Gold World News Flash |

- Silver Demand: When Investment Trumps Industrial

- Gerald Celente - Collapse of currencies, raiding your safety deposit box?

- Gilder, Mundell, Vieira to speak at CMRE's October dinner meeting in New York

- Maguire - Fed, LBMA, Comex & Banks On The Edge Of Disaster

- The REAL Fukushima Danger

- Maguire – Fed, LBMA, Comex & Banks On The Edge Of Disaster

- Economic Collapse Coming - Financial Weapons 2013

- Gilder, Mundell, Vieira to speak at CMRE’s October dinner meeting in New York

- TDV Week in Review

- Reserve Bank of India is 'just curious' about temples' gold holdings

- Bullion banks appropriate unallocated gold for price suppression, Maguire tells KWN

- Happy Birthday Lehman Brothers

- Futures Soar To All Time High On Summers' Exit

- More Official Reactions To Summers' Stunner

- Summers withdraws from consideration for Fed chairman

- Bitcoin Goldrush or Fools Gold, Why Everyone is Excited About Bitcoin

- The State of the World’s Economy is Dire!

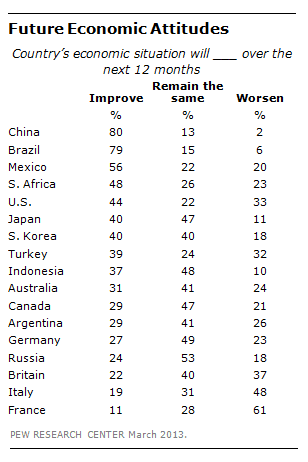

- How Optimistic/Pessimistic Is Your Country About Its Future Economy?

- 4 Clues That a Stock Market Collapse Is Coming

- Gold IRA page updated. Now includes regular updates with the retirement planner in mind.

- Gold IRA page updated. Now includes regular updates with the retirement planner in mind.

- Gold And Silver - Do You Prefer Fundamental Tale Or Technical Reality?

- Gold And Silver – Do You Prefer Fundamental Tale Or Technical Reality?

- Gold And Silver – Fundamental Tale Or Technical Reality?

- Gold Damaged, Bulls Back on the Defensive

- COMEX Deliverable Gold Bullion Plunges By 78% in 2013

| Silver Demand: When Investment Trumps Industrial Posted: 15 Sep 2013 10:30 PM PDT Jeffrey Lewis |

| Gerald Celente - Collapse of currencies, raiding your safety deposit box? Posted: 15 Sep 2013 10:22 PM PDT The Money and Wealth Show Guests: Gerald Celente, David Skarica - September 14, 2013 Gerald Celente - Collapse of currencies, raiding your safety deposit box? David Skarica - Dow de-lists companies,... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gilder, Mundell, Vieira to speak at CMRE's October dinner meeting in New York Posted: 15 Sep 2013 09:43 PM PDT 12:41a ET Monday, September 16, 2013 Dear Friend of GATA and Gold: Economist and fund manager George Gilder, Nobel Prize-winning economist Robert Mundell, and monetary historian Edward Vieira will be among the speakers at the fall dinner meeting of the Committee for Monetary Research and Education, to be held Thursday, October 24, at the 3 West Club, 3 West 51st St., New York. The theme of the meeting will be: "Is It Time To Reboot The Nation -- Its Economy and Its Money?" Also speaking will be Cato Institute Senior Fellow and Forbes columnist Steve H. Hanke; historian and market strategist Bob Hoye; Capital Alpha Partners Managing Director James Lucier; monetary historian Thomas Selgas; fund manager Victor Sperandeo; and monetary historian and lawyer Walker F. Todd. Admission will be $175 for CMRE members and spouses, $185 for others. The bar will open at 4 p.m. and proceedings will begin at 5 p.m. A reservation form is posted at GATA's Internet site here: http://www.gata.org/files/CMREReservationFormOctober2013.doc Questions may be directed to CMRE President Elizabeth Currier at CMRE@BellSouth.net. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Maguire - Fed, LBMA, Comex & Banks On The Edge Of Disaster Posted: 15 Sep 2013 09:01 PM PDT  London metals trader Andrew Maguire, who broke the news to King World News about two courageous JP Morgan whistleblowers confessing that JPM manipulates the gold and silver markets, warned KWN that the Fed, LBMA, Comex, and the bullion banks are now on the edge of disaster. He also told KWN exactly where massive central bank buying will come into the gold market. Below is what Maguire had to say in this powerful interview. London metals trader Andrew Maguire, who broke the news to King World News about two courageous JP Morgan whistleblowers confessing that JPM manipulates the gold and silver markets, warned KWN that the Fed, LBMA, Comex, and the bullion banks are now on the edge of disaster. He also told KWN exactly where massive central bank buying will come into the gold market. Below is what Maguire had to say in this powerful interview.This posting includes an audio/video/photo media file: Download Now |

| Posted: 15 Sep 2013 08:32 PM PDT The Real Problem …The fact that the Fukushima reactors have been leaking huge amounts of radioactive water ever since the 2011 earthquake is certainly newsworthy. As are the facts that:

But the real problem is that the idiots who caused this mess are probably about to cause a much bigger problem. Specifically, the greatest short-term threat to humanity is from the fuel pools at Fukushima. If one of the pools collapsed or caught fire, it could have severe adverse impacts not only on Japan … but the rest of the world, including the United States. Indeed, a Senator called it a national security concern for the U.S.:

Nuclear expert Arnie Gundersen and physician Helen Caldicott have both said that people should evacuate the Northern Hemisphere if one of the Fukushima fuel pools collapses. Gundersen said:

Former U.N. adviser Akio Matsumura calls removing the radioactive materials from the Fukushima fuel pools “an issue of human survival”. So the stakes in decommissioning the fuel pools are high, indeed. But in 2 months, Tepco – the knuckleheads who caused the accident – are going to start doing this very difficult operation on their own. The New York Times reports:

The Telegraph notes:

The Japan Times writes:

CNBC points out:

CNN reports:

Reuters notes:

ABC Radio Australia quotes an expert on the situation (at 1:30):

Xinua writes:

Japan Focus points out:

Like Pulling Cigarettes Out of a Crumpled PackFuel rod expert Arnie Gundersen – a nuclear engineer and former senior manager of a nuclear power company which manufactured nuclear fuel rods – recently explained the biggest problem with the fuel rods (at 15:45):

In another interview, Gundersen provides additional details (at 31:00):

|

| Maguire – Fed, LBMA, Comex & Banks On The Edge Of Disaster Posted: 15 Sep 2013 07:37 PM PDT Dear CIGAs, London metals trader Andrew Maguire, who broke the news to King World News about two courageous JP Morgan whistleblowers confessing that JPM manipulates the gold and silver markets, warned KWN that the Fed, LBMA, Comex, and the bullion banks are now on the edge of disaster. He also told KWN exactly where massive... Read more » The post Maguire – Fed, LBMA, Comex & Banks On The Edge Of Disaster appeared first on Jim Sinclair's Mineset. |

| Economic Collapse Coming - Financial Weapons 2013 Posted: 15 Sep 2013 07:35 PM PDT Our founders knew about central banks. The main reason for the revolutionary war was the Bank of England. That's why in our constitution it says our money will be made of gold, and silver. You can't... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gilder, Mundell, Vieira to speak at CMRE’s October dinner meeting in New York Posted: 15 Sep 2013 07:00 PM PDT by Chris Powell, GATA:

Economist and fund manager George Gilder, Nobel Prize-winning economist Robert Mundell, and monetary historian Edward Vieira will be among the speakers at the fall dinner meeting of the Committee for Monetary Research and Education, to be held Thursday, October 24, at the 3 West Club, 3 West 51st St., New York. The theme of the meeting will be: “Is It Time To Reboot The Nation — Its Economy and Its Money?” |

| Posted: 15 Sep 2013 06:30 PM PDT by Gary Gibson, Dollar Vigilante:

I was trying to work up some outrage over the US police state…or the US beating the drums of war with Syria. But it’s just not working today. Don’t get me wrong. I think it’s outrageous that police are revealing themselves as a typical public program with the usual perverse results. You pay at gunpoint for protection and end up with a trigger happy, occupying force that fills innocent people and their pets with bullets and occasionally burns them to death in their homes. I also think it’s outrageous that the Nobel Peace Prize winning president who campaigned on stopping the neocon evils of invasion, occupation and torture is now trumping up reasons to violently dismember the bodies of yet more civilians in a sandy country. |

| Reserve Bank of India is 'just curious' about temples' gold holdings Posted: 15 Sep 2013 06:09 PM PDT Kerala Temples Say No to RBI Request on Gold By T.K. Devasia http://www.khaleejtimes.com/kt-article-display-1.asp?xfile=data/internat... The Guruvayur Devaswom Board, which administers the famous Sri Krishna Temple at Gurvayoor in Trichur district of Kerala in India, has rejected the Reserve Bank of India's request to provide the bank with details of gold assets of the temple. A meeting of the temple's ad-hoc managing committee, chaired by permanent member Samoothiri Manavadevanraja, took the decision unanimously, saying it was impractical to assess the gold stock correctly. Board administrator K. Muralidharan said the bank had requested the committee to provide details of gold stock in its possession as part of collecting the gold assets of places of religious worship, trusts, and other establishments in the country. The Sri Krishna Temple is one of the richest temples in India. Sources close to the temple say the amount of the gold reserves and other valuables could be more than 600 kilograms. The temple has already deposited 500 kilograms of gold bars with the State Bank of India. The other temples have also expressed apprehension over the RBI query. ... Dispatch continues below ... ADVERTISEMENT Precious Metals Round Table: On Tuesday, September 24, Sprott Asset Management will assemble four experts for a live Internet broadcast about the prospects for the precious metals. Participating will be Sprott's CEO, Eric Sprott; financial letter writer and internationally renowned conference speaker Marc Faber; Sprott's chief investment strategist, John Embry; and Sprott Asset Management President Rick Rule. To participate, please visit: https://event.on24.com/eventRegistration/EventLobbyServlet?target=regist... The Travancore Devaswom Board, which administers more than 1,000 temples in the southern districts of the state, will be meeting next week to consider the RBI request. Temple authorities and various Hindu bodies came out openly against the RBI move, saying it was part of a well-planned effort to convert the gold into bullion to tide over the financial crisis faced by the government. They also expressed fear over the security risk the revelation poses to the temples. Shantha Kumar, deputy general manager at the RBI regional office in Dubai, has termed the apprehensions being raised by various quarters baseless. He told the Khaleej Times that the RBI had no intention to convert the gold into bullion. "We sought the details as part of a statistical exercise to gather details of the gold in the possession of all places of worship and other public bodies. We started the process with temples. We had planned to cover the places of worship of other communities, trusts, and establishment in subsequent phases," Shantha Kumar said. Shantha Kumar said the move was prompted by the curiosity and not guided by the current economic situation marked by the slide in the Indian rupee or the rising price of gold in the international market. Referring to the security concern expressed by certain quarters, Shantha Kumar said the RBI had guaranteed total confidentiality for the information shared with the bank. "We had promised not to share it with anyone else," he added. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Bullion banks appropriate unallocated gold for price suppression, Maguire tells KWN Posted: 15 Sep 2013 05:20 PM PDT 8:19p ET Sunday, September 15, 2013 Dear Friend of GATA and Gold: In the second part of his latest interview with King World News, London metals trader Andrew Maguire says central banks are supporting bullion banks with guarantees, the Bank of England acting as intermediary, as the bullion banks appropriate the unallocated gold of their customers to suppress the gold price with. The scheme will end, Maguire says, with abrupt cash settlement for investors whose gold is unallocated. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/16_Ma... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Happy Birthday Lehman Brothers Posted: 15 Sep 2013 03:31 PM PDT Follow ZeroHedge in Real-Time on FinancialJuice Anniversaries and celebrations of past historic events are part and parcel of our everyday lives. We celebrate to remember and to grow up, to change and to learn from what happened. But sometimes that just doesn't mean very much apart from the fact that that we spend endless amounts of time reassessing the moments that have brought us to where we are today, sometimes with a cold thudding halt in our tracks. One of those dates is September 15th 2008, which will remain poignantly celebrated or mourned by most as the start of the public knowledge of the financial crash with the collapse of Lehman Brothers. There's a second anniversary that is coming up too this month. It's the date when the US government sees its deadline expire to be able to file charges against bankers accused of having a significant role in the financial crisis and the collapse of our economies. But where are the prosecutions and where are the people that played major parts in what made us all go under in the world? More importantly, why has the US administration not done anything to prosecute those people as the public have demanded? Are we to allow them to get off scot free and walk away?

There were 15 million documents that were analyzed by theSecurities and Exchange Commission in the US when considering whether or not to prosecute executives from Lehman Brothers. Over thirty witnesses were called in to give their versions of what happened. A federal prosecutor once stated that it was nothing like a murder case with a dead body splattered in blood on the sidewalk after being gunned down. That was supposed to infer that it was impossible to determine whether or not someone was actually guilty or not. Have the federal prosecutors not actually seen the zombies that are walking around now in society that have been resuscitated from the dead after the economies of our world collapsed due to the banker's mistakes? There are plenty of walking dead as a result of those bankers' turning off the risk-alarms in their brains that should have told them to stop while they were ahead.

Of course Wall Street has a negative image for the world. It's simply because there is no power that has prosecuted the banksters that caused the financial crises. Richard Fuld Jr. (who was at the head of Lehman Brothers for nearly15 years) was allowed to carry doing whatever he wanted after the collapse of the world. He might have been the 'most hated man in America' in self-titled fashion, but it never stopped him after the biggest bankruptcy in the history of the United States from founding the 2009 consulting firm (mergers and acquisitions) called Matrix Advisors. Rather poignant that he chose the word 'matrix' as part of the company's name. Matrix means 'a situation or surrounding substance within which something else originates or develops'. The originating matter was the risky business that caused the financial crisis. He just started all over again doing the same thing. He was titled the 'villain' of Wall Street by the Republican Representative John Mica of Florida. But villains are likeable characters, aren't they? They're not the gangster criminals that everybody hates. That was an understatement as to the role played out by Fuld in the crash and the ensuing financial crisis. The majority of the executives went on working in the financial sector for Barclays Bank when it bought up Lehman Brothers. President Bart McDade of Lehman Brothers went on to found River Birch Capital an investment company.George Walker ran and continues to run the now independent Neuberger Berman (former) wealth management side of Lehman Brothers. The Securities and Exchange Commission and the Federal Prosecutors have never closed the case against the Lehman Brothers' executives. It's just hanging there in the air, suspended like a bad smell under all of our noses. I thought we were meant to instill trust in the banking system once again. At least that's what we were told was going to happen. But, bankers don't think like normal people. They are fuelled by greed and narcissistic behavior that powers their heightened sense of competition along with dysfunctional reactions to the way that one should act. This is exacerbated by alpha-male behavior of harassment and demands that are unreasonable by those running the financial sectors and the executives at the top. Bankers don't think like everyone else because they have been driven by the overpowering feeling of motivation that soon turns into irrationality and a world devoid of humanity and certainly one that is bound by no-limits. Power-hungry people see that rub off on each other in a big game of survival. It's no surprise that the banking system hasn't changed. We have nothing to celebrate with the death of the Brothers. We should have buried them long ago; but we didn't. They were allowed to go and work elsewhere, they were allowed to stay in the financial sector and they were allowed to carry on regardless doing the self-same thing. The risk zone of their brains was rescinded to the back office of their brains for good and they have just continued feeding off their big boy's game.Septaper Will Open Floodgates | How Sinister is the State? | Food: Walking the Breadline | Obama NOT Worst President in reply to Obama: Worst President in US History? Obama's Corporate Grand Bargain Death of the Dollar | Joseph Stiglitz was Right: Suicide | China Injects Cash in Bid to Improve Liquidity Technical Analysis: Bear Expanding Triangle | Bull Expanding Triangle | Bull Falling Wedge | Bear Rising Wedge | High & Tight Flag

|

| Futures Soar To All Time High On Summers' Exit Posted: 15 Sep 2013 03:08 PM PDT "The (potential) hawk is dead, long live the doves," appears the chorus of approving 'traders' who have just bid the S&P 500 futures up over 1% to a new all-time high. The USD is getting monkey-hammered, Gold futures jumped $20 and Silver futures are up 3.5% (from the Friday PM fix) but are fading back close to the Friday trading close. Treasury futures open up over 1 point (implying 30Y -4bps, 10Y -8bps, 5Y -11bps) - jubilant at the money-printing to come - oh and WTI crude is -1.3% at $107. BTFATH!!!

and sell the USD...

Of course we've seen these kind of knee-jerk reactions when a 'leader' steps aside - cough Ballmer cough - and that didn't end well.

Charts: Bloomberg |

| More Official Reactions To Summers' Stunner Posted: 15 Sep 2013 03:06 PM PDT DAN FUSS, VICE CHAIRMAN AND PORTFOLIO MANAGER, LOOMIS SAYLES, BOSTON: "This is a good move by Larry. This is a short-term plus for the bond market." Treasuries will rally on this news as investors saw Summers as hawkish toward quantitative easing. LARRY JEDDELOH, FOUNDER AND CHIEF INVESTMENT OFFICER, TIS GROUP, NORTH OAKS, MINNESOTA: The 10-year Treasury note had partially priced a Summers chairmanship. "If it's almost anybody but Larry, I think bonds will rally." Jeddeloh said he would not surprised to see the 10-year Treasury rally back to the 2.3 percent-2.4 percent range. ERIC STEIN, PORTFOLIO MANAGER, EATON VANCE, BOSTON: "I do think there will be less for investors to worry about as there will be more policy continuity at the Fed." The knee jerk reaction will likely be good for USTs, bad for the US dollar, and good for equities, Stein said. "I think this development is generally a good one because while Summers has a brilliant mind and is a very talented economist, I think his style would have made life at the Fed very challenging for his colleagues. "Bernanke has made a lot of progress in depersonalizing the institution and making it less dependent on the Chairman, and under Summers this depersonalization probably would have reversed a lot." ADAM GREEN, CO-FOUNDER, PROGRESSIVE CHANGE CAMPAIGN COMMITTEE, WASHINGTON: "Larry Summers' past decisions to deregulate Wall Street and do the bidding of corporate America has made the lives of millions of Americans more acrimonious. He would have been an awful Fed Chair. President Obama should appoint someone to lead the Fed who has not accepted millions in payments from Wall Street, and who will prioritize an economy that works for the little guy above further enrichment for the big guy." Source: Reuters |

| Summers withdraws from consideration for Fed chairman Posted: 15 Sep 2013 03:03 PM PDT By Zachardy A. Goldfarb http://www.washingtonpost.com/business/economy/larry-summers-withdraws-n... Former Treasury secretary Lawrence H. Summers has withdrawn his name as a candidate for Federal Reserve chairman, in a startling development that raises new questions about who will lead the central bank when Chairman Ben S. Bernanke steps down in four months. The other main candidates for the job have been Fed vice chairman Janet Yellen and former Fed vice chairman Don Kohn, though it is still possible that President Obama will seek another choice. Time is short for nominating someone for the critical post, with a confirmation process expected to last several months. ... Dispatch continues below ... ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Obama had been strongly leaning toward picking Summers, who helped him navigate the depths of the financial crisis and recession at the beginning of his term, and had assurances from Democratic Senate leadership leaders that they would work to get him confirmed, according to people familiar with the matter. But amid an intensifying uproar of liberal Democrats and left-wing groups opposed to his nomination, Summers decided to withdraw his name on Sunday, telephoning the president to tell him his decision. "It has been a privilege to work with you since the beginning of your administration as you led the nation through a severe recession into a sustained economic recovery," Summers, a Harvard professor, wrote in a letter to the president. "This is a complex moment in our national life. I have reluctantly concluded that any possible confirmation process for me would be acrimonious and would not serve the interest of the Federal Reserve, the administration, or ultimately, the interests of the nation's ongoing economic recovery." Obama accepted Summers' decision, lauding him and saying that he planned to continue to consult his former adviser. "Larry was a critical member of my team as we faced down the worst economic crisis since the Great Depression, and it was in no small part because of his expertise, wisdom, and leadership that we wrestled the economy back to growth and made the kind of progress we are seeing today," Obama said. "I will always be grateful to Larry for his tireless work and service on behalf of his country." People close to the Fed process said Summers faced not only a rebellion among liberal Democrats but also other unexpected interruptions, including the debate over whether to strike Syria, that stretched out the process and gave time for more opposition to build. Summers' nomination would have also collided with a tumultuous series of fall debates on the budget. "It was just a perfect storm of bad timing," said one person close to the White House, who requested anonymity in order to speak candidly about private deliberations. "It would have been absolute war, and the president would have had to spend all of his political capital. Larry decided not to drag him through it." The contest for Fed chairman had taken on the shape of a political race, with allies of both Summers and Yellen advancing their cases on the record and behind the scenes. A wide array of current and former Obama officials backed Summers, arguing that his crisis experience and economic prowess made him an exceptional candidate. Yellen's supporters, meanwhile, noted that she has deep Fed experience and has been an architect of the central bank's efforts to reduce unemployment. When word of Summers' candidacy first circulated, liberals erupted, furious at what they said was his record of supporting deregulation in the Clinton administration. Obama took to defending him when questioned on Capitol Hill, and his supporters noted that he was an architect of the president's regulatory response to the crisis. In order to buy time and cool tensions, the White House announced that no decision would be made until the fall. But that only gave space for Summers' opponents to strengthen their protests to his candidacy, with four of the 12 Democrats on the Senate Banking Committee, which would confirm Summers, signaling opposition. That would have meant that the president would have probably had to court Republican support for a Summers nomination, while also trying to strike deals to keep the government open and operating. Summers' withdrawal is a disappointing setback for a renowned economist who had climbed to the top of nearly every ladder of his profession -- as Treasury secretary, Harvard president, and senior White House economic adviser. The Fed chairman would have represented the peak of that ascent. I''s also a setback for Obama, who is fiercely loyal to his aides but has now on several occasions seen his preferred candidates for jobs lose out as a result of political opposition. It's especially painful given that it's Obama's own party that cost Summers the nomination. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Bitcoin Goldrush or Fools Gold, Why Everyone is Excited About Bitcoin Posted: 15 Sep 2013 02:44 PM PDT Gold/Silver and Copper Coins are The Ultimate Form Of Payment and Store Of Wealth...When the Dollar crashes Everyone Will Want The Real Deal...And They Will Use Paper Money To Wipe Their... [[ This is a content summary only. Visit http://FinanceArmageddon.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The State of the World’s Economy is Dire! Posted: 15 Sep 2013 10:36 AM PDT Minor tidbits of good news, combined with manipulated and seasonally adjusted So says Egon von Greyerz (goldswitzerland.com) in edited excerpts from his original article* entitled The Real State of the Economy Is Dire. [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]von Greyerz goes on to say in further edited excerpts: A world based on debt How can a world with $250 trillion of debt and over $1 quadrillion of worthless derivatives ever recover? Of course it can't, especially since this is a world that is supported by legs of worthless printed paper money – legs that are just getting longer and more unstable by the day as trillions are added to the debt every year. Wherever we turn Europe, USA, Japan and many other nations, the situation is totally beyond repair….It is not just beyond repair but we are likely to be at the end of a major economic cycle that started at the end of the Dark Ages. I wrote about this back in 2009 in my article "The Dark Years Are Here" . Major economic cycles take a long time to develop and if we are now at the beginning of a major downturn in the world economy, people living today will only experience the very beginning of the downturn but, sadly, the beginning will be a major and very unpleasant upheaval that virtually nobody will escape. We have had a century of false prosperity based on printed money and credit. In the last 100 years we have seen the creation of the Fed in the US (a central bank owned, created and controlled by private bankers) combined with fractional reserve banking (allowing banks to leverage 10 to 50 times), exploding government debt and a derivatives market of $1.4+ quadrillion. These are the principal reasons why the world economy has expanded in the last century and particularly in the last 40 years. These four extremely shaky legs:

have created a world of delusional wealth and illusory prosperity. Also, there is a total absence of moral and ethical values. We are in the final stages of an era of extreme decadence, an era that sadly cannot and will not have a happy ending. Europe a hopeless case …In Europe the Mediterranean countries are expanding their debt at exponential rates. Government debt-to-GDP of Spain, Portugal, Italy and Greece is ranging from 100% to 180%. There are futile attempt at austerity but this only leads to lower growth and higher debts. There is sadly no way out for these countries whose population is suffering terribly. The best solution would be to leave the EU and the Euro [and] renege on the debts and devalue currencies but the Eurocrats are unlikely to accept this and would rather add more debt and print more money, making the situation even worse. US debt will sink the world The situation in the U.S. is no better. There is hardly one economic figure being published that has anything to do with reality.

US government debt was $1 trillion in 1980, $8 trillion in 2006 when Bernanke became Chairman of the Fed and is now $17 trillion and growing by at least one trillion a year. Bernanke has managed to create $9 trillion of debt during his brief 7 years as Chairman of the Fed…and this debt excludes unfunded government liabilities of around $220 trillion. Who in their right mind can believe that the U.S. can get out of this hole! Yes, the U.S. and the rest of the world will print unlimited amounts of money but printed money is printed worthless pieces of paper and has nothing to do with wealth creation. The worldwide printing will just add to the already unsustainable debt worldwide and not create one penny of added prosperity. Instead we are likely to see a hyperinflationary depression in many countries. Conclusion For the privileged few that have financial assets to protect, physical gold stored outside the banking system is likely to be the best way to preserve wealth and purchasing power. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://goldswitzerland.com/the-real-state-of-the-world-economy-is-dire/ (Click here to subscribe to our mailings) Related Articles: 1. How Optimistic/Pessimistic Is Your Country About Its Future Economy?

To what extent do residents of these 39 countries think their country’s economy will improve or worsen by the spring of 2014? Take a look. Read More » 2. We're Heading Toward Another Nightmarish Financial Crisis! Here's Why We have not seen so many financial trouble signs all come together at one time like this since just prior to the last major financial crisis in 2008. It is almost as if a “perfect storm” is brewing, and a lot of the “smart money” has already gotten out of stocks and bonds. Could it be possible that we are heading toward another nightmarish financial crisis? Read More » 3. When the Debt Bubble Bursts We're Going to See Economic Chaos So Get Ready – NOW! Never before has the world faced such a serious debt crisis. Yes, in the past there have certainly been nations that have gotten into trouble with debt, but we have never had a situation where virtually all of the major powers around the globe were all drowning in debt at the same time. Right now, confidence is being shaken as debt levels skyrocket to extremely dangerous levels. Many are openly wondering how much longer this can possibly go on. [Here's my take on the situation.] Read More » The post The State of the World’s Economy is Dire! appeared first on munKNEE dot.com. |

| How Optimistic/Pessimistic Is Your Country About Its Future Economy? Posted: 15 Sep 2013 10:20 AM PDT To what extent do residents of these 39 countries think their country’s economy will The original article* was written by Bruce Stokes, Director of Global Economic Attitudes at the Pew Research Center's Global Attitudes Project (pewresearch.org) entitled Downbeat views prevail in G20 countries as summit begins. The original article below is paraphrased by Lorimer Wilson, editor of www.munKNEE.com and www.FinancialArticleSummariesToday.com and the FREE Market Intelligence Report newsletter (sample here – register here). Please note that this paragraph must be included in any article reposting with a link to the article source to avoid copyright infringement.The article conveys the following: According to a survey of the residents of 39 countries conducted by the Pew Research Center earlier this year x% of the residents of the following countries were: The Most Pessimistic:

The Most Optimistic:

The Status Quo:

*http://www.pewresearch.org/fact-tank/2013/09/04/downbeat-views-prevail-in-g20-countries-as-summit-begins/ Related Articles: 1. We're Heading Toward Another Nightmarish Financial Crisis! Here's Why

We have not seen so many financial trouble signs all come together at one time like this since just prior to the last major financial crisis in 2008. It is almost as if a “perfect storm” is brewing, and a lot of the “smart money” has already gotten out of stocks and bonds. Could it be possible that we are heading toward another nightmarish financial crisis? Read More » The madmen who are responsible for the coming economic disaster continue to behave as if they can manage to avoid it. Violating Einstein's definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. The end is certain, only its timing is unknown, and, once interest rates begin to rise, and they will, it’s game over so it begs the questions “How much longer this can possibly go on?” and “What will happen to the U.S. and the world when it does?” Read More » We often take things far too seriously when looking at the world of high finance, the global economy and the ins and outs of investing. Lighten up and relax. See the world for what it really is through the eyes (and words) of some individuals who can do just that. Read More » There is one vitally important number that everyone needs to be watching right now, and it doesn’t have anything to do with unemployment, inflation or housing. If this number gets too high, it will collapse the entire U.S. financial system. The number that I am talking about is the yield on 10 year U.S. Treasuries. Here’s why. Words: 1161; Charts: 2 Read More » 5. Another Crisis Is Coming & It May Be Imminent – Here's Why Is there going to be another crisis? Of course there is. The liberalised global financial system remains intact and unregulated, if a little battered…The question therefore becomes one of timing: when will the next crash happen? To that I offer the tentative answer: it may be imminent…[This article puts forth my explanation as to why that will likely be the case.] Read More » The post How Optimistic/Pessimistic Is Your Country About Its Future Economy? appeared first on munKNEE dot.com. |

| 4 Clues That a Stock Market Collapse Is Coming Posted: 15 Sep 2013 10:07 AM PDT You might be well advised to keep your powder dry and your portfolio small – or The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.Mayer goes on to say in further edited (and perhaps paraphrased in some cases) excerpts: There are 4 clues that tells us there is a stock market collapse coming: 1. Looming Debt Ceiling Drama Jacob Lew, the Treasury secretary, just whispered that the next market crash begins no later than mid-October. Of course he didn't say those exact words but he did report that the Treasury's "extraordinary measures" to avoid hitting the debt ceiling will be "exhausted in the middle of October" and you no doubt remember that the 2011 debt ceiling talks and the drama around a government shutdown led Standard & Poor's to downgrade the U.S.' credit rating for the first time ever. The market fell more than 15% while all of this was going on from April to August and we're looking at something like that all over again as the government's debt presses up against that ceiling. Even though Lew's whispering those words now, soon he'll begin screaming about it. The budget deficit crisis will likely soon be front-page news…as the brinkmanship over the debt ceiling ramps up again. I think we're in for a rough couple of months. 2. Huge and Unsustainable Amount of "Stimulus" Buying As John Williams at ShadowStats points out, the Federal Reserve has bought 110% of the net issuance of U.S. Treasury this year meaning that the Federal Reserve Bank has bought every new dollar of debt issued and then some. As Williams says, this is "a pace suggestive of a Treasury that is unable to borrow otherwise." By mid-October, the Federal Reserve's purchases should be approaching 140%, by Williams calculations. This is clearly absurd and can't go on forever. (If for no other reason than the Fed will eventually own the entire federal debt market. As it stands now, it owns about a third of it!) When it ends, interest rates will likely rise. That could also bring the easy-money party to a close. Ironically, right before Labor Day weekend, the government issued its revised GDP numbers claiming that the economy grew at an annual rate of 2.5% for the second quarter which was a 47% boost from the initial government estimate of 1.7%. Officially, the government is telling us that the economy has now completely recovered from the 2008 crisis – that economic activity is now higher than it was at the 2007 peak. What's most interesting is the contrasting picture of a glowing GDP report with everything else. As Williams points out, "No other major economic series has shown a parallel pattern of full economic recovery. Either the GDP reporting is wrong, or all other major economic series are wrong." 3. An Economy Far Weaker Than Gov’t Reporting There is a lot of nonsense in economic reporting, and GDP is the worst of all. (Williams himself admits that GDP "remains the most worthless and most heavily politicized" of the government series) but when you look at something that's harder to fudge – median household income – you don't see any recovery, and these are the government's official numbers. The point is there has been no full recovery as can be clearly seen the chart below. 4. Slowing Profit Growth and a Rising Market The bigger concern is that the market doesn't have any of this priced in at all…

Slowing profit growth and rising market mean valuations have climbed. Bloomberg reports that "Valuations last climbed this fast in the final year of the 1990s technology bubble, just before the index began a 49% tumble." I don't think we have that big of a decline ahead of us, simply because we're starting at a much lower valuation. In 1999, the market went for 30 times earnings. Today, it goes 18 times earnings. That's still a high number, reflective of too much optimism about future growth. Most still see earnings and the economy growing briskly in the back half of the year. Barron's recently polled 10 of the most influential Wall Street seers. They project 8% earnings growth in the second half! When it becomes obvious that is a fairy tale, the market is going to be in for a shock. Conclusion Keep your powder dry and your portfolio small. After reading the above, you might be tempted to sell everything and wait for the storm to blow over. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://dailyreckoning.com/near-the-debt-ceiling-no-one-can-hear-you-scream/ (© 2013 Agora Financial, LLC. All Rights Reserved.) Related Articles: 1. The Stock Market Is NOT About to Crash Any Time Soon! Here's Why

There's nothing to be bearish about regarding the stock market these days. US stocks are not overpriced or overleveraged, and remain more attractive than at prior peaks so pop a pill and relax. There's no immediate danger threatening stocks as the following market analyses clearly outline. Read More » 2. 5 Reasons It's Really "Different This Time" for the Stock Market We have experienced a huge bull market this year but any pundits are calling for the bullish move to end in a sharp downward correction…The bears have a case, historically and cyclically, but I am going to go out on a limb and say things are really different this time. Here are 5 reasons why. Read More » 3. Stock Markets Look Ripe For a MAJOR Correction – Here's Why Divergences between fundamentals, confidence and the valuation of markets are large and, as such, cannot last for long. The only question is how – and how quickly – this correction occurs. Read More » The post 4 Clues That a Stock Market Collapse Is Coming appeared first on munKNEE dot.com. |

| Gold IRA page updated. Now includes regular updates with the retirement planner in mind. Posted: 15 Sep 2013 08:36 AM PDT

We have revised and updated our page on gold retirement plans, including the IRA. It now includes a section in the right column called “Inside the Precious Metals Retirement Plan” devoted to items of interest to the retirement planner. The column is edited by George Cooper, J.D. — our retirement specialist. The first installment covers the recent resurgence of interest in silver American Eagles at a time of subdued gold Eagle sales. Premiums are again on the rise, but USAGOLD can still offer this popular coin at regular pricing — at least for now. We have a large number of clients who purchase gold and silver through their self-directed IRAs. This page is devoted both to an initial introduction to the process as well as regular updates of interest to the retirement planner who already owns precious metals in his or her plan, or plans to. We invite your visit and encourage you to bookmark the page for quick reference. |

| Gold IRA page updated. Now includes regular updates with the retirement planner in mind. Posted: 15 Sep 2013 08:35 AM PDT

We have revised and updated our page on gold retirement plans, including the IRA. It now includes a section in the right column called “Inside the Precious Metals Retirement Plan” devoted to items of interest to the retirement planner. The column is edited by George Cooper, J.D. — our retirement specialist. The first installment covers the recent resurgence of interest in silver American Eagles at a time of subdued gold Eagle sales. Premiums are again on the rise, but USAGOLD can still offer this popular coin at regular pricing — at least for now. We have a large number of clients who purchase gold and silver through their self-directed IRAs. This page is devoted both to an initial introduction to the process as well as regular updates of interest to the retirement planner who already owns precious metals in his or her plan, or plans to. We invite your visit and encourage you to bookmark the page for quick reference. |

| Gold And Silver - Do You Prefer Fundamental Tale Or Technical Reality? Posted: 15 Sep 2013 07:51 AM PDT A few have inquired about our greater focus on the charts as they pertain to the Precious Metals, of late, a shift of which we have been cognizant. The reason is, it suits our purpose. Our purpose is to pursue profitable trading, and telling ... Read More... |

| Gold And Silver – Do You Prefer Fundamental Tale Or Technical Reality? Posted: 15 Sep 2013 04:25 AM PDT A few have inquired about our greater focus on the charts as they pertain to the Precious Metals, of late, a shift of which we have been cognizant. The reason is, it suits our purpose. Our purpose is to pursue profitable trading, and telling "stories" is not always apt, especially when almost all of them have been amply related in the news and written endlessly by cheerleading precious metals [PM] writers and newsletters. Why is an analysis more focused on charts seem like such an obvious question? Last week, we provided a list of nine of the most recognized reasons for viewing gold and silver from a demand side perspective. There are many others you can think of, additionally. [See: It Is Always About One Thing: Timing] Repeating the same things is unnecessary, and those which have been aired so frequently seem not to have had much influence on sustaining higher prices. From a totally different perspective, reminding and/or informing people about the intrinsic qualities in owning gold and silver: rights, title, and interest should have sealed the deal, as it were, as the ultimate reasons for acquiring and owning both PMs. [See: When Precious Metals Bottom Is Irrelevant To Your Financial Health]. What else is needed to enhance the strong demand side of the market, and one that gets stronger with each passing month? Almost everyone is aware of the disappearing gold act sponsored [in stealth hiding] by the central bankers and abetted by lackey PM exchanges, COMEX and LBMA. Yet, on Thursday into Friday, there was another "take-down" in gold and silver futures. Where is all of this demand that is supposed to take price to elevated heights when it counts? Should you believe what you read/hear, or what you actually see? The only problem that keeps PMs suppressed is the proverbial 900 lb gorilla in the room. It would be easier to identify that gorilla as the New World Order, [NWO], but too many do not comprehend/accept/believe that context. People are not capable of differentiating one's country with the corporate government running/ruining it, and the real power behind the corporate government. With over half the population dependent on some form of socialized government hand-out, and almost all of the Main Streeters overdosed on credit, for those politically unaware, but unaware of being unaware, from where is any opposition to government going to come? Central banker/Lying Ben's policy of keeping interest rates artificially low serves one purpose and one purpose only: bail out the corrupt bankers and keep all of the failed banks on resuscitation. The propping up of the banker's massive Ponzi scheme is being accomplished at the destruction of people's wealth. Wealth is not confined just to those in the upper 1%, 5%, or even 10%. Wealth can be applied and defined in more ways than expressed high "dollar" figures. Health is one that rates highly. To the people in Cyprus, Greece, Ireland, and recently Poland, and elsewhere, bankers stealing from individual's accounts, many of whom need what little money they have just to survive from one day/week/month to the next, and those amounts may not qualify them as wealthy, but the amounts mean a wealth to them. The primary functioning arm of the NWO is control of money, and it is accomplished through the central bankers, none of whom have been elected in any representative fashion, but who, nonetheless run/control almost everyone's lives. The reason why we cannot say everyone is because those who own and hold gold and silver are truly independent of government control over how they choose to live, financially. Guess what bankers just did, while you were sleeping? They passed bankruptcy laws that puts derivatives in the highest secured position. First of all, who is responsible for the collapse of so many financial institutions since Lehman and AIG? Bankers! They engaged in high-risk ventures, [really nothing more than scams] that blew up in their greedy faces. A lot had to do with derivatives. Where have the trillions of fiat "dollars" needed to save the economy gone? To those same bankers who failed in what they created. But the unwritten law is, bankers cannot take a loss. Their practice is to reap and keep all the gains and socialize all the losses to the public. What are derivatives? Essentially, derivatives are a contract between two parties dealing in equity, foreign exchange, interest rates, and recently Wall Streets' mortgage securitization Ponzi scheme. Who created these derivatives? Wall Street bankers. Who suffered trillions in losses? Wall Street bankers. Who is footing the bill for these financial disasters? The unknowing American public. The value of the derivative market could be 20 – 30 times the value of the stock market, in the neighborhood of $700 to $800 trillion fiat "dollars." They are also called swaps, credit default swaps, currency swaps, etc. With derivatives now immune from bankruptcy laws, who secures them? Guess what America, you do! How are they secured? By your bank accounts, brokerage accounts, pensions, IRAs, 401ks. Remember M F Global, a few short years ago? Why did people lose billions of dollars? That money went to Wall Street bankers who held tons of high- risk [and worthless] derivative claims that were first-in-line for payoff because bankers passed such a law. After bankers paid themselves for their failed losses, there was no money left to pay those who had deposits in their brokerage accounts. Poof! Vaporized. Gone! We are sure the bankers thank you very much for your generosity in insuring them against all loss exposure. You did agree to it, didn't you? The NWO dictates that you did. Anyone with money in a brokerage account is at risk, to the tune of 100%! Got money in a bank? Any/every deposit you make into a bank is no longer your money. It belongs to the bank, and you are now an unsecured creditor! If the bank fails, and every single major bank has failed, being propped up by government loans, [not money you loaned, but your loss, anyway], your "deposit[s] is/are gone, poof, vaporized. How does the risk is keeping money in a brokerage and bank account stack up, to use a PM term, to owning gold at $1,200, $1,500, or $1,800, and silver at $20, $30, $40? There is no third counter-party risk in owning either metal. None! Neither gold nor silver can go poof on you, get vaporized, or disappear, [unless you hold it in "enemy territory" where it can [and will be] confiscated. With gold and silver, you have 100% interest in, rights and title to their ownership [another mention of When Precious Metals Bottom Is Irrelevant To Your Financial Health]. What other investment affords you 100% backing? It remains the only investment with a history going back over 5,000 years, and it is recognized and accepted around the world. Stop and [re]think. What does $1,300 gold mean? It means instead of requiring the old $35 fiats, or $250 fiats, $500 fiats, you now need 1,300 fiats to purchase the same ounce of gold that used to be just $35. Gold and silver are not going up in value, they are holding relative value. Fiat currency has declined in "value," and you need more and more of the worthless fiats that the 900 pound gorilla NWO is constantly depreciating. Who/What else can exert such "influence" at will in a PM market that is dominated by exceptional demand and limited supply relative to the growing demand? Only the NWO central bankers. What other positive "news" or "new" development have you heard or read about that can rally gold and silver? Why do they continue to be so easily manipulated to the downside, at will and whim? We can think of no other situation or story that has not already been covered, many times over that will cause a sustained rally in gold and silver. As we often say, do not listen to what others are saying about the market, listen to what the market is saying about others. And that information comes from the charts. Write your own bullish scenario for gold, then compare it to what the chart says. Which is to be believed, an incredible tale of demand, or the reality of the chart?

The situation is no different in silver. Do you really need another "bullish story" to enforce your existing belief in silver or gold? If you do, you are reading the wrong analysis. The chart says neither PM has blossomed into a bullish chart picture, and we place our beliefs in what the charts say. Quite frankly, we have run out of bullish reasons and simply prefer the reality of the story of the market, always the best and most reliable source. We expect higher prices will be forthcoming, but not in the way most PM pundits have been "predicting." We offer no predictions. Instead, we read what the market says and endeavor to follow accordingly. For right now, the market is in no pressing hurry to the upside, and it continues to remain susceptible to easy declines. The 900 pound gorilla still holds sway.

|

| Gold And Silver – Fundamental Tale Or Technical Reality? Posted: 15 Sep 2013 03:17 AM PDT A few have inquired about our greater focus on the charts as they pertain to the Precious Metals, of late, a shift of which we have been cognizant. The reason is, it suits our purpose. Our purpose is to pursue profitable trading, and telling “stories” is not always apt, especially when almost all of them have been amply related in the news and written endlessly by cheerleading precious metals [PM] writers and newsletters. Why is an analysis more focused on charts seem like such an obvious question? Last week, we provided a list of nine of the most recognized reasons for viewing gold and silver from a demand side perspective. There are many others you can think of, additionally. [See: It Is Always About One Thing: Timing, click on http://bit.ly/17Hctst} Repeating the same things is unnecessary, and those which have been aired so frequently seem not to have had much influence on sustaining higher prices. |

| Gold Damaged, Bulls Back on the Defensive Posted: 15 Sep 2013 02:24 AM PDT As I mentioned in my last post there is a disturbing possibility that gold's intermediate cycle has topped, and done so in a left translated manner. For clarification, left translated cycles often lead to lower lows. In this case if gold did top on week 9 and the intermediate cycle is now in decline, then the odds are high we are going to see the June low of $1179 tested and broken before the next intermediate bottom. |

| COMEX Deliverable Gold Bullion Plunges By 78% in 2013 Posted: 14 Sep 2013 09:25 AM PDT The last time that the claims per ounce were nearly this high was in the late 1990's. At that time the central banks had to intervene to keep one or more bullion banks from faltering. It occurred during a period of coordinated bullion selling from the central banks into the market under the Washington Agreement, culminating in the notorious gold dumping known as Brown's Bottom. At least the Germans still have a receipt. That selling failed to hold the line, and shortly thereafter gold began its great bull market run. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold:

No comments:

Post a Comment