Gold World News Flash |

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 1% on the Week

- Davies sees a big new gold buyer; Cashin sees central banks 'playing with fire'

- Jan Skoyles: Outside U.S., gold is far more than tradition

- James Turk: Real estate priced in gold

- EURO: Is It Bottoming Out against the US Dollar?

- “We Buy Gold”

- Entrail reading after a volatile week in the monetary metals

- By the Numbers for the Week Ending November 16

- GATA Chairman Murphy interviewed Saturday on Phoenix radio station

- TRICKLE UP POVERTY

- IT CAN'T HAPPEN HERE, RIGHT?

- I Expect the Gold Price to Rise Briskly into the Year End then Keep Marching Higher

- Guest Post: Ceilings, Cliffs And TAG - 3 Immediate Risks

- Guest Post: Very Few People Understand This Trend...

- What Marc Faber Said to the LBMA About Gold

- Countdown To Total Collapse

- Will speedy new chips and smaller margins spell doom for the currency's core users?

- Stocks End Green; AAPL Volume Obscene; Treasury/FX Volatility Unseen

- Bullish PM Technicals

- Gold and Silver Disaggregated COT Report (DCOT) for November 16

- Gold and Silver Bullish Technicals

- High Gold Prices Push Many Indians to Silver for Diwali

- Gold Daily and Silver Weekly Charts - Trading Places, Gilded Rage

- COT Gold, Silver and US Dollar Index Report - November 16, 2012

- Look Out Above?

- Marc Faber, Gold and a Special Picture of Ben Bernanke

- KWN - Special Friday Gold ‘Chart Mania’

- Gold Investment: The Top 5 Slides from LBMA 2012

- As the Election Results Sink In, Economic Realities Become Clearer

- Gold Supported by Rockets in Israel

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 1% on the Week Posted: 16 Nov 2012 10:00 PM PST |

| Davies sees a big new gold buyer; Cashin sees central banks 'playing with fire' Posted: 16 Nov 2012 08:41 PM PST 10:37p ET Friday, November 16, 2012 Dear Friend of GATA and Gold: Hinde Capital CEO Ben Davies tonight tells King World News there's a big new buyer in the gold market, a nation whose policy has just become "QEternity." An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/16_B... Also at King World News, Art Cashin of UBS sees central banks starting to "play with fire" and risking more currency war: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/16_A... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. |

| Jan Skoyles: Outside U.S., gold is far more than tradition Posted: 16 Nov 2012 08:36 PM PST 10:33p ET Friday, November 16, 2012 Dear Friend of GATA and Gold: While gold is officially ignored by the U.S. government in public, with Federal Reserve Chairman Ben Bernanke sniffing that central banks hold it as mere "tradition," Jan Skoyles of The Real Asset Co. in Britain summarizes recent government undertakings with gold around the world that show that gold is regaining recognition as money. And not just ordinary money but better money than government is offering lately. Skoyles' commentary is headlined "Money Is Far Too Important to Be Left to the Politicians" and it's posted at The Real Asset Co.'s Internet site here: http://therealasset.co.uk/money-politicians-gold/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| James Turk: Real estate priced in gold Posted: 16 Nov 2012 08:06 PM PST 10:05p ET Friday, November 16, 2012 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk compares the appreciation of real estate prices against gold and concludes that while real estate can provide shelter, gold protects wealth better and doesn't give tedious relatives an excuse to visit for weeks at a time. Turk's commentary is headlined "Real Estate Priced in Gold" and it's posted at GoldMoney here: http://www.goldmoney.com/gold-research/james-turk/real-estate-priced-in-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... |

| EURO: Is It Bottoming Out against the US Dollar? Posted: 16 Nov 2012 08:05 PM PST |

| Posted: 16 Nov 2012 08:00 PM PST from Miller's Money:

During my annual trip to Arizona, my friend Phil asked me about gold. He owns some gold with no emotional value tied to it, and I convinced him of two things. First, he should not sell his gold; and second, he should hold it in a portable form with an easily recognizable value, like Gold Eagles. If things really get tough, he wouldn't want to have to barter jewelry with no easily agreed-upon value. There are many places where he could probably sell his jewelry, but how would he know if he was getting a fair price? I didn't know either, but I knew I had a friend who would. |

| Entrail reading after a volatile week in the monetary metals Posted: 16 Nov 2012 07:43 PM PST 9:40p ET Friday, November 16, 2012 Dear Friend of GATA and Gold: If you've got an urge for entrail reading after a volatile week in the monetary metals, Citigroup market analyst Tom Fitzpatrick tonight provides King World News with 11 charts that tell him that gold is going back up soon: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/16_K... 321Gold's Bob Moriarty says the same about silver, concluding that the record low premium on the Sprott Physical Silver Trust is the mark of a major bottom: http://www.321gold.com/editorials/moriarty/moriarty111612.html Jim Sinclair concurs about gold's direction but he warns that technical analysis has become a tool of market manipulation. That is, the market riggers know how to "paint the tape" to construct wonderful charts to misrepresent market conditions. Sinclair's commentary is at JSMineSet here: http://www.jsmineset.com/2012/11/16/in-the-news-today-1371/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard |

| By the Numbers for the Week Ending November 16 Posted: 16 Nov 2012 07:38 PM PST |

| GATA Chairman Murphy interviewed Saturday on Phoenix radio station Posted: 16 Nov 2012 07:26 PM PST 9:22p ET Friday, November 16, 2012 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy will be interviewed live on the program "Your Wealth Preservation" on radio station KKNT-AM960 in Phoenix, Arizona, on Saturday at 1 p.m. Phoenix time, 3 p.m. Eastern time, and noon Pacific time. KKNT, a news and talk station, broadcasts its programming live on the Internet so you should be able to listen to the program anywhere in the world here: http://saleminteractivemedia.com/ListenLive/player/KKNTAM CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opinion Around the World Is Changing When Deutschebank calls gold "good money" and paper "bad money". ... http://www.gata.org/node/11765 When the president of the German central bank, the Bundesbank, pays tribute to gold as "a timeless classic". ... http://www.forbes.com/sites/ralphbenko/2012/09/24/signs-of-the-gold-stan... When a leading member of the policy committee of the People's Bank of China calls the gold standard "an excellent monetary system". ... http://www.forbes.com/sites/ralphbenko/2012/10/01/signs-of-the-gold-stan... When a CNN reporter writes in The China Post that the "gold commission" plank in the 2012 Republican platform will "reverberate around the world". ... http://www.thegoldstandardnow.org/key-blogs/1563-china-post-the-gop-gold... When the Subcommittee on Domestic Monetary Policy of the U.S. House of Representatives twice called on economist, historian, and gold standard advocate Lewis E. Lehrman to testify. ... World opinion is changing in favor of gold. How can you learn why and what it will mean to you? Read the newly updated and expanded edition of Lehrman's book, "The True Gold Standard." Financial journalist James Grant says of "The True Gold Standard": "If you have ever wondered how the world can get from here to there -- from the chaos of depreciating paper to a convertible currency worthy of our children and our grandchildren -- wonder no more. The answer, brilliantly expounded, is between these covers. America has long needed a modern Alexander Hamilton. In Lewis E. Lehrman she has finally found him." To buy a copy of "The True Gold Standard," please visit: http://www.thegoldstandardnow.com/publications/the-true-gold-standard Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. |

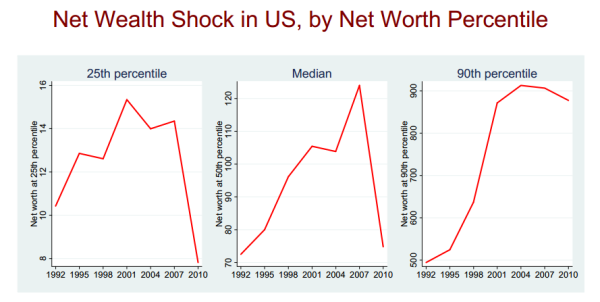

| Posted: 16 Nov 2012 06:41 PM PST The graph below pretty well says it all. Around 2008, two things happened. The housing bubble collapsed, and Barack Obama became president. The poor became massively poorer, and the middle class also became dramatically poorer. More American families are falling out of the middle class every single day. New numbers that were just released by the U.S. Census Bureau show that the number of Americans living in poverty rose to a new all-time record of 49.7 million last year. Once upon a time, people would have laughed at you if you suggested that someday 50 million Americans would be living in poverty. As always, the rich stay rich or get richer. Obama, the redistribution "robin hood" has wiped out the middle and lower classes. But he has the answer: become dependent on the government. Many people are in a place they never thought they'd be: in poverty and on food stamps. Higher net worth group jumping ahead while middle and lower class grows in size: The below chart is an interesting look at net worth by percentiles:

Most Americans are still in a much worse economic condition than they were over a decade ago. The numbers in terms of net worth, the true measure of wealth, highlight this very clearly. There are two primary drivers for this: -90 percent of households have negligible holdings of actual stocks -Most households derive their wealth from real estate This explains why after the near non-stop run-up of the stock market since early 2009, most families are still in a tight financial pinch. High net-worth households with higher stock holdings rode this boom and bust much nicer. Part of this has to do with the fact that real estate is a small part of their portfolio and the massive stock market run has aided in boosting net worth back up. The real estate market is being manipulated. Millions of foreclosures are being kept off the market to buoy housing prices. And millions of people are still living in their homes and not making any payments, sometimes for years. Socialism doesn't work. The poor get poorer. The middle class is taxed to death, private businesses shut down, and people lose their jobs. The welfare state grows exponentially, until the government can no longer fund it. Then a collapse. Considering how much wealth has been lost in the last 4 years, a decrease in real wages, and the never-ending devaluation caused by inflation, things for the future don't look to bright. Obama and the criminals in Washington will keep handing out free shit until the game's over. It won't be long.

|

| Posted: 16 Nov 2012 06:40 PM PST You never hear much about protests in Europe on our good 'ol MSM. That's because they're unpleasant, and show the end results of socialism. It can't happen here right? Spain had, for example, the same overpaid, early-retirement, huge-pension public employee gravy train we have here. They've had a welfare state and socialism for decades, and went into massive debt to fund it all. Now, the money is gone, and only a cataclysmic pile of debt remains. With no money, they are forced to begin "austerity", their economy is collapsing, there are no jobs, and people are very upset. They say we're about 2 years behind Spain and Greece. Pretty soon, the debt is going to become an all consuming juggernaut (like in Europe now). Can you imagine what will happen here when "austerity" is finally started, not because anyone wants it, but because there is simply no money left to fund the welfare state and government employees? Everyone already knows about the unfunded pensions and obligations, some $70 trillion or more, which are simply austerity measures not yet enforced. It will be very interesting, when the FSA and government parasites (the 53%) come up against financial reality. What do you think will happen when unemployment reaches 25%? Businesses are being squeezed now, and 55,000 manufacturing facilities have closed in the last decade. We just set a new record for food stamp usage and a new record for the number of people in poverty. Obamacare will result in millions of people losing their jobs or having their hours cut back. A massive increase in taxes will drive away whatever businesses are left in the U.S. So, how do you think austerity will play out here? It is coming. Socialism has never worked anywhere in the past. Criminal politicians have learned nothing. Socialism is great until you run out of other people's money. I'm interested to hear what you have to say.

Europe In the Grip of Anti-Austerity Protests Strikes and Demonstrations Across the Periphery As if we needed more proof that the course implemented by the eurocracy becomes increasingly untenable politically, millions decided to strike in several European countries this week. The demonstrations have, as they are wont to do these days, turned violent in a number places. The protests were most intense in Spain, where unemployment is at over 25% and desperation over the collapse of the bubble economy is growing by the day. The 'Big Picture' has brought a number of photographs of the worst clashes between protesters and police. Der Spiegel writes: "Millions of Europeans joined together in general strikes and demonstrations on Wednesday to protest the strict austerity measures undertaken by their countries. In Portugal and Spain, hard hit by the debt crisis, locals conducted a 24-hour general strike that largely paralyzed public infrastructure, suspending train service and grounding hundreds of flights, in addition to shutting down factories. Most of the protests remained peaceful, but in Madrid there were some violent clashes between demonstrators and police. Officers at Cibeles Square in the city center fired rubber bullets and used batons against protesters, reporting 34 injuries and the arrest of more than 70 protesters. Officials warned the situation could escalate further on Wednesday night, with major protests planned for Madrid and Barcelona. A similar demonstration had also been planned for Portugal's capital city, Lisbon. The day of strikes had been called by organized labor across Europe as part of a "European Day of Action and Solidarity," and similar events were staged in Italy, Greece, Belgium, Austria and France. The protesters believe that the austerity measures being taken in those countries to combat the debt crisis are worsening the recession. "We're on strike to stop these suicidal policies," said Candido Mendez, the head of Spain's UGT union, the country's second-biggest labor federation." (emphasis added) This is what happens when after decades of socialism, the money to pay for the freebies finally runs out. To be sure, this is a bit too simplistic. We are inclined to sympathize with the demonstrators for the following reason: instead of liquidating unsound credit and letting a few over-extended banks and their bondholders bite the dust, the eurocrats have decided to spread the joys of bankruptcy around and let their populations pay the bill. In most cases the poorest members of society have been hit the hardest. Most of the people thronging the streets don't fully understand what has happened. They don't realize that the deadly combination of a cradle-to-grave welfare state with a centrally planned fractionally reserved banking system has produced a terminal boom and that there is simply no painless way out of the situation anymore. There never was. An enormous amount of wealth has been squandered and consumed during the boom. There is no salvation in abandoning the euro and trying to inflate and spend oneself out of the hole that has been dug either: that would only invite an even greater economic catastrophe. However, Europe's political and monetary elites continue to misdiagnose the problem, in many cases refuse to level with their populations and are too halfhearted in implementing reform. What the protesters don't seem to get: the status quo ante cannot be recreated by decree. There is no magic wand for anyone to wave. The protesters have every right to be enraged, but they are raging against something that cannot be changed at the flick of a switch – the wealth is gone. If governments were to start on a renewed deficit spending spree, they would merely invite a greater crisis, very likely without delay. Even more government cannot be the solution for a problem that too much government has created. Radical pro free market economic reform is called for, but this is apparently neither recognized, nor does anyone have the guts to implement it. And so the European Chinese water torture version of 'austerity', which includes only a shrinking private sector, but not a shrinking government, continues without offering any light at the end of the tunnel to the people living in the periphery.

|

| I Expect the Gold Price to Rise Briskly into the Year End then Keep Marching Higher Posted: 16 Nov 2012 06:27 PM PST Gold Price Close Today : 1,714.30 Gold Price Close 9-Nov : 1,730.30 Change : -16.00 or -0.9% Silver Price Close Today : 32.36 Silver Price Close 9-Nov : 32.59 Change : -22.90 or -0.7% Gold Silver Ratio Today : 52.974 Gold Silver Ratio 9-Nov : 53.093 Change : -0.12 or -0.2% Silver Gold Ratio : 0.01888 Silver Gold Ratio 9-Nov : 0.01883 Change : 0.00004 or 0.2% Dow in Gold Dollars : $ 151.80 Dow in Gold Dollars 9-Nov : $ 153.11 Change : $ -1.31 or -0.9% Dow in Gold Ounces : 7.343 Dow in Gold Ounces 9-Nov : 7.406 Change : -0.06 or -0.9% Dow in Silver Ounces : 389.00 Dow in Silver Ounces 9-Nov : 393.23 Change : -4.23 or -1.1% Dow Industrial : 12,588.31 Dow Industrial 9-Nov : 12,815.39 Change : -227.08 or -1.8% S&P 500 : 1,359.88 S&P 500 9-Nov : 1,379.85 Change : -19.97 or -1.4% US Dollar Index : 81.194 US Dollar Index 9-Nov : 81.051 Change : 0.143 or 0.2% Platinum Price Close Today : 1,559.00 Platinum Price Close 9-Nov : 1,554.40 Change : 4.60 or 0.3% Palladium Price Close Today : 625.75 Palladium Price Close 9-Nov : 610.25 Change : 15.50 or 2.5% The silver and GOLD PRICE gainsaid each other today, silver down and gold up. Silver dropped 30.4 cents to 3236.1c while gold gained $1.00 to $1,714.30. Mighty quiet day. The GOLD PRICE ranged a little less than $11 from its $1,705.79 low to its $1,716.30 high, but support at $1,705 again checked its fall and reversed it's course. That left another V-bottom on the chart, and possible firm reversal to the upside next week. The SILVER PRICE five day chart blows hot and cold out of both sides of its mouth. It's having a political moment. Silver hit a low Monday and Tuesday around 3210, climbed to a peak on Wednesday at 3290c, then rolled down to another low today at 3207c. That could be a rounding top, or a double bottom reversal. Until silver violates the neckline of the head and shoulders-ey formation built since 22 October, which now stands about 3170c, it will continue rising. Analogous spot for gold is $1,705, struck today. If I am right about those two upside-down head and shoulders formations, then both silver and gold ought to continue climbing next week. Right, and what if they don't? What if they break those lines? Then you'd better reckon with a trip back to the last low, $1,672.50 and 3066c, and an even BETTER buying opportunity than you have now. Unless both metals fall and tumble like Humpty Dumpty, I expect to see them rise briskly into year end, and keep on marching higher through every barrier and way-new highs by spring. Time to buy, not to quake in your booties. 'Twas a wild ride this week. Silver and gold decided to spend a bit more time building a springboard, platinum and palladium edged up, stocks hit the greased skids, and the US dollar index held on above 81 and even gained some. The simple recitation of the US dollar index' close at 81.194, up 14.3 basis points doesn't even come close to depicting today's performance. The Dollar index in fact smashed 81.20 resistance today which had bound it all week long. High today was 81.455. The wave up from yesterday's 81.95 low looks impulsive to me, which says that the dollar has embarked on a rally. It may be slower than a kid going for a whipping, but rally it will. To losses Wednesday and Thursday totalling 2.14% the yen today added another 0.22% loss and closed at 122.77c/Y100. Looking at those two gigantic gaps -- no, tears -- in the chart leaves not much doubt the Japanese Nice Government Men pulled the plug not only by their public pronouncements (everything every politician says about currencies is planned and vetted) but also by covert market sales. Mercy! I have a suspicious nature. Y'all remember the euro? That scabrous Franken-currency cobbled together to force centralization and control on the European member states? Well it's sicker'n a dog eating strychnined steak. Fell today 0.28% to $1.2743, and the best thing you can say for it is that it hasn't hit $1.2000 again lately. But y'all hang around. More skeletons and half-rotten corpses will fall out of more Euro-closets bringing more bad surprises. Stay away from euros. Currencies: US$1=Y81.33=E0.7847=0.03090 oz silver = 0.00058 oz gold. Picture in your mind Iguaçu or Niagara or Victoria Falls, and you'll have a pretty tight grasp on stocks' course the last two weeks. "Collapse" doesn't quite bear the burden of description, but comes nigh. From 13,661 to 12,588.31, almost 8%. Today, though, stocks enjoyed an up-day. Dow gained 45.93 (0.37%) to 12,588.31. S&P500 gained 6.55 (0.48%) to 1,359.88. With few exceptions stocks have been falling since early October in a classic impulsive downleg. They crashed through their 20, 50, and then 200 day moving averages, and now the 20, having fallen already below the 50, is fixing to smash through the 200. The phrase, "Dead man walking" comes to mind. After this much plunging you'd think, "Surely, surely, some little rally must come." You'd look in vain until now. This downleg could have ended yesterday, so the Dow ought to rally, maybe as high as the 200 DMA (12,992). Down below, well, there's not much support until 12,450. Then comes the last really big low in June at 12,035. Think with me a moment not about Monday or next week or next month, or even next year. Think rather about the next five or ten years. Picture stocks eroding down in gigantic, long-lived dives, then pitifully seeking to rally for months and months, only to be slapped down again. That's a bear market, a primary downtrend. That is what you are watching. That is what you will see unfold. That is why I keep telling y'all to SELL stocks and put the proceeds into silver and gold. But then, y'all all know I'm just a natural born fool from Tennessee living WAAAAY out on the edge of the bell-shaped curve, and it ain't nothing but a coincidence that all the time I've been warning y'all about stocks since 2000 they really have been dangerous. Don't listen to me. Shoot, y'all listen to me and I'm liable to convince you silver gold really are money and that green paper is just a con-game. Where'd y'all be then? Why, un-American! On this black and ever-to-be-mourned day in 1914 the Federal Reserve system formally opened. It's been sucking the lifeblood out of us ever since. SPECIAL OFFER: US GOLD and US MORGAN DOLLARS Pay close attention, because y'all won't see this ever again. I am cleaning out my inventory and have a few US $20 Liberty gold coins (before 1908), a few pre-1905 Morgan silver dollars, and a very few modern US $10 commemorative golds. Prices are based on gold spot at $1,714.30 and silver spot at $32.361. All lots are sold subject to the special conditions below, no exceptions. Lot # 1. Three (3) US $20 gold pieces pre-1908 Liberty type. Although I believe these coins are much better than VG (Very Good) grade, I am selling them at that. Some have a little dirt on them, but I do not clean coins and do not recommend cleaning them. Dirt only shows they are unashamedly genuine. Sold as is, at a six percent premium (6%) over the value of the 0.9675 gold content ($20 golds do NOT contain one ounce of gold). I am not selling these as collector's (numismatic) coins but as bullion coins, as is, no picky-picky. I am selling you exactly what I would buy and hold myself. Next grade up (Extremely Fine) costs $1,845 at wholesale, so these are a ridiculous bargain. One lot is three coins each at $1,758.00 for a total of $5,274.00 + $25 shipping or a grand total of $5,299.00. I have only seven lots, and cannot re-order at these prices. Lot # 2. I have a few VG or better pre-1905 Morgan silver dollars. Each contains 0.765 troy ounce fine silver. Wholesale on these coins today is $32.50, and I am selling those I have for $34 each. I have only TWO (2) lots of Sixty (60) coins each at $34 for a total of $2,040 plus $25 shipping or a grand total of $2,065. Lot # 3. I have Twenty-eight (28) more pre-1905 VG or better Morgan silver dollars at $34 each, PLUS Three (3) each modern (after 1980) US $10 gold commemoratives containing 0.48375 troy ounce of gold. I'll sell those at 3.5% over their gold melt value. I have one lot only of 28 ea pre-1905 VG+ Morgan dollars @ $34/ea. PLUS Three (3) each US $10 gold commems at $858.30 for a total of $3,526.90 plus $25 shipping, a grand total of $3,551.90. Special Conditions: If I have miscounted my inventory and come up short, the LAST person to order will receive fewer coins, at a price reduced to reflect the smaller quantity. First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. We will not take orders for less than the minimums shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. If you want faster shipping, please send a wire (wire instructions will appear on your trade confirmation). ORDERING INSTRUCTIONS: 1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Your email must include your complete name, address, and phone number. We cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. Repeat, you must include your complete name, address, and phone number. Our clairvoyant quit without warning last week and we can no longer read your mind. 2. Orders are on a first-come, first-served basis until supply is exhausted. 3. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail. 4. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 5. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. 6. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. 7. Mention goldprice.org in your email. Y'all enjoy your weekend. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

| Guest Post: Ceilings, Cliffs And TAG - 3 Immediate Risks Posted: 16 Nov 2012 05:14 PM PST Via Lance Roberts of Street Talk Live, |

| Guest Post: Very Few People Understand This Trend... Posted: 16 Nov 2012 03:40 PM PST Submitted by Simon Black of Sovereign Man blog, There are only a few people who get it: the era of cheap food is over. Then there's bonehead government policy decisions to contend with... like converting valuable grains into inefficient biofuel for automobiles. Paying farmers to NOT plant. Banning exports. Etc. Of course, the most destructive is monetary policy. The unmitigated expansion of the money supply has led to substantial inflation of agriculture commodities prices. These fundamentals overwhelmingly point to a simple trend: food prices will continue rising. And that's the best case. The worst case is severe shortages. This is a trend that thinking, creative people ought to be aware of and do something about. One solution is to buying farmland overseas. It provides an excellent hedge against inflation, plus it's one of the best (and most private) ways to move money abroad, out of the jurisdiction of your home government. In a way, overseas farmland is like storing gold abroad. But unlike gold, it produces a yield, ensures that you have a steady food supply, and even provides a place to stay in case you ever need to leave your home country. So where are the best places to buy? After travel to over 100 countries, looking at more properties than I can count, and investing in quite a few of them, I've come up with a few top picks that meet the following criteria:

Believe it or not, these simple requirements eliminate most of the world. Much of central and Eastern Europe is too politically risky. Western Europe and the US tend to be cost prohibitive. Most of Asia disallows foreign ownership of farmland. Etc. But there are still several places that remain. I'll share two of them:

|

| What Marc Faber Said to the LBMA About Gold Posted: 16 Nov 2012 03:40 PM PST The ANNUAL CONFERENCE of the London Bullion Market Association always includes great presentations from the biggest players in gold and silver, writes Adrian Ash at BullionVault. Being in Hong Kong this year, the world's premier event for the bullion industry also got lots of great insights from genuine Asian insiders – ICBC, Kotak Mahindra, the People's Bank of China no less. "When the People's Bank speaks it pays to listen," as Tom Kendall of Credit Suisse put it in his conference summary. "Especially when it talks about gold." But the star of the show, at least by popular vote at Tuesday's close, was Swiss ex-pat and long-time Asian resident, Marc Faber. [source] |

| Posted: 16 Nov 2012 03:21 PM PST |

| Will speedy new chips and smaller margins spell doom for the currency's core users? Posted: 16 Nov 2012 03:05 PM PST Miner problem: big changes are coming for Bitcoin's working class Bitcoin has been described as cash for the internet, but gold is a more appropriate analogy. Anyone can "mine" Bitcoins on their own computers by running a program that's designed … Continue reading |

| Stocks End Green; AAPL Volume Obscene; Treasury/FX Volatility Unseen Posted: 16 Nov 2012 02:25 PM PST Equities closed the day-session near the highs of the day as OPEX shenanigans were evident everywhere. Early and ugly macro data was swept under the proverbial carpet (as it is transitory Sandy effects?), the ubiquitous European-close trend reversal started us higher, and then platitudes from D.C., and a late-day Fed-Head jawbone did the rest on a day when AAPL saw its largest volume in 8 months and pinned between 520 and 530 VWAPs. Risk assets did not follow the path of most exuberance that stocks did on the day (surprise). Credit tracked with stocks today in general but remains an underperformer on the week. Oil was the week's big beta winner with the USD (despite underlying dispersion in EUR and JPY) and Treasuries rather dull. Gold sagged but by the close today the S&P 500 had recoupled with the barbarous relic on a beta basis. VIX compressed (exciting some that are incapable of comprehending a term structure) as put overlays were unwound into OPEX (and given the VWAP/volume moves it would seem AAPL saw hedges taken down and exposure reduced). Red week as stocks continue to catch down to bond's new normal.

Equities surged away and retraced and then surged away agin into the close relative to a much more subdued road risk market...

but on the week Gold and stocks recoupled (again), Treasury yields and the USD recoupled (and were quiet), as Oil surged...

but the USD ended the week up a mere 0.2% (with JPY down 2.25%) amid very low realized vol...

AAPL was a major driver today (as always) with huge flows in stocks and options (impacting index price and vol)... evidently the algos were in charge as yesterday's VWAP and today's kept us pinned around $525 for OPEX...

and here is today's implied vol move for AAPL - this is put implied vol collapsing as overlays are unwound into the close (and theta effects obviously from OPEX). Notably unlike in the index - where vol positions were rolled and we saw outer dates rise - AAPL's longer-dated vols did not rise which somewhat confirms our suspicion (given the skews) that the world and his pet giraffe eric loaded up on puts on the way down to protect their overweight positions and then used today (see volume above) to unwind hedges and reduce size in the underlying...

AAPL is now underperforming broad equity indices from the mid-May lows of the year...

but remains a big winner from the start of the year (for now)...

Year-to-date, Gold and Silver remain the winners and the US long bond has now overtaken European stocks once again... +5% YTD.

Charts: Bloomberg and Capital Context

Bonus Chart: Commodities look like they went full-retard this week - with a US-open-to-EU-close cardiac arest every day... margin-calls anyone? |

| Posted: 16 Nov 2012 02:14 PM PST Adam Hamilton November 16, 2012 2788 Words With the US stock markets falling sharply since the elections, shell-shocked investors are scrambling for the exits. And this mass exodus is certainly rational in light of 2013's record tax hikes looming for American investors. But with interest rates near record lows, cash yields nothing and bonds are hyper-risky. So a fantastic alternative for capital is the precious metals, which are very cheap technically. For many contrarians, the investment potential of precious metals is blindingly obvious. Over the past decade or so, gold and silver have rocketed 638% and 1105% higher at best! But despite these stupendous gains, investment in precious metals remains low. The financial establishment has long discouraged investors from buying gold and silver, as they don't generate all kinds of fees like stocks. This chronic underin... |

| Gold and Silver Disaggregated COT Report (DCOT) for November 16 Posted: 16 Nov 2012 02:14 PM PST HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below. More... In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday (by 18:00 ET). |

| Gold and Silver Bullish Technicals Posted: 16 Nov 2012 02:07 PM PST With the US stock markets falling sharply since the elections, shell-shocked investors are scrambling for the exits. And this mass exodus is certainly rational in light of 2013’s record tax hikes looming for American investors. But with interest rates near record lows, cash yields nothing and bonds are hyper-risky. So a fantastic alternative for capital is the precious metals, which are very cheap technically. |

| High Gold Prices Push Many Indians to Silver for Diwali Posted: 16 Nov 2012 02:07 PM PST |

| Gold Daily and Silver Weekly Charts - Trading Places, Gilded Rage Posted: 16 Nov 2012 02:05 PM PST |

| COT Gold, Silver and US Dollar Index Report - November 16, 2012 Posted: 16 Nov 2012 01:35 PM PST |

| Posted: 16 Nov 2012 01:32 PM PST When too many investors are rushing for the doors at once and everyone is looking down, it usually marks a turning point for a market that has been dropping pretty quickly. The precious metals and mining stocks have been in a sharp decline since September 21 for the miners per the HUI and since early October for gold and silver. This week I've witnessed several seasoned metals and mining stock investors capitulate and either exit their positions completely or put on hedges. The time to put on a hedge was a 3-4 weeks ago. Although this isn't necessarily the absolute bottom, the probabilities are that - barring some unforeseen exogenous event that hammers all the markets - we've seen 80-90% of the downside movement. Brief interruption here. I've been saying for weeks now that Capitol Hill would figure out a way to avoid the Fiscal Cliff by kicking it down the road. It turns out that the can is sitting in front of the White House and Obama's leg is in a backswing: http://www.zerohedge.com/news/2012-11-16/fiscal-cliff-can-about-be-kicked-2013 This means more debt, more printing and higher prices for gold and silver... At any rate, with regard to the current price correction in gold and silver and hammering of the mining stocks, I'm not saying we've bottomed, but I will go on record saying that the worst is over based on indicators I've observed over the last 11 years in this market. I'm cutting and pasting some comments that I sent earlier to Bill "Midas" Murphy at www.LemetropoleCafe.com: The most significant indicator is the number of seasoned and unseasoned metals market participants who have either bailed on their positions or put on fear hedges. Just yesterday a long time silver futures trader I know, who recently began trading the mining stocks and who goes by fairly sophisticated technical signals, announced she had bailed on her stock positions on Wed. Another fellow I know announced that he had hedged his bullion with puts on GLD. Quite frankly, I can see getting scared out of the miners, but it's clearly late in the game to be buying puts on gold and he clearly does not have the access to information which shows that India has been buying gold in the low 1700's and China buys hard anytime gold below $1700, thereby putting a floor under the gold market (we pay a lot of money for this particular research). If you are going to hedge positions, you need to do it BEFORE the top is in, otherwise the drop happens so quickly you miss at least half the move before you capitulate and hedge near the bottom - been there, done that. Finally, I'm getting several comments on my blog of newer gold market players who are pissed off, taking shots at guys like Embry and Turk and dumping their positions. This is usually a perfect indicator that a bottom is near. I usually don't post most of these comments because they are abusive and profanity-laced, but if you're curious at a sampling, I posted one from last night along with my response. I also sent Bill this: Part of the action this week in metals has been influenced by it being the "roll" period, when the front month longs either have to sell, take delivery or roll to the next front-month. Usually during the roll period the open interest declines and the cartel uses this as an opportunity to hit the market. Yesterday, however, was different. Yesterday was an unusually large roll from Dec gold to Feb gold, 17,212 dropped from Dec but 17,281 added to Feb. In addition, another 1,330 added to June gold. A big drop from the front month accompanied by an outright increase is rare - beyond my recollection when the drop from the current front month is this large. Same deal in silver. 4,268 silver carts dropped from Dec and 5,386 added to March, silver's next front month. The silver o/i increased to 1,263. The open interest in silver is 145k. As Dan Norcini pointed out the other day, something different is occurring right now. Despite the big cartel-led sell-off in silver over the past 6 weeks, the silver open interest has persisted in the 140k area. Historically the o/i has been liquidated down to 100k or less in pullbacks like this. Furthermore, for those intimidated by the 140k o/i, my partner pointed out that the high in open interest since we've been keeping track of it - going back to around 2003, was 189,151 back on 2/19/2008 with silver at $17.53. That leaves a lot of room for the specs to add longs and drive the price a lot higher. So before anyone gets worried about what seems to be high open interest in silver and that big COT liquidation run is coming, they better examine the facts. I really get sick and tired of all of the misinformation between tossed around, especially by gold/silver site aggregators, bloggers and blog commenters. As I said earlier, I'm not officially saying this pullback is over, but it sure is starting to smell like it could be... As always, the market is governed to a large degree by random probabilities. Measuring the past is a function of math - a science. But taking those results and projecting them forward is where the "art" of money management and market speculation takes place. Based on past market behavior and the probabilities associated with those behaviors, I would bet that the risk of getting short/hedged right now and missing a big upside move is greater than the risk of the bottom "falling out" from here. Have a great weekend! |

| Marc Faber, Gold and a Special Picture of Ben Bernanke Posted: 16 Nov 2012 01:26 PM PST |

| KWN - Special Friday Gold ‘Chart Mania’ Posted: 16 Nov 2012 12:49 PM PST  With the wild action in gold and silver, top Citi analyst Tom Fitzpatrick put together a 'Gold Chartapalooza' where he laid out the roadmap for gold going forward. Fitzpatrick also explains what gold will trade like in a bear market in stocks. There are a series of fascinating gold charts in this piece. Below is his piece and the KWN Special Friday Gold 'Chart Mania.' With the wild action in gold and silver, top Citi analyst Tom Fitzpatrick put together a 'Gold Chartapalooza' where he laid out the roadmap for gold going forward. Fitzpatrick also explains what gold will trade like in a bear market in stocks. There are a series of fascinating gold charts in this piece. Below is his piece and the KWN Special Friday Gold 'Chart Mania.' This posting includes an audio/video/photo media file: Download Now |

| Gold Investment: The Top 5 Slides from LBMA 2012 Posted: 16 Nov 2012 11:54 AM PST The five most important slides from this year's London Bullion Market Association conference... |

| As the Election Results Sink In, Economic Realities Become Clearer Posted: 16 Nov 2012 11:53 AM PST Synopsis: Taxes, credit cards, and the "silver lining" to Obama's re-election. Dear Reader, Vedran Vuk here, filling in for David Galland. I'm prefacing today's issue with a slight warning. Since the fiscal cliff is center stage, it's hard to keep discussions of this issue completely nonpolitical. With Washington politics driving the economy downward at the moment, politics are unfortunately an inescapable topic. However, I just want you to know that I'm not a fan of either party. In this last election, I wrote in "Ron Paul," refusing to vote for the other "options." If someone held a gun to my head, would I have voted Obama or Romney? Well, I'd likely karate chop the assailant's arm to disarm him and then would have thrown him over my shoulder. However, if his grip was pretty strong, I'd likely go for Obama, but it would be a tough choice. And with 20/20 hindsight knowing what happened to the market after Obama's election,... |

| Gold Supported by Rockets in Israel Posted: 16 Nov 2012 11:53 AM PST [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Gold continues to hold above support (see the earlier post from yesterday) as rockets flying in Israel and explosions are not something that even the most stalwart gold bear wants to deal with, especially over a long weekend during which anything could happen. If we come into trading in Asia on Sunday evening here, and we have a further escalation over in the mid-East, gold will continue to attract buying. If we see tensions fade, then gold will likely move lower. The mining shares appear to have finally attracted some decent buying after being beaten to a bloody pulp for most of this week. The divergence between the shares and the price of the metal continues however so perhaps we will see a closing of the gap with the shares moving higher and gold either holding stable or drifting somewhat lower. It is difficult to say which right now but the gap will be closed. ... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Florida Avenue is the main drag in our little town in central Florida. In less than a mile, you're likely to see three or four folks standing on the sidewalk wearing headphones, bopping to music, and waving big glittery signs or arrows with "We Buy Gold" written across them. It's a common sight across many cities today.

Florida Avenue is the main drag in our little town in central Florida. In less than a mile, you're likely to see three or four folks standing on the sidewalk wearing headphones, bopping to music, and waving big glittery signs or arrows with "We Buy Gold" written across them. It's a common sight across many cities today.

No comments:

Post a Comment