saveyourassetsfirst3 |

- October Alpha In Gold Mining ETFs

- Despite The Lawsuit, Wells Fargo Will Benefit From A Recovery In U.S Housing Market

- The Case Against The Case Against Gold

- Gold & Gold Stocks Ready for Rise vs. Stocks

- Thomas Peterffy – Freedom to Succeed

- Corvus Gold Reports Increased Gold Recovery Results, Mayflower Deposit, North Bullfrog Project, Nevada

- Another thoughtful speculation on a huge upward official revaluation of gold

- Gold suppression researcher Dimitri Speck interviewed by Lars Schall

- Jobless Claims Plummet to 339K

- Economic Collapse & Capital Controls Assured

- Poll-Analysts’ View – Reuters Q3 Precious Metals Price Poll

- Guggenheim on Gold: The “Return to Bretton Woods”

- Too Often Regulators Play the Role of Police, Judge and Executioner: Witness Liberty Silver Corp.

- The Collapse Continues: Greek Unemployment Rises For 35th Consecutive Month, Passes 25%

- Possible Profit-Taking Event in Progress

- Lost Confidence Can’t Be Restored & Gold’s Final Move

- Europe & The Major Breakout For Gold Is Still In Front Of Us

- Great video: How to Find Silver: The Art of Drilling

- Hathaway – Gold To Hit New All-Time Highs, Despite Pullbacks

- More People Ask ‘How Do You Buy Silver?’

- S.Africas gold output is up in Aug, platinum down

- Killing the Wrong Pig

- Bullion Bounces Back after Spanish Ratings Cut

- Matthew Stein: When All Hell Breaks Loose

- Commodities Wait for G7 Amid Global Slump Fears

- Links 10/11/12

| October Alpha In Gold Mining ETFs Posted: 11 Oct 2012 11:02 AM PDT By Christian Magoon: Gold mining ETFs are being beat up more than physical gold ETFs in October yet bounces in their prices show promise for alpha seekers. The largest of all gold stock ETFs, the Market Vectors Gold Miners ETF (GDX), has lost close to 2.7% eight trading days into the month of October. Meanwhile physical gold ETF, the SPDR Gold Trust (GLD), has lost about 1%. Despite under-performing GLD, GDX experienced a significant bounce upward earlier in the month that delivered considerable alpha versus GLD. More importantly GDX now appears poised for another alpha opportunity. GDX's behavior is highlighted in the annotated chart below from the NASDAQ.com interactive chart center. (click to enlarge) BEST BET: GDXJ A more attractive dynamic is at work for the second largest gold stock ETF, the Market Vectors Junior Gold Miners ETF (GDXJ Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Despite The Lawsuit, Wells Fargo Will Benefit From A Recovery In U.S Housing Market Posted: 11 Oct 2012 10:56 AM PDT By Qineqt: The recent lawsuit on America's largest home lender is part of an initiative by the U.S. president, where a committee was appointed to check the wrongdoings that led to the financial meltdown, and implicate money center banks for their involvement. We believe Wells Fargo (WFC) is well positioned to benefit from the recovering U.S. housing markets in the coming quarters. Therefore, the current lawsuit will not have a significant adverse financial impact. Therefore, we reiterate our buy rating on the stock. Lawsuit: Wells Fargo was slapped with a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Case Against The Case Against Gold Posted: 11 Oct 2012 10:54 AM PDT By Dr. Duru: When the Federal Reserve promises to print money for an indefinite amount of time, it seems obvious to put trashy cash into assets that cannot be so easily manufactured. This shift allows investors to gain the advantage of relative supply differentials. Gold (GLD) should be at least one of those assets. Yet, the gold bear arguments persist, mainly because gold seems like money from the "ignorant days" when civilization had not yet figured out how to breathe value into paper out of sheer will. In all my years of writing about gold, I have rarely referenced specific gold bear articles or posts, but I found myself compelled to break with tradition after reading a recent piece from Zacks Investment Research called "The Case Against Gold In Today's Market." Based on a quick web search, I noticed that many gold bears have written pieces with the same or similar titles. Clearly, Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold & Gold Stocks Ready for Rise vs. Stocks Posted: 11 Oct 2012 09:46 AM PDT The performance of the gold stocks, being a hyper-volatile sector has been more erratic and less consistent than gold. However, the gold shares as depicted below by the HUI gold bugs index have maintained their uptrend against the S&P 500. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Thomas Peterffy – Freedom to Succeed Posted: 11 Oct 2012 08:49 AM PDT The setup for the video below reads: "Thomas Peterffy grew up in socialist Hungary. Despite the fact that he could not speak English when he immigrated to the United States in 1956, Thomas fulfilled the American dream. With hard work and dedication, he started a business that today employs thousands of people. In the 1970s, Thomas bought a seat on the American Stock Exchange. He played a key role in developing the electronic trading of securities and is the founder of Interactive Brokers, an online discount brokerage firm with offices all over the world." We witnessed this commercial running on CNBC Thursday, October 11, 2012. We are moved by it and thankful that Mr. Peterffy would share his views with his adopted countrymen. We salute Mr. Peterffy as a modern American patriot and although we do not use Interactive Brokers (knowingly), we are now more disposed to do so.

Source: Thomas Peterffy via YouTube Slightly longer version of the same ad here, with information to learn more about FoundersIntent.org. http://www.youtube.com/watch?feature=player_detailpage&v=B4ysvJq2N4E | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

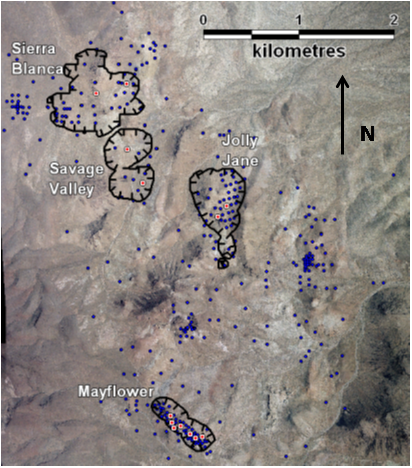

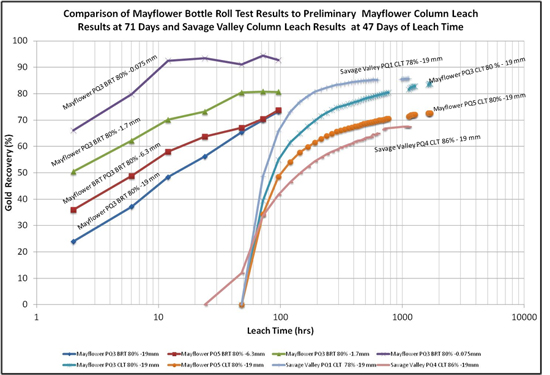

| Posted: 11 Oct 2012 08:27 AM PDT Vancouver, B.C……..Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces the results of a series of bottle roll and column leach tests on large diameter sample composites from the phase I Mayflower deposit and the Savage Zone in the phase II North Area (Figure 1). These results from ongoing heap leaching studies are enhancing the overall gold recovery rates for both areas. At the Mayflower deposit, column leach recoveries after 71 days ranged from 73% to 84% of the contained gold for the 80% -19mm (-3/4 inch) material (see Chart 1 and Tables 1 & 3), which is significantly higher than the overall 69% average recovery reported in the February 2012 Preliminary Economic Assessment (PEA, Technical Report and Preliminary Economic Assessment for the North Bullfrog Project, Bullfrog Mining District, Nye County, Nevada, February 28, 2012). Bottle roll tests (Table 1) from the Mayflower indicate high recovery of the contained gold (92-99%) for particles ≤ 200 mesh (0.075 mm), indicating that the gold is highly soluble for leach extraction. In addition, initial test results for the first 30 days on material from the Savage Valley zone of the larger North Area deposit has shown similar leaching characteristics to the Mayflower suggesting improving recoveries from this area as well. In the Savage Valley zone, which is the southern extension of the Sierra Blanca deposit in the North Area, initial results have been very encouraging averaging above the recovery values used in the February 2012 PEA (Chart 1, Table 2 & 4). The bulk of the zone has produced recoveries similar to those at Mayflower and from depths of over 150 metres. Similar large diameter core composites have been prepared from the Sierra Blanca and Jolly Jane zones. A group of 6 sets of columns were developed for Jolly Jane and have been under leach for 6 days. At Sierra Blanca a similar series of columns are being prepared, with leaching scheduled to start in the next several weeks. The results from the ongoing North Area metallurgical studies will be completed next year ahead of the planned North Area feasibility study scheduled for completion in early 2014. Carl Brechtel, COO of Corvus, stated: "The current gold recovery results are very encouraging and fully support and enhance our Mayflower and North Area mining plans. We will be finalizing our recovery studies for the Mayflower project later this year ahead of completion of our feasibility study due early next year. With these highly encouraging results we see significant potential for the North Bullfrog project to evolve into a major new Nevada gold producing district."

Table 1: Mayflower PQ Core Composite Samples, Phase I Drilling, North Bullfrog Project

*-based on Au head assay Table 2: Savage Valley PQ Core Composite Samples, Phase I Drilling, North Bullfrog Project

*-based on Au head assay Table 3: Mayflower PQ Core Composite Samples , Phase I Drilling, North Bullfrog Project

Table 4: Savage Valley PQ Core Composite Samples, Phase I Drilling, North Bullfrog Project

About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 24 square kilometres in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold Corporation. The property package is made up of a number of private mineral leases of patented federal mining claims and 161 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The project currently includes numerous prospective gold targets, with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,000 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,000 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted by structural zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access, and 2010 winter drilling is available on the Company's website at http://www.corvusgold.com/investors/video/. Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Carl E. Brechtel, PE, a qualified person as defined by National Instrument 43-101, is responsible for planning and execution of the technical and engineering studies at North Bullfrog, and has prepared this news release and approved the disclosure herein. He has over 30 years of experience in the mining industry, is a registered professional engineer in the States of Colorado and Nevada, and is a Registered Member of SME. Mr. Brechtel is not independent of Corvus, as he is the COO and holds common shares and incentive stock options. Mr. William J. Penstrom, Jr., a consulting process engineer and President of Pennstrom Consulting, Inc. has acted as the Qualified Person, as defined by NI 43-101, for evaluation of the metallurgical testing data. He has over 30 years of experience in mineral process design and operation, and has been an independent process and metallurgical consultant for the mining industry for the last 10 years. He is a Registered Member of the Society of Mining, Metallurgy and Exploration (SME Member No. 2503900). Mr. Pennstrom and Pennstrom Consulting Inc. are both independent of the Company under NI 43-101. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, a Qualified Person defined by NI 43-101, and by Mark Reischman, Corvus Nevada Exploration Manager, who are jointly responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc. Corvus Gold Inc. is a resource exploration company, focused in Alaska and Nevada, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is committed to building shareholder value through new discoveries and leveraging those discoveries via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: Ryan Ko | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another thoughtful speculation on a huge upward official revaluation of gold Posted: 11 Oct 2012 08:03 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold suppression researcher Dimitri Speck interviewed by Lars Schall Posted: 11 Oct 2012 07:50 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jobless Claims Plummet to 339K Posted: 11 Oct 2012 07:48 AM PDT CNBC coverage of the weekly U.S. initial jobless claims figure Thursday, October 11, 2012. Initial claims dropped by a remarkable amount right after the beyond belief drop in the unemployment rate reported Friday. (From 369,000 to 339,000 claims.) CNBC's Becky Quick hits nails on heads when it comes to New York Senator Charles (Chuck) Schumer in our humble opinion.

Source: CNBC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse & Capital Controls Assured Posted: 11 Oct 2012 07:39 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Poll-Analysts’ View – Reuters Q3 Precious Metals Price Poll Posted: 11 Oct 2012 07:31 AM PDT

from in.reuters.com: LONDON, Oct 10 (Reuters) – Precious metals analysts have become more bullish for the prospects for gold and silver than they were three months ago, but their outlook for platinum and palladium has darkened in line with the outlook for global growth, a Reuters poll showed on Wednesday. The impact of the euro zone debt crisis on the global economy is expected to keep global monetary policy loose, which should favour gold, while restricting demand for the more industrial metals like silver and the platinum group metals. Keep on reading @ in.reuters.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guggenheim on Gold: The “Return to Bretton Woods” Posted: 11 Oct 2012 07:30 AM PDT

from caseyresearch.com: Yesterday in Gold and Silver It was a pretty quiet trading day everywhere on Planet Earth on Wednesday…with all and sundry rally attempts during the Comex trading session being dealt with in the usual fashion. The gold price would have finished well above Tuesday's closing price, if left to its own devices. Gold closed in New York at $1,762.60 spot…down $1.30 on the day. Volume was pretty decent at around 137,000 contracts. Keep on reading @ caseyresearch.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Too Often Regulators Play the Role of Police, Judge and Executioner: Witness Liberty Silver Corp. Posted: 11 Oct 2012 07:29 AM PDT

from thedailybell.com: To say that regulatory democracy is out of control and doing more damage than good … well, that may be an understatement. In this editorial I will examine a very disturbing recent situation in which the US Securities and Exchange Commission (SEC) has once again arrested, found guilty and executed a publicly traded opportunity – all without laying a single charge or any court appearances. And I ask you to think a bit about how this might feel. Personally speaking, I am all too aware of what this "process" is like and the destructive damage it causes … financially, maritally and socially. I would like to discuss the SEC and its decision to impose a trading halt (essentially a death sentence) on Liberty Silver Corp. (TSX: LSL, OTCBB: LBSV). This from the LibertySilverCorp.com website sums up what just took place: Keep on reading @ thedailybell.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Collapse Continues: Greek Unemployment Rises For 35th Consecutive Month, Passes 25% Posted: 11 Oct 2012 07:28 AM PDT

from zerohedge.com: When we reported on the 34th consecutive month of Greek unemployment increases, following the June number hitting a record high 24.4%, the only good news was that the May number had been revised higher from 23.1% to 23.5%, making the monthly jump seem just under 1%. Well, that revision was re-revised, with Greek Statistic Service ELSTAT reporting that the original 24.4% number has now been revised to 24.8%, meaning in June unemployment rose officially by 1.3%. That's in one month! ELSTAT also reported the July number, and at 25.1% (pre-revision higher next month), it just hit a new all time high, increasing for the 35th month in a row. More than one quarter of those eligible for work in Greece (not many), are working. THis means labor related taxes are now being levied on a record low percentage of the population. Indicatively, Greek unemployment at the end of 2011 was "only" 21.2%. It also means that in order to restore even a tiny iota of confidence, the Greek labor department needs to hire a BLS consultant or two, or least license an old version of the ARIMA goalseek software, to find a seasonally adjusted decimal comma in there somewhere, and report that the jobless rate is really only 2.5%, which would be on par in credibility with everything else out of Europe these days. Finally, our question is at what point does anyone finally admit the Greek situation is not only a depression but outright economic death and the merciful thing to do at this point is to just pull the plug? Keep on reading @ zerohedge.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Possible Profit-Taking Event in Progress Posted: 11 Oct 2012 07:24 AM PDT Since the breakdown out of the bear flag on the dollar index hasn't followed through, the odds now favor that the dollar has generated an intermediate degree bottom. First off this should be a countertrend move as I think the three year cycle has already topped. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lost Confidence Can’t Be Restored & Gold’s Final Move Posted: 11 Oct 2012 07:21 AM PDT

from kingworldnews.com: Today a legend in the business surprised King World News when he said, "Gold is going to keep going up until the US dollar is finished. So the reign of the US dollar will come to an end." Keith Barron, who consults with major gold companies around the world, and is responsible for one of the largest gold discoveries in the last quarter century, also said, "At that point the global collapse will be in full-swing." On the heels of another major country being downgraded yesterday, Barron also warned, "The real problem here is that you can't restore confidence at this point in the cycle." Here is what he had to say: "Europe is getting worse all the time. The IMF is now saying that European banks may have to sell off an additional $4.5 trillion of assets. At the same time, they are trying to push various governments for increased austerity measures, and it's not working. Either the countries are simply not implementing the increased austerity or they are not implementing them to the extent that the troika wants." Keep on reading @ kingworldnews.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe & The Major Breakout For Gold Is Still In Front Of Us Posted: 11 Oct 2012 07:19 AM PDT

from kingworldnews.com: Today 25 year veteran Caesar Bryan told King World News that "… problems in Europe could, once again, reignite a fire under the gold market." Bryan, from Gabelli & Company, also said the major breakout for gold is still in front of us and investors should be prepared for the next advance. Here is what Caesar had to say: "Gold is still in a holding pattern, but investors should use these quiet times to accumulate physical gold. Gold is the ultimate way for investors to maintain their purchasing power. People have to remember that many of the surplus countries, especially in the Far East, have a very low weighting of gold relative to their fiat currency holdings." Keep on reading @ kingworldnews.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Great video: How to Find Silver: The Art of Drilling Posted: 11 Oct 2012 07:18 AM PDT Quote: A fascinating look at the techniques and methods used to explore for silver and other precious metals. We look at prospecting, operating a drill rig and the various challenges involved with mineral exploration. Visit http://www.edrsilver.com for more information. Presented by Endeavour Silver Corp. as part of an ongoing series of educational films on all things silver. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hathaway – Gold To Hit New All-Time Highs, Despite Pullbacks Posted: 11 Oct 2012 07:18 AM PDT

from kingworldnews.com: With gold still trading near the $1,760 level and silver close to $34, today King World News was given exclusive distribution rights to this rare piece by superstar John Hathaway of Tocqueville Asset Management L.P.. John is without question one of the most respected institutional minds in the world today when it comes to gold and his fund was awarded a coveted 5-star rating by Morningstar. By John Hathaway, Tocqueville Asset Management L.P. Keep on reading @ kingworldnews.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More People Ask ‘How Do You Buy Silver?’ Posted: 11 Oct 2012 07:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| S.Africas gold output is up in Aug, platinum down Posted: 11 Oct 2012 06:17 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Oct 2012 05:54 AM PDT

One such story, possibly apocryphal, regards the bulldog's regret at partnering with the Russians to defeat the Germans in World War II. On comprehending the awfulness of Stalin, and the mistake of letting him consolidate power, Churchill reportedly exclaimed: "We have killed the wrong pig!" In our estimation, all the recent hand-wringing over Western debt levels — see "Hey Bill Gross" for reference — is tantamount to killing the wrong pig. The pig to be focused on at this point is protectionism risk, not excessive concern over safe-haven debt-to-GDP ratios… Consider the following (via WSJ):

To which we say, "Dude. Seriously?" Sober awareness of future problems is all well and good. But here is why such talk could be more dangerous than constructive:

In the upcoming U.S. elections, "get tough on China" is a resonating message on both sides of the aisle. Mitt Romney has made the China crackdown message part of his election platform, and on the democratic side, pols like New York senator Chuck Schumer have been beating the anti-China drum for some time now (with the full-throated support of labor unions).  China, too, is taking a particularly nutty path, as shown via "China snubs financial meetings in Japan:"

China is playing a dangerous game of economic brinkmanship with one of its largest trading partners. The calculation among the mandarins may be that China is more important to Japan than vice versa. And Japan has to be alarmed by developments like this (via WSJ):

Regardless of who has the upper hand, this has the potential to end very badly. It may be, too, that China's leaders are losing the plot, forced into more aggressive posturing over the Senkaku Islands than is healthy or even sane, as a result of the populist sentiment whipped up among China's citizenry that has now grown into a monster of its own making. And then of course there is the Huawei flap between China and the United States:

Bottom line: The recent focus on Western (and Japanese) debt levels is an example of myopic fixation on a conventionally popular topic that overlooks real and mounting risks to the global economy in the form of protectionist threat and trade war outbreak. The debt-to-GDP obsessed authorities, bolstered by pandering politicians, are fighting the last war — or perhaps not looking back far enough, to the Smoot-Hawley led debacle of the 1930s — and killing the wrong pig. JS (jack@mercenarytrader.com) p.s. Like this article? For more, visit our Knowledge Center!p.p.s. Break the Institutional Barrier - and Substantially Increase Assets Under Management! Access our FREE report to find out how...  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bullion Bounces Back after Spanish Ratings Cut Posted: 11 Oct 2012 05:10 AM PDT Spot market gold bullion prices climbed back above $1,770 an ounce during Thursday morning's London trading – still a few dollars below where it started the week – as the euro also recovered ground following falls overnight after Spain had its credit rating cut. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Matthew Stein: When All Hell Breaks Loose Posted: 11 Oct 2012 04:57 AM PDT Alex Jones talks with engineer, designer, and author Matthew Stein about the impending collapse and how we can prepare for it. Stein is the author of When Technology Fails and When Disaster Strikes, both available at the Infowars Store. from thealexjoneschannel: The key to being prepared is planning and educating yourself before disasters strike. M.I.T. graduate Matthew Stein is one of the foremost authors about planning for man-made and natural disasters. His two books When Disaster Strikes and When Technology Fails will show you how to be prepared, self-reliant, and able to survive in an incredibly wide array of potential future catastrophes. Save when you purchase these two important books together and learn how to be self-reliant in an increasingly fragile world. ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commodities Wait for G7 Amid Global Slump Fears Posted: 11 Oct 2012 04:45 AM PDT On balance, a net sentiment-negative outcome to the varied mix of catalysts on offer stands to weigh cycle-sensitive crude oil and copper prices. Meanwhile, gold and silver may decline as ebbing risk appetite boosts haven demand for the US dollar. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Oct 2012 03:43 AM PDT I hate giving apologies of sorts BUT Lambert and I spent a fair chunk of Wednesday on the phone with two different firms that might help with our tech mess. This is the first time we've felt cautiously optimistic that we might find service providers who could help. In the mean time, our current software guy will be making some changes over the next week that should improve performance (we need to work through that first before we can address the Mystery of the Disappearing Comments). The Chinese Soft-Shelled turtle urinates through its mouth QI Elves. Yet another anti-antidote from Richard Smith. For Some Drivers, an Electric Motorcycle Could Be the Best of Both Worlds New York Times (furzy mouse). I resolved never to own a car, but this might be an acceptable compromise. If you can carry a bag or two of groceries as well, it would be a great device. Lance Armstrong accused in USADA files of being the ringleader of biggest doping conspiracy in sporting history Telegraph. I know this has been in the news a while, and I really hoped that Armstrong would prove his critics wrong. But the use of performance enhancing techniques is so widespread in sports, it's hard to believe that many accomplishments at the very top end these days are real. Europe Dispensing Wrong Fiscal Medicine, Economist Koo Warns Bloomberg. What is most interesting is that in the "for the masses" version of the site, this story has the most prominent placement. Spain's credit rating downgraded to near junk Telegraph Spanish Bond Yields Rise Wall Street Journal Carlyle's China problem: some questions for David Rubenstein John Hempton The Nation's deeply deceptive Obama-endorsement editorial Vast Left Wing Conspiracy (Lambert). A top notch shredding. Rep. Ann Marie Buerkle, Ursula Rozum agree to four town hall meetings without Dan Maffei Syracuse. I know this is really parochial, but Ann Marie Buerkle is the stupidest person I have ever seen appear on television. A potted plant has a higher IQ. I can't fathom how she has a driver's license, much the less got into Congress. Reader bob (a local) writes: "Danny muffin decided he doesn't want to play. Ursula is pretty brave, those "town hall meetings" that AMB organizes are notorious for a hand picked crowd and questions, and threats." So if you are in the Oswego area and are free tomorrow at 6 PM, you might see if you can snag a seat. When Conservative Republicans Loved Keynes and Expansionary Fiscal Policy Brad DeLong (Scott) The Disingenuous James Bullard Tim Duy Controversies over economics and genetics Tyler Cowen Do falling trade costs benefit all countries equally? VoxEU Neil Barofsky on the Fed Stress Test mathbabe E-Mails Cited to Back Lawsuit's Claim That Equity Firms Colluded on Big Deals New York Times (Richard Smith) Goldman's 'muppet hunt' draws a blank Financial Times. The literalness is a cute distraction. And as Congressional investigations of Goldman show, the firm's staff are far more careful about what they say in e-mails than staff of other shops. Fed's Tarullo Calls for Cap on Bank Sizes Wall Street Journal Canadian bank goes after homes to collect credit card debts Bay Citizen (Lisa Epstein) The Marshmallow Study revisited EureakAlert (Mark Thoma). This is important. Poor people are accused of being bad at math and/or deferred gratification (known formally as hyperbolic discounting) but this suggests that behavior may be a rational response to environmental instability. * * * lambert here: Mission elapsed time: T + 33 and counting* "When an old man dies, a library burns to the ground." ~African proverb Walmart actions. Deadline: "'We feel like if they refuse to listen to our proposition we will make sure that on Black Friday we will take action inside and outside of stores,' said Colby Harris, 22, a Walmart worker from Dallas, TX, and a member of OUR Walmart [here], a United Food and Commercial Workers-backed worker organization closely affiliated with Making Change at Walmart [here]. 'We'll make it known that Walmart's deadline is Black Friday,' he added." An attack on the supply chain in time, rather than space. Interesting because it scales continentally, unlike previous Capitol and "square" occupations. … Association: "OUR Walmart [Organization United for Respect at Walmart] is a kind of return to labor formations of the 1930s. It's an association–they aren't looking for legal certification, they don't claim to represent everyone. They're a minority that is willing to stick their necks out" (good explainer). …. Spreading: "Until Friday, when about 60 Wal-Mart employees walked off the job for a day in LA, no Wal-Mart retail workers had ever gone on strike, the [United Food and Commercial Workers] said." … Spreading: "Protests that began in Los Angeles on Oct. 4 have spread to at least 11 cities nationwide over the past week, including the Bay Area, Sacramento, Miami, and the Washington DC-area." … Spreading: "The [UFCW] said several workers from a Wal-Mart store in Sacramento walked off the job early today and are now in Bentonville, AR, to join a protest of the retailer's worker policies." … Grievances: "'People were really tired that any time they would speak out against the pay, hours, how much they would work, that management would cut their hours or not give them a schedule,' said [Evelin Cruz, a department manager at Walmart in Pico Rivera, CA], who is one of thousands of members of Our Walmart." … Bentonville, AR: "The director of the Making Change at Walmart coalition said he couldn't confirm the number or Walmart workers participating in a 'National Day of Action' Wednesday at the company's annual investor meeting at its headquarters in Bentonville, AR." (See other Patch stories San Leandro, CA, Castro Valley, CA, San Ramon, CA, Laurel, MD, and Fridley, MN.) … Challenge: "'We are more than happy to have our HR team meet with you on an individual basis that you have about you, your store or your team management,' said David Scott, human resources vice president." (I would be more than happy to live in a world where the term "human resources" was regarded with loathing and horror.) … Response: "'We've come to them all this way to talk but as a group because some issues are not individual based,' said Gregory Fletcher, Walmart associate." (more) "'I think as we move as one they can't ignore us," [Lori Amos, Walmart associate] said." CA. Media critique: "After being sold over the summer, the [Orange Country Register] is hiring about 50 editorial staffers and adding new print sections — because print's where the money is." FL. Voting: "Pasco County Elections Supervisor Brian Corley earlier this month said many voters were confused about a recorded call from the Obama campaign encouraging them to visit their elections office, request absentee ballots, and cast them on the spot. He said some voters did not understand the difference between voting at early voting sites and voting in-person using absentee ballots, which is already under way." Jeebus, who wouldn't be confused? IL. Walmart strike: "Striking workers at a Walmart distribution center in Elwood, IL won a victory this week when the managing subcontractor RoadLink rescinded the worker's suspensions after they confronted the employer demanding better conditions. The 38 workers will return to work with full pay for the time they were on strike. Ted Ledwa, one of the striking workers, said in a press release 'With this victory, we forced the company to respect our rights. We showed that when workers are united we can stand up to the biggest corporations in the world and win.'"(Elwood is where Imperial Troopers arrested 17 peaceful protesters [NC 2012-10-03]. So that didn't work. But the conditions? …. Walmart strike: "'I think there's been a hit in Walmart's armor,' said Phil Bailey, one of the strikers who marched triumphantly back into the warehouse in matching Warehouse Workers for Justice t-shirts. 'There's been this expectation that they can't be damaged at all. Not true!'" Of course, with Obama on the picket line in his home state… Oh, wait… Walmart: "Today workers and their supporters plan to protest at 35 different Walmart locations in Chicago, including the Walmart express at 570 W. Monroe." LA. About that sinkhole: "Shaw officials working with the Louisiana Department of Natural Resources on the sinkhole told about 100 residents gathered for a community meeting Tuesday that the well north of La. 70 and another drilled on the same site would be linked to a flare to begin removing the gas gradually." ND. Control of the Senate: "In rural western ND, tens of thousands of men work in the lucrative oil fields. The residents of these "man camps" could decide which party controls the Senate. Only one or two races will determine the Senate majority in November's elections — and the North Dakota race is one of the most competitive. But it's the state's lax voting requirements and small population that make nomadic oil-field workers politically relevant." NY. Greens: "U.S. Rep. Ann Marie Buerkle [R] and Green Party candidate Ursula Rozum said today they have agreed to a series of four town hall meetings without D challenger Dan Maffei. All three candidates have agreed to at least two televised debates that will be split up and carried by every broadcast station in Central New York. Rozum, who has consistently received support in the single digits — up to 7 percent." Ha ha, a D empty chair! … Unions: "During negotiations on Tuesday, the Guild asked why members were offered zero raises in 2011 and a one percent bump for the final months of this year. Bernard Plum, the lawyer representing the Times Company, allegedly responded, 'This is a declining industry and a declining business,' and that it was common for management to ask staffers to make sacrifices, and 'even more common to have zeros.'" Oh? How about the execs? OH. Rallying the base: "In Mr. Romney's three-stop trek across OH Wednesday, every destination is nestled in a county that McCain won handily in 2008 with at least 59% of the vote." PA. The new normal: "[Rick] Renz, a 58-year-old sales manager, said he had never felt so disheartened about his country. 'Everyone says the job numbers are good. But my two adult kids are sitting at home'" (good interview piece). … Swing states: "A Romney campaign source, who would only speak if not identified, told PhillyClout that the campaign is shifting five of 64 staffers to OH to help organize efforts with early voting in that state. The source emphasized that all of Romney's 'victory center' offices in PA remain open." TX. Walmart: "Walmart employees picketed the company's store on West Wheatland Road in Dallas on Tuesday. They say the company retaliates against workers who speak out against low wages and cutting hours. The workers say wages are so low that some must rely on public programs to support their families." … ObamaCare: "[I]f TX would participate in the mostly federally funded (90/10, when it rolls out completely) Medicaid expansion under the ACA, it would have an enormous palliative benefit for the justice system. Right now, the state's approach is mostly to ignore mental health issues until they falls into government's lap via the criminal justice system." WI. Walker: "[Kelly Rindfleisch's plea deal to charges she conducted campaign work as an aide to Gov. Scott Walker when he was Milwaukee County executive] means Walker won't have to testify at Rindfleisch's trial, which had been scheduled for next week. Walker was subpoenaed to testify by Gimbel. The plea deal also means testimony of several Walker campaign aides in open court won't happen. " Hold the popcorn. The trail. Voting: "For the most part, opponents have been unable to win the crucial argument: That voter ID laws are an unconstitutional infringement on voting rights." Losing the war. … Obama/Romney debate: "[M]ost Ds still refuse to admit what happened right before their eyes. While criticizing the president's debate performance they were not willing to admit that the Obama who stood on stage is the real Obama. Stripped of a script he was laid bare before the world, an empty suit devoid of any conviction except the desire to stay in office." Reversion to the mean. … Obama/Romney debate: "By cleverly exploiting Mr Romney's tactical missteps, such as his failure to come to grips with the tax-return issue, and publicising his outright 'gaffes', Obama's team had managed to outperform the fundamentals for most of September. But Wednesday's widely-watched debate served as a focusing event, allowing voters to see the two men side by side. In effect, then, the debate helped recalibrate the race back to where it should have been all along." Reversion to the mean. … Biden/Ryan debate: "According to research by the D pollster Stan Greenberg, Obama's performance was viewed poorly by unmarried women, who wanted a more combative tone and a sharper critique of Romney's views about the middle class. Unmarried women were a crucial constituency for Mr. Obama in 2008, voting for him, 70 to 29 percent, over John McCain." (Biden, sponsor of VAWA, may help there.) … Outside baseball. ObamaCare: "According to Labor Campaign for Single-Payer Coordinator Mark Dudzic: "The ACA has four tiers of benefits from a platinum plan down to a bronze plan. Most unions plans are actually above the platinum level. And I think the pressure will be to push people down that ladder into these lower actuarial plans" (DCB). Shocker! … Sequestration: "Though a trio of Senators has traveled the country warning of impending job losses caused by automatic budget cuts that take effect Jan. 2, industry insiders and budget experts say defense contractors are unlikely to need to lay off workers on the day the cuts are scheduled to begin. Assurances from the White House helped. [T]he guidance 'takes away from the companies the requirement to [issue notices] in order to meet that fiduciary responsibility," said Cord Sterling, the top lobbyist with the Aerospace Industries Association.'" "Guidance" is a very important word in official Washington. It will also be interesting to see if social insurance programs do lay people off. Robama vs. Obomney watch. Flip flop: "The Obama campaign has shifted its emphasis away from attacks portraying Romney as a flip-flopper without core principles. Instead, its message has focused on painting Romney as a hardcore conservative — a label not easily applied to the former governor of MA, a traditionally blue state, who signed into law the template for the Affordable Care Act, also known as ObamaCare." So now the Obama campaign is going to flip flip on whether Romney's a flip flopper. If the election is all that important, shouldn't it be easy for them to make up their minds? The Romney. Fear: "Romney isn't an ideological moderate. He's a pragmatic executive. When he needs to govern from the center, he does. When he needs to lurch to the right, off he goes. So if you want to know how he'll govern, don't listen to what he says. Look at who he has reason to fear" (Ezra Klein). A lesson here, for "progressives." The Obama. Headline you never want to see: "Obama campaign attempts to quell panic." … Pollster: "Democratic pollster Tom Jensen: 'I'm open to the idea of freaking out, but I'm not quite there yet.'" ,… Mêng (Youthful Folly): "Obama's campaign is divided into two camps: impassive warhorses and anxiety-ridden newbies. Battle-scarred operatives have been doing nonstop psychic triage since the debate, calming nerves. That became easier on Wednesday when the first patch of internal polls came back from key swing states. They revealed that Obama was not in free fall, as some feared, but that his support has returned to where it was in July and August. 'Voters haven't switched from us to him,' the strategist said. 'But they are giving him a second look.' In other words, in 90 minutes, Obama flushed a month's worth of convention and 47-percent bounce." Ha. So I guess we know which age cohort that leak to the Daily Mail came from. …. * Slogan of the day: Learn From Comrade Mitt Romney! * * * Antidote du jour (furzy mouse): |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Winston Churchill is perhaps the most quotable world leader of all time. There are many tales of his memorable remarks.

Winston Churchill is perhaps the most quotable world leader of all time. There are many tales of his memorable remarks.

No comments:

Post a Comment