saveyourassetsfirst3 |

- Is Biotech Getting Too Frothy? Investor Sentiment Suggests Irrational Exuberance

- Gold Market Dip Buying Strategy

- CRASH: Iran Rial Implodes By 20% In One Day

- Brian Booth's Weekly Gold Report

- Technicals: Silver Volatility 10.1.12

- Corvus Starts Follow-up Drilling at North Bullfrog

- Spain’s Deflationary Quagmire

- Defeat of Position Limits Direct Threat to Precious Metals Potential

- Eurozone Unemployment at Record Levels

- Third-time Lucky for Gold at $1800?

- China’s Black Box, Plus Three Reasons Why Energy and Base Metals Are Strong

- In Praise of a Silver Miners ETF

- What kind of BS is this?

- Declining Metal, Commodity Influence for QE3?

- 'Bull Trend Remains Intact' for Gold Bullion

- Euro Zone Unemployment at Record Levels

- Rob Gray: What is Money?

- In Praise of a Silver Miners ETF

- Third-time lucky for gold at $1,800?

- Precious metals shares more attractive on fundamentals and technicals

- Gold and Silver Market morning, October 1, 2012

- Helicopter Ben & Bank Bullion Buying

- Why I Remain Irritated at the Sierra Club

- Major Risk On Rotation As Junior Miners Outperform Gold and Silver Bullion

- What Does Gold Have Going For It?

- Hard Times for Hard Rocks

| Is Biotech Getting Too Frothy? Investor Sentiment Suggests Irrational Exuberance Posted: 01 Oct 2012 11:03 AM PDT By Stephen Simpson: Investors with many years of experience in biotech know there's something to the idea that the best time to prepare for war is during peace (and vice versa). With the biotech sector heading for its second straight year of strong returns, it's worth asking whether investors are getting a little too cavalier about risk and whether investors in the sector are getting set up for a sizable correction. Anecdotal Data Is Still Data One of the least scientific measurements I use when thinking about and assessing the biotech sector is reader/investor feedback. When investors are running scared and too scared to touch biotechs, bargains often abound. On the flip side, when investors seem to have dollar signs in their eyes and a "What? Me worry?" attitude toward risk, I get a little more concerned. To that end, I'm finding more and more readers taking me to task for being insufficiently Complete Story » |

| Gold Market Dip Buying Strategy Posted: 01 Oct 2012 10:52 AM PDT By EconMatters: Gold saw some profit taking last week along with equities as the quarter closed out with new money waiting to get in only after a significant pullback. This has attracted buyers at the $1735 level with a nice move just above the $1782 level before profit-taking sending it to close at $1771 point for the week. After the ECB and FOMC news briefly drove gold futures just a nudge above $1800, buyers have been lacking to push gold through this level with a bust out to test the next level of $1900 and $1920. It is this kind of momentum that will be required to make a serious push to $2000. The $2000 price point is what all the gold Bugs have said is a foregone conclusion, but has yet to actually materialize even with all the money printing, currency debasing, and outright doubts over standard measures for retaining stores Complete Story » |

| CRASH: Iran Rial Implodes By 20% In One Day Posted: 01 Oct 2012 10:12 AM PDT

from zerohedge.com: Iranian clerics' attempts to curb speculation in the Rial and stabilize the currency appear to have backfired as the un-official (real) Rial rate traded as low as 34,250 Rial to the USD this morning – a massive 20% plunge. Demand for gold is surging (as Tehran exchange volume is up almost 18% today) as the population appears to be readying itself for hyperinflationary death – as we wrote yesterday, it really is no fun in Iran. The following tables/links will allow the real-time monitoring of that market's collapse – since Bloomberg's official rates are entirely useless.

Keep on reading @ zerohedge.com |

| Brian Booth's Weekly Gold Report Posted: 01 Oct 2012 10:08 AM PDT Brian Booth, Long Leaf Trading Group, writes October 1, 2012: "Better late than never" comes to mind as I prepare this week's Weekly Gold Report. Just as I sat down to capture the weekly chart for December Gold, the market erupted after another perfectly timed announcement from a US FED official. After dismal news from the European Manufacturing sector overnight, a European Union Commissioner made upbeat remarks about Spain, followed by FED member Charles Evans stating that he would like to see "Operation Twist" continue past the December 2012 deadline and go on for another calendar year. The remarks from Olli Rehn in Europe and supportive comments from Evans in the US were enough to offset the worst Manufacturing number that Europe has seen in three months.Last week, Gold prices took a continued breather after QE3 news in the United States the prior week. I was surprised that the markets was unable to hit $1800 an ounce after Spain released their banking data, which suggested that their recapitalization needs were in line with expectation. I expected the pullback we experienced last week after Philly FED member, Plosser announced he was not thoroughly excited about another round of Quantitative Easing, would be quickly bought. I thought Spain's banking announcement would be enough to offset Plosser's negativity and drive Gold to near $1800 an ounce, but my idea fell just short of expectation by the end of the week. Nonetheless, the Gold rallied this morning to just a few dollars short of my expected target. Better late than never. This week is very important as the market will see Interest Rate decisions in Australia, England, and in Europe before the week is over. By the end of the day on Thursday, we will know if the Euro can stay underpinned and help the rally in the Gold continue. There is some speculation that the ECB may again lower Interest Rates to another record low of .5% by the end of the year. Whether it happens this month or not, is the question. I believe that the ECB will make supportive remarks on Thursday along with England and the rallies in the respective Currencies will put pressure on the US Dollar, which will favor Gold. I expect the Gold futures to hover around $1800 until we get the final decision in Europe on Thursday. I expect the strength to continue today, followed by choppy trading on Tuesday and Wednesday, and a rally on Thursday which will target $1825 in the December Futures. If the ECB announces an Interest Rate cut, I expect Gold futures to trade even higher than $1825. If The BOE and the ECB disappoint this week, I would expect a correction in Gold and other Precious Metals, and would look for any drops in prices to pause for buyers in $25 increments below $1800. I think that it is important for the BOE and the ECB to maintain order in the markets this month before the election in the United States. I do not see either of them doing anything that would deflate the markets and undercut the US FED's Quantitative Easing Decision before our November Elections. Good luck this week and as always, feel free to contact me directly if you wish to discuss this article or discuss trading in general. I would be happy to hear your thoughts, and also to share specific ideas as the market moves throughout the week. I can be reached by email at bbooth@longleaftrading.com or by phone at (888) 272-6926. October 1, 2012 (Source: Brian Booth, Long Leaf Trading Group) |

| Technicals: Silver Volatility 10.1.12 Posted: 01 Oct 2012 10:02 AM PDT |

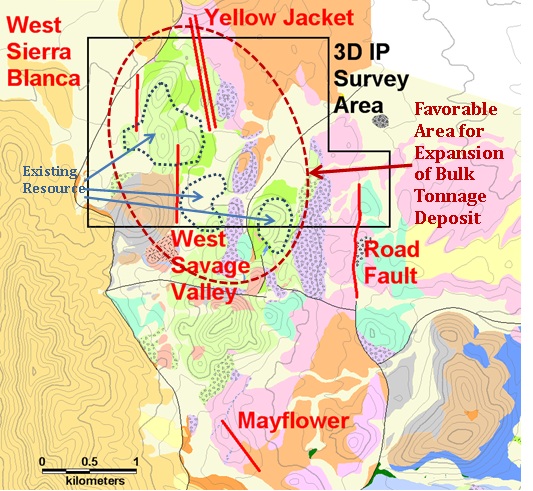

| Corvus Starts Follow-up Drilling at North Bullfrog Posted: 01 Oct 2012 09:08 AM PDT Vancouver, B.C. – Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces the start of its follow up drill program on the high-grade gold target at Yellow Jacket on its North Bullfrog project in Nevada. The program will target the down dip extension of core zone mineralization that was intersected in the Company's recent hole NB12-138 (4.3 metres at 20.0 g/t gold and 1,519 g/t silver). Results from a recently completed 3D IP geophysical survey at North Bullfrog has provided important targeting information for follow up drilling. In addition to targets at Yellow Jacket, results have highlighted a number of other highly favourable structural zones with high-grade potential on the property (Figure 1). In addition, this survey has further defined favourable areas for the expansion of the bulk tonnage deposits in the North Area. The drilling program will begin with one diamond core rig and expand when new permits are received at the end of the year. Jeff Pontius, Corvus Gold CEO states: "Follow-up drilling is opening up an exciting new value component for the project and our Company as a whole. The new high-grade targeting information has identified a number of highly encouraging targets that indicate expansion potential of both high-grade and bulk tonnage mineralization outside the current defined area." Yellow Jacket Target The Yellow Jacket target is associated with an intensely fractured, deep seated north-south trending fault zone. This zone hosts a variety of vein related high-grade gold and silver mineralization with a large surrounding, low-grade, disseminated zones. There are two important types of veins. Single stage quartz veins with pyrite have been encountered in holes NB-12-126 (5.7 metres of 6.56 g/t gold and 9.94 g/t silver) and NB-12-127 (7.7 metres of 2.43 g/t gold and 11.31 g/t silver) while more complex silicified hydrothermal breccias with fragments of banded colloform quartz were encountered in hole NB-12-138 (4.3 metres of 20.0 g/t gold and 1,519 g/t silver). Analysis of vein textural variations together with variations in clay mineralogy is helping to unravel the mechanics of this kilometer long structural zone that hosts significant high-grade mineralization. The follow up drill program will initially focus on expanding and defining the geometry of the core zone mineralization but will then begin to look at other high priority targets in the District. District High-Grade Potential Surface sampling, drilling and the new geophysical study have highlighted several high potential areas for both expansions of the current oxide heap leach resource and undiscovered high-grade systems. Historically several high-grade vein systems where mined at the turn of the century in the North Bullfrog District with similarities to the veins mine by Barrick Gold in the 1990's at the Bullfrog Mine 8 kilometres south. New priority high-grade targets have been identified at the Road Fault, West Sierra Blanca and West Savage Valley which will be tested following the next phase of Yellow Jacket drilling. In addition, targeting work is ongoing in the Mayflower area to follow up the new high-grade, banded adularia vein discovery (NB-12-141 with 1.1 metres of 6.85 g/t gold and 1.9 g/t silver).

Figure 1: Geological map showing the area of the recently completed 3D IP survey and structures that have now been highlighted as potential high grade systems. The survey has confirmed the geological continuity of the bulk tonnage alteration system which will help expansion of the resource under cover. New 3D Induced Polarization Geophysical Survey The 3D induced polarization survey, conducted by SJ Geophysics, was designed to provide information about the structure and alteration around the North Area deposits. The survey consisted of 36 line kilometres which has provided 3D coverage over an area of 5.6km2. The primary objective of the survey was to define the locations of key structures related to high-grade vein type mineralization, particularly in the Yellow Jacket area. In addition the survey has mapped key stratigraphic controls and alteration associated with the large bulk tonnage deposits in the area. The final 3D inversion was received in mid-September and the data has played an important role in the targeting of follow-up drilling programs for both the high-grade program and the extension of existing oxide heap leach resources. About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 43 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold. The property package is made up of a number of leased patented federal mining claims and 461 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company and its independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in February 2012. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an NI 43-101 compliant estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website at: http://www.corvusgold.com/investors/video/. Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc. About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: Ryan Ko |

| Posted: 01 Oct 2012 09:05 AM PDT

from rickackerman.com: Spain's deflationary quagmire lies well beyond remedy at this point, dooming Europe's bold but ill-conceived attempt to forge a political and economic union under a single currency. That Spain's collapse is imminent should be obvious to all by now, as the country attempts to borrow its way back to prosperity amidst 25% unemployment, savage budget cuts and a flight of capital to banks in England, Germany and elsewhere. Recall that it was just two weeks ago that the world's bourses wildly celebrated a German constitutional court's decision to uphold the latest bailout facility, the European Stability Mechanism (ESM). Stocks and bullion rallied sharply on the news, acting as though yet more monetary pump-priming would somehow surmount the irresistible deflationary drag of the world's imploding, quadrillion dollar derivatives edifice. In fact, the supposedly all-knowing, all-seeing stock markets showed themselves to be deaf, dumb and blind to fact and reality, since the court's decision actually raised more obstacles to a bailout than it eliminated. (Traders have since repented, having given up nearly all of their earlier price gains.) Keep on reading @ rickackerman.com |

| Defeat of Position Limits Direct Threat to Precious Metals Potential Posted: 01 Oct 2012 09:00 AM PDT

from news.goldseek.com: I can't say as I'm surprised by the announcement late Friday that lobbyists representing JP Morgan, Goldman Sachs, and Morgan Stanley, among others, had successfully obtained a judgement quashing the proposed position limits on speculative traders in commodities. According to Bloomberg: "U.S. District Judge Robert Wilkins in Washington today ruled that the 2010 Dodd-Frank Act is unclear as to whether the agency was ordered by Congress to cap the number of contracts a trader can have in oil, natural gas and other commodities without first assessing whether the rule was necessary and appropriate. Keep on reading @ news.goldseek.com |

| Eurozone Unemployment at Record Levels Posted: 01 Oct 2012 08:55 AM PDT

from goldcore.com: Today's AM fix was USD 1,770.50, EUR 1,372.80, and GBP 1,096.01 per ounce. Friday's AM fix was USD 1,781.00, EUR 1,374.65 and GBP 1,098.77 per ounce. Silver is trading at $34.40/oz, €26.80/oz and £21.40/oz. Platinum is trading at $1,665.00/oz, palladium at $633.30/oz and rhodium at $1,100/oz. Gold edged down $4.00 or 0.23% in New York on Friday and closed at $1,773.30. Silver was down to a low of $34.27 and finished with a loss of 0.35%. Both gold and silver were relatively unchanged for the week. Euro gold reached a new high at €1,381.15. Gold was down Monday after seeing its largest quarterly rise in over two years, as it tracks a weaker euro on Spain's struggle to control its finances deeply troubles investors. Moody's Investors Service's will make a decision on Spain's credit rating and it may be announced later today or will be forthcoming. Keep on reading @ goldcore.com |

| Third-time Lucky for Gold at $1800? Posted: 01 Oct 2012 08:53 AM PDT

from goldmoney.com: Another Monday, and the start of another quarter. We are also heading into the Indian festival season, which is often a period of strength for precious metals prices. Over the last decade, the gold price has on average performed best during Q4. Right now though, the metal is struggling to clear resistance at $1,780. Though some of the selling pressure last week was a result of hedge funds taking profits/squaring books at the end of the quarter, look at a gold price chart for the last year plus and it's pretty clear that the $1,780-1,800 zone is an important resistance level for gold. Dan Norcini highlights gold's year-long trading range at his site – with $1,530-40 marking the bottom, and $1,800 the top. So we could be in for quite a struggle to best $1,800 over the coming days, given its technical significance. This is the third time in the last 12 months that gold has risen this high. Given the wind is very definitely at the bulls' backs as a result of the recent spate of central bank money printing announcements, there's a good case for thinking – as Dan does – that it'll be third time lucky this time though. Keep on reading @ goldmoney.com |

| China’s Black Box, Plus Three Reasons Why Energy and Base Metals Are Strong Posted: 01 Oct 2012 08:01 AM PDT

We were reminded of this by the following nutty Reuters story, China slides faster into pensions black hole: Eighty-year-old Chinese farmer Guo Shuhe receives a state pension equivalent to just $9 a month, not enough to buy a month worth of groceries, but enough it seems, to risk punching a gaping hole in government finances. Guo, whose palms are thick and rough from a life spent hoeing fields in southwest China, is one of over 150 million people covered by a rapidly expanding rural retirement scheme which is accelerating the nation's slide into a pension crisis… Policy makers and economists have long been worried about the financial burden of China's expanding patchwork of pension schemes, but those concerns have recently escalated as its rural pension scheme took off in the past three years. The funding shortage is daunting: economists say it could blow out to a whopping $10.8 trillion in the next 20 years from $2.6 trillion in 2010, towering over China's $3 trillion onshore savings, the biggest hoard of domestic savings in the world. Time is not on China's side. Its fast-maturing society and economy — thanks to a one-child policy and a rapid rise in living standards — demand better pension coverage in future. Yet China is already straining to hold things up… Supbrime lending schemes, suicidal shadow bankers, copper collateral ponzi pyramids, deadly demographics, and now a pension time bomb… the Dragon truly has it all… Black boxes are all too often nasty. When the lid comes open, bad things tend to come out. Those saying don't worry, chill out, China is strong, invest in China for the long run etcetera display the same mentality as the complacent hand wavers who were buying black box financials in size, and averaging down, in the 2007-2008 period prior to leverage implosion and catastrophe. All of those black-box-buyers got fried, some of them to career-destroying result (ahem, Bill Miller, cough cough). As Market Wizard Larry Hite once put it, "risk is a no fooling around game."

There are many energy and base metals charts with this rough pattern:

The oil and gas / base metals strength is strange on its face because 1) crude oil looks terrible and 2) the global slowdown thesis appears to be strengthening, not weakening. So why would energy and metals be looking healthy? What gives? Here are three interlinked hypotheses (possible explanations): 1) Western central bank activities are EM negative, but resource positive. To the degree that the major currencies (dollar, euro, yen) are on a path to being debased, emerging market economies will be hit with the double whammy of slowing exports (to Western countries) and rising inflation (via higher food and energy costs), possibly forcing a tightening of monetary policy (which further fuels dollar weakness). And yet, this same phenomenon that is EM negative is resource positive. If everything else starts looking worse, even as inflationary pressures rise with food and energy costs, resource names start looking better on a relative and absolute basis. Keep in mind that the United States is an agrarian superpower, and that grain, oil etc. are priced in dollars. Thus, as dollars get debased (via the will of Bernanke & co), the output of oil and gas producers becomes more valuable (in nominal inflationary terms) even if the economic outlook for EM economies deteriorates. 2) Energy and metals producers as best house in a bad neighborhood. Institutional capital has a desperate need to be long… and so many areas of the market look overbought, overhyped or just plain lackluster, energy and metals are one of the few areas where relatively decent valuations can still be found, coupled with a longer term thesis that "debasement trumps all" (as Western CBs try to print their way out of this mess) and EM demand / growth eventually comes back. 3) Belief that Draghi and Bernanke will do what they say they are going to do. Not in terms of fixing U.S. unemployment, necessarily, or saving Europe from the throes of recession / austerity-induced depression… but rather in the sense of central banks pre-emptively going "all in" to such a degree that deflation does not take hold… in paper assets anyway…

JS (jack@mercenarytrader.com)  p.s. Institutional allocator seeks talented traders and money managers. Potential allocation amount: $2 to $10 million. See if your track record qualifies... |

| In Praise of a Silver Miners ETF Posted: 01 Oct 2012 07:57 AM PDT Zealllc |

| Posted: 01 Oct 2012 07:55 AM PDT Same old, same old.   |

| Declining Metal, Commodity Influence for QE3? Posted: 01 Oct 2012 07:19 AM PDT The fourth quarter began with modest losses in precious metals as well as the US dollar and the euro this morning. Spot gold started the new month with a $3 loss and it was quoted at $1,768 per ounce in New York. Silver fell 20 cents to open near $34.31... |

| 'Bull Trend Remains Intact' for Gold Bullion Posted: 01 Oct 2012 05:33 AM PDT Spot market gold bullion prices dipped below $1,770 an ounce during Monday morning London trading, though they remained in line with the last fortnight's price action, while European stock markets rallied along with the euro. |

| Euro Zone Unemployment at Record Levels Posted: 01 Oct 2012 04:53 AM PDT Gold was down Monday after seeing its largest quarterly rise in over two years, as it tracks a weaker euro on Spain's struggle to control its finances deeply troubles investors. |

| Posted: 01 Oct 2012 04:46 AM PDT Rob Gray of The American Open Currency Standard joins SGT to talk about what solutions we the PEOPLE have to combat the FED's criminal printing press. from sgtbull07: Ron Paul correctly argues that COMPETING CURRENCIES are the answer to the monetary mischief of the powers that be. And some communities are doing just that – embracing alternative currencies to compete with the FED's fiat Dollars. Rob & AOCS are behind the beautiful Lakota Nation rounds and the new Silver Bullet Silver Shield rounds, which are available at http://SGTreport.com/ Rob & I also talk about the risks of returning to a gold standard when the world's wealthiest families own most of the gold! ~TVR |

| In Praise of a Silver Miners ETF Posted: 01 Oct 2012 04:09 AM PDT After taking a closer look at SIL, a case can be made that this ETF represents an excellent proxy for this high-risk high-reward sector. And as a new wave of investors find their way to silver stocks, SIL will be waiting with open arms. |

| Third-time lucky for gold at $1,800? Posted: 01 Oct 2012 03:30 AM PDT Another Monday, and the start of another quarter. We are also heading into the Indian festival season, which is often a period of strength for precious metals prices. Over the last decade, ... |

| Precious metals shares more attractive on fundamentals and technicals Posted: 01 Oct 2012 03:03 AM PDT "Goldcorp Inc. (G), the world's second-largest producer of the metal, said mining acquisition targets are looking more attractive as tougher financing conditions have depressed share prices. 'The development-company valuations have come down to where, at least on paper, it looks like there's some opportunities,' Chief Executive Officer Chuck Jeannes said in an interview last week. 'There's a lot of looking going on." "Exploration and development companies, or so-called juniors, underperformed the large gold miners last year after they struggled to raise funds and investors shunned risky assets. The juniors are on average lagging the seniors again this year, even after rising 25 percent since hitting a two-year low on June 28. "The 74 companies in a Bloomberg Industries index (BBRGLDEX) of gold explorers now trade at an average 1.54 times book value, versus a three-year average of 2.58. "'A lot of the juniors have been hard up for cash, the financing window wasn't necessarily open,' Marc Sontrop, a Toronto-based portfolio manager at Interward Asset Management Ltd., said by phone on September 14. I think we're going to see takeover activity pick up, given the valuations. "The Bloomberg Industries Global Explorers Gold Competitive Peers Index has fallen 15 percent this year, compared with a 2.8 percent decline in an index of 14 senior gold producers, which includes Vancouver-based Goldcorp. In that time, gold futures in New York have gained 13 percent. "'The challenge is now finding something that after thorough due diligence you would want, and finding something that the owners are willing to part with at what are historically low prices,' Jeannes, 53, said in the interview at the Denver Gold Forum. 'There are things that look more attractive today than they have been for some time.' "There have been seven takeovers of gold companies worth $200 million or more announced this year, valued at $2.54 billion. That compares with nine deals valued at $11.61 billion in the same period last year. "'The tide went out due to a combination of factors including overvaluation, stagnant gold price, cost escalation, new super profits taxes, funding evaporation and high profile operational hiccups by the majors, which highlighted to nervous investors the rarity of economically feasible gold deposits,' Tahiliani said by e-mail. "Jeannes said he expects gold equities broadly will outperform the metal as investors seek to take advantage of historically low valuations and producers promise to make better investment decisions. Miners including Barrick Gold Corp. (ABX), the biggest producer of the metal by market value, and Kinross Gold Corp. (K) have said they will be more disciplined in spending on projects and will target higher returns rather than output growth.

This posting includes an audio/video/photo media file: Download Now |

| Gold and Silver Market morning, October 1, 2012 Posted: 01 Oct 2012 03:00 AM PDT |

| Helicopter Ben & Bank Bullion Buying Posted: 01 Oct 2012 01:12 AM PDT This extra money will be an embarrassment for banks everywhere: what will they do with it? The search for good non-cyclical returns is on, and two possibilities stand out: for traders agricultural commodities and energy; and for treasury departments gold. |

| Why I Remain Irritated at the Sierra Club Posted: 01 Oct 2012 12:55 AM PDT By lambert strether. A version of this post appeared at Corrente. This post has with new material added that applies in part to fracking. So here's the deal, and linky goodness will be lacking today (and a lot of this is what activists have put together in discussion, so links are lacking anyhow. And as the great Peggy Noonan once said: "It would be irresponsible not to speculate!") One of Maine's issues as a state is that we have an extractive economy that's doesn't support us as well as it used to, what with producing more with less in pulp and paper, and with the forest product industry tending to move where costs and regulations are lower, and/or closer to the equator, where trees grow faster and bigger. We continue to extract from fisheries and summer people, naturally, but those resources, although renewable with careful management, are seasonal and mostly support the coast. And Nestlé extracts our water at Poland Springs. But the sort of people who play golf together and fly over the state in executive jets seem to see two main "opportunities": One is our oodles of empty space,* hence landfills and importing of out-of-state trash.** The other is our geographical position between Quebec and New Brunswick. Location, location, location! Which brings me to the "East-West Corridor." Here's a map. The blue strip shows the Corridor's route, kinda sorta. (The local oligarch shilling the plan, Cianbro construction czar Peter Vigue, has the real map, but he keeps it locked up in his office.)

Now, a word about the business model behind the Corridor. The Corridor is essentially a land deal. Key point: The Corridor would be privately owned. That means that the (unnamed, as yet unknown) owners of the corridor would be able to run whatever they want along the strip:*** Could be a highway, could be power lines, could be pipelines for tar sands.**** The sales pitch is that the Corridor would enable Maine to "compete in the global" economy, which is exactly what a lot of Mainers — and especially the Mainers who moved north into all that empty space and bought farms that have turned out to be right in the Corridor's footprint — do not want to do. (And why should we?) Note that the right of way discussed is considerably wider than Route 95′s (which runs North-South) so one can only wonder why that is, and what they would do with the extra space. Now, Vigue et al. are marketing the Corridor as a "highway," and that's clever, because people think, just as I thought, "Super! We can drive to Montréal!" So let's consider the Corridor under that aspect for one moment, assuming that the descriptions used by proponents are not deceptive. First, the Corridor, being private land, would be fenced along its entire length, and there will be very few exits. If families or friends on either side want to cross going North-South, they'll have to drive or hike miles out of their way to a crossing. If animals want to cross the Corridor, they'll have to use wildlife crossings (which is so ridiculous. I can just imagine a bear at one end and a moose at the other. How does that work, exactly?) That means that the Corridor is, in essence, splitting the state into two, like the Berlin Wall, or the DMZs of Korea or Vietnam, or any fence around a sacrifice zone. Second, the only permanent jobs the Corridor would bring Mainers would be those servicing truck and truckers at those very few exits: 7/11 cashiers, hotel attendants, dealers, and hookers. Not that there's anything wrong with any of that, but Vigue keeps claiming the Corridor would let "our children" stay in Maine, and it's just not so. (There's a reason that multiple studies have been done on this consultant- and lawyer-funding boondoggle, and it's been shelved, every time.) Third, there seems to be no business rationale for a highway that benefits Mainers. It's easy to see how Canadian truckers save time and money with a shorter route across Maine instead of around it, but not so easy to see how that helps Maine, or helps "our children" stay in Maine. Fourth, it's also not easy to see which Maine businesses are going to ship their goods out to market using the Corridor. The forest products industry already has its supply chain. Now, it could be that the Corridor will conjure entire new industries into being up in the Unorganized Territories, but if that's true, Vigue is being notably coy about what those new industries might be. Water? Do we really want to send our water out of state? Mineral mines?***** And from the Eastport end of the Corridor? Eastport can't compete with New York, Newark, Baltimore, or Charleston, all of whom have spent billions upgrading their facilities and are wired directly into massive intermodal transport networks, none of which are available at Eastport or ever would be. Finally, it is easy to see that some goods can shipped in to Maine from away. One obvious candidate is Canadian and European trash: The state-owned landfill is right on the Corridor's route, and is already permitted for international medical waste. In summary: We've got a situation where the best case scenario is a boondoggle that benefits Cianbro and the usual slithering eel bucket of lawyers, legislators, consultants, and fixers (sorry for the redundancy) down in Augusta. The proponents don't make a clear business case for the Highway, and can't show it nets out positive for Mainers. And opponents can develop business cases for the Corridor, but if the proponents have those cases in mind, they're not saying, and it's not clear that tar sands pipelines, water export, mineral export, or trash import would benefit anybody but a few "global" corporations, and all of them put our land and water at risk (which "the children" would then pay to clean up). And these objections scratch the surface; here's more. So the state of play right now is that local activists have made this case against the Corridor very powerfully and effectively on the ground.****** On the critical path is a so-called feasibility study (which studies the financial aspects of the highway only; see under "private equity," perhaps. The study, since it is funded by the state, might possibly be used to show public benefit, and hence be used by the private owners of the Corridor to justify the use of eminent domain). Well, the Corridor's legislative sponsor (Doug Thomas) got an earful from constituents and asked the Governor to put the feasibility study on hold. This is a good thing! * * * So, into this context steps the regional Sierra Club office, who sponsored a public informational meeting the other day at a rawther expensive venue without managing to contact the local activists for their mailing lists or using their phone tree, so most of us came through word of mouth. And the regional honcho was gracious enough to ask us for our feedback on the PowerPoint presentation they intend to show throughout the state. And things went wrong from Slide One (though we were courteous enough to wait until Slide Two to point this out). In short form: The Sierra Club parachutes in and frames the issue as "The East-West Highway" not "The East-West Corridor," thereby undoing all the careful framing that the actual, local activists had used to beat up on Doug Thomas and bring the thing to a halt. Worse, this weekend is The Common Ground Fair, a deeply Maine event way up at the tippie-top of the hippie gradient in Unity, and I picture the activists having a table with some flyers saying "Corridor" and the Sierra Club having a booth with printed brochures saying "Highway," stomping all over the local message. Way to go. So I'll be interested to see whether the Sierra Club is able to display adaptability or not. [It seems that the Sierra Club focused on national campaigns like "Moving Planet". Jym St. Pierre of RESTORE at did adapt, saying "East-West Highway and Utility Corridor," according to Martha Stewart's stable manager (!), who did a write-up for the Fair (photo 26).] Even worse, having framed the issue as "Highway bad" the Sierra Club has an answer: "Rail good." And as it turns out, there is trackage more or less along the kinda sorta known route of the Corridor, making the business case for the Corridor even more iffy than it already is (unless it's not really a highway at all, of course, but a real estate deal just waiting for pipelines, power lines, giant conveyor belts, catapults, or whatever). Clue stick, Sierra Club: I don't give two sh*ts whether medical waste from Canada or Europe comes into the state by rail or by highway. I don't give two sh*ts whether the slurry from mountaintop removal for minerals leaves the state in a ten-wheeler or a hopper. And I don't give two sh*ts whether oil spills into the alder swamps or the Penobscot or the Kennebec or Moosehead Lake because a pipeline broke or because a tank car overturned or a whole train went off the rails. In fact, I don't even buy the premise that Maine, and especially northern Maine, should "compete in the global economy" at all, a premise both Vigue and the Sierra Club share. The whole neo-liberal paradigm is doubling down on #FAIL, and I don't see any reason why Maine ("Dirigo") shouldn't say "This stops here." The Sierra Club thinks or at least says that "We're on the same side." Well, if we're on the same side, then don't stomp on our framing and don't enable the more efficient extraction of resources from our state! In fairness, the regional Sierra Club employees were quite happy to have their highly educated and mostly under- or disemployed audience correct their PowerPoint for errors in spelling, grammar, and consistency, which were quite numerous and unbecoming in a professional presentation. In fact, it was clear that they weren't empowered to do anything else. * * * If I had to guess why the Sierra Club behaved as it did, my guess would go something like this: The Sierra Club was driven by its own institutional imperatives rather than the need for Mainers to retain public goods like clean water and a state without a giant corridor-ectomy scar stitched across its middle. The Sierra Club is in the business of running — and seeking funding for — "campaigns" against highways and for rail. So — rather like the classic story of the drunk looking for their lost keys under the streetlamp because that's where the light is — they gussied up a presentation from an old campaign with some new graphics and bullet points, and parachuted into the local activist community with it, hoping to get some free copy editing and, oh, buy in. Didn't happen. I'm crying. Oh, and the best part? One Sierra Club representative or hanger-on mentioned, late in the meeting, that one reason they favored rail was that they (the Sierra Club) didn't want to be seen as nay-sayers, heaven forfend. Well, pushing an outcome where international medical waste could end up being dumped in Maine's state-owned landfill so the Sierra Club can burnish its cred in Washington, D.C.… Well, it just makes me feel warm inside, ya know? * * * In closing, all anti-extractive/pro-sustainability activists are really fighting the same fight: Fracking, landfills, mountaintop removal, pipelines, water, etc. The resource may vary, but the playbook and the stakes remain the same. Here are some characteristics that seem general to me (and I'm probably reinventing the wheel here, so more experienced activists should feel free to jump in and correct, add links, etc.). 1. The "Jobs" talking point. In a state where people are desperate for work, that's a big selling point. Our landfill was sold on the basis that it would save "the mill" (don't ask; the scam was incredibly intricate). That turned out to be a lie. Film at 11! At its most intense, this talking point is straight up "Shock Doctrine" stuff. It has occurred to me that one reason our elites won't put anything like a Jobs Guarantee on the table is that the "Jobs" talking point would go away, and the locals would be much harder to muscle. 2. The "Children" talking point. Just as with charters, when advocates say "it's all about the children" it never is. 3. Social capital. One reason the our meeting went so well (for us), and anti-Corridor activism generally has been so effective, is that people who've come to know and trust each other in previous campaigns came together quickly and effectively for this one. 4. Civic engagement. The permitting process — and not, for whatever reason, the electoral process — is one terrain on which these campaigns are fought. (Sorry for the metaphor, which is both militaristic and may not even be correct. But it's the one I have. Civil resistance, as with the Keystone tree-sitters, is a topic for another time.) While we landfill activists haven't stopped the landfill, we at least — with a very small and unpaid crew — have been able to slow it down, and more to the point, turn the climate of opinion in the State against the landfill, and its proponents (among them the former Democratic governor). The permitting process provides the press with a ready made narrative and a calendar of events. Moreover, the activists generally become subject matter experts in the form of extraction they oppose, and begin to appear in the press as authoritative sources as the narrative proceeds. The permitting process is also rife with lack of transparency, lack of accountability, and even corruption (whether in the form of cognitive regulatory capture, the revolving door, etc.) all of which must be discovered and rooted out. In other words, the civic engagement demanded by the permitting process is terrific for building social capital from "all walks of life." Necessary. But sufficient? Leading me to…. 5. "But what are you for?" Here, if I may say so, I think that "we" tend to fall down. There doesn't really need to be an alternative to the East-West Highway other than not building it; so the case is easy. Landfills are a little harder, because, after all, the waste has to go somewhere, though the Europeans (and Massachusetts) should deal with their own waste instead of shipping it here. Nevertheless, Maine has a solid waste hierarchy with landfills as a last resort, and so all that's really necessary is to get the state government to adhere to its own policy, which I didn't say would be easy. Fracking seems much harder: Our elites (as Ian Welsh pointed out some years ago in a post I have never been able to find; readers?) don't know how to do anything other than run a political economy based on extracting hydrocarbons, so they are doubling down on Twilight in the Desert with fracking. But it's not at all clear what a political economy that wasn't based on hydrocarbons would look like, anti-frackers don't articulate that vision, and "you can't fight something with nothing." "Sustainability" isn't defined operationally, and people have to pay the bills, and take care of their hostages to fortune, and good for them. So what to do? NOTE: Fracking also has private property and home rule issues to contend with, which I don't address yet. In any case, we need to share experience, strength, and hope, and this post is an effort to do that. NOTE * Empty except for the people who live there. Most people think of all New England states as small, but Maine is big and has a big sky. Up in the "unorganized territories" there are hundreds of square miles without any public roads or facilities of any kind. Off-the-gridders like this. NOTE ** Interestingly, David Foster Wallace seems to have anticipated the views of our elites in Infinite Jest, with his vision of a New England walled off from the rest of the continent with plexiglass, IIRC, and toxic waste fired over the wall from points south with giant catapults (from the Infinite Jest Live Blog). Technology:

Oh, and we ceded "the concavity" to Canada (to them "the convexity"). Here's an extract from Wallace's "fly on the map" transcript of the key decision makers cutting the deal:

Quite an ear, Foster Wallace had. I guess the shorter version of my problems with the Sierra Club is that I can just see them at this meeting, proposing that catapults made out of wood be used ("sustainable!") or that the plexiglass wall be painted with colorful murals, possibly by schoolchildren. NOTE *** I should know, but don't, the permitting regime that a private corridor would run under. One can only believe that it would be even more lax than the permitting process under which our state-owned/privately operated landfill has been run, a process marked by the reversal of Maine's solid waste hierarchy, which by statute makes landfills a last resort, not a first, and also marked by the corruption of state and local government in the forms of the revolving door, fees for lawyers and "consultants," secret contract amendments, meetings run for years with no bylaws, a general lack of transparency and accountability, and a Katahdin-high mountain of bullshit from the operator about their plans and intentions. Oh, and they sited the thing near the Penobscot, so when the liner fails, as all landfill liners do, the best case scenario is that the quality of our surface water would be sacrificed. I go on like this to show the nature of our local oligarchy. All I can say in defense is of these guys is that Maine is so poor they never engineered a housing bubble. NOTE **** Some speculate that the East West Corridor would hook up to a proposed Enbridge tar sands pipeline running through Michigan and up through Ontario and Quebec, terminating at Eastport. An alternative would be to use an existing aircraft fuel pipeline running from Quebec south and terminating in Portland, but that pipeline is old, is flow direction would need to be reversed, and not its necessarily suitable for tar sands oil. NOTE ***** There is one possibility: Mineral mines. It's not clear to me that the potential gold mine in Aroostook County is on the route, however. Although I suppose it could be! There is, however, a certain beauty to the concept of (just guessing) Irving Canada bootstrapping its private highway with the proceeds from the gold mine it owns. NOTE ****** Vigue, when he's not presenting to Chamber of Commerce types, comes off as touchy and paranoid. Was it really necessary to call in the police from all the surrounding towns at a so-called open meeting? And then pre-clear all questions from citizens, instead of having an open mike? UPDATE In discussing the jobs the Corridor would bring to Maine, I have just realized I forgot the mention the security guards, and apparatus, needed to patrol the fence. My bad.

All the way across Maine! But jobs! Think of the children! |

| Major Risk On Rotation As Junior Miners Outperform Gold and Silver Bullion Posted: 01 Oct 2012 12:22 AM PDT |

| What Does Gold Have Going For It? Posted: 30 Sep 2012 11:24 PM PDT Gold no longer has a legal role in the world's monetary system, but because of a collapse of faith in sovereign obligations and a coming complete lack of trust in governments and financial institutions, gold is going to quickly become a core banking asset. |

| Posted: 30 Sep 2012 11:11 PM PDT It's not only the falling terms of trade that's making Australia poorer by the day. It's the fact half the country has the day off! It's a public holiday in four Australian states and the ACT today. No wonder there's a productivity crisis in the economy. C'mon Australia. Do you think anybody has the day off at the Foxconn factory in China? Alas, here in Victoria (and, we're assuming, Tasmania) we've turned up for another week's reckoning. And oh what a week it could be. The official hand-wringing has begun about the end of the mining boom. Smart investors have known it was coming for a while now, and have already prepared. Do yourself a favour and remove pages 16 and 17 from today's Australian Financial Review (AFR). The 'Fin' is a pretty useful newspaper. But those two pages in today's paper contain the results of a survey from Australia's major banks, brokerages, and economists. As the old joke goes, you could lie all of Australia's economists from end to end and they still wouldn't reach a conclusion. The conventional wisdom is that the Reserve Bank of Australia will probably cut the cash rate at least once before the end of the year; if not tomorrow, then definitely on Melbourne Cup Day (November 6th). In the unimaginative and banal world of big bank economists, this rate cut will be enough to keep the Aussie economy growing at 3% while China 'slows'. Is it possible that the same profession that completely missed the global financial crisis would completely underestimate the severity of China's pull-back? Well, past performance is no guarantee of future results. But when it comes to underestimating severe shocks to the economy, economists are as reliable as the sun. You can bet their sunny disposition will be inclined to view 2013 in the best possible light. The best-case scenario is that the investment boom reaches its climax in the next year. Big spending by the miners and energy companies will support GDP. Then, once the investment pipeline tapers off, increased production of commodities (even at lower prices) will lead to steady growth in national income. Everything will be fine. China's new leaders will spend to the heavens and the iron ore price will rise. Nothing to see here. Move along. But China itself isn't exactly moving along. The volume of cargo moved by rail fell 9.2% in August, year-over-year, according to data from China's National Bureau of Statistics. The decline in the volume of stuff moving on China's railroads matches the size of the decline in 2008 and 2009.  Back then, China reignited the mining boom by spending nearly $600 billion on 'shovel-ready' infrastructure projects. Will a similar spending boom bail Australia out again? No! The mining boom is dead. That's the view we articulated in our most recent report, 'How To Make Money from the End of the Mining Boom'. Based on our picture in that report, you might conclude that the mining boom ended because we ate it. But that is not the case. The mining boom ended because the Chinese growth model of the last 30-years isn't working anymore. PIMCO analyst Ramin Touloi says it this way in today's Age: 'Our view for the last year has been that many analysts were underestimating the extent of the impending slowdown in China...policymakers [in China] are grappling with a major change in the economic growth model.' If, by 'a major change in', he means 'the death of', then he's dead right. Most major economists won't/don't see this coming. They can only perceive the world through the Keynesian senses of debt, GDP growth, government spending, and aggregate demand. They don't understand or believe in sound money (real money). If you think we're exaggerating, you should have a look at why Michael Pettis has gone out on a limb to show why, 'By 2015, hard commodity prices will have collapsed.' Pettis reckons there are four reasons. First, the initial gap between supply and demand at the beginning of the boom has been closed by increased commodity production. Second, the gap was driven by China's 'unbalanced' growth model, now in disrepair. Third, the rebalancing of Chinese growth will be less commodity-intensive. Fourth, Chinese commodity inventories are bulging and more destocking is needed. It's all persuasive. And absent some economic sleight of hand by the new communists in charge, it seems like a plausible scenario. But economic facts aside, if it's the end of the mining boom, what are you to do with a company like BHP? This is where 2013 could get really interesting for investors. BHP is not only a hard rock miner. It's an oil and energy company as well. That could pay off in 2013. It may not be enough to compensate for falling iron ore and coal prices. But it's better than having nothing to fall back on (see Rio Tinto). Bloomberg had an interesting story over the weekend about the US shale industry. The story was actually about Australian-listed companies with shale assets in America. In turns out many of those companies are trading at a discount to their US peers. Bloomberg reports:

'Australian companies exploring for oil and natural gas that's trapped in shale rock in the U.S. and Canada are valued at a median of 11 times their reserves, a 23 percent discount to their counterparts that are listed on stock exchanges in North America, according to data compiled by Bloomberg. The valuation gap driven by Australian investors who are more than 8,000 miles (12,800 kilometres) from the companies' wells in Texas and Oklahoma may lure acquirers, said RBS Morgans Ltd.' It's true that Aussie companies with US shale assets may be undervalued because Australian investors know less about them, or are unsure how to value them. The US shale gas industry is more mature. And if the companies have an actual reserve number — an idea of how much (and what kind) of gas they could extract at a profit — then the discount really could be Aussie investors not paying attention. But the bigger story in 2013 is not going to be Aussie companies with US shale assets. It's going to be Aussie companies with Aussie shale assets. For its part, BHP is already turning its focus back to off-shore LNG in Western Australia. Check out the maps below. Source: BHP Billiton Petroleum Annual Review, 2012 BHP made special note of the Tallanganda discovery in the annual report. Tap Oil has a 20% stake in that project, and has previously claimed the field could hold as much as 1.3 trillion cubic feet of gas. BHP didn't confirm that in its report. But it certainly highlighted the project. All of this is part of the global boom in off-shore and on-shore natural gas production. This article highlights how the gas boom is changing the world's geopolitical picture. Russia is worried that shale gas could lessen its influence over energy consumers in Europe (a point Kris Sayce made earlier this year and turned into an investment idea). The shale revolution is certainly shaking things up everywhere. For Aussie investors, the biggest gains may not come from BHP or Aussie firms with US assets. They may come from Aussie companies developing Aussie shale assets. That's our position anyway. And we're sticking with it. By the way, did you notice that BHP highlighted its off-shore gas assets in the South China Sea? Hmm. Is it possible the territorial disputes in the South China Sea and the East China Sea aren't about fishing rights or American influence? Are they about oil and gas and which country gets to sell the permits to extract them and collect the royalties from them? Hmm. Regards, Dan Denning From the Archives... Liquid Paper Banks versus the Farms A Familiar Sequence: Print, Spend, Crash The Hamburglar's Budget The Cheeseburger Police

|

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment