Gold World News Flash |

- The Price of Gold in the Cold-Gold War

- No Gold Jewelry For You

- Let's end currency war with gold standard!

- One Huge Gold Buyer & Hedge Fund Moves

- Silver Plunges: Eagles and Maples Mysteriously Back – YouTube

- A Few Thoughts on Silver, Gold and The US$

- Gold and silver hit again with silver breaking below 30.00/Yet silver OI rises to 154,300 contracts/European data still remains weak

- Gold Chart VS Silver Chart – Historical Analysis – YouTube

- January Gold Imports Into India Surge 23 Percent, Hit 18-Month High

- Silver Unboxing !!! 200 Ounces !!!

- Guest Post: Currency Wars Are Trade Wars

- No Tool To Balance Offending Balance Sheets Other Than Gold

- Fed?s Actions Should Cause Gold to Glitter In 2013 ? Here?s Why

- The USD & U.S. Dollar Index ? What Affect Are They Having On the Price of Gold?

- Gold & Silver Price Takedown February 15th: Noise vs Facts

- Norcini & Haynes - One Huge Gold Buyer & Hedge Fund Moves

- Is This Where The Secret JP Morgan London Gold Vault Is Located?

- What Happens to a Financial System When Its Two Biggest Pillars Collapse?

- Currency wars are fiat wars

- Trend Power Synchronized

- Gold And Silver Current Decline Not Over

- Gold Cycles, Where is he Bottom?

- Bob Janjuah Blog: Common sense ignored during market tops

- The USD & U.S. Dollar Index – What Affect Are They Having On the Price of Gold?

- How The Super-Rich Avoid Paying Taxes | Zero Hedge

- Gold Falls Below $1,600; What’s Next?

- Fed's Actions Should Cause Gold to Glitter In 2013 – Here's Why

- If Europe Were a House... It'd Be Condemned

- Gold Backwardation Chatter

- IS REVOLUTION OUR DESTINY?

- 1,510,000 Views: A Satirical Look at U.S. Debt Ceiling Limit from a Personal Perspective

- Ian Gordan: “This Collapse Will Be Very Frightening—Because Once The Credit Stops, The Economy Stops”

- More Layoffs Coming in Financial Markets

- This Past Week in Gold

- Gold And Silver - Current Decline Not Over - Watch Market Activity For Turnaround

- Grandich laments mining industry's obtuseness in face of price suppression

| The Price of Gold in the Cold-Gold War Posted: 16 Feb 2013 11:30 PM PST by Darryl Schoon, SilverBearCafe.com:

The West, as Mao Tse-Tung once claimed, is not a paper tiger; unless, of course, you're referring to its paper money. In 1991, communism was, in fact, collapsing. But capitalism, unbeknownst to itself and others, was bankrupt after its costly decades-long struggle with communism. Today, the former communist super-powers, Russia and China, have re-emerged and are playing the high-hand of gold against England, the US and the West and their now vulnerable paper currencies. | ||

| Posted: 16 Feb 2013 10:30 PM PST from Silver Vigilante:

The US, to be sure, was not the only wester market to witness a drop in demand for gold jewelry, for the price of gold is too hard for meager pocketbooks. "A further erosion of tonnage in the Western markets was again caused by consumers reacting to higher prices during a prolonged period of economic distress," the council said. "Although silver tonnage has been seen gaining at the expense of gold, it is interesting to note that much of this will be in the form of gold-plated jewelry, confirming that the desirability of pure gold jewelry, which is being undermined by affordability. | ||

| Let's end currency war with gold standard! Posted: 16 Feb 2013 10:00 PM PST from Russia Today: | ||

| One Huge Gold Buyer & Hedge Fund Moves Posted: 16 Feb 2013 09:30 PM PST from KingWorldNews:

First, here is what Haynes had to say: "It was a solid week of steady buying. Quite a few large orders, with one huge order. This was solid buying despite prices being range bound. Range bound of course until today, with big price drops in both metals. Half of this week's $58 price drop (in gold), and 1/3 of silver's price drop came Friday." | ||

| Silver Plunges: Eagles and Maples Mysteriously Back – YouTube Posted: 16 Feb 2013 09:11 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||

| A Few Thoughts on Silver, Gold and The US$ Posted: 16 Feb 2013 09:03 PM PST Back in the end of June of last year, I adapted the comparative with silver from the Nasdaq top in 2000, to the prequel asset bubble of the late 1980's - the Japanese Nikkei market. And although the Fed subsequently intervened ... Read More... | ||

| Posted: 16 Feb 2013 09:00 PM PST by Harvey Organ, HarveyOrgan.Blogspot.ca:

In the access market, here are the final prices: gold; $1610.10 Friday's selling was well orchestrated and hopefully we had capitulation. The bankers have sold enough paper shorts to get the main stream media to state that the gold/silver bull run is over. This has brought on the large specs to play along with the bankers and go short e.g. Dennis Gartman. (see the COT report below) The rigging started in earnest when the CME lowered the margin requirements. This brought in more weaker longs into gold and silver. Then the constant raids brought main stream media to report the end of the gold/silver bull. Dennis Gartman who always gets the sell side right but never the buy side, announced that he was going short in gold. Today the selling reached a climax with gold at one point gold breaching the 1600 dollar barrier. Silver on the other hand breached 30.00 and stayed below that level for the rest of the day. However, when you have massive selling of paper silver and gold, you generally see liquidation of the paper contracts (OI). | ||

| Gold Chart VS Silver Chart – Historical Analysis – YouTube Posted: 16 Feb 2013 08:03 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||

| January Gold Imports Into India Surge 23 Percent, Hit 18-Month High Posted: 16 Feb 2013 08:00 PM PST by Ed Steer, Casey Research:

The gold price traded pretty flat through Far East trading on their Friday…but then dipped slightly at the London open going into the a.m. gold fix. From there it traded flat until 1:00 p.m. GMT…8:00 a.m. in New York…and about twenty minutes before the Comex open. By the time that JPMorgan et al were done for the day, the low tick checked in at $1,596.00 spot around 10:35 a.m. Eastern time. From there, the price rallied back to the $1,610 spot mark, but wasn't allowed to trade above that price for the rest of the Friday session. On an engineered price decline of this magnitude, the trading volume was immense…around 284,000 contracts, give or take…and gold closed at $1,610.10 spot…down $24.30 on the day. | ||

| Silver Unboxing !!! 200 Ounces !!! Posted: 16 Feb 2013 07:00 PM PST from lowpross11: | ||

| Guest Post: Currency Wars Are Trade Wars Posted: 16 Feb 2013 06:14 PM PST Submitted by John Aziz of Azizonomics blog, Paul Krugman is all for currency wars, but not trade wars:

There is a serious intellectual error here, typical of much of the recent discussion of this issue. A currency war is by definition a low-level form of a trade war because currencies are internationally traded commodities. The intent (and there is much circumstantial evidence to suggest that Japan at least is acting with mercantilist intent, but that is another story for another day) is not relevant — currency depreciation is currency depreciation and still has the same effects on creditors and trade partners, whatever the claimed intent. Krugman cites Barry Eichengreen as evidence that competitive devaluation does not necessarily mean a trade war, but Eichengreen does not address the issue of a trade war directly, much less denying the possibility of one. Indeed, while broadly supportive of competitive devaluation Eichengreen notes that the process was "disorderly and disruptive". And the risks of disorder and disruption are still very real today.

The mechanism here is very simple. Some countries — those with a lower domestic rate of inflation, like Japan — have a natural advantage in a currency war against countries with a higher domestic rate of inflation like Brazil and China. If one side runs out of leverage to debase their currency because of heightened domestic inflation, their next recourse is to resort to direction trade measures like quotas and tariffs.

Since I made that statement, there has been a great lot of debasement without any great spiral of damaging trade measures. But with the world locked into ever greater monetary and trade interdependency, and with fiery trade rhetoric continuing to spew forth from the BRIC nations, who by-and-large seem to continue to believe that American money-printing is damaging their interests — who in the past two years have put together a new global reserve currency framework — it would be deeply complacent to believe that the risks of a severe trade war have gone away. (Unfortunately, Krugman and Eichengreen both seem to discount the reality that Okun's law has broken down, and that monetary expansion today is supporting crony industries, and exacerbating income inequality, but those are another story for another day) | ||

| No Tool To Balance Offending Balance Sheets Other Than Gold Posted: 16 Feb 2013 05:34 PM PST Dear CIGAs, QE to Infinity, followed by Gold balancing the balance sheets of the sovereign balance sheet disasters. Just as there is no tool other than QE to feign financial solvency, there is no tool to balance the balance sheet of the offending entities other than Gold. It is just that simple. Gold will Continue reading No Tool To Balance Offending Balance Sheets Other Than Gold | ||

| Fed?s Actions Should Cause Gold to Glitter In 2013 ? Here?s Why Posted: 16 Feb 2013 04:13 PM PST "Follow the [COLOR=#0000ff][U]munKNEE" [/U][/COLOR]via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients*restricted to only 1000 active subscribers) Gold investors often fail to watch the Federal Reserve with enough attention to detail and can miss buying opportunities like the present one, as a result. The case for gold is as strong as ever and I outline in this article why with details you’re unlikely to see anywhere else. Words: 775; Charts: 6 So writes Adam Rabie ([url]www.gold.net[/url]) in edited excerpts from an article* posted on Seeking Alpha under the title Fed To Help Gold Soar Off 6-Month Low. [INDENT] This article is presented compliments of [B]www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and [COLOR=#ff0000]www.munKNEE.com [/COLOR](Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarit... | ||

| The USD & U.S. Dollar Index ? What Affect Are They Having On the Price of Gold? Posted: 16 Feb 2013 04:13 PM PST "Follow the [COLOR=#0000ff][U]munKNEE"[/U][/COLOR] via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1000 active subscribers) The U.S. Dollar Index is made up of a basket of [6] currencies that are,*themselves, not static and, indeed, are involved in various forms of debasement as nations have taken the view that a weaker currency will boost their exports. As each nation enacts such policies, the result*is gridlock, as every action taken to weaken one’s currency is neutralized by a similar action taken by the competing currencies. That is currently what is happening with the constituents of the U.S. Dollar Index*and why, as such,*the U.S. dollar has not weakened. [Given the fact that] gold tends to have an inverse relationship with the dollar, and has increased when the value of the dollar has declined, we could, as a result,*continue to see a capping in the advance of gold prices, at least in dollar terms. [Let me expla... | ||

| Gold & Silver Price Takedown February 15th: Noise vs Facts Posted: 16 Feb 2013 03:33 PM PST As from its inception, Gold Silver Worlds has been focusing on the real facts, rather than irrelevant facts, interpretations or half truths. Readers should understand what caused the price takedown on Friday February 15th 2013 and should be able to distinguish the noise from the true facts that the mainstream press attributed to the lower gold and silver prices. In this article, we show the real value of the biggest recent headlines and urge readers to value them for what they are: mainstream headlines.

Negative mainstream sentimentIt is interesting to note that this significant downward pressure on the gold and silver price came exactly on the day of the G20 meeting in Moscow. Coincidentally, all news out of Moscow was positive and economic recovery appeared to be the theme of the day. Ben Bernanke admitted that the unemployment was still high, but emphasized that the US economic recovery is underway lifting the global economy up. "As a consequence," sentiment for gold turned bearish… at least, that's how the mainstream linked the two events together. One of the many headlines reads "Gold dips to 6-month low as Bernanke says U.S. economy is improving" (source: Investing.com) Furthermore, the US announced on the very same day yesterday, with a big headline on Reuters.com, that sanctions will be taken to eliminate the gold flow from Turkey to Iran. The "exclusive" article (source) pointed to the "gold for gas" and "gold for oil" transactions between the two countries. The significant increase in usage of gold as an alternative way of payments, were the result of past year's sanctions to exclude Iran from the international payment system. On the other side of the mainstream press, one of the most successful people in the gold business for decades wrote the following:

Regarding the rumours that QE was about end this year, another commentator with a proven track record, pointed out the following:

Our message at Gold Silver Worlds is to be careful with the negativity. It is common knowledge that the mainstream media and financial markets are characterized by a heard mentality. It does not come as a surprise that the Hulbert sentiment indicator which showed that gold was at a significant low (source). Be careful not to be caught with the heard at the bottom of emotions.

Are Soros and PIMCO truly bearish?Furthermore, Soros and PIMCO made big headlines, adding to the negative sentiment. CNBC, for instance, wrote that "George Soros and Pimco Turned Bearish on Gold" (source). The facts? Well, in the fourth quarter of 2012 they reduced their paper gold holdings. Let's be clear here: there is no explicit link between reducing gold holdings and being bearish. As we wrote back in August, Soros e.a. had been accumulating gold in May at the lowest levels. So taking a profit of some 15% (our best guess) as an institutional investor is normal. Besides, even more importantly, Frank Holmes points out that "Soros may have liquidated his gold holdings because he identified a significant short-term opportunity in the currency markets." It is simply not known. Frank Holmes continued:

Our message is the same: be careful with interpreting the headlines and distinguish facts from noise. Do not get confused by the interpretation of a fact. Obvious disconnect between physical and paper marketsMost importantly, the explanation for which the gold and silver price has come down, was related to the futures positions. We explained only a week ago in our crash course "Short Term Gold & Silver Price Forecasting" that the open interest especially in silver was too high for a price rally to occur. The gold and silver paper market pointed to downside pressure. The latest futures market report showed an open interest in silver of approximately 152,000 contracts (which equals more than 26k tonnes). As explained in our aforementioned article, the open interest is in the area which indicates a very likely short term price decline. From a technical point of view, the picture for gold and silver short term does not look really well, as both metals have broken their 50 day moving average and a "death cross" is very close. It implies more downside is very likely. Again, those are indicators used in short to mid-term trading. Mind the irony in this: trading "metals" … in the paper market. Make no mistake, the futures market is a purely paper based market and is almost exclusively accessible for institutional investors. The contrast with the physical market is becoming very big and so obvious. We reported a continuing investment and central bank increase physical gold demand and historic Gold and Silver Eagle sales. In the same way, Jim Sinclair wrote the following yesterday: "How in the world do you take down at the same time in the same place every day when liquidity is the lowest in true liquidation of physical hold investment positions?" Moreover, Darryl Schoon wrote an excellent article about the gold cold war, in which he explains the massive physical gold buying in the East versus the trading of paper gold in the West. Peter Schiff explained it in an excellent way during yesterday's CNBC interview:

Please do not get confused by the signals that the lower gold and silver prices sent out. They were primarily for traders. If you are a believer in the fundamentals of gold, you should really not care about some downside and negative sentiment. In closing, we should really mention Ted Butler's view. In today's update to his premium subscribers, he wrote the following quote which summarizes his outlook. As we all know, his primary focus is on the COT analysis (futures market).

For more detailed analysis on Ted Butler's view on the gold and silver price decline and their prospects (short, mid and long term), please consider subscribing to this excellent analysis on Butler Research. | ||

| Norcini & Haynes - One Huge Gold Buyer & Hedge Fund Moves Posted: 16 Feb 2013 02:56 PM PST  Today acclaimed trader Dan Norcini and 40-year veteran Bill Haynes, President of CMI Gold & Silver, spoke with King World News about the recent gold and silver smash. Haynes told KWN there was a very large first time buyer, and Norcini spoke about the key hedge fund activity in both gold and silver. Today acclaimed trader Dan Norcini and 40-year veteran Bill Haynes, President of CMI Gold & Silver, spoke with King World News about the recent gold and silver smash. Haynes told KWN there was a very large first time buyer, and Norcini spoke about the key hedge fund activity in both gold and silver.First, here is what Haynes had to say: "It was a solid week of steady buying. Quite a few large orders, with one huge order. This was solid buying despite prices being range bound. Range bound of course until today, with big price drops in both metals. Half of this week's $58 price drop (in gold), and 1/3 of silver's price drop came Friday." This posting includes an audio/video/photo media file: Download Now | ||

| Is This Where The Secret JP Morgan London Gold Vault Is Located? Posted: 16 Feb 2013 02:33 PM PST In a world defined by "financial innovation", where $1 of hard collateral can spawn over $1000 in repoed and rehypothecated liabilities (and assets), where "shadow banking" is far more important than traditional bank liabilities (and to this date remains completely misunderstood), and where every month the central and commercial banks force create over $100 billion in credit money (which end consumers refuse to absorb and which therefore ends up in the stock market), the concept of a "hard asset" is an increasingly redundant anachronism. Yet while the Federal Reserve has emerged as the bastion of the New Normal's financial innovation front in which the concept of money is backed by absolutely nothing other than the Dollar's increasingly fleeting reserve status, when it comes to the definition of "Old Normal" money - gold - it still is the domain of the first and original central bank: London. At first blush, most would not associate London with the hard asset mecca of the world: in fact, when it comes to some of the most spectacular hyper-levered "New Normal" cataclysms in recent years: AIG, Lehman, MF Global, JPMorgan's London Whale, all of them originated in London. Yet for the most part these events occurred precisely because of the mindboggling leverage already employed by the London financial system. Recall that the UK has some 600% in financial debt/GDP - an unprecedented amount compared to any other developed world nation. Yet, paradoxically, the fact that there is so much financial leverage implies that there must be an abundance of hard assets at the bottom of the London Exter Pyramid. After all, financial counterparties, especially in this day and age, may be insolvent but they are not idiots, and all will demand at least some paper representation that there is a trace of hard collateral at the bottom of the latest financial Frankenstein CDO, SPV, CLO, CPDO, RMBS or [insert any other modern financial "asset" acronym]. And keep in mind we are talking private sector gold: Gordon Brown's epic blunder of dumping the sovereign UK gold at rock bottom prices hardly needs a mention. Which is why in order to spawn such a gargantuan amount of financial debt, London, which for centuries was the financial capital of the world and which sequestered the bulk of the world's real, tangible wealth until the ascendancy of the US in the 20th century, London's commercial vaults, are literally full of gold (as much as it may pale in comparison with the total notional amount of liabilities it has created). After all it is the London Billion Market Association. Not New York, Zurich or Singapore. Why is London such an integral part of the gold financial world? We'll let none other than JPMorgan explain:

And speaking of JP Morgan, incidentally the subject of this post, what do we know about their London-based gold vault services? Once again, in their words:

Who is the other largest commercial gold vault in London? Why HSBC of course: the bank which has recently been embroiled in virtually every scandal involving global money laundering, also happens to be the custodian for such massive (supposedly) physical gold repositories as those of the SPDR Gold GLD ETF. The HSBC gold vault is also known as "Gold's secret hiding place" as CNBC penned it, when Bob Pisani was allowed to take a look deep inside the vault's bowels but only after he was theatrically blindfolded (a visit which we commented on at the time). Yet Pisani's blindfold, while theatrical, was premeditated: the number of people who know where the HSBC vault is located is a handful, because the last thing commercial gold vaults, and certainly their customers, would want to deal with is a Simon Gruber-type Die Hard 2-style goldjacking. Amusingly it was none other than the Bundesbank who in November invoked the ghost of the fictional New York Fed gold heist when a member of its executive board told NY Fed's Bill Dudley that "you can be assured that we are confident that our gold is in safe hands with you. The days in which Hollywood Germans such as Gerd Fröbe, better known as Goldfinger, and East German terrorist Simon Gruber, masterminded gold heists in US vaults are long gone. Nobody can seriously imagine scenarios like these, which are reminiscent of a James Bond movie with Goldfinger playing the role of a US Fed accounting clerk." This happened two months before the Bundesbank diametrically (and embarrassingly) flip-flopped and decided to, all pinky swears to the contrary, begin repatriating its gold from the New York Fed (and Paris) after all. But not London (at least not yet). It also perhaps means that the days of Simon Gruber may not be "long gone", especially if the whereabouts of vaults containing billions worth of gold bullion were known to the public. And just like the SPDR would want nothing less than to have the address of the HSBC gold vault made public (the same goes for HSBC of course), so those other ETF providers who use JPM's London gold vault as a custodian, such as Blackrock's iShares IAU ETF, or ETF Securities, would want nothing less than to have the location of JPM's vault exposed. Needless to say, the actual addresses of "LBMA Vault" provided by the LBMA in its Annex 2 for "The Good Delivery Rules for Gold and Silver Bars" lists the headquarters office of the vaulting firm, and certainly not the actual address, because it would have been somewhat disingenuous to blindfold Pisani just to deliver him toe 8 Canada Square, or the HSBC head office in London, the address provided by the LBMA as vaulting address of HSBC. And certainly the address given for the JPM vault at 125 London Wall, aka Alban Gate, which was the firm's headquarters until its move to 25 Bank Street in 2012, is the last place even one bar of gold would be found. Which is why we were quite stunned to find, in the deep recesses of the internet (and hosted by the Indonesian stock exchange of all place), a trade ticket from May 26, 2011, issued by the Perth Mint of Australia to Avocet Gold Mining (a West African gold miner), in which the Mint confirms its purchase of 2,126 ounces of gold at a price of $1,526 for a total transaction price of $3.246 million. What is notable about the trade ticket is the additional information provided for the account clearer, in this case, none other than JPMorgan Chase Bank NA, London, as well as the number of the Gold Account held by said clearer: "No. 01380" but what is by far the most interesting, is that the actual physical address of the JPMorgan facility is provided: 60 Victoria Embankment, London. Ladies and gentlemen: we may just have uncovered the actual location of the ultra-secretive JPMorgan gold vault in the city of London. Where is 60 Victoria Embankment, London? See below: The building's southern/river face is the glorious facade of the City of London School which occupied this location from 1879 until 1986 (and which is currently situated just east of here along the Blackfriars Underpass, next to the Millennium Bridge). As the map above shows, it is a rather sizable building, located just off the Thames river and steps away from the Blackfriars Bridge, whose official designation until recently was Morgan Guaranty Trust Company of New York, Ltd, a remnant from the firm's merger with Guaranty Trust Company in 1959 (recall that JPM was called Morgan Guaranty Trust until 1989). A cursory media search about the otherwise very nondescript looking building at 60 Victoria reveals that it had been fully leased by JP Morgan as long ago as 1991. What is more interesting, is that the property had previously been bundled as part of a high-profile commercial mortgage-backed securities, or CMBS, deal called White Tower 2006-3. The deal consolidated properties formerly owned by one-time London real estate mogul, Simon Halabi, one of the financial crisis most notable falls from Grace, who had an estimated net worth of $4.3 billion in 2007, and in April 2010 was declared bankrupt, and whose current whereabouts have since been unknown. White Tower 2006-3, most infamous for being the first CMBS deal to be placed in liquidation after the start of the currency crisis, held a variety of properties near and dear to JPMorgan's heart, first and foremost 60 Victoria Embankment, the 420,000 sq ft of office buildings fully let to JP Morgan Chase; but notably Alban Gate, the 382,000 sq ft office property located on London Wall What happened next is interesting: in July 2010 Carlyle bought the bulk of the "White Tower" asset portfolio from the defunct CMBS, paying some £173 million for the 60 Victoria Embankment location. Three very short months later, none other than long-time 60 Victoria resident JPMorgan bought the very same building from Carlyle for a whopping £350 million: a transaction which doubled Carlyle's money in an unprecedented three months! At the time the now former CEO of JPM's investment bank Jes Staley (and who currently works for BlueMountain - the same fund that made a killing by squeezing none other than JPMorgan's London Whale traders), said, "These properties are long-term investments and represent our continued commitment to London as one of the world's most important financial centres." Frank Bisignano, chief administrative officer, added: "These properties are among the most attractive pieces of real estate in London. These buildings ensure that our employees will have the necessary technology, infrastructure and amenities to take our businesses forward." Curiously, JPM showed zero love for its Alban Gate location, which it promptly departed to go to its new Canary Wharf HQ, and Carlyle was forced to pull the sale of this property a year later as it did not get enough satisfactory bids. A pressing question remains: why did JPM, a long-time tenant of 60 Victoria not submit its own bid for the location it knew it would end up purchasing outright in a few months from Carlyle anyway? Why overpay by £177 million in exchange for merely having one more middleman do a three-month transaction? We hope to find out. Yet what is very clear is that there was something of far greater value to JPM at the 60 Victoria location than at its old headquarters. What that "thing" may be, and what is the missing puzzle piece in this story, comes from a very peculiar article written nearly four years ago in an Abu Dhabi/Arab Emirates website titled TheNational, titled "Mystery gold cargo linked to Saad, Gosaibi feud", which described just that - the fate of a series of very peculiar gold shipments, the key of which once again involved the two main abovementioned players: Perth Mint and 60 Victoria Embankment. We repost the entire story below, while highlighting the key parts:

Courtesy of TheNational, we now know that one of the key features of the building at 60 Victoria is that it houses at least the vault of the Standard Bank of South Africa: in other words, somewhere deep underground, there is, indeed, a major gold vault. We also know, that after leasing this location for nearly two decades, JPMorgan decided to take the plunge and bought it outright in 2010, in a transaction that as shown above was a scramble to park cash and to procure the property for sale. In other words, JPM now has sole custodial possession of all the vaulting services offered | ||

| What Happens to a Financial System When Its Two Biggest Pillars Collapse? Posted: 16 Feb 2013 02:32 PM PST Those EU leaders who have yet to be implicated in scandals are not faring much better than their more corrupt counterparts. In France, socialist Prime Minister Francois Hollande, has proven yet again that socialism doesn’t work by chasing after the wealthy and trying to grow France’s public sector… when the public sector already accounts for 56% of French employment. | ||

| Posted: 16 Feb 2013 02:27 PM PST The financial press is tossing the term "currency war" around with more abandon than partiers circulating punch at a New Year's bash. Most commentators tell us we're having such a war right now, though at least one denies it. James Rickards has published a book on the subject that's become a hot seller. So what exactly is a currency war and why are nations engaging in it? Wikipedia offers an explanation that reminds me of a man traversing a rickety bridge over a deep canyon. The first few planks feel secure, leading him onward to the middle, where the bridge sags and sways in the canyon's updrafts. We read that a Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency.Why would countries devalue their currencies? As the price to buy a particular currency falls so too does the real price of exports from the country.Cheaper exports means - what? If an American dollar buys 5 Mexican pesos, then the dollar is said to be stronger against the peso, the peso cheaper against the dollar, and Mexican products marketed in the U.S. will be priced lower in dollars than otherwise. If those prices are lower than those of competing American firms, they will be more appealing to American buyers. Other things equal, low bid wins. The flip side of this means that the country with the cheapest currency will experience diminished import trade. In our example, fewer American products will be sold in Mexico, ceteris paribus. Why? Because it requires more pesos to buy them. In other words, Imports become more expensive.Wikipedia concludes: So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets.Our bridge crosser has had a plank split under his foot. How could domestic industry and employment as a whole receive a boost? Domestic exporters receive a boost in demand in foreign markets because their stuff is priced lower in foreign countries. Employment in domestic exporting firms will receive a boost because of the increase in foreign demand. But domestic industry as a whole does not receive a boost because currency devaluation means their domestic customers have to pay higher prices. Industries that don't export or whose exports are not a significant part of their revenue will suffer. The Wikipedia article agrees, sort of: However, the price increase for imports can harm citizens' purchasing power.What about price increases generally, caused by the flood of new money? These too will be impoverishing. Furthermore, The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.According to the U.S. Department of Commerce, exports accounted for 13.8% of GDP in 2011, a record high but still a small fraction of the total. Devaluing the currency for the alleged benefit of a small segment of the economy hardly makes economic sense when it penalizes all participants with higher prices. It also buttresses the sense that the currency wars will ignite a shooting war and end like all wars, with only a handful of winners and millions of losers. As we know Keynesians star-struck with World War II believe otherwise, and Keynesians run the economy. Even the exporting firms will get hit when the devaluation stops and demand in foreign markets declines. If the devaluation doesn't stop voluntarily, it will end at the brick wall of hyperinflation. Nations are not unaware of this possibility and of the need to reassure investors that they're not in fact on a fast track to monetary oblivion. MarketWatch tells us that The Group of 20 finance ministers and central bank governors on Saturday [2-16-2013] pledged to monitor negative currency spillovers to other countries caused by monetary policies implemented for domestic purposes."Negative currency spillovers" is a euphemism for the harm inflicted on trading partners by subsidizing exports through monetary inflation. Of course they have only "pledged to monitor" these "spillovers," not eliminate them. How careful they are with words when they're careless with money. The Swiss are traditionally anti-inflationary but they caved to their export firms after the Fed's QE made the Swiss franc rise in value against the dollar. The Swiss bought up dollars (and euros) to keep the franc from rising in value against those currencies. The Swiss buy them up by printing more francs - i.e., by inflating - i.e., by counterfeiting. Japan is trying to do the same thing. The whole purpose of government sovereignty over money is to inflate it to the advantage of itself and certain favored groups, beginning with the fractional reserve banking cartel. The inflation (or counterfeiting) will always work against the vast majority through higher prices and repeated cycles of euphoria followed by depression. The solution is to establish a monetary system governed exclusively by the market forces of profit and loss. Banking and money should be completely divorced from government, without which the system as it presently exists would have collapsed long ago. On the market - the free market - there is no such thing as too big to fail or prices that are too low. The first step in getting there is to allow open competition of currencies. | ||

| Posted: 16 Feb 2013 02:13 PM PST Looking at any chart since October 2012, we can see ageneral overall downtrend in [COLOR=#e06666]Gold,Silver and the XAU. Alongthe way, there were two positive daily up trends interspersed, both of whichfailed. The question is why.[/COLOR] Change in the Dynamics One has to do with fundamental money flows whichTrader Dan Norcini covers very well [COLOR=#e06666]here.The second involves the current waterfall exhaustion effect which eliminatesall but those with vision, money management skills and cash reserves.[/COLOR] The third is really interesting. It has to do with aparticular chart feature that compels its completion before any progress can beachieved. While there are many in the leadership group that have thischaracteristic, just to keep it simple, I include Central Fund (CEF), New Gold(NGD) and Hecla (HL). Only CEF has completed part one of this technical issuewhich first occurred precisely 8 months ago. This is still work in progresswhich implies further downside action ... | ||

| Gold And Silver Current Decline Not Over Posted: 16 Feb 2013 02:02 PM PST We often make a distinction between buyers of physical precious metals, [PMs] and buyers of futures, exhorting the former to buy with impunity, and some may see that as cavalier, given how the price for both gold and silver have been in recent decline. The point for buyers of PMs is for both protection and creation of wealth. Protection against insidious central bankers destroying currency-purchasing power, over time, and wealth creation as evidenced by those buying PMs over the past decade and seeing the intrinsic value grow dramatically. | ||

| Gold Cycles, Where is he Bottom? Posted: 16 Feb 2013 01:54 PM PST Gold has been moving essentially sideways for more than a year since printing a high in August/September 2011. With last week's drop to below the lows of last December/ January many investors must be asking 'where is the bottom in gold?' | ||

| Bob Janjuah Blog: Common sense ignored during market tops Posted: 16 Feb 2013 01:42 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||

| The USD & U.S. Dollar Index – What Affect Are They Having On the Price of Gold? Posted: 16 Feb 2013 01:40 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1000 active subscribers) The U.S. Dollar Index is made up of a basket of [6] currencies that  are, themselves, not static and, indeed, are involved in various forms of debasement as nations have taken the view that a weaker currency will boost their exports. As each nation enacts such policies, the result is gridlock, as every action taken to weaken one's currency is neutralized by a similar action taken by the competing currencies. That is currently what is happening with the constituents of the U.S. Dollar Index and why, as such, the U.S. dollar has not weakened. [Given the fact that] gold tends to have an inverse relationship with the dollar, and has increased when the value of the dollar has declined, we could, as a result, continue to see a capping in the advance of gold prices, at least in dollar terms. [Let me explain in further detail.] Words: 804; Charts: 1 are, themselves, not static and, indeed, are involved in various forms of debasement as nations have taken the view that a weaker currency will boost their exports. As each nation enacts such policies, the result is gridlock, as every action taken to weaken one's currency is neutralized by a similar action taken by the competing currencies. That is currently what is happening with the constituents of the U.S. Dollar Index and why, as such, the U.S. dollar has not weakened. [Given the fact that] gold tends to have an inverse relationship with the dollar, and has increased when the value of the dollar has declined, we could, as a result, continue to see a capping in the advance of gold prices, at least in dollar terms. [Let me explain in further detail.] Words: 804; Charts: 1So writes Bob Kirtley (www.gold-prices.biz) in edited excerpts from his original article as posted on Seeking Alpha under the title Gold And The U.S. Dollar.

Kirtley goes on to say in further edited excerpts: The printing of more paper money usually has the effect of debasing or diluting the strength of that particular currency. The lowering of interest rates also renders a currency less attractive to investors, as better returns might be available elsewhere. The demise of the U.S. dollar can be attributed, in part, to both of the above reasons. However, when this debasement is plotted against other currencies as per the U.S. Dollar Index, we can see that it is having some difficulty when it comes to heading lower, as the chart below depicts. The reason for this is that the U.S. Dollar Index is made up of a basket of currencies that in themselves are not static and indeed, are involved in various forms of debasement as nations have taken the view that a weaker currency will boost their exports. [According to Wikipedia: The US Dollar Index (USDX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies. It is a weighted geometric mean of the dollar's value compared only with

USDX started in March 1973, soon after the dismantling of the Bretton Woods system. At its start, the value of the US Dollar Index was 100.000. It has since traded as high as 148.1244 in February 1985, and as low as 70.698 on March 16, 2008.] Japan, for instance, has recently elected a new government whose mandate is to avoid deflation by printing more paper money in order to boost their economy and increase exports via a cheaper yen. As we write, the European Union is meeting to discuss the strength of the euro and the effect that it is having on their ability to export goods. As each nation adopts similar policies, the result could be a kind of gridlock, as every action taken to weaken one's currency is neutralized by a similar action taken by the competing currencies. [That appears to be, in fact, what's happening as] we can see that, despite Operation Twist and Quantitative Easing, the U.S. dollar is sitting at the "80″ level on the Index. Gold tends to have an inverse relationship with the dollar, and has increased when the value of the dollar has declined…Therefore, if the actions of our political masters [in the constituent countries of the Index] are copied across the board, we could find ourselves in a situation where the dollar trades within a limited range for some time to come, thus capping an advance in gold prices, at least in dollar terms. One would think that we would be experiencing a huge leap in inflation with all this paper money swamping the world [but that] is contrary to what the "official" figures suggest, that inflation is under control. This leads…[me] to conclude that, for now, the demise in the dollar is on hold and that inflation is having little effect on the price of gold. I have difficulty believing that inflation will not come roaring back, but for now, we have to deal with what we have. [Therefore,] if gold prices are to head north, then it will be because of the fundamentals for gold, supply and demand [and, as such] consideration should be given to:

All of…[the above] suggests support for gold prices in the longer term, however, the short-term outlook is, as always, subject to volatile oscillations in both directions. Conclusion We need to proceed gently with our positioning in the precious metals market place, and also be prepared to weather the storm if and when it materializes. *http://www.gold-prices.biz/home/gold-and-the-us-dollar.html

Related Articles: 1. It Soon Will Be Decision Time for the U.S. Dollar Index – Which Way Will It Go? The U.S. Dollar has lost over a third of its value inside a 10-year falling channel as it continues to create a series of lower highs while holding on to a small rising support line. The question now is whether the U.S. Dollar Index will gain enough strength to break out to the upside or continue to trend lower and lower over the ensuing weeks and months. 2. Hopes of a Gold Spike In Dollar-denominated Terms Are Just That – Hopes! Here's Why [We read over and over again that] because of the massive amounts of money the Feds are injecting into the USA economy through quantitative easing, inflation is going to spike any day now, and the dollar is going to crash and, with that, gold will go to the moon – but it is not happening. It must be frustrating for gold investors. It is likely also puzzling to them. In this article I will try to explain why the U.S. dollar is not likely to crash anytime soon, and hopes of a gold spike in dollar-denominated terms are just that, hopes. Words: 730 I expect the eventual endgame to this whole Keynesian monetary experiment that has been going on ever since World War II [will] finally terminate in a global currency crisis. [That being said,] I'm starting to wonder if we aren't seeing the first domino – the Japanese yen – start to topple…[It has] cut through not only the 2012 yearly cycle low, but also the 2011 yearly cycle low and never even blinked [and should it continue its steep decline] and break through the 2010 yearly cycle low [of 105.66] I think we have a serious currency crisis on our hands. Needless to say, if the world sees a major currency collapse… it's going to spark a panic for protection – to gold and silver. Wouldn't it be fitting that at a time when they are completely loathed by the market they are about to become most cherished? [This article analyzes the situation supported by 3 charts to make for a very interesting read.] Words: 620; Charts: 3 | ||

| How The Super-Rich Avoid Paying Taxes | Zero Hedge Posted: 16 Feb 2013 01:19 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||

| Gold Falls Below $1,600; What’s Next? Posted: 16 Feb 2013 01:14 PM PST Check our website daily at... [[ This is a content summary only. Visit http://www.figanews.com for full Content ]] | ||

| Fed's Actions Should Cause Gold to Glitter In 2013 – Here's Why Posted: 16 Feb 2013 12:19 PM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1000 active subscribers) Gold investors often fail to watch the Federal Reserve with enough So writes Adam Rabie (www.gold.net) in edited excerpts from an article* posted on Seeking Alpha under the title Fed To Help Gold Soar Off 6-Month Low.

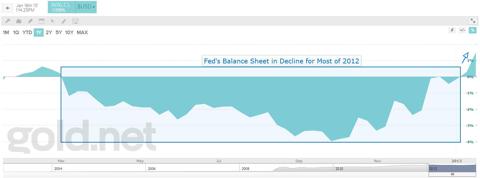

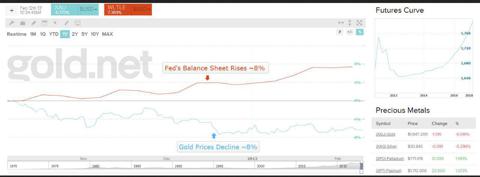

Rabie goes on to say in further edited excerpts: Why Gold Has Suffered So Far Gold prices suffered in 2012…[because] the Federal Reserve's balance sheet flat-lined over the last 12 months [as can be seen in the chart below]: Gold Prices Correlate with the Fed's Printing The correlation between the price of gold and the amount of assets purchased by the Federal Reserve is much higher than many realize [as can be seen in the chart below]: A proactive Fed is an obvious driver of the price of gold and, in particular, quantitative easing measures seem to have some of the largest effects, albeit with a lag. Over the last year, despite no net balance sheet growth, the Fed engaged in a heavy qualitative easing, aka "Operation Twist," a measure to increase the average maturity of the Fed's holdings, by swapping relatively safe short-term assets, with riskier, longer-maturing assets. These measures, along with negative real interest rates, have helped sustain gold prices but do not seem capable of lifting the precious metal to new highs on their own. No More Room to Twist, Infinite Room to Grow While the Fed has indicated they will continue their maturity expansion, the fact is they have run out of room, having sold almost all of their short-term assets [as can be seen in the chart below]: The Fed's agency holdings have almost run out as well [see below]: QE Is Back in Action Given the de facto end of the Fed's qualitative easing, the one measure they can engage with their balance sheet – that can never dry – is more quantitative easing and this is exactly what is happening. The Fed's balance sheet so far this year has risen at an annualized pace of 21%, its first real…[advance] in more than a year…[but,] interestingly, [the price of] gold has not…[caught] on to the trend [as of yet]. The gold price today…[is down approx. 8% from 6 months ago and,] interestingly, this decline nearly perfectly mimics the growth in the Fed's balance sheet over the same period [as can be clearly seen in the chart below]: (click to enlarge) Broken Correlations or Golden Discounts? While these facts seem to indicate that gold does not follow the Fed's expansionary efforts, it is important to realize that gold price trends historically tend to react to the Fed's action with a lag. If this is the case, gold prices may prove to be heavily discounted at present... A forward look at the Fed as well may help solidify which direction the yellow metal will head because, despite some internal dissent in the Fed, the overwhelming direction of monetary policy seems to indicate stimulus will remain or increase. Federal Reserve Leadership Is United It is important to focus on who matters at the Fed at least as much as the information that is coming from representatives of the central bank. While the media and markets have been flooded with quasi-hawkish comments from St Louis Fed President James Bullard, his voting action and conviction do not seem to align with his vocal sentiment, as he heeds to the direction of his voting board's leaders. The main directors of the Federal Reserve include its Chairman, Ben Bernanke, the vice-chair, Janet Yellen and the President of the New York Fed, Bill Dudley. These three Fed leaders have not voiced any qualms over present stimulus measures and rather the sentiment is quite the opposite, with Janet Yellen just…[recently] reminding the public that stimulus measures may even remain once unemployment guidelines are hit. The macro environment they are facing also seems to corroborate their stance, with the 10-year yield close to 2% [which is] an implicit target of the Fed, and America's outstanding debt continually growing to record levels. A desire to lift off the downward pressure on borrowing costs does not even seem considerable. Gold Prices May Be Set to Rise If this analysis of the Fed is correct, the rising ratio of the Fed's balance sheet priced in gold while the gold price declines, indicates a potentially lucrative buying opportunity for gold investors. The Fed is currently set to purchase about $85 billion in net assets a month, which implies a more than 30% annual growth in the Fed's balance sheet, and could spell 2013 glitters for gold investors who just suffered a rough year….

*http://seekingalpha.com/article/1177791-fed-to-help-gold-soar-off-6-month-low

Related Articles: 1. Startling Relationship Between Gold Price & U.S. Gov't Debt Suggests What Price for Gold in 2017? The price of gold, on a quarterly basis, is 86% correlated – yes, 86%! – to total government debt going back to 1975… and a shocking 98% over the past 15 years! [As such,] it would seem like a no-brainer investment thesis to buy gold… as a proxy for the not-otherwise-investable thesis that US total government debt will increase in the future. [But there is more - and it is disappointment for gold bugs - read on!] The U.S. is one of the worst debt 'offenders' in the world [and, as such, unless] dramatic spending cuts and tax increases [are undertaken within the next 5 years,] America's debt/GDP ratio will continue to rise, the Fed will print money to pay for the deficiency, inflation will follow, the dollar will inevitably decline, bonds will be burned to a crisp, and only gold and real assets will thrive. [Here's why.] Words: 674 | ||

| If Europe Were a House... It'd Be Condemned Posted: 16 Feb 2013 12:17 PM PST

One of the primary focal points of our writing is the corruption that has become endemic to the political and financial elites of the world. When we refer to corruption we are referring to insider deals, cronyism, lies and fraud. Since the Great Crisis began in 2008, these have become the four pillars of the financial system replacing the pillars of trust, transparency, truth and reality that are the true foundation of capitalism and wealth generation.

As we regularly note, corruption only works as long as the benefits of being “on the take” outweigh the consequences of getting caught. As soon as the consequences become real (namely someone gets in major trouble), then everyone starts to talk.

This process has now begun in Spain.

MADRID — Spain’s governing Popular Party was drawn deeper into a web of corruption scandals this past week, after the Swiss authorities informed the Spanish judiciary that the party’s former treasurer had amassed as much as 22 million euros, or $29 million, in Swiss bank accounts.

The treasurer, Luis Bárcenas, resigned from his job in 2009, after being indicted in the early stages of an investigation, which is still ongoing, into a scheme of kickbacks and illegal payments allegedly involving other conservative party politicians…

Nonetheless, the revelations have brought a fast-growing list of corruption investigations, which have unspooled across Spain, to the doorstep of the conservative government of Prime Minister Mariano Rajoy, who has so far remained silent. About 300 Spanish politicians from across the party spectrum have been indicted or charged in corruption investigations since the start of the financial crisis. Few have been sentenced so far.

http://www.nytimes.com/2013/01/19/world/europe/corruption-scandals-widen-in-spain.html?_r=0

Outside of Spain, corruption scandals have also erupted in Greece. There it was revealed that the very Greek political parties that were negotiated the Greek bailout had received over €200 million in loans from the Greek banks.

Greek prosecutors have ordered the two main ruling parties to testify in an investigation into more than 200 million euros in loans they received from banks, officials said on Friday.

The investigation - which is examining whether the loans are legal and whether any wrongdoing was involved - could embarrass the fragile conservative-led government, which relies on aid from the European Union and the International Monetary Fund.

Last year a Reuters report revealed the conservative New Democracy and the Socialist PASOK parties were close to being overwhelmed by debts of more than 200 million euros as they face a slump in state funding because of falling public support.

http://www.reuters.com/article/2013/02/01/us-greece-parties-idUSBRE91010O20130201

Here again, we find that politicians were “on the take” via questionable if not illegal funds. The fact that this story is coming out now does not bode well for Greece, which is barely holding together as a country.

The consequences of this discovery will not be positive for the Greek political class:

Greece's finance minister was sent a bullet and a death threat from a group protesting home foreclosures, police officials said on Monday, in the latest incident to raise fears of growing political violence.

The package was sent by a little-known group called "Cretan Revolution", which warned the minister against any efforts to seize homes and evict homeowners, police sources said. The group sent similar letters to tax offices in Crete last week.

http://news.yahoo.com/greek-finance-minister-sent-bullet-mail-165717734.html

Italy is also facing a major scandal implicating key political figures including the biggest player for European financial system, ECB President Mario Draghi:

Back in mid-January, Bloomberg’s Elisa Martinuzzi and Nicholas Dunbar reported that Deutsche Bank helped Italy’s third-largest bank, Monte Paschi, cover up a 367 million euro loss at the end of 2008 with a shady derivative deal. That swap helped the bank look better than it really was just before taxpayers bailed it out—echoes of Goldman Sachs’s deal to hide Greece’s national debt.

The Italian papers followed Bloomberg’s scoop days later with news that Nomura had structured a derivative for Monte Paschi along similar lines. The Italian central bank then disclosed Monte Paschi executives had concealed documents on the trades from them. Reuters reported that JPMorgan also did a sketchy derivative for the bank.

But the scandal only continued to grow. So far, the bank may have lost a billion dollars on the deals, and it turns out that the Bank of Italy knew about the allegedly fraudulent deals back in 2010, when Mario Draghi was its chief. Draghi is now head of the European Central Bank, and has been critical in tamping down the euro crisis in the last several months.

Now, the scandal threatens to change the course of Italian national elections being held later this month, giving a leg up to Silvio Berlusconi…

http://www.cjr.org/the_audit/bloomberg_unearths_an_italian.php

The key item in the above story is Mario Draghi’s involvement. As head of the European Central Bank, Draghi is arguably the most powerful man in Europe. Indeed, it was his promise to provide unlimited bond buying that stopped the systemic implosion of Europe last summer.

In this sense, the entire EU has been held together by Draghi’s credibility as head of the ECB. The fact that we now have a major scandal indicating that he was not only aware of fraudulent deals in 2010, but gave them a free pass will have major repercussions for the future of the Euro, the EU, and the EU banking system.

We hope by now that you see why we have remained bearish on Europe when 99% of analysts believe the Crisis is over. The only thing that has the EU together has been the credibility of politicians who we are now discovering are all either corrupt, inept or both.

To use a metaphor, if Europe were a single house, it would be rotten to its core with termites and mold. It should have been condemned years ago, but the one thing that has kept it “on the market” was the fact that its owners were all very powerful, connected individual. We are now finding out that the owners not only knew that the home should have been condemned but were in fact getting rich via insider deals while those who lived in the house were in grave danger.

As we stated at the beginning of this issue, corruption only works as long as the benefits of being “on the take” outweigh the consequences of getting caught. As soon as the consequences become real (in that someone gets in major trouble), then everyone starts to talk.

The above stories about Greece, Spain, Italy reveal that we have entered the stage at which people have begun to talk about Europe’s corruption.

We have produced a FREE Special Report available to all investors titled What Europe’s Collapse Means For You and Your Savings. This report features ten pages of material outlining our independent analysis real debt situation in Europe (numbers far worse than is publicly admitted), the true nature of the EU banking system, and the systemic risks Europe poses to investors around the world. It also outlines a number of investments to profit from this; investments that anyone can use to take advantage of the European Debt Crisis. Best of all, this report is 100% FREE. You can pick up a copy today at: http://gainspainscapital.com/eu-report/ Best Phoenix Capital Research

| ||

| Posted: 16 Feb 2013 12:14 PM PST [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] I have been receiving a fair amount of emails asking my opinion on a recent article chatting up "Gold Backwardation". The unspoken inference from the article is that this is bullish for gold. Let me state two things before proceeding. Number one - I am a trader and make my living by so doing. If I am on the right side of the market, I make money. If I am not, I lose money. It is that simple. Johnnie one notes cannot trade and make money because they are only always on one side of a market. IN the case of gold, that means that they are always long. Markets go up and markets go down and if you on the long side of a market going lower crashing through support levels, guess what.... You are losing money, sometimes lots of it. Leverage is your friend on the way up if you are long; it is the grim reaper if you are long and the market is dropping lower and lower. My advice to those who are using f... | ||

| Posted: 16 Feb 2013 11:10 AM PST Submitted by Brandon Smith from Alt-Market Gun Rights: Are There Any Peaceful Solutions Left? Throughout history, citizen disarmament generally leads to one of two inevitable outcomes: Government tyranny and genocide, or, revolution and civil war. Anti-gun statists would, of course, argue that countries like the UK and Australia have not suffered such a result. My response would be – just give them time. You may believe that gun control efforts are part and parcel of a totalitarian agenda (as they usually are), or, you may believe that gun registration and confiscation are a natural extension of the government's concern for our "safety and well-being". Either way, the temptation of power that comes after a populace is made defenseless is almost always too great for any political entity to dismiss. One way or another, for one reason or another, they WILL take advantage of the fact that the people have no leverage to determine their own cultural future beyond a twisted system of law and governance which is, in the end, easily corrupted. The unawake and the unaware among us will also argue that revolution or extreme dissent against the establishment is not practical or necessary, because the government "is made of regular people like us, who can be elected or removed at any time". This is the way a Republic is supposed to function, yes. However, the system we have today has strayed far from the methods of a Free Republic and towards the machinations of a single party system. Our government does NOT represent the common American anymore. It has become a centralized and Sovietized monstrosity. A seething hydra with two poisonous heads; one Democrat in name, one Republican in name. Both heads feed the same bottomless stomach; the predatory and cannibalistic pit of socialized oligarchy. On the Republican side, we are offered Neo-Con sharks like George W. Bush, John McCain, and Mitt Romney, who argue for "conservative" policies such as limited government interference and reduced spending, all while introducing legislation which does the exact opposite. The recent passage of the "Safe Act" in New York with extensive Republican support proves that Republicans cannot be counted on to defend true conservative values. The Democrats get candidates like John Kerry, Hillary Clinton, and Barack Obama, who claim to be anti-war and against government abuse of civil liberties, and yet, these same "progressive and compassionate" politicians now froth at the mouth like rabid dogs sinking their teeth into the flesh of the citizenry, expanding on every tyrannical initiative the Republicans began, and are bombing more civilian targets in more foreign countries than anyone with a conscience should be able to bear. I've said it before and I'll say it again; the government is not our buddy. It is not our ally or friend. It is not a "part of us". It is now a separate and dangerous entity. A parasite feeding off the masses. It has become a clear threat to the freedoms of average Americans. It is time for the public to grow up, snap out of its childish delusions, and accept that there is no solace or justice to be found anymore in Washington D.C. Once we understand this fact, a question then arises – What do we do about it? If we cannot redress our grievances through the election process because both parties favor the same authoritarian direction, and if our street protests are utterly ignored by the mainstream media and the establishment, and if civil suits do nothing but drag on for years with little to no benefit, then what is left for us? Is the way of the gun the only answer left for the American people at this crossroads? I cannot deny that we are very close to such a conclusion. Anyone who does deny it is living in a candy coated fantasy land. However, there are still certain options that have not been exhausted, and we should utilize them if for no other reason than to maintain the moral high ground while the power elite continue to expose their own despotic innards. State And County Nullification The assertion of local authority in opposition to federal tyranny is already being applied across the country. Multiple states, counties, and municipalities are issuing declarations of defiance and passing legislation which nullifies any future federal incursions against 2nd Amendment protections. For instance, the Gilberton Borough Council in PA in conjunction with Police Chief Mark Kessler has recently adopted a resolution defending all 2nd Amendment rights within their municipal borders up to and including the denial of operations by federal officers: http://oathkeepers.org/oath/2013/02/03/first-molon-labe-town-in-america/ Approximately 283 county Sheriffs and multiple police officers have taken a hard stand, stating that they will either not aid federal enforcement officials with gun control related activities, or, that they will not allow such activities within their county, period: http://cspoa.org/sheriffs-gun-rights/ This trend of dissent amongst law enforcement officials debunks the nihilistic view promoted by disinformation agents that "no one in law enforcement will have the guts to stand up to the government no matter how sour it turns". It has also shaken the Obama Administration enough that the White House is struggling to counter it by wining and dining police unions and sheriffs departments in order to form their own "coalition of the willing". Obama seems to believe that holding press conferences using children or police as background props will somehow earn him political capital in the battle for gun rights, but I have my doubts: http://news.yahoo.com/obama-asks-police-help-pass-183056466.html http://www.sltrib.com/sltrib/politics/55716645-90/com-congress-doing-enforcement.html.csp Multiple states have legislation on the table to nullify as well, and it would seem that the violent push by the establishment to extinguish the 2nd Amendment has actually sharply rekindled the public's interest in States Rights and the 10th Amendment. This does not mean, though, that we should rely on nullification alone. While the gun grabbers are stumbling into severe resistance at the national level, some representatives are attempting to supplant gun rights at the state level, including New York, California, Washington State, and Missouri. The goal here is obvious; counter states rights arguments by using anti-gun legislators to impose federal controls through the back door of state legislation. They will claim that if we support states rights, then we have to abide by the decisions of regions like New York when they ban and confiscate firearms. It's sad how gun grabbers lose track of reality. Neither federal authority, nor state authority, supplants the legal barriers of the Constitution itself, meaning, no federal or local authority has the right or power to remove our freedom of speech, our freedom of assembly, our freedom of privacy, OR our freedom to own firearms (including firearms of military utility). The Constitution and the Bill of Rights supersede all other legal and political entities (including treaties, as ruled by the Supreme Court). At least, that's what the Founding Fathers intended when they established this nation. The point is, a state is well within its rights to defy the Federal Government if it is enacting unconstitutional abuses, and the people are well within their rights to defy a state when it does the same. There is actually a fantastic economic opportunity to be had by states and counties that nullify gun control legislation. Many gun manufacturers and retail businesses are facing financial oblivion if the establishment has its way, and moving operations outside the U.S. is not necessarily practical for most of them (gun manufacturing is one of the last business models we still do better than the rest of the world). Municipalities could offer safe haven to these businesses, allowing them to continue producing firearms and high capacity magazines, fulfill expanding public demand, and create a surging cash flow into their area while at the same time giving the federal government the finger. This strategy does not come without dangers, though. Many states and counties are addicted to federal funding, and some would go bankrupt without it. The obvious first response by the feds to protesting local governments will be to cut off the river of cash and starve them into subservience. This brand of internal financial warfare can be countered by local governments by nullifying a few other unconstitutional regulations, including those issued by the EPA and the BLM. States and counties could easily disable federal land development restrictions and begin using resource development as a means to generate supplemental income. North Dakota is essentially doing this right now in the Bakken Oil Fields, becoming one of the few states in America that is actually creating legitimate high paying jobs (instead of part time wage slave jobs), and growing more prosperous every year. This tactic is not limited to state governments either. Counties also have the ability, with the right officials involved, to regain control of their economic destinies anytime they want. All it takes is the courage to rock the establishment boat. National firearms registration and gun databases are almost always followed by full gun confiscation. The process is usually done in a standardized manner: First demand extensive registration and cataloging of gun owners. Second, ban more effective styles of weaponry, including semi-automatics and high capacity rifles (Let the sport hunters keep their bolt actions for a time, and lure them onto your side with the promise that they will get to keep their .270 or their 30-06). Then take all semi-auto handguns. Then, ban high powered magnum style bolt actions by labeling them "sniper rifles". Then demand that the gun owners that still remain allow official "inspections" of their home by law enforcement to ensure that they are "storing their weapons properly". Then, force them to move those weapons to a designated "warehouse or range", locked away for any use other than recreational shooting. Then, when the public is thoroughly disconnected from their original right to bear arms, take everything that's left. Keep in mind that the federal government and certain state governments are acting as if they would like to skip ALL of the preliminary steps and go straight to full confiscation. I am not discounting that possibility. But, they may feign certain concessions in the near term in order to get the one thing they really want – full registration. Registration must be the line in the sand for every single gun owner in this country, whether they own several semi-automatics, or one pump action shotgun. Once you give in to being registered, fingerprinted, photographed, and tracked wherever you decide to live like a convicted sexual predator, you have shown that you have no will or spirit. You have shown that you will submit to anything. After a full registration has been enacted, every gun (and maybe every bullet) will be tracked. If confiscation is utilized, they know exactly what you have and what you should not have, and exactly where you are. Criminals will still acquire weapons illegally, as they always have. The only people who will suffer are law abiding citizens. It's a recipe for dictatorship and nothing more. The retail firearms and ammo markets are Sahara dry right now, and will probably remain that way in the foreseeable future. Anything that is available for purchase is usually twice the price it was last year. Extremely high demand is removing retail from the picture before any legislation is even passed. Enter barter… Cash will remain a bargaining tool for as long as the dollar remains the world reserve currency and holds at least some semblance of value (this will end sooner than most people think). That said, as gun items become scarce, the allure of cash may be supplanted. The signs of this are already evident. Gun owners are now looking more to trade firearms and accessories for OTHER firearms and accessories, because they know that once they sell an item, they may never see it again, and the usefulness of cash is fleeting. Gun Barter is not only a way for firearms enthusiasts to get what they need, it is also a way for them to move around any future gun sale restrictions that may arise. Private gun sales are legal in some states, but do not count on this to last. Barter leaves no paper trail, and thus, no traceable evidence of transaction. For those who fear this idea as "legally questionable", all I can do is remind them that an unconstitutional law is no law at all. If it does not adhere to the guidelines of our founding principles, our founding documents, and our natural rights, then it is just a bunch of meaningless words on a meaningless piece of paper signed by a meaningless political puppet. 3D Printing And Home Manufacturing 3D Printing is now available to the public and for those with the money, I recommend they invest quickly. Unless the establishment wants to make the possession of these printers illegal, as well as shut down the internet, there will be no way to stop data streamers from supplying the software needed to make molds for every conceivable gun part, including high capacity mags. This technology has been effectively promoted by the Wiki Weapons Project: http://defensedistributed.com/ According to current ATF law, the home manufacture of gun parts is not technically illegal, as long as they are not being produced for sale. But in a state or county where federal gun laws have been nullified, what the ATF says is irrelevant. Home manufacturing of gun parts and ammo would be a highly lucrative business in such safe haven areas. And, the ability to build one's own self defense platform is a vital skill in a sparse market environment. The ultimate freedom is being able to supply your own needs without having to ask for materials or permission from others. It should be the goal of every pro-gun activist to reach this independence. Force The Establishment To Show Its True Colors While some in the general public may be incensed by the trampling of our freedoms by government, many (including myself) would view direct action and aimless French Revolution-style violence as distasteful and disastrous. The moral high ground is all that any dissenting movement has. It will be hard enough to keep this ground with the constant demonization of liberty minded people that is being espoused by propaganda peddlers like the SPLC and numerous media outlets. We do not need to help them do their jobs. Now, to be clear, I have NO illusions that the above strategies will defuse a confrontation between those who value freedom, and those who desire power. The hope is that enough people within our population will refuse to comply, and that this will make any future despotism impossible to construct. However, it is far more likely that these acts of defiance will elicit a brutal response from the government. And in a way, that is exactly what we want… The Founding Fathers went through steps very similar to those I listed above and more to counter the tightening grip of the British Empire during the first American Revolution. The idea is simple: Peacefully deny the corrupt system's authority over your life by supplying your own needs and your own security, rather than lashing out blindly. Force them to show their true colors. Expose their dishonor and maliciousness. Make them come after you like the predators they are, and then, once they can no longer play the role of the "defending hero" in the eyes of the public, use your right to self defense to send them a message they won't forget. Skeptics will claim that physical defense is useless against a technologically advanced enemy. They will claim that we need a "majority" we do not have in order to prevail. These are usually people who have never fought for anything in their lives. They do not understand that the "odds" are unimportant. They mean nothing. No revolution for good ever begins with "majority support". Each is fought by a minority of strong willed and aware individuals. When all other methods of protest have been dismantled, the system leaves us with only two options: stand and fight, or kneel and beg for mercy. All you need to know is what YOU would do when faced with that choice. There is no other culture on earth that has the capacity, like Americans currently do, to defeat centralists, defend individual liberty, and end the pursuit of total global power in this lifetime. We are the first and last line. If freedom is undone here, it is undone everywhere for generations to come. This is our responsibility. This is our providence. There can be no complacency. There can be no compromise. There can be no fear. It ends on this ground. One way, or another… | ||

| 1,510,000 Views: A Satirical Look at U.S. Debt Ceiling Limit from a Personal Perspective Posted: 16 Feb 2013 11:06 AM PST "Follow the munKNEE" via twitter & Facebook or Register to receive our daily Intelligence Report (Membership limited to only 1000 active subscribers) The United States debt limit is explained in this 3:09 satirical video This video from www.debtlimits.org was produced by Seth William Meier, DP/Edited by Craig Evans, 1st AC Brian Andrews, Sound Mixer Gus Salazar, Written and Directed by Brian Stepanek.

Help us spread the word – pass it on - [and also read this article which gives a more serious look at what the debt ceiling is and why it is important].