Gold World News Flash |

- Whistleblower – Gold & Silver Smash Orchestrated By The BIS

- How Close to the Final Bottom in Gold Are We?

- Rob McEwen: The Economy Gets “Better” When You Add In A Few Trillion—But It’s Illusory And People Will Return To Gold

- Gold short position has been transferred to weak hands, Maguire tells King World News

- Gold And The Potential Dollar Endgame Part 3: Backwardation And Gold

- 2013 Silver Bullion Coins From Around the World

- Richard Russell - 3 Key Charts & Some Things To Think About

- Maguire - Stunning $24 Premiums For Gold In Shanghai

- The Last, Best Chance to Buy Gold and Silver Stocks?

- Time to Buy Precious Metals Now

- Consumer Spending Plummets After Payroll Tax Increase | Taxes | Fox Nation

- Is NJ law enforcement targeting “Doomsday Preppers”?

- Pawn Stars in Vegas buy $111,000 of Silver – YouTube

- China, Gold, and the “Boom of the Century”

- By the Numbers for the Week Ending February 22

- Peter Schiff Explains the Pullback in Gold & What the Future Holds

- 3 Reasons Gold Might Rally, and Might Not, & What to Do Right Now

- A Pivotal Point for Gold and Silver Prices – YouTube

- Dow 20,000 Only a Matter of Time

- The Silver and Gold Price Took a Beating this Week — Inflation Continues Gold Will Rise

- Silver Specs Reduce Long-side Exposure

- Correcting Antal Fekete's Historical Silver Errors

- Discover 35 Mining Stocks with Potential: Henk Krasenberg

- Confessions of a Banking Insider: “It's time to be very worried!” Here's Why & How to Protect Yourself

- Speculators Exit from Gold Market Continues

- “Not Possible”, Says the Pentagon

- Why The Smartest and Richest Minds Are Buying Mines

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Almost 2% and 4% on the Week

- Maguire: Smashdown was aimed to avert gold and silver breakout and BIS arranged it

- Gold Daily and Silver Weekly Charts - Life During Wartime - Moody's Downgrades UK

- Attention Chicken Little: GOLD AND SILVER NOW FUELED FOR LIFT-OFF

- Gold & the Developed World in the Face of Massive Change in the Next Two Decades

- Gold Overreacts to the Fed Minutes

- VIA MAT won't vault for U.S. taxpayers anymore but no effect on GoldMoney

- Gold and Silver Disaggregated COT Report (DCOT) for February 22

- Powerful contra-indications for gold from whistleblower Maguire and GGR's Arensberg

| Whistleblower – Gold & Silver Smash Orchestrated By The BIS Posted: 23 Feb 2013 12:30 AM PST from KingWorldNews:

"The gold and silver markets have become virtual markets. There is no physical aspect, essentially, to the way they trade on an intraday basis. Extremely large volumes of synthetic supply is just created and exchanged. That's primarily through the bullion banks, who also have exposure to the physical market, and the managed money and the specs." | ||||

| How Close to the Final Bottom in Gold Are We? Posted: 23 Feb 2013 12:00 AM PST by Przemyslaw Radomski, Gold Seek:

The most interesting point in this chart is not that prices moved to the long-term support line and reversed but rather the current RSI level, based on weekly closing prices. It is the most oversold since the beginning of the bull market and is now more oversold than after the 2008 plunge. | ||||

| Posted: 22 Feb 2013 11:30 PM PST by Tekoa Da Silva, Bull Market Thinking:

It was a powerful conversation, as Mr. McEwen spoke to why so many miners are failing to deliver returns to shareholders, the "illusory" strength of the post-presidential election economy, and his thoughts on gold and silver going forward. | ||||

| Gold short position has been transferred to weak hands, Maguire tells King World News Posted: 22 Feb 2013 10:59 PM PST 9:55p PT Friday, February 22, 2013 Dear Friend of GATA and Gold: London metals trader and silver market whistleblower Andrew Maguire tells King World News today, in the third segment of his interview, that bullion banks have managed to offload much of their gold short position to weak hands, that premiums for real gold in Shanghai are enormous, and that he expects a rapid upward reversal in the gold market. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/2/23_Ma... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Get the real story about the precious metals Now you don't have to travel to attend a financial conference to hear Sprott Asset Management's precious metals experts -- Eric Sprott, Rick Rule, and John Embry. They held a round-table discussion on February 12 and you can watch it on the Internet. Among their topics: -- Why are precious metals such a compelling investment opportunity? -- Why are non-G7 central banks buying gold? Do Western central banks have any left? -- Why are investors buying as much silver as gold in dollar terms? What does this mean for the price of silver? -- Is the growing supply deficit of platinum and palladium going to push their prices higher? To watch the conference, please visit: http://w.on24.com/r.htm?e=579230&s=1&k=70B829852A33CD255CC2A43ED63D18D0&... Join GATA here: California Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Gold And The Potential Dollar Endgame Part 3: Backwardation And Gold Posted: 22 Feb 2013 10:25 PM PST from Zero Hedge:

| ||||

| 2013 Silver Bullion Coins From Around the World Posted: 22 Feb 2013 10:20 PM PST by Michael Zielinski World Mint News Blog:

Many mints from around the world produce high quality bullion priced coins which often feature rotating designs and carry limited mintages. In most cases, these are available for a modest premium above the spot price of silver during the year of release. While not generally the lowest premium method for acquiring silver bullion, these coins provide a showcase of the variety and artistry available from the mints, which should be pleasing to coin collectors and bullion investors alike. To prepare this post, I recently purchased one example each of some of the most popular one ounce silver bullion coins from various world mints. This article will provide an image of each coin, the cost, a brief description of the design, some comments on the finish and quality, and any pertinent information on mintage. The coins are presented in no particular order. | ||||

| Richard Russell - 3 Key Charts & Some Things To Think About Posted: 22 Feb 2013 10:03 PM PST  With key global markets at or near breakout levels, and gold turning higher in after-hours trading, the Godfather of newsletter writers, Richard Russell, released 3 key charts covering everything from stocks, to commodities and gold. KWN even included a bonus chart of hedge fund activity in gold. Here is what Russell had to say in a note to subscribers: "From its recent high, the Dow (intraday yesterday) was down almost 200 points. Normally, this would be considered an overdue minor "back-off" from an overbought situation ... When one Average advances to a new high, and that new high is unconfirmed by the other Average, trouble may be waiting." With key global markets at or near breakout levels, and gold turning higher in after-hours trading, the Godfather of newsletter writers, Richard Russell, released 3 key charts covering everything from stocks, to commodities and gold. KWN even included a bonus chart of hedge fund activity in gold. Here is what Russell had to say in a note to subscribers: "From its recent high, the Dow (intraday yesterday) was down almost 200 points. Normally, this would be considered an overdue minor "back-off" from an overbought situation ... When one Average advances to a new high, and that new high is unconfirmed by the other Average, trouble may be waiting."This posting includes an audio/video/photo media file: Download Now | ||||

| Maguire - Stunning $24 Premiums For Gold In Shanghai Posted: 22 Feb 2013 10:01 PM PST  Today whistleblower Andrew Maguire spoke with King World News about the stunning premiums being paid in Shanghai for gold, and what price investors and traders need to watch to see buy stops triggered on the upside in the gold market. This is the third and final in a series of interviews with Maguire lifting the curtain on what is going on behind the scenes in the ongoing gold and silver war which continues to rage. Below is Part III of Maguire's extraordinary interview. Today whistleblower Andrew Maguire spoke with King World News about the stunning premiums being paid in Shanghai for gold, and what price investors and traders need to watch to see buy stops triggered on the upside in the gold market. This is the third and final in a series of interviews with Maguire lifting the curtain on what is going on behind the scenes in the ongoing gold and silver war which continues to rage. Below is Part III of Maguire's extraordinary interview.This posting includes an audio/video/photo media file: Download Now | ||||

| The Last, Best Chance to Buy Gold and Silver Stocks? Posted: 22 Feb 2013 09:40 PM PST from silver investor.com: | ||||

| Time to Buy Precious Metals Now Posted: 22 Feb 2013 09:20 PM PST by Jordan Roy-Byrne, Gold Seek:

Technicals In our article three weeks ago we noted this major trendline support for the gold stocks. The market is about 6% from this major trendline which also coincides with the 62% retracement of the 2008 to 2011 cyclical bull. | ||||

| Consumer Spending Plummets After Payroll Tax Increase | Taxes | Fox Nation Posted: 22 Feb 2013 09:12 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||||

| Is NJ law enforcement targeting “Doomsday Preppers”? Posted: 22 Feb 2013 09:00 PM PST by Joe Wright, Activist Post:

As Michael Snyder pointed out in his article, Why are Preppers Hated So Much? an extreme backlash is shaping up into a trend to vilify preppers by those fearful of what they don't understand. It is worrisome, too, that this lack of understanding comes not only from those who would willingly find distracting forms of entertainment in an effort to not face reality, but from law enforcement as well. Instead of encouraging a self-sufficient (and armed) population that would work alongside well-trained and well-intentioned peace officers, there is a move to make even the most innocous prepping activities synonymous with domestic terror and insurrection. | ||||

| Pawn Stars in Vegas buy $111,000 of Silver – YouTube Posted: 22 Feb 2013 08:56 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||||

| China, Gold, and the “Boom of the Century” Posted: 22 Feb 2013 08:40 PM PST by Ralph J. Benko , The Gold Standard Now:

"China's foreign exchange reserves have not increased for almost two years…." The Califia Beach Pundit provides an extraordinarily canny assessment of Chinese monetary policy, its dollar peg, foreign exchange accumulation, and gold's commodity price:

| ||||

| By the Numbers for the Week Ending February 22 Posted: 22 Feb 2013 08:39 PM PST This week's closing table is just below. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday (by 18:00 ET). Stunning changes in the COT data this week, as we intend to detail in this weekend's reporting. To subscribe to Got Gold Report please click on the "Subscribe to GGR" button at top right. Join us today. | ||||

| Peter Schiff Explains the Pullback in Gold & What the Future Holds Posted: 22 Feb 2013 08:01 PM PST "Follow the [COLOR=#0000ff][U]munKNEE"[/U][/COLOR] via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1,000 active subscribers) Peter Schiff responds to skeptics who claim gold's bull run is over in this 12:48 video. Many believe the economy is improving and therefore that gold's rise has ended. However, Peter explains why the longterm fundamentals for gold have never been better, and how investors still have time to take advantage of gold's temporary decline. So says an introduction to*this new video* on the gold market by Peter Schiff ([url]http://blog.europacmetals.com[/url]) entitled The Gold Bull is Far from Dead. [INDENT]This post is presented compliments of [B]www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and [COLOR=#ff0000]www.munKNEE.com [/COLOR](Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) fo... | ||||

| 3 Reasons Gold Might Rally, and Might Not, & What to Do Right Now Posted: 22 Feb 2013 08:01 PM PST "Follow the [COLOR=#0000ff][U]munKNEE"[/U][/COLOR] via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1,000 active subscribers) The price action in gold and gold miners over the past six months*has many investors turning their back on the precious metal. Gold fell below $1,600 last week to reach a six month low,***** prompting many to step back and wonder aloud if the precious metal’s*decade long bull market has officially come to an end. With the price of gold now back to where it was in July of 2011,*it’s time to decipher whether this is a buying opportunity, or time to head for the exits.So writes Tyler Laundon ([url]www.wyattresearch.com[/url]) in edited excerpts from his original article* entitled 3 Reasons For and Against a Gold Rally.[INDENT]This*article is presented compliments of [B]www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and [COLOR=#ff0000]www.munKNEE.com [/COLOR]... | ||||

| A Pivotal Point for Gold and Silver Prices – YouTube Posted: 22 Feb 2013 07:07 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||||

| Dow 20,000 Only a Matter of Time Posted: 22 Feb 2013 06:30 PM PST

By EconMatters

Dow Record in sight

We are 200 points from breaking a new high in the Dow Industrials which got me looking back at assets over the last 25 years in relation to the value of the US Dollar Index and the overall money supply.

25 years in Markets

Some of the best performing assets are the stock market and gasoline with bonds and housing putting in steady gains. Of course with all assets you get a whole lot more bang for your buck if you happen to time the market correctly. And assets like Stocks, Housing and Gasoline all have crash periods where Dow components go bankrupt and are replaced, homeowners lose their homes, and in the financial crash any Gasoline investor would have been forced out of the market.

Need to be Invested

But make no mistake the long-term trend is that you want to be invested in something that appreciates in value, you can get out of it if you need to as in liquid, and is going to be attractive to other investors over the long haul. But you have to be invested to take advantage of the trend of the growing money supply, currency in circulation, printing press phenomenon that ultimately underlies all asset values.

Your Grandpa was on to something

Whether it is the price of a car, a new house, the price of gasoline, a movie ticket, or a good stock there is going to be more money created each year chasing these assets in the system. This represents the phenomenon of "when I was a kid a coke cost a nickel" or you could buy a home or a vehicle in the 1950`s for prices that are unrecognizable today.

Dow 20,000 only a matter of time

In looking back at history of markets, if we take the Dow Industrials, there is no doubt we are going to blow past Dow 15,000, 16,000, 17,000 and so on based upon currency creation effects alone. The fact that markets are liquid, capital will flow in and out, there will be major pullbacks, those who fail to market time will get crushed at times, but make no mistake Dow 20,000 is a foregone conclusion.

If we filter out the noise, and it is considerable at times, the unmistakable point is that most assets appreciate over time. The last 25 years show quite clearly in Gold, Lean Hogs, Real Estate, Stocks and Energy the benefit of being invested, especially in relation to the ever-present growing money supply in the economy.

I would say that if the economy cooperates even modestly over the next three years that the Dow 20,000 milestone will be reached. For how soon we get there will depend upon other variables for sure, but watch how the market performs once we break through the 14,200 level, and start putting in new highs in the other indexes. The pace can really take off once markets are in unchartered territory, and we can start taking 1000 point monthly clips that will leave you speechless.

And of course Dow 20,000 isn`t going to happen without some pain along the way, but make no mistake it will happen, and it is closer than you think! We are on the verge of taking that next leg up in the Dow, in fact, we should set a new high pretty soon; enjoy the ride as this breakout has been a long time coming.

© EconMatters All Rights Reserved | Facebook | Twitter | Post Alert | Kindle | ||||

| The Silver and Gold Price Took a Beating this Week — Inflation Continues Gold Will Rise Posted: 22 Feb 2013 06:01 PM PST Gold Price Close Today : 1,572.40 Gold Price Close 15-Feb-13 : 1,608.80 Change : -36.40 or -2.3% Silver Price Close Today : 28.46 Silver Price Close 15-Feb-13 : 29.84 Change : -1.38 or -4.6% Gold Silver Ratio Today : 55.249 Gold Silver Ratio 15-Feb-13 : 53.916 Change : 1.33 or 2.5% Silver Gold Ratio : 0.01810 Silver Gold Ratio 15-Feb-13 : 0.01855 Change : -0.00045 or -2.4% Dow in Gold Dollars : $ 184.06 Dow in Gold Dollars 15-Feb-13 : $ 178.98 Change : $5.08 or 2.8% Dow in Gold Ounces : 8.904 Dow in Gold Ounces 15-Feb-13 : 8.658 Change : 0.25 or 2.8% Dow in Silver Ounces : 491.94 Dow in Silver Ounces 15-Feb-13 : 466.81 Change : 25.13 or 5.4% Dow Industrial : 14,000.57 Dow Industrial 15-Feb-13 : 13,929.23 Change : 71.34 or 0.5% S&P 500 : 1,515.60 S&P 500 15-Feb-13 : 1,519.64 Change : -4.04 or -0.3% US Dollar Index : 80.470 US Dollar Index 15-Feb-13 : 80.507 Change : -0.037 or 0.0% Platinum Price Close Today : 1,606.30 Platinum Price Close 15-Feb-13 : 1,676.60 Change : -70.30 or -4.2% Palladium Price Close Today : 735.30 Palladium Price Close 15-Feb-13 : 752.75 Change : -17.45 or -2.3% The silver and GOLD PRICE have been beat with a barbed wire whip this week. Stocks moved sideways, as did the US dollar. Platinum and Palladium went to the woodshed, too. And to all of you folks who are sending me prophecies from Nostradamus, etc., about what silver and gold will do, I appreciate your efforts but I'll pass. On Comex the GOLD PRICE lost $5.80 and plagued yesterday's trading with equivocation today. Silver lost 23.9 cents to 2846c. Both are up stoutly in the aftermarket, gold to $1,582 and silver to 2880c. On a five day chart gold made a spike bottom about $1,558 Wednesday night, then climbed to a high at $1,586.93 today. That leg up looks impulsive, i.e., that's not merely a reaction to the previous fall, but the direction the market wants to go. Gold backed off most of the day, and the close at $1,572.40 nearly caught the low at $1,571.50. That low was about $10 higher than yesterday's. If gold intends to continue rising, it must not break today's low. Longer term chart offers more encouragement still. Day before yesterday and yesterday gold punctured the lower Bollinger Band. Generally that marks the extremity of the move. Now it has traded up above the downtrend line form the 2011 high, and back within the lower B-band. RSI is strongly oversold and has been for a week. It's too early to judge, but all these point to a reversal soon. Remember that at lows everybody is fearful, but at highs they bulge with bravery -- just the opposite of how they ought to feel. Therefore negative sentiment and pessimism -- especially our own -- often accurately pinpoints lows. The SILVER PRICE five day chart reveals double bottoms Wednesday at 2631c and Thursday at 2832c. Today a third low came in at 2836c. Clearly, silver will fall much further if it breaks 2830c. Up above it needs to clamber over the wall at 2890c. On the four month chart silver never has fallen as far as the downtrend line from April 2011 high. It has clung regularly to a higher downtrend line, the bottom of its trading channel. In the last three days it visited that lower channel line, and broke through the bottom B-bands. Today it closed again inside the B-bands. Other indicators are also oversold. I ruefully confess that the stubborn length of this correction has buffaloed me over and over, and stocks' strength. Then again, I don't claim to be a clairvoyant. When this happens I run back to my premises and check them out. They're still sound. Inflation continues, silver and gold will keep on rising. Cause continues, so will the effect. Some sign will emerge, probably soon, that tells us it's time to load up on silver and gold. Meanwhile, the brave can buy. Stocks had a rough week, but strong day. At the very end of the day today it managed to reach 14,000 and climb over by half a point -- I'm not making this up. Dow closed at 14,000.57, up 119.95 (-.86). Not to be outdone, the S&P500 rose 13.18 (0.88%) to 1,515.60. Trend remains up and unbroken for stocks, but the down must not close below 13,835. Will most like reach a new all-time high very soon. Only thing in the way is 14,035. No, I have not changed my mind about stocks. The top of this move will bring cheering and shouts, but that joy will turn to sharp sorrow. Look at stocks adjusted for inflation: the high came in 2000, and they remain in a primary down trend (bear market). Yes, I know that makes me sound dumber than a horned toad, but there it is. Dow in Gold and Dow in Silver gapped up two days ago, gapped down yesterday, then rose a little today. Three days ago looked like a top, last two days they have blown hot and cold out of both sides of its mouth, like the man who killed his parents then threw himself on the mercy of the court because he was an orphan. Not sure what to make of it yet, but tain't normal, and 'twon't live long this way. About this time yesterday the dollar index was trading at 81.475, and today is trading at 81.47. Dollar index is bumping up against 81.60, trying to break through to 82 - 82.50. Every convincing lie contains some truth. That little bit of truth is what makes the counterfeit believable. Hence Ben the Bagman must occasionally manage the dollar upward to create the illusion of strength. It's all a great illusion, the economy, the financial system, the banks, but as long as enough people believe the lie, the liar can get by with it. At times it takes so long that you begin to wonder if you ain't WORSE than a natural born fool for holding back, for not just going along to get along. Then you shake your head and say, "Shucks! I'd rather be a fool than a liar any day. A fool may be taken, but liars will be fryers." I ain't THAT big a fool. The euro kept its head down and stayed flat today, closed at $1.3187, no change. Chart screams loudly that its rally is broken. Only needs to drop below $1.3150 to confirm that. Yen continues to move sideways. Lost 0.32% today to close at 107.04. Euro/Yen cross rate rose a little today, but hit its high at 1 February and appears to have turned. Probably part of a deal made before the G20 met. US$1=Y93.42=E0.7583=0.035137 oz Ag=0.000636 oz. Au. On 22 February 1793 died Roger Sherman, b. 1721. He helped draft and signed the Declaration of Independence, member of the Continental Congress, and served in the constitutional convention (1787). It was Sherman who saw there an opportunity to shut and bar the door against paper money. Thus the new constitution did not allow the federal government to issue paper money, and provided that "No state shall . . . make any Thing but gold and silver Coin a Tender in Payment of Debts." Wonder is that though these words stand unchanged and unchallenged today, the safety they provide to all of us has been stolen. You want to see a judge wince and wallow and throw you in jail, next time you go to court for a traffic fine, etc., say to the judge, "Your honor, I want to pay this fine, but I understand that the constitution provides that no state shall make any thing but gold and silver coin a tender in payment of debt. Unless I give you gold and silver coin, I can't be sure I've paid the fine, but I have none. How can I pay the fine?" It will change your life. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. | ||||

| Silver Specs Reduce Long-side Exposure Posted: 22 Feb 2013 04:24 PM PST [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] This is by request.... The big hedge funds are also exiting from the Silver market as they have been doing in gold but not near to the same extent. The reason is because of silver's industrial use. As a monetary metal it is experiencing selling tied to money flows leaving other sectors and flowing into equites; however, those same money flows, with many looking at the so-called "improving growth" scenario, are finding some of their way into the metal on the way down. We do need to keep a close eye on the copper market however for if hedgies begin to get bearish on copper, it will be a tough order to keep them bullish on Silver. As of this Friday's COT report, hedge funds remain net long in Copper although they have trimmed that exposure by nearly 12,000 contracts through the reporting period. Silver bulls do not want to see downside support near $26.25 - $26.00 give way for ANY REASON. It ... | ||||

| Correcting Antal Fekete's Historical Silver Errors Posted: 22 Feb 2013 04:11 PM PST In "The Double Whammy of Geopolitical Gold Games" reposted in February 2013 (from January 31, 2008) by Antal Fekete he stated some errors of fact! Marco Polo, guide us on this excursion to China! Read More... | ||||

| Discover 35 Mining Stocks with Potential: Henk Krasenberg Posted: 22 Feb 2013 04:01 PM PST The Gold Report: Where's the rally for gold? Henk Krasenberg: The general investment public is not in the right mood for resource stocks. Those who own them are not happy with their performance, and those who don't own them are not convinced that they should own them. Only 2% of all investment capital is in gold, other metals and related vehicles. I believe that gold is not as high as most people think. I relate it to the all-time high of $850/ounce ($850/oz) in 1980 and if you correct that to today's standards, that would equal $2,400–2,500/oz. So we are well below the real historical high. Further, the market for resource shares has not been very stimulating. Resource shares are greatly undervalued in my opinion. That surprises me. Several producers are reporting record production and record earnings and project further increases for the next few years. Also, the results that exploration companies report are generally very encouraging. TGR: A lot of people would say that the m... | ||||

| Posted: 22 Feb 2013 03:47 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1,000 active subscribers) [In a recent] conversation about international banking and the state of the global So writes Simon Black (www.sovereignman.com) in edited excerpts from his original article* entitled Why a banking insider says "it's time to be very worried".

Black goes on to say in further edited excerpts: [Here's what the banking insider said:] 1. …Banks are frauds; most banks, particularly in the developed west, only hold a tiny fraction of their customer's deposits in cash [and] the rest is gambled away on whatever the popular toxic "security du jour" happens to be. 2. Most of the investment products promoted to their customers are "crap" and, as such, it struck him as incredible that people still had confidence in banks. 3. Central bankers are destructive, creating untold amounts of inflation that only serves to make people poorer, while enabling governments to go deeper into debt. 4. Very few of the banking sector's underlying deficiencies have been addressed since the 2008 meltdown and that many western banks are still insolvent, with the key difference that their governments are now also insolvent. 5. In the coming years this confluence of risk will finally burst, most likely induced by the effects of the currency wars and competitive devaluation. It was astounding, he said, that the G7 actually published a statement trying to soothe concerns about the global currency wars. "Whenever the government tells you to not worry about something," he said, "it's time to be very worried." Unfortunately, most people:

From a big picture perspective, it all seems so obvious:

Conclusion The writing is on the wall and taking some basic steps now can make a world of difference. This includes:

The above are steps that make sense no matter what. Even if the worst never occurs, you won't be worse off – and should the house of cards collapse, you'll be one of the few people left standing.

* http://www.sovereignman.com/finance/why-a-banking-insider-says-its-time-to-be-very-worried-10938/

Related Articles: 1. The Currency War: Which Country Will End Up With the Fastest Currency in the Race to the Bottom? We believe that we are in the "competitive devaluation" stage presently [see graph below] as country after country is printing money in order to lower rates and doing whatever possible to devalue their currency – to have the fastest currency in the…race to the bottom – in order to export their goods and services. [The next stage will be protectionism and tariffs. This article gives an update on the race to debase.] I keep wondering to myself, do our money-printing central banks and their cheerleaders understand the full consequences of the monetary debasement they continue to engineer? [Below is what I think awaits us.] Words: 1013 3. These 25 Videos Warn of Impending Economic Collapse & Chaos The internet is awash (drowning?) in hundreds of doom and gloom videos providing dire warnings of coming world depression, food shortages, rioting in the streets, rampant (hyper) inflation, deepening banking crisis, economic apocalypse, financial Armageddon, the demise of America – well, you get the idea. Below is a small sample of such videos with a hyperlink to each.

"The end of the world as we know it" is what David Korowicz predicts is coming sometime this decade – an "ultimate" crash that will be irreversible – TEOTWAWKI! Words: 1395 5. Gov't Debt Will Keep Increasing Until the System Implodes! Are You Ready? Why are so many politicians around the world declaring that the debt crisis is "over" when debt-to-GDP ratios all over the planet continue to skyrocket? The global economy has never seen anything like the sovereign debt bubble that we are experiencing today. This insanity will continue until a day of reckoning arrives and the system implodes. Nobody knows exactly when that moment will be reached, but without a doubt it is coming. Are you ready? Words: 1270 6. If You Are Not Preparing For a US Debt Collapse, NOW Is the Time to Do So! Here's Why 7. This Will NOT End Well – Enjoy It While It Lasts – Here's Why …The US Government and its catastrophic fiscal morass are now viewed by the world as a 'safe haven'. This would easily qualify for a comedy shtick if it weren't so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

9. John Mauldin: The Next Few Years Are Not Going To Be Pretty – Here's Why

10. U.S Likely to Hit the Financial Wall by 2017! Here's Why The deficits aren't going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can't keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833 11. U.S.'s Runaway Financial Train is About to Destroy the Status Quo 12. Take Note: Don't Say You Weren't Forewarned!

13. A Must Watch Video On Why America Is In A "Death Spiral" Speculators Exit from Gold Market Continues Posted: 22 Feb 2013 03:02 PM PST | ||||

| “Not Possible”, Says the Pentagon Posted: 22 Feb 2013 02:41 PM PST

He delivered those words aboard the USS Theodore Roosevelt. This week came word that the Roosevelt is one of four active carriers — there are 10 in all — that the Navy would shut down "at various intervals" if automatic budget cuts known as "sequestration" kick in a week from today. "The threat of these cuts," said the current president on Wednesday, "has forced the Navy to delay an aircraft carrier that was supposed to deploy to the Persian Gulf." Today, we take a quick peek behind the pig-squealing rhetoric of "sequestration" nearing its crescendo 35 miles to our south. Cover your ears, but read on…

"Two-thirds of the Army active combat brigade teams, other than those that are currently deployed, would be at below-acceptable levels of readiness," added Pentagon comptroller Robert Hale.

"The F-22 program has become a parody of itself," writes Time military blogger Mark Thompson, "and of all that is wrong and warped in the military-industrial complex." The jet became "operational" in 2005… but has yet to fly a single combat mission. Some pilots refuse to fly it because the oxygen system is iffy. The F-22 program was supposed to cost $67 billion — $350 million per plane, but who's counting? With this latest contract, that cost has ballooned to $81.3 billion. Shrill "sequestration" banter is more political theatre. The steroid of a bond downgrade that animates the debt ceiling drama is missing… so we're treated to grave national security concerns, instead. Lucky us.

"The budget," Ratnam adds, "is driven largely by champions of existing programs in Congress, the defense industry and the uniformed services." Result: The military faces the prospect of $500 million in less spending over the next decade. But "the behemoth of an entity called the Pentagon is not going to shrink," says retired Army colonel and Boston University professor Andrew Bacevich. Least of all, not the hot new sector of Pentagon spending — cybersecurity.

Hayden — who's also a retired Air Force general — is reacting to the report from the computer security firm Mandiant that we took a gander at yesterday. The report claims China's People's Liberation Army is behind more than 140 cyberattacks on companies and government agencies — the overwhelming majority in the United States.

Mandiant's map of cyberattacks by China This is hardly the first widespread spate of attacks linked to China. In 2011, McAfee, another cybersecurity firm, uncovered something called Operation Shady RAT. "Operation Shady RAT," said a Vanity Fair article, "has been stealing valuable intellectual property (including government secrets, email archives, legal contracts, negotiation plans for business activities and design schematics) from more than 70 public- and private-sector organizations in 14 countries." Some experts in the field are skeptical that the attacks can be traced to China. They believe there's a host of potential culprits. But the reds do present a convenient target, don't they?

At least that's the conclusion of yet another cybersecurity firm, Kaspersky. Last month, Kaspersky issued a report on a cyberattack campaign known as Red October. "We're not saying they are Russian hackers, but the developers are of Russian-speaking origin," Kaspersky's Kurt Baumgartner told CBSNews.com — even as the creators of the trouble appear to be Chinese. Kaspersky's map of Red October attacks The targets: mostly government agencies, embassies, nuclear research centers and the military… mostly in Eastern Europe, but Americans have not been exempt. Ahem.

"The digital networks that run the backbone of the information systems and networks of congressional staff and lawmakers are treasure troves of sensitive data for foreign intelligence services and independent hacker groups alike," according to the D.C. insider newspaper The Hill. "Experts warn that Congress isn't using the types of technology and security methods that could prevent sophisticated hacker attacks." The "InfoSec" industry can practically smell the contract money coming its way, "sequestration" or no. To say nothing of the new cybersecurity initiative announced by the White House on Wednesday. Huge flows of federal cash are about to inundate a tiny sector… and those who invest in the trend earliest will profit the most.

"Any panic at the moment is completely overblown," advise our technicians Greg Guenthner and Jonas Elmerraji. "Stocks are back to where they were less than two weeks ago. "The uptrend is still intact. Stocks have been trading way above their short-term moving averages for a while now. The S&P 500 crossed above its rising 20-day moving average in late December and hasn't come close to touching it since." On the other hand, one renowned trader is feeling rather cautious — a stance that yields up a juicy opportunity if you're in a short-selling mood. PRO-level subscribers can read on for today's idea from Dan Amoss. [Not a PRO reader? In response to popular demand, we're opening up The 5 Min. Forecast PRO to new subscribers. See what you've been missing right here.]

Since it was Greg who warned us about gold on Feb. 13 — when it was still above $1,640 — we figure we'd better pay heed. "In just a matter of days or weeks," he says, "this important industrial metal could break its multiyear uptrend…

Copper, The Wall Street Journal said this week, "has a history of moving in the same direction as stocks, because both assets are sensitive to economic outlook." But not recently, says Greg: Copper has been considerably weaker than the S&P since late 2011. It also has posted a series of lower highs dating back to early 2012. "The metal's post-financial crisis uptrend remains intact — at least for now. But the price is getting dangerously close to a critical support level near $3.50," Greg concludes. Bad news for copper thieves…

Our long and loving chronicle of copper theft — we still can't forget the guys who snagged copper tubing from a TV transmitter, 35,000 volts be damned — has taken a couple of strange turns this week. First, the Detroit Free Press reports copper thefts are to blame for 20% of dark streetlights on the city's freeway system. Then there's the 1,000 feet of copper stolen from lights used for low-visibility landings at Seattle-Tacoma International. Fortunately, the thieves hit only one of the airport's three runways. "There have been no flight delays as a result," KING 5 News assures us. Whew…

Hmmm… guess our military-technology theme and our drone petition are starting to converge… Introducing the micro air vehicles, or MAVs, tested and created in a 4,000-square-foot "microaviary" at Wright-Patterson Air Force Base in Ohio. According to a video released by the Air Vehicles Directorate, an Air Force research ring, "MAVs will become a vital element in the ever-changing war-fighting environment and will help ensure success on the battlefield of the future." The video, a simulation of the microdrones in action, begins with a large drone air-dropping tiny energy-harvesting drones over a city. The microdrones, modeled from pigeons and hawk moths, conduct "swarm operations" and, in one instance, shoot a sniper in the back of the head. "Unobtrusive, pervasive, lethal: micro air vehicles" The entire project is revealed in National Geographic's March issue. And according to Richard Cobb, the developer of the hawk moth drone, the project aims to create drones that "hide in plain sight." Jay Stanley of the American Civil Liberties Union is less than enthusiastic. In his article titled "Drone: The Nightmare Scenario," he outlines the future of drones and how domestic police drone use could unfold in 13 steps. In summary: After the FAA slowly begins to loosen regulations for police departments, "despite opposition, a few police departments begin deploying drones 24/7 over certain areas." And as drone technology advances, Stanley goes on, drones will become more popular and eventually synch up with other technologies such as "face recognition, gait recognition, license plate scanners and cellphone location data." Finally, when the data is mined, computers will "comb through this data, looking for 'suspicious patterns,' and when the algorithms kick up an alarm, the person involved becomes the subject of much more extensive surveillance." Oh boy. [Ed. Note: Looking forward to your drone-filled future yet? Neither are we. That's why we're still making waves with our anti-drone petition. We urge you to sign it now if you haven't already.]

"Idea for an enterpriser: Fashion veils (to defeat facial recognition programs) for both men and women." The 5: Too late. There's a provision of New York's loitering law forbidding three or more people to wear masks in public. Meanwhile, in Canada, masked protesters who have the misfortune of taking part in an event that turns violent face up to 10 years in prison.

"If so, which way was she traveling? The drugs travel east, while the money flows to the west, resulting in 10 times more westbound stops than eastbound." [Nice job of connecting the dots! We mentioned the terrific investigative reporting by a Nashville TV station last year exposing bogus traffic stops aiming to seize cash, while drug shipments are largely left alone. "Law enforcement is supposed to be about getting the bad guys," said Scott Bullock of the Institute for Justice. "It's not supposed to be about making money."] "Heh," our reader goes on, "I thought it was about protecting the rights of the innocent. What a country!!"

[Everyone's a comedian...] "Sorry, just taking the mickey. Keep up the good work…You're definitely worth reading. Don't mind the loooooong videos since you've added the transcript option." The 5: We aim to please… Have a good weekend, Dave Gonigam The 5 Min. Forecast | ||||

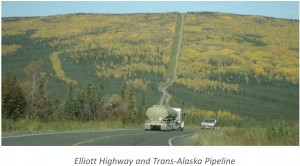

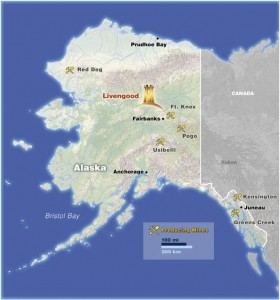

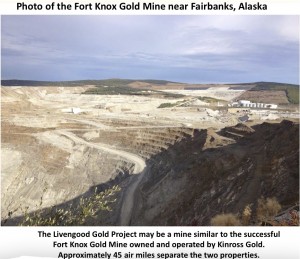

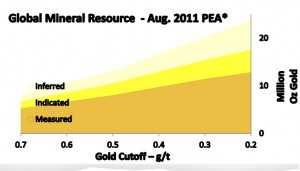

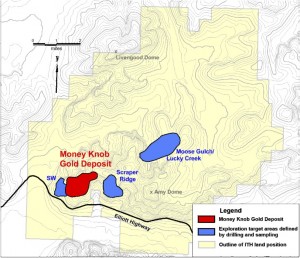

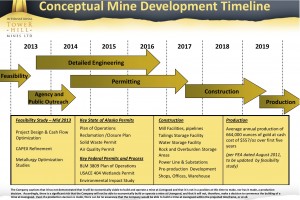

| Why The Smartest and Richest Minds Are Buying Mines Posted: 22 Feb 2013 02:37 PM PST Gold may look to base at 2012 lows at $1550. Whenever gold has moved below the 200 day moving average it has proved to be a buying opportunity in this 12 year uptrend, which I believe is firmly intact due to the underlying fundamentals. Record sovereign debt, negative real rates and continued currency wars could all be catalysts for the next price spike. Remember billionaire traders such as Soros always seem to cut their stakes when gold hits a bottom and tends to buy when it is overbought. I would use these bearish media articles as a contrary signal. Remember the filings are for the previous quarter and is like looking in a rear view mirror. Many times a few weeks later one sees these same traders come right back into the market and buy. Some investors are concerned about the death cross in gold where the 50 day crosses below the 200 day moving average. We have witnessed in the past that these death crosses often turn into golden crosses after all the weak hands are shaken out. This recent decline was exacerbated by fund redemptions and margin calls. However, I also observe large hedge funds making bullish bets on the juniors such as SAC Capital. SAC Capital with over $20 billion under Stephen Cohen's management placed a $240 million dollar bet on the miners. In addition, John Paulson, hedge fund manager and one of the smartest minds in the business continues to be bullish on the undervalued gold miners and especially one of our long term GST recommendations. Do not forget the world's richest man, Carlos Slim made a $750 million bet to buy a Mexican gold miner. Similar to Paulson and Slim, I also believe we are headed into a period of gut-wrenching inflation where the U.S. dollar could move into new lows and gold could continue soaring into new highs. Investors must position themselves ahead of the herd as once the masses catch on to a potential hyper-inflation, the rally can move parabolically to the upside. As I have written for several weeks, gold is basing at the $1550 area along its 2 year low. We are moving closer to the pinnacle of the rectangle base which means that there could be a breakout possibly before the 2nd Quarter of 2013. Gold hit a major oversold position at the end of December and is due for a rally past the breakout point at $1800. A technical target of $2250 is possibly in reach to be hit in the second half of this year. Gold is building a powerful 18 month base indicating a healthy minimal correction of less than 20%. Healthy corrections could be anywhere from 20-30%. Despite this powerful base gold is building and the minimal correction, many investors have been shaken out and impatient seeking out greener pastures in the toxic housing and financial sector, which is being manipulated by the Banks. I have always advised patience and may have investment horizons longer than the average investor. I follow the long term cycles and trends, which still indicates by both technical and fundamental analysis that precious metals and wealth in the earth are in a secular bull market. All these quantitative easing moves around the world to boost housing and financials could have major long term consequences on our banking and foreign exchange system. Precious metals will continue to climb as the expansion of the monetary base continues to reach record levels. Short term, the real estate and banking sectors may get a boost and inflation may be tempered. Historically, capital will flow to quality hedges against inflation which is precious metals, commodities and the undervalued miners. These undervalued sectors have been forming long multi-year bases and may be on the verge of a potential breakout. Attempts at boosting toxic sectors while keeping the lid on inflation may be working temporarily. However, the general equity markets are reaching record heights while our sectors are testing multi-year lows. This is a record divergence from the historical mean. Whenever divergences occur be prepared for a move back to the long term average. This means the miners could outpace equities. Do not follow the herd and become impatient. As the miners test 2012 lows look at cheap value quality situations and be ready for a rebound. The Gold Bugs Index which tracks the largest miners has broken into new three year lows and is at a record oversold position. I expect the miners to possibly bounce off of these levels leaving no more sellers. Observe the positive momentum even though the price is breaking 2012 lows. This may indicate a bullish reversal in the near term. Despite the soaring Dow which is breaking 14k, demand for gold bullion is soaring in China and hitting record levels. Many are expecting China to overtake India as the largest consumer of gold. Short term investors are being shaken out of the precious metals space chasing overbought equities, while the long term investors, Central Banks and billionaires continue to accumulate. Recently billionaire John Paulson recommended to Anglogold Ashanti to split into two companies. Anglogold takes his recommendation seriously as he is one of the largest shareholders of the gold mining giant with a 7.4% stake. One company would be focused on South African production which is under pressure from rising labor tensions and the threat of nationalization. The other company would be focussed on exploration growth in other potentially more mining friendly jurisdictions. Anglogold is suffering with labor disputes at its South African mines and dealing with major geopolitical risk in Mali. Paulson may have a shrewd strategy to divest from Africa and look to grow in more stable jurisdictions. Anglogold should take a closer look to increase their position in International Tower Hill Mines (THM or ITH.TO) which stands out as a truly world class gold deposit with over 20 million ounces of gold. Between Paulson and Anglogold they own over 20% of International Tower Hill Mines. In addition, the respected Tocqueville Gold Fund managed by famous fund manager John Hathaway owns over 17%. Tower Hill shareholders are positioned alongside the smartest investors in the precious metals industry. What do these investment giants find so compelling in Tower Hill Mines? This company controls one of the largest undeveloped gold resources in the entire world and should provide great leverage to a rising gold bullion price. Tower Hill feels that there is still potential exploration upside and that their Livengood Project could be one of the largest producing gold mines in North America. The project is located about 70 miles northwest of Fairbanks, Alaska, one of the most favorable jurisdictions in the entire world. This area of Alaska has a history of mining and the land use has been designated for mining. There are other mines in the district including Kinross's world class Fort Knox Mine which has been a success. This means that there is an available highly skilled labor force nearby. International Tower Hill Mines controls 100% of a world class gold deposit located in an exceptional mining district. The company is working on the bankable feasibility study (BFS) due mid year 2013. This may be a true value driver as it will provide third party verification of the economic viability of the project. This BFS may attract majors who are looking to invest in geopolitically safe mining jurisdictions with reasonable economics with the potential to produce at least 500k ounces of gold annually. The rising threats of resource nationalism and labor violence is making the big miners reconsider prior risky moves and look for growth only in stable areas. Tower Hill Mines is studying different scenarios to increase cash flow and the internal rate of return for the project. The strength of the management and technical team is remarkable. Tower Hill has the know how and a proven track record of Alaska success to possibly bring Livengood into production. Some of the management team has worked on permitting and construction of some of the largest mines in Alaska. The company is very well positioned both financially with great shareholders and technically with a proven track record of Alaska success to build the next major gold mine in North America. Remember with Tower Hill, one is investing alongside some of the smartest minds in the business. New investors have the advantage of buying below the purchase price of the institutions as the stock tests multi-year lows. Despite having a very difficult two years, I believe that 2013 could be a turnaround year as they come closer to publishing a bankable feasibility study. Just be aware that a major could gobble them up beforehand. Look for 2 year downtrend to be broken to the upside. Disclosure: Author owns THM and THM is a sponsor of my free website and newsletter. ___________________________ Sign up for my free newsletter by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here…

| ||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall Almost 2% and 4% on the Week Posted: 22 Feb 2013 02:19 PM PST Gold saw a $10.31 gain at $1587.21 in Asia before it fell back to $1569.88 at about 9:30AM EST, but it then rallied back higher in the last few hours of trade and ended with a gain of 0.23%. Silver slipped to as low as $28.345 before it also rallied back higher and ended with a gain of 0.28%. | ||||

| Maguire: Smashdown was aimed to avert gold and silver breakout and BIS arranged it Posted: 22 Feb 2013 02:16 PM PST 1:12p PT Friday, February 22, 2013 Dear Friend of GATA and Gold: In the second installment of King World News' interview with him today, London metal trader and silver market whistleblower Andrew Maguire describes a vast scheme of naked shorting of gold in the futures markets, asserts that the recent smashing of monetary metals prices was done to avert their upward breakout, and charges the Bank for International Settlements with coordinating the scheme. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/2/22_Wh... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Get the real story about the precious metals Now you don't have to travel to attend a financial conference to hear Sprott Asset Management's precious metals experts -- Eric Sprott, Rick Rule, and John Embry. They'll be holding a round-table discussion via the Internet at 2 p.m. ET Tuesday, February 12, and you can be part of it. Among their topics: -- Why are precious metals such a compelling investment opportunity? -- Why are non-G7 central banks buying gold? Do Western central banks have any left? -- Why are investors buying as much silver as gold in dollar terms? What does this mean for the price of silver? -- Is the growing supply deficit of platinum and palladium going to push their prices higher? To register for this Internet conference and participate from the comfort of your own home or office, please visit: http://w.on24.com/r.htm?e=579230&s=1&k=70B829852A33CD255CC2A43ED63D18D0 Join GATA here: California Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Gold Daily and Silver Weekly Charts - Life During Wartime - Moody's Downgrades UK Posted: 22 Feb 2013 02:11 PM PST This posting includes an audio/video/photo media file: Download Now | ||||

| Attention Chicken Little: GOLD AND SILVER NOW FUELED FOR LIFT-OFF Posted: 22 Feb 2013 02:09 PM PST The untold reality of gold and silver price controlsConsider for a moment the remarkably high volume of COMEX contracts traded during the days when the spot prices for gold and/or silver were driven sharply lower. An illusion of weakness tends to prevail in these situations because the majority of precious metal traders do not seem to understand the difference between a paper claim and the real thing, nor do they seem to realize that only paper contracts or claims are being sold when the price of the precious metals drops — not the actual metal itself. Basically, the futures contract seller cannot be forced to deliver physical metal, and so sellers can simply settle their profit or loss on the trade in cash. Furthermore, the fact that such price drops are typically initiated by the dumping of huge swaths of paper contracts by proprietary traders working at giant bullion banks that are too big to bail and/or fail, makes them seem more like manipulative attempts to scare the precious metals market into a selling panic. No one is actually selling real bullion during these allegedly "not-for-profit"-led precious metal sell-offs. Instead, the paper market is moving the metal prices as the tail seemingly wags the dog. ____________________________ Silver price targeting and the will of central banksPerhaps one of the most frustrating things about trading the precious metals is that price action unfortunately directs perception. As GATA's Chris Powell has pointed out, movements in the price makes market commentary. So, as soon as the price of silver drops, investors start to think that silver is heading down to $4 again. Conversely, when the price of silver rises, then they tend to think it must be a bubble. This cycle seems crazy considering the ever-depreciating value of the U.S. dollar. Perhaps instead of looking at the price, investors could simply open up the COT report and follow the flow of paper futures and option contracts if they want to know the state of a currency or financial system. ____________________________ Silver's Four Hour Slamdown WindowSubmitted by Tyler Durden on 02/19/2013 12:44 -0500 As silver suffers its biggest one-day drop of the year, following a February of strange 'spikey' behavior, we thought it might be useful to show just what has been going on for the last few weeks. It appears that from the open of US equity trading pre-market to the close of Europe's equity markets (~0730ET to ~1130ET), Silver has been offered non-stop. Out of that four-hour window, on average, Silver has not moved in the month of February. With the dramatic nature of physical demand at the Mint, this serial slam-down of Silver just seems a little too premeditated and predictable. February has seen more than its fair share of price drops... ____________________________ Bank short silver positions near record, risk squeezeLast Friday night (European time) the Bank Participation Report for Feb. 5 was released. This showed that the U.S. banks reduced their net short gold position by 12,886 contracts over the month of January, while non-U.S. banks increased theirs by 2,887 contracts. This is evidence that the U.S. banking community is aggressively closing its short positions. A little of this was picked up by the non-bank commercials (mostly mines, refiners and processors) whose net shorts increased by 6,512 contracts to 56,573. In silver they were unable to close down their positions, the U.S. banks increasing their exposure by 7,956 contracts over the month. The non-U.S. banks increased their short positions by 457 contracts, representing more than 42 million ounces between them to give a total short position of 277,810,000 ounces, the second highest on record. The two charts below show the contrasting positions for U.S. banks in gold and silver.   We can be sure that the massive short position in silver is causing difficulties for the banks concerned, because of the lack of physical supply. Therefore, the bullion banks have an exposure that appears to be out of control. While they frequently conduct bear raids (which are more successful in gold) they face the risk in silver of themselves becoming victims in a bear squeeze. Unusually, they have got themselves into this mess on a low silver price, and it is roughly double the short position when the silver price was over $40. This being the case, when silver turns up the banks are likely to be very badly squeezed, throwing up enormous losses. Meanwhile, the non-bank commercials have kept a level head and reduced their net short position by 2,268 contracts to 3,616. It is against that background that gold and silver prices declined this week, with gold falling about $30 to the $1,630 level, and silver by $1.50 to the $30.25 level. Given that the bullion banks are trying to close down their positions, you would expect open interest to fall. Instead they have both risen, gold by more than 25,000 contracts and silver by 2,936 contracts, indicating that buyers are taking the opportunity to accumulate at these low prices. ____________________________ Gold's Regular Morning MuggingA broad daylight crime-in-progress? Tuesday, February 19, 2013, 8:38 PM The EvidenceThe precious metals are routinely sold off at or soon after the 8:20am EST morning open of the New York NYMEX exchange. Below are the daily gold price charts (source: Kitco) for each Monday (or Tuesday, if Monday was a holiday) since early this year. The current day's gold price is noted by the bright green line. The morning takedown is highlighted by the orange oval. Monday, January 7Gold is taken down $10 immediately after the 8am NYMEX open  Monday, January 14A late breaking rally begun on the London exchange is quickly contained at the NYMEX open, and then beaten down nearly $10. Notice that the previous Friday's gold price action (the bright blue line) also showed the same behavior at the same time, but with an even more severe response once the NYMEX opened.  Monday, January 21The 8am sell-off is smaller here (only a few $), but still noticeable.  Monday, January 28Again, a sell-off happens after the 8am open. Note again how the previous Friday's action was similar, but even more severe.  Monday, February 4Finally, an outlier. While there was an initial dip in the first hour of the NYMEX, the price took off soon after. So let's not count this one.  Monday, February 11An immediate $14 drop at the 8am open. The downward momentum started in London, but the vertical downdraft once the NYMEX opened is unmistakable.  Tuesday, February 19While less sharp, the steady selling clearly begins at 8am, beating gold down $12 to the technically significant $1,600 threshold.  Volume & TimingRunning the above data by Chris, he noted two additional observations. The first is that the price suppression is commencing increasingly in advance of the start of the NYMEX's open outcry process at 8:20am EST (i.e., how trading happens at the NYMEX). This suggests that it's being done on behalf of powerful players granted permission to circumvent the rules.  The second is that the volume levels in this pre-open trading is similar to that seen during active hours. That is very unusual in markets, and exceptionally high.  ________________________________ Gene Arensberg's GGR: Gold futures setup becoming bullishTuesday, February 19, 2013Gold & the Developed World in the Face of Massive Change in the Next Two Decades Posted: 22 Feb 2013 02:00 PM PST In the last five years, we have seen the start of the decline of the developed world and the real impact of the economic rise of China on that world. What lies ahead? James Wolfensohn, the ex-president of the World Bank gave a short lecture in which he forecasts what the world's cash flows would be like in 2030. | ||||

| Gold Overreacts to the Fed Minutes Posted: 22 Feb 2013 01:58 PM PST Synopsis: What the latest FOMC minutes really signaled to the markets... and why it may make your blood boil. Dear Reader, Vedran Vuk here, filling in for David Galland. In today's issue, I'll closely analyze the recent FOMC minutes, which were partially responsible for gold's performance on Wednesday. Unlike many Fed minutes, this one was full of interesting comments. However, I don't agree that the minutes spell doom for gold, as some people think. We'll get to that in a second, but first I wanted to mention that we just released what I consider to be the best issue of Miller's Money Forever so far. The reason for my enthusiasm is that this issue virtually pays for itself – and I'm not just talking about the stock recommendations. The main topic this month is how to find a financial advisor who has your best interests at heart… which, in my book, is just about the most valuable information you can get. Case in point: Ri... | ||||

| VIA MAT won't vault for U.S. taxpayers anymore but no effect on GoldMoney Posted: 22 Feb 2013 01:50 PM PST 12:46p PT Friday, February 22, 2013 Dear Friend of GATA and Gold: GoldMoney today acknowledges the VIA MAT vaulting company's decision to stop providing services to people with U.S. tax obligations but produces a letter from VIA MAT affirming that this will have no application to the company's services to GoldMoney: http://www.goldmoney.com/faq/are-us-residents-allowed-to-hold-metal-with... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT GoldMoney adds Singapore vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, Toronto, and the United Kingdom, now with GoldMoney you can store gold and silver in Singapore in a high-security vault operated by Brink's Singapore Pte Limited. To find out more about the new vault, please visit: http://www.goldmoney.com/singapore?gmrefcode=gata GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: California Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit in the new year with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||

| Gold and Silver Disaggregated COT Report (DCOT) for February 22 Posted: 22 Feb 2013 01:44 PM PST HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below. (DCOT Table for February 22, 2013, for data as of the close on Tuesday, February 19. Source CFTC for COT data, Cash Market for gold and silver.) (More...) In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. If there is one of our DCOT charts that bears special mention it just about has to be the one below.

| ||||

| Powerful contra-indications for gold from whistleblower Maguire and GGR's Arensberg Posted: 22 Feb 2013 01:36 PM PST 12:34p PT Friday, February 22, 2013 Dear Friend of GATA and Gold: London metal trader and silver market whistleblower Andrew Maguire today tells King World News that Eastern central banks have used the recent smashdown in gold to acquire hundreds of tonnes and that the smashdown is actually a "bubble short position" likely subject to a "violent" reversal. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/2/22_Ma... Meanwhile over at the Got Gold Report, Gene Arensberg notes the recent big reduction in gold holdings by the exchange-traded fund GLD and finds that the four most recent big reductions in GLD holdings were quickly followed not by a "death cross" apocalypse but by rising gold prices. Arensberg's commentary is posted in the clear at the Got Gold Report here: http://www.gotgoldreport.com/2013/02/huge-gld-metal-reduction-scary-buyi... And market analyst Al Jolson's outlook has been posted at YouTube here: http://www.youtube.com/watch?v=vtkhJ1xqw2o CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit in the new year with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: California Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Singapore vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, Toronto, and the United Kingdom, now with GoldMoney you can store gold and silver in Singapore in a high-security vault operated by Brink's Singapore Pte Limited. To find out more about the new vault, please visit: http://www.goldmoney.com/singapore?gmrefcode=gata GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Today whistleblower Andrew Maguire told King World News that that the BIS (Bank for International Settlements) orchestrated this latest takedown in gold and silver. Maguire also stated there is now a major dislocation in the gold and silver markets that is about to blow up. This is the second in a series of interviews with Maguire lifting the curtain on what is going on behind the scenes in the ongoing gold and silver war which continues to rage.

Today whistleblower Andrew Maguire told King World News that that the BIS (Bank for International Settlements) orchestrated this latest takedown in gold and silver. Maguire also stated there is now a major dislocation in the gold and silver markets that is about to blow up. This is the second in a series of interviews with Maguire lifting the curtain on what is going on behind the scenes in the ongoing gold and silver war which continues to rage.  Gold roller coaster seems to go on and on without an end. But what we have seen this week was more of a bungee jumping. However, at this time there seems to be no more room for further declines, as major support lines have been reached already or are about to be reached. Does this mean that we are close to the final bottom and that a strong rally will emerge soon? Let us jump straight into the technical part of today's essay to find out – we'll start with the yellow metal's long-term chart (charts courtesy by http://stockcharts.com.)

Gold roller coaster seems to go on and on without an end. But what we have seen this week was more of a bungee jumping. However, at this time there seems to be no more room for further declines, as major support lines have been reached already or are about to be reached. Does this mean that we are close to the final bottom and that a strong rally will emerge soon? Let us jump straight into the technical part of today's essay to find out – we'll start with the yellow metal's long-term chart (charts courtesy by http://stockcharts.com.) I had the opportunity yesterday to speak with legendary founder and former CEO of GoldCorp, Rob McEwen. He is now the CEO, Chairman, and largest shareholder of McEwen Mining.

I had the opportunity yesterday to speak with legendary founder and former CEO of GoldCorp, Rob McEwen. He is now the CEO, Chairman, and largest shareholder of McEwen Mining.

In response to some reader requests, I wanted to provide a post which showcases and reviews the various 2013-dated Silver Bullion Coin offerings from around the world.

In response to some reader requests, I wanted to provide a post which showcases and reviews the various 2013-dated Silver Bullion Coin offerings from around the world. Since the end of December we've been writing about the coming bottom in precious metals. Our forecast for 2013 was to see a low in Q1 and then continued consolidation until the end of the summer in which Gold could be in good position to break $1800. That forecast remains largely intact, although it appears the mining stocks will bottom quite a bit lower than we thought two months ago and even five months ago. Three weeks ago we noted that a potential final bottom was on the way. After beating around the bush we are ready to say that now is the time to begin buying and we'll show you why.

Since the end of December we've been writing about the coming bottom in precious metals. Our forecast for 2013 was to see a low in Q1 and then continued consolidation until the end of the summer in which Gold could be in good position to break $1800. That forecast remains largely intact, although it appears the mining stocks will bottom quite a bit lower than we thought two months ago and even five months ago. Three weeks ago we noted that a potential final bottom was on the way. After beating around the bush we are ready to say that now is the time to begin buying and we'll show you why. As the world visibly collapses all around us, the idea of survivalism — or prepping — has gone mainstream. No longer should either word signify paranoia; rather, these words should signify adaptability in the face of proven challenges. Whether it is the

As the world visibly collapses all around us, the idea of survivalism — or prepping — has gone mainstream. No longer should either word signify paranoia; rather, these words should signify adaptability in the face of proven challenges. Whether it is the

"When word of crisis breaks out in Washington," said President Bill Clinton in 1993, "it's no accident the first question that comes to everyone's lips is, 'Where is the nearest carrier?'"

"When word of crisis breaks out in Washington," said President Bill Clinton in 1993, "it's no accident the first question that comes to everyone's lips is, 'Where is the nearest carrier?'"

No comments:

Post a Comment