Gold World News Flash |

- Terrible Technicals

- Owning Mining Shares Is Not the Same as Having a Position in Physical Gold and Silver

- MUST READ: Gold, Einstein And The Great Fed Robbery

- The Path to $10,000 an Ounce Gold, Revisited

- 6 Things To Ponder This Weekend

- A Funny Thing Happened In 2008

- GATA secretary interviewed by King World News on Fed's retreat

- The Gold Index Game

- Silver and Gold Prices Ended the Week Higher — Gold Price Closed at $1,332.50

- Silver and Gold Prices Ended the Week Higher — Gold Price Closed at $1,332.50

- This Week Was A Disaster And It Will Lead To More Tyranny

- Gold, Einstein And The Great Fed Robbery

- Dan Norcini About Today’s Gold & Silver Price Drop

- What?s the Indian Gov?t doing to Gold?

- Ted Butler: JP Morgan Holds 2 Corners In The Gold And Silver Market

- Australian bankers frosted by Fed, want their own dollar lower

- Von Greyerz, Barron expect increase in QE, not 'tapering'

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Near Unchanged on the Week

- Gold Daily and Silver Weekly Charts - Triple Witching Hit on GLD and SLV, COMEX Next Week

- Gold Daily and Silver Weekly Charts - Triple Witching Hit on GLD and SLV, COMEX Next Week

- An Economic Collapse Of Biblical Proportions Is Coming. By Gregory Mannarino

- In The News Today

- Man Who Predicted No Fed Tapering Now Says To Expect Chaos

- COT Gold, Silver and US Dollar Index Report - September 20, 2013

- India to resume gold imports but rules mean no rush

- Terrible Technicals

- Gold Backed Money: The Choice of a Free Society

- E-Alchemy with the US Fed

- Special Offer: BU Denmark 20 Kroner & MS64 U.S. $20 Liberty Gold Coins

- All markets now depend on endless QE, Roberts tells KWN

- The Fed's Incredibly Reckless E-Money Printing

- The Fed's Incredibly Reckless E-Money Printing

- The Fed's Incredibly Reckless E-Money Printing

- Special Offer: BU Denmark 20 Kroner & MS64 $20 Liberty Gold Coins

- Fed Unleashes Gold

- 11.6 Billion and Counting: Voyager 1 Makes Interstellar History

- The Daily Market Report

- Market rigging whistleblower Ted Butler interviewed by Sprott Money News

- Former US Treasury Official - Terrifying US Collapse Ahead

- Forex Weekly Report 23-29 September, 2013

- Fed Unleashes Gold

- Fed Decision to Delay QE Tapering Unleashes Gold

- Gold and Silver and Being Long Gamma

- Gold and Silver Prices — Mapping Short Term Volatility

- India's Gold Bullion Imports to Restart "Immediately"

- India's Gold Bullion Imports to Restart "Immediately"

- Ron Paul Warns Prepare for the Destruction of the U.S. Dollar

- Ben Bernanke Is Just Stringing You Along – Gold Miners Weekly

- Recent Rally in Gold - A Sign of Strength?

- Recent Rally in Gold - A Sign of Strength?

| Posted: 21 Sep 2013 12:00 AM PDT by John Rubino, Dollar Collapse:

I have a theory about technical indicators, which is that most people only pay attention to the ones that that confirm what they already think. Technicals are primarily entertainment, in other words. But every once in a while a market's charts, graphs, and images line up in a persuasive way, and for U.S. stocks this looks like one of those times. A few examples: Margin debt |

| Owning Mining Shares Is Not the Same as Having a Position in Physical Gold and Silver Posted: 20 Sep 2013 09:40 PM PDT by David Schectman, MilesFranklin.com:

Owning mining shares are for profit, but the profit is the same as a profit made in Apple or Google stocks. At some point, you convert out of the stocks and into dollars. It makes no difference if the dollars came from SLV, TRX or any mining share or Apple; a dollar is a dollar, it's the same dollar. At what point will you sell your mining shares? Most likely when they have risen dramatically in price and the bull market is in full gear. If the bull market follows the model on the 1970s, the dollar will be "like a hot potato" and there will be a mad rush, globally, to dump dollars. |

| MUST READ: Gold, Einstein And The Great Fed Robbery Posted: 20 Sep 2013 09:02 PM PDT from Zero Hedge:

|

| The Path to $10,000 an Ounce Gold, Revisited Posted: 20 Sep 2013 09:00 PM PDT by Dan Amoss, Daily Reckoning.com.au:

This week, we saw the spectacle of the most anticipated Fed meeting in recent history. In the end, the decision (surprise, surprise) was made to continue the Fed's stimulus plan, to the tune of $85B a month. However, most traders, obsessed with the tiniest tweaks to the monthly rate of Fed printing, are missing the big picture: Credit growth has outpaced the economy's productive potential, both here and around the globe. Each successive growth spurt in money and credit has a weaker marginal impact on the real economy; this requires permanently easy monetary policy, and perhaps, eventually, a formal devaluation of paper against gold. |

| 6 Things To Ponder This Weekend Posted: 20 Sep 2013 06:28 PM PDT Submitted by Lance Roberts of Street Talk Live blog, As we wrap up a most interesting, and volatile, week there are some things that I have discussed previously that are now brewing, interesting points to consider and risks to be aware of. In this regard I thought I would share a few things that caught my attention as I look forward to wrapping up the week that was. 1) Angela Merkel Election No So Assured Some months ago in a missive entitled "Is The Eurozone Crisis Set To Flare Up?" I discussed the potential threat to the Eurozone being the dethroning of Angela Merkel by her opponents who are staunchly opposed to further bailouts for the weak Eurozone members and would prefer to see countries like Greece be expelled. My friend Tyler Durden at Zero Hedge picked up on worry stating:

The worry, as I have stated previously, is that if Angela Merkel loses control of the Chancellorship it could well mean significant turmoil to an already very weak Eurozone situation. Furthermore, since Germany is the primary funding source of the European Central Bank, a lack of financial support could well mean the end of the ECB and its Eurozone lifelines. 2) The Debt Ceiling Debate The Republican's on Friday passed a bill, 230-189, that would keep the government funded past the September 30th deadline but would also strip funding for the Affordable Care Act. If anyone has been paying attention the ACA represents a huge economic problem in 2014-2015 due to massive increases in the cost of healthcare for the middle class which has seen both incomes and net worth decline in recent years. The problem is that the bill will be immediately rejected by the democratically controlled Senate. This will kick the bill back to the House once again which is becoming increasing entangled in its own division within its rank and file. The question then becomes whether, or not, the Republican controlled house will allow for a temporary government shutdown to promote a compromise on budgetary issues. As we approach the deadline the markets could be roiled by the heated debates as the President threatens "default" if Congress doesn't act quickly to increase the debt limit. As I stated in the recent missive "The Real Reason For No Fed Taper:"

However, Ruth Marcus summed up the risks to the economy and the markets eloquently stating:

3) The "Taper" Indecision Is Back It certainly didn't take long for the markets to go from indecision, to decision, back to indecision on the Fed's future actions regarding its current bond buying program. On Friday, Senior Federal Reserve Official James Bullard suggested that the current bond buying programs could begin being scaled back as early as October. This would correspond with my views above on getting past a potential debacle in Washington over the debt ceiling debate. However, what is particularly important about his speech was that he acknowledged that Fed policy has conventional monetary impacts.

The importance of this statement should not be dismissed. The implication is that "tapering" is effectively the same as "tightening" monetary policy which would be a negative for the stock market in the short run. 4) In The "Economy Is Improving" Camp If the economy is indeed improving then why do officials continue to change the way we calculate the measures of the economy. First, the Bureau of Economic Analysis changed the calculation of GDP to include pension deficit liabilities and intellectual property, such as research and development, which boosted GDP by roughly $500 billion in total. Now, the European Union is changing the budget calculation to ease austerity. From ABC News:

So, if your debt is increasing to the point that it becomes unlikely you can qualify for further bailouts and supports - change the way you measure it. While you can mask problems in the short term through accounting gimmickry, and other shenanigans, eventually the issue will have to dealt with. The problem is that by the time that point is reached it has historically been the catalyst for a crisis. 5) Syria Already Set To Miss A Deadline As I opined recently in "8-Risks That Remain":

That certainly didn't take long as Syria, according to the LA Times, is already set to miss an initial deadline in the U.S.-Russia chemical arms deal.

It is likely that in the months ahead that the markets will once again be faced with turmoil in Syria. This is particularly the case now that a third faction has now formed in region and is now exposing rifts between the FSA and Assad's forces in the region. Islamic State in Iraq and Syria, or ISIS, recently drove the Free Syrian Army out of Azaz. ISIS is primarily composed of Al Qaeda linked terrorists and hardline jihadists. According to a recent IHS Janes report:

With President Obama recently turning over the ban to provide arms to terrorist organizations the blow-back in the future could be significant leading to further turmoil for the financial markets. This is particularly the case if you add in Lindsey Graham's recent proposal to gain authorization for a U.S. attack on Iran:

6) Video Interview Of The Week This interview with Stanley Druckenmiller earlier this week is a must watch. As per Zero Hedge:

Druckenmiller begins at 8:03...

Complacency Not An Option While the recent Federal Reserve inaction is bullish for stocks in the short term there are p |

| A Funny Thing Happened In 2008 Posted: 20 Sep 2013 05:48 PM PDT Given Bullard's earlier comments on 'bubbles' being so obvious to spot in the prior two examples he noted, we thought the following chart was instructive. As Global Financial Data's Ralph Dillon notes, They often say that the past is a mirror of the future. This has rung true a few times in our markets' history and this chart demonstrates that precisely. Except for one thing... In looking at this chart you will see 3 distinct bubbles. Each one bigger than the previous one and each one has the same characteristics except for the last. In looking at the first during the early 1920's we saw a huge expansion in both equity prices and real estate followed by a huge collapse in 1932. During that depression, we saw equity prices and home prices all fall dramatically and converge at the price of gold in 1932. From the 1950's thru the 1970's, our economy made great economic progress. We became a global super power, innovation and technological advances flourished and we became the beacon of prosperity around the world. With that, equity and real estate prices once again expanded at a tremendous rate. In the early 1970's, with sky high interest rates and massive inflation, we saw yet another market bubble eviscerate. Ironically, all of these asset classes once again converged on gold in 1979. Only this time the bubble was larger from the 1929 bubble. The 80's were ushered in by Ronald Reagan and a new feeling of optimism spurred in much part by patriotism and great global economic expansion. From the early 80's to the present we have enjoyed much prosperity until 2008.

If the past is a reflection of the future, then shouldn't have equity prices, real estate prices and gold all have converged as they did in 1932 and 1979 in 2008 or 2009? In looking at the chart, it's clear that they began that convergence once again but something different happened. The FED started pumping massive amounts of liquidity into the system. Something they have never done before at this level and certainly, never seen in our history. I would speculate that if the FED did not intervene, then we may have seen all of these asset levels converge at around the 256 level and we may have had a normal reset. But instead, what we got was a complete reversal in all of these asset prices. Today we sit at historic highs in the equity markets and home prices are just off a time high. Gold on the other hand has taken a sharp decline and I can only speculate that if the pumping continues, we will only see this bubble inflate even more. All of these asset classes are being artificially inflated to levels never seen before. What happens when it stops? And how does the FED exit? I hope we will not be Yellen and screaming when it pops...

Source: Global Financial Data |

| GATA secretary interviewed by King World News on Fed's retreat Posted: 20 Sep 2013 05:22 PM PDT 8:20p Friday, September 20, 2013 Dear Friend of GATA and Gold: Interviewed today by King World News, your secretary/treasurer remarked that the Federal Reserve's retreat from its plans to reduce bond purchases probably foreshadows more "financial represssion" to prevent markets from happening and that preventing markets from happening has become the main objective of central banking. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/20_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 20 Sep 2013 05:09 PM PDT Dear CIGAs, The industry indices of the exchanges are decided upon by a committee of the exchange made up of members of that exchange. The proceedings of their discussions which impacts huge trading is sealed under secrecy in Canada. Secrecy that is from anyone but the members who are also members of the exchange. In... Read more » The post The Gold Index Game appeared first on Jim Sinclair's Mineset. |

| Silver and Gold Prices Ended the Week Higher — Gold Price Closed at $1,332.50 Posted: 20 Sep 2013 04:37 PM PDT Gold Price Close Today : 1,332.50 Gold Price Close 13-Sep-13 : 1,308.40 Change : 24.10 or 1.8% Silver Price Close Today : 21.876 Silver Price Close 13-Sep-13 : 21.67 Change : 0.206 or 1.0% Gold Silver Ratio Today : 60.912 Gold Silver Ratio 13-Sep-13 : 60.378 Change : 0.53 or 0.9% Silver Gold Ratio : 0.01642 Silver Gold Ratio 13-Sep-13 : 0.01656 Change : -0.00014 or -0.9% Dow in Gold Dollars : $ 239.70 Dow in Gold Dollars 13-Sep-13 : $ 242.93 Change : -$3.23 or -1.3% Dow in Gold Ounces : 11.596 Dow in Gold Ounces 13-Sep-13 : 11.752 Change : -0.16 or -1.3% Dow in Silver Ounces : 706.30 Dow in Silver Ounces 13-Sep-13 : 709.56 Change : -3.25 or -0.5% Dow Industrial : 15,451.09 Dow Industrial 13-Sep-13 : 15,376.06 Change : 75.03 or 0.5% S&P 500 : 1,709.91 S&P 500 13-Sep-13 : 1,687.99 Change : 21.92 or 1.3% US Dollar Index : 80.454 US Dollar Index 13-Sep-13 : 81.470 Change : -1.016 or -1.2% Platinum Price Close Today : 1,432.10 Platinum Price Close 13-Sep-13 : 1,443.60 Change : -11.50 or -0.8% Palladium Price Close Today : 720.30 Palladium Price Close 13-Sep-13 : 697.50 Change : 22.80 or 3.3% For a week that wore so hard on the nerves and posted such big jumps Wednesday, it showed little difference in the end. For the week silver and GOLD PRICES, which starved my ego today and fed my humility, in fact ended higher by 1% and 1.8%. Yes, higher. Stocks rose, but the Dow rose only one-half percent and the S&P500 1.3%. The white metals, platinum and palladium, gainsaid each other, platinum lower and palladium higher. Biggest loser was the dollar index, where a 1.2% loss is a big move, and punctured long established support. Silver and GOLD PRICES acted just like the stock market today, giving up most of the gains from Wednesday. Silver gained 8% yesterday, and gave up 5.9% or 136.6 cents today to close Comex at 2187.6 cents. Gold gained 4.7% yesterday, and lost 2.7% today, or $36.90 closing at $1,332.50. I am tempted to say gold's failure to hold above $1,350 support dooms it to a large fall. That was terrible behavior. Then I look at the chart. Last low hit $1,291.50. Support lies at $1,325 and just above $1,300. I stared longer. Last three days might mark the beginning of a long down leg that runs to $1,240 or even lower. But then again, it might be only the bottom of the first leg up in a new upleg. The former is more likely, but the latter is possible. MACD and RSI are neutral. The gold price also stands below its 50 DMA ($1,342.56), another negative. The SILVER PRICE, on the other hand, at 2187.6c stands above its 2170c 50 DMA. If I were silver and filling out an upside down head and shoulders, I'd do exactly what silver has done. But if silver closes below the last low at 2126, that formation will be ruled out. In the end, both silver and gold prices stand at the same crossroads. If the gold price falls through $1,291.50 and the silver price through 2125c, they will drop toward $1,240 and 1900c. If they break not those marks, they will turn and climb. Come to think of it, the present debt ceiling war between Bernard O'Bama and the Lilliputian congress might provide enough hot air to draft gold up. First two days of next week are critical. If silver and gold prices hold, they'll rally. If not, they could decline into an October low. How'd y'all like that taste of Federal Reserve stability this week? Right, the Fed stabilizes like a tornado. Wednesday the markets that supposedly thrive on a weak dollar soared on the FOMC's announcement they would not be tapering any time soon, say, before the 21st century ends. Think of it this way: yesterday Ben Bernanke sent a personal note to you, me, and everybody in the US reading, "We are going to keep on creating money -- lots of money." Wherefore, burn this bottom line into your brain: gold and silver will rise. After this indecision ends, probably by the time October expires, gold and silver will begin a rally that will reach far higher, and move faster, than anything you've seen so far. You have Ben Bernanke's word on it. Stocks stumbled badly today. Dow lost 185.44 (1.19%) to 15,451.09 while the S&P500 gave up 12.43 (0.72%) to 1,709.91. This leaves a really stinking Big Bird footprint on the chart: bit jump Wednesday, little toe of a fall yesterday, big fall today taking them below where they started. Feels very toppy and sets up stocks for visit to 50 day moving averages (15,305 and 1679). After yesterday's sharp fall, the Dow in Gold and Dow in Silver rose a bit today, but remain firmly in a downtrend from the June Highs. Odd -- the Dow in gold is above its 50 DMA (11.42 oz) but the Dow in Silver remains below its 50 DMA (710.57 oz). Dow in gold today rose 1.5% to 11.596 oz (G$239.70 gold dollars). Gaining 5%, the Dow in silver added 33.36 oz to end at 706.30. US Dollar Index gained 11.1 basis points (0.14%) today but did nothing to prettify its hair-raising chart. Wednesday's fall dragged the dollar index under water. It punctured support that had held since May 2011. Dollar index has a chance of catching at 79.50, but beneath that it will fly like an anvil pushed out of a 747 Jumbo Jet. Wednesday the euro punched through resistance stretching back to February of this year, poked its head around, and fell back to that line. Today the euro lost a piddling 0.08% to end at $1.3523. Should the euro not fall back through that resistance, 'twill point toward $1.3700. Japanese yen keeps trading sideways, carefully managed, I reckon, by the Japanese Nice Government Men. Gained 0.14% today to 100.68 cents/Y100. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Silver and Gold Prices Ended the Week Higher — Gold Price Closed at $1,332.50 Posted: 20 Sep 2013 04:37 PM PDT Gold Price Close Today : 1,332.50 Gold Price Close 13-Sep-13 : 1,308.40 Change : 24.10 or 1.8% Silver Price Close Today : 21.876 Silver Price Close 13-Sep-13 : 21.67 Change : 0.206 or 1.0% Gold Silver Ratio Today : 60.912 Gold Silver Ratio 13-Sep-13 : 60.378 Change : 0.53 or 0.9% Silver Gold Ratio : 0.01642 Silver Gold Ratio 13-Sep-13 : 0.01656 Change : -0.00014 or -0.9% Dow in Gold Dollars : $ 239.70 Dow in Gold Dollars 13-Sep-13 : $ 242.93 Change : -$3.23 or -1.3% Dow in Gold Ounces : 11.596 Dow in Gold Ounces 13-Sep-13 : 11.752 Change : -0.16 or -1.3% Dow in Silver Ounces : 706.30 Dow in Silver Ounces 13-Sep-13 : 709.56 Change : -3.25 or -0.5% Dow Industrial : 15,451.09 Dow Industrial 13-Sep-13 : 15,376.06 Change : 75.03 or 0.5% S&P 500 : 1,709.91 S&P 500 13-Sep-13 : 1,687.99 Change : 21.92 or 1.3% US Dollar Index : 80.454 US Dollar Index 13-Sep-13 : 81.470 Change : -1.016 or -1.2% Platinum Price Close Today : 1,432.10 Platinum Price Close 13-Sep-13 : 1,443.60 Change : -11.50 or -0.8% Palladium Price Close Today : 720.30 Palladium Price Close 13-Sep-13 : 697.50 Change : 22.80 or 3.3% For a week that wore so hard on the nerves and posted such big jumps Wednesday, it showed little difference in the end. For the week silver and GOLD PRICES, which starved my ego today and fed my humility, in fact ended higher by 1% and 1.8%. Yes, higher. Stocks rose, but the Dow rose only one-half percent and the S&P500 1.3%. The white metals, platinum and palladium, gainsaid each other, platinum lower and palladium higher. Biggest loser was the dollar index, where a 1.2% loss is a big move, and punctured long established support. Silver and GOLD PRICES acted just like the stock market today, giving up most of the gains from Wednesday. Silver gained 8% yesterday, and gave up 5.9% or 136.6 cents today to close Comex at 2187.6 cents. Gold gained 4.7% yesterday, and lost 2.7% today, or $36.90 closing at $1,332.50. I am tempted to say gold's failure to hold above $1,350 support dooms it to a large fall. That was terrible behavior. Then I look at the chart. Last low hit $1,291.50. Support lies at $1,325 and just above $1,300. I stared longer. Last three days might mark the beginning of a long down leg that runs to $1,240 or even lower. But then again, it might be only the bottom of the first leg up in a new upleg. The former is more likely, but the latter is possible. MACD and RSI are neutral. The gold price also stands below its 50 DMA ($1,342.56), another negative. The SILVER PRICE, on the other hand, at 2187.6c stands above its 2170c 50 DMA. If I were silver and filling out an upside down head and shoulders, I'd do exactly what silver has done. But if silver closes below the last low at 2126, that formation will be ruled out. In the end, both silver and gold prices stand at the same crossroads. If the gold price falls through $1,291.50 and the silver price through 2125c, they will drop toward $1,240 and 1900c. If they break not those marks, they will turn and climb. Come to think of it, the present debt ceiling war between Bernard O'Bama and the Lilliputian congress might provide enough hot air to draft gold up. First two days of next week are critical. If silver and gold prices hold, they'll rally. If not, they could decline into an October low. How'd y'all like that taste of Federal Reserve stability this week? Right, the Fed stabilizes like a tornado. Wednesday the markets that supposedly thrive on a weak dollar soared on the FOMC's announcement they would not be tapering any time soon, say, before the 21st century ends. Think of it this way: yesterday Ben Bernanke sent a personal note to you, me, and everybody in the US reading, "We are going to keep on creating money -- lots of money." Wherefore, burn this bottom line into your brain: gold and silver will rise. After this indecision ends, probably by the time October expires, gold and silver will begin a rally that will reach far higher, and move faster, than anything you've seen so far. You have Ben Bernanke's word on it. Stocks stumbled badly today. Dow lost 185.44 (1.19%) to 15,451.09 while the S&P500 gave up 12.43 (0.72%) to 1,709.91. This leaves a really stinking Big Bird footprint on the chart: bit jump Wednesday, little toe of a fall yesterday, big fall today taking them below where they started. Feels very toppy and sets up stocks for visit to 50 day moving averages (15,305 and 1679). After yesterday's sharp fall, the Dow in Gold and Dow in Silver rose a bit today, but remain firmly in a downtrend from the June Highs. Odd -- the Dow in gold is above its 50 DMA (11.42 oz) but the Dow in Silver remains below its 50 DMA (710.57 oz). Dow in gold today rose 1.5% to 11.596 oz (G$239.70 gold dollars). Gaining 5%, the Dow in silver added 33.36 oz to end at 706.30. US Dollar Index gained 11.1 basis points (0.14%) today but did nothing to prettify its hair-raising chart. Wednesday's fall dragged the dollar index under water. It punctured support that had held since May 2011. Dollar index has a chance of catching at 79.50, but beneath that it will fly like an anvil pushed out of a 747 Jumbo Jet. Wednesday the euro punched through resistance stretching back to February of this year, poked its head around, and fell back to that line. Today the euro lost a piddling 0.08% to end at $1.3523. Should the euro not fall back through that resistance, 'twill point toward $1.3700. Japanese yen keeps trading sideways, carefully managed, I reckon, by the Japanese Nice Government Men. Gained 0.14% today to 100.68 cents/Y100. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| This Week Was A Disaster And It Will Lead To More Tyranny Posted: 20 Sep 2013 04:06 PM PDT  In the aftermath of more incredibly turbulent trading this week, today King World News spoke to the man who has been focused on uncovering sensitive government and market information for over 15 years. What he had to say will fascinate KWN readers around the world. Chris Powell covered everything from secret government agreements, to market manipulation, gold, and a coming new financial system. Below is what Powell had to say. In the aftermath of more incredibly turbulent trading this week, today King World News spoke to the man who has been focused on uncovering sensitive government and market information for over 15 years. What he had to say will fascinate KWN readers around the world. Chris Powell covered everything from secret government agreements, to market manipulation, gold, and a coming new financial system. Below is what Powell had to say.This posting includes an audio/video/photo media file: Download Now |

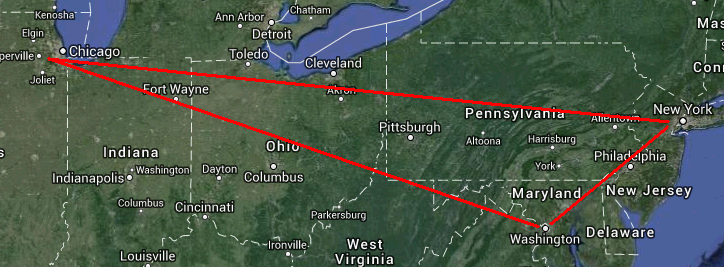

| Gold, Einstein And The Great Fed Robbery Posted: 20 Sep 2013 03:42 PM PDT One of Einstein's great contributions to mankind was the theory of relativity, which is based on the fact that there is a real limit on the speed of light. Information doesn't travel instantly, it is limited by the speed of light, which in a perfect setting is 186 miles (300km) per millisecond. This has been proven in countless scientific experiments over nearly a century of time. Light, or anything else, has never been found to go faster than 186 miles per millisecond. It is simply impossible to transmit information faster. Too bad that the bad guys on Wall Street who pulled off The Great Fed Robbery didn't pay attention in science class. Because hard evidence, along with the speed of light, proves that someone got the Fed announcement news before everyone else. There is simply no way for Wall Street to squirm its way out of this one. Before 2pm, the Fed news was given to a group of reporters under embargo - which means in a secured lock-up room. This is done so reporters have time to write their stories and publish when the Fed releases its statement at 2pm. The lock-up room is in Washington DC. Stocks are traded in New York (New Jersey really), and many financial futures are traded in Chicago. The distances between these 3 cities and the speed of light is key to proving the theft of public information (early, tradeable access to Fed news). We've learned that the speed of light (information), takes 1 millisecond to travel 186 miles (300km). Therefore, the amount of time it takes to transmit information between two points is limited by distance and how fast computers can encode and decode the information on both sides. Our experience analyzing the impact of hundreds of news events at the millisecond level tells us that it takes at least 5 milliseconds for information to travel between Chicago and New York. Even though Chicago is closer to Washington DC than New York, the path between the two cities is not straight or optimized: so it takes information a bit longer, about 7 milliseconds, to travel between Chicago and Washington. It takes little under 2 milliseconds between Washington and New York.

Therefore, when the information was officially released in Washington, New York should see it 2 milliseconds later, and Chicago should see it 7 milliseconds later. Which means we should see a reaction in stocks (which trade in New York) about 5 milliseconds before a reaction in financial futures (which trade in Chicago). And this is in fact what we normally see when news is released from Washington. However, upon close analysis of millisecond time-stamps of trades in stocks and futures (and options, and futures options, and anything else publicly traded), we find that activity in stocks and futures exploded in the same millisecond. This is a physical impossibility. Also, the reaction was within 1 millisecond, meaning it couldn't have reached Chicago (or New York): another physical possibility. Then there is the case that the information on the Fed Website was not readily understandable for a machine - less than a thousandth of a second is not enough time for someone to commit well over a billion dollars that effectively bought all stocks, futures and options. The DataMinutes before the Fed announcement at 14:00 on September 18, 2013, there was significant activity in Comex Gold Futures (traded in Chicago) and the ETF symbol GLD (traded in New Jersey). This gives us an opportunity to measure closely, the exact (to the millisecond) amount of time between trading between these two instruments. The first two charts show about 3.5 minutes of time around the Fed Announcement release, giving us an overview. The stack of charts that follow allow you to easily compare between GLD (New York) and GC Futures (Chicago) for 6 different active periods. You will see that in the first 5 pairs - before the announcement, activity first shows up in GC Futures, followed by activity in GLD between 5 and 7 milliseconds later. In the last pair, which compares activity at exactly 14:00:00.000, you will see both GC futures and GLD react exactly at the same time. See also: More Charts of Evidence. 1. Animation of December 2013 Gold (GC) Futures followed by GLD stock on September 18, 2013 from 13:57 to 14:00:30.

2. Zooming in 150 milliseconds of time for the high activity periods minutes before and during the annoucement.

ConclusionThere are 2 possibilities, and both aren't good news for Wall Street. 1. Released by a News Organization

2. Leaked to Wall Street

We think it was leaked. The evidence is overwhelming. |

| Dan Norcini About Today’s Gold & Silver Price Drop Posted: 20 Sep 2013 02:59 PM PDT Gold has now surrendered half of the gains that it put on as a result of Wednesday’s FOMC announcement that the TAPERING was on hold. It is currently trading at 1337 as I type these comments. While the US equity markets are a bit weaker, the S&P 500 is still sitting firmly above the 1700 level. Interest rates on the Ten Year are near 2.75% while the grain markets are imploding lower and crude oil continues to drop off its best post-FOMC announcement levels. In short, we are pretty much back to where we were prior to the FOMC. Why do I say this? Simple – this morning Fed governor Bullard managed to do what many in the Fed have been doing since May of this year, namely, jawboning the markets and setting them up for another possibility of tapering later this year. What has it been, 2 days since we got that FOMC press release and here we already are talking about starting the Tapering once again. Good grief! This is like some sort of sick version of the movie “GroundHog Day”. It seems as if these people simply cannot restrain themselves from yakking away whenever a microphone is present. I do not know about some of you, but I get the distinct impression from watching these events unfold that the Fed literally has no earthly idea what to do next. They would like to start reducing the amount of bond buying but understand that they cannot, given the current economic conditions. So they talk about it perhaps to comfort themselves or even persuade themselves, that they really are being responsible stewards of the nation’s monetary policies and are aware of the inherent dangers in a near-endless barrage of money printing. The truth is that the Fed is trapped in a net of their own making and I think some of these governors realize it. Maybe some of them are making speeches as a sort of CYA strategy just in case history is not kind to them. They can point to their various speeches and say: ” Hey I was out there making a case for ending this QE stuff. Don’t blame me!” As I have written repeatedly this week, these QE programs have managed to take on near immortality simply because the job market in this nation is so pathetic that many consumers simply do not have the confidence or financial wherewithal to taken on new and large loads of debt. Velocity of Money keeps moving lower, not higher and thus the driving force needed to generate strong, upward price pressures in the economy is not there. With wages flat and many working at part time jobs, where is the force going to come from to propel economic activity in this nation strongly higher? IN a debt based system, more and more, larger and larger, amounts of debt have to be taken on for the economy to grow. It is difficult to do that if consumers are afraid to spend with the same reckless abandon as they did during the boom years. Remember when re-financing was the coolest trick in town – turn your house into a giant ATM machine and use the savings from the lower rates to go and buy that new ATV or Jet-ski? Those days are long gone so if the consumer cannot tap their home equity and wages are going nowhere, where is the cash going to come from? Maybe the Fed should just skip this nonsense about buying MBS’s and Treasuries and just send checks to every tax paying household in the US to the tune of $85 billion each and every month? I don’t know about you, but I think this money would get directly injected into the economy a helluva lot faster than it does by sitting in the reserves of the big banks or in the equity markets.I guarantee you that if I were to receive a nice, big, fat check from the Fed each and every month, I would have my ATV upgraded to a woodgrain dash and chrome wheels. Heck I would buy a new Polaris RZR just for fun! A nice COBALT boat would somehow find its way into my establishment also! Obviously I am being facetious here but I think my point is made – most of this new money being created by the Fed is not moving into the system. What ails this nation cannot be fixed by Fed action only; it requires STRUCTURAL REFORMS, and we are not going to get that while the current administration remains in office. It really is that simple. At this point in time, seeing that inflation is not a serious concern of most market participants, it is going to take an issue dealing with CONFIDENCE to take gold sharply higher into a sustained uptrend. Remember gold is an asset that pays no interest; therefore it must appreciate in value if it is to be of any benefit to those who buy it as an investment. That means we must have all of the elements in place that are required to drive the price of gold higher. First and foremost among those is CONFIDENCE, especially in the currency of a nation. A loss of confidence in a nation’s currency results in rising prices as the currency’s loss of value is reflected in that area first. This is why I keep coming back to the commodity complex as a whole… we must see a broad-based upward move in the commodity complex before gold will find strong, SUSTAINED, new speculative inflows. Currently we are not getting that. (original source: Dan Norcini’s personal blog) |

| What?s the Indian Gov?t doing to Gold? Posted: 20 Sep 2013 02:59 PM PDT Gold Forecaster |

| Ted Butler: JP Morgan Holds 2 Corners In The Gold And Silver Market Posted: 20 Sep 2013 02:53 PM PDT In this interview with SprottMoney, Ted Butler comments on the latest evolutions in the gold and silver market. In particular, the conversation is focused on the current concentrated positions of JP Morgan and its evolution on price. Mr. Butler is convinced the manipulation is there but he is also sure that it will end sooner or later with a huge upside impact on the prices. Ted Butler explains how JP Morgan started out this year massively short in gold and silver. Their position was around 75,000 contracts net short in gold and 35,000 contracts net short in silver. The whole reason behind the decline in the first half of the year was JP Morgan rigging prices through their monopoly in the COMEX to the point that prices came down and they were able to buy back many of their short positions in silver and all of their short positions in gold. The company made about 3 billion dollars on closing out these shorts. In gold, they went long till they reached 85,000 contracts long in gold. In the August rally they made another 350 million dollar of profits. JP Morgan was not able to get long in the silver market however. Right now they are sitting on a monopoly on the long side of the gold market and a concentration on the COMEX silver market. - Ted Butler on JP Morgan’s incentive to corner the gold market to the long side.

- The likelihood that JP Morgan was behind the sharp sell offs in price?

- What to think about the fact there is not any response on his allegations?

- Can the gold and silver price only rise after the COMEX and LBMA will default?

- Butler’s take on the price of gold and silver for the remainder of this year.

Ted Butler offers an excellent premium service with weekly updates on the gold and silver market evolutions: www.butlerresearch.com. |

| Australian bankers frosted by Fed, want their own dollar lower Posted: 20 Sep 2013 02:15 PM PDT Dollar Rise Frustrates RBA Board By Jacob Greber, Bianca Hartge-Hazelman, and Ben Potter http://www.afr.com/p/national/dollar_rise_frustrates_rba_board_Gy5H95rxH... Reserve Bank of Australia board member John Edwards has expressed frustration that the shock US Federal Reserve decision to continue injecting billions into the global financial markets sent the Australian dollar to a three-month high. The decision not to wind back the quantitative easing sent tremors through financial markets around the world, increased the chances of more interest rate cuts by the RBA, and pushed the [Australian] dollar above US95 cents. The higher dollar is likely to frustrate the new government and the Reserve Bank board, which wants a lower currency to make Australian manufacturers, tourism operators, and other companies more competitive with their foreign counterparts. ... Dispatch continues below ... ADVERTISEMENT Precious Metals Round Table: On Tuesday, September 24, Sprott Asset Management will assemble four experts for a live Internet broadcast about the prospects for the precious metals. Participating will be Sprott's CEO, Eric Sprott; financial letter writer and internationally renowned conference speaker Marc Faber; Sprott's chief investment strategist, John Embry; and Sprott Asset Management President Rick Rule. To participate, please visit: https://event.on24.com/eventRegistration/EventLobbyServlet?target=regist... "I want to see a lower dollar and it's going to take us longer to get there -- so it's not great," said Dr Edwards, who was an economics adviser to former prime minister Paul Keating. Asked what level he would like to see for the dollar, he said: "I wouldn't put a number on it. Lower is good." Fallout from the decision dominated Treasurer Joe Hockey's first international meeting in the job. At an APEC finance ministers' meeting in Bali he discussed the consequences for the global economy with counterparts from China, Indonesia, and Singapore, whose economies are vulnerable to a switch in capital to the US economy if rates there start to rise again. The Federal Reserve's Open Market Committee's decision to refrain from slowing the pace of the $US85 billion-a-month bond purchases sent global sharemarkets, most major currencies, and gold surging. The S&P/ASX 200 rallied 1.1 per cent to a five-year high of 5295.5, the dollar surged to as much as $US95.22, taking this month's gains to more than 6 per cent. Gold jumped 5.6 per cent to $US1,370 an ounce. The decision wrong-footed most financial market forecasters and reinflamed debate about a global currency war, where countries manipulate their currencies lower to boost exports. Westpac chief economist Bill Evans, one of a small minority of local analysts to anticipate the Fed move, predicted the RBA would be forced to cut the official interest rate to 2 per cent from its record low of 2.5 per cent, a move that could drive up house prices further and fuel fears of a property bubble. Leading businessman Richard Goyder, chief executive of Wesfarmers, urged the central bank to hold its nerve and avoid further rate cuts. "If I was the RBA I'd be advocating for a good open economy that allows us to adapt and not just rely on monetary policy," which can have unintended consequences, he said. Dr Edwards downplayed concern about rising property prices, echoing RBA assistant governor Malcolm Edey, who said Australia was some way from a house price bubble. "While you might say that the house price issue is effected by the level of our rates, it's certainly not affected by the level of Fed rates, and what's going on there really is an issue of timing of the normalisation of US momentary policy," Dr Edwards said. In a sign the decision has worried the Reserve Bank's policymakers, Dr Edwards said he was disappointed the dollar was back up and "it would have been better to have [the taper] sooner." "I would have thought the main thing to be concerned about, overwhelmingly, is that the FOMC, in its wisdom, has come to the view the US economy as too weak to begin to taper. That's quite concerning," he said. "At the same time the consensus of FOMC members is that growth is now, through 2013-14, weaker than they expected." Dr Edwards said the Fed was likely to slow bond purchases before the end of the year. "Whether they taper this month, at the October meeting, or the December meeting is more of a detail," he said. "The response to this decision, which seems to be universal indignation in markets, will likely prompt them to move faster than not." A spokesman for Mr Hockey said the US move had been a "source of significant conversation" among APEC finance ministers meeting in Bali. Mr Hockey, accompanied by Treasury secretary Martin Parkinson, held talks with the Indonesian minister of finance, Chatib Basri. They issued a statement that said: "While there are some positive economic signs coming from Japan and the US, we still face difficult and potentially volatile economic conditions globally." Another Australian expert to predict that the Fed wouldn't taper, Colonial First State Global Asset Management's head of rates, Annette Mullen, said she doubts the Reserve Bank will cut rates because the dollar has crept higher. "Why would you be the Reserve Bank of Australia fighting the Fed?" she said. Ms Mullen believes the Reserve Bank faces a challenging task balancing the prospect of lower borrowing costs, which could spur economic activity but send the wrong message to property investors. "If you think that housing investment in Australia has improved in recent weeks, you probably don't want to facilitate that," she said. Westpac foreign exchange strategist Richard Franulovich predicted that the dollar would climb back towards parity with the US dollar. "Look for currencies like the Aussie, Kiwi, and some key emerging market currencies to trade on the front foot against the US dollar and they could see gains in the order of several percentage points over the coming weeks," he said. Another bullish currency forecaster, UBS, maintains the dollar could reach around US98 cents by year's end. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Von Greyerz, Barron expect increase in QE, not 'tapering' Posted: 20 Sep 2013 01:56 PM PDT 4:50p ET Friday, September 20, 2013 Dear Friend of GATA and Gold: Having predicted that the Federal Reserve would cancel its plan to reduce its bond buying, Swiss gold fund manager Egon von Greyerz today tells King World News that he expects the Fed to increase "quantitative easing" next year and for all major currencies to head toward hyperinflation. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/20_Ma... Meanwhile at King World News, mining entrepreneur Keith Barron concurs with von Greyerz, adding that while the Indian government has done well at suppressing official imports of gold, smuggling is booming: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/20_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Near Unchanged on the Week Posted: 20 Sep 2013 01:26 PM PDT Gold fell throughout most of trade and ended near its last minute low of $1325.26 with a loss of 2.92%. Silver slipped to as low as $21.725 and ended with a loss of 5.84%. |

| Gold Daily and Silver Weekly Charts - Triple Witching Hit on GLD and SLV, COMEX Next Week Posted: 20 Sep 2013 01:16 PM PDT |

| Gold Daily and Silver Weekly Charts - Triple Witching Hit on GLD and SLV, COMEX Next Week Posted: 20 Sep 2013 01:16 PM PDT |

| An Economic Collapse Of Biblical Proportions Is Coming. By Gregory Mannarino Posted: 20 Sep 2013 01:11 PM PDT An Economic Collapse Of Biblical Proportions Is Coming. By Gregory Mannarino The PetroDollar has hit the end of it's life span. The president is trying to keep it alive so he won't be blamed when... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 20 Sep 2013 01:06 PM PDT Gold And The Securities Markets: Taper on according to Financial TV today. Taper off according to the Federal Reserve yesterday. Risk off according the lifeless algos. Risk on according to the lifeless algos. What an unbelievable level for the madness of the crowd. What a game for total fools that runs the gold and securities... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Man Who Predicted No Fed Tapering Now Says To Expect Chaos Posted: 20 Sep 2013 12:33 PM PDT  On the back of a wild week of trading in global markets, today the 42-year market veteran, who correctly predicted on Tuesday that the Fed would not taper, is now warning King World News that we should expect chaos in the aftermath of this week's historic events. He also discussed what all of this means for gold and silver. Below is what Egon von Greyerz, founder of Matterhorn Asset Management out of Switzerland, had to say in his interview. On the back of a wild week of trading in global markets, today the 42-year market veteran, who correctly predicted on Tuesday that the Fed would not taper, is now warning King World News that we should expect chaos in the aftermath of this week's historic events. He also discussed what all of this means for gold and silver. Below is what Egon von Greyerz, founder of Matterhorn Asset Management out of Switzerland, had to say in his interview.This posting includes an audio/video/photo media file: Download Now |

| COT Gold, Silver and US Dollar Index Report - September 20, 2013 Posted: 20 Sep 2013 12:33 PM PDT COT Gold, Silver and US Dollar Index Report - September 20, 2013 |

| India to resume gold imports but rules mean no rush Posted: 20 Sep 2013 12:11 PM PDT By Anurag Kotoky and Mayank Bhardwaj NEW DELHI, India -- India will start buying gold again after a two-month gap as the government and banks have agreed how new rules on imports should work, easing prices in the world's biggest bullion buyer and helping supplies just as seasonal demand kicks in. But monthly shipments by the world's top importer are unlikely to be even a quarter of May's record 162 tonnes to start with and annual imports will be sharply down, helping to cut a bulging current account deficit and support the rupee. ... For the complete story: http://in.reuters.com/article/2013/09/20/india-gold-idINDEE98J0902013092... ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 20 Sep 2013 12:01 PM PDT I have a theory about technical indicators, which is that most people only pay attention to the ones that that confirm what they already think. Technicals are primarily entertainment, in other words. But every once a while a market's charts, graphs, and images line up in a persuasive way, and for U.S. stocks this looks like one of those times. A few examples: Margin debt Magazine cover hyperbole Excessive P/E ratios

|

| Gold Backed Money: The Choice of a Free Society Posted: 20 Sep 2013 11:40 AM PDT Is there a connection between human freedom and a gold-redeemable money? At first glance, it would seem that money belongs to the world of economics and human freedom to the political sphere. But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty. I hold here what is called a $20 gold piece… But today the ownership of such gold pieces as money… is outlawed. Also, when you find that Lenin declared and demonstrated that a sure way to overturn the existing social order and bring about communism was by printing-press paper money, then again you are impressed with the possibility of a relationship between a gold-backed money and human freedom. In that case, then certainly you and I as Americans should know the connection. We must find it even if money is a difficult and tricky subject. I suppose that if most people were asked for their views on money, the almost universal answer would be that they didn’t have enough of it. In a free country, the monetary unit rests upon a fixed foundation of gold or gold and silver independent of the ruling politicians. Our dollar was that kind of money before 1933. Under that system, paper currency is redeemable for a certain weight of gold, at the free option and choice of the holder of paper money. That redemption right gives money a large degree of stability. The owner of such gold-redeemable currency has economic independence. He can move around either within or without his country, because his money holdings have accepted value anywhere. For example, I hold here what is called a $20 gold piece. Before 1933, if you possessed paper money, you could exchange it at your option for gold coin. This gold coin had a recognizable and definite value all over the world. It does so today. In most countries of the world this gold piece, if you have enough of them, will give you much independence. But today, the ownership of such gold pieces as money in this country, Russia and all divers other places is outlawed. The subject of a Hitler or a Stalin is a serf by the mere fact that his money can be called in and depreciated at the whim of his rulers. That actually happened in Russia a few months ago, when the Russian people, holding cash, had to turn it in — 10 old rubles and receive back one new ruble. I hold here a small packet of this second kind of money — printing-press paper money — technically known as fiat money because its value is arbitrarily fixed by rulers or statute. The amount of this money in numerals is very large. This little packet amounts to CNC$680,000. It cost me $5 at regular exchange rates. I understand I got clipped on the deal. I could have gotten $2.5 million if I had purchased in the black market. But you can readily see that this Chinese money, which is a fine grade of paper money, gives the individual who owns it no independence, because it has no redemptive value. Under such conditions, the individual citizen is deprived of freedom of movement. He is prevented from laying away purchasing power for the future. He becomes dependent upon the goodwill of the politicians for his daily bread. Unless he lives on land that will sustain him, freedom for him does not exist. You have heard a lot of oratory on inflation from politicians in both parties. Actually, that oratory and the inflation maneuvering around here are mostly sly efforts designed to lay the blame on the other party’s doorstep. All our politicians regularly announce their intention to stop inflation. I believe I can show that until they move to restore your right to own gold, that talk is hogwash. But first, let me clear away a bit of underbrush. I will not take time to review the history of paper money experiments. So far as I can discover, paper money systems have always wound up with collapse and economic chaos. Here somebody might like to interrupt and ask if we are not now on the gold standard. That is true internationally, but not domestically. Even though there is a lot of gold buried down at Fort Knox, that gold is not subject to demand by American citizens. It could all be shipped out of this country without the people having any chance to prevent it. That is not probable in the near future, for a small trickle of gold is still coming in. But it can happen in the future. This gold is temporarily and theoretically partial security for our paper currency. But in reality, it is not. Also, currently, we are enjoying a large surplus in tax revenues, but this happy condition is only a phenomenon of postwar inflation and our global WPA. It cannot be relied upon as an accurate gauge of our financial condition. So we should disregard the current flush Treasury in considering this problem. From 1930-1946, your government went into the red every year and the debt steadily mounted. Various plans have been proposed to reverse this spiral of debt. One is that a fixed amount of tax revenue each year would go for debt reduction. Another is that Congress be prohibited by statute from appropriating more than anticipated revenues in peacetime. Still another is that 10% of the taxes be set aside each year for debt reduction. All of these proposals look good. But they are unrealistic under our paper money system. They will not stand against postwar spending pressures. The accuracy of this conclusion has already been demonstrated. Under the streamlining act passed by Congress in 1946, the Senate and the House were required to fix a maximum budget each year. In 1947, the Senate and the House could not reach an agreement on this maximum budget, so that the law was ignored. On March 4 this year, the House and Senate agreed on a budget of $37.5 billion. Appropriations already passed or on the docket will most certainly take expenditures past the $40 billion mark. The statute providing for a maximum budget has fallen by the wayside even in the first two years it has been operating and in a period of prosperity. There is only one way that these spending pressures can be halted, and that is to restore the final decisions on public spending to the producers of the nation. The producers of wealth — taxpayers — must regain their right to obtain gold in exchange for the fruits of their labor. This restoration would give the people the final say-so on governmental spending and would enable wealth producers to control the issuance of paper money and bonds. I do not ask you to accept this contention outright. But if you look at the political facts of life, I think you will agree that this action is the only genuine cure. There is a parallel between business and politics that quickly illustrates the weakness in political control of money. Each of you is in business to make profits. If your firm does not make profits, it goes out of business. If I were to bring a product to you and say this item is splendid for your customers, but you would have to sell it without profit, or even at a loss that would put you out of business… Well, I would get thrown out of your office, perhaps politely, but certainly quickly. Your business must have profits. The producers of wealth — taxpayers — must regain their right to obtain gold in exchange for the fruits of their labor. In politics, votes have a similar vital importance to an elected official. That situation is not ideal, but it exists, probably because generally no one gives up power willingly. Perhaps you are right now saying to yourself: “That’s just what I have always thought. The politicians are thinking of votes when they ought to think about the future of the country. What we need is a Congress with some ‘guts.’ If we elected a Congress with intestinal fortitude, it would stop the spending, all right!” I went to Washington with exactly that hope and belief. But I have had to discard it as unrealistic. Why? Because a congressman under our printing-press money system is in the position of a fireman running into a burning building with a hose that is not connected with the water plug. His courage may be commendable, but he is not hooked up right at the other end of the line. So it is now with a congressman working for economy. There is no sustained hookup with the taxpayers to give him strength. When the people’s right to restrain public spending by demanding gold coin was taken from them, the automatic flow of strength from the grass roots to enforce economy in Washington was disconnected. I’ll come back to this later. In January, you heard the president’s message to Congress, or at least you heard about it. It made Harry Hopkins, in memory, look like Old Scrooge himself. Truman’s State of the Union message was “pie in the sky” for everybody except business. These promises were to be expected under our paper currency system. Why? Because his continuance in office depends upon pleasing a majority of the pressure groups. Before you judge him too harshly for that performance, let us speculate on his thinking. Certainly, he can persuade himself that the Republicans would do the same thing if they were in power. Already, he has characterized our talk of economy as “just conversation.” To date, we have been proving him right. Neither the president nor the Republican Congress is under real compulsion to cut federal spending. And so neither one does so, and the people are largely helpless. But it was not always this way… Edited from an article featured in the Commercial and Financial Chronicle, 5/6/48 Ed. Note: This essay was prominently featured in The Daily Reckoning email edition, which offers readers regular commentary on everything from gold to the markets at large… and gives them specific opportunities to profit from them. Signing up is completely free, and only takes about 30 seconds. Find out what all the hype is about. Sign up for The Daily Reckoning email edition, for free, right here. |

| Posted: 20 Sep 2013 11:03 AM PDT SO LIKE ME, the world and its stockbroker thought the US Fed would start trimming QE money-printing this Wednesday. US Treasury bonds were down, stocks were soft, and gold and silver were long set for a cut to the money-creation scheme, too. |

| Special Offer: BU Denmark 20 Kroner & MS64 U.S. $20 Liberty Gold Coins Posted: 20 Sep 2013 10:32 AM PDT We have two limited quantity specials for you today, one European, one U.S. Please scroll to U.S. offer: Special #1 – Denmark 20 Kroner BU .2592 oz Christian X, Frederick VII An offer came in this week out of Europe that we couldn’t refuse. A tidy group of 250 Brilliant Uncirculated Denmark 20 Kroner gold coins has shaken loose, and were offered to us so cheaply we almost didn’t believe the offer was legitimate. Denmark 20 Kroner gold coins have always been one of the most highly coveted and scarcest European coin issued in the market and typically trade at high premiums to the gold price. Only once in the past decade have we offered these coins. But given the discount we received in buying this entire group (a discount we will happily pass on to our clients), these coins are offered at rates competitive with pre-1933 mainstays like British Sovereigns and Swiss Francs. To our surprise, we also received 10 of the almost mystical Christian IX “Mermaid” 20 Kroner gold coins. In our experience, once these coins find their way into private holdings, they never make their way back out. As such, we’ve seen these only a few times in company history. These just came to us ‘in the draw’ so to speak, so we’ve decided to pass them on as an incentive to clients who buy 20 or more coins. Anyone who buys 20 or more coins will have the opportunity to buy 1 Mermaid per 20 coins purchased, at the same price. To give you a sense of their relative rarity, only 1.175 million Frederick VII and only 3.668 million Christian X gold coins were minted in just 10 years of total coin production from 1908-1917. By comparison, single year mintages of British Sovereigns frequently topped 30 million pieces. This is an excellent opportunity to secure a unique, hard-to-find position in your gold portfolio and not pay a premium to do so.

To see yearly mintages, coin details, and item history, please visit: Offer Details/Incentives: How to order? Call our trading desk: 1-800-869-5115×100 Special #2 – U.S. $20 Liberty MS64 A little over a month ago, we ran a promotion on MS63 $20 St. Gaudens (200 coins) that sold out in about 24 hours. For those of you who missed that offer, or who wish to take another step down the same road, I’ve uncovered another superb opportunity – this time in the MS64 $20 Liberty gold coins. Read on…

Like the MS63 St. Gaudens deal recently offered, MS64 $20 Liberty gold coins are nominally at their cheapest level since 2009. Based on premium, they are currently about 1.6x the price of gold. While they have been slightly cheaper in premium before (the lowest recorded is about 1.45x spot gold – though when the gold price was much higher), they typically carry premiums of about double the price of gold. Moreover, in middle 2009 during the height of the financial crisis, these coins carried premiums of about 3.4x the price of gold. All told, premiums on these coins currently sit just above all-time lows, and have been considerably higher in the past.

The real display in just how under-valued these coins are can be seen by comparing them to their counterpart, the MS65 $20 St. Gaudens. MS64 $20 Liberty coins have almost always traded higher that the MS 65 St. Gaudens on a nominal basis (as seen in the chart below), but currently sit about $150 per unit less. This is meaningful because according to PCGS(Professional Coin Grading Service), only 45K or so MS64 $20 Liberties exist, versus close to 200K $20 St. Gaudens MS65. So it seems a little disjointed that they be less than the Saints, and there’s a good value there. In the cart below, the MS 65 St. Gaudens price is in dark blue and the MS64 $20 Liberty price in purple. The past few weeks have only marked the second time in six years these coins are trading for less than 65 St.’s, whereas they have, at times, been as much as $1000 more expensive to purchase, and have on average cost $288 more over the same period graphed below. So at a current discount of $150/unit to that of 65 St. Gaudens, we conclude that the $20 Liberty MS64 gold coins are roughly $450 undervalued by relative metrics. Here’s a link to a specifications page that contains the price/premium history charts for the MS64 $20 Liberty: * Only 40 Coins available at special discounted prices How to order? Call our trading desk: 1-800-869-5115×100 |

| All markets now depend on endless QE, Roberts tells KWN Posted: 20 Sep 2013 10:32 AM PDT 1:28p ET Friday, September 20, 2013 Dear Friend of GATA and Gold: Former Assistant U.S. Treasury Secretary Paul Craig Roberts today tells King World News that all markets now depend on the Federal Reserve's continuing to buy U.S. government debt through "quantitative easing" and that this debt monetization will lead to a flight from the dollar and a general economic crash, but the question is when. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/20_Fo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |