saveyourassetsfirst3 |

- Investing In A Reverse Volcker Moment

- Leveraged Gold Miner ETF Surges 133% In 2 Months

- Top 5 Stocks With Insider Sells Filed On September 21 To Consider

- 3 Stocks Upgraded On September 20 To Consider

- Bart Chilton: Silver Market Investigation Statement Coming Soon

- RBI to issue gold sovereign bonds to strengthen rupee

- One dead, four injured in clash near Barrick Gold's Peru mine

- Three King World News Blogs/Audio Interviews

- Top 5 Stocks With Insider Buys Filed On September 21 To Consider

- Links for 2012-09-21 [del.icio.us]

- Gold-Silver Ratio Declining As U.S. Dollar Collapses

- Examining This New Silver Upleg

- Simon Johnson, Peter Boone: The Doomsday Cycle Turns: Who’s Next?

- Gold stock investing made easier

- Mark Twain’s Lost Gold Mine

- By the Numbers for the Week Ending September 21

- Traveling With Precious Metals

- What is the Government Smoking?

- Gold and Silver Disaggregated COT Report (DCOT) for September 21

- Neglia: Look for $2400 Gold in Next Few Years

- Precious Metals Update (Long-Term)

- Examining This New Silver Upleg

- Critical Trends for Investors

- Two Reasons Silver Has Surpassed Gold As The Trendiest Metal To Wear

| Investing In A Reverse Volcker Moment Posted: 22 Sep 2012 10:42 AM PDT By Faisal Humayun: Dr. Mohamed A. El-Erian, the PIMCO CEO, is of the opinion that the Federal Reserve and Chairman Ben Bernanke not only are willing to tolerate inflation, but are actually trying to create higher inflation. Mr. El-Erian calls the policy a "Reverse Volcker Moment." This article looks into the reasons for believing that inflation will be meaningfully higher in the medium to long-term. In line with this expectation, the best investment options are discussed. The bear market for Treasury bonds ended in the early 1980's after Mr. Volcker's strategy of controlling inflation through high interest rates yielded results. (click to enlarge) Since then, interest rates have been trending down and will remain at near-zero levels for an extended period. Even if interest rates trend higher, they will remain negative (adjusted for inflation). The reverse Volcker moment, combined with QE3, has the potential to create runaway inflation like the 1980's over the Complete Story » |

| Leveraged Gold Miner ETF Surges 133% In 2 Months Posted: 22 Sep 2012 08:57 AM PDT By Sammy Pollack: Shares of Direxion Daily Gold Miners Bull 3x Shares ETF (NUGT) are up 133% over the past two months. Click to enlarge Central Bank Stimulus The major driver of the move higher in NUGT has been the rally in gold itself. As shown by the chart below, gold prices have surged more than 12% over the past two months. The catalyst for the rally in gold has been central bank action. The most recent round of central bank stimulus began in early September, with the ECB's announcement of its newest program called "Monetary Outright Purchases." The ECB's program seems to have removed the risk of an ugly deflationary situation in Europe. However, the positive impact on gold from this program may be muted as the program will be sterilized, meaning the ECB will not engage in an operation which will increase the money supply. Following the Complete Story » |

| Top 5 Stocks With Insider Sells Filed On September 21 To Consider Posted: 22 Sep 2012 08:00 AM PDT By Markus Aarnio: I screened with Open Insider for insider sell transactions filed on September 21. I then checked with Stock Charts if the stocks had bearish Point and Figure counts. From this list, I chose the top 5 stocks with insider selling in dollar terms. Here is a look at the top 5 stocks: 1. Garmin (GRMN) and its subsidiaries have designed, manufactured, marketed and sold navigation, communication and information devices and applications since 1989 - most of which are enabled by GPS technology. Garmin's products serve automotive, mobile, wireless, outdoor recreation, marine, aviation, and OEM applications. Garmin is incorporated in Switzerland, and its principal subsidiaries are located in the United States, Taiwan and the United Kingdom. Click to enlarge Insider sells Min Kao sold 113,476 shares on September 19-21, 350,000 shares on September 14-17, 466,000 shares on September 12-13, 150,300 shares on September 7-10, 474,000 shares on September 4-6 and 300,000 Complete Story » |

| 3 Stocks Upgraded On September 20 To Consider Posted: 22 Sep 2012 07:09 AM PDT By Jorge Aura: Speculating on companies that have recently changed their ratings can be a good short-term strategy. Normally, companies will see increases in their prices after these changes. The ratings are updated daily and can therefore change daily. They can change because of a change in the analyst's estimate of the stock's fair value, a change in the analyst's assessment of a company's business risk, or a combination of any of these factors. I assessed companies that were upgraded on September 20, and I chose the top three companies with a change on ratings. These significant changes are:

These ratings are a way to qualify how the analyst views the potential for stock price appreciation. When an analyst changes his/her Complete Story » |

| Bart Chilton: Silver Market Investigation Statement Coming Soon Posted: 22 Sep 2012 05:21 AM PDT ¤ Yesterday in Gold and SilverThe gold price chopped and flopped around through all of Far East and most of early London trading yesterday...and was up about five bucks by lunchtime in London. Then, about ten minutes before Comex trading began in New York, a rally of some significance got underway. That rally got capped in less than an hour...and from there the price traded more or less sideways until a not-for-profit seller showed up at 10:40 a.m. Eastern time...and thirty minutes later, the gold price was back below where the rally had started. The subsequent rally petered out...and the price drifted lower from there, before trading sideways from 2:30 p.m. Eastern time onwards into the electronic close. Gold closed the Friday trading day at $1,773.00 spot...up $4.50 from Thursday's close. Volume was sky high at 195,000 contracts. It was precisely the same story in silver at precisely the same times, except for the sell-off that came at 10:40 a.m. Eastern time. The not-for-profit seller had silver down almost a dollar in less than ten minutes. After that pounding was over, silver traded in the same pattern as gold into the 5:15 p.m. Eastern time electronic close. Silver's high around 9:00 a.m. Eastern time was $35.32 spot...and the low around 10:45 a.m. was $34.23 spot. The silver price, which had been up 66 cents at one point, closed on Friday at $34.52 spot...down 12 cents on the day. Volume was monstrous at 68,000 contracts. Here's the New York Spot Silver [Bid] chart on its own so you can see the stunning waterfall decline in much greater detail. A mini-version of that happened in platinum as well...but there was no sign of it all in palladium. These rallies/price smashes were gold and silver specific...and the 10:40 a.m. price declines were as far away from free-market price action as you can get. The dollar index moved mostly lower in Far East, London and early trading in New York. The two low price ticks...just above 79.05...coming at precisely 10:00 a.m. in London and precisely 9:00 a.m. in New York. After the second low, the index rallied about 32 basis points and finished the Friday trading session basically unchanged from Thursday's close, at 79.39. It only takes a cursory glance to see that there was no co-relation between gold and silver prices...and the dollar index...during the New York trading session. Not surprisingly, the gold stocks gapped up strongly at the open...and headed lower from there. They went slightly negative when gold got hit...but bounced back into positive territory immediately...and stayed there for the rest of the day. The HUI finished up 0.64%. Despite the fact that silver finished down on the day, the silver stocks that mattered, did pretty well for themselves...and Nick Laird's Silver Sentiment Index closed up 0.99%. (Click on image to enlarge) The CME's Daily Delivery Report showed that 24 gold and 222 silver contracts were posted for delivery on Tuesday within the Comex-approved depositories. The short/issuer turned out to be none other than Deutsche Bank with all 222 contracts. These contracts will be received by seven different long/stoppers. Most will be delivered to JPMorgan, the Bank of Nova Scotia...and Jefferies. The link to yesterday's Issuers and Stoppers Report is here...and it's worth a peek. There was a really big deposit into the GLD ETF, as an authorized participant added 300,538 troy ounces yesterday. There were no reported changes in SLV. Nick Laird informed me that Sprott's Physical Silver Trust [PSLV] added another 285,000 ounces to their fund yesterday. The U.S. Mint had another sales report. They sold 6,500 ounces of gold eagles...500 one-ounce 24K gold buffaloes...and 314,000 silver eagles. Month-to-date the mint has sold 45,000 ounces of gold eagles...7,000 one-ounce 24K gold buffaloes...and 2,275,000 silver eagles. It's been a pretty decent sales month so far...and there are still five business days left. It was a busy day over at the Comex-approved depositories on Thursday. They reported receiving 627,405 troy ounces of silver...and shipped a very chunky 1,516,525 troy ounces out the door. The link to that activity is here. As expected, it was another pretty unhappy looking Commitment of Traders Report yesterday. In silver, the Commercial traders increased their net short position by another 3,202 contracts, or 16.0 million ounces and, according to Ted Butler, about 2,500 of that was Morgan. The Commercial net short position currently stands at 252.4 million ounces of silver and, according to Ted, JPMorgan is currently short 147.5 million ounces of silver all by itself. JPMorgan's holdings represents 58.4% of the Commercial net short position in silver...and dare I mention that JPM holds short 28.5% of the entire Comex futures market in silver on a net basis. The 'Big 4' traders...including JPMorgan...are short 44.7% of the entire Comex futures market in silver on a net basis...and the '5 through 8' largest traders are short an additional 8.8 percentage points. As a group, the 'Big 8' short holders hold short 53.5% of the Comex silver futures market on a net basis...and that's a minimum number. In gold, the Commercial net short position increased by 1,254,200 troy ounces...and now stands at 24.96 million ounces of gold. Ted says that it was all the 'Big 4'..as they increased their short position by about 1.65 million ounces...and the '5 through 8' and the raptors didn't do much. As of the Tuesday cut-off, the 'Big 4' traders on the short side are short 14.36 million ounces of gold...and the '5 through 8' traders are short an additional 5.36 million ounces...for a total of 19.72 million ounces held short by the 'Big 8' traders. As a percentage of the Comex gold market on a net basis, the 'Big 4' are short 31.9%...and the '5 through 8' are short an additional 11.9 percentage points. So, altogether, the 'Big 8' traders are short 43.8% of the Comex gold market on a net basis and, once again, those are minimum numbers. Reader E.W.F. pointed out in his weekly e-mail to me yesterday that..."The non-reportable gold traders (small speculators) hold their largest net long position since February 4, 2002." Here's Nick Laird's "Days of World Production to Cover Short Contracts" updated with Tuesday's COT data... (Click on image to enlarge) And here are a couple of charts that Washington state reader S.A. sent my way yesterday...and I would suspect that he stole them for some Zero Hedge article. The first chart shows the gold price against various currencies and indexes both before and after the Swiss pegged the franc to the euro. The euro is the dark blue trace. (Click on image to enlarge) The second chart is the euro chart on its own going back just over two years. Note the break out in the last few days. (Click on image to enlarge) It should come as no surprise that I have a lot of stories in today's column...and I hope you can find the time over what's left of the weekend to read the ones that interest you the most. I'm still as nervous as a long-tailed cat in a room full of rocking chairs about what JPMorgan et al will do in the very short term Dalio on Gold: Buffett is Making a Big Mistake. Gold Seen Luring Wealthy as Central Bankers Expand Stimulus. Now China has the claim on Venezuela's Las Cristinas gold mine. ¤ Critical ReadsSubscribe$2.5 billion sent to victims of Madoff's fraudBernard Madoff's victims will soon receive $2.48 billion to help cover their losses, by far the largest payout since the swindler's massive fraud was uncovered nearly four years ago. Checks ranging from $1,784 to $526.9 million were mailed Wednesday to 1,230 former customers of Bernard L. Madoff Investment Securities, according to Irving Picard, the trustee liquidating the firm. The latest payout more than triples the total recovery to $3.63 billion, Picard said Thursday. Thus 1,074 customers with valid claims, or 44 percent of the total number, will be fully repaid, he added. Customers had previously recovered $1.15 billion, including sums committed by the Securities Investor Protection Corp., which helps customers of failed brokerages. The average payout in Wednesday's distribution was $2.02 million. This story showed up on The Washington Post's Internet site on Thursday sometime...and I thank Donald Sinclair for our first story of the day. The link is here.  Peregrine customers to get first payoutPeregrine Financial Group customers will receive their first payout — totaling roughly $123 million — after a federal bankruptcy judge Thursday approved a distribution plan from trustee Ira Bodenstein. The first wave of funds will go to customers with accounts totaling less $50,000, and will be distributed on or before Oct. 8. A second distribution to be made on or before Oct. 29 will include customers with account balances of more than $50,000, provided that the trustee's office is able to determine the validity to those accounts. This short story showed up on the futuresmag.com website yesterday...and is Donald Sinclair's second offering in a row. The link is here.  Senate JPMorgan Probe Said to Seek Tougher Volcker RuleA U.S. Senate panel probing the multibillion-dollar trading loss by JPMorgan Chase & Co. (JPM) plans to unveil its findings at a hearing this year to press regulators to tighten the Volcker rule, according to three people briefed on the matter. Staff members of the Permanent Subcommittee on Investigations, headed by Senator Carl Levin, have interviewed JPMorgan officials as well as examiners and supervisors at the institution's regulator, the Office of the Comptroller of the Currency, said the people, who spoke on condition of anonymity because the inquiry isn't public. One focus of the queries is whether JPMorgan's wrong-way bets on derivatives would have been permitted under regulators' initial draft of the Volcker ban on proprietary trading, the people said. The lender lost $5.8 billion on the trades in the first six months of the year. This Bloomberg story from yesterday was sent to me by reader 'David in California'...and the link is here.  Housing, Diminishing Returns and Opportunity CostThe Fed's policies of keeping interest rates at zero and buying mortgage-backed securities are intended, we're assured, to bolster the housing market by making it cheaper for buyers to borrow money. With mortgage rates under 4% and a trillion (soon to be two) dollars of dodgy mortgages transferred from the banks' tottering balance sheets to the Fed's wonderfully opaque balance sheet, then this appears plausible. But of course it's all a PR ruse, like everything else the Fed says. If the Fed wanted to "save" housing and not the banks, why not buy mortgages directly from homeowners? Instead of buying underwater mortgages from the banks, why not just buy the entire $10 trillion of residential mortgages outstanding and charge the homeowners the same rate the Fed charges banks, i.e. zero? The Fed's goal is not to relieve debt-serfdom, it's to enforce it. The entire purpose of the Fed's policies is to ensure homeowners keep paying interest to banks for the rest of the lives, and to encourage those who are not yet debt-serfs to join the serfdom with a "cheap" mortgage. This short story by Charles Hugh Smith was posted over at the financialsense.com Internet site yesterday...and is your first must read of the day. I thank reader U.D. for bringing it to our attention...and the link is here.  Doug Noland: Credit Bubble Bulletin - Z1, QE3 and Deleveraging"Our economic structure certainly enjoys unmatched capacity to absorb Credit excess without engendering traditional consumer price inflation. Yet there is indeed a huge problem that no one seems to want to recognize: Our system also has an unprecedented capacity to expand Credit that is backed by little in the way of wealth-creating capacity. Our government literally throws Trillions at the economy – Credit that inflates incomes and sustains consumption and elevates asset prices. The downside of this economic miracle is that, at the end of the day, there's little left to show for the whole exercise except for an ever-expanding mountain of suspect financial claims. Moreover, market values of these claims are sustained only by the unrelenting expansion of additional claims/Credit. This is Minsky's "Ponzi Finance" at a systemic level." Doug's 'big picture' view of the world's credit markets are always worth reading...and his missive from yesterday certainly falls into that category. The link is here.  Debt Relief: Lenders Reportedly Consider New Greek HaircutIn order to restore the country's debt sustainability, Greece's lenders are reportedly considering further relief in the form of a partial debt haircut for the crisis-wracked country, the Financial Times Deutschland reported on Friday. Citing unnamed "euro-zone sources," the paper said the focus was on bilateral loans from the currency union's first bailout program for the country, the nearly €53-billion ($69 billion) Greek Loan Facility, which ran from May 2010 to the end of 2011. "There is a discussion," a high-level official told the paper. Martin Blessing, chairman of Germany's second-largest bank, Commerzbank, has also said a second debt haircut is likely. "In the end we will see another debt haircut for Greece, in which all creditors will take part," he said on Thursday in Frankfurt. Sooner or later, all the world's debt will disappear...either by hyperinflation or by default. This story appeared on the German website spiegel.de yesterday...and I thank Roy Stephens for his first offering of the day. The link is here.  RBI to issue gold sovereign bonds to strengthen rupee Posted: 22 Sep 2012 05:21 AM PDT  The Reserve Bank of India is planning to set up a panel to suggest a roadmap to tap into India's gold holdings reports CNBC-TV18's Siddharth Zarabi. |

| One dead, four injured in clash near Barrick Gold's Peru mine Posted: 22 Sep 2012 05:21 AM PDT  One person died and four were injured when police clashed with protesters blocking a road leading to top gold miner Barrick's Peruvian mine Pierina, company and police officials said on Thursday. Protesters were demanding that the mining company provide water infrastructure to towns near the mine, which sits 13,400 feet (4,100 m) high in the Andes, when the clash occurred late on Wednesday. So far 19 people have died in clashes over natural resources since President Ollanta Humala took office in July, 2011. Peru's human rights agency says there are hundreds of lingering disputes over water, mining, and oil projects in rural Peru. |

| Three King World News Blogs/Audio Interviews Posted: 22 Sep 2012 05:21 AM PDT  The first blog is with Egon von Greyerz. It's headlined "Gold, Silver, the US, Europe & the Tungsten Scare". The second blog is with Caesar Bryan...and it's entitled "Gold to Advance Another $700 - $1,200 Within Months". The audio interview is with Dr. |

| Top 5 Stocks With Insider Buys Filed On September 21 To Consider Posted: 22 Sep 2012 03:44 AM PDT By Markus Aarnio: I screened with Open Insider for insider buy transactions filed on September 21. I then checked with Stock Charts if the stocks had bullish Point and Figure counts. From this list I chose the top 5 stocks with insider buying in dollar terms. Here is a look at the top 5 stocks: 1. First National Community Bancorp (FNCB.PK) is the bank holding company of First National Community Bank, which provides personal, small business and commercial banking services to individuals and businesses throughout Lackawanna, Luzerne, Monroe and Wayne Counties in Northeastern Pennsylvania. The institution was established as a National Banking Association in 1910 as The First National Bank of Dunmore, and has been operating under its current name since 1988. Click to enlarge Insider buys

Complete Story » |

| Links for 2012-09-21 [del.icio.us] Posted: 22 Sep 2012 12:00 AM PDT

|

| Gold-Silver Ratio Declining As U.S. Dollar Collapses Posted: 21 Sep 2012 11:50 PM PDT |

| Examining This New Silver Upleg Posted: 21 Sep 2012 11:36 PM PDT |

| Simon Johnson, Peter Boone: The Doomsday Cycle Turns: Who’s Next? Posted: 21 Sep 2012 10:51 PM PDT By Simon Johnson, Peter Boone. Johnson is Professor of Entrepreneurship, Sloan School of Management, MIT and CEPR Research Fellow. Boone is Research Associate, Centre for Economic Performance, LSE. Originally published at VoxEU. Industrialised countries today face serious risks – for their financial sectors, for their public finances, and for their growth prospects. This column explains how, through our financial systems, we have created enormous, complex financial structures that can inflict tragic consequences with failure and yet are inherently difficult to regulate and control. It explains how this has happened and why there are more and worse crises to come. There is a common problem underlying the economic troubles of Europe, Japan, and the US: the symbiotic relationship between politicians who heed narrow interests and the growth of a financial sector that has become increasingly opaque (Igan and Mishra 2011). Bailouts have encouraged reckless behaviour in the financial sector, which builds up further risks – and will lead to another round of shocks, collapses, and bailouts. This is what we have called the 'doomsday cycle' (Boone and Johnson 2010). The cycle turned in 2007-8 and was most dramatically manifest in the weeks and months that followed the fall of Lehman Brothers, the collapse of Iceland's banks and the botched 'rescue' of the big three Irish financial institutions. The consequences have included sovereign debt restructuring by Greece, as well as continuing problems – and lending programmes by the IMF and the EU – for Greece, Ireland, and Portugal. Italy, Spain and other parts of the Eurozone remain under intense pressure. Yet in some circles, there is a sense that the countries of the Eurozone have put the worst of their problems behind them. Following a string of summits, it is argued, Europe is now more decisively on the path to a unified financial system backed by what will become the substance of a fiscal union. The doomsday cycle is indeed turning – and problems are undoubtedly heading towards Japan and the US: the current level of complacency among policymakers in those countries is alarming. But the next turn of the global cycle looks likely to hit Europe again and probably harder than before. The structure of the doomsday cycle In the 1980s and 1990s, deep economic crises occurred primarily in middle- and low-income countries that were too small to have direct global effects. The crises we should fear today are in relatively rich countries that are big enough to reduce growth around the world. The problem is that the modern financial infrastructure makes it possible to borrow a great deal relative to the size of an economy – and far more than is sustainable relative to growth prospects. The expectation of bailouts has become built into the system, in terms of government and central bank support. But this expectation is also faulty because, at times, the claims on the system are more than can ultimately be paid.

It enables them to buy favour and win re-election. The problems will become apparent, they calculate, on someone else's watch. So repeated bailouts have become the expectation not the exception.

The complexity and scale of modern finance make it easy to hide what is going on. The regulated financial sector has little interest in speaking truth to authority; that would just undercut their business. Banks that are 'too big to fail' benefit from giant, hidden and very dangerous government subsidies. Yet despite repeated failures, many top officials pretend that 'the market' or 'smart regulators' can take care of this problem.

The issues are abstract and lack the personal drama that grabs headlines. The policy community does not understand the issues or becomes complicit in the schemes of politicians and big banks. The true costs of bailouts are disguised and not broadly understood. Millions of jobs are lost, lives ruined, fiscal balance sheets damaged – and for what, exactly? Over the past four centuries, financial development has strongly supported economic development. The market-based creation of new institutions and products encouraged savings by a broad cross-section of society, allowing capital to flow into more productive uses. But in recent decades, parts of our financial development have gone badly off-track – becoming much more a 'rent-seeking' mechanism that draws support from politicians because it facilitates irresponsible public policy.

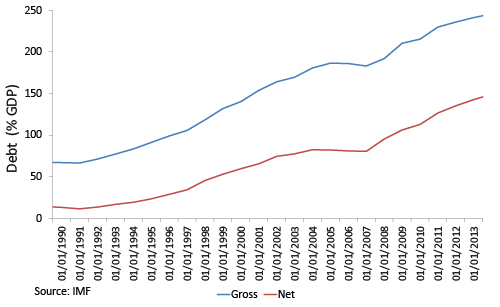

There are three prominent candidates: Japan, the US, and the Eurozone. Japan's long march to collapse Figure 1 shows the path of Japan's ratio of debt to GDP over the last 30 years, including IMF forecasts to 2016. Figure 1 This is a worrying picture:

The average Japanese woman today has 1.39 children, far fewer than is needed to replace the elderly. This means that the total population is set to decline by 26% by 2050. Having peaked in the mid-1990s, the country's working age population will decline by a staggering 40% between 1995 and 2050. Naturally, many of the ageing Japanese have been saving for their retirement for decades. They deposit those funds in banks, buy government bonds, hold cash savings or buy Japanese equities.

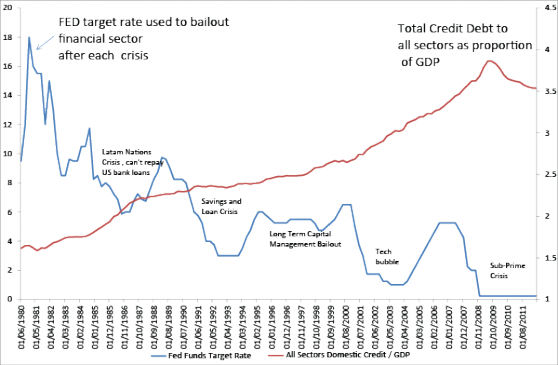

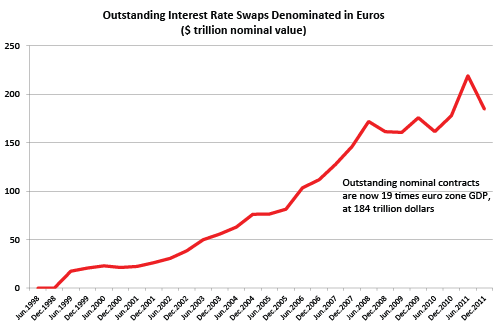

With an ageing population and slower growth, the broad outlines of responsible policy are straightforward. Japan should become a big investor in countries with younger populations, providing the capital investment needed to generate growth. Those countries can then return the savings to the Japanese as they retire. Singapore's government does just that via one of the world's largest investment funds. Instead, for the last two decades, Japan's government has been running large deficits, borrowing and then spending the savings of the young. When the elderly finally demand their savings back in the form of pensions, the government will need to reduce its budget deficit of 8% of GDP and start running a sizeable budget surplus. Unless there is a sudden burst of romance and fertility, there will be far fewer Japanese taxpayers in the future to pay this debt. The government has not been willing to raise taxes in a timely manner to match its spending. The latest agreement is for a modest (5%) increase in the retail sales tax, which would only be fully implemented in 2015. Why would it do so in the future when the burden on the remaining workers will need to be ever larger? Japan is saved from immediate pressure by the fact that about 95% of its government debt is held by domestic residents. As long as these investors are satisfied with very low – or perhaps negative – real rates, this situation can continue. But sooner or later, Japan's dreadful fiscal mathematics will catch up with the government. There is no sign yet of a broad loss of confidence, but major shifts in market sentiment are not typically signalled in advance. America's reckless private finance In the US, the symptoms are different. Figure 2 illustrates the US version of the doomsday cycle: the rise of total credit as a fraction of national income. Major players in the financial system have become too big to be allowed to fail – and consequently receive large subsidies. Figure 2 The latest crisis has led to the largest monetary and fiscal bailouts on record. The Congressional Budget Office estimates that the final fiscal impact of the crisis of 2007-8 will end up increasing debt relative to GDP by about 50 percentage points. This is the second largest debt shock in US history; measured in this way, only the Second World War cost more. (For more detail, see Johnson and Kwak 2012.) The alliance that leads to unsustainable finance here is simple: the US financial system earns large 'rents' (excess returns to labour and capital) from the implicit subsidies offered by taxpayers. These rents finance a massive system of lobbyists and campaign donations that ensures 'pro-bailout' politicians win elections regularly. Each time the US has a crisis, politicians and technocrats admit their errors and buttress regulators to ensure that 'it never happens again'. Yet still it happens, again and again. We are now on our third round of the so-called Basel international rules for banks, with the architects of each new reform admonishing the previous architects for their mistakes. There's no doubt that the US will someday soon be correcting Basel 3 and moving on to Basel 4, 5, 6 and more. The problem that the country faces is that with each crisis, the financial risks are getting larger. If continued in this manner, bailing out the system will eventually be unaffordable. When the US finally runs out of enough savers to buy the bonds needed to bail out the system, it will suffer the ultimate collapse. (For more detail, see Schularick and Taylor 2012.) Roughly half of all US federal debt is currently held by non-residents. So US fiscal policy remains viable only as long as the dollar is seen as the ultimate safe haven for investors. But what is the competition? Japan is not appealing today as a haven and it is unlikely to become more appealing in the near term. A great deal of the prospects for the US budget and growth therefore rest on what happens in the Eurozone. The Eurozone: Flawed dreams There is no sign that the Eurozone will emerge from crisis any time soon. The incentive structure of the Eurozone ensured that each country's financial sector clamoured to join it. The key feature that made it so attractive was the liquidity window at the ECB. For smaller countries, the ECB is a modern day Rumpelstiltskin. Rather than spinning straw into gold, the ECB converts unattractive government and bank-issued securities into highly liquid 'collateral' that can be readily swapped for cash from the ECB. This feature instantly made sovereign and bank bonds very attractive debt instruments. Knowing that the borrowers had essentially unlimited access to liquidity from the ECB, investors became willing lenders at low interest rates to all banks in the Eurozone. Given such attractive features, it is easy to understand why 17 countries mastered the political debate to join the Eurozone. It is also easy to understand how the system got abused and why it will be so difficult ever to make it 'safe'. If the Japanese can't control their public finances and if the US can't control its too-big-to-fail banks, the added complexity of merging 17 regulators and 17 national governments into a system where someone else can be made responsible for bailing out the intransigents seems a financial and regulatory nightmare. Such a system is sure to be crisis-prone. The Federal Reserve and the US federal government's attempt to provide bailouts when there is trouble in the US. But in Europe, the bailouts are only partial. No country has a 'lender of last resort' like the Federal Reserve or the Bank of Japan – so markets are now learning that large risk premia are needed to reflect default risk in troubled countries. Flexible exchange rates would undoubtedly make it easier to manage these crises. Devaluations instantly reduce wages and raise countries' competitiveness. If Greece had managed a large devaluation, it could probably have avoided much of the unemployment and social turmoil we see today. Instead, each troubled country in Europe now suffers when having to force down wages and prices during adjustment. This system poses great dangers to global financial stability. The Eurozone faces myriad problems, including insufficient bank capital, high levels of private and public debt, and the chronic inability of some member countries to grow. It is now common to hear policymakers blackmailing populations: unless the Eurozone survives, tragedy will result. And it is true that tragedy will result; we only need to look at the rise of complex derivatives and the dangers they pose were the Eurozone to dismantle. (For a broader discussion of Europe's problems, see Boone and Johnson 2011 and 2012.) Figure 3 illustrates the growth of euro-denominated interest rate derivatives, the notional value of which now totals more than 10 times the GDP of the Eurozone. Regulators commonly use net figures when they consider ultimate risk for banks and this makes sense under the usual circumstances of bankruptcy. But when a currency area breaks up, the practice of netting off contracts needs to change dramatically and banks will be facing far more risks than regulators and risk officers currently report. Figure 3 For example, if a German bank has a contract with a French bank and an opposite identical contract with a German pension fund, it can net those two contracts and report the ultimate risk as zero. (Of course there is counterparty risk, but under standard agreements, derivatives are cleared instantly at liquidation so the counterparty risks can be netted). But if investors start to believe that there will be new currencies in each country, then the two contracts in this example are no longer offsetting so they must not be netted. It is reasonable to think that after any demise of the euro, the contracts between two German counterparties will be converted into deutsche marks, while contracts with international partners will be disputed or maintained in a euro proxy. As a result, risk officers at banks should understand that if the Eurozone breaks up, all banks in Europe face enormous and unaccountable currency risk. Each of their 'euro' assets and liabilities needs to be examined to understand into which currency it would be converted. (For more discussion on redenomination issues, see Nordvig and Firoozye 2012.) The threat of future crises The tragedy of the Eurozone appears unavoidable, but it reflects far greater risks that will spread to Japan, the US, and other advanced economies. The continuing crisis in the Eurozone merely buys times for Japan and the US. Investors are seeking refuge in these two countries only because the dangers are most imminent in the Eurozone. Will these countries take this time to fix their underlying fiscal and financial problems? That seems unlikely. The lesson from all these troubles is clear: the relatively recent rise of the institutions of complex financial markets, around the world, has permitted the growth of large, unsustainable finance. We rely on our political systems to check these dangers, but instead the politicians naturally develop symbiotic relationships that encourage irresponsible growth. The nature of 'irresponsible growth' is different in each country and region – but it is similarly unsustainable and it is still growing. There are more crises to come and they are likely to be worse than the last one. Editor's note: this piece first appeared in CentrePiece magazine (Centre for Economic Performance, LSE). References Boone, Peter and Simon Johnson (2010), "The Doomsday Cycle", CentrePiece, 14:3. NOTE Lambert here. A question Johnson and Boone do not ask: Is there really such a thing as 'responsible growth'? (How would we tell?) Some have argued not; see The Waning of the Modern Ages, from Links, yesterday. |

| Gold stock investing made easier Posted: 21 Sep 2012 10:30 PM PDT 321 Gold |

| Posted: 21 Sep 2012 10:04 PM PDT E-Goldprospecting |

| By the Numbers for the Week Ending September 21 Posted: 21 Sep 2012 08:59 PM PDT This week's closing table is just below.

|

| Traveling With Precious Metals Posted: 21 Sep 2012 05:34 PM PDT Traveling With Precious Metals Friday, 21 September 2012 09:19 Written by International Man By Robert E. Bauman Offshore Confidential Imagine you are docilely going through the long security line at John F. Kennedy International Airport, headed for your overnight flight to London Heathrow. As your carry-on bag goes through the X-ray, a burly TSA agent is called over to confer with the machine operator. He then looks at you and says: "Please come with me, sir." As you are led to a small cubicle, you nervously try to think of what you might have done wrong. While you open your bag as instructed, the stern-faced TSA agent points to a small package and demands to know what it contains. Inside are antique, collectible gold coins that you intend to sell to the same British dealer from whom you bought them years ago, but now they are worth much more. Now the agent says: "I'm sorry, sir, I will have to confiscate them, but I will give you a receipt. You have the right to file an appeal." You stand there dumbfounded, the whole purpose of your journey destroyed. Safely Transporting Your Coins or Precious Metals Serious problems can arise when gold or silver coins (or any precious metals) are transported personally out of the U.S. to other countries by auto, airplane, boat or public transportation - or the reverse, when entering the U.S. In May 2010, the Houston reported that U.S. Immigration and Customs (ICE) agents and Border Protection officers at Houston's George Bush Intercontinental Airport confiscated more than $250,000 in cash and almost $160,000 in gold and silver in 14 separate seizures from individual travelers during that one month alone. At the time, I checked with several precious-metal experts and none had ever heard of government agents doing what these ICE agents did. It was news to them - and to me. And Houston, of course, is one of many international airports and entry and exit points in the U.S. So those figures could be multiplied many times over. Because of the confiscations that already have occurred, I urge you not to travel with precious metals in any form, including coins. Any border crossing with more than $10,000 or more in U.S. dollars or foreign equivalent in any form must be reported on U.S. Customs Declaration Form 6059B. If you're moving U.S.-issued gold or silver coins, some advisors claim that you need to declare only the face value; $50 for a one-ounce gold Eagle, for instance, but that may cause trouble. Your friendly Homeland Security Administration agent isn't likely to be terribly sympathetic to this argument, and just might seize your coins. Also, when you arrive in your intended foreign country you may face another Customs gauntlet. However, if you declare the gold as "cash," you'll hopefully be permitted to proceed. If you must personally carry coins, my advice is to contact the nearest office of the U.S. Customs and Border Protection Agency, well ahead of travel, and explain what you propose to do and ask them how you can conform to the law. You should ask for and receive a written response so that you can show it if questioned by ICE agents. Also ask Customs if you need to notify them of your date and departure flight as a precaution against the very real possibility that a local Customs agent at the airport may not know the rules that cover this situation. You will need to complete and bring with you a Census Bureau Form 7525-V, Shipper's Export Declaration. This form is required for exported commodities with a value exceeding $2,500. At current silver and gold prices, many coins would exceed this reporting threshold. Failure to file this declaration can result in seizure. The consequences for stating incorrect information are severe, including confiscation. They may also result in a fine of up to $10,000 and/or imprisonment. If you have difficulty dealing with the U.S. Customs office, call the office of your local Member of the U.S. House of Representatives or one of your U.S. Senators and ask for their assistance. They should be pleased to help you. There probably will be reporting formalities and Customs duties payable when you enter a foreign country. Most require you to fill out, sign and submit Customs Declarations upon entry, asking if you are importing currency or the equivalent. You should contact your destination country's embassy or consulate here in the U.S. to determine how they deal with silver and gold imports or exports. Don't give them any definitive identification or travel information in case they put you on a travelers watch list. If you intend to import gold or silver coins from offshore, it is advisable to hire a U.S. customs broker in advance of your travel. The customs broker can appraise the value of the coins and arrange for payment of the foreign country's Customs or other goods and services taxes. Your local FedEx or UPS office can advise you about how to contact customs brokers in your area. Of course, you should also bring with you proof of your ownership of specific coins or precious metals, as well as a statement of appraised value from a recognized appraiser. |

| What is the Government Smoking? Posted: 21 Sep 2012 04:05 PM PDT

'Everyone is on the edge of his seat. It's been a crucial two weeks. Germany's constitutional court ruled that the European bailout fund is legal. Ben Bernanke, Mario Draghi and Masaaki Shirakawa fiddled with the money supply in America, Europe and Japan. The result was impressive. Not much happened. That about sums up the last few years, too. The most tumultuous economic times we've seen for decades globally and nothing much happens in Australian asset markets. It doesn't matter whether you use a 1 year, 5 year, or 10 year chart, the Aussie stock market has been in the doldrums. Here's the last four years of going nowhere: ASX200 4 Year Chart  So much for diversification and index investing. If you picked your stocks carefully and reinvested dividends, you might have done ok. Adding insult to injury, the Aussie dollar has absorbed the supposedly positive effects of money printing around the world. It remains very high, keeping a lid on the Australian stock market. While US stocks rally to 2007 highs, their Australian cousins remain in no-man's land. In the face of all this, your best investment option has been to go on holiday overseas to take advantage of the high dollar. But be careful where you go. Our clandestine roving reporter in Europe has this to report:

'I'm in Athens at the moment. So much graffiti and a lot of apartments are empty. A lot of the people in Athens work for nothing just so they have a job when the economy picks up. On the islands you wouldn't know there was a problem with the economy.' Economic reality has been rampaging through people's personal lives everywhere other than Australia. American median income is back to 1995 levels. European unemployment is at depression levels. Japanese elderly are resorting to shoplifting for food and a cheap thrill. In the face of all this ridiculous economic and financial news, it's time to discuss something more serious. Back when prohibition was enacted in many places around the world, your average man was turned into a criminal. Smokers today are ostracised from social settings by law. And taxes on many guilty pleasures make them more guilty than pleasurable. You can't fish, sail, swim, build or shoot as you please, even on your own land. It's pretty tough to come up with solutions for enjoying life in the face of a government trying to stop you. We're working on some at the moment. And Kris Sayce, editor of the Australian Small Cap Investigator, is preparing for the launch of an entire new eletter dedicated to something similar. All we really know so far is that he got fined for jaywalking outside our office. Now he's all fired up and has decided to make the new eletter free. While we wait for the newsletter launch, let's go through some ways the government is busy ruining your lifestyle: Compliance Not only does the government come up with stupid policies and schemes, it forces you to comply with them. And that is a direct cost to your quality of life. Here are some examples from home and elsewhere:

So what happens when we don't comply with stupid government rules? Well, if you abolish road rules it makes traffic safer and more efficient. At least two trials have proven it so far. X is Dangerous The idea that dangerous things must be banned, or restricted, is a government favourite. The cigarette industry has been the recent victim of this idea. But cars do damage too. So do kitchen knives. In fact, just about everything can give you cancer these days. If you believe the studies, that is. When the government bans things because they are dangerous, it hands them over to the black market. Prohibition tore communities apart, as does the drug war today. But the black market is very efficient too. Many people claim drugs are more available than alcohol in American schools. Occasionally, the government gets some positive effects out of their stupid policies. Like the attempt to tackle obesity at the Australian Tax Office. The pen pushers will get some exercise out of their latest cigarette clampdown:

'Tax commissioner Michael D'Ascenzo says he is "looking forward to donning a pair of galoshes to help the team out" as they help squelch and squash hundreds of millions of unsold branded cigarettes when plain packaging begins. "Between October and December 2012, there will be up to 100 cubic metres a day being destroyed, which means squelched and squashed and graded into landfill," Mr D'Ascenzo said in his internal weekly column. "For smokers, it will be approximately 540 million cigarettes destroyed as each stick is individually branded."' Notice the language. We know how many cigarettes will be destroyed 'for smokers'. But we're not sure how many cigarettes will be destroyed 'for non smokers'. Protect the X Government policies to protect things backfire in ways that require another policy to deal with. The cane toad is a good example. The government's favourite fuel policy to protect the environment is even more instructive. All around the world, subsidies, tax cuts and research grants were dished out to support the use of ethanol as fuel. Australia's policies included a bounty, excise, exemption and subsidy. Here's the impressive result:

'A report by Dr. Indur Goklany, writing in the Journal of American Physicians and Surgeons (Volume 16 Number 1, Spring 2011), estimates that at least 192,000 excess deaths and 6.7 million additional Disability-Adjusted Life Years lost to disease have been caused by using food crops to make ethanol for fuel. These deaths have been mainly in third world countries where the rise in price of food staples or the loss of availability of food puts people over the edge.' Oops. If you've been doing your bit for the environment at the petrol pump, you are now a murderer on the side as well. Ok, we'll downgrade it to manslaughter. The EU is in the process of limiting the use of ethanol in fuel. A few thousand deaths are reasonable, but not 192,000. Probably because the ethanol industry is worth 17 billion euro a year. Just imagine the lobbying. But it's too late. People in Africa need food! Aid and welfare The welfare mob is the same globally. It doesn't matter whether they're in a rich country or a poor country. In Africa, development aid in the form of cash was given to malnourished people. They bought TVs with the cash. So the development economists came up with the ingenious idea of giving them food directly. They sold the food and bought TVs with the cash. So the development economists came up with another idea, by which time the local farmers had gone bankrupt because of all the food provided to the local area by aid programs. In Germany, welfare recipients are getting around laws restricting what they can buy with their welfare cheques in a clever way. They buy mineral water, send it down the drain outside the shop, go back into the shop, collect the cash refund given for bottles, and spend that cash on, you guessed it, cigarettes. In America, people use government provided food stamps for all sorts of questionable consumption items. But our favourite welfare trend from the new world is keeping dead people in your home to collect their social security cheque. In one case, a full on mummification featured. Science Proves Possibly the worst government intervention is one that seems scientifically justified. That's because science, politics and government policy never combine to bring a good result. Not that the government even cares about the expected result in the first place:

And we're in a pessimistic mood about science again after listening to this podcast. The transcript hasn't been posted yet, but here is the gist: Most studies are utter rubbish. So you ethanol users might not have killed anyone after all. At this point, we don't know what's worse. Science tainted by politics or politics tainted by so called science. Your average Joe is well informed though. Commenting on a study which revealed that a barbeque pollutes more than a truck, one incredibly intelligent individual said this:

' "Either way, we're living in a world (where) we're still going through pollution. But the difference is we are getting some type of benefit from (the burger)," said Maria Segura.' Yes, trucks do not provide a benefit. In a true democracy, such people are unable to find the polling booth to vote. But in Australia we force them to vote anyway. Until then, Nickolai Hubble. About the author: having escaped from academia, Nick decided to drop his tights (the required attire of a trapeze artist) and joined Port Phillip Publishing. Instead of telling everyone about the Daily Reckoning, he now spends his time writing for the weekend edition. From the Archives... Be Very, Very Scared How QE Favours the Rich To the Barricades! The Power of Pork Waiting on Beijing

This posting includes an audio/video/photo media file: Download Now |

| Gold and Silver Disaggregated COT Report (DCOT) for September 21 Posted: 21 Sep 2012 01:54 PM PDT Table Totals Mask Stunning Changes in Commercial Trader Positioning HOUSTON -- This week's Commodity Futures Trading Commission (CFTC) disaggregated commitments of traders (DCOT) report was released at 15:30 ET Friday. Our recap of the changes in weekly positioning by the disaggregated trader classes, as compiled by the CFTC, is just below. The recap masks massive changes in positioning by the traders the CFTC classes as "commercial." Continued... In the DCOT table above a net short position shows as a negative figure in red. A net long position shows in black. In the Change column, a negative number indicates either an increase to an existing net short position or a reduction of a net long position. A black figure in the Change column indicates an increase to an existing long position or a reduction of an existing net short position. The way to think of it is that black figures in the Change column are traders getting "longer" and red figures are traders getting less long or shorter. All of the trader's positions are calculated net of spreading contracts as of the Tuesday disaggregated COT report. Vultures, (Got Gold Report Subscribers) please note that updates to our linked technical charts, including our comments about the COT reports and the week's technical changes, should be completed by the usual time on Sunday (by 18:00 ET). If one was looking just at the legacy COT report, and only at the net positioning of commercial traders, they would have seen an increase of 12,542 contracts (5.3%) to the combined commercial net short positioning (LCNS), which is perhaps less of an increase in commercial hedging than we might expect for a $39.85 or 2.3% advance in the price of gold - with gold near potential technical resistance. They would have also missed the almost 30,000-lot evaporation of the Producer/Merchants from both the long and short sides of the battlefield. The graph below shows the legacy COT positioning of the combined commercial traders, which includes both the Producer Merchants and the Swap Delaers as a group. The combined commercial traders held a net short position of 249,633 lots on the COMEX as of September 18, the largest combined commercial net short position for gold futures since August 2, 2011 (287,634 lots net short then with $1,659 gold). Gold would peak five weeks and $266 later in September near $1,923, but not before the combined commercial traders had reduced their collective net short hedges by more than 59,000 contracts in a rare, but dramatic short covering retreat (to 227,714 contracts net short on September 6, 2011). While we are at it, there was similar activity in the COMEX futures for silver. Just below is the graph for the Producer/Merchants for silver futures short positions, showing a huge 12,618-lot (19.6%) reduction in PM short positions, to show 51,855 lots short. Meanwhile, traders the CFTC classes as Swap Dealers, the mercenary banks and firms that sell swaps in other markets and then hedge those derivatives using futures, reported a similarly large 11,681-lot (117%) increase in their pure short positions to show 21,650 contracts short - the highest number of Swap Dealer short bets since March 19, 2011 (21,914 then with $43.94 silver). Below is a chart of just the Swap Dealer short positioning for reference. Interestingly, just since June 26, the Swap Dealers have gone from being record net long to their largest net short positioning since February 22, 2011. On June 26 the SDs were net long 19,681 contracts. By Tuesday, September 18, they reported 7,875 lots net short. Below is a graph of the Swap Dealer net positioning in COMEX silver futures. In the words of Sammy Wright, "there's something funny going on." More later this weekend for subscribers. |

| Neglia: Look for $2400 Gold in Next Few Years Posted: 21 Sep 2012 12:42 PM PDT Anthony Neglia, president at Tower Trading LLC, Sarah Quinlan, chief investment office at Qam and John Netto, president at M3 Capital, talk with Bloomberg's Alix Steel and Adam Johnson about what is driving the gold trade and just how high futures can be expected to climb. They speak on Bloomberg Television's "Lunch Money."

|

| Precious Metals Update (Long-Term) Posted: 21 Sep 2012 12:14 PM PDT Courtesy of Short Side of Long In the first part of a two part Precious Metals Update, we looked at the way Gold, Silver, Platinum and other Precious Metal assets broke out above various technical resistance levels. We also covered sentiment and fund flows, while we discussed a huge short squeeze going on in GLD and SLV ETFs earlier in the month. All in all, the conclusion stated that:

Regardless of whether we have seen a major low or not, in the second part of the update I would like to focus on the long term Precious Metals picture, while eliminating short term market noise. So to do that, we should re-focus on why we are investing into Precious Metals and how to value the asset. Let us begin: Everyone has their own reasons for investing in a certain asset class, but instead of covering them all and getting side tracked, I will just explain the reason why I invest in the Precious Metals sector. I have my own wealth and also the wealth of my clients to manage. These people have worked hard for the last few years to acquire, save and create their wealth. Their main priority, as well as my own, is not to lose it. In these uncertain times with high volatility and limited growth, the basic linear way of thinking is that the safest investment would be cash. After all, that is usually considered the most risk-free asset class. While conventional wisdom like that might hold some truth to it, one has to pay close attention to current events (and also those throughout history), because one of the easiest ways to lose wealth during turbulent economic periods, is through monetary devaluation or money printing. You see, in plain English, global central banks throughout history have always tried to stimulate economies via currency devaluation during periods of low economic growth. They have always failed, because printing money does not create prosperity, but nevertheless they always seem to have "another crack at it" and this time is no different. The chart above shows major central bank balance sheet expansions from the beginning of the Global Financial Crisis in 2007. Do keep in mind that the chart is slightly outdated, because in recent times the Fed, ECB and BoJ have all announced new "money printing" programs. Federal Reserve's QE∞ (infinity) has already started as of last Friday and plans to print money until the unemployment rate moves below 7% and closer to 6% in the US. In other words, the printing of money will continue as far as the eye can see. It is during these periods that Precious Metals like Gold and Silver retain their purchasing power and act as an alternative currency to the fiat paper system. In Human Action, on page 401, Ludwig von Mises states that:

As a matter of fact, I think the current currency devaluation programs are just the tip of the iceberg. Now, I am not saying that the current programs will get automatically expanded in the near term. After all, I didn't even think the Federal Reserve would start QE until there was a catalyst for it (I elected a stock market pullback first), but it seems that Bernanke & Co are just too eager. The chart above shows that the Federal Reserve voting members are extremely dovish in 2012 and even more so in 2013. That essentially guarantees Precious Metal investors that the Fed will not tighten dramatically. Furthermore, as the economy continues to weaken, it could also mean that the Fed will stimulate even more. Here on the Short Side of Long blog, we regularly track global leading indicators. Let us summarise recent posts regarding the state of global economy:

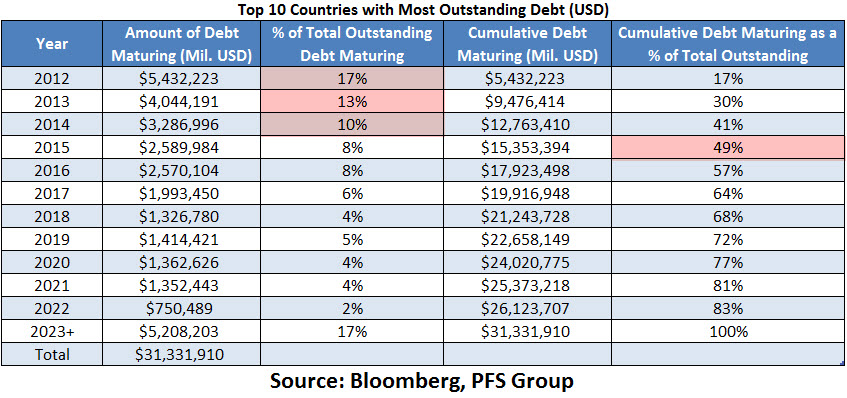

We are on the edge of another global recession. Basically, the worse that the data gets, the more money will be printed; and the lower stock markets go, the more money will be printed; and when geopolitical tensions escalate around the world, more money will be printed; and finally as governments run larger and larger deficits… you guessed it… even more money will be printed! In other words, fundamentals continue to improve from Precious Metals and continue to deteriorate for the stock market (money printing doesn't help earnings forever). Furthermore, the last point mentioned above was Government deficits, which brings me to another major fundamental positive for Precious Metals. In his recent article dating back to July, Chris Puplava concluded that the top 10 global economies have over 15 trillion dollars (with a capital T) maturing into 2015 (chart above). He concluded that:

Interestingly, not only Mr Puplava, but quite a few other wise investors talk about Gold's "mania phase" as the main reason they continue to stay long this asset class. Basically, to simplify the theory and eliminate a lot of when, why and what, we are currently in an inflationary monetary phase, as opposed to a stabilising monetary phase (chart above). What usually occurs during monetary inflation (fancy world for currency devaluation) is that Gold tends to move rapidly higher in value until it reaches a price where it essentially backs the monetary system. This historical phenomena which occurred in 1933 and in 1979, is created through investor fear, a primary component of human emotion which tends to spike Gold prices towards dizzying heights. Based on the monetary expansion by central banks, if Gold was to back the system as of today, the price would essentially rise towards $8,000 per ounce. Moving away from Gold's valuation linked with the monetary base, we turn to valuing Gold relative to other financial assets such as stocks. Personally, this is a much more preferred measure, because market participants buy and sell these assets everyday (free market). In the chart above, we can see how Gold and the Dow Jones Industrial performed in nominal price during the 1970s. While equities stayed flat for more than a decade, Gold entered a "mania phase" in the latter parts of the 1970s and then went parabolic into 1979, and finally touching the nominal value of the Dow Jones in the early parts of 1980. True die hard Gold bugs will argue that we are in for a 1:1 Dow Gold ratio again. Rather than try to guess what will happen in the future, I prefer to leave that to weather forecasters, card readers, crystal ball fortune tellers and astrologists. I am not the one to agree or disagree, but if this event was to occur in a similar time span as during the 1970s, then Gold has a lot of catching up to do, because today the Dow Jones Industrial trades at 13,597 points. Even if the Dow Jones was to experience a 30% bear market, which is quite possible during a secular sideways trading range just like the 1970s, Gold would still have to reach at least $9,500 per ounce to arrive at the 1:1 ratio. Another way to value Gold relative to the stock market is comparing the ratio of S&P 500 and Gold. Because most investors only look at one side of the ratio, S&P 500 vs Gold (black line), they easily arrive at a conclusion that stocks are extremely cheap relative to Gold as of today, and therefore Gold must be extremely expensive. This could not be further from the truth. Since every story has two sides, one cannot just focus on one and disregard the other. By simply switching the ratio over to Gold vs S&P 500 (gold line), we can see that Gold is extremely undervalued relative to the S&P 500. Overvaluation tends to occur when Gold trades at 3 to 4 times the value of the S&P 500, however in 1979/80 mania it went as far as 6 times the value. Today, the S&P 500 trades at 1,460 so even if stocks were to experience a 30% bear market (as already stated above), Gold could move towards $4,000 per ounce. Higher targets could occur if the ratio was to move to 6 times or more. However, stocks are not the only overvalued asset class, relative to the last Gold peak in 1980. Bonds, which have experienced a super powerful secular bull market since 1981, are also extremely overvalued relative to Gold (even more so than stocks). The chart above shows just how cheap Gold is relative to its 1980 nominal ratio against Stocks and Bonds. If you are a believer that Gold will spike back to its former glory days of the late 1970s, then in percentage terms Gold is still more than 80% below its ratio all time high. That is still extremely cheap, despite Gold rising 500% in the last 11 years! Having said that, Gold might only reach this stage for a short amount of time, before financial assets once again start to outperform. In their July Gold report, which is a must read for any investor, Erste Group writes:

The chart above explains that quote from the report rather well. If the price action was to track the Pareto distribution, or also known as the 80/20 rule, then we could expect some serious Gold movements in the coming months, quarters and years as we witness a fast parabolic movement towards the sky (and much higher). In the last several years of this secular bull market, Gold could accelerate rather quickly and approximately hit a target of $8,000 per ounce or even higher, according to the chart above. While we can talk about the Precious Metals bull market for days on end, especially if true die hard Gold bugs are present in the discussion, the main point is that Precious Metals are still a good investment today. Furthermore, in my opinion we haven't even seen the major phase of the current secular bull market just yet. If you consider the chart above, you can see that all of the largest daily percentage changes on both the upside and downside occurred during the last great bull market of 1970s. Days when we see Gold rise 5% or even 10% in a single day are still in front of us. Consider that these prices movements could be $100 to $300 per day in the future. These will be the days when retail investors and dumb money, as well as all the current bull market disbelievers and remainder of the general public, start piling into Precious Metals. Finally, the question that I get asked all the time regarding my Silver investment – how high could it go? The short answer is I do not know, but the longer answer would state that if history is any guide, Gold's smaller cousin Silver, could move towards its historical ratio of at least 16 Silver ounces for 1 Gold ounce. You can do the maths yourself… |

| Examining This New Silver Upleg Posted: 21 Sep 2012 12:13 PM PDT Because this surge looks nearly vertical on short-term charts, some traders are getting nervous about this rally's staying power. While silver may indeed be temporarily overbought, its recent strength actually looks like the vanguard of a major new upleg. |