Gold World News Flash |

- Get ready, the silver price is heading up – Interview with David Morgan

- They Denied That We Were In A Depression In 1933 And They Are Doing It Again In 2013

- Billionaire Sprott Issues Warning To Western Central Planners

- Why The Price Of Gold & Silver Was Crushed Today

- Nigel Farage Slams Barroso's European "Disaster"

- Gold Price Closed Down at $1,330.60

- Gold Price Closed Down at $1,330.60

- Gold: These Charts Say It All!

- Kaye blames Fed, BIS for pounding of gold and silver

- Thomson Reuters Expects A Decent Gold Price Recovery In 2013

- Stocks Showing Multiple Signs of a Top

- Silver – 3 Innovative Applications In Technology & Biology

- This Is Why The Price Of Gold & Silver Was Crushed Today

- Gold & Silver Price Back To 50 Day Moving Average

- Gold Daily and Silver Weekly Charts - Here Comes the Twitter IPO After the Bell

- Gold Daily and Silver Weekly Charts - Here Comes the Twitter IPO After the Bell

- And It Begins

- Midnight Raid for Gold, Silver – Again

- Midnight Raid for Gold, Silver – Again

- Gold Chart Intraday - Is the COMEX Still 'The Market' For Anything Except Paper?

- Gold Chart Intraday - Is the COMEX Still 'The Market' For Anything Except Paper?

- The Joke Shack of the Housing Sector

- The New-Era Arms Race

- Planned Attack on Gold Begins, Waiting for Manipulation to End

- Are You Really Retired Just Because You Stopped Working?

- GOLD Elliott Wave Technical Analysis

- SILVER Elliott Wave Technical Analysis

- Romania faces uphill battle if sued over gold mine – Minister

- Gold hits 1-month lows pre-Fed meeting next week

- India’s anti-gold policies: symptom, not cure

- Jumping Chinese gold imports on pace to 1,000 tonnes

- Indian government officials covet temple gods’ gold

- Gold demand to fall before prices resume drop in 2014 – GFMS

- India's Anti-Gold Policies: Symptom, Not Cure

- The Daily Market Report

- Sprott comments on central bank gold dishoarding, sudden interventions

- Sprott comments on central bank gold dishoarding, sudden interventions

- “Privacy” Held Hostage By “Security” – Public Unimpressed

- The Changing Relationship Between U.S. Stocks and Gold is Good for Gold

- Billionaire Sprott - Metals Smashed As West Hemorrhages Gold

- Sunset on the Summer Gold Rally

- Gold Sinks to 4-Week Low as Silver Declines on Taper Bets

- Invest Around The Burning Middle East

- AND IT BEGINS

- Precious Metals Market Report with Franklin Sanders

- Bernard von NotHaus: The 'domestic terrorist' you can call a hero

- Gold Price Slumps, "Traders Expect QE Tapering" as Asia's Stockpiling Cuts Bar Demand Outlook in Half

- Gold sharply lower at 1333.85 (-30.75). Silver 22.41 (-0.733). Dollar higher. Euro drops. Stocks called mixed. US 10yr 2.89% (-2 bps).

- TF Metals Report: Big banks (JPM) remain astonishingly long in gold futures

- Smart Money magazine publishes edition on gold price suppression

| Get ready, the silver price is heading up – Interview with David Morgan Posted: 12 Sep 2013 10:00 PM PDT from cambridgehouseintl: |

| They Denied That We Were In A Depression In 1933 And They Are Doing It Again In 2013 Posted: 12 Sep 2013 09:40 PM PDT by Michael Snyder, Economic Collapse Blog:

As I have already noted, the mainstream media was doing the exact same thing back during the days of the Great Depression. The following are actual Associated Press headlines from 1933… |

| Billionaire Sprott Issues Warning To Western Central Planners Posted: 12 Sep 2013 09:01 PM PDT  In the aftermath of the gold and silver plunge, today billionaire Eric Sprott spoke with King World News about the ongoing war in the gold market. He also issued a very big warning to Western central planners, and in particular the Fed. Below is what Sprott, Chairman of Sprott Asset Management, had to say in part II of this remarkably powerful interview series. In the aftermath of the gold and silver plunge, today billionaire Eric Sprott spoke with King World News about the ongoing war in the gold market. He also issued a very big warning to Western central planners, and in particular the Fed. Below is what Sprott, Chairman of Sprott Asset Management, had to say in part II of this remarkably powerful interview series.This posting includes an audio/video/photo media file: Download Now |

| Why The Price Of Gold & Silver Was Crushed Today Posted: 12 Sep 2013 08:20 PM PDT from KingWorldNews:

But they do have the ability in markets, that still aren't quite as liquid as they are normally, to push prices around a bit and create some downside volatility. |

| Nigel Farage Slams Barroso's European "Disaster" Posted: 12 Sep 2013 07:01 PM PDT Following Barroso's State of the EU speech, we thought it useful to reflect on the true state of the EU. Nigel Farage's recent tirade slamming "Communist" Barroso's pro-bureaucrat policies are poignant as he exclaims the "disaster" that the EU has become for the poor and unemployed. To further color this rant we nopte Charles Gavekal's recent note on why Europe's still broken as worthless IOUs are 'transferred' around the union and "no one really knows who is going to take the final loss." Perhaps it is The Hamiltonian's summary ofthe structural problem (an interlocking set of European political, bureaucratic, media, academic and financial elites) and the sad fact that history suggests a crisis deferred is a crisis magnified. The first few minutes of Farage's speech focus on the real-world problems that his peers "are in denial" over... (the rest is global warming related) But to provide more specific reasons for why Europe's still broken, here is Charles Gave (of Gavekal Research),

and From The Hamiltonian, Europe - Crisis Deferred Is Crisis Magnified,

But apart from that, PMIs tell us all is well, right? (well, no!) |

| Gold Price Closed Down at $1,330.60 Posted: 12 Sep 2013 06:11 PM PDT Gold Price Close Today : 1,330.60 Change : -33.20 or -2.43% Silver Price Close Today : 22.10 Change : -1.02 or -4.42% Gold Silver Ratio Today : 60.21 Change : 1.23 or 2.08% Franklin Sanders will be on vacation from the 6th through to 15th of September and will not be publishing any commentaries during this time. Daily gold and silver price closes will be published during this time. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Gold Price Closed Down at $1,330.60 Posted: 12 Sep 2013 06:11 PM PDT Gold Price Close Today : 1,330.60 Change : -33.20 or -2.43% Silver Price Close Today : 22.10 Change : -1.02 or -4.42% Gold Silver Ratio Today : 60.21 Change : 1.23 or 2.08% Franklin Sanders will be on vacation from the 6th through to 15th of September and will not be publishing any commentaries during this time. Daily gold and silver price closes will be published during this time. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

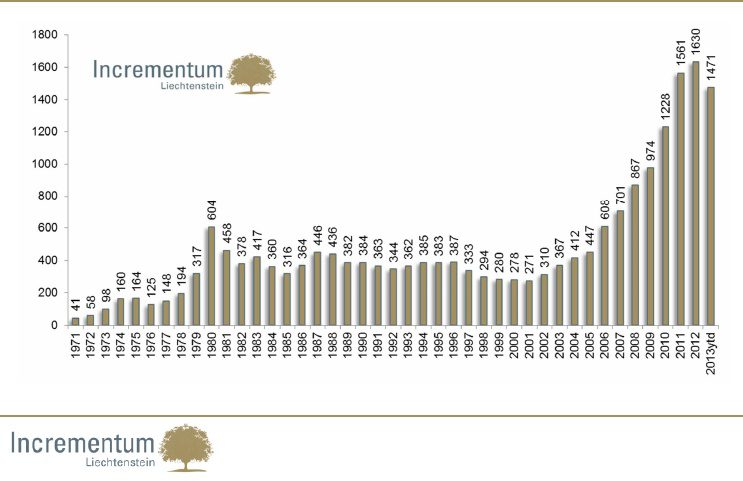

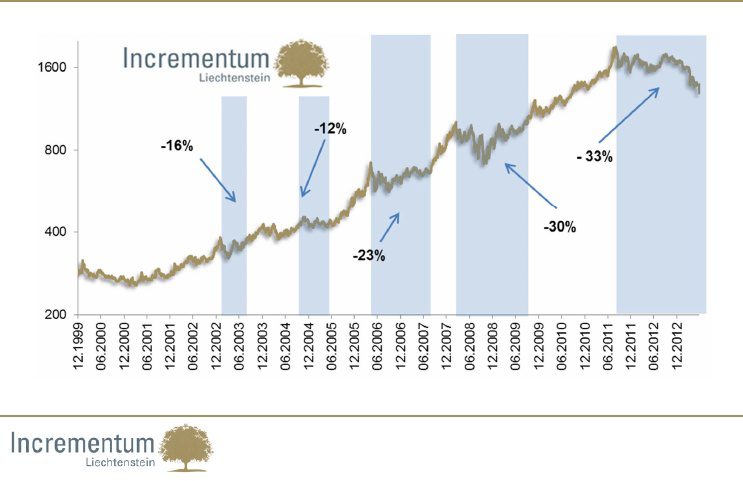

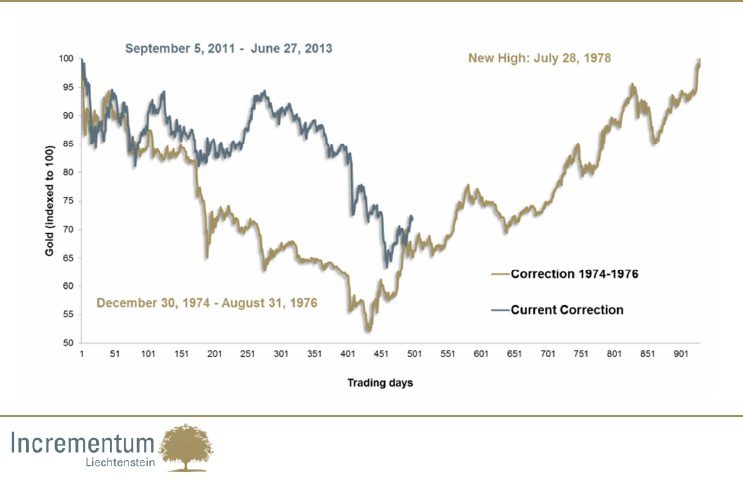

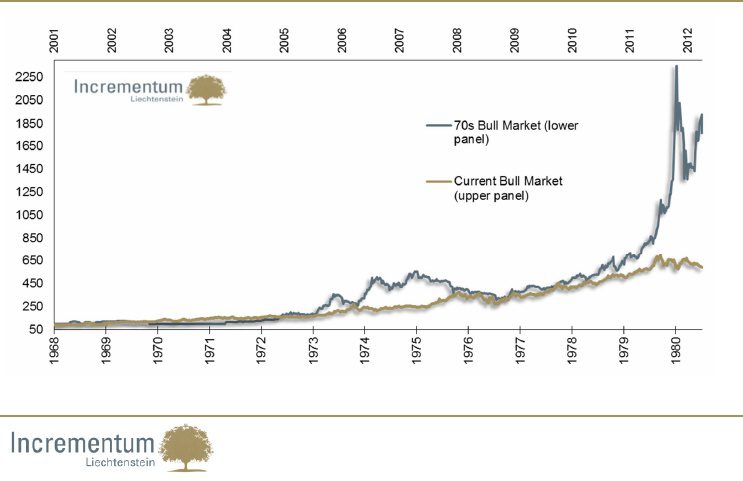

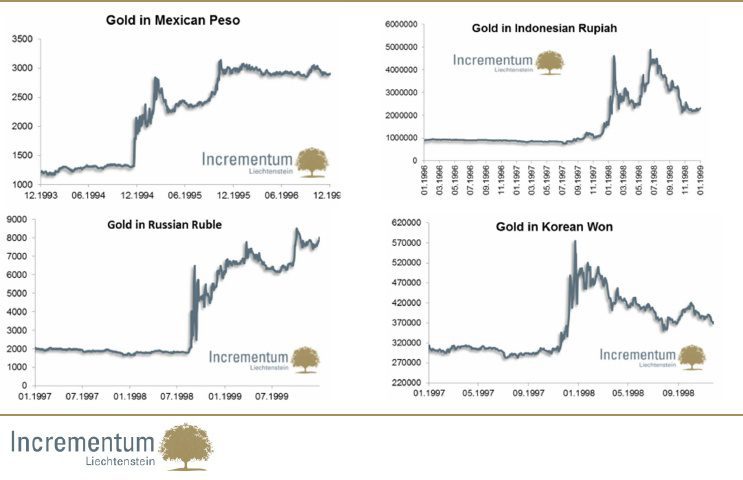

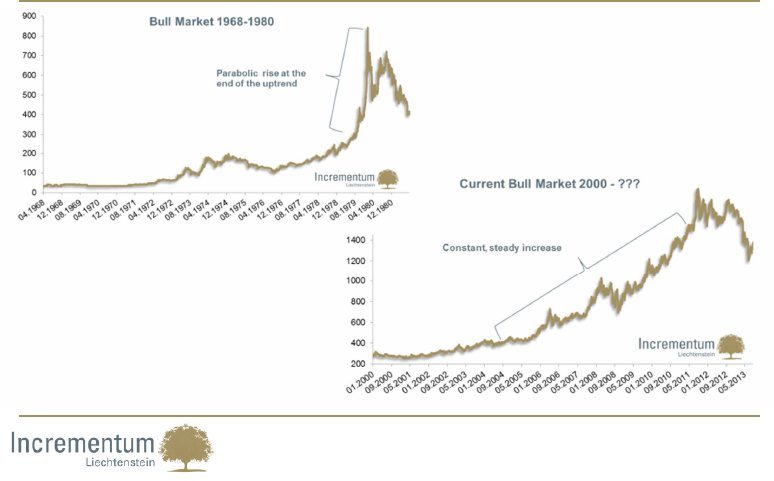

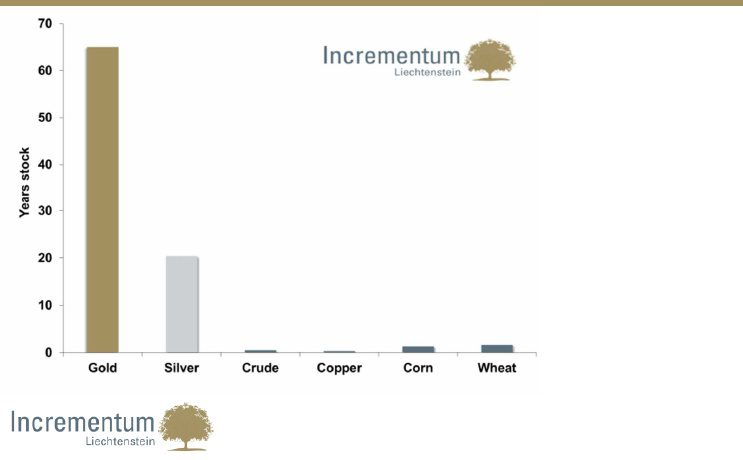

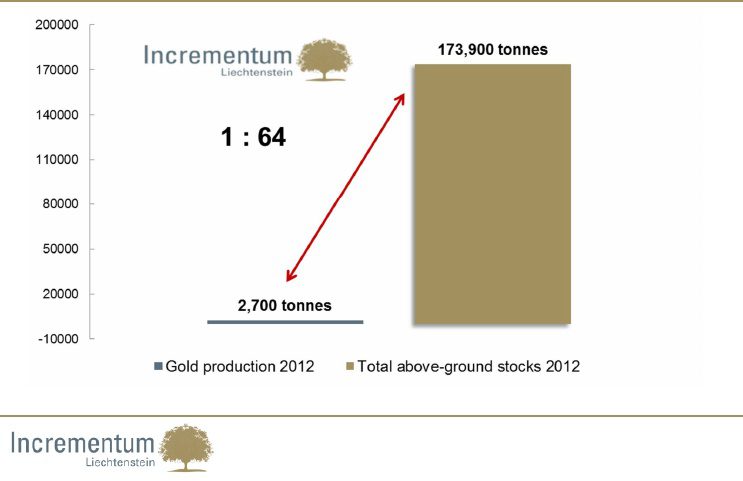

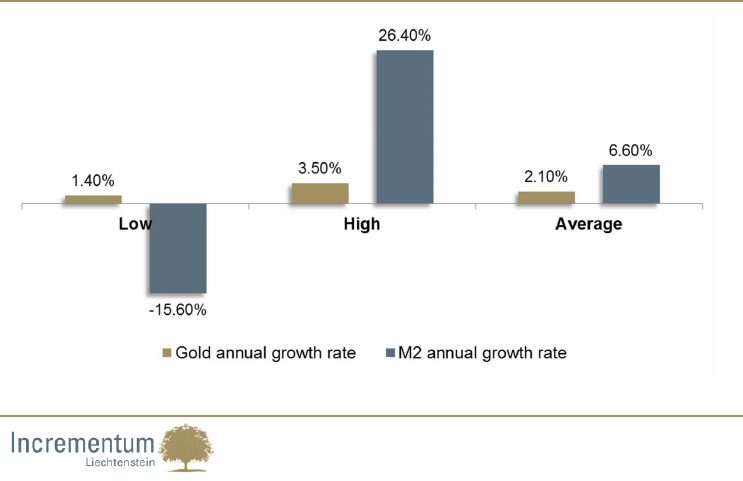

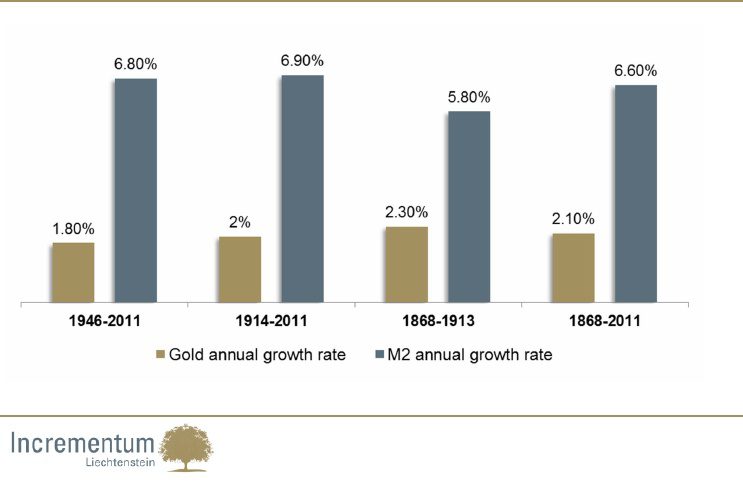

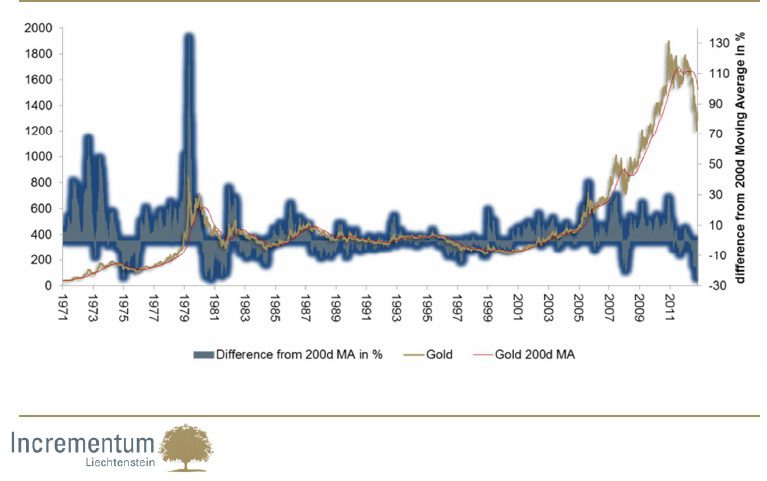

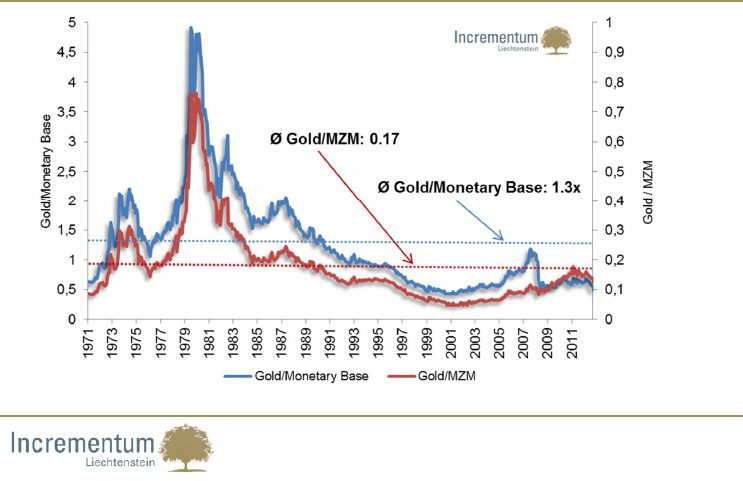

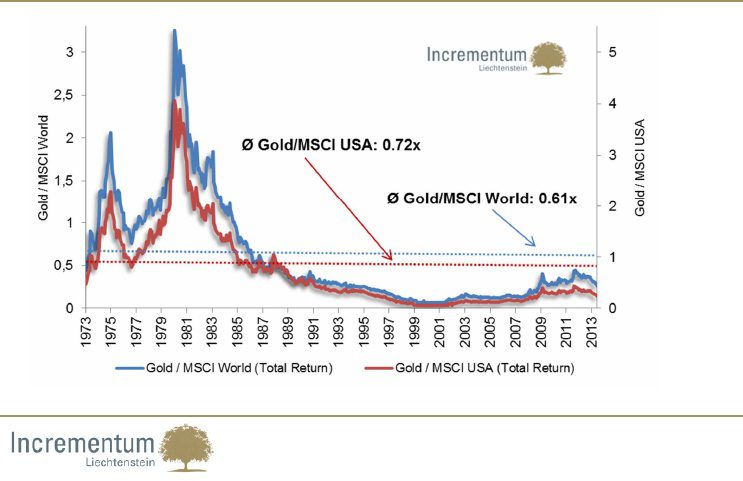

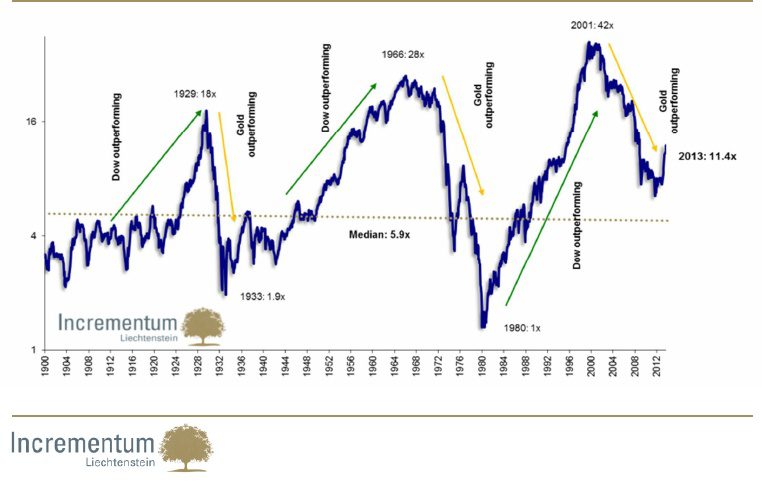

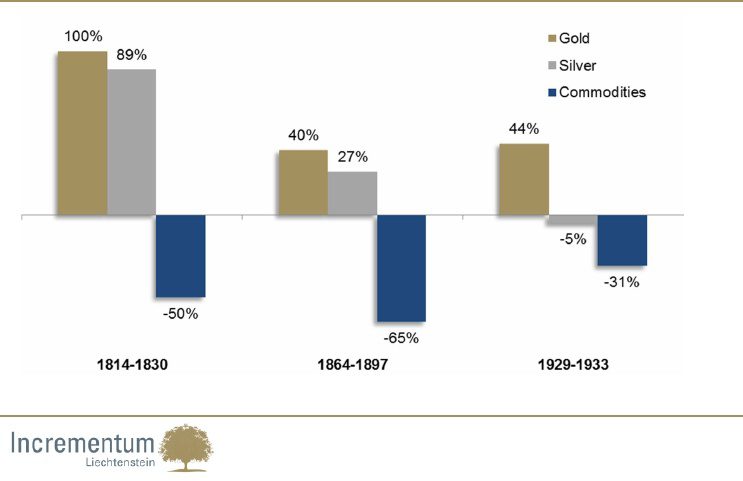

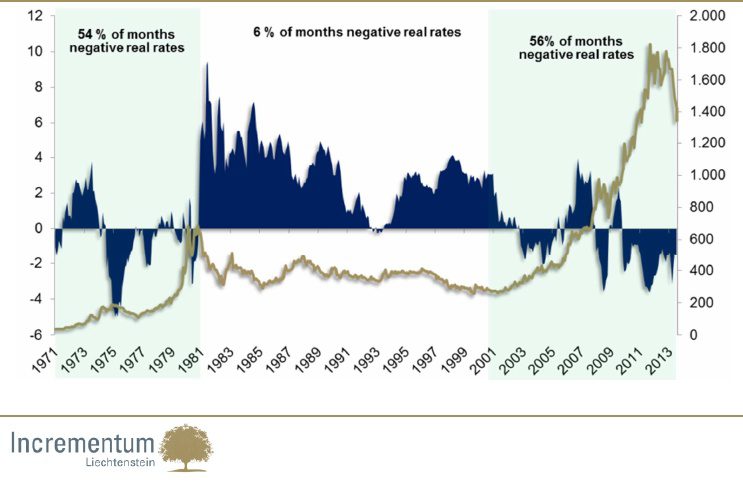

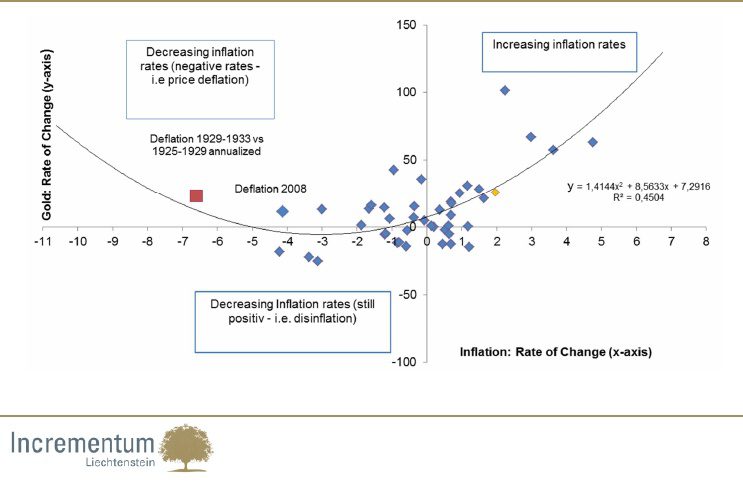

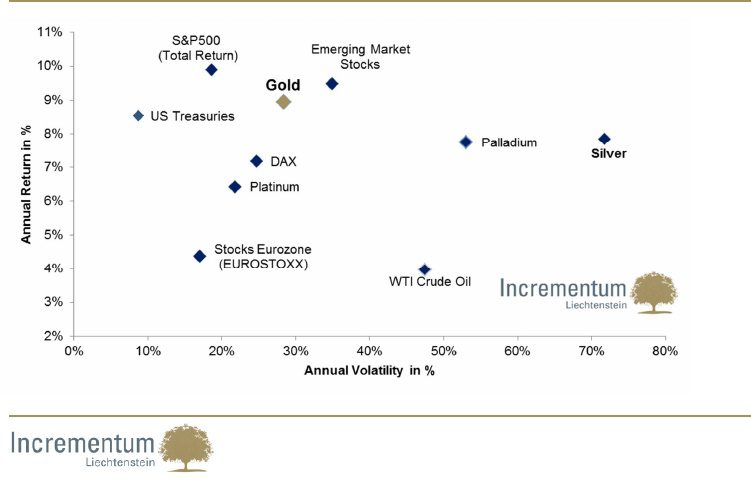

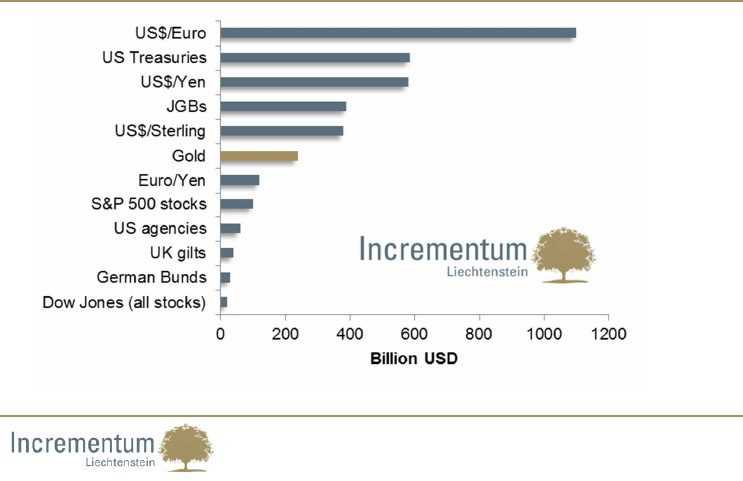

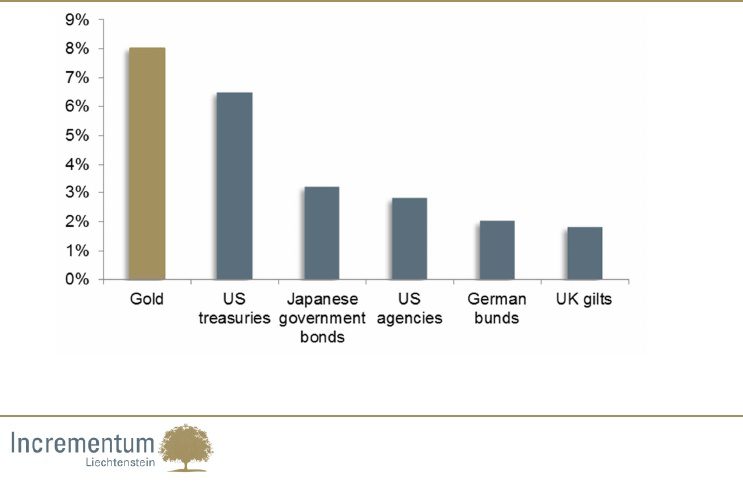

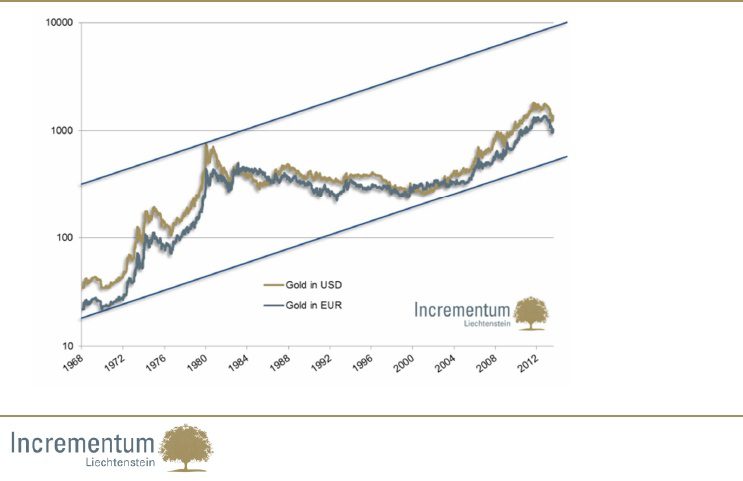

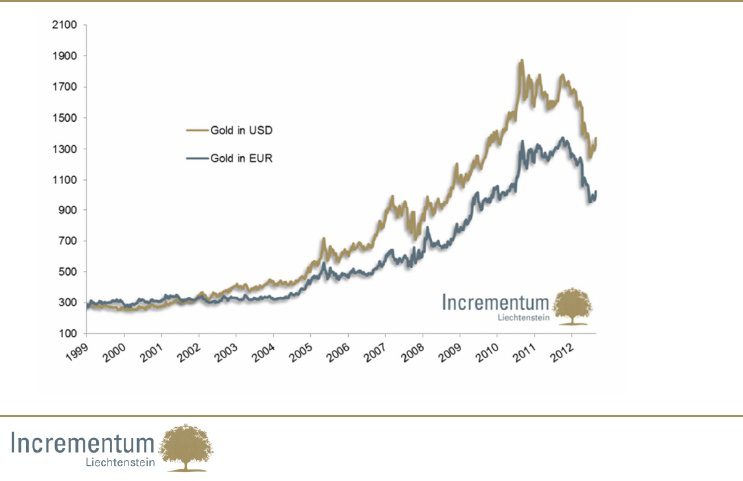

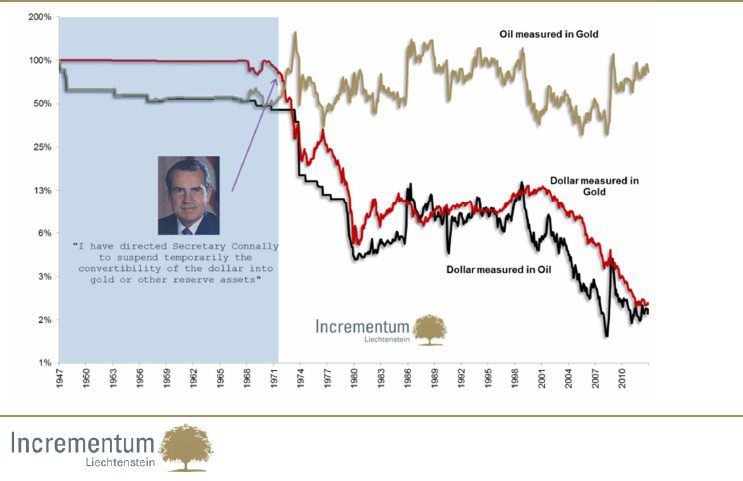

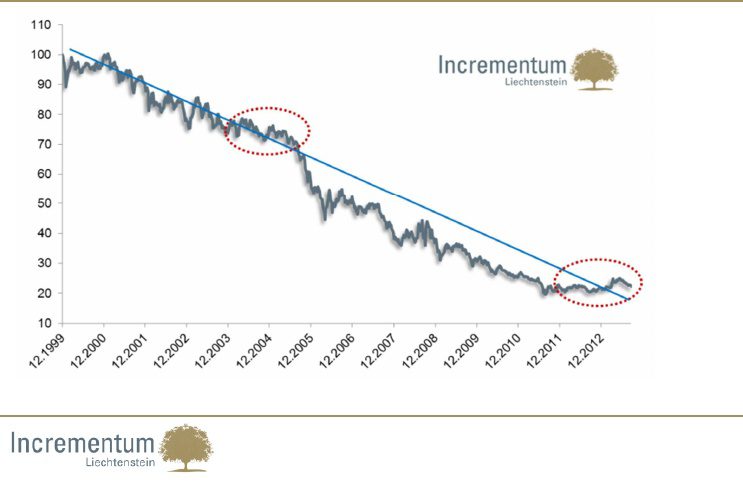

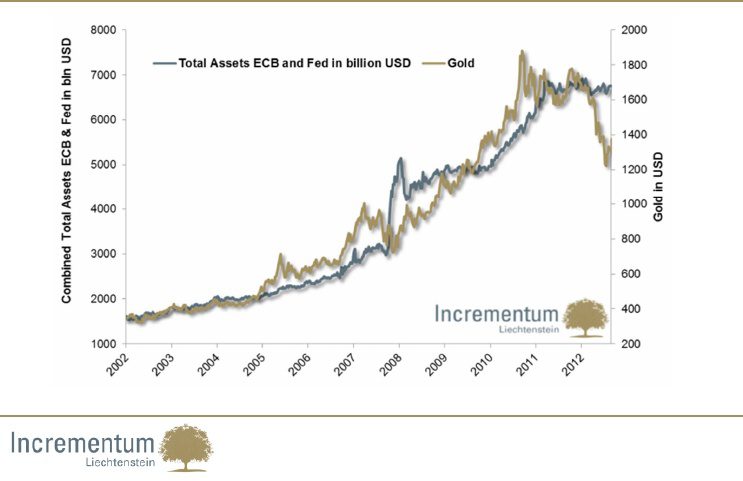

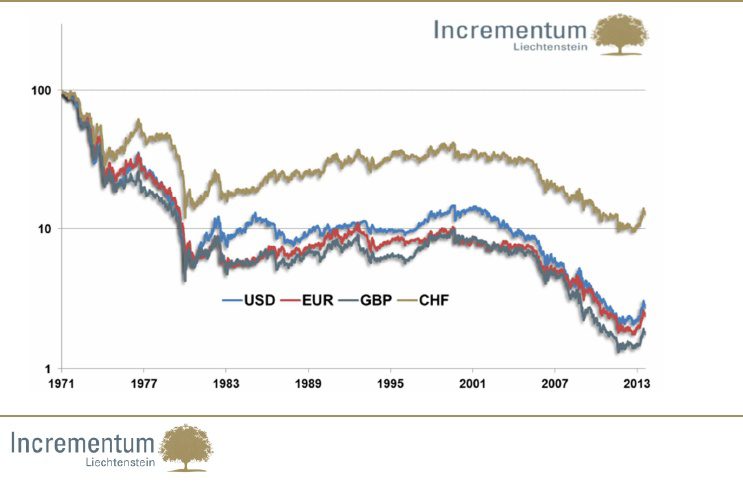

| Gold: These Charts Say It All! Posted: 12 Sep 2013 06:07 PM PDT The following 27 charts provide a historical perspective on Gold in and of itself and its relation with Debt, Inflation and other factors. Anyone interested in gold should look at these charts. [The charts in this post come from Incrementum* and are presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). This paragraph must be included in any article re-posting to avoid copyright infringement.] 1. Average Annual Gold Price 2. Comparison With Mid-Cycle Correction in 70s 3. Corrections Since The Beginning of This Bull Market (Logarithmic Scale) 4. Two Bull Markets: No Parabolic Trend Acceleration Yet 5. Gold During Various Currency Crises 6. Two Bull Markets: No Parabolic Trend Acceleration Yet 7. Stock-To-Flow Ratio: The Most Important Reason for Gold's Monetary Status 8. Stock-To-Flow Ratio: Annual Production vs. Total Stock in Tonnes 9. Relative Scarcity: Gold's Supply Curve vs. M2 Growth Maximum, Minimum and Average Rate of Change From 1868 To 2011 10. Relative Scarcity: Gold's Supply Curve vs. M2 Average Rate of Change: Gold & M2 in Different Time Periods Relative Scarcity: 11. Gold vs. 200 Day Moving Average and Deviation From 200 Day Moving Average 12. Gold is "Cheap" vs. FIAT-Money (M0 and MZM) 13. No Overvaluation Compared to Stock Market Indices! Gold vs. MSCI USA & MSCI World (Total Return) 14. Dow/Gold Ratio since 1900 15. Gold, Silver & Commodities During Deflation

22. Gold in USD & EUR Since 1968 (Logarithmic Scale) 23. Gold Price in USD and EUR Since 1999

*http://www.scribd.com/doc/166098163/Chartbook-Incrementum-The-Gold-Bull-and-Debt-Bear The post Gold: These Charts Say It All! appeared first on munKNEE dot.com. |

| Kaye blames Fed, BIS for pounding of gold and silver Posted: 12 Sep 2013 05:12 PM PDT 8:10p ET Thursday, September 12, 2013 Dear Friend of GATA and Gold: Hong Kong fund manager William Kaye, interviewed by King World News, blames today's pounding of gold and silver on the Federal Reserve and Bank for International Settlements. Kaye acknowledges that he invests in gold in expectation of the collapse of the paper market. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/12_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Thomson Reuters Expects A Decent Gold Price Recovery In 2013 Posted: 12 Sep 2013 04:23 PM PDT This is a summary from the latest Gold Survey from Thomson Reuters. The first eight months of 2013 saw a major rebalancing in the gold market with an exodus of professional investors countered by an explosion in grass roots demand. From their peak at the start of the year through to early August, Exchange Traded Fund (ETF) holdings fell by 26% and this, coupled with the withdrawal of momentum-driven money, contributed to a 30% intraday price decline from the high of $1,696/oz in January to a low of $1,181/oz at end-June. The price fall triggered a huge leap in physical bar-hoarding and coin demand, while also marking a possible end to the decade-long substitution away from gold in the jewellery market. The first half of 2013 saw an increase of more than 550 tonnes of gold offtake in jewellery, investment bars, coins and medals. This helped to reverse the price fall, prompting a recovery towards $1,440 by end-August. The rebound in demand was widespread, through the Middle East and South and East Asia, and highlighted the Indian government's continued concern about the contribution of gold imports to the country's trade deficit. This year looks set to be the first year in modern times when China will overtake India as the metal's number one consumer, by as much as 100 tonnes. Global mine production in the first half of 2013 increased by 3% to 1,416 tonnes. The number and scale of mines that have been placed on care and maintenance due to lower gold prices has as yet been modest, and is likely to remain so in the near term. Cost containment is emerging, though, notably through reduced capital expenditure budgets and slowing project development. Gold movements have also been heavily affected by monetary policy particularly in the United States. Now, however, professional investors have priced in the tapering of monetary stimulus and the private buyer is centre stage. The counterbalance between physical and professional demand will help to give gold some renewed relative price stability to refresh its appeal as an asset class to longer-term investors as a portfolio balancer. We expect gold to edge higher through the rest of 2013 and towards $1,500 in early 2014, before a gentle decline thereafter. The falls in the second quarter of 2013 have flushed out many weak-handed holders, but it remains questionable as to whether there will be sufficient investor appetite to absorb large quantities of gold at prices much above $1,400. SUPPLY (summary) Mine production was 3% higher in the first half compared with the first half of 2012 — Global scrap supply fell 14% to an estimated 662 tonnes chiefly as a result of weaker gold prices. DEMAND (summary) Jewellery fabrication jumped by 22.8% in the first half, in response to a marked decline in gold prices. —First half industrial demand slipped by 1.3%. —Net official sector purchases dropped by 32.0% to 191 tonnes in the first half of 2013. —Producers' dehedging increased, with some miners taking advantage of lower prices to close positions. — World Investment plunged by 28.3% to 517 tonnes MARKET OUTLOOK Notable improvements in gold's underlying supply/ demand fundamentals, and a rush to physical gold in particular, have been among the key factors to provide some cushion to gold following two price crashes in the second quarter. Nevertheless, while we remain generally positive about physical demand, such heightened volumes will prove hard to sustain for the rest of the year. Furthermore, while we have witnessed widespread gains in physical offtake in the year-to-date, the gold market has still relied heavily on India and China, with their combined share of global gold demand standing at 54% in the first half. With a weakening Indian rupee and a series of measures by the government to curb gold imports, demand in India is forecast to be some way short of the elevated level in the second quarter. Turning to China, the prospect for local demand is more promising, but growth is expected to cool down once the general public starts to become accustomed to new price levels and bargain hunting recedes. While demand from the key consuming markets may well slacken somewhat, we expect restrained supply to remain in place in the second half. Our forecast is primarily based on an assumption that scrap supply will fall by 12.2% on a year-on-year basis, as a return to mid-$1,400s will not be sufficient to stimulate a wave of recycling. At the same time, mine production is expected to rise marginally. More importantly, despite a hefty price decline, producers have so far remained resistant to engaging in hedging as a strategy for preserving revenue. The underlying surplus in the gold market (which has ballooned in recent years) is therefore likely to shrink by a fair amount this year. This, along with a probable recovery in buy-side interest from professional investors and ongoing central bank purchases, should pave the way for a decent price recovery later this year. |

| Stocks Showing Multiple Signs of a Top Posted: 12 Sep 2013 04:16 PM PDT

Tops never form cleanly.

I’ve made the mistake of attempting to call a top on the “dot” in the past. The reality is that anyone who attempts to do so is exercising their ego more than their judgment.

Market tops occur when investor psychology changes. But it’s not a clean shift. Investors, like any category of people, are comprised of numerous groups or sub-sects: some get it sooner than others.

In this sense there are certain tell tale signs that a top is forming. This doesn’t mean a top is “in” nor does it imply a specific timeline for a top to form (say a week vs. a few weeks).

However, there are clear signals that appear around tops. And I want to alert you that multiple ones are flashing right now.

First and foremost, the number of stocks that continue to break to new highs is contracting sharply.

This means that fewer and fewer stocks are breaking out to new highs while the market continues to surge higher. In other words, the market rally is being driven by fewer and fewer companies.

We get additional confirmation that the market is likely forming a top from the “smart money.”

Over the last 12 months, institutional investors have been net sellers of stocks for most of the time. This trend became much more pronounced in July with institutions selling an average of $1 billion in stocks during that .

In particular I want to note that institutional investors are dumping stocks at a pace last seen in the first half of 2008.

Among the financial institutions that are dumping stocks include Apollo Group, Blackstone Group, and Fortress Investment Group.

These groups are not only selling themselves, but have been urging their high net worth clients to sell stocks as well.

In addition to this, those at the top of the corporate food chain are uneasy with the prospects for growth. According to Markit’s semi-annual Global Business Outlook Survey of 11,000 CEOs found Chief Executives to be the most negative since the depths of the Great Recession in early 2009.

Thus, we see the “smart money” exiting the markets. We also see fewer and fewer companies participating in the market rally. Those who run these companies are more pessimistic than at any point in the last five years dating back to the nadir of the 2009 collapse. And finally we have investors as a whole displaying the most complacency about the market in history.

If you have not taken steps to prepare for a market collapse, we have a FREE Special Report that outlines how to prepare your portfolio. To pick up a copy, swing by:

http://gainspainscapital.com/protect-your-portfolio/

Best Regards

Phoenix Capital Research

|

| Silver – 3 Innovative Applications In Technology & Biology Posted: 12 Sep 2013 04:07 PM PDT This article is courtesy of The Silver Institute. Silver-Based Memory Devices May Replace Flash Drives You may not have heard the acronym ReRAM, but you will soon. Resistive Random Access Memory or ReRAMs (sometimes written as RRAMs) operate like tiny battery cells and store data through changes in the electrical resistance of the cell. The presence or absence of an electrical charge can be used This burgeoning technology for storing information will eventually replace flash memory – used in thumb drives and many notebooks. Currently, all tablets and smartphones use flash memory, but that too will change in coming years as ReRAMs take their place. ReRAMs hold advantages over conventional flash drives. Because ReRAMs use so little power – in the nanowatt range compared to hundreds of milliwatts for flash drives – they could allow your smartphone to operate up to a week without recharging. A ReRAM chip the size of a postage stamp can hold a terabyte of data, enough to store 250 high-definition movies. Information is written to ReRAMs faster, nanoseconds compared to milliseconds for flash drives. ReRAMS also last longer; they are able to handle millions of rewrites compared to flash drives that fail after about 10,000 rewrites. One company, Crossbar Inc., based in Santa Clara, California, touts its silver-ion based technology for its memory devices, which CEO George Minassian expects to be commercially available next year. Their ReRAM version relies on the formation of a filament produced by the movement of silver ions within a silicon base. "Non-volatile memory is ubiquitous today as the storage technology at the heart of the over a trillion dollar electronics market – from tablets and USBsticks to enterprise storage systems," said Minassian in a prepared statement. "And yet, today's nonvolatile memory technologies are running out of steam, hitting significant barriers as they scale to smaller manufacturing processes. With our working Crossbar array, we have achieved all the major technical milestones that prove ourReRAM technology is easy to manufacture and ready for commercialization. It's a watershed moment for the non-volatile memory industry." Other companies including Toshiba, Panasonic, HP, Micron and Samsung are also working on their own versions of ReRAMs, with many of their designs based on silver ions, too Silver Ions Deposited on Glass by High-Speed Spinning South Korean scientists have discovered a new way to coat glass with a layer of silver ions to prevent the growth of bacteria. This glass can be especially useful for medical apparatus, food service and other applications in which glass equipment must be kept sanitary despite germ-filled The team at Yonsei University in Seoul spin-coats the glass with 'sol-gel,' a gelatinous solution holding silver ions in the form of silver nitrate. The gel is spun at 2,000 revolutions per The researchers plan to try their spin-coating technique on other substances such as metals and plastics which would benefit from an antibacterial layer of silver ions Silver's Antibacterial Power – College Doors Coated With Silver Doors in four buildings at Penn State Erie have been coated with silver ions to help keep students healthy, according to school officials, and the project may lead to an industry-wide logo touting the antibacterial benefits of silver coatings. "It does seem to be effective," said Beth Potter, assistant professor of microbiology. Potter's students swabbed 50 door handles on campus and measured bacteria on surfaces with and without the silver treatment. The door handles treated with Agion School officials and representatives from Advanced Finishing USA, the company that sprayed the silver ion solution onto the handles, are considering other targets such as water bottles, bus strap handles, gas pumps and emergency exit door bars. The school's marketing department got involved in the project, too. Students of marketing professor Mary Beth Pinto used the coating to answer the question: How do you market an invisible product? Early tests on a stair railing at the college used a white coating, and the students found that people were reluctant to touch it, thinking it was wet paint. Tests in which they employed a clear coating to door handles at two local convenience stores showed that customers had no hesitation about touching it, but this presented a new issue: How do you let users know that they just received a benefit from the silver ion coating? This led students to develop signs and logos explaining the value of Agion products. "Ideally, we'll get to some kind of identifiable symbol," said GregYahn, president of Advanced Finishing USA. "Something like the Nike swoosh, where you know from 10 feet away: 'That’s antimicrobial. It's OK to touch it.'" This is an excerpt from the latest Silver News from The Silver Institute. |

| This Is Why The Price Of Gold & Silver Was Crushed Today Posted: 12 Sep 2013 02:19 PM PDT  Today one of the savviest and most well-connected hedge fund managers in the world spoke with King World News about the takedown in gold and silver. Outspoken Hong Kong hedge fund manager William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, had this to say in his powerful interview. Today one of the savviest and most well-connected hedge fund managers in the world spoke with King World News about the takedown in gold and silver. Outspoken Hong Kong hedge fund manager William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, had this to say in his powerful interview.This posting includes an audio/video/photo media file: Download Now |

| Gold & Silver Price Back To 50 Day Moving Average Posted: 12 Sep 2013 01:19 PM PDT After two months of strength, the gold and silver price have shown today a significant correction. At the London AM Fix, gold was trading at 1340.25 US dollar per ounce and 1008.54 euro per ounce. The afternoon trading was much weaker as the PM Fix closed at 1328.00 dollar per ounce and 1000.07 euro per ounce. Yesterday’s close in London was at 1363.75 dollar per ounce and 1025.83 euro per ounce. At the moment of writing (close to 16h NYT, 21h GMT), COMEX gold is trading at 1324.40 dollar, which is a 2.89% loss on the day. Silver closed in London at 22.67 US dollar per ounce and 17.05 euro per ounce. COMEX silver is trading at 21.93 dollar, which is a 5.38% loss on the day. From a chart point of view, both gold and silver are back at their 50 day moving average, a key technical price point. In August, the precious metals had moved to their 200 day moving average but were not strong enough to hold that level.

The odd thing about this price action is that the dollar is showing weakness as well in the last week. It is trading at 81.5, coming off its peak of 82.8 a week ago. On the other hand, oil is holding up very well near a multi-year high. Oil has been trading between 107 and 111 dollar per barrel in the last two weeks. This divergence is hard to explain apart from technical selling in gold and silver. This is somehow confirmed Dan Norcini’s latest commentary: “I keep coming back to the same thing I have been focusing on for the last couple of weeks now – namely – the recent gains in gold have come mainly from hedge fund short covering as their short positions had become rather large from an historical perspective. Now that they have covered a large number of those shorts ( bought them back) there is simply no additional source of buying on a large enough scale to take the market through important overhead chart resistance levels. Large speculators do not have any technical reasons to chase the price of the metal higher and thus they are NOT ENTERING this market in large numbers. Without thrust to counteract the pull of gravity, markets will tend to follow the path of least resistance and that is lower. It will take some sort of economic data news release to trigger any strong, concerted, and more importantly, SUSTAINED NEW BUYING.” The mining shares have been lagging lately as well. GDX is trading at 25.26 while it briefly touched 30 only two weeks ago. Full focus will be on the Fed meeting next week Wednesday and Thursday. The Chairman, Bernanke, will do a press conference after the meeting. Some expect that tapering will be announced, as it is the last press conference during Bernanke’s term in which he could announce such a decision. Expect more price volatility going forward. |

| Gold Daily and Silver Weekly Charts - Here Comes the Twitter IPO After the Bell Posted: 12 Sep 2013 01:19 PM PDT |

| Gold Daily and Silver Weekly Charts - Here Comes the Twitter IPO After the Bell Posted: 12 Sep 2013 01:19 PM PDT |

| Posted: 12 Sep 2013 01:00 PM PDT As I was afraid would happen, gold suffered an overnight hit that drove it back below the $1350 support zone. The drop occurred in the span of one minute so it's pretty obvious this was a planned attack with the intent of taking out ... Read More... |

| Midnight Raid for Gold, Silver – Again Posted: 12 Sep 2013 12:39 PM PDT Well, okay, it was more like a 2:45 am ET raid than a midnight raid, but we thought we would share with readers the action in five-minute increments as, once again, someone decided to run the stops in the thin Asian markets, just ahead of the London open. Importantly the sell raid took out key implied linear support near $1351, so it was successful in sending London traders to the sidelines, adding to the selling pressure. Gold is currently challenging its 50-day moving average near $1330 so the focus shifts to whether it will hold that popular moving average on a weekly closing basis. Should the 50-day give way, it sets up the possibility of a 50% to 61.8% Fibonacci retrace of the June28/August 28 rally from $1180 to $1434. Call the expected retrace zone somewhere between $1275 and $1305 then, and watch for where support attempts to form. By the way, the volume spike showing is not really all that large compared to past sell raids. So perhaps this sell-stop running gambit took advantage of a market that already primed and ready to be manhandled lower. It just needed a little shove, in the thin Asian markets on a Thursday… Consider the market amply "shoved" then. Below is the COMEX silver market (Globex, Dec SI) for the same time period for comparison. As usual, silver was along for the gold ride. |

| Midnight Raid for Gold, Silver – Again Posted: 12 Sep 2013 12:39 PM PDT Well, okay, it was more like a 2:45 am ET raid than a midnight raid, but we thought we would share with readers the action in five-minute increments as, once again, someone decided to run the stops in the thin Asian markets, just ahead of the London open. Importantly the sell raid took out key implied linear support near $1351, so it was successful in sending London traders to the sidelines, adding to the selling pressure. Gold is currently challenging its 50-day moving average near $1330 so the focus shifts to whether it will hold that popular moving average on a weekly closing basis. Should the 50-day give way, it sets up the possibility of a 50% to 61.8% Fibonacci retrace of the June28/August 28 rally from $1180 to $1434. Call the expected retrace zone somewhere between $1275 and $1305 then, and watch for where support attempts to form. By the way, the volume spike showing is not really all that large compared to past sell raids. So perhaps this sell-stop running gambit took advantage of a market that already primed and ready to be manhandled lower. It just needed a little shove, in the thin Asian markets on a Thursday… Consider the market amply "shoved" then. Below is the COMEX silver market (Globex, Dec SI) for the same time period for comparison. As usual, silver was along for the gold ride. |

| Gold Chart Intraday - Is the COMEX Still 'The Market' For Anything Except Paper? Posted: 12 Sep 2013 12:03 PM PDT |

| Gold Chart Intraday - Is the COMEX Still 'The Market' For Anything Except Paper? Posted: 12 Sep 2013 12:03 PM PDT |

| The Joke Shack of the Housing Sector Posted: 12 Sep 2013 11:38 AM PDT It's not often you hear one executive call another business "a joke." But it happened on a second-quarter earnings call this July. The target of this criticism is the new crop of publicly traded single-family rental REITs. (REITs, or real estate investment trusts, are companies that own and manage real estate.) Before December of last year, there was no such thing. Now there are three, with more on the way. Do these vehicles deserve a spot in your portfolio? I'm going to make the case that they do not. I say this as someone who has been a housing bull. I still think housing is OK, but not as attractive as it was. The investment case for rental homes was plain and I made the case a number of times in these pages in 2011 and 2012. I even bought a rental property for myself. And it's worked out very well so far. I was far from the only one who saw such an opportunity. Wayne Hughes saw the opportunity as well. He is a 79-year-old Malibu-based billionaire and founder of Public Storage, one of the largest REITs in the country. Hughes, who has seen the passing of many market suns, said, "I've seen a lot of property types. And I've seen deals where you buy below replacement cost. But I never have seen anything like this. You buy the house for less than the cost to build it, and you get the land free." Hughes founded American Homes 4 Rent in 2011 to take advantage of those deals. This year, it went public. It joins Silver Bay Realty Trust and American Residential Properties (which owns about 4,000 homes) as the publicly traded stocks in this new sector. More are on the way.

Silver Bay was the first. It went public in December. I panned it in my January Capital & Crisis letter. That was a good call, as the stock fell about 25% — in a rising market, no less! My main objection is that I don't think running a portfolio of thousands of single-family homes is going to be profitable enough to make it worthwhile to run as a public company. It looks like a dog of a business to me. First, you layer on the costs of being public. You need a management team. They will get stock options, big salaries and perks. You need a legal team, compliance, human resources and the rest of the bureaucracy. Then there is the sheer logistical nightmare of trying to manage thousands of homes across a number of states. It is not like running apartments, which is a proven business model in a public wrapper. "I think that these claims that [single-family renters] are going to operate with the same margins as multifamily, it's just a joke." Recently, I listened in on the second-quarter conference call of Equity Residential, which is a publicly traded apartment REIT. As I noted earlier, the apartment (or multifamily) stocks are beaten down and look interesting. Anyway, the CEO is David Neithercut. On the call, someone asked him what he thought about the single-family rental business. He did not mince words.

It gets better. Neithercut cited a good example of how scale is important. Equity Residential used to own the Lexford portfolio. The apartment buildings in this portfolio were small, averaging only 88 units. "Believe me," Neithercut said, "the profit margins on the Lexford portfolio were nothing like the margins that we enjoy in our high-density urban assets. So I think that these claims that [single-family renters] are going to operate with the same margins as multifamily, it's just a joke." You might dismiss him as an interested party, since indirectly you may think he competes with single-family landlords. But they are two different markets. The overlap is not that great. I'll cite another executive of a multifamily REIT: Keith Oden at Camden Property Trust. He also gave his opinion on his second-quarter conference call. Oden said his firm "spent a lot of time and energy… about a year and a half ago" trying to figure out the single-family puzzle. Oden made some pithy observations about the economics of single-family housing that he thinks are lost in the discussion. This is worth sharing:

Oden, like Neithercut, sounded like a tough apartment operator, shorn of illusions about what can be done. The housing stocks also come public with a lot of work to do. Many of their homes are empty. Most rental home companies have vacancy rates of 50%, according to The Wall Street Journal. American Homes 4 Rent, for example, had a 42% vacancy rate. As one investment banker put: "You don't see REITs in any other sector coming public when they're not fully occupied." Perhaps the only way these new housing stocks work is if they can cash in on a surge in housing prices down the road. That's no sure thing, especially since prices have already moved a lot and the best deals have long since passed. And they will likely have to contend with rising mortgage rates. To me, the stocks — which have all come down after going public — may look reasonable on an asset basis. If you look at what they paid to acquire their homes, you'll find the stocks trade close to that figure or even below it. But an asset that does not generate a minimum acceptable cash return does not deserve a premium — and may, in fact, warrant a discount. Count me a skeptic on these housing REITs. There are better investment opportunities out there. Regards, Chris Mayer P.S. I’ve found 10 such investment opportunities that, as of this writing, are turning an average profit of 38%. Readers of The Daily Reckoning were given an opportunity to discover how to gain access to these 10 stocks. If you didn’t get it, there’s still time to get that, and many other opportunities just like it. Sign up for The Daily Reckoning for free, right here. |

| Posted: 12 Sep 2013 11:34 AM PDT September 12, 2013

When newspaper editorial boards glom onto a theme that we’ve been pounding in our pages for weeks, we know it’s entering mass consciousness… and becoming a prime investment opportunity. “Defeat,” the Republic goes on, “may not result in mushroom clouds rising over our cities. But the economic devastation of a successful, widespread attack on our encrypted computer systems could be nearly as bad.”

Mr. Riggs is spending this week in Washington for a conference held by the Police Executive Research Forum, a think tank for police chiefs. So a variation on this story might be airing where you live. “One of the greatest threats that we have to the safety of American citizens and to our economic freedom is cybersecurity,” Riggs obliges with a boilerplate sound bite, “and we have been invited to participate in a small group of individuals that’s going to try to look at the issues we’re facing now and craft our response for the future.” “Riggs says it’s good that Indianapolis will be represented at the forum,” adds WIBC, “which may help the city secure additional federal grant money in the future.” Ah, yes… follow the money.

“These kids are so plugged in technologically,” says Gov. Jack Markell, who visited a Wilmington school this week to drum up publicity. “If we give them exposure early on, when they can be thinking about these cybersecurity issues as teenagers, imagine what they can do when they continue their education and get into the workforce.” More from the report: “Participants don’t have to have any prior experience. Using the Cyber Aces website, interested students can take free courses and compete in state championships.” And maybe move on to international competitions. From The National, the major newspaper in the United Arab Emirates, we learn that “High school students from the UAE will be given the chance take part in a cybersecurity competition against U.S.-based students.”

“EtherGuard L3,” according to a UPI report, “is designed to prevent malware such as Stuxnet or ‘insider’ attacks from targeting defense and industrial environments, as well as countering the inadequate security that exposes networks and critical-edge devices to exploitation.” Stuxnet, you’ll recall, is the joint U.S.-Israeli project that wrecked the centrifuges Iran is using to build up its nuclear program. “Developed by military hackers,” says our Byron King, “this virus acted like a digital drone that flew into the network. When the Iranians finally discovered the virus, it was too late. Their work was destroyed.” A device that can prevent that sort of damage is sure to be in high demand by governments and businesses worldwide. Alas, Ultra Electronics is listed on the London Stock Exchange… and its over-the-counter shares in the U.S. are so thinly traded we can’t possibly suggest them in good conscience. Besides, Byron has pinpointed seven companies traded on either the NYSE or the Nasdaq that have at least as much, if not more, potential to generate big gains as the cyber arms race amps up. He settled on these seven stocks after a review of declassified government documents and extensive discussions with his network of government and defense industry insiders built up over three decades. Check out his research right here.

Treasury yields are backing down slightly. At last check, the 10-year was at 2.88%.

The Midas metal took a dive in electronic trading overnight, and it’s continued this morning. At last check, the bid is $1,331. Silver has tumbled 4%, to $22.28. Greg has been a skeptic about the summer rally in gold, seeing as it couldn’t break above $1,425. “This price was crucial for gold since it marked the consolidation area after the big dump back in April- May. When it rolled over after briefly topping $1,425 just a few weeks ago, it became clear that lower prices were on the way.

“My long-term landing zone for gold is still between $1,100-1,000,” Greg adds. “A break below $1,200 sometime over the next several weeks will bring us another step closer to my downside target.”

Bankrate’s monthly survey asking about retirement savings reveals more than half of respondents are saving the same amount as they did a year ago. Another 18% say they’re socking away more; 17% say they’re setting aside less. “Not only are very few people saving more for retirement than they were a year ago,” says Bankrate’s Greg McBride, “but what’s troubling is that Americans between the ages of 50 and 64 were the most likely to be saving less.” Even more troubling: Among Americans age 55-64, 40% have no retirement savings at all. And among the remaining 60%, the median balance is $100,000. “People underestimate what their needs are going to be when they’re older,” says Gary Koenig from AARP, and “underestimate how long they’re going to live. I think they overestimate how much a pot of money that they build up in their 401(k) will translate into in terms of your lifetime income.” [Ed. Note: We trust you're further along in your retirement goals than the average American. But if you're looking to accelerate the process, you should learn more about our aggressive "30-day retirement" research. Act before midnight tonight and you can still take advantage of our first-mover discount.]

“Come 2014,” Fox News begins, bringing the party music to a screeching halt, “voters may be able to make congressional campaign donations using the cyber currency Bitcoin.” [Cue crickets] “Last week,” Fox goes on, filling the silence, “the Conservative Action Fund PAC asked the Federal Election Commission (FEC) to rule how the virtual currency could be used in political fundraising campaigns.” Apparently, the group noticed the cryptocurrency being “rapidly adopted” by many of its libertarian-minded donors — so says Dan Backer of DB Capitol Strategies, who filed the request with the FEC. Should we be surprised? Maybe not. “Five years ago,” chairman of the Bitcoin Foundation’s regulatory affairs committee Marco Santori tells Fox, “it was not convenient to pay someone in cash, it was more convenient to send PayPal donations. Now it is more convenient to send Bitcoin. “Bitcoin is a great vehicle for [campaign finance],” Santori tells Fox, “and being able to accept donations over the Internet. It can be transmitted easily and quickly over the Internet, just like cash can be done in person. I think the chances of this happening are really good.” What was it Gandhi said? First they ignore you, then they mock you, then they fight you, then you’re subject to regulation under the Federal Election Campaign Act? Something like that…

We figured we’d touch a nerve or two with our take on “income inequality,” and we did. “The so-called disparity between the rich and poor is misrepresented as a permanent condition,” a reader writes. “It is a fabrication of the left. The reality is that the poor and the rich are the same people at different stages of life. We — almost all of us — start out as a teenager earning minimum wage, but we advance through our lives, often visiting all of the quintiles. “One of the things that make America exceptional is the fact that we have no permanent economic classes. Quit printing such nonsense as you printed today.” The 5: What was that Jethro Tull song about “living in the past”? On the one hand, we have the figure we cited earlier: Of the 60% of Americans approaching “retirement age” who have any retirement account at all, the median balance is a mere $100,000. On the other hand, we have the Millennial generation larded down with student loan debts. The average 2013 graduate has a $28,000 hole to climb out of — and a quarter of them haven’t lined up jobs yet. “Instead of buying [a home] at 25, you buy something at 35,” says real estate gazillionaire Sam Zell — who’s investing in apartment complexes nowadays. Every generation is being hollowed out — the end result of the “extraction” process we’ve described for a couple of years now: “Washington’s empire,” says Paul Craig Roberts, “extracts resources from the American people for the benefit of the few powerful interest groups that rule America… The U.S. Constitution has been extracted in the interests of the security state, and Americans’ incomes have been redirected to the pockets of the 1%.” And that’s coming from a guy sometimes described as “the father of Reaganomics.”

“In 1974″ — the year that income inequality was at its lowest — “unions were at their peak in this country — both in strength and earning power — that brought up the nonunionized workers in the country. Bosses had to pay a premium for good workers. “Today that is only a dream for most of the young people who would aspire to do the tough jobs. No benefits for the most part, and the pay isn’t what it was by a long shot! Whose fault, you ask? All of us privy to a mirror have someone to blame. “The unions got greedy — that old bushwa about crooked union leaders is for the most part hogwash. The rich got greedier — but the rich knew where to find the right brainpower to make their system work. At least for now… “I just hope that they really understand that it takes a working man (or woman) with a good take-home check to make this ‘consumer economy’ of ours work. I just hope they wake up ahead of the chaos!” The 5: We don’t know whether the “consumer economy” is ever coming back… or even that it should. The system’s been rotted out by three or four generations of economists worshipping at the altar of “aggregate demand” — pushing consumers to borrow and spend on junk that even their mortgaged-to-the-hilt McMansions weren’t big enough to hold, so they had to rent a storage unit. Now they’re so overwhelmed with debt they can’t keep even Wal-Mart’s margins on an even keel. Heck, a few of them are even living in those storage units… Regards, Dave Gonigam P.S. We’re not sure what set us off on such a curmudgeonly tangent this morning. Assuming you’re still prosperous enough to live comfortably, but you’d still like to live better in retirement… we direct your attention to our research exploring a “subniche” of the market that holds the potential to dramatically accelerate your retirement plans. For several weeks, we’ve offered a first-mover discount for access to this research. That discount expires tonight at midnight. |

| Planned Attack on Gold Begins, Waiting for Manipulation to End Posted: 12 Sep 2013 11:30 AM PDT As I was afraid would happen, gold suffered an overnight hit that drove it back below the $1350 support zone. The drop occurred in the span of one minute so it's pretty obvious this was a planned attack with the intent of taking out that support zone in the thin overnight market when there would not be any buyers to defend the against the attack. |

| Are You Really Retired Just Because You Stopped Working? Posted: 12 Sep 2013 11:22 AM PDT From the time I took my first job washing cars at age 15 to the day I retired, working kept money flowing into my bank account. I needed money, and so I had to work (no silver spoon here). A few weeks back, I penned an article highlighting how most older folks . Several readers suggested that continuing to work as long as possible is the best way to quell that fear. Could the solution be that simple? |

| GOLD Elliott Wave Technical Analysis Posted: 12 Sep 2013 11:11 AM PDT Yesterday's analysis expected upwards movement. Price has moved sideways in a small range. This lack of upwards movement has made me take another look at the bigger picture, and I have adjusted my alternate wave count accordingly today. Read More... |

| SILVER Elliott Wave Technical Analysis Posted: 12 Sep 2013 11:10 AM PDT Last week's analysis expected some downwards movement towards a short term target at 22.463 to 22.481 before a trend change and upwards movement. Read More... |

| Romania faces uphill battle if sued over gold mine – Minister Posted: 12 Sep 2013 09:39 AM PDT Romania’s Foreign Investment Minister Dan Sova casts doubt on government’s ability to win court battle if Gabriel sues following possible rejection of Rosia Montana gold mine. |

| Gold hits 1-month lows pre-Fed meeting next week Posted: 12 Sep 2013 09:39 AM PDT With the US Federal Reserve widely expected to start tapering its QE program next week, analysts expect the market to remain volatile till then. |

| India’s anti-gold policies: symptom, not cure Posted: 12 Sep 2013 09:39 AM PDT BullionVault's Miguel Perez-Santalla takes the Indian government to task on its economic policies, arguing strangling gold won’t help its cause. |

| Jumping Chinese gold imports on pace to 1,000 tonnes Posted: 12 Sep 2013 09:39 AM PDT China continues to pile into gold, with record breaking imports record of 129 tonnes in July, as compared to 76 tonnes in July 2012. |

| Indian government officials covet temple gods’ gold Posted: 12 Sep 2013 09:39 AM PDT With an estimated 30,000 tonnes of gold, Indian temples are the next stop for a worried Indian government looking to convert available gold. |

| Gold demand to fall before prices resume drop in 2014 – GFMS Posted: 12 Sep 2013 09:39 AM PDT Thomson Reuters GFMS says gold demand will fall in the second half, while prices may climb toward $1,500/oz by early next year before declining. |

| India's Anti-Gold Policies: Symptom, Not Cure Posted: 12 Sep 2013 09:31 AM PDT Controls on gold inflows don't fix the causes of capital outflows. What's going on in India is nothing new. We've seen it over and over again throughout struggling economies. Read More... |

| Posted: 12 Sep 2013 09:14 AM PDT Gold Falls to Four-Week Lows

The decline in the price of gold was further spurred by a sharp drop in initial jobless claims last week. Claims fell 31k to a cycle low 292k for the week ended 07-Sep. However, this was likely attributable — at least in part — to computer upgrades in two states that resulted in the under-reporting of claims. Certainly there are some FOMC members that don’t believe the time is right to commence tapering, so the decision will probably hinge on where chairman Bernanke stands on the matter. Today’s dubious claims data not withstanding, the jobs market remains quite weak. Meanwhile, both import and export prices for August missed on the downside. These were the latest indications that price risks remain in check. The takeaway here is that a still wobbly jobs market, and the absence of inflation (at least in official terms) seems to be a green-light for continuation of QE at the current levels. The wildcard of course is that the Fed is not at the moment necessarily dedicated to fulfilling the dual-mandate of maximum employment and price stability. They may for example be looking to push Congress to avert a debt ceiling crisis and get on with concrete fiscal reforms. U.S. Secretary of State John Kerry is in Geneva to meet with Russian officials on the proffered deal to secure Syrian chemical weapons. President Obama said he hoped to see “concrete results,” but Syrian President Assad seems to be attempting to leverage the U.S. decision to forestall military strikes. Here are a couple of headlines from Russia’s RMI news service:

There are plenty of questions as to implementing and enforcing the Russian deal. However, I’m going to imagine that if the aforementioned conditions are real, the deal could fall apart in a hurry. If tensions ratchet higher again, gold may find support on renewed safe-haven demand. |

| Sprott comments on central bank gold dishoarding, sudden interventions Posted: 12 Sep 2013 09:10 AM PDT GATA 12:10p ET Thursday, September 12, 2013 Dear Friend of GATA and Gold: Interviewed today by King World News, Sprott Asset Management’s Eric Sprott remarks on evidence that Western central banks are dishoarding gold at a furious rate. Sprott also notes that gold price declines come abruptly, out of the blue, seemingly without cause except market intervention. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/12_Bi… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Sprott comments on central bank gold dishoarding, sudden interventions Posted: 12 Sep 2013 09:10 AM PDT 12:10p ET Thursday, September 12, 2013 Dear Friend of GATA and Gold: Interviewed today by King World News, Sprott Asset Management's Eric Sprott remarks on evidence that Western central banks are dishoarding gold at a furious rate. Sprott also notes that gold price declines come abruptly, out of the blue, seemingly without cause except market intervention. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/12_Bi... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Gold Investment Symposium 2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| “Privacy” Held Hostage By “Security” – Public Unimpressed Posted: 12 Sep 2013 09:01 AM PDT Sometimes, the news of the day causes me to say, "Huh?" The New York Times revelations last month about NSA programs and activities to enhance the agency's ability to spy on ordinary citizens prompts today's "Huh?" Who knew that our every phone call, Internet post and tweet is being recorded by the government? I have operated under the (apparently mistaken) impression that the Constitution of the United States prohibits the random, warrantless surveillance of ordinary citizens. In fact, I'm certain it's written down somewhere… oh, yes, it's the Fourth Amendment. It specifically states:

So what am I missing? Since Sept. 11, our government has acted as if security and privacy were an either/or proposition. In other words, an increase in one causes a decrease in the other. Like a seesaw, if one side goes up, the other side must go down. As federal security consultant Ed Giorgio stated several years ago in a widely quoted New Yorker article, "Privacy and security are a zero-sum game." Apparently, in order to be more "secure," we must accept less "privacy." That includes allowing increased warrantless surveillance and scrutiny by the government. So is the government's argument sound? Before we can know whether it is sound, let's define some terms. In particular, "security" and "privacy." Security is generally defined as "freedom from danger, fear, or anxiety." And privacy is defined as "freedom from undesired outside influence or intrusion." But are those the right definitions? Is "freedom from danger, fear, or anxiety" really the opposite of "freedom from undesired outside influence or intrusion"? In particular, are they mutually exclusive? On the contrary, these limited definitions are not appropriate in this scenario. Security comprises more than a feeling that one is safe. In a broader sense, it represents tools and methods that you could potentially use to ensure your privacy. Privacy, on the other hand, is different. It's something you would want to make secure. Something you want to protect, like your car or home. That sounds a lot more like property to me. Embedded in this notion of property is the idea of ownership. In fact, an owner is defined as someone with "the right to exclusive use, use, or control of property." So can privacy, like property, be owned? If so, who controls it? Current norms do not designate "privacy" as something you possess, but prior to 1890, privacy was not separated from your property. In the Supreme Court decision Boyd v. United States, the court ruled that constitutional guarantees securing people in their persons, houses, papers, and effects transcend the concrete case. It goes on to say that it "appl[ies] to all invasions on the part of government and its employees of the sanctity of a man's home and the privacies of life. It is not the breaking of his doors and the rummaging in his drawers that constitutes the essence of the offense; but it is the invasion of his indefeasible right of personal security, personal liberty, and private property." If we accept the government's initial argument, we are really giving up control of our privacy to others, and who then decides how much of it we deserve. Under this assumption, privacy is meaningless. It holds that someone other than you decides what is or is not private to you. As security expert Bruce Schneier would say, the debate is not really between security and privacy, but between control and liberty. The government's argument does not stand up to even the simplest logical examination. They argue that security and privacy are mutually exclusive without any proof and believe that statements like "Privacy and security are a zero-sum game" are true by default. The government's argument takes for granted acceptance of the government's initial definitions. This implies that surveillance that reduces privacy automatically enhances security. It also takes for granted a complete lack of familiarity with history and our shared common beliefs that are implicit in the telling of that history. The tension between control and liberty was without a doubt the fundamental concern faced by the Founding Fathers. They established the Constitution as the law to limit government interference in citizens' affairs. Recall John Adams' sentiments on "a government of laws and not of men." The Founding Fathers established the Constitution with a series of processes and a system of checks and balances. This was meant to restrain and replace the people in power because they feared the human tendency to seek and control one another. Today, we share their deep-seated belief in limited government. Although the government promises increased security, its tools of invasive surveillance and cavalier dismissal of rights protected by the Constitution are not in keeping with our common notions or our law. Accordingly, their argument fails on this count too. The defense the government uses to justify more surveillance is twofold. First, they argue that unlimited observation provides the watchers with the opportunity to step in and prevent dangerous actions and events. (Of course, danger to whom does not appear to be relevant in their reasoning.) Second, because of the potential for this intervention, individuals' fear and anxiety about dangerous actions and events should be reduced. Because of this, actual encounters with such events will be reduced. In support of this, the government regularly informs the media about how its increased surveillance has led to the discovery and neutralization of "terrorist" threats. This confirms its belief that security and privacy are mutually exclusive concepts. However, unlimited surveillance is by definition incompatible with limited government. According to many security experts, it is also incompatible with enhanced security. In today's world, information can be misused or stolen more easily every day. Placing more and more information into gigantic government databases merely means that stealing or abusing information will become easier over time. Creation of such data platforms merely creates another "one-stop shopping" experience so common in today's convenience-driven world. And it's ripe for exploitation. The possibilities for "insecurity" due to this are endless. Although our grandparents kept their private information in their desks "with their important papers," today, those records are a cornucopia of data about each of us. And they reside in computer servers and "in the cloud," available to others without their knowledge or permission. So how does subjecting yourself to such scrutiny make you safer or more secure? It doesn't. A real-world example is in order here. Subsequent to the tragic event in Connecticut last year where an individual entered an elementary school and murdered students and teachers, The Journal News published an interactive map showing the names and addresses of all handgun permit holders in New York’s Westchester and Rockland counties. According to Al Tompkins of the Poynter Institute, a school for journalists, “Publishing gun owners’ names makes them targets for theft or public ridicule. It is journalistic arrogance to abuse public record privilege, just as it is to air 911 calls for no reason or to publish the home addresses of police or judges without cause.” Exposure to theft of one's firearm through disclosure most certainly would not "enhance" their security. The privacy-versus-security dichotomy fostered by government presumes that the government will maintain control of your private information, thereby increasing the government's security potentially. In that light, the revelations about the NSA's trillion-dollar expenditures to spy on us make sense. In the end, it's really all just a question of whom they are protecting. Regards, Mike Leahy Ed. Note: Regardless of what the Feds try to do, there are still ways to protect your privacy. The folks at Laissez Faire Today have made it their mission to find legal ways for your to protect your family, your privacy and your wealth from the prying eyes (and sticky hands) of various federal agencies. Learn more by signing up for free, right here. This article originally appeared at Laissez Faire Today |

| The Changing Relationship Between U.S. Stocks and Gold is Good for Gold Posted: 12 Sep 2013 08:50 AM PDT Precious metals are selling off today, in large part due to easing tensions in the Middle East and the near certainty that the Federal Reserve will reduce its $85 billion monthly bond purchases next week as detailed here a few days ago. Technical factors are also playing a key role as resistance-turned-support at [...] |

| Billionaire Sprott - Metals Smashed As West Hemorrhages Gold Posted: 12 Sep 2013 08:03 AM PDT  On the heels of another plunge in gold and silver, today billionaire Eric Sprott warned King World News that the smash in gold and silver is being accomplished through unprecedented levels of dwindling Western central bank gold being supplied into the market. He also spoke about the massive gold and silver demand. Below is what Sprott, Chairman of Sprott Asset Management, had to say in part I of this remarkably powerful interview series. On the heels of another plunge in gold and silver, today billionaire Eric Sprott warned King World News that the smash in gold and silver is being accomplished through unprecedented levels of dwindling Western central bank gold being supplied into the market. He also spoke about the massive gold and silver demand. Below is what Sprott, Chairman of Sprott Asset Management, had to say in part I of this remarkably powerful interview series.This posting includes an audio/video/photo media file: Download Now |

| Sunset on the Summer Gold Rally Posted: 12 Sep 2013 07:46 AM PDT Gold’s counter-trend rally is quickly falling apart. The summer gold rally that began in late June ended overnight as the metal plunged below $1,350. As of early this morning, gold is off $32, resting near its recent lows at $1,330. September — a month that is usually very good for gold — has not been kind to the yellow metal so far…

I’ve remained skeptical of gold’s summer rally since it failed to top its June highs near $1,425 last month. This price was crucial for gold since it marked the consolidation area after the big dump back in April- May. When it rolled over after briefly topping $1,425 just a few weeks ago, it became clear that lower prices were on the way. Now that the counter-trend rally is broken, I suspect gold will make a quick break toward $1,200 and its 2013 lows. Keep in mind that gold continues to break down from a massive, secular bull market that lasted more than a decade. While these counter-trend rallies are great for traders, they also act as opportunities for trapped longs to unwind their positions. Many traders and investors have insisted for weeks that the June lows would become a major turning point for gold. Some even said it was the beginning of another major push toward new highs. This was simply wishful thinking. When it comes to investing, hope is a dangerous emotion. Don’t allow your opinions to be swayed by hopeful investors. It only leads to losses… Regards, Greg Guenthner P.S. My long-term landing zone for gold is still between $1,100 – $1,000. A break below $1,200 sometime over the next several weeks will bring us another step closer to my downside target. Sign up for my free Rude Awakening email, and learn how to plan accordingly. |

| Gold Sinks to 4-Week Low as Silver Declines on Taper Bets Posted: 12 Sep 2013 06:48 AM PDT 12-Sep (Bloomberg) — Gold fell to a four-week low in New York on speculation that the U.S. Federal Reserve will commit to reducing stimulus next week. Silver and platinum declined. Gold has dropped 20 percent this year amid expectations that the Fed will pare its $85 billion a month of bond-buying as the economy improves. While data today may show U.S. jobless claims rose for the first time in three weeks, a Bloomberg survey on Sept. 6 forecast that the central bank will taper its quantitative easing by $10 billion at the Sept. 17-18 meeting. "With initial jobless claims out this afternoon, the market may pause," David Govett, head of precious metals at Marex Spectron Group in London, said today in an e-mailed report. "But quite frankly unless the figure is appalling, the tapering feeling will continue and the market will stay under pressure." [source] PG View: Claims in fact dropped sharply, but apparently that was due to faulty data from two states. |