saveyourassetsfirst3 |

- The Daily Gold Nails Market Bottom & Rebound

- Poor jobs report causes gold and silver to skyrocket/Reports from Europe on their "operation twist"

- Silver Steals the Spotlight from Gold: But Watch Out for Silver's Volatility

- Sprott Physical Gold Trust prices follow-on offering of trust units in an aggregate amount of US$341,320,000

- Three King World News Blogs/Audio Interviews

- ECB Collateral Moves Reopen ‘Soup Kitchen’ for Struggling Banks

- Top 5 Insider Sells Filed On September 7

- Peak Silver Redux

- Silver Update: Biflation 9.7.12

- Moneybags73: Junk Silver Fights Inflation

- 90 Minutes with Lindsey Williams

- Alex Jones: Gold and George Soros

- Top 5 Insider Buys Filed On September 7

- Vivus, Arena: Don't Be Too Late To The Punch Bowl, Buy Other Stocks

- Mike Niehuser's Gold Investing Lessons From Banking School

- Gold Imports To China From Hong Kong Double Again On Haven Demand

- Gold Hits Near-Record Euro Highs as Markets Jump on ECB Anticipation

- Subprime auto nation

- Supra Mario, Bond Vigilante

- Central banker berates Indians for preferring gold to a crappy currency

- By the Numbers for the Week Ending September 7

- US Banks and Sociopaths

- The Fly in the Inflation Ointment

- Gold and Silver Disaggregated COT Report (DCOT) for September 7

- Missing Gold: Another $80 Million Vanishes

| The Daily Gold Nails Market Bottom & Rebound Posted: 08 Sep 2012 09:54 AM PDT Back in May with precious metals falling and heavily oversold we wrote an article, "Major Bottom could Happen this Week." The evidence presented was too hard for us to ignore. The sector was extremely oversold and Gold, Silver and GDX was nearing strong enough support that would produce a rebound. After publishing, we received some lashings in the comment section. Some were so obscene that we had to delete them. A few months later, after the stable bottom, we published "Short-Term Outlook is Bullish." The chart below shows Silver, Gold, SIL, GDX and GDXJ. We mark when we published each article. Do we get every market call right? Of course not. We thought the market was close to a bottom in April but then it became apparent to us that the market was readying for a May bottom, similar to 2005. As a result of our timely calls and superior stock picking, our model portfolio (currently comprised of 10 mining equities) is up 17.2% year to date while GDXJ is down 5.0% year to date. Consider a subscription to The Daily Gold Premium | ||||||||||||||||||||

| Poor jobs report causes gold and silver to skyrocket/Reports from Europe on their "operation twist" Posted: 08 Sep 2012 06:58 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||

| Silver Steals the Spotlight from Gold: But Watch Out for Silver's Volatility Posted: 08 Sep 2012 06:38 AM PDT Yesterday in Gold and SilverGold got sold off about ten bucks during the morning trading session in the Far East. But the bottom was in by 1:00 p.m. Hong Kong time...and the gold price crawled higher from there until the jobs numbers were released at 8:30 a.m. in New York. The rest, as they say, is history. Gold blasted thirty dollars higher in about fifteen minutes...and this had all the hallmarks of a short-covering rally. Once that was done, the gold price worked its way higher from there until it ran out of gas...or into a not-for-profit seller...about ten minutes before London closed for the weekend. From there it more or less traded sideways into the 5:15 p.m. Eastern close. Gold finished the Friday trading session at $1,735.50 spot up $34.20 spot. Volume was an absolutely gargantuan 230,000 contracts. The silver chart looks the same as the gold chart, so I'll spare you the play-by-play on that. Silver's low tick [under $32.00 spot] came during the Hong Kong lunch hour...and the high tick [$33.80 spot] came shortly before the Comex close in New York. Silver closed up 98 cents at $33.69 spot...but had an intraday move of 5.5%. Volume was way up there at 57,000 contracts. The dollar index opened at 81.12...and began to slide lower starting at the open of London trading. The real decline began at 8:30 a.m. in New York...and by 10:40 a.m. most of the decline was in...and the dollar more or less traded sideways into the close. The dollar index finished the Friday trading session at 80.17...down 96 basis points, or 1.23%. Gold and silver prices were almost the inverse of the move in the dollar index...but to say that there was an exact relationship between the two is a bit of a stretch. The gold stocks gapped higher at the open...moved a bit higher from there...and only sold off a hair into the close. The HUI finished up 2.77%. Despite the big move in silver yesterday, the stocks didn't do as well as one would expect...and a few actually finished down on the day here in Canada, with Silver Standard Resources being the most prominent...although a few junior producers put in a first-class showing. But, overall, I was underwhelmed. I felt the same with Thursday's silver stock price action as well. But, having said all that, Nick Laird's Silver Sentiment Index closed up 2.99%. (Click on image to enlarge) The CME's Daily Delivery Report showed that 23 gold and 3 silver contracts were posted for delivery on Tuesday. Nothing to see here. For the second day in a row, there were no reported changes in either GLD or SLV. One can only imagine just how much metal is owed to both these ETFs...especially SLV. I'm sure that the authorized participants were forced to short the shares again both Thursday and yesterday. In an e-mail from Nick Laird in the wee hours of this morning, he informed me that Sprott did an offering on their Physical Gold Trust...and added 172,270 troy ounces of gold to it yesterday...along with another 89,848 troy ounces of silver to PSLV. I have more on Sprott's gold offering in the 'Critical Reads' section further down. The U.S. Mint had a sales report yesterday. They sold 4,000 ounces of gold eagles...1,000 one-ounce 24K gold buffaloes...and 304,000 silver eagles. For the first four business days of September, the mint has sold 10,500 ounces of gold eagles...1,500 one-ounce 24K gold buffaloes...and 679,000 silver eagles. The silver/gold ratio based on these sales is just a bit under 57 to 1. It was a rather quiet day over at the Comex-approved depositories on Thursday. They reported receiving 600,848 troy ounces of silver...and shipped a smallish 30,599 ounces of the stuff out the door. The link to that activity is here. Here's a rather interesting chart that Nick Laird sent me early this morning...and the chart title says it all. The 'click to enlarge' feature comes in handy here. (Click on image to enlarge) For the second week in a row, the Commitment of Traders Report was not happy reading. The Commercial net short position increased by another 6,346 contracts, or 31.7 million ounces. Ted Butler said that JPMorgan went short an additional 4,000 contracts...and the raptors sold another 1,000 long positions...and the rest of the increase was spread related. The Commercial net short position now stands at 224.6 million ounces. The 'big 4' shorts in the Commercial category are short 210.9 million ounces of silver...and the '5 through 8' big shorts add another 40.6 million ounces. In total, the 'Big 8' are short 251.5 million ounces of silver. On a net basis, the 'big 4' are short 43.0% of the entire Comex futures market...and the '5 through 8' add another 8.3 percentage points to that total. Adding it up, eight traders are short 51.3% of the entire Comex futures market in silver. Ted said that JPMorgan's short position is now 26,000 contracts [130 million ounces] at a minimum...and that represents 26.3% of the entire Comex futures market in silver. Ted was incensed...and you should be as well, dear reader. One trader holding such a position is outrageous beyond belief. The CFTC and CME should be doing the perp walk for this...along with Jamie Dimon at JPMorgan. In gold, the Commercial net short position increased another chunky 15,762 contracts, or 1.56 million ounces. Ted Butler said that all of the increase was the 'Big 4' traders going short against all comers. The Commercial net short position now sits at 21.94 million ounces. The 'big 4' traders are short 11.51 million ounces of gold...and the '5 through 8' traders are short an additional 5.29 million ounces. The 'big 8' are short 16.8 million ounces of gold, or 76.6% of the Commercial net short position. On a net basis, once you subtract the market-neutral spread trades out of the Non-Commercial category, the 'big 4' are short 27.7% of the entire Comex futures market in gold...and the '5 through 8' are short an additional 12.7 percentage points. Straight addition shows that the 'Big 8' are short 40.4% of the entire Comex futures market in gold. Without doubt, the situation has deteriorated significantly once you consider the price action during the Friday trading session in both silver and gold. Here's Nick Laird's "Days of World Production to Cover Short Contracts". Over two thirds of the red bar in silver is JPMorgan's short position. At 26,000 Comex futures contracts...130 million ounces...that's about 65 days of world silver production. The tiny difference between the red and green bar in silver, is the short position of the '5 through 8' largest traders. It's easy to see that the bulk of the short position in silver is held by only four traders...and almost all of that is held by JPMorgan. (Click on image to enlarge) It should come as no surprise, that the September Bank Participation Report, which is derived from the same data set as yesterday's Commitment of Traders Report, was pretty ugly as well. During the prior month, the 4 U.S. banks that hold Comex futures contracts in the silver market, increased their short position by 8,295 Comex futures contracts...and I'm guessing that most of that amount would have been JPMorgan. The BPR states that these four U.S. banks are now net short 28,760 Comex silver contracts...29.3% of the entire Comex futures market. Don't forget that Ted figures that JPMorgan is short 26,000 Comex silver contracts on its own, so that doesn't leave too many short positions left to be divided up between the other three U.S. banks in this category, now does it? Reader E.W.F...who sends me a complete set of COT charts based on the Disaggregated Commitment of Traders Report made the following comment..."The U.S. bank net short position in silver hasn't been this large since 11/2/2010, the day before QE2 was announced." The 13 non-U.S. banks that hold Comex futures positions in the silver market were net long 828 Comex futures contracts in silver in the August report, but in the September report, they now are net short 2,801 contracts...a swing of 3,629 contracts in one month, but only 215 Comex contracts per bank on average, which is a rounding error in the grand scheme of things...especially when JPM is short 26,000 Comex silver contracts on its own. So, in one month, the world's banks have increased their short position in the Comex silver futures market by 11,924 contracts...or 59.6 million ounces of silver. But it's still a "Made in the U.S.A. by JPMorgan" silver price management scheme from top to bottom. In gold the situation is just about as egregious. The 4 U.S. banks that hold Comex futures contracts are now net short 84,583 contracts, or 8.46 million ounces...an increase of 26,894 contracts [2.69 million ounces] from the August Bank Participation Report. The 20 non-U.S. banks are short 53,434 Comex contracts in gold...5.34 million ounces, an increase of 12,861 contracts [1.29 million ounces] since the August BPR. On a net basis, the 4 U.S. banks are short 20.3% of the entire Comex futures market...and the 20 non-U.S. banks are short 12.8%...making the grand total 33.1% of the entire Comex futures market in gold. The short positions in gold are much more spread out between all the world's banks...but in silver, it's all U.S.A...and virtually all JPMorgan. Reader Scott Pluschau has posted commentary over at his Internet site headlined "Bull Pennant" forms as the "Triangle" target gets nailed in Gold...and the link is here. With some ruthless editing on my part, I managed to keep the number of stories down to a reasonable level, so I hope you have the time to at least skim them all over what's left of the weekend. All we can hope for is that we've covered all the bases in our own personal efforts to protect ourselves from what lies ahead. Sprott Physical Gold Trust has offering of US$341,320,000. Jeff Clark: What to Do When – Not If – Inflation Gets Out of Hand. Fractal Analysis: Huge dollar devaluation will drive gold much higher. Critical ReadsJobs Report: Men See Lowest Participation Rate on RecordThe monthly U.S. jobs report generated its usual plethora of data, much of it discouraging. Fewer jobs than expected were created in August, and the welcome decline in the unemployment rate has to be significantly tempered by its link to the 368,000 people who departed the counted work force. Leading the pack of the woeful were the numbers on the labor force participation rate. There are a couple of reasons for this view. One, you should pay attention when data are either at the lowest or the highest level in years. In this case, the lowest. More important, a declining percentage of people in the work force means long-term problems. Too many people discouraged, with atrophying skills. Bad news for them and their families, economically and psychologically. Bad news for the overall economy that loses productive capacity and willing and able consumers. Bad news for the overall spirit and optimism of pretty much everyone. This commentary showed up as a blog posted on The Wall Street Journal website yesterday just before lunch in New York. I thank Ulrike Marx for providing today's first story...and the link is here. Investors yank $3.7 billion out of stocksThe move out of the U.S. stock market continued through the final week of summer, as investors remained stuck in a rut and refrained from making any big moves ahead of Federal Reserve chairman Ben Bernanke's big speech in Jackson Hole. In fact, investors pulled another $3.7 billion from U.S. stock market mutual funds during the week ended Aug. 31, according to the Investment Company Institute, bringing the 2012 outflow total to more than $76 billion. By comparison, those funds lost in the neighborhood of $70 billion during the first eight months of 2011, and just $52 billion during the first eight months of 2010. This story was posted over at the money.cnn.com Internet site on Thursday...and I borrowed it from yesterday's edition of the King Report. The link is here. ECB Collateral Moves Reopen 'Soup Kitchen' for Struggling BanksThe European Central Bank's decision to relax bank funding rules to mirror conditions last seen after Lehman Brothers Holdings Inc.'s collapse signals hard times for lenders. "The soup kitchen for impoverished euro-zone banks is re- opening," said Simon Maughan, a strategist at Olivetree Securities Ltd. in London. The easing shows "some peripheral banks have run out of collateral and so we need to widen the bounds of acceptability to accommodate them." ECB President Mario Draghi said yesterday the central bank will lend against assets in dollars, pounds and Japanese yen, as well as in euros, reopening a program that ran for two years following the September 2008 bankruptcy of the U.S. investment bank. The ECB also eased borrowing against government-issued or guaranteed assets by dropping rating requirements. Kicking the can down the road...until the currency itself is worthless. That fact is showing up plainly in the precious metals market at the moment. This Bloomberg story, filed from London early yesterday morning Eastern time, was sent to me by reader Ulrike Marx...and the link is here. The World from Berlin: 'The ECB Is Doing Governments' Dirty Work'The ECB's announcement on Thursday that it is prepared to make unlimited bond purchases in order to lower borrowing costs for countries in crisis could mark a turning point in the euro crisis. German commentators, however, criticize the bank for becoming a hostage to politics. But the criticism of the ECB's course continued in Germany. Bundesbank President Weidmann reiterated his opposition to the move, saying it was too close to "state financing via the money presses." Alexander Dobrindt, general secretary of Bavaria's conservative Christian Social Union, said that the ECB must be "a stability bank and not an inflation bank". Jörg Asmussen, a German member of the ECB's Executive Board, defended the decision, however. "We have no inflationary pressure," he said. "Everyone has to do their part to make the euro irreversible." On Friday, German commentators expressed their considerable doubts about the plan. This story showed up on the German website spiegel.de yesterday...and I thank Ulrike Marx for her second offering in a row. The link is here. Nationalist backlash in Italy and Spain to test Mario Draghi bond planThe European Central Bank's ground-breaking plan for mass purchases of Spanish and Italian bonds is fraught with political risk and may soon be overwhelmed by nationalist anger in the crisis states, leading economists and statesmen warned at a gathering of the European policy elites in Italy. "The ECB move is helpful but is not a game-changer. The eurozone is still in crisis," said Nouriel Roubini, head of Roubini Global Economics. "Unless Europe stops the recession and offers people in the peripheral countries some light at the end of the tunnel - not in five years but within 12 months - the political backlash will be overwhelming, with strikes, riots and weak governments collapsing." Professor Roubini said the German Bundesbank and will insist that "severe" conditions are imposed on Spain once the country requests a rescue from the eurozone EFSF/ESM bail-out funds and signs a memorandum ceding budgetary sovereignty. This Ambrose Evans-Pritchard story was posted on the telegraph.co.uk Internet site late yesterday afternoon BST...and is another item courtesy of Ulrike Marx. The link is here. Record Corn Imports by China to Drive Rally, Rabobank SaysThe biggest-ever imports of corn by China, the world's largest livestock producer, may help sustain a record rally in Chicago that's been driven by drought across the U.S. Midwest, according to Rabobank International. Shipments may climb to 7 million metric tons in the year starting Oct. 1 from about 5 million tons this year, Daron Hoffman, Shanghai-based director of research, said in an interview. That compares with a U.S. Department of Agriculture forecast for a 60 percent drop to 2 million tons in 2012-2013. Record imports by China may spur higher prices, lifting global food costs and forcing rival importers to cut purchases. China's demand needs to be met by imports no matter what the price, according to Nathan Broders, director of feed ingredients at INTL FCStone Inc. Corn has rallied 24 percent to a record this year as the worst U.S. drought since 1936 slashed output. This Bloomberg story, filed from Shanghai early yesterday morning local time, is Ulrike Marx final offering in today's column. It's a short read, and well worth your time...and the link is | ||||||||||||||||||||

| Posted: 08 Sep 2012 06:38 AM PDT  Sprott Asset Management LP, announced today that it has priced its follow-on offering of 23,000,000 transferable, redeemable units of the Trust ("Units") at a price of US$14.84 per unit (the "Offering"). As part of the Offering, the Trust has granted the underwriters an over-allotment option to purchase up to 3,450,000 additional Units. The gross proceeds from the Offering will be US$341,320,000 (US$392,518,000 if the underwriters exercise in full the over-allotment option). | ||||||||||||||||||||

| Three King World News Blogs/Audio Interviews Posted: 08 Sep 2012 06:38 AM PDT  The first of two blogs is with Caesar Bryan of Gabelli & Company. It's headlined "Top Fund Manager - Gold Should Already be Above $1,900". The second blog is with Dr. | ||||||||||||||||||||

| ECB Collateral Moves Reopen ‘Soup Kitchen’ for Struggling Banks Posted: 08 Sep 2012 06:38 AM PDT  The European Central Bank's decision to relax bank funding rules to mirror conditions last seen after Lehman Brothers Holdings Inc.'s collapse signals hard times for lenders. "The soup kitchen for impoverished euro-zone banks is re- opening," said Simon Maughan, a strategist at Olivetree Securities Ltd. in London. The easing shows "some peripheral banks have run out of collateral and so we need to widen the bounds of acceptability to accommodate them." | ||||||||||||||||||||

| Top 5 Insider Sells Filed On September 7 Posted: 08 Sep 2012 04:30 AM PDT By Markus Aarnio: A study titled "Predictive and Statistical Properties of Insider Trading" by James H. Lorie and Victor Niederhoffer reached the following conclusion:

Based on the findings of this encouraging insider trading study, I screened for companies where at least one insider made a sell transaction filed on September 7. I chose the top five companies with insider selling in dollar terms. Here is a look at the five stocks: 1. LyondellBasell (LYB) is one of the world's largest plastics, chemical and refining companies Complete Story » | ||||||||||||||||||||

| Posted: 08 Sep 2012 03:52 AM PDT By Jeffrey Lewis: As prices at the pump gradually move back up, one finds no shortage of people calling for new financial regulations. Frequently blamed on speculators, higher gasoline prices are - as some politicians say - the result of lax laws regulating the financial system. Nevertheless, can it really be only speculators that are driving up the price of oil? Surely, the petroleum market is deeper than that. Without question, those with very deep pockets can drive up the price of just about any commodity, but typically only for a very short amount of time. Unless of course they have access to a virtually unlimited supply of paper money. Monetary Stimulus Today, monetary stimulus implemented by the Federal Reserve is transmitted primarily through incentivizing risk-taking and leveraging in the securities, derivatives and other risk asset markets. Nevertheless, as Doug Noland recently put it:

Complete Story » | ||||||||||||||||||||

| Silver Update: Biflation 9.7.12 Posted: 08 Sep 2012 03:29 AM PDT | ||||||||||||||||||||

| Moneybags73: Junk Silver Fights Inflation Posted: 08 Sep 2012 03:28 AM PDT Excessive money printing by central banks as well as U.S. dollar debasement are on the horizon. The clouds are gathering and soon you will be met with a storm that steals the purchasing power of your currency. Holding some Junk Silver is one of the best things you can do to prepare besides the obvious: food supply, guns, ammo etc. from moneybags73: The analysis and discussion provided by MoneyBags73 is for your education and entertainment purposes only, it is not recommended for trading purposes. I am not an investment adviser and information obtained here should not be taken for professional investment advice. ~TVR | ||||||||||||||||||||

| 90 Minutes with Lindsey Williams Posted: 08 Sep 2012 03:23 AM PDT

About Gold Seek Radio: More interviews @ radio.goldseek.com ~TVR This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||

| Alex Jones: Gold and George Soros Posted: 08 Sep 2012 03:22 AM PDT In a harbinger of what may be coming our way in the Fall of 2012, billionaire financier George Soros has sold all of his equity positions in major financial stocks according to a 13-F report filed with the SEC for the quarter ending June 30, 2012. from thealexjoneschannel: Soros, who manages funds through various accounts in the US and the Cayman Islands, has reportedly unloaded over one million shares of stock in financial companies and banks that include Citigroup (420,000 shares), JP Morgan (701,400 shares) and Goldman Sachs (120,000 shares). The total value of the stock sales amounts to nearly $50 million. What's equally as interesting as his sale of major financials is where Soros has shifted his money. At the same time he was selling bank stocks, he was acquiring some 884,000 shares (approx. $130 million) of Gold via the SPDR Gold Trust. ~TVR | ||||||||||||||||||||

| Top 5 Insider Buys Filed On September 7 Posted: 08 Sep 2012 03:07 AM PDT By Markus Aarnio: Insider buying is often a sign of potential positive developments within a company, particularly if the insiders who are buying have a good track record with respect to their own buying. This is, however, only a secondary indicator and should not be relied upon solely when making the decision on whether to purchase a security. Insider buying in and of itself will not make a stock move higher, but can provide a further clue if all the other pieces of the puzzle - e.g., earnings, sales, return on equity, profit margins, etc. - are in place. I screened for companies where at least one insider made a buy filed on September 7. I chose the top five companies with insider buying in dollar terms. Here are the five stocks: 1. Uranium Resources (URRE) explores for, develops and mines uranium. Since its incorporation in 1977, URI has produced over 8 million Complete Story » | ||||||||||||||||||||

| Vivus, Arena: Don't Be Too Late To The Punch Bowl, Buy Other Stocks Posted: 08 Sep 2012 02:53 AM PDT By Takeover Analyst: If you are looking for high returns, biotechnology may very well be your best bet. The industry is positioned to outperform broader indices, since it is "macro-blind" - that is, largely unaffected by the economic ups and downs relative to, say, consumer goods, software producers, gold miners, etc. Instead, the industry develops what many hope to be "breakthrough solutions." Sometimes, even the speculation that these "breakthroughs" will materialize is enough to ride your portfolio towards an attractive return. Vivus (VVUS) and Arena (ARNA) are two good examples. They were both exploring anti-obesity drugs and, while both were approved, many market commentators are coming together and saying that all of the market excitement was overblown. That is to say, the future fundamentals will be a wet blanket to all of the bulls who pushed up the stock. At the same time, four analysts recently raised forecasts for Vivus. Erectile dysfunction drug Complete Story » | ||||||||||||||||||||

| Mike Niehuser's Gold Investing Lessons From Banking School Posted: 08 Sep 2012 12:59 AM PDT By The Gold Report: Mike Niehuser, founder of Beacon Rock Research, incorporates his banking school background into his mining industry analysis. In this exclusive interview with The Gold Report, he assesses the macroeconomic situation from a banker's perspective, explains why he is convinced gold is ready to take off and shares the names of companies poised to profit from mining in the northwestern United States. The Gold Report: You were at the Pacific Coast Banking School last Friday when gold prices dipped and then surged on Federal Reserve Chairman Ben Bernanke's comments. Why are you attending banking school? Mike Niehuser: In a former life I was a real estate construction lender; I attended a mid-career banking school and found out there that I am not a banker. I also learned how to analyze banks and in 2000 transitioned to become a bank analyst. In 2004, I fell in love with the mining industry. I Complete Story » | ||||||||||||||||||||

| Gold Imports To China From Hong Kong Double Again On Haven Demand Posted: 08 Sep 2012 12:17 AM PDT gold.ie | ||||||||||||||||||||

| Gold Hits Near-Record Euro Highs as Markets Jump on ECB Anticipation Posted: 08 Sep 2012 12:10 AM PDT | ||||||||||||||||||||

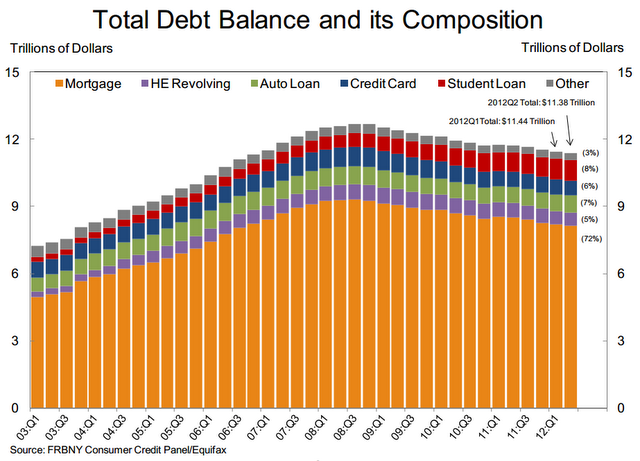

| Posted: 08 Sep 2012 12:00 AM PDT By jimq, who operates the Burning Platform website. Originally published at Washington's Blog. Have you heard the news? Auto sales are booming. Total sales for the month of August were 1,285,202 vehicles, according to Autodata Corp, the highest monthly sales figure for any August since 2007, when 1.47 million autos were sold in the United States. Year to date auto sales have totaled 9.7 million and are on track to reach 14.5 million. Between 2006 and 2007, auto sales ranged between 16 million and 18 million. They crashed below 10 million in 2009. The Keynesians running our government have pulled out all the stops to restart this engine of consumer spending. First they wasted $3 billion of taxpayer funds on the Cash for Clunkers debacle. Almost 700,000 perfectly good cars were destroyed in order to keep union workers happy. This Keynesian brain fart distorted the used car market for two years, raising prices for cars needed by the working poor. After that miserable failure, they realized the true secret to selling vehicles is to give them away to anyone that can scratch an X on a loan document, with 0% interest for 60 months, financed by Federal government controlled banking interests. Add in some massive channel stuffing and presto!!! – You've got an auto sales boom.

General Motors sales are up 3.7% over 2011. Ford Motors sales are up 6% over 2011. The Obama administration continues to tout their saving of the U.S. auto industry with their bailout in 2009 that saved unions and screwed bondholders. If this strong auto recovery is not an illusion, how do you explain the two charts below? General Motors stock is down 42% since 2011. The highly proclaimed success story called Ford Motors has seen their stock collapse by 50% since 2011. This is surely a sign of tremendous success and anticipation of soaring profits for these bastions of American manufacturing dominance. This is America, land of the delusional and home of the vain. The appearance of success is more important than actual success. The corporate mainstream media dutifully reports the surge in auto sales is surely a sign the economy is recovering and the consumer has finished deleveraging and is ready to spend again. The government propaganda machine proclaims the surging auto sales are due to their wise and forward thinking policies (like the Chevy Volt). Luckily for them, there are millions of gullible Americans who believe the storyline and are easily convinced that driving a $30,000 new car, financed over seven years, makes them a success. The decades of Bernaysian marketing propaganda has worked its magic on the government educated, math challenged citizenry. There are only two things that matter to the non-thinking auto buyer (renter) – the monthly payment and what the next door neighbor and his coworkers will think. Buying a fuel efficient car they can afford, paying it off in three or four years, and driving it for ten years, while saving the monthly car payment, is what a practical, rational thinking person would do. The fact that only 20% of the 9.7 million vehicles sold this year have been small cars and the average sales price of new cars sold is now $31,000 proves Americans are still living in a delusional fantasyland of cheap gas and monthly payments for eternity.

As gas prices surpass $4 per gallon across the country, somehow 4.7 million of the 9.7 million vehicles sold in 2012 have been pickups, vans, crossovers or SUVs. Three of the top eight selling vehicles are pickups. Luxury vehicle sales are booming, with Mercedes, BMW, Porsche, Land Rover and Audi showing double digit percentage sales gains over 2011. We've entered a recession, gas prices are approaching all-time highs, job growth is pitiful, and Americans continue to buy luxury gas guzzlers on credit. This will surely end well. The average payment on a new car in 2012 is $461. For used cars, the average monthly payment is $346. Today, 77% of new car purchases are financed. About half of all used vehicles involve financing. Of those cars financed, 89% are through a loan vs. 11% with a lease. A critical thinking person might wonder how a country with 4 million less employed people than we had in 2007, median household net worth down 35%, and real wages lower than they were in 2007, could be experiencing an auto boom. The answer is a government/corporate/banker/media effort to funnel taxpayer funds to deadbeats across the land in a fruitless attempt to create a facade of recovery. Our governing elite are convinced that more debt peddled to the masses is the path to recovery for an economy that imploded due to excessive debt peddled to the masses in the first place. Essentially, it comes down to who benefits from the peddling of debt. It isn't the masses, as they become enslaved in the chains of debt and monthly payments in perpetuity. Debt peddling benefits Wall Street bankers, politicians, and mega-corporations selling crap to the masses. The storyline being sold to the vegetative dupes (watching Honey Boo Boo) that occupy space in this delusional paradise we call America, by the corporate media, is that consumers have deleveraged and are ready to resume their "normal" pattern of spending money they don't have on stuff they don't need. Of course, the facts always seem to get in the way of a good yarn. Consumers have never deleveraged. Consumer credit outstanding is at an all-time high of $2.58 trillion. The decline from $2.55 trillion in 2008 to $2.4 trillion in 2010 was NOT deleveraging. It was the Wall Street Too Big To Fail banks taking a big dump on the American taxpayers. They passed their bad debts to you through TARP, the Federal Reserve buying their toxic "assets", and ZIRP.

Revolving credit (credit card) debt peaked at just above $1 trillion in 2008 and "declined" to $850 billion during 2010. The media storyline is that you buckled down and paid off your credit cards, therefore depressing consumer spending and creating a recession. Sounds convincing except for the fact that it's a load of bullshit. The Federal Reserve's own data proves it to be false. Your friendly Wall Street banks have written off $213 billion of credit card debt since 2008 and passed the bill to the few remaining taxpayers in this country. For the math challenged, this means that consumers have actually INCREASED their credit card debt by $68 billion since 2008. The bad news for our Chinese crap peddling mega-retailers is that the significantly poorer average middle class American household is using their credit cards to pay their property tax bills, IRS bills, and utility bills in order to survive. Credit Card Charge-off in Dollars 2005 – 2011 — Not Seasonally Adjusted:

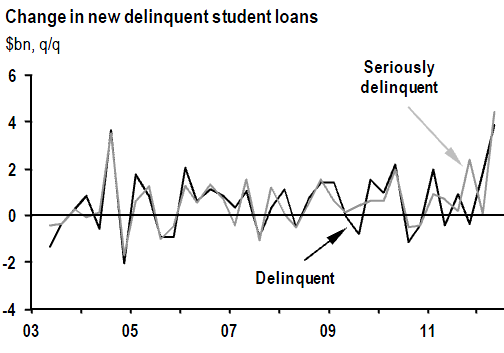

The category of debt that barely budged in the 2009 collapse was non-revolving credit. It stayed in the $1.5 trillion range in 2009 and has since surged to over $1.7 trillion in 2012. What could possibly have made this debt skyrocket by 33% when the GDP has only grown by 12% over the same time frame? You guessed it – your corporate fascist friends in Washington DC and on Wall Street. Non-revolving debt consists of auto loan debt of $663 billion and student loan debt of approximately $1 trillion. Student loan debt has shot up by $300 billion since 2008. This student loan debt is being distributed, like candy by a pedophile, from the Federal government in an effort to artificially hold down the unemployment rate.

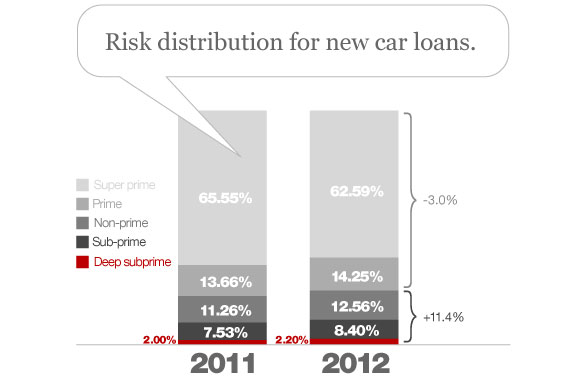

Approximately $500 billion of the student loan debt is held directly by the Federal government, up from $100 billion in 2008. The Feds guarantee the majority of the remaining student loan debt. Can you think of a more subprime borrower than a 40 year old former construction worker getting a liberal arts degree from the University of Phoenix, sitting at his computer in his underwear scratching his balls, and paying with a $10,000 Federal student loan from you? This fraudulent attempt to obscure the true employment situation will end in tears for the borrowers and the American taxpayer. It's tough to make a loan payment without a job. The student loan bailout is just over the horizon and will cost you at least $300 billion. Delinquencies are already off the charts. When has offering low interest debt in ample portions to people without jobs, income or assets ever backfired before? The bankers and politicians that control this country seem to be a one-trick pony. They will never admit that debt is the problem and reducing it the solution. The real solution would make them poorer, so their solution is to pour gasoline on the fire with more debt at lower interest rates to more people. The addict will keep injecting more poison into their system until sudden death. The bankers and politicians know we are a car-centric society and appeal to our vanity and poor math skills to keep the game going. During the first quarter of this year, total U.S. car loans totaled $52.5 billion. That's 49% higher than the same period in 2009. Also during the first quarter, the average amount financed on new vehicles rose by $589, to $25,995, and for used cars by $411, to $17,050. Furthermore, buyers are stretching out payments for longer terms: The average length of new- and used-vehicle loans jumped a full month during the first three months of this year, to 64 and 59 months, respectively. The surge in auto sales is being completely driven by doling out more loans for a longer time frame to deadbeat borrowers. Subprime auto loans now make up 45% of all car loans and the vast majority of all used car loans. They have even created a category called Deep Subprime. Borrowers classified as "deep subprime" (i.e. those with Vantage scores below 600) account for 10.7% of auto loans. You can also classify them as loans that will never be repaid.

Two thirds of all car sales are for used cars, so the fact that 37% of all new cars are being sold to subprime borrowers is exacerbated by the ridiculous lending practices for used cars. The fine folks at Zero Hedge have provided the outrageous data and a chart that proves beyond a shadow of a doubt what awaits the American taxpayer – another bailout. Zero Hedge has already revealed the GM fake recovery by detailing their channel stuffing over the last two years. Now they've dug up more dirt on why car sales are surging. What could possibly go wrong providing loans for more than the value of the asset to people with a history of not paying their debts?

It's amazing how many cars you can sell when you aren't worried about getting paid. This is the beauty of a fiat currency, a printing press, and a taxpayer available to pick up the tab after the drunken party gets out of hand. The chart below provides the details of our superhighway to disaster. The percentage of used car loans to prime borrowers is now at an all-time low, while the percentage of loans to subprime borrowers is near all-time highs reached just prior to the 2008 crash. When lenders cared about being paid back in the early 2000′s, they rarely made loans longer than five years. Today, more than 77% of all subprime used car loans are longer than five years and average FICO scores are now well below 600. Just to clarify – if your FICO score is below 600 – YOU ARE A DEADBEAT.

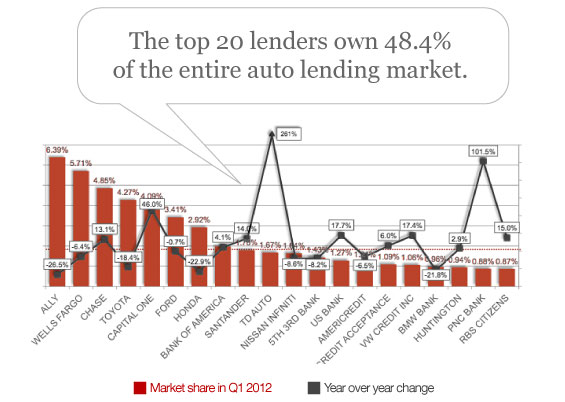

When you start to connect the dots, things that didn't seem to make sense begin to crystallize. This is all part of the master plan concocted by Bernanke, Geithner, Obama and the Wall Street Shysters. The auto section of my local paper now makes sense. Offers of 7 year financing at 0% interest and monthly lease offers of $150 to $200 for brand new cars now are understandable. The newer model BMWs, Cadillac Escalades, Volvos, and Jaguars I see parked in front of the low income luxury gated townhome community in West Philadelphia now makes sense. A pizza delivery guy driving a new Lexus is now explainable. The master plan is fairly simple. The Federal Reserve lends money to the Wall Street banks for 0% interest. These banks then turn around and provide credit card debt at 13% interest, new & used car loans to prime borrowers at 5% interest, and new & used car loans to subprime borrowers at 16%. When you can borrow for free, you can take a chance that a significant number of your borrowers will default. Essentially, Ben Bernanke is screwing the prudent savers and senior citizens by paying them 0.15% on their savings in order to subsidize the bankers that destroyed the country so they can make auto loans to the same people who took out the zero percent down interest only no doc mortgage loans in 2005. In addition, Wall Street knows the Bernanke Put is still in place. If and when these subprime loans explode in their faces again, Bennie, Timmy and Obamaney will come to the rescue with your tax dollars. Its heads you lose, tails you lose, again. The chart below is like a who's who of TARP recipients. The top 20 auto lenders control half the market. And look at the leader of the pack. Our friends at Ally Bank are the market share leader. You remember Ally Bank – they conveniently changed their name from GMAC (also known as Ditech – biggest subprime mortgage lender) after losing billions and being bailed out by you. They still owe you $11 billion and are 85% owned by the U.S. Treasury. No conflict of interest there. You have the biggest auto lender on earth controlled by the Obama administration. Do you think they have an incentive to make as many loans as humanly possible to help Obama create the illusion of an auto recovery? The only downside is for the American taxpayer when we have to eat billions more in Ally/GMAC losses. This insolvent excuse for a lending institution has been extremely aggressive in the subprime auto lending market and has forced the other wannabes – Wells Fargo, JP Morgan, Capital One and Bank of America – to lower their lending standards. Does this scenario ring a bell? We've become a subprime auto nation, addicted to easy debt, living lives of hope, delusion and minimum monthly payments. Storylines about economic recovery, fraudulent government statistics showing lower unemployment, feel good propaganda from the corporate mainstream media, and a return to easy money debt fueled spending does not constitute a real recovery. Until the bad debt is purged from the system and saving takes precedence over spending, the country will stagger and ultimately fall under the weight of its immense debt. We are lost in a blizzard of lies. This subprime fueled engine of recovery will propel the country into the same canyon of reality we entered in 2008. The crack up boom approaches.

* * * Lambert here: I've never owned a car, so I found this JimQ's post especially interesting. | ||||||||||||||||||||

| Posted: 07 Sep 2012 11:00 PM PDT Bullion Vault | ||||||||||||||||||||

| Central banker berates Indians for preferring gold to a crappy currency Posted: 07 Sep 2012 10:30 PM PDT | ||||||||||||||||||||

| By the Numbers for the Week Ending September 7 Posted: 07 Sep 2012 05:16 PM PDT | ||||||||||||||||||||

| Posted: 07 Sep 2012 04:00 PM PDT Oceans of [US] taxpayer money and patience have been devoted to propping up the US banking system. Why? So that when we go to retrieve our money from an ATM our money will actually come out. At least that's what then-Treasury Secretary Hank Paulson told us when the big US banks were on the verge of hitting the fan in 2008 and 2009. The implication was that if the US banks failed - "poof" - our money would go with them. Nobody wanted to lose their cash, not at the same time many people's 401(k)s were being turned into 201(k)s. The government wasn't going to let that happen. In the heat of the crisis the federal government committed $23.7 trillion - yes, with a "t" - to make sure bank depositors could sleep at night and bank executives had a place to work during the day. That big, scary, impossible-to-comprehend number was calculated by Kevin Puvalowski, who worked directly for Neil Barofsky, the special inspector general for TARP (SIGTARP) and author of an illuminating new book about his experience, Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street. Barofsky writes that the alphabet soup of programs actually maxed out funding at only $4.7 trillion. But again, that number, $4.7 trillion, is $4,700 billion, or $4,700,000 million, or $4,700,000,000,000. Now that we're three years down the road, one would expect the US banking system to be healed, given all of the government's monetary medicine. But while the FDIC's Quarterly Banking Profile for the second quarter painted a positive picture for the banks, it was anything but rosy. Sure, 63% of US banks reported higher earnings, but 732 US banks are still on the deposit insurer's "problem" bank list (after 454 banks failed since the crisis began). That's 10% of all insured institutions. Industry earnings rose 21% over the past year, the 12th consecutive quarter of increased earnings. However, earnings continue to be driven by lowering of loan loss provisions and gains on sales of loans and assets. The net interest margin continues to sink with the Fed's zero rate policy, and bank balance sheets are still loaded with troubled assets. And while consumers and businesses are funneling money into bank deposits for safety, the FDIC Deposit Insurance Fund is now $22.7 billion, only a tiny fraction (30 basis points) of the $7.1 trillion in deposits the DIF backstops. The Problem Bank List website points out the problem:

Dodd-Frank legislation requires that the DIF increase to 1.35% (135 basis points) by Sept. 30, 2020. Good luck with that. The Dodd-Frank Act also set up another agency - the Financial Stability Oversight Council (FSOC) - to keep an eye out for future systemic risk. After all, since the financial meltdown, the big institutions have only gotten bigger and the total number of US banks has shrunk. One percent of the banks now hold 78% of deposits. And when it comes to derivatives exposure, the one percenters hold virtually 100%, totaling almost $225 trillion at the end of the second quarter. When asked if he thought the FSOC would prevent the next crisis, the ex-head man at the Office of the Comptroller of the Currency, John Walsh, told American Banker, "I would love to think that FSOC, the next time around, will have a meeting and catch the crystal just before it hits the cement floor, but I don't think so. I think they'll come with a broom and sweep up the debris." It won't be long before another crash comes along, and no doubt there will be government agencies created to sweep up the glass. Fixing the problem isn't ever the government's priority, but instead, as Barofsky writes:

The head of SIGTARP also learned "shading of the truth was an accepted part of doing business in Washington." Barofsky's depictions of Tim Geithner and Neel Kashkari are withering. Kashkari, interim assistant secretary of the Treasury for financial stability, does come out looking a bit better, with Barofsky writing, "I don't think he ever flat out lied to me, which in Washington put him in rarefied air." Geithner would seem to be just a plain-old sociopath. Barofsky could get Geithner to meet with him only by threatening to report the secretary's behavior to Congress. When they did meet, Geithner was hostile:

Barofsky's wife, a psychiatrist, told her husband Geithner might suffer from narcissism, "and therefore might be psychologically incapable of truly admitting that he made a mistake." The man who would go from running the New York Fed to Treasury secretary would prove her long-distance diagnosis correct. Again, these were the guys dishing out trillions of taxpayer money to save the US banks. TARP, TALF, PPIP, and the rest turned out to be programs for Geithner and Kashkari to shovel money with no accountability to their friends on Wall Street. There's been plenty of criticism of the loose lending standards employed by the mortgage industry during the boom. But from what Barofsky describes, TARP was every bit as loose. Wall Street speculators put little money down to buy the toxic assets, with the government providing nonrecourse financing. The rescue of AIG is especially galling, given it was essentially a bailout of the insurer's counterparties. The New York Fed, under Geithner, authorized $60 billion to buy bonds from the insurer's counterparties "that were worth less than half of that amount." Barofsky's audit determined that Geithner never attempted to negotiate a discount, even when one of the US banks had offered it upfront. When asked about it, the New York Fed's general counsel insisted that US banking laws required the payment of full price. Geithner's Treasury department went so far as to fudge the numbers on the AIG bailout, making tens of billions of TARP losses disappear for a report it prepared for Congress. In the end, the ATMs kept working, and by 2010, compensation at the top 25 Wall Street firms broke records at $135 billion. JPMorgan Chase grew 36% in size, and Wells Fargo more than doubled. Wall Street lives happily ever after. The taxpayers, not so much. The question is will the 848-page Dodd-Frank bill keep the financial system intact? Don't bet on it. As Barofsky explains:

U.S. banking: a fragile system living off fake reserves, awash in mispriced assets, regulated by sociopaths, and insured with but a wisp of reserves. Barofsky lays it all out in this firsthand report. Nothing to worry about, right? The printing press is always close at hand. Regards, Douglas E. French From the Archives... The Pin-Up Stock of the Iron Ore Boom How Australia Grew Fat and Lazy Off the China Boom Why You'll Never Change Our Mind About Inflation The Make Believe World of Economists, Continued... Iron Ore, a Love Story

| ||||||||||||||||||||

| The Fly in the Inflation Ointment Posted: 07 Sep 2012 04:00 PM PDT The European Central Bank lit a fire under the stock markets of Europe and America on Thursday night. More bond buying is expected from the money printers, which is apparently a good thing. But is it? To answer the question, we turn to central banker extraordinaire, Ben Bernanke. Where would we be without Bernanke's QEs? What would have happened if the Federal Reserve Chairman hadn't resorted to the good old printing presses? What if he hadn't pumped up the global financial system, including Australia's banks? We'll never know the answer. But we do know something Bernanke doesn't. He has his causes and cures mixed up. And that means there's money to be made. The problem Bernanke is dealing with is America's over indebtedness. It has too much public and private debt. He thinks that the solution to this problem is inflation. If prices rise, it's easier to pay off a given amount of debt. And so deflation is the cause of America's troubles. That's because debt is harder to pay if prices are falling. Looking at the problem like this is like blaming a tight shoe on the size of a centimetre. Changing how many millimetres make up a centimetre won't make the shoe fit. Inflation is the cause of the problem, not the cure. And deflation is the symptom that the economy is repairing itself. It's getting rid of all that debt. More on why Bernanke is wrong in a moment. Your investment opportunity bundled up inside his mistake has changed. It used to be about investing in the recurring bubbles caused by monetary policy. The trick was to find them before they really got going and sell out before they burst. Let's look at the American housing bubble as an example of how monetary policy creates bubbles for investors to profit from. After the tech bubble crashed, America went through a recession. Interest rates were pushed down to combat the recession. To get prices rising and Americans spending, Federal Reserve Chairman 'Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble,' said economist Paul Krugman at the time. Alan Greenspan's low interest rates and money creation achieved just that. Homeowners made a lot of money. Of course, it was just a debt-funded bubble. And at some point, you just can't borrow any more. Then the bust hits. (Krugman got his Nobel Prize in 2008.) As always, the central bank came back with more inflation, allowing the next bubble to get going. At least, that's what was supposed to happen. Monetary policy is looser than it's been in our lifetime. So where is the bubble now? Unfortunately, we've missed it. It's in government bonds. Central banks have been pumping trillions into sovereign bonds around the world. The Australian calls it the best bull market in our lifetimes. But bond prices can't go much higher for many nations. So where's the next bubble you can make money on? Well, there may not be a next one. Unless you're willing to buy properties in Germany. There, the European Central Bank's loose monetary policy is inflating the housing bubble the Germans missed out on in the 2000s.  So why might there not be another bubble after the government bond bubble? Because, at some point, central banking policies fail to get any traction where they're supposed to. Central bankers want houses, stock markets and other assets to go up in price when they print money. That makes people feel wealthy, which makes the economy look rosy. But what if consumer prices move instead of asset prices? What if the kind of inflation that makes us poorer instead of (feeling) richer takes place? Then there's trouble. Unless you're a nincompoop and like the idea of consumer price inflation. Enter Germany's Wolfgang Muenchau. He reckons a 4% rate of inflation would be a good idea for the Germans. His argument is that money printing doesn't increase prices, because it didn't in Japan. There, the money supply increased but deflation persisted. He then negates his own argument by pointing out the Japanese raised interest rates, bringing on deflation. But let's focus on his first argument - that a change in the money supply doesn't affect inflation. The mistake Muenchau makes is to assume the counterfactual is a 0% rate of inflation. In other words, he assumes there would be 0% inflation without central bank intervention. Because the inflation rate hasn't moved far above 0% in places where central banks have printed money, there hasn't been any inflation from the money printed. This is like saying there won't be a plane crash because you can't see anything in the aircraft cabin falling. Once you look out the window, you realise something is up. Muenchau also assumes that only the money supply changed during the period of deflation in Japan. Otherwise his analysis would be useless. If, for example, there was a financial crisis while the money supply expanded of course there would still be deflation. The question is what effect the growing money supply did have, given everything else going on. It might have offset some of the deflation, for example. Knowing all this, has there been inflation as a result of all the money printing since 2008? Well, take a guess at what would have happened without central banks printing money. The price level would have crashed. During the Great Depression it fell by about a quarter. We don't know how much it would have fallen in 2008 and 2009, but chances are a lot. Therefore, money printing has had a significant effect. The inflation created just offset deflation. The difference of opinion between Muenchau and common sense only matters if you accept that deflation is an important part of the economy trying to purge excessive debt. Stopping the deflation by creating inflation prevents the economy from fixing itself. That's why the global recovery has been so poor. In fact, American income fell more during the recovery than the recession! The real worry is that the policy makers won't give up on trying to find a new bubble to inflate. Seeing very little happen as a result of their efforts so far, they will just do more. Eventually, their money printing will gain traction in consumer prices. All you have to do to protect yourself is go out and buy some gold. Problem solved, right? The coming inflation may be a whole lot worse than what America experienced in the 1970s. Much worse. But we'll save the 'why' for next week. Until then, Nickolai Hubble. About the author: having recently escaped from academia, Nick decided to drop his tights (the required attire of a trapeze artist) and joined Port Phillip Publishing. Instead of telling everyone about the Daily Reckoning, he now spends his time writing for the weekend edition. ALSO THIS WEEK in The Daily Reckoning Australia... Iron Ore Prices Sink Like a Stone Let's shove that question aside for just a moment and return to the urgent matter of the plummeting iron ore price. When last spotted, the spot iron ore price was busy falling below US$90. It's over 50% down from around this time last year. Many interested parties want to know how much further it will fall, or when it will rebound. The Australian Dollar is Not the Euro We flirted with the idea that Australia has higher interest rates than the rest of the developed world because it has to. When you run a regular current account deficit, you have to promise higher yields on your stocks and bonds to make up the difference. If the Reserve Bank of Australia lowers interest rates too much, it could trigger a flood of foreign money out of the country and usher in a banking crisis. The Shove the US Economy Needs Ben Bernanke - yes, the Hero of '08 - is in the spotlight. Will the Fed announce a sweeping programme of 'open ended' QE - buying bonds whenever it wants? Will it thereby help the US jump over the 'fiscal cliff,' like Evel Knievel over the Snake River (poor Evel didn't make it; he ended up in the river and almost drowned)? Or will the Fed hold its tongue... and its fire? The RBA is Impotent, Not Omnipotent As we've pointed out before, very low interest rates are not exactly a sign of good economic health. Ask Japan, the US, Europe or Britain. That lower rates are on their way is inevitable. The question is how low can they really go, and how effective will the cuts actually be? Similar Posts:

| ||||||||||||||||||||

| Gold and Silver Disaggregated COT Report (DCOT) for September 7 Posted: 07 Sep 2012 03:13 PM PDT HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below. In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday (by 18:00 ET). That is all for now. | ||||||||||||||||||||

| Missing Gold: Another $80 Million Vanishes Posted: 07 Sep 2012 02:03 PM PDT $80 Million In Gold Safe Deposit Box Stolen. Can we really trust the system. from pastordowell: ~TVR |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment