saveyourassetsfirst3 |

- By the Numbers for the Week Ending October 26

- Gold and Silver Disaggregated COT Report (DCOT) for October 26

- Dividends – How to Combine Reliable Income and Capital Gains

- Take a Tour of a South African Gold Mine!

- Complexity is Not Sophistication

- 6 Ways To Get Your Dividends In Gold And Silver Bullion

- A Light on the Future for Investors

- Profiting from Silver Mining in the Age of Resource Nationalism: Sean Rakhimov

- Silver Futures – Concentration, Confidence & COT

- Links 10/26/12

- Rentier CEOs Advocate Austerity for America

| By the Numbers for the Week Ending October 26 Posted: 26 Oct 2012 09:50 PM PDT |

| Gold and Silver Disaggregated COT Report (DCOT) for October 26 Posted: 26 Oct 2012 09:46 PM PDT NEW ORLEANS -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below. In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by sometime on Monday, October 29 – almost certainly by 18:00 ET.

|

| Dividends – How to Combine Reliable Income and Capital Gains Posted: 26 Oct 2012 04:00 PM PDT Stock markets have stabilised over the last few days after a couple of big drops on Wall Street. America's earnings season is turning into a disappointment. We're not sure what that means, because you can only be disappointed in something you don't expect to be so bad. The real question is what you expected in the first place. The same goes for your portfolio's performance. Some people would look at the stock market and say 'whoopee, my shares are up 100% since the lows of 2009'. Others would be disappointed their shares aren't worth more than they were seven years ago. If you're sick of the way your results can be spun any way your financial advisor and broker like, we've got an alternative for you below. But first, what's our perspective on where you stand with your shares? Yesterday we showed Greg Canavan our chart of America's sideways moving stock market.

|

| Take a Tour of a South African Gold Mine! Posted: 26 Oct 2012 04:00 PM PDT Last week I was over 1,000 feet underground at the Modder East gold mine, near Johannesburg, South Africa. Actually, for as "cool" as the visit was, the mine was kind of warm. After a couple hours walking - and at times crawling - underground, my T-shirt was soaked with sweat. I skipped the hotel gym that day. The Modder East mine is one of the newest gold mines in South Africa. In May 2006, the site was a wheat field. By late 2009, the shafts were sunk, equipment was installed and operators pulled the first gold out of the ground. By mid-2010 the mine was cash-flow positive. Easy, right? No. Not at all. No way! There are innumerable angles to this story. For now, I'll just say that despite what I told you in the last paragraph, it's hard - and I mean REALLY hard - to mine gold. You've got to see it to believe it. Do you want to see real, deep, hard-rock, gold-chasing mining? First, you suit up in safety clothing - Nomex overalls with lots of reflective patches and rubberized, steel-toed boots. Then you strap on about 25 pounds of other safety gear - headlamp, battery (one size - like a brick!), emergency breathing pack (one size - bulky) and more. Suitably garbed in battle rattle, you go down an elevator shaft to the first level. The nonstop ride down takes you about as deep as the Empire State Building is high. At Modder East, you then travel through a long, dark, wet, rocky tunnel about 12 feet wide by 15 feet high. Eventually, you get to what are called "side panels," where eight-men (and a few women) teams of miners chase "gold reefs" far into the crust of the earth. Using water-powered tools, they drill holes into the rock. Then a guy called the "blaster" comes along and emplaces charges. Twice a day, the earth shakes with energy from explosions. After blasting is over, a few brave souls go in to check rock stability. Later, after the all-clear signal, miners move in to haul out the debris. At Modder East, the pay zone is called the "Buckshot Reef." It's a quartz pebble conglomerate heavily infused with gold-laced pyrite. The Buckshot Reef ore zone is about 8-12 inches thick, at best. Sure, it's rich in gold - around 40 grams per tonne (g/T). But you can't just mine a 1-foot seam. There's no technology for that. You have to remove a lot of rock - mostly below the ore zone, just to get the pay dirt out. But you can't dig out too much barren rock, because you're paying for every hunk that you break up and move out. It's all about cost per tonne. Thus, this kind of mining involves digging relatively thin "panels" out from the side of the large main tunnel. How thick are the side panels? Well, just to get things started, there's a very tight, perpendicular, man-sized hole where the driller stands. This more or less perpendicular hole strikes out from the main tunnel. And off that hole, miners dig out into the ore zone, creating an opening about 4 feet high. All along, the miners have to support the roof with thick timbers. During the mining and clearing process, large chunks of Buckshot ore (gold-infused pyrite) go straight into the mine carts, to be hauled to the surface. But after that, there's a lot of fine detritus as well - it's the remnant debris of the blasting-mining process. This detritus is sandy, gritty stuff, but it's also where a lot of fine gold settles out. That is, gold is much heavier than the rest of the minerals in the Buckshot pebble conglomerate. So gold tends to concentrate down toward the bottom of the sandy material - kind of like panning for gold in a stream. Miners have to get down on hands and knees and literally shovel the fine stuff sideways for collection. Still, it's worth the effort because that gray sand is among the most valuable ore in the mine. It's chock-full of gold (microscopic, to be sure). So by the time the side panel is cleaned out, the bottom surface has literally been swept with a broom, to get every grain and fraction of a gram. Then the ore goes topside for crushing, separation and concentration. Modder East has no set schedule for final refining and pouring gold, because they don't want to make it easy for anyone to plan a heist. Still, it's accurate to say that about once every week or so, they pour gold. Then the yellow metal is promptly picked up by a helicopter and transported to South Africa's Rand Refinery for final treatment. That's where the gold bars, ingots, Krugerrands and such come from. Safety UndergroundAs a new mine, Modder East incorporates every form of advanced safety feature. From what I could discern, the mine owners spared no expense in designing safety into the system from the beginning -- starting with a mine manager who embodies safety as an ethic and value. For example, in terms of mine design, all human access is via dedicated elevators. And all ore is removed via separate access tunnels. Thus there's much less likelihood of someone getting run over by a hauling truck in a dark tunnel. In terms of operations, and for a variety of reasons that I won't lay out in detail, the water-powered (hydraulic) equipment tends to be safer than pneumatic or electrical equipment. On the human factors side of things, Modder East fosters a culture of safety, with an unstinting management focus on safe operations. At the heart of things, the entire pay and incentive system is designed around safe mining, versus a "hurry up" approach that leads to people cutting corners. Indeed, this particular pay scheme has become a model for deep mining across South Africa. Topside, there's a full-time doctor (a real MD) on site. The doc deals with every manner of medical issue - from worksite injuries to ailments like the flu or a skin rash. The idea is to instil a sense of medical respect - related to respect for safety - within the entire workforce. There's much more to say, but time constrains me just now. I'll end by noting that the next time you want to bellyache about your job, consider coming to South Africa and trading places with some of these shovel-swinging miners for a couple of days. You want hard, hot, sweaty physical labor? Where you're stooped over for hours at a time, swinging a shovel full of heavy rock and grit? Hey, there ain't no whining and crying in the mines, OK? Regards, Byron King for The Daily Reckoning Australia From the Archives... China's GDP Growth Ponzi Scheme An Australian Property Boom and Bust all at Once The Fed's New Stooge Discordian Religious Advice for the Investor Electric Cars and Platinum Mines

|

| Complexity is Not Sophistication Posted: 26 Oct 2012 03:50 PM PDT

- Niklaus Wirth, designer of the Pascal programming language JS Comment: Master practitioners, who wrestle with complexity on a regular basis, understand that the goal is always to strip away ambiguity — to reduce complexity, and amplify clarity, to as great a degree as possible. In keeping with this, all true masters of their craft speak plainly. Bruce Lee, in echo of Wirth, extols simplicity as the "ultimate sophistication." Richard Feynman, one of the greatest physicists of the 20th century, has said if you can't explain it to a six-year-old, you don't really understand it. E.O. Wilson, the founder of sociobiology, writes so clearly his prose is like pinging a crystal glass. And in the trading and investing world, there are multiple examples of crystal clear communication: The annual Berkshire Hathaway and Baupost letters… the Schwager and Drobny interviews… the Howard Marks memos… and so on. Those who practice "mumblespeak," on the other hand, or otherwise hide behind a wall of esoteric jargon, should immediately raise doubts. What are they trying to hide? Who are they trying to fool? Suggestion — if you haven't read it, check out "Consilience" by E.O. Wilson. A mind-blowing book in its own right, Consilience is the gold standard, or perhaps the platinum standard, for transparent writing.  p.p.s. Sign up for our Hedge Fund Regulatory Alerts! p.p.s. follow us on Stocktwits & Twitter! @MercenaryJack and @MercenaryMike |

| 6 Ways To Get Your Dividends In Gold And Silver Bullion Posted: 26 Oct 2012 03:21 PM PDT By CommodityHQ: By Jared Cummans Investing for income has become a popular strategy in recent years, as low rate environments and paltry yields have made a steady stream of income a coveted luxury. Similarly, investing in gold and silver has been surging in popularity as the years have gone on. Investors worried about inflation and a weakening economy have flocked to these precious metals in order to protect their portfolios. But what many investors do not know is that they can combine these two worlds. By owning certain mining firms, investors can actually get their dividend payouts in the form of silver and gold bullion -- an ideal situation for many investors. Below, we list several mining stocks and how much you would need to own to receive bullion as a payout (assuming gold prices of $1,717/oz and silver at $32.1/oz).

Complete Story » |

| A Light on the Future for Investors Posted: 26 Oct 2012 01:41 PM PDT "The challenge for Ben Bernanke and the Fed governors since the 2008 bailouts has been how to deal with the backlog of fraud – not just fraudulent mortgages and fraudulent mortgage securities but the derivatives piled on top and the politics of who owns them, such as sovereign nations with nuclear arsenals, and how they feel about taking massive losses on AAA paper purchased in good faith. "On one hand, you could let them all default. The problem is the criminal liabilities would drive the global and national leadership into factionalism that could turn violent, not to mention what such defaults would do to liquidity in the financial system. Then there is the fact that a great deal of the fraudulent paper has been purchased by pension funds. So the mark down would hit the retirement savings of the people who have now also lost their homes or equity in their homes. The politics of this in an election year are terrifying for the Administration to contemplate. "So, it looks like the Fed decision last week to buy $40 billion a month in mortgage paper is the ultimate plan to clear the market once and for all of fraudulent mortgages, mortgage backed securities, and related derivatives. This means Fannie and Freddie will be bailed out and winding down through the back door. This means the big banks may be paid in full for your mortgage. It also means your pension fund assets will not be marked to market – at the price of debasing the purchasing power of your assets and benefits. "The Fed is now where mortgages go to die. …As this happens, trillions of dollars that have been amassed offshore will be free to come back into the US to buy up and reposition land, farmland, residential, and commercial real estate and other tangibles. With documents shredded, criminal liabilities extinguished, and financial institutions made whole, funds can return without fear of seizure. "QE3 proves beyond any shadow of a doubt that the extent of the fraud was as bad as I said it was. You can count up the bailouts. The QE1, QE2, QE3 the numbers speak for themselves. The fraud was indeed in the many trillions of dollars. It was intentional. It was a plan." "QE3 – Pay Attention If You Are in the Real Estate Market" Catherine Austin Fitts, solari.com, 9/17/2012 Critical recent Developments reveal likely future ones important to Investors; that is, they shed a Light on the Future. The recently announced U.S. Attorneys civil suit against Countrywide/Bank of America alleging Fraud lends credibility to Ms. Fitts claims which were written before the suit was announced. And the Civil Suits against the Mega-Banks for rigging LIBOR lend credibility to her claims as well. But what is important to note also is the inconsistency, once again, between The Fed's public justification for QE3 – to help the Economy and Reduce Unemployment – and The Reality. If The Fed's Disinformation were not about so serious a matter, it would be almost as laughable as Mario Draghi's comment that the Central Banks' QE was not inflationary, because, he claims, the threat to the Economy is Deflation not Inflation. In fact the repeated QE's have done next to nothing for the Real Economy, and increasingly have provided decreasing boosts for Wall Street Financial Assets. But, they are already increasing Real inflation which is already 9.64% in the U.S. for example. (Note 3) That is, "the debasing of the purchasing power of your assets and benefits" will be the Reality going forward. As to where the QE and related Central Bank actions are leading, billionaire investor Frank Giustra, has given us an excellent summary as related by Matt Badiali. "Giustra is a giant in the resource world. A noted philanthropist, he is the founder of a major Canadian venture capital provider for mining stocks, Yorkton Securities... gold producer Goldcorp... gold and precious metals producer Wheaton River... and independent film producer Lionsgate Studios. "In his talk, Giustra said that with QE3, the Fed "crossed the Rubicon." In other words, there is no turning back from this money-printing strategy. He believes it's the end of the U.S. dollar, and that it marks the start of one of the largest transfers of wealth in history. "In his view, the Fed is now boxed in on three sides... by excess liquidity, artificially low borrowing rates for the federal government, and its own balance sheet. "All the money printing will add too many dollars into the system. And the only way to rid the world of that excess liquidity is to raise interest rates, which will kill any economic rally. "The federal government allows itself to borrow money at rates far lower than anyone would actually lend money to them. That means if the rates are allowed to float normally, they will soar. And if the government has to pay interest at those high rates, it won't be able to pay off its debt. "The Federal Reserve's own balance sheet is leveraged 51-to-1 with long-dated, illiquid securities. In other words, for every $1 it holds, it has borrowed $51. That debt won't trade at face value, so it can't be easily sold. And it's sensitive to rising interest rates. If rates rise, that debt becomes much less valuable... and the Federal Reserve could be insolvent. "According to Giustra, the government will not be able to pay off its debt. It's only choice is to keep printing money... And that, he says, will lead to a hyperinflation event. "Giustra says the only reason we aren't seeing inflation now is due to the "speed of money." According to Giustra, money is not moving right now. No one is lending, no one is investing... so the speed of money is incredibly slow. And that's why we haven't seen a massive inflation yet. "His guidance for investors is to stay away from the dollar... and buy commodities. In his interview at the conference, Giustra cited a study of the 1970s inflation that showed the four best-performing asset classes from that period...

"When pressed about his own investments, he said his No. 1 is gold. It's his largest position and will remain so until this cycle ends." (emphasis added) Matt Badiali, S&A Junior Resource Trader, 10/22/2012 Giusta is mainly correct, and especially regarding the probability of a "Hyperinflation Event," a point which we have been making for many months now. Giusta's inference "stay away from the dollar" is also correct. And we also agree that the best performing asset classes going forward are likely to be the precious metals and agriculture. (Regarding our specific Recommendations see Notes 1 and 2.) But we doubt Rare Art will perform as well as in past Inflations. Indeed, bad news for holders of U.S. Dollar Denominated Assets is that Major Economic Players are already moving away from the $US as World's Reserve Currency. China, for example, has made deals with several other countries that transactions will be made in renminbi. And some countries are already rejecting the $US entirely for certain transactions. Both DBS Bank in Economic Powerhouse Singapore and Nordea Bank in Sweden, for example, both recently refused to comply with the Swaps Registration provisions of the USA's Foreign Account Tax Compliance Act. These developments hasten the move away from the $US as the World's Reserve Currency. Investors take note. As well, going forward Investors will have to continue to contend with Bogus Official Statistics (see the Real Numbers for the U.S. below in Note 3 per shadowstats.com) and with Cartel Precious Metals Price Suppression Attempts (see Note 4). So in addition to hyperinflation and a dramatic reduction in the Purchasing Power of the U.S. Dollar and Bogus Official Statistics and Precious Metals Price Suppression attempts, Investors have one more Reality to Face. Major Sovereign nations not only cannot pay their debt (likely including the U.S., U.K. and France), but some likely cannot even play interest on that debt, under any reasonable assumption about economic growth or lack thereof. Money Printing is only a flawed "Solution" because it is leading to Hyperinflation. The other is partial or total Debt Repudiation, following the example of Iceland. Consider: "While regional independence is superior to both the failing European Union and the façade of special interest controlled democracy, one further action should taken by any jurisdictions that choose secession: Newly restored sovereign nations should repudiate their share of the illegitimate sovereign debt when they exit existing unions and nation-states. Created by distant banking elites buying national politicians and parliaments to load up on sovereign debts that can never be paid off, this massive national debt load is illegitimate and destructive to existing and new national economies. "The first nations to repudiate sovereign debt will have the advantage; this is why restored nations should repudiate these debts and not burden their new national economy and citizens with this junk debt. In addition, these nations should repudiate their existing politicians and representatives, controlled by the financial elites who supported the debt accumulation; because once independence is restored there is nothing to stop politicians on the take from doing the same thing again. "Although the establishment press issues many negative news accounts about secession fever sweeping Europe, I believe this is actually a positive political development and possibly the only solution to the sovereign debt crisis. For instance: "The Return of the Venetian Republic? "Catalonia Secession From Spain "Bavaria Interested in Secession "Europe's Richer Regions Want Out "Secessionist Wave Sweeps Belgium "Flanders Wants Out of Belgium "Scotland Seals Terms of Historic Independence Vote "Some Want Out of the USA "Vermont Independence "It is time for the restoration of formerly independent countries, each with their own unique cultural and ethnic heritage, that were forced at gunpoint into larger empire states. My recommendation is to leave most of the illegitimate sovereign debt behind when they go. "Venice wants out of Italy, Catalonia out of Spain, Bavaria out of Germany, Scotland and Wales want to leave the United Kingdom, the Flemish want out of Belgium. Even Vermont and some in the South want to regain their former status as sovereign republics separate from the most debt-ridden empire in world history, the United States. "Just as important, Greece, Italy, Ireland, Spain and Portugal – and there are even demands in Germany itself – want to leave the EU and euro witches' brew created by their leaders. After all, the EU is a failure and these member nations may have to leave the European Union and restore their national currencies in order to grow their economies once again. "The Necessity of Sovereign Debt Repudiation "Once austerity measures and tax increases have bankrupted most of the private sector and the current sovereign debt crisis reaches critical mass, then every nation will repudiate most of its debts as well as renege on promised health and social benefits. Newly sovereign nations can act now to position themselves with a distinct advantage when this occurs. These nations will have been able to limit austerity measures, reduce confiscatory tax increases and safeguard their citizens' private wealth by repudiating sovereign debt. If these steps are taken immediately upon independence, they should be able to avoid the majority of economic collapse caused by the coming Western sovereign debt repudiation. "Most of the countries in the West will eventually default on their sovereign debts using a war or financial crisis as the excuse. Like the Reichstag fire under Hitler, the excuse can be either a manufactured black-flag event or a policy readied in advance and implemented when the right excuse comes along." "Secession Fever Sweeping Europe" Ron Holland, thedailybell.com, 10/24/2012 So one Main Battle going forward will be over who takes the Hit – the Mega-Banks or the Taxpayer. So far, Taxpayers have been the losers, but the public anger is building and that may change. The Icelandic Model may eventually predominate. Finally, regarding Investors Deployment of the Assets, consider the recent Action of the German Government. "A German federal court has said that country's central bank should conduct annual audits and physically inspect its gold reserves worldwide, including gold in the custody of the Federal Reserve Bank of New York. In addition to the FRBNY, Bundesbank gold is stored in London, Paris and Frankfurt. "For decades, the Bundesbank has relied on written confirmation of its gold holdings in London, Paris and New York. According to the report from the German audit court, the last time Bundesbank officials physically inspected the central banks gold holdings was, well, never...." "The Germans Are Coming for Their Gold" Published: Wednesday, 24 Oct 2012 | 5:10 PM ET John Carney, Senior Editor, CNBC.com Best regards, Deepcaster October 26, 2012 Note 1: WTI Crude Oil is still bouncing just under $90/bbl even though U.S. Crude stockpiles are up over 8% from a year ago. And Gasoline has a $4 handle around most of the US. And Corn, Wheat, and Soybeans have $7, $8, and $15 handles today, and were at record highs even before the U.S. Drought. All these higher prices are mainly caused by The Force. And though our Forecast "Warning" a couple of weeks ago that a Cartel-generated Precious Metals Price Takedown was imminent, was correct, even The Cartel will not be able to prevail against The Force, for long. And while last Friday's Tech Takedown does confirm our earlier forecast that the Tech Bubble was going to burst, that bursting too is partially catalyzed by The Force. The Force is Here, Now, and it is Increasing, and it is time to profit from it. To consider The Force and how to profit from it, read Deepcaster's most recent alert, "Profit from the Force, Now; Forecasts: U.S. Dollar/Euro, U.S. T-Notes, T- Bonds, & Interest Rates, Gold, Silver, Crude Oil, & Equities" in 'Alerts Cache' at www.deepcaster.com. Note 2: The $US dropped nearly 200 basis points at one point in the last few weeks. No surprise since the Fed's U.S. Dollar-Destructive Q.E. to Infinity Action, coupled with the ECB's Similar Action boosted the Euro vis-à-vis the Dollar, as we earlier Forecast. The recent $US bounce does not change its weakening Trend. This Debauchery of the $US weakens its Purchasing Power and thus increases Burdens on the agonized disappearing Middle Class. The Bernanke claim that buying $40 billion per month in Mortgage Backed Securities would Stimulate the Economy and help the Housing Market is just a Fictitious Cover Story. In fact, it is just another Gift to the Mega-Banks who hold Underwater Paper, and to Wall Street which proceeded to rally on The Fed-sugared High. Both the Continuous Commodities Index which show Average Annual Price Inflation of 15% and the Real Inflation Number (9.64% per year from shadowstats.com) reveal Serious Inflation is with us and it is Intensifying. And Especially Food Price Inflation. To increase Yields, Farmers increasingly employ Fertilizer. Deepcaster's Reco – a Fertilizer Producer – was trading near its 52 week low at under 40¢ per share when we recommended it, and we have raised our "Buy under" price to 45¢. To see our latest Buy Reco aimed at Profiting from the Fed's Inflation Rocket, read Deepcaster's latest Alert, "Buy Reco (under 40¢/share) to Ride Inflation Rocket; Forecasts: U.S. Dollar/Euro, U.S. T-Notes, T- Bonds, & Interest Rates, Gold, Silver, Crude Oil, & Equities," just posted in 'Alerts Cache', on deepcaster.com. Note 3: *Shadowstats.com calculates Key Statistics the way they were calculated in the 1980s and 1990s before Official Data Manipulation began in earnest. Consider Bogus Official Numbers vs. Real Numbers (per Shadowstats.com) Annual U.S. Consumer Price Inflation reported October 16, 2012 1.41% / 9.64% U.S. Unemployment reported October 5, 2012 8.3% / 22.8% U.S. GDP Annual Growth/Decline reported September 27, 2012 2.21% / -2.15% U.S. M3 reported October 16, 2012 (Month of September, Y.O.Y.) No Official Report / 3.32% Note 4: We encourage those who doubt the scope and power of Overt and Covert Interventions by a Fed-led Cartel of Key Central Bankers and Favored Financial Institutions to read Deepcaster's December, 2009, Special Alert containing a summary overview of Intervention entitled "Forecasts and December, 2009 Special Alert: Profiting From The Cartel's Dark Interventions - III" and Deepcaster's July, 2010 Letter entitled "Profit from a Weakening Cartel; Buy Reco; Forecasts: Gold, Silver, Equities, Crude Oil, U.S. Dollar & U.S. T-Notes & T-Bonds" in the 'Alerts Cache' and 'Latest Letter' Cache at www.deepcaster.com. Also consider the substantial evidence collected by the Gold AntiTrust Action Committee at www.gata.org, including testimony before the CFTC, for information on precious metals price manipulation. Virtually all of the evidence for Intervention has been gleaned from publicly available records. Deepcaster's profitable recommendations displayed at www.deepcaster.com have been facilitated by attention to these "Interventionals." Attention to The Interventionals facilitated Deepcaster's recommending five short positions prior to the Fall, 2008 Market Crash all of which were subsequently liquidated profitably. |

| Profiting from Silver Mining in the Age of Resource Nationalism: Sean Rakhimov Posted: 26 Oct 2012 12:57 PM PDT TICKERS: AXR; AXU, AUN; AUNFF, CDM; CDE, DV, EXN, FR; AG; FMV, FSM; FVI; F4S, CTG; DPF, G; GG, HL, HDA, SCZ, SVM, SVL; SVLC Source: Brian Sylvester of The Gold Report (10/26/12)

Companies Mentioned : Alexco Resource Corp. : Aurcana Corporation : Coeur d'Alene Mines Corp. : Dolly Varden Silver Corp. : Excellon Resources Inc. : First Majestic Silver Corp. : Fortuna Silver Mines Inc. : Global Minerals Ltd. : Goldcorp Inc. : Hecla Mining Co. : Huldra Silver Inc. : Santacruz Silver Mining Ltd. : Silvercorp Metals Inc. : SilverCrest Mines Inc.

The Gold Report: You have written that the pace of global resource nationalism is gaining momentum, affecting the supplies and prices of many commodities. You believe resource nationalism in all of its current forms is likely to affect silver more than other metals, particularly investable silver. Would you explain why? Sean Rakhimov: The effect of resource nationalism on the physical supply market has not been significant yet, but I do think it's going to affect future supply. Large-scale projects like the Navidad in Argentina owned by Pan American Silver Corp. (PAA:TSX; PAAS:NASDAQ), the Corani and Santa Ana projects in Peru owned by Bear Creek Mining Corp. (BCM:TSX.V) and most recently the Malku Khota project in Bolivia owned by South American Silver Corp. (SAC:TSX; SOHAF:OTCBB) are already affected. Combined, these projects represent about a billion and a half ounces that were expected to be coming on-line at this time. Yet sales are nowhere on the horizon and it's largely due to the actions of the governments where these projects are located. TGR: If you had to take a guess at which one of those is least in jeopardy, which would you choose? SR: It's a bit of a toss-up between Navidad and Corani. Navidad is higher grade and would likely bring more revenue to the government of Argentina, so the government may reconsider. On the flip side, Peru is largely a mining country. Mining makes up a large part of the economy compared to Argentina. These projects are so remote that I don't necessarily buy some of the arguments and reasoning why their development has been held up. These economies need additional money. Large-scale projects such as the ones in question would generate thousands of jobs and bring hundreds of millions of dollars of investment. Logic would suggest that respective governments should soften their stance, yet Argentina is still going full tilt to the other side where it is not only tightening screws on mining but also is creating obstacles for any foreign business. TGR: Can we go back to your original thesis of how resource nationalism is going to affect investable silver? SR: Venezuela has been on that path of resource nationalism for the longest time. Ecuador is on that list as well as other countries. I think any new money coming into the sector will likely be diverted away from those countries. Look at Bolivia, for example. It has a number of operating mines, but it turned around and nationalized the exploration projects. TGR: Why did Bolivia nationalize South American Silver's silver project instead of a project that it could take over that doesn't need developing? SR: I don't have the definitive answer. Most likely it was a political decision to appease a certain constituency. In addition, the decision had a pragmatic element in that if you nationalize an operating mine, the implications in the international trade circles are further reaching and more negative. It could lead to some trade sanctions by other countries and so on. TGR: In an article entitled "Shrinking Silver Space" on SilverStrategies.com, you argue that silver investors are largely limited to Mexico, Canada, the U.S., Europe and to a lesser extent Australia. To the casual investor that seems like a fair number of choices. Isn't that enough? SR: It may be enough, but I think the underlying theme here is that perhaps it is advisable to avoid the jurisdictions we mentioned earlier. Their actions demonstrate that your money is at a greater risk if you're investing in those jurisdictions The key thing is that some monster projects located in risky jurisdictions are not coming on-line and future silver supplies are going to be affected. Silver supply growth may not be there a few years from now. Right now the supply is growing about 3% a year, but I don't see a lot of big projects coming on-line. The last big one that came on-line was Penasquito, owned by Goldcorp Inc. (G:TSX; GG:NYSE) in Mexico. And the next one is supposed to be the Escobar project in Guatemala. Lack of silver supply growth is going to be significant because the demand is increasing at a healthy pace. I liken this event in some respects to what's going to hit the uranium market at the end of this year when Russia stops its megatons to megawatts program, which would probably take away a good portion of the current uranium supply worldwide. Another event with similar implications is the mining labor unrest in South Africa. That affects the platinum and gold markets, but the major impact is squarely on the platinum market. These are major events for the sectors. TGR: Do you think the resource nationalism is going to result in a significant rise in silver prices? SR: Over time, yes. We're not going to get a billion and a half ounces of silver from the aforementioned projects in countries with unfriendly mining jurisdictions. That's one and one half years of annual worldwide supply. TGR: Do you think that we're ever going to get to what Eric Sprott is saying, that eventually silver will return to its historic 15:1 silver-to-gold price ratio? SR: I think it's in the cards at some time toward the end of the cycle, probably by the end of this decade. I don't have a more specific time frame. That's mainly because this cycle is different from a number of previous ones from recent history; this one is a worldwide crisis and we're talking about systemic problems with the global currencies. The four dominant currencies in the world—the U.S. dollar, euro, British pound and Japanese yen—are shaky. We're talking about 80% or so of the currency market. This cycle has been going on for a long time. If this were an ordinary cycle, I think things would have been played out by now. We're about 10 years into it. TGR: Is this the beginning of a seismic shift? SR: Yes, this cycle is larger and more severe by an order of magnitude, and because of that it may take longer. There's a lot more at stake and a lot more powerful forces are involved. These forces will be much more active in trying to affect the outcome or timeline of events and they have already. TGR: One of the interesting features about SilverStrategies.com is that you take some companies to task for things that you believe were not in the best interest of shareholders. One of your favorite targets is Hecla Mining Co. (HL:NYSE) and you suggest that it "successfully squandered its vast advantages over other silver companies when the current cycle began more than 10 year ago." But more recently Hecla has taken a different tack and it is borrowing its strategy essentially from a competitor and other larger companies in the precious metals space. Can you tell our readers about that? SR: Hecla used to be the household name when people thought about silver companies. But look at it today. It's trading at $1.7B market cap and probably a half dozen companies that either didn't exist or were half its size 10 years ago have outgrown it. Its management did not adjust when the boom times started, so today it doesn't have much of a growth pipeline. Take a look at its closest competitor, Coeur d'Alene Mines Corp. (CDM:TSX; CDE:NYSE). Both companies started in the Silver Valley in Idaho. Coming into the cycle both firms were established companies, roughly comparable peers. In that timeframe, Hecla didn't do much and has little to show for the last 10 years. But look at Coeur d'Alene Mines. It went into Mexico and bought Palmarejo, one of the top 10 silver-producing mines in the world. It also built mines in Bolivia and Argentina and extended its reach into Australia. Management completely reinvented the company, despite not being known as a risk-taking company or at the cutting edge of anything coming into this cycle. It was an obscure company, but it certainly handled things better in this cycle than Hecla. No wonder that today it has about $1B more in market cap than Hecla. TGR: Hecla recently took a step to possibly develop its pipeline of projects. Tell us about that. SR: Hecla recently made a strategic investment in another junior company and that was a good move. The company is Dolly Varden Silver Corp. (DV:TSX). That project is in northern British Columbia and is a high-grade underground past-producing mine. It's a small mine but underground mines usually start small and then can grow to significant size. Hecla's familiar with that. It's the company's bread and butter, underground mining. It's good to see it making adjustments to the game plan here. It may be worth noting that Hecla also made a bid for U.S. Silver Corp., which is in the Silver Valley. But it didn't happen despite Hecla offering a higher price than RX Gold & Silver Inc. (RXE:TSV.V), the company that ultimately succeeded in the bidding. Dolly Varden has promise. The paths it is pursing geologically are very similar to Eskay Creek in terms of its origins. The hope is that the company will find deposits that are similar or comparable to Eskay Creek. Now that Hecla made that cash infusion, Dolly Varden has the funds to actually do some work on the ground. TGR: Some silver producers are generating significant cash flow as silver prices hover around $32/ounce. Are there producers that you are more fond of than others? SR: One producer I'm very fond of is First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE). The company has grown throughout the cycle to become a very significant player. I think it will soon become a major in this space, certainly a growth company. It has been very aggressive in building the company. The company made a number of acquisitions and built mines, expanded them and has a very healthy pipeline of projects to grow the company and production. TGR: OK. What about another one? SR: Coeur D'Alene would fall in that camp as well, though it's a major and that's not an area where I spend a lot of time. In the smaller companies, one of the companies I like a lot is SilverCrest Mines Inc. (SVL:TSX.V; SVLC:NYSE.MKT). This is a company that I've followed for a very long time and is another company that was victimized by resource nationalism. It had a major silver project in El Salvador years back, but the government wouldn't let the company develop it. So SilverCrest came to Mexico and got back to work. Since then it made a discovery, built a mine and that mine is now in production. SilverCrest is making about $3 million (M) a month at current metal prices. TGR: Do you think that that's fully priced into the stock? SR: That may be fully priced into the stock. That's hard to call mainly because the price of the metal moves and that changes the bottom line on a weekly basis, or what the bottom line would be based on that price. TGR: Are you getting the La Joya exploration potential for free with that? SR: Absolutely. I believe that the expansion of the Santa Elena mine to go underground and to build a mill is not priced in. Granted it is at least a year away for that expansion to come on-line, but I believe the current plan is to finance that mill out of cash flow. I don't think the expansion is priced in because that would take them toward about 5 million ounce (Moz) silver production, on par with a company like Aurcana Corporation (AUN:TSX.V; AUNFF:OTCQX) that is trading something like $400–600M in market cap. Another company in that range is Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE), although Fortuna has a base metal segment to it. There's certainly room for growing the valuation of SilverCrest based on that expansion and because the La Joya project is going to be very big. The company already has about a 100 Moz silver equivalent, the equivalent coming half from gold and half from copper. So 75% of value is in precious metals, between silver and gold. I believe it should come out with a new resource calculation sometime this year, which I expect to significantly increase the overall resource. I believe SilverCrest is getting no value for La Joya, which is common for producing companies. They get very little value for assets that are not in production once a company is valued on a cash-flow basis. TGR: Are there any other producers you want to talk about? SR: There are two new ones that I am tracking closely. One is a company called Huldra Silver Inc. (HDA:TSX.V). It will likely declare commercial production early in 2013. This is a high-grade mine in British Columbia. TGR: What sort of production is the company looking at for its first year? SR: Something on the order of 2 Moz. This is a very good project and it's very high grade. There are other companies that are in the same group. One would be Excellon Resources Inc. (EXN:TSX), which has a mine in Mexico. Two other companies in the same category are Alexco Resource Corp. (AXR:TSX; AXU:NYSE.MKT), which is in Canada, and Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE), which operates mines in China. The reason I bring those three companies up is that they're all high-grade underground silver-lead-zinc mines. Huldra would be another one whose ore grades are somewhere around 800–900 grams per ton, which is quite high for the industry. TGR: Why haven't investors heard of Huldra Silver? SR: It's a very young company. It started, or re-started, in March 2010, and we haven't had the best resource markets since then, with the exception of that brief silver spike through $49/ounce (oz). It also has had a very tight share structure with not a lot of stakeholders. The new management team has done a good job. It came in and took things over, and in two and a half years the company went from a dormant project to one with over 100 employees. The mine is operating and the mill has been built and is running as we speak. Another impressive accomplishment is that the management got the mine permitted in British Columbia in a very short time. TGR: Do you think some of these midtier and larger silver producers will use some of their burgeoning cash flow to pick up some underpriced assets? SR: Absolutely. Usually the mergers and acquisitions in the sector happen in waves, often at the top or bottom of the market. We had an intermediate term top when gold hit $1,800/oz in spring 2011 and silver hit $49/oz. When the cycle is topping, large companies are usually flush with cash and they're looking to grow the company because that's the expectation from the market and investors—to demonstrate future growth. Companies have two ways to spend it: dividends and growth—buy somebody, increase production. Larger companies' balance sheets are in much better shape than exploration companies or junior companies. In addition, their valuations are higher, trading at several times better valuations than juniors. So these firms go for value and buy companies that are trading very cheaply. TGR: What are some companies that are trading very cheaply? Are there some potential takeover targets that you think might be enticing? SR: Merger and acquisition activity dovetails with what I have been saying about resource nationalism. A lot of capital has been flowing into Mexico and other "safe" jurisdictions. As far as takeover targets go, Global Minerals Ltd. (CTG:TSX.V; DPF:FSE), which is advancing a past-producing silver project in Slovakia, could be a possibility. The project is growing and Europe doesn't have many large-scale projects in the silver space. So Global is probably the next silver mine in Europe and it would be good acquisition target. The Mexican story that I like a lot is Santacruz Silver Mining Ltd. (SCZ:TSX.V). It raised $20M at $0.90/share in April 2011 in a weak and declining market. In the initial public offering (IPO) the company did not offer any warrants, and yet it was fully subscribed. When was the last time you saw a junior exploration company do a $20M IPO? The company has done very well since. It is rapidly advancing one of its projects toward production. There are a lot of reasons to like this company. Santacruz has three projects and all are good grade with significant size potential. Santacruz is already building a mill at its first, smaller Rosario project. It plans to be in production within a year of the IPO and eventually to be producing 2 Moz/year from this project. That's significant. The other two projects are larger and there aren't a lot of these types of projects to be had. There aren't a lot of producing mines with good grade and decent mine life, therefore, Santacruz's Gavilanes and San Felipe projects can potentially provide a growth pipeline. TGR: You once told us that you never sell silver bullion, but is now a good time to buy it? Or would you wait? SR: It's always a good time to buy silver. I don't do much timing as a trading strategy. I think you should be buying silver when you have excess cash. TGR: Is silver any closer to being purchased as a reserve currency by the world's central banks, as you once speculated it would be? SR: I think silver will be purchased at a point where gold is priced out of range for small central banks. The central banks are well aware of the gold/silver ratio, which is around 50:1 now and should be going down. The trend is in that direction and, as I mentioned earlier, I expect it to hit 15:1. I'm not sure how exactly it will play out. As discussed earlier, this is a much larger cycle than the last several, and a lot more is at stake here. And there will be a currency crisis. We're beginning to see governments around the world buying gold to add to their currency reserves and gold is still within central banks' price range. But if gold goes to, say, $5,000/oz, as is routinely forecasted by many these days, are we going to see governments continue buying it as they do today? I don't know. Maybe they'll buy silver, maybe they'll buy palladium. But at some point I expect countries to buy silver because, in addition to being a precious metal, it is also a strategic metal like the rare earths or uranium. Silver is an important industrial commodity and countries that don't have any will have to either source it elsewhere including the open market or export manufacturing to some place where silver is available. TGR: Thanks for your time. Sean Rakhimov launched his website, SilverStrategies.com, in 2004. His writing has appeared on such Internet portals as Le Metropole Cafe, 24hGold, 321gold, Kitco, GoldSeek, Gold Seiten and The Gold Report. He previously designed financial systems for the investment banking business, learning about options trading, securities lending, payments processing, clearing and settlement, fixed income securities and margin transactions. Rakhimov is constantly looking for value opportunities in new and established stock stories. Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page. DISCLOSURE: |

| Silver Futures – Concentration, Confidence & COT Posted: 26 Oct 2012 11:31 AM PDT The real value of the Commitment of Traders or COT Report for silver traders lies in revealing the marked concentration of short silver futures positions held by the major bullion banks, who are classed as commercial traders. |

| Posted: 26 Oct 2012 03:55 AM PDT Why beauty is rarely worth it Telegraph Nineteen species of fern named for Lady Gaga EarthSky (furzy mouse) 2 Siblings Killed in New York City; Nanny Arrested New York Times How to eat a Triceratops Nature Fish Caught in Fukushima as Tainted as a Year Ago, Study Says Bloomberg :-( Jailbreaking now legal under DMCA for smartphones, but not tablets ars technica Apple warns of pre-Christmas profit fall Financial Times Eurozone nears Japan-style trap as money and credit contract again Ambrose Evans-Pritchard, Telegraph Austerity continues to kill European credit MacroBusiness Hedge Fund Havens Weigh Taxes as Caribbean's Debt Rivals Greece Bloomberg (furzy mouse) A Finnish parallel currency is imaginable Gillian Tett, Financial Times UK rejects bases plea as US plans Iran contingency Guardian WikiLeaks Releases US Military Policies for Detention & Avoiding Accountability for Torture Kevin Gosztola, Firedoglake October Surprise: Romney may have screwed over his friend's ex-wife Salon (YY). Sadly, "screwed over" is less newsworthy than "screwed". Robert Samuelson Takes on NYT Editorial Board: Government Does Not Create Jobs! Dean Baker Will CDO Managers Be Held Accountable For Their Role in the Financial Crisis? Bloomberg BNA (Michael C). NC is in the footnotes! Still The Scariest Data Tim Duy Bipartisan Trouble Ahead Simon Johnson. Tells you why the "Financial Regulatory Reform Initiative of the Bipartisan Policy Center" is rubbish. Hurricane Sandy Track for the Next Five Days Jesse Burglars Posing As Repo Workers Steal Woman's Belongings WFMY (Lisa Epstein) Nine more banks added to Libor probe Financial Times. So has Benjamin Lawsky gotten Schneiderman to man up? Citi Chairman Is Said to Have Planned Chief's Exit Over Months New York Times. So why was the morning after fumbled so badly? Banks Pushing Into Small Loans Compete With Payday Shops Bloomberg (hat tip Credit Slips) Mission elapsed time: T + 48 and counting* When he laughed, respectable senators burst with laughter, Occupy. Nashville, TN: "More than a dozen Occupy Nashville protesters filed a lawsuit against the state in the U.S. District Court . These New Rules unconstitutionally limit access by the public to [Legislative Plaze,] a forum universally accepted to be an area protected for the speech of the governed," the lawsuit said." IA. Food: "[N]ever has an administration taken the issues raised by the food movement so seriously and stood up for small farms so aggressively. For example, USDA has institutionalized its support through the Know Your Farmer Know Your Food work within the department. Again, this will all go away if Obama loses this election and agribusiness once again runs every aspect of USDA." IN. Voting: " The D party chair is asking the federal government to get involved in the wrongful purge of 13,000 voters in La Porte County last year." LA. Public goods: "The latest budget signed by Jindal eliminates state funding for public libraries, cutting close to a million dollars out of their budgets." … Charters: "[S]ome private schools participating in LA's new voucher program will be educating taxpayer-subsidized students tout their creationist views." … Oil: "The dome that was leaking oil at the bottom of the Gulf has a new lid. BP capped and plugged the latest oil seepage coming from the site of the 2010 Deepwater Horizon disaster this week." OH. Voting: "Having hundreds of thousands of [provisional ballots] effectively on hold would keep the presidential election in limbo if Ohio's electoral votes are needed for either Obama or Romney to reach the 270-vote majority required." … Swing state Keynesianism: "White, working-class voters in OH are supporting Obama at higher levels than in other swing states, making it tougher for Romney to catch the incumbent in perhaps the most vital of all battlegrounds." PA. Foreclosure: "The federal court has upheld the Montgomery County Recorder of Deeds' right to sue [MERS] and banks doing business with [MERS] for $15.7 million that she claims is owed to the county in recording fees." TX. Dark sky: "A small but growing number of TX cities are passing lighting ordinances aimed at protecting star-gazing." … Voting: "TX authorities have threatened to arrest international election observers, prompting a furious response from the Organization for Security and Co-operation in Europe (OSCE)." VA. Voting: "Less than two weeks away from the election, the VA State Board of Elections website, in the midst of a 'convenient' remodel, features broken links and missing pages essential to the transparency necessary for confidence in the Virginia outcome. Election night, we might not have a window on Virginia results." … Horticulture: "The de-lawning movement is slowly taking hold in the Richmond region. Converting grass into flower beds and vegetable gardens creates more attractive yards, cuts the expense of lawn maintenance and helps clean the Bay." WI. Corruption: "Last week, the newspaper reported that the agency had discovered it had failed to systematically track nearly $9 million in loans that are not current. As a result, WEDC's chief financial officer resigned and GOP Gov. Scott Walker, a champion of the quasi-public agency created last year, brought in a new interim leader*." [* Note the use of t he generic and authoritarian "leader," as opposed to using an official title.] Supply chain. Walmart: "The key to Walmart's success has been getting low-cost goods to customers at precisely the right moment according to microanalysis of market patterns. But that is also what makes it so vulnerable to work stoppages. Workers at key points in the supply chain can create massive disruptions in the process. " Outside baseball. Disposition matrix: "A paramilitary spy agency empowered to kill in secret via remote control. What could go wrong?" … Disposition matrix: ""It really is like swatting flies. We can do it forever easily and you feel nothing. But how often do you really think about killing a fly?" (CFR) … Disposition matrix: "Like last year's NY Times piece that first detailed the murder racket being run directly out of the White House, the new Washington Post story is replete with quotes from 'senior Administration officials' who have obviously been authorized to speak. Once again, this is a story that Obama and his team WANT to tell." … Disposition matrix: "[T]he government wants Americans to know all about the horrors. It is increasingly eager to discuss its programs and to describe how it goes about murdering ever greater numbers of people. The government does this so that Americans become accustomed to the murders, precisely so that Americans regard the murders as a matter of routine, everyday business." … Disposition matrix: "In response to the Post story, Chris Hayes asked: "If you have a 'kill list', but the list keeps growing, are you succeeding?" The answer all depends upon what the objective is" (cf. self-licking ice cream cone). … Disposition matrix: "A bureaucratized paramilitary killing program that targets people far from any battlefield is not just unlawful, it will create more enemies than it kills." … Disposition matrix: "When the president kills you with a drone strike, that means you are a terrorist." … Disposition matrix: "If politicians can get away with not knowing what a 'kill list' is, which has been prominently featured on the front page of The New York Times, who's guessing they'll be able to plead ignorance about something as bureaucratically innocuous-sounding as 'disposition matrix'?" … Disposition matrix: "[T]he NCTC is also the government outfit in charge of crafting a 'disposition matrix' to oversee the management and institutionalization of the US government's extrajudicial assassinations — a power the Obama administration asserts it can (without due process) apply to US citizens as well as foreigners." … Disposition matrix: "Should he win the election in two weeks, Romney will inherit an institutionalized, bureaucratic machine for using lethal robots to target and kill suspected terrorists and their allies. Killing Osama bin Laden was a one-time event; this 'Disposition Matrix' is Barack Obama's real national-security legacy." Grand Bargain™-brand Catfood Watch. PR: "Over 80 CEOs from some of the world's largest companies announced Thursday they were calling on Congress and the White House to strike a deficit deal sooner rather than later." Desperate people make better serfs. … Bullshit: "The chart on the right, from Rex Nutting, shows what's actually going on: total US debt to GDP was rising alarmingly until the crisis, but it has been falling impressively since then" (Felix Salmon). "Impressively" iff you believe financial ratios are more important than the real economy. The trail. Russell Means: "May we, the next generation of elders, never forget those who've pierced a path with their tongue and spine for our voices to be heard." … Polls: "Obama 73% to win w/ those polls added. Bottom line simple: Romney is trailing – slightly – in tipping point states" (Nate Silver). Consistent narrative. …. The state of the republic: "'And Nate Silver is like my Racing Form.' 'But what about the issues? Pakistan? Education? A woman's right to choose? Who will be on the Supreme Court?' 'You're kidding, right?' said Tony. 'You know what Nate Silver says your vote in Illinois is worth in terms of the outcome of the election? Less than .1%. Unless you live in the suburbs of Canton, OH, your vote is worth bupkis mit kuduchas. Given that, I'm better off concerned about my bets at Intrade. Right now I got Obama at about 57% to win. Although Nate Silver has him a little better."" …. Voting: Lambert here: Putting people who have entirely justified skepticism of e-voting in the same "truther" bag as Jack Welch? I'm throwing a flag (which I hate to do because I read that blog avidly). The Obama vs. The Romney III. Alan Grayson: " Let's go over the basic facts. There are two large oceans that separate us from 191 of the 193 other countries in the world. Our northern border has been peaceful since 1812. Our southern border has been peaceful, more or less, since 1848. In the 229 years since the Treaty of Paris, establishing our independence, foreign military forces have attacked American territory only twice – in both cases, on the outermost periphery." … Police state: "[Lynn U student Cody] Luongo said that in the days before the debate, security around campus began to gradually escalate, and by Monday it was an almost like a state of martial law. Beginning five hours before the debate and lasting for another hour after its conclusion (it ran from 9 to 10:30 p.m.) every movement was regimented and oversee." The Romney. Celebrity endorsement: "'Like I said, never before have I endorsed a single candidate 'til now, so let me hear y'all repeat after me.' Meat Loaf said, leading a call-and-response with Mitt Romney's name, the crowd repeating it after him." The Obama. On Romney: "[OBAMA: ] [Kids] look at the other guy and say, 'Well, that's a bullsh—er, I can tell.'" Pure projection. … Air war: "'Your first time shouldn't be with just anybody. You want to do it with a great guy,' [the actress in Obama's "Your First Time" TV ad] says, referring to casting your first ballot for Obama." Yes, but did Mr. Hope and Change respect you in the morning? Also too, the ad apparently clones an ad from another Presidential campaign: Vladimir Putin's. Ha. * Slogan of the day: Energetically Complete The Task of Party Rectification, Bring About a Basic Turn for the Better in Party Spirit! Antidote du jour: |

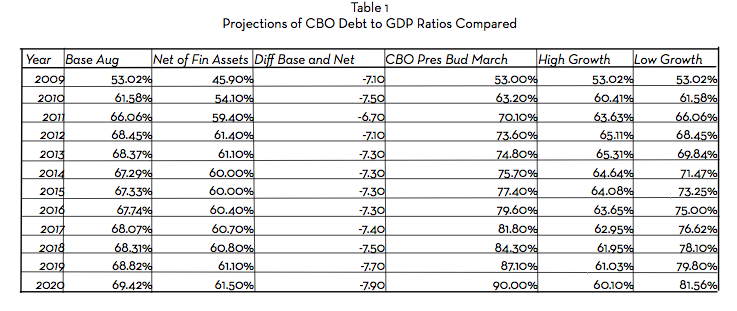

| Rentier CEOs Advocate Austerity for America Posted: 26 Oct 2012 03:38 AM PDT Felix Salmon did an admirable takedown of a "CEOs [sic] Deficit Manifesto" in the Wall Street Journal. It's yet another entry in the long-running, dishonest campaign funded by billionaire Pete Peterson to pretend that all right thinking people (and of course CEOs believe they have the right to think for everybody else) should be all in favor of trashing the middle class and the economy through misguided deficit cutting. Salmon could have gone further in his critique, but the letter was so lame he didn't need to, and the issues he raised would be plenty persuasive to most Americans. Felix correctly styled the letter as "self serving" and described the idea of deficit cutting now as "ridiculous". Debt to GDP is falling and the economy would tank if we were to reduce the Federal deficit while the economy is deleveraging. But these corporate leaders tried overegging the pudding by depicting the current federal debt levels as a security threat. One aspect of this debate that doesn't get the attention that it deserves is that the deficit hawks keep claiming that the US is about to hit a 90% federal debt to GDP ratio, which Carmen Reinhart and Ken Rogoff claim is correlated with lower economic growth. Aside from the fact that this study is questionable (it mixes gold standard countries with fiat currency countries, plus correlation is not causation; in many cases, a major financial crisis produced both the low growth and an increase in debt levels, meaning its spurious to treat debt as a driver of lower growth), the US is actually not at any imminent risk of breaching this level. The CBO, astonishingly, has kept publishing reports that project gross debt levels, not net debt. This 2010 analysis by Rob Johnson and Tom Ferguson shows what a large adjustment netting out the government's financial assets makes (click to enlarge): Their discussion:

The authors contacted the CBO about their analysis. The CBO has acknowledged it is correct but refuses to change its reporting. So much for the vaunted independence of the CBO. Salmon also makes a point near and dear to our heart:

The situation is even worse than he suggests. It isn't just that corporations aren't investing now; they weren't investing in the last expansion. The corporate sector in aggregate was disinvesting and we first took note of this in 2005!. If you look at the 80 CEOs that signed this list, you don't see a single Silicon Valley or tech darling (well, there is Microsoft, but they are too long in the tooth to be darlings, and one small cap tech company, Investment Technology Group, but it's on Motley Fool's current list of 10 Worst Small Cap CEOs, so it proves our point). There's a complete absence of the sort of companies that America likes to hold up as its winners. Instead, the list is heavy with finance, including private equity firms, and mature industries. A sampling: AT&T Now having said that, some of the members of the list are solid, well run companies, such as Deere, Caterpillar, M&T Bank, Marriott. But this is not a list of big company outperformers. Plus you have the hypocrisy of tax-dodge General Electric and the beneficiary-of-NIH-basic-research Merck happy to impose the costs of the bennies they've gotten on ordinary Americans. And you've also got some CEOs from much smaller service/not for profits players who are clearly there to curry favor, such as the head of PR firm Weber Shandwick Worldwide, leadership consultant Interaction Associates, and our favorite banking industry brown-nose, Kathryn Wylde of the New York City Partnership. The good news is that the letter appears to have landed like a lead balloon with the audience most likely to be receptive, namely WSJ readers themselves. It got a mere 5 comments. But the bad news is that this letter is the least important aspect of this CEO effort to get Medicare and Social Security "reforms" meaning cuts, through (yes, they make noises about other "responsible" actions they'd like to see happen, but this one is the one they are most keen to get done). Ordinary Americans have complacent as this plan to gore their ox has moved relentlessly forward. But they've been sold on the false idea that deficit cuts are necessary and salutary. Central bankers are perversely imposing costs on savers through ZIRP as a poor second best for greater spending. As Felix concludes:

|

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

"Increasingly, people seem to misinterpret complexity as sophistication, which is baffling — the incomprehensible should cause suspicion rather than admiration. Possibly this trend results from a mistaken belief that using a somewhat mysterious device confers an aura of power on the user."

"Increasingly, people seem to misinterpret complexity as sophistication, which is baffling — the incomprehensible should cause suspicion rather than admiration. Possibly this trend results from a mistaken belief that using a somewhat mysterious device confers an aura of power on the user." Resource nationalism is becoming a growing problem for many mining companies. In this exclusive interview with

Resource nationalism is becoming a growing problem for many mining companies. In this exclusive interview with

No comments:

Post a Comment