Gold World News Flash |

- The gold price and the exponential growth of our problems

- 18 Indications That Europe Has Become An Economic Black Hole Which Is Going To Suck The Life Out Of The Global Economy

- Market Thoughts

- Where Should I Hide My Precious Metals?

- Ron Paul – “The World Will Abandon The Dollar As The Global Reserve Currency”

- Let Central Banking Lose Its Franchise, Not Its Independence

- Swiss National Bank vows to keep holding franc down

- A Remarkable & Historic Breakout In Gold & Silver

- Alasdair Macleod- Silver Dirt Cheap

- Silver Update 9/3/12 $500 Silver

- Man Who Sold the World

- 40 Signs That We Have Seriously Messed Up The Next Generation Of Americans

- How Long Will the Dollar Remain the World's Reserve Currency?

- The Gold Price Close Up $30.50 to Close at $1,685.30

- Is Spain Running Out Of Cash?

- Guest Post: The Big Swiss Faustian Bargain

- Gold May Not Be Money But It Is An... Airline? Bloomberg Freudian Slip Du Jour

- Thoughts on a "Too Quiet" Labor Day

- Gold's New High At $1,694.80 oz Today – EU Manufacturing Shrinks More Than Expected, CPI accelerates to 2.6% – China Manufacturing Close To Contraction – Japan Industrial Production Slumps – India's fiscal '13 Growth View Cut ̵

- Chasing GoldQuest in the Dominican Republic

- GoldMoney's Turk on the historic breakout in gold and silver

- HAS QE3 ALREADY BEGUN? GOLD & COMMODITIES MAY BE SAYING YES.

- Turk - A Remarkable & Historic Breakout In Gold & Silver

- An In-depth Interview with Frank Giustra

- Frank Giustra explains his bet on the resource sector

- Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

- Butler tells MineWeb why he sees silver's potential greater than gold's

- Tentacles of Deception [Video]

| The gold price and the exponential growth of our problems Posted: 04 Sep 2012 01:04 AM PDT |

| Posted: 03 Sep 2012 11:15 PM PDT from The Economic Collapse Blog:

|

| Posted: 03 Sep 2012 10:34 PM PDT The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! September 03, 2012 08:00 PM With Summer unofficially behind us now, we enter three of the more interesting months of every trading year. U.S. Stock Market - The “Don’t Worry, Be Happy” crowd on Wall Street shall eat up the perception that Bernanke and the FED have or will be in QE3 mode. Despite numerous fundamental and technical reasons for concern, it’s been my belief that the path of least resistance remains up, not down. I continue to think a marginal, new all-time high is possible. U.S. Bonds – Thanks to QE3 unfolding, I continue to hope the 10yr. T-Bond yield can get down to 1.25% It would be a screaming short if and when it does. U.S. bonds look to be the worse investment vehicle for the next decade. U.S. Dollar – Despite something like 95%-98% bulls, the U.S. Dollar managed only a dead-cat bounce an... |

| Where Should I Hide My Precious Metals? Posted: 03 Sep 2012 10:30 PM PDT by AGXIIK, Silver Doctors:

Where Should I Hide My Precious Metals? Hiding PM's is a tough decisions and there is no one perfect answer. I personally believe having your metals at your home is the best idea. A fire rated safe can contain a huge amount of physical metal Use a dial type safe, not electronic. The E type can be hacked. In case of fire, E types are hard to open. Mount it on a cement or very solid floor since it can weigh 1,000 lbs. Memorize the safe number. |

| Ron Paul – “The World Will Abandon The Dollar As The Global Reserve Currency” Posted: 03 Sep 2012 10:17 PM PDT In August Ron Paul accused the U.S. Treasury "guilty of counterfeiting dollars" by virtue of its monopoly power on money in America. Paul noted that the expanding role of the Federal Reserve in monetizing government debt has resulted in a massive debasement of the purchasing power of the U.S. dollar. Continued reckless money printing by [...] |

| Let Central Banking Lose Its Franchise, Not Its Independence Posted: 03 Sep 2012 10:00 PM PDT from Staff Report, The Daily Bell:

At Jackson Hole, a growing fear for Fed independence … Increasing political encroachment on the Federal Reserve, particularly from the Republican Party, could threaten the central bank's hard-won independence and undermine confidence in the nearly 100-year old institution. That was the pervasive sentiment among economists gathered at the Fed's annual monetary policy symposium in Jackson Hole, Wyoming. – Reuters Dominant Social Theme: If we don't have a central bank, what have we got? Free-Market Analysis: Here at the Daily Bell, we have simple questions that we ask regularly about central banking: How much money is enough, and how do central bankers know it? The answer is that central bankers DON'T know how much money is too much. Only the market can inform us of the volume and value of money. The market can do this two ways: via the pricing of gold and silver and the pricing of competitive currencies. |

| Swiss National Bank vows to keep holding franc down Posted: 03 Sep 2012 09:46 PM PDT By Alice Ross http://www.ft.com/intl/cms/s/0/23278860-f5df-11e1-bf76-00144feabdc0.html The head of the Swiss National Bank has vowed to continue its policy of halting rises for the franc against the euro and has warned that a stronger currency would be a "substantial threat" to Switzerland's export-dependent economy. Thomas Jordan, in a speech in Zurich on the challenges for Switzerland as a financial centre, warned of the negative effect of the eurozone crisis and the damage to the Swiss economy that a stronger franc could create. "In the current situation, a further appreciation of the Swiss franc would constitute a very substantial threat to the Swiss economy and would carry with it the risk of deflationary developments," Mr Jordan said. ... Dispatch continues below ... ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. "With this in mind, we will continue to enforce the minimum exchange rate with the utmost determination." He added that economic uncertainty in the eurozone was of "great concern" to Switzerland and the bank, underlining the role of the franc policy as an attempt to reduce the negative implications for the country. Mr Jordan's comments were made almost a year after the SNB introduced its policy of keeping the franc weak by maintaining an exchange rate of SFr1.20 against the euro. The move, introduced on September 6 last year, was put in place following overwhelming demand for Swiss assets from foreign investors seeking a haven amid the eurozone crisis. The SNB was viewed as so credible in the markets that its franc policy was not tested until May, when growing fears that Greece could leave the eurozone prompted fresh demand for the currency. The central bank has since spent tens of billions each month buying euros to weaken the franc and hold the exchange rate at SFr1.20. That has helped the SNB's foreign currency reserves to rise to record levels. The most recent figures show SFr406 billion ($425.9 billion) in forex reserves on its balance sheet at the end of July, an increase of 71 per cent over a three-month period. However, foreign currency analysts believe the foreign exchange reserve figures for August, due to be published in coming days, will show that the pressure on the SNB has abated in recent weeks amid a period of relative optimism over the euro. UBS analysts pointed to a slowdown in weekly deposit data at the bank during August, in contrast with higher weekly inflows in June and July. The forthcoming anniversary of the bank's decision to set a ceiling for the franc has prompted questions over how much longer it can continue with the costly policy. "We expect the SFr1.20 floor to hold indefinitely, notwithstanding the buildup of foreign exchange reserves," Credit Suisse analysts wrote in a note on Monday. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... |

| A Remarkable & Historic Breakout In Gold & Silver Posted: 03 Sep 2012 09:00 PM PDT from KingWorldNews:

Today James Turk told King World News, "This breakout (in gold and silver) is very important historically because it is not only ushering in the next great move in the metals, but it also signals the beginning of the next leg of the destruction of fiat money." Turk also said, "Given that silver is still in stage 1, the media attention won't begin until silver hits a new record high over $50 per ounce, and I think this is coming in just a few months." Here is what Turk had to say: "Even though the US is closed for the Labor Day holiday market, Eric, gold and silver are on fire over here in Europe. Silver has hurdled $32 while gold looks ready to take on resistance at $1700, which is a key level the bears have been defending since last March." |

| Alasdair Macleod- Silver Dirt Cheap Posted: 03 Sep 2012 09:00 PM PDT |

| Silver Update 9/3/12 $500 Silver Posted: 03 Sep 2012 08:56 PM PDT |

| Posted: 03 Sep 2012 08:45 PM PDT by ilene, Zero Hedge:

Here's the latest installment of MarketShadows: The Man Who Sold the World: Sept. 2, 12. Overview:

|

| 40 Signs That We Have Seriously Messed Up The Next Generation Of Americans Posted: 03 Sep 2012 08:30 PM PDT by Michael Snyder, Activist Post

What in the world have we done to our kids? If you spend much time with them, you quickly realize that the next generation of Americans is woefully unprepared to deal with the real world. They are overweight, lazy, undisciplined, disrespectful, disobedient to their parents, selfish, self-centered, and completely addicted to entertainment. And that is just for starters. We feed them insane amounts of sugar and high fructose corn syrup and then when they become overactive we pump them full of prescription drugs to calm them down. Instead of raising our children ourselves, we allow the government schools and the entertainment industry to do it. By the time they reach the age of 18, they have spent far more time with their teachers, their video games and the television than they have spent with us. Our young people are #1 in a lot of global categories, but almost all of them are bad. Young people in the United States are more obese than anyone else in the world, more sexually active than anyone else in the world and they become pregnant more often than anyone else in the world. Of course it probably doesn't help that we have the highest divorce rate in the world either. Our families are a complete and total mess, and it is our kids that are paying the price. One top of everything else, we have accumulated a 16 trillion dollar debt which we will be handing down to the next generation. I am sure that they will appreciate that. |

| How Long Will the Dollar Remain the World's Reserve Currency? Posted: 03 Sep 2012 08:07 PM PDT from Paul.House.Gov:

We frequently hear the financial press refer to the U.S. dollar as the "world's reserve currency," implying that our dollar will always retain its value in an ever shifting world economy. But this is a dangerous and mistaken assumption. Since August 15, 1971, when President Nixon closed the gold window and refused to pay out any of our remaining 280 million ounces of gold, the U.S. dollar has operated as a pure fiat currency. This means the dollar became an article of faith in the continued stability and might of the U.S. government. In essence, we declared our insolvency in 1971. Everyone recognized some other monetary system had to be devised in order to bring stability to the markets. Amazingly, a new system was devised which allowed the U.S. to operate the printing presses for the world reserve currency with no restraints placed on it– not even a pretense of gold convertibility! Realizing the world was embarking on something new and mind-boggling, elite money managers, with especially strong support from U.S. authorities, struck an agreement with OPEC in the 1970s to price oil in U.S. dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence backed the dollar with oil. |

| The Gold Price Close Up $30.50 to Close at $1,685.30 Posted: 03 Sep 2012 08:00 PM PDT Gold Price Close Today : 1685.30 Change : 30.50 or 1.8% Silver Price Close Today : 31.37 Change : 1.00 or 3.2% Platinum Price Close Today : 1536.30 Change : 33.60 or 2.2% Palladium Price Close Today : 627.95 Change : 13.05 or 2.1% Gold Silver Ratio Today : 53.72 Change : -0.76 or 0.99% Dow Industrial : 13,090.84 Change : 90.13 or 0.7% US Dollar Index : 81.69 Change : 0.14 or 0.2% Franklin Sanders didn't publish commentary today, if he publishes later it will be available here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. |

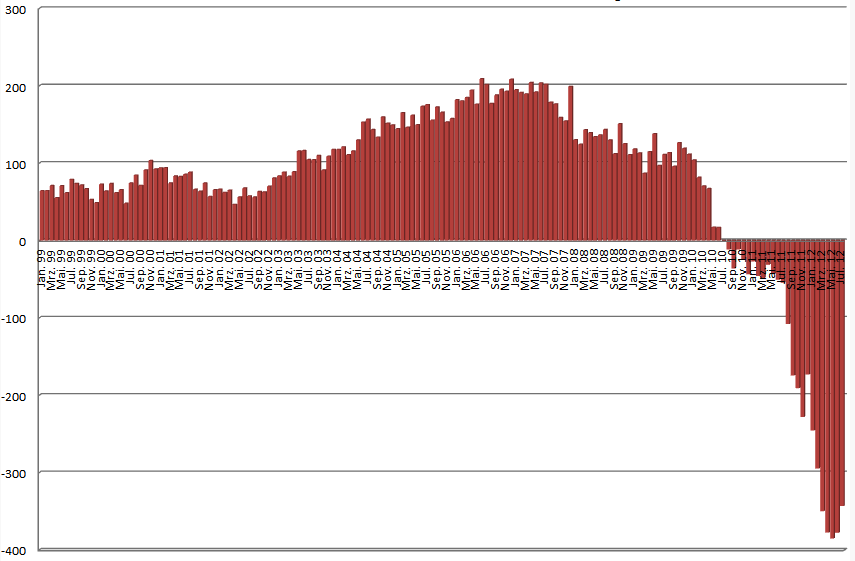

| Posted: 03 Sep 2012 07:29 PM PDT Some hours ago Spain finally bit the bullet, and after months of waffling had no choice but to hand over €4.5 billion (the first of many such cash rescues) in the form of a bridge loan to insolvent Bankia, which last week reported staggering losses (translation: huge deposit outflows which have made the fudging of its balance sheet impossible). As a reminder, in June Spain formally announced it would request up to €100 billion in bailout cash for its insolvent banking system, which subsequently was determined would come from the bank rescue fund, the Frob, which in turn would be funded with ESM debt which subordinates regular Spanish bonds, promises to the contrary by all politicians (whose job is to lie when it becomes serious) notwithstanding. And while Rajoy has promised that the whole €100 billion will not be used, the truth is that considering the soaring level of nonperforming loans in Spain - the biggest drain of both bank capital and liquidity - it is guaranteed that the final funding need for Spain's banks will be far greater. As a further reminder, Deutsche Bank calculated that when (not if) the recap amount hits €120 billion, Spanish total debt/GDP would soar to 97% in 2014 from an official number of 68.5% in 2011 (luckily the endspiel will come far sooner than that). But all of that is well-known, and what we wanted to focus on instead was the fact that bank bailout notwithstanding, Spain will have no choice but to demand a full blown rescue within a few short months for one simple reason: its cash will run out. Before we dig deeper, a quick reminder: while everyone focuses on the cash generation by the Spanish sovereign, via the almost daily Bill and Bond auctions, what many forget is that the bulk of the proceeds is merely used to refinance existing debt. The remainder goes to fund the actual national deficit (of which there is plenty to go round), and to be deployed via various less than legitimate channels to keep insolvent financial institutions "solvent" until such time as these can become someone else's problem. Namely Germany's. Until that happens however, Spain is facing crunchtime as it has to fund over €40 billion in debt maturities in the next two months alone. A secondary problem is that not only is Spain still facing a gaping primary deficit, it also has to pay the interest on its rolling refis which as everyone knows, and Rajoy most certainly, are unsustainable in the 6%+ range, not so much standalone, but certainly when juxtaposed with an economy which is collapsing in nominal terms, and is "growing" at a -0.4% growth rate. In other words, compounding the refi issue, is the fact that ever more of the organic growth from the economy has to be paid out to various state creditors. Add the fact that the economy itself continues to collapse, with unemployment deteriorating with no bottom in sight, only completes the triangle of terror. Which brings us to Exhibit A: the chart below shows Spain's National Account monthly cash balance, broken into its two subcomponents: the deposits at the Banco de Espana, and the Treasury Liquidity Tenders (columns 11 and 12; full historical breakdown here). The reason we bring it up is that this is the chart that everyone loves to forget. The chart shows is that in July the Spanish cash balance dropped to €23 billion after hitting a 2012 high of €54 in March. It has plunged straight line since then, unable to repeat last year's July cash surge (when the number was more than double), and if the recent deposit outflow is any indication, the government will have had to plug many bank holes using fungible cash using any means necessary and possible. In other words, once the next Spanish State Liability update is posted, we wouldn't be surprised to see this number plunge to a new post-Lehman low. Yet what is scariest is that all else equal (and it never is), at the current run rate Spain may well run out of cash by the end of the year even assuming it manages to conclude all its remaining auctions through year's end without a glitch. What all this really means it that any debate over whether Spain needs a bailout is at this point moot. It also means that absent a direct cash injection into the Spanish sovereign, Rajoy will have no choice, but to demand a bailout. What he does subsequently - whether he stays or he goes - will determine if the Spanish transition from a sovereign state to the latest vassal entity of the Troika and, more importantly, Germany will be peaceful (as much as possible) or rather violent. h/t Wallstreetmane |

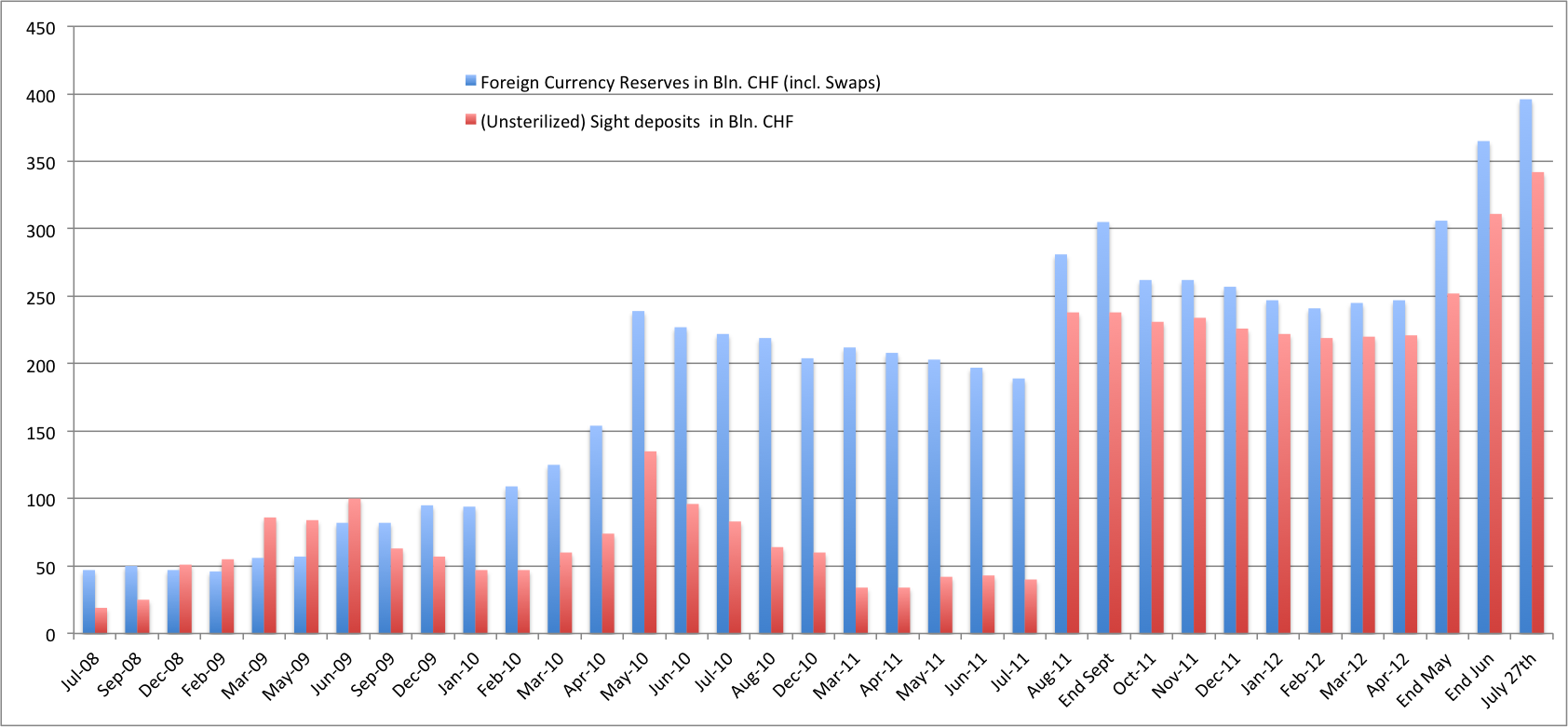

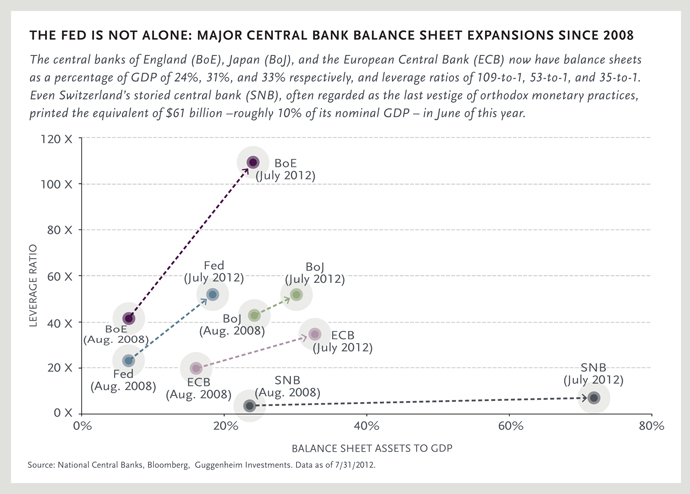

| Guest Post: The Big Swiss Faustian Bargain Posted: 03 Sep 2012 07:13 PM PDT Submitted by George Dorgan of SNBCHF blog, Differences between SNB, ECB and Fed Money Printing ExplainedMost recently Guggenheim Partners showed in their "Faustian Bargain of Central Banks", also appeared in the FT, that the Fed could lose 200 billion US$, when inflation comes back again. Interest rates would increase by 100 basis points and the US central bank would be bankrupt according to US-GAAP. We explain in this post the differences between money printing as for the Swiss National Bank (SNB), the ECB and the Fed. We show the risks the central banks run when they increase money supply, when they "print". This link to the SNB website gives insights how many francs the Swiss National Bank requested commercial banks to deposit during the last week. It is just a technical accounting process: Minus (or liability) for the SNB, Plus (or assets) for the banks. Therefore it is often called "printing" like adding a zero to a currency exchange rate. The SNB uses this "printed" money to buy more and more currency reserves and to enforce the peg. At the same time printing increases the banks' reserves at the central bank. It allows banks to give more loans to consumers and home builders via the money multiplier. During the times when the SNB buys FX reserves, the increase of bank deposits, i.e.SNB debt at banks, moves nearly in-line with the increase of FX reserves. The Limits of Money Printing

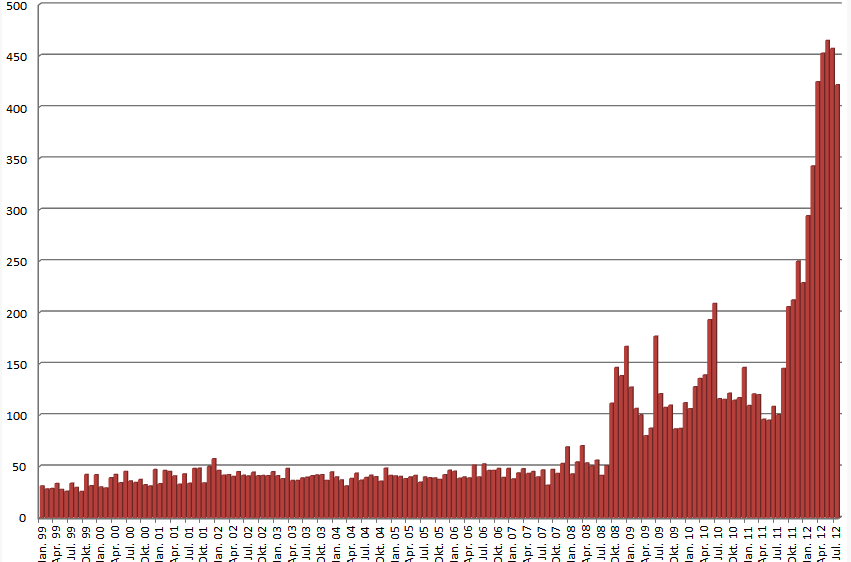

The following graph from the SNB former president Hildebrand (2004) shows that a period of inflation had regularly followed the SNB monetary expansion with a delay of about 2-3 years.

Theoretically banks could tell the SNB not to credit their accounts any more, this would prevent the SNB from further printing. Still banks are sure to get the money back one day and they want to be more profitable issuing more loans. Therefore the SNB had ideas for an anti-cyclical capital buffer in order to stop excessive mortgage loans practices and preserve banks' capital for a possible downturn. Many people fear the a similar bust of the Swiss real estate bubble like in the 1990s. The SNB thinks to be able to get rid of their excessive currency reserves one day and/or to sterilize deposits (i.e. remove sight deposits from the banks and to convert them into SNB bills). The deputy member of the SNB board Dewet Moser proudly presented in this SNB paper how easy it was to sterilize between May 2010 and July 2011 (see also in the reserves overview above). However he does not speak about the fact that the Swissie strongly appreciated (from EUR/CHF 1.40 to 1.10) during that period and the SNB had to accept huge losses.

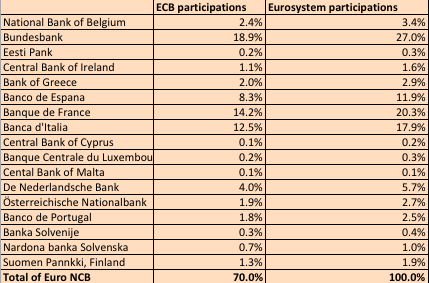

Money Printing in the euro system and the potential tax-payer bailout of the Bundesbank

Inside the euro system, the most important way of money printing is debiting the account of the ECB and crediting the accounts of the National Central Banks (NCBs) according to their participation in the Euro system. This is along the following schema: 30% of the ECB capital belongs to non-euro states like the UK, Sweden, Denmark, Poland or other non-euro EU member states. These 30% are removed in order to obtain the participations in the euro system. Printing money means that the ECB increases its debt towards the NCBs in the ratio of the euro system participations, namely Bundesbank 27%, Banque de France 20%, Banca d'Italia 20% and Banco de Espana 12%. If the ECB buys peripheral bonds with this "printed" money, it implies an implicit transfer from the Bundesbank and the Banque de France and other Northern states towards the periphery, i.e. state financing via the printing press. By nature of the bad ECB assets this is also called "qualitative easing". The Bundesbank losses could be partially realized, when one day a country leaves the eurozone (either Germany or some peripheral countries). What does "partially" mean: The Bundesbank refinances the credit to the ECB, via an increase of its debt at German commercial banks. These again will possess more reserves. Based on those they may give more loans to German firms and housing. This operation will increase inflation over the medium and long-term. The following graphs gives an overview of the of German banks' deposits at the Bundesbank, i.e. the Bundesbank debt with German commercial banks.

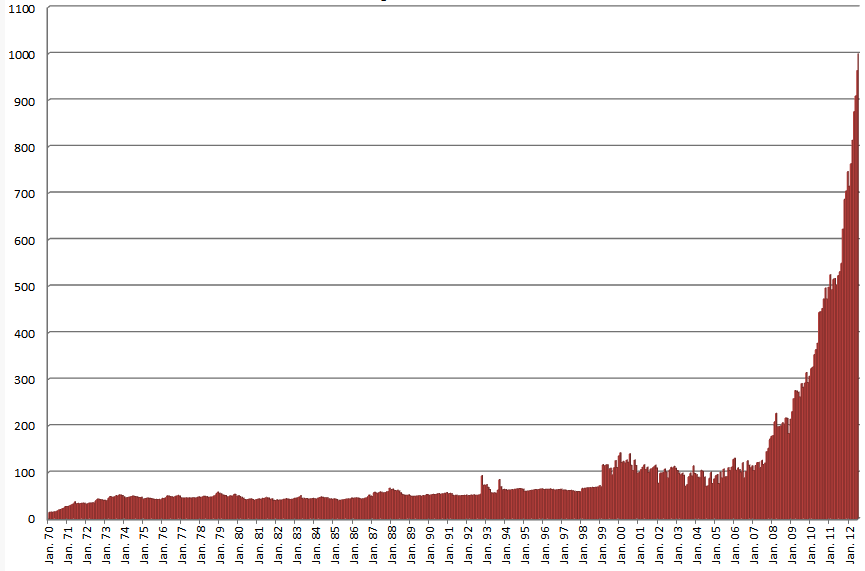

On one side the Bundesbank has more and more liabilities with German banks. On the other side this graph shows how much foreign Bundesbank foreign assets have risen over the years:

A future haircut of 30% on peripheral positions (of currently about 700 billion €), would cost German taxpayers, 210 billion €, 5% of German GDP, more than the Bundesbank equity. This haircut would require German tax-payers to bailout the German Bundesbank. See more why Weidmann has finally realized this problem together with inflationary risks and his critics with the ECB. The Swiss Faustian Bargain: Swiss Money Printing a lot more risky than the Fed's QE3

Most recently Guggenheim Partners showed in their "Faustian Bargain", also appeared in the FT, that the Fed would loose 200 billion US$, when inflation comes back again. Interest rates could increase by 100 basis points and the US central bank would be bankrupt according to US-GAAP. For them the Fed's Faustian Bargain with the Mephisto "inflation". For us the SNB money printing is a even lot more risky than the Fed's Quantitative Easing. The graph shows where the Swiss problem lies:

The SNB's ratio of printed money to GDP is a lot higher than the one of the Fed. In case of inflation the Fed's losses of 200 billion USD amount "only" to 1.2% percent of the US GDP. It would imply, as Guggenheim Partners state, a bankruptcy in terms of US-GAAP. But still the Fed will be refinanced by the generous US tax payers. The risks for the SNB, however, are eight to ten times higher: based on current FX reserves, it will cost at least 10% of the Swiss GDP,if Swiss inflation picks up and the Euro crisis will be not resolved till then. As opposed to the ECB, the SNB only buys high-quality assets, mostly German and French government bonds. However for the SNB the assets are in foreign currencies, for the big part they are denominated in euros. FX rates move a lot more quickly than American government bond yields do. This is a risk the Fed does not have, and the Bundesbank neither, as long as the euro zone stays together. Further Fed quantitative easing drives the demand for gold and the correlated Swiss francs upwards. Sooner or later this will pump more American money into the Swiss economy and will raise Swiss inflation. At the extreme a Quantitative Easing number XXL will bankrupt the SNB or force the tax-payer to bail out the SNB. This might raise the currently low Swiss public debt to levels similar to Germany or France. The same applies for ECB printing and purchases of peripheral bonds: This will drive money out of the euro zone and out of Germany into Switzerland. Therefore the SNB can still hope that QE3 and ECB peripheral bond purchases never come. For the SNB these two are the Mephistos: Bernanke and Draghi, the ones who promise easy life based on printed money. |

| Gold May Not Be Money But It Is An... Airline? Bloomberg Freudian Slip Du Jour Posted: 03 Sep 2012 06:06 PM PDT Ignore the news about what is surely the next airline to join every other legacy, and not so legacy, carrier into Chapter 11 and focus on the headline, where both the story author and its editor seem to have been preoccupied with Freudian ruminations if not on whether gold is money, then certainly how much paper money one can generate by selling gold... Source: Biggest Airline Debt Spurs Gold Asset Sale Speculation |

| Thoughts on a "Too Quiet" Labor Day Posted: 03 Sep 2012 03:49 PM PDT

Swing by www.gainspainscapital.com for more market commentary, investment strategies, and several FREE reports devoted to help you navigate the coming economic and capital market changes safely. The stock market is closed today for Labor Day.

A few thoughts on the preceding week:

Investors and the mainstream financial media are desperate to claim he did something similar this time around. He did not. Instead, he issued the same message the Fed has issued for over a year: we stand ready to act if things get bad.

However, this has not stopped the media from proclaiming that the Fed has left the door wide open for announcements of QE at its September 12-13 FOMC meeting. This however is virtually impossible due to a) food prices, b) gas prices, c) the upcoming US Presidential election election and d) the fact that the banks don’t need QE, they already have ample liquidity sitting around (this is a solvency crisis, not a liquidity one).

From a banking capital basis, the answer is nothing. EU banks remain under capitalized and over leveraged. No new capital has been created.

From a bailout mechanism perspective the answer is again nothing. The EFSF bailout fund has roughly €65 billion in firepower left while the ESM doesn’t even exist yet (and won’t until Germany rules it constitutional on September 12… a development that is not guaranteed).

From a political perspective Draghi once again has accomplished nothing. Germany, which remains the real de facto backstop for the EU, remains opposed to more bailouts. Meanwhile Spain and Greece are back at the bailout trough demanding more funds or more time. And of course, Italy remains in the side-wings ready to take center stage in the coming weeks.

So… no new money, no new funds, and no change in the political landscape. Draghi has obviously learned the power of verbal intervention (the US Fed’s primary tool over the last year)… How long can he use this tool successfully remains to be seen.

Oh, and France just nationalized its second largest mortgage lender. But don’t worry, the EU Crisis is definitely contained and Draghi and others have got everything under control. After all, when the US nationalized Fannie Mae and Freddie Mac in 2008 the financial crisis came to a screeching halt… didn’t it?

From a more analytical standpoint, we have to consider that this is a solvency crisis. You cannot solve a solvency crisis via more debt.Nor does liquidity solve anything major: liquidity only helps in day to day funding which banks need when they are truly on the brink of collapse a la 2008.

So, printing doesn’t help or change anything.

But what about debt monetization? Surely the Central Banks can print money and then use this money to buy bonds much as the Fed did with QE 1 and 2?

Again, this argument doesn’t add up. There is a reason that French, US, and German bonds are yielding so little right now. That reason is that the global financial system is starved for quality collateral: sovereign bonds remain the senior most assets/ trading collateral for the major banks.

QE or printing money to buy bonds actually removes collateral from the financial system. It may be helpful in terms of short-term funding for banks and nations that are truly on the brink of collapse and whose collateral is garbage anyway (Spain and the other PIIGS), but this “help” is much like a shot of adrenaline for a patient who is on the verge of death.

But why can’t cash be used as collateral much like sovereign bonds?

Because the global banking system is based on sovereign bonds, not cash. Look at any bank’s balance sheet and the senior most items are “cash and cash equivalents.” Read the notes on this “asset” and you’ll see that it’s actually “highly liquid sovereign bonds.”

True, banks use actual cash for day-to-day funding. But when it comes to building their trading portfolios (where much of the profits are made) it’s sovereign bonds backstopping the whole mess. And banks have built some truly insane trading portfolios: the global derivatives market is over $700 TRILLION in size.

This is why the ECB keeps letting banks pledge their sovereign bonds as collateral for cash, only to then give them more sovereign bonds which they can then pledge as more collateral to get more money, rather than the other way around. By the way, the same tactic is being used in the UK and elsewhere.

To return to an earlier point: this is why French, German, and US sovereign bonds are yielding so little: they are considered the least risky of the sovereign bond market and therefore are the best collateral.

Consequently, banks are piling into these bonds, pushing the prices up to the point of little or no yield (the US) or even negative yield (recently France and Germany).

It’s also why everyone was so clear that Greece didn’t actually “default” during the second bailout. And it explains why the ECB and others are doing everything they can to stop any EU sovereign nation from defaulting: because doing so means the collateral for hundreds of billions of Euros worth of trades going up in smoke… and down go the EU banks and the EU banking system.

A question for you on this Labor Day when you’re enjoying a cook-out or playing with your kids… how can the Central Banks fix this mess?

Swing by www.gainspainscapital.com for more market commentary, investment strategies, and several FREE reports devoted to help you navigate the coming economic and capital market changes safely.

Graham Summers

|

| Posted: 03 Sep 2012 01:59 PM PDT Gold Just Made A New High At $1,694.80 oz Today Your Window to Buy Gold Below $1,700 Is Closing Global Manufacturing Update Indicates 80% Of The World Is Now In Contraction EUROPE Euro-zone manufacturing shrinks more than expected Euro-zone Aug. … Continue reading |

| Chasing GoldQuest in the Dominican Republic Posted: 03 Sep 2012 01:48 PM PDT Junior Precipitate Gold, backed by the likes of Adrian Fleming and Eric Coffin, makes a strong area play on GoldQuest Mining. Kip Keen, writing for MineWeb begins: "HALIFAX, NS (MINEWEB) - As hatched-out via an IPO this year, Precipitate Gold (TSX-V: PRG) was to be a Yukon-BC gold story. Given the names at its core, this came as no surprise. It is backed by some Yukon savvy directors, including Adrian Fleming as chairman, who headed up Underworld Resources in the Yukon before Kinross took it out, and Gary Freeman, of Ethos Capital, which is looking to replicate Kaminak Gold's success nearby. There were also a couple other notable names, strong Yukon proponents, that got behind Precipitate in its IPO this year, Eric and the late David Coffin of HRA. Yes, it all smelled very Yukon with a focus on sediment-hosted gold deposits that are fueling a new wave of exploration up North. Precipitate holds some 70,000 hectares in prospective sediment-hosted ground in Yukon and the BC and initial plans were to start drilling this year. But then, post IPO, Precipitate stepped back, saying there would be no drillholes in the Yukon in 2012. It also dropped a big hint to Mineweb in August about why it was putting a damper on Yukon drilling this year; apart from conserving cash on tempestuous markets, it was "keeping its options open" and looking at acquisitions. Now we know there was, in fact, another iron in the fire months previous: An area play in the Dominican Republic. It goes like this. Back in late May GoldQuest Mining, operating in the western Dominican Republic, released results on a monster gold-copper drillhole. It marked an important discovery for GoldQuest, which has since pulled out several more impressive drillholes as it expands what is now known as the Romero zone. GoldQuest kicked Romero off with 231 metres @ 2.42 g/t gold and 0.44 percent copper starting 33 metres downhole. Since then it drilled better, both in gold and copper mineralization, with an aim to sketch out the potential of a 500 by 300 metre target it defined by geophysics. For the visually inclined, GoldQuest lays out the latest Romero drillholes here; they include as much as 235 metres @ 7.88 g/t Au (uncut) and 1.43 percent Cu. Crucially, the post-discovery drillholes show that the maiden hit was no solo marvel, with notable drillholes in a 100 by 150 metre area, so far, in flat-lying volcanics of the Tireo formation. Precipitate is running after that drilling success. It said last week it had applied for (and expects to get) concessions covering 15,000 hectares southeast and adjacent to GoldQuest in the Tireo gold belt that runs through Haiti and Dominican Republic. Precipitate moved on the concessions "immediately after" the monster GoldQuest drillhole came out in May, a Precipitate spokesman told Mineweb. To fund exploration there, it seems probable Precipitate will try to raise some more cash, beyond the C$2 million it has banked, in another round of financing. This is not a random move by a junior suffering attention deficit disorder or succumbing to the whims of management looking, in the first at least, to work on their tans during the frigid Yukon winter. That GoldQuest would go after Dominican Republican ground may not be that surprising. Eric Coffin, who has touted GoldQuest as promising, also has friendly ties with GoldQuest director Bill Fischer, a Precipitate spokersperson said. But here's an important question: Why didn't GoldQuest just go and sow up title to prospective Tireo ground following its Romero discovery in May, or earlier for that matter? Why let a competitor into the Tireo belt to the southeast? As it turns out, it might have wanted to but Dominican Republic rules wouldn't allow it. In the Dominican Republic companies are limited to holding 30,000 hectares in mineral concessions. Quite simply GoldQuest is maxed out on holdings and couldn't pick up extra ground, a fact its president and CEO Julio Espaillat brought up in answer to an emailed question about the prospectivity of the Tireo gold belt. The point being, in some area plays juniors can only pick up scraps - land first movers don't want. But in this case, the ground does not appear to be stinking leftovers, geologically speaking at least, though much remains to be seen in terms of exploration. As GoldQuest's Espaillat said, "In terms of the prospectivity of the areas nearby or within the Tireo Formation, I think they all have some merits, but need to be very well investigated before defining their potential." Source: Please visit MineWeb at the link below for more… View the latest Precipitate Gold (PRG) corporate presentation at the link below: http://www.precipitategold.com/i/PDF/ppt/Corporate-Presentation-August-23-2012.pdf View the latest GoldQuest (GQC) corporate presentation at the link below: http://www.goldquestcorp.com/images/pdf/presentation/GQC_Presentation_Aug_2012_1.pdf Thanks to Vulture S.G. for bringing this story to our attention. Disclosure: Precipitate Gold is a Vulture Bargain Candidate of Interest (VBCI). Members of the GGR team may hold long positions in PRG.V. The editor of GGR participated in a private placement for Precipitate Gold and holds a long position at the time of publication. Disclosure: GoldQuest Mining Corp. is a Vulture Bargain Candidate of Interest (VBCI). Members of the GGR team may hold long positions in GQC.V. |

| GoldMoney's Turk on the historic breakout in gold and silver Posted: 03 Sep 2012 01:18 PM PDT 3:15p ET Monday, September 3, 2012 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk today tells King World News that the breakout of gold and silver is under way and is just as important for signifying the impending destruction of fiat money amid sovereign debt and bank insolvency problems. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/9/3_Tur... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... |

| HAS QE3 ALREADY BEGUN? GOLD & COMMODITIES MAY BE SAYING YES. Posted: 03 Sep 2012 12:44 PM PDT According to recent statements by Bernanke, the Fed stands ready to act with further easing of monetary policy (QE3) if economic conditions warrant it. But let's face it, because the Fed has never been audited we only receive the data they deem fit to publish. We know the government lies to us about inflation, unemployment, GDP, etc. Does anyone really believe the Fed is publishing true accounting numbers? I'm starting to suspect Bernanke has already begun the next round of quantitative easing. Politically QE is a hot potato and impossible to publicly announce. But there have been enough hints (the last FOMC minutes may have been the loudest) that it is clear that Bernanke intends to print. Hey, we are in a currency war after all, and one can't win the war if you don't shoot your guns! First case in point; the CRB exploded out of its three year cycle low in June just as I had predicted. Oil is already knocking on the door of $100 a barrel again. Grains in many cases have rallied 50% or more and show no signs of reversing. As a matter of fact, the CRB is showing no inclination to even retest the summer bottom. The complete failure up to this point of commodities to retest the three year cycle low is in itself a warning bell that something has changed. I think we can all agree that the global economy didn't all of a sudden ratchet into high gear, creating a surge in demand. Barring that, the only thing that would generate this kind of explosive move without even a hint of a correction would be another round of massive liquidity injections. Another odd development is the action in bonds. A month and a half ago the bond market started to discount the inflationary surge as commodities launched out of their three year cycle low. Mysteriously, two weeks ago, interest rates started to tank. One has to ask themselves, who in their right mind would be buying bonds with a negative yield in a rapidly accelerating inflationary environment? This sudden reversal in interest rates is another warning bell, in my opinion, that QE3 may have already begun, and Bernanke is already buying bonds in the attempt to hold interest rates under 2%. The next confirmation will come from the stock market. As we have seen in the past, the daily cycle in the stock market has tended to stretch far beyond its normal timing band (35-40 days) during periods of quantitative easing. The current cycle is due to bottom right around the next Fed meeting on September 13. If stocks are still rising with no clear decline into a cycle low by mid-September that would be a pretty clear sign in my opinion that Bernanke is lying to us and QE3 has already begun. If I am correct then the penetration of the three year cycle trendline by the dollar index on Friday is going to be a harbinger of hard times ahead for the world's reserve currency. As many of you may recall I've been expecting the three year cycle low in the CRB to correspond fairly closely to a top in the three year cycle on the dollar index. So far the rally out of the May 2011 three year cycle low has been very weak. The dollar still isn't close to moving above the 2008-2011 three year cycle high, and has now formed a monthly swing. The dollar's three year cycle is now at risk of having topped in only 14 months in a left translated manner. If so, this greatly increases the odds that we will see the dollar index fall below 72 and probably below 70 by the time the next three year cycle bottoms in mid-2014. If the dollar's current daily cycle continues to drop all the way into the FOMC meeting on September 13, then it will be unlikely we see any significant corrective action in commodities or stocks for the next two weeks, and at that point I am going to seriously entertain the idea that the Fed is lying to us and has already begun the next round of bond purchases. The big question though, is how do we invest based on this possibility? First off one doesn't want to be short if there is even the slightest risk that the Fed has resumed bond purchases. Second, one has to ask themselves which sector stands to benefit the most from another massive increase in liquidity? The obvious answer is commodities. But most commodities have already rallied quite significantly as we've seen with the grains and energy. That doesn't mean there isn't more upside, I'm sure there is. But I think much larger percentage gains are going to be made in the precious metals as price and breadth are still quite depressed in this sector. The metals are now set to "catch up" as traders take profits on some of their other commodity positions that have already generated large gains, and look to put that capital back to work in undervalued areas with more upside potential (precious metals, especially miners). It's been my theory for several months now that we saw a B-Wave bottom for gold back in May. With the recent breakout of the frustrating consolidation zone that always follows a B-Wave bottom, I think gold is now ready to begin the initial phase of the next C-wave advance. Gold is now entering the high demand fall season. It has been my expectation that gold will generate its first test of the all time highs sometime this fall. If my intermediate cycle count is correct (explained in depth in the nightly premium newsletter) we should see a move above the A-wave top of $1800 and a rally close to $1900 by late October or early November. At that point the intermediate cycle will enter the timing band for the next corrective move, which should prevent gold breaking out to new highs Following an intermediate degree decline in late November to mid December the breakout to new highs should occur during the next intermediate cycle this spring, followed by a retest of that breakout at the next intermediate bottom. Yes I know these daily and intermediate cycle counts are some what complicated and beyond the scope of this short article. I do cover them extensively in my premium newsletter. Suffice it to say that cycle analysis lays a general guideline for when to expect major bottoms, and to a lesser extent tops. I like to think of it as a tool that signals when to step on the gas and when to start tapping on the brakes. While I don't think gold has much chance of moving above $1920 this year, conditions are definitely in place for a significant rally in the sector over the next couple of months. Miners, and silver in particular, have the potential to generate some pretty respectable gains over the next 2-3 months. SMT premium newsletter. This posting includes an audio/video/photo media file: Download Now |

| Turk - A Remarkable & Historic Breakout In Gold & Silver Posted: 03 Sep 2012 12:35 PM PDT  Today James Turk told King World News, "This breakout (in gold and silver) is very important historically because it is not only ushering in the next great move in the metals, but it also signals the beginning of the next leg of the destruction of fiat money." Turk also said, "Given that silver is still in stage 1, the media attention won't begin until silver hits a new record high over $50 per ounce, and I think this is coming in just a few months." Today James Turk told King World News, "This breakout (in gold and silver) is very important historically because it is not only ushering in the next great move in the metals, but it also signals the beginning of the next leg of the destruction of fiat money." Turk also said, "Given that silver is still in stage 1, the media attention won't begin until silver hits a new record high over $50 per ounce, and I think this is coming in just a few months." Here is what Turk had to say: "Even though the US is closed for the Labor Day holiday market, Eric, gold and silver are on fire over here in Europe. Silver has hurdled $32 while gold looks ready to take on resistance at $1700, which is a key level the bears have been defending since last March." This posting includes an audio/video/photo media file: Download Now |

| An In-depth Interview with Frank Giustra Posted: 03 Sep 2012 10:59 AM PDT Mining magnate and film mogul Frank Giustra gives an in-depth interview to Cambridge House' Tommy Humphries in the video below. Topics include gold, the Fed, structural problems in the U.S. political system, inflation, deflation, crisis investing, Europe, banks, attitudes of the people, key words in the public discourse, debt in the U.S., quantitative easing, moral hazard, important changes to come, political conflict of interest, resource stocks, commodity prices, China, market confidence, European money printing, junior exploration companies in particular and a lot more. In the long run the people who get destroyed by the broken system we live under are the people who have savings, Giustra says. Since the system is inherently un-fixable, we might as well go along for the ride and profit on the inevitable inflation ahead. Mr. Giustra says in the future the world is almost certainly heading for more money printing and more inflation. Avoiding cash, bonds and fixed income securities and focusing on gold and stocks is how one positions to benefit from that scenario. Currency debasement is the only choice left to the central planners and that is fertile ground for gold. Not until everyone wants to own gold will it be time to sell it. The resource market is in the worst state Giustra has ever seen it in 34 years of investing and trading stocks. "I think it will turn around. What people might be losing sight of is that people usually connect irrational and stupid market behavior with peaks of markets, but it takes place at the bottom of markets too. And, it's just as bad. When you think about it fear is a much greater, stronger emotion than greed. The sense of hopelessness that people have about the resource sector right now, is something that you know, if you are logical about it, it will change – it's not going to stay like this forever. So I think you have to sometimes – if you lose complete faith, you have to give your head a shake, … you realize that this is really, really bad, but guess what – it will change. And the other thing you have to understand is that there is a lot of cash out there in the world – a lot of cash sitting on the sidelines – trillions of dollars of cash and it eventually has to go somewhere and it will go somewhere, it can't stay in cash forever." Frank Giustra. Giustra's criteria for picking juniors are simple. Great assets, great management, grossly undervalued and most importantly able to weather this storm without heavy dilution. "I've done my homework and chosen my companies and I've invested a significant amount in a number of these companies. … If I were an investor out there I would really start to think about the fact that this (bear market) will change. … Pick right and sit tight," Frank said, "but you might have to have a lot of patience." Spend the better part of an hour with a very successful investor and deep thinker in the video below. We have a kinship with Mr. Giustra in the form of a particular book he mentions toward the end of the discussion.* For those who have not yet had the pleasure of reading it, we do indeed highly recommend making a note of it and ordering either the book itself or the book on tape version (for those with a reading aversion, but a hunger to hear great thoughts). We also highly recommend giving the book, as an important life-changing event to young people, especially those near the end of their collegiate experience.

Source: Cambridge House via YouTube Thanks to Joe Martin at Cambridge House for the link. Our complements to Tommy for a worthwhile interview. We want to see more of these, Mr. Humphreys. *The book we are referring to is the first of the two books mentioned although both books are worthwhile. |

| Frank Giustra explains his bet on the resource sector Posted: 03 Sep 2012 10:03 AM PDT 12:02p ET Monday, September 3, 2012 Dear Friend of GATA and Gold: Mining entrepreneur Frank Giustra has given Tommy Humphries of CEO.ca a wide-ranging interview making points that will be of great interest to investors in the monetary metals. Among them: -- Governments are choosing to inflate their unpayable obligations away and are already conditioning their publics to accept this. -- The position of the United States is like that of imperial Spain three centuries ago, where colonization and war produced great wealth but then corrupted society and hollowed out industry and resulted in decline. -- The resource sector is irrationally depressed, which is why he is betting heavily on it. "World-class assets," he says, are "trading at pennies on the dollar." The interview is 44 minutes long and its video is posted at CEO.ca here: http://ceo.ca/frank-giustra-long-form-interview/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata |

| Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good Posted: 03 Sep 2012 10:03 AM PDT  Barack Obama has destroyed the future of America in order to improve his chances of winning the next election. Under Obama, 5.3 trillion dollars has been ruthlessly stolen from our children and our grandchildren. That money has been used to pump up the debt-fueled false prosperity that we have been experiencing. When the U.S. government borrows money that it does not have from someone else (such as China) and spends that money into the economy it is going to make our economic numbers look better. Even if the government spends that money on incredibly stupid things, it still gets into the hands of average Americans who in turn spend that money on food, gas, clothes, etc. If we were to go back and take that extra 5.3 trillion dollars out of the U.S. economy, I guarantee you that we would be in a rip-roaring depression right now. We would look a lot like Greece at this point. Barack Obama has destroyed the future of America in order to improve his chances of winning the next election. Under Obama, 5.3 trillion dollars has been ruthlessly stolen from our children and our grandchildren. That money has been used to pump up the debt-fueled false prosperity that we have been experiencing. When the U.S. government borrows money that it does not have from someone else (such as China) and spends that money into the economy it is going to make our economic numbers look better. Even if the government spends that money on incredibly stupid things, it still gets into the hands of average Americans who in turn spend that money on food, gas, clothes, etc. If we were to go back and take that extra 5.3 trillion dollars out of the U.S. economy, I guarantee you that we would be in a rip-roaring depression right now. We would look a lot like Greece at this point.For several years Greece has been raising taxes and cutting government spending in an attempt to balance the budget and these austerity measures have resulted in an unemployment rate of over 23 percent and an economy that has contracted by close to 25 percent. Most Americans don't want to go through pain like that so they are okay with continuing to financially rape our children and our grandchildren. Just imagine how you would feel if your parents died tomorrow and you found out that they had left you with a million dollar debt that you were legally obligated to pay off. How would you feel, knowing that you had just been sold into debt slavery for the rest of your life? Well, that is how our children and our grandchildren are going to feel. We are destroying the greatest economic machine the world has ever seen, we are accumulating the biggest mountain of debt in the history of the planet, and the coming economic collapse that we have caused is going to wipe out the promising future that our children and our grandchildren were supposed to have. If they get the chance, future generations of Americans will curse us bitterly and will spit on our graves. What we are doing to our children and our grandchildren is the kind of stuff that horror movies are made of. You should be ashamed of yourself America. Read more....... This posting includes an audio/video/photo media file: Download Now |

| Butler tells MineWeb why he sees silver's potential greater than gold's Posted: 03 Sep 2012 09:45 AM PDT 11:41a ET Monday, September 3, 2012 Dear Friend of GATA and Gold (and Silver): MineWeb's Lawrence Williams today interviews silver market analyst and market manipulation exposer Ted Butler, who explains why he thinks the white metal's prospects are even better than the yellow metal's. "It is rarer than gold in investment quantities," Butler says, "yet priced as if it were more than 50 times as plentiful." The interview is headlined "Silver Gives You More -- At Least Potentially" and it's posted at MineWeb here: http://www.mineweb.com/mineweb/view/mineweb/en/page32?oid=158052&sn=Deta... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Fred Goldstein and Tim Murphy open All Pro Gold Longtime GATA supporters Fred Goldstein and Tim Murphy have brought their many years of experience in the precious metals and numismatic coins to All Pro Gold as metals brokers who specialize in the delivery of gold and silver bullion bars and coins as well as numismatic gold and silver coins. Fred and Tim follow these markets closely and are assisted by a team of consultants in monitoring market trends. All Pro Gold offers GATA supporters competitive pricing on all bullion products and welcomes inquiries. Tim can be reached at 602-299-2585 and Tim@allprogold.com, Fred at 602-799-8378 and Fred@allprogold.com. Ask about their ratio strategy and the relationship of generic $20 dollar gold pieces to 1-ounce gold bullion coins. Visit their Internet site at http://www.allprogold.com/. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... |

| Tentacles of Deception [Video] Posted: 03 Sep 2012 09:05 AM PDT Italy will soon collapse despite the pending EU Monetary "Bazooka". It will be only the next example of failed public policy, whether Monetary or Fiscal. Politicians, public servants and the electorate consistently fail to understand the central issues that are operating in an ever more complex global economic system. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Summer vacation is over and things are about to get very interesting in Europe. Most Americans don't realize this, but much of Europe shuts down for the entire month of August. I wish we had something similar in the United States. But now millions of Europeans are returning from their extended family vacations and the fun is about to begin. During August economic conditions continued to degenerate in Europe, but I figured that it wouldn't be until after August that the European debt crisis would take center stage once again. And as I wrote about last week, if there is going to be a financial panic, it typically happens

Summer vacation is over and things are about to get very interesting in Europe. Most Americans don't realize this, but much of Europe shuts down for the entire month of August. I wish we had something similar in the United States. But now millions of Europeans are returning from their extended family vacations and the fun is about to begin. During August economic conditions continued to degenerate in Europe, but I figured that it wouldn't be until after August that the European debt crisis would take center stage once again. And as I wrote about last week, if there is going to be a financial panic, it typically happens

No comments:

Post a Comment