold sees damaged weekly charts Posted: 16 Sep 2013 10:57 AM PDT There is a disturbing possibility that gold's intermediate cycle has topped, and done so in a left translated manner. For clarification, left translated cycles often lead to lower lows. |

| Summers' Fed exit fails to spur precious metals as fundamentals return Posted: 16 Sep 2013 10:50 AM PDT The price of gold fell hard Monday morning, retreating near Friday's five-week lows after earlier spiking to $1,336 per ounce in Asian hours despite wholesale dealers reporting lacklustre trade. |

| War Is Coming: 10 Reasons Why A Diplomatic Solution To The Syria Crisis Is Extremely Unlikely Posted: 16 Sep 2013 10:30 AM PDT

Over the past few days, there has been a tremendous wave of optimism that it may be possible for war with Syria to be averted. Unfortunately, it appears that a diplomatic solution to the crisis in Syria is extremely unlikely. The following are ten reasons why war is almost certainly coming… 2013 Gold Eagles As [...] The post War Is Coming: 10 Reasons Why A Diplomatic Solution To The Syria Crisis Is Extremely Unlikely appeared first on Silver Doctors. |

| Does the moon control gold and silver prices? Posted: 16 Sep 2013 10:27 AM PDT With all this talk of war and tapering, it might be time to step back and look more at forces outside of human control and their impact on precious metal prices. Is it so unusual to ask if something older than mankind might be affecting how we price these metals? |

| Chart of the Day: Where Has All the Gold Gone? Posted: 16 Sep 2013 10:24 AM PDT |

| Gold up in Asia after Summers exits Fed race Posted: 16 Sep 2013 10:11 AM PDT Gold and silver futures surged 2.1% and 3.6% respectively and the dollar fell on the open in Asia prior to determined selling which again capped precious metal prices. Analysts attributed the price gains on the withdrawal of Larry Summers from the Fed chairman race. |

| JPMorgan in the Manipulation Of The Gold And Silver Posted: 16 Sep 2013 10:00 AM PDT I'm not writing today but I dug up a few short and interesting articles for you to read. Be sure and watch the following two short videos below. Up first is an interview with Charles Nenner in Jim Sinclair's section below. They explain why they are so bullish on gold and silver and so bearish on the stock market. These folks have been very accurate in the past on their gold calls. Also, be sure and watch the Egon von Greyerz video in the GATA section. There is a discussion of Andrew Maguire's stunning revelation that two whistleblowers, former employees of JPMorgan, have come forward implicating JPMorgan in the manipulation of the gold and silver markets. If proven true, this is explosive! Read the following below from Ted Butler, who has been writing about the JPMorgan (illegal but so far allowed) corner of the gold and silver market. If you want to know what is going on with silver, subscribe to Butler Research.

I also grabbed of few of the highlights from Zero Hedge (The Best And Worst Performing Assets Since Lehman Are…) Bix Weir (Bart Chilton Speaks to Congress) and Richard Russell (I Suspect That Silver Is Readying Itself For a Push To The Upside). Couple this information with the regular articles from Bill Holter and Andy Hoffman, in today's newsletter, and your time will be well spent.

Below is the article from GATA: Egon von Greyerz: Today’s report of confession of JPM’s rigging moved gold Submitted by cpowell on Sat, 2013-09-14 00:36 Dear Friend of GATA and Gold: Gold fund manager Egon von Greyerz, writing tonight for King World News, finds terribly significant and even market-moving today’s KWN interview with London metals trader Andrew Maguire about two JPMorgan Chase employees who have disclosed the bank’s metals market rigging to the U.S. Commodity Futures Trading Commission: CHRIS POWELL, Secretary/Treasurer Gold Anti-Trust Action Committee Inc. Similar Posts: |

| Gold trims gains but still up after Summers news Posted: 16 Sep 2013 09:20 AM PDT SAN FRANCISCO (MarketWatch) — Gold futures gained ground Monday but were off the day's high hit on news that former Treasury Secretary Larry Summers had withdrawn from consideration for the job of Federal Reserve chairman. Gold for December delivery rose $8.70, or 0.7%, to $1,317.30 an ounce on the Comex division of the New York Mercantile Exchange, erasing some of its 1.7% loss from Friday. The contract had been trading around$1,330 in the early morning hours on Monday. "It was an interesting move overnight, but it just didn't really seem to have much staying power," said Darin Newsom, senior analyst at DTN, a commodity-market research company. He described gold's initial jump as "a knee-jerk reaction" to the Summers news, adding that traders are now focused on "the next round of headlines." Summers was widely viewed as more hawkish than other leading candidates to run the Fed, meaning he was seen as more likely to push for a speedier end to the central bank's easy-money policies. Those policies have supported gold and pressured the dollar. "The market now sees continuity for the Fed as a groundswell of support for [Fed Vice Chair] Janet Yellen to take the helm is likely," said Gene Arensberg, editor of the Got Gold Report. "We have to wonder, however, if Summers's decision is a signal that the smartest man in the room sees too much trouble ahead and that is why he chose to stand down," said Arensberg. (Continued...) Please see the entire article at the source: MarketWatch http://www.marketwatch.com/story/gold-gains-sharply-as-dollar-drops-on-summers-news-2013-09-16?link=MW_home_latest_news By Myra P. Saefong and Victor Reklaitis, MarketWatch |

| Chart of the Day: Where Has All the Gold Gone? Posted: 16 Sep 2013 09:00 AM PDT

Today’s MUST SEE Chart of the Day examines COMEX warehouse registered gold inventories vanishing act, as registered gold has plunged from 3.5 million ounces in 2012 to 663,002 today! 2013 Gold Eagles As Low As $52.99 Over Spot at SDBullion! 1 Oz Gold Krugerrands As Low As $34.99 Over Spot at SDBullion! The post Chart of the Day: Where Has All the Gold Gone? appeared first on Silver Doctors. |

| Posted: 16 Sep 2013 09:00 AM PDT I have long been a devoted "Trekkie"; not so much regarding the original series – although I have a great deal of respect for it – but two of the four television "sequels." I could never get in to Deep Space Nine or the lesser known, and newest of the four – Enterprise. However, I rank The Next Generation and Voyager as two of the best written, acted, and produced shows I have ever watched; and to this day, watch reruns despite having seen each episode multiple times. And that's a LOT of episodes, as "TNG" filmed 176, and Voyager 168! Regarding the latter, I always thought its name was simply made up to reflect the show's theme; i.e., a voyage to space's outer reaches. However, given the typical brilliance of Star Trek writers, I should have known better; and only today did I realize the title's genesis. Sure, I should have remembered the NASA satellite Voyager I being launched in 1977; and certainly when it flew by Jupiter, Saturn, Uranus, and Neptune in 1979, 1980, 1986, and 1989, respectively. It never met up with Pluto, but remember that at the time, Pluto was NOT the most distant planet (heck, it's not even categorized as a planet anymore). Anyhow, Pluto's orbit crosses with Neptune's for 20 out of every 248 years – and in the 1990s when Voyager I was in the vicinity, such was the case. And thus, demonstrating just how vast the galaxy is; it took Voyager 24 years from passing Neptune to reaching the edge of the Milky Way itself; i.e., "interstellar space." And thus, eleven billion miles from its launch point, it has truly gone boldly "where no man has gone before." Why do I bring this up, you ask? Because essentially ALL reasons has left the cancer-stricken global economy; replaced by the PROPAGANDA supporting financial markets underpinned solely by MONEY PRINTING and MANIPULATION. In other words, ALL I learned in earning my Finance degree and CFA designation – not to mention, 24 years of Wall Street experience – is now moot; i.e., as "out of this world" as the death throes of a 42-year made fiat currency experiment. At the moment, "news" no longer matters; and frankly, neither does the Fed's "tapering" decision next week. Even MSM lackey Reuters can't figure out what the heck the FOMC is doing; i.e., discussing (miniscule) reductions in bond monetization amidst an environment of surging yields, weak economic data, and an unemployment rate not only well above the Fed's stated 6.5% 'tapering threshold,' but grotesquely overstated due to the plunging Labor Participation rate and other structural weaknesses. Not to mention, the gaping disconnect between surging "waiters and bartenders" jobs and plunging restaurant sales; which in my view, is due to the explosion of part-time hiring as businesses reduce full-time, benefits-eligible employees ahead of Obamacare's full implementation. And how about this morning's "trifecta of doom"; as retail sales were dramatically below expectations – just three days from Wednesday's FOMC meeting; annualized inflation was nearly 4% above expectations; and the Consumer Sentiment plunge was the worst on record? And the result, of course: higher stock and Treasury prices – and continuing capping of Precious Metals following an already ridiculous two-week smack-down! Yes, logic has left the universe – at least from a reporting standpoint. However, "Economic Mother Nature" is still here; and given that PHYSICAL gold and silver demand are experiencing historic demand – whilst production is already freefalling – you can "bank on" fundamentals eventually winning the day; just as they ALWAYS do! As for today's topic, I'm not even close to done. Yes, logic has "left the building"; but that alone is not worthy of a dedicated article. What is, however, is the giant sucking sound from the East becoming more audible with each passing day; i.e., the MASSIVE flow of gold from the Western Hemisphere to the East. Whether legally – via Chinese imports, for example; or illegally, amidst exploding Indian smuggling; the gold is making Western vaults look like sieves – en route to its new, PERMANENT homes in the East. The Chinese demand numbers are simply "otherworldly"; as combining imports from Hong Kong and estimated domestic production – ALL of which is purchased by the government – China is purchasing up to 80% of ALL global production. And those numbers, of course, ignore the fact that gold entering the country in cities other than Hong Kong are not even reported. In India, the recent import tariffs and restrictions have catalyzed record smuggling, while the Shanghai Exchange has seen a literal explosion in physical deliveries. Keep in mind, the below chart only contains 2013 data through July; and thus, it is entirely possible Chinese imports will end up more than double the 2012 level. Now do you understand why the TPTB work so hard to suppress the PAPER PM market; and more importantly, why they're doomed to fail?

Equally incredible is the route such exports are taking; as per the above "sucking sound" article, and this one from Mike Krieger, the amount of gold exports from London to Switzerland is at least ten times faster than in 2012 – as you might expect, at RECORD levels. This gold is undoubtedly being sent to Swiss refiners – which cumulatively, process roughly 70% of the world's doer into bars and coins. And given that roughly 80% of global gold production is being exported to (or kept within) China, clearly the refiners are being asked to recast 400 ounce "London Good Delivery" bars into denominations more commonly used in Asia. I reported on such MASSIVE Chinese retail demand when I traveled to Guangzhou last month; and trust me, it's for REAL! Reliable LBMA inventory data is difficult to find, but COMEX "registered" gold could literally disappear any day now; per the alarming chart below, depicting a 77% plunge since the April 12th-15th "ALTERNATIVE CURRENCIES DESTRUCTION; not to mention, the 32% YTD decline in the GLD ETF's inventory – assuming it even exists – compared to just a 20% price decline…

Perhaps the space comparison is a bit hokey; but the fact remains that the aforementioned trends – of soaring gold demand, exploding Eastern imports, hemorrhaging Western inventories, and of course, the West's "temporary insanity" as regards its analysis of such – are dramatically strengthening each day. At the current rate, COMEX registered inventories will be gone by early next year; whilst GLD's remaining credibility of is on the verge of disappearing, now that it is denying holders their contractual right to redeem shares for PHYSICAL bullion. If you believe "Economic Mother Nature" can be defeated by the forces of MONEY PRINTING, MARKET MANIPULATION, and PROPAGANDA, you're welcome to "press your luck" with the diseased PAPER money system – despite the gaping, expanding leaks it's experiencing each day. But I must warn you, she has never lost to such petty, short-range weapons; and given how much self-inflicted damage they have already incurred, the odds of losing her undefeated status are "slim to none." I'll continue to sleep the "SLEEP OF THE JUST" knowing my assets are protected with REAL MONEY. Will you?Similar Posts: |

| What the Orgy of “Lehman Five Years On” Stories Missed Posted: 16 Sep 2013 08:34 AM PDT One of the reasons I haven’t weighed in with the obligatory Lehman five year anniversary piece is that so many of them are variations on a limited range of themes, to wit:

Mind you, we’ve been getting a steady diet of these types of stories for years, so a concentrated dose, particularly for someone like yours truly, who was pretty attentive to the events in real time and all the flailing around to deal with the upheaval and engage in reregulation theater, is cloying. And aside from all this rehash feeling more like an overdose of tired tropes than new insight, the focus on what has come to be known as Lehman weekend is also the most bankster-flattering frame for viewing the crisis. Making Lehman the critical episode averts attention the fact that the perturbations began more than a full year earlier, when the asset-backed commercial paper market seized up, and went through two additional acute phases, each requiring more radical interventions before the turmoil of September-October 2008. It also puts the spotlight on the collapse of Lehman itself, the loss of the next domino, AIG, and the political and market mayhem of the next few weeks to prevent further wreckage. If I were a propagandist, I’d want the public to equate the crisis with the Lehman implosion. The Lehman death spiral is strongly identified with the Andrew Ross Sorkin “great men struggling to save the world economy” version of events, as well as the “could/should Lehman have been saved?” debate. It also takes attention away from the bigger questions of how much the crisis really cost, and how the Obama Administration and the Fed continued to subsidize the banks even while pretending that the crisis was past and everything was fine (ZIRP and QE, which are taxes on savers and retirees, the continuing foreclosure/mortgage mess, which was acknowledged in Geithner’s infamous “foaming the runway” comment to be all about sacrificing homeowners for the benefit of bank balance sheets). Perhaps the ugliest part of this picture is that the officialdom believes its own PR, that a zombified economy with broadly-measured unemployment in the mid-teens and years of a desperately difficult job market for young adults is a good outcome and they can rest on their laurels. This year, the Lehman meltdown anniversary has brought out some new variants on old post-crisis themes. The add-on to the “Great Men Who Saved Us From the Meltdown” account is to contend that their efforts were successful when viewed over a longer time frame. An example is New York Magazine’s Yes, Wall Street Has Changed Since Lehman Went Bust. Let’s look at one of its arguments:

Huh? This obtusely misses the issue. Who gets hurt by this litigation? Not the responsible parties, the bank executives and producers, but bank shareholders. In addition, the legal costs he cites are all legal costs since the crisis, not all legal costs that resulted from the crisis. Recall that Josh Rosner developed a rap sheet as long as an arm for JP Morgan. Here is his list of of the matters underlying this $8.5 billion of regulatory settlements:

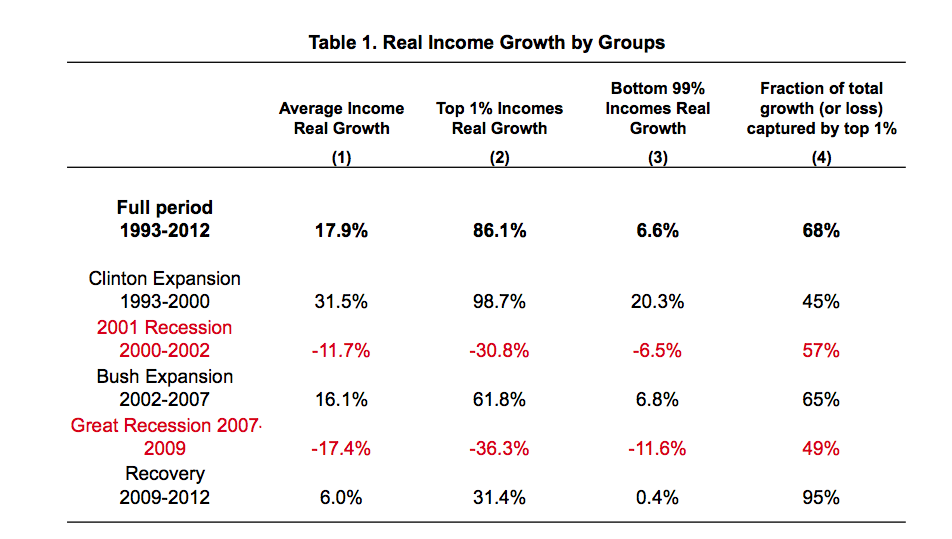

Mind you, most of the ones that resulted in large dollar amounts likely resulted from the filing of litigation. Also note this list and thus the $8.5 billion total excludes payouts made by JP Morgan resulting from private lawsuits, like the $50 million awarded to billionaire Len Blavatnik because the bank lost $100 million of his money as a result of violated its guidelines for investing funds in a low-risk cash management vehicle. Finally, that total is the amount of regulatory settlements only and does not include JP Morgan’s legal costs. Now admittedly JP Morgan has the most extreme skew of all the major banks in terms of how much bad conduct it has engaged in outside the mortgage arena. Nevertheless, you get the picture that calling all the legal costs that banks have incurred since the crisis as crisis-related is just plain misleading. Finally, in many (likely nearly all) cases, the damages would be tax deductible, and third-party legal expenses certainly would be. So comparing these largely pre-tax charges to after-tax dividends is yet another bit of misdirection. Let’s now turn to the stories you should be reading but from what I can tell, aren’t: The Media and Pundits Are Wrong When They Call the Crisis a “Housing Crisis”. Repeat after me: it wasn’t a “housing crisis.” A “housing crisis” would still have been ugly, but it would not have produced a meteor-hitting-the-planet level of disruption to the markets. Look, subprime was a $1.3 trillion market. Losses were roughly 40%. That crisis would have produced a really serious recession, but not a financial system near- death experience.* This was an “wildly interconnected and undercapitalized big financial firms got high on CDOs and other leveraged bets on housing and killed themselves and got turned into zombies” crisis. CDOs and credit default swaps allowed banks, monolines, and AIG to wind up with exposures way way in excess of the real economy value of subprime lending. How Gillian Tett Ran Rings Around All the Financial Regulators in the Runup to the Crisis. There’s been some effort in recent years to single out economists like William White, Claudio Borio, and Steven Keen, who warned that the bubbles underway were likely to end badly. But the commentators warned about the uniquely destructive feature of this crisis, the amplification of real economy exposures, haven’t gotten the kudos they deserve. The Financial Times’ Tett and an astonishing analyst named Henry Maxey were among the few that wrote about how the leverage-on-leverage created by CDOs prior to the crisis and their potential explosive impact. The regulator that was closest to having a good real time reading (as in had many of the critical details and risks right but didn’t appreciate the key mechanisms till later) was the Bank of England in its terrific semi-annual Financial Stability Reports. Tett has been indirectly acknowledged with her star turns (the most notable in Charles Ferguson’s Oscar-award-winning Inside Job) but more formal recognition of the significance of her pre-crisis work is way past due. Simon Johnson Was Right, Dammmit, and the Looting Continues. While many of the accounts of the last few days discuss regulatory reform and generally conclude not enough was done, few will take that sorry fact to its logical conclusion, namely, that the financial services industry is still predatory and parasitic. Simon Johnson, in May 2009, described the crisis as a “quiet coup” that cemented the control of financial oligarchs. The resolution of the crisis has left them even more deeply entrenched. Not only did they come out richer from the “blow up the economy for fun and profit” exercise (Wall Street bonuses in 2009 and 2010 were higher than record 2007 levels), but the rescues also placated the monied classes by goosing asset values and accelerating the redistribution of income away from ordinary people to the 0.1% and their bag-carriers. Edward Saez, who with his regular co-author Thomas Piketty is generally recognized as the most authoritative expert on income and wealth inequality in the US, just released his latest update last week. It’s clear who benefitted from how the crisis was resolved: Big Finance Could Have Been Reformed and Obama is the Reason it Wasn’t. The resigned “the banks were too powerful” meme is convenient and completely untrue. We wrote in 2010:

Now that we’ve had more commentary from insiders like Sheila Bair and Neil Barofsky, it’s clear that Obama, who whipped for the TARP and has finance Machiavel Bob Rubin as one of his major sponsors, was never going to do anything that might inconvenience Big Finance. One of the most important measures to rein in banks would have been to restructure Citigroup, to demonstrate that persistently reckless institutions (Citi nearly failed in the early 1990s and had gotten in deep doo-doo in the Latin American lending crisis of the late 1970s) would be cut down to a less dangerous size. But that would never happen with Rubin as a Citi board member. Had Obama been serious about banking reform, it would have been possible to get the other major actors on the same page. The Bank of England has been keen to fix banks; Mervyn King and Andrew Haldane, along with Adair Turner at the FSA, have been fierce critics (you’ve heard nothing remotely comparable from US regulators) and fought to get a version of Glass Steagall implemented. Had the US been leashing and collaring its financial firms, the Bank of England and FSA would have has more success in beating back opposition from the UK Treasury, which has been a stalwart bank defender. And the ECB? Remember how it needed US dollar swap lines in a pinch to save its financial institutions? The ECB might have grumbled a lot, but with the top regulators in the two major financial centers taking a tough stance, it would have fallen in line. But this section of ECONNED, published in early 2010, not only recaps the crisis but anticipates where we are now. And it’s disappointing to see that there really is not much to add:

The reason that so many words continue to be spilled on the crisis with so little fresh insight is that most pundits are unwilling to describe the degree to which it enabled the bankers to cement their control, and how much that sorry fact is costing the rest of us. _____ |

| 90% Silver Sale! Any QTY Only $1.49 Over Spot! Posted: 16 Sep 2013 08:16 AM PDT