saveyourassetsfirst3 |

- SA gold miners confirm strike to start from Tuesday

- Gold erases week’s gain after UK rejects Syrian action

- India's Economic Wounds Are Self-Inflicted

- Polyus Gold slumps to loss on $469m impairment charge

- 'Crash Alert' Flag Still Flying

- Ecuador/Codelco to create JV to explore Llurimagua reserves

- Week In FX Americas - Loonie Contained For The Time Being

- Why Sryia? It’s Not What You Think, & It’s Not What You’ve Been Told

- Week In FX Asia - INR Caught In A Perfect Storm

- Syria, Gold & the Emergency Crisis in Money

- Gold Erases Weeks 2.5% Gain After UK Rejects Syrian Action

- *Breaking: Rebels admit they were behind chemical attack in Syria!

- The shadowy web of collateral and war

- Gold’s Strongest Months Since 1975 Are September And November

- Precious Metals Will Rise As the Economic Recovery Disintegrates

- What do (mining) stocks tell us about gold’s future moves?

- Gold erases week's 2.5% gain after U.K. rejects Syrian action

- Will gold fail to end month on high?

- Comex Registered Inventories – Could Disappear Any Day!

- SA gold CEOs build cash barricades as strikes loom

- Gold’s strongest months since 1975 are September and November

- Chris Martenson: The Periphery is Failing

- Is This a “Normal” Market?

- Gold, Silver, and the Status Quo

- Gold traders turned bullish ahead of next week's U.S. payroll data

- Physical Gold and Silver Are Safe Havens

- Gold, silver consolidate as traders shake bearish sentiment

- Gold’s Strongest Months Since 1975 Are September And November

- End Of Summer Blowout Sale!! Industry Low Prices On Silver Eagles, Maples, Philharmonics, and Buffalos!!

- Gold’s Strongest Months Since 1975 Are September And November

- The eternal love for Gold

- Civilizations Don’t Die of Old Age

- ObamaCare Staggers Toward the October 1 Finish Line (2)

- Silver, what could be in store.

- India Might Buy Gold From Citizens to Ease Rupee Crisis

- Worldwide loss of oil supply heightens Syria attack risk

- Four King World News Blogs/Audio Interviews

- A Finicky Thief of the Finest Silver Is Arrested Again

- Marc Faber on Gold & Debt

- Michael Kosares: A new contagion is brewing

- U.S. Gold Mine Output Rises 5% Month-on-Month In May – USGS

- NewPlat becomes world's largest platinum ETF

- South African gold companies plan to lock out employees - Solidarity

- State ‘will not intervene in South African gold strike talks’

- India might buy gold from citizens to ease rupee crisis

- As prices soar in India, gold exchanged for cash

- John Embry: Gold market in for a wonderful Fall

- Silver Price Forecast: Massive Debt Levels Will Push Silver To $150 And Beyond

- Larry Summers as Fed chairman would spike the dollar upwards and lower stocks

- The Implosion Has Begun, But Not Yet!

| SA gold miners confirm strike to start from Tuesday Posted: 30 Aug 2013 03:39 PM PDT The companies say NUM has served notice of a strike over wage demands starting from the night shift on Tuesday. |

| Gold erases week’s gain after UK rejects Syrian action Posted: 30 Aug 2013 03:08 PM PDT The gold price fell $15 in London trade Friday morning, reversing the last of the week's 2.5% gain. |

| India's Economic Wounds Are Self-Inflicted Posted: 30 Aug 2013 11:23 AM PDT By Ian Fraser Ben Bernanke is a convenient bogeyman for India's unfolding economic woes. On May 22 this year, the 59-year-old Federal Reserve chairman unnerved global investors by suggesting that, if appropriate, the quantitative easing program that has helped prop up the US economy since early 2009 would be scaled back from next month. Bernanke's "taper" talk, based on the premise that QE may have done the trick for the US, drove many investors to reassess their portfolios and withdraw funds from emerging markets. The worst-affected currency has been the Indian rupee. As investors pulled "hot money" out of the subcontinent, the cracks in its economic model fell into sharp relief, specifically its dependence flighty international capital to fund its widening current account deficit. The rupee has shed 25% of its value since January, hitting record lows of 69 rupees to the US dollar on Wednesday, August 29. This is |

| Polyus Gold slumps to loss on $469m impairment charge Posted: 30 Aug 2013 11:20 AM PDT The leading Russian gold miner tumbled to a first-half net loss after taking a $469 million impairment charge. |

| 'Crash Alert' Flag Still Flying Posted: 30 Aug 2013 11:19 AM PDT By Bill Bonner We hoisted our "Crash Alert" flag last week. So far, no crash. The US stock market came back a bit on Wednesday, with a 48 point gain on the Dow. Gold was flat. The flag is not a prediction. It's merely a warning - like the flag at the beach that warns of a dangerous riptide. You can still go in the water. But watch out. You could get washed out to sea. Syria? Tapering? The return of the debt-ceiling debate? Anemic real economic growth? A preponderance of negative earnings guidance? Rising Treasury yields? A panic in the emerging markets? And here's the Financial Times warning that central bankers may not be willing to protect investors from every danger:

|

| Ecuador/Codelco to create JV to explore Llurimagua reserves Posted: 30 Aug 2013 11:14 AM PDT Ecuador has no mining industry to speak of and is seeking to attract investment to tap its large copper, gold and silver reserves. |

| Week In FX Americas - Loonie Contained For The Time Being Posted: 30 Aug 2013 11:03 AM PDT Canadian GDP brought forth few surprises on Friday, with the Canadian economy growing in the second quarter very much in line with market expectations (+1.7% annualized vs. +1.6%). The best consumer spending performance in over two years mostly backed the strength. However, June's month-over-month print (-0.5%) was the biggest loss since the beginning of the global recession. The steep monthly decline was driven lower by construction, mostly due to the labor disputes in Quebec. The recent soft tone of weak employment data and still-elevated housing activity levels suggest little scope for change in policy from the Bank of Canada in the near term. What of the Canadian dollar? There seems to |

| Why Sryia? It’s Not What You Think, & It’s Not What You’ve Been Told Posted: 30 Aug 2013 11:00 AM PDT Sun Tzu said that “All war is deception.” Syria like Iraq and Afghanistan before it is no different. Let us look at the real reason why the globalist corporations and banking interests are fixated on this nation. A fixation that started over a decade ago. A fixation that has the potential to lead to a [...] The post Why Sryia? It’s Not What You Think, & It’s Not What You’ve Been Told appeared first on Silver Doctors. |

| Week In FX Asia - INR Caught In A Perfect Storm Posted: 30 Aug 2013 10:56 AM PDT This week saw the Indian rupee print a new record low against the "mighty" dollar. Currently, India is facing a perfect storm of negative factors. And, in the eye of this storm, Indian Prime Minister Dr. Singh has come out swinging in favor of his beleaguered currency, stating that recent government steps are helping to stabilize the economy and, by default, he expects the currency to recover. India's beaten-down currency has been battling and has not yet given up the fight. On Thursday, it happened to stage its biggest one-day gain in 15 years on central bank intervention. The currency continues to pare its recent losses and is trading sub-67.00 to the dollar as we close out the week. With policy measures in the realm of "no good options," there remains a market risk that INR could trade back and through the psychological 70 levels. The emerging market crisis is |

| Syria, Gold & the Emergency Crisis in Money Posted: 30 Aug 2013 10:41 AM PDT Yes, geopolitical turmoil can push gold prices higher. But if Syria is to blame for this run, then the world's in very big trouble... AND JUST like that, there were no sellers in the gold or silver markets. It's been buyers only amongst BullionVault users this week, writes Adrian Ash at the world's largest bullion service for private investors online. New account openings were strong this week too, the greatest number since the April price crash in fact. Cash deposits were also sharply higher, the heaviest since end-June – the week gold and silver hit their second big slump, and bargain hunters on BullionVault got just the crash they wanted. Since then, silver added a staggering 38% to this week's high. It hadn't moved so fast month-on-month since September last year! Gold is a relative laggard, but it's still put on 20% from the end-June low of $1182. Yet two whole months into this rally, the newswires and pundits today offer one reason for this jump and 1 reason only: Syria. Which if true, would be a very bad sign indeed. Not that news-writers and pundits need to get this stuff right. Helping you manage your money is mere info-tainment remember, with "gold = blood" offering a peep at more financial porn. No, it's not quite Hannah Montana on crack. But for anyone trying to glimpse the big picture outside their own roomful of black mirrors, it sure beats 10 things your spouse won't tell you. September for instance will mark the fifth anniversary of Lehman Brothers' collapse. Hard-bitten hacks spotted that early this summer, with a BBC radio trailer claiming it was "five years after the financial crisis began with the collapse of Lehman Brothers." Even the Evening Standard's Anthony Hilton said the same in print. This false memory has long infected otherwise useful analysis, but get ready for plenty more as the fateful echo of 15 September 2008 draws near. What this hack-handed "fifth anniversary" misses is that, sure – today's permanent emergency began 60 months back, when politicians and central-bank wonks finally awoke to the mess they'd ignored (even as they'd helped to create it), and then set about destroying money in the hope of saving the system. But Northern Rock hit its banking run in the UK a year before. The US home-loan implosion was well underway by Christmas 2006. And the "crisis" – meaning that turning point at which the future path to instability and chaos was decided – started long before that. Lehmans was an outcome, not a beginning. Cheap money's mischief ran wild for five years and more before your newspaper caught on. It simply took the biggest bank failures in history for them to notice. Those numbskulls buying gold and silver as the trouble built up were just smart alecs. They've never tired of saying it since. But back to today's political turmoil over the unholy horror in Syria. Yes, saber-rattling can add to gold and silver prices in times of extreme stress. But in times of extreme stress only, such as the Soviet invasion of Afghanistan in late 1979. Otherwise, Western investors making the running tend to ignore trouble and strife overseas, and precious metals tend to focus instead on monetary matters instead. Witness the Russian invasion of South Ossetia in summer 2008. It did nothing to buoy gold, which kept falling from a then record-high of $1000 per ounce as the snowballing credit collapse sucked air out of the gold futures markets before destroying Lehman's surrealist balancesheet. Syria is a different mess altogether, however. Its tangled web of friends, alliances and enemy's enemies is almost as ominous as its borders with Turkey and Israel. The West's push for action also comes as today's statesmen and other boneheads return from the beach, dragging suitcases full of must-read books trying to explain the First World War in time for next year's centenary. Politically, nothing was inevitable about the disaster of WWI. Financially, it made precious metals too valuable to use as money any more. But plenty of other monetary trends were already in play before Archduke Franz Ferdinand's chauffeur missed his diversion and indicated right onto Sarajevo's Franzjosefstrasse. Cradle-to-grave welfare and the state-run central banking it demanded would make hard money impossible, first in the way that a toddler is, and then as an idea which only history can ever revive. Roll on almost 100 years, and September 2013 also marks the second anniversary of gold's all-time peak. Was $1920 per ounce really both so long ago and so near? Recording two London Fixes of $1895 and one at $1896 per ounce, gold hit that intraday high on Tues 6 Sept. 2011. Today we're more than 25% below that peak. Which is better than the near-40% drop at end-June this year. But it still puts this summer's sharp recovery into context. Why the peak, and why are we so far off it today? In a word, crisis. Or rather the lack of it. Summer 2011 took the Greek debt collapse, and smeared it across Europe, sending Eurozone leaders into panic. Then it added the US debt downgrade, sparked by broken politics and the debt ceiling row. That deleted the words "risk free" from the world's reserve currency, and sent world stock markets into tailspin. To cap it all, summer 2011 then set fire to England's towns and cities in four days of mass lawlessness. Almost unchallenged by the police, its blazing High Streets made the evening news every night everywhere, right next to the financial crisis. Such social stress is, thankfully, rare. Such a singular point of investment stress is rarer still. But insurance is what you buy before the mob sets fire to your shop. And between the end of June and the start of Sept. 2011, the gold price rose 29%, jumping from $1480 to that brief top at $1920. Oddly, gold has made a near look-a-like move so far this summer too. Jumping from end-June's low of $1182, the gold price has now added 20% – pretty much what history said it would for UK investors (if not Dollar and Euro buyers) after a drop as severe as spring 2013's gold crash. Whether there's another 9% to come in the next week, we daren't guess. But after the "financial crisis" of 2007-2009 came the "sovereign debt crisis" of 2010-2012. And trouble comes in threes, of course. Gold's recent surge gives notice, perhaps, that today's geopolitical crisis may yet catch fire too. Certainly, something awful is afoot in Syria. |

| Gold Erases Weeks 2.5% Gain After UK Rejects Syrian Action Posted: 30 Aug 2013 10:34 AM PDT Bullion Vault |

| *Breaking: Rebels admit they were behind chemical attack in Syria! Posted: 30 Aug 2013 09:37 AM PDT *Breaking* Respected 20 year Middle Eastern reporter and Associated Press, BBC and NPR correspondent Dale Gavrak was told by Syrian rebels that they were responsible for last week's chemical weapons incident in Ghouta. The rebels informed Gavarak that the chemical weapons were accidentally mishandled by their group after they received them from the Saudis! Will [...] The post *Breaking: Rebels admit they were behind chemical attack in Syria! appeared first on Silver Doctors. |

| The shadowy web of collateral and war Posted: 30 Aug 2013 09:05 AM PDT It seems that few people have yet realized the possible scenario that a repo market failure will result in a liquidity freeze that could then spark off a full scale financial collapse. |

| Gold’s Strongest Months Since 1975 Are September And November Posted: 30 Aug 2013 09:02 AM PDT gold.ie |

| Precious Metals Will Rise As the Economic Recovery Disintegrates Posted: 30 Aug 2013 09:00 AM PDT What we are witnessing here is the disintegration of the so-called economic recovery. A great deal of effort by the FED to print, pump and prime the market seems to be losing steam. The tide has now changed as the broader stock markets decline, the precious metals have decoupled moving higher making significant gains. The [...] The post Precious Metals Will Rise As the Economic Recovery Disintegrates appeared first on Silver Doctors. |

| What do (mining) stocks tell us about gold’s future moves? Posted: 30 Aug 2013 08:53 AM PDT If you want to be an effective and profitable investor, you should look at the situation from different perspectives. That's why we are examining the stock market and the mining stocks to see if there's anything on the horizon that could drive gold prices higher or lower. |

| Gold erases week's 2.5% gain after U.K. rejects Syrian action Posted: 30 Aug 2013 08:48 AM PDT The price of gold fell $15 in London trade Friday morning, reversing the last of the week's 2.5% gain to sit flat at $1,395 per ounce. |

| Will gold fail to end month on high? Posted: 30 Aug 2013 08:31 AM PDT An imminent attack on Syria is looking less likely today and gold has reacted accordingly, falling below $1,400 this morning. It no longer appears as though it is heading for its second-monthly gain. Meanwhile silver is still aiming for its best month since January 2012. |

| Comex Registered Inventories – Could Disappear Any Day! Posted: 30 Aug 2013 08:30 AM PDT First, let me caveat with what I always state when analyzing COMEX inventories – or, for that matter, any information emanating from government and/or "quasi-government" agencies (in this case, the CME, which I consider the latter). That is, don't believe everything you read, as it may be "fudged" to serve those seeking to harm you. After all, it was just three months ago when the COMEX quietly added the below disclaimer to the bottom of its weekly inventory reports…

Moreover, one mustn't cling to long time myths of the predictive value of such reports – such as that "commercials" like JP Morgan are always correct. Admittedly, such data had a VERY high correlation to near-term price movements in the PM bull's early stages; but as I wrote last year in "THE COT's NO LONGER MATTER," such relationships have been tenuous at best for the past five years or so. In fact, one needs to look no further than this year to see what I mean. Recall October 2012, when gold last traded at $1,775/oz. – whilst the "commercial" short position peaked at 269,000 contracts. Subsequently, the Cartel attacked PAPER PMs with a vengeance – pushing PAPER gold down to a low of $1,180/oz in June 2013; at which point, the "commercial" short position bottomed at just 19,000 contracts. Since then, the commercials have been manically shorting gold again – reaching a net short position of 67,000 contracts as of last week – whilst gold surged from $1,180/oz to $1,430/oz. And by the way, in both cases the supposedly dumb "speculators" were DEAD ON in their trades. Thus, don't "fear" what the commercials are doing in the short-term; as for a government-backed, FASB-sanctioned Cartel member like JP Morgan, such trading is simply a "loss leader" for what they are doing in the long-term. And what they are doing in said long-term is decidedly different from the "smoke-screen" suggested by the aforementioned, COMEX-disclaimed "COT data" – per the world's pre-eminent COMEX expert himself, Ted Butler…

OK, data is just that – data. That and $0.50 once bought a cup of coffee – or for our oldest readers, five cups of coffee. My point is that what really matters is how much PHYSICAL metal actually exist to back the PAPER contracts; and again, one must caveat all reports emanating from the COMEX – or specifically, its parent the Chicago Mercantile Exchange, or CME. However, my sense is that such data is far more reliable than that of PAPER positions – as clients must confirm deliveries and receipts of PHYSICAL metal. Not to mention, JP Morgan itself admits to plummeting inventories in its own warehouses – validating the information stated in the COMEX reports to be discussed shortly…

Before I go further, let me clarify the COMEX "lingo" regarding inventory classifications. Essentially, there are two types to speak of – eligible and registered. If you consider these terms literally, you will be eternally confused, as "eligible" could not be a bigger misnomer. In fact, "eligible" metal is actually NOT eligible to be delivered to long contract holders – as it is simply stored at the COMEX on behalf of current customers. Conversely, "registered" gold and silver are available for delivery to contract buyers; and thus, by far the more important category. True, the eligible inventory must be watched, too – to see if customers are withdrawing metal out of fear of a potential "force majeure" confiscation. However, only the registered category tells the tale of how close – or far – the COMEX is from delivery default. Once again, look at the above chart of JP Morgan's supposed "eligible" COMEX gold inventory – which last month, plunged to a measly 46,000 ounces (roughly one tonne), down a stunning 99% from the 2,000,000 ounces held on December 2012; which, per what I wrote above, happened to be when the current PM raid commenced. In other words, as the PAPER gold price was taken from $1,775/oz to $1,180/oz – below the cost of production at nearly ALL the world's mines, nearly ALL of JP Morgan's inventories were drained; presumably sent to points East. Validating this point, the ENTIRE COMEX has experienced the same "inventory exodus." In fact, the intensity of the COMEX gold inventory drain is even stronger; as it stood at a 52-week high of 3,000,000 ounces as recently as April 2013 – i.e, just before the Cartel orchestrated "ALTERNATIVE CURRENCIES DESTRUCTION." Why JPM's inventory drain started five months earlier we'll probably never know; however, the end result is the same – as total COMEX registered gold inventory has in the past four months plunged by an astounding 75%, to just 768,000 ounces…

As for silver, the recent trajectory has been slightly different, but the big picture trend no different. Since December, COMEX registered silver inventories have meandered in the 35 million to 50 million range; however, they recently plunged to 39 million ounces. And consistent with Miles Franklin's experience in the retail bullion markets, the PHYSICAL silver drain has been far more dramatic in recent years. Since 2008's Global Meltdown I, COMEX registered gold inventories have fluctuated wildly with market trends (actually, note how fast they drained when "DOLLAR-PRICED GOLD" achieved its ALL-TIME HIGH in September 2011). However, they have been relatively range-bound until this year's plunge. Conversely, the silver inventory drain has been far more pervasive and uninterrupted since 2008 – with the net result being a reduction in registered inventories of 57% in the past five years…

And now for the punch line, per the title of today's article; to be accomplished with a wee bit of second-grade math. First, let's look at the COMEX registered gold inventory of 768,000 ounces; at $1,400/oz, worth roughly $1.1 billion; and next, the registered silver inventory of just 39 million ounces; at $24/oz, valued at $936 million. In other words, just $2 billion measly "dollars" – or €1.5 billion "euros" – could take out the ENTIRE COMEX PM inventory in a single day. "ADMIRAL SPROTT" alone has purchased $2.4 billion of PHYSICAL gold through his PHYS bullion fund since its inception in 2010; and $1.4 billion of PHYSICAL silver through its PSLV fund in that same period. And don't forget the three "Spicer Funds" seeking to do the same; the GTU gold trust, the SVRZF silver trust, and the "granddaddy of them all" – the $4.3 billion market cap Central Fund of Canada, ticker CEF. As readers are well aware, I am not a major fan of these funds because the Cartel clearly naked shorts them to prevent trading at the premiums to Net Asset Value necessary to catalyze new offerings. However, I am very encouraged as to how PSLV has fought through the Cartel's hurdles to trade at a 2% premium to NAV as I write. If it gets back to a 5% premium or so – and before yesterday's Cartel raid, it was up to 3%, I expect the Admiral to pull the trigger on a new, MASSIVE offering intended on forever silencing the manipulators. Anyhow, my point is that the Sprott and Spicer Funds are merely "pimples on the arse" of the global financial community. Just in the private realm, there are nearly 1,500 billionaires; let alone, the countless corporations, municipalities, and sovereign wealth funds capable of taking up the rapidly dwindling amount of inventory. Until that – inevitable – time, you have the "opportunity of a lifetime" to PROTECT your net worth with the limited – and contracting – PHYSICAL gold and silver supply still available. Unfortunately, if you wait until afterwards, you will be forever "sentenced" to join the masses in HYPERINFLATIONARY HELL. And trust me, the smartest "1%" are already doing so – per this quote below from Steve St. Angelo…

|

| Gold, Silver, and the Status Quo Posted: 30 Aug 2013 07:00 AM PDT When debt grows far more rapidly than GDP, the consequences will eventually be catastrophic. Yes, we have ignored the reality of excessive spending, unpayable debts, unsustainable monetary policies, and Ponzi-finance for several decades, but that does not mean we can delay the consequences forever. Yes, the consequences of failed policies, expensive wars, massive debts, and [...] The post Gold, Silver, and the Status Quo appeared first on Silver Doctors. |

| Gold traders turned bullish ahead of next week's U.S. payroll data Posted: 30 Aug 2013 06:38 AM PDT According to the CFTC, the managed money short positions dropped 13% while the long positions rose about 8% during the week ending Aug. 20. The net position at 73,216 contracts is the highest since Feb. 5. |

| Physical Gold and Silver Are Safe Havens Posted: 30 Aug 2013 06:33 AM PDT On a quiet, pre-holiday Friday morning – with nearly the entire world on holiday, and ALL markets down except, of course, the "DOW JONES PROPAGANDA AVERAGE" – What better time to tie together what I have written this week? In other words, a primer on "Gold Cartel Strategy 101." On Wednesday, I wrote of how the metals had a rare options expiration day (Tuesday) in which the prices were in the money for many great contracts; and also, how very few contracts are ever redeemed for metal on the nearly PAPER-only CRIMEX – er, COMEX. Yesterday, I wrote of how the real Cartel target is not Expiration Day, but "First Delivery Day" – i.e., today – as said option holders have until the close of today's COMEX trading to exercise their right to PHYSICAL delivery. And thus – per today's topic, the Cartel is far more worried about being swamped with delivery requests – for the little actual metal that still exists – than losing a few PAPER dollars (that the Fed can print up for them at will) in the options markets. And hence, despite imminent WAR, plunging global currencies, rising interest rates, cratering economic data, next week's potentially historic, dollar-killing G-20 meeting, and oh yeah, a likely long-term, debilitating South African gold mining strike, the Cartel went on a MASSIVE, week-long, PAPER PM "attack-fest" – utilizing every possible tactic – from "THE 2:15 AM" (seen EVERY DAY this week), to yesterday's 8:20 AM EST (COMEX open), 10:00 AM EST (PM Fix), and even 2:00 PM EST "CRYBABY ATTACKs" to make sure the $1,400 and $1,420 gold calls are out-of-the-money by the time the delivery decisions are made this afternoon (as traders typically wait until the last second to make such decisions) – as well as the $24.00 and $24.50 silver calls. In fact, the desperation to avoid losing the inevitable, MASSIVE run on the remaining COMEX PHYSICAL inventories has become so desperate, the Cartel naked shorted the recently awakened mining stocks with a vengeance – taking the HUI down a whopping 12 points Tuesday (with gold and silver up!) and eight points Wednesday (with gold and silver flat!) to demoralize potential "momentum buyers" into "going elsewhere." And notice how yesterday, when they finally succeeded in ATTACKING PAPER PMs, the HUI was up as they quietly covered shorts. FYI, for those that still own mining shares, keep in mind what I have always said, as eloquently put yesterday by James Turk…

In the big picture, said lack of PHYSICAL gold and silver to continue the dying game of PM suppression may well be the catalyst that destroys the entire, ill-fated global fiat currency regime; and even if it's not, it WILL rear its ugly head and swamp the game of "PAPER musical chairs" that has allowed evil bankers and politicians to ruin the world with debt and inflation. Per Keith Barron's quote below, it is these issues behind the inexorable growth of PHYSICAL PM demand – which will only grow more intense with each "currency unit", PRINTED; and not "one-off" events like Syria, although they certainly don't help the Cartel's case…

We are now in the FINAL stages of history's most heinous, citizen-killing financial experiment of all time; and if you don't PROTECT your assets while you still can, you may wake up (shortly) without any. Enjoy your holiday weekend.Similar Posts: |

| Gold, silver consolidate as traders shake bearish sentiment Posted: 30 Aug 2013 06:03 AM PDT Gold and silver consolidated this week, following an explosive $30 rise for gold ($1.20 for silver) last Friday. In precious metals markets there has been a change in sentiment from extreme bearishness to "don't know." |

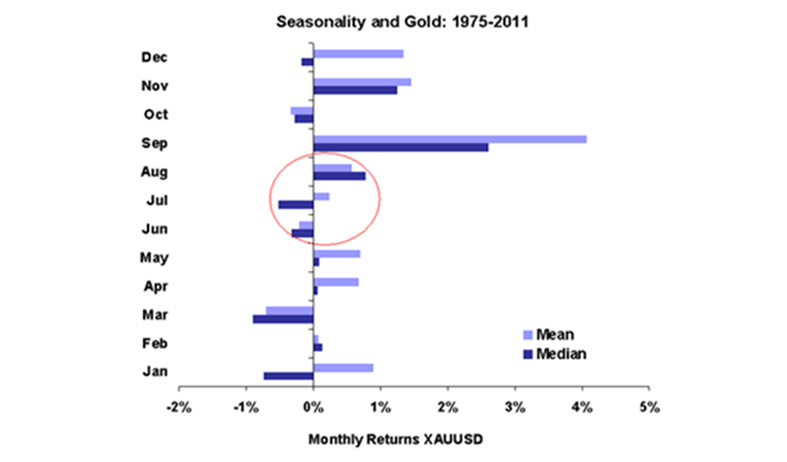

| Gold’s Strongest Months Since 1975 Are September And November Posted: 30 Aug 2013 05:53 AM PDT Gold is set for its second consecutive higher monthly close which is bullish from a momentum and technical perspective. Gold is nearly 5% higher for the month in dollars and euros, 2.5% in pounds and 12% in rupees after the rupee collapsed in August. This week will see the end of August trading and September [...] The post Gold's Strongest Months Since 1975 Are September And November appeared first on Silver Doctors. |

| Posted: 30 Aug 2013 05:10 AM PDT Doc’s End of Summer Blowout Sale!! 2013 Silver Eagles As Low As $2.49 Over Spot!! 2013 Silver Maples As Low As $1.99 Over Spot!! 2013 Silver Philharmonics As Low As $1.89 Over Spot!! 1oz Silver Buffalo Rounds 99 Cents Over Spot..ANY QTY!! Shop Online or Call 614.300.1094 Now!! Small Stacker Day Friday [...] The post End Of Summer Blowout Sale!! Industry Low Prices On Silver Eagles, Maples, Philharmonics, and Buffalos!! appeared first on Silver Doctors. |

| Gold’s Strongest Months Since 1975 Are September And November Posted: 30 Aug 2013 05:02 AM PDT Absolutely nothing has changed regarding the fundamentals driving the gold market. Today's AM fix was USD 1,392.75, EUR 1,051.85 and GBP 899.19 per ounce. Gold fell $8.60 or 0.61% yesterday, closing at $1,407.10/oz. Silver fell $0.44 or 1.81%, closing at $23.85. Platinum fell $11.61 or 0.8% to $1,518.99/oz, while palladium was down $8.78 or 1.2% to $734.22/oz. Gold is set for its second consecutive higher monthly close which is bullish from a momentum and technical perspective. Gold is nearly 5% higher for the month in dollars and euros, 2.5% in pounds and 12% in rupees after the rupee collapsed in August.

Gold quickly fell from $1,407/oz to $1,395/oz at 0800 London time despite no data of note and little corresponding movement in oil and stock markets. Profit taking and an increase in risk appetite may have contributed to the falls after the U.K. parliament voted to reject military action against Syria and fears over oil supply disruptions in the Middle East eased. Oil prices are still heading for the largest monthly gain in a year, with Brent up more than 6% in August after unrest cut output in Libya by around 1 million barrels per day and production fell in Iraq, Nigeria and elsewhere. The U.S. seems likely to proceed with a strike against Syria even after U.K. lawmakers rejected action which should support prices. The yellow metal reached $1,433.83/oz on August 28th, its highest since mid May on concerns that the U.S. will go to war with Syria. Gold's recent gains are primarily due to very strong physical demand globally and increasing supply issues, particularly in the LBMA gold bullion market. Syria and the increasing geopolitical uncertainty in the Middle East are creating real oil price and inflation risk which has contributed to the increased bullion buying in recent days. As ever it is important to focus on the medium and long term drivers of the gold market: Medium Term Market Drivers Seasonal This is the case especially in Asia for weddings and festivals and into year end and for Chinese New Year when China stocks up on gold. Gold and silver often see periods of weakness in the summer doldrum months of May, June and July. This week will see the end of August trading and September is, along with November, one of the strongest months to own gold. This is seen in the charts showing gold's monthly performance over different time frames – 1975 to 2011, 2000 to 2011 and our Bloomberg Gold Seasonality table from 2003 to 2013 (10 years is the maximum that can be used). Thackray’s 2011 Investor’s Guide notes that the optimal period to own gold bullion is from July 12 to October 9. During the past 25 periods, gold bullion has outperformed the S&P 500 Index by 4.7%. COMEX Short positions held by hedge funds in the gold and silver markets remain very high and the stage is now set for a significant short squeeze which should propel prices higher in the coming months. Arguably we are in the early stages of this short squeeze. Hedge funds have consistently been caught wrong footed at market bottoms for gold and silver in recent years and high short positions have been seen near market bottoms, prior to rallies in gold and silver. Conversely, the smart speculative money, bullion banks such as JP Morgan have reduced their short positions and are now long in quite a significant way and positioned to profit from higher prices in the coming weeks and months. Federal Reserve "Tapering" 'Talk is cheap', 'actions speak louder than words' and it is always best to watch what central banks do rather than what they say. Near zero interest rates and bond buying are set to continue for the foreseeable future. Precious metals will only be threatened if there is a sustained period of rising interest rates which lead to positive real interest rates. This is not going to happen anytime soon as it would lead to an economic recession and possibly a severe Depression. Chinese Demand Demand surged 87% for bars and 44% for jewelry. China’s gold demand should hit a record 1,000 tonnes this year and will almost certainly overtake India, the world's largest saver in gold. The People's Bank of China is almost certainly continuing to quietly accumulate gold bullion reserves. As was the case previously, they will not announce their gold bullion purchases to the market in order to ensure they accumulate sizeable reserves at more competitive prices. They also do not wish to create a run on the dollar – thereby devaluing their sizeable foreign exchange reserves. Expect an announcement from the PBOC, sometime in 2013 or 2104, that they have doubled or even trebled their reserves to over 2,000 or 3,000 tonnes. India Gold Forward Offered Rates (GOFO) Gold Backwardation Eurozone Debt Crisis Greece, Spain, Portugal, Italy, Ireland, now Cyprus and even France remain vulnerable. Japan, U.K., U.S. Debt Crisis The U.K. is one of the most indebted countries in the industrialised world – the national debt continues to rise rapidly and is now at more than 1.2 trillion pounds ($1.8 trillion) and total (private and public) debt to GDP in the U.K. remains over 500%. The U.S. government is once again on the brink of defaulting. At the start of the ‘credit crisis’ six years ago, U.S. federal debt was just $8.9 trillion. Today, U.S. federal debt stands at $16.738 trillion – 88% higher and increasing rapidly. This does not include the $70 trillion to $100 trillion in unfunded liabilities for social security, medicare and medicaid. Long Term Fundamentals Macroeconomic Risk Geopolitical Risk Systemic Risk Monetary Risk Should the macroeconomic, systemic and geopolitical risks increase even further in the coming months, as seems likely, than the central banks response will likely again be more cheap money policies and further currency debasement which risks currency wars deepening. Conclusion Owning physical gold coins and/or bars in your possession and owning physical gold and silver in allocated accounts will continue to protect and grow wealth in the coming years. |

| Posted: 30 Aug 2013 05:00 AM PDT People cling on to anything precious-relationships are precious, that's the reason why we mourn the death of our beloved ones. When it comes to gold, it has held a fascination for people since ancient times because it's so precious that it costs a lot of money to extract one additional ounce of gold from underneath which the likes of Anglogold, Barrick Gold, Harmony Gold and others are realising now when the market turned bearish. |

| Civilizations Don’t Die of Old Age Posted: 30 Aug 2013 04:46 AM PDT A simple video explains what has happened and how it is no different from any other country/civilization that rises and falls. It focuses on money/gold and provides an historical as well as a causal explanation of why a major crash is inevitable. We can either die in the flames of inflation or freeze in deflation/depression. [...] |

| ObamaCare Staggers Toward the October 1 Finish Line (2) Posted: 30 Aug 2013 03:25 AM PDT By Lambert Strether of Corrente. Perhaps this will be a useful metaphor to explain how ObamaCare really works: Imagine you walk into a hospital seeking health care: Perhaps for something major, like heart failure, or something minor, like a broken arm. You sign in at the front desk and explain your situation to the nurse on duty. In response, they reach under the desk and pull out an extraordinary contraption: A combination, it seems, of a miniature steam engine, the Wheel of Fortune, a cuckoo-clock, and a football scoreboard. There’s a crank on the side of it, which the nurse, having rolled up their sleeves, turns vigorously with one arm, while feeding lumps of coal into the steam engine’s firebox with the other. Clutching your chest (or your arm) you notice two doors behind the desk. They have signs which read: Special Limited Facilities, and Service Grand Royale. The cranking stops: The steam engine emits three shrill whistles: The Wheel of Fortune judders to a halt at $500: you hear “Cuckoo, cuckoo”: and see (in lights) 42. The nurse notes these results, consults a large three-ring binder, and points you to the door marked Special Limited Facilities. Or perhaps it’s your lucky day, and Service Grand Royale is yours, all yours! Yes, that really is how ObamaCare works: ObamaCare is a machine that delivers random results; unfair results, unequal results. The health care will actually be available to you will vary capriciously by past (and projected (and reported)) income, jurisdiction, geography, family structure, employment on Capitol Hill, age, existing insurance coverage, jurisdiction, and market segment. But the suffering from heart failure (or from a broken arm) is the same for everyone, so why isn’t the same health care available to everyone? So, when ObamaCare apologists say that ObamaCare helped some people* — or, when they want to really pile on the emotional blackmail and start taking hostages, they ask “Why do you want my spouse to die?” — ask them “Why don’t you want to everyone to get the help that some do?” or “Why don’t you want everyone to get the help your spouse does”? And if you get a good faith answer, offer to write a joint letter to the editor with them, supporting single payer Medicare for All. (Congressional offices pay attention to Letters to the Editor as, you will find, do your neighbors.)** Anyhow, miniature steam engines with integrated Wheels of Fortune and cuckoo clock and scoreboard peripherals present significant systems integration challenges. So — and, readers, I know this will surprise you — ObamaCare, bloatware that it is, has slipped yet another deadline, with 32 days before enrollment begins. Reuters:

Well, that’s a concern, since the Exchanges are supposed to enable plans to be compared.

Of course, administration apologists are already starting to prepare the fallback position: The launch date doesn’t really matter!***

Uh huh. So there are “substantive” deadlines, and, I suppose, non-substantive deadlines. Alrighty then. Meanwhile, the sort of people who invent such obfuscatory verbiage are profiting mightily from the rental extraction opportunities created by the very artificial complexity they themselves created (especially the cuckoo clock makers). From The Hill:

One might almost imagine these glowing prospects had something to do with single payer being systematically kept off “the table.”

So, the very things that make ObamaCare a technical disaster and a project manager’s nightmare — the triaged requirements, the slipped deadlines, the crazy pants secrecy — are, from K Street’s perspective, a gold mine, a veritable fountain of information arbitrage and billable hours. Good to know. Finally, AFL-CIO’s Richard Trumka throws the membership under the bus. (For those who came in late, “Mistakes were made” is a classic Beltway non-apology apology, the key point being that questions of good faith don’t enter. Anybody can make a mistake!) The Hill:

Nobody could have predicted that a statute crafted by a health insurance company vice president wouldn't take organized labor's concerns into account!

ObamaCare's failures are systemic, a consequence of its complex steam- and cuckoo clock-powered system of eligibility determination; "tweaks" are not the answer. As they say in the Navy: "You can't buff a turd."

"Problems" which Obama fixed immediately for business, and not at all for you. Are you sensing a pattern? Bueller? Bueller? Bueller? For my money, the only way to get anything out of Obama at all is to threaten him: That's what the gay bundlers and the Hispanics did before election 2012, and they got something, however pathetically inadequate. Trumka didn't do that, and so of course he gets nothing, and so his membership will suffer. Well done, all. NOTE * Ursula LeGuin had something to say about this mode of thought in Those Who Walk Away From Omelas. TROLL PROPHYLACTIC ** Yes, ObamaCare will help some people; a program so large could hardly fail to do so; ObamaCare isn't HAMP, after all. Of course, that's not the issue. NOTE *** Sarah Kliff frames the "deadlines don't matter" argument this way:

So it’s when coverage begins that matters, and not when choice begins? Bollocks. Insiders don’t have to worry about what their fate will be under ObamaCare or the exchanges. The rest of us would like to know our fate under the Exchanges sooner rather than later, so we can plan our lives accordingly. The choice deadline was supposed to be October 1, and choice is substantive. The promise was made by Sebelius, and now the Democratic nomenklatura wants to weasel out of it because they can’t deliver. |

| Silver, what could be in store. Posted: 30 Aug 2013 03:21 AM PDT In January myself and other commentators felt confident enough about silver that we all wrote about how 2013 would be silver's year. It was a hard sell even then, the price had climbed to $33 at the beginning of December 2012 to then just above $29. But that drop seems like nothing compared to the fall to $18.61/oz we saw at the end of June. Why is it down by so much? At the beginning of the year top analysts were predicting the price to climb 29% in 2013. Their optimism was not surprising, and it is even less so today. Compared to gold the environment appears pretty welcoming to the precious metal.

Silver has climbed to $24.65 this week and is expected to climb higher, but the precious metal is still down by nearly 23% on last year. In contrast gold is down by around 20%. In the short-term many analysts expect the silver price to fall given the sentiment surrounding tapering and how it will affect the gold price. However, in the long-run a reduction in bond-purchases indicates that economic recovery is on its way (so the FOMC like to think) thanks to a pick-up in industrial activity. Which, in turn, means increased silver demand. Whilst the paper silver trade may work to push the price lower, supply/demand fundamentals are likely to kick in and provide support to the price. We take a quick look at some of these key fundamentals and notice that they're looking even healthier than gold's. |

| India Might Buy Gold From Citizens to Ease Rupee Crisis Posted: 30 Aug 2013 02:29 AM PDT "4.1 million ounces of silver would take a very large bite out of what Scotiabank is still short" ¤ Yesterday In Gold & SilverThe gold price got sold down about ten bucks during the first hour of trading in Hong Kong and then traded in a tight $10 price range for the remainder of the Thursday trading session. The two small rally attempts in New York, one at the Comex open and the other during their lunch hour, didn't get far. The last rally, such as it was, died just minutes before the Comex close. The highs and lows aren't worth mentioning. Gold finished the trading day in New York on Thursday at $1,407.20 spot, down $10.60 from Wednesday. Volume, net of what few rollovers there were, came in around the 143,000 contract mark. The price pattern in silver had a little more shape to it, but was very similar to gold's. Silver got sold down two bits in the early going in Far East trading. The tiny rally that began during the Hong Kong lunch hour got sold down hard. Then the rally that began late in the morning in London got dealt with a few minutes after the Comex open, and the last rally attempt died at the Comex close. After that, the silver price got sold back below the $24 spot price mark, and then traded sideways into the 5:15 p.m. electronic close. Silver finished the day at $23.87 spot, down 52 cents from Wednesday. Net volume was pretty heavy at 48,000 contracts, with almost all of it in the new front month for silver, which is December. Both platinum and palladium sold off gently in every market on Planet Earth yesterday. Here are the charts. The dollar index closed late on Wednesday afternoon in New York at 81.44. When trading began in the Far East shortly thereafter on their Thursday morning, the index traded flat until noon in Hong Kong. Then away it went to the upside for the second day in a row, with the rally topping out at 82.05 around 11:20 a.m. in New York, shortly after London closed for the day. After that it traded pretty flat into the close. The index finished Thursday at 82.005, up about 56 basis points. In the face of a negative day for the metal itself, the gold shares did rather well, and the HUI managed to eke out a small gain, closing the day up 0.80%. With the exception of one mining company, all the stocks in Nick Laird's Intraday Silver Sentiment Index closed down on the day. The index closed lower by 0.82%. (Click on image to enlarge) The CME's Daily Delivery Report showed that only 9 gold contracts were posted for delivery later today within the Comex-approved depositories and, true to form, JPMorgan stopped 8 of them in its proprietary trading account. This completes the deliveries in both gold and silver for the August month. But the big surprise was the first notice day in silver, as 1,661 contracts were posted for delivery next Tuesday. It wasn't the amount that was a surprise, it was the identity of the big short/issuer, who turned out to be none other than JPMorgan Chase with 985 contracts out of it's in-house [proprietary] trading account. There was quite a list of short/issuers, each with a decent amount of contracts issued. The list of long/stoppers was also a bit of a surprise. As usual for first notice day, there were a couple of dozen of them, but the major ones were Canada's Bank of Nova Scotia with 825, Credit Suisse in its proprietary trading account with 241, and JPMorgan in its client account with 233 contracts. The link to yesterday's Issuers and Stoppers Report is link here, and is definitely worth a minute or so of your time. For the second day in a row there were no reported changes in GLD or SLV, and no sales report from the U.S. Mint. Over at the Comex-approved depository in gold, there was only 514 troy ounces shipped out the door, and none was received. In silver there was 658,320 troy ounces received, and 260,846 troy ounces shipped out. The link to that activity is here. I have a decent number of stories again today, and some of them are quite important, so I hope you have the time to read the ones that interest you. ¤ Critical ReadsJPMorgan Bribe Probe Said to Expand in Asia as Spreadsheet Is FoundA probe of JPMorgan Chase & Co.'s hiring practices in China has uncovered red flags across Asia, including an internal spreadsheet that linked appointments to specific deals pursued by the bank, people with knowledge of the matter said. The Justice Department has joined the Securities and Exchange Commission in examining whether JPMorgan hired people so that their family members in government and elsewhere would steer business to the firm, possibly violating bribery laws, said one of the people, all of whom asked to not be named because the inquiry isn’t public. The bank has opened an internal investigation that has flagged more than 200 hires for review, said two people with knowledge of the examination, results of which JPMorgan is sharing with regulators. The scrutiny began in Hong Kong and has now expanded to countries across Asia, looking at interns as well as full-time workers, two people said. The employees include influential politicians’ family members who worked in JPMorgan’s investment bank, as well as relatives of asset-management clients, the people said. Wall Street firms have long enlisted people whose pedigree and connections can win business, a practice that doesn’t necessarily violate the law. This Bloomberg piece was filed on their website very late on Wednesday evening MDT...and I thank reader M.A. for today's first story. August U.S. Equity Trading Volume Plunges to Lowest in 16 Years Earlier we showed one indicator of the U.S. investor's (should they exist anymore) loss of interest in the Federal-Reserve-sponsored equity market - i.e. CNBC ratings at 20-year lows. In the interest of being more fair-and-balanced we present anther perspective... U.S. equity trading volume in August of 2013 is the lowest on average in 16 years... and all-time highs, middle-east war, taper, weak macro, housing un-recovery, German elections, Asian FX crisis will do little to improve that risk-appetite for the retiring boomer army. United States' 2nd-Quarter Growth Is Revised Up to 2.5%, From 1.7%The nation’s economic output grew at a much faster rate in the second quarter than originally estimated, buoyed by an increase in exports. Gross domestic product, a broad measure of goods and services produced across the economy, grew in the second quarter at an annualized rate of 2.5 percent in April through June of this year, the Commerce Department reported on Thursday. The government initially estimated G.D.P. at 1.7 percent. The growth rate is still far lower than what the country needs to recover the ground lost during the recent recession anytime soon. The long-term average growth rate for the economy is more than 3 percent, and the economy needs above-trend growth to make up for sharp losses from the downturn. The U.S. economy barely has a pulse. One can only imagine the implosion that would occur if the Fed wasn't running the printing presses white hot. I'm still of the opinion, as are many others, that the Fed's 'tapering' ain't going to happen. This article appeared on The New York Times website yesterday...and I thank reader Ken Hurt for sending it. 'Brilliant' Snowden Digitally Impersonated NSA OfficialsEdward Snowden successfully assumed the electronic identities of top NSA officials to access some of the secret National Security Agency documents he leaked, Richard Esposito, Matthew Cole and Robert Windrem of NBC News report. “Every day, they are learning how brilliant [Snowden] was,” a former U.S. official with knowledge of the case told NBC. “This is why you don’t hire brilliant people for jobs like this. You hire smart people. Brilliant people get you in trouble.” The 30-year-old's role as a "system administrator" meant that he was able to access NSAnet, the agency’s intranet, using those user profiles and without leaving any signature. Wow! If you're getting a little jaded with all the Snowden stories you've read, this one is truly amazing. Someone is going to make a movie out out of this some day, and when they do, I'll be happy to pay good money to see it. This businessinsider.com story was posted on their Internet site yesterday morning...and I thank Roy Stephens for his first offering in today's column. Cameron backs down on urgent Syria strikesDavid Cameron backed down and agreed to delay a military attack on Syria following a growing revolt over the UK's rushed response to the crisis on Wednesday night. The Prime Minister has now said he will wait for a report by United Nations weapons inspectors before seeking the approval of MPs for “direct British involvement” in the Syrian intervention. Downing Street said the decision to wait for the UN was based on the “deep concerns” the country still harbours over the Iraq War. MPs had been recalled to vote on a motion on Thursday expected to sanction military action. Instead, after a Labour intervention, they will debate a broader motion calling for a “humanitarian response”. This very worthwhile story was posted on the telegraph.co.uk Internet site late on Wednesday evening BST. Roy Stephens sent me this news item early yesterday morning. U.S. Finally Admits What Ron Paul Said: "Nobody Knows Who Set Off The Gas"The AP reports that US intelligence officials are admitting that linking Syrian President Bashar Assad or his inner circle to an alleged chemical weapons attack is no "slam dunk," as opposed to Obama (and Kerry) who are 'unequivocal' of the fact. "The intelligence linking Syrian President Bashar Assad or his inner circle to an alleged chemical weapons attack is no "slam dunk," with questions remaining about who actually controls some of Syria's chemical weapons stores and doubts about whether Assad himself ordered the strike, U.S. intelligence officials say." - AP "The danger of escalation with Russia is very high," Ron Paul warns in this brief Fox News interview. After casting doubts on the government's 'knowledge' and reasoning in the region, Paul gets straight to the point. Simply put, he notes, despite the ongoing headlines of 'proof' and 'dreadful videos', Paul states "We're not positive who set off the gas," and indeed - who is set to benefit most from any Assad-regime-smackdown? Al-Qaeda. "Assad is not an idiot," Paul adds, "it's unlikely he would do this on purpose...look how many lies were told to us about Saddam Hussein prior to that build-up." A lot of uncomfortable truths in this brief clip for an administration that has crossed its own red line on actions against Syria now..."I think it's a false flag..." Paul adds, there is a big risk that "we are getting sucked in" and the American people are against this war. This must read commentary was posted on the zerohedge.com Internet site during the noon hour on the east coast yesterday...and it's another offering from reader M.A. Britain's Rejection of Syrian Response Reflects Fear of Rushing to ActThe stunning parliamentary defeat on Thursday for Prime Minister David Cameron that led him to rule out British military participation in any strike on Syria reflected British fears of rushing to act against Damascus without certain evidence. By just 13 votes, British lawmakers rejected a motion urging an international response to a chemical weapons strike for which the United States has blamed the forces of the Syrian president, Bashar al-Assad. The vote, and Mr. Cameron’s pledge to honor it, is a blow to President Obama. Like nearly all presidents since the Vietnam War, he has relied on Britain to be shoulder-to-shoulder with Washington in any serious military or security engagement. This must read story was posted on The New York Times website late yesterday...and it's another offering from Roy Stephens. U.S. ready to decide on military action in Syria 'on our own' - White HousePresident Obama could well consider a military strike in Syria despite the British Parliament rejecting a motion authorizing the UK’s involvement in the conflict. White House officials told reporters Thursday that the statement from United States’ closest ally, reluctance from the United Nations Security Council, and widespread uncertainty in the US Congress would not be enough to sway Obama from a limited missile strike on Syrian targets. Obama, who has been criticized for not consulting with Congress over Syria, met with lawmakers and other top leaders in a White House conference call Thursday. “We have seen the result of the Parliament vote in the UK tonight. The US will continue to consult with the UK government - one of our closest allies and friends. As we've said, President Obama's decision-making will be guided by what is in the best interests of the United States,” said a White House statement following the meeting. “He believes that there are core interests at stake for the United States and that countries who violate international norms regarding chemical weapons need to be held accountable.” This must read commentary was posted on the Russia Today website shortly after midnight Moscow time...and my thanks go out to Roy Stephens for bringing this story to our attention. Worldwide loss of oil supply heightens Syria attack riskLibya's oil output has crashed to a near standstill over the past year as warlords and strikes paralyse the country, tightening the screws on global crude supply as the crisis in Syria comes to a head. “We are currently witnessing the collapse of state in Libya, and the country is getting closer to local wars for oil revenues,” said the Swiss-based group Petromatrix. The country’s oil ministry said production has slumped to an average of 300,000 barrels per day (b/d) in August, down by more than four-fifths from its peak after the overthrow of the Gaddafi regime two years ago. “Militia groups are behaving like terrorists, using control over oil as political leverage to extract concessions,” said Dr Elizabeth Stephens, head of political risk at insurers Jardine Lloyd Thompson. Port closures and strikes have compounded the damage but the deeper story is the disintegration of political authority. This news item was posted on The Telegraphs' website yesterday evening BST...and I thank Manitoba reader Ulrike Marx for her first story in today's column. It's definitely a must read as well. U.S. Banker Deploys Polygraph to Thwart Kazakhstan TheftWhen Michael Eggleton arrived in Kazakhstan in 2009 after three banks defaulted on about $20 billion in debt, he thought something drastic had to be done. So the former Merrill Lynch & Co. and Credit Suisse Group AG banker, who had been appointed chief executive officer of Almaty-based Eurasian Bank JSC, flew a polygraph machine into the Central Asian country to bolster client trust. The bank, Kazakhstan’s 10th largest, was losing money, and Eggleton’s predecessor, Zhomart Yertayev, had been arrested on suspicion of embezzlement in connection with $1.1 billion in losses at Alliance Bank, which he led from 2002 to 2007. Yertayev, who denied wrongdoing, was convicted in 2011. Why just Kazakhstan? A couple of dozen of these should be required on both Wall Street and in Washington. They'll also need a machine permanently installed at JPMorgan Chase as well. This Bloomberg story was posted on their website on Wednesday afternoon MDT...and I thank U.A.E. reader Laurent-Patrick Gally for bringing it to our attention. Four King World News Blogs/Audio Interviews1. John Hathaway: "Unprecedented Run on Physical Gold Now Set to Accelerate". 2. Tom Fitzpatrick: "The Frightening "Stairway To Hell" Gold and Silver |

| Worldwide loss of oil supply heightens Syria attack risk Posted: 30 Aug 2013 02:29 AM PDT Libya's oil output has crashed to a near standstill over the past year as warlords and strikes paralyse the country, tightening the screws on global crude supply as the crisis in Syria comes to a head. “We are currently witnessing the collapse of state in Libya, and the country is getting closer to local wars for oil revenues,” said the Swiss-based group Petromatrix. The country’s oil ministry said production has slumped to an average of 300,000 barrels per day (b/d) in August, down by more than four-fifths from its peak after the overthrow of the Gaddafi regime two years ago. “Militia groups are behaving like terrorists, using control over oil as political leverage to extract concessions,” said Dr Elizabeth Stephens, head of political risk at insurers Jardine Lloyd Thompson. Port closures and strikes have compounded the damage but the deeper story is the disintegration of political authority. This news item was posted on The Telegraphs' website yesterday evening BST...and I thank Manitoba reader Ulrike Marx for her first story in today's column. It's definitely a must read as well. |

| Four King World News Blogs/Audio Interviews Posted: 30 Aug 2013 02:29 AM PDT 1. John Hathaway: "Unprecedented Run on Physical Gold Now Set to Accelerate". 2. Tom Fitzpatrick: "The Frightening "Stairway To Hell" Gold and Silver Are Climbing". 3. Jeffrey Saut: "Gold Market Now Very Close to Issuing a Major "Buy" Signal". 4. The audio interview is with James Turk. |

| A Finicky Thief of the Finest Silver Is Arrested Again Posted: 30 Aug 2013 02:29 AM PDT Even before someone carefully removed a windowpane from a secluded Buckhead home here one rainy June night and slipped away with a 1734 silver mug that had belonged to George II, it was clear to detectives that a meticulous thief with a singular obsession was stealing the great silver pieces of the Old South. For months, exquisite sterling silver collections had been disappearing, taken in the dead of night from historic homes in Charleston, S.C., and the wealthy enclaves of Belle Meade, Tenn. Nothing else was touched. The police in different states did not at first connect the thefts, some of which initially went unnoticed even by the owners. But as the burglaries piled up, a retired New Jersey detective watching reports on the Internet recognized a familiar pattern. Reader Phil Barlett sent me this fascinating 2-page story a couple of days ago, but because The New York Times website was being hacked at the time, the link wouldn't work. But they're back up and here's it is. |

| Posted: 30 Aug 2013 02:29 AM PDT HardAssetsInvestor: What are your views on the stock market? Marc Faber: Following the huge increase in stock prices we had since March 2009, when the S&P was at 666, a 20% correction would not surprise me at all. I don't look at the 20% correction as a huge decline in stock prices. In Asia, we've had corrections in the order of 20% in many markets. We had a huge decline in bond prices in the US. In July 2012, yields on the 10-year bond were at 1.43%; we're now close to 2.9%. Yields have doubled. The longs have been hit quite hard. I don't regard a 20% correction in stocks as a huge bear market. HAI: So no more than 20 per cent? Marc Faber: We have to assess stocks when we are there. We don't know to what extent the Fed will continue bond purchases, increase bond purchases or even buy stocks. We're dealing with markets today that are basically manipulated by the Federal Reserve and other central banks. That's why any forecast is very tentative. |

| Michael Kosares: A new contagion is brewing Posted: 30 Aug 2013 02:29 AM PDT Gold could see new mega-highs according to two prominent international bank economists. While all eyes have been on Syria, what might turn to be a much more insidious problem for the world economy has been bubbling below the surface – and for the most part out of the public eye – in what we used to call the “third world.” In the end, what amounts to a new currency and debt debacle in the emerging world could undermine the world’s stock markets, including Wall Street, the value of those country’s currencies as well as the debt denominated in those currencies. The list includes China, India, Brazil, Argentina, Indonesia, South Africa, Russia and Mexico – just to name a few (and we won’t even get into the problems in the southern rim of Europe). Some see the developing situation as a repeat of the 1996-1997 Asian contagion, but it goes beyond the Pacific Rim, as just noted, to include most of the southern hemisphere. Kevin Lai, who is chief regional economist at Daiwa Securities stated in a recent Financial Times article that “all this QE money has led to a massive credit inflation bubble in Asia. The crime has been committed, we just have the aftermath. During that process, there will be a lot of damage. . .It’s like a margin call. Households will need to sell their assets. There will be a lot of wealth destruction.” Later in the article he adds to those concerns. “The choice is either you protect your currency or you protect domestic growth. You can do only one or the other. There is no easy way out.” The former will lead to inflation; the latter to disinflation or stagflation – whichever term fits your fancy. This short commentary by Michael was posted yesterday on his website usagold.com. |

| U.S. Gold Mine Output Rises 5% Month-on-Month In May – USGS Posted: 30 Aug 2013 02:29 AM PDT U.S. gold mine output was 18,000 kilograms in May, the U.S. Geological Survey said Thursday. May output was 5% above the revised April production of 17,100 kilograms. May output was down 5% from year-ago production of 18,900 kilograms. The average daily production rate in May was 582 kgs of gold, USGS said. This compares to April’s average daily rate of 570 kgs, the May 2012 average daily rate of 609 kgs, and the 2012 average of 639 kgs. If you read between the lines, the take-away from this very brief Kitco story is that gold production in the U.S has declined in 2013 compared to 2012. It's another offering in today's column from reader M.A. |

| NewPlat becomes world's largest platinum ETF Posted: 30 Aug 2013 02:29 AM PDT New Gold Platinum, the physically backed South African platinum exchange-traded fund operated by Absa Capital, has become the largest fund of its type in volume terms just four months after its launch, Absa said on Thursday. Holdings of the rand-denominated NewPlat ETF, as the fund is known, increased by nearly 12,000 ounces on Thursday to 579,198 ounces, Absa's head of investments Vladimir Nedeljkovic said. That puts its platinum reserves above those of the next largest platinum exchange-traded product, New York's ETFS Physical Platinum, which holds 572,409 ounces of metal. I'd love to know who the ten largest shareholders of this fund are, as you have to wonder why this fund has become so popular so quickly. This Reuters story was posted on the mineweb.com Internet site yesterday...and it's definitely worth reading. I thank reader M.A. for another contribution to today's column. |

| South African gold companies plan to lock out employees - Solidarity Posted: 30 Aug 2013 02:29 AM PDT South African gold companies plan to lock out employees after labor groups refused to accept a revised pay offer, according to the Solidarity union. Labor unions were to meet over incentives with the Chamber of Mines, representing producers including AngloGold Ashanti Ltd., when the discussion was canceled and a lockout declared, General Secretary Gideon du Plessis said by mobile phone. “It is clear that the chamber was following the lockout route, which could lead to a brutal strike by aggrieved miners of other unions,” Solidarity said in an e-mailed statement. “The chamber will probably make the announcement at a press conference this afternoon.” This Bloomberg story found a home on the mineweb.com Internet site yesterday as well...and it's courtesy of Ulrike Marx. |

| State ‘will not intervene in South African gold strike talks’ Posted: 30 Aug 2013 02:29 AM PDT The South African government will not intervene in deadlocked wage talks between gold producers and unions even as some producers prepare for work stoppages of up to three months, the South African mines minister said on Thursday. The National Union of Mineworkers (NUM) has said it will give producers on Friday 48-hours' notice of its members' intention to strike over the wage talks. “The government will not intervene,” Susan Shabangu told Reuters on the sidelines of a mining industry conference in Perth, Australia. “There's nothing new in parties being miles apart. Our concern as government is that they need to settle and find common ground.” This article was posted on the iol.co.za Internet site early yesterday afternoon local time...and I thank reader M.A. for digging it up for us. |

| India might buy gold from citizens to ease rupee crisis Posted: 30 Aug 2013 02:29 AM PDT India is considering a radical plan to direct commercial banks to buy gold from ordinary citizens and divert it to precious metal refiners in an attempt to curb imports and take some heat off the plunging currency. A pilot project will be launched soon, a source familiar with the Reserve Bank of India (RBI) plans told Reuters. India has the world's third-largest current account deficit, which is approaching nearly $90 billion, driven in a large part by appetite for gold imports in the world's biggest consumer of the metal. With 31,000 tonnes of commercially available gold in the country - worth $1.4 trillion at current prices - diverting even a fraction of that to refiners would sate domestic demand for the metal. India imported 860 tonnes of gold in 2012. This Reuters article, filed from Mumbai, was posted on their website early yesterday morning EDT...and I found it in a GATA release. It's worth the read. |

| As prices soar in India, gold exchanged for cash Posted: 30 Aug 2013 02:29 AM PDT As gold prices rocketed to a record high of Rs 34,000 per 10 gram, Hyderabadis flocked to jewellery stores to dispose of their gold valuables, while in Seemandhra cities, traders said weeks of protests have made the existence of their badly-hit businesses doubtful. Jewellery associations in Hyderabad said with the single day surge of Rs 2,500, customers were coming in droves from early morning to take back cash in exchange for their gold jewellery. "If the customers have bought jewellery from here, we have no option but exchange it for cash if they want to," said G Sampath Reddy, manager, J C Brother Jewellery store in Dilsukhnagar. This gold-related news item, filed from Hyderabad, was posted on the Times of India website in the wee hours of Thursday morning IST...and I thank Ulrike Marx for her final offering in today's column. |

| John Embry: Gold market in for a wonderful Fall Posted: 30 Aug 2013 02:29 AM PDT “I suspect we are in for a wonderful Fall,” John Embry, Sprott Asset Management's chief investment strategist, told Mineweb’s Gold Weekly Podcast, primarily because the yellow metal is currently very under-priced and the Indian market has been taking note. “At this point I am probably as bullish as I’ve been in living memory actually,” Embry said, “adding “I thought this summer might be a little slow because it’s a quiet market and you can play around in the paper market, but I think that’s going to change quite significantly in the fall and I would not be surprised if, by early next year, we weren’t challenging all-time high.” While recent activity in India is clearly indicative of continued high demand, the government is intent on trying to curb imports. Asked his view of the recent interventions made by the Indian government, Embry explains that, India is under the hegemony of the US, which is currently very anti-gold. But, he adds, he doesn’t think the measures being adopted will work because “Indians almost have gold in their DNA and when you try and stop them from getting it…I am told the smuggling has been extreme.” This commentary, plus the embedded podcast, was posted on the mineweb.com Internet site yesterday...and I thank reader M.A. for his final contribution of the day. |

| Silver Price Forecast: Massive Debt Levels Will Push Silver To $150 And Beyond Posted: 30 Aug 2013 12:00 AM PDT Hubert Moolman |

| Larry Summers as Fed chairman would spike the dollar upwards and lower stocks Posted: 29 Aug 2013 10:28 PM PDT The S&P 500 has likely peaked for this year. The real issue for investors on Wall Street is not Syria and $150 oil but who becomes the next Fed chairman. The madness of Wall Street continues. Lido Isle Advisors President Jason Rotman explains why he thinks the S&P 500 Index has peaked for the year and Larry Summers would be good news for the US dollar. He speaks with Olivia Sterns on Bloomberg Television’s ‘Street Smart’… |

| The Implosion Has Begun, But Not Yet! Posted: 29 Aug 2013 09:55 PM PDT World War 3 does not kick off tomorrow… but by October all bets are off! From V, SteveQuayle.com: One of the cardinal rules of banking states that during a currency crisis good money leaves and there is a rush for specie or hard assets. I will tell you right now that the first victim of [...] The post The Implosion Has Begun, But Not Yet! appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment